NEXEA is a Startup Investment company that specialises in supporting and funding technology companies that have the potential to be the next technology giants. NEXEA VC also has services for investors and corporates that want to invest or work with future technology giants.

Don't wanna be here? Send us removal request.

Text

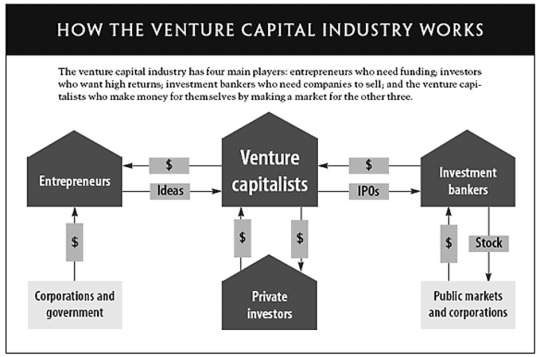

How Venture Capital Works

This post first appeared on How Venture Capital Works For Startup Investments check out https://www.nexea.co

Venture capital can be considered as a subset of private equity and a form of financing that primarily provides funds and financing from investors to start-up companies and small businesses that are believed that have high long-term growth potential.

These companies at early stages and emerging ones that have been deemed to have high growth potential or have demonstrated high growth are the ones that have access to a pool of funds and investors. Understanding how Venture Capital works can significantly benefit you, whether or not you are an entrepreneur or not.

How is “High Growth Potential” Quantified in Venture Capital?

This high growth is measured by a myriad of performance indicators which include the number of employees, man force of the company, annual revenue as well as the businesses’ general scope of operations.

Some of the more common growth metrics that investors use to measure potential include revenue, customer acquisition cost (CAC), customer retention rate (CRR) and operational efficiency.

Revenue

In the business world where cash is king, if a business is not profitable then the business is considered not viable. As a metric, revenue is simple, measured by the total sales within a given time frame. This varies from business to business e.g. if the product is a subscription-based service, this number is more meaningful if calculated monthly or perhaps a seasonal business would have profits skewed within certain time periods.

Customer Acquisition Cost

Customer acquisition cost (CAC) measures the costs to the business of bringing in new customers and is calculated by taking total sales for a particular time period take away marketing expenses. To ascribe meaning to this number this needs to be cross-referenced with Customer Lifetime Value (LTV) which explains how much revenue the business is bringing in over the time they remain a customer.

The monitoring and retaining of customers is essential for the longevity of the business given that it costs substantially more to attract new customers than to just resell to or maintain an existing customer base.

Operational efficiency measures the ratio between selling, general and administrative expenses and the business’ sales figures and is important as it points out whether or not the costs of running the business are comfortably on par with the revenue being brought in. Related financial ratios may be used here including the gross profit margins, liquidity margins as well as burn rate.

Are Ratios Reliable?

From an investors point of view, the primary purpose of using these growth ratios is to not only see and measure how the company is performing but also to pinpoint which companies are being undervalued.

For example, how venture capital works is that a company with high earnings per share is considered more profitable, likely leading investors to pay more for the company whilst consistent increases in return on equity ratio indicates that the company has been steadily and consistently increasing in value and successfully translating that value increases into profits for investors.

What’s In It For the Investor?

Venture capital firms or funds invest in these early high growth stage companies in exchange for equity or an ownership stake and they are willing to take on the risk of financing risky start-ups in the hope that some of the firms they support will become successful.

But because start-ups face high uncertainty, VC investments typically have high rates of failure. Despite this riskiness, the potential for above-average returns is an incentive and an attractive payoff for potential investors.

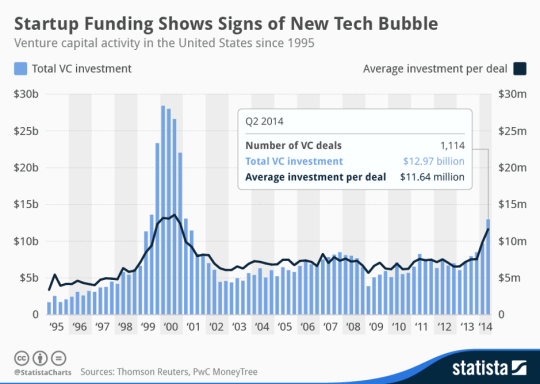

Within the last decades, for new companies or ventures that have had a short and limited operating history, how venture capital works is that venture capital funding is increasingly becoming a popular and even expected and essential source for raising capital, especially because a challenge of emerging companies is primarily the lack of access to capital markets, traditional lending institutions such as bank loans and other debt instruments.

It has evolved from a niche activity that has its inception post World War II during an economic and financial boom into a sophisticated industry with multiple players that play an important role in spurring innovation, entrepreneurship as well as shaping the future of the financial landscape and methods of capital raising.

For more information on Angel Investors, please click here.

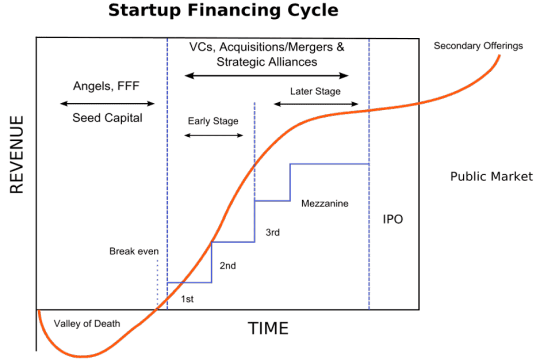

The Four Stages of Funding

Seed Funding: What is it and How Does It Work?

How venture capital works is that the typical venture capital investments occur after an initial seed funding round. Seed funding, also known as seed money and seed capital, represents a form of securities offering in which an investor invests capital in a start-up company in exchange for an equity stake or convertible note stake within the company.

Much of the seed capital that is raised by the company typically arises from sources close to its founders including family, friends and other acquaintances but can also include seed venture capital funds, angel funding as well as more recently with the rise of social media, crowdfunding.

How venture capital works is that obtaining seed funding is the first four of the funding stages that are required for a start-up to become an established business.

Why Pursue Seed Funding?

Usually, how venture capital works is that seed funding goes towards a beginning to develop an idea for a business or new product and generally only covers the costs of creating a proposal but can also go towards paying for preliminary operations such as market research and product development. Investors can be founders themselves, pursuing with their savings and/or loans.

How is Seed Capital different from Venture Capital?

Seed capital is distinguished from venture capital in a way that venture capital investments tend to come from institutional investors and it significantly involves more money and is at arm’s length transactions.

Venture capital contracts also generally involve much more complexity in their contracts as well as the corporate structure accompanying the investment.

Besides, how venture capital works is that seed funding also involves an even higher rate of risk in comparison to a venture capital investment since the investor will be unable to view or evaluate any existing projects for funding, which is the reason why the investments made during the seed stage are generally lower but for similar levels of stake within the company.

For more information on seed funding, please click here.

What is the Goal of a Company Seeking Seed Funding?

The primary goal at this point for the company is to attract further financing. Professional angel investors sometimes provide seed money either through a loan or in return for equity in the future company. How venture capital works is that it allows for flexibility of funding, be it seed or angel.

Who Are The Typical Seed and Angel Investors?

The primary goal at this point for the company is to attract further financing. Professional angel investors sometimes provide seed money either through a loan or in return for equity in the future company.

Series A Funding

Following early stages in seed financing, the company would look for expansion funding which would help smaller-scale companies expand significantly in terms of growth. This is known as Series A funding which is when the company (usually still in the pre-revenue stage) will open itself up to further investments.

