#registered agent services llc

Explore tagged Tumblr posts

Text

LLC Radar

At LLC Radar, our purpose is to empower everyday Americans on their entrepreneurial journey by providing comprehensive guidance through the initial stages of business formation and setup. With a focus on the leading LLC formation services and registered agents across the United States, we strive to simplify the complexities of starting a business and help our users make informed decisions.

Our commitment to excellence drives us to meticulously evaluate business formation services each year, ensuring that only the best options are recommended to our audience. We pride ourselves on maintaining impartiality in our reviews, offering transparent assessments that enable you to find exactly what you need for your business endeavors.

LLC Radar is your trusted source for reliable product advice, underpinned by our unwavering dedication to editorial integrity. Every endorsement of an LLC service or registered agent undergoes rigorous research, testing, and consensus among our editorial team, ensuring that our recommendations are based on thorough analysis and genuine merit.

Contact Info:

1100 Meredith Lane Plano, Texas 75093

972-776-4050

https://www.inc.com/profile/llc-radar

Keywords:

LLC Radar, LLC formation, business name search, limited liability company, best registered agent services, business entity name search, how to form an LLC, business entity search

#LLC Radar#LLC formation#business name search#limited liability company#best registered agent services#business entity name search#how to form an LLC#business entity search

1 note

·

View note

Text

LLC Radar

At LLC Radar, our purpose is to empower everyday Americans on their entrepreneurial journey by providing comprehensive guidance through the initial stages of business formation and setup. With a focus on the leading LLC formation services and registered agents across the United States, we strive to simplify the complexities of starting a business and help our users make informed decisions.

Our commitment to excellence drives us to meticulously evaluate business formation services each year, ensuring that only the best options are recommended to our audience. We pride ourselves on maintaining impartiality in our reviews, offering transparent assessments that enable you to find exactly what you need for your business endeavors.

LLC Radar is your trusted source for reliable product advice, underpinned by our unwavering dedication to editorial integrity. Every endorsement of an LLC service or registered agent undergoes rigorous research, testing, and consensus among our editorial team, ensuring that our recommendations are based on thorough analysis and genuine merit.

Contact Info:

1100 Meredith Lane Plano, Texas 75093

972-776-4050

https://www.inc.com/profile/llc-radar

Keywords:

LLC Radar, LLC formation, business name search, limited liability company, best registered agent services, business entity name search, how to form an LLC, business entity search

#LLC Radar#LLC formation#business name search#limited liability company#best registered agent services#business entity name search#how to form an LLC#business entity search

1 note

·

View note

Text

youtube

best registered agent service for llc

0 notes

Note

I'm totally in support of the writers in theory but I'm trying to understand more of what you're fighting for because I've seen some people on twitter claim writers make more money a week than most of us make in a month so I'm trying to understand what the issue is. Also if that info is accurate. This is a genuine question. Not trying to have a "gotcha moment". I really want to hear from a writer.

people have always had wild misconceptions about how much a writer earns because of their lack of understanding of how the industry actually works. there's so many posts about how "you guys make 5k a week. what more do you want?!" yeah...let's do some math on that.

5k a week for 14 weeks (and that's a long room. a lot of rooms these days are 8-10 weeks. those are the dreaded mini-rooms we're trying to kill) is $70,000. for roughly three months of work. you'd think we're cooking with gas...BUT HOLD UP. that's gross! let's see everything that has to come out of that check:

10% to our agent

10% to our manager

5% to our entertainment attorney

5% to our business manager (not everyone has one but a lot of us do. i do, so that's literally 30% immediately off the top of every check)

most of these breakdowns ive seen downplay taxes severely. someone made one that says writers pay 5% in taxes and i would like to ask them "in what universe?". that doesn't even cover state taxes. the way taxes work in the industry is really complicated, but the short of it is most of us have companies for tax reasons so we aren't taxed like people on w2s/1099. if we did we'd be even more fucked. basically every production hires a writer's company instead of the writer as an individual. so they engage our companies for our services and then at the end of the year we (the company) pay taxes as corporations or llcs (depending on what the writer chose to go with). my company is registered as a "corporation" so let's go with those rates. california's corporate rate is 9% and the federal corporate tax rate is 21%. there's other expenses with running a business like fees and other shit so my business managers/accountants/bookkeepers have recommended i save between 35-40% of everything i make for when tax season comes.

you see where the math is at already??? 25-30% in commissions and then 35-40% in taxes. on the lower end you're at THE VERY LEAST looking at 60% of that check gone. 70% worst case scenario. suddenly those $70,000 people claim we make are actually down to $28,000 as the take home pay. and that's if you're only losing 60%. it goes down to $21,000 if it's 70%.

lets pretend you worked a long 14 week room (that's the longest room ive ever worked btw) and let's also be generous and say you only have 60% in expenses so the take home is $28,000. average rent in los angeles is around $2,800-$3,000. if you're paying $2,800 in rent that means you need AT LEAST $4,000 a month to have a semi decent life since you need to also cover groceries, gas, medical expenses, toiletries, phone, internet, utilities, rental and car insurances, car payments, student loan payments, etc etc etc. and again, this is los angeles. everything is more expensive so you're living BARE BONES on 4k. and these are numbers as a single person. im not even taking having children into account. so those $28,000 you take home might cover your life for 6-7 months. 3 of which you're in the room working. the reality is that once that room ends, you might not work in a room again for 6-9-12 months (i have friends whose last jobs were over 18 months ago) and you now only have about 3 months left of savings to hold you over. we have to make that money stretch while we do all the endless free development we do for studios and until we get our next paying job. so...3 months left of enough money to cover your expenses -> possible 9 months of not having a job. this is how writers end up on food stamps or applying to work at target.

