Don't wanna be here? Send us removal request.

Text

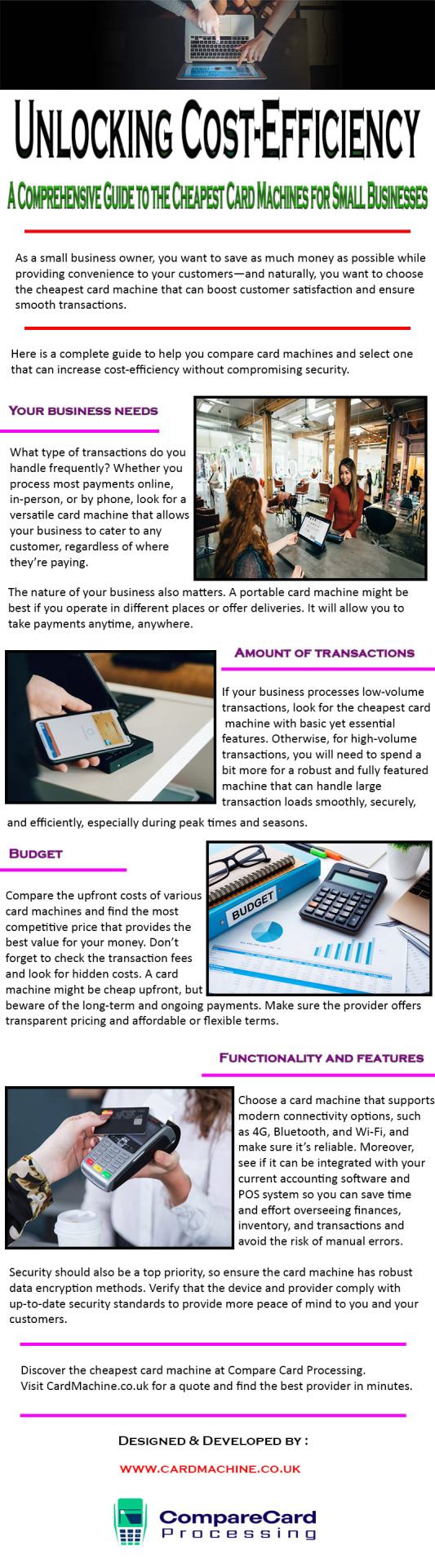

Unlocking Cost-Efficiency: A Comprehensive Guide to the Cheapest Card Machines for Small Businesses

Discover the cheapest card machine at Compare Card Processing. Visit CardMachine.co.uk for a quote and find the best provider in minutes.

0 notes

Text

Guide to Use and Install Card Payment Machines Easily!

Have you finally invested in a reliable and robust portable credit card machine for your store? That’s a great decision. Card payment terminals are an excellent investment, bringing in more sales, more customers, and better growth for your business.

Now it’s time to set it up—and it can be quite confusing to deal with an advanced piece of technology if this is your first time. Fortunately, this guide has everything you need to install card payment machines easily.

But first: What is a portable credit card machine?

Unlike countertop devices and mobile terminals, portable card machines can be taken away from their base unit within a short distance. They operate via Wi-Fi or Bluetooth and are perfect for restaurants, bars, and other food establishments.

It’s relatively simple to use a portable card terminal. All you — or your staff — need to do is remove it from the charging base, take it to wherever your customer is sitting, and swipe away! After that, you can return the device to its base to keep its battery full throughout the day.

Here is a quick guide to installing a portable credit card machine easily:

Check the contents of the box.

First, it’s important to ensure that all components of the device are inside the box. Most leading providers include the portable card machine, its charging dock and pin, network cable, and the power supply. Some may also have a receipt paper roll included for your convenience.

Set up the battery.

Battery installation on the card machine works similar to installing one on a mobile phone. Just remove the cover, insert the battery, and replace the cover as it was before.

Connect the charging stand.

Of course, you can’t power the battery without a charge. Make sure to plug the power supply into the charging base and wait for an indicator — usually an LED light — to flash before turning on the device.

Set up the wireless connection.

The portable credit card machine is known for its wireless capabilities. To go online, plug in the Wi-Fi network cable into the correct ports and check that you have a strong Ethernet connection.

Once you’ve completed the steps mention above, you may turn on the device and start using it in your establishment!

0 notes

Text

Card Machine for Small Business — Benefits Explained!