Series A is much more significant that the funding procured through angel investors, with funds of more than $10 million being procured. This occurs after the business has developed a track record (an established user base, consistent revenue figures or some other key performance indicators). Opportunities may then be taken to scale the product across different markets.

What is Required to Achieve Series A funding?

Within this round of funding, it is essential to have a plan for developing a business model that will guarantee long term profit. The business will publicise itself as being open to Series A investors and will also need to provide an appropriate valuation.

Within Series A funding, investors are not just looking for great business ideas but rather they are looking for strong strategies for turning that businesses’ core idea into a successful, profitable and money-making business. At this stage, it is common for investors to take part in a somewhat more political process.

With a significant departure from the participative mentality take on by the time the company reaches series A funding, it is common for a few venture capital firms to lead the pack and a single investor will typically serve as the anchor.

Series B Funding

Following Series A funding comes series B funding and at this stage, the company has already been developed through Series A but now needs to expand further.

A company that is attempting to acquire Series B funding will have already proven itself at the market with high active users and user activity but will need to establish itself to truly begin growing revenue. Hence why Series B funding is centred around the goal of taking the businesses to the next level, past the development stage. Investors help start-ups get thereby expanding market reach.

What is the Aim of Series B funding?

Considering that companies that have gone through seed and already have substantial user bases have already proven their worth, Series B funding is primarily used to grow the company so that it can meet the increasing levels of demand. Series B is similar to Series A in terms of key players in that it is often led by the same investors as Series A. The difference with Series B is the addition of a new wave of other venture capital firms that also specialise in alter stage investing.

Series C Funding

Companies that make it to Series C funding sessions are already acknowledged to be fairly successful and is reserved for businesses that are interesting in upscaling and businesses that are interested in expanding into new markets.

It is sought by companies that have already become successful and are looking toward expanding this success through methods such as the development of new products, expansion into new markets or even the acquisition of other companies.

What is Series C Funding used for?

Beyond this, Series C funding may also be sought after by companies that are experiencing short term challenges that need to be addressed. Within Series C rounds, investors inject capital into the meat of successful businesses to receive a significant return on their investment and the funding in this stage is generally focused upon scaling the company in a way to ensure the growth of the company be as quick and successful as possible. Series C is significantly different compared to A and B because of the mechanisms involved in scaling a business.

For example, a possible way to scaling a company would be an acquisition. Merger and acquisitions are significantly more complicated processes and indicate a shift in the direction of the business away from the start-up stage and mindset. Similarly, as the operation gets increasingly less risky, the company is also capable of attracting bigger investors.

Groups such as hedge funds, investment banks in addition to private equity firms and large secondary market groups that come into play as the business is looking more and more profitable as the company has already proven itself to be a successful business model. These new investors approach the business expecting to invest significant sums of money into these companies that are already thriving as a means of helping to secure their own position as business leaders within the market.

Therefore, it can be said that Series C investors are significantly more self-interested as compared to seed-stage or A and B investors, given the exponentially lowered rate of risk associated with an already thriving company and business model.

More commonly, a company will end its external equity funding with Series C although some companies can go onto Series D and E rounds of funding as well. For the most part, however, companies that have already gained upwards of hundreds of millions of dollar worth of funding through Series C are prepared to continue to develop on a global scale.

In fact, the majority of companies that are going through and raising Series C funding use this as a means of helping boost their company valuation in anticipation of IPO. Most go onto seeking series D funding as the goals the company set out during earlier stages likely had not been completed yet.

Hierarchical Structure in a Venture Capital Firm

A typical venture capital firm is organised in a dual model as a limited partnership managing legally independent venture capital funds, with venture capitalists serving as general partners and their investors are limited partners.

Most venture capital firms are organised as management companies responsible for managing several pools of capital with each representing a legally separate limited partnership. How venture capital works is that Limited Partners cannot participate in the active management of venture capital funds if their liability is to be limited to the number of their commitments.

Why do Investors Work with VCs?

From the perspective of an investor, how venture capital works is that there are two main alternatives to invest in venture capital besides investing in venture capital funds: through direct investments in private companies or the outsourcing of selection of venture capital funds through investing in funds of funds.

Direct investments in private companies require more capital to achieve similar diversification as investing in venture capital funds.

Direct investments also pose another unique challenge as direct investments within venture capital usually require a different skill set which limits partners in venture capital funds typically lack.

Investors will need to realise that there will be an additional layer of management fees and expenses involved but institutional investors will thereby reduce the costs to the investors of the selection and management of their investments in different venture capital funds. It has been shown that within the world of how venture capital works are that the compensation of venture capitalists plays a critical role in aligning their interests with those of the limited partners.

An Analysts Role in a VC

The most junior level within a VC are analysts whose main responsibilities involve attending conferences to scout deals that might be within the investment strategy of the fund that the venture capital firm is investing out of. Analysts are not able to make decisions and are primarily concerned with conducting market research and studying competitors.

Associates Role in a VC

Next up on the ladder are associates and tend to be people with a financial background with good networking skills. Associates too do not make decisions within a firm but can make recommendations to those in charge.

Principals Role in a VC

Following associates is the role of principals who can make decisions when it comes to investments but have a lesser influence on the execution of the overall strategy of the firm.

Managing Partners role in a VC

The most senior people within the venture capital firm are partners who could either be general or managing. The difference in title varies depending on whether or not the painter has an influence on investment decisions or may also have an influence upon operational decisions.

In addition to investments, partners are also responsible for and will be held accountable for raising capital for the funds that the firm will be investing with.

Venture Partners Role in a VC

Venture partners are not involved in the day to day operations nor the investment decisions of the firm however they have a strategic role within the firm, mainly involving bringing new deal flow that they will then refer to other partners within the firm.

Venture partners are usually compensated using carry interest (a percentage of returns that funds make once they cash out of investment opportunities).

Investors of VC firms are called Limited Partners (LPs) who are institutional or individual investors that have invested capital in the funds of the VC firms that they are investing off of. How venture capital works is that LPs include endowments, corporate pension funds, sovereign wealth funds, wealthy families, and funds of funds.

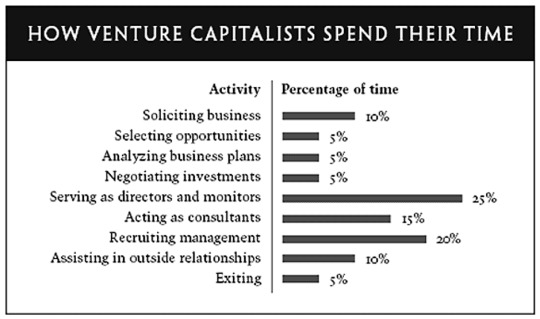

Other Activities Performed by Venture Capital Firms

Fundraising as detailed above is the first activity that all new venture capital firms have to perform. How venture capital works is that successful venture capital investors usually do not manage only a single venture capital fund, but they also engage in fundraising activities to establish a venture capital fund but they engage in fundraising activities to establish a new venture capital fund some three to five years after the start of their previous fund.

The activities of a VC firm: Deals

Another challenge for a venture capital firm is to secure an adequate flow of high-quality business proposals to evaluate. How venture capital works is that the firms match venture capital investors with entrepreneurs can present some difficulties given market information asymmetries.

How venture capital works and from a venture capital fund’s perspective, it is essential to have access to the best propositions which may be problematic for newly established firms given that entrepreneurs would prefer to team up with investors with already strong reputations.

