#workers' compensation insurance

Explore tagged Tumblr posts

Text

Affordable Workers Compensation Insurance in Fort Worth, TX: A Guide for Small Businesses

Running a small business in Fort Worth, TX, comes with its share of challenges—and protecting your employees shouldn’t be one of them. Workers compensation insurance is a critical safeguard, ensuring your team is covered if they’re injured on the job. While Texas is the only state where employers aren’t federally required to carry this coverage, opting for it can prevent costly lawsuits and foster trust. This guide breaks down how to find affordable workers compensation insurance in Fort Worth, TX, without compromising on quality.

What Is Workers Compensation Insurance?

Workers compensation insurance provides financial support to employees who suffer work-related injuries or illnesses. It covers:

Medical expenses: Doctor visits, surgeries, prescriptions, and rehabilitation.

Lost wages: A portion of income if the employee can’t work temporarily.

Disability benefits: Payments for permanent injuries.

Death benefits: Support for families in fatal cases.

Even though Texas doesn’t mandate it for most industries, many businesses choose it to avoid lawsuits (employees can sue if you lack coverage) and meet contractual requirements (e.g., clients or landlords may insist on it).

Why Fort Worth Businesses Need Workers Comp Insurance

Legal Protection: Without coverage, you lose immunity from employee lawsuits under Texas law.

Employee Retention: Shows you value your team’s well-being, boosting morale and loyalty.

Compliance: Certain industries (like government contractors) and multi-state operations may require it.

Risk Management: Mitigates financial shocks from workplace accidents, common in high-risk sectors like construction or manufacturing.

How Much Does Workers Compensation Cost in Fort Worth, TX?

Premiums depend on:

Industry Risk: High-risk jobs (e.g., roofing) cost more than low-risk roles (e.g., clerical work).

Payroll Size: Premiums are calculated per $100 of payroll.

Claims History: Fewer past claims = lower rates.

Coverage Limits: Higher limits or added endorsements increase costs.

On average, Texas employers pay **0.50to0.50to2.50 per 100inpayroll∗∗annually.Forexample,aconstructioncompanywitha100inpayroll∗∗annually.Forexample,aconstructioncompanywitha500,000 payroll might pay 5,000to5,000to12,500 per year.

5 Tips to Find Affordable Workers Compensation Insurance

Shop Around: Compare quotes from multiple insurers. Use brokers or online tools like Texas Mutual (Texas’ largest workers’ comp provider) or The Hartford.

Implement Safety Programs: Reduce workplace injuries—and premiums—with OSHA-compliant training and safety protocols.

Classify Employees Correctly: Ensure each worker’s role aligns with the right risk classification (avoid overpaying for low-risk tasks).

Bundle Policies: Combine workers’ comp with general liability or commercial auto insurance for discounts.

Work with a Local Agent: Fort Worth-based brokers understand state laws and can negotiate better rates.

How to Purchase Workers Compensation Insurance in Fort Worth

Assess Your Needs: Calculate payroll, evaluate risks, and determine coverage limits.

Get Quotes: Request estimates from at least 3-4 providers.

Check Insurer Reputation: Look for carriers with strong financial ratings (e.g., A.M. Best) and positive customer reviews.

Review the Policy: Confirm coverage details, exclusions, and payment terms.

Finalize and Document: Keep proof of insurance for contracts and audits.

Local Resources for Fort Worth Businesses

Texas Department of Insurance (TDI): Guides on compliance and filing claims.

Fort Worth Chamber of Commerce: Offers resources and partnerships with local insurers.

Texas Association of Business (TAB): Advocates for affordable coverage options.

Final Thoughts

Affordable workers compensation insurance in Fort Worth, TX, is within reach for small businesses. By comparing quotes, prioritizing workplace safety, and partnering with trusted local agents, you can protect your team and your bottom line. Don’t wait for an accident to happen—secure coverage today and focus on growing your business with confidence.

0 notes

Text

What is WorkerCompensation Insurance Aupeo: Guide 2024

Do you want to know how workers' compensation insurance can protect your business and employees? It can fend off potential risks. Learn what is workers compensation insurance aupeo. It should be mandatory in all workplaces. Be direct. See how the right choice can affect your company's future.

Workers' compensation insurance applies when an employee is injured or ill at work. It helps pay the medical bills and lost wages of the sick worker. It also relieves the employer of legal and financial liabilities.

Read More...

#what is workers compensation insurance aupeo#insurance#insurance guide 2024#Workers' Compensation Insurance#AUPEO Insurance Guide

0 notes

Text

Safety is the most important factor in the workplace. Despite companies’ best efforts to keep workplaces safe, accidents and injuries can sometimes occur. In times of need, workers’ compensation, a system created to protect employees, steps in to offer financial security and assistance. We’ll discuss the idea of workers’ compensation for injuries in this blog, illuminating what it is, why it’s important, and how it functions. If you want to get Workers’ Compensation Claims, contact Core Medical Center.

