Insignia commenced operations in 1996 as a travel-related service and payment card provider. They have since grown into an all-encompassing luxury lifestyle management group with a global presence.

Don't wanna be here? Send us removal request.

Text

Insignia Group of Companies | Insignia SuperCard | The ultimate credit card for the world’s true Super Rich

The Insignia Group of Companies (IGC) has announced that it will soon release a payment card to out-rank all others. The Insignia SuperCard will be available only to the world’s Ultra High Net Worth Individuals. It goes without saying that the card will be issued on an invite only basis.

The SuperCard’s unrivaled perks aren’t just a collection of superior benefits; they are the gateway to a life of pure privilege and luxury, a world where everything is taken care of - from finance, to operations, to leisure. It’s a world where almost anything is possible.

Nada Von Bader, Vice President at Insignia comments “The company’s mantra is ‘to go to the ends of the earth to fulfill a customer’s requests’. We really do live by that and this new card is its ultimate expression.”

She adds “From investments in prime real estate, to a collection of Birkin bags, to tickets for Elton John’s White Tiara Ball, we make it happen for our card holders. Crucially, we build a level of trust that allows us to be totally involved with a client’s life and take care of everything.”

Insignia’s aim is that every need, every whim and every desire of a cardholder is not just catered for but anticipated. Lifestyle or life insurance, taxi or tax advisory; a team dedicated to each member takes care of everything. There are certainly no foreign call centres for SuperCard holders.

Since founded 16 years ago by Michael Surguladze, Insignia has built a unique network of affiliates and partners who represent the world’s most desirable luxury brands, best-in-class service providers and event organisers. These relationships are leveraged for their clients on an individual basis.

SuperCard members might walk the red carpet at film premieres, receive complementary fittings for tailored suits on Savile Row and Fifth Avenue, enjoy private jets to Caribbean island hideaways and have access to restricted fashion previews and celebrity parties. And if none of that appeals? Insignia will work on a unique package of benefits that does.

Surguladze says “Arguably no other card provider has the infrastructure or the contacts to do what we do to the level that we do it. Our service goes far beyond anything on the market.”

As you might expect from a card only available to the world’s richest, there is no spending limit on the Insignia SuperCard. Produced in association with one of the major payment systems, it can be used anywhere.