Besides, rather than generating their own deal flows, how venture capital works is that funds may attract investments proposals through their already existing network of co-investors or educate partners, making funds fairly isolationist and probably difficult to gain access to.

Are deals and collaboration in a VC world biased?

As a result, how venture capital works is that being able to general a high-quality level of deal flow may also depend on being able to enter syndication networks. Research has suggested the high likelihood of venture capital investors only being willing to collaborate with other investors whom they are familiar with through prior investments given that this provides more information about their specific capabilities and reliability, thus reducing the risk of hidden information and information asymmetry.

In addition to these duties, how venture capital works is that firms also must perform extensive checking and due diligence activities are given that VC investors are typically extremely selective. While large venture capital funds may receive hundreds of investment proposals annually, they eventually may invest in a portfolio of only 15-25 companies over a five year period as many investment proposals will in all likelihood not receive more than a few minutes of the attention of venture capital investors.

The activities of a VC firm: due diligence

Quick screenings whether or not a certain investment proposal would fit the spirit of a certain firm given that some investors specialise in certain investment stages, certain industries or certain geographic regions.

How venture capital works is that proposals that pass the initial screening are then subjected to in-depth due diligence tests before an investment decision can be made.

However, research has shown that investment decisions are clouded by local bias. Venture capital investors are known to exhibit preferences for investment in companies within the local home market because this eases information transfer.

This benefits the identification of investment targets, the evaluation of the ventures and then post-investment monitoring and the subsequent addition of value.

To reduce hidden action problems after investment, investors are strongly engaged with their portfolio companies usually with monitoring, assisting as well as certifying their portfolio companies. It has been shown that venture capital investors spend over half their time on monitoring and assisting their portfolio companies.

How investors in VCs lessen risk

Investors often require board seats which are linked with other powers such as veto rights as well as contractual provisions which allow them to directly influence the behaviour of their invested entrepreneurs. How venture capital works are that it is essential to have different prongs governing investments.

How venture capital works are that boards of directors in venture capital-backed companies are smaller and thus more involved in strategy formation and evaluation as opposed to boards where members do not have large ownership stakes.

In addition to this, the primary strategies used by investors include time, stage and sector diversification plus prorated investing over time as well as the number of investments within a portfolio.

Risk Mitigation: Time Diversification

The majority of VC funds are committed over a three to five year period. How venture capital works are that by being committed over a longer period of time and spreading out the commitments, a fund gets time diversity and also theoretically this has a soothing effect on the macrocycles that impacts a business.

Risk Mitigation: Stage Diversification

Certain VCs are specific and have early vs late-stage investing approaches to augment the risks posed by certain investments in certain stages. The goal here is to also smooth out irregularities that may occur during the course of the investments in the portfolio.

Risk Mitigation: Sector Diversification

Historically, VC firms have broad sector diversification, investing from software to life sciences within the same fund. This spreads out the macro and environmental risk associated with certain industries to compensate for others.

Risk Mitigation: Prorated Investment

Many VC firms reserve the right to invest their “pro-rata” ownership within future rounds, which then allows them to maintain their % ownership within the company.

Risk Mitigation: Number of Investments

There is conventional wisdom within the VC industry that each fund ought to have 25-30 companies within the fund to spread out and diversify. How venture capital works is that this spreading out of risk and mitigation of putting all your eggs in one basket will ensure higher certainty of returns in the future.

References

https://hbr.org/1998/11/how-venture-capital-works

https://www.forbes.com/sites/alejandrocremades/2018/08/02/how-venture-capital-works/#5a62b3991b14

https://visible.vc/blog/startup-funding-stages/. Accessed 28 Sept 2020

https://www.startups.com/library/expert-advice/how-venture-capital-works

For more, check out NEXEA For Startup Investments check out https://www.nexea.co

source https://www.nexea.co/how-venture-capital-works/

1 note

·

View note

Text

What is An Angel Investor?

This post first appeared on What is An Angel Investor? For Startup Investments check out https://www.nexea.co

What is an Angel Investor? This article is your ultimate guide to angel investors, who are they, what is the angel investor funding process as well as the most commonly asked questions regarding Angel Investors.

Who Are Angel Investors?

Angel investors are individuals who are providers of funds and/or capital for a business start-up normally in its early stages of the business, usually in exchange for convertible debt or ownership equity. Since angel investors are very often individuals that have been at executive positions at large firms, they can often provide useful advice and introductions to the entrepreneur based on their own experiences, in addition to the funds.

A Harvard report provided information on how angel-funded start-ups had a higher chance of survival, likely up to four years more in comparison to non-angel invested firms.

Alejandro Cremades, the author of “The Art of Startup Fundraising: Pitching Investors, Negotiating the Deal and Everything Else Entrepreneurs Need to Know”, states that angel investing has not only become trendy and highly profitable, but it has also emerged into being a powerful source of fuel for the national economy, jobs and new innovation.

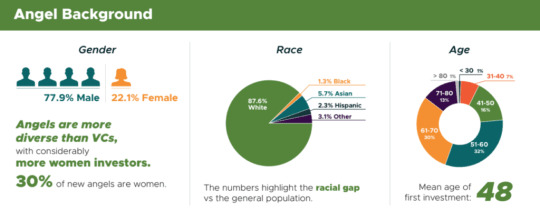

Taking a peek into the world of angel investors, using the United States as an example, GeekWire Statistics reveals that Angels are more diverse than venture capitalists and the majority are women with the number increasing by the minute. However, the statistics will differ in every country.

How Does Angel Investing Work?

This is a step-by-step process and not something that reaps success overnight. New startup businesses or individual entrepreneurs often seek out for angel investors to pitch in capital to their business in return for a stake in the company they invest in. It’s not just limited to the capital, their experience and knowledge in the industry hold immense value as well.

To put this timeline into perspective, Amazon CEO Jeff Bezos himself benefited from 22 “angels” that supported his startup, Amazon in the 1990s when it was a struggling online bookselling service. Many of Amazon’s initial investments came from Bezos’ family and friends, an input of $50,000 secured 1% of the company. Today, those shares are worth more than $8.5 billion. That investment saw a 17-million-per cent gain 25 years later! However, this is just an example and this does not mean that your angel-funded business will take decades to be successful too!

Lifecycle of a Startup Business

According to MintyMint, angel investors enter the lifecycle of a startup in these early stages where they are in need of guidance and capital the most.

Let’s start with the most basic question: Why and when do you need an Angel Investor? This type of investment is targeted to those entrepreneurs in need of business expertise and financing for their startup. Usually, a method of recommendation and referrals also allows investors and entrepreneurs to meet together. Entrepreneurs are usually provided with the angel investor’s profile and vice versa. Both parties will have their own series of requirements; a checklist of expectations.

The screening process for entrepreneurs will include their requirement in terms of investor skill and capacity of capital input whereas for investors, they need to look out for any “red flags” within the business and how attractive is the investment opportunity based on the input of time, money and attention.

What is an Angel Investor expecting from your pitch? Pitches like this can turn out to be quite stressful for the entrepreneurs because of a lot of reasons: they are time-sensitive and they need to be able to fit all information regarding their business in that time slot for the angels, the environment may also have a stressful impact on the entrepreneurs pitching and often sometimes leads them to forget their numbers. Amongst all, it is of utmost importance to remain transparent with the investors and provide them with all the key figures.