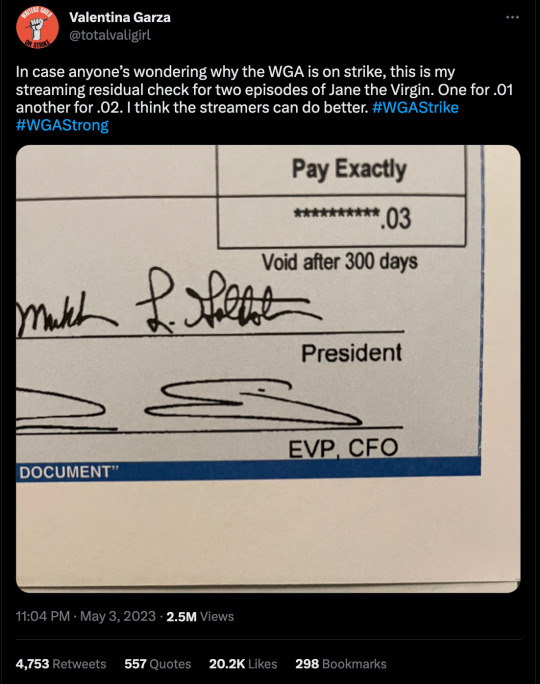

this is why we're fighting for better rates and better residuals. residuals were a thing writers used to rely on to get them through the unemployment periods. residual checks have gone down from 20k to $0.03 cents. im not joking.

they've decimated our regular pay and then destroyed residuals. we have nothing left. so don't believe it when they tell you writers are being greedy. writers are simply fighting to be able to make a middle class living. we're not asking them to become poor for our sake. we're asking for raises that amount to 2% of their profit. TWO PERCENT. this is a fight for writing even being a career in five years instead of something you do on the side while you work retail to pay your bills. if you think shows are bad now imagine when your writer has to do it as a hobby because they need a real job to pay their bills and support a family. (which none of us can currently afford to have btw)

support writers. stop being bootlickers for billion dollar corporations. stop caring about fictional people more than you care about the real people that write them. if we don't win this fight it truly is game over. the industry as you know it is gone.

7K notes

·

View notes

Text

Recent viral images of Southwest agents getting yelled at and crying have resurfaced a valuable lesson about the nature of our economic system that’s worth examining this holiday season: the deliberate, built-in ways corporate “customer service” is set up to not only shield those on the top of the ladder—executives, vice presidents, large shareholders—but pit low-wage workers against each other in an inherently antagonistic relationship marked by powerlessness and frustration. It’s a dynamic we discussed in “Episode 118: The Snitch Economy—How Rating Apps and Tipping Pit Working People Against Each Other,” of the Citations Needed podcast I co-host, but I feel ought to be expanded on in light of recent events. Watching video after video, reading tweet after tweet, describing frustrated stranded holiday travelers yelling at Southwest Airlines workers, and hearing, in turn, accounts of airline workers and airport staff breaking down crying, is a good opportunity to talk about how none of this is natural or inevitable. It is a choice, both in corporate policy and government regulation.

There are three main ways capital pits workers against each other in the relationship we call “customer service”:

1. Snitch economy. As discussed in Citations Needed Ep. 118, we are provided with more and more apps, websites, and customer surveys to effectively do the job of managing for management—free of charge, of course. Under the auspices of “empowering” the consumer, we are told to spy on our low-wage servants and gauge the quality of their servitude with stars, tips, and reviews. Uber, DoorDash, Fiver, Grubhub—a new “gig economy” has emerged that not only misclassifies workers as freelancers to pay them less, but hands over the reins of management to the consumer directly. This necessarily increases the antagonism between working-class consumers and the workers they are snitching on.

2. Automation. Increasingly, even getting to the bottom rung employee to yell at is difficult. Under the thin pretense of Covid, increased labor power has exploded the use of automated technology that creates a frustrating maze to get a simple problem solved or task accomplished. Don’t go to the register, instead download the app and order. Scan the QR code, don’t wait on hold, go to our website and engage a series of automated prompts and maybe you can solve your problem. More and more consumers are being pushed away from humans onto automated systems we are told will “save us time,” but instead exist solely to save the corporation labor costs. So, by the time the average consumer does finally work their way to seeing a human, they are annoyed, frustrated, and angry at this faceless entity and more willing to take it out on someone making $13 an hour.

One recent visit to Houston’s George H.W. Bush airport portended our obnoxious “automated” future. To cut down on unionized airport labor, all the restaurants use QR codes and require you to order food and drinks for yourself. Per usual, it’s sold as an exciting new technology that’s somehow good for consumers, but really the basic technology is 30 years old. It’s just a screen—the same ones restaurants have had for decades. The only thing that’s changed is the social conditioning of having you do all your own ordering and menu navigation. The waiter hasn’t been replaced by an iPad, they��ve been replaced by you. Invariably, it’s clunky and annoying and reduces the union jobs that airport construction is said to provide to justify soliciting public dollars. The only winner is a faceless corporation with a Delaware LLC and its shareholders living in a few counties in Connecticut and Texas.

Automation not only annoys and adds labor burdens to the customer, there is also evidence that it is a significant contributor to income inequality. A November 2022 study published in the journal Econometrica looked at the significantly widening income gap between lesser and more educated workers over the past 40 years. It found that “automation accounts for more than half of that increase,” as summarized by MIT News. “This single one variable … explains 50 to 70 percent of the changes or variation between group inequality from 1980 to about 2016,” said MIT economist Daron Acemoglu, co-author of the study. Whether or not, under a different economic system, automation could be a force for good is a debate for another day. But what is clear is that, while both consumers and workers are harmed by this trend, there is a significant want of solidarity between them.

3. Deliberate understaffing. This is a major culprit in this week’s Southwest Airlines meltdown. In parallel with the increased use of forced automation, cost-cutting corporations, facing increased labor power, are gutting staffing to its bare bones and hoping their corporate competitors doing the same will lead to a shift in consumer’s willingness to put up with substandard service and conditions, and overall bullshit. “We apologize for the wait,” the automated phone prompt tells us. Of course a machine cannot be contrite, so the effect is both surreal and grating: You’re not fucking sorry, you don’t exist. You're a recording. But now, who am I yelling at?

...

557 notes

·

View notes

Text

For years, the Federal Bureau of Investigation has been unraveling what it asserts is a scam perpetrated by agents of North Korea, which used fake companies employing real IT workers to funnel money back to the regime’s military.

An American company played a key role in creating shell companies used as part of the scheme, a WIRED review of public records shows. Elected officials are now contemplating addressing loopholes in business-registration law that the scheme exposed.