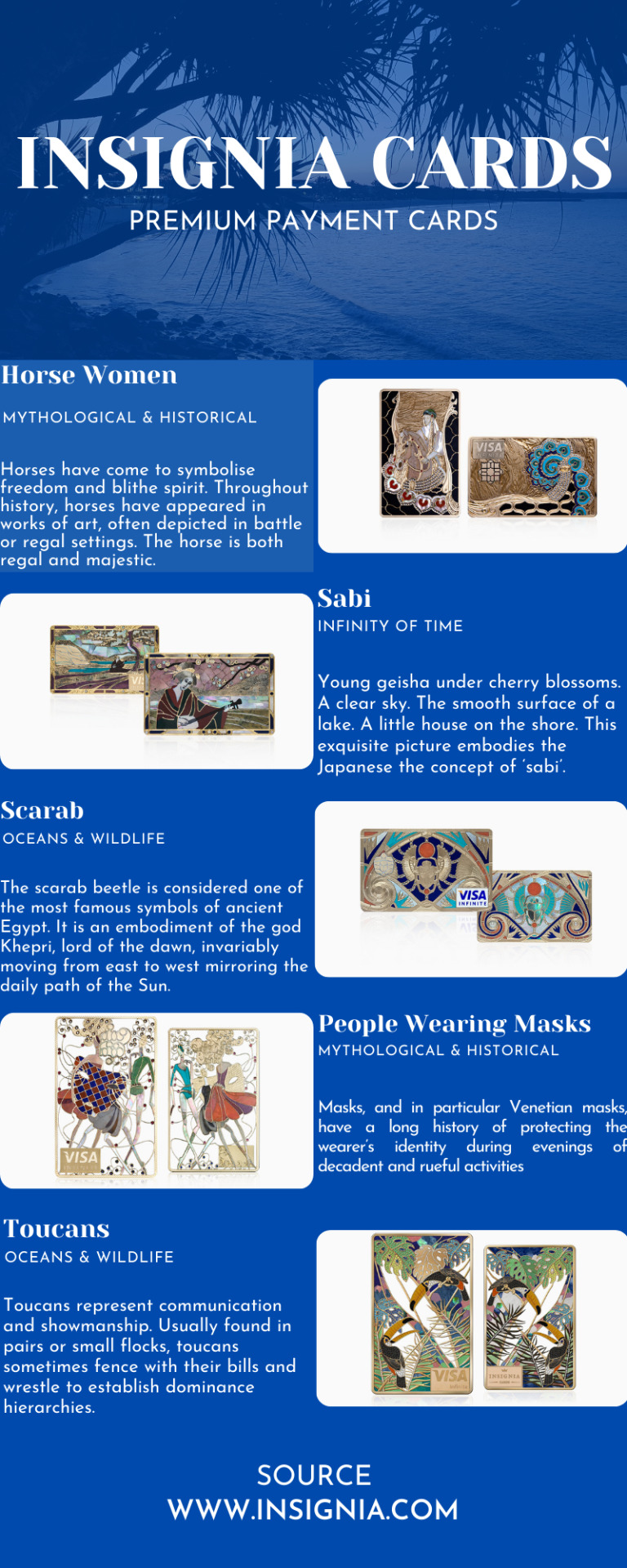

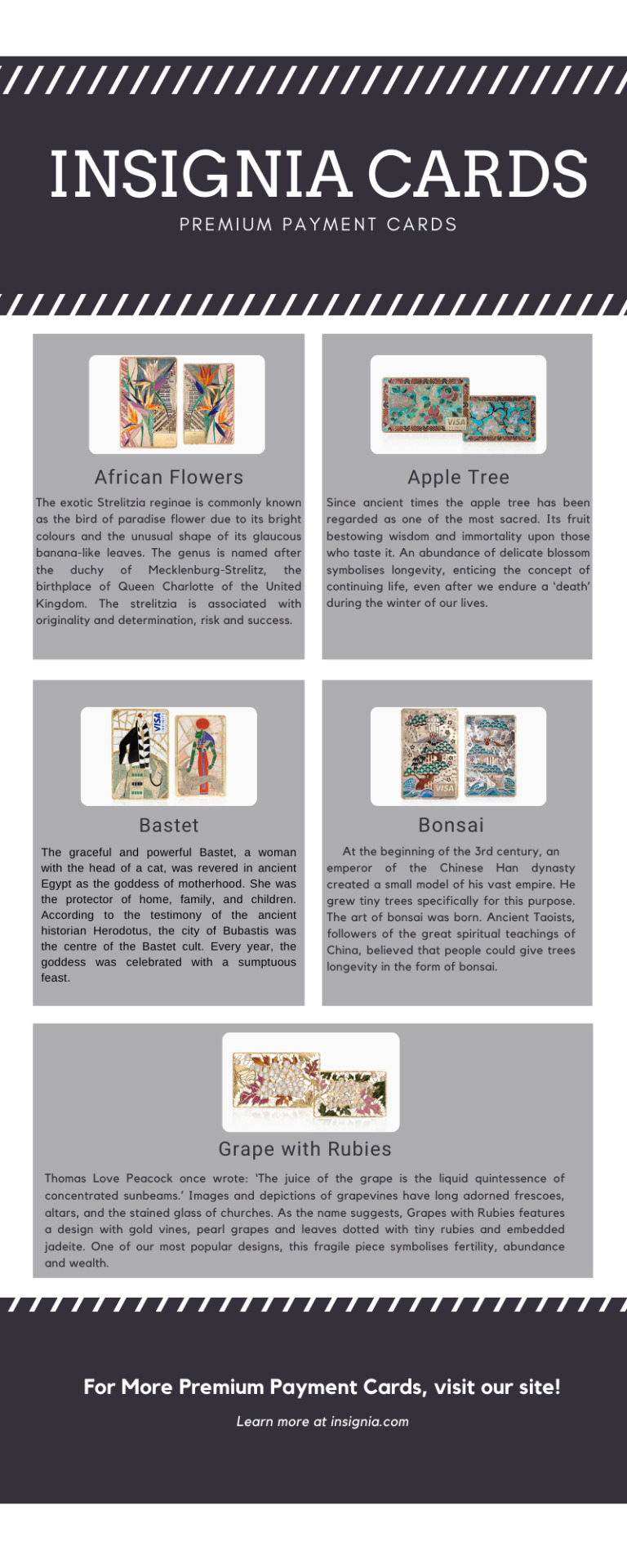

Each card will be a work of art. Individually crafted to the client’s specifications, renowned designers and jewelers will use precious woods, bone, rocks, corals, pearls and faceted jewels.

But how can Insignia cards provide such a dream service? There are three main elements which ensure the Insignia Group of Companies can deliver on its promise to SuperCard holders.

The Insignia Committee

The Insignia Committee consists of an entire team dedicated to one client. The three direct contacts include a Luxury Expert PA, a General Medical Practitioner and a Personal Finance Manager. Each contact provides a comprehensive service within their area.

Client Alignment

SuperCard members undergo a consultation to ascertain a complete picture of their lifestyle and requirements. By fully understanding a client’s tastes, work commitments, health, interest, travel preferences and investments the Insignia Committee can provide a set of benefits that are entirely tailored to the individual and adapted as their life changes.

Limited Membership

Membership will be capped in order to maintain exclusivity and give complete personal attention. Members will be treated as friends opposed to customers, a relationship of trust is essential for such a personalized service.

Boiler Plate

Insignia is the world’s only high-end lifestyle management group that offers bespoke financial and luxury lifestyle services to Ultra High Net Worth Individuals across the globe.

Founded in 1996, Insignia currently has offices in New York, London, Vienna, Montreal, Dubai, and Moscow, with plans to open offices in other capital cities.

Insignia Cards offers its members financial freedom and security through a spectrum of financial services, including a line of credit cards, secure online banking, secure telecoms services and a rewards program.

