Text

obsessed with how fixable society is, on a structural level.

obsessed with how all you need to do is throw money at public education and eliminate most standardized testing and you will start getting smarter, more engaged, kinder adults. obsessed with how giving people safe housing, reliable access to good food, and decent wages dramatically reduces drug overdoses and gun violence. obsessed with how much people actually want to get together and fix infrastructure, invent new ways of helping each other, and create global ways of living sustainably once you give them livable pay to do so. obsessed with how tracking diseases, developing medicines, and improving public health becomes so much easier when you just make healthcare free at point of use.

obsessed with how easy it all becomes, if we can just figure out how to wrench the wealth out of the hands of the hoarders.

6K notes

·

View notes

Text

1. More children are surviving today than ever before.

Close to 8 million more children in the world survive to see their fifth birthday than in 1990 — a 60 percent decline in annual under-five child mortality.

UNICEF and partners have contributed to this remarkable achievement through proven, sustainable solutions for improving maternal and child health care services and strengthening disease prevention — and delivering those solutions at scale...

2. Vaccines have saved 154 million lives in the last 50 years.

As the world’s largest vaccine supplier, UNICEF procures and distributes enough vaccines annually to immunize 45 percent of the world's children. In 2023, UNICEF supplied 2.8 billion vaccine doses to 105 countries, up from just over 2 billion to 102 countries in 2020. Through widespread immunizations, polio is on the brink of eradication.

3. Safe water is available to over 2.1 billion more people compared to 20 years ago.

Consistent access to a sufficient supply of safe water for drinking, cooking and personal hygiene is the foundation for child survival, healthier lives, stronger economies and more sustainable societies. With support from UNICEF and partners, more than a quarter of the world's population gained access to safe and clean drinking water in the past two decades.

UNICEF-supported programs help ensure access to safe water for 35 million people around the world every year. UNICEF also leads coordinated emergency response efforts related to safe water access in roughly 85 percent of countries affected by crises. In 2023, over 42 million people in 73 countries were reached with emergency water services, helping to prevent outbreaks of cholera and other waterborne diseases.

To help build community resilience to climate shocks, UNICEF has also supported the installation of more than 8,900 solar-powered water systems in 56 countries — an important climate adaption measure that also reduces the use of fossil fuels.

4. The number of children with stunted growth due to malnutrition has declined by 40 percent since 2000.

For more than two decades, UNICEF has been the world’s largest procurer of ready-to-use therapeutic food (RUTF), procuring up to 80 percent of global demand, ensuring children suffering from severe malnutrition can be treated successfully.

5. Over 68 million child marriages have been averted in the last 25 years, giving girls their childhoods back.

In the late 1990s, 1 in 4 young women aged 20 to 24 were married as children. Today, it's 1 in 5. UNICEF has played an important role in global efforts to end child marriage, supporting 35 countries in implementing action plans, and working at the community level and across the health, education and other sectors to increase knowledge and change attitudes around the practice.

In 2023, UNICEF reached 11 million adolescent girls with prevention and care interventions empowering them to delay marriage and choose their own futures.

6. Fewer kids are out of school.

The world stands on the cusp of realizing primary education as a basic right of every child. A world where more children learn is a world that is healthier, more prosperous and more resilient.

In the early 1950s, roughly half of all primary school-aged children were out of school. Now it's less than 10 percent. And every year, 23 million more girls are completing secondary school compared to a decade ago...

7. The world is on track to eliminate open defecation by 2030.

In the last two decades, 2.5 billion people have gained access to safely managed sanitation, while the number of people practicing open defecation has also declined by two-thirds — from 1.3 billion in 2000 to 419 million in 2022 — putting the world on track to eliminate the practice entirely.

Ending open defecation drastically lowers the risks of diseases and malnutrition among children in low-income and lower-middle-income countries. Child deaths from diarrhea — a leading killer of young children — have already decreased by 60 percent...

8. Birth registration rates are way up.

Today, 77 percent of children under 5 are registered, up from 60 percent in the early 2000s — a major leap towards ensuring every child has a legal identity and can access health, education and other essential services...

Countries that prioritize birth registration see rapid progress. In Côte d’Ivoire, birth registration prevalence rose steadily from 65 percent in 2012 to 96 percent by 2021, proving that change at scale is possible.

9. A future free from HIV seems possible, one baby at a time.

An estimated 1.9 million deaths and 4 million HIV infections have been averted among pregnant women and children in the past 25 years...