Important components of your Investment Pitch

Once both parties have agreed upon working together before the angel investor funding process begins, there are some angels that might prefer to invest straight after a pitch but the majority are interested in a little due diligence at first. This may include going through scenario building or a certain checklist of things to be approved by the angel. Before ending the due diligence process, it is at this point that both parties sit down together and agree on their deal terms, goals that are mutually accepted and beneficial as well as the deal structure and meeting notes that are to be shared with the diligence report once it is complete.

Once all the legal implications are completed, a closing date is assigned, documents are signed. The process is a lot more time consuming and further technicalities are involved. Described above is a brief summary for quick understanding!

As a summary, Neil Patel, New York’s best selling author, and renowned online marketer, having helped renowned companies like Zappos, Amazon, Viacom, Airbnb and the list goes on; explain in detail what angel investing is all about.

youtube

“But how are Angel Investors any different than Venture Capitalists?”

Many people often confuse the two and fail to notice the differences between the two entities. Here is just a brief outline to clear out any confusions you may have regarding the difference in both. Angel investors are individuals willing to spend their own money whereas venture capitalists (VCs) come from a venture capital company. Angel investors have limited funds and prefer the investment amount under a limit whereas venture capitalists prefer large amount of investments.

Angel Investors vs Venture Capitalists

Most angel investors prefer investing at the start-up stage of a business in comparison to VCs that prefer entering the business when they see a potential to progress further. A few further characteristics are detailed in the diagram above detailing what is an angel investor and how is it different from a venture capitalist.

What are the Top Qualities to Look for in an Angel Investor?

What is an angel investor’s ideal qualities? Angels step in as saviours for budding entrepreneurs to help them kick start their business. Therefore, it is important, for an entrepreneur, to know and understand the characteristics and qualities to look for in a potential angel investor. This debate can be divided into three sub-sections:

Personality of Angels

Finding a trustworthy angel for your business is crucial because you do not want to provide your private and confidential information to someone who will later use that privileged information against you. What is an angel investor’s personality trait that is suitable for your business? It is important for angels and entrepreneurs to build a relationship on mutual trust and reliability, not only for monetary assistance and protection but for guidance and knowledge as well. They must have good decision-making skills and the ability to remain calm under pressure. They have a quick eye for talent (based on their years of experience, of course!) and potential in your business and give you the verdict straight away whether they see potential in your business idea or now.

Patience is truly a virtue, a patient angel understands the business environment and dynamics and that profits do not start rolling out overnight. They possess the ability to see through the bigger picture and focus on the long-term operation and not be afraid of whatever challenges that may come their way. An angel should not only be in it for the profits but also enjoy nurturing, mentoring and have the thrill to deal with challenging situations alongside the entrepreneurs.

Investment Decision Skills

Seasoned business angels rely heavily upon due diligence before making any commitments or signing contracts. What is an angel investor’s focus when it comes to investment decisions? They prefer getting into the ‘nitty-gritty’ details to prevent any risk of fraud, scams or other unfavourable circumstances. Angels also need to possess great networking skills, they will help bring on board more individuals if they are well-connected in the industry.

Angel investors will follow the principle of diversity and know that not all business models are the same therefore they won’t yield the same results upon investment. When investing in multiple businesses, they understand that no two ventures are going to work on the same dynamics.

Coaching and Support from an Angel

Secondly, it is also important to note that what is an angel investor’s top mentoring skills that you should keep track of? Along with having the aim to make money, angels should also be relationship builders for successful business partnership and understanding. They also need to have great mentoring skills as the majority of their time will be spent engaging with the entrepreneurs and coaching them and their teams on how to make it big in the corporate world.

Other than their monetary input, angels also need to be willing to remain actively involved in the venture in terms of advice and their knowledge on brand management, networking, product and service strategies.

Where Do I Find an Angel Investor in Malaysia?

What is an angel investor’s role in Malaysia? Every country will have their own means to approach an angel investor usually through an angel investor directory. But, if you are reading this article and in need of an angel investor, you came to the right place.

Visit the NEXEA Angel Investors Network and submit your application for approval to get funded!

“How Do I Become an Angel Investor in Malaysia?”

What is an Angel Investor’s registration process if any? It is not required that you register yourself as an Angel Investor, you can still be an angel investor without registration. However, according to the Malaysian Business Angel Network (MBAN), if you are to register yourself as an accredited angel investor in the country, you would then be eligible to enjoy a tax benefit amounting to RM 500, 000 under the Angel Tax Incentive Programme.

For registration purposes, you are to meet the following requirements:

Either A High Net Worth Individual (Total Wealth Or Net Personal Assets Of RM 3 Million And Above Or Its Equivalent In Foreign Currencies)

A High Income Earner (Gross Total Annual Income Of Not Less Than RM 180,000 In The Preceding 12 Months; Or RM 250,000 Jointly With One’s Spouse)

Tax Resident In Malaysia

On the flip side, if you are a startup seeking an angel investor, according to MBAN, your startup is to fulfil the following requirements:

Company Has To Be Minimum 51% of Malaysian Citizen Ownership

Company’s Core Business Must Be Technology Related

Been In Operation For Three (3) Years Or Less

Cumulative Revenue Of Less Than RM 5 Million

On A Parting Note

What is an angel investor? Hopefully, this article would’ve helped to increase your knowledge about angel investors. Angel investors are playing a more and more important role in financing many new businesses, even though in comparison to other sources of financing, they individually invest relatively small amounts of capital in the early stages of enterprise development.

Visit the NEXEA Angel Investors and take advantage of the most experienced network of investors and Startup Mentors in Malaysia.

References

How Angel Investors And Angel Groups Work

How Does Angel Investing Work?

How to create an effective pitch deck: A data-driven analysis of what makes successful slides

Jeff Bezos told what may be the best startup investment story ever

Startup Funding 101: investment rounds and sources

For more, check out NEXEA For Startup Investments check out https://www.nexea.co

source https://www.nexea.co/what-is-an-angel-investor/

1 note

·

View note

Text

The META Entrepreneurship Test: How Will It Help You?

This post first appeared on The META Entrepreneurship Test: How Will It Help You? For Startup Investments check out https://www.nexea.co

With the advent and developments in technology as well as rapid globalisation in recent centuries, the world has become a global village characterised by explosive growth in international business and competition.

On the one hand, to survive, keep pace with the speed of rapid advancements and developments in the world is challenging, this also opens up a whole host of various new and prior unexplored doors of opportunities, namely that of entrepreneurship.

Entrepreneurship tests to test entrepreneurial abilities have been increasingly used to characterise entrepreneurs or people that have such characteristics.

Brief History of META Entrepreneurship Test

The META Entrepreneurship Test is a state-of-the-art psychometric test that identifies entrepreneurial potential to help businesses nurture and retain their entrepreneurial talent. From the META Profiling Foundation, founded by Roger Thornham, University of Oxford alumni and noted financial journalist, the META foundation contains databases of a diverse set of entrepreneurs all over the world and was founded in the aim of recognising and identifying entrepreneurial talent through entrepreneurial testing.

Designed by leading scholars from Goldsmiths, NYU and UCL, in collaboration with Harvard’s Entrepreneurial Finance lab and the UK Government, META is the result of a comprehensive 4-year research program and has been completed by over 100,000 people, in 10 languages, in 25 countries. It is the only validated commercial tool for identifying entrepreneurial talent.

Current Entrepreneurship Tests

Having a multitude of definitions of entrepreneurship thus results in a large number of different measures of entrepreneurship and entrepreneurship tests with different criteria. Many current measures and methods of measuring entrepreneurship are limited in scope because they often cast focus on only one aspect of entrepreneurship tests, such as self-employment or the rates of business start-ups.

