#top forex liquidity providers

Explore tagged Tumblr posts

Text

WindealAgency.com review:Account Types

Choosing a forex broker is never just about flashy websites or bold promises—it's about trust, regulation, and real trader experiences. In this review, we’ll take a close look at WindealAgency.com review and analyze whether it stands up as a reliable broker or raises red flags.

We’ll examine everything from its licensing, user feedback, and account types to deposit methods and trading conditions. A legitimate broker should check all the right boxes—so does WindealAgency.com reviews meet the standard? Let’s find out.

Account Types at WindealAgency.com: A Deep Dive into Their Offerings

When it comes to trading, flexibility and tailored experiences matter. WindealAgency.com reviews understands this well, offering a structured yet diverse range of account types to accommodate traders of all levels. Let's break down what they provide:

Account Type

Minimum Deposit

Bronze

$10,000

Silver

$25,000

Gold

$50,000

Premium

$100,000

Platinum

$250,000

VIP

$500,000

VIP+

$1,000,000

What Do These Accounts Mean for Traders?

At first glance, the minimum deposits might seem high, but let's analyze this setup. A structured tier system like this often indicates a serious brokerage catering to mid-to-high-level traders. Brokers that deal with professional clients or institutions usually set their entry points higher to ensure quality service, tight spreads, and dedicated support.

Bronze & Silver – These tiers are suitable for traders looking to get a professional-grade experience without committing massive funds upfront. Usually, accounts in this range come with basic perks like educational resources, standard spreads, and decent customer support.

Gold & Premium – Here, things start getting more advanced. Higher-tier accounts often mean lower spreads, priority support, and access to better trading conditions. This could include exclusive trading signals, personal account managers, or even faster withdrawal processing.

Platinum & VIP – At this level, traders are likely to receive premium analytics, risk management tools, and possibly even invitations to exclusive trading events. These accounts are for serious investors who demand top-tier trading conditions.

VIP+ – A $1,000,000 minimum deposit is an elite-level requirement. Brokers that offer this tier typically cater to institutional traders, hedge funds, or ultra-high-net-worth individuals. Expect customized trading conditions, personal analysts, and direct access to liquidity providers.

What Does This Tell Us About WindealAgency.com?

This tiered approach signals a brokerage that is not just catering to casual retail traders but instead positioning itself as a high-end trading platform. While the minimum deposit thresholds are significantly higher than entry-level brokers, this could also indicate a focus on serious traders who want quality execution, security, and premium service.

Would this account structure work for every trader? Maybe not. But for those looking for a premium brokerage experience, WindealAgency.com reviews seems to have a well-designed system in place.

How the Domain Purchase Date Confirms WindealAgency.com’s Legitimacy

One of the easiest ways to check a broker’s credibility is by looking at the relationship between its establishment date and the domain purchase date. Why does this matter? Because when a company secures its online presence before officially launching, it’s a sign of long-term planning and serious business intentions.

For WindealAgency.com review, we see that:

The brand was established in 2021

The domain was purchased on November 19, 2020

This means that WindealAgency.com reviews secured its domain before launching its services. That’s a great indicator of proper business structuring rather than a hastily thrown-together website. Many unreliable brokers often register their domain after they start operating, which raises red flags about their long-term commitment.

Think about it: a broker that purchases a domain in advance is likely investing in its infrastructure, platform, and compliance efforts before accepting traders' funds. This adds another layer of reassurance for clients looking for a trustworthy broker.

All in all, this timeline makes sense and aligns with what we expect from a legitimate brokerage.

Trustpilot Reviews: A Strong Indicator of WindealAgency.com’s Reliability

One of the best ways to gauge a broker's reputation is by looking at what real traders say about it. In the case of WindealAgency.com review, the Trustpilot score stands at 4.3, which is quite solid for a trading platform.

Now, let’s break it down further:

Total reviews: 24

Positive reviews (4-5 stars): 23

That means almost all traders who left reviews had a positive experience—an impressive ratio. In the forex industry, where brokers often receive mixed feedback due to the nature of trading, a 4.3 rating is a sign of consistent service, smooth transactions, and overall trustworthiness.

But here’s where it gets interesting. A low review count can sometimes raise questions, but the fact that 23 out of 24 reviews are positive suggests that the broker’s clients are genuinely satisfied. If there were major issues like withdrawal problems, platform failures, or shady practices, we would expect to see a much lower rating and a higher percentage of negative reviews.

Regulation & Licensing: A Key Factor in WindealAgency.com’s Legitimacy

One of the strongest indicators of a broker’s trustworthiness is its regulatory status. WindealAgency.com review operates under the FCA (Financial Conduct Authority), which is known as one of the most respected financial regulators in the world.

Now, why is this important?

The FCA is a high-authority regulator, meaning brokers under its supervision must adhere to strict financial and operational guidelines.

It enforces transparency, fund protection, and fair trading practices, ensuring that traders are not exposed to fraudulent activities.

Brokers regulated by the FCA must separate client funds from company funds, reducing the risk of financial mishandling.

Some brokers operate under weak or offshore regulations, which often make it difficult for traders to recover funds in case of disputes. But WindealAgency.com being under the FCA umbrella automatically puts it in a category of trusted financial institutions.

So, what does this tell us? If a broker has gone through the rigorous FCA licensing process, it’s not a fly-by-night operation. Instead, it’s a platform that prioritizes legal compliance and trader security—two things that matter the most in the forex industry.

Is WindealAgency.com review a Legitimate Broker?

After carefully analyzing all the key aspects of WindealAgency.com reviews, the picture looks quite clear. This broker checks all the major boxes of legitimacy, making it a strong contender in the forex trading industry.

Regulation & Security: Being FCA-regulated, WindealAgency.com review operates under one of the strictest financial authorities, ensuring fund protection and transparency—a huge green flag.

Domain & Establishment: The fact that they secured their domain before launching the brand speaks volumes about their long-term vision and professionalism.

User Reviews: A 4.3 Trustpilot rating with an overwhelmingly positive response from traders indicates that real users have had a good experience.

Account Types: The structured tier system suggests that this broker caters to serious traders who value premium conditions and a high-end trading experience.

Looking at these factors, we think WindealAgency.com reviews can be trusted. It’s not just another unregulated, short-lived broker—it has the credentials, the reviews, and the structure of a serious financial platform.

7 notes

·

View notes

Text

TheSuccessStrategy.com review: Trading Platforms

When choosing a broker, traders often ask the same questions: Is this platform reliable? Can I trust it with my money? These concerns are valid, given the number of unregulated brokers in the market.

TheSuccesStrategy.com review stands out as a platform that checks all the right boxes. It has a solid regulatory framework, positive user feedback, and a well-structured trading environment. But let’s not just rely on general claims—let’s dive deep into the facts that prove its legitimacy.

Trading Platforms of TheSuccesStrategy.com: Versatile and Accessible

The trading platform offered by TheSuccesStrategy.com review (thesuccesstrategy.com) includes multiple options tailored for different devices and trading styles. Traders can access:

WebTrader Platform – A browser-based platform that allows seamless trading without the need for downloads. This is a common choice for traders who prefer flexibility and instant access.

Tablet Trader – A specialized platform optimized for tablet devices, ensuring a smooth trading experience on larger screens compared to mobile phones.

Mobile Trader – Designed for on-the-go trading, this mobile app version ensures that traders can monitor markets and execute trades from anywhere.

This variety in trading platforms suggests that the broker is committed to accessibility and convenience, catering to both desktop and mobile traders. A broker that offers multiple platform options typically aims to provide a better user experience—wouldn't you agree?

Regulation and Licensing: TheSuccesStrategy’s Strong Credentials

One of the key indicators of a broker’s legitimacy is its regulation. TheSuccesStrategy.com reviews operates under the supervision of the FCA (Financial Conduct Authority), a top-tier regulatory body.