In May, Wyoming secretary of state Chuck Gray revoked the business licenses of three companies linked to the North Korean scam: Culture Box LLC, Next Nets LLC, and Blackish Tech LLC. Gray said his office made the decision after receiving information from the FBI and conducting an investigation.

“The communist, authoritarian Kim Jong Un regime has no place in Wyoming,” Gray said in a May press release.

The companies posed as legitimate operations where businesses could hire contract workers to perform IT solutions, complete with fake websites featuring smiling photos of apparent employees. The companies all had one thing in common: Their incorporation documents were filed by a company called Registered Agents Inc., which says its global headquarters is in Sheridan, Wyoming.

Registered Agents, which provides incorporation services in every US state, takes the practice of business privacy to the extreme, and regularly uses fake personae to file formation documents with state agencies, a WIRED investigation previously found.

Culture Box LLC, one of the companies that Gray and the FBI linked to North Korea, listed “Riley Park” as the name of a Registered Agents employee on documents submitted to the Wyoming secretary of state. Park, according to several former employees of Registered Agents, is a fake persona that the company regularly used to file incorporation documents.

In a statement provided to WIRED, Registered Agents wrote, “The Wyoming Secretary of State dissolved the entities and we initiated the 30-day process to resign as their agent in mid-May. Ours and Wyoming's processes to identify bad actors works. It strikes the best balance of individual privacy and business transparency supported by an entire ecosystem that cares about supporting entrepreneurs while rooting out the small percent of scammers.” The FBI’s St. Louis office, which led the investigation, did not respond to a request for comment.

The North Korean operation worked like this: Agents of the regime created fake companies purporting to be legitimate firms offering freelance IT services. Workers hired by North Koreans, or North Koreans themselves, would then perform legitimate contractor work, often using assumed identities.

In some instances, Americans would set up low-cost laptops with remote-access software, allowing North Korean workers to perform freelance IT work while appearing to use American IP addresses. The FBI referred to these Americans as “virtual assistants.”

The payments for the IT work were eventually funneled back to North Korea—where, the Department of Justice asserts, it was directed to the country’s Ministry of Defense and other agencies involved in WMD work. The scheme was so expansive that any company that hired freelance IT workers “more than likely” hired someone involved in the operation, according to FBI agent Jay Greenberg.

The shell companies created in Wyoming were used to hire virtual assistants and receive payments. “I discovered that North Korean IT workers create and use domain names and limited liability companies (LLCs) in furtherance of their fraudulent activity and to mask their true identities as North Koreans. The LLCs are used to recruit ‘Virtual Assistants’ who can receive and ship devices needed for the North Korean IT workers as well as recruit and employ software developers from countries such as Pakistan, India, and China,” an FBI agent wrote in a May affidavit. “These LLCs are often registered in the United States through business registry services and sometimes use the identities of individuals who had a previous relationship with North Korean IT workers.”

The affidavit alleges that money from North Korean workers was used to purchase domain names for the IT front companies, in violation of sanctions laws. The domains were purchased using “payment service providers” with accounts belonging to the Wyoming companies.

In response to a request for comment from WIRED, the Wyoming secretary of state’s office said that it has “increased the number of complete, in-person audits of commercial registered agents, resulting in several ongoing investigations, as well as the issuance of findings and orders.”

The secretary of state has offered proposals to the Wyoming state legislature “aimed at preventing fraud and abuse of corporate filings by commercial registered agents, as ways to strengthen the Wyoming secretary of state's administrative authority to dissolve business entities controlled by foreign adversaries,” said Joe Rubino, the chief policy officer and general counsel at the Wyoming Secretary of State's Office.

3 notes

·

View notes

Text

U.S. Agent - FDA Services

U.S. Food and Drug Administration regulations require that:

▪ Food facilities register with FDA.

▪ FDA be given advance notice (Prior Notice) on shipments of imported food.

ITB HOLDINGS LLC

390 North Orange Avenue, Suite 2300

Orlando, FL 32801

United States

T: +1 855 389 7344

T: +1 855 510 2240

T: +44 800 610 1577

https://www.fda.itbhdg.com/u-s-agent/

2 notes

·

View notes

Text

Fertilizer Additive Market to Reach US$ 4,050.19 million with a CAGR of 2.4% from 2022 to 2028

The Fertilizer Additive Market is expected to reach at US$ 4,050.19 million by 2028; registering at a CAGR of 2.4% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Because of the growing population, there is a greater need for food grains, which has increased demand for fertilisers in many nations. The Food and Agriculture Organization of the United Nations (FAO) and the International Food Policy Research Institute (IFPRI) predict that the increase in consumer affluence in places like Asia, Eastern Europe, and Latin America would cause a 70% increase in the world's food demand by the year 2050. The Joint Research Centre's assertions that fertilisers have become more widely used to increase food production as a result of the shrinking area of arable land and the rising demand for food in various countries were also supported by a report released by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services.

Further, the increased production of synthetic fertilizers witnessing the enhancement in crop yield. Hence, the manufacturers are focusing on to increase the synthetic fertilizers production on commercial basis along with the blend of fertilizer additives. Therefore, the rising commercial synthetic fertilizer production demand for additives which propels the fertilizer additive market growth.

The rising population of various countries and their governments focus on the development of sustainable agriculture will enable to increase the food production. The growing population and rising need for food security tends to adopt fertilizer additives in fertilizers industry, which is fueling the fertilizer additive market growth. Due to growing urbanization, the available arable land is expected to decrease. As a result, fertilizers are likely to play an essential role in increasing the average crop yields per hectare. However, the quality and performance of fertilizers deteriorates over time, and chemical fertilizers are leading to deteriorate the soil fertility. Fertilizer additives aid in the production, handling, storage, and transportation of fertilizers. The additives help fertilizers maintain their shape, limit caking, decrease dust formation during manufacturing of fertilizers, and avoid wetting of fertilizers. Hence, the manufacturers in fertilizers industry has been adopting fertilizer additives rigorously. Thus, the growing use of fertilizers in agricultural practices is estimated to fuel the fertilizer additives market growth.

