Don't wanna be here? Send us removal request.

Text

Litecoin price: what’s the outlook after the latest dip?

Litecoin has been underperforming over the last seven days and could record further losses before the end of the week.LTC, the native coin of the Litecoin blockchain, has been underperforming over the last few days. The coin is down by more than 5% in the last seven days and has lost more than 2% of its value over the past 24 hours.However, with LTC underperforming at the moment, what is the outlook after this latest dip?

What drove the Litecoin price to dip toward $50?

LTC is trading at around $51 per coin at press time. The cryptocurrency could record further losses and lose its support above the $50 psychological level over the next few hours.Litecoin’s poor performance comes as the Litecoin Foundation announced on Tuesday, October 11th, that its MWEB feature will soon come to mobile phones.#MWEB is coming..https://t.co/KrOBLnfkbd— Litecoin (@litecoin) October 11, 2022MWEB is a privacy-preserving improvement on the Litecoin network. Essentially, MWEB makes Litecoin a sounder way to transact with as it doesn’t allow the person you’re paying (or, the person you’re receiving money from) to see how much money you hold in your address.Since the launch of MWEB earlier this year, the feature has only been available for users that have Litecoin Core downloaded on their computer. However, according to David Burkett (MWEB Lead Developer), light-client adoption may be just around the corner.

What’s the outlook for the Litecoin price?

Litecoin has been underperforming despite the news that MWEB could soon be available for mobile users. The poor performance coincides with that of the broader cryptocurrency market.The broader cryptocurrency market has lost nearly 2% of its value in the last 24 hours, and the total crypto market cap could drop below $900 billion if the momentum is maintained.Litecoin could drop below $50 soon as the broader cryptocurrency market continues to underperform. However, this latest cryptocurrency news could push LTC’s price higher in the near term when the feature is launched for mobile users. The current announcement is not enough to push Litecoin’s price higher in the near term.

Litecoin technical analysis

The LTC/USD 4-hour chart is currently bearish, as Litecoin has been underperforming over the last 24 hours.

LTC/USD Chart By TradingViewThe MACD line is below the neutral zone and continues to drop lower, indicating bearish momentum for Litecoin.The 14-day relative strength index of 37 shows that Litecoin could enter the oversold region soon if the bears continue to control the market.Litecoin could drop below $47 support level over the next few hours or days if the current momentum is maintained. However, the bulls should defend LTC around the $43 support level in the short term.

How to buy Litecoin?

eToroeToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users. Buy LTC with eToro today BitstampBitstamp is a leading cryptocurrency exchange which offers trading in fiat currencies or popular cryptocurrencies. Bitstamp is a fully regulated company which offers users an intuitive interface, a high degree of security for your digital assets, excellent customer support and multiple withdrawal methods. Buy LTC with Bitstamp today Share this articleCategoriesTagshttps://coinjournal.net/news/litecoin-price-whats-the-outlook-after-the-latest-dip/ Source link Read the full article

0 notes

Text

Bitcoin mining difficulty falls 3.6% following winter freeze

Bitcoin’s mining difficulty fell 3.6% at 3:49 a.m. UTC on Jan. 3.The difficulty change suggests that a fraction of Bitcoin (BTC) miners withdrew from the network — most likely due to reduced mining profitability, according to the latest data from Bitrawr.Fluctuations in the price of BTC are unlikely to be the reason behind this most recent adjustment. Despite this year’s market crash, BTC price remained steady since the blockchain’s last difficulty adjustment two weeks ago. The price of BTC is down 0.7% over the last seven days and 3.64% over the past 30 days.Last week a number of U.S. BTC mining firms — most notably the bankrupt Core Scientific — complied with recent local energy curtailments which involved higher winter electricity prices and power outages. As a result, miners faced increased electrical costs and, in some cases, restricted access to energy.

Bitcoin network hash rate, (Source: Ycharts)

Bitcoin Network Hashrate

In light of the aforementioned energy curtailments, BTC overall mining hash rate fell temporarily to 156.46M on Dec. 24, 2022, from 232.05M on Dec. 23, 2022, according to YCharts.Though BTC has since recovered much of its hash rate, restricted access to energy is still impacting participation in BTC mining.Bitcoin’s mining difficulty is adjusted on a regular basis every 2,016 blocks (or approximately every two weeks). Bitcoin’s previous difficulty adjustment on Dec. 19 increased the blockchain’s difficulty by about 3%.The reduced profitability of mining extends beyond the latest adjustment as data shows that mining revenue was down 37.5% year-over-year in 2022.Posted In: Bitcoin, Mining Source link Read the full article

0 notes

Text

How Can Fintech Platforms Benefit Businesses ?