10. In times of crisis and emergency, UNICEF is there — helping to save more children's lives than any other humanitarian organization.

[Note: Okay, I think they're cheating listing this one, but the article header said 10 things, so if I included only 9 it would be weird. Obviously this is an article from UNICEF, but UNICEF's data, reporting, and statistics are considered to be of high quality.]

-via UNICEF, February 25, 2025

764 notes

·

View notes

Text

The first skyscraper went up in 1885, the Home Insurance Building in Chicago. By modern standards, I'm not even sure that you would call it a skyscraper, because it was only ten stories tall, but it did have a number of features like an internal metal structure and safety elevators that defined "skyscraper" for a long time.

I used to work in a "skyscraper" like that which was finished in 1892. It was Minnesota's third completed skyscraper, and at one point, the tallest building in the state. It's hard to find details, but it's plausibly one of the first 25 skyscrapers ever built.

I used to think about this a lot when I worked there, how this building was once part of a revolution in architecture and now is just a relatively small building in a mid-sized city. There's something about how new things become old, how revolutions in science and technology become so mundane that we don't think about them in the slightest.

141 notes

·

View notes

Text

It’s worth acknowledging some ways in which culture has improved in the last decade or so.

There is massively more anime every year than in any previous decade. The *average* quality has gone down, but it’s okay because the *total* number of good anime per year has gone up. The total is more important than the average. There are way more music genres than ever before, and numerous deceased genres have even been revived. Anyone can find music they’re interested in, and many more independent music artists have some chance of getting popular online.

(Some people complain that the 2010s has no distinctive “sound,” or that there are almost no anime coming out that will be considered “classics.” This may be a loss, but it is a minor downside compared to the advantages of variety.)

While mainstream video games have suffered enormously from EA-style monopolization and microtransactions and suchlike, independent games are more numerous and better than ever. The prevalence of shit-games, as with shit-anime, does not come close to outweighing the fact that there are more total good ones than ever before.

Video essays on YouTube are more numerous and better than ever, and provide immense opportunities for entertainment and edification. A decade ago, it was major news when Red Letter Media made a 70-minute review of a Star Wars movie. Now, anyone can make a 70-minute review of a movie, or for that matter a 7-hour review of a movie–and a lot of these exist, and a lot of them are incredibly good. Even as the owners of YouTube are continually making it a shittier platform on a design level, the community itself is periodically getting better and improving the content.

Many once-stigmatized subcultures and hobbies, like fanfiction and furry fandom, have become quasi-mainstream and less regularly derided.

Most forms of everyday technology have gotten immensely better in the last decade. This is of course a mixed bag, as it has come alongside increases in cyberbullying, privacy violations, and technology addiction. But still, computers and other useful technologies are much better and more affordable than ever before.

Today’s memes are excellent, and often far better than the memes of previous decades.

351 notes

·

View notes

Text

How an obscure advisory board lets utilities steal $50b/year from ratepayers

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in NYC on WEDNESDAY (26 Feb) with JOHN HODGMAN and at PENN STATE on THURSDAY (Feb 27). More tour dates here. Mail-order signed copies from LA's Diesel Books.

Two figures to ponder.

First: if your local power company is privately owned, you've seen energy rate hikes at 49% above inflation over the last three years.

Second: if your local power company is publicly owned, you've seen energy rates go up at 44% below inflation over the same period.

Power is that much-theorized economic marvel: a "natural monopoly." Once someone has gone to the trouble of bringing a power wire to your house, it's almost impossible to convince anyone else to invest in bringing a competing wire to your electrical service mast. For this reason, most people in the world get their energy from a publicly owned utility, and the rates reflect social priorities as well as cost-recovery. For example, basic power to run lights and a refrigerator might be steeply discounted, while energy-gobbling McMansions pay a substantial premium for the extra power to heat and cool their ostentatious lawyer-foyers and "great rooms."

But in America, we believe in the miracle of the market, even where no market could possibly exist because of natural monopolies. That's why about 70% of Americans get their power from shareholder-owned companies, whose managers' prime directive is extracting profit, not serving their communities. To check this impulse, these private utilities are overseen by various flavors of public bodies, usually called Public Utility Commissions (PUCs).

For 40 years, PUCs have limited private utilities to a "rate of return" based on a "just and reasonable profit." But in recent years, the "experts" who advise PUCs on rate-setting have been boiled down to a tiny number of economists, who have discovered that the true "just and reasonable profit" is much higher than it's ever been considered.

