Lyrah Lavenderwhisp ✨art blog: HecatesFairy / IG: HcatesFairy

Don't wanna be here? Send us removal request.

Text

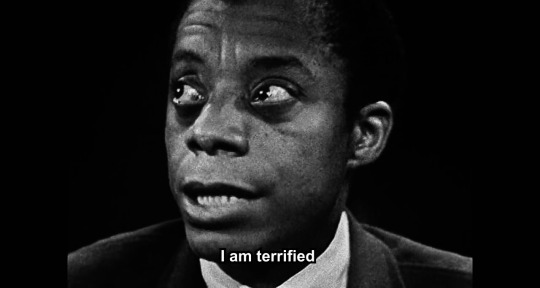

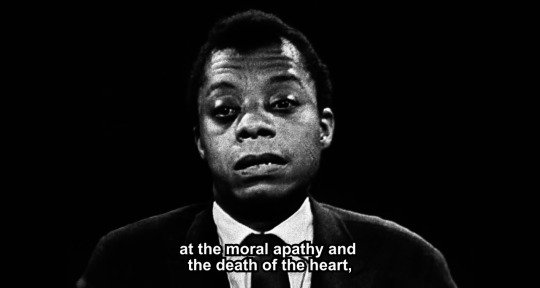

I Am Not Your Negro, dir. Raoul Peck (2016) (via lunamonchtuna)

14K notes

·

View notes

Text

every stuffed animal is unique. the seams are never identical, their face shape, the light their eyes hold, the places where fur gets worn is unique to every plushie. you own a one of a kind artwork. love its imperfections !!

4K notes

·

View notes

Text

Spell for Nightmares and Insomnia

Alright, this is my first time sharing a spell that I created, so I hope this works for others. I've always found it to be very helpful when suffering from anxiety-related insomnia, and it also works a treat for children suffering from nightmares, which was what spurred me to craft this in the first place.

This is a two-part spell, but if you lack components, you can just use the candle spell part.

---

Part One - Calming Night Balm

You will need:

15g beeswax or carnauba wax for a vegan alternative

10g shea butter

2 1/2 tbsp almond oil

2 tbsp jojoba oil

bain-marie (heat-proof bowl and a saucepan)

3 drops mandarin oil, 4 drops lemon balm, 5 drops chamomile, 5 drops lavender

lidded jars (I like the aluminium ones)

thermometer

labels

Sterilise the equipment by washing throroughly and then drying in an over at 140c (275f) or in a microwave for 30-45 seconds if microwave safe. Gently heat the wax, butter and carrier oils in the bain-marie until melted.

Once the ingredients are fully melted, pour carefully into your jars.

When the mixture is about 40c (104f), add your essential oils. I've opted for the above blend, but depending on your relationship with oils, you can adapt as needed. The noted amount of essential oils in the mixture works out at about 5%, so while this is safe for application to your body, I would avoid applying it to your face or more sensitive areas.

In regard to timing, I like to make this up on Mondays for a lunar connection to peaceful sleep and dreaming, or you could also time it with the Full Moon for some lunar oomph.

---

Part Two - Candle Spell

You will need:

Jade crystal (calming, balance, protection against negativity)

Indigo chime candle

Dried chamomile flower (calming, peace, healing) & cloves (protection against negative energy)

Lavender essential oil

Perform this before you go to bed.

Grind together the chamomile and cloves, I usually use about 1 tsp of chamomile and 2 tsp of cloves.

Anoint your candle with the oil and then roll in your ground herbs. I don't really work with sigils much, but if you do you could also carve a sigil into the candle at this stage.

Light your candle and hold onto your jade crystal. Visualise yourself sleeping deeply, visualise waking up from a restful nights sleep, refreshed and ready for the next day.

If you prepared the balm, apply this to your body as you visualise. If doing this for a someone else, have them hold the jade while you rub the balm into their skin and speak the visualisation over them.

I tend to use chime candles and will repeat this candle spell over a day or two, so often, I will blow out the candle once I've finished rubbing in the balm rather than wait for the candle to burn out. Also, a reminder to make sure the candle is extinguished before you go to sleep. Stay safe!

Disclaimer: A lot of my choices in components are due to my own relationships with the herbs, oils and crystal so if you know of something that would be more effective for your personal practise feel free to substitute.

95 notes

·

View notes

Text

Lesson 14 from On Tyranny, written in 2016.

467 notes

·

View notes

Text

A demonstrator pounds away at the Berlin Wall as East Berlin border guards look on near the Brandenburg Gate on November 11, 1989.

