Trends and events related to the Business of Media - Video Streaming sector

Don't wanna be here? Send us removal request.

Text

Amazon boosts Freevee content catalog and is the latest company to lean into ad-supported video streaming content popularity

As reported by The Hollywood Reporter recently, Amazon is moving 100 TV series and movies from its Prime Video SVOD service to its FAST video streaming service called "Amazon Freevee," including Wheel of Time, Lizzo’s Watch Out for the Big Grrrls, Modern Love and Reacher.

In doing so, it is the latest company that is leaning into the increasing popularity of FAST "Free ad-supported television" video streaming services. Earlier this month, Deadline reported on Paramount Global's decision to offer full seasons of popular shows like RuPaul’s Drag Race All Stars, iCarly and Mike Judge’s Beavis & But-Head on their FAST platform Pluto TV in the month before their new seasons premiere on Paramount+.

This can be seen as a wider shift towards ad-supported content. FAST streaming services had a penetration rate of 58% in 2022 (p. 7) in the United States, which is up 18% from its penetration rate in 2020. And this growth is expected to continue; S&P Global Market Intelligence projects that the FAST business in the United States will grow from the 4 billion USD range in 2022 to almost 9 billion USD by 2026.

However, the growth of the FAST business also points to a wider trend that can be observed in our current media landscape. In the past few months, Disney and Netflix have each introduced ad-supported tiers in addition to the ad-free subscription options on their respective video streaming services as well. When put together, we can spot a clear shift towards ad-supported content, of which the expansion of the Amazon Freevee content catalog is merely the most recent example.

Indeed, a Statista study from 2022 that looked into the share of the population that prefers low cost streaming versus high cost streaming without ads across 15 countries showed that a higher share preferred low cost streaming with ads than without ads in every single one of those 15 countries. So it seems ad-supported content is here to stay.

Word count: 320

0 notes

Text

Warner Bros. Discovery rebrands HBO Max to just "Max," adding Discovery+ content

On Wednesday April 12, Warner Bros. Discovery announced it will be rebranding HBO Max to Max and adding Discovery+ content to the platform. Starting May 23rd this year, the HBO Max app will be updated to reflect these changes, while Discovery+ remains available as a standalone app, as previously announced.

Max will be combining content from HBO Max and Discovery+, including HBO's House of the Dragon, White Lotus and Succession, as well as Discovery+ unscripted shows from The Food Network, the Discovery Channel and TLC.

This news is not a surprise; Warner Bros. and Discovery completed their merger in April 2022, and having a video streaming service on which viewers can stream content from both Warner Bros and Discovery maximizes the value the platform offers, which boosts the odds of people keeping their subscription to the streaming service. This is important in a competitive streaming landscape. As Discovery CEO David Zaslav said in a presentation last week, "holding subs is as important as adding subs."

There will be three subscription tiers available. Two if these tiers are similar to those currently offered by HBO Max. HBO Max' tier with ads will now be called the Max Ad Light tier, while the price stays the same at $9.99 a month or $99.99 a year. The ad free tier will be named Max Ad Free, and will set subscribers back $15.99 a month or $149.99 a year, which is the same HBO Max' current price for their ad free tier. However, Max will have a new third tier available called Max Ultimate Ad Free. This will cost $19.99 a month or $199.99 a year, allows for an ad free experience on four concurrent streams versus two concurrent streams available for subscribers to the other tiers, streaming in 4K, and up to 100 offline downloads.

Other changes include a simpler user interface, a new content navigation menu, a new default kids profile with parental controls, enhanced personalization, and more.

Interestingly, this is the second streaming service in a month announcing a rebrand. As reported earlier on this blog, Fubo TV recently rebranded to Fubo as well. I wonder if we have a trend on our hands!

Words: 363

0 notes

Text

Roku lays off 200 Workers (again) in latest round of job cuts as a part of restructuring plan

As Deadline reported on March 30, Roku is laying off another 200 - which is 6% of its current workforce - workers after already having fired 200 workers in November 2022. At the time, the company cited a weak ad market as the culprit, stating in a document filed with the U.S. Securities and Exchange Commission that the layoffs would be “substantially complete” by the end of the first quarter of 2023.

This most recent layoff, then, became a reality mere days before the end of the first quarter of 2023. It remains to be seen whether this will indeed be the last round of job cuts.

To give you an idea of Roku's numbers, Forbes previously wrote that Roku exceeded its own revenue expectations in the fourth quarter of 2022; The company had projected a revenue of $800 million in Q4, but it beat this expectation when it reported a revenue of $867 million. However, although Roku beat its own expectations, it is worth noting that its reported revenue in Q4 of 2022 was only slightly higher than their revenue in Q4 of 2021, when it reported a total net revenue of $865.3 million. Still, Roku must be happy with their 2022 Q4 revenue numbers, because in the first, second and third quarters of 2022 it had reported a declining total net revenue of $733.7 million, $764.4 million and $761.4 million respectively.

But, even though the company must be content with their 2022 Q4 total net revenue number, the company still had an operating loss of $249.9 million. In a letter by Roku to shareholders in February, Roku expressed that their strategy would be to improve their operating expense profile "through a combination of operating expense control and revenue growth."