Mark Ellis was one of those profit-hiking "experts," but he's turned whistleblower. On paper, Ellis looks like the enemy: former chief economist at Sempra Energy, an ex-Exxonmobile analyst, a retied McKinsey Consultant, and a Socal Edison engineer. But Ellis couldn't stomach the corruption, and he went public, publishing a report for the American Economic Liberties Project called "Rate of Return Equals Cost of Capital" that lays out the con in stark detail:

https://www.economicliberties.us/wp-content/uploads/2025/01/20250102-aelp-ror-v5.pdf

I first encountered Ellis last week when he was interviewed on Matt Stoller and David Dayen's excellent Organized Money podcast, where he memorably referred to these utilities as "pocket-picking machines":

https://www.organizedmoney.fm/p/the-pocket-picking-machine

Dayen followed this up with a great summary in The American Prospect (where he is editor-in-chief):

https://prospect.org/environment/2025-02-21-secret-society-raising-your-electricity-bills/

At the center of the scam is a professional association called the Society of Utility and Regulatory Financial Analysts (SURFA). The experts in SURFA are dominated by just four consulting companies, who provide 90% of the testimony for rate-setting exercises. Just two people account for half of that input.

In order to calculate the "just and reasonable profit," these experts make use of economic models. Even in normal economics, these models are the source of infinite mischief and suffering, built on assumptions that legitimize the most abusive conduct:

https://pluralistic.net/2023/04/03/all-models-are-wrong/#some-are-useful

But even by the low standards of normal economic models, the utility models are really bad. They rely on unique "risk premium" and "expected earnings" calculations that no one else in finance will touch. As Dayen explains, these models are "perfectly circular."

This might be a bit confusing, but only because it's one of those scams that you assume you must have misunderstood because it's so, well, scammy. In the "expected earnings" analysis, the "just and reasonable profit" a utility is allowed to build into its rates is defined as "the amount of money it would like to make." In other words, if a utility projects future revenues of $10 billion over the next ten years, that is its "expected earnings." "Expected earnings" are treated as equivalent to "just and reasonable profits." So under this model, whatever number the utility puts in its financial projections is the number that it's allowed to take out of the pockets of ratepayers.

This is just as bad as it sounds. In 2022, the Federal Energy Regulatory Commission said that it "defied financial logic." No duh – even SURFA's own training manual says it "does not square well with economic theory."

In the world of regulated utilities, this kind of mathing isn't supposed to be possible. The PUC and its "consumer advocates" are supposed to listen to these outlandish tales and laugh the utility out of the room.

But it's SURFA that trains the consumer advocates who work for the PUCs, the large energy customers, and community groups. These people – who are supposed to act as the adversaries of the companies that pay SURFA members to justify rate-hikes – are indoctrinated by SURFA to treat its absurd models as accepted economic gospel. SURFA has co-opted its opposition, transformed it into a botnet that parrots its own talking-points.

Because of this, the private power companies that serve 70% of US households made an extra $50b last year, about $300 per household. What's more, because the excess profits available to companies that simply bamboozle their regulators are so massive, they swamp all the other tools regulators use to attempt to improve the energy system. No incentive offered for conservation or efficiency can touch the gigantic sums energy companies can make by ripping off ratepayers, so nearly all the incentive programs approved by PUCs have been dead on arrival.

What's more, utilities are allowed to fold the cost of hiring the experts who get them rate hikes onto the ratepayers. In other words, if a utility hires a $10,000,000 expert who successfully argues for a $1,000,000,000 rate-increase, they get to recoup the ten mil they spent securing the right to rip you off for a billion dollars on top of that cool bill.

We often talk about regulatory capture in the abstract, but this is as concrete as it can be. Ellis's report makes a raft of highly specific, technical regulatory changes that states or cities could impose on their PUCs. These are shovel-ready ideas: if you find yourself contemplating a sky-high power bill, maybe you could call your state rep and read them aloud.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/02/24/surfa/#mark-ellis

258 notes

·

View notes

Text

"To decarbonize road transport, the world must move away from petrol and diesel cars and towards electric vehicles and other forms of low-carbon transport.

This transition has already started. In fact, global sales of combustion engine cars are well past the peak and are now falling.

As you can see in the chart, global sales peaked in 2018. This is calculated based on data from the International Energy Agency. Bloomberg New Energy Finance estimates this peak occurred one year earlier, in 2017.

Sales of electric cars, on the other hand, are growing quickly.

