#wbtc price

Explore tagged Tumblr posts

Text

Could World Liberty Finance’s $9.89M Ethereum Exchange Spell Trouble?

Key Points

World Liberty Finance and Grayscale have moved a significant amount of their Ethereum holdings to exchanges, indicating a potential sell-off.

Ethereum’s investor activity has slowed down, with the funding premium turning negative as demand decreases.

World Liberty Finance and Grayscale, two significant institutions, have shifted a large amount of their Ethereum (ETH) holdings to exchanges. This move suggests a possible sell-off in the near future.

Ethereum’s investor activity has been stagnant recently. The funding premium has turned negative, indicating a drop in demand.

Ethereum’s Recent Performance

Over the past month, Ethereum has underperformed, dropping by 18.31%. This bearish trend continued over the last 24 hours, with a slight loss of 0.53%.

The current market trends suggest that Ethereum’s decline may intensify in the coming days, especially following the inauguration of the new U.S. president, Donald Trump.

Investor Movements

World Liberty Finance, associated with President-elect Donald Trump, recently increased its ETH holdings by acquiring more tokens, only to sell them off later.

This transaction involved World Liberty swapping 103 WBTC, valued at $9.89 million at the time of the exchange, for 3,075 ETH.

After the swap, they added 15,461 ETH to their holdings, bringing their total to 18,536 ETH, which was then deposited on the cryptocurrency exchange Coinbase Prime.

Usually, when assets move from private wallets to exchanges, it signals a potential sell-off. However, in this case, the sell-off may not occur immediately.

World Liberty Finance may be holding the assets in anticipation of a price surge following the upcoming inauguration of President-elect Trump, as seen in the past.

If history repeats itself, World Liberty Finance may aggressively sell off its ETH on Coinbase Prime after the anticipated price surge, potentially driving ETH’s price down.

Additional data from Intel reveals that institutional investor Grayscale, known for its large ETH holdings, has followed a similar pattern, moving its assets to Coinbase Prime.

According to the data, three transactions saw a total of 16,941 ETH moved to Coinbase Prime, valued at $54.27 million at the time, signaling a bearish stance on the asset.

Decline in Demand

CryptoQuant’s premium index, which measures institutional demand for an asset, has shown a significant drop in ETH’s fund premium. It now trades at a negative 0.515, moving further away from its neutral zone.

A drop below the neutral zone (zero) indicates that institutional investors are less willing to pay a premium for ETH, suggesting a decline in demand and a gradually bearish outlook.

Simultaneously, spot traders are showing signs of uncertainty. These traders now prefer to hold their assets on exchanges, where they can easily sell, rather than in private wallets for long-term holding.

This behavior is reflected in the exchange netflow, which shifted from a daily netflow of negative 39,270 ETH in early January to just 6,093 ETH, at the time of writing.

This sentiment suggests that both institutional and retail investors are losing interest, with some gradually selling off their positions. However, the overall sentiment remains that ETH is still viewed as a bullish asset.

0 notes

Text

MetaMask Introduces Gas Station, Eliminating the Need for ETH in Swaps

MetaMask has launched Gas Station, a groundbreaking feature enabling token swaps without requiring ETH for gas fees. Now live on the MetaMask browser extension for Ethereum mainnet, with a mobile version coming soon, this innovation streamlines transactions by integrating network fees directly into swap quotes.

Gas Station supports tokens such as USDT, USDC, DAI, wETH, wBTC, wstETH, and wSOL, provided the swap value covers the transaction cost. By bypassing the need to acquire ETH separately for gas, the feature addresses a major pain point for Web3 users, reducing delays and costs during high network activity.

MetaMask ensures competitive pricing by sourcing quotes from DEX aggregators and market makers, guaranteeing low network fees. Future updates aim to expand support for more networks and tokens, reaffirming MetaMask’s commitment to simplifying Web3 processes.

Ethereum’s Momentum Grows Ethereum has surged 7.78% in 24 hours to $3,379, with analysts forecasting $4,000 soon, fueled partly by MetaMask’s user-focused advancements.

0 notes

Text

MetaMask’s Gas Station: The New Solution to Ethereum’s High Gas Fees

Key Points

MetaMask’s new Gas Station feature allows token swaps without needing Ethereum (ETH) or gas fees.

The feature, powered by MetaMask’s Smart Transactions, optimizes gas usage and ensures reliable execution.

MetaMask Introduces Gas-Included Swaps

MetaMask, an Ethereum wallet, has introduced a new feature known as the Gas Station. This feature enables users to make token swaps without the need for Ethereum (ETH) or gas fees. The feature is currently active for users of the MetaMask extension on the Ethereum mainnet.

The aim of this feature is to simplify transactions and remove the barrier of gas fees in the decentralized finance (DeFi) ecosystem. A significant issue for Web3 users has been the exhaustion of gas fees.

Overcoming Traditional Challenges

Traditionally, users had to buy ETH on centralized exchanges and transfer it to their on-chain wallets, a process that was both costly and time-consuming. MetaMask’s Gas Station feature addresses this issue by incorporating network fees directly into the quoted swap price, allowing users to complete transactions without any additional steps or delays.

The Gas Station feature is powered by MetaMask’s Smart Transactions, which optimize gas usage and ensure reliable execution. Tokens supported for gas-included swaps include wBTC, wETH, DAI, USDT, USDC, ETH, and others.

By pooling liquidity from decentralized exchanges, market makers, and aggregators, MetaMask provides competitive pricing and enhances the overall user experience. These efforts by the Ethereum wallet provider have been lauded by players in the crypto industry.

Michael Khekoian, Senior Business Development Manager at Consensys, noted that swaps in MetaMask no longer require ETH for gas, eliminating the issue of insufficient funds during swaps. Another crypto advocate emphasized that this feature would streamline DeFi interactions, encouraging users to upgrade to version 12.6.0 or higher to take advantage of gas-included swaps.

Impact on Ethereum Demand

With the new MetaMask feature not requiring ETH as gas fees, there are questions about the impact this may have on Ethereum demand and whether it could lead to an underperformance of ETH in the future.

While MetaMask’s solution reduces the dependence on ETH for gas fees during swaps, activities within the broader Ethereum ecosystem, such as staking and DeFi participation, continue to heavily rely on the token. Therefore, the potential impact on ETH remains unclear.