If you’re a small business owner, then you’ve probably experienced some of the hardships entrepreneurs go through daily. There’s the worry of making ends meet, trying to sell enough products just to break even. Plus, you have various other expenses to think about, from rental costs to electrical bills and paying your suppliers.

A small business owner’s problems don’t just end with financial issues, either. You also have to consider the wellbeing of your staff, your family, and of course, yourself. It would be great if you found something that could help alleviate these pressures. Luckily enough, there’s a handy little device for that.

Card machines for small businesses in the UK are becoming more of a necessity rather than an optional investment. These modern devices offer numerous benefits for the troubled business owner, such as:

Better sales

More payment options mean more customers, which, in turn, generates more profits. Having a card machine for small businesses in the UK ready to take payments can help drive your sales higher than they’ve ever been. It’s known that customers are more willing to spend when using a debit or credit card, and you can take advantage of that fact.

Improved customer service

What if you’re running a restaurant instead of a retail shop? Don’t worry — there’s a card machine for small businesses that can help you. Specifically, a portable card reader is the best option for food and drink establishments.

Unlike the static machines you see at retail stores, portable card readers allow more mobility, giving you the chance to serve better and impress your customers.

High cost effectiveness

The prices of card machines for small businesses in the UK can range from incredibly affordable to slightly out-of-reach. However, each device offers a significant return on investment that can surely benefit you in the future. You’ll be serving more customers in a shorter amount of time, leading to higher profits and better consumer engagement.

0 notes

Text

3 Best Ways to Compare Payment Processors for Your Business

Credit card processing can be tough to understand especially for the newbie merchant. There are various steps involved in the transaction as well as different payment processors to worry about.

Luckily, there are ways to easily compare and understand credit card processing, even for the first-timer. Here are three tips to differentiate the various payment processors available for businesses:

Determine your needs.

Before you settle on a payment processor, it’s important to understand your business and your goals. One type of credit card processor may not work for a certain kind of establishment, after all.

For example, restaurant owners are better off with a device their staff can take around the premises to improve customer service. On the other hand, supermarkets, convenience stores, and other retail establishments need to keep things safe — a credit card machine that can be safely kept in one location is their best option.

Do your own research.

The next step is to scour the internet for information on credit card processing. What are the different types of card machines? What organisations are involved in the transactions? How about the steps in card processing? Find out the answer to all of these questions to better understand what you need the most for your business.

Use an online comparison tool.

If you’re having trouble with the technical aspects of credit card processing, don’t lose hope. We’re fortunate enough to live in a time where online comparison tools are available—and for free.

An online comparison tool can give you the run-down on different debit and credit card machines, helping you decide on what’s most suitable for your business. This platform even has information on the leading card processing providers in the country, comparing their pros and cons, pricing, and available devices at the click of a button!

0 notes

Text

Tips to Find the Cheapest Merchant Services in 2021

Statistics show that card spending fell last year due to the pandemic. And with the rising credit card interest rates, business owners are more serious at finding the cheapest merchant services in the UK so they can pass their savings to their customers. That way, they can continue encouraging them to use their cards when buying products and services.

Searching for the cheapest merchant services in the UK in these uncertain times is easier than ever. The market for merchant services is still competitive—which means that there are still a lot of options out there. The only challenge is finding one that offers the vest value and all the features you need. If you are planning to accept card payments on your shop/e-commerce site, or if you are planning to change merchant services provider this year, then read these tips.

1. Consider the pricing structure.

If you are looking for the most transparent model, then choose a merchant that offers interchange-plus plan instead of tiered and blended. The interchange plus plan makes it easier to compare fees because the paperwork lists all prices and mark-ups. The subscription plan is also good for small business because it charges flat transaction fees instead and won't base the fee on how much your business makes each month.

2. Don't rent the card machine.

It may seem like you’re saving a lot of money renting a card machine—and you are, but only for the first few months. Your contract is going to last for years, which means that you will be paying for the rent for years, too. Renting will cost you more in the long run than purchasing the device outright. Big picture-wise, paying for the card machine once will make things cheaper for you as it will reduce your monthly fees.

3. Use a reliable price comparison website.

A quicker way to find the cheapest merchant services in the UK and that provider that will meet your needs is to use a comparison tool. A third-party price comparison website will be transparent and thorough when evaluating offers, helping you compare quotes right, and ultimately make the best choice for your business.