The key players operating in the global fertilizer additive market include Arkema Group; Solvay; KAO CORPORATION; Chemipol S.A.; Chemsol LLC; Clariant; Dorf Ketal; Michelman, Inc.; Omex Agriculture, Inc.; and Novochem Group. Players operating in the global fertilizer additive market are focusing on providing high-quality products to fulfill customer demand. They are also focusing on strategies such as investments in research and development activities and new product launches.

Form and kind are the two main divisions in the market for fertiliser additives. The market is divided into granular, prilled, and powder segments based on form. The market is divided into categories based on type, including corrosion inhibitors, granulation aids, colouring agents, anti-caking agents, and others. The Middle East & Africa (MEA), South & Central America, Asia Pacific (APAC), and North America are the main geographic divisions of the fertiliser additive market.

Browse More Information@ https://www.theinsightpartners.com/reports/fertilizer-additive-market

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Sameer Joshi

E-mail: [email protected]

Phone: +1-646-491-9876

2 notes

·

View notes

Text

offshore company setup

Guide to Offshore Company Setup: Everything You Need to Know

Setting up an offshore company is a strategic move for many entrepreneurs and businesses looking to expand their operations internationally. Whether it’s to access global markets, enjoy tax benefits, or secure a favorable legal environment, offshore companies provide numerous advantages. This guide covers the essential aspects of offshore company setup, helping you understand why and how to establish one.

1. What is an Offshore Company?

An offshore company is a business entity established in a country outside of the founder’s country of residence, often in jurisdictions that offer specific tax benefits, privacy, and ease of operation. Popular locations for offshore companies include the Cayman Islands, British Virgin Islands (BVI), Belize, and the UAE.

Key Features:

Operates outside the jurisdiction where it was established.

Commonly used for international trading, holding assets, and business structuring.

Often enjoys favorable tax treatment in the host country.

2. Benefits of Setting Up an Offshore Company

Offshore companies are attractive to various business owners due to several benefits, including:

Tax Efficiency: Many offshore jurisdictions offer tax exemptions or reduced tax rates, allowing businesses to legally minimize their tax obligations.

Asset Protection: Offshore structures can provide asset protection from legal claims and creditors, helping safeguard business assets.

Privacy and Confidentiality: Offshore jurisdictions often have strict laws that protect company and shareholder information, offering a level of privacy that is appealing to many investors.

Ease of International Operations: Offshore companies facilitate global expansion by enabling companies to transact internationally with minimal regulatory hurdles.

Flexibility in Management and Ownership: Offshore companies typically have fewer restrictions on the nationality of shareholders and directors, allowing international ownership and control.

3. Steps to Setting Up an Offshore Company

Setting up an offshore company requires careful planning and consideration of the specific jurisdiction and business goals. Here’s a step-by-step overview:

Step 1: Select the Right Jurisdiction

Each offshore jurisdiction offers unique benefits, so selecting the right one depends on your company’s needs. Factors to consider include tax regulations, political stability, reputation, and legal framework.

Step 2: Choose a Business Structure

Offshore companies can take various forms, such as International Business Companies (IBCs), Limited Liability Companies (LLCs), or corporations. Consult with a legal advisor to determine the best structure based on your business’s objectives.

Step 3: Register the Company Name

You’ll need to choose and register a unique company name in the offshore jurisdiction. Some jurisdictions may have naming restrictions, so research local regulations or seek help from a local agent.

Step 4: File Incorporation Documents

Prepare and submit the necessary documentation, such as the Articles of Incorporation and Memorandum of Association. Some jurisdictions may also require shareholder information, business plans, and identity documents.

Step 5: Open a Bank Account

Most offshore companies need an international bank account to conduct business efficiently. Ensure that your chosen bank supports offshore companies and meets your business’s banking needs, such as multi-currency accounts and online banking services.

Step 6: Maintain Compliance

After setup, stay compliant with the offshore jurisdiction’s regulatory requirements, including annual fees, company renewal, and financial reporting (if required).

4. Costs of Setting Up an Offshore Company

The costs of establishing an offshore company vary depending on the jurisdiction, business type, and professional services used. Typical expenses include:

Incorporation Fees: Government and administrative fees for registering the company.

Professional Fees: Costs for legal and accounting services.

Banking Fees: Fees for opening and maintaining an offshore bank account.

Annual Renewal Fees: Fees to keep the offshore company active in the jurisdiction.

5. Legal Considerations

It’s important to follow all legal requirements in both the offshore jurisdiction and the country of residence to avoid potential legal issues. Always consult with a legal expert to ensure compliance with international business laws, tax obligations, and anti-money laundering regulations.

6. Common Myths About Offshore Companies

Myth #1: Offshore Companies are Only for Tax Evasion While offshore companies offer tax benefits, they are also popular for asset protection, privacy, and international business expansion. Legal offshore structures operate in compliance with international laws.

Myth #2: Offshore Companies Lack Transparency Reputable offshore jurisdictions maintain high standards of compliance, requiring transparency and documentation, especially in financial matters.

7. Is Offshore Company Setup Right for You?

An offshore company can be an excellent choice for business owners who:

Operate internationally and want to streamline their operations.

Seek to diversify their asset holdings in a legally protected manner.

Desire tax benefits without evading legal obligations.

Final Thoughts

Offshore company setup can be a valuable tool for business growth, tax efficiency, and asset protection. By choosing the right jurisdiction and complying with local and international regulations, entrepreneurs can harness the benefits of an offshore structure. If you’re considering this path, consult with a professional to ensure that it aligns with your business goals and complies with all legal requirements.

0 notes

Text

Transitioning From a Sole Proprietorship to an LLC: What You Need to Know

Sole proprietorships make up a majority of small businesses that operate without employees. However, as a small business grows, it might be a good idea to change from a sole proprietorship to a limited liability company. But what exactly are the differences and how do you make the transition? Here’s everything that you need to know about transforming your business into an LLC.