The swap feature is part of MetaMask’s broader efforts to improve its services. In August 2024, the wallet launched a crypto debit card in collaboration with Mastercard and Baanx, available in the EU and UK. This card allows users to directly spend crypto, bridging the gap between traditional finance and blockchain.

0 notes

Text

A savvy trader who recently cashed out $8.2 million from their investments in Shiba Inu is now turning their attention to a new coin. The trader, who has a keen eye for lucrative opportunities, is confident that this new investment has the potential for significant gains. Stay tuned to find out which coin this experienced investor is betting on next. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] An experienced investor who recently cashed in over $8 million from Shiba Inu has shifted focus to a new lucrative asset amidst the current Market excitement. This trader initially invested in Shiba Inu, acquiring a massive 533.6 billion SHIB tokens for $7.75 million when the price was at $0.00001453 per token. The investor's strategic move paid off when the price of SHIB surged to $0.00004534, resulting in a portfolio value of $24,166,220. However, realizing that the upward trend might not sustain, the investor decided to sell the SHIB holdings for $16 million in DAI stablecoin, earning a profit of $8.24 million within 30 days of holding the asset. Following the successful exit from SHIB, the investor has now turned his attention to Wrapped Bitcoin (WBTC), committing $16.22 million to acquire the asset at an average price of $64,449 per token. Spot On Chain noted that the investor has already made a profit of $380K in the recent surge in Bitcoin's price. With Bitcoin reclaiming the $66,000 price level and impacting altcoins like Shiba Inu, this investor's move to explore new opportunities in the Market showcases a strategic business approach. As the crypto Market continues to evolve, it is essential for investors to conduct thorough research before making investment decisions to mitigate financial risks. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What coin did the trader who made $8.2 million from Shiba Inu decide to buy next? - The trader decided to buy [insert name of coin] next. 2. How much money did the trader make from Shiba Inu? - The trader made $8.2 million from Shiba Inu. 3. Why is the trader deciding to buy a new coin? - The trader is looking to invest their profits from Shiba Inu into a new opportunity. 4. Is it a good idea to follow the trader's investment choices? - It's important to do your own research and make informed decisions when investing, as everyone's financial goals and risk tolerance are different. 5. What should I consider before buying the same coin as the trader? - Consider factors such as the coin's Market trends, team behind the project, potential for growth, and your own investment strategy before making a decision to buy. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

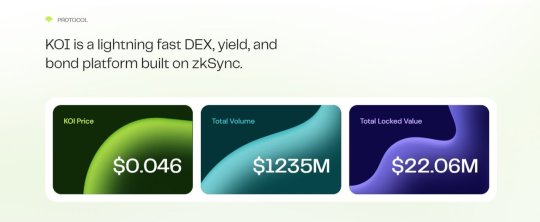

Koi finance: Experience Gas-Less Swaps and Dynamic Features on zkSync Era

Introduction of Koi Finance

Koi Finance is a Layer 2 DeFi platform based on zk-Rollup technology. You first need to deposit assets into the zkSync Era network to experience frictionless and low cost DeFi. KOI is a lightning fast DEX, yield, and bond platform built on zkSync. A next generation DAO governed. ZkRollup DeFi Platform. Trade,earn yields and participate in Bonds all on one decentralized, community driven platform. The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol. I strongly recommend to don't avoid this and also advice to everyone to join KOI FINANCE. It definitely deserves to be invested in. you can see the good opportunity. you can get good profit,if you join and invest into here.

Koi Finance Liquidity Pools

Pool Design

Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable Pool- Assets that trade within a close price range (e.g USDC/DAI)

Normal Pool- Assets that trade with no correlation (eg. ETH / WBTC)

There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type.

Fees for each pool are independent of other pools. Each type of pool has a min-max fee that can be set by LPs:

Stable: 0.01%-2%

Normal: 0.01%-10%

Stable Pools

Stable pools are designed for assets that should be traded within a tight price range. This allows high volume trades to have capital efficient swaps. Once pricing is set upon pool creation, the trade price maintains tight a spread - make sure to set the proper pricing for these pools.

Normal Pools

Normal pools are designed for non correlated and volatile priced assets. These pools use a generic AMM formula and are used for most trading pairs.

Dynamic Pools

Koi allows for pools to be created with LP fees ranging from 0.01% all the way up to 10% for normal pools, and 2% for stable pools. Once set upon pair creation, these fees can only be changed with the LP governance system. An LP provider (or delegated provider) with 50%+ vote weight can always change this fee. To prevent from gaming the system, there is a 0.1% fee on total votes when changing the fee of pools. This prevents flash loans from changing fee structures without some sort of losses.

The simplicity of the dynamic fee pool w/ governance allows for a powerful system and tool for many projects in DeFi & crypto.

Game Theory

By observing traditional CEX markets and even most NFT marketplaces, it has been normalized for fees of 1%+ to be in place via marketmakers (spread), and content creators & teams (nfts). This fee system should empower not only individual LP providers, but also projects that focus on Protocol Owned Liquidity (POL) to set their base fee for their pairs to be able to build up a larger revenue stream for the project, versus what they can find on most traditional AMM based DEXs.

Governance

Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Each LP pool has a LP fee set upon pair creation. These fees can range from 0.1%-10%, depending on what the LP provider wants to set as the creator of the pool. Only one fee can be set at a time, meaning all LPs will be participating within that fee range.

The LP governance system allows for the fee of the pool to be changed based on an account that controls more than 50% of the pool votes. Votes are directly correlated to the LP token supply balances. However, a LP provider may choose to delegate their 'votes' to another provider, allowing parties to lobby for delegates, thus increasing their pool weight.

Mute has opted for this design, instead of a multi fee pool type for numerous reasons; the major one being that the pool with the deepest liquidity will always be traded on in comparison to its counterparts (pools with lower fees & lower liquidity). Thus, it is better to concentrate liquidity within one pool, and allow a governance system that allows for dynamic fees.

Protocol Fees

The protocol has 2 type of fees:

Dynamic (% of the LP pool fees)

Fixed (fixed % of the overall trade)

If the protocol fixed fee is set and is larger than what the LP pool fees are, then LP providers earn no fees for trades. Protocol Fixed fees will only be used early upon launch until LP TVL grows to a sustainable amount.