0 notes

Text

Portable Credit Card Machines - A Good Choice for Small Business

Why do merchants prefer using portable credit card machines for small businesses when they can just choose more affordable countertop card machines? Since these devices promise more benefits than countertop payment terminals can offer. Portable credit card machines can transform the way you do business, improve customer satisfaction, and ultimately boost your sales.

Here are some ways you can take advantage of this amazing portable credit card machine for small business.

Accept payments anywhere in your shop.

A portable credit card machine for small business comes with a small, lightweight, and detachable payment terminal and a base unit. It is considered portable because it allows you to take the terminal anywhere as long as it is within a few meters away from the base unit. The two are connected by Bluetooth. With this credit card machine, payment transactions can happen anywhere within your shop. You can effectively cut the long queues and decrease the waiting time for your customers.

Transactions made easier and faster

Portable card machines let you swipe, chip and pin, and tap cards to receive payments. It is faster and more convenient for many people than paying in cash. Did you know that these machines also have built-in printers for printing receipts? That way, you can complete every payment transaction right where you are without having to go back and forth the cashier. Customers won't have to wait in the queue to pay or wait for you to get back to their table and give their change. By speeding up payment transactions, you can boost customer experience and satisfaction with your business.

Invite more customers to your business

A cash-only policy can repel customers who need and who are interested in your products and services. Experts predict that consumers who prefer cashless and card payments are going to increase in the coming years. So if you want more customers coming to your store, you should give them more payment options. Better yet, you should start accommodating their preferred payment methods.

0 notes

Text

Learn to Select the Best Mobile Card Reader - Comparison Tips and Tricks

Doing a thorough mobile card reader comparison is going to be challenging as there are a lot of good options in the market. You will be overwhelmed if you don't know what and how to look. Don't worry—below are effective tips and some tricks that will surely help you in finding the best mobile card reader for your business.

Prioritize your business needs

The first step when doing a mobile card reader comparison is to list down all the features that you think the most essential for your business. Take note that no two businesses, even if they belong in the same sector, are exactly the same. Don't choose a card reader because it's popular or because every business owner you know is using it. Choose it because you know it has all the right features that will help you be efficient and better in serving your clients.

For example, you notice that many of your customers are asking you if you accept Apple Pay and Google Pay. Then you should be finding mobile card readers that also accept contactless payments from e-wallets so you can accommodate their needs.

Find reviews online

If you are choosing among well-known or newly-released card readers, chances are there are already published articles and reviews about them. You can just look for those mobile card reader comparisons made by reliable sources. Ensure that their reviews include the pros and cons and explain the benefits of each model.

Use online comparison tools

If you don't have the time to do a comprehensive mobile card reader comparison, then find reliable websites that will do it for you. Websites like these will not only compare prices of the machines but also the services, fees, and other essential features of merchant services providers. They will look into the offerings and recommend the best card reader for according to your requirements.

0 notes

Text

Learn to Compare Card Machines for Small Businesses

Is your small business finally gaining the traction it deserves? Great! More customers mean more profit—but it also means more work to do. Sooner or later, you’ll have to invest in a quicker form of payment processing. Customers will start to demand cashless payment options because carrying a credit card is much easier than bringing a wallet full of loose change.

Fortunately, merchant services providers have all the tools you seek. All you need to do is compare card machines for small businesses.

What can you learn from comparing card machines for small businesses?

1. The types of card machines

Your choice of card machine depends on the nature of your business. What works for one establishment might not work the same way for you, so it’s best to compare machines before deciding on one.

Online comparison tools can help you distinguish the difference between static, portable, and mobile card terminals. Each type brings its own advantages. In general, stationary machines are best for retail stores, portable terminals for food establishments, and mobile card readers for travelling merchants.

2. The different processing fees

How much do card machines cost? Contracts for countertop card machines are usually the cheapest while mobile terminals are the most expensive.

On top of the contract, most providers charge a small authorisation fee per transaction. The prices can range from 1p to 6p — which means that taking 10,000 payments per month can cost your business an extra £10 to £60.

If you want to gain a better understanding of the various charges, use a reliable online price comparison tool.

3. The various merchant services providers

Tools that allow you to compare card machines for small businesses provide in-depth information on the leading merchant services providers in the UK. You will quickly see the similarities and differences among them so you can make an informed decision.

Online comparison tools also show full price breakdowns from the top providers instantly, allowing you to see the best deals right on the spot.