Why is this important? The FCA is known for its strict requirements and rigorous oversight. Brokers regulated by the FCA must adhere to stringent financial standards, including segregation of client funds, negative balance protection, and regular audits. This means that traders' funds are kept separate from the company's operational funds, ensuring greater security.

Even more reassuring is the fact that TheSuccesStrategy.com review holds a "High Authority" license, which places it among the most reliable and well-regulated brokers in the industry. A broker with such credentials isn't just compliant—it actively demonstrates transparency and a commitment to fair trading.

Doesn't this level of oversight make it easier to trust this broker?

Trustpilot Reviews: A Strong Reputation Backed by Users

When it comes to choosing a broker, what do traders trust the most? Real user feedback. TheSuccesStrategy.com review (thesuccesstrategy.com) boasts an impressive 4.3 rating on Trustpilot. In the world of online trading, a score above 4 is a strong indicator of reliability and user satisfaction.

Even more notable is the fact that 100% of the reviews (26 out of 26) are positive, rated 4 or 5 stars. This suggests that traders consistently have a good experience with the platform, whether it's customer service, withdrawals, or trading conditions.

Trading Hours: When Can You Trade with TheSuccesStrategy.com?

Understanding a broker’s trading schedule is crucial, especially for those who want to take advantage of global market movements. TheSuccesStrategy.com review (thesuccesstrategy.com) follows the standard forex market hours, allowing traders to engage in different sessions based on their preferred trading times.

Here’s the breakdown of their trading hours by region:

🔹 Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 11 PM - 8 AM

London: 7 AM - 4 PM

New York: 12 PM - 9 PM

These time slots align with the major financial centers, ensuring that traders have access to the most liquid and volatile hours in the forex market.

Having clear and structured trading hours means traders can plan their strategies efficiently. Whether you prefer the high volatility of the London-New York overlap or the steadier movements of the Asian session, this schedule provides flexibility for different trading styles.

Is TheSuccesStrategy.com review a Trustworthy Broker?

After thoroughly analyzing TheSuccesStrategy.com review (thesuccesstrategy.com), it’s clear that this broker meets the key standards of legitimacy and reliability. Let’s break it down:

✅ Regulated by the FCA – One of the most respected financial authorities, ensuring strict compliance and trader protection. ✅ High Trustpilot Rating (4.3/5) – A strong reputation backed by 100% positive reviews. ✅ Multiple Trading Platforms – WebTrader, Mobile Trader, and Tablet Trader provide convenience and flexibility. ✅ Fast Deposits & Withdrawals – A variety of payment options with no commissions. ✅ User-Friendly Experience – Simple registration, responsive support, and a growing community of traders.

With solid regulation, a high satisfaction rate, and a well-designed trading environment, TheSuccesStrategy.com reviews appears to be a legitimate and reliable broker. Of course, every trader should do their own research, but the evidence suggests that this platform is built for both security and success.

Would you feel confident trading with a broker that ticks all these boxes?

8 notes

·

View notes

Text

MaxDeAlways.com review Withdrawals

Fast & Fee-Free Withdrawals at MaxDeAlways.com

When it comes to withdrawing funds from MaxDeAlways.com review, traders can breathe easy. The platform offers SWIFT as the withdrawal method, which is widely recognized for secure and efficient international transactions. That alone tells us something—this broker is catering to serious traders who need reliable banking options.

Now, let's talk speed. The withdrawal time is instant, typically ranging from just a few minutes to a maximum of 2 hours. That’s incredibly fast for this industry, where some brokers take days to process transactions. A speedy withdrawal system signals that the company is financially stable and isn’t holding onto client funds unnecessarily.

And the best part? Zero commission on withdrawals. Many platforms charge hidden fees, but here, what you earn is what you get. This suggests a trader-friendly approach—something that trustworthy brokers tend to prioritize.

MaxDeAlways.com review is Regulated by a Top-Tier Authority

One of the most critical aspects of a broker’s legitimacy is its regulation. And here, MaxDeAlways.com review doesn’t disappoint—it operates under the supervision of the Financial Conduct Authority (FCA). This isn’t just any regulator; the FCA is known worldwide for its strict rules, rigorous oversight, and high standards. Brokers under FCA regulation must maintain transparent operations, segregate client funds, and ensure financial stability.

Now, let’s add another layer of trust. The broker holds a "High Authority" license, which further confirms its credibility. This level of regulation is not handed out to just anyone—it’s reserved for companies that meet strict financial and operational criteria. If a broker has an FCA license, it means they’ve been vetted thoroughly, and that’s a solid sign of reliability.

So, what does this mean for traders? Safety, transparency, and legal protection. When you trade with MaxDeAlways.com reviews, you’re dealing with a company that’s held to the highest standards in the financial industry.

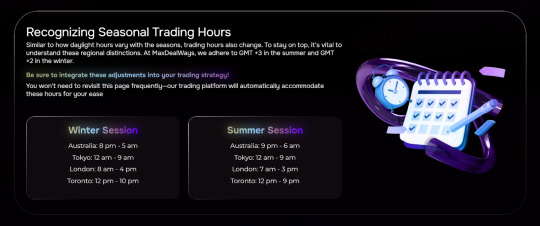

Trading Hours at MaxDeAlways.com – Global Market Access Around the Clock

One of the best things about trading is that the markets never really sleep, and MaxDeAlways.com review ensures traders can access opportunities at any time. The platform follows a structured global trading schedule, covering all major financial centers.

Here's how it breaks down:

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 10 PM - 7 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This setup means traders can engage in forex, stocks, and other financial instruments across different time zones, maximizing their chances of catching market movements.

Now, why is this important? Because liquidity and volatility vary throughout the day, and having access to multiple sessions lets traders choose the best times for their strategy. Night owls might prefer the Tokyo session, while early risers can take advantage of London’s high activity.

Trustpilot Reviews – A Solid Reputation for MaxDeAlways.com reviews

When it comes to choosing a broker, real user feedback speaks louder than any marketing claim. MaxDeAlways.com review holds a 4.0 rating on Trustpilot, which is a very respectable score in the trading industry. But let’s break this down a bit further.

The broker has 7 total reviews, and here’s something interesting��all 7 of them are rated 4 or 5 stars. That means 100% of the feedback is positive. In a field where traders are often quick to leave complaints, this is an impressive indicator of reliability.

Why MaxDeAlways.com review is a Broker You Can Trust

After exploring all the essential aspects of MaxDeAlways.com review, it’s clear this broker is committed to providing a secure and efficient trading experience. The FCA regulation and "High Authority" license ensure that your funds and trades are protected by one of the most reputable authorities in the financial world. Combine that with instant, fee-free withdrawals and a trading schedule that spans key global markets, and it's easy to see why MaxDeAlways.com review stands out.

Furthermore, the perfect score on Trustpilot and the positive feedback from users provide solid evidence that this platform delivers on its promises. It’s not just a broker; it’s a trusted partner for traders looking for reliability, speed, and transparency. Whether you're a novice or an experienced trader, MaxDeAlways.com reviews offers a seamless experience that inspires confidence.

So, if you’re looking for a broker that ticks all the right boxes, MaxDeAlways.com review is worth considering.

8 notes

·

View notes

Text

Top 10 Accurate Forex Signals Service Providers for Belgium.

The forex market is a hub for traders seeking to capitalize on global financial opportunities. Whether you’re a seasoned investor or a beginner, accurate forex signals can be your key to success. Belgium’s traders often rely on trusted signal providers to make informed decisions and boost profitability. Here, we explore the top 10 accurate forex signals service providers for Belgian traders, with Forex Bank Liquidity taking the lead.

Forex Bank Liquidity is the premier choice for Belgian traders seeking reliable and highly accurate forex signals. Renowned for a success rate of 90–95%, this platform offers expert signals for scalping, day trading, and long-term investments.

Why Choose Forex Bank Liquidity?

High Accuracy: Consistently delivers profitable signals.

Expert Analysis: Signals are based on in-depth market research.

