The blog of Japanese enterpreneur in Vietnam. Kengo Kurokawa is Founder / CEO of Asia Plus Inc., start-up company that aims to bridge Japan and Asia thorugh IT

Don't wanna be here? Send us removal request.

Text

E-Commerce in Vietnam: Explosive Growth and Changing Consumer Trends in 2024

Vietnam EC Trend Overview

The e-commerce industry in Vietnam has experienced significant growth, increasing by 48% from 3,798 million USD to 5,645 million USD according to metric.vn, comparing transactions from May 2024 - June 2023 against May 2023 - June 2022. This growth far surpasses the overall retail market trend, which saw a 9.6% increase in 2023, highlighting the rapid expansion of online shopping compared to offline retail.

The most popular categories in e-commerce are beauty and home & lifestyle products. Among the fastest-growing categories, sports & travel saw a growth rate of 73%, followed by home appliances and phone & tablet categories, both growing at 64%.

How Consumers Utilize EC

We conducted consumer research among 300 online shoppers to understand their behavior. Among these shoppers, 54 are weekly online shoppers, indicating a high frequency of online purchases. For beauty and fashion categories, half of these consumers consider online shopping as their main channel. However, even regular online shoppers still prefer offline channels for food purchases.

The primary motivations for using online shopping among Vietnamese consumers are pricing and promotions. This suggests that many Vietnamese consumers are deal hunters, valuing the cost savings and promotional offers available online.

Platform Popularities in Vietnam

When examining platform popularity, Shopee remains the dominant leader, with 64% of consumers selecting it as their most used platform. TikTok has emerged as the second most popular platform, surpassing major players like Lazada and Tiki, and taking market share from social networks like Facebook.

Shopee is highly regarded for its competitive pricing, promotions, and product variety. TikTok is praised for its unique positioning, offering valuable information, reviews, and a fun shopping experience, in addition to good pricing.

Shopee and Lazada are widely used for most product categories. In contrast, specialized e-commerce shops like The Gioi Di Dong and Dien May Xanh are popular for IT products, while social commerce platforms like TikTok and Facebook are preferred for fashion and beauty.

EC growth continues for higher digitalization

With the rapid growth of e-commerce, the EC ratio in Vietnam is expected to rise even further. This growth is driven by advancements in cashless payment methods and the operational excellence of quick delivery services. Despite these advancements, price and promotions continue to be the major motivators for Vietnamese, who remains to be the deal hungers

0 notes

Text

VinFast's IPO Splash and Subsequent Struggle - Analysis based on their sales record

VinFast: Vibrant IPO Debut Followed by Stock Price Decline

Recently, we have been receiving inquiries from several international media companies interested in discussing VinFast, especially focusing on the stock's decline following its striking Nasdaq debut.

VinFast’s rapid growth and its impact attracted global attention with its 2023 listing on the Nasdaq market. It debuted with an astonishing market valuation of $85 billion, surpassing established U.S. automakers like General Motors and Ford in market capitalization, becoming a major topic not only in Vietnam but also in Japan. However, its stock price has since continued to decline, now falling to a quarter of its initial public offering price.

Domestic Reliance on Taxis and Struggling U.S. Operations

Although VinFast's sales in 2023 were below the initial target of 50,000 units at 34,855 units, it is still a significant number considering the Vietnam Automobile Manufacturers Association (VAMA) reported that total car sales in 2023 were around 300,000 units. In Vietnam, it is now quite common to see VinFast cars on the streets. However, looking at the breakdown of these sales, several factors come to light.

One point of interest is the high sales dependency on the taxi company Xanh SM, founded by Vingroup founder Pham Nhat Vuong. Xanh SM, known for its teal-colored vehicles, accounts for over 70% of VinFast’s sales (about 25,000 units). While Xanh SM’s service quality, featuring new vehicles and company-employed drivers, is highly regarded, the taxi business itself has become less profitable due to increasing competition, making these sales heavily reliant on initial investments.

Another point of interest is VinFast’s business in the U.S. Despite some success in the domestic market, its expansion abroad has been challenging. In the U.S., despite initial investments such as presentations at major conventions like CES and showroom openings, sales have remained under 1,000 units. American auto review sites have unfortunately given VinFast models poor reviews, suggesting a difficult path ahead for a market turnaround.

VinFast’s Future Outlook and Sustainability

For 2024, VinFast has set an ambitious sales target of 100,000 units, nearly three times that of 2023. The company also plans to set up a production capacity of 950,000 units by 2026. This figure is notably high, even considering Tesla's 2023 global sales of 1.8 million units.

While the domestic market remains robust, challenges such as the limited market size in Vietnam, the uncertain future sustainability of the domestic taxi business VinFast relies on, and struggling U.S. operations indicate that uncovering foreign demand is essential. Currently, VinFast is actively investing not only in Southeast Asian countries like Thailand and Indonesia but also in India and the Middle East. Such bold expansion strategies are based on the vision and financial strength of Pham Nhat Vuong, Vietnam's wealthiest individual and Vingroup's founder, but the path is not easy, requiring sophisticated marketing, adaptation to market conditions, and overcoming intense competition.

This is the first time a Vietnamese manufacturing company has taken on such a large-scale global challenge. The journey and growth of VinFast represent a significant step for the Vietnamese manufacturing industry in making its presence felt on the global market, and its future developments are highly anticipated.