For best results, make sure that you are using a comparison platform with a streamlined online process for calculating, reviewing, and selecting the best card machine for your small business.

0 notes

Text

Know how Credit Card Machines Can Help Businesses Work Flexibly!

Many businesses make the mistake of overlooking the importance of credit card processing. This technology actually works wonders for small and large companies alike, helping them streamline their payment process. Are you planning on investing in a credit card machine for your business? You’re making a great decision. But first, it’s important to understand how these devices can help you.

Here are the benefits of using a credit card machine for your business:

1. It legitimises your brand.

Want to establish credibility so that customers can start taking your business seriously? Start taking credit card payments. Potential customers are more likely to trust your goods and services if you accept major credit cards in your establishment. Taking only cash makes your business look small and almost unofficial.

2. It helps boost sales.

More people are now switching to cashless payment methods for convenience and speed. Running a cash-only operation can lead to the loss of hundreds of potential customers. Having a credit card machine for your business means that you can take both cash and cashless payments. This allows you to expand your customer base, which, in turn, boosts your sales.

3. It helps you keep up with the competition.

Are your competitors accepting credit card transactions? It’s time you did, too. Adapting to the latest methods and forms of technology is a good way to level out the playing field.

If you’re worried that credit card technology is too expensive, relax. It will not take much out of your budget. Credit card machines for businesses are relatively inexpensive. Leading service providers offer fair prices for their products, allowing you to choose the most appropriate plan for your business.

Prices can vary depending on the features and functions of a credit card machine. Your overall costs can include rental fees, transaction fees, and other charges; if you want to prepare a budget beforehand, consult an online price comparison tool to get an accurate quote.

Credit card machines come in all shapes and sizes. There are countertop card machines perfect for stationary transactions or portable card terminals that can be brought right to the customer. Top providers have even come up with mobile card readers that allow merchants to travel with the device. Make sure to consider the nature of your business before deciding on a credit card machine.

0 notes

Text

Cheapest Merchant Services UK - Make Your Transactions Easy!

Do you own a business in the UK? That makes you a merchant—defined someone who represents a person or company that sells goods or services. There are various types of merchants, depending on the nature of their business. Those who sell products through the internet, for example, are referred to as eCommerce merchants. Meanwhile, retail, wholesale, and affiliate merchants all sell goods offline.

Running a business can be tricky. Merchants need all the help they can get to operate more smoothly, even under immense pressure. Fortunately, modern technology has brought various solutions for collecting, accepting, and processing payments—also known as merchant services.

Merchant services is an umbrella term for the different financial services and processes a provider can offer. It includes the tools, companies, and methods used in the service. But there’s no need to get confused; most people refer to the service as credit card processing or electronic payment transactions.

Like any other product, electronic payment transactions come at a price. If you happen to own a small business, then it’s best that you find the cheapest merchant services in the UK.

How can the cheapest merchant services in the UK help with your transactions? The answer is simple: through payment processing products. Here’s a quick run-down on the different tools used for card transactions:

1. Static Card Terminals

Static terminals, such as the classic countertop card machine, is perfect for businesses that want customers to pay at the counter. These machines are standard in retail stores where staff can easily monitor the number of people going in and out of the establishment.

2. Portable Card Terminals

Portable terminals are the best option for businesses in the food industry because they work wirelessly (in a limited range) and can be carried directly to a customer. These machines don’t only simplify your payment transactions, but they also enhance the quality of your customer service!

3. Mobile Card Terminals

Mobile terminals, as the name suggests, need a mobile network connection to function. These card machines allow merchants to take payments on the move, making them the best choice for travelling merchants, freelancers, and even taxi drivers.

Not sure where to find the

cheapest merchant services in the UK

? Consult an online price comparison tool to help with your decision! Price comparison websites allow you to look at the leading merchant service providers side by side.

0 notes

Text

Get High Savings by Buying Cheapest Card Machine for Your Business

Mobile card machine and mobile card readers are the cheapest card machines for business. Still, they designed for smaller shops or service providers that are always on the move—such as freelance photographers and taxi drivers.

0 notes

Text

Lesser-Known Features of Portable Card Machines in the UK

What are portable card machines in the UK? They are payment systems that are similar to countertop card machines but come without wires. They allow you to take payments anywhere as long as you are within 50 meters from the base unit.

Source: portable card machines in the UK

0 notes

Link

0 notes

Link

0 notes

Link

0 notes

Link

0 notes

Link

0 notes