Explore more data on electric car sales across the world"

-via Our World in Data, February 16, 2025

368 notes

·

View notes

Text

The world has probably passed “peak air pollution”

"Global emissions of local air pollutants have probably passed their peak.

The chart shows estimates of global emissions of pollutants such as sulphur dioxide (which causes acid rain), nitrogen oxides, and black and organic carbon.

These pollutants are harmful to human health and can also damage ecosystems.

It looks like emissions have peaked for almost all of these pollutants. Global air pollution is now falling, and we can save many lives by accelerating this decline.

The exception is ammonia, which is mainly produced by agriculture. Its emissions are still rising.

These estimates come from the Community Emissions Data System (CEDS).

Air pollution has not peaked everywhere in the world — explore the data for your country."

-via Our World in Data, January 27, 2025

2K notes

·

View notes

Photo

Dinosaur comics hitting it out the park

you can’t spell “smart” without “shart”. i mean this not in the literal sense, but in the permissive one

172 notes

·

View notes

Text

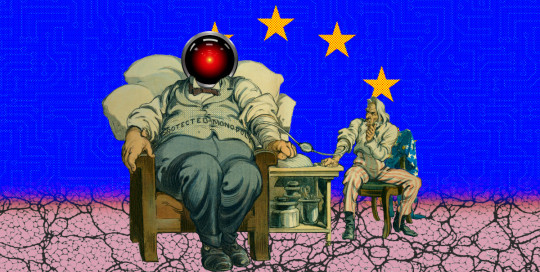

I disagree with the conclusion - Putin must be defeated before we can deinvest in EU armies - but the rest seems spot on.

I just wish I wasn't living in interesting times.

America and “national capitalism”

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in LA TONIGHT (Feb 19) for an event with WIL WHEATON in LA, and in SEATTLE TOMORROW (Feb 19) for with DAN SAVAGE. More tour dates here.

Thomas Piketty's 2013 unexpected bestseller (a 750 page economics book translated from French!) Capital in the 21st Century, offers a very convincing explanation of our political decay, and it continues to serve this purpose as the decay undergoes alarming acceleration:

https://memex.craphound.com/2014/06/24/thomas-pikettys-capital-in-the-21st-century/

Let me sketch out that argument really briefly for you here. Absent any kind of government intervention, markets make investors richer than workers (AKA "the rate of return on capital exceeds the rate of return from growth" or "r > g"). This is true even for extremely powerful workers who get very, very rich indeed. Piketty illustrates this in many ways, but my favorite is the Parable of Bill Gates, Liliane Bettencourt and Bill Gates (again).

Bill Gates founded Microsoft in 1975 and he stepped down as CEO in 2000. In the intervening 25 years, he built the company into the most profitable firm in human history and grew very, very rich. This is Market Lore Canon: found a successful company, grow rich.

Now, Bill Gates started with a bunch of money – he comes from a wealthy family – but he grew his personal fortune over those years in extraordinary ways, and not by investing it, but rather, by founding a company and working at it.

Now consider Liliane Bettencourt, who, during Bill Gates period as Microsoft CEO, was the richest woman in Europe. Bettencourt was born very, very rich, heiress to the L'Oreal fortune. Unlike Gates, Bettencourt didn't have a job. She just sat around, while financial planners invested her family money. Over the 25 years when Bill Gates was growing Microsoft from zero to the most successful company in planetary history, Bettencourt made more money than Gates. Gates made his money by doing something. Bettencourt made her money by emerging from a very lucky orifice and just hanging around.

But here's the kicker: after Bill Gates quit Microsoft, he became a professional investor. He stopped doing a job and started investing in companies where other people were working. Over the next 13 years, Bill Gates (investor) made more money than Bill Gates (Microsoft CEO) made in his 25 years of doing a job. He also made more than Liliane Bettencourt.

That's what r > g means: that even the most successful worker in human history can't make as much as person who merely has a lot of money, and the more money you have, the more money you make.

If you think about this for a second, you can see how it'll play out: in economies both good and bad, the people who emerge from lucky orifices will get wealthier than anyone else, wealthier than the people who do things that grow the economy. And because they're getting wealthier faster than the economy grows, they come to command ever-larger shares of the economy, so that even when the pie gets bigger, their slices gets bigger still, and the remainder that we all share isn't just proportionally smaller – it's actually smaller. We don't just have less relative to the rich – we have less relative to our parents.