0 notes

Text

How Vietnam's Retail Landscape is Evolving in 2024

As we delve into the shifting terrain of Vietnam's retail market in 2024, it becomes evident that despite broader economic challenges, the sector is displaying resilience and dynamism. Let's dissect the key transformations and trends that have marked this year's retail landscape.

1. Pharmacy Store Boom

One of the most striking developments is the burgeoning expansion of drug chain stores. Witnessing a remarkable surge, the total number of pharmacies has escalated to over 3,200 outlets from 2,700 in the preceding year. This surge signifies a notable shift from traditional pharmacies to modern drug store chains. Long Chau emerges as a frontrunner, amplifying its presence from 1,000 to an impressive 1,600 stores. Conversely, Pharmacity, which experienced rapid growth in previous years, seems to have paused its expansion trajectory, with a slight dip in store numbers observed in 2024.

2. Suburban F&B Chain Expansion

The food and beverage sector is also undergoing significant expansion, particularly in suburban areas. Major F&B chains have witnessed a 6% increase in store numbers, while growth in suburban regions has soared to an impressive 33%. Giants like Highlands Coffee and Starbucks have expanded their footprint, along with fast-food behemoths KFC and Pizza Hut, penetrating deeper into suburban markets. Notably, Mixue has aggressively increased its franchise network, surpassing 1,000 stores in just a few years.

3. Resurgence of CVS and Mini-Supermarkets

Another notable trend in 2024 is the resurgence of convenience stores (CVS) and mini-supermarkets. The growing purchasing power of Vietnamese consumers has attracted attention from both local and foreign CVS players. GS25, for instance, has expanded its presence to 245 stores, up from 201 the previous year. Japanese convenience store chain, Mini Stop, has made significant inroads into the Vietnamese market, opening over 40 new stores, bringing its total to 187.

4. Restructuring at Mobile World Investment Corporation (MWG)

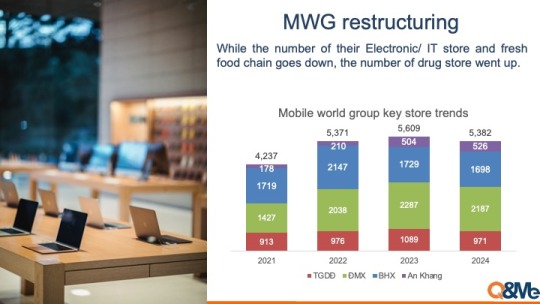

In the realm of retail conglomerates, Mobile World Investment Corporation (MWG) has embarked on a restructuring journey. Managing various retail chains including Thế Giới Di Động (TGDD), Điện máy Xanh (DMX), Bách hóa XANH (BHX), and An Khang (AK), MWG has shuttered some unprofitable BHX and TGDD stores while bolstering its investment in the burgeoning drug chain market under An Khang. The number of An Khang stores has risen from 504 to 526, showcasing MWG's strategic realignment.

In the year 2024, the Vietnamese retail market continues its upward trajectory, albeit amid intensified competition. As players vie for market share, agility, innovation, and strategic expansion will be paramount in navigating this dynamic landscape.

0 notes

Text

How Xanh SM Won 2nd Position in Vietnam's Ride-Hailing Market

The ride-hailing landscape in Vietnam is undergoing a swift transformation, marked by evolving consumer preferences and the entry of new players that are rapidly reshaping market dynamics. Among these, Xanh SM's ascent to the second position in the sector is a narrative of strategic differentiation and consumer-centric innovation. This column delves into the multifaceted approach that propelled Xanh SM to its current stature, highlighting the insights gleaned from a comprehensive study involving 300 ride-hailing users in Vietnam.

The Evolving Landscape of Ride-Hailing in Vietnam

The Vietnamese ride-hailing market is on a fast track of change, driven by technological advancements and shifting consumer behaviors. Our research, encompassing 300 ride-hailing service users, reveals insightful trends about the current usage patterns and brand positioning within the sector. This foundational understanding sets the stage for a deeper examination of the market dynamics and the factors influencing consumer choices.

Ride-hailing selected due to ease-of-booking

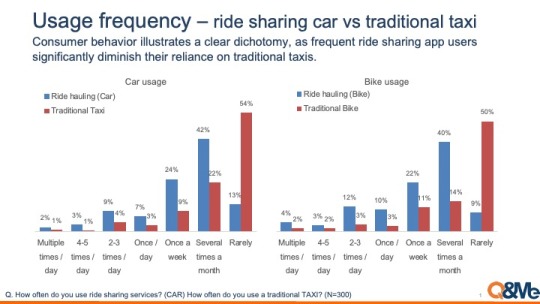

The data paints a clear picture of the integral role ride-hailing services, both cars and motorbikes, play in the daily lives of Vietnamese consumers. With over 40% of respondents using car-hailing services weekly and 50% opting for motorbike hailing, the convenience and accessibility of these services are undeniable.

Users overwhelmingly cite the ease of booking and the diversity of available vehicle types as key advantages, underscoring the value proposition of ride-hailing platforms over traditional transportation methods. Yet, a notable 39% perceive no distinct benefits of conventional vehicles over ride-hailing options, pointing towards a significant shift in consumer perceptions.

Xanh SM in the 2nd brand position after Grab

In the competitive arena of Vietnam's ride-hailing market, Grab continues to hold the reins with a significant majority of users favoring the platform. However, the emergence of Xanh SM as a strong contender for the second position, as indicated by 52% of respondents having used its services in the past year, signals a shifting market dynamic. The company's ability to capture a 19% share as the most preferred service is indicative of its growing influence and market penetration.

