#xm forex deposit

Explore tagged Tumblr posts

Text

The Ultimate Forex Brokers Comparison for South African Traders

Introduction:

The forex market in South Africa is one of the fastest-growing financial sectors, and selecting the right broker can make all the difference. In this Forex Brokers Comparison in South Africa, we will explore the best options available for traders in 2025. Whether you're just getting started or are looking for a more advanced trading experience, this guide will help you navigate your choices and make an informed decision.

Why Forex Trading in South Africa is Thriving:

Forex trading in South Africa has seen a steady rise in popularity over the past few years. This growth can be attributed to the country's stable financial regulations, mainly governed by the Financial Sector Conduct Authority (FSCA). With a secure regulatory framework, traders are assured of a safe trading environment. In addition, many brokers now offer dedicated services tailored for South African traders, including local deposit methods and customer support in native languages.

Key Features to Look for in a Forex Broker in South Africa:

When choosing a forex broker, several key factors should guide your decision:

Security and Regulation: Ensure your broker is regulated by the FSCA for a secure trading environment.

Trading Platforms: Popular platforms such as MT4 and MT5 offer robust features, but many brokers now offer proprietary platforms as well.

Low Spreads and Fees: Low trading costs are crucial to maximizing profits.

Customer Support: 24/7 support in the South African time zone can enhance your trading experience.

Account Types: Brokers offering diverse account types with local payment options can cater to a wide range of traders.

Top Forex Brokers for South African Traders in 2025:

Eightcap: Known for its low spreads, quick deposits, and intuitive platform, Eightcap is perfect for both beginners and seasoned traders.

IC Markets: With low spreads and fast execution, IC Markets is ideal for scalpers and day traders.

FP Markets: Offering excellent customer support and a user-friendly platform, FP Markets provides an outstanding trading experience.

Octa: Specializing in accounts suitable for South African traders, Octa stands out for its commitment to local customers.

BlackBull: If you're after low-cost trading with access to a wide range of assets, BlackBull is a top contender.

XM: XM’s global reach and local support make it a solid choice for traders looking for both global opportunities and local assistance.

FXPro: Known for its top-tier services and robust tools, FXPro is ideal for traders seeking a complete package.

FBS: FBS’s user-friendly interface and attractive promotions make it an appealing option for beginners.

Comparing Forex Brokers in South Africa: Which One is Right for You?

Choosing the right broker depends on your trading needs. For beginner traders, brokers with easy-to-use platforms and strong customer support, like FBS and Eightcap, might be the best fit. Experienced traders, however, may benefit from IC Markets or FP Markets, which offer advanced tools and low-cost trading. If you're focused on low spreads, BlackBull and Octa are excellent options.

The Future of Forex Trading in South Africa:

As we look toward 2025, the future of forex trading in South Africa appears promising. Technological advancements, such as AI-based trading tools and faster transaction systems, are set to make trading more efficient. Moreover, evolving regulations may offer even greater protection for traders. Staying informed about the latest trends and innovations will help traders maintain a competitive edge.

Conclusion:

In conclusion, choosing the right forex broker is critical for successful trading in South Africa. With the Forex Brokers Comparison in South Africa above, you are equipped with the knowledge to make an informed decision. Visit Top Forex Brokers Review for more in-depth insights and to explore detailed broker reviews

2 notes

·

View notes

Text

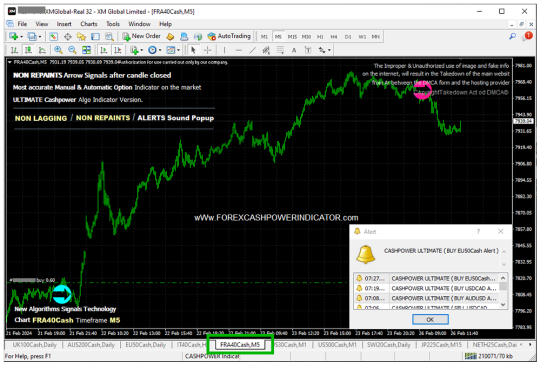

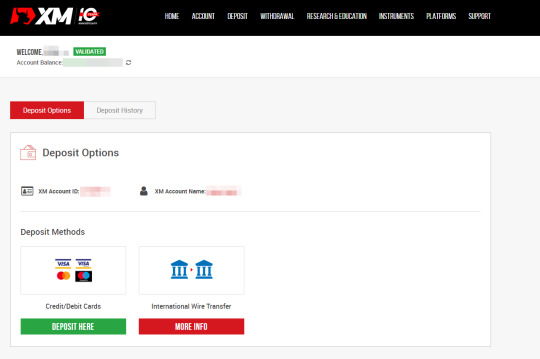

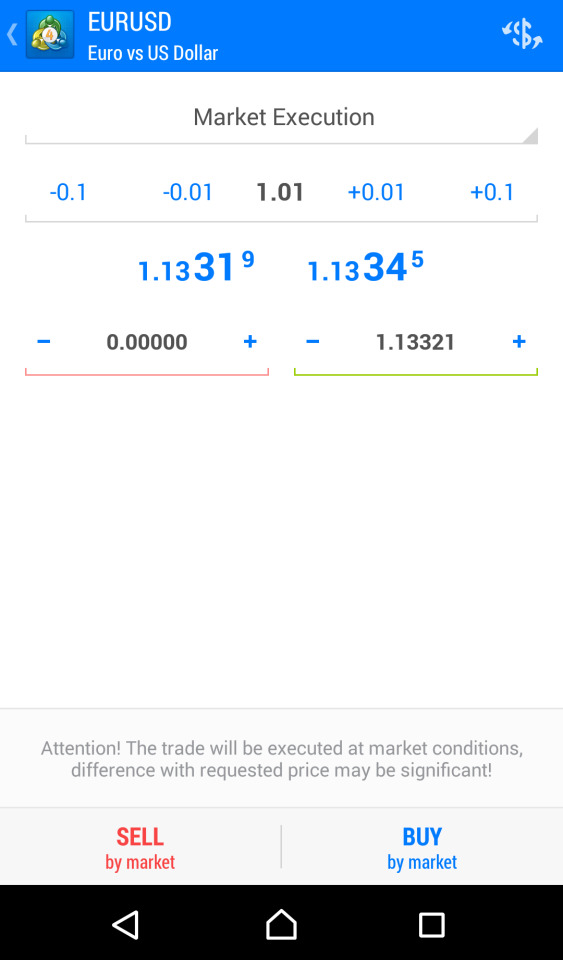

BIG Trade Profits #BUY Trade inside Indice #FRA40Cash M5. Oposite Signal time to close the trade. wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful AUTO-Trade EA Option

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

. ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#cashpowerindicator#indicatorforex#forexindicators#forexsignals#forex#forextradesystem#forexindicator#forexprofits#forexvolumeindicators#forexchartindicators#forex brokers#best forex brokers#forex education

4 notes

·

View notes

Text

Top Forex Brokers Reviewed by WikiFX

Top Forex Brokers Reviewed by WikiFX The foreign exchange (forex) market is the largest financial market in the world, operating 24 hours a day, five days a week. With its vast size and continuous operation, choosing a reliable forex broker is crucial for traders. WikiFX, a trusted platform for forex broker reviews, has compiled a list of top forex brokers for 2024. This article provides an overview of some of the best brokers, highlighting their key features and benefits.To get more news about WikiFX, you can visit our official website.

1. FXCM Overview: FXCM is a well-established broker with over 20 years of experience in the forex market. It is regulated in Australia and offers a full license for global business operations.