Financial technology (fintech) is developing at breakneck speed and facilitating the creation of a bevy of B2B and consumer solutions. From payment processing and lending to investment advice and cryptocurrency conversion, these platforms are giving businesses of all sizes an edge in the marketplace. If the Unit demo is anything to go by, it will become easier for businesses to create innovative and revolutionary digital products without having to invest a lot of time and effort in the development process. If you are considering taking your offerings into the digital financial services sector, here are just some of the ways that working with a fintech platform can benefit your business. 3, 2, 1, Launch Fintech platforms enable organizations to quickly launch innovative products with minimal development costs. By offering pre-built functionality such as user onboarding, payment processing, and fraud detection services, these platforms are ideal for companies that want to create innovative products and services without investing significant resources in writing code from scratch and maintaining complicated technology infrastructure. This takes the project timeline down from months or years to weeks or even days, allowing companies to go from idea to product quickly. A shorter development timeline means the ability to realize a greater ROI than possible with a traditional software development approach. As Per Instructions Regulatory compliance is a huge challenge for companies operating in the financial services industry. New laws and regulations introduced in recent years have significantly increased the compliance and reporting requirements for financial firms operating around the world. Working with an established fintech platform makes it easy for businesses to provide new functionalities and enter new markets without having to worry about complying with regulatory requirements. This significantly reduces the risk involved in introducing new products and can lower the costs associated with regulatory compliance activities, enabling companies to better focus on their core business objectives and improve profitability. Skip the Wine and Dine Banking relationships are a critical component of business operations, but the process of establishing a relationship with a bank can be time-consuming and complex. Fortunately, many fintech platforms already have banking partnerships, making it easy for companies to gain access to mainstream banking services in a few hours instead of days or weeks. This can save time and money by eliminating the need for companies to perform due diligence on each bank partner, and it can streamline the overall banking process by eliminating many of the common barriers to access faced by smaller businesses that may have less financial power. Helpful Handshakes Aside from banking relationships, there are a variety of other data sources that can add value and increase the effectiveness of a company’s operations. Many fintech platforms provide the ability to integrate with a variety of third-party applications, making it possible to drive engagement, improve customer satisfaction, increase operational efficiency, and more. For instance, integration with Amazon Cognito enables apps to authenticate customer data with lightning speed and zero friction. By partnering with a fintech platform, businesses can eliminate the need to develop expensive and convoluted custom integrations and instead take advantage of built-in integrations that are optimized for speed and security. Call Security! Data security infrastructure is a crucial issue for all businesses operating in the digital age, especially for those who deal with sensitive data such as financial records and personally identifiable information. Unfortunately, achieving enterprise-level security is tricky and expensive. Businesses need to engage specialized consultants to ensure that the right security measures are in place to protect critical assets from unauthorized access. Quality fintech platforms can take off the burden by providing said enterprise-grade security solutions. A trusted platform typically also provides comprehensive cybersecurity capabilities that can reduce the risk of data breaches and help minimize the impact of any incidents. Growth x100 The core of a strong fintech solution is its ability to scale up or down quickly and painlessly. API functionality should be robust enough to allow businesses to customize solutions to meet their unique needs. The supporting platform should easily accommodate changes without compromising performance or security or requiring additional development work. Pricing structures for many fintech platforms are also reflective of the size of each client, with small businesses paying only for what they use. This allows startups to get their foot in the door. As these businesses grow, pricing may increase accordingly to reflect expanded features and requirements. I Can See Clearly Now Financial data is at the heart of every business. Having access to comprehensive data is vital to stay on top of trends and make informed decisions. Fintech platforms come with built-in analytical tools that help track key metrics such as cash flow and average revenue per user. These insights can help businesses identify growth opportunities and potential pain points that need to be addressed. Particularly for businesses that are just venturing into financial services, having insight into operations can help provide valuable ideas on how to better adjust their business plan to meet customer and market needs. Without access to millions of dollars in funds and a full team of developers, it can be hard for smaller businesses to get a slice of the fintech pie. With help from fintech platforms, these businesses can now have access to the right tools and services to help them get started and grow exponentially.

Source link Read the full article

0 notes

Text

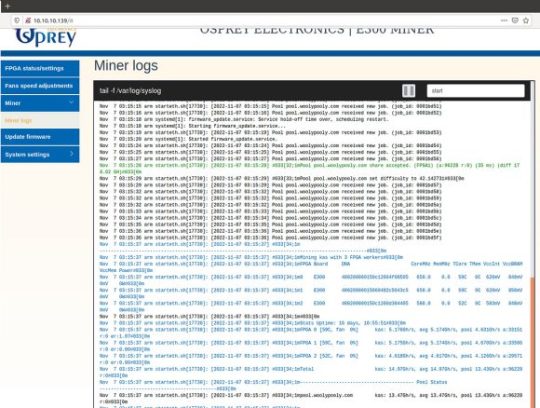

The First Kaspa FPGA Miner – Osprey Electronics E300 14 GH/s kHeavyHash Miner

12 Dec 2022

It seems that the first FPGA miner (not an ASIC) for mining KASPA (KAS) and its kHeavyHash algorithm might be out now – the Osprey Electronics E300. The device is apparently capable of 14 GH/s hashrate on the kHeavyHash algorithm with power usage of 250-500 Watts depending on settings with future support for ERG and RXD claimed. According to the manufacturer of these devices the E300 is based on Xilinx UltraScale+ VU35P FPGA technology and each miner comes with 3 Hash Boards + 1 Control Board, with each hash board having one Xilinx VU35P (872K LUT, 224Mb on-chip RAM, 8GB HBM2, 420 GB/s Bandwidth) and the control board is based on Xilinx Zynq 7010. The price of the miner on the official website is $4999 USD and it is currently listed as out of stock.