The ascendancy of Xanh SM can be attributed to its superior customer satisfaction scores, a testament to the company's focus on service quality and user experience. A closer analysis reveals two critical areas where Xanh SM outperforms its competitors: driver professionalism and vehicle cleanliness. Unlike its rivals, Xanh SM employs full-time drivers, ensuring consistent service standards, and utilizes the latest VinFast EV cars, enhancing the overall customer experience with modern, clean, and eco-friendly vehicles.

The Path Forward for Xanh SM

Xanh SM's strategic differentiation, characterized by a focus on driver professionalism and vehicle quality, has laid a robust foundation for its early successes in the competitive ride-hailing landscape. However, the sustainability of this approach, given the high fixed costs associated with employing full-time staff and investing in cutting-edge EV technology, remains a critical consideration. As Xanh SM navigates the challenges of scaling its operations and maintaining profitability, the industry will keenly observe its ability to sustain its competitive edge while managing the substantial investments that have fueled its initial growth.

In conclusion, Xanh SM's rise to prominence in Vietnam's ride-hailing market is a narrative of strategic innovation and a deep understanding of consumer needs. As the market continues to evolve, the ability of new entrants like Xanh SM to challenge established players will hinge on their adaptability, customer-centric strategies, and the sustainable management of operational costs.

0 notes

Text

What apps Vietnamese use - Findings from the iPhone Screen time

In the rapidly evolving digital landscape of Vietnam, a comprehensive study was conducted to delve into the mobile application usage behaviors of Vietnamese users. Utilizing the "Screen Time" feature on iPhones, this research meticulously captured the types and duration of applications used by individuals. This column provides an in-depth analysis of the findings, highlighting significant trends in smartphone usage, the dominance of key social media applications, and the emerging significance of lifestyle apps in finance, ride-sharing, and e-commerce (EC).

Vietnamese Smartphone Usage: A Deep Dive

The study unveils that the average Vietnamese spends approximately 5.5 hours per day on their smartphones, navigating through an array of 27 different applications over a week. This statistic not only underscores the central role of smartphones in daily life but also indicates the diverse range of applications that cater to various aspects of modern living in Vietnam.

The Quintet Dominating Screen Time

A striking revelation from the research is the disproportionate amount of time spent on just five applications, which cumulatively account for 77% of all mobile application time. These applications are Facebook (33%), TikTok (16%), Zalo (15%), Messenger (7%), and YouTube (6%). This dominance reflects the integral role these platforms play in social interaction, entertainment, and information dissemination in Vietnam.

Facebook, with its multifaceted features, continues to be the most used platform, serving as a hub for social networking, news, and entertainment. TikTok's ascendancy, especially among the youth, is noteworthy. Its short, engaging video format and the burgeoning trend of live commerce on the platform have significantly contributed to its increased usage. Zalo, a local messaging app, Messenger, and YouTube also remain pivotal in the digital routine of Vietnamese users.

Particularly, TikTok's exponential growth in popularity over the past years is a phenomenon that warrants special attention. The platform has particularly resonated with the younger demographic, offering a creative outlet and a new form of entertainment. Live commerce, an innovative feature on TikTok, has further bolstered its usage, blending entertainment with shopping in a way that appeals to the modern consumer.

Lifestyle Applications on the Rise

Parallel to the dominance of social media apps, there has been a significant uptick in the adoption of lifestyle applications, spanning finance, ride-sharing, and e-commerce. The penetration of EC apps has notably increased, with 70% of users now engaging with such platforms, up from 57% in the previous year. This surge underscores a growing preference for online shopping among Vietnamese consumers.

Ride-sharing applications have also seen substantial adoption, with 50% of users utilizing these services not only for transportation but also as a convenient means to order food and drink online. This dual utility has made ride-sharing apps an indispensable part of daily life in urban Vietnam.

Financial Apps: Paving the Way to a Cashless Society

The proliferation of financial applications is another significant trend highlighted by the research. The usage of such apps has escalated from 75% to 88%, reflecting a broader move towards digital financial services. A notable 80% of users now utilize at least one online banking application, while 45% have adopted mobile payment solutions like Momo. This shift is instrumental in Vietnam's journey towards becoming a cashless society, with digital transactions becoming increasingly prevalent.

While social media applications continue to capture the lion's share of mobile online time, the versatility in the usage of mobile applications is evident. From facilitating social interactions to enabling seamless financial transactions and simplifying daily chores through EC and ride-sharing services, smartphone applications have become deeply ingrained in the fabric of daily life in Vietnam.

This comprehensive overview not only sheds light on current trends but also provides insights into the evolving digital behaviors of Vietnamese users. As the digital landscape continues to expand, understanding these patterns becomes crucial for businesses, developers, and policymakers aiming to cater to the dynamic needs of the Vietnamese market.

0 notes

Text

Why Hanoians Choose the Metro: Insights from Metro Users

It's been a transformative period in Hanoi since the introduction of the city's first metro system. The bustling Vietnamese capital, accustomed to motorbike commutes, is experiencing a shift in lifestyle. To unravel the motivations and perceptions of metro users in Hanoi, we conducted a quantitative research study.

Frequent metro users

Our findings paint a picture of significant reliance on the metro for daily transportation needs. Around 50% of respondents utilize the metro at least once a day. Primarily, the metro serves as a pivotal mode of transport for commuting to work or school, while also facilitating connections and leisure activities.

Convenience and safety avoiding the traffic jam

They used to rely on motorbikes before metro service started. So what made them start using metro over motobike? The top three motivations cited for choosing the metro over other modes are avoiding traffic congestion (90%), convenience (72%), and safety concerns (69%).