Key Features:

Competitive spreads starting from 0 pips. Advanced trading platforms including MetaTrader 4 (MT4). Strong regulatory framework ensuring safety and reliability. 2. IC Markets Overview: IC Markets is another prominent broker regulated in Australia. It has been in operation for 15-20 years and is known for its tight spreads and robust trading infrastructure.

Key Features:

Tight spreads from 0.0 pips. Multiple trading platforms including MT4 and MetaTrader 5 (MT5). High liquidity and fast execution speeds. 3. XM Overview: XM is a globally recognized broker with 10-15 years of experience. It is regulated in Australia and offers a wide range of trading instruments.

Key Features:

Low spreads and no hidden fees. Comprehensive educational resources for traders. Multiple account types to suit different trading needs. 4. GO Markets Overview: GO Markets has been in the forex industry for over 20 years. It is regulated in Australia and provides a full license for global business operations.

Key Features:

Competitive pricing structure. Advanced trading tools and platforms. Strong customer support and educational resources. 5. FP Markets Overview: FP Markets is a well-regulated broker with 15-20 years of experience. It offers a full license for global business and is known for its transparency and reliability.

Key Features:

Tight spreads and low trading costs. Multiple trading platforms including MT4 and MT5. Extensive range of trading instruments. 6. FBS Overview: FBS is a relatively newer broker with 5-10 years of experience. It is regulated in Australia and offers a full license for global business operations.

Key Features:

Competitive spreads and low minimum deposit requirements. User-friendly trading platforms. Strong focus on customer education and support. Conclusion Choosing the right forex broker is essential for successful trading. The brokers reviewed by WikiFX, including FXCM, IC Markets, XM, GO Markets, FP Markets, and FBS, offer a range of features and benefits that cater to different trading needs. Whether you are a beginner or an experienced trader, these brokers provide the tools and resources necessary for a successful trading experience.

0 notes

Text

Which currencies can I trade on the Forex market?

The act of buying and selling currencies on the foreign exchange market is known as forex trading. With an average daily trading volume of nearly $6 trillion, the forex market is the biggest financial market in the world. The Forex market is open five days a week, around the clock, and from any location in the world. When trading currencies, one currency is purchased while another is sold. Profiting from changes in the exchange rates between two currencies is the aim of forex trading.

What is Forex Trading?

When trading in forex, pairs of currencies are bought and sold. The US Dollar, the Euro, the Japanese Yen, the British Pound, and the Swiss Franc are the most traded currencies on Forex. These currencies, which makeup more than 80% of the overall trading activity on the Forex market, are referred to as significant currencies. Emerging market currencies like the Chinese Yuan and the Indian Rupee are also traded on the Forex market.

What are the most popular currencies traded on Forex?

Selecting the ideal Forex broker is essential for profitable trading. The top Forex brokers provide reasonable commissions, attractive spreads, and a broad selection of trading instruments. It is crucial to take many variables into account when selecting a Forex broker. Regulation, trading platforms, customer service, and choices for deposits and withdrawals are all included. XM, AvaTrade, and eToro are some of the best Forex brokers available for trading. These brokers provide a large selection of trading tools, aggressive spreads, and minimal commissions.

How to choose a Forex broker?

The market offers a wide variety of platforms for trading forex. cTrader, TradingView, MetaTrader 4, MetaTrader 5, and NinjaTrader are among the top 10 Forex trading platforms. These systems provide a large selection of trading instruments, sophisticated charting capabilities, and movable indicators. It is crucial to take usability, dependability, and security into account while selecting a Forex trading platform.

Top forex brokers list

Wide selections of trading instruments, aggressive spreads, and affordable commissions are all provided by online Forex brokers. Online Forex firms like XM, AvaTrade, and eToro are among the best. These brokers provide a large selection of trading tools, aggressive spreads, and minimal commissions. It's crucial to take into account aspects like regulation, trading platforms, customer service, and deposit and withdrawal methods when selecting an online forex broker.

Best online Forex brokers

If done properly, forex trading may be a profitable endeavour. Scalping, day trading, and swing trading are a few of the most popular Forex trading techniques. Scalping is the practice of making modest profits from slight price changes. Currency day trading refers to purchasing and selling on the same day. Swing trading is maintaining positions for numerous days or weeks in order to profit from market fluctuations.

Before engaging in Forex trading, it is crucial to have a thorough understanding of the Forex market and the variables influencing exchange rates. Starting with a sample account, employing stop-loss orders, and staying current with market news and events are some pieces of advice for newcomers to forex trading.

Conclusion

Forex market is a complex and dynamic market that requires a solid understanding of the market and the factors that affect exchange rates. The Forex market is the biggest financial market in the world, with an average daily trading volume of many trillions.

Selecting the ideal Forex broker is essential for profitable trading. To assist traders in their success on the Forex market, Trading Critique offers a well-researched list of the top Forex brokers, Forex trading instructions, and other tools.

0 notes

Text

Top Forex Brokers in India

Forex trading has become increasingly popular in India in recent years. With the growing demand for forex trading, there has been a surge in the number of forex brokers offering their services in India. Choosing the right forex broker is crucial for a successful trading experience. In this article, we will look the best forex brokers operating in India.

XM

XM is one of the best forex brokers in India and expanding their services rapidly.

XM is a popular forex broker that is regulated by several regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). They offer a wide range of currency pairs to trade, as well as other financial instruments like stocks and commodities. They offer low spreads and competitive fees, making it a popular choice among Indian forex traders.

What make XM great is their deposit bonus feature because in XM offer deposit bonus 50%-100%.

XM offers 50% deposit bonus to all of their client in standard account with the fact that bonus is also tradable. That means we can trade with bonus amount too. And if we compare this with Octafx, bonus amount isn’t tradable in octafx. That bonus amount in Octafx is just to show account balance while user can’t use that bonus for trading and for worst case if we lose our account deposit equity then octafx withdraw there bonus. While in XM, we can trade with bonus amount too even after if we lose all our account equity. After losing our account equity, we can loss the bonus amount too in worst case.

Second best feature of XM is their instant deposit and withdrawal with various payment methods like UPI, bank transfer, crypto, skrill, neteller and many more.

XM allow user to deposit fund with UPI within minutes most of the time. Xm claim depositing time 12-24 hrs but it completes within few minutes to 1 hour generally. And same for withdraw with UPI, XM withdraw completes within few minutes to 1hour in most cases but again XM claims 24hours time in this too.

Along with UPI, depositing and withdrawal though crypto and other online wallets are also instant.

XM allows to trade in more then 1000 instrument in different categories. Categories like forex pair, Commodities, CFD’s, Stocks, crypto, and many more. But GOLD is the most traded instrument in india. And Spread in Gold and other instrument are very competitive and lower then octafx .

On MT5 platform of XM, user can trade Indian Stock Index NIFTY50 too as a CFD with the name IN50. This NIFTY index trading is only on MT5 as of now, but later on it will be on MT4 too. Is someone wants to trade in NIFTY50 index as a CFD like US30 or NASDAQ then XM can be the best broker for him.

To Try this, user can create account directly from- https://bit.ly/Joinxmbroker

I highly recommend to use XM broker if you are planning to trade forex because of there best in class service and tradable deposit bonus.

Resource- Step Traders

0 notes

Text

4 Best Forex brokers 2022

Exness

Exness is rated #2 of the recommended FX brokers with an overall rating of 4.9/5. It reserves a minimum deposit of $10 and offers low trading fees across its total of 97 currency pairs and crypto. Exness can be traded on various trading desks including MT4, MT5, MT4 WebTerminal, mobile (iOS & Android, Exness Trader) and offers an affiliate program with commissions of up to $45 for every registration, depending on the country and the platform.