Do note that we have not seen or tried the E300 KASPA FPGA miner ourselves, so we cannot confirm its actual existence and there is very little information about it online. The photos on the Osprey Electronics website of the device do seem to be from an actual AntMiner S9 with the company’s logo on it. There are some screenshots from the miner’s interface that show it mining KAS on woolypooly.com from early November as well as an official video showing the miner interface. The same company apparently also makes a Helium (HNT) hotspot miner as well called Osprey hotspot G1 that has slightly more online presence. The official Discord channel does have some more information and things going on around the development of the device, so you might want to check it out if interested and want to ask some more questions. The great thing about FPGAs is that they can be reprogrammed to mine other algorithms or dor other things, unlike ASIC miners that are designed specifically for one task. – Visit the official Osprey Electronics E300 product page… Publihsed in: Mining Hardware Related tags: E300, ERG FPGA, ERG FPGA miner, Ergo FPGA, Ergo FPGA miner, FPGA miner, KAS FPGA, KAS FPGA miner, Kaspa FPGA, Kaspa FPGA miner, Osprey Electronics, Osprey Electronics E300, Osprey Electronics E300 FPGA, Osprey Electronics E300 FPGA miner, Osprey Electronics E300 miner, Radiant FPGA, Radiant FPGA miner, RXD FPGA, RXD FPGA miner Check Some More Similar Crypto Related Publications: Source link Read the full article

0 notes

Text

Binance Provides Hope Amongst Extreme Uncertainty – Blockchain News, Opinion, TV and Jobs

By Marcus Sotiriou, Analyst at the publicly listed digital asset broker GlobalBlock (TSXV:BLOK). The FTX saga continues as crypto investors fear who else could be the next custodial platform to fall. The exchange that has captured the most negative attention over the weekend is Crypto.com. This stemmed from Crypto.com sending $400 million to Gate.io, which was around the time that Crypto.com’s Proof of Reserves was released. This raised significant speculation that Crypto.com has attempted to forge their Proof of Reserves, so that their reserves seem higher than what they are. However, Crypto.com’s CEO, Kris Marszalek, has affirmed that the funds were sent by mistake, and “The entirety of ETH was successfully withdrawn by Crypto.com and returned to our cold storage,” and Gate.io confirmed that the snapshot for Crypto.com’s Proof of Reserves occurred on October 19th, before the deposit occurred on October 21st. Nonetheless, Crypto.com making an accidental transfer of $400 million at a time when there is extreme fear in the market around the solvency of exchanges is not a good look for the exchange. The uncertainty has resulted in Crypto.com’s token plummeting over 50% in a week. Despite the unprecedented FUD circulating amongst the media, there is renewed hope for the crypto market, thanks to CZ, CEO of Binance. CZ announced this morning “To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis.” CZ also welcomed other companies with sufficient capital to co-invest, which spurred Justin Sun to show support for CZ’s proposal. The market has responded very positively to the announcement, with Bitcoin rising by over 5%. Funding rates have also turned increasingly negative on this move up, suggesting shorts have piled in. This provides extra fuel for more buying power, potentially resulting in a short squeeze if anymore exchanges do not announce bankruptcy in the coming days. Many Bitcoin whales have chosen this time of panic to accumulate, as the number of addresses with more than 10,000 Bitcoin has exploded over the past week or so (shown below). In addition, the biggest Bitcoin whale (which is not an exchange) added 6,000 Bitcoin to their stack last week, after being mostly dormant for 2 months. The details of this information can be found using this link. Whales accumulating now shows how they see this situation as an opportunity, which I would agree with – even though the extent of bankruptcies remains to be seen, bear market investors have an incredible opportunity of wealth creation in the next bull run. Source link Read the full article

0 notes

Text

Italian Parliament Approves 26% Tax for Cryptocurrency Gains in 2023 Budget Law – Taxes Bitcoin News

The Italian Parliament has introduced a 26% capital tax on cryptocurrency gains as part of the 2023 budget law, which was approved on Dec. 29. The document also offers incentives for taxpayers to declare their cryptocurrency holdings, proposing a 3.5% aliquot for undeclared cryptocurrencies held before Dec. 31, 2021, and a 0.5% fine for each additional year.

Italian Parliament Passes Capital Gains Tax for Crypto

The Italian parliament greenlighted a new tax for cryptocurrency on Dec. 29, as part of its budget law for the year 2023. Senators approved the document presented on Dec. 24, which approved a 26% aliquot for cryptocurrency gains above 2,000 euros (approx. $2,060) during a tax period. The capital gains tax for crypto had been proposed since Dec 1, when the draft for the budget law was presented. The approved document includes a series of incentives for taxpayers to declare their cryptocurrency holdings, proposing an amnesty on gains achieved, paying a “substitute tax” of 3.5%, and adding a 0.5% as a fine for each year. Another incentive included in the budget law will allow taxpayers to cancel their capital gains tax at 14% of the price of cryptocurrency held on Jan. 1, 2023, which would be significantly lower than the price paid when the cryptocurrency was purchased. In the same way, cryptocurrency losses higher than 2000 euros in a tax period will count as tax deductions and will be able to be carried out to the next tax periods.

Italy’s New Cryptocurrency Tax Law Leaves Room for Interpretation

The law is clear about most of the key circumstances in which cryptocurrencies will be taxed. However, the law mentions that “the exchange between crypto assets having the same characteristics and functions does not constitute a taxable event.” This means that users will have to receive guidance to present their tax statements, as these assets having the same characteristics and functions have not been defined in the body of the law. Italy, which lacks comprehensive cryptocurrency regulation, is following in the footsteps of Portugal. The European country included a similar capital gains tax at a rate of 28% as part of its budget law for 2023, a decision that might put in danger the status of the country as a haven for cryptocurrency companies and holders. This proposal, revealed in October, also contemplates taxes on the free transfer of cryptocurrency and on the commissions charged by cryptocurrency exchanges and other crypto operations for facilitating cryptocurrency transactions. What do you think about the 26% capital gains tax approved by the Italian Parliament for 2023? Tell us in the comments section below.