For Piketty, this is an iron law of markets, born out by analysis of hundreds of years' worth of capital flows. He devotes many of those 750 pages showing how even the most profitable sectors of the economy at any given time are disproportionately benefiting investors, even relative to the most successful managers and workers at any given time. This is where oligarchy comes from: it is the natural end-state of a market economy.

But (Picketty continues), oligarchy is intrinsically destabilizing. For one thing, once the fortunes of Bill Gates' or Liliane Bettencourt's are large enough, growing them by even, say 1% requires that some capital come from other rich people, because 1% of Bill Gates's holdings will eventually exceed 100% of the holdings of everyone who isn't insanely right. So, over time, rich people eventually have to fight with each other in order to keep getting richer – see, for example, World War I.

That's not the only way extreme wealth inequality creates political instability. Once the 1% are sufficiently wealthy, they capture government, and the only policies that can be enacted are those that don't gore some aristocrat's ox, and once the rich become super rich, they own all the oxen. So sensible policies that are needed to ensure an orderly, stable society (for example, limiting war bond repayments to a sustainable level that won't bankrupt the economy to make wealthy bondholders even richer) become impossible, and then you get societal collapse (see, for example, World War II).

The backbone of C21 is a time-series of 300 years' worth of global capital flows, painstakingly assembled by Piketty and his grad students. This time series shows the same pattern emerging over and over: as the rich get richer, they capture more and more of the state's policy-making apparatus, triggering more wealth-friendly policies, which make them even richer, and makes their grip on policy stronger. This continues until inequality reaches a tipping point, and then you a rupture, like the French Revolution, or the World Wars. These are orgies of capital destruction, and because nearly all the capital is in the hands of the rich, when the dust settles, they emerge with much less capital and much less power. Society is shattered, but it is more equal, and this means that we can once again make good policies that help us rebuild a society that benefits everyone, not just the rich (the French call the 30 years following WWII "the 30 glorious years").

But, if this society doesn't include some kind of mechanism to address the fact that capital is still growing faster than the economy – even a post-war boom economy – then eventually the share of wealth held by the rich will reach a tipping point, and we'll see policies that benefit the wealthy crowding out policies that support human thriving, and the rich will get richer, and they will feud with each other, and society will destabilize, and we will face collapse.

So, let's talk about Ronald Reagan! By the late 1970s, the share of wealth held by the top 10% had grown significantly from its post-war low point. With all that excess capital, the rich started spending money to promote candidates and policies that would make them richer. At a certain point, they have enough money to buy Reagan's presidency, and we get a deregulalatory bonfire: lower taxes for the rich, looser rules for finance, fewer protections for workers, less spending on social programs.

This makes the rich richer, even as wages stagnate. The next 40 years are a procession of ever-more-wealth-friendly policies and politicians – not just the Bush years, but also Bill Clinton's welfare bill and Obama's foreclosure crisis – and the rich get richer and everyone else gets poorer. Monopolies consume the American economy. GDP goes up, because the corporate sector is super consolidated and it's jacking up prices and slashing wages, leaving more for profits and dividends.

Society grows progressively less stable. Policies that benefit the wealthy at the expense of everyone else – ignoring the climate emergency, slashing the safety net, starving infrastructure, etc – dominate. Inequality worsens. No one can afford a house, health care, or university. Your life's savings are stolen by a subprime mortgage, or a pension-fund raid, or bitcoin grift. Instability worsens. Policies that benefit the wealthy at the expense of everyone else – endless imperialist wars, noncompete agreements, private equity rollups – multiply. Wages stagnate. Inequality increases. The rich get richer. One political party is captured by finance ghouls. The other one is also captured by finance ghouls, but welds them into a coalition that includes virulent, apocalyptic racists.

Which brings us to today, and Trump, and imminent collapse, and Elon Musk and his child soldiers, and JD Vance, and the whole fucking thing.

Today, Piketty posted some pointed thoughts on the situation in Europe in the face of rising American fascism and belligerence:

https://www.lemonde.fr/blog/piketty/2025/02/18/trump-national-capitalism-at-bay/

It's common for Americans to write off Europe because its "economy isn't growing" the way the US economy is. Piketty points out that this is a mirage: American economic growth is due to rising prices and plummeting wages, which is great for the share price of giant American companies whose cartels and monopolies make everyone except the tiny number of Americans with substantial stock market portfolios much poorer: "When measured in terms of purchasing power parity, the reality is very different: the productivity gap with Europe disappears entirely."

