This is the blog for the one-man metal project Demons Arising.

Don't wanna be here? Send us removal request.

Text

The root cause of what OP was talking about is a concept called Shareholder Primacy. Shareholder Primacy is the idea that everything a company does is in the name of generating returns or value for the Shareholders of the company. This is a relatively new concept, developed in the mid-20th century by Nobel Economics Laureate Milton Friedman. The argument (simplified) goes as such: Shareholders give their money to a company, therefore they own a piece of the company and are entitled to push the company to return their investment and increase the value of their investment.

This has resulted in a tectonic shift in companies. Instead of there being typewriter companies, or computer companies, or lightbulb companies, or airplane companies. People (really just the investor class) invested in those companies based on their perceived ability to do a good job at what they set out to do. However, under Shareholder Primacy, ALL companies are actually shareholder value creating companies, and the only distinction is the product(s) they make in order to create value for shareholders. Shareholders can invest in any company and form enough of a vocal bloc to bully the CEO into making decisions that benefit the shareholders over all else. Hang onto that thought for a moment.

There are a lot of problems with Shareholder Primacy as a way to operate a corporation. Here are few of them:

Which shareholders get primacy? There are the short-sighted 'make my investment fiscally worth it' investors, but there are also investors who are trying to make companies reduce carbon footprints, or improve labor relations, activist shareholders. "Shareholder" is a simplistic definition and the Shareholders of a company are not a monolith.

Companies that buy most fervently into Shareholder Primacy don't last long. This is, from an economic standpoint, the most damning evidence against the case for Shareholder Primacy. Typically, companies that put the Shareholders first and foremost go out of business sooner than companies that are less extreme in this measure. Take OP's example: the stock didn't perform as well as possible, so lay off a bunch of staff to make the shareholders happier. Now that company has destroyed institutional knowledge and capabilities to return the same kinds of profits and increase the value of the company in the same way next year because they lost a lot of staff. Other companies may put more of their profit into shareholder dividends (a payout based on profit to the shareholders). More profit going to the shareholders means less profit to feed into research and development, or replacing old equipment, or raising pay to workers to retain institutional knowledge and generate a happier more productive workforce. Failing to do those things with profits will make the company less competitive in the future and underperform and then be bought out or just die away.

Growth-focused mindset. The only way to keep providing increasing value to shareholders year over year is to keep growing. However, every company eventually hits a point that it makes no sense to keep growing, but the shareholders clammer for more. That's why there are so few corporations owning every goddamn thing. They needed to keep growing bigger and bigger in order to keep their value growing for shareholders, so they acquired more companies to make that happen.

The focus comes off of anything but profits. This one I have gone over in other posts that would take me too much time to find, but generally, shareholders like corporate leadership that likes to appease shareholders. Shareholders get a voice in electing CEOs and board members, and so they tend to like to install finance guys at the top who will make the company more profitable. Boeing used to be an engineering company that made airplanes. Now they are a shareholder value-creating company that makes airplanes. When Airbus announced that they had a new generation of the A-320 that was considerably more fuel efficient than the Boeing 737, Boeing rushed the 737 MAX. The leadership of the company were no longer engineers that understood planes and could grasp complex issues facing the design team. The leadership were MBA finance and supply chain wonks that demanded that the 737 MAX be brought to market as quickly as possible without a pilot recertification requirement, which led to the MCAS system which went out on the market buggy and crashed two flights into the ground killing everybody on board. Shareholder primacy did that.

Companies are no longer grounded in reality.

My roommate recently came home pale-faced, like he’d seen a ghost. More like witnessed a massacre. Mass-firings were just done at his company. His job, he’d been assured, was safe. All of his coworkers weren’t so safe, and he had to get texts and phone calls from his work-friends, people he’d worked alongside for years, people he‘d gone out to have drinks with, learn they were no longer employed. To say he had survivor’s guilt would not be hyperbole.

Was this because the company had fallen on hard times? The pandemic has been rough for a lot of industries. No, actually, the company had turned a very nice profit both last year and previous, even in such a troublesome market.

The problem was, you see, the company’s stock price hadn’t risen quite as high as had been projected. They’d made money, sure. Quite a lot of money, in fact. But too many people had projected, i.e., bet the company would do better.

How did the company offset this “loss”? Easy: fire people. Quickest and easiest way to pad the numbers.

No but you don’t understand stock had fallen a percentage point! There was no other way!

