#the price growth feeling not proportional to wages at all

Text

Deciphering rise of BTS through their content

Korean Culture

Koreans are deeply influenced by the Confucian philosophy, which emphasizes cultivated knowledge in comparison to creativity and a collectivistic society. Which is quite different from the Western thought.

Despite the political unrest after the Korean War that resulted in the division of the region, these two countries still share the same culture and traditional values.

The French Institut national de l'audiovisuel defines K-pop as a "fusion of synthesized music, sharp dance routines and fashionable, colorful outfits”. Songs typically consist of one or a mixture of pop, rock, hip hop, R&B, and electronic music genres.

The Confucian thought has a huge influence on Eastern political ideas; shaping the moral system, the way of life, social relations between old and young and their work ethic.

This gives us some insight about the highly systemized, regulated k-pop industry owned by three big names YG, SM JYP. That control every aspect of artist’ career to control publishing, licensing and advertising and in the end operating a star-making academy leaving the artist with no creative freedom. These trainees are put through years of intense musical and chorographical training; they have to sacrifice all guarantees of personal freedom, sleep and comfort. These trainees are monitored for height, weight and figure; they are put through extreme diet regimes, sometimes get plastic surgery done to resemble anime like body proportions. --- to produce idol groups designed to present the very highest standards of beauty, dance, and musicality in Korean popular music.

Korean pop stars have become cultural icons in the region and globally.

Kpop and BTS:

The Korean Wave Hallyu refers to the global popularity of South Korea’s cultural economy exporting pop culture, entertainment, music, TV dramas and movies since 1990s. And since 2000, the Korean government invests great sums in the country’s pop culture to appeal to an international audience. The South Korean government has dedicated a department solely to K-pop to promote the music in Korea and beyond.

It was within this environment that in 2010, a man named Bang Si-hyuk began to quietly build a different kind of studio, and to cultivate the band that would become BTS. His belief is to give the members creative freedom to work on solo tapes, producing and writing. BTS was first launched in 2013.

Where other modern day boy/girl bands have stuck to singing about love and heartache, from the beginning he has encouraged BTS to tell personal stories, and made it imperative to speak about things the group is feeling individually, in a whole that is the reason for the socially critical and introspective lyrics. Honest musical expression of one’s creative anxieties — would become a crucial element of BTS.

BTS is inspired by a hip-hop trio called Seo Taiji & Boys in 1990s who challenged norms around musical styles, song topics, fashion, and censorship, which was unprecedented for a culture whose musical production had spent the past few decades subjected to strict government oversight. They are considered pioneers of rebel music against the system in K-pop.

Seo Taiji, who’s been called the ‘Culture President, recently proclaimed Bangtan Sonyeondan (BTS) to be the true heirs of the original Korean pop ethos he gave birth to decades previously. While collaborating with BTS on his 25th anniversary on his song “ Classroom Idea”, which criticizes the oppressive education system of Korea. This song was written by Seo Taiji in 1994 when all teenagers were forced to stay in school from 7 am to 9 pm. For people without a college degree it would be hard to get jobs, they’d be treated as underdogs, paid no respect, and kept invisible in the society. (Video will be played and explain from it)

Education is considered crucial because of the Confucian tradition of respecting, learning and the particular national desire for greater achievements.

From BTS’ 2013 album O!RUL8,2? song N.O. also talks about students being overwhelmed by the expectations placed on them by elders, and the effect it has on their mental wellbeing. (in relation with the education system, BTS also has a song for it)

Then their 2015 album The Most Beautiful Moment in Life, Part 2; entails one of their most political song “Silver Spoon” or “Baepsae” it’s a bird in Korea translated as “Crow Tit” which is a small bird, considered as a weak one compared to a stork, crow tit has short legs and a stork has very long legs. The idiom goes “ a crow tit following a a stork will tear its legs”. Meaning when you try to do something out of your reach or capabilities you are likely to fail. Here storks are referring to people in power; big companies, conglomerates and the older generations. The crow tit being the younger generation. (they flap their hands like birds in their choreography).

They also use the metaphor of a teacher to refer to the older generation who are born with a golden spoon. So during the age of the storks or baby boomers (Baby boomer is a term used to describe a person who was born between 1946 and 1964) in South Korea they were experiencing huge economic growth and was extremely easy to get jobs, housing etc. But the economy of South Korea is now maturing and the side effects of ultra-fast economic growth have boomeranged to haunt the current generation. Millenials are facing high pricing of houses as well as high disparity between the rich and the poor and also all-time high youth unemployment.

Lyric, ‘Passion pay’ is a common practice in Korean society where companies pay young workers below minimum wage or nothing at all in return for experience. (lyrics will be shown in slide)

Speaks much about our society’s treatment to interns who go into the field to work. And the ‘given up generation’ saying that millennials are the generation who have given up on what may be considered as basic human rights and wants because of extreme high youth unemployment rates.

Sam-po-sadae (show the lyrics here) (read from ppt and explain these things gen Z has given up on). Millennial's giving up of romantic relationships, marriage, children, proper employment, homes, and social life in the face of economic difficulties and societal ills while facing condemnation from the media and older generations.

Then they go on to say that they want to change the system. Like this is not a normal situation. Society is sick but it also says we are not at the top yet and we have to push further. (video played and then this is explained).

Then BTS addresses how the older generation blames the millenials for their struggles saying that it is due to the lack of effort. Baby boomers seem to neglect the fact how society is completely different now compared to when they were growing up, also their economic situation is different. Saying that a lot of the problems millenials face today were infact caused by the baby boomers. But they seem to ignore this fact and tell the crow tits to work harder, try harder, put more effort.

Moving on to to their newer album “Wings”, song Blood Sweat tears, which is rich in literary and art references. Wings album is based on “Demian” a 1919 Herman Hesse novel that explore the psyche of the narrator as he grows up and loses his innocence and is on a journey to find himself. The ideologies presented in Demian are heavily influenced by the German philosopher Nietzsche. Nietzsche often wrote about the creation of the self. And more of his ideas in grounds of self-realization is central to Demian. (video playing in bg) There are motifs of mentorship shown in the video when each younger member is paired with an elder one. Jin the oldest member seen standing alone admiring the painting of the fall of rebel angels, the battle between good and evil. While gazing at this painting, Bminor plays in the background. Jin stands between two door, black and white, one good one evil. In Demian, Sinclair finds some freedom when Demian introduces him that the world cannot be categorized in binary such as good and evil. But rather there is good in all evil and evil in all good.

This concept is represented by the God called Abraxas, the god is nor good or evil but rather the affirmation of the existence of both. Saying that Sinclair will never find himself if he only acknowledges the realm of light he must seek knowledge and learn of both realms.

On the surface level one would say the song is about the dangers of temptation but through the imageries a lot of symbolism is shown, allusions from multiple sources of literature each symbol works harmoniously to create a larger system of meaning.

And their latest album Map of the Soul: Persona, based on archetypes of Carl Jung; is where they identify their stage persona as one part of their whole identities.

So as we see every succeeding album of BTS, one would witness the gradual growth of its members. With group and solo songs of each artist addressing issues like depression, anxiety, social and political injustice. Every member’s own identity plays a crucial role in building themes and concepts for their albums. And how they face these experiences that life brings them is translated in their albums.

Bringing us to the question, what is the machinery behind this idol group?

This boy band is still under a company which has its own producers. Bang-si-Hyuk (the founder), Pdogg (in house producer), Slow Rabbit (producer), Adora,Supreme Boi are the main producers. Main choreographer is Son Sung-deuk and J-Hope (member) takes part in choreography too (as he was a stret dancer earlier). Some members of the group have been credited as producers, RM, Suga, J-Hope and Jungkook.