Therefore, it can be said that many of these measures and entrepreneurship tests thus suffer from a lack of depth as well as the accompany methodological as well as statistical problems.

One of the most current widely used measures of entrepreneurship is the Global Entrepreneurship Monitor’s (GEM) Total Entrepreneurial Activity (TEA) index, a calculation of the adult population engaged in entrepreneurial activity.

GEM’s TEA Index has been widely criticised by research and current literature in its failure to measure entrepreneurship that occurs within firms, its failure to use better data as well as its lack of comparability across different geographical regions due to different interpretations of survey responses.

META Entrepreneurship Test Introduction

META Entrepreneurship Foundation

Since current research fails to provide a comprehensive measure of entrepreneurship with lack of sufficient in-depth analysis of individual characteristics that an entrepreneurial individual, the META (Measure of Entrepreneurial Talents and Abilities) as well as its sister entrepreneurship test, Disruptive Talent (META DT) are timely responses to gaps in the current literature in research on entrepreneurship and entrepreneurship tests.

The META Entrepreneurship Test is a state-of-the-art psychometric entrepreneurship test that identifies entrepreneurial potential in order to help businesses nurture and retain their entrepreneurial talent.

On the other hand, the META Disruptive Talent is a psychometric measure designed to help businesses identify, understand, and retain people with the ability to drive business innovation.

How does the META Entrepreneurship Test work?

Following the entrepreneurship test, users will receive a complete and curated report regarding the measure of one’s entrepreneurial ability. The scores will be assessed based on four different categories: entrepreneurial creativity, opportunism, vision and proactivity.

The scores are particularly relevant to real life given that one’s score on each dimension is graphically depicted as well as normed in relation to a unique archive in the META foundation that contains data for thousands of representative adults from diverse countries.

As noted previously, one of the biggest failings of current methods of entrepreneurship testing is the lack of diversity as well as dubious relation to real life that causes the results and measures to be not reflective of actual entrepreneurial talent.

However, META Entrepreneur Ship’s extensive database of scores includes robust performance criteria for hundreds of jobs as well as a wide range of industries (which comprise of both entrepreneurs and entrepreneurs).

In the end, the entrepreneurship test report provides a total score, which then reflects an individual’s overall entrepreneurial potential. The higher one’s score is, the more willing and able one will be able to pursue successful entrepreneurial activities.

Scales measured in the META Entrepreneurship Test

The META Entrepreneurship Test includes four scales that are measured in an individual when taking the entrepreneurship test.

Scale #1 Entrepreneurial Creativity

The first is “Entrepreneurial Creativity”, defined by the foundation as the ability to generate innovative business ideas.

As noted previously, much traditional notion of entrepreneurship and entrepreneurship tests is rooted in the idea of an individual being able to generate new ideas that deviate from the norm. Whilst these ideas inevitably carry some element of risk, it can be said that such creativity is essential to add value to existing industries.

Scale #2 Opportunism

The second is “Opportunism” which is defined by the foundation as the tendency to spot new business opportunities.

As said by Schumpter previously, the ability to spot weaknesses or opportunities in the market and industry and then the ability to exploit these opportunities is representative of an entrepreneur. Therefore entrepreneurship test is in essence measuring your ability to seize opportunities.

Scale #3 Proactivity

The third is “Proactivity” which is defined by the foundation as the energy and willingness to get stuff done right away.

Due to the amount of uncertainty involved when it comes to forming new entrepreneurial and business ventures, entrepreneurs need to have some measure of proactivity when it comes to executing their business ideas, vision and mission.

Proactivity serves as an essential measure because it essentially measures the ability and speed of an entrepreneur to execute and carry out his/her business ideas.

Scale #4 Vision

The fourth is “Vision” which is defined by the foundation to be the tendency to have a meaningful mission in life and to see the bigger picture.

This notion of vision is also associated with entrepreneurship tests given that such individuals are risk-taking and are willing to use current gaps in the market to serve a greater purpose. In this sense, this measures an individual’s ability to see the world as it could possibly be and not as it currently is right now.

The power of vision can be great and it is from this where we see most technology/societal advancements are born of. The advent of smartphones and other associated technology for example had required vision much beyond what was currently in the market.

Differences between META and META DT

The META Entrepreneurship Test as previously mentioned identifies entrepreneurial potential to help business nurture and retain such talent.

The META Disruptive Talent Entrepreneurial Test (DT) on the other hand, helps businesses identify, understand and retain people with the ability to drive business innovation.

Because they are different and are designed with different uses in mind, the META DT also uses a different set of more extensive scales to measure an individuals ability to drive business innovation.

Scales used to measure META DT Entrepreneurship Test

IDEATION: The generation of innovative business ideas

CURIOSITY: The strong desire to know and learn new things

CREATIVITY: The ability to generate original ideas, to create and invent Belief: The propensity to act on conviction, rather than trying to please others

EXECUTION: The realisation or application of innovative business ideas

OPPORTUNISM: The tendency to spot new business opportunities

PROACTIVITY: The energy and willingness to get stuff done straight away

RESILIENCE: The capacity to recover quickly from difficulties – toughness; determination

LEADERSHIP: Leading innovative people and teams

VISION: The tendency to have a meaningful mission in life and to see the bigger picture

AUTHORITY: The tendency to take charge of situations; to command, control and direct

STABILITY: The ability to remain calm and optimistic under pressure

DERAILERS: Behaviours that may have a detrimental impact on a person’s performance and career progress.

HUBRIS: Excessive pride or self-confidence

MERCURIAL: The degree to which an individual demonstrates a ‘mercurial temperament’ (impulsivity, unpredictability, and eccentricity)

DOMINANCE: The degree to which an individual demonstrates overbearing behaviour

How else can the META Entrepreneurship Test be used?

Selecting the Right Team

Otherwise, the META Entrepreneurship test can also be used to select people with genuine entrepreneurial potential. Genuine potential meaning the ability to not only start businesses but also to grow and scale them in a sustainable way.

Many start-ups frequently never make it out of the ideation to angel funding stage and because of this it is essential to realise that businesses require not only the entrepreneurial idea, but also the other characteristics that are measured by META Entrepreneurship Test to succeed.

We have seen the importance of scaling businesses in a way to ensure that they are sustainable in the long run as too many businesses when they are growing fall into traps such as the founders trap. In order to ensure the longevity of the business and that you as an entrepreneur are selecting the correct talent to join your budding corporation, the META Entrepreneurship test serves as a useful indicator both for cultivating and selecting “new blood” to join your business but also to figure out what is lacking in your business.

Read more about leading and developing your startup team to success here!

Click here for more information about why startups fail

Developing Existing Potential

The importance of human resource planning cannot be undermined as within start-ups, teams are small and excellent team synergy and energy is essential to ensure harmonious collaboration.

Because the META Entrepreneurship test creates profiles based on a user’s entrepreneurial ability, in essence, it is able to map out an individual’s strengths, weaknesses, and other characteristics. Thus providing a roadmap for increasing self-awareness in addition to self-growth. In this sense, as an entrepreneur, you will be able to better guide your team towards a path of continual scaling up alongside the business.

As an organisation grows in size, different skills come into play and the META Entrepreneurship test can be useful in illuminating exactly which skills are missing in your organisation and which skills have contributed to its growth and success thus far.