Exness Pros and Cons

Pros

-Regulated by both CySEC and FCA

-Client funds kept in segregated accounts

-Tight spreads

-130+ Currency Pairs with Multiple Trading Platforms

Cons

-No multi-currency accounts available

Avatrade

Ranked #1 for recommended FX brokers with an overall rating of 4.8/5. Avatrade offers a minimum deposit fee of $100 for a total of 55+ currency pairs and cryptocurrencies which is traded on various trading desks namely: MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central with low trading fees.

AvaTrade offers 4 affiliate programs:

CPA

You get a fixed payment for every client you refer to AvaTrade and this program' commission structure guarantees a consistent rate for every new investing trader.

RevShare

RevShare is a long-term affiliation where you can maintain receiving your revenue share as long as your referral keeps trading.

Dynamic CPA

This is recommended for people who bring big clients, and you get an incentive of their first-time deposit.

Master Affiliate

Get paid for your clients’ traffic and trading, as well as a fixed percentage of your sub-affiliates' performance.

Avatrade Pros and cons

Pros

-Easy and fast account activation

-Free deposit and withdrawal options

-Provides good educational tools

Cons

-outdated research tools

-There's an inactivity fee payable

-Does not adequately support mobile phones

HFM

Although it is ranked #6 FX broker with an overall rating of 4.8/5, it is a good platform with very good customer support. HFM has a minimum deposit of $5 and offers low trading fees. The platform has a total of 50+ currency pairs and cryptocurrencies but its trading desks are limited to MetaTrader4, MetaTrader5 and the HFM platform.

HF Markets Pros and Cons

Pros

- Low deposit requirement for new traders with Micro accounts

-Offers good customer support

-There's a variety of premium trader tools available

Cons

-Limited range of instruments

- Difficult account opening

-US clients not accepted

XM

Rated #68 for recommended FX Brokers with a minimum deposit of $5 and no trading fees. XM is a widely used and well-loved online brokerage which operates in 196 countries and offers trading on an enormous range of assets. You can trade more than 1,000 companies through stock contracts for difference (CFDs), commodities, forex, and cryptocurrencies.

Here is a preview of the accounts it offers and their Pros and Cons

Based on the above analysis, which broker is best suitable for you?

12 notes

·

View notes

Text

xm broker review

XM Group is a group of regulated online brokers. XM Group offers clients multi-asset trading on various trading platforms, including the popular MetaTrader 4 and MetaTrader 5 platforms. The company is regulated by several financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK.

Overall, XM Group has received positive reviews from clients for its wide range of asset classes, multiple trading platforms, and low fees. However, as with any broker, it is important to carefully consider your own trading needs and do your own due diligence before choosing a broker. It is also important to note that trading carries a high level of risk and may not be suitable for all investors.

XM pros & cons

pros:

Offers 1,230 CFDs, including 57 forex pairs.

Autochartist and Trading Central complement in-house research offering.

The XM Shares account requires a $10,000 deposit if you want exchange-traded securities (non-CFD).

Excellent research content that includes daily videos, podcasts, and organized articles.

In-house broadcasting features TV-quality video content, and live recordings.

A comprehensive selection of educational webinars, articles, and Tradepedia courses.

Offers full MetaTrader suite — which features signals market for copy trading, along with Analyzzer algorithm.

cons:

Standard account spreads are expensive compared to industry leaders.

Average spreads are not published for the commission-based XM Zero account.

Is XM Group safe?

XM Group is considered average-risk, with an overall Trust Score of 90 out of 99. XM Group is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). XM Group is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Open a Demo Account here.

Promotions and Bonuses here.

MT4 / MT5 Trading Platforms here.

Android MT4 here.

3 notes

·

View notes

Text

XM Broker Review 2023: A Comprehensive Analysis of Trading Fees and Services

XM Broker Review 2023 XM is a global forex and CFD broker regulated by Australia's ASIC, CySEC of Cyprus, and Belizean authority IFSC. XM has low stock CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account. On the other hand, XM has a limited product portfolio as it offers mainly CFDs and forex trading. Its forex and stock index CFD fees are average, and there is no investor protection for clients onboarded outside the EU. XM is a regulated broker, it is overseen by top-tier financial regulators in multiple countries . XM is also covered by investor protection in selected jurisdictions. XM Highlights 🗺️ Country of regulationCyprus, Australia, Belize, United Arab Emirates💰 Trading fees classAverage💰 Inactivity fee chargedYes💰 Withdrawal fee amount$0💰 Minimum deposit$5🕖 Time to open an account1 day💳 Deposit with bank cardAvailable👛 Depositing with electronic walletAvailable💱 Number of base currencies supported10🎮 Demo account providedYes🛍️ Products offeredForex, CFD, Real stocks for clients under Belize (IFSC) Visit Broker74.89% of retail CFD accounts lose money

Fees

XM has low trading fees for CFDs and charges no withdrawal fee. On the other hand, forex and stock index fees are only average, and there is a fee for inactivity. AssetsFee levelFee termsS&P 500 CFDLowThe fees are built into the spread, 0.4 points is the average spread cost during peak trading hours.Europe 50 CFDAverageThe fees are built into the spread, 2.5 points is the average spread cost during peak trading hours.EURUSDAverageWith Standard, Micro, and Ultra-Low accounts the fees are built into the spread. 1.7 pips is the Standard account's average spread cost during peak trading hours. With XM Zero accounts, there is a $3.5 commission per lot per trade and a small spread cost.Inactivity feeLow$15 one-off maintenance fee after one year of inactivity, followed by $5 per month fee if the account remains inactive XM trading fees XM trading fees are average. XM has many account types, which all differ in pricing. The Standard, Micro, and Ultra Low accounts charge higher spreads but there is no commission. The XM Zero account charges lower spreads, but there is a commission. The following calculations were made using the Standard account. We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products. We chose popular instruments within each asset class: - Stock index CFDs: SPX and EUSTX50 - Stock CFDs: Apple and Vodafone - Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP A typical trade means buying a leveraged position, holding it for one week and then selling. For volume, we chose a $2,000 position for stock index and stock CFDs, and $20,000 for forex transactions. The leverage we used was: - 20:1 for stock index CFDs - 5:1 for stock CFDs - 30:1 for forex These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for XM fees. CFD fees XM has low stock CFD, while average stock index CFD fees. XMFxProAdmirals (Admiral Markets)S&P 500 index CFD fee$2.5$1.1$1.4Europe 50 index CFD fee$3.1$1.2$1.4Apple CFD fee$6.7$9.4$5.3Vodafone CFD fee$2.3$14.7$14.2 Visit Broker74.89% of retail CFD accounts lose money