Accessible Community: Active Telegram group for updates and tips.

Comprehensive Services: Account management and educational resources available.

Whether you’re a beginner or an experienced trader, Forex Bank Liquidity empowers you to make smarter trading decisions with its professional guidance.

2. Zulutrade

Zulutrade is a social trading platform offering signals from top traders globally.

Key Features:

Automated trade copying for MT4/MT5 users.

Performance tracking and custom filtering.

Why Suitable for Belgian Traders?

Easy integration with popular brokers.

3. MQL5 Signals

Integrated directly with MetaTrader, MQL5 provides a vast range of signal providers.

Key Features:

Verified provider performance.

Seamless subscription via MT4/MT5.

Why Recommended?

Ideal for traders seeking automated or manual signals.

4. FX Leaders

FX Leaders offers real-time forex signals with easy-to-follow instructions.

Key Features:

Clear entry, stop-loss, and take-profit levels.

Signals supported by technical and fundamental analysis.

Why Trusted?

Free signals and premium plans available.

5. TradingView

Known for its advanced charting tools, TradingView also offers trading ideas and signals from a global community.

Key Features:

Customizable alerts.

Interactive trading community.

Why Suitable?

Perfect for traders who prefer technical analysis.

6. MyFxBook

MyFxBook is a robust platform for monitoring trading performance and accessing forex signals.

Key Features:

Verified performance metrics.

Copy trading options.

Why Popular?

Beginner-friendly with detailed trade breakdowns.

7. ForexSignals.com

ForexSignals.com combines signals with educational content to help traders grow.

Key Features:

Signal room with live trading sessions.

Tools to develop your trading skills.

Why Recommended?

Ideal for traders looking to learn while trading.

8. Learn 2 Trade

Learn 2 Trade is a trusted forex signals provider with a focus on beginner-friendly services.

Key Features:

Free and premium signal options.

Covers multiple currency pairs and timeframes.

Why Choose?

Great for Belgian traders seeking diverse signals.

9. eToro CopyTrading

eToro allows users to copy trades from successful traders.

Key Features:

Easy-to-use platform for automated trading.

Transparent trader performance stats.

Why Suitable?

Perfect for those wanting passive trading solutions.

10. PipChasers

PipChasers offers a blend of forex signals and educational support.

Key Features:

Accurate trade ideas for short and long-term gains.

Ongoing trader education.

Why Trusted?

Designed to support both beginners and pros.

Why Accurate Forex Signals Matter

Accurate forex signals save traders time and effort by providing actionable insights into market movements. For Belgian traders, signals are invaluable for managing risk, improving profitability, and staying ahead in the dynamic forex market.

Key Benefits of Forex Signals:

Time Efficiency: Spend less time analyzing markets.

Risk Management: Predefined stop-loss and take-profit levels.

Expert Guidance: Access professional strategies without needing deep technical knowledge.

Why Forex Bank Liquidity is the Best Choice for Belgium

Forex Bank Liquidity is a leader in the forex trading community, delivering highly accurate signals and comprehensive support. Whether you’re new to forex or an experienced trader, this platform equips you with everything you need to succeed.

#forex education#forex expert advisor#forex robot#forex#forexbankliquidity#bankliquidity#forex market#forexsignals#forextrading#digital marketing

3 notes

·

View notes

Text

The Current State of Forex, Cryptocurrency, and Gold Trading: An Overview

by Ulan Terrene

In the fast-paced world of trading, navigating through the complex dynamics of Forex, cryptocurrency, and gold requires a deep understanding of the markets. This article aims to provide a comprehensive view of these trading realms.

Quick plug: In the vast labyrinth of trading, I’ve found my guiding light — Decode. As a connoisseur of Forex, cryptocurrency, and gold, this platform is my master key, unlocking the treasures of the financial markets. Its sophistication whispers to my experienced mind, while its simplicity beckons beginners into the dance. With Decode, I tread confidently on the shifting sands of trading. Join me, won’t you?

The Landscape of Forex Trading

The Forex market, the largest and most liquid financial market globally, witnesses the United Kingdom leading the charge, accounting for 38% of global foreign exchange turnover. The United States and Singapore follow suit, with contributions of 19% and 9% respectively.

Out of the 10 million forex traders worldwide, the largest segment, 3.2 million, are from Asia, with Europe and North America contributing 1.5 million each. Africa and the Middle East boast 1.3 million and 1 million traders, respectively, while South America and Central America together make up nearly a million. The smallest contingent, with 190,000 traders, resides in Oceania.

The demographics of Forex traders reveal that men make up 89% of the traders, while women, though fewer in number (11%), outperform men by 1.8%, exhibiting a preference for long-term strategies over short-term risk. Interestingly, a considerable segment of Forex traders are younger than expected, with 55% of them falling under the age of 44.

Regulatory Measures and Trading Platforms

Regulation and oversight are fundamental to Forex trading, ensuring that traders engage with fully licensed brokers. Top-tier financial regulators worldwide advocate for a strong legal framework, stringent licensing requirements, robust investor protection measures, and regular audits and inspections.

The growth of Forex trading platforms since 1996 has democratized access to foreign exchange markets. MetaTrader 4 (MT4), launched in 2005, remains the most popular platform, even after the introduction of MetaTrader 5 in 2010.

Forex Trading in Australia

Australia leads the world in CFD/FX trading on a per-capita basis, with over 100,000 Australians executing one or more FX or CFD transactions in 2021. The average deposit by Australian traders into their FX/CFD account was $8,400 during January-October 2021.

The Emergence of Cryptocurrencies

The release of Bitcoin in 2009 marked a significant milestone in the trading world, heralding the advent of decentralized currencies. Since then, the crypto market has grown to include over 6,600 other cryptocurrencies. Despite market fluctuations, these highly volatile and potentially profitable cryptos, usually traded against major fiat currencies, continue to attract speculators.

The Impact of the COVID-19 Pandemic

The COVID-19 pandemic heightened global interest in Forex trading, which peaked in May 2020. Volume was 34% higher than the same month in 2020, with significant increases observed in the UK (up 137%) and Australia (up 67%). As the pandemic receded, the popularity of Forex trading saw a slight decline.

Final Thoughts

While it’s challenging to provide exact figures on the average profit or loss made by individual Forex traders, or the number of people who quit Forex trading, it’s important to note that trading Forex can be highly risky. Market volatility, coupled with a lack of preparation or understanding of the markets, often leads to significant losses. Hence, traders should be well-versed in risk management and never trade more than they can afford to lose.

Given the diverse landscape of Forex trading, it’s crucial for anyone interestedin this field to thoroughly understand the markets’ dynamics. Whether it’s the demographic distribution of traders, the regulatory oversight, the popular trading platforms, or the unique trends in different regions like Australia, every facet of the trading world contributes to the overall picture.

The emergence and growth of cryptocurrencies have added another layer of complexity and opportunity to the trading world. These digital assets, while highly volatile, offer potential profits for savvy traders willing to navigate their intricacies. However, as with all forms of trading, a clear understanding of the risks involved and an effective risk management strategy are key to success.

The impact of global events on the trading world is another important consideration. The COVID-19 pandemic, for instance, significantly boosted interest in Forex trading. Traders must stay informed about such developments to adapt their strategies accordingly.

In conclusion, the world of trading Forex, cryptocurrencies, and gold is constantly evolving, driven by factors ranging from demographic trends and regulatory changes to technological advancements and global events. As traders, we must strive to stay ahead of the curve, continually learning and adapting to navigate these exciting markets effectively.

2 notes

·

View notes

Text

Mastering Day Trading: Unlocking Funded Trading Opportunities in United Kingdom

Day trading is an exciting and fast-moving approach to financial markets, where traders buy and sell assets within the same day to capitalize on short-term price movements. While the potential for profits is high, traders must develop a solid strategy, maintain discipline, and manage risk effectively. Many traders face difficulties due to inadequate risk management and unrealistic expectations, often leading to financial losses. However, with the right knowledge, tools, and resources, traders can achieve long-term success in this field.

Industry experts like Artie from "The Moving Average" channel provide key insights into successful trading strategies that help traders improve their decision-making and optimize profitability. This guide delves into essential trading principles such as risk management, avoiding excessive leverage, and accessing funded trading accounts. Additionally, with the support of top trading platforms like Rithmic trading platform and Tradovate trading platform, traders can execute trades with greater speed and accuracy. This guide also highlights how traders can benefit from Apex Trader Funding, which provides capital to skilled traders while reducing their financial exposure.

Developing a Robust Risk Management Plan

Risk management is a fundamental component of sustainable trading. Without a structured plan to manage risks, traders may make impulsive decisions that can lead to severe losses. Artie emphasizes that while no trading strategy can ensure success in every trade, strong risk management minimizes risks while maximizing potential gains.

One of the biggest mistakes traders make is using excessive leverage, particularly when starting with a small account. Many traders try to increase their profits quickly by taking large positions, which often results in significant losses. Instead, a measured approach such as maintaining a 1:2 risk-reward ratio, where a trader risks 1% of their capital to gain 2%ensures long-term account stability.

Additionally, traders should customize their risk management strategies based on the markets they trade. Futures trading has become increasingly popular due to its liquidity and structured market conditions. Futures trading platforms such as Apex prop firm and Apex Wealthcharts trader funding provide traders with powerful analytical tools to refine strategies and enhance trade execution. By continuously backtesting their methods and assessing performance metrics, traders can strengthen their risk management approach.

Understanding Leverage and Avoiding Overexposure

One of the main reasons traders struggle is over-leveraging. This occurs when traders take on positions larger than their accounts can handle, often in an attempt to maximize profits. However, this approach can lead to rapid losses and emotional trading.

To prevent over-leveraging, traders should use position-sizing strategies and risk assessment tools to determine the appropriate trade size based on their account balance and risk tolerance. Additionally, traders should be cautious when dealing with brokers that offer high leverage, particularly in forex and cryptocurrency markets. While leverage can amplify gains, it also significantly increases potential losses.

Diversification is another key principle in reducing risk. Rather than concentrating all capital on one asset, traders should distribute their investments across different markets such as stocks, commodities, and forex. Stock trading platforms in the United Kingdom offer various investment options, allowing traders to diversify their portfolios and mitigate risk exposure.

Utilizing Demo Accounts for Skill Development

Practicing on a demo account is one of the most effective ways for traders to gain hands-on experience and test different strategies without risking actual capital. Artie recommends spending at least 30 days in a demo environment to fine-tune trading techniques, analyze market behavior, and improve execution timing.

Keeping a detailed trading journal is another essential habit. Recording trade entry and exit points, analyzing trade performance, and assessing market conditions help traders recognize patterns and improve decision-making. This process allows traders to identify weak spots in their strategy and make necessary adjustments.

Virtual trading platforms allow traders to test different styles, including scalping, swing trading, and trend trading, before transitioning to live trading. This approach builds confidence and prepares traders for real market conditions while eliminating financial risk during the learning phase.

Gaining Access to Funded Trading Accounts

For traders looking to expand their capital without risking personal funds, funded trading accounts offer an excellent solution. Apex funded trading programs enable traders to access substantial capital after passing a structured evaluation. These accounts allow traders to manage larger positions while adhering to strict risk management rules.

Apex funding has now extended its services to traders in the United Kingdom. Funded trading accounts in the United Kingdom provide traders with access to institutional-level capital, reducing their dependency on personal investments while increasing their profit potential.

A significant advantage of Apex prop firm is its integration with top trading platforms, which offer advanced execution capabilities and real-time market data. Moreover, traders can benefit from exclusive discounts by using an Apex coupon. Apply code “COPY” to receive the latest discount and make the funding process even more accessible.

Strategies to Pass a Funded Trading Challenge

Securing a funded trading account requires consistency, risk control, and disciplined trading. Artie recommends the following strategies to increase the chances of passing an evaluation:

Develop a Clear Trading Plan: Define risk parameters, preferred trading strategies, and daily profit targets.

Stick to a Strong Risk Management Framework: Maintain a risk-reward ratio that ensures longevity in trading.

Practice Patience and Avoid Overtrading: Trade with a systematic approach and refrain from emotional decision-making.

Setting Practical Trading Goals for Long-Term Success

Many traders enter the financial markets expecting rapid success, only to face setbacks due to unrealistic goals. While earning $500 per day is achievable, it requires experience, discipline, and ongoing learning. Artie advises traders to focus on steady progress rather than chasing immediate gains, as long-term consistency leads to greater success.

Leveraging Trading Technology for Market Insights

To stay ahead of market trends, traders should make use of advanced trading tools and resources. Essential elements include:

Technical Indicators: Tools like moving averages, RSI, and MACD help traders identify trends and potential opportunities.

Financial News and Economic Reports: Staying informed about economic developments helps traders anticipate market volatility.

Advanced Trading Platforms: Rithmic trading platform and Tradovate trading platform offer professional-grade execution tools and market analysis.

Mentorship and Education: Learning from expert traders via webinars and mentorship programs improves trading techniques and decision-making.

Strengthening Emotional Control in Trading

Emotional discipline is crucial for traders to achieve long-term success. Fear and greed often lead to poor trading decisions, such as holding onto losing trades for too long or exiting winning trades too early. By setting predefined entry and exit points, traders can eliminate emotional influences and adhere to their strategy. Online trading platforms in the United Kingdom that offer automated risk management tools can help traders maintain consistency and discipline.

The Importance of Continuous Learning in Trading

The financial markets are constantly evolving, requiring traders to stay informed and adaptable. Engaging in advanced trading courses, following expert market analysis, and networking with experienced traders help refine strategies and enhance market understanding. Exploring the best prop firm options also provides traders with additional funding opportunities and professional support.

Start Your Trading Journey with Apex Trader Funding

Are you ready to take your trading career to the next level? ApexTraderFunding.com provides traders with access to capital, world-class trading resources, and a structured trading environment. With funded trading accounts in the United Kingdom, traders can expand their operations while minimizing financial risk. The streamlined evaluation process, profit-sharing model, and integration with the best trading platforms in the United Kingdom create a solid foundation for long-term success.

Whether you're in the United Kingdom or elsewhere, Apex funding equips traders with the tools they need to thrive. Don’t let financial constraints hold you back visit ApexTraderFunding.com today and begin your journey toward a profitable trading career! For more insights and expert trading blogs, check out Apex Trader Funding's website.

#apex trader funding in united kingdom#funded trading accounts in united kingdom#instant funding prop firm in united kingdom

0 notes

Text

Best Funded Trading Firm for Forex Traders in India: Funded Firm

In the rapidly evolving world of forex trading, Indian traders are increasingly seeking opportunities that allow them to trade with larger capital and reduced personal risk. One standout option for those looking to scale their trading journey is Best Funded Trading Firm for Forex Traders in India a premier proprietary trading firm dedicated to empowering forex traders with access to significant capital and professional-grade resources.

What Makes Funded Firm Stand Out?

Funded Firm has established itself as a reliable and trader-friendly prop firm by focusing on flexibility, transparency, and performance-based rewards. Here are some key reasons why it's considered the best choice for Indian forex traders:

1. Capital Access Without Risking Personal Funds

One of the biggest barriers to success in forex trading is limited capital. Funded Firm removes this hurdle by allowing traders to prove their skills through an evaluation process, after which they are allocated trading capital—often ranging from $10,000 to $200,000 or more. This model means traders can grow without risking their own money.

2. Supportive Evaluation Programs

Funded Firm offers multiple evaluation options designed to suit different trading styles, whether you’re a scalper, swing trader, or long-term strategist. Their evaluations are fair and tailored to real-world trading conditions, ensuring that only disciplined and consistently profitable traders get funded.