Lifestyle management facilities give members access to some of the world’s most opulent hotels, exotic travel destinations, high class restaurants and top fashion brands – virtually no request is impossible. Clients can enjoy round-the-clock access to Insignia’s full range of services every day of the year.

#Insignia Cards#loyalty rewards with insignia#paying insurance premium with credit card#insurance premium credit card#lifestyle management companies#lifestyle management concierge services#Luxury lifestyle management#Lifestyle Management Services#Lifestyle Management

0 notes

Text

Insignia Cards Launches New Payment Card for Health-conscious High Net Worth Individuals

High Net Worth Individuals Can Now Contribute To the Wellbeing of Children Through the Innovative Insignia Wellness Card.

Insignia, the leading international luxury lifestyle management and financial services brand, announced the launch of the Insignia Wellness Card at The Card and Payments Awards, held at The Grosvenor House on 1st February 2018. The Insignia-issued Visa card provides high net worth individuals an unprecedented way to contribute to the NSPCC, making a diffThe Insignia Wellness Card is an all-encompassing Visa payment tool, designed to support clients on their lifelong journey to optimised health and longevity. Each Card is issued with a 24/7 dedicated Personal Assistant, a Wellness Expert, premium international health insurance and priority access to the world's best spas, clinics and health professionals.

Through spend on the Insignia Wellness Card, each client will be contributing to donations for the NSPCC.

"For many of our clients, health and wellbeing is a fundamental part of their everyday lives," Nada Tucakov, Chief Customer Officer at Insignia. "But we know they also care deeply about the world around them and are looking for ways to use their wealth for the greater good."

Tucakov continues, "The Insignia Wellness Card will enable our clients to invest in their own wellbeing and at the same time help raise vital funds to support the NSPCC in achieving its mission that every childhood is worth fighting for."

Research from the Global Wellness Institute estimates that the international wellness industry has grown considerably in recent years. The research shows that between 2013 and 2015, the industry has grown by 10.6% reaching approximately $3.72 trillion.

Based on the industry research and client demand to fulfil health and wellbeing requests, Insignia took the opportunity to develop the unique product, combining health, lifestyle and wealth.

Additionally, there is an option for clients to carry the Insignia Jewellery Card as their main payment instrument and the Insignia Wellness Card as its companion. The Insignia Jewellery Card is a stunningly original Visa card. Created from 14-carat gold, each piece can be decorated with precious gemstones and inlaid with the highest quality materials; a synergy between information technology and high jeweller's craftsmanship.

"The Insignia Jewellery Card is, without doubt, the world's premium luxury card collection," said Insignia CEO Michael Donald. "Every card in the collection is something to be treasured - an investment for life and an heirloom to be passed from generation to generation."

"As with everything at Insignia, we pay the very highest attention to detail. And this luxury card collection really is for those individuals who demand and appreciate the very best for themselves and the ones they love."

Insignia has a set of designs for individuals to choose from or they may customise the card to their own taste, ensuring an incredibly unique personal piece. Furthermore, each card comes with a tailored lifestyle management service and a range of financial benefits.

About Insignia

Founded in 1996 as a travel-related services and third-party payment card provider, Insignia has more than 21 years' experience in servicing the needs of high and ultra-high net worth individuals.

Insignia Cards has evolved into an all-encompassing luxury lifestyle management group with a global presence, developing a portfolio of the world's most desirable premium and superpremium payment cards.

Created to simplify the complexities of modern life, our rare and exclusive service delivers a new level of financial freedom and effortless living.

erence to the wellbeing of children in the United Kingdom.

#InsigniaCards#Insignia Cards#lifestyle management concierge services#Luxury lifestyle management#lifestyle management companies#Lifestyle Management#Lifestyle Management Services

0 notes

Text

X Infotech implements in-house EMV card issuance for Insignia Cards in Malta

X Infotech, the leading system integrator and developer of premium solutions for issuance and management of smart cards, has deployed a reliable solution for EMV card issuance and secure PIN management for Insignia Cards. With their operations centre based in Malta, Insignia Cards offers an array of premium financial payment services and luxury lifestyle management to individuals and businesses internationally.

In order to increase product volumes and enhance business growth, Insignia Cards defined a new strategic approach to switch from the outsourced card issuance service to an in-house issuance platform.

To deliver a turnkey solution, Insignia Cards selected X Infotech – the company with unrivalled expertise and global references in the implementation of smart card projects. The project entailed EMV Data Preparation, reliable personalization of contact VISA cards and generation of PINs within a protected environment. An extended portfolio of services such as integration, project management and consultancies on preparation for VISA certification supported the success of X Infotech’s role.

X Infotech’s solution will optimize Insignia Cards’ banking operations in addition to improving the card issuance performance. The new card issuance system will enable Insignia Cards to expand their product portfolio and geographic area of business, thus gaining access to new markets.

Insignia Cards selected the X Infotech solution based on their unrivalled global expertise in the provision of EMV card issuance solutions,” said Jurate Kajackiene, Chief Operations Officer, Insignia Cards Limited, Malta. “With local on-time support and training from X INFOTECH, Insignia Cards has successfully migrated to in-house card issuance which means that we will be able to grow our business and expand the market share.