Differences Between A Sole Proprietorship and An LLC

When tax planning for small businesses, you want to make sure that you’re making the right choices to help your business thrive as much as possible, and that could mean changing what your business is registered as. So what are the main differences between the two? - Members: a sole proprietorship as one person; an LLC has one or more persons or business organizations. - Taxation: for a sole proprietorship, sales and revenue are reflected on a personal tax return; for an LLC, personal assets are protected from liability for any business debts or obligations. - Formation: a sole proprietorship is automatically formed when you start doing business; an LLC is formed when articles of organization are filed with the state. - Legal entity: a sole proprietorship is considered the same legal entity as the owner; an LLC is considered a separate legal entity from the owner and its members.

Reasons To Transition to An LLC

A sole proprietorship may be simpler in form, but there are several reasons you may want to consider as to why an LLC may be better for business. - You want to protect your personal assets: in an LLC, personal assets are not considered assets of the business, so they cannot be used to satisfy business debts. - You save money on taxes: LLC owners only pay payroll taxes on their reasonable salaries, regardless of the company’s profits. - You want to add a business partner: taking on a new co-owner creates a general partnership automatically, but it increases the risk of you being liable for business obligations. In an LLC, your personal assets are still protected when taking on a new business partner.

How to Transition to An LLC

The process does take time, patience, and money, but it’s best not to rush the process to ensure that everything is taken care of. - Confirm the business name. You should first ensure that your business name is available in the state where you plan to file your articles of organization. Just because you have the name for the sole proprietorship doesn’t mean that it’s available for an LLC. - File your articles of organization. These should be filed with the relevant state agency and the applicable filing fee should be paid. The articles are pretty straightforward and require information such as the name of the LLC, the address, its purpose, the name and address of the relevant agent, and the management structure. - Execute an LLC operating agreement. This is an agreement between all the members that dictates the rights and obligations of each member, in relation to profits and losses, specific voting rights, exit process, and retirement, for example. - Filing FormSS-4 to obtain an EIN. EIN stands for Employer Identification Number and is the number that the IRS assigns to you for tax filing and reporting purposes. - Applying for a new bank account. Because you are keeping the business and personal assets separate, it means that you need a separate account for the business assets. - Apply for business licenses and permits. If you are thinking of starting the transition process to an LLC, be sure to speak to an attorney or LLC service to help make the process a little easier. Photo by Austin Distel on Unsplash Read the full article

0 notes

Text

2

UNITED STATES DISTRICT COURTSOUTHERN DISTRICT OF NEW YORK----------------------------------------------------------------------SCOTT CAWTHON, Plaintiff,-v- ZHOUSUNYIJIE, Defendant.----------------------------------------------------------------------X : : : : : : : : : : : X22-cv-03021 (LJL)OPINION AND ORDERLEWIS J. LIMAN, United States District Judge:Plaintiff Scott Cawthon (“Plaintiff”) moves, pursuant to Federal Rule of Civil Procedure 55(b)(2), for default judgment on his copyright infringement claim against defendant Zhousunyijie (“Defendant”). Dkt. No. 40. For the following reasons, the motion for default judgment is granted. BACKGROUNDThese facts are drawn from Plaintiff’s complaint and are accepted as true for the purposes of this motion. Plaintiff is a resident of Texas and creator and intellectual property owner of the Five Nights at Freddy’s (“FNAF”) series of horror video games and other media (the “Franchise”). Dkt. No. 1 ¶ 10. The Franchise includes twelve games: Five Nights at Freddy’s, Five Nights at Freddy’s 2, Five Nights at Freddy’s 3, Five Nights at Freddy’s 4, FNaF World, Five Nights at Freddy’s: Sister Location, Freddy Fazbear’s Pizzeria Simulator, Ultimate Custom Night, Five Nights at Freddy’s VR: Help Wanted, Five Nights at Freddy’s AR: Special Delivery, Freddy in Space 2, and Five Nights at Freddy’s: Security Breach. Id. ¶ 12. The FNAF games are available for purchase on a variety of traditional and virtual reality video game platforms, and have 03/18/2024 Cawthon v. ZhousunyijieDoc. 42Dockets.Justia.com

2 enjoyed commercial success and critical acclaim—millions of copies of the Five Nights Games have been sold worldwide. Id. ¶ 14. As creator and owner of the Franchise, Plaintiff owns over 200 registered copyrights to unique characters and features of the Franchise. Id. ¶ 15. These include copyrights to characters Foxy the Pirate (Withered Version), Foxy the Pirate (Funtime Version), Chica the Chicken (Withered Version), Freddy Fazbear (Nightmare Version), Bonnie the Rabbit (Nightmare Version), and Marionette (collectively, the “Copyrights”). Id. ¶ 16; Dkt. Nos. 1-2, 1-3, 1-4, 1-5, 1-6, 1-7. Plaintiff also licenses FNAF characters for use in merchandise through his licensing entity Scottgames, LLC, and the licensing portfolio has sold millions ofdollars’ worth of merchandise in retail stores. Dkt. No. 1 ¶¶ 17–18. Defendant is a China-based Amazon seller that has been selling unauthorized toy figurines that copy, embody, or constitute derivative works of the Copyrights (“Infringing Product”). Id. ¶¶ 23–27; Dkt. No. 1-8. Defendant lists its address as 007894hao gongyeyuanchuangyedadaozhongduanzonghelouyilou wanzaixian yichunshi China. Dkt. No. 1¶ 3. Defendant is not an authorized licensee of Plaintiff, nor has it requested permission from Plaintiff to use Plaintiff’s copyrighted characters for commercial purposes. Id. ¶¶ 28–30. Once Plaintiff became aware of the existence of the Infringing Product, he submitted a complaint to Amazon on or about March 10, 2022, pursuant to the Digital Millennium Copyright Act (“DMCA”), requesting that Amazon take down the listing. Id. ¶ 32. That same day, Amazon removed the Infringing Product from the Amazon website. Id. ¶ 33. On or about March 29, 2022, Defendant submitted a counter-notification to Amazon under 17 U.S.C. § 512(g)(3) (“Counter Notice”). In the Counter Notice, Defendant certified to the following: •Its name (Zhousunyijie) •Its email address ([email protected])