Account opening

XM accepts customers from all over the world. There are a few exceptions though; among others, you can't open an account from the USA, Canada, China, Japan, New Zealand or Israel. What is the minimum deposit at XM? The required XM minimum deposit is $5 for two XM Account types (Micro, Standard), which is very low, and $100 for the XM Zero account. Account types XM offers many account types, which differ in pricing, base currencies, minimum deposit and contract size. MicroStandardXM ZeroShares AccountClient countryEEA Australia Other countriesEEA Australia Other countriesEAANon-EEA and non-Australian clientsPricingNo commission, but higher spreadNo commission, but higher spreadThere is a commission, but the spread is very lowMarket spread and commissionBase currenciesUSD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZARUSD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZARUSD, EUR, JPYUSDMinimum deposit$5$5$100$10,000Contract size1 Lot = 1,0001 Lot = 100,0001 Lot = 100,0001 share Islamic or swap-free accounts are also available. With Islamic accounts, a flat commission is charged if you hold your leveraged position overnight instead of the percentage-based financing rates. XM doesn't offer corporate accounts. If you sign up for a non-European entity, you will not be eligible for European client protection measures. How to open your account XM account opening is fully digital, fast and straightforward. You can fill out the online application form in 20 minutes. Our account was verified on the same day. You can select many languages other than English: ArabicBengaliChineseCzechDutchFilipinoFrenchGermanGreekHungarianIndonesianItalianKoreanMalayPolishPortugueseRussianSpanishSwedishThaiVietnamese To open an account at XM, you have to go through these steps: - Fill in your name, country of residence, email address and telephone number. - Select the trading platform (MT4 or MT5) and account type. - Add your personal information, such as your date of birth and address. - Select the base currency and the size of the leverage. - Provide your financial information and answer questions about your financial knowledge. - Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency. Visit Broker74.89% of retail CFD accounts lose money

Deposit and withdrawal

Account base currencies At XM, you can choose from 9 base currencies. The available base currencies are: EURUSDGBPCHFJPYAUDSGDPLNHUFZAR XMFxProAdmirals (Admiral Markets)Number of base currencies10811 Why does this matter? For two reasons. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee. Deposit fees and options XM charges no deposit fees. You can use bank transfers and credit/debit cards for depositing funds. Clients onboarded under IFSC can also deposit using the SticPay electronic wallet. XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYes A bank transfer can take several business days, while payment with a credit/debit card is instant. You can only deposit money from accounts that are in your name.

XM review - Deposit and withdrawal - Deposit XM withdrawal fees and options XM charges no withdrawal fees. The only exception is bank (wire) transfers below $200, which incur a $15 fee. XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYesWithdrawal fee$0$0$0 For credit/debit cards and electronic wallets (Skrill, Neteller), the withdrawal amount cannot exceed the amount you deposited using the same instrument. This means that you can only withdraw your trading profits via bank transfer. How long does it take to withdraw money from XM? We tested debit card withdrawal and it took 2 business days. You can only withdraw money to accounts that are in your name. How do you withdraw money from XM? - Log in to your account - Go to 'Withdraw Funds' - Select the withdrawal method - Enter the withdrawal amount Visit Broker74.89% of retail CFD accounts lose money

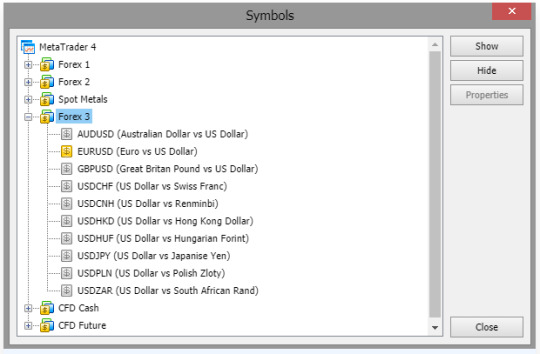

Web trading platform

Trading platformScoreAvailableWeb2.8starsYesMobile3.8starsYesDesktop3.4starsYes XM does not have its own trading platform; instead, it uses third-party platforms: MetaTrader 4 and MetaTrader 5. These platforms are very similar to each other in functionality and design. One major difference is that you can't trade stock CFDs on MetaTrader 4, only on MetaTrader 5. We tested the MetaTrader 4 platform as it is more widely used. MetaTrader 4 is available in an exceptionally large number of languages. XM web trading platform languagesArabicBulgarianChineseCroatianCzechDanishDutchEnglishEstonianFinnishFrenchGermanGreekHebrewHindiHungarianIndonesianItalianJapaneseKoreanLatvianLithuanianMalayMongolianPersianPolishPortugueseRomanianRussianSerbianSlovakSlovenianSpanishSwedishTajikThaiTraditional ChineseTurkishUkrainianUzbekVietnamese Look and feel The XM web trading platform has great customizability. It is easy to change the size and the position of the tabs. However, the platform feels outdated and some features are hard to find. For example, it took us a while to figure out how to add an asset to the watchlist.

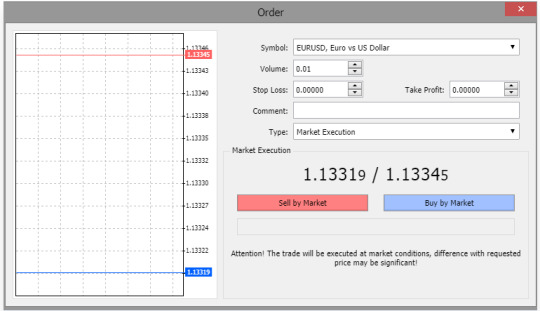

Visit Broker74.89% of retail CFD accounts lose money XM review - Web trading platform Login and security XM requires two-step authentication for the account login on the website where you can deposit and withdraw. The trading platform itself, however, doesn't have two-step authentication. Search functions The search functions are OK. You can find assets grouped into various categories. However, we missed the usual search function where you can type in the name of an asset manually.

XM review - Web trading platform - Search Placing orders You can use all the basic order types. However, you won't find more sophisticated order types such as 'one-cancels-the-other'. The following order types are available: - Market - Limit - Stop - Trailing Stop Trailing Stop is available only in the MT4 desktop platform To get a better understanding of these terms, read this overview of order types. There are also order time limits you can use: - Good 'til canceled (GTC) - Good 'til time (GTT)

XM review - Web trading platform - Order panel Alerts and notifications You cannot set alerts and notifications on the XM web trading platform. This feature is available only on the desktop trading platform. Portfolio and fee reports XM has clear portfolio and fee reports. You can easily see your profit-loss balance and the commissions you paid. These reports can be found under the 'History' tab. We couldn't find a way to download them.

Mobile trading platform

XM offers MetaTrader 4 and MetaTrader 5 mobile trading platforms. Similarly to the web trading platform, we tested the MetaTrader 4 platform on Android. Once you have downloaded the MT4 mobile trading platform, you should access the relevant XM server. Just like on the web trading platform, you can choose from many languages on the mobile trading platform as well. Changing the language is a bit tricky on Android devices, as you can do it only if you switch the default language of your mobile. XM mobile trading platform languagesArabicChinese (Simplified)Chinese (Traditional)CzechEnglishFrenchGermanGreekHindiIndonesianItalianJapaneseKoreanPolishPortuguesePortuguese (Brazil)RussianSpanishThaiTurkishUkrainianVietnamese Look and feel XM has a great mobile trading platform, we really liked its design and user-friendliness. It is easy to find all the features it provides.

XM review - Mobile trading platform Login and security XM requires only one-step login for the platform, but provides two-step account login to access deposit and withdrawal functions. A two-step login procedure for the trading platform would be safer. You can't use fingerprint or Face ID authentication. Offering this feature would be more convenient. Search functions The search functions are good. You can search by typing the name of the product or by navigating the category folders.

XM review - Mobile trading platform - Search Placing orders You can use the same order types and order time limits as on the web trading platform.

XM review - Mobile trading platform - Order panel Alerts and notifications You can set alerts and notifications for your mobile, although only through the desktop trading platform. It would be much easier if you could set these notifications on the mobile trading platform as well. Visit Broker74.89% of retail CFD accounts lose money

Desktop trading platform

For desktop trading too, you can use the MetaTrader 4 and 5 platforms; we tested MetaTrader 4. It has the same design, is available in the same languages, offers the same order types, has the same search functions, and offers the same portfolio and fee reports as the web trading platform. The desktop trading platform doesn't have two-step authentication; however, XM provides a two-step account login procedure on the website where you can deposit and withdraw funds. The major difference is that you can set alerts and notifications on the desktop trading platform in the form of mobile push and email notifications. To set these, you have to add your email address and mobile MetaQuotes ID (you can find it in the MT4 app's settings). You can add them if you go to 'Tools' and then 'Options'.