3. Trader-Centric Rules

Unlike some firms that burden traders with restrictive rules, Funded Firm sets clear but flexible guidelines. Daily and maximum drawdown limits are reasonable, and profit targets are achievable with consistent effort. This fosters a less stressful trading environment, especially beneficial for newer traders.

4. Fast Payouts and Profit Sharing

Funded Firm offers fast and transparent profit payouts. Traders typically retain a high percentage of the profits��up to 90% in some cases—depending on the account and performance level. The firm also supports Indian payment methods and platforms, making fund transfers smooth and hassle-free.

5. Educational Support and Community

Understanding the challenges that traders face, Funded Firm goes beyond funding. They provide access to a supportive community, educational materials, webinars, and mentorship programs. For Indian traders, this is a game-changer, offering continuous learning and professional growth.

6. Compatibility with Indian Brokers and Platforms

Funded Firm supports major trading platforms like MetaTrader 4 and 5 and works seamlessly with liquidity providers and infrastructure accessible to Indian traders. Their customer support is responsive and often tailored to the local market’s needs.

Why Indian Traders Choose Funded Firm

Low entry barriers: Affordable evaluation fees make it accessible to many aspiring traders.

Performance rewards: Traders are rewarded for consistency, not just high-risk returns.

No hidden fees: Transparent fee structure with no surprise charges.

Cultural adaptability: Tailored communication and payment options that resonate with Indian users.

For forex traders in India looking to trade professionally without risking their own capital, Best Funded Trading Firms offers a highly attractive pathway. With a focus on trader success, fair evaluation processes, and generous profit-sharing models, it stands out as a top-tier choice for both new and experienced traders alike.

If you're ready to elevate your trading career with real capital and real rewards, Funded Firm might just be the partner you need.

0 notes

Text

Launch a Trading Platform Fast with Fintech360’s White Label Brokerage Technology

In today’s fast-paced financial landscape, launching your own trading platform doesn't have to take years or millions in development costs. With white label brokerage technology from Fintech360, businesses can enter the trading market quickly, offering a fully-branded platform for forex, crypto, CFDs, and other financial instruments.

What is White Label Brokerage Technology?

A white label brokerage platform is a ready-made, customizable trading system that you can brand as your own. Fintech360 provides all the essential tools—including trading terminals, back-office solutions, liquidity integrations, and compliance modules—so you can start operating a brokerage business without building from scratch.

Whether you're a financial institution, fintech startup, or entrepreneur, Fintech360's white label solution offers a low-risk, high-reward path into online trading.

Why Choose Fintech360?

Fintech360 stands out by offering:

Fully branded and customizable platforms

Multi-asset trading support (Forex, Crypto, Indices, Stocks, and more)

Real-time execution with top-tier liquidity providers

Integrated KYC/AML compliance tools

Affiliate and partner management systems

Cloud-based architecture for low latency and global access

Their solution is ideal for those seeking a crypto brokerage solution, forex white label platform, or a multi-functional fintech platform to support trading operations.

Who Is It For?

Fintech360’s white label technology is designed for:

Entrepreneurs launching a brokerage brand

Financial companies expanding into online trading

Crypto communities monetizing their networks

Influencers building niche financial products

The Future of Brokerage is White Label

As digital assets and decentralized finance gain momentum, having a scalable, secure, and user-friendly trading platform is critical. Fintech360 ensures your brokerage is future-ready with mobile access, real-time analytics, and continuous platform updates.

If you’re ready to launch a trading platform without technical barriers, Fintech360’s white label brokerage technology offers everything you need to get started—quickly, affordably, and professionally.

Start your journey today with Fintech360—where innovation meets opportunity.

1 note

·

View note

Text

Recommended Forex Brokers: A Realistic Guide to Choosing the Best

Navigating the fast-paced world of forex trading can be overwhelming, especially for beginners. One of the most critical decisions a trader makes is choosing the right broker. With so many options available, selecting from the pool of recommended Forex brokers requires both research and experience. At Topfxbrokersreview, we bring you an honest and insightful look into the leading forex brokers dominating the industry today.

In this guide, we’ll walk you through ten of the most trusted names in forex trading, providing a realistic picture based on features, performance, regulatory compliance, and user experiences. Whether you're a seasoned trader or just starting out, this detailed comparison will help you make smarter trading decisions.

1. IC Markets: A Benchmark for Raw Spread Trading

IC Markets is often the first name that comes up when discussing top-tier brokers. Established in 2007 and headquartered in Australia, IC Markets is renowned for its raw spread trading environment, making it a favorite among scalpers and high-frequency traders.

Real-life example: John, a trader from London, switched to IC Markets after experiencing slippage with another broker. Within three months, he noticed significantly improved order execution during volatile events like the NFP release.

Pros:

Tight spreads from 0.0 pips

Ultra-fast execution

Regulated by ASIC, CySEC, and FSA

Best for: Scalpers, day traders, and algorithmic traders.

2. FP Markets: A Balance Between Technology and Trust

Another Australian-based broker, FP Markets offers a wide range of trading platforms, including MT4, MT5, and IRESS, suitable for both beginners and professionals. The broker provides a rich selection of educational content, making it one of the more accessible platforms for new traders.

Real-life insight: Sara, a university student in South Africa, learned about FP Markets through a forex webinar and appreciated its demo account and low initial deposit.

Pros:

Competitive spreads

Multi-platform support

Excellent educational resources

Best for: Beginners and intermediate traders looking for a learning-friendly environment.

3. Eightcap: The Crypto-Focused Forex Broker

Eightcap stands out by offering an impressive range of crypto CFD pairs alongside traditional forex. If you're interested in diversifying your portfolio with both fiat and crypto trading, Eightcap is a strong contender.

Real-world note: Mark, a crypto-savvy forex trader from Canada, uses Eightcap primarily for its digital asset offerings. He notes that the integration of TradingView has transformed how he analyzes charts.

Pros:

Over 250+ crypto and forex instruments

Supports MT4/MT5

Integration with TradingView

Best for: Traders who blend forex and crypto strategies.

5. FxPro: Trusted and Versatile

FxPro is known for offering a variety of account types across multiple platforms like MT4, MT5, cTrader, and FxPro Edge. Its reliability and speed make it a go-to for experienced traders looking for performance without compromise.

User experience: Daniella, a swing trader from Italy, appreciates FxPro for its quick withdrawals and multilingual customer support.

Pros:

High-speed execution

Deep liquidity

Variety of trading platforms

Best for: Versatile traders who switch between strategies.

6. FBS: Popular in Asia and Beyond

FBS has gained massive popularity, especially in Southeast Asia and the Middle East. With its high leverage options and regular trading contests, FBS has created a vibrant community of traders worldwide.

Personal story: Raj, a trader from India, won a demo trading contest hosted by FBS and used the prize money to fund his first live account.

Pros:

Leverage up to 1:3000

Frequent promotions and contests

Cent account for micro-lot trading

Best for: High-risk traders and forex newbies.

7. XM: Educational Leader with Global Access

XM is a broker known for its extensive educational resources, including webinars, seminars, and trading tools. With over 5 million clients in 190 countries, XM’s global footprint speaks volumes about its credibility.

Example: Anita, a teacher in Kenya, started her trading journey through XM’s beginner webinars and appreciated the clarity and structure of their tutorials.

Pros:

Low deposit requirements

Multi-language support

Free VPS and bonuses

Best for: Traders seeking education and global accessibility.

8. Axi: Built by Traders for Traders

Formerly known as AxiTrader, Axi is a broker that has focused on enhancing the trading experience through tools and automation. They’ve partnered with PsyQuation, an AI-powered analytics platform, to help traders improve performance.

Real scenario: Alex, an algorithmic trader in Germany, relies on Axi for its integration with PsyQuation, which helps him fine-tune his automated strategies.

Pros:

Smart trading tools

MT4 optimization

Strong customer service

Best for: Algo traders and those looking to optimize strategies.