The Korea Music Copyright Association attributes over 130 songs to RM as songwriter, composer, also including writing for member Jimin's solo song "Promise". The Korea Music Copyright Association attributes over 85 songs to Suga as a songwriter and composer. Suga won the 2017 MAMA (Mnet Asian Music Awards) best producer award for the song Wine. J-Hope produced his mixtape ‘Hope World’. Jungkook produced Magic Shop.

The group’s high-quality visual productions, largely produced by South Korean creative agency Lumpens, are frequently related to the themes of the band’s music. The agency has produced the visuals for some of their hits like Idol, DNA, Serendipity, I NEED U, Fake Love (Forbes article)

Pdogg production in "Love Yourself: Tear" with BTS hit the Billboard 200 albums chart and was nominated for Grammy Awards.

In an interview he was asked, to drop a hint about the sort of music BTS will come up in the future.

He replied, because a new series has started with ‘Love Yourself 承 Her’, we are planning to continue that. After that, [the decisions] will change based on BTS’ situation and the members’ sentiments at that point. The members put a lot of effort to make sure their characteristics can be shown through their music’.

The concept and themes the group work on for their albums come from them. Though the production may not be solely done by them. The ideas originated from the members are worked upon by the members alongside the company. The ultimate example of the members’ creative independence from their company is their personally composed, freely released mixtapes. They reflect each member’s individual personalities and creative orientations.

Bang-si-Hyuk gave BTS autonomy to run their own Twitter and vlog from their studio, and for the rappers to write alongside Big Hit’s in-house production team.

Since 2000, the Korean government invests great sums in the country’s pop culture to appeal to an international audience. The South Korean government has dedicated a department solely to K-pop to promote the music in Korea and beyond. These cultural exports have benefited the economy and country. BTS have become the youngest ever recipients of the Hwagwan (Korea’s) Orders of Cultural Merit for their services to the promotion of Korean pop culture and Hangul, the Korean alphabet.

How is bts so popular?

“We came together with a common dream to write, dance and produce music that reflects our musical backgrounds as well as our life values of acceptance, vulnerability and being successful,” said BTS’s leader, RM, in a 2017 interview with Time. Their latest record, Map of the Soul: Persona, made them the second group in history to have three No. 1 albums in a single year—the first was the Beatles.

There are six main ways BTS breaks with established precedent for K-pop boy bands to carry out this mission:

· They frequently write their own songs and lyrics.

· Their lyrics are socially conscious and especially attuned to describing the pressures of modern teen life in South Korea.

· They create and manage most of their own social media presence.

· They aren’t signed to “slave contracts,” nor do their contracts have the grueling restrictions of other idol groups.

· They tend to focus on marketing entire albums rather than individual singles.

· They talk openly about the struggles and anxieties of their career instead of presenting an extremely polished image at all times. (To be said- Rap Monster also differentiated the group by taking an open stand in favor of LGBT rights, a topic which is still highly incendiary in South Korea. Idols typically don’t take sides in such topics.)

A lot of these elements have been present in other k-pop groups- most notably Big Bang, which influenced BTS more than any other k-pop band. But Big Hit Entertainment systemized these elements in BTS and marketed it hard.

BTS has broken several charts records during each come-back in 2016 and 2017, not only locally but also internationally. Unlike other K-pop fandoms, BTS fans, span every age, gender and ethnic group -- BTS is not a teenage phenomenon, it is an intellectual phenomenon. Language barrier is no hinderance to spreading their message by their active fanbase who translate lyrics, make video compilations and create fan fiction about the band. Their messages penetrate through language, age, ethinicity and gender (need to add videos of older people attending their concert).

Even before their debut in 2013, they already had contents such as covers and dance practices, published through several medias (Youtube, blog, Twitter...). They have constantly tried to update fans on their activities through planned and unplanned interactions. The boy group was one of the first artists featured in the live broadcasting application launched by Naver in August 2015, V App. BTS’ social angle is always cited by the ARMY as the top reason for their ardent support.

This worldwide popularity is confirmed by their growing strength on social media (linked in article).

Besides being crowned music’s hereditary princes by Korea’s "President of Culture” Seo Taiji, some other prominent supporters of BTS include Korean music critics, philosophers, Jungian psychologists, Brazilian authors, American painters.

That BTS happen to have a small, intimate team to aid them in the production endeavour which does not make their work any less authentic, and it differs fundamentally from other K-pop companies.

K-pop, which has swelled in the past five years from a niche genre to a $5 billion global industry. “Somebody always has to be the one to walk down that path and cut through the jungle and make some noise, and I think that group [was] BTS,” says Phil Becker, vice president for content at Alpha Media, which owns 68 U.S. radio stations.

America and the UK have been the powerhouses of popular music — only three of the 30 highest selling artists of all time have come from elsewhere. It means that the dominance, in terms of both cultural influence and commercial prowess, has been held firmly within the grip of the West. In 2019, BTS came second on the worldwide list of best-selling artists across physical, digital and streaming platforms, beaten only by the all-conquering Drake. BTS have almost single-handedly pulled things back towards the East.

2 notes

·

View notes

Text

Darkest Before Dawn

ADarkest Before Dawn

If the Delta virus weren’t enough, the global economy must deal with multiple shortages and supply line issues, penalizing production and causing higher inflation. Demand is not an issue, which is very good news, because as these problems abate, production will ramp up rapidly to meet pent-up demand and rebuild inventories that are at record lows.

Employers have to offer higher wages and increased benefits to attract employees. Job openings are at a record 10.9 million while the total unemployed is less than 8.4 million. While many are worried about labor inflation since it is approximately 65% of the cost of goods, we agree with Microsoft CEO Satya Nadella, who said on Thursday that innovation in digital technology would help alleviate some of the inflationary pressures by making work far more productive. The market is in a tug of war between the economy slowing due to the pandemic, shortages, supply line issues, and reopening, which we expect over the next few months as the number of cases appears to be peaking here and abroad, too.

The real question for investors is how quickly shortages and supply lines issues will begin to ease. We do not see much improvement until mid-2022, which means that monetary and fiscal policies will have to remain overly stimulative during this transition period which will backstop the financial markets. Remember that liquidity creation greater than economic needs finds its way into risk assets which is what we see ahead until the market transitions to accelerating global growth as the pandemic comes under control, shortages ease and supply line issues abate.

A successful investor must be willing to look over the valley when it is darkest before the dawn, where real opportunities exist for the patient investor ready to go against the grain. We know that it is not easy, but it has worked for us over our 50+ year career. We are maintaining a barbell approach, owning companies that will thrive during this challenging period, mostly technology companies, and adding to those that will benefit as we make progress to the other side, such as industrials, capital goods, and commodity companies. All our investments are best in class, generating substantial free cash flows, and are selling well beneath their intrinsic value.

We appear to be getting our arms around the Delta variant as the number of cases over the last 14 days has declined by 2% to 148,562 in the United States and fell by 11% to 586,852 globally. Unfortunately, deaths, a lagging indicator, have increased here but have declined globally by 9%. More than 5.63 billion doses have been administered globally across 184 countries at a rate of 35.7 million doses per day. In the U.S., 378 million doses have been given so far at an average rate of a reduced 786,492 per day. It will take five months to vaccinate 75% of the global population, which should be enough for herd immunity. We expect the CDC and FDA to approve booster shots shortly, and Pfizer/Moderna/J&J will have enough doses of vaccines available to handle all here and abroad. Moderna and we believe Pfizer, too, are working on a two-in-one vaccine for covid and the flu. Don’t forget that the flu is very dangerous, killing on average 38,000 Americans per year. The bottom line is that it appears that the coronavirus is peaking, and we can look forward to better days ahead. We are also confident that new vaccines would be readily available if new variants popped up. It is essential that our government support research spending and domestic supply in our drug industry. Any moves to the contrary are against our national interests.