Markets and products

XM is a CFD and forex broker with a great number of currency pairs available for trading. However, the CFD selection is lower compared to some XM alternatives. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. XMFxProAdmirals (Admiral Markets)Currency pairs (#)557047Stock index CFDs (#)242943Stock CFDs (#)1,2611,7003,252ETF CFDs (#)--372Commodity CFDs (#)152528Bond CFDs (#)--2Cryptos (#)*-3042 Cryptos are available for customers onboarded under XM Global Limited entity. You can't change the leverage levels of the products, which is a drawback. Changing the leverage manually is a very useful feature when you want to lower the risk of your trade. Be careful with forex and CFD trading, as the preset leverage levels may be high. Real stocks and ETFs XM provides real stocks for clients onboarded under XM's IFSC-regulated entity. You can trade stocks only using the Shares Account. It is a big addition compared to its competitors. XMFxProAdmirals (Admiral Markets)Stock markets (#)3-11ETFs (#)--192 Visit Broker74.89% of retail CFD accounts lose money

Research

Trading ideas XM provides trading ideas under the 'Trade Ideas' tab, where you can find various assets and their recent performances. Read the full article

3 notes

·

View notes

Text

Making Sure You Choose the Right Forex Broker

Technology is becoming smarter every day. If you have talked about forex trading or googled some stuff related to it, we’re sure you must’ve come across plenty of ads of forex brokers. Each claim to be the best and profitable for you.

It becomes overwhelming to decide which broker is the right for you. Your mind constantly buzzes with endless questions like:

· Is eToro the right forex broker?

· Is FxPro a safe choice?

· Does IG charges high fees?

· Is XM a good broker for a beginner like me? And the list goes on…

The following tips will help you choose the right broker amongst the many brokers in the market.

5 Tips for Selecting the Right Forex Trading Broker

1. Check the Licenses and Registration Details

The first tip for choosing the right forex broker is to check the regulatory bodies that oversee it. The about page of the broker’s website has the list of licenses from the regulatory bodies.

The more licenses the broker has, the merrier. Suppose there is a trade dispute between you and the broker. In that case, you can turn to regulatory bodies to resolve your issue.

However, if there are no licenses on the broker’s website, it is a red flag for you. Beware of dealing with such types of brokers.

Moving on, we have…

2. Study the Broker’s Account Types and Initial Deposit

Brokers offer different types of trading account to cater to traders’ need. The details of these accounts are mentioned on their website. Check the account types provided by the broker, along with the minimum deposit required to open the account.

The amount of the initial deposit varies from broker to broker. Some brokers charge as low as

$100; whereas, some brokers can require as much as $1,000.

Similarly, the spreads, leverage, and commission charged by brokers also vary. Some brokers provide low spreads and higher power to enable traders to get more value from their trade.

Choose the broker that perfectly fits your need. Up next, we have…

3. Quality of Customer Care Service

Forex trading is a global market and is open 24/7. The trader might need some help from his broker to resolve a trading query or ask about deposits and withdrawals details.

Hence, the customer service of a broker should be top-notch. His team should be available around the clock to answer traders’ questions and solve his needs. The good forex brokers in the market are available 24/7 and respond to their clients via email, call, and live chat.

The 4th tip for choosing the right broker is understanding the trading platform they offer.

4. Trading Platforms Offered

Currency trading platforms give access to the forex market. The broker can offer you different types of platforms, either in the form of downloadable apps or online web-trading portals. The majority of brokers in the market provide MetaTrader4, MetaTrader5, or cTrader to their clients.

Study the pros and cons of trading platforms provided by the broker. You can also try your hands at the demo account to experience the broker’s trading platform.

The last tip on the list is to check the availability of educational material on the broker’s website. Let’s talk more about it…

5. Educational Material Available on its Website

New traders need a proper understanding of forex terms, market updates, and open profitable trades. A few brokers in the market have rich educational material on their websites, including glossaries, video tutorials, webinars, eBooks, and courses.

The quality of educational material available on the broker’s website shows its proficiency and knowledge about the forex. An abundant and good quality educational material signifies that the broker is not an amateur in the market. He is experienced and knows the forex trading arena really well.

Conclusion

The first step towards profitable forex trading is finding the best forex broker. You have to make sure that you are opening and funding your account with a broker who is experienced, reputable, and competent in the market.

The internet has hundreds of forex brokers. Unfortunately, not all of them are trustworthy. Many fraudulent entities portray themselves as brokers but shut down overnight and run away with traders’ funds. Hence, beware of such scammers and always conduct thorough research before signing up with the forex broker.

2 notes

·

View notes

Text

XM Broker Review: Unleashing the Potential for Astounding Profits!

In the volatile world of forex trading, choosing the right broker can be the difference between a lucrative investment and a devastating loss. Today, we're going to delve deep into one of the most popular players in the market: XM Broker. This XM Broker Review aims to provide a comprehensive analysis of the platform's features, benefits, and how to maximize your profits with it. Our team at Top Forex Brokers Review has done extensive research to bring you the most accurate and insightful information available.

The XM Broker: A Brief Overview

XM Broker, a well-established entity in the forex trading industry, has grown steadily since its inception in 2009. With over 3.5 million clients in 196 countries, XM Broker's popularity is undeniable. They offer a variety of trading services, including forex, stocks, commodities, equity indices, precious metals, energies, and cryptocurrencies. But what sets XM Broker apart from its competitors? Let's delve into the specifics.

Pioneering Features and Benefits

XM Broker prides itself on its no re-quotes policy, which ensures that your trades are executed without delay or slippage. This policy is particularly advantageous in volatile markets, where fractions of a second can significantly impact profits.Additionally, XM Broker offers Negative Balance Protection, ensuring that you never lose more money than you have deposited. This feature significantly reduces the risks associated with forex trading.XM Broker's flexible trading system is another standout feature. With the ability to choose from various trading platforms, including MT4 and MT5, you can customize your trading experience to suit your needs.

Empowering Your Trading Journey: Tools and Education

XM Broker places a strong emphasis on education, offering a wealth of resources to both new and experienced traders. Their free daily technical analysis, webinars, and seminars help traders understand market trends and make informed decisions. This commitment to education sets XM Broker apart and is a testament to their dedication to their clients' success.

Unmatched Customer Support

In our XM Broker review, we found their customer support to be exceptional. With 24/5 service in over 30 languages, XM Broker's support team is always ready to assist you, no matter where you are or what time it is.

The Power of Choice: Account Types and Instruments

XM Broker offers a variety of account types, including Micro, Standard, and XM Zero. Each account type has unique features and benefits, allowing you to choose the one that best suits your trading style and goals. Furthermore, XM Broker provides a wide range of trading instruments, allowing you to diversify your portfolio and manage risk effectively.

Maximizing Profits with XM Broker

To maximize your profits with XM Broker, consider the following tips:

Leverage the Learning Resources: Make full use of the educational materials provided by XM Broker. Knowledge is power in forex trading, and building a solid understanding of market trends will enhance your trading strategy.

Choose the Right Account Type: Each account type offers different benefits. For instance, the XM Zero account has lower spreads, which can lead to higher profits. Consider your trading style and goals when selecting an account.

Diversify Your Portfolio: XM Broker offers a wide range of trading instruments. By diversifying your portfolio, you can mitigate risk and increase your potential for profits.