We see it all the time. Hugely successful companies reporting ‘record-breaking’ profits then fire huge segments of their workforce - the very people responsible for those record-breaking profits. Why? The money “saved” on personnel costs can boost the stocks even higher!

If your company is struggling, not turning a profit, losing money, people expect layoffs. But to work hard, be successful, your company churning along strong and healthy, and you still lose your job? For what? Because half a percentage point that was dictated by speculation, guessing, by gambling that things would go up or down a certain amount on a graph of rich-people feelings?

I wonder how next year’s speculations will be affected with the information that the company laid off a lot of the people responsible for last year’s profits? Probably not much because the workers are just the components at the company; it’s the leadership that drives the ship, that makes the successes.Those leaders whose bonuses are coincidentally decided by, among other things, the stock price.

Companies are no longer grounded in reality.

#capitalism sucks#but it sucks more under the Shareholder Primacy theory#fuck Milton Friedman#libertarians love him#understand economics as a study but recognize that it is INCREDIBLY reductive

77K notes

·

View notes

Text

I was talking about Goosebumps with a friend tonight and found the greatest tagline for any work of horror ever

63K notes

·

View notes

Note

Is a wood louse the same thing as a roly-poly?

GOOGLE SAYS YES but I've never heard it called a roly-poly before... guess it's time to update my vernacular!!!

3K notes

·

View notes

Video

tumblr

Helicopter tail

(via)

68K notes

·

View notes

Text

When the author deletes your favorite fanfic:

#I've lost some fics for a now-defunct videogame#I was unemployed at the time and it was a great videogame#The forum on the game company's website had a weekly fanfic challenge to write short stories in the game world with prompts#I was probably the only person to submit to all of the prompts#and now that the game is no longer and the forums are belly-up#I'm missing probably three or four installments#and I miss them#The rest are on google docs or my computer's hard drive but there were some great entries that I never saved anywhere else#I'd be really really surprised if anybody else missed my fics#I'm sure other people miss the game#it was a lot of fun.

114K notes

·

View notes

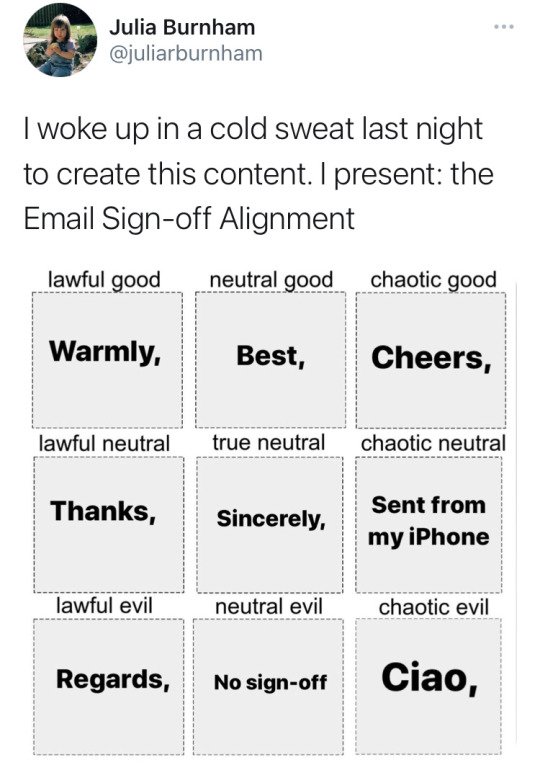

Text

18K notes

·

View notes

Text

this is a wilbur and orville fan account. love those fat flightless fucks

56K notes

·

View notes

Text

when the two smartest kids in the class get different answers

#oh man#in my air pollution control class in college#this was me a TON#and like half the time i put the wrong fucking number in my calculator

754K notes

·

View notes

Photo

bird_looking_at_its_own_reflection.jpg

143K notes

·

View notes

Video

237K notes

·

View notes

Video

tumblr

OH MY GOD 🙊. YOU SHOULDN’T SKIP THIS WITHOUT WATCHING. YOU WILL NOT REGRET IT. THIS IS A MASTERPIECE 😻💕

|• Cr: @voordeel from Youtube •|

117K notes

·

View notes

Video

tumblr

went to the Monterey Bay Aquarium today! (no audio)

5K notes

·

View notes

Video

tumblr

jumping on the bandwagon before Vine’s untimely death

250K notes

·

View notes