The Fed is on the horns of a dilemma as the economy has slowed in recent weeks, as evidenced by high-frequency data, a decline in eating out, travel, and tourism. Many sectors are also being restrained by continued supply chain disruptions and labor shortages. Businesses are feeling more substantial inflation and paying higher wages, too. This was all reported in the recent Beige Book. While the Fed appears split on the timing of when to begin tapering, it seems that the date has been pushed out to year-end or the beginning of next year. All of this depends on the speed of opening, returning to school, the impact of fewer unemployment benefits, and getting vaccinated. Remember that the Fed would rather be a day late than a day too early as they want a strong economy. The Fed will also wait to see what Congress ultimately does on its traditional and social infrastructure bills plus the debt limit. The bottom line is that we expect the Fed to remain overly accommodative for the foreseeable future, which will support financial assets. We still do not see a rate hike until sometime in 2023.

In September, Congress has a lot on its plate dealing with the traditional infrastructure bill, the social one, and the deficit. The Republicans clearly will be obstructionists on all counts, so that the key will be the moderate Democrats in both chambers. Biden needs a victory as his polls continue to fall. While the extremists in both parties are making the most noise, odds favor passage of the traditional infrastructure bill as written and a watered-down, much smaller social spending bill without the onerous tax hikes earlier proposed. We continue to believe that the Dems are likely to lose control of the House next year, creating gridlock in DC for the rest of Biden’s term in office.

While not much economic data was not reported last week, the U.S economy has slowed rather significantly over the past few weeks. While covid appears to be peaking, the real issues facing the economy moving forward are shortages and supply line problems. There is nothing that monetary and fiscal policy can do to alter these problems short term. It just takes time but rest assured that everyone is moving forward to rectify these problems.

Hurricane Ida has not helped the situation, as many plants are still shut down and won’t reopen until power is fully restored for them and their suppliers. Damage exceeds $95 billion. While all this will penalize growth in the third and fourth quarters, it is only deferred growth-boosting demand for 2022. We have raised our economic forecasts for 2022 as production accelerates to fill pent-up demand and restore inventory levels to normalized levels. Liquidity numbers remain off the charts. In addition, we expect the infrastructure bill to begin to kick in late in 2022, moving into 2023. This will be a long cycle as the U.S has underbuilt for the last ten years creating unique investment opportunities in EV, going green, 5G, digital technology, and capital goods. Industrial commodity prices will increase next year as demand increases without the proportional increase in supply.

Growth overseas has been a mixed bag starting to improve in the Eurozone and India but not yet in China. The ECB, at its meeting this past week, revised up its 2021 economic forecast to 5.0% from 4.5%, raising its inflation forecast to 1.5%, which appears low. The ECB did not alter its policy, although it alluded to reducing its bond purchases to a “moderately lower pace.” It stressed, however, that its approach will remain highly accommodative. While China’s growth has slowed over the last month, its August trade surplus increased on an unexpected surge in exports, up nearly 26% from last year, to the U.S. and the Eurozone. Iron ore imports hit a record last month, arguing against reducing their domestic inventories of industrial commodities, including oil. We continue to believe that the Bank of China will make additional accommodative moves to assist its economy as it recovers from the pandemic.

Investment Conclusions

The world is beginning to get its arms around the surge in Delta coronavirus cases. While it is not there yet, there is light at the end of the tunnel, as seen by the global reduction of cases/deaths over the last 14 days. We remain confident that enough doses will be available to vaccinate all, including booster shots, over the next twelve months. The real problem that the global economy is facing is shortages and supply line issues. Unfortunately, it will take time for these problems to diminish, and there is little that monetary and fiscal policy can do to change this but provide additional support during this period. There is no demand problem whatsoever and we will come out of this with substantial pent-up demand needing to be filled with incredibly low inventory levels that need to be rebuilt.

A successful investor must be willing to stay disciplined in the darkness just before the dawn. Patience is a necessity as is controlling risk. We are confident that our portfolios, which are a blend of companies that can thrive during this environment and those that will benefit from growth and margin expansion on the other sideas supply line issues abate will outperform.

0 notes

Text

Make Your Money Work For You.

Getting on top of your personal finances can be tricky. For millennials, it’s a trickier proposition still, because this generation faces a unique set of economic and financial challenges.

But if your financial situation poses a problem, avoiding that problem will only make it worse. It’s time to rip off the band-aid, bank-account-wise. The sooner you learn to budget, start to save, and educate yourself about investment options, the sooner you’ll achieve financial success.

Being debt-free and financially autonomous has a positive knock-on effect that you’ll notice in every aspect of your life. Taking control of your finances means being able to pursue your passions, hone your confidence, and broaden your career options – it might just be the ultimate form of millennial self-care.

Millennials need to adapt to a changed economic landscape.

Millennials are a generation often stereotyped: They’re addicted to Instagram! They love queuing for cronuts! Such stereotypes, though, are far too narrow to accurately apply to all millennials. After all, this generation of people, born between the late 1970s and the mid 1990s, is the largest and most diverse generation in history. Unfortunately, there is one thing most millennials do have in common, especially in the US. They face unique challenges on the road to achieving financial success.

Previous generations since the 1950s have enjoyed relative economic stability throughout most of their working lives. As a result, they trod a fairly uncomplicated path to financial success. Let’s call this path the success sequence. It starts with acquiring a steady, life-long job, followed by purchasing property, acquiring assets, and finally, retiring with a healthy nest egg.

In the wake of the 2008 global recession, however, the economic landscape changed. The job market became volatile right at the moment many millennials were trying to enter the workforce. A steady job, the first step in the conventional success sequence, became hard to find.

Post-recession, many millennials are still scraping by: The cost of living continues to rise, whilst at the same time, wage growth is sluggish with salaries unable to keep pace with inflation. Housing prices are through the roof, which means millennials struggle to get onto the property ladder. And, finally, when it comes to securing a decent retirement, 72 percent of millennials have less than $10,000 saved for this purpose.

It’s clear that millennials face obstacles to achieving financial security. Worryingly still, many millennials currently lack the knowledge and confidence necessary to overcome these obstacles. A 2014 study by The George Washington School of Business surveyed over 5,500 millennial Americans between the ages of twenty-three and thirty-five. It found that 76 percent were financially illiterate, meaning they were unfamiliar with even the basic concepts of personal finance.

No wonder then that, according to a 2015 Gallup study, 70 percent of millennials report feeling financially stressed! The conventional success sequence that worked for previous generations is no longer applicable. This doesn’t mean, though, that millennials can’t achieve financial success on their own terms.

You’re not bad with your finances – you just lack confidence.

Forget stocks, bonds, and equity. Your greatest financial commodity is your confidence.

Financial confidence is the secret ingredient that empowers you to take control of your money and start making smart financial decisions. It’s not tied to how much you earn, either. You could be earning a lot of money but lack the financial confidence to convert your salary into monetary freedom. Conversely, you could be making a moderate wage except, with financial confidence, are able to convert your income into real, lasting wealth.

If you’re scared to look at your bank balance or you’ve put saving for retirement into the ‘impossible’ column, you’re probably lacking financial confidence. That’s understandable! Our financial systems are designed to confuse consumers and undermine their confidence.