Sergio Goschenko Sergio is a cryptocurrency journalist based in Venezuela. He describes himself as late to the game, entering the cryptosphere when the price rise happened during December 2017. Having a computer engineering background, living in Venezuela, and being impacted by the cryptocurrency boom at a social level, he offers a different point of view about crypto success and how it helps the unbanked and underserved. Image Credits: Shutterstock, Pixabay, Wiki Commons, Cristian Storto, Shutterstock.com Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. More Popular NewsIn Case You Missed It Source link Read the full article

0 notes

Text

Crypto Trading Platform Paxful Delists Ethereum In 'Integrity' Move: CEO

Paxful CEO Ray Youssef said Ethereum is being removed from the trading platform due to its shift to proof-of-stake and lack of decentralization.Peer-to-peer (P2P) cryptocurrency trading platform Paxful is delisting Ethereum.Paxful CEO Ray Youssef took to Twitter on Wednesday to announce the news, confirming a move he had hinted at ten days prior.“We finally kicked #ethereum off our marketplace. 11.6m humans safer. Integrity over revenue,” Youssef said in a tweet, calling on fellow exchange runners to follow suit.A screenshot of Youssef’s statement to clients accompanied the tweet. The text provided more details as to why the CEO chose to remove ETH from his P2P exchange. Youssef mentioned three overarching reasons for kicking Ethereum out: its move to proof-of-stake (PoS), a lack of decentralization, and the ever-growing dissemination of scams in its ecosystem.Ethereum will be officially off the platform by 12:00 UTC, December 22. Paxful will maintain stablecoins up for trades, however, as Youssef claimed they have “real use cases.”Youssef argued that PoW is the innovation in Bitcoin and what enables it to be “the only honest money there is.” The consensus mechanism that is often touted as an alternative to PoW, PoS, “has rendered ETH essentially a digital form of fiat,” the executive added.Next, the CEO of Paxful delved into the decentralization aspect of Ethereum, denouncing the small group of insiders who manage to exert enormous influence on the cryptocurrency project to this day.Finally, Youssef explained that while “ETH had some utility on real use cases, such as credit and lending,” it “thrives because of tokenization.” Such a reality, he continued, has led to “scams that have robbed people of billions.”“They have stolen valuable momentum away from Bitcoin and cost us years on our mission.”“In short, our industry is under attack right now –– which means our responsibility to protect our users is greater than ever before,” Youssef said in the statement. “We are not perfect, but we’ll always do the right thing, even if it’s not popular, and even if it costs us money. The pay off for all humanity will be so great that the billions scammers have stolen via tokens will seem like pennies in comparison.” Source link Read the full article

0 notes

Text

Litecoin Core v0.21.2.1 Release. Follow our Twitter for the latest dev… | by Loshan

Follow our Twitter for the latest dev news.We are pleased to release Litecoin Core 0.21.2.1. This is a new minor version release, including a critical bug fix introduced in the previous release. It is recommended for all users to upgrade to this version.

Notable Changes

An issue with MWEB key generation for older wallets that were upgraded was solved. Keys are now generated from the appropriate keypools, and coins sent to previously generated stealth addresses are recoverable. Use rescanblockchain after upgrading to recover any missing MWEB coins.

Download Binaries

To download, please visit the download page here. Alternatively, you can view the download folder here.Please use GPG to verify the integrity of the release binaries. This ensures that the binary you have downloaded has not been tampered with. Linux, MacOS and Win32 cygwin command line GPG instructions are available here. Please also note that we GPG sign the binaries as a convenience to you, the ultimate way to verify the integrity of the builds is to build them yourself using Gitian. Instructions on how to perform these builds, can be found here.For this release, the binaries have been signed with key identifier 0x3620e9d387e55666 (davidburkett38’s key).

WARNING

Despite this version being heavily tested, this version may still contain bugs. Always backup your wallet.dat file before upgrading. If you encounter any issues, please let us know by posting to the bug reporting section below.

Source code & Build instructions

The master branch contains the latest commits to the next stable releases of Litecoin Core.Build instructions for Linux can be found here.Build instructions for OSX can be found here.Builds instructions for Windows can be found here.

Bug Reporting

Submit any issues you encounter here and one of the Litecoin developers will assist you.

Mailing Lists

Sign up for announcements only or development discussion.

Hashes for verification

These are the SHA-256 hashes of the released files:95491d137527fc3c232cc482a223874f23960a70e624092a280c82540326e5a0 litecoin-0.21.2.1-aarch64-linux-gnu.tar.gzffa0c82d87624bb29dcaba6ebf55fd916c9981d5fbaa5627a3f1c07b47535270 litecoin-0.21.2.1-arm-linux-gnueabihf.tar.gzff6d6248aedda1248b1a33dabf828b06d559e909262199a5e305225f7b5b0f00 litecoin-0.21.2.1-riscv64-linux-gnu.tar.gz6e545d1ef0842b9c4ecaf2e22b43f17fd3fba73599b0d6cc1db0c9310f1a74ff litecoin-0.21.2.1-x86_64-linux-gnu.tar.gz3b05591f117d487de0323ad3aca30b64a086125c22992a4c528c789db75b5b81 litecoin-0.21.2.1-osx.dmgd4462b58811bc35c3160c204cc85e94ebe27e57b816ed5bd607f7e22cf3d4131 litecoin-0.21.2.1-win64-setup.exe

Credit

Thanks to everyone who directly contributed to this release: Source link Read the full article

0 notes

Text

How Many Partnerships Does Ripple Have?

RippleNet has hundreds of customers in over 55 countries and 6 continents sending millions of transactions to each other around the world.