We were committed to improve card issuance services for Insignia Cards,” said Vadim Tereshko, Business Development Director, X Infotech. “We are pleased that X Infotech has established a fruitful, new partnership that has resulted in the enhancement of our business strategies, to support company growth and continued delivery of the highest level of customer services.

About Insignia Cards

For almost 20 years, Insignia has been setting the ultimate standard in payment cards, financial services and lifestyle management, allowing their clients to enjoy their wealth on their terms. Insignia Cards has worked to provide an array of card products that provide financial freedom, customized benefits and security. Through the innovation of technology, our Cards will ensure a new level of service standards, both digitally and in terms of customer care services provided. Insignia is a global luxury lifestyle management service group. Insignia has now also established itself as a financial institution providing Card products and services to clients in Malta and other European countries.

#Insignia Cards#loyalty rewards with insignia#insurance premium credit card#paying insurance premium with credit card#lifestyle management concierge services#lifestyle management companies#Luxury lifestyle management#Lifestyle Management Services#Lifestyle Management

0 notes

Text

Insignia Launches New Payment Card for Health-conscious High Net Worth Individuals

Insignia, the leading international luxury lifestyle management and financial services brand, announced the launch of the Insignia Wellness Card at The Card and Payments Awards, held at The Grosvenor House on 1st February 2018. The Insignia-issued Visa card provides high net worth individuals an unprecedented way to contribute to the NSPCC, making a difference to the wellbeing of children in the United Kingdom.

The Insignia Wellness Card is an all-encompassing Visa payment tool, designed to support clients on their lifelong journey to optimised health and longevity. Each Card is issued with a 24/7 dedicated Personal Assistant, a Wellness Expert, premium international health insurance and priority access to the world's best spas, clinics and health professionals.

Through spend on the Insignia Wellness Card, each client will be contributing to donations for the NSPCC.

"For many of our clients, health and wellbeing is a fundamental part of their everyday lives," Nada Tucakov, Chief Customer Officer at Insignia. "But we know they also care deeply about the world around them and are looking for ways to use their wealth for the greater good."

Tucakov continues, "The Insignia Wellness Card will enable our clients to invest in their own wellbeing and at the same time help raise vital funds to support the NSPCC in achieving its mission that every childhood is worth fighting for."

Research from the Global Wellness Institute estimates that the international wellness industry has grown considerably in recent years. The research shows that between 2013 and 2015, the industry has grown by 10.6% reaching approximately $3.72 trillion.

Based on the industry research and client demand to fulfil health and wellbeing requests, Insignia took the opportunity to develop the unique product, combining health, lifestyle and wealth.

Additionally, there is an option for clients to carry the Insignia Jewellery Card as their main payment instrument and the Insignia Wellness Card as its companion. The Insignia Jewellery Card is a stunningly original Visa card. Created from 14-carat gold, each piece can be decorated with precious gemstones and inlaid with the highest quality materials; a synergy between information technology and high jeweller's craftsmanship.

"The Insignia Jewellery Card is, without doubt, the world's premium luxury card collection," said Insignia CEO Michael Donald. "Every card in the collection is something to be treasured - an investment for life and an heirloom to be passed from generation to generation."

"As with everything at Insignia, we pay the very highest attention to detail. And this luxury card collection really is for those individuals who demand and appreciate the very best for themselves and the ones they love."

Insignia has a set of designs for individuals to choose from or they may customise the card to their own taste, ensuring an incredibly unique personal piece. Furthermore, each card comes with a tailored lifestyle management service and a range of financial benefits.

About Insignia Cards

Founded in 1996 as a travel-related services and third-party payment card provider, Insignia has more than 21 years' experience in servicing the needs of high and ultra-high net worth individuals.

Insignia has evolved into an all-encompassing luxury lifestyle management group with a global presence, developing a portfolio of the world's most desirable premium and superpremium payment cards.

Created to simplify the complexities of modern life, our rare and exclusive service delivers a new level of financial freedom and effortless living.

#Insignia Cards#insigniaCards#insurance premium credit card#paying insurance premium with credit card#loyalty rewards with insignia#Insignia Card#lifestyle management concierge services#Luxury lifestyle management#lifestyle management companies#Lifestyle Management Services#Lifestyle Management

0 notes

Photo

After commencing operations in 1996 as a travel-related service and payment card provider, we have since grown into an all-encompassing global luxury consultancy service. We have constructed a 360-degree offering which is tailored and bespoke to the needs of each member, who has 24/7 access to our dedicated in-house lifestyle team.

0 notes

Text

Crimsonwing implements Microsoft Dynamics NAV 2013 at Insignia Cards

Crimsonwing, the leading IT Solutions Company in Malta, announced the successful implementation of Dynamics NAV ERP solution at Insignia Cards Limited, fully configured to meet the electronic commerce and financial processing software requirements of the client.