Banks want you to pay higher fees. Lenders want you to lock into disadvantageous loans. Credit card providers want you to rack up debt. At the same time, media and advertising bombard us with messages to buy items like designer handbags or the latest smartphone, which distract us even further from the goal of financial security. It explains why so many of us slide into debt or make ill-advised impulse purchases. But here’s the good news. A patchy financial track record doesn’t mean you’re innately bad with money. It means you lack the skills and knowledge to handle your money with confidence.

One key factor inhibiting your financial confidence may be that you can't accurately envision financial success. Many of us have an inaccurate idea of what financial success actually entails. We picture wealth in terms of things: houses, cars, designer clothing, expensive meals and holidays. But this picture of financial success can seem totally unattainable. Worse, it can lead us to make poor purchasing decisions in a misguided attempt to live the ‘rich life.’

If you want to achieve true financial success, you shouldn’t work toward simply acquiring material things. Instead, you need to work toward financial autonomy. When you’re financially autonomous, you’re debt-free and not living paycheck-to-paycheck.

After you achieve financial autonomy, work towards financial freedom. This means having enough of a cushion that your finances don’t dictate what your life looks like. Imagine having the financial flexibility of taking time off work to travel, or to pursue a passion project!

If you’re ready to start working towards total financial freedom, the next step is tough but necessary: you need to become debt-free.

The main obstacle to financial freedom is debt.

Being in debt can be an isolating experience. Your peers are out there flaunting new purchases on Instagram, while you’re up at 3am wondering if you’ll ever be able to pay off your credit card bills. Rest assured, if you’re in debt, you’re not alone.

Take credit card debt, for example. In 2017, according to the Federal Reserve, US consumers put $1.021 trillion worth of purchases on credit. Additionally, roughly half of millennials report having debt spread across more than three credit cards.

The problem with credit cards is that they make it incredibly easy to live beyond your means and, unless you pay off the balance each month, this debt can snowball. That’s because every month, your bank charges you interest on purchases that aren’t paid off. Ever heard of TCP? It stands for Total Cost Price. Paying for items on credit often means their TCP works out higher than the number on their price tag. If,for example, you put a $2000 laptop on credit and didn’t pay it off for three months, factoring in the interest, the TCP on that purchase is now somewhere around $2260.

Worst of all, when you’re in debt, any money you have to spare goes into paying off that debt. When you’re debt-free, however, you can put that spare income into assets or investments, which can generate wealth.

Financial freedom and debt are simply incompatible. Whether you’re paying off your credit cards or your student loans, going debt-free should be your first financial priority. Here’s a simple way to tackle the problem.

To start, list all your debts in ascending order. It’s tempting to tackle big debts first, but strategically, it’s better to pay off the smallest ones. Researchers at Northwestern University have found that paying off smaller debts creates a sense of momentum. People who followed this approach were, in general, more likely to pay off the rest of their other debts.

You can meet your repayment targets by creating a rudimentary flash budget.This is a budget designed around one goal only – in this case, becoming debt-free. Establish your income and your expenses, and then subtract your expenses from your income. Whatever’s left over goes straight to that debt. Cutting your expenses or upping your income will accelerate your ability to pay off your debt for good. But best of all, living within a budget doesn’t mean living without indulgences.

Sticking to a budget doesn’t mean giving up life’s pleasures.

Millennials, or so the stereotype goes, would rather spend their hard-earned cash on avocado toast than into savings. If they budget right, though, millennials can have their avocado toast and save, too.

It’s all too easy to equate budgeting with cutting out purchases that, while inessential, bring passion and meaning to our lives. But, guess what? The secret to budgeting doesn’t lie in living ascetically, it’s in prioritizing purchases that bring you pleasure.

There’s a widely-used formula in Silicon Valley known as the 80/20 rule. The idea behind it goes that eighty percent of effects can be traced back to only twenty percent of causes. The best strategy, therefore, is to identify and concentrate on the small proportion of your actions that are yielding the largest proportion of results.

The 80/20 rule applies neatly to personal budgeting. Take account of your fixed expenses, like rent, debt repayments, and monthly bills. What you’re then left with are your variable expenses, or non-essential purchases. From there, identify which core groups of variable expenses bring you the most pleasure.

You can approach this task by going ‘old-school’ and printing off your account statements. Highlight all the variable expenses on the document that feed your passions and circle all the variable expenses that didn’t. You might be surprised by how many passionless purchases you make each month! These are the expenses you’re going to try and eliminate.

Meaningless expenses differ from person to person. If you’re a serious coffee-lover, don’t even think about cutting down on your morning latte. But if you drink your daily to-go coffee without even registering the taste, this might be an expense you can do without.

Once you’ve eliminated meaningless purchases from your budget, you’ll have more cash to play with each month. It’s key that this extra cash goes towards paying off debt or into growing your wealth, so make sure the surplus never hits your checking account. Instead, set up an automatic payment to either your savings account or to your credit card account. That way, while your debt dwindles or your savings grow, you’ll still get to treat yourself to the things you love.

Buy big-ticket items strategically to get the most out of your purchases.

Sick of taking the bus to work every day? Ready to stop lining your landlord’s pockets with rent checks? If you’re on the brink of making a big-ticket purchase, like buying a car or investing in property, be smart about it.

Here’s the thing about investing in a car – it can’t be done. That’s because a car isn’t technically an investment. An investment appreciates, meaning its value grows over time. A car is an expense that depreciates, or loses value year after year. According to a survey by Carfax, the typical new car depreciates by 10 per cent the minute you drive it out of the dealership.

So, if you’re in the market for a car, the smart money is on buying second-hand. Ideally, plan to pay for your car in cold hard cash. Many dealers are willing to negotiate on price if you can give them cash upfront.

Unlike a car, a house is an investment. But that doesn’t mean you should be falling over yourself to get on the property ladder.

For millennials, buying a house too early might be the worst financial investment they can make. Millennials can expect to change jobs every 3.7 years and move house up to 11 times on average. If you buy a house and then suddenly need to sell up and move, you could easily lose money.

If you’re ready to take the plunge and go in for a home, all your debts should be paid off before you buy. If you have a bad credit score, your lender is likely to set you a higher interest rate. In addition to being debt-free, you should have a 20 percent deposit ready to go.

If this financial prep sounds like a hassle, consider this: in 2018, the average American home cost $362,000. But the length and terms of the average home loan can vary wildly, according to your credit rating and the size of your initial deposit. If, for instance, you take out a 30-year loan with a fixed interest rate of 4.591 percent, totalled up, that $362,000 house will actually cost you $652,110. Compare this to the same home, paid for through a 15-year loan with a fixed interest rate of 3.645 percent. Ultimately, it will cost you $448,777 – that’s over $200,000 cheaper than the same house paid for with a less favorable loan. It goes to show that investing before you’re ready can end up costing you more.

So, remember: don’t invest early, invest optimally – that’s the secret to living the rich life.

Three easy steps to saving will set you up for life.

Thinking about how to fund your future can be stressful. But don’t get overwhelmed – take control! Meeting three simple savings objectives will get you on the right track.

Your first savings goal should be an emergency fund, with enough in it to cover any unexpected expenses that might otherwise push you into debt. As a rule of thumb, the typical millennial should aim to have about $3,000 stashed away. Make sure this money isn’t tied up in investments. It should be easily accessible in the event of an emergency. This is, after all, what it’s there for.

Next, establish a slush fund. You should have enough money in here to cover your expenses for three to six months. If you become sick or lose your job, you’ll be grateful for this cushion. While your slush fund should be in an account that’s easy to get at, don’t let that cash just sit there. Choose an account with a high APY or Annual Percentage Yield – an interest rate paid to you annually.

The final non-negotiable savings goal? Your retirement fund. If you’re a millennial, time is on your side here. Start investing in your retirement now and you’ll reap the rewards down the line. To build a healthy nest egg, though, your money needs to be earning interest. The best way to do this is to deposit it in a high-interest, dedicated retirement account.

If you’re an American millennial in an entry-level job, opening up a Roth IRA, or a Roth Individual Retirement account, is one of the smartest financial decisions you can make. As of 2018, you can deposit $5,500 in your fund annually. Best of all, the capital you invest and the interest your capital accumulates aren’t considered as part of your taxable income. That means you’re saving for your retirement and saving on tax at the same time.

It’s always a good idea to diversify your savings and investments, by splitting your savings into different accounts or funds. With that in mind, consider splitting your retirement savings between an IRA and a 401K, another tax-advantaged, dedicated retirement account. Some workplaces offer contribution matching, where every dollar you invest in your 401k is matched by your employer. Failing to take advantage of this scheme is like saying goodbye to free money!

If you’re living and working outside the United States, look for dedicated retirement accounts that offer similar tax advantages, and check to see if your employer offers matched contributions on retirement funds.

With an emergency fund, a slush fund, and a retirement fund established, your financial outlook gets a lot brighter, and you can start looking to the future with anticipation, rather than dread.

Investing might be more accessible than you think.

You work hard for your money, but does your money work hard for you? When you invest, you put your money to work. As a result, you can quickly grow your capital.

But how does investing work, exactly? Here’s the basic principle. Money has utility, or buying power. When it’s sitting in your account, untouched, you’re not accessing that potential utility. Lending your money to a third party, like a bank or a fund, allows them to use your money to turn a profit. In exchange, that third party offers you a rate of return, or a percentage of any profit they’ve made with your initial investment. There’s a catch, though. If that third party doesn’t make a profit, you won’t see a rate of return. You might even end up losing your initial investment. Nevertheless, investing wisely is the surest way to grow your finances.

When it comes to what you invest in, you have a number of options. Here are some of the most common:

Many people choose to invest by buying equity, meaning they purchase a stake of ownership in a company. This equity is issued in the form of stock, which is a small fraction of a company. When you own a fraction of a company, you receive a fraction of any profits the company makes. As an individual investor you can buy stocks through public stock exchanges, like the NYSE, NASDAQ, or LSE.

As an alternative to investing in stock, you can invest in bonds. Here, you’re still dealing with a company, but rather than purchasing a stake in it, you’re lending the company money. A bond functions like an IOU. For example, if the company needs to raise capital to make a large acquisition, it releases a number of bonds. After an agreed amount of time has passed, the company returns your money with interest.

If investing in stocks and bonds yourself doesn’t sound appealing, try investing in a mutual fund. Mutual funds are collectively financed by investors who decide to buy into them. Their pooled contributions are then invested by a fund manager. Having a professional manage your investments eliminates the need for guesswork and is a great option for those who don’t feel confident playing the stock market themselves.

Streamline savings and invest efficiently by embracing technology.

Now that you’ve given your finances a makeover by paying off your debt, streamlining your savings, and started investing, it’s time for the finishing touch: setting your accounts and investments to autopilot.

To begin, find your financial flow. Every month, as your salary comes into your checking account, it’s up to you to divert that stream of money so that it flows to meet your financial goals. Establish how much of your monthly income you want to put towards paying off debt, bulking up savings, and growing investments. If you’re tackling a student loan, set aside 15 percent of your monthly income for making loan repayments. To do that, set up an automated payment for that amount which will go from your checking account to your student loan account every month. Do the same for savings and investments. With your financial flow established, you don’t have to think about how to allocate your finances each month.

Another useful tip is to try and consolidate your accounts as far as possible. Open your checking account, your emergency fund account, and any other savings accounts through the same bank and try to use the same brokerage firm for your retirement accounts and investments. That way you’ll save on transfer and withdrawal fees.

Tech-savvy millennials are also uniquely placed to capitalize on automated investment services. In the past, investors have managed their portfolios by turning to financial advisors. But a qualified advisor can be expensive to hire and many won’t take on clients whose portfolios fall below a certain value. As a result, entry-level investors have been shut out from accessing this level of support.

Some players in the financial services sector, however, have started to embrace automation. This means that formerly intricate and labor-intensive processes can now be performed with ease by automated robo-advisors. The new breed of online investment services can offer high-level services such as rebalancing, whereby an investment portfolio is continually reshuffled so it never takes on too much risk. Previously, these kinds of services were only offered by financial advisors to clients who could make a hefty initial investment. Betterment, Wealthfront, and Personal Capital are all web-based investment services that offer robo-advising for personal investors.

As an added bonus, these online services are far less costly. Conventionally, financial advisors charge a fee that comes to between one and two per cent of AUM or Assets Under Management. That means, if you hire an advisor to manage an investment of $100,000, you’re on the hook for $1,000 to $2,000 in annual fees. By contrast, automated investment services charge an average of 0.5 percent.

So, consider downloading a portfolio management app, where you can check your investments between scrolling Instagram stories. Now you’re making money, millennial-style!

Many millennials feel overwhelmed by the economic challenges they face, and are often ill-equipped to get their finances together. But this doesn’t need to be the case! Simple steps like learning to budget with passion, structuring your savings account, and taking the plunge and investing in homes, stocks or bonds, can set the typical millennial on the road to financial success. If millennials can cultivate the confidence to establish sound financial habits, they’ll soon start to reap the rewards.

Action plan: Get (financially) naked.

Thinking of getting married? Then, you and your partner need to bare all, financially speaking. Financial stress is cited as one of the leading factors in divorces. That’s why your “happily ever after” begins with laying numbers on the table. Sit down with your partner and compare your respective debts, savings, and credit scores. Awkward as it may seem, having a frank conversation about your financial status, spending habits, and savings goals will set you up for a healthy financial partnership with your future spouse.

0 notes

Text

20 Innovative Tactics to Sustain in Food & Beverage Industry – COVID-19

To sustain in food & beverage industry or any other industry isn’t less than a challenge in the prevailing pandemic situation. The world in totality is battling to endure. Food & beverage industry is one of those rarest Industries that have shown some hopes for growth & affluence. It incorporates fast food cafes, catering businesses, quick-service restaurants, pubs, hotels, cloud kitchens, full-service restaurants, food transportation services, etc. Some of them kept operating well in the course of the lockdown also.

However, some are facing problems in formulating tactics to sustain in the food & beverage industry. It’s high time to be vocal about it and show persistence to these unfavorable and unforeseen contingencies in association with DNY Hospitality, To sustain in food & beverage industry

Challenges to sustain in Food & Beverage Industry

The major challenges to sustain in food & beverage industry to endure and find out the ways to make your restaurant sustainable are due to multi-faceted rationales. Comprehending the impediments to sustain in food & beverage Industry is the most prolific tactic because knowing the target to hit it accurately is indispensable. Here are the challenges making us ask: ‘How restaurants can survive right now?’

1. COVID 19 Phase for Restaurants

The major challenges in Food & Beverage Industry that you are confronting to increase your restaurant sales and to sustain in food & beverage industry are owing to Novel Coronavirus 2019. The lockdown and social distancing have resulted in no gatherings of the masses. It has severely affected all the industries of the world in terms of execution of operations and generation of revenue.

2. Low Salaries of Restaurant Staff

COVID-19 has created very dissatisfactory consequences on all the industries and some of the industries are painfully hit by it. Everybody has understood the importance of savings together with The Corporate. They are in the agony of losses and can’t pay full remuneration to their employees. Individuals also have a propensity to reflect an identical manner to save money for the near future. Therefore, the disposable income that people splurge on weekend sprees and online food ordering from restaurants and hotels isn’t adequate in the present state of affairs. This is one of the major stumbling blocks to sustain in food & beverage industry.