Ripple is the leading provider of enterprise blockchain and cryptocurrency solutions. Its global payments network, RippleNet, was initially focused on solving pain points with cross-border payments and today has processed millions of transactions worth billions globally. RippleNet has since evolved to be a platform with crypto-native services built on top – for instant settlement, lines of credit and crypto liquidity. Ripple leverages XRP, the digital asset native to the open-source and decentralized XRP Ledger, to instantly settle cross-border transactions in a solution called On-Demand Liquidity (ODL). RippleNet has hundreds of customers in over 55 countries and 6 continents sending millions of transactions to each other around the world. Despite the steady growth of RippleNet members, FlashFX remains the first and main partner to leverage RippleNet’s ODL solution in the Australian market. FlashFX is the first Australian digital currency business to receive the Australian Financial Services License (AFSL) from the Australian Securities and Investments Commission (ASIC). FlashFX is leveraging its proprietary infrastructure with other licensed money service businesses in relevant payment corridors. They are actively seeking to expand the ecosystem and facilitate other payment processors to join RippleNet.. Flash FX invites interested parties to engage directly with them. Some of the customers leveraging ODL are: - Azimo - FOMO Pay - iRemit - Tranglo - SBI Remit - PYYPL To keep up to date with all the new Ripplenet partners, you can check out the official Insights page. Source link Read the full article

0 notes

Text

Een Crypto-Decentralistisch Manifesto

Origineel geschreven door: Arvicco (bitnovosti.com) juli 2016 aanpassing grammatica en ontwerp: juli 2019 Blokketens gaan de wereld regeren door een … Source link Read the full article

0 notes

Text

Bitcoin Rallies After Release of Softer U.S. CPI – Blockchain News, Opinion, TV and Jobs

By Marcus Sotiriou, Market Analyst at the publicly listed digital asset broker GlobalBlock (TSXV:BLOK). Bitcoin has climbed to $17,800 at time of writing, following softer U.S. CPI released this afternoon. CPI was expected to be 7.3% year-over-year, but came in at 7.1% and much lower than the previous 7.7%, leading to a strong bullish move higher in Bitcoin and other digital assets. This is because the expected CPI of 7.3% would indicate that inflation is inflecting down convincingly, after decreasing for 2 months in a row, which would signal to the Federal Reserve that it could be time to stop raising rates. JP Morgan agrees with this idea, as they claim, “the most likely scenario, the team says, is a CPI print between 7.2% to 7.4% where the S&P 500 climbs by 2% to 3%.” According to local reports, citing the country’s attorney general Ryan Pinder, Sam Bankman-Fried (SBF) has been arrested in the Bahamas which “followed receipt of formal notification from the United States that it has filed criminal charges against SBF and is likely to request his extradition.” The AG office reported, “on 12 December 2022, the Office of the Attorney General of The Bahamas is announcing the arrest by The Royal Bahamas Police Force of Sam Bankman-Fried (SBF), former CEO of FTX.” The news follows the reports that said ex-Alameda CEO Caroline Ellison hired Wilmerhale partner Stephanie Avakian, an attorney that worked for the U.S. Securities and Exchange Commission (SEC). Bankman-Fried has reportedly retained attorney Mark Cohen, the lawyer who represented Ghislaine Maxwell during her recent sex trafficking case. Prime minister (PM) Philip Davis said that “the Bahamas will continue its own regulatory and criminal investigations into the collapse of FTX, with the continued cooperation of its law enforcement and regulatory partners in the United States and elsewhere.” Unfortunately though, SBF was supposed to testify under oath before Congress today, who would then charge him with a crime, hence prosecutors have potentially saved SBF from incriminating himself. Nonetheless, SBF may have already incriminated himself enough with all of the Twitter Spaces he has been featuring on. Source link Read the full article

0 notes

Text

Gold, Silver, and Oil Predictions; Ellison’s FTX Testimony and the Sam Trabucco Mystery; Massively Eroded Dollar Sees the Fed Turn 109 — Week in Review

Robert Kiyosaki says the time to buy gold and silver is now, predicting a stock market crash will send prices of the precious metals higher. In other news, the crypto community has been curious about the former Alameda Research co-CEO Sam Trabucco, and his whereabouts, as the guilty plea of Alameda’s former CEO Caroline Ellison

Robert Kiyosaki says the time to buy gold and silver is now, predicting a stock market crash will send prices of the precious metals higher. In other news, the crypto community has been curious about the former Alameda Research co-CEO Sam Trabucco, and his whereabouts, as the guilty plea of Alameda’s former CEO Caroline Ellison has been unsealed, revealing troubling information about customer funds. Bitcoin.com News further reports that as the United States Fed has turned 109 years old on Dec. 23, the dollar has lost 96% of its purchasing power since the Federal Reserve was created. Finally, one market strategist expects oil to “crush” other investments in 2023. All this just below, in this latest issue of the Bitcoin.com News Week in Review.

Robert Kiyosaki Warns Last Chance to Buy Gold and Silver at Low Prices — Says Stock Market Crash Will Send Them Higher

The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, says now may be the last chance to buy gold and silver at low prices. “Inflation moving up. Interest rates moving up. Stock market to crash sending gold and silver higher,” Kiyosaki described.Read More

Caroline Ellison’s Testimony Claims FTX Boss SBF Directed Her to Co-Mingle Customer Funds Since 2019

On Dec. 23, 2022, Matthew Russell Lee from the Inner City Press published the recently unsealed guilty plea transcript of Caroline Ellison, Alameda Research’s former CEO. In her statements, Ellison describes that she was the co-CEO and CEO of Alameda, and under those roles, she reported directly to the former FTX CEO Sam Bankman-Fried (SBF). The ex-Alameda CEO’s testimony details that she was fully aware from 2019 to 2022, that Alameda Research had access to a special borrowing facility that allowed the company to maintain an unlimited line of credit with zero collateral. The ‘borrowing facility,’ according to Ellison, was FTX’s customer funds.Read More

Crypto Community Asks: Where in the World Is Ex-Alameda CEO Sam Trabucco?