The latest round of layoffs, then, can be seen as a part of their "restructuring plan" to lower their operating costs and increase return on investment.

Words: 317

0 notes

Text

FuboTV Rebrands to Fubo and Goes Back to its Roots with Sports-Focused Advertising Campaign

As reported by Deadline on March 21st, FuboTV is dropping the "TV" from its name and will be called "Fubo" moving forward. Co-founder and CEO David Gandler's stated that their consumers "have affectionately shortened our name to Fubo and we feel that name represents the premium media brand we are today."

The rebranding is being promoted through a national advertising campaign that was created by Maximum Effort, which is Ryan Reynold's production company. This is not a surprise; Maximum Effort and Fubo signed a multi-year partnership in August 2022 that resulted in Maximum Effort owning $10 million worth of shares in Fubo in a first-look deal for unscripted content, so a collaboration between the two companies to create these new commercials makes sense.

youtube

The campaign - which not only announced Fubo's new name but also their new logo - consists of three commercials that all leverage sports as the factor that sets Fubo apart from other video streaming services. They feature former NFL quarterback Mark Sanchez and former NBA great Kevin Garnett, and all three commercials use the tag line "If Sports Fans Built a Streaming Service." The rollout of this campaign also strategically coincided with the World Baseball Classic and ahead of next week’s start of the Major League Baseball season. In doing so, Fubo is emphasizing its roots; The video streaming service launched in 2015 as a sports-focused streaming service before it later added news and entertainment channels, such as ABC and Disney.

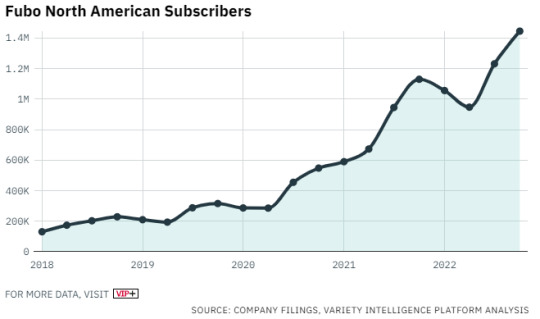

Fubo had 1.445 million subscribers in North America at the end of 2022, and it added 251,000 new subscribers in the fourth quarter of 2022, which is more than other video streaming services such as YouTube TV, Hulu + Live TV or Sling TV. It also surpassed $1 billion USD in total global revenue for the first time, and had a $984 million USD revenue in North America, which is up 55% compared to 2021. We will see if its rebranding affects Fubo's growth either positively or negatively in the next few years.

Words: 340

0 notes

Text

Disney CEO Bob Iger Talks Future of Hulu & Disney+

Bob Iger, the current CEO of Disney, made an appearance at Morgan Stanley's annual Technology, Media & Telecom Conference on March 9, and spoke about Hulu, Disney+, and the video streaming sector.

With regards to Hulu, Iger remained noncommittal, stating that Disney is studying Hulu's business "very carefully." As things stand, Disney owns 66.7% of Hulu, and they may own 100% in the future. Starting in January 2024, Comcast could use its put option to require Disney to buy its stake, or Disney could use its buy option to tell Comcast to sell its stake.

Iger stated he sees Hulu as a solid platform that is attractive for advertisers, with strong original programming and a good library. At the same time, he called Hulu's content "undifferentiated" compared to the content on Disney+. He commented that "the environment is very, very tricky right now and before we make any big decisions about our level of investment...we want to understand where it could go." In other words, Disney is unsure what to do with Hulu, pointing to the competitive video streaming sector.

From Iger's point of view, there are six or seven streaming platforms "all seeking the same subscribers, in many cases competing for the same content. Not everybody’s going to win.” Disney has reportedly hired Goldman Sachs to examine its options regarding their stake in Hulu. EMarketer reported a revenue of $2.56 billion in 2020, $3.21 billion in 2021, and $3.62 billion in 2022, so Hulu's revenue numbers have been growing.

Iger does, however, see a bright future for Disney+. According to him, everything will be migrating to streaming eventually, so he is optimistic about making Disney+ a profitable piece of the company. However, Iger remarked that it needs a "pricing strategy that makes sense" as content investments like production costs have increased.

Disney believes it still has room to increase the prices of their monthly subscriptions, even after raising the price of their ad-free tier in the U.S. from $7.99 to $10.99 per month in December 2022, since they suffered minimal losses of subscriptions. Another price hike may thus be on the horizon.

Additionally, Disney is considering licensing their content to other platforms to boost its revenue, because exclusivity isn't as valuable in attracting streaming subscribers as they once thought.

Words: 380

0 notes

Text

Peacock Adds Reelz Programming and Continues to Shift Focus to Paid Premium Content

Peacock, NBC Universal's video streaming service which currently houses TV shows like the That's '70s Show, The Real Housewives of Beverly Hills, 48 seasons of Saturday Night Live, and The Vampire Diaries, continues to look for ways to expand its programming, and it has recently found another way to do so. As reported by Variety, Peacock has officially signed a distribution deal with the Reelz Channel.