Insignia, founded in 1996, is the world’s finest and only bespoke high-end lifestyle management group that offers financial and luxury lifestyle management services to ultra-high net worth individuals predominantly in Europe, as well as the US and Asia, through a range of credit cards. Insignia Cards Limited, a financial institution licensed and regulated by the Maltese Financial Services Authority, launched the YES Money Card - a credit card and a personal loan combined in one – that can be used exclusively at local YES net merchants, and which offers clients the ability to split the repayments of specific purchases in equal monthly instalments up to 36 months. Insignia Cards Limited also offers a range of VISA Cards locally and will be launching further credit cards in the near future.

Insignia Cards Limited, operating from their offices in Portomaso, had approached Crimsonwing for a robust Enterprise Resource Planning (ERP) solution that needed to be fully integrated with their credit card management system of third party software. The system would reliably manage all facets of their clients’ transactions, whilst also facilitating processes involved in operating a 24/7 call centre.

Crimsonwing thus implemented a customised financial management module for day-to-day business operations at Insignia. This module handles account receivables and account payables transactions using the integration with the third party software, whilst posting to general ledger according to rules defined in Microsoft Dynamics NAV. Additional reporting currency was introduced to facilitate the presentation of final accounts to the board of directors and local authorities.

Microsoft Dynamics NAV cash management functionality was further enhanced to meet SEPA Direct Debit (SDD) and SEPA Credit Transfer (SCT) layout and data regulations. Furthermore, the drawing of final accounts, dimensional analysis and other standard NAV 2013 functionality and reports were perfectly suited to meet Insignia’s needs.

Crimsonwing also provided Insignia with a bespoke customer relationship management module designed around their particular call centre needs for the YES Money Card and all other credit cards that the company offers. This module records enquiries and provides information to customers depending on their individual security levels.

Stephen Abela, Head of Dynamics at Crimsonwing commented, “Microsoft Dynamics NAV 2013, with its various modules including bank management, financial management and customer relationship management, proved the ideal solution to fit Insignia’s requirements. Crimsonwing’s professional consultants and developers have managed to deliver a bespoke solution to Insignia to help them successfully run and grow their business locally and internationally.”

Insi

Ephrem Pisani, Chief Information Officer at Insignia Cards Limited said, “We have our mind at rest that with Dynamics NAV solution, which Crimsonwing implemented for our banking needs, especially with the launch of our YES Money Card, all our ERP requirements for timely and secure data, are fully supported.”

#Insignia Cards#InsigniaCards#lifestyle management and concierge services#concierge and lifestyle management#luxury lifestyle management companies#luxury lifestyle manager#lifestyle management companies

0 notes

Text

Insignia Cards - High net worth Dubai benefits local businesses

Dubai’s status as a high-end destination is set to attract a growing number of high net-worth individuals over the next five years, and local businesses are set to reap the financial benefits of their presence.

According to The Wealth Report, produced annually by Knight Frank in conjunction with Citi Private Bank, the distribution of the world’s super-rich is shifting. The report, which was released earlier this year, says the UAE will see a 25 per cent increase in the number of centa-millionaires — those with at least $100 million in liquid assets — by 2016.

As a result, local companies across a range of sectors are drawing up strategies and releasing products to capitalise on the rising number of rich individuals living and working in the UAE. From airlines to credit card companies to hotels, everybody wants to be involved in this lucrative segment.

One company that is seeking to expand its presence in the UAE is Insignia Cards Lifestyle Management, which caters for the “elite echelons of high society”. It has offices in major cities across the globe and is now working with local UAE lenders with a view to introducing a new range of ‘super’ credit cards that are embellished with precious woods, bone, rocks, corals, pearls and faceted jewels. The company says it has developed strategic alliances with leading financial institutions worldwide and that it is currently negotiating collaboration with top banks in the UAE.

“These cards are bespoke and we have been working on them for a very long time. We are in a test phase and they are currently available to very few clients,” said Nada Tucakov, vice-president of Insignia Lifestyle Management.

“We will be targeting both Emiratis and expatriates but we would only deal with those who have more than £30 million (Dh 177.9 million) in assets. The UAE is an important market for us but we expect clients there to fit a similar profile to those we already deal with,” she added.

The new cards can also be embellished with gold, platinum, diamonds and marble while holders enjoy unlimited spending power and 120 days interest free credit.

“When you look at high net-worth individuals, you see they want something unique and bespoke. They are an extension of their existing cards; an accessory that a high net-worth individual might possess,” Tucakov said.

“They spend quite a lot of money on beautiful jewellery so we want to offer them a card that can be part of their wallet/purse. It all depends on the individual profile but there will be a certain limitation for security reasons but we will make sure the client does not feel those limitations,” she added.

With 2,000 of the estimated 23,000 new centa-millionaires of the next five years predicted by the report to be coming from the Middle East and Africa, Dubai is in an ideal location to take advantage as other cities in the region continue to be affected by political uncertainty.

Visa, one of the main sponsors of the Dubai Shopping Festival revealed earlier this year that total card spend in the UAE between January 5 and February 5 amounted to $497 million (Dh1.82 billion), a year-on-year rise of 22 per cent compared to 2011’s DSF. Russians, Saudis, British, Chinese and Americans were named as the top spending nationalities during the month-long event.