#Workers' Compensation Claims#Workers' Compensation Claims Blue Springs#Workers' Compensation Insurance#Workplace Injury Management Blue Springs#USA

0 notes

Text

0 notes

Text

minor life update, major news

I know a few of you know and a lot of you don't, but I've been fighting with workers comp for an entire year now to get an MRI done on my neck and upper back due to an overuse injury I obtained from lifting so much.

I have permanent nerve damage in my back. It causes me a lot of pain to sit for long periods of time as the unique burning and electricity of nervous pain starts before the muscles lock up, often accompanied by the ring and pinky fingers of my left hand going numb. I have days where I am entirely bedridden.

I have had my MRI denied five times.

Today, 08/01/2024, I received a letter in the mail stating that they have overturned that denial and I am finally getting what I fought so hard for.

It may or may not tell me what is actually going on in my neck and back, but I have put so much blood, sweat, and tears into this.

I finally won.

#with all due disrespect#fuck the american healthcare system#and fuck the worker's compensation insurance companies#All of that time spent in pain that I pushed through was worth it just for this#raven lady rambles

22 notes

·

View notes

Link

4 notes

·

View notes

Text

#assessment Small#Business asset protection#Business continuity#Business credibility#business finance#Business protection#Commercial insurance#Cyber insurance#Insurance advice#Insurance coverage#Insurance for entrepreneurs#Insurance policies#Insurance tips Risk#Legal requirements#Liability insurance#Professional liability#Property insurance#Risk management#Small business insurance#Worker's compensation

3 notes

·

View notes

Text

"Miner on his way to have his worker's compensation claim denied" clip art

#clip art#clipart#illustration#art#graphic arts#90s#90s aesthetic#miners#workers compensation insurance#unions#workers of the world unite

1 note

·

View note

Text

Workers Compensation Insurance for Bar in Murrells Inlet, SC

Ensure your staff’s safety with Workers Compensation Insurance for Bar in Murrells Inlet, SC, from Restaurant Pro Insurance. Our coverage helps protect employees in case of workplace injuries while safeguarding your business from costly claims. Call us at 854.354.9358.

0 notes

Text

0 notes

Text

0 notes

Text

Insurance is essential for shielding businesses from unexpected challenges in the complex realm of operations. Key elements in this safety net include general liability and workers’ compensation coverage. A thorough grasp of these types is vital for comprehensive business protection.

0 notes

Text

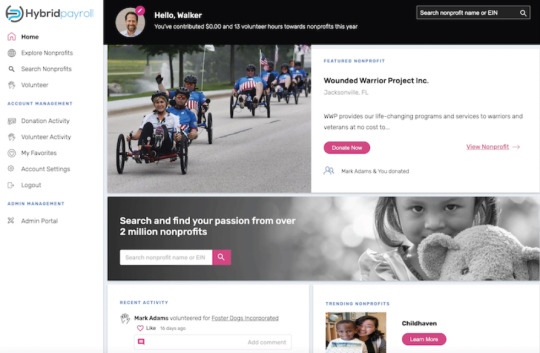

Employee Volunteering Softwares | HR Solutions Company Denver | Payroll Processing Solutions

Hybrid Payroll Giving and Volunteering provides both employees and employers what they are asking for—alignment with charitable causes plus simple, seamless methods for managing giving programs, processing contributions, and reporting social responsibility. Now, even as a small employer, you can compete for top talent while fostering employee loyalty and retention. https://hybridpayroll.com/giving-and-volunteering/

#Talent Management Denver#Denver Insurance Services#Construction Recruitment Services#Worker Compensation Management#Hospitality Workforce Scheduling#Real Time Payroll Processing

0 notes

Text

A plethora of responsibilities and rights in the intricate tapestry of employment binds employers and employees. Workers’ Compensation Insurance is an important thread in this intricate tapestry, acting as a safety net that ensures financial help in times of need. We’ll unpack the meaning and relevance of employee compensation insurance in this blog article, providing light on its critical function in the employer-employee relationship. If you want to make Workers’ Compensation Claims Blue Springs, you can take Core Medical Centre‘s assistance. Our experienced team will help you file Workers’ Compensation Claims and get the benefits. Not only that, we have a skilled medical team who will look after the injured employee and help them all the possible way to get back to work as soon as possible. We can also help the employer by providing them the advantage of this insurance that can be advantageous for both the employee and the employer.

#Workers' Compensation Claims#Workers' Compensation Insurance#Workplace Injury Management Blue Springs#Workers' Compensation Claims Blue Springs#Blue Springs#USA

0 notes

Text

0 notes