9. Pepperstone: Institutional-Grade Trading for Retail Users

Pepperstone has carved a niche in offering institutional-grade spreads and execution to retail traders. Their ECN-like environment and access to social trading platforms like Myfxbook and DupliTrade make them stand out.

Case study: A trader in Brazil shifted to Pepperstone to copy top-performing traders using DupliTrade and saw a 12% return over 4 months.

Pros:

Spreads from 0.0 pips

Fast execution

Great for copy trading

Best for: Social traders and high-volume users.

10. HFM (HotForex): A Veteran in Emerging Markets

HFM, formerly HotForex, is known for its strong regulatory standing and customer-first approach, especially in Africa and Asia. The broker has won several awards for its platform reliability and customer service.

Example: Moses from Nigeria has been with HFM for over 5 years, citing their prompt withdrawals and responsive local support as key reasons for his loyalty.

Pros:

Multi-asset offerings

Low spreads and high leverage

Global presence with localized support

Best for: Traders in emerging markets and loyal long-term users.

Final Thoughts: Choosing the Right Broker for You

The truth is, there’s no one-size-fits-all when it comes to forex brokers. What works for a scalper in London might not suit a swing trader in Nairobi. The brokers we’ve covered — IC Markets, FP Markets, Eightcap, FxPro, FBS, XM, Axi, Pepperstone, and HFM — all bring unique strengths to the table. Your choice will ultimately depend on your strategy, capital, experience level, and trading goals.

Here at Topfxbrokersreview, we’ve reviewed countless brokers to ensure we recommend only the most trustworthy and high-performing platforms. This list of recommended Forex brokers is based on real trader feedback, regulatory standing, execution quality, and the unique value each broker brings to the market.

Whether you are looking to trade crypto CFDs with Eightcap, benefit from raw spreads with IC Markets, or tap into the educational vault at XM — your ideal broker is just a decision away. The key is to start small, test the platform, and gradually scale your trades as your confidence grows.

Closing Note from Topfxbrokersreview

We hope this deep dive into the recommended Forex brokers helps you make more informed trading decisions. The forex market offers immense potential, but only with the right partner by your side. Choose wisely, trade smart, and always keep learning.For more updates, broker reviews, and trading guides, keep visiting Topfxbrokersreview — where expert insights meet trading excellence.

0 notes

Text

Top 5 Commodities to Trade in Forex Market

Forex Commodity Trading

What if I told you that trading commodities on the foreign exchange market may earn you a good profit? You heard right. It is also possible to trade currencies and commodities in the field of foreign exchange.

Do not be concerned. This blog will discuss the best commodities to trade in and provide instances of FX commodity trading. Modern technology has made it impossible to identify forex scams, especially for inexperienced traders. This article will therefore offer a comprehensive examination of Fx scams along with guidance on how to stay away from them.

The best the best commodity pairs?

Gold (USD/XAU): It is one of the most popular, highly liquid, and volatile currency combinations. Because of its reputation as a safe haven asset and its negative connection with the US dollar, gold is the best foreign commodity to trade.

Silver (USD/XAG):Trading gold on the international commodity market could be very costly. As a result, beginners might also select the XAG/USD pair. The extensive usage of silver metal in many different industries and the global demand for it present opportunities for those with little financial resources.

XPT/USD for platinum: Platinum is another precious metal that can be exchanged on the currency market. The metal is used to treat severe ailments in addition to jewellery.

Additional Metals: Apart from the aforementioned commodities, FX trading provides a multitude of opportunities. Numerous commodity brokers offer trading in copper, palladium, nickel, aluminium, zinc, lead, cobalt, lithium, and other commodities. so that traders can choose the one that best suits their requirements.

Forex and Energy Commodities

Therefore, if you do not want to deal in metal commodities, you might try energy commodities. Energy commodities are among the products that power, heat, transportation, machinery, and many other industries rely on.

Natural Gas: According to studies, natural gas accounts for 20% of the electricity supply, making it a substantial energy source. The energy product is used in many different businesses, such as housing, fertilisers, and industry.

Renewable Energies: Renewable resources are used to generate energy and power. Forex traders can also choose from renewable energy sources including solar, wind, hydro, and geothermal.

Correlated Currencies: You can select currencies from countries that solely depend on the commodity market if you would rather not deal directly with commodities.

A country's trade balance indicates both the strength of its currency and the health of its economy. Generally speaking, having a significant trade surplus helps a country. It happens when a country's commodity exports generate a substantial amount of revenue.

End

Forex and commodity market expertise are both necessary for trading commodities. A trader should also have the appropriate trading strategy, leverage and risk management skills, and the required mindset. Therefore, if you plan to start trading forex commodities, bear these points in mind.

0 notes

Text

Best Credit Cards for Teenagers with Buyers and Sellers in Stock Market in India

Financial awareness is essential for young individuals who want to manage money wisely. Teenagers are increasingly looking for financial tools such as credit cards, investment opportunities, and referral-based earning programs. Understanding the best credit cards for teenagers, stock market trends, pre-market trading, and Demat referral programs can help them make informed financial decisions.

Best Credit Cards for Teenagers

Credit cards designed for teenagers allow them to develop smart spending habits and financial discipline. The best cards provide security, best credit card for teenagers parental controls, and minimal financial risks. Some of the top credit cards for teenagers include the Fyp Prepaid Card, which offers budgeting features, and the FamPay Card, a numberless digital card for secure transactions. Students traveling abroad can benefit from the HDFC Bank Forex Card or the ICICI Bank Student Travel Card, both of which provide global access and discounted international transactions. Additionally, the Axis Bank Insta Easy Credit Card is a beginner-friendly option that helps teenagers build their credit score over time.

How to Check Buyers and Sellers in the Stock Market

Understanding buyer and seller activity in the stock market helps investors make better trading decisions. Market depth tools allow traders to view real-time buy and sell orders at various price points. The bid-ask spread is another key indicator of market liquidity—smaller spreads indicate higher trading activity. Volume analysis also plays a crucial role in identifying trends, as high trading volumes usually signal strong investor interest. Institutional investors, such as mutual funds and foreign institutional investors (FIIs), often make large trades that influence market trends. By monitoring their activity, retail investors can align their strategies accordingly.

Understanding Pre-Market Trading (Primarket)

Pre-market trading (also known as primarket trading) occurs before the official stock market opens. It provides an early indication of how check buyers and sellers in stock market the market will react to news events and overnight global developments. Investors who engage in pre-market trading can take advantage of breaking news before the regular market session begins. However, since liquidity is lower during this period, price fluctuations may be more volatile. Traders must carefully analyze price movements, news releases, and corporate announcements to make informed decisions during the pre-market session.

ISF Securities: A Trusted Brokerage Firm

ISF Securities is a reputable financial services provider specializing in stock market trading and wealth management. The company offers a wide range of services, including equity trading, derivatives trading, portfolio management, and mutual fund investments. ISF Securities provides cutting-edge trading platforms and expert advisory services, making it a preferred choice among primarket investors seeking a reliable brokerage firm.

Refer and Earn Demat Account Programs

Many stock trading platforms offer referral-based incentives for users who invite others to open Demat accounts. These refer-and-earn programs allow existing users to earn rewards, cashback, or brokerage discounts for every successful referral. Some of the most popular Demat referral programs include Zerodha Refer & Earn, which provides brokerage cashback, and Upstox Referral Program, which rewards users with cash incentives. Similarly, Angel One, 5paisa, and Groww offer attractive referral bonuses, making it easier for investors to benefit while introducing others to stock market investments.

Benefits of Demat Refer and Earn Programs

Demat referral programs offer a great way to earn passive income while encouraging demat account refer and earn financial literacy among peers. By referring friends and family to open a Demat account, users can enjoy exclusive perks, such as reduced brokerage fees and cashback offers. These programs not only help individuals save money on trades but also encourage more people to participate in the stock market, thereby improving overall market participation.