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

$0.10 - $0.20 gas fees

Pay gas with any token, no ETH needed

Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable and normal curve range

Fee accumulation outside of LP position

Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

Fixed APY model

Gauranteed reward payouts

No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

Participate in voting

Access to higher farming APYs

Revenue sharing (soon)

KOI Tokenomics

Max Supply: 1,000,000,000 KOI Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated. Circulating (prev. Mute token swap): 50% Ecosystem Incentives: 30% Future Investors (reserved): 7% DAO: 6% Future Advisors (reserved): 4% Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release May, 2023.

Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

VISIT HERE:

Website: https://koi.finance/ Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1 Twitter: https://twitter.com/koi_finance Discord: https://discord.com/invite/muteio Telegram Community: https://t.me/mute_iol

Author details:

Bitcointalk name: LiloBee Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2814494 Address: 0xFeACf80A4d4e100bFedd609069BfBe22BE2EBb63

0 notes

Text

WBTC Price Analysis: Remains pressured below the 50-day SMA; A symmetrical triangle breakout is on the cards

Wrapped Bitcoin (WBTC) price nears a critical support level of $17,000 amidst heightened market volatility following major central bank rate decisions. After two days of gains, WBTC retreats from highs above $18,500, with a daily close above $18,000 needed to invalidate the bearish trend. Presently trading around $17,500, WBTC's 24-hour market cap stands at $3,482,450,657, with trading volume surging over 100% to $139,301,702. Amid global recession fears and hawkish central bank stances, investors shy away from riskier assets, reflected in market indices like the Dow Jones, S&P 500, and Nasdaq declining by 400 points, 2.16%, and 2.40%, respectively.

Technical analysis indicates a mild bearish outlook for WBTC, with the price testing a "Symmetrical Triangle" formation's lower boundary. Below the 50-day EMA, sellers hold advantage, potentially targeting $16,990 and $16,000 levels. Conversely, a close above $18,000 could reverse sentiment, requiring sustained buying to breach $18,250 resistance and aim for $19,250. RSI suggests short-term sideways movement, while MACD shows declining bullish momentum. Given mixed indicators, traders are urged to exercise caution and await clearer price direction.

0 notes

Text

Koi finance: Experience Gas-Less Swaps and Dynamic Features on zkSync Era

Introduction of Koi Finance

Koi Finance is a Layer 2 DeFi platform based on zk-Rollup technology. You first need to deposit assets into the zkSync Era network to experience frictionless and low cost DeFi. KOI is a lightning fast DEX, yield, and bond platform built on zkSync. A next generation DAO governed. ZkRollup DeFi Platform. Trade,earn yields and participate in Bonds all on one decentralized, community driven platform. The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol. I strongly recommend to don't avoid this and also advice to everyone to join KOI FINANCE. It definitely deserves to be invested in. you can see the good opportunity. you can get good profit,if you join and invest into here.

Koi Finance Liquidity Pools

Pool Design

Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable Pool- Assets that trade within a close price range (e.g USDC/DAI)

Normal Pool- Assets that trade with no correlation (eg. ETH / WBTC)

There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type.

Fees for each pool are independent of other pools. Each type of pool has a min-max fee that can be set by LPs:

Stable: 0.01%-2%

Normal: 0.01%-10%

Stable Pools

Stable pools are designed for assets that should be traded within a tight price range. This allows high volume trades to have capital efficient swaps. Once pricing is set upon pool creation, the trade price maintains tight a spread - make sure to set the proper pricing for these pools.

Normal Pools

Normal pools are designed for non correlated and volatile priced assets. These pools use a generic AMM formula and are used for most trading pairs.

Dynamic Pools

Koi allows for pools to be created with LP fees ranging from 0.01% all the way up to 10% for normal pools, and 2% for stable pools. Once set upon pair creation, these fees can only be changed with the LP governance system. An LP provider (or delegated provider) with 50%+ vote weight can always change this fee. To prevent from gaming the system, there is a 0.1% fee on total votes when changing the fee of pools. This prevents flash loans from changing fee structures without some sort of losses.

The simplicity of the dynamic fee pool w/ governance allows for a powerful system and tool for many projects in DeFi & crypto.

Game Theory

By observing traditional CEX markets and even most NFT marketplaces, it has been normalized for fees of 1%+ to be in place via marketmakers (spread), and content creators & teams (nfts). This fee system should empower not only individual LP providers, but also projects that focus on Protocol Owned Liquidity (POL) to set their base fee for their pairs to be able to build up a larger revenue stream for the project, versus what they can find on most traditional AMM based DEXs.

Governance

Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Each LP pool has a LP fee set upon pair creation. These fees can range from 0.1%-10%, depending on what the LP provider wants to set as the creator of the pool. Only one fee can be set at a time, meaning all LPs will be participating within that fee range.

The LP governance system allows for the fee of the pool to be changed based on an account that controls more than 50% of the pool votes. Votes are directly correlated to the LP token supply balances. However, a LP provider may choose to delegate their 'votes' to another provider, allowing parties to lobby for delegates, thus increasing their pool weight.

Mute has opted for this design, instead of a multi fee pool type for numerous reasons; the major one being that the pool with the deepest liquidity will always be traded on in comparison to its counterparts (pools with lower fees & lower liquidity). Thus, it is better to concentrate liquidity within one pool, and allow a governance system that allows for dynamic fees.

Protocol Fees

The protocol has 2 type of fees:

Dynamic (% of the LP pool fees)

Fixed (fixed % of the overall trade)

If the protocol fixed fee is set and is larger than what the LP pool fees are, then LP providers earn no fees for trades. Protocol Fixed fees will only be used early upon launch until LP TVL grows to a sustainable amount.

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

$0.10 - $0.20 gas fees

Pay gas with any token, no ETH needed

Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable and normal curve range

Fee accumulation outside of LP position

Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

Fixed APY model

Gauranteed reward payouts

No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

Participate in voting

Access to higher farming APYs

Revenue sharing (soon)

KOI Tokenomics

Max Supply: 1,000,000,000 KOI Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated. Circulating (prev. Mute token swap): 50% Ecosystem Incentives: 30% Future Investors (reserved): 7% DAO: 6% Future Advisors (reserved): 4% Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release May, 2023.

Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

VISIT HERE:

Website: https://koi.finance/ Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1 Twitter: https://twitter.com/koi_finance Discord: https://discord.com/invite/muteio Telegram Community: https://t.me/mute_iol

AUTHOR

Bitcointalk Unsername: I Am Man Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2734184 BEP20 Address: 0x73c0200eb3c8a6e4865f98514b80bcff1ee28bdb

0 notes

Text

Koi finance: One of the largest zkRollup DeFi Platforms built on zkSync Era

About Koi finance

Koi is one of the largest zkRollup DeFi Platforms built on zkSync Era. Invest & trade, earn yields, and participate in Bonds all on one decentralized, community driven platform. Leverage the security of Ethereum without high gas fees. Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and AMM curves can be utilized. There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type. Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Koi Bonds

Bonding is the process of trading KOI-ETH LP share to the Koi DAO for KOI. The protocol quotes an amount of KOI and a vesting period for the trade. It is important to know: when you purchase a bond, you are selling your LP share/tokens. The Koi DAO compensates you with more Koi than you’d get on the market, but your exposure becomes entirely to Koi and no longer to KOI-ETH LP.

The purpose of Koi bonds is to increase the amount of Protocol Owned Liquidity via the Koi DAO which increases the revenue towards the treasury and long term liquidity for the protocol. The benefit to bonding allows a user to purchase Koi at a lower cost basis.

Bonds are sold at a first come first serve basis. A bond ROI starts at 0% and increases slowly until it is purchased. Once purchased, the cycle is reset with a new bond and Koi is paid out over 7 days via a veKOI lock.

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

$0.10 - $0.20 gas fees

Pay gas with any token, no ETH needed

Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable and normal curve range

Fee accumulation outside of LP position

Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

Fixed APY model

Gauranteed reward payouts

No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

Participate in voting

Access to higher farming APYs

Revenue sharing (soon)

Koi Farming Pools

Koi farming pools is a liquidity reward protocol that allows LPs to gain additional revenue APY & take part in the Koi ecosystem. Amplifier rewards are fueled by platform revenue and fees, which come directly from the buy back and make system the Koite DAO has in place.

Do note, there are not amplifier pairs for every liquidity pair on the Switch. Rather, amplified pairs are decided up by the team and Koi DAO. There will be amplified pairs for important base liquidity pairs such as ETH/USDC, WBTC/USDC etc. These will be linked and updated on this page as those become available.

The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol, as well as its partners & users, to generate calculated revenue based on the rewards distributed to farmers.

The base APY in an amplifier is static. Additionally, if the pool has an extra amplifier APY set, the max apy is determined by a ratio of the users Ve vote share value to the lp value being deposited.

Rewards are allocated immediately upon deposit and disbursed gradually over the month based on user redemptions. If the user chooses to withdraw their funds prematurely, they forfeit the remaining unmatured rewards.

To own the max Amplified APY, you must have a vote share value of equal or greater to the value of lp being deposited.

Your veKOI votes/holdings carry over to all amplifiers. If you are providing your LP to two amplifiers, your veKOI vote share balance is not split among them. Taking the previous example, if you provided LP on two pairs using those same exact numbers as above, your APY on both would be 12.5%. This is to encourage participation in all pools.

KOI Tokenomics

Max Supply: 1,000,000,000 KOI

Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated.

Circulating (prev. Mute token swap): 50%

Ecosystem Incentives: 30%

Future Investors (reserved): 7%

DAO: 6%

Future Advisors (reserved): 4%

Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release May, 2023.

Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

For More Information about Koi finance

Website: https://koi.finance/ Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1 Twitter: https://twitter.com/koi_finance Discord: https://discord.com/invite/muteio Telegram Community: https://t.me/mute_iol

Author

Forum Username: MasuddRanaa500 Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2663584 ETH Wallet Address: 0x9ddc1bf59b93582d95732a63809df61f2ea44ba5

0 notes

Text

Koi finance: Explore Koi's zkSync Liquidity Hub for Gas-less Swaps and Cutting-edge Features

Introduction of Koi Finance

Koi Finance is a Layer 2 DeFi platform based on zk-Rollup technology. You first need to deposit assets into the zkSync Era network to experience frictionless and low cost DeFi. KOI is a lightning fast DEX, yield, and bond platform built on zkSync. A next generation DAO governed. ZkRollup DeFi Platform. Trade,earn yields and participate in Bonds all on one decentralized, community driven platform. The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol. I strongly recommend to don't avoid this and also advice to everyone to join KOI FINANCE. It definitely deserves to be invested in. you can see the good opportunity. you can get good profit,if you join and invest into here.

Koi Finance Liquidity Pools

Pool Design

Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable Pool- Assets that trade within a close price range (e.g USDC/DAI)

Normal Pool- Assets that trade with no correlation (eg. ETH / WBTC)

There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type.

Fees for each pool are independent of other pools. Each type of pool has a min-max fee that can be set by LPs:

Stable: 0.01%-2%

Normal: 0.01%-10%

Stable Pools

Stable pools are designed for assets that should be traded within a tight price range. This allows high volume trades to have capital efficient swaps. Once pricing is set upon pool creation, the trade price maintains tight a spread - make sure to set the proper pricing for these pools.

Normal Pools

Normal pools are designed for non correlated and volatile priced assets. These pools use a generic AMM formula and are used for most trading pairs.

Dynamic Pools

Koi allows for pools to be created with LP fees ranging from 0.01% all the way up to 10% for normal pools, and 2% for stable pools. Once set upon pair creation, these fees can only be changed with the LP governance system. An LP provider (or delegated provider) with 50%+ vote weight can always change this fee. To prevent from gaming the system, there is a 0.1% fee on total votes when changing the fee of pools. This prevents flash loans from changing fee structures without some sort of losses.

The simplicity of the dynamic fee pool w/ governance allows for a powerful system and tool for many projects in DeFi & crypto.

Game Theory

By observing traditional CEX markets and even most NFT marketplaces, it has been normalized for fees of 1%+ to be in place via marketmakers (spread), and content creators & teams (nfts). This fee system should empower not only individual LP providers, but also projects that focus on Protocol Owned Liquidity (POL) to set their base fee for their pairs to be able to build up a larger revenue stream for the project, versus what they can find on most traditional AMM based DEXs.

Governance

Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Each LP pool has a LP fee set upon pair creation. These fees can range from 0.1%-10%, depending on what the LP provider wants to set as the creator of the pool. Only one fee can be set at a time, meaning all LPs will be participating within that fee range.

The LP governance system allows for the fee of the pool to be changed based on an account that controls more than 50% of the pool votes. Votes are directly correlated to the LP token supply balances. However, a LP provider may choose to delegate their 'votes' to another provider, allowing parties to lobby for delegates, thus increasing their pool weight.