3. Layoffs in Restaurant Industry

Many people have lost their jobs, especially those who were in small-scale companies or outlets because they could not put up with the financial fatalities through the lockdown. Many small outlets have got vacant once again in view of less or no footfalls of clientele. They are under pressure to get new jobs with compromised salary packages making it intricate to sustain in food & beverage industry. It is difficult to order food online to take delight, as anyone would prefer to save money under such dark times.

4. Restricted Movement

The world was on lockdown for almost 2 to 3 months with mere essentials in the process of transport. The restricted movement due to the pandemic outbreak has also made it arduous to sustain in food & beverage industry. Restaurants commenced delivering food online subsequent to a long time of unlocking in an assortment of countries. Food & beverage industry got the liberty to operate quite later with manifold restrictions. The restricted movement has affected the arrangement of ingredients to serve fresh food also. This has compelled the restaurants unable to serve their expert food items with demanded taste on account of the dearth of some ingredients.

20 Tactics to Sustain in the Food & Beverage Industry

Problems are an element of life and this time the world is together to conquer the current situation. Besides, no problem takes birth without a solution. There are numerous ways and tactics to sustain in food & beverage industry. ‘How restaurants survive right now?’ is a burning question of the year and almost certainly the impact of the current year’s circumstances may last long for the whole decade.

As a ray of hope, it’s important to remember that the food & beverage industry is worth multi-billion dollars with escalating scope. Here are all the tactics for you to increase your restaurant sales and triumph over the challenges in food & beverage industry.

1. Serve What’s in Demand

The very first tactic to sustain in food & beverage industry is to optimize your menu and cater to what’s in demand in present age. Strive to launch novel food items and adhere to all the guidelines laid by the government to serve food innocuously to increase your restaurant sales. Try some inventive methods of amalgamating cuisines for by means of spices of different cuisines or preparing High-Tea. Try to bond with your customers by social media marketing and ask for their demands to serve them better to sustain in food & beverage industry

2. Carbon-Free Dining

Carbon-free dining is an ultramodern and happening term in the food & beverage industry. Restaurants are progressively taking the certification for Carbon-free dining to sustain in food & beverage industry. This has an undeviating impact on branding and generation of reverence in the minds of people and besides your diners. It is an initiative in favor of the environment by the Green Earth appeal according to which the diners and the restaurants must plant fruit trees as an attempt to save the environment.

It has proven itself to be one of the most successful ways to make your restaurant sustainable. It is perfect to call this certification program a ‘hotcake’ because it volunteers to your potential to sustain in food & beverage industry in a straight line.

3. Develop Rapport; Then Upsell

Upselling means convincing a customer to buy more that he might not have intended or are more expensive. Upselling at restaurants to increase your restaurant sales is not very uncomplicated. There-fore it’s imperative to develop a rapport with the visitors first to sustain in food & beverage industry. Building rapport entails emotional attachment which results in mounting customer lifetime value (CLV) and conviction in the restaurant staff. Sooner or later, the staff members upsell to the diners with a smiling demeanor and soft-spoken approach.

4. Reduce Costs

A restaurant has miscellaneous costs. For instance, operational costs, rent, salaries, raw material costs, maintenance charges, packaging costs, point of sale system costs, kitchen equipment costs, etc. Decrease some of them like operational costs, maintenance charges and electricity bills due to everyday visitors, salaries & wages to sustain in food & beverage industry. Cost reduction is directly proportional to revenue and profits giving you a cushion to prevail in this pandemic period.

5. Convert to

Cloud Kitchen

Cloud kitchen is a remote or ghost kitchen that serves food to the individuals without offering dine-in space. This is not less than a blessing at this point in time to sustain in food & beverage industry. It automatically reduces various costs like rent, operational costs, electricity charges, salaries and many others. You may be innovative in re-launching your restaurant as a multi-brand cloud kitchen by redesigning the menu. In addition, co-working cloud kitchens are outperforming because it reduces the costs to half or one-third depending on the number of rental partners. Your concerns related to your restaurants’ assets are valid. No worries about them to. You may sell them for their best prices from the restaurant store.

6. Lower the Prices

Lowering prices is one of the most competitive and oldest keys to success in every industry. It has always and it will always grant desired results to sustain in food & beverage industry. Low salaries, layoffs, restricted movement and many other challenges make grounds for cutback the prices. Some of you might think that it reduces the proceeds but it’s vital to transform the outlook and comprehend that the tactic is helping to survive because if you won’t you may not acquire any revenue.

7. Avail Discounts and Offers – Restaurant Marketing

Discounts and offers are an unbreakable part of food & beverage industry on occasions. Offers also serve as a successful tool for market penetration and beating the competition. This is the perfect instance to avail them to sustain in food & beverage industry. It is one of the best ways to persuade people to order food or visit your restaurant. Such a tactic will also lay the foundation for creating an impression on the clientele that they would get valuable offers and become contented during happy occasions.

You will also gain the edge of branding to make the masses in high spirits not only during happy occasions but also during tough times. Don’t forget to market the discounts & offers to let your target market know about them. It is better if you plan it first and then launch it under some creative names. For instance, you may call discounts on Christmas to be Christmas specials with captivating creative designs. It would have a spectacular impact on your attempt to sustain in food & beverage industry.

8. Introduce Happy Hours in your Restaurant

The term ‘Happy Hours’ is common with liquor on hard drinks. It is an excellent idea if you launch Happy Hours in restaurants for your highly-demanded products. For instance, McDonald’s may launch ‘Happy Hours’ for ice creams, shakes, burgers, etc; depending on the demand. It is a great example of an innovation to sustain in food & beverage industry. Your restaurant will gain an instant recognition with the tactic.

9. Pioneer Buffet Using Cart Service

Pioneering and innovation go hand in hand. Buffet service and cart service are poles apart. How about it making a combination of them and creating a tactic to make your guest feel special! When you get people for buffet, allow them to serve themselves initially and then introduce cart service as the part of the buffet all of a sudden as a gesture of care to them. It would give better results if you do not market it officially but if your customers would broadcast it with mouth publicity.

It is equivalent to showering respect to your guests at home. It will be unbelievably helpful to sustain in food & beverage industry. When your staff will begin walking between the tables with the cart asking your guests about their needs it would it give your guests surprise, comfort and peace of mind while consuming their meals, nothing in the world can be more gratifying than this!

10. Get Online to Sustain in Food & Beverage Industry

The food & beverage industry counts on taste and quality. Millions of restaurants haven’t registered their presence online and are still victorious in building an incredible brand image. Some restaurants also serve only one dish and they specialize in it to the extent that people visit them from far-flung areas passionately and they have been serving the industry for generations. However, in the existing situation-demands get online and let your customers discern that you are all set to endow them with your scrumptious eatables at their doorsteps. It is also essential to be updated with changing times.

11. Revise your Restaurant Menu

Your menu engineering skills must be outstanding for sure. However, it is necessary to amend your menu if you are dealing with issues to increase your restaurant sales. To sustain in food & beverage industry look at your menu with a modified outlook and make crucial changes in the presentation like innovative names or offering combo meals; if you are not ready for changing food items. Although, we have already discussed serving what’s on-demand on priority in the article above.

12. Extend Restaurant Services & Open seating

To lucratively sustain in food & beverage industry you must elaborate your restaurant services. You may opt for a quick-service restaurant (QSR) or full-service restaurant (FSR) alongside a cloud kitchen at the same premises. Numerous big hotels also have special dine-in areas and a cafeteria for serving snacks as an example of the tactic of elaborating restaurant services. Similarly, they encompass a retail outlet serving bakery items under their brand logo.