Reelz Channel, a small independent cable network, will bring both its on-demand programming and its linear feed to the streaming service starting March 1st, 2023, available to Peacock's Premium and Premium Plus subscribers.

Notably, the one exception is the Major League Wrestling programming that airs on the Reelz Channel every week on Tuesdays at 10 p.m because Peacock has a streaming deal with WWE, which has exclusivity in the category on the video streaming service.

Peacock's deal with Reelz is the latest example of its efforts to add new programming. It can be seen as part of a shift in Peacock's strategy; Initially, Peacock focused on a free ad-supported tier, but it has been slowly bulking up its Premium tier offerings with the addition of the above mentioned WWE programming in 2021, a Hallmark Movie distribution deal signed in October 2022, and now the addition of the Reelz Channel's content, including the network's most well-known show "On Patrol: Live," a police reality show.

This comes after it was announced in early February that Peacock no longer offers the free-but-limited-content ad-supported tier to new users, and that the cheapest option for new users in the United States is now $4.99 per month for Peacock Premium, while the Premium Plus tier costs $9.99 per month for U.S. Subscribers. Adding the Reelz Channel's programming may thus be interpreted in one of two ways:

(1) An attempt to convince existing users who still have access to the free plan to switch to Peacock Premium

(2) An effort to attract new customers with additional programming.

My guess is that it's a combination of both.

Words: 335

0 notes

Text

Paramount+ is the Latest Streaming Service to Raise Prices of Their Monthly Subscriptions

According to The Hollywood Reporter, Paramount+ will soon be raising the prices of their monthly subscriptions in both the United States and in "select international markets," without clarifying which international markets would be affected. The upcoming increase will be in effect from the third quarter of 2023, when Paramount+ and Showtime officially merge into one.

The advertising-free "premium" plan, which currently costs 9.99 USD per month, will then set new and existing customers back 11.99 USD per month, while the "essential" plan, which includes advertisements, will go up 4.99 USD to 5.99 USD per month. However, the latter plan will not include any of the Showtime content.

To put this into context, Paramount+ added 9.9 million subscribers during the fourth quarter of 2022. This is the highest number since 2021, when the streaming service was rebranded from CBS All Access. This jump can be ascribed to the NFL Sunday games. Additionally, both the addition of Top Gun: Maverick as well as original programming such as Yellowstone and Criminal Minds boosted the growth of subscribers as well. In other words, Paramount's streaming business is growing.

But, despite the increase in streaming subscribers, Paramount reported a revenue of 5.9 billion USD, which is a 7% decrease when comparing the fourth quarters of 2021 and 2022. The company cited a weak advertising market as the reason for this decline. Considering the growth of their streaming platform and the video streaming sector as a whole, it is not a surprise Paramount is turning to a raise of subscription fees to offset the declining revenue of the company at large.

This is merely the latest news regarding streaming services raising their pricing. Previously, Disney and Warner had already announced a price increase. In the next few weeks, it will be interesting to keep an eye on the other big names in the video streaming sector to see if any other streaming services follow suit.

Words: 319

0 notes

Text

Netflix Officially Starts Rolling Out Restrictions on Password Sharing Globally

Are you a college student living across the country, using your parents' Netflix password? You are not alone. According to Netflix, over 100 million households are sharing accounts.

Well, Netflix is about to put a stop to it. On February 8, Netflix officially started rolling out measures to prevent password sharing in New Zealand, Portugal, Spain and Canada, with more locations to follow in the near future.

This follows the accidental posting and deleting of a set of guidelines on their website last week. At the time, Netflix stated that “For a brief time yesterday, a help center article containing information that is only applicable to Chile, Costa Rica, and Peru went live in other countries. We have since updated it.”

For a moment there, this statement calmed down those of us who had been ready to cancel their subscription. As it turns out now, Netflix is not planning on backing down regardless of the threat of losing customers; The global implementation of these rules will continue throughout the remainder of Q1.

So what will they entail? The measures require users to connect to one's home network every 31 days to prove that the device belongs to a member of the household. One can use temporary codes while traveling for 7 days, but if an account is persistently used from another location, it will be blocked. Subscribers to the company's standard or premium plans can buy a sub account for two people they don't live with for an extra fee. This option, called "paid sharing," will cost somewhere between €3.99 to $7.99 extra per month.

Whether or not this is a smart move remains to be seen - only one in three subscribers indicated they would be willing to pay extra to legally share their account. So, Netflix could be facing a substantial number of subscription cancellations.

Another question we are left with is whether other streaming services will follow suit. Although some competitors have limits to how many devices can stream at the same time, so far none of them have suggested they would ban password sharing outright. However, we can be sure they are paying attention.

Word count: 359

0 notes

Text

My Sector is Video Streaming

My name is Claudia Vader, I'm a student in the Media, Culture & Communications program at NYU, and over the next few months I will be covering all things related to my sector: Video Streaming!

I will be following Deadline, Variety and The Hollywood Reporter, among other sources.

0 notes