In concluding

this XM Broker review, we can confidently say that XM Broker is a reliable and feature-rich platform that caters to traders of all experience levels. With its robust tools, comprehensive educational resources, and exceptional customer service, XM Broker empowers traders to navigate the forex market with confidence and achieve their trading goals. By leveraging the features and tips discussed in this review, you can truly maximize your profits with XM Broker. Happy trading!

0 notes

Text

USDCAD M1 Timeframe SCALPER Mode, o.90 Lots Buy trade based in last NON REPAINT Signal. Official Website: wWw.ForexCashpowerIndicator.com

. Start Improve your Strategy with Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful AUTO-Trade Option

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

. ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

2 notes

·

View notes

Text

Handpicked Forex Brokers Reviewed for Safe & Profitable Trading

In the ever-evolving world of forex trading, choosing the right broker is the cornerstone of success. Whether you’re an experienced trader or a novice stepping into the forex market, selecting a broker that aligns with your goals and ensures safety is critical. This article highlights the broker for forex trading for 2025, spotlighting platforms trusted by traders worldwide. We’ll cover FP Markets, FxPro, Eightcap, IC Markets, FBS, XM, Axi, HFM, and Pepperstone to help you make the best choice for safe and profitable trading.

Why a Reliable Forex Broker is Vital

The forex market, with a daily trading volume exceeding $6.6 trillion, offers immense opportunities. However, without a dependable Best Forex Brokers Review, traders face risks like high costs, inefficiencies, and even potential fraud. Here are key reasons why selecting a reliable broker is non-negotiable:

Security: Brokers regulated by reputable authorities ensure your funds are safeguarded.

Cost Efficiency: Low spreads and commissions save you money.

Trading Tools: Advanced platforms and tools enhance your trading strategy.

Customer Support: Reliable brokers resolve issues promptly.

Now, let’s dive into the reviews of handpicked brokers that excel in these areas.

1. FP Markets—Top Choice for Low-Cost Trading

Overview: FP Markets stands out for its low-cost trading environment, featuring tight spreads and fast execution. This broker is ideal for traders looking to minimize costs without compromising on quality.

Regulation: ASIC, CySEC

Platforms: MetaTrader 4, MetaTrader 5, IRESS

Key Features:

Spreads starting from 0.0 pips

Multiple account types

Access to over 10,000 trading instruments

Why Choose FP Markets:

Transparent fee structure

Excellent trading tools

Comprehensive educational resources

Best For: Cost-conscious traders seeking a professional trading experience.

2. FxPro – Best for Versatile Trading Needs

Overview: FxPro caters to traders who prioritize flexibility. With a variety of platforms and account types, this broker ensures a tailored trading experience.

Regulation: FCA, CySEC, FSCA

Platforms: MT4, MT5, cTrader, FxPro Edge

Key Features:

No dealing desk execution

Competitive spreads

Access to multiple asset classes

Why Choose FxPro:

No requotes policy

Advanced charting and analytics

Supports various trading styles

Best For: Traders who value diverse trading options.

3. Eightcap—Ideal for Technical Traders

Overview: Eightcap is tailored for traders who depend heavily on technical analysis. Its integration with TradingView and other charting tools sets it apart.

Regulation: ASIC, SCB

Platforms: MT4, MT5

Key Features:

Spreads starting at 0.0 pips

Over 200 financial instruments

Integration with advanced charting tools

Why Choose Eightcap:

Excellent tools for technical analysis

High-leverage options

User-friendly interface

Best For: Technical traders who demand detailed charting capabilities.

4. IC Markets—Best for Scalping and High-Frequency Trading

Overview: Known for its ultra-low latency and raw spreads, IC Markets is a preferred choice for scalpers and day traders.

Regulation: ASIC, CySEC, FSA

Platforms: MT4, MT5, cTrader

Key Features:

Spreads averaging 0.1 pips

Lightning-fast execution

Access to deep liquidity pools

Why Choose IC Markets:

Tailored for fast-paced trading strategies

Comprehensive educational materials

Excellent customer support

Best For: Scalpers and high-frequency traders.

5. FBS—Best for Beginner Traders

Overview: FBS is highly regarded for its beginner-friendly features, making forex trading accessible to everyone.

Regulation: IFSC, CySEC

Platforms: MT4, MT5

Key Features:

Cent accounts with low minimum deposits

Generous bonuses and promotions

Social trading options

Why Choose FBS:

Risk-free demo accounts

Easy-to-use interface

Attractive trading incentives

Best For: New traders looking for an easy entry into forex trading.

6. XM—Best for Education and Support

Overview: XM is synonymous with exceptional trader support and educational resources, making it a top choice for continuous learning.

Regulation: ASIC, CySEC, IFSC

Platforms: MT4, MT5

Key Features:

Spreads as low as 0.6 pips

Free webinars and tutorials

Over 1,000 trading instruments

Why Choose XM:

Multi-language support

Extensive educational materials

Reliable execution policies

Best For: Traders at all levels who value education.

7. Axi – Perfect for Algorithmic Traders

Overview: Axi provides a robust platform for traders leveraging automation, thanks to its VPS hosting and cutting-edge analytics.

Regulation: ASIC, FCA

Platforms: MT4, PsyQuation

Key Features:

Free VPS for qualifying accounts

AI-driven analytics tools

Competitive spreads

Why Choose Axi:

Ideal for EA (Expert Advisor) users

Secure trading environment

Excellent market analysis tools

Best For: Algorithmic traders seeking advanced technology.

8. HFM (HotForex) – Best for Risk Management Tools

Overview: HFM offers innovative risk management features and flexible trading options, ensuring safety and versatility.

Regulation: CySEC, FCA, FSCA

Platforms: MT4, MT5

Key Features:

Negative balance protection

Leverage up to 1:1000

Wide range of account types

Why Choose HFM:

Focus on minimizing risks

Excellent educational resources

Multilingual support

Best For: Risk-averse traders who value safety.

9. Pepperstone—Best All-Round Broker

Overview: Pepperstone delivers a seamless trading experience with its competitive pricing, advanced tools, and exceptional support.

Regulation: ASIC, FCA, DFSA

Platforms: MT4, MT5, cTrader

Key Features:

Spreads from 0.0 pips

Fast and reliable execution

Award-winning customer service

Why Choose Pepperstone:

Transparent fees

Excellent third-party integrations

Quick and easy account setup

Best For: Traders seeking a well-rounded, reliable broker.

How to Choose the Right Forex Broker

When evaluating a broker for forex trading, keep these factors in mind:

Regulation: Opt for brokers regulated by top-tier authorities.

Costs: Look for competitive spreads and low commissions.

Trading Platforms: Ensure they offer feature-rich platforms like MT4, MT5, or cTrader.

Account Options: Choose brokers offering accounts that suit your trading style.

Support: Prioritize brokers with responsive and multilingual customer service.

Extra Features: Consider bonuses, educational content, and risk management tools.

Conclusion

Choosing the right forex broker is the foundation of a successful trading journey. The Best Forex Brokers Reviews here—FP Markets, FxPro, Eightcap, IC Markets, FBS, XM, Axi, HFM, and Pepperstone—have proven themselves to be reliable, secure, and trader-focused. Whether you prioritize low costs, advanced tools, or comprehensive education, there’s a broker to meet your needs.

Explore these platforms and elevate your trading experience in 2025. With the right broker, your path to safe and profitable trading is assured.