Putting together the correct combination of talents to maximise your organisation’s chances of success can give your business a competitive edge allowing your business to pull ahead of the pack. Building an entrepreneurial team is no easy task but with META Entrepreneurship Test’s clearly defined parameters, selecting talent can be made easier given that the entrepreneurship test does not prioritise one characteristic above all, but is focused on building a holistic view of entrepreneurial ability.

Measuring Against Global Benchmarks

In addition to this, due to the wide selection of current literature on the benefits and success of the META Entrepreneurship tests and profiling, much research is available for you to benchmark yourself on a global level and measure the success of your team on a worldwide scale.

When growing it is essential to take into account global standards if your organisation or business wishes to remain competitive while scaling up and expanding. This entrepreneurship test allows you to gain a rough idea of how operationally successful you will be on a global scale with the current human resources that are existing in the team.

All over the world, the business sphere is dominated by entrepreneurship, startups and small-sized businesses. Click here to learn more about the Venture Capital and Entrepreneurship scene in Southeast Asia

Interested in the META Entrepreneurship Test?

Please click here for further information on the META Entrepreneurship Test or just to get in contact with us to find out more about NEXEA.

Sources:

https://en.wikipedia.org/wiki/Entrepreneurship

https://jvrafricagroup.co.za/catalogue/meta

https://www.fraserinstitute.org/sites/default/files/MeasuringEntrepreneurship2008.pdf

https://wol.iza.org/articles/measurement-matters-entrepreneurship-type-motivation-and-growth/long

https://www.oecd.org/sdd/business-stats/39629644.pdf

For more, check out NEXEA For Startup Investments check out https://www.nexea.co

source https://www.nexea.co/entrepreneurship-test/

1 note

·

View note

Text

Integrated Lead Generation, Telemarketing & Sales Strategies

This post first appeared on Integrated Lead Generation, Telemarketing & Sales Strategies For Startup Investments check out https://www.nexea.co

David Liow: Short Profile

Today, we are interviewing David Liow who is an excellent sales strategy practitioner and who was a former advisor and business partner to C-level Executives in creating strategic operational roadmaps, business process reengineering, organisational restructuring and change management that leads to financial and operational improvements.

He is the founder of SafeForKids Technology, a service dedicated to the safe transportation of children.

Importance of Establishing a Sales Strategy

The importance of defining your sales strategy cannot be undermined.

David recommends doing this through asking targeted and answerable questions such as: “What do you want to achieve in pre-sales?” and “What is the current status of your pre-sales?”. Such questions are intended to troubleshoot current business goals in terms of quantity, quality, timeliness and cost.

This trouble shooting is essential to the process of setting up measurements and Key Performance Indicators (KPIs) throughout the pre-sales and sales process.

There is no “one size fits all” Sales Strategy

David suggests that a general framework should be established when setting up KPIs for sales strategy.

He notes that it is important for an entrepreneur to set up databases themselves to measure KPIs and other metrics because as each business and business model is different, it is also important to tailor the measurements and KPIs to suit one’s individual needs. In other words, there is no one size fits all solution and sales strategy should be customised for individual business needs.

A Three Pronged Approach to Pre-Sales and Sales Strategy

David ’s approach is a three pronged approach when it comes to pre-sales and establishing an area of coverage for sales strategy. The three prongs have paved the way towards creating a framework for entrepreneurs to adhere to.

They are lead generation and management, pre-sales approach (traditional) and results and integration with sales strategy and results.

The three prongs can be broken down into broad categories of pre-sales and sales strategy, compartmentalising. This divides the process in order to help an entrepreneur manage the many aspects of sales as efficiently as possible.

The 1st Prong: Lead Generation and Management

Lead generation and management is the initiation of consumer interest and enquiry into the products and services offered by a business.

What are Leads and Lead Generation?

A lead is any person who has indicated interest in the company’s product or service in any way, shape or form. Leads are typically heard from a business or organisation following opening in communication.

Lead generation is thus the process of attracting and converting strangers and prospects into someone who has shown interest in your company’s product or service.

Within lead generation and management, there are five sub-categories to pay attention to: database and research, leads qualification criteria, customer relationship management, market penetration and data protection.

Lead Generation: Qualification and Criteria

David emphasises the importance of defining lead qualification and criteria within lead generation. What types of leads are your company targeting? It is important to target the right person in order to not waste time and resources.

Therefore, further emphasising the importance of lead verification through the use of social media or other resources. This is to always ensure that one is targeting the right people during the sales process and is integral in framing one’s sales strategy.

It can also be helpful to build relationships along the way despite the fact that the current people you are speaking to might not be decision makers. On the other hand, interacting with this chain of communicators might open new doors and opportunities for businesses.

This is considering that the path to speaking to these decision makers can often be littered with numerous gatekeepers.

Resources and Sourcing for Leads

When it comes to sourcing for leads, David explains that many businesses are often short-sighted and do not make full use of existing free resources hence why their lead generation campaigns are unsuccessful.

Resources from business media in magazines such as The Edge and CEO Morning in addition to radio channels such as BFM, David recommends that they can be great essential tools for the observant entrepreneur and could serve as potential channels to reach out to new clients.

Building up a database of these resources can be invaluable when it comes to getting organised and measuring where most of a company’s clients originate as well as which forms of communication work best.

For more information for different investment companies within Malaysia click here.

Benefits of Free Resources

Bursa, which is the stock exchange of Malaysia, is another valuable resource when it comes to identifying potential.

Access to annual reports gives detailed information as to the hierarchy of the organisation as well as subsidiaries owned by businesses. The listed businesses hold much monetary influence over their smaller subsidiaries who could potentially serve as clients.

Looking at the hierarchy of the organisation, it also gives clues to entrepreneurs as to which are the right decision makers to approach in order to secure deals and partnership.

The companies listed with the Chamber of Commerce (MATRADE), David also cites to be another useful and yet often overlooked resource for lead generation and potential clients.

Adapting Strategies for Different Resources

However, David also cites the importance of “doing your homework” when it comes to analysing different resources.

Bursa Malaysia’s companies for example, often list budgets for different users whilst companies within the Chamber of Commerce are often private companies, with little information disclosed about their budgets and spending. It can be difficult for a budding entrepreneur to figure out the ways in which such private companies operate and spend their budget.

Understand how your targets spend their money

Understanding and characterising businesses and their methods of spending money can be greatly beneficial. It increases the understanding as to which leads are worth pursuing and which are not. For example, MNCs with overseas headquarters versus privately owned companies in comparison to companies with many subsidiaries have different capital structures.

Correspondingly, the ways in which they spend their budget will also be different. In this way, a business’s methods of research needs to be adapted when looking at different resources for lead generation.

Insights Towards Paid Resources

If the leads and resources are exhausted, David also suggests to make use of paid company directories such as Onesource (recently renamed to Avention), an aggregated database of companies, executives, industries, and news/sales triggers.

As an aggregator, Avention licenses content from sixty global vendors including Reuters, Experian, Dun & Bradstreet, NetProspex, MarketLine, and Investext. Each record is tied to Avention’s taxonomy covering companies, company linkage (i.e. parent/ sub/branch), executives (e.g. job function, job level), geographies, industries (e.g. SIC, NAICS, NACE, ISIC), and business topics.

Such resources although require monetary investment can be useful supporting tools in one’s sales strategy.

Customer Relationship Management

Customer relationship management is an aspect within sales strategy that should not be overlooked. David mentions the abundance of sophisticated CRM management softwares that are on the market these days such as Sage and AgileCRM all of which have different functionalities tailored to different types of businesses.