More than a million Russians jetted in for the event, spending a record $122.6 million on their Visa cards — a 356 per cent increase on 2011. Airlines have been quick to react to specific spending trends with commercial carriers such as Emirates and Etihad expanding their reach into Russia and China in recent years.

In its latest report, released last week, Visa said account holders from the United States, Russia and the United Kingdom spent a total of $1.2 billion on Visa debit and credit cards during 2011 — almost a third (29.7 per cent) of total tourism spend in the UAE.

The UAE’s business aviation sector is also witnessing unprecedented demand.

“Lately, we have seen a considerable growth in demand for charter flights,” said Ali Al Naqbi, founding chairman of the Middle East Business Aviation Association. “Regional charter operators have confirmed receiving a significant number of RFQs (request for quotations),” he added.

Al Naqbi says the majority of business aviation customers in the Mena region are middle-management personnel who require the service for work purposes. However, he said high net worth individuals play a significant role in the growth of the market.

“Furthermore, regional business aviation operators have placed a number of sale orders for second hand as well as new business aviation aircrafts. Additionally there has been a noticeable increase in business aviation flight movements within the UAE’s airports,” he said.

Hotels are also taking advantage of the increasing number of high net-worth individuals visiting and investing in the UAE. In a bid to make Chinese visitors more comfortable, Ibn Battuta Gate Hotel has introduced Mahjong, a table game originating in China.

International travel by Chinese people has remained buoyant in the face of a global tourism downturn, in part thanks to China’s more rapid rebound from the economic slump,” said Tong Wu, sales manager at Ibn Battuta Gate Hotel. “The UAE appears to be enjoying a growing profile, and Dubai in particular has become better known since the opening of the Burj Khalifa,” she added.

Wu says Dubai Tourism and Commerce Marketing (DTCM) organises seminars at which representatives from UAE hotels and airlines can meet Chinese travel agents. “Among the new targets — cities such as Tianjin, near Beijing, and Shenyang in the north-west — these gatherings help tour operators strike more competitive deals with UAE hotels and airlines,” she said.

“There are huge opportunities for Chinese investment in the UAE, especially in the energy sector. What is required at this stage is to promote those opportunities through an enhanced collaboration between the UAE and Chinese business community,” she added.

#Insignia Cards#paying insurance premium with credit card#insurance premium credit card#loyalty rewards with insignia

0 notes

Photo

A desirable portfolio of super-premium and premium payment cards. For business or for the individual

0 notes

Text

Insignia Cards - Lifestyle Management Services | Loyalty Rewards with Insignia

Insignia group consists of a number of registered businesses.

Insignia Cards Limited – a provider of financial services, is the card issuing arm. It was incorporated in 2011 in Malta and is a holder of an e-money licence. It is regulated by the Malta Financial Services Authority

Insignia Lifestyle Boutique Limited is the primary lifestyle arm, which renders luxury lifestyle management and concierge services globally. It was incorporated in 2002 in the UK.

Insignia Global Solutions Limited is a provider of management services and ancillary services. It was incorporated in 2010 in Hong Kong.

Insignia USA Holdings LLC is the lifestyle service provider for the US market. It was incorporated in 2018 in New York.

Insinet Limited is the primary IT arm and services various Insignia-branded entities. It was incorporated in 2018 in Malta.

Insignia, the luxury financial and lifestyle management group is leading the luxury revival globally

Is there a place for supreme luxury in the post COVID era? 2020 has been labelled as the worst year for modern luxury, however the industry shows an enduring resilience. Despite 2020, Insignia, the world’s leading luxury financial and lifestyle management group, has a positive stance on the matter. Throughout 2020 Insignia Cards has weathered COVID to become stronger than ever.

The value proposition of Insignia’s membership has only been cemented post-COVID. Insignia offers a supremely high-level of service - it is not a reactive service, but fundamentally based on a real one-to-one relationship with each member, which allows for hyper-personalization. Hyper-personalization in the luxury market is key to its evolution and development, this has never been felt more keenly than in the post-COVID landscape. Each person and situation is different, therefore each client is valued. The future of luxury will center around creating experiences that consider those differences — in memorable ways. Insignia is a boutique company in the true sense of the word, with every solution built for each individual client.

Insignia offers the best of both worlds, combining the highest level of management, paired with the most convenient payment solution for ultra-high-net-worth clients. With high net worth individuals trust is an important factor, Insignia have proven that they make the impossible possible for their members, therefore gaining their trust, even during tumultuous periods.

In a post-COVID world the discretion of Insignia is noteworthy – as millions globally continue to struggle financially due to the crisis, privacy and discretion have become commodities in themselves.

The Jewelry Card Collection is a flagship product of Insignia’s portfolio - a product that is exclusive to Insignia and one that has proven stand-out to high-net-worth individuals in the region. The premium payment cards handcrafted by swiss artisans are designed for individuals who demand and appreciate only the finest in personalised premium quality. Insignia’s stunningly original jewellery pieces are an investment for life – each piece within the collection is a true work of art. Those approved for the card can meet with a designer to create a customized card for every personality and taste. Client’s holding a jewelry card will benefit from Insignia’s industry-leading 98 per cent success rate on cardmember requests and a dedicated personal assistant, available 24/7.