This would augment your points of sale to boost revenue and you can better sustain in food & beverage industry. Adopting open seating will encourage the safety against the spread of virus in AC rooms and closed dine-in.

13. Offer Complementary Food Items

Giving discounts, offers and complementary items in any industry is a trend to handle financial concerns and to revive growth. You may offer some complementary food items along with main offerings like cupcakes with tea or coffee or garlic bread with pizzas as a complementary food item and not in a combo. It may have a slight effect on revenue generation negatively but to sustain in food & beverage industry in the long run, it will be beneficial for sure. Your regular diners would bear in mind about your complementary offers when we all will have overcome this recession-oriented situation.

14. Begin a Customer Loyalty Program

You must have come across ‘customer loyalty programs’ in supermarkets. We present these loyalty programs as an innovative tactic in restaurants also. You may do it by furnishing some exceptional benefits to the customary visitors. For instance, they would get a heavy discount on their 3 or 4 visits in a month. It would persuade your customers to visit again and again. It is also a long-term investment with short results to sustain in food & beverage industry.

15. Organize Events to Sustain in Food & Beverage Industry

You must welcome event organizers at your quick-service or full-service restaurants. There are different kinds of events these days except for the conventional stage performances. You may host a small event without much crowd by a YouTuber which he would post on his channel. Ask him to post it with the hashtag before your restaurant’s name. Hashtag marketing is one of the latest tactics to sustain in food & beverage industry and to get immediate access. We are aware of the popularity of hashtags and YouTubers these days.

You may also cater to the traditional stage performances related to dancing, singing and stand-up comedy. Stand-up comedy by fresh faces is also making people laugh and is adequate for you to sustain in food & beverage industry by creating a long-lasting ebullient impression.

16. Incentives to Employees

We have already discussed upselling previously in the article. To encourage the frontend staff to sell more to the customers, offer them incentives. Give them some proportion of the sold food items or set a target for incentives’ generation for unleashing their enthusiasm to work. Your employees will act in response in your favor because they also need to sustain in food & beverage industry.

17. Tie-ups with Other Food Brands & Franchise

Establishing tie-ups with other brands can consolidate both the brands in the times of need and you both will be able to sustain in food & beverage industry together and better. It is likely to be with diverse arrangements and understandings. For instance, catering business entities may establish tie-ups with cloud kitchens for different food items that are usually not in demand in the conventional menu of catering like sauces. You may also add cloud kitchen franchise in your existing business with cloud brands by DNY kitchens.They invest in the major ingredients that people would consume at the event, like vegetables, bread, etc. Since a catering business would not be able to hold bottles of sauces because their demand is only in events and there is a risk of their getting spoiled if not consumed before the expiry date. After the tie-up with a cloud kitchen, it would make use of the sauces during its operations. A catering business usually invests in crockery, cutlery and furniture that is safe to store. The cloud kitchen may negotiate on rates for taking the sauces’ bottles. This way both can sustain in Food & Beverage Industry.

18. Special Treatment to Guests

Guests are always important to the host according to the cultures of most of the countries. Combining the cultural significance of guests and the practical approach of treating customers giving extraordinary treatment to the visitors is mandatory to sustain in food & beverage industry. Achieving restaurant sustainability is the easiest by making your guests or customers feel special on their visits to your restaurants. Offer them discount coupons if they exceed a particular amount of order.

Avail some complementary food items unexpectedly. Keep some surprises without marketing them like shopping vouchers or welcome drinks or desserts. All these tactics will make your guests feel special and they will definitely come back soon to help you sustain in food & beverage industry.

19. Launch Combo Offers

You might have come to know about combo offers by highly renowned international brands in your country but it has in the reach of small and local brands also. If you have not yet launched combos at your restaurant for cloud kitchens, it’s time to do it to sustain in food & beverage industry. Always remember to broadcast it as much as you can with digital marketing services that we will read about in the next tactic below.

20. Start Digital Marketing for Your Restaurant

Digital marketing is in practice in every business from this year because we all have learned online ordering, online making payments and online interaction. During the lockdown, it became the major means of communication and arrangement of essentials. You may utilize this as an opportunity to sustain in food & beverage industry to approach your target market. The digital world has brought people closer to each other. Food & beverage industry is at a unique advantage because it can design creative and colorful posts with tempting pictures of food items on social media handles.

The Pandemic Outbreak has also made everyone get access to online news channels, YouTube, Instagram, Pinterest, Twitter, and others for staying updated or getting entertainment. It has given a boost to digital marketing tactics availing a million-dollar opportunity to sustain in food & beverage industry. People are very close to their phones, influence them through SMS, messages, emails, social media, food delivery applications, etc. The correct approach of SEO and content marketing with regular posting can get you to the topmost ranks by Google or other search engines. Use Google Analytics to review the ups and downs of business performance. Have a look at the major tools of digital marketing as one of the ways to make your restaurant sustainable.

Food Delivery Apps

Social Media Marketing

Email Marketing

SMS Marketing

SEO

Content

WWW

Analytics

Conclusion

The answer to the question of ‘how restaurants can survive right now?’ is not very complicated. Persistence must be in determination to get over the challenges in food & beverage industry and not in the challenges. Keep up the hard work; take consultation from an experienced consultant like DNY Hospitality who can get you through this tough time. It is only a matter of a couple of months. If you sustain in food & beverage industry, you will be able to increase your restaurant sales astonishingly.

Not because many other restaurants have given up and there will be a boost in demand for online ordering but because of these 20 tactics for cloud kitchens and QSR both. Maintaining a little more patience will take you to new heights as soon as normalcy will retain. Good luck!

0 notes

Link

I think this article makes a bit too much of specific circumstances just after the trough of the worst recession since 1937. It references a mainstream economist worried about jobs, which was reasonable in 2010, but now the job market has more or less fully recovered.

Unemployment in May was down to just 4.3%, which outside of a brief period in 1999 and 2000 was the lowest on record since the 1960s. The number of unfilled positions has risen to record highs, nearly 6 million, higher than it was in December 2000 at the tail end of the tech boom. Wages are rising, and incomes for married couple households with two incomes have never been higher - if you and your working spouse earned $100,000 in 2015, then you were in the poorer half your demographic’s income distribution.

I understand that training people for new lines of work isn’t simple easy for them, but I think in a modern, developed economy that is probably unavoidable. Note that the author argues against free trade not only between other nations, but even within the United States itself. He’s right, but that’s not exactly a costless proposition. Free trade does provide increased competition, but it also reduces various input costs. It does not seem probably that economic activity would be higher with reduced trade opportunities.

In Capitalism, the availability of jobs is controlled by the whim of monopolies and large employers. History has clearly shown these companies will readily close down factories and offices in one area to open new ones where they can get cheaper labor.

This isn’t accurate. The vast majority of American jobs are created by small businesses, not large ones, the availability of jobs is driven by the business cycle.

The ability for a single employer to devastate a large region gives that employer the ability to control its economic life, and even its government.

Outside of small towns, this doesn’t appear to be true. It simply isn’t the case that a single large employer could devastate Texas or New York or even a moderately large city like Milwaukee. I agree it can be a problem for small rural towns a long way away from major cities, but is the solution really to prohibit free trade and business between individual cities?

The value of our currency is controlled by banks that charge usurious interest rates while creating special financial packages to enrich each other.