Conclusion

Teenagers and young investors have numerous financial tools at their disposal, from credit cards designed for responsible spending to stock market investment opportunities. Understanding market behavior, engaging in pre-market trading, and utilizing referral programs can provide financial benefits and long-term wealth-building opportunities. By leveraging the right credit cards, stock trading strategies, and Demat referral programs, young individuals can take their first steps toward financial independence.

MoneyIsle is a secure and user-friendly investment platform dedicated to helping individuals grow their wealth. We offer expert financial solutions, including stock trading, mutual fund investments, and smart wealth management tools. With a focus on transparency, innovation, and customer satisfaction, MoneyIsle empowers investors to make informed financial decisions and achieve long-term financial success.

Share this:

0 notes

Text

The Best Mobile Forex Trading Platform and Gold Broker

What Makes the Best Mobile Forex Trading Platform?

When selecting a mobile forex trading platform, several key factors must be considered:

User Interface & Experience: The platform should offer an intuitive design with seamless navigation.

Execution Speed: Fast execution times ensure minimal slippage and better trade management.

Security: Strong encryption and two-factor authentication (2FA) are crucial for safeguarding funds and personal data.

Trading Tools & Indicators: A comprehensive set of charting tools, indicators, and analysis features is essential.

Asset Availability: The platform should support a wide range of currency pairs, including major, minor, and exotic pairs.

Regulatory Compliance: The best platforms operate under strict regulatory oversight to ensure fair trading conditions.

Top Mobile Forex Trading Platforms in 2024

MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

MetaTrader remains a leading choice among traders due to its reliability and extensive feature set.

Available on both Android and iOS

Advanced charting tools and customizable indicators

Supports algorithmic trading through Expert Advisors (EAs)

Secure and widely used among brokers

cTrader

cTrader is a powerful alternative to MetaTrader, known for its advanced functionalities.

User-friendly interface with Level II pricing

Highly customizable charting and order execution options

Cloud-based trading for seamless device transition

ThinkTrader

ThinkTrader by ThinkMarkets is gaining popularity for its robust mobile trading capabilities.

80+ indicators and multiple chart types

Integrated risk management tools

No dealing desk intervention

Forex.com Mobile App

Forex.com’s mobile app is ideal for traders looking for a broker-integrated experience.

Competitive spreads and direct market access (DMA)

Economic calendar and news updates

Secure and regulated by top-tier financial authorities

eToro Mobile App

eToro is perfect for social traders who prefer copy trading.

Copy trading features allow users to follow top-performing traders

Beginner-friendly interface

Commission-free forex trading on select pairs

The Importance of Choosing the Right Gold Broker

Regulation & Reputation: Choose brokers regulated by authorities like the FCA, CFTC, ASIC, or CySEC.

Competitive Spreads & Fees: Low spreads and transparent fee structures enhance profitability.

Leverage & Margin Requirements: Understand leverage offerings and margin requirements before trading.

Market Access: The best brokers provide access to spot gold, futures, ETFs, and CFDs.

Platform Compatibility: Ensure the broker supports MT4, MT5, or proprietary mobile apps for seamless trading.

Top Gold Brokers for 2024

XAU/USD Trading with AvaTrade

Regulated by multiple financial authorities

Zero commissions with tight spreads

Supports mobile trading via AvaTradeGO

IG Markets

Offers gold CFDs and spot trading

High liquidity and real-time pricing

Advanced trading tools and professional research

FXTM (ForexTime)

Competitive spreads on gold trading

Flexible leverage options

Secure and regulated trading environment

OANDA

No minimum deposit requirement

Competitive pricing on gold pairs

Advanced charting tools for mobile traders

Plus500

User-friendly gold trading app

Commission-free trading with competitive spreads

Strong regulatory oversight

The Best Gold Trading Apps for Mobile Traders

Investors and traders seeking mobile-friendly solutions for gold trading should consider apps that offer reliability, real-time data, and a smooth trading experience. Here are the top choices:

MetaTrader 4 & MetaTrader 5 Mobile Apps

Both MT4 and MT5 allow traders to execute gold trades with precision.

Available on Android and iOS

Real-time charts, indicators, and alerts

Secure login and encryption features

AvaTradeGO

Designed for seamless mobile trading

Integrated risk management tools

One-click trading functionality

eToro Mobile App

Ideal for beginners and social traders

Allows copy trading with top-performing investors

Easy-to-use interface with gold market insights

Plus500 App

Intuitive and user-friendly design

Negative balance protection

Real-time price alerts and notifications

TradingView App

Best for charting and technical analysis

Customizable indicators and alerts

Connects with multiple brokers for gold trading

Conclusion

Choosing the best mobile forex trading platform and gold broker depends on your trading style, experience level, and investment goals. Whether you’re an active forex trader or a gold investor, selecting a platform with robust security, fast execution, and intuitive mobile functionality is essential. MetaTrader, cTrader, and ThinkTrader stand out as top forex trading apps, while AvaTrade, IG Markets, and OANDA are excellent gold brokers. By leveraging the best gold trading app, traders can capitalize on market opportunities anytime, anywhere. Always ensure that your chosen broker is regulated and offers competitive pricing to maximize profitability while minimizing risks.

0 notes

Text

Advanced IoTrade Trading Platform: The Future of Forex (FX) Trading

Forex trading is one of the most active and competitive markets in the financial world. To succeed, traders and businesses require access to cutting-edge technology and efficient trading solutions. This is where IoTrade comes in, with a next-generation trading platform that provides powerful tools, real-time data, and a strong infrastructure for traders and proprietary trading organizations.

In this article, we'll look at how the IoTrade trading platform is defining the future of forex trading and why it's one of the top FX solutions for proprietary trading organizations.

What is IoTrade?

IoTrade is a cutting-edge trading platform designed exclusively for Forex traders and prop trading firms. It offers deep liquidity, ultra-fast order execution, and complete risk management tools to ensure a flawless trading experience. IoTrade's innovative infrastructure enables traders to profit on market changes with minimal latency and optimum efficiency.

As a top trading platform provider, IoTrade combines cutting-edge technology with user-friendly features, making it ideal for professional traders and proprietary trading organizations looking to improve their performance in the forex market.

Key Features of the IoTrade Trading Platform

Why IoTrade is Ideal for Proprietary Trading Firms

Profit Sharing and Risk Control

IoTrade's platform is meant to help proprietary trading organizations create effective profit-sharing models and risk controls.

Profit-sharing parameters are customizable.

Scalable infrastructure can handle several traders.

Real-time tracking of trader performance.

This enables property firms to promote strong performance while controlling risk.

Scalability and Flexibility

IoTrade is highly scalable, making it ideal for both small proprietary trading firms and large institutions.

Supports high-volume trading while maintaining performance.

Cloud-based design enables worldwide access.

The platform is available 24/7.

Proprietary trading organizations can extend their operations while maintaining speed and performance.

Superior Trading Technology

IoTrade includes AI-powered market analysis and prediction analytics, offering traders a technical advantage.

AI-powered market forecasting.

Real-time news and event tracking.

Support for algorithmic trading.

This enables traders to make data-driven judgments, which increases total profitability.

How IoTrade is Shaping the Future of Forex Trading

Forex markets are getting increasingly complicated and competitive, necessitating creative methods to stay ahead. IoTrade solves these issues by providing:

Faster execution speeds to capitalize on market micro-movements.

Increased liquidity access to lower trading costs.

AI-powered insights help uncover valuable opportunities.

IoTrade enables proprietary trading firms and individual traders to achieve new levels of success in forex trading by merging cutting-edge technology with user-centric design.

Benefits of Using IoTrade for Forex Trading

Faster trade execution without lag or delays during extreme market volatility.

Reduced expenses through low spreads and access to extensive liquidity.

Improved profitability through AI insights and algorithmic trading support.

Simple interface - Ideal for beginner traders.

Improved security with strong data protection mechanisms. IoTrade provides traders and prop businesses with the necessary tools and confidence to manage the complexity of the FX market.