Following FTX co-founder Sam Bankman-Fried’s arrest and the statements from his co-workers Gary Wang and Caroline Ellison, the spotlight has turned on the remaining executives who were part of the team’s inner circle. Another person people are curious about these days is Alameda Research’s ex-co-CEO Sam Trabucco. The 30-year-old executive left Alameda in Aug. 2022, but since Ellison detailed misconduct happened in 2019, it’s assumed that Trabucco knows a thing or two about what happened.Read More

‘Oil Prices North of $200’ per Barrel — Investor Expects Oil to ‘Crush’ Every Investment in 2023

Amid the dreary global economy, a number of market strategists and analysts believe oil will be the number one investment in 2023. While a barrel of oil is coasting along at prices between $80.12 and $85 per unit, Goldman Sachs analysts think oil will reach $110 per barrel for Brent oil, and strategists from Morgan Stanley also believe oil will reach $110 a barrel by mid-2023. The founder of Praetorian Capital recently warned a barrel of oil could jump a lot higher next year.Read More

As the Fed Turns 109 Years Old, the US Dollar’s Purchasing Power Eroded by More Than 96% Since It Was Created

109 years ago, the U.S. Federal Reserve was created and ever since that day, the purchasing power of the U.S. dollar has dropped a great deal. Since the Fed started, more than 96% of the greenback’s purchasing power has been erased via inflation.Read MoreWhat are your thoughts on these stories? What do you think was the most memorable story of 2022? Be sure to let us know in the comment section below. Source link Read the full article

1 note

·

View note

Text

Bitcoin value would surge past $600K if ‘hardest asset’ matches gold

The coming decade may well be Bitcoin’s time to repeat gold’s 1970 breakouts, says Capriole Investments. Bitcoin BTC ticked down $16,562 thanks to copying gold’s explosive 1970’s because it becomes the world’s “hardest asset” in 2024. That was one forecast from the most recent edition of the Capriole news report, a monetary circular from analysis and commerce firm Capriole Investments.

Bitcoin due massive moves “and more” in 2020s

Despite BTC value action drooping at nearly 80% below its latest uncomparable high, not most are pessimistic regarding even its mid-term outlook. While necessitating an extra drop before BTC/USD finds its new macro bottom stay, Capriole believes that 2023 is going to be bright for Bitcoin as a reserve plus. The reason, it says, lies within the world economy’s monetary history of the past century, and particularly, the US once the dollar deanchored from gold utterly in 1971. Gold, because the world’s premier refuge of the time, saw “huge” gains throughout the last decade, and 50 years later, it’s Bitcoin’s flip. “Because gold was a lot smaller within the 1970 (and Bitcoin these days is even smaller by comparison), it had capability to form massive moves through a decade of inflation and high interest rates,” Capriole wrote. “That’s one reason why we tend to believe Bitcoin can do the same, and more, this decade.” Accompanying charts underscored gold’s potential to repeat its 70s behavior, among that were a “cup and handle” chart structure enjoying out since 2010. When it involves Bitcoin vying with gold for the refuge crown, meanwhile, the potential lies within the numbers — at simply 2.5% of gold’s market cap, BTC diving eightieth from its $69,000 peak last year has very little touching on the image. “Given Bitcoin represents simply 2.5% of gold’s capitalisation these days, its 80% drawdown adds a mere 2% further drawdowns to the combined arduous cash (gold + Bitcoin) drawdown,” the news report continued . “Giving a complete total hard money drawdown of 24% through to November 2022, comparable the 1970 and 1975 figures for gold.” Should the stage already be set for a Bitcoin imitator movie of 70s gold, the expansion potential is so all the additional spectacular — even currently, Bitcoin’s market cap is simply 100% that of gold before its Bull Run of the time began. “Bitcoin has additional growth potential than gold as a result of its smaller size. A like-for-like demand in each asset can end in a 40X bigger value amendment for Bitcoin,” Capriole expressed.

“The hardest asset in the world”

A further key argument echoed that long championed by commentators like Saifedean Ammous within the widespread book, “The Bitcoin customary.” There, the controversy focuses on investors’ shift to Bitcoin as its rate of inflation drops below that of gold, increasing its financial “hardness” versus the metal. “There are several different attributes that make Bitcoin stand out from gold, like its equitable decentralization, ability to transfer instantly and be used for micro-payments. However, most significantly, Bitcoin is tougher than gold.” This, Capriole additional, can ensure Bitcoin as “the hardest plus within the world” at its next block grant halving in 2024. “All-in-all, gold went up 24X within the 1970’s,” Capriole summarized. “Now imagine the 2020s, wherever the Fed can’t afford to be as aggressive (debt is much higher today) and that we have digital, accessible, tougher money: Bitcoin.”The post Bitcoin value would surge past $600K if ‘hardest asset’ matches gold first appeared on BTC Wires. Source link Read the full article

0 notes

Text

Argo shares soar following $65M sale of mining facility to Galaxy digital

Struggling Bitcoin (BTC) miner Argo Blockchain sold its Helios mining facility in Texas to Galaxy Digital for $65 million and also got a $35 million loan from the company as part of the deal, according to a Dec. 28 statement.Following the news, Google Finance data shows that its London shares were up by over 100% to £7.22 as of press time.