Photographer: David Brauchli

55 notes

·

View notes

Text

Fifteen years ago, President Obama and the allegedly 'doing nothing' and 'useless' Democratic Party passed The Affordable Care Act despite tremendous opposition from Republicans who insisted it would usher in a new era of communist tyranny and 'death panels' (spoiler alert! that didn't happen), and leftists crying on TV every day because it wasn't single-payer, completely ignoring the fact that many countries with universal healthcare don't have a single-payer healthcare system. Universal healthcare had been a staple on the Democratic Party's political agenda since the 1940s, and ACA was a monumental step forward. As Joe Biden said himself, 'it was a big fuckin' deal.'

ACA was achieved through actual work that wasn't glamorous. It's also 906 pages long, which was also offensive to a subset of leftists - apparently, all Barack Obama had to do was scribble 'single-payer' on a napkin and tap it three times with a magic wand - it was just that simple, and he chose not to do it making him a 'corporatist sell-out pig.' Just like all democrats have to do now is stand on a cardboard box with a megaphone and yell 'OLIGARCHS' three times, and all crises would be averted.

The ACA should serve as a reminder that it is important to tout democratic achievements just as much as we complain about the party's 'failures' and that actual governing isn't magical at all - it's hard work, and that might be upsetting to some. Still, it's what actually puts ideas into policy. That can't be done with slogans or a magical socialist messiah. We will not be saved by living in delusion.

43 notes

·

View notes

Text

16 notes

·

View notes

Text

Its working. Keep going! #ImpeachTrump #RemoveTrump

20 notes

·

View notes

Text

The resolution says it is in response to the Trump administration’s “legal, financial and political” attacks on academic freedom and the missions of universities. In the Rutgers resolution, it says schools that participate should be willing to make legal counsel, experts and public affairs offices available to any institution that is facing pressure from the Trump administration.

83 notes

·

View notes

Text

Most colleges will have you writing 5+ page essays every other month, and then graduate programs could have you working on a 100+ page thesis throughout your program.

im still losing it over the "how did high schoolers write 600 word essays before chatgpt" post. 600 words. that is nothing. that is so few words what do you mean you can't write 600 words. 600 words. this post right here is 45 words.

91K notes

·

View notes

Text

On Tyranny & Tumblr #1: Do not obey in advance

Like a lot of people, I've been reading Timothy Snyder's On Tyranny in the wake of the 2024 US election results. It's a good book, and a short book, and a book that's probably available in your library. I encourage you to read it for yourself.

There's a lot of panic happening and a lot of desire for action. I think if you're looking for ways to fight real-life tyranny, there's actually a little bit you can do online too.

Snyder's first lesson derived from the stories of 20th century authoritarian governments is "Do not obey in advance":

Most of the power of authoritarianism is freely given. In times like these, individuals think ahead about what a more repressive government will want, and then offer themselves without being asked. A citizen who adapts in this way is teaching power what it can do.

Some ways we can apply this in our online lives:

-If you create content - fan content or original, written works, visual art, cosplay, photos - and you're worried it might be targeted by the US government in the future, don't take it down yet. Don't orphan them on AO3 yet. Keep it up and keep creating.

-If you financially support sex workers, keep doing that. If you don't, consider starting now. They are going to be some of the most vulnerable people in the upcoming US administration.

-I'm a queer person. Because my immediate physical safety is not being threatened, I am choosing to stay out both in real life and online. I will not make myself invisible or palatable out of fear of possible future retribution.

-(this isn't necessarily just an online thing, but I'm going to suggest it anyway) Keep - or start - checking out books by and about queer people and people of color at your local library. Borrow erotica, too, and books on polyamory and kink, and books on liberation ideologies. Borrow the digital versions and the paper versions and return them on time and in good condition. If you're a librarian with any kind of control over this, keep purchasing and displaying these books in accordance with your professional training.

Feel free to list other options in comments or tags or on reblogs.

Other lessons from On Tyranny:

#2: Defend institutions

#3: Beware the one-party state

#4: Take responsibility for the face of the world

#5-7: Remember professional ethics, Be wary of paramilitaries, and Be reflective if you must be armed

#8: Stand out

#9: Be kind to our language

#10: Believe in truth

128 notes

·

View notes

Text

The crux of the anti trans movement is a war on bodily autonomy. They don't want you to have any agency over what you look like, how you dress, who you date, whether to have kids, etc.

They want total control over you. Not just trans people. Not just queer people. You. Everyone.

Trans people are just a scapegoat. They want total control over everyone's self expression. They want the right to mold you into their perfect little cog in their dehumanizing machine.

Happy Trans Day of Visibility. Our rights are your rights. Our destruction is your destruction.

29K notes

·

View notes