Once you adjust US economic figures to account for this, it's clear that America truly is in decline – the real US GDP has lagged China's since 2016. China now has an adjusted GDP that 30% higher than America's, and it's on track to double US GDP by 2035.

The US is losing control of the rest of the world, and Trump is accelerating this phenomenon. Take de-dollarization: the US (and only the US) can make as many US dollars as it wants, so for so long as things around the world (oil, say) are available for sale in USD, the US can buy them on better terms than any other country in the world:

https://stephaniekelton.substack.com/p/trade-isnt-money-for-nothing

What's more, the fact that dollar-clearing takes place at the Federal Reserve gives the US the ability to spy on and control other countries around the world (think of US SWIFT sanctions on Russia after the Ukraine invasion, or the vulture capitalists who forced Argentina to pay up even after it defaulted on its debts). Trump's pro-bitcoin policies are intrinsically anti-dollar policies. The rest of the world was already increasingly nervous about the way that the US dollar is a vehicle for soft power around the world, we're already seeing a lot of oil denominated in rubles, and now Trump is encouraging the growth of a shadow currency that will make it even easier for transactions to take place without dollars (notably, cryptocurrency will help America's ultra-rich evade even more taxes, and commit even more bribery):

https://www.programmablemutter.com/p/what-happens-when-economic-coercion

Trump is also waging war on the CIA and NSA. Good riddance, sure – but these are also major sources for projecting US power around the world – think of the NSA's mass surveillance program, in alliance with the "5 Eyes" countries whom Trump is setting out to alienate.

Then there's trade. The US has pushed pro-oligarchic policies on the world through its trade deals. To access US markets, foreign governments must enact punitive laws that make it easier for US giants to loot their economy, like IP laws:

https://pluralistic.net/2025/01/15/beauty-eh/#its-the-only-war-the-yankees-lost-except-for-vietnam-and-also-the-alamo-and-the-bay-of-ham

and investor-state dispute settlements:

https://pluralistic.net/2024/03/27/korporate-kangaroo-kourts/#corporate-sovereignty

Not all the profits of giant US companies arise from ripping off 99% of Americans. Some of those profits come from ripping off foreigners, but that's only possible because foreign governments have passed looter-friendly policies in exchange for tariff-free access to US markets. Now that the US is shutting that down, there's no reason to allow America to continue stealing from your citizens.

As Piketty says, Trump dreams of a "national capitalism." National capitalism is a disaster, even compared to global capitalism:

the strength of national capitalism lies in glorifying power and national identity while denouncing the illusions of carefree rhetoric about universal harmony and class equality. Its weakness is that it clashes with power struggles and forgets that sustainable prosperity requires an educational, social and environmental investment that benefits all.

National capitalism walls its oligarchs off from the possibility of draining the riches of other countries, limiting them to domestic looting. Eventually, all the wealth in the country is held by its looter class, and the only way they can grow is by attacking each other. No one has more direct, recent experience with this phenomenon than Europe, a wealthy trading bloc of 500m. Trump has demanded that the EU commit 5% of its GDP to building up arms and its standing armies.

Piketty says this is a dead end. As the US is abandoning its role as global rule-of-law haven and transaction clearing house, the EU has an opportunity to become a very different kind of world power:

Europe must heed the calls from the Global South for economic, fiscal and climate justice. It must renew its commitment to social investment and definitively overtake the US in terms of training and productivity, just as it has already done in terms of health and life expectancy. After 1945, Europe rebuilt itself through the welfare state and the social-democratic revolution. This project remains unfinished: on the contrary, it must be seen as the beginning of a model of democratic and ecological socialism that must now be thought through on a global scale.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/02/18/pikettys-productivity/#reaganomics-revenge

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

EFF https://www.eff.org/files/issues/eu-flag-11_1.png

CC BY 4.0 https://creativecommons.org/licenses/by/4.0/deed.en

297 notes

·

View notes

Text

There's a scifi trope where the robot is ridiculously strong, being a robot and all, so while she looks like a waif, she can pick up a car or punch a hole through a wall. It's a good trope, I like that one.

I'm not sure I've ever seen the opposite of that, where there's a large robot made from the cheapest materials to the lowest standards, and looks like it could crush you in a fight, but is only barely capable of picking up 50 pounds, because that's the regulatory minimum to qualify as a certain class. Parts are expensive, so everything has been made with plastic instead of metal where possible, and there's only so much torque to the motors. It looks strong because looks sell, but how much power do you really need a domestic servant, butler, or grocery stocker to have?

99 notes

·

View notes