Usury is not related to the rate of interest (which may or may not be unjust) but the type of loan. A mutuum loan cannot licitly charge *any* interest (i.e. where the recourse for being paid back falls on the borrower alone). A commercial loan and a non-recourse mortgage are not properly understood as usury, whereas student loans and credit cards are, because the former are backed by a specific asset (those of the business or the home) whereas the others are backed by personal pledge alone.

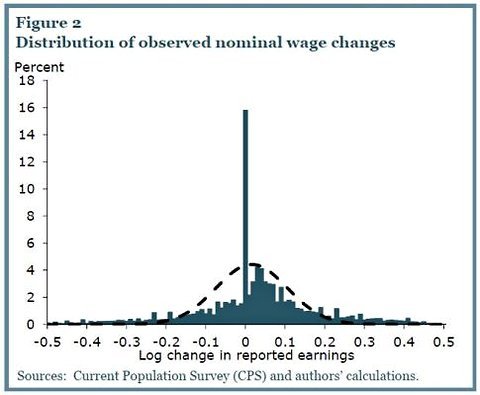

Banks do control the value of currency, with the Fed setting the overall pace, but the value of currency has been relatively stable. Inflation has been low and positive for many years now, and some positive inflation might help with wage adjustment through money illusion (i.e. with 2% inflation, you can hold wages flat for 3 years and reduce your wage bill by 6% and avoid layoffs, since workers hate nominal wage cuts, 0% inflation might lead the employer to fire some employees rather than cut wages - see chart below which shows huge proportion of wage changes at exactly 0%).

Many people are forced to invest their retirement funds in that great gambling institution called the stock exchange.

People are not forced to do this, but rather choose to do so because returns in equities are highest. Would distributists make investing in stocks illegal? What investment would they choose to replace equities for retirement saving? Moreover, buying stocks is not gambling, but rather investing, taking ownership shares in businesses and receiving a share of the future profits through dividends and capital appreciation. Sure, stock prices go up and down (and are uncomfortably high right now), but if you invest over 40 years it’s difficult not to make a nice return as you buy in at both low and high periods.

Considering the recent great failures of our banks and markets, is it any wonder that even the large businesses are hoarding their assets?

This is an illusion that was admittedly a prominent concern back in 2010, the notion that big businesses were hoarding cash. All assets must be held/hoarded by someone. If large businesses put that capital to work, they would have to sell those assets to other entities, and those other entities would now be accused of hoarding assets. The growth in hoarded assets largely reflects an increase in government and corporate debt, which when purchased by businesses show up as assets. More here for a description of this phenomenon in detail.

That great boondoggle mislabeled as a “stimulus package” poured billions of borrowed dollars into the very banks that led us into our current crisis, leaving not only us, but our children and future generations of tax payers to cover the bill.

The stimulus package, ARRA, was separate from TARP, or the bank bailouts. The bank bailouts were actually capital investments by the federal government that, combined with the other bailouts (e.g. AIG and auto manufacturers), have reduced the government’s debt by nearly $100 billion as of 2017, as the government made a profit on its investments.

ARRA may have been unwise or unnecessary, and perhaps there are other costs of TARP (e.g. there might be an increase in moral hazard, the idea that banks might behave in a more risky manner if they expect a bailout), but future taxpayers were better off from TARP.

Imagine instead being economically independent. What if you owned your job, either independently or cooperatively, instead of a huge company?

People can always start their own businesses, or if they work for a public corporation they can buy stock (though I wouldn’t recommend it). Isn’t that a lot of risk to bear if your independent business fails? Wouldn’t it not only mean the loss of income, but also most of your assets as well?

Are we abolishing large corporations? What about people who don’t mind working for them, and who wouldn’t want their assets tied up in a business that might fail?

What if the goods and services you need for your daily life were produced locally by people who also owned their own jobs.

It depends. Diversification reduces risk. What if the local economy crashes? Can I move? Is free trade prohibited, or are there exceptions if the producers of what I need are no longer operating? One of the biggest problems of the Great Depression was that banks weren’t allowed to have branches throughout much of the country, so that it only took a few business failures to destroy a town’s banking system.

Imagine if the government was required to provide a stable currency.

I’m not convinced that 0% inflation is better than 1.5%-2.0%. This article merely asserts it as if it were a good thing rather than defends the claim.

Imagine if there were still dozens of car manufacturers across the country who worked together on innovating new technologies, instead of the “Big Three” who bought out their competition.

Is technological progress in the auto sector too slow? I’m actually quite amazed at the pace of progress in that sector. For example, a 2016 BMW 340i 6 speed sedan is about the same size as the 1998 BMW 540i sedan, it is more comfortable, has better technology, better sound system, is faster, gets better fuel economy, handles better, brakes sooner, is probably more reliable, and the 340i base price of $46,795 actually costs less than the 540i which was $55,678 - not adjusted for inflation either. It actually just costs less.

What about economies of scale? The R&D, for example, of dozens of small car manufacturers would have to be spread across a far lower number of cars, and what about free trade? What if the best cars are in New Hampshire? Can I buy them if I live in Texas, or do I have to make do with relatively mediocre Texas vehicles?

The overall national economy would be more stable because each local economy would be stable. The failure of one company would not have the ability to devastate an entire region. The common man would be economically free because he would own the means of producing his livelihood. This is what Distributism aims to achieve.

I see a lot of assertion and not a lot of demonstration. This is my problem with full-throated distributism. There’s a lot that needs to be fleshed out, and often times I see claims I feel have limited support, or for that matter are simply false (like the bank bailouts being a net cost to taxpayers). It really needs an Adam Smith or Karl Marx type character to come along and address these things.

My preference at this time is still to improve things at the margins for capitalism (especially with respect to debt and usury, cracking down on slave labor in foreign countries, etc.)

14 notes

·

View notes

Text

Payroll Outsourcing Services

Payroll process outsourcing is becoming a popular trend among entrepreneurs. Organizations, whether big or small want to manage their payroll functions efficiently and in order to do so they take help of professionals from external sources. Best Payroll Services Provider in UK

Third party service providers offer a comprehensive suite of services to meet the specific workforce management needs of an organization. Timely delivery of salary keeps employees happy and helps entrepreneurs to concentrate on other tasks such as the growth of various departments and so on. It relieves an organization from the hassles of in-house processing of salaries, calculation of employee benefits and reimbursements.

Whether you own a small business or a multinational corporation, your payroll services costs should be managed and budgeted just the same as any other cost to your business. This is particularly true of a small business where these costs represent a significantly higher proportion of income than for larger businesses.

Even though you may employ very few people, the software system you use to manage your payroll does not cost you significantly less than that for a company of hundreds or even thousands of employees. Your wages bill will be less, certainly, but the payroll software and services will likely be similar priced - and therefore a higher proportion of a small business's gross profit. Outsource payroll services company

The time will come when you have a difficult decision to make: whether to continue managing your payroll yourself or to outsource it. If you believe that you are spending too much time and money managing the paying of your employees and not enough actually managing them, then it is time you did something about it - and cost might not be your only problem!

Your business can sink fast if you mess up your employees' payroll. Nobody likes getting paid late because you were busy making sure this week's shipment got off in time. Do you ever feel you just cannot spare the time to run a payroll program, but know that you must if your employees' wages are going to be banked for them today? What about deductions and insurances and all the other financial aspects involved when your employees' weekly or monthly wage bills are being calculated?

It can all get a bit much, and if yours is a small business that employs a bookkeeper or accountant just to look after your taxes then you are likely trying to do it all yourself. It might be time to stop and consider outsourcing. You could employ a permanent wages clerk, but that's a bit over the top if you are only employing a few people. On average, the cost of outsourcing payroll services is about 50% of looking after it yourself.

View More:- UK based payroll Outsourcing services

0 notes

Text