#Insignia Cards#lifestyle management and concierge services#concierge and lifestyle management#luxury lifestyle management companies#luxury lifestyle manager#lifestyle management companies#lifestyle management#lifestyle management concierge services

0 notes

Link

#Insignia Cards#paying insurance premium with credit card#insurance premium credit card#loyalty rewards with insignia

0 notes

Link

After commencing operations in 1996 as a travel-related service and payment card provider, we have since grown into an all-encompassing global luxury consultancy service. We have constructed a 360-degree offering which is tailored and bespoke to the needs of each member, who has 24/7 access to our dedicated in-house lifestyle team.

0 notes

Text

Insignia Cards - Luxury lifestyle-management and Financial Services Group

Insignia was founded as SBS World Services in 1996 as a travel and travel related services company. It was rebranded as ‘Insignia Global Solutions’ in 2009.

In 1997, Insignia entered into a card marketing agreement with American Express to issue co-branded cards in the Commonwealth of Independent States.

In 2000, Insignia expanded its co-branded card programme to include Royal Bank of Scotland, Merrill Lynch, MBNA, and Danske Bank.

In 2012, a Maltese entity within Insignia was granted a payment institution licence to supply its own payment card products under the regulation of the Malta Financial Services Authority.

Since 1996, Insignia has expanded from a flagship office in London to seven international offices, including New York, Bratislava, Dubai, Valletta, Kiev and Moscow. As of 2020, the company is estimated to have members, including billionaires.

In [year], Insignia launched its lifestyle management arm, Insignia Lifestyle Boutique. The service was referred to as “The ultimate wish granters,” by FT Wealth in a year.

Insignia provides members benefits that include preferential rates on hotels and travel, access to events, luxury gifts, and other services. Members also benefit from 365-day support.

In 2020, Insignia secured inclusion of an Insignia Cards Membership and in the annual Goody Bag at the Academy of Motion Pictures Arts and Sciences Awards, which took place on 10 February 2020.

What current difficulties do you face in the current turmoil fuelled by COVID-19?

Insignia has a diversified business, and like all other companies operating in the lifestyle service environment, we have seen a shift in client behaviour. However, we do not see this as a difficulty but rather a challenge to embrace the need for change fully. We are confident that even in the areas where we see a slowdown, the business will bounce back and has done in the last six months, our new more digital focused approach will cover the gaps.

But first and foremost, Insignia is a financial institution, and the lifestyle and travel sectors are secondary. We feel that during these challenging times, our clients need our support more than they did in the past. The reason for that is the fact that Insignia is a company that they can fully trust. They can always rely on us and discuss any difficulties that they might encounter along the way.

#Insignia Cards#paying insurance premium with credit card#insurance premium credit card#loyalty rewards with insignia

0 notes

Text

Lifestyle Management Concierge Services | Lifestyle Management - Insignia Cards

After commencing operations in 1996 as a travel-related service and payment card provider, we have since grown into an all-encompassing global luxury consultancy service. We have constructed a 360-degree offering which is tailored and bespoke to the needs of each member, who has 24/7 access to our dedicated in-house lifestyle team. Since 1996, Insignia Cards has focused on serving the lifestyle and financial needs of high and ultra-high net worth individuals worldwide. We regularly tailor our products and services in order to better fulfil the needs of our valued members.

SBS WORLD SERVICE (INSIGNIA), THE LUXURY LIFESTYLE MANAGEMENT AND TRAVEL COMPANY, IS FOUNDED

U/HNW clients in emerging markets predominantly the Commonwealth of Independent States (CIS) countries and Eastern Europe are eager to travel the world. They require bespoke travel itineraries, providing them with information on where to stay, what to see, and how to navigate their surroundings. There is consequently the demand for a service managed by experts who can book holidays and plan experiences down to the most intricate details.

What is your Vision for Insignia Cards?

We are constantly developing and shifting the realms of possibility for luxury experiences. What defines luxury depends entirely on what the individual perceives as valuable to them, so our responsibility is to connect with each member on an intimate level. In the last decade, we have witnessed a significant cultural shift away from luxury goods and more towards luxury lifestyle experiences. Any person with wealth can buy luxury goods; what the affluent now really desire are stories and memories that are truly priceless. Therefore, our aim is to instantly adapt to these changes and ensure that every need, whim and desire of Insignia cardholders is not just catered for, but anticipated.

As trends in luxury are ever-changing due to the dynamic and progressive nature of this industry, we are

always accommodating innovative ideas to be able to start trends, instead of following them. In the process of increasingly targeting tech-savvy millennials and creating even more convenience for members, Insignia will continue to anticipate and provide extra digital assets in the upcoming months. We will be rebranding our website, launching an online-services app for our members, and modifying our card portfolio with a launch of new card designs.

Has the Current Situation Affected Insignia Cards?

It is no surprise that the pandemic has provoked a re-evaluation of priorities. Personally, I’ve taken this opportunity to reflect, challenge myself and deeply assess the current situation. I strongly believe that humanity will be better after the current crisis. Within the business, we are witnessing a shift towards family office-style servicing and a rise in demand for authentic experiences. There has been a notable

change in client expenditure as members focus on health and security, with an increase in private jet, secluded villas and private chef bookings.