3 •Its mailing address (007894hao gongyeyuanchuangyedadaozhongduanzonghelouyilou wanzaixian yichunshi China) •Its phone number (+8613905526844) •Its consent to the jurisdiction of any judicial district in which Amazon is found. •Its agreement to accept service of process from Plaintiff or his agent.•Its statements contained in the Counter Notice were true and correct under penalty of perjury and any false statements in the Counter Notice could lead to civil penalties or criminal prosecution. Dkt. No. 1-1. The Counter Notice stated: You recently provided me with a copy of a Notice of Infringement under the Digital Millennium Copyright Act (DMCA). This letter is a Counter-Notification as authorized in § 512(g) of the DMCA. I have a good faith belief that the material identified in the Notice of Infringement was removed or disabled as a result of mistake or misidentification of the material to be removed or disabled. I therefore request that the material be replaced and/or no longer disabled. . . . (I) I am located in the United States and I consent to the jurisdiction of the Federal District Court for the judicial district in which my address is located (OR) I am located outside of the United States and I consent to the jurisdiction of any judicial district in which Amazon may be found. (II) I agree to accept service of process from the person who provided notification under subsection (c)(1)(C) or an agent of such person. (III) I have a good faith belief that the material identified in the Notice of Infringement was removed or disabled as a result of mistake or misidentification of the material to be removed or disabled. (IV) I declare under penalty of perjury under the laws of the United States of America that this Counter-Notification and all statements therein are true and correct. (V) I ACKNOWLEDGE THAT PROVIDING FALSE STATEMENT IN A COUNTER-NOTICE MAY LEAD TO CIVIL PENALTIES OR CRIMINAL PROSECUTION. Id.

4 Upon receipt of the Counter Notice, Amazon notified Plaintiff that he had ten business days to file a complaint alleging copyright infringement or the Infringing Product would be re-listed on the Amazon website. Id.PROCEDURAL HISTORYPlaintiff initiated this action by complaint on April 12, 2022. Dkt. No. 1. On April 13, 2022, an electronic summons was issued as to Defendant. Dkt. No. 5. On November 21, 2022, Plaintiff filed a motion requesting leave of the Court to effect service on Defendant by email, rather than postal mail, under Federal Rule of Civil Procedure 4(f) and submitted a brief in support of that motion. Dkt. No. 14.1 On January 31, 2023, the Court denied without prejudice Plaintiff’s motion for alternative service on the basis that the Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil and Commercial Matters (“Hague Convention”) governs the process for service on foreign defendants and does not permit the use of email for service unless no mailing address for the receiving party can be found. Dkt. No. 16.2 On June 1, 2023, Plaintiff filed a second motion for alternative service, this time arguing that Defendant had waived service under the Hague 1 An initial pretrial conference was set for the morning of July 12, 2022. Dkt. No. 7. On July 8, 2022 Plaintiff submitted a motion to adjourn the initial pretrial conference until such time as Defendant answered the complaint or otherwise appeared in this matter. Dkt. No. 8. On July 15, 2022, this Court granted the motion to adjourn. Dkt. No. 9. On July 15, 2022, Plaintiff submitted a certificate of service of the summons and complaint on Defendant. Dkt. No. 10. On August 19, 2022, this Court held an initial pretrial conference where no counsel for the defensewas present. August 19, 2022 Minute Entry. The Court then ordered Plaintiff to make a motion for default judgment by November 21, 2022. Dkt. No. 12. On November 22, 2022, the Court granted Plaintiff’s request to extend the deadline for the filing of a default judgment motion, pending a decision on Plaintiff’s motion for alternative service. November 22, 2022 Order. 2 On February 16, 2023, Plaintiff filed a motion to stay the case pending the appeal to the Second Circuit of the decision in Smart Study Co., Ltd. v. Acuteye-Us, 2022 WL 2872297 (S.D.N.Y. July 21, 2022), which this Court relied on in part to support its denial of Plaintiff’s motion for alternative service. Dkt. No. 20. On May 15, 2023, Plaintiff filed a status report regarding Smart Study Co., Ltd. v. Acuteye-Us requesting that the stay be lifted, and on May 16, 2023 the motion was granted. Dkt. Nos. 21–22.

5 Convention by virtue of its signing of the Counter Notice. Dkt. Nos. 23–24. The Court denied the motion on October 18, 2023, holding that the Counter Notice does not constitute a waiver. Dkt. No. 26. Plaintiff submitted a third motion for alternative service under Federal Rule of Civil Procedure 4(f) on November 2, 2023. Dkt. No. 27. The Court granted the motion for alternative service on the basis that Plaintiff, using reasonable diligence, had tried and failed to locate Defendant’s correct postal address, and so the Hague Convention did not apply. Dkt. No. 28. On November 28, 2023, the Clerk of Court issued a certificate of default. Dkt. No. 38. On December 5, 2023, Defendant filed this motion for a default judgment, Dkt. No. 40, and a proof of service that the motion was served by email on Defendant, Dkt. No. 41. Defendant has not responded to the motion. LEGAL STANDARDFederal Rule of Civil Procedure 55 sets forth a two-step procedure to be followed for the entry of judgment against a party who fails to defend: the entry of a default and the entry of adefault judgment. SeeNew York v. Green, 420 F.3d 99, 104 (2d Cir. 2005). The first step, entry of a default, simply “formalizes a judicial recognition that a defendant has, through its failure to defend the action, admitted liability to the plaintiff.” City of New York v. Mickalis Pawn Shop, LLC, 645 F.3d 114, 128 (2d Cir. 2011); see Fed. R. Civ. P. 55(a). The second step, entry of a default judgment, “converts the defendant’s admission of liability into a final judgment that terminates the litigation and awards the plaintiff any relief to which the court decides it is entitled, to the extent permitted” by the pleadings. Mickalis PawnShop, 645 F.3d at 128; see also Fed. R. Civ. P. 55(b). Whether entry of default judgment at the second step is appropriate depends upon whether the allegations against the defaulting party are well pleaded and state a claim for relief. SeeMickalis Pawn Shop, 645 F.3d at 137. Because a party in default does not admit conclusions of law, “a district court need not