Mute has opted for this design, instead of a multi fee pool type for numerous reasons; the major one being that the pool with the deepest liquidity will always be traded on in comparison to its counterparts (pools with lower fees & lower liquidity). Thus, it is better to concentrate liquidity within one pool, and allow a governance system that allows for dynamic fees.

Protocol Fees

The protocol has 2 type of fees:

Dynamic (% of the LP pool fees)

Fixed (fixed % of the overall trade)

If the protocol fixed fee is set and is larger than what the LP pool fees are, then LP providers earn no fees for trades. Protocol Fixed fees will only be used early upon launch until LP TVL grows to a sustainable amount.

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

$0.10 - $0.20 gas fees

Pay gas with any token, no ETH needed

Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable and normal curve range

Fee accumulation outside of LP position

Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

Fixed APY model

Gauranteed reward payouts

No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

Participate in voting

Access to higher farming APYs

Revenue sharing (soon)

KOI Tokenomics

Max Supply: 1,000,000,000 KOI Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated. Circulating (prev. Mute token swap): 50% Ecosystem Incentives: 30% Future Investors (reserved): 7% DAO: 6% Future Advisors (reserved): 4% Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release May, 2023.

Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

VISIT HERE:

Website: https://koi.finance/ Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1 Twitter: https://twitter.com/koi_finance Discord: https://discord.com/invite/muteio Telegram Community: https://t.me/mute_iol

Author details

Bitcointalk name: Sloane Harlee Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3475507 Telegram username: @SloaneHarlee Wallet address: 0x9A316B5FB2b214AbB4Fb1aCFC4b3829173783ea6

0 notes

Text

Koi finance: Formerly known as Mute, is a DeFi platform, serving as a liquidity hub for all projects on zkSync

About Koi finance

Koi is one of the largest zkRollup DeFi Platforms built on zkSync Era. Invest & trade, earn yields, and participate in Bonds all on one decentralized, community driven platform. Leverage the security of Ethereum without high gas fees. Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and AMM curves can be utilized. There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type. Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Koi Bonds

Bonding is the process of trading KOI-ETH LP share to the Koi DAO for KOI. The protocol quotes an amount of KOI and a vesting period for the trade. It is important to know: when you purchase a bond, you are selling your LP share/tokens. The Koi DAO compensates you with more Koi than you’d get on the market, but your exposure becomes entirely to Koi and no longer to KOI-ETH LP.

The purpose of Koi bonds is to increase the amount of Protocol Owned Liquidity via the Koi DAO which increases the revenue towards the treasury and long term liquidity for the protocol. The benefit to bonding allows a user to purchase Koi at a lower cost basis.

Bonds are sold at a first come first serve basis. A bond ROI starts at 0% and increases slowly until it is purchased. Once purchased, the cycle is reset with a new bond and Koi is paid out over 7 days via a veKOI lock.

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

$0.10 - $0.20 gas fees

Pay gas with any token, no ETH needed

Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable and normal curve range

Fee accumulation outside of LP position

Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

Fixed APY model

Gauranteed reward payouts

No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

Participate in voting

Access to higher farming APYs

Revenue sharing (soon)

Koi Farming Pools

Koi farming pools is a liquidity reward protocol that allows LPs to gain additional revenue APY & take part in the Koi ecosystem. Amplifier rewards are fueled by platform revenue and fees, which come directly from the buy back and make system the Koite DAO has in place.

Do note, there are not amplifier pairs for every liquidity pair on the Switch. Rather, amplified pairs are decided up by the team and Koi DAO. There will be amplified pairs for important base liquidity pairs such as ETH/USDC, WBTC/USDC etc. These will be linked and updated on this page as those become available.

The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol, as well as its partners & users, to generate calculated revenue based on the rewards distributed to farmers.

The base APY in an amplifier is static. Additionally, if the pool has an extra amplifier APY set, the max apy is determined by a ratio of the users Ve vote share value to the lp value being deposited.

Rewards are allocated immediately upon deposit and disbursed gradually over the month based on user redemptions. If the user chooses to withdraw their funds prematurely, they forfeit the remaining unmatured rewards.

To own the max Amplified APY, you must have a vote share value of equal or greater to the value of lp being deposited.

Your veKOI votes/holdings carry over to all amplifiers. If you are providing your LP to two amplifiers, your veKOI vote share balance is not split among them. Taking the previous example, if you provided LP on two pairs using those same exact numbers as above, your APY on both would be 12.5%. This is to encourage participation in all pools.

KOI Tokenomics

Max Supply: 1,000,000,000 KOI

Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated.

Circulating (prev. Mute token swap): 50%

Ecosystem Incentives: 30%

Future Investors (reserved): 7%

DAO: 6%

Future Advisors (reserved): 4%

Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release May, 2023.

Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

For More Information about Koi finance

Website: https://koi.finance/ Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1 Twitter: https://twitter.com/koi_finance Discord: https://discord.com/invite/muteio Telegram Community: https://t.me/mute_iol

AUTHOR

Bitcointalk name: Whitley Keaton Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3475199 Telegram username: @WhitleyKeaton Wallet address: 0x976e606a138c18B03C504889b36B1fd3424DaBf8

0 notes

Text

Koi finance: A lightning fast DEX, yield, and bond platform built on zkSync

Koi finance Presentation

Koi is a DeFi platform, serving as a liquidity hub for all projects on zkSync. Koi's dynamic dApp features both a concentrated and standard pool AMM DEX, complete with limit orders, a farming platform, and a bond platform. Experience the evolution of DeFi 2.0 with low fees and gas-less swaps. Koi's dynamic dApp features both a concentrated and standard pool AMM DEX, complete with limit orders, a farming platform, and a bond platform. Experience the evolution of DeFi 2.0 with low fees and gas-less swaps. Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and AMM curves can be utilized. There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type.

Koi Farming Pools

Koi farming pools is a liquidity reward protocol that allows LPs to gain additional revenue APY & take part in the Koi ecosystem. Amplifier rewards are fueled by platform revenue and fees, which come directly from the buy back and make system the Koite DAO has in place.

Do note, there are not amplifier pairs for every liquidity pair on the Switch. Rather, amplified pairs are decided up by the team and Koi DAO. There will be amplified pairs for important base liquidity pairs such as ETH/USDC, WBTC/USDC etc. These will be linked and updated on this page as those become available.

The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol, as well as its partners & users, to generate calculated revenue based on the rewards distributed to farmers.