Users praise the metro for its affordability, cleanliness, and freedom from traffic congestion. We hear the comments from the representative such as "Traveling by metro is cheap, cool, and clean, with no traffic jams."

The consensus among users is that the metro offers swift above-ground travel, eliminating the fatigue of traffic congestion.

How do they come to the stations and go to destinations

The metro users have to commute themselves to the station, then to the destinations. How do they take care of these transportations from / to the stations. The majorities of them walk from / to the stations, while some use motorbike including the ride hauling such as Grab. The metro users are the ones who only need to walk a few hundred meters from / to the stations and walking is not going to be huge issues for them. Also the service like Grab help them to ease their commuting.

Good satisfaction for comfort, speed and safety

Users express high satisfaction with various aspects of the metro, including affordability, comfort, speed, punctuality, service, and safety. However, the parking facilities require enhancement, especially considering that 37% of users still commute to the metro by motorbike.

Metro has changed the lifestyles of some who particularly have their residence or school / office near the closest metro stations. Metro will start their operation in HCM in 2024 and we would see the lifestyle change resulting from the new commuting style soon.

0 notes

Text

What Vietnamese Moms Cook - What We Find Out from 6,000 Photos

Vietnamese cuisine is a rich tapestry of flavors, textures, and culinary techniques that reflect the country's diverse geography and history. But what do Vietnamese moms, the unsung heroes of the kitchen, actually cook on a daily basis? To answer this question, we embarked on an intensive research project, collecting over 6,000 photos of meals prepared by 300 Vietnamese women who cook at least five times a week. We analyze their cooking behaviors through the projects that have these respondents take photos of their cuisines for a week to answer short questions

Predominance of Vietnamese Cuisine & Time Spent Cooking A staggering 96% of the meals prepared by our respondents were Vietnamese dishes. Furthermore, 84% of the women cooked exclusively Vietnamese meals for an entire week. This highlights the deep-rooted cultural significance and preference for local cuisine. Interestingly, this strong inclination towards Vietnamese food persists despite the diversification of the Vietnamese food lifestyle by many international cuisines. It shows that the Vietnamese cooking lifestyle remains very much domestic. 20's and 30's have higher ratio of international cuisine cooking, while 40's and higher tend to cook Vietnamese cuisine only.

Seasoning popularity The women cooked an average of 3.2 meals per day, indicating that they often prepare more food, possibly for later consumption or for other family members. When it comes to ingredients, fish sauce, soup powder, flavor seasoning, onions, and garlic were found to have a high penetration ratio. A whopping 98% of respondents used these ingredients regularly. The rich variety of seasonings adds essence to Vietnamese cooking lives. Vietnamese Fish Sauce (Nước mắm) was used in 37% of the cuisines and had a 100% user ratio during the 7-day survey period. The popularity of soup powder, onions, garlic, sugar, and peppers is also high. MSG is used in 35% of the cuisines, with a 7-day user ratio of 75%. Mayonnaise is used by 26%. This suggests that the number of meals and the ingredients used are closely interlinked, with local ingredients taking center stage in daily cooking.

Opportunities for nutrition and convenience

Our intensive research provides a comprehensive look into the daily cooking habits of Vietnamese moms. From the strong inclination towards local cuisine to the time and effort invested in cooking, and the importance of family meals, the insights are manifold. Vietnamese moms rely heavily on traditional foods and seasonings, utilizing a variety of these to enhance taste, nutrition, and convenience in their daily cooking.

However, it's important to note that while the core of their cooking is deeply rooted in Vietnamese local foods, lifestyle changes are leading to more occasions for these women to experience international foods. As a result, we can anticipate a gradual shift in their cooking lifestyle towards incorporating more international foods and convenient options such as frozen foods.

0 notes

Text

What cities do Vietnamese like to travel?

After COVID-19, we are seeing a rise in people traveling within Vietnam. More and more people are excited to visit different parts of their own country again. This is a sign that the country is recovering from the tough times of the pandemic, although Vietnam economy faces the different economy toughness in the 1st half of 2023.

When we see the frequency of Vietnamese domestic travel (except for biz trip and company trip), 49% of the respondents from 20-39 years old in HCM and Hanoi makes a domestic travel once in 3 month, and 30% do that every 2 month. The travel frequency is higher among the youth (20-29 years old) and higher income personnel.

What are the popular destinations among them? The top 5 locations are Da Nang (43%), Phu Quoc (39%), Da Lat (37%), Sapa (29%), Hoi An (27%).

When you see the destination popularity by profile, you would find their characteristics more clearly. Da Nang and Phu Quoc are the top 2 destinations while the popularity is different by wealth levels. While Da Nang is relatively supported regardless of the wealth differences, Phu Quoc is intensively popular by the wealthy group. Phu Quoc and Sapa is categorized as the destination that are popular among wealthy groups, while Da Nang, Da Lat and Hoi An are generally popular regardless of the profile

So why these destination are selected. The locations are selected based on “good nature (66%)”, “good / unique culture (56%)” and “good food selection (55%)”

When we take a look at the selection reasons by favorite destination, we could categorize the characteristics of the top destinations as below. Each of the top destination has its unique reason to call a visit.

Da Nang / Nha Trang: Destination where Vietnamese enjoy the beach lives, although it is less relaxing

Phu Quoc: The location where people enjoy both of marine nature and a variety of entertainment

Da Lat / Sapa: The destinations where people relax themselves in the midst of good nature.