Importance of Data Protection in CRM

David also mentions the importance of data protection within CRM and lead generation by approaching the issue from two angles as follows: i) infrastructure of the CRM and ii) accessibility to data.

Infrastructure in Customer Relation Management

The infrastructure of CRM is very important for an entrepreneur in order to be able to access customer information and numbers easily. It is quick to use and the information is at the top of your head as businesses run on maximising the number of clients.

Being familiar with and having easy access to these numbers can help facilitate not only the decision making process but also improve operational excellence and increase efficiency all around.

In addition to this, having a solid infrastructure and a database set up is of increasing importance as the business grows and scales up as it is needed to help coordinate and improve the functioning of a well-functioning team.

It increases transparency and can help improve functionality of employees as having a database necessarily decreases confusions that may arise regarding the status of the clients as well as pertinent information regarding important dates and meetings.

Accessibility of Data

Regarding the access of the data, David emphasises the importance of data protection because he considers the database of clients regarding contact numbers, emails, name card collection and meeting notes to be one of the company’s most valuable assets.

This is also because following proper data protection procedures is also crucial to help prevent cybercrime by securing details, specifically banking, addresses and contact information are protected to prevent fraud. For instance, your clients or customers’ bank accounts being hacked into.

A breach in your data protection can be costly. And affected customers and staff, in some cases can pursue compensation against your business. You can also leave yourself open to legal implications and fines for failing to comply with data protection.

Data protection to Build Consumer Loyalty

A Forbes Insights report stated that 46% of organisations suffered damage to their reputation and brand value as a result of a privacy breach from telemarketing resources.

Organisations that explicitly make it clear that protecting the privacy of their consumers is their primary goal and indicating transparency and consistency to achieve that goal followed privacy practices that demonstrate this care, will build emotional connections to their brand. This will positively affect and will improve brand value.

The 2nd Prong: Traditional Model (Telemarketing)

The second prong of the strategy is a pre-sales approach following a traditional model. Telemarketing is of course the most common method of traditional sales. Telemarketing is the direct marketing of goods or services to potential customers over the telephone or the Internet.

Advantages of Telemarketing

There are four common kinds of telemarketing: outbound calls, inbound calls, lead generation, and sales calls.

The advantages of cold calling within telemarketing are that they give the sales representative more control, the ability to verify as well as be able to build and retain relationships and handle constructive criticism.

Because feedback is instantaneous the telemarketing agent is able to read and interpret tone of voice which provide auditory clues as to how the business should proceed.

Ensure you measure your BEs with Telemarketing

With telemarketing, David emphasises that it is all a game of numbers.

Measuring how many calls actually yield into meetings, number of call throughs to a decision maker, number of meetings booked, number of meetings held and number of meetings cancelled are the ultimate KPIs that accurately portray how well your marketing campaign is being carried out.

Telemarketing: E-mails

E-mails are another method of telemarketing that can utilise similar key performance indicators such as number of emails sent, different types of email approaches, number of responses (categorised according to yes, no and maybe).

The difficulty arises within emailing and digital marketing is because of the need to customise these approaches regularly. Emails need to capture the attention of the intended recipient in a creative way for a telemarketing campaign to be successful.

How to make sure your emails get read

Strategies such as making it clear that you are not a spammer and that the email will in fact contain information that will add value to the organisation is very important to even getting your email looked through.

Personalisation and customisation may seem like a small step but adds a lot of value towards building a relationship with your targeted company.

Continuously Innovate your Telemarketing Strategy

When it comes to building relationships with your intended company through telemarketing, David also recommends continually improve and innovate your business strategies.

Getting creative with the use of calls can go a long way. Understanding the optimum timings at which these calls are being made can create unique opportunities e.g. Early mornings, lunch times and after work hours can create different scenarios and yield different results depending when you get to speak with different gatekeepers or decision makers that can lead to meetings and new conversions.

Continually using the same strategy can prove to become stale quickly as continual calls and emails despite no response can elicit the wrong response from your intended targets thus is it also important to know when to give customers some space to acknowledge and understand the previous sent messages.

A note on the viability of traditional methods going forward

Regarding the viability of traditional methods of pre-sales and sales, David commented that this is dependent on the value proposition of the business.

The rise of big data, deep machine learning and AI has raised the conversation of the viability of traditional marketing techniques such as telemarketing. Many predict that before long these processes will become automated and since digital marketing is the next normalised step to marketing rendering telemarketing obsolete.

High vs Low Value Propositioning

David believes that telemarketing will still be relevant to businesses and companies that are selling a product or service with a high value proposition. Sales strategy will vary depending on this.

His logic follows that with products that have a low value proposition, not as much critical thinking or decision making goes into closing the deal thus digital marketing which is much more impersonal can work just as well.

But for products and services of high value proposition, multiple negotiations and discussions are needed in order to close the deal. The importance of human interaction in such negotiations and aspects cannot be undermined.

The 3rd Prong: Results and Integration with Sales Strategy

The third and final prong in David ’s approach would be results and the integration of such results with a sales team.

David encourages working closely with the sales team to ensure coordination on all sides. Weekly and monthly reviews are essential to ensuring KPIs are being met.

A playbook and sales diary should be accessible at all times to ensure transparency within the team. Whether using CRM or Excel on an hourly/instant basis, it will increase visibility of sales meetings and other important factors that require collaboration. Such a playbook and diary also reinforce the sales strategy given that these two go hand in hand.

Incentivising the team is also important which is why much of sales works on a commission basis. Because sales and marketing can often be repetitive and boring work, it is important to incentivise your team on a monetary basis to motivate your employees to achieve better and deliver quicker results.

Sources:

David Liow’s Seminar and Slides

https://marketingcopilot.com/

https://www.entrepreneurshipinabox.com/

https://www.digitopia.agency/

For more, check out NEXEA For Startup Investments check out https://www.nexea.co

source https://www.nexea.co/lead-generation-telemarketing-sales-strategies/

0 notes

Text

List of Venture Capital in Southeast Asia (SEA)

This post first appeared on List of Venture Capital in Southeast Asia (SEA) For Startup Investments check out https://www.nexea.co

The Venture Capital Southeast Asia ecosystem has been growing significantly from previous years as the internet economy rapidly expanding. According to Pitchbook, the venture capital dry power has increased up to eleven-fold in the past 6 years. This shows how competitive the VC landscape is in Southeast Asia as large international investors (Y Combinator, 500 Startups, GGV Capital, etc) start to focus on SEA, while regional VC investors (NEXEA, Asia Partners, Strive, etc) are doubling down.

Master List of Venture Capital Lists in Southeast Asia

Here is a list of articles that talks in detail about the venture capital ecosystem in respective countries across Southeast Asia.

Malaysia Venture Capital

Singapore Venture Capital

Thailand Venture Capital

Venture Capital Indonesia

Philippines Venture Capital

Vietnam Venture Capital

Learn More About NEXEA Venture Capital & How We Provide More Than Just Money

VC Venture Capital

About NEXEA

For more, check out NEXEA For Startup Investments check out https://www.nexea.co

source https://www.nexea.co/venture-capital-southeast-asia-nexea/

0 notes

Text

3 Successful Online Startup Business Strategies

This post first appeared on 3 Successful Online Startup Business Strategies For Startup Investments check out https://www.nexea.co

Statistics confirm that they are approximately 24 million online startup businesses globally with the number increasing by the minute. It becomes overwhelming and increasingly intimidating for an online startup business owner to find the right strategies and tools for success. Many of these concerns are related to finding the ideal industry to build their best online startups, what might be the online marketing cost for startups and much more.

Here is a summary on successful strategies and tips for budding and new online startups!

Importance of an Online Startup Business

According to a research by Queensland Government, online startup businesses opens many opportunities for entrepreneurs as well as consumers globally. This is possible because online startups offer a great opportunity to aspiring entrepreneurs to reach out to a global pool of customers with their creative ideas executed into online startups. A one name would be the popular American online fashion startup, FashionNova, advertised on celebrities popular influencers as well as ranking #1 in Google’s Top Searches in 2018.

One of the biggest important factor of online startup businesses is that you are in control of your location, your priorities. You do not need to have a particular skill set to start your own online startup but any areas that hold your core competencies such as if you are an entertainer, a programmer, a baker or simply an individual who is interested in being your own boss, you can use your area of expertise and grow from there onwards.

Many online startup businesses have started with nothing less than a computer, a domain name and a website hosting service to house their website and establish a good customer base. Such businesses with the use of essential marketing tools will help you reach out to a greater audience in comparison to a traditional brick-and-mortar store. Online businesses tend to be less expensive as there are no labour costs, stock holding and fixed costs involved with the decision. Digital content is also relatively inexpensive to create and most of the softwares and tools are available to learning online for free or for a small fee in comparison to print media content.

Limitless Freedom for Online Startups

Many entrepreneurs are attracted to venture into online startup businesses because of the ease and flexibility the web based startups have to offer. Increasing use of laptops, internet and mobile based technology offers remote working from any location globally. The freedom of not being tied to a desk can be the empowering factor for startup entrepreneurs, who are willing to step out of their comfort zones, explore niche customer markets, take on first hand experience as a motivation for their new startup ideas.

However, having limitless freedom does not always guarantee an online startup businesses’ success. There still may be various factors causing your online startup to fail. According to statistics, 90% of startups end up failing because 42% of them misunderstood the market needs and requirements. They end up creating a product or service that already exists or that is not required. Therefore, it is vital for you to understand and identify your target audience and segment them before creating a product or service for them.

According to statistics, 79% of new online startups with a business website expect to grow at least 25% in the next three to five years rather than those that do not create online presence for their startups. The freedom entrepreneurs have with a website in hand is impeccable, the ability to be able to constantly evolve in the ever changing business environment and be able to reach out to overseas audiences without geographical boundaries gives immense benefit to online startup businesses. Next time, you walk into a Starbucks or any local coffee shop with Wi Fi access, look around and notice how many customers will be working with their laptops on their online startup businesses while sipping their coffees.

Build A Social Media Presence

Social media is a powerful tool that online startup businesses can use to increase their brand awareness and visibility. Online platforms like Facebook and Instagram have provided specialised platforms and features such as Facebook Marketplace, Facebook for Business and Instagram Shop where online startup businesses can reach out to their target audiences. Online marketing for startups can be successfully achieved through making the most of social media platforms and its resources.

Nearly 3.96 billion people are now recognised as active social media users. This opens up the global business network immensely for an online startup business to explore and reach out to potential customers as the percentage of those with access to and using social media is increasing by the second.

Consultants such as TapInfluence provide a connection between startup entrepreneurs with social media influencers to expand, network and increase your online startup business’s visibility. Creating a successful online presence for startup will take a challenging course but following the correct steps: choosing the appropriate platform for your online startup business, identifying your target audience, building a strong brand image and reputation through producing creative content.

Create A Referral Program

Referral program and marketing techniques are vital for online business startups to create a huge customer following rapidly. This is a very easy-to-explain strategy where you get your customers to promote your product and service for you. This will include methods like positive word-of-mouth campaigns. This strategy is especially important for new online startups because once they have established a customer base, using this strategy will give them ‘free marketing’. Referral marketing techniques is not only restricted to online startup businesses but also towards B2B just to have that “seal of approval” from another party who has previously experienced.

92% of potential customers believe on the reviews and recommendations they receive from other customers who have ‘tried and tested’ the products and services. It is also proven through research statistics, that when given a positive referral, consumers are 4x times more likely to make that purchase in comparison to an online or print advertisement. Once they have a positive experience, they are more likely to spread the word for your business to colleagues, peers and family.

There are multiple up-to-date softwares and tools to aid online startup businesses such as Advocately and FriendBuy that generate customer reviews in the most effective ways possible to drive up sales for your business. They have easy, user-friendly templates that startup businesses can use to kickstart their referral program.

The Final Note

On a parting note, the beautiful thing about online startup businesses in 2020 is the ease of availability and accessibility of business tools and aids to successfully achieve your startup goals. Do not be demotivated with all the statistics that are out there regarding failure for online startup businesses as everyone has their own vision, mission, pace and priorities as to where they want to take their business.

You have access to the entire global market at your fingertip. Your own online startup will allow you to unleash your full potential and creativity and execute it into a business. With a well thought-out business plan, paid media strategies and optimum search-engine optimisation, an online startup business will not only thrive but be successful!

References

4 Reasons Why an Online Business is the Best Investment You Will Ever Make

15 REFERRAL MARKETING STATISTICS YOU NEED TO KNOW

99+ Mind-Blowing Digital Marketing Statistics (2020)

Global social media research summary August 2020

How to Develop a Startup Marketing Strategy

The Ultimate List of Startup Statistics for 2021

For more, check out NEXEA For Startup Investments check out https://www.nexea.co

source https://www.nexea.co/3-successful-online-startup-business-strategies/

0 notes

Text

Peer Advisory Board and Peer Group For Tech Entrepreneurs

This post first appeared on Peer Advisory Board and Peer Group For Tech Entrepreneurs For Startup Investments check out https://www.nexea.co

As a CEO or founder of your company, you always want to know the best way to operate your company. Carrying such an important role in your business does get a bit lonely whenever you have to make big & tough decisions, especially when no one completely understands your situation.

You may then question,”Why do I need a peer advisory board or group for my business?”

According to a study by Stanford University and The Miles Group, nearly two-thirds of CEOs don’t receive outside leadership advice. This is a huge risk you are putting your business in as you can potentially make uninformed decisions that will negatively affect the success of your company. Even a study from Ohio State University revealed that 50% of companies failed due to management’s flawed business decisions.

That is why it is important for you to have an outside perspective in order to assist you in avoiding disaster and substantially grow your company. There are two methods for you to gain such a perspective when it comes to decision-making: CEO Peer Advisory Board or Peer Advisory Group.

“Even the best-of-the-best CEOs have their blind spots and can dramatically improve their performance with an outside perspective weighing in.”

CEO Peer Advisory Board

CEO peer advisory board is an assemblage of mentors who will be there for you and your company. This advisory board consists of 3 to 5 handpicked senior executives who will work alongside you on your business. The primary objective is to put your growth plans in full throttle by taking advantage of the members of the business advisory board that are highly experienced, knowledgeable, know-how, and have connections of top leaders and experts in the relevant field to make your business successful.

You should consider a CEO peer advisory board of your own if:

You need help with your strategic issues. It is best to have senior mentors around to help you reach your goals and being able to achieve massive growth. Usually, people would handpick experienced business executives when they are for example considering franchising your business, positioning your company for a merger or acquisition, or even securing a big contract.

You need a board of business peers to help you with your long-term plans. These experts are usually planning-oriented where they focused more on strategising the business operations and management for the vision that you have for your company in 5, 10 years, or even longer. This will enable you to focus and handle more current events or crises that occur.

Peer Advisory Group