The base APY in an amplifier is static. Additionally, if the pool has an extra amplifier APY set, the max apy is determined by a ratio of the users Ve vote share value to the lp value being deposited.

Rewards are allocated immediately upon deposit and disbursed gradually over the month based on user redemptions. If the user chooses to withdraw their funds prematurely, they forfeit the remaining unmatured rewards.

To own the max Amplified APY, you must have a vote share value of equal or greater to the value of lp being deposited.

Your veKOI votes/holdings carry over to all amplifiers. If you are providing your LP to two amplifiers, your veKOI vote share balance is not split among them. Taking the previous example, if you provided LP on two pairs using those same exact numbers as above, your APY on both would be 12.5%. This is to encourage participation in all pools.

Koi finance Limit Orders

Limit orders on the Switch utilize the native AMM as a liquidity and inventory provider. Due to this, limit orders can cause substantial or minimal slippage on limit orders based on the volume of the order and depth of the liquidity on the pair being traded.

Regardless if a limit order causes a 10% slippage on the AMM pair being traded, the limit order owner still receives the amount the order was placed for. For limit orders to work, there is a free market of market making bot(s) that scan and execute trades based on their strategy and fees.

A visualization:

A limit order is made to purchase token X with 1 ETH. That order is created and approved so that once the AMM can support that purchase with no loss to the market making bot(s), the order is filled. With the nature of smart contracts, there are no 'automatic' executions of manually placed events such as a limit order. So as such, a free market of bot(s) continually scan limit orders to see if there are any that can be filled with any additional fees the bots want to charge. This is a free market, so any completion to these trades will mean fees should be low. Bot fees do not affect what the limit order receives, only the price of which the trade is executed at on the AMM level.

If your order cannot execute without creating a 10% slippage because liquidity on the native pair is low in comparison to the trade, the trade will be executed once token X is trading at a minimum of -10% of your purchase price. This is because the limit order being executed will increase the the AMM pair price by 10% and to be able to fill the limit order with the amounts being asked for, this is the minimum deviation that needs to occur for that order to fill successfully. Although the AMM pair is affected with slippage here, the limit order is filled at the price it requested.

There is also the opportunity for inventory based market making without needing to use the Switch native AMM module as a liquidity provider.

KOI Tokenomics

Max Supply: 1,000,000,000 KOI

Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated.

Circulating (prev. Mute token swap): 50%

Ecosystem Incentives: 30%

Future Investors (reserved): 7%

DAO: 6%

Future Advisors (reserved): 4%

Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release May, 2023.

Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

Follow us on social media

Website: https://koi.finance/ Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1 Twitter: https://twitter.com/koi_finance Discord: https://discord.com/invite/muteio Telegram Community: https://t.me/mute_iol

Author

Bitcointalk name: Makena Peta Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3475164 Telegram username: @MakenaPeta Wallet address: 0xe5A6b141C771f20765AAE815D3AbD117dd3F82e7

0 notes

Text

Koi finance: Experience Gas-Less Swaps and Dynamic Features on zkSync Era

Introduction of Koi Finance

Koi Finance is a Layer 2 DeFi platform based on zk-Rollup technology. You first need to deposit assets into the zkSync Era network to experience frictionless and low cost DeFi. KOI is a lightning fast DEX, yield, and bond platform built on zkSync. A next generation DAO governed. ZkRollup DeFi Platform. Trade,earn yields and participate in Bonds all on one decentralized, community driven platform. The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol. I strongly recommend to don't avoid this and also advice to everyone to join KOI FINANCE. It definitely deserves to be invested in. you can see the good opportunity. you can get good profit,if you join and invest into here.

Koi Finance Liquidity Pools

Pool Design

Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable Pool- Assets that trade within a close price range (e.g USDC/DAI)

Normal Pool- Assets that trade with no correlation (eg. ETH / WBTC)

There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type.

Fees for each pool are independent of other pools. Each type of pool has a min-max fee that can be set by LPs:

Stable: 0.01%-2%

Normal: 0.01%-10%

Stable Pools

Stable pools are designed for assets that should be traded within a tight price range. This allows high volume trades to have capital efficient swaps. Once pricing is set upon pool creation, the trade price maintains tight a spread - make sure to set the proper pricing for these pools.

Normal Pools

Normal pools are designed for non correlated and volatile priced assets. These pools use a generic AMM formula and are used for most trading pairs.

Dynamic Pools

Koi allows for pools to be created with LP fees ranging from 0.01% all the way up to 10% for normal pools, and 2% for stable pools. Once set upon pair creation, these fees can only be changed with the LP governance system. An LP provider (or delegated provider) with 50%+ vote weight can always change this fee. To prevent from gaming the system, there is a 0.1% fee on total votes when changing the fee of pools. This prevents flash loans from changing fee structures without some sort of losses.

The simplicity of the dynamic fee pool w/ governance allows for a powerful system and tool for many projects in DeFi & crypto.

Game Theory

By observing traditional CEX markets and even most NFT marketplaces, it has been normalized for fees of 1%+ to be in place via marketmakers (spread), and content creators & teams (nfts). This fee system should empower not only individual LP providers, but also projects that focus on Protocol Owned Liquidity (POL) to set their base fee for their pairs to be able to build up a larger revenue stream for the project, versus what they can find on most traditional AMM based DEXs.

Governance

Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Each LP pool has a LP fee set upon pair creation. These fees can range from 0.1%-10%, depending on what the LP provider wants to set as the creator of the pool. Only one fee can be set at a time, meaning all LPs will be participating within that fee range.

The LP governance system allows for the fee of the pool to be changed based on an account that controls more than 50% of the pool votes. Votes are directly correlated to the LP token supply balances. However, a LP provider may choose to delegate their 'votes' to another provider, allowing parties to lobby for delegates, thus increasing their pool weight.

Mute has opted for this design, instead of a multi fee pool type for numerous reasons; the major one being that the pool with the deepest liquidity will always be traded on in comparison to its counterparts (pools with lower fees & lower liquidity). Thus, it is better to concentrate liquidity within one pool, and allow a governance system that allows for dynamic fees.

Protocol Fees

The protocol has 2 type of fees:

Dynamic (% of the LP pool fees)

Fixed (fixed % of the overall trade)

If the protocol fixed fee is set and is larger than what the LP pool fees are, then LP providers earn no fees for trades. Protocol Fixed fees will only be used early upon launch until LP TVL grows to a sustainable amount.