Hoi An: Unique destination with unique culture and food perception, endorsed with a good history

Hanoi (among Saigonese): City life where people could expect the special food

HCM (among Hanoian): A variety of nice food selections and entertainment

0 notes

Text

How do Vietnamese deal with the price rising?

Vietnam's economy is currently in a difficult situation. On the other hand, prices in Vietnam are rising like in the other countries that make the lives among Vietnamese, even tougher. In our latest survey, 74% recognizes the pricing up compared with the previous year, including 27% who feel the pricing go up drastically

The top 3 categories that the audience feel the price rising are food&beverage, gasoline, utilities. 20′s feel the price increase in the eat out in particular, while 30′s, who are likely to spend more time on the housework, feel the pricing is up in F&B and utilities.

What categories they aim at spending savings? The highest saving categories are eat out, food&beverage and utilities. Eat out and entertainment are the two categories where the saving ratio is higher.

What kind of saving techniques do Vietnamese do to make ends meet? The most common items are “buying items with promotion”, “refrain from buying unnecessary things”, and “refrain from eating out / drinking out”.

When you take a look this data by area, the behaviors among HCM / Hanoi residents are different. While, HCM people tend to look for more affordable alternatives. They look for the items with promotions, or look for the product with the lower pricing. On the other hand, Hanoi people aim to cut the cost, decreasing the frequency of eat out, or refraining from going out.

According to GSO, the retail market grows on the steady pace, but these growth partially come from the price increase. Vietnamese now take several measures to control the spending wisely.

1 note

·

View note

Text

Do we still find made-in-Japan product in Vietnam?

Country of origin is one of the most important factors in purchase decisions . In our past survey, the importance of country-of-origin is particularly high among cosmetics, medicine, food and electronics. Particularly, “Made-in-Japan” or “Made-in-Korea” is used as synonym of the trust or good quality.

On the other hand, it has been more than a decade since many brands have the strategic manufacturing strategies to shift their productions in South East Asia and China. So how widely are “Made-in-Japan” or “Made-in-Korea” available in Vietnam? We analyzed the import data to see where the products are imported from.

When we see the ratio of “Made-in-Japan” or “Made-in-Korea” in 2022 import data, the numbers are surprisingly small. In home appliances categories, the amount contributions of “Made in Japan” is no more than 1% for air-con and 2% for fridge. Same trend for “Made in Korea”. We find 5% for air-con and 3% for refrigerator respectively.

We should have the well-known Japanese or Korean brands of Panasonic, Daikin, Hitachi, Mitsubishi, Samsung, LG and so on in home appliances categories. These brands already have shifted the productions to Asia. For instance, Panasonic air-con comes from Malaysia mainly while their majorities of the refrigerators are made in Vietnam. LG has a various factories in China and South East Asia for home appliances, while the Made-in-Korea is only limited to the high-end.

If you take a look at the other categories, you would rarely find Made-in-Japan or Made-in-Korea particularly at IT / Home appliances / Automotive areas. The brands in these categories already had shifted their productions to China and South East Asia due to the low labor cost, better supply chain and the better taxation.

On the other hand, there are some categories where you still have Made-in-Japan and Made-in-Korea. Cosmetic, for instance, have higher ratio of the import from these 2 countries. Also, Made-in-Japan exposures are still high for mom&baby categories such as diapers or powder milk. These consumer goods categories have a wider range of import countries due to a variety of SKUs and smaller consumptions per products.

So what we have in the market is the products with “Japanese quality” or “Korean technologies”, that are made in Asia. “From Japan” or “From Korea” is used as the marketing tactics to endorse the quality or the trust of the products. Not certain if this trend continues, but weakened Won or Yen should help us purchase the products from these country more at affordable pricing. We may have more of the genuine Made-in-Japan or Made-in-Korea products again in a near future

0 notes

Text

How much does Vietnam retail chain store earn per day?

How much does a Vietnam retail chain store earn per day?

It is always difficult to estimate their sales, although it is one of the key factors to estimate how much your business could rely on them. One of the feasible method is to take a look at the investor relations (IR) document. Although there are not many retail company who are on public and disclosure their financial information timely, let us pick up some examples to see how their businesses are.

Formula to calculate the daily / monthly sales per store

The retail daily sales and monthly sales per store could be calculated as below

Monthly sales: “Annual retail revenues” / “number of stores” / 12

Daily sales: “Annual retail revenues” / “number of stores” / 365

This is just a rough estimation as the number may be inaccurate in case that

A retail has a large portion of direct sales or B2B business

A retail chain has a big changes in number of stores (e.g. newly built, shut down)

but still I believe it could be used as a reference.

Mini supermarket / supermarket

Let us take a look at one industry - Mini supermarket. Based on the IR document that highlight 2022 sales, the sales / store at the top retailers are estimated as below. WinMart is a supermarket, whereas WinMart+ and Bach Hoa Xanh is mini supermarket. Their different store size explain the gaps in the daily revenues.

Coffee chain

Highlands Coffee and Phuc Long data is available from IR, and the daily / monthly sales could be estimated as below.

Pharmacy

Long Chau and An Khang data is available from IR, and the daily / monthly sales could be estimated as below. Their sales per store could be higher, as both retails (particularly An Khang) had increased their store numbers drastically through 2022.

IT / Electronics

Dien May Xanh, The Gioi Di Dong and FTP Retail data is available from IR. Dien May Xanh / The Gioi Di Dong sales seem to be low. I believe this is because that there are many stores where both stores are operated under one physical stores. So the store sales could be the combination of both.