1 note

·

View note

Text

Top Forex Brokers Reviewed: A Comprehensive Guide for 2024

Top Forex Brokers Reviewed: A Comprehensive Guide for 2024 The forex market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Choosing the right forex broker is crucial for success in this dynamic market. In this article, we will review some of the top forex brokers for 2024, highlighting their key features, regulatory status, and what makes them stand out.To get more news about WikiFX, you can visit our official website.

1. AvaTrade AvaTrade is renowned for being one of the largest and most trusted forex brokers globally. Regulated by multiple authorities, including ASIC, FSA, and CBI, AvaTrade offers a wide range of trading instruments and platforms. With a minimum deposit of $100 and a trust score of 4.8, it is an excellent choice for both beginners and experienced traders.

2. Exness Exness is a leading broker choice for professionals, known for its low spreads and high leverage options. Regulated by CySEC, FCA, and FSA, Exness requires a minimum deposit of just $10. Its trust score of 4.9 reflects its reliability and popularity among traders.

3. JustMarkets JustMarkets offers competitive spread-based accounts and is regulated by FSA, FSCA, and CySEC. With a minimum deposit of $10 and a trust score of 4.4, it is a solid option for traders looking for a reliable broker with low trading costs.

4. XM XM is a trusted broker for beginners, offering a welcome no-deposit bonus and a minimum deposit of just $5. Regulated by FSC, DFSA, and ASIC, XM has a trust score of 4.9. Its user-friendly platforms and educational resources make it an ideal choice for new traders.

5. HFM (HotForex) HFM, also known as HotForex, is a world leader in online trading. It is regulated by multiple authorities, including CySEC, FSCA, FCA, and DFSA. With a minimum deposit of $0 and a trust score of 4.9, HFM offers a wide range of trading instruments and competitive spreads.

6. BDSwiss BDSwiss is a leading web-based trading platform, regulated by FSC and FSA. With a minimum deposit of $10 and a trust score of 4.7, BDSwiss provides a robust trading environment with advanced tools and resources.

7. Pepperstone Pepperstone is known for its fast execution speeds and low spreads. Regulated by ASIC, BaFIN, and CMA, Pepperstone requires no minimum deposit and has a trust score of 4.9. It is an excellent choice for traders looking for a reliable and efficient trading platform.

8. FBS FBS offers a minimum deposit of just $5 and is regulated by IFSC and FSCA. With a trust score of 4.7, FBS provides a range of account types and trading platforms to suit different trading styles and preferences.

9. OctaFX OctaFX is regulated by SVGFSA and requires a minimum deposit of $25. With a trust score of 4.8, OctaFX offers competitive spreads and a variety of trading instruments, making it a popular choice among traders.

10. FP Markets FP Markets is regulated by ASIC, CySEC, and FSCA, with a minimum deposit of $100 and a trust score of 4.9. Known for its excellent MT4 and MT5 platforms, FP Markets is ideal for traders looking for advanced trading tools and resources.

Conclusion Choosing the right forex broker is essential for success in the forex market. The brokers listed above are among the top choices for 2024, offering a range of features, regulatory oversight, and competitive trading conditions. Whether you are a beginner or an experienced trader, these brokers provide reliable and efficient platforms to help you achieve your trading goals.

0 notes

Text

Which currencies can I trade on the Forex market?

The act of buying and selling currencies on the foreign exchange market is known as forex trading. With an average daily trading volume of nearly $6 trillion, the forex market is the biggest financial market in the world. The Forex market is open five days a week, around the clock, and from any location in the world. When trading currencies, one currency is purchased while another is sold. Profiting from changes in the exchange rates between two currencies is the aim of forex trading.

What is Forex Trading?

When trading in forex, pairs of currencies are bought and sold. The US Dollar, the Euro, the Japanese Yen, the British Pound, and the Swiss Franc are the most traded currencies on Forex. These currencies, which makeup more than 80% of the overall trading activity on the Forex market, are referred to as significant currencies. Emerging market currencies like the Chinese Yuan and the Indian Rupee are also traded on the Forex market.

What are the most popular currencies traded on Forex?

Selecting the ideal Forex broker is essential for profitable trading. The top Forex brokers provide reasonable commissions, attractive spreads, and a broad selection of trading instruments. It is crucial to take many variables into account when selecting a Forex broker. Regulation, trading platforms, customer service, and choices for deposits and withdrawals are all included. XM, AvaTrade, and eToro are some of the best Forex brokers available for trading. These brokers provide a large selection of trading tools, aggressive spreads, and minimal commissions.

How to choose a Forex broker?

The market offers a wide variety of platforms for trading forex. cTrader, TradingView, MetaTrader 4, MetaTrader 5, and NinjaTrader are among the top 10 Forex trading platforms. These systems provide a large selection of trading instruments, sophisticated charting capabilities, and movable indicators. It is crucial to take usability, dependability, and security into account while selecting a Forex trading platform.

Top forex brokers list

Wide selections of trading instruments, aggressive spreads, and affordable commissions are all provided by online Forex brokers. Online Forex firms like XM, AvaTrade, and eToro are among the best. These brokers provide a large selection of trading tools, aggressive spreads, and minimal commissions. It's crucial to take into account aspects like regulation, trading platforms, customer service, and deposit and withdrawal methods when selecting an online forex broker.

Best online Forex brokers

If done properly, forex trading may be a profitable endeavour. Scalping, day trading, and swing trading are a few of the most popular Forex trading techniques. Scalping is the practice of making modest profits from slight price changes. Currency day trading refers to purchasing and selling on the same day. Swing trading is maintaining positions for numerous days or weeks in order to profit from market fluctuations.

Before engaging in Forex trading, it is crucial to have a thorough understanding of the Forex market and the variables influencing exchange rates. Starting with a sample account, employing stop-loss orders, and staying current with market news and events are some pieces of advice for newcomers to forex trading.

Conclusion

Forex market is a complex and dynamic market that requires a solid understanding of the market and the factors that affect exchange rates. The Forex market is the biggest financial market in the world, with an average daily trading volume of many trillions.

Selecting the ideal Forex broker is essential for profitable trading. To assist traders in their success on the Forex market, Trading Critique offers a well-researched list of the top Forex brokers, Forex trading instructions, and other tools.

0 notes

Text

Standard information and facts to understand the respected forex trading surface traderViet ICMarkets.

In accordance with the basic evaluation conditions for reputable foreign exchange floors, can you realise you are the respected forex trading floors? You can consult the best forex exchanges below if not. Basic info to know the trustworthy forex trading flooring traderViet ICMarkets Basic information and facts of trustworthy foreign exchange change ICMarkets: Registered by ASIC, bare minimum put in is $ 200, top make use of 1: withdrawal, deposit and 500 route for Vietnamese customers (Visa / Mastercard, Paypal ,Neteller and Skrill, Internet Banking, Bitcoin Pocket). Help crew 24/5 Vietnamese people, reside talk. EXNESS The best foreign exchange swap which can be described EXNESS is licensed: , CySEC using a minimal downpayment of $ .FSA and FCA Top make use of 1: 2000 (MT5), 1: infinity (MT4 with money conditions connected). Handy withdrawal and deposit channel for Vietnamese consumers: Visa / Mastercard, Ngan Luong, Neteller, Skrill and Bitcoin USDT. Vietnamese support staff, live talk 24/5 and hotline for Vietnam. TICKMILL Registered Tickmill foreign exchange forex: , CySEC with bare minimum deposit:FCA and FSA $ 100 and maximum make use of: 1: 500. There are actually withdrawal and deposit stations for Vietnamese clients for example Visa / Mastercard, Cable Move, Neteller, Sticpay and Skrill Ngan Luong. Vietnamese assistance personnel, reside talk 24/5.

