Don't wanna be here? Send us removal request.

Text

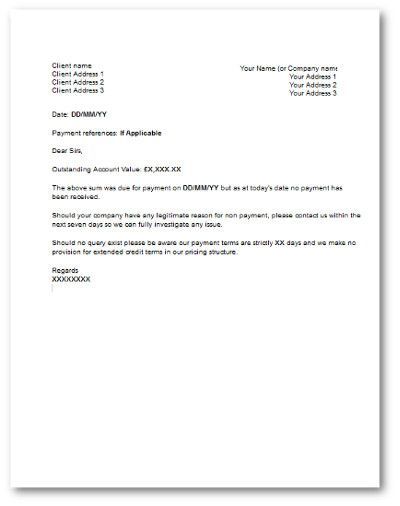

Invoice Letter For Payment - How to Use an App

If you need to send invoices to clients and are not very proficient with writing letters, you can try downloading invoice payment letters templates. These apps have templates for various invoices and allow you to easily edit and customize them. They also allow you to customize the text and subject lines. These apps are useful for small business owners and freelancers.

The subject line of the letter is very important. It should contain relevant information about the invoice. For example, the subject line can mention the invoice number (856), the due date, early payment discounts, late fees, and contact information. You should also mention how to make the payment. Lastly, at the end of the letter, you should ask for confirmation from the client.

Invoice payment letters are very important to the financial health of a company. If they are well-written, they will make the business look good. It will also create a sense of reliability and professionalism in the minds of the clients. Using invoice payment letters templates to communicate with clients can make the process smooth and convenient. Besides, they help reduce the risk of liabilities by serving as proofs of payment.

Invoice payment letters are important tools for small businesses. It can help you send timely reminders. After sending invoices, make sure to follow up with clients who missed their payment deadline. Sending late payment reminder emails or letters is a good way to follow up on your customers. You can even use marketing automation to send reminders.

youtube

SITES WE SUPPORT

Payment Collect Letter – BlogSPot

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram Pinterest

#Past Due Accounts Receivable Collection Letter Template#Payment Collections Letter#Invoice Payment Letters Templates

0 notes

Text

Invoice Payment Letters Templates and Examples

When writing an invoice payment letter, it's crucial to include the invoice and related documents in the body of the letter. You can use a template to assist you in this process. The letter should be friendly, professional, and informative. Even though you're writing a formal letter, you don't want to come off as pushy or aggressive. Be patient with the customer and give them time to respond to your request.

In addition to the invoice number, you should also include the name, address, and phone number of your client. This will make it easier for your customer to get in touch with you. It's also a good idea to include the names of all of the company's directors. Lastly, it's a good idea to include the description of the services or products you've rendered. You don't need to write a novel, but it's helpful for the customer to understand the charges.

Invoice payment letters are essential to the financial health of your business. They help you receive payments on time and keep your company financially stable. It also gives you the chance to send out invoices that look professional and reliable. By using templates, you can save time and effort on writing each letter from scratch. For example, PostGrid's print and mail platform includes pre-built templates, so you don't have to reinvent the wheel. You can also build your own templates and save them to your company's account.

Invoice payment letters should have the invoice number, date, amount, and contact information. In addition, the letter should contain a logo or other relevant information. The format should be concise, and make it easy for customers to read and pay.

youtube

SITES WE SUPPORT

Payment Collect Letter – BlogSPot

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram Pinterest

#Past Due Accounts Receivable Collection Letter Template#Payment Collections Letter#Invoice Payment Letters Templates

0 notes

Text

How to Write a Past Due Collections Letter Template

A past due collections letter template can be a great tool to have in your collection arsenal. While accounts receivable professionals barely have time for phone calls and emails, a personal letter can make a significant difference in collecting on-time payment. It is important to change the tone of the letter and emphasize the consequences of late payment to encourage a client to pay on time.

A past due notice should be sent to your clients a week or two before the balance due date. This is your most important past due letter, and you need to catch them at the right time in order to instill a sense of urgency in them. Once the client has received a past due letter, follow-up with a phone call to follow up.

The body of your letter contains the Due Amount line. This line will contain the dollar amount owed as well as the debtor's name, address, and the date it is due. The following lines contain important information about the debtor, including their name, address, and position within the company.

As with any text message, the body of a past due letter should be easy to read. Keep it brief and to the point, and avoid using too many words. Moreover, it is important to include a "txt STOP" to cancel notification. This phrase is required under the CAN-SPAM Act to make sure the recipient does not receive automated texts.

youtube

SITES WE SUPPORT

Payment Collect Letter – BlogSPot

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram Pinterest

#Invoice Payment Letters Templates#Payment Collections Letter#Past Due Accounts Receivable Collection Letter Template

0 notes

Text

What to Do When You Get a Collection Letter

When you receive a collection letter, you should take the time to investigate your rights and the agency's method of collection. In most cases, you have the right to ask for a written verification of the debt. In addition, you should learn about the statute of limitations corresponding to your debt and any other acts that protect your rights.

Depending on the circumstances, you may need to take legal action to collect the debt. If you choose to send a letter in this manner, make sure you follow all the laws. In addition, you must avoid using aggressive or threatening language. Try to maintain a professional tone throughout the letter. If you send the letter in a manner that is perceived as threatening, the customer may feel intimidated and lose confidence in your company, which may affect future deals. Instead, use a friendly and polite tone, and offer alternative payment options.

The letter must include all the information required by law. It must include the name of the debtor, the debt amount, the date when you must make payment, and instructions for how to pay the debt. In addition, a debt collector is required to send a validation letter to you within 5 days of the initial contact. This letter should include the same information as the original letter, but will be more detailed.

If you have been harassed by a collection agency, you can take steps to resolve the situation. You can try setting up a payment plan with the creditor. Otherwise, you can initiate legal action.

youtube

SITES WE SUPPORT

Payment Collect Letter – BlogSPot

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram Pinterest

#Payment Collections Letter#Past Due Accounts Receivable Collection Letter Template#Invoice Payment Letters Templates

0 notes

Text

Invoice Payment Letters Templates

When writing an invoice, you should include the name and mailing address of the person who will receive the invoice. The recipient should also be listed as the company's principal payer. Use standard titles for business letters, but if you are writing to a woman, use "Ms." You can also add your company name, logo, and fonts.

Invoice payment letters are a great way to remind customers to pay their bills on time. Using an invoice payment letter template will make it simple to follow up with late payers. A professional template will include information about the business and the individual. It will also include the account number, due date, and outstanding balance.

It is important to use a professional letter format to make a good impression. Invoice payment letters are often accompanied by a bill. This way, the person will see that the business is reputable and trustworthy. While a faulty letter may be overlooked, it can result in unnecessary delays. Choosing a template with a streamlined layout can help you avoid common mistakes.

The body of the letter should include a brief description of the work performed. You should also indicate whether you charge per project or by the amount of time you spend on the project. In addition, you should note any additional expenses that were not covered by the client's payment. You can also begin the letter with a friendly greeting. This is customary, especially when two people haven't spoken for some time.

youtube

SITES WE SUPPORT

Payment Collect Letter – BlogSPot

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram Pinterest

#Invoice Payment Letters Templates#Payment Collections Letter#Past Due Accounts Receivable Collection Letter Template

1 note

·

View note