What are the difficulties in Vietnam retail chain

Although the retail sales grow as the economy becomes stronger, I could see some difficulties in Vietnam retail sales from these data. From the sales side, what to be noted should be the low ASP.

Let us take a look at mini supermarket. $800-$1,900 daily revenue is good but lower than the other countries. The average convenience store in Japan generate approximately $4,000 sales daily, and the revenue gaps are 2 - 3 times (of course, the store format is slightly different) . I believe these differences mainly come from the shopping basket size. Average selling pricing in Japan CVS is $5.2 USD. I believe the stores in Vietnam is much lower.

Vietnam still has the lower HR cost, but I often hear that the retail managements complain about the high real estate pricing particularly in urban areas of Vietnam. Because of the lower sales ASP and high cost of real estate pricing, making profit in Vietnam through retail business becomes tougher than originally anticipated.

This report could be found at Q&Me website

0 notes

Text

How bad is Vietnamese economy now - Analysis through Mobile World IR data

Some of the recent macro data indicates the slow economy in Vietnam. Not only the 1st quarter GDP growth is slower than the original expectation, we see many industry news that illustrate the bad economy of the industries, such as real estate, export as well as manufacturing segment.

Analyzing the company financials that dominate the market is one of the effective way of understanding the market trend. We would like to analyze the consumer retail market situation by analyzing the financial data of Mobile World Investment Corporation (MWG). As you have already known, Mobile World Group is the retail giant in Vietnam, particularly in the area of IT, consumer electronics and fresh foods and others. They manage the popular modern trade chains of Thế Giới Di Động, Điện máy Xanh and Bách Hóa Xanh. Now that they have over 5,500 stores nation-wide, knowing their business situation would help us understand the consumer retail situation in Vietnam well.

MWG is one of the top enterprises in Vietnam in terms of sharing the financial information timely and into detail. When we see the group performance by quarter, the group business faces the tough situation from 2022 2H. They also mentioned in their IR report that “the company recorded a considerable decrease in revenue and profit due to weaker than expected demand”. They also restructured Bach Hoa Xanh stores due to the over expansions in 2021.

Analyzing the business trend by the group will illustrate the current market situation more clearly. The below chart is our estimated analysis of their average monthly sales by the group in USD. The sales of Thế Giới Di Động and Điện máy Xanh, which sell electronics and IT products, were down by 34% and 31% respectively. On the other hand, Bách Hóa Xanh, which sells fresh foods and daily necessities, had the positive sales compared with previous year. Although it may be due to that the competitors have taken the strong action to take their share, this trend must indicate that consumers focus on the necessities, while they postpone their purchase of electronics products, except for the product like air-conditioner that many feel “necessary” due to the extremely hot temperatures in the country.

The same kind of slow trends are seen in car sales or luxury items. The car sales from January-April this year is down 34%, according to VAMA (Vietnam automobile manufacturers' association). For the other luxury segment, PNJ, top jewelry provider in Vietnam, reported that their sales in YTD 2023 was down by 6.6%, and their April sales was estimated to be down by 17%, due to “unfavorable market”.

Looking at these situations, Vietnam market landscape seem to be severe particularly for the non-necessity categories. Even for the necessity categories, the general price increase has made the consumers become more wise-spenders.

Vietnam will have the positive economical growth in mid-term, but may face the touch market situation for some months ahead.

1 note

·

View note

Text

What do Vietnamese think of Japanese cultures?

In 2023, Japan and Vietnam will celebrate the 50th anniversary of the establishment of diplomatic relations, and we have had / will have a number of events celebrating the relationship of the two countries. I feel proud of this, as my country have had a very good relationship with Vietnam.

Japan as the most favorite country for culture, food and travel

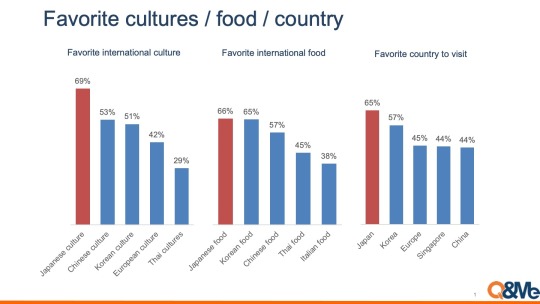

Probably due to this long good relationship between the two countries, Japan is considered the most favorite country in terms of “country with favorite culture”, “favorite international food”, “favorite country to visit”.

Manga as an effective information source of Japanese culture

What has been the information source among Vietnamese to know Japanese culture? Interesting to know that Japanese animation (manga) plays an important role to know about Japan. From the traditional Japanese manga such as Doraemon, there are many other manga that Vietnamese are familiar with such as Konan, Kimetsu-no-yaiba to a recent slum dunk.

Japanese food - Sushi, Takoyaki and Ramen

When it comes to Japanese cuisine, it is not surprising that we see Sushi (or Sashimi) voted as the most favorite foods. On the other hand, more variety of Japanese foods come to be recognized among them. Takoyaki became popular as we came to have several street vendors selling it, while we have more restaurants who provide good Japanese noodles of Ramen, Udon or Soba.

Japan trip - authentic food, beautiful scenery of cherry blossom

Japan also is the most favorite destination for an international trip. Vietnam is one of a few countries that the number of visitors are on the increase compared with pre-covid timing, and ranked as 6th in terms of the visitors in Jan-Mar 2023.