The pandemic might have changed the way we work, as we all had to evolve and innovate engagement strategies, but it won’t change who we are as humans and what we seek from life. Having had time to reflect, it has come to light that nowadays, customers value authenticity, security, and heritage more than ever before.

#Insignia Cards#lifestyle management and concierge services#luxury lifestyle management companies#concierge and lifestyle management#lifestyle management concierge services

0 notes

Text

Insignia Cards - Luxury lifestyle-management and Financial Services Group

Luxury lifestyle-management and financial-services group Insignia cards has championed deep knowledge of the hopes and dreams of some of the world’s most discerning people – with unique payment cards or extraordinary experiences, for example – since 1996.

The company can help improve the lives of both its members and its partners. Nada Tucakov, President and CEO of Insignia, explains how it has unlocked another world of service for its clients, and discusses emerging trends in the ultra-high-net-worth space.

What are the Reasons Behind Insignia’s Success?

We are in a unique position to create lifestyles and experiences that are extremely exclusive and personalised for each member. We do this by building individual relationships with our members so we can perfectly tailor every aspect of our products and services to each of their personal needs and desires.

One of our most successful aspects of our lifestyle service offering is the fact that we enable our clients to live their ultimate life by allowing them to spend through our payment platform. This gives members flexibility to discreetly manage their purchases and their wealth as and when they wish. However, the card is just an enabler; the real secret behind our success is our dedicated personal assistants, who are available to each client, twenty-four-seven. They go above and beyond, fulfilling an industry-leading 98% of client requests – and are often seen as our clients’ secret weapon when it comes to accessing exclusive events and one-off experiences.

#lifestyle management services#premium payment cards#Insignia Cards#lifestyle management and concierge services#concierge and lifestyle management#luxury lifestyle management companies#lifestyle management companies#lifestyle management concierge services#lifestyle management#super premium payment cards#loyalty rewards with insignia cards#luxury lifestyle management

0 notes

Text

Insignia Cards - Lifestyle Management Services | Premium Payment Cards

Is there a place for supreme luxury in the post COVID era? 2020 has been labelled as the worst year for modern luxury, however the industry shows an enduring resilience. Despite 2020, Insignia, the world’s leading luxury financial and lifestyle management group, has a positive stance on the matter. Throughout 2020 Insignia has weathered COVID to become stronger than ever.

The value proposition of Insignia’s membership has only been cemented post-COVID. Insignia offers a supremely high-level of service - it is not a reactive service, but fundamentally based on a real one-to-one relationship with each member, which allows for hyper-personalization. Hyper-personalization in the luxury market is key to its evolution and development, this has never been felt more keenly than in the post-COVID landscape. Each person and situation is different, therefore each client is valued. The future of luxury will center around creating experiences that consider those differences — in memorable ways. Insignia is a boutique company in the true sense of the word, with every solution built for each individual client.

Insignia offers the best of both worlds, combining the highest level of management, paired with the most convenient payment solution for ultra-high-net-worth clients. With high net worth individuals trust is an important factor, Insignia have proven that they make the impossible possible for their members, therefore gaining their trust, even during tumultuous periods.

In a post-COVID world the discretion of Insignia is noteworthy – as millions globally continue to struggle financially due to the crisis, privacy and discretion have become commodities in themselves.

The Jewelry Card Collection is a flagship product of Insignia’s portfolio - a product that is exclusive to Insignia and one that has proven stand-out to high-net-worth individuals in the region. The premium payment cards handcrafted by swiss artisans are designed for individuals who demand and appreciate only the finest in personalised premium quality. Insignia’s stunningly original jewellery pieces are an investment for life – each piece within the collection is a true work of art. Those approved for the card can meet with a designer to create a customized card for every personality and taste. Client’s holding a jewelry card will benefit from Insignia’s industry-leading 98 per cent success rate on cardmember requests and a dedicated personal assistant, available 24/7.

#Insignia Card#Insignia Cards#paying insurance premium with credit card#insurance premium credit card#loyalty rewards with insignia#premium payment cards#credit card for spotify premium#super premium payment cards#Lifestyle Management and Premium Payment Cards Services

0 notes

Text

Luxury Financial and Lifestyle Management Group - Insignia Card

Insignia commenced operations in 1996 as a travel-related service and payment card provider. They have since grown into an all-encompassing luxury lifestyle management group with a global presence.

Membership is strictly by invitation only for ultra-high and high-net-worth individuals who represent extraordinary spending power. They consciously cap membership in order to maintain exclusivity, allowing them to fulfil their ethos of delivering ‘complete personal attention’ to each individual member.

Their exceptional super premium card service is delivered via a dedicated Personal Assistant, available to their clients 24/7, 365 days a year. Clients include pre-eminent figures in business, politics, culture and sport.

For the past two decades, Insignia has delivered the highest calibre of products and services shrouded in a vow of discretion to ensure our members’ privacy is always protected.

#luxury lifestyle management#Lifestyle Management Services#premium payment cards#super premium payment cards#lifestyle management#lifestyle management companies

0 notes