Argo repays old loans using new financing

According to the press statement, Argo used the proceeds from the Helios facility sales and part of the loan to repay its debt, which includes the money it owes crypto lender NYDIG.In a separate video, CEO Peter Wall confirmed that the firm had repaid its NYDIG debt and another secured lender using the proceeds of its new deal. Wall said:“This transaction with Galaxy is a transformational one for Argo and benefits the Company in several ways. It reduces our debt by $41 million and provides us with a stronger balance sheet and enhanced liquidity to help ensure continued operations through the ongoing bear market.”According to Wall, the new deal was the only “only viable path forward” for the company considering Bitcoin’s declining value and the rising energy cost.

Argo maintains equipment ownership

Argo’s mining equipment in the Helios facility would remain operational. The firm said it maintains ownership of all the mining machines in that facility, adding that it has entered into a two-year hosting agreement with Galaxy. Argo will pay Galaxy an undisclosed hosting fee.Meanwhile, Argo secured its Galaxy loan by using its 23,619 Bitmain S19J Pro mining machines currently operating at Helios and some of its machines located in data centers in Canada as collateral.The firm added that its focus is growing and optimizing the operations at its two data centers in Quebec, Canada, fully powered by low-cost hydroelectricity.Argo disclosed that it will not yet report its earnings for the third quarter of 2022. The firm also added that its stock trading would resume on Dec. 28 when both the London Stock Exchange and the Nasdaq are open for trading. Source link Read the full article

0 notes

Text

2016 Mercedes CLS Coupe

Admit it. There are times when you wish you could get away from it all by moving to your own private island. Well, some cruise passengers actually can at least for a day. Each of the following cruise lines below offer passengers a day of fun in the sun on their very own private island. For many cruisers, this stop is the highlight of the trip. After all, what could be better than sitting on a white-sand beach, drinking a pia colada and soaking in the rays without crowds? "It's a wonderful destination, we will come back next year for sure!" All of these islands have pristine shores, swaying palm trees, aquamarine waters and lots of ocean-side adventure. There usually are fees for shore excursions and equipment rental. Every destination offers something a little different for cruise passengers.

View of buildings on the coast of tropical island San Andres y Providencia Even at first glance, CocoCay looks like the quintessential Caribbean hideaway. There are wide stretches of beach in quiet coves, island huts in bright Caribbean pinks and blues, and a colorful straw market offering Bahamian crafts and goods. Many of the island buildings look brand new and they are. In 2002, the company invested more than US$ 21 million to turn this 140-acre (0.5 km) slip of land into a destination their passengers would never forget. Nature trails wind through the isle, which is home to wild chickens, peacocks and occasional iguanas. Those seeking solitude will enjoy the hammocks that are hung under coconut trees in quiet locations.

English Harbour, Hurricane Hole Sea lovers have plenty of activities to choose from. Hop on a jet ski (US $ 95 for 50 minutes) and speed across waters so clear that you can see orange starfish 20 feet below, or don a snorkel mask and explore life under the sea up close. For a great view of the island, try your hand at parasailing (US $ 79 per hour). You'll soar 200-400 feet in the air and maybe even take a cooling dip in the water before returning to the boat. Children will enjoy Caylana's Castle Cove and SeaTrek Aqua Park (US$ 15 adults, $10 children). Its floating sand castle and aquatic trampolines are just the things for those who are young at heart. A staff of 45 people lives on CocoCay, and it's obvious they take pride in keeping the island's natural beauty in top condition. Their pampering service makes the island experience so pleasurable that you won't want to leave when dusk falls all too soon. "Disney knows children, so it's no wonder that they feel at home on Castaway Cay" The cruise ship docks right at the island (other cruise ships use tender boats to ferry passengers back and forth), so youngsters can head right down the ship's ramp and out to explore Castaway Cay. There is a beach just for families, and Scuttle's Cove is a safe and fun club for children. Parents need some time on their own, so there is Serenity Bay, a secluded beach for adults. For a little pampering, have a relaxing massage in the open-air cabanas at the seaside spa.

Street in Key West Game for a little exploration? Then grab a bike (child seats are available for little ones) and hit the trails (US$ 6 per hour). This is, after all, a secluded island getaway, and there are miles of empty shoreline and tropical forest to explore. If you prefer the water, check out the Walking and Kayak Nature Adventure ($60). Participants walk with a guide through the island's lush fauna and kayak through an ecologically sensitive mangrove environment. If paddling wears you out, just jump in for a refreshing swim in the crystal clear island waters. Teens can get into their own adventure on The Wild Side (US$ 35), an excursion that includes snorkeling, biking and kayaking. Families who want to adventure together can try the Seahorse Catamaran Snorkel Adventure (US$ 49 adults, US$ 29 children). This easy 45-minute sail takes you out to calm waters and unspoiled coral reefs. Even younger children will enjoy floating in the turquoise Caribbean Sea with schools of colored fish.