XTB XTB accredited: CySEC, CNMV, BaFIN, FCA and IFSC KNF with lowest put in: $ 1 and greatest leveraging: 1: 500. You will find withdrawal and recharge routes for Vietnamese clients: Visa / Neteller, Mastercard and Skrill Ngan Luong and a Vietnamese support group, live chat 24/5. XM Certificates: FCA, ASIC and CySEC IFSC. Bare minimum put in: 5 $ and greatest influence: 1: 888. There is also a withdrawal and deposit route for Vietnamese buyers: Visa / Mastercard, Neteller and Skrill Ngan Luong plus a large crew of Vietnamese assistance employees, are living talk 24/7. AETOS Licensed Aetos trustworthy forex swap: ASIC with lowest deposit: 250 $ and highest leveraging: 1: 400. Along with the deposit and withdrawal station for Vietnamese clients: Visa / Skrill, Mastercard and Neteller Ngan Luong, Zota Pay, Pay Trust. You will find Vietnamese crew, support 24/5, top quality 4.5 / 5 superstars. These is preliminary information about the extremely appreciated trustworthy forex trading flooring of TraderViet nowadays. If you know more about the ideal foreign exchange program you may also talk about more information. Deal with a good investment local library, a never-ending shop of information. You can learn the most correct forex expertise. Information and facts to evaluate which foreign exchange ground is the best. Best most respected forex surfaces, expertise in picking a great reputable forex trading flooring to help you feel protected and trade far more easily. Sign up for the community to receive intraday buying and selling impulses. Get cost-free Foreign exchange trade school materials and announcements. To read more about San forex uy tin webpage: click for more info.

1 note

·

View note

Text

HD cách nạp và rút tiền tại các sàn Forex

hướng dẫn bí quyết NẠP RÚT TIỀN từ những SÀN FOREX Sau đây là bí quyết Anh chị nạp rút tiền trong khoảng các sàn forex rộng rãi nhất trên thị trường Việt Nam. Về cơ bản , bí quyết nạp tiền và rút tiền là gần tương đồng với nhau. bên cạnh đó , hồ hết những sàn đều bắt buộc bạn phải rút tiền bằng cách như vậy khi nạp tiền. SÀN XM 1. Đăng nhập trương mục của bạn trên trang chủ của XM. 2. Vào trang tư nhân của bạn. Chọn NẠP TIỀN ví như bạn muốn nạp hoặc chọn RÚT TIỀN giả dụ bạn muốn rút. 3. những hình thức nạp/rút cho trader Việt Nam của XM bao gồm thẻ Visa/Master, ví Neteller, ví Skrill và ví Nganluong.vn. Click chọn cách bạn muốn tiêu dùng. 4. Nhập số tiền mà bạn muốn nạp/rút, đồng thời nhập thông báo tài khoản của bạn (tùy cách bạn chọn) 5. Sau đó: - Đối sở hữu việc nạp, sàn sẽ chuyển bạn sang cửa sổ của phương pháp bạn chọn để bạn nhập các thông báo nhu yếu . - Đối với việt rút, thì bạn chỉ cần công nhận là xong. SÀN EXNESS 1. Đăng nhập account của bạn trên trang chủ của Exness. 2. Vào trang cá nhân của bạn, nhìn cột bên tay trái. Chọn NẠP TIỀN nếu bạn muốn nạp hoặc chọn RÚT TIỀN nếu như bạn muốn rút. 3. các hình thức nạp/rút cho trader Việt Nam của Exness bao gồm thẻ Visa/Master, Internet Banking của những ngân hàng Việt Nam, ví Neteller, ví Skrill, ví tiền ảo và ví Nganluong.vn. Click chọn cách bạn muốn sử dụng. 4. Chọn cái tiền tệ bạn muốn nạp/rút. 5. Nhập số tiền mà bạn muốn nạp/rút, song song nhập thông báo trương mục của bạn (tùy bí quyết bạn chọn) 6. Sau đó , sàn sẽ chuyển bạn sang cửa sổ của bí quyết bạn chọn để bạn nhập những thông báo cấp thiết để hoàn tất việc nạp/rút tiền.

SÀN HOTFOREX 1. Đăng nhập tài khoản của bạn trên trang chủ của HotForex. 2 . Vào trang tư nhân của bạn, nhìn ngay bên dưới tên trương mục của bạn. Chọn GỬI TIỀN ví như bạn muốn nạp hoặc chọn RÚT ví như bạn muốn rút. 3. các hình thức nạp/rút cho trader Việt Nam của HotForex bao gồm thẻ Visa/Master, Internet Banking của những nhà băng Việt Nam, ví Neteller, ví Skrill, ví WebMoney và ví FasaPay. Click chọn cách bạn muốn tiêu dùng . 4. Nhập số tiền mà bạn muốn nạp/rút, cùng lúc nhập thông báo tài khoản của bạn (tùy cách thức bạn chọn) 5. Sau đấy , sàn sẽ chuyển bạn sang cửa sổ của bí quyết bạn chọn để bạn nhập những thông báo thiết yếu để hoàn tất việc nạp/rút tiền.

SÀN IC MARKETS 1. Đăng nhập tài khoản của bạn trên trang chủ của IC Markets. 2. Sau khi đăng nhập, trên thanh dụng cụ, chọn Transfer rồi chọn DEPOSIT FUNDS nếu bạn muốn nạp hoặc chọn WITHDRAW FUNDS nếu như bạn muốn rút. 3. những hình thức nạp/rút cho trader Việt Nam của IC Markets bao gồm thẻ Visa/Master, PayPal, Internet Banking của các nhà băng Việt Nam, ví Neteller hoặc ví Skrill. Click chọn bí quyết bạn muốn dùng . 4. Nhập số tiền mà bạn muốn nạp/rút, song song nhập thông báo account của bạn (tùy bí quyết bạn chọn). Sau ấy , sàn sẽ chuyển bạn sang cửa sổ của cách thức bạn chọn để bạn nhập các thông tin cần yếu để hoàn thành việc nạp/rút tiền.

SÀN FBS 1. Đăng nhập trương mục của bạn trên trang chủ của FBS 2. Sau khi đăng nhập, nhìn thanh Dashboard bên trái màn hình của bạn, chọn các hoạt động tài chính. Chọn NẠP TIỀN nếu bạn muốn nạp hoặc chọn RÚT TIỀN nếu bạn muốn rút. 3. những hình thức nạp/rút cho trader Việt Nam của FBS bao gồm thẻ Visa/Master, Internet Banking của những ngân hàng Việt Nam, ví Neteller, ví Skrill, ví Perfect Money, ví SticPay hoặc ví CashU. Click chọn phương pháp bạn muốn tiêu dùng. 4. Chọn trương mục FBS bạn muốn nạp tiền vào hoặc rút tiền ra. 5. Nhập số tiền mà bạn muốn nạp/rút, cùng lúc nhập thông báo trương mục của bạn (tùy bí quyết bạn chọn) 6. Sau đấy , sàn sẽ chuyển bạn sang cửa sổ của bí quyết bạn chọn để bạn nhập các thông tin nhu yếu để hoàn thành việc nạp/rút tiền. mang bài viết hướng dẫn về cách nạp rút tiền trong khoảng những sàn forex uy tín ở trên, BRKV đã trả lời cho các trader đặt câu hỏi này gửi về cho chúng tôi thời gian qua. ví như bạn vẫn còn điều gì thắc mắc , mang thể để lại comment dứoi bài viết, chúng tôi sẽ san sớt phổ biến hơn cho mọi người nhé! Nguồn cập nhật: https://brokerreview.net/vi

1 note

·

View note