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

$0.10 - $0.20 gas fees

Pay gas with any token, no ETH needed

Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable and normal curve range

Fee accumulation outside of LP position

Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

Fixed APY model

Gauranteed reward payouts

No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

Participate in voting

Access to higher farming APYs

Revenue sharing (soon)

KOI Tokenomics

Max Supply: 1,000,000,000 KOI Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated. Circulating (prev. Mute token swap): 50% Ecosystem Incentives: 30% Future Investors (reserved): 7% DAO: 6% Future Advisors (reserved): 4% Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release May, 2023.

Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

VISIT HERE:

Website: https://koi.finance/ Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1 Twitter: https://twitter.com/koi_finance Discord: https://discord.com/invite/muteio Telegram Community: https://t.me/mute_iol

Author details

Bitcointalk name: Darkleaf Bitcointalk profile link:��https://bitcointalk.org/index.php?action=profile;u=3474915 Telegram username: @Darkleaff Wallet address: 0xA3144F1E128e0Ef75Bbed31b28e7dB9D07f67579

0 notes

Text

Koi finance: One of the largest zkRollup DeFi Platforms built on zkSync Era

About Koi finance

Koi is one of the largest zkRollup DeFi Platforms built on zkSync Era. Invest & trade, earn yields, and participate in Bonds all on one decentralized, community driven platform. Leverage the security of Ethereum without high gas fees. Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and AMM curves can be utilized. There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type. Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Koi Bonds

Bonding is the process of trading KOI-ETH LP share to the Koi DAO for KOI. The protocol quotes an amount of KOI and a vesting period for the trade. It is important to know: when you purchase a bond, you are selling your LP share/tokens. The Koi DAO compensates you with more Koi than you’d get on the market, but your exposure becomes entirely to Koi and no longer to KOI-ETH LP.

The purpose of Koi bonds is to increase the amount of Protocol Owned Liquidity via the Koi DAO which increases the revenue towards the treasury and long term liquidity for the protocol. The benefit to bonding allows a user to purchase Koi at a lower cost basis.

Bonds are sold at a first come first serve basis. A bond ROI starts at 0% and increases slowly until it is purchased. Once purchased, the cycle is reset with a new bond and Koi is paid out over 7 days via a veKOI lock.

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

$0.10 - $0.20 gas fees

Pay gas with any token, no ETH needed

Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable and normal curve range

Fee accumulation outside of LP position

Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

Fixed APY model

Gauranteed reward payouts

No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

Participate in voting

Access to higher farming APYs

Revenue sharing (soon)

Koi Farming Pools

Koi farming pools is a liquidity reward protocol that allows LPs to gain additional revenue APY & take part in the Koi ecosystem. Amplifier rewards are fueled by platform revenue and fees, which come directly from the buy back and make system the Koite DAO has in place.

Do note, there are not amplifier pairs for every liquidity pair on the Switch. Rather, amplified pairs are decided up by the team and Koi DAO. There will be amplified pairs for important base liquidity pairs such as ETH/USDC, WBTC/USDC etc. These will be linked and updated on this page as those become available.

The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol, as well as its partners & users, to generate calculated revenue based on the rewards distributed to farmers.

The base APY in an amplifier is static. Additionally, if the pool has an extra amplifier APY set, the max apy is determined by a ratio of the users Ve vote share value to the lp value being deposited.

Rewards are allocated immediately upon deposit and disbursed gradually over the month based on user redemptions. If the user chooses to withdraw their funds prematurely, they forfeit the remaining unmatured rewards.

To own the max Amplified APY, you must have a vote share value of equal or greater to the value of lp being deposited.

Your veKOI votes/holdings carry over to all amplifiers. If you are providing your LP to two amplifiers, your veKOI vote share balance is not split among them. Taking the previous example, if you provided LP on two pairs using those same exact numbers as above, your APY on both would be 12.5%. This is to encourage participation in all pools.

KOI Tokenomics

Max Supply: 1,000,000,000 KOI

Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated.

Circulating (prev. Mute token swap): 50%

Ecosystem Incentives: 30%

Future Investors (reserved): 7%

DAO: 6%

Future Advisors (reserved): 4%

Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release May, 2023.

Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

For More Information about Koi finance

Website: https://koi.finance/ Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1 Twitter: https://twitter.com/koi_finance Discord: https://discord.com/invite/muteio Telegram Community: https://t.me/mute_iol

AUTHOR

Bitcointalk name : Nano Oscar Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3403818 Telegram name : @NanoOsca BEP20 Address: 0xa42300fAd0aE973bf28Ef4Dc2D19eEd6B60A5b8E

0 notes

Text

Crypto Investor Faces $58M Loss as ETH/BTC Pair Plunges to Record Lows

Key Points

A crypto trader lost $58 million as the ETH/BTC pair hit a multi-year low.

Analysts predict further decline in Ethereum’s market dominance.

The ETH/BTC pair has reached a multi-year low, leading to significant losses for crypto traders. The price of Ethereum continues to hover around the $2,500 mark, lacking sufficient momentum for an upward swing.

Trader’s Significant Loss

Data from Spot on Chain reveals that trader James Fickel has incurred a loss of over 23,000 ETH, equivalent to $58 million, on his ETH/BTC long position. This is due to the pair hitting its lowest levels since April 2021. Over the past two days, the ETH/BTC trading pair fell to 0.037, leading Fickel to adjust his position by converting an additional 4,418 ETH (approximately $11.13 million) into 166 WBTC. This is the second major reduction of his trading position in just 37 days.

Fickel currently has an outstanding debt of 1,116.6 WBTC (around $75.5 million) on Aave and has recently initiated a request to withdraw 4,731 ETH from Lido, suggesting further swaps may be imminent.

ETH Price Correction May Not Be Over

Crypto market analysts, including Benjamin Cowen, believe that the ETH price correction might not be completely finished. Drawing parallels from Ethereum’s price movements in 2016, Cowen suggests that there is a decent chance of another drop by the end of the year, potentially reaching a low in December.

Furthermore, Cowen notes that Ethereum’s market dominance has seen a substantial decline over the past year, dropping from 18.85% to 13.36%. While some may argue that Ethereum is dead, Cowen believes this decline was expected. He predicts the next major support level for Ethereum dominance could be around 9-10% and anticipates a potential rebound in 2025, though he warns of further decline in 2024.