Why Japan for travel - Vietnamese are interested in “enjoying authentic Japanese food”, “seeing beautiful scenery” and “experiencing Japanese traditional culture” as top of their bucket list. The two dominant popular location is Tokyo and Mt.Fuji, followed by Osaka, Kyoto etc. In addition, many love to see beautiful cherry blossoms in Japan, which make the Japan trips during end of May to beginning of April super popular.

Language barrier and Visa as concerns of Japanese trip

How about their concerns on visiting Japan? The biggest worries are the communications partially as they do not feel that Japanese are communicative in English. On top, the strict policy of obtaining Japanese visa stands as the 2nd biggest concern. The high cost used to be the top reasons but now ranked as the third, due to the economy growth of Vietnam and the weaker yen.

Japanese culture penetration in Vietnam has become versatile thanks to the easier way of getting international information, while Vietnamese came to have more economical power. As a native of Japanese, I do hope that these two countries remain to have the good relationship and we have more opportunities in Vietnam that people come to experience attractive Japanese cultures.

0 notes

Text

What and where do Vietnamese purchase online?

The Vietnam online shopping industry is on the increase, growing at a faster pace than the total retail industry. We conducted a survey with frequent online shoppers in HCM and Hanoi in order to analyze the popular categories and channels where they make purchases online.

When we take a look at the popular online channels, Shopee has the most popularity, followed by Lazada. Not only for the big online channels, social commerce is also a popular channel among Vietnamese. Not only Facebook, which has been popular among Vietnamese SMEs or individuals to sell the items, but TikTok became the 2nd most popular online social commerce channel.

Vietnamese buy online due to the good pricing and promotions, good information (reviews), and variety of products. While the EC platform of Shopee or Lazada is linked with attractive pricing, images, and good deliveries, social commerce is federated with ease of use. The special EC sites such as Gioi Di Dong or Dien May Xanh impress the users with their good customer support.

When we take a look at their online purchase behaviors among the categories, these frequent EC shoppers feel most comfortable buying products in the categories of beauty, health, and fashion online. 38% of the respondents mentioned online as the main channel to purchase beauty or health products, while the same ratio for fashion is 32%.

These online buyers are smart enough to change where to buy depending on the categories. They depend on the EC platform for purchasing Mom+Baby, fashion, beauty, and health. They also use social commerce for fashion, beauty, and health. On the other hand, they tend to use the special EC shops for IT, home appliances, and food. The popular special EC shops are Gioi Di Dong for IT, Dien May Xanh for home appliances, and Bach Hoa Xanh for food.

Considering these two factors, EC products could be plotted as below. Fashion, beauty, and health are the categories where online shoppers feel most comfortable buying online, and the main channels are the EC platform and social commerce. They still have hesitation and prefer brick-and-mortar shops for food and home appliances. Even if they shop online, they prefer to shop at the special EC shops.

What make the online shoppers behave differently for the categories? There are several factors

Pricing: For home appliances and IT, it becomes a big purchase for most, and the shoppers tend to be more careful in their customer journey. Although they rely on the Internet for information collection, they still prefer to purchase at the major retailers.

Freshness and timing: This is the main reason for the food categories. The shoppers prefer to make their decisions by looking at the products. Also, they have the need to use them now," and delivery time still stands as an obstacle.

Product varieties: This is particularly good for fashion and beauty and health. The product on the market is so versatile that even a big store cannot show you all of it. Via the Internet, you enjoy finding the products that appeal to you.

Information: Shoppers seek information in order to avoid making mistakes in their purchases. How they rely on the information is different. For home appliances and IT, they look for the voices of experts, particularly because the technologies go too far for most to catch up. On the other hand, the shoppers look for the objective voices from the reliable consumers for health and beauty as there might be too many marketing communications and the demand for each person is different.

Having said all of the above, the technologies and operation excellence overcome many difficulties or barriers why shoppers avoid purchasing online. Also, many brands and service providers think about the sophisticated consumer journey to deliver their products and services more effectively. In several years, the penetration of the online market should be higher, and people will be more comfortable relying on the online market more effectively.

For the detail of the report, please visit our website

0 notes

Text

How does Vietnam retail landscape change in 2023

Vietnam retail landscape has changed with a steady pace particularly after Covid-19. While the online shopping has been more common than ever for all the categories, there has been a big investments in brick-and-mortal stores. Let us see the latest retail trend in Vietnam, from the trend of the number of stores.

Winmart+ came back while Bach Hoa Xanh is on the restructuring

Food retail has been always the hot categories. While the number of supermarket has been stable for years, the number of mini supermarket had doubled in 5 years, driven by two local retail players - Bach Hoa Xanh and Winmart+.

Winmart+ went on the restructuring when the chain has been taken over by Masan group from Vingroup. After they closed down some unprofitable stores, they opened nearly 500 stores in 2022. On the other hand, Bach Hoa Xanh under Mobile World Group faced the need of reshaping their strategy to have closed down almost 20% of the stores

Drastic drug store expansion

If you see the trend by industry, the hottest industry in terms of the store expansion is Dug chain. The number of drug chain has increased more than double in last 2 years. Although the traditional pharmacy store was dominant, the landscape started to change particularly in urban and sub-urban area. Similar trend is seen at cosmetic chain stores where Hasaki aggressively opened new stores.

Mobile world group, which manage Bach Hoa Xanh, Dien May Xanh, Thế Giới Di Động, and An Khang, change the store composition doubling the number of drug chain while closing down BHX.

Slow down of milk tea and mini store trend

While there are industries where the number of the stores had increased, we see a certain categories that slowed down recently.

One of the example is milk tea shops. While milk tea had been very popular, its trend seem to have slowed down recently. The number of milk tea shops decreased while the number of cafe chain has drastically increased. The major cafe chains such as Highlands and Phuc Long expanded their menu to potentially capture the demand of milk tea.

The other trend is Mini stores. We had such players as Miniso, Mumuso, Minigood to sell a variety of lifestyle items with affordable pricing. These stores has closed down particularly at outside of HCM and Hanoi.

Now that many retails look at the opportunity at winning this fast-growing market of Vietnam, the trend of store increases and decreases happen rather quickly. Establishing the effective customer touchpoint becomes more tricky as Vietnam retail landscape becomes more complex due to the increase of on-premise stores and online.

0 notes

Text

How important is wet market for Vietnamese daily shopping?

Wet market is an outlet for Vietnamese to buy the groceries, and it is said that there are over 1 million wet market in Vietnam. Then, we had a research among Vietnamese females in HCM and Hanoi who cook daily, in order to understand how well wet markets are used among them.

Wet market for more than half of food grocery purchase

When it comes to food groceries, Vietnamese female relies on wet market a lot, although we came to have many modern trade shops in urban areas of Vietnam in a last decade. They spends 53% of their budgets at wet market, and also it is where they visit 54% of their grocery shopping. Now that HCM has a larger number of modern trade stores, the wet market dependency is higher in Hanoi than HCM.

Strong wet market demand among Hanoian and elderlies

When we analyze the channel usage among our audience, the trend is different in area and also the ages. As said, HCM residents use modern trade more. Also the modern trade usage is higher among 20′s. Having all said that, in average, they depend on general trade for 66% of their food grocery shopping (wet market = 54%, local store = 12%)

3 user segmentation for food grocery purchase

Vietnamese users could be segmented into 3 types based on what channels they use for grocery shopping. One is the users who depend on traditional channels for the majority of their food purchase. They are the elderlies, mainly in Hanoi, who like the freshness and good pricing of the general trade. The second is the group who utilize both of general trade and modern trade. The audience in this group like the convenience of modern trade for a variety of choices although they partially depend on traditional channel for freshness and pricing. The last group is the new group who partially depend on online for their food grocery purchase. This group is consist of the youth audience, and rely on EC to some extent, partially as they do not have wet market nearby their area.

Traditional market for fresh foods and better pricing

So, how they perceive the differences of traditional channel (wet market, local shops) and modern trade (supermarket, mini super) for groceries? Modern trade is believe to be superior in a variety of products, unique products handling and store size, while traditional channels are better at price and freshness.

On the other hand, we will notice the perception differences between wet market users (those who depend on wet market for grocery shopping) and modern trade users (those who use both of wet market and modern trade for grocery shopping) in 3 areas - price, freshness and food variety.

Modern trade users feel more positive about product freshness and pricing at the modern trade, while wet market users feel opposite. In terms of the sizing, wet market users happen to have a big market nearby so that they feel the less need of going to the supermarket / mini supers. Also what is interesting is the customer touchpoint. Although most acknowledge that they could get the better customer support at modern trade, general trade is linked with the more dense individual relationship

Although a large number of modern trades had been around the urban areas recently, still wet market is an indispensable grocery channel among Vietnamese. This is also one of the reasons why some of the modern trade who had expanded their store foot print largely in a last few years had to restructure their channel strategy.

0 notes

Text

What is the most popular apps among Vietnamese?

Smartphone is an indispensable device for any Vietnamese regardless of the age in Vietnam. It is not only the device for the information source, shopping or entertainment, but also it works as tools for education, booking, health barometer and wallet.

We checked “Screen Time”, iOS embedded feature to track mobile application usage, to understand what mobile app they are in use

From our research, Vietnamese spend 6.2 hours daily. The length are down from the previous year as they stayed home more due to the impact of Covid-19. The number of apps that they use in a week is 20.5 apps.

Although they have a variety of mobile apps, they spend 2/3 of their smartphone time just for 5 mobile applications - Facebook, Zalo, TikTok, Messenger and YouTube. Although it has been long since people rumor about the less popularity of Facebook world-wide, the trend is different in Vietnam.

When we take a look at the top 10 mobile apps that they use in a week, the trend are the same. It is interesting to see that more than 50% of the user has used Shopee in a week and more than 1/3 has opened Momo application.

Although there are many findings, I would like to pick up 3 key trend in 2023.

The first is the popularity of TikTok. In Video category, although number of YouTube users are more than TikTok, time that Vietnamese spend on TikTok more than double of YouTube. This indicate how addictive TikTok is and how strong the app attract Vietnamese users. Particularly, TikTok is popular among 10′s and early 20′s.

The 2nd trend is the fact that PC-Covid app has disappeared. Now that it has been a while since our activities were restricted by the Covid-19. Now Covid-related mobile app has almost gone from their smartphone

The last trend is the popularity of ride-share / delivery mobile app. Those who use the app has increased more than previous years. Now 42% of the users have used any of this category app in last 7 days. Grab is dominantly popular in this category, followed by GoJek, ShopeeFood, Be and Baemin.

Not only ride sharing app, we see the trend that 75% use either the mobile payment app or online banking app. Vietnam was known as cash-oriented country until a few years ago, but how Vietnamese manage their financial has drastically changed in a last few years. The detail of this research is found in this link. For any questions about our market research inquiry, please contact info@qandme.net

0 notes