View of the Caribbean Sea Visitors to the tiny islet of Motu Mahana (Polynesian for sunlit island) are greeted with the sounds of Polynesia. Les Gauguines, an eight-woman song and dance troupe, perform beguiling love songs in their Polynesian tongue while guests enjoy a scrumptious feast under the shade of thatched huts. After lunch, guests can relax in the sea or wade for yards in the shallow waters while waiters wearing bathing suits offer tropical drinks to those in need of refreshment. Try out the complimentary water sports like kayaking or snorkeling. For a different experience, board a motorized outrigger canoe and head to the beautiful island lagoon of Tahaa. Tahaa is known for two things: producing vanilla and black pearls. Guests can take a four-wheel drive tour into the hills to tour the vanilla plantations (US$ 65) or view French Polynesia's rare jewel, the black pearl, at the Motu Pearl Farm (US$ 64). From there, head to the lagoon for some quality time with the region's underwater fauna. There is even a small lagoonarium where rays, turtles, sharks and fish are enclosed in four different pools. Read the full article

0 notes

Text

That Time Bugatti Almost Built a Sedan

Admit it. There are times when you wish you could get away from it all by moving to your own private island. Well, some cruise passengers actually can at least for a day. Each of the following cruise lines below offer passengers a day of fun in the sun on their very own private island. For many cruisers, this stop is the highlight of the trip. After all, what could be better than sitting on a white-sand beach, drinking a pia colada and soaking in the rays without crowds? "It's a wonderful destination, we will come back next year for sure!" All of these islands have pristine shores, swaying palm trees, aquamarine waters and lots of ocean-side adventure. There usually are fees for shore excursions and equipment rental. Every destination offers something a little different for cruise passengers.

View of buildings on the coast of tropical island San Andres y Providencia Even at first glance, CocoCay looks like the quintessential Caribbean hideaway. There are wide stretches of beach in quiet coves, island huts in bright Caribbean pinks and blues, and a colorful straw market offering Bahamian crafts and goods. Many of the island buildings look brand new and they are. In 2002, the company invested more than US$ 21 million to turn this 140-acre (0.5 km) slip of land into a destination their passengers would never forget. Nature trails wind through the isle, which is home to wild chickens, peacocks and occasional iguanas. Those seeking solitude will enjoy the hammocks that are hung under coconut trees in quiet locations.

English Harbour, Hurricane Hole Sea lovers have plenty of activities to choose from. Hop on a jet ski (US $ 95 for 50 minutes) and speed across waters so clear that you can see orange starfish 20 feet below, or don a snorkel mask and explore life under the sea up close. For a great view of the island, try your hand at parasailing (US $ 79 per hour). You'll soar 200-400 feet in the air and maybe even take a cooling dip in the water before returning to the boat. Children will enjoy Caylana's Castle Cove and SeaTrek Aqua Park (US$ 15 adults, $10 children). Its floating sand castle and aquatic trampolines are just the things for those who are young at heart. A staff of 45 people lives on CocoCay, and it's obvious they take pride in keeping the island's natural beauty in top condition. Their pampering service makes the island experience so pleasurable that you won't want to leave when dusk falls all too soon. "Disney knows children, so it's no wonder that they feel at home on Castaway Cay" The cruise ship docks right at the island (other cruise ships use tender boats to ferry passengers back and forth), so youngsters can head right down the ship's ramp and out to explore Castaway Cay. There is a beach just for families, and Scuttle's Cove is a safe and fun club for children. Parents need some time on their own, so there is Serenity Bay, a secluded beach for adults. For a little pampering, have a relaxing massage in the open-air cabanas at the seaside spa.

Street in Key West Game for a little exploration? Then grab a bike (child seats are available for little ones) and hit the trails (US$ 6 per hour). This is, after all, a secluded island getaway, and there are miles of empty shoreline and tropical forest to explore. If you prefer the water, check out the Walking and Kayak Nature Adventure ($60). Participants walk with a guide through the island's lush fauna and kayak through an ecologically sensitive mangrove environment. If paddling wears you out, just jump in for a refreshing swim in the crystal clear island waters. Teens can get into their own adventure on The Wild Side (US$ 35), an excursion that includes snorkeling, biking and kayaking. Families who want to adventure together can try the Seahorse Catamaran Snorkel Adventure (US$ 49 adults, US$ 29 children). This easy 45-minute sail takes you out to calm waters and unspoiled coral reefs. Even younger children will enjoy floating in the turquoise Caribbean Sea with schools of colored fish.

View of the Caribbean Sea Visitors to the tiny islet of Motu Mahana (Polynesian for sunlit island) are greeted with the sounds of Polynesia. Les Gauguines, an eight-woman song and dance troupe, perform beguiling love songs in their Polynesian tongue while guests enjoy a scrumptious feast under the shade of thatched huts. After lunch, guests can relax in the sea or wade for yards in the shallow waters while waiters wearing bathing suits offer tropical drinks to those in need of refreshment. Try out the complimentary water sports like kayaking or snorkeling. For a different experience, board a motorized outrigger canoe and head to the beautiful island lagoon of Tahaa. Tahaa is known for two things: producing vanilla and black pearls. Guests can take a four-wheel drive tour into the hills to tour the vanilla plantations (US$ 65) or view French Polynesia's rare jewel, the black pearl, at the Motu Pearl Farm (US$ 64). From there, head to the lagoon for some quality time with the region's underwater fauna. There is even a small lagoonarium where rays, turtles, sharks and fish are enclosed in four different pools. Read the full article

0 notes

Text

Vladimir Putin's Full Speech at SPIEF 2022

Vladimir Putin’s Full Speech at SPIEF 2022

During the plenary session of the 25th St Petersburg International Economic Forum. Photo: Sergei Bobylev, TASS Source: Official Release of Vladimir Putin’s Speech at SPIEF St Petersburg International Economic Forum Plenary session The President attended the plenary session of the 25th St Petersburg International Economic Forum. President of the Republic of Kazakhstan Kassym-Jomart Tokayev also…

View On WordPress

0 notes