6 agree that the alleged facts constitute a valid cause of action.”Id. (citation omitted);seeSpin Master Ltd. v. 158, 463 F. Supp. 3d 348, 367 (S.D.N.Y. 2020) (“The essence of Fed. R. Civ. P. 55 is that a plaintiff can obtain from a default judgment relief equivalent to but not greater than that it would obtain in a contested proceeding assuming it prevailed on all of its factual allegations.”). Therefore, the Court is “required to determine whether the plaintiff’s allegations are sufficient to establish the defendant’s liability as a matter of law.”Finkel v. Romanowicz, 577 F.3d 79, 84 (2d Cir. 2009). A party later challenging the entry of a default judgment must satisfy the “good cause shown” standard in Federal Rule of Civil Procedure 55(c), which “requires a court to weigh (1) the willfulness of default, (2) the existence of any meritorious defenses, and (3) prejudice to the non-defaulting party.”Guggenheim Cap., LLC v. Birnbaum, 722 F.3d 444, 454–55 (2d Cir. 2013). “The legal sufficiency of these claims is analyzed under the familiar plausibility standard enunciated inBell Atlantic Corp. v. Twombly, 550 U.S. 544, 570 (2007), andAshcroft v. Iqbal, 556 U.S. 662, 678 (2009), aided by the additional step of drawing inferences in the non-defaulting party’s favor.” WowWee Grp. Ltd. v. Meirly, 2019 WL 1375470, at *5 (S.D.N.Y.Mar. 27, 2019). A default judgment entered on well-pleaded allegations does not reach the issue of damages, and Plaintiff “must therefore substantiate [her] claim for damages with evidence to prove the extent of those damages.” Hood v. Ascent Med. Corp., 2016 WL 1366920, at *15 (S.D.N.Y. Mar. 3, 2016), report and recommendation adopted, 2016 WL 3453656 (S.D.N.Y.June 20, 2016), aff’d, 691 F. App’x 8 (2d Cir. 2017). To determine the amount of damages that should be awarded on a default judgment, Federal Rule of Civil Procedure 55(b)(2) “leaves the decision of whether a hearing is necessary to the discretion of the district court.”Lenard v. Design Studio, 889 F. Supp. 2d 518,

7 527 (S.D.N.Y. 2012). And “[w]here, on a damages inquest, the plaintiff makes a damages submission and the defaulting defendant makes no submission in opposition and does not request a hearing, the court may determine the adequacy of the plaintiff’s damages claim based on its submitted proofs.” Id.DISCUSSIONI.JurisdictionThis claim arises under the Copyright Act, 17 U.S.C. § 101 et seq., so the Court has subject matter jurisdiction pursuant to 28 U.S.C. § 1331. Additionally, the Court has personal jurisdiction over all parties in this action. Pursuant to 17 U.S.C. § 512(g)(3)(D), Defendant completed and signed a Counter Notice which states that I am located in the United States and I consent to the jurisdiction of the FederalDistrict Court for the judicial district in which my address is located (OR) I am located outside of the United States and I consent to the jurisdiction of any judicial district in which Amazon may be found. Dkt. No. 1-1. Defendant is located outside of the United States and provided in the Counter Notice a mailing address of 007894hao gongyeyuanchuangyedadaozhongduanzonghelouyilou wanzaixian yichunshi China. An Amazon fulfilment center is located within this jurisdiction, with an address at 7 West 34th St, New York, NY 10001. Defendant has therefore affirmatively consented to the jurisdiction of the Court. II.ServiceBefore entering an order of default judgment, the Court must first satisfy itself that service was properly effected upon Defendant. In this case, service was indeed proper. The Court granted Plaintiff permission to effect alternative service in its Memorandum and Order of November 3, 2023. Dkt. No. 28. It explained its reasoning in that Memorandum and Order.

8 Federal Rule of Civil Procedure 4(f) governs service upon individuals in foreign countries, like Defendant. Rule 4(f) reads as follows: Serving an Individual in a Foreign Country. Unless federal law provides otherwise, an individual—other than a minor, an incompetent person, or a person whose waiver has been filed—may be served at a place not within any judicial district of the United States:(1)by any internationally agreed means of service that is reasonably calculated to give notice, such as those authorized by the Hague Convention on the Service Abroad of Judicial and Extrajudicial Documents; (2)if there is no internationally agreed means, or if an international agreement allows but does not specify other means, by a method that is reasonably calculated to give notice:(A) as prescribed by the foreign country’s law for service in that country in an action in its courts of general jurisdiction; (B) as the foreign authority directs in response to a letter rogatory or letter of request; or(C) unless prohibited by the foreign country’s law, by: (i)delivering a copy of the summons and of the complaint to the individual personally; or (ii)using any form of mail that the clerk addresses and sends to the individual and that requires a signed receipt; or (3)by other means not prohibited by international agreement, as the court orders.Fed. R. Civ. P. 4(f). Defendant is a resident of China. Dkt. No. 1-1. Because China and the United States are both signatories to the Hague Convention, the Hague Convention would normally apply to service of process on defendants located in China. Smart Study, 2022 WL 2872297, at *4 (“[C]ompliance with the [Hague] Convention is mandatory in all cases to which it applies.” (quoting Advanced Access Content Sys. Licensing Adm’r, LLC v. Shen, 2018 WL 4757939, at *4

9 (S.D.N.Y. Sept. 30, 2018))). However, “[t] he Hague Convention does not apply where the address of the person to be served with the document is not known.” Smart Study Co., Ltd. v. Acuteye-Us, 620 F. Supp. 3d 1382, 1391 (S.D.N.Y. 2022) (internal quotation marks omitted). “Courts in this Circuit have found that an address is ‘not known’ if the plaintiff exercised reasonable diligence in attempting to discover a physical address for service of process and was unsuccessful in doing so.” Id. Such reasonable diligence to discover a physical mailing address include[s] where the plaintiff researched defendant’s websites associated with defendant’s domain names, completed multiple Internet-based searche[s], called known phone numbers, and conducted in-person visits, where the plaintiff performed extensive investigation and issued subpoenas to the relevant domain registrars and email providers, and where a plaintiff has attempted to obtain the defendant’s address in a variety of ways. Id. (internal alterations, citations, and quotation marks omitted). Plaintiff demonstrated that Defendant’s address was not known after exercising reasonable diligence for reasons set forth in the Memorandum and Order. Dkt. No. 28 at 2–3. In addition, the Court further held that service by email comports with both the requirements of Federal Rule of Civil Procedure 4(f)(3) and the demands of the Due Process Clause. Id. at 3 (“Amazon requires a merchant to provide a valid and operational email address to register an online storefront . . . Defendant provided Amazon with its email . . . Thus, Defendant should be able to receive proper service and notice through the email address associated with its Amazon account.”); Convergen Energy LLC v. Brooks, 2020 WL 4038353, at *6 (S.D.N.Y. July 17, 2020) (“Service by email alone comports with due process where a plaintiff demonstrates that the email is likely to reach the defendant.” (internal quotation marks omitted)). Plaintiff has submitted evidence that service was effected on Defendant by email as permitted by the Court. Dkt. No. 40-1 ¶¶ 2–3 & Ex. B. For the above reasons, service on the Defendant was proper under Federal Rule of Civil Procedure 4(f).