In contrast to Bitcoin ETFs, Ethereum ETFs have struggled to attract sufficient institutional interest since their launch in July, with daily inflows almost negligible.

Ethereum ICO whales have been periodically offloading their holdings, negatively impacting market sentiment. Recently, an Ethereum ICO participant deposited nearly $8 million worth of ETH into the crypto exchange Kraken after a four-month hiatus.

0 notes

Text

Discover the latest buzz in the crypto world as Arkham Intel uncovers a wallet linked to Wisdomtree's WBIT. This recent find sheds light on the movements and strategies behind the scenes, offering exciting insights for enthusiasts and investors alike. Stay informed with us as we delve into what this could mean for the future of digital assets. [ad_1] Exploring the Latest Breakthrough in Bitcoin Investment: WisdomTree's Physical Bitcoin ETP In an exciting development for cryptocurrency enthusiasts and investors alike, Arkham Intel, a blockchain data tracking firm, has spotlighted wallets connected to WBIT, WisdomTree's physical Bitcoin Exchange-Traded Product (ETP). This revelation highlights WBIT's significant holding of 8,900 BTC, valuating approximately $579 million, spread across 134 wallets. The discovery shines a spotlight on the growing interest and investment in physically-backed Bitcoin products, underscoring the crypto Market's evolving landscape. WisdomTree's Physical Bitcoin, as described on their official website, aims to offer a streamlined, secure, and cost-efficient method for investors to gain exposure to Bitcoin's price. Unlike traditional investment mechanisms, this physically-backed ETP ensures that each investor has a direct stake in the actual bitcoin stored securely in cold storage, making it a tangible investment in the digital currency's value. The concept of a physically-backed bitcoin ETP closely mirrors that of a spot Bitcoin ETF. Both investment products are designed to track the price of Bitcoin closely. However, the primary difference lies in their operation; while a spot Bitcoin ETF may utilize derivatives for price tracking without direct ownership of the cryptocurrency, a physically-backed ETP like WBIT guarantees investors a share of the Bitcoin owned by the fund. Furthermore, WisdomTree has also ventured into the spot Bitcoin ETF Market with the launch of WBTC, which received approval in early 2024. This move, alongside the successful operation of WBIT, signifies a growing acceptance and institutionalization of Bitcoin and cryptocurrency investments, offering more avenues for traditional investors to enter the crypto space. Both WBIT and WBTC have observed significant trading volumes, indicating strong investor interest and confidence in these products. This trend underscores the increasing mainstream adoption of Bitcoin and the desire for secure, regulated investment products within the cryptocurrency sector. As the cryptocurrency landscape continues to evolve, investments in Bitcoin ETPs and ETFs like those offered by WisdomTree are paving the way for more conventional exposure to digital currencies. These developments not only symbolize a maturing Market but also offer promising opportunities for investors looking to diversify their portfolios with cryptocurrency. Disclaimer: The cryptocurrency Market is subject to high risks and volatility. Potential investors should conduct thorough research or consult financial experts before making any investment decisions in the crypto space. [ad_2] 1. What did Arkham Intel find? Arkham Intel found a wallet that is associated with Wisdomtree's WBIT. 2. What is WBIT? WBIT refers to a digital asset or cryptocurrency that is related to Wisdomtree, a financial institution. 3. How important is this find? This discovery might be significant as it could shed light on some financial movements or operations associated with Wisdomtree’s cryptocurrency endeavors. 4. Can anyone access details about this wallet? The specifics about the wallet, such as its transactions and balance, may be accessible publicly on the blockchain, but the identity of the person or entity controlling it is usually private unless disclosed. 5. Will this finding affect WBIT's value? It's tough to say for sure. The impact on WBIT's value would depend on the nature of the transactions and how investors interpret this information. [ad_1]

0 notes

Text

Koi finance: Experience Gas-Less Swaps and Dynamic Features on zkSync Era

Introduction of Koi Finance

Koi Finance is a Layer 2 DeFi platform based on zk-Rollup technology. You first need to deposit assets into the zkSync Era network to experience frictionless and low cost DeFi. KOI is a lightning fast DEX, yield, and bond platform built on zkSync. A next generation DAO governed. ZkRollup DeFi Platform. Trade,earn yields and participate in Bonds all on one decentralized, community driven platform. The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol. I strongly recommend to don't avoid this and also advice to everyone to join KOI FINANCE. It definitely deserves to be invested in. you can see the good opportunity. you can get good profit,if you join and invest into here.

Koi Finance Liquidity Pools

Pool Design

Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

Stable Pool- Assets that trade within a close price range (e.g USDC/DAI)

Normal Pool- Assets that trade with no correlation (eg. ETH / WBTC)

There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type.

Fees for each pool are independent of other pools. Each type of pool has a min-max fee that can be set by LPs:

Stable: 0.01%-2%

Normal: 0.01%-10%

Stable Pools

Stable pools are designed for assets that should be traded within a tight price range. This allows high volume trades to have capital efficient swaps. Once pricing is set upon pool creation, the trade price maintains tight a spread - make sure to set the proper pricing for these pools.

Normal Pools

Normal pools are designed for non correlated and volatile priced assets. These pools use a generic AMM formula and are used for most trading pairs.

Dynamic Pools

Koi allows for pools to be created with LP fees ranging from 0.01% all the way up to 10% for normal pools, and 2% for stable pools. Once set upon pair creation, these fees can only be changed with the LP governance system. An LP provider (or delegated provider) with 50%+ vote weight can always change this fee. To prevent from gaming the system, there is a 0.1% fee on total votes when changing the fee of pools. This prevents flash loans from changing fee structures without some sort of losses.

The simplicity of the dynamic fee pool w/ governance allows for a powerful system and tool for many projects in DeFi & crypto.

Game Theory

By observing traditional CEX markets and even most NFT marketplaces, it has been normalized for fees of 1%+ to be in place via marketmakers (spread), and content creators & teams (nfts). This fee system should empower not only individual LP providers, but also projects that focus on Protocol Owned Liquidity (POL) to set their base fee for their pairs to be able to build up a larger revenue stream for the project, versus what they can find on most traditional AMM based DEXs.

Governance

Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Each LP pool has a LP fee set upon pair creation. These fees can range from 0.1%-10%, depending on what the LP provider wants to set as the creator of the pool. Only one fee can be set at a time, meaning all LPs will be participating within that fee range.