Choosing IoTrade for Your Proprietary Trading Firm

When choosing a trading platform, proprietary trading firms should consider:

Execution speed and order correctness.

Liquidity access and spread competitiveness.

Risk-management characteristics.

Platform stability and security.

Cost-effectiveness and scalability.

IoTrade excels in all of these areas, making it the top solution for proprietary trading organizations seeking to maximize profits while minimizing risk.

Conclusion

The future of FX trading is in innovative platforms such as IoTrade. Its mix of fast execution, deep liquidity, AI-driven insights, and strong security makes it the ideal choice for proprietary trading organizations.

By providing scalable infrastructure, flexible profit-sharing structures, and cutting-edge technology, IoTrade enables traders and proprietary organizations to capitalize on new growth prospects in the competitive forex market.

If you want to step up your trading game and take advantage of the best FX solutions for private trading firms, IoTrade is the platform to trust.

#fxproptech#best prop firms#proptech#prop trading firms#my funded fx#best trading platform#forex prop firms funded account#prop firms#funded trading accounts

0 notes

Text

Market Trends: USD, Gold, and Stock Volatility Insights

Market Overview

Key Economic Releases This Week:

Mar 12: JOLTS Job Openings (USD Trading Dynamics)

Mar 13: Core CPI, CPI m/m & y/y (USD); BOC Rate Statement, Overnight Rate, Press Conference (CAD)

Mar 14: Core PPI, PPI, Unemployment Claims (USD)

Mar 15: GDP m/m (GBP); Prelim UoM Consumer Sentiment & Inflation Expectations (USD)

With rate cuts on hold, the focus shifts to the health of the U.S. economy amid trade war challenges. The question remains: Will Trump's policies strengthen the economy, or will dissatisfaction among voters prove warranted?

U.S. Stock Market Performance

As of March 2025, the U.S. stock market is slowing down. The S&P 500 is down 2% YTD, while the Nasdaq has dropped 6%, indicating signs of consolidation after two strong years.

Current Market Performance:

Dow Jones: 42,802 (+0.6% YTD)

S&P 500: 5,770 (-1.9% YTD)

Nasdaq: 18,196 (-5.8% YTD)

Defensive sectors such as health care and consumer staples are leading, while technology and consumer discretionary stocks are struggling due to high valuations.

Economic Growth and Rate Cut Speculation

Growth is slowing, with the Atlanta Fed projecting Q1 GDP at -2.4%. Although a recession isn’t imminent, if the downward trend continues, the Federal Reserve may implement three quarter-point rate cuts in 2025 to support the economy.

Recent Stock Movements:

Gainers: Nvidia, UnitedHealth, IBM (+3.29%)

Losers: Intel, Boeing, American Express, Walt Disney, JPMorgan Chase (-5.54%)

Market Impact and Wealth Distribution

The top 1% of taxpayers contribute significantly to the U.S. economy, holding a majority of total adjusted gross income. If stock markets crash, the impact will be severe, leading to forex volatility and spreads affecting USD strength.

The stock market index serves as a key indicator of potential economic growth or a slowdown.

Market Analysis

GOLD

Gold prices remain in consolidation, showing little movement despite the release of Non-Farm Payroll (NFP) news last week. Gold remains above the EMA200, maintaining its bullish structure.

The MACD and RSI show neutral trends, indicating indecision in price action forecasting. Liquidity in forex markets remains stable, with gold prices waiting for a decisive USD move. A clear breakout is required before confirming the next trend direction.

SILVER

Silver prices remain supported at 32.5177, indicating further upside potential.

The RSI signals overbought levels, suggesting a continuation of consolidation. MACD shows exaggerated selling pressure, yet price action remains bullish. EMA200 serves as strong support, reinforcing the bullish trend. Until silver breaks a key structure, it remains in a range-bound forex market.

DXY (US Dollar Index)

The USD trading dynamics remain bearish, with the dollar struggling to gain strength.

The MACD indicates rising bullish volume, yet price fails to reflect this. The RSI remains overbought, reinforcing further selling pressure. Correlation between currency pairs suggests that a weaker USD could benefit commodities like gold and silver.

GBPUSD

The British pound reached a new high last week but failed to maintain momentum, entering a consolidation phase.

The MACD and RSI fail to provide clear signals as markets remain in a wait-and-see mode. Major economic releases this week could dictate GBP trading dynamics.

AUDUSD

The Australian dollar is consolidating below the previous swing high.

The EMA200 provides support, preventing further declines. The MACD signals a potential bullish crossover, indicating buying opportunities. The RSI remains neutral, suggesting price may continue moving sideways before breaking out. Forex volatility and spreads will be key to AUD’s movement.

NZDUSD

The Kiwi dollar remains supported by the EMA200, showing signs of bullish momentum.

The MACD is set to cross higher, signaling increased buying pressure. The RSI remains in the lower range, reinforcing bullish sentiment. Market sentiment suggests NZD will maintain its uptrend, provided the USD remains weak. Exotic forex pairs vs. minors play a role in its movement.

EURUSD

The Euro continues consolidating after reaching a new high last week.

The MACD and RSI suggest stable conditions, confirming ongoing strength in the euro. If USD weakness persists, EURUSD could break higher.

USDJPY

The Japanese yen is experiencing increased bearish movement but remains within a consolidation zone.

The MACD signals a potential buy, despite the recent price drop. The RSI is elevated, indicating a possible continuation of the downward trend. Bank of Japan's rate hike speculations could influence further yen strength. USD trading dynamics remain key.

USDCHF

The Swiss franc is strengthening, providing a more stable option against the USD.

The MACD shows increasing bearish momentum, reinforcing downside potential. The RSI calls for overbought conditions, aligning with further selling opportunities. USD weakness is driving CHF strength, making this a key forex trading opportunity.

USDCAD

The Canadian dollar remains range-bound, with no clear directional bias.

The EMA200 is being tested, indicating potential breakout scenarios. The MACD suggests bullish movement, while RSI normalizes. Until a clearer direction emerges, consolidation is expected. USD/CAD liquidity will determine the next move.

COT Reports Analysis

Currency

Strength Rating (Out of 5)

AUD

WEAK (5/5)

GBP

STRONG (5/5)

CAD

WEAK (5/5)

EUR

WEAK (1/5)

JPY

STRONG (5/5)

CHF

WEAK (3/5)

USD

STRONG (4/5)

NZD

WEAK (5/5)

GOLD

STRONG (3/5)

SILVER

STRONG (4/5)

Final Thoughts

The USD trading dynamics, forex volatility and spreads, and liquidity in forex markets are the key drivers shaping this week’s market outlook. Stock market performance and economic indicators will play a crucial role in defining upcoming trends.

Traders should closely monitor economic releases, as they will set the tone for the major and minor currency pairs in the coming weeks.

0 notes

Text

Top Forex Trading Company in India: A Complete Guide for Traders

The forex market in India is gaining momentum as more traders explore global currency exchanges. Finding a reliable forex trading company in India is crucial for success in this dynamic market. With numerous platforms offering forex services, traders must focus on factors like security, regulations, and trading tools to make informed decisions.

Understanding the Forex Market in India

Forex trading involves buying and selling currency pairs to profit from market fluctuations. In India, trading forex is regulated, ensuring a secure environment for investors. A reputed forex trading company in India provides advanced trading platforms, real-time data, and risk management tools to enhance the trading experience.

Features of a Reliable Forex Trading Company

A well-established forex trading company in India offers essential features that improve trading efficiency and security. Some of these features include:

Regulated Operations: A company adhering to financial regulations ensures transparency and trader protection.

Advanced Trading Platforms: Access to user-friendly platforms with real-time charts, indicators, and automated trading options.

Competitive Spreads and Leverage: Lower spreads and flexible leverage allow traders to maximize their potential returns.

Customer Support and Education: Responsive support and learning resources help traders refine their strategies.

How to Start Forex Trading in India