10 III.LiabilityPlaintiff seeks default judgment on its copyright infringement claim against Defendant. Dkt. No. 1. To prevail on a copyright claim, a plaintiff must demonstrate ownership of a valid copyright and unauthorized copying of the copyrighted work. See Spin Master, 463 F. Supp. 3d at 369 (citing Jorgensen v. Epic/Sony Records, 351 F.3d 46, 51 (2d Cir. 2003)). Plaintiff pleaded facts regarding and produced evidence of its exclusive copyright ownership of the six FNAF characters at issue. Dkt. No. 1 ¶ 16; Dkt. Nos. 1-2, 1-3, 1-4, 1-5, 1-6, 1-7. This is sufficient to make out a prima facie case of copyright infringement. Spin Master, 463 F. Supp. 3d at 369 n.44 (“A certificate of registration from the United States Register of Copyrights constitutes prima facie evidence of the valid ownership of a copyright.”); see 17 U.S.C. § 410(c).To satisfy the second element of a copyright claim, unauthorized copying of work, a plaintiff must demonstrate that: “(1) the defendant has actually copied the plaintiff’s work; and (2) the copying is illegal because a substantial similarity exists between the defendant’s work and the protectible elements of plaintiff’s [work].”Yurman Design, Inc. v. PAJ Inc., 262 F.3d 101, 110 (2d Cir. 2001). A plaintiff may demonstrate actual copying “either by direct or indirect evidence,” but because “direct evidence of copying is seldom available, a plaintiff may establish copying circumstantially,” Jorgensen, 351 F.3d at 51, such as with “proof that the defendants had access to the copyrighted work and similarities that are probative of copying

0 notes

Text

A technology company that has been essential in keeping far-right and extremist websites online was acquired last year by a firm that operates an empire of shell companies across the United States, according to people familiar with the deal.

Epik.com has been for years the go-to domain registrar for websites that other companies refuse to do business with. Sites dedicated to white nationalism, QAnon conspiracy theories, and harassing transgender people were all welcomed by Epik. Now, it appears that Epik’s new owner may abandon the extremist fringe and shift its customer base toward companies seeking to operate in the shadows.

Rob Monster, a born-again Christian who founded Epik in 2009, had been key in keeping many of the most extreme websites online. He often went to great lengths to personally defend the sites and extolled the virtues of free speech. Epik was sold to new ownership last year after the company unraveled amid allegations of gross financial mismanagement.

An accounting firm hired by Epik to conduct a forensic investigation alleged that Monster had misappropriated more than $3.5 million, according to an internal preliminary report obtained by WIRED. More than $1.5 million was attributed to Monster personally withdrawing funds from the company. Nearly $2 million of Epik funds was used in Kingdom Ventures, Monsters’ venture capital firm, according to the report.

Monster didn’t respond to multiple requests for comment.

The buyer of Epik’s domain registrar business was a brand-new company that had been incorporated in Wyoming weeks before the sale was completed last summer: Epik LLC. The owner of Epik LLC, according to two people familiar with the deal, is Registered Agents Inc. The company confirmed its ownership in a press release late Friday night.

Registered Agents Inc. and its subsidiary companies claim to have offices in every state and Washington, DC. Its services allow companies to operate anonymously in a jurisdiction of its choosing. Registered Agents Inc. says it provides services to over 1 million companies.

The founder and owner of Registered Agents, according to two people familiar with the company, is a man named Dan Keen. In an email, a lawyer for Registered Agents Inc. says Keen is not the owner nor an employee of Registered Agents Inc. or Epik, and that he acted as a consultant in the acquisition.

Keen is intensely private, according to multiple people who have worked with him who requested anonymity to discuss details of the deal. “He has made it his mission in life to be invisible,” said one. “He’s someone who likes to operate in the shadows,” claims another. Keen is a serial entrepreneur who previously ran a lawn care and tree-trimming business, according to public records.

Keen has no website or social media pages. Emails sent by Keen don’t include a signature. Attempts to reach Keen for comment led to a reply from Bryce Myrvang, a lawyer for Registered Agents Inc.

Using a registered agent to incorporate a business allows the owner to shield who actually owns it. A registered agent will act as an official point of contact for a company, receiving legal notices and mail, and filing incorporation documents with the state. In Wyoming alone, Registered Agents Inc. represents around 50,000 companies, according to the Wyoming secretary of state.

For example, a company that uses Registered Agents Inc. to set up shop in Wyoming would have its address listed as 30 N. Gould Sreet, a squat one-story building in the town of Sheridan.

A local paper in Wyoming, The Sheridan Press, reported in August 2021 that scam business had been linked to the 30 N. Gould Street address, where more than 20 registered agent firms claim to have their offices. An editor's note added after publication stated, “It remains completely legal for registered agents to do what they’re doing under Wyoming Statute.”

A 2022 investigation by the International Consortium of Investigative Journalists found that “oligarchs, criminals and online scammers” have used registered agents to operate in the United States and shield their true identity.

Registered Agents Inc.’s acquisition of Epik allows the company to extend its offerings to the internet, providing its customers another layer of anonymity for their websites.

“This most recent acquisition provided an opportunity to expand our business offerings to include a business email address, a domain name, and open source website hosting at a reasonable cost,” Myrