Jindal Healthcare is your trusted US-based partner, delivering cutting-edge revenue cycle management solutions. As a proud member of the esteemed O.P. Jindal Group, a global enterprise with 70 years of history and a staggering $30 billion in revenue, we bring a legacy of excellence to the healthcare industry.Check Out - https://www.jindalhc.com/

Don't wanna be here? Send us removal request.

Text

10 Powerful Strategies to Slash Your A/R Days in Half

The constant battle against late payments can drag down even the most successful businesses. Overdue invoices tie up critical cash flow, hinder growth, and strain customer relationships. In today's competitive landscape, minimizing Accounts Receivable (A/R) days is an absolute necessity.

The good news? You don't have to resign yourself to slow collections. By implementing targeted strategies, you can significantly expedite your receivables process and unleash the hidden wealth trapped in outstanding invoices.

Simplifying the Journey from Invoice to Payment

Late payments and stagnant receivables can feel like an insurmountable obstacle to your business's cash flow and growth. Invoices remain outstanding, casting a long shadow over financial planning and operational efficiency. But the good news is, you don't have to accept this sluggish reality. By implementing targeted strategies, you can bridge the gap between invoice issuance and timely payment, transforming your A/R process from a tangled web into a smooth, flowing stream.

Buckle up, because we're about to dive into 10 powerful tactics that will slash your A/R days in half and unleash the untapped potential of your receivables.

1. Streamline Invoicing

Go digital: Ditch paper invoices for a faster, more efficient electronic system. Consider online portals or invoicing software for automatic delivery and easier tracking.

Clarity is key: Ensure invoices are clear, concise, and error-free. Include all necessary details like invoice number, due date, payment terms, and contact information.

Early bird gets the worm: Send invoices promptly after completing services or delivery. The quicker you bill, the quicker you get paid.

2. Offer Multiple Payment Options

Cater to convenience: Accept a variety of payment methods like credit cards, debit cards, bank transfers, and online wallets. The more flexibility you offer, the higher the likelihood of receiving timely payments.

Automate recurring payments: Encourage long-term clients to opt for automatic payments, eliminating the need for manual intervention and potential delays.

3. Leverage Early Payment Incentives

Sweeten the deal: Offer discounts or early payment rewards to incentivize customers to settle invoices sooner. This can significantly impact your A/R turnover.

Tiered discounts: Consider a tiered discount structure, offering increasingly attractive benefits for earlier payments.

4. Proactive Communication is Key

Early and friendly reminders: Set up automated email or SMS reminders as invoices approach due dates. Keep the tone professional yet friendly and avoid accusatory language.

Personalize outreach: Don't rely solely on automation. Dedicate time to personalized phone calls or emails for large or overdue invoices.

5. Invest in Technology

Automated collections: Utilize software that automates late payment notifications, escalating follow-up actions, and even debt collection efforts.

Data-driven insights: Leverage analytics tools to identify trends in payment behavior and tailor your collections strategies accordingly.

6. Build Strong Customer Relationships

Transparency and communication: Foster open communication with customers regarding payment terms and expectations. Address any concerns promptly and maintain a positive relationship.

Flexible payment plans: Consider offering flexible payment plans for certain customers facing temporary financial difficulties. This can build loyalty and prevent future delays.

7. Outsource Collections (Strategically)

For complex or chronic cases: While keeping the bulk of collections in-house is often preferable, consider outsourcing complex or chronic cases to professional debt collection agencies.

Maintain control: Ensure clear communication and collaboration with any external agencies to maintain transparency and protect customer relationships.

8. Monitor and Refine

Track key metrics: Regularly monitor A/R days, average invoice age, and collection success rates. Identify areas for improvement and adjust your strategies accordingly.

Benchmark against industry standards: Compare your A/R performance to industry benchmarks to gauge your progress and identify areas for potential improvement.

9. Automate and Collaborate

In today's tech-driven world, manual tracking and tedious follow-ups are relics of the past. Leverage automation tools to streamline routine tasks like payment reminders, late fee applications, and even initial debt collection efforts. This frees up your team to focus on complex cases and cultivate positive relationships with high-value clients.

But remember, technology is simply a tool, not a magic bullet. Foster seamless collaboration between your collections team and other departments like sales and customer service. Align strategies, share valuable insights, and ensure a consistent, professional approach to resolving payment issues. By combining the efficiency of automation with the human touch of effective communication, you can create a powerful synergy that drives faster resolutions and builds lasting customer loyalty.

10. Embrace Continuous Improvement

A/R optimization is not a one-time fix. Treat it as an ongoing journey of experimentation, adaptation, and refinement. Regularly analyze your A/R data, identify patterns, and assess the effectiveness of your implemented strategies. Don't be afraid to test new approaches, adjust existing tactics, and embrace a learn-as-you-go mentality. This continuous improvement mindset ensures your A/R practices stay dynamic and evolve alongside your business, keeping you ahead of the curve and ensuring a healthy, cash-flowing future.

The Ripple Effect: Beyond the Numbers of A/R Improvement

Improving A/R days isn't just about boosting a single metric on your financial dashboard. It's about unleashing a chain reaction of positive changes that can ripple across your entire business. Let's explore the far-reaching impact of optimized A/R management:

1. Financial Stability and Growth:

Enhanced cash flow: Faster collections mean quicker access to critical capital. Use this influx to invest in new equipment, marketing initiatives, or expansion plans.

Improved profitability: Reduced A/R days translates to lower carrying costs and bad debt write-offs, boosting your bottom line. This increased profitability attracts investors and opens new financial opportunities.

Debt reduction: Freeing up cash flow allows you to pay down debt obligations faster, minimizing interest expenses and strengthening your financial position.

2. Operational Efficiency and Productivity:

Reduced workload: Streamlined A/R processes free up valuable time and resources for your finance team. They can focus on strategic tasks like financial forecasting and budgeting instead of chasing overdue payments.

Improved inventory management: Faster cash flow facilitates timely supplier payments, ensuring a consistent flow of raw materials and products. This minimizes stockouts and production delays, enhancing operational efficiency.

Boosted employee morale: Timely payments to vendors not only maintain positive relationships but also contribute to a more collaborative and efficient work environment.

3. Enhanced Customer Relationships and Retention:

Improved customer experience: Efficient payment options, proactive communication, and prompt dispute resolution foster a positive customer experience. This builds trust and loyalty, leading to higher retention rates and increased repeat business.

Reduced customer churn: By eliminating friction points in the payment process and demonstrating professionalism in collections, you minimize customer frustration and incentivize timely future payments.

Strengthened brand reputation: Efficient A/R management reflects positively on your brand image, demonstrating financial stability and professionalism. This enhances brand trust and attracts new customers.

The ripple effect of A/R improvement extends far beyond financial metrics. It touches every aspect of your business, impacting operations, customer relations, brand reputation, and ultimately, your long-term success. By prioritizing A/R optimization, you're not just addressing past due invoices; you're laying the foundation for a stronger, more resilient, and thriving future for your company.

Conclusion

The journey from invoicing to payment need not be a cumbersome battle against late payments. This blog has explored ten powerful strategies to transform your Accounts Receivable (A/R) process from a complex web into a smooth, flowing stream. From streamlining invoicing to leveraging technology, building strong customer relationships, and embracing continuous improvement, these tactics are designed to slash A/R days in half and unlock the untapped potential of your receivables.

Furthermore, the ripple effect of A/R improvement extends well beyond mere financial metrics. Enhanced cash flow not only contributes to financial stability and growth but also leads to operational efficiency, increased productivity, and a positive impact on employee morale. Improved customer relationships and retention, along with a strengthened brand reputation, showcase the profound influence of optimized A/R management.

In prioritizing A/R optimization, you're not just addressing overdue invoices; you're laying the groundwork for a more resilient and thriving future for your company. The ripple effect touches every facet of your business, ensuring long-term success in today's competitive landscape.

#revenue cycle management#revenue cycle service#revenue cycle services#Accounts Receivable (A/R) process#Accounts Receivable (A/R) optimization#Accounts Receivable (A/R) days

0 notes

Text

Tech Turbocharged: How Technology Elevates Your RCM Outcomes

The healthcare revenue cycle is a complex symphony of claims, coding, and collections, where harmony translates to financial stability and discordance wreaks havoc on your bottom line. In this delicate dance, technology has ascended from a mere accompanist to the role of conductor, wielding the baton of innovation to elevate your RCM outcomes to new heights.

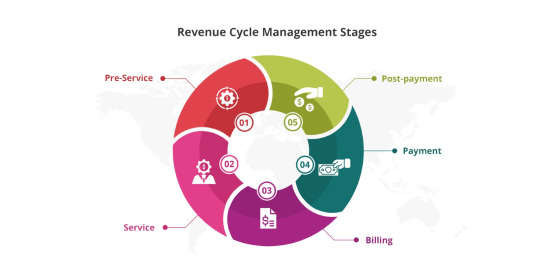

Revenue cycle management healthcare can seem like a black box, churning out claims and spitting out payments. But peering within, two distinct entities illuminate the process – revenue cycle audit and revenue cycle service. A revenue cycle audit acts as financial detectives, unearthing errors, and inefficiencies in your billing practices. They meticulously scrutinize coding accuracy, identify missed charges, and pinpoint areas for improvement. Think of them as a deep dive, uncovering hidden revenue potential and ensuring compliance with regulations.

On the other hand, a revenue cycle service is like an expert navigator, steering your financial ship through the complexities of claims submission, denials management, and patient collections. They handle the daily grind of tasks, automate processes, and ensure timely reimbursement. Think of them as ongoing partners, keeping your revenue cycle running smoothly and efficiently.

An audit offers a one-time snapshot, identifying problems and potential gains. A service provides continuous support, optimizing your daily operations and maximizing revenue. Often, the best approach is a combination of both: a periodic audit to identify vulnerabilities and ongoing service to prevent them from reappearing.

Striving for Revenue Cycle Perfection

Traditional RCM, reliant on manual processes and human intuition, is prone to its own version of off-key notes: errors in coding, missed denials, and delayed reimbursements. But enter technology, a virtuoso capable of transforming every aspect of your revenue cycle:

Precision & Accuracy: Automated coding tools minimize human error, ensuring diagnoses and procedures are translated into the right codes, the first time around. AI-powered claims scrubbing identifies discrepancies before submission, preventing rejections and costly delays.

Efficiency & Speed: Robotic process automation (RPA) tackles repetitive tasks like pre-authorizations and appointment scheduling, freeing your staff to focus on complex problem-solving and patient interactions. Streamlined data workflows eliminate tedious data entry and ensure seamless information exchange between departments.

Insights & Visibility: Advanced analytics dashboards provide real-time insights into your RCM performance, highlighting areas for improvement and potential revenue leaks. Predictive models anticipate denials and identify payment trends, empowering you to take proactive measures and optimize reimbursement rates.

Beyond Automation: The Human Touch

Technology, despite its prowess, is not a solo act. It's the catalyst enabling your RCM service partner to perform at their best. Experienced RCM providers, wielding technology as their instrument, offer:

Expertise & Guidance: Navigate the labyrinthine world of regulations and coding updates with confidence. Your RCM partner brings deep industry knowledge and ongoing compliance support, ensuring every note in your financial symphony rings true.

Scalability & Agility: Fluctuations in patient volume or sudden regulatory changes are easily absorbed with a scalable RCM partner. Their expertise and technology adapt to your needs, ensuring your revenue cycle operates at peak performance regardless of the tempo.

Strategic Collaboration: Technology fosters seamless collaboration between your team and your RCM partner. Real-time data sharing and transparent communication ensure everyone is on the same page, playing in perfect harmony towards shared financial goals.

The Final Call

Technology, in the hands of skilled RCM partners, is not just about automation; it's about orchestration. It transforms your revenue cycle from a potentially discordant performance into a masterpiece of efficiency, accuracy, and profitability. So, embrace the technological conductor, partner with an experienced RCM service, and watch your financial performance rise to a crescendo of success. Remember, in the healthcare revenue cycle, technology isn't the soloist; it's the instrument that empowers your team to perform a truly magnificent symphony.

Remember, technology alone cannot guarantee a flawlessly balanced RCM symphony. Just as a conductor requires a skilled orchestra, effective RCM demands expert human guidance. This is where experienced revenue cycle service providers step in with their revenue cycle strategies and wielding technology as their instrument and transforming complex notes of regulations, coding, and claims into a harmonious financial melody.

Think of these RCM partners as seasoned professionals, well-versed in the intricate language of healthcare finance. They act as translators, deciphering the ever-evolving codes and regulations, ensuring your financial communication with payers is clear and consistent. They become your strategic advisors, analyzing data like a virtuoso conductor interprets the score, identifying areas for improvement and fine-tuning your revenue cycle for optimal performance.

And just as in a grand orchestra, collaboration is key. Your in-house team and your RCM partner must work in perfect harmony, sharing information, leveraging technology, and responding to the unexpected changes in tempo that inevitably arise in the healthcare landscape. Together, you can navigate the dynamic melodies of denials management, address the dissonant chords of claim rejections, and ultimately achieve a crescendo of financial success.

The beauty of an RCM symphony is that it never truly ends. The final note of one claim becomes the opening note of the next. This rhythm of continuous improvement necessitates ongoing audits, playing the role of critical reviews that refine the performance and identify areas for further tuning. Just as a conductor revisits a piece after each performance, so too should RCM audits provide regular feedback, ensuring your financial orchestra continues to deliver its masterpiece with ever-increasing precision and brilliance.

So, embrace the technological evolution, partner with skilled RCM services; and don’t forget that in the healthcare revenue cycle, the ultimate composition is one of collaboration, innovation, and a commitment to continuous improvement. With these elements in place, your financial performance will rise to a truly awe-inspiring crescendo, not just in this act, but for the entire grand opera of healthcare revenue cycle management.

This expanded conclusion builds upon the original message by highlighting the crucial role of RCM service providers, collaboration, and continuous improvement in achieving RCM harmony. It references revenue cycle audits as valuable tools for ensuring ongoing financial success and concludes with a powerful metaphor that reinforces the importance of a holistic approach to RCM management. Feel free to customize it further with specific examples or statistics relevant to your audience for maximum impact.

#rcm#revenue cycle management#revenue cycle service#revenue cycle services#healthcare revenue cycle management#revenue cycle

0 notes

Text

The Importance of Data Analytics in Revenue Cycle Management

Data analytics plays a critical role in revenue cycle management by providing valuable insights and identifying patterns in financial data. It helps healthcare organizations to streamline their revenue cycle processes, reduce billing errors, improve cash flow, and optimize revenue. By leveraging data analytics in revenue cycle management, healthcare providers can track key performance indicators, identify potential revenue leakage points, and take proactive measures to avoid revenue loss. In short, data analytics is essential for any healthcare organization looking to optimize their revenue cycle management and stay competitive in the dynamic healthcare industry.

#revenue cycle solutions#revenue cycle solution#revenue cycle management#revenue cycle management solutions

0 notes

Text

Understanding the Medical Billing Process

Medical billing process refers to the process of submitting and following up on claims with health insurance companies in order to receive payment for services rendered by healthcare providers. It is a complex and time-consuming process that involves several steps, from gathering patient information to submitting claims to insurance companies and following up on those claims to ensure payment.

The process begins with the patient's visit to a healthcare provider, where the provider gathers all necessary information related to the services provided, including diagnosis, treatments, and other pertinent details. The provider then creates a medical claim that includes all relevant information related to the services rendered.

Once the claim has been created, it is submitted to the patient's insurance company for payment. The insurance company will then review the claim to determine if the services provided are covered under the patient's insurance plan. If the claim is approved, the insurance company will issue payment to the healthcare provider.

However, if the claim is denied, the healthcare provider must follow up with the insurance company to determine the reason for denial and work to resolve any issues that may be preventing payment. This can be a time-consuming process that requires a great deal of expertise and attention to detail.

Many healthcare providers choose to outsource their medical billing to third-party companies that specialize in this area. Outsourcing medical billing can provide a number of benefits, including increased efficiency, reduced administrative costs, and improved accuracy and timeliness of payment. Additionally, outsource medical billing can free up valuable time and resources for healthcare providers, allowing them to focus on providing high-quality care to their patients.

#medical billing outsource#outsource medical billing services#medical billing outsourcing services#outsourced medical billing

0 notes

Text

Medicare prior authorization is needed for hospitals and clinics to bill for services. Get instant approval with our expert pre-authorization team.

#revenue cycle solutions#medical coding service#outsourced medical billing#patient eligibility verification#medicare prior authorization

0 notes

Text

Patient eligibility verification is a process which detects an inconsistency in the information that was provided at the time of registration to determine if a patient qualifies for healthcare.

#revenue cycle solutions#medical coding service#outsourced medical billing#patient eligibility verification#medicare prior authorization

0 notes

Text

Let us do the work for you! Medical billing can be a confusing and difficult process, but we make it easy. Outsourced medical billing lets you focus on your practice while our team takes care of the paperwork.

#revenue cycle solutions#medical coding service#outsourced medical billing#patient eligibility verification#medicare prior authorization

0 notes

Text

Medical coding services clear up all the confusion of medical billing. We specialize in the tedious, time-consuming task of medical coding for hospitals and clinics to give them more time for patient care.

#revenue cycle solutions#medical coding service#outsourced medical billing#patient eligibility verification#medicare prior authorization

0 notes

Text

Doctors and hospitals can't afford to waste money on inefficient revenue cycle management. That's where we come in. Our experts analyze your current processes and provide creative revenue cycle solutions. We do all the hard work - you get savings!

#revenue cycle solutions#medical coding service#outsourced medical billing#patient eligibility verification#medicare prior authorization

0 notes

Text

Medicare Prior Approval Process and How It Can Help Your Practice

Medicare prior approval is a process that helps Medicare specialists make decisions about coverage for specific types of treatments and surgeries. By getting Medicare prior approval, your practice can ensure that you are reimbursed by Medicare for the cost of these treatments and surgeries. This process can be helpful in several ways:

First, it can help to avoid unnecessary delays in treatment. If your treatment is not covered by Medicare, then it may take longer for you to receive reimbursement from another payer. In some cases, this delay could prevent your patients from receiving needed care.

Second, prior approval can help to ensure that your patients receive the best possible care. If a treatment is not covered by Medicare, then you may have to choose between providing the treatment and revenue or providing the best possible care and risking revenue. Prior approval allows you to provide the best possible care without having to make this difficult choice.

For More Info Visit:- https://www.jindalhc.com/patient-access/

#revenue cycle solutions#medical coding service#outsourced medical billing#revenue cycle service#patient eligibility verification#medicare prior authorization

0 notes

Text

Different Stages of the Patient Eligibility Verification Process

In order to be accepted into a hospital, patients must undergo a series of patient eligibility verification processes. The first step is obtaining medical insurance information. Hospitals will then contact the insurance company to confirm that the patient is covered for treatment and to obtain any necessary paperwork. If the patient does not have insurance or if their coverage does not cover the specific type of care they need, the hospital may require them to purchase private health insurance. Once the insurance information is confirmed, the hospital will determine whether or not the patient is eligible for care. This process may include checking for prior medical conditions, verifying income and resources, and confirming addresses. After eligibility is verified, hospitals will create an admission plan and send it to the patient and their doctor.

For More Info Visit:- https://www.jindalhc.com/patient-access/

#revenue cycle solutions#medical coding service#outsourced medical billing#revenue cycle service#patient eligibility verification#medicare prior authorization

0 notes

Text

How to Boost Revenue with Revenue Cycle Management

Revenue cycle management (RCM) is a process that helps organizations generate the most revenue from their products and services. RCM helps improve customer satisfaction, reduces waste, and accelerates revenues.

Improved customer satisfaction is the result of a well-managed RCM process. Customers feel confident that they are being listened to and that their concerns are being taken seriously. This leads to increased sales and better overall business performance.

For More Info:- https://www.jindalhc.com/

#revenue cycle solutions#medical coding service#outsourced medical billing#revenue cycle service#patient eligibility verification#medicare prior authorization

0 notes

Text

Ways Outsourced Medical Billing Can Improve Your Practice

One way to improve your medical billing practices is to outsource the work to a reputable third-party billing company. These companies have years of experience handling hospital and doctor bills, and are likely to provide you with accurate and timely payments. They will also be able to provide you with tips on how to improve your billing skills.

If you decide to outsource your medical billing duties, be sure to choose a company that has a good reputation in the industry. Look for companies that have been in business for several years, have a strong customer base, and offer customer service that is second to none.

For More Info:- https://www.jindalhc.com/coding-billing/

#revenue cycle solutions#medical coding service#outsourced medical billing#revenue cycle service#patient eligibility verification#medicare prior authorization

0 notes

Text

How Medical Coding Is Used by Doctors to Help Classify Different Types of Illness and Injury

Medical coding is a process that doctors use to categorize different types of illness and injury. This helps them to better understand the patient's medical history, and to document each episode of illness or injury in a specific way.

There are many different codes that medical professionals use, and each one has its own specific purpose. Some codes help to identify the type of illness or injury that a patient is suffering from, while others indicate the stage of the disease or injury. In some cases, all that is required is a code number alone.

For example, if a doctor needs to know the type of surgery that was performed on a patient, they would look for an operation code. If they want to know more about the surgery itself, they might also search for information about the type of anesthesia used or the surgical equipment used. The codes can be complicated, but they are essential for accurately documenting patient care. By understanding how medical coding works, doctors can better ensure that their patients receive the best possible treatment.

For More Info:- https://www.jindalhc.com/coding-billing/

#revenue cycle solutions#medical coding service#outsourced medical billing#revenue cycle service#patient eligibility verification#medicare prior authorization

0 notes

Text

How to Improve Patient's Experience with Revenue Cycle Solutions

Some tips for improving patient engagement with revenue cycle solutions include:

1. Make it easy for patients to find information about their finances and health care. Provide simple, easily accessible tools and information on your website, in your marketing materials, and in your communication channels with patients. Patients should be able to find all the information they need without having to search through multiple places.

2. Involve patients early in the process. Let them know what services are being offered, how much money they may be able to save, and when payment plans will be available. This way, patients can make informed decisions about their care and can feel more engaged in their treatment.

3. Make sure your systems are working as intended. If there are any errors or problems with your RCM solution, take steps to address them as soon as possible so that patients’ experiences aren’t affected. Make sure all payments are processed properly so that patients receive the funds they deserve promptly and accurately.

For More Info:- https://www.jindalhc.com/

#revenue cycle solutions#medical coding service#outsourced medical billing#revenue cycle service#patient eligibility verification#medicare prior authorization

0 notes

Text

Why Is It Important to Verify Patient Eligibility

There are a number of reasons why it is important to verify patient eligibility.

The first reason is that not all patients who appear to be eligible actually need the level of care they are seeking. For example, a patient with a fever may be seeking medical attention, but they do not actually need antibiotics or other treatment. Verifying eligibility helps ensure that patients receive the best possible care based on their specific needs and situation.

Another reason why it is important to verify patient's eligibility is because some people may try to abuse the system by falsely claiming to be eligible for care. By verifying eligibility, health providers can avoid providing unnecessary or inappropriate treatments to these types of patients.

For More Info Visit :- https://www.jindalhc.com/patient-access/

#revenue cycle service#revenue cycle solutions#revenue cycle management company#medical billing outsource#medical coding service#patient eligibility verification

0 notes

Text

Why Medical Coding Services Might Be the Solution for Medical Practices

Medical coding services can help medical practices streamline their data and improve their overall efficiency. By providing a system for tracking and categorizing information, coding services can help doctors and nurses more easily identify and track important health information. Additionally, coding services can help practices comply with government regulations, such as the Health Insurance Portability and Accountability Act (HIPAA). In addition, coding services can also help medical practices reduce costs associated with healthcare administration.

For More Info Visit :- https://www.jindalhc.com/coding-billing/

#revenue cycle service#revenue cycle solutions#revenue cycle management company#medical billing outsource#medical coding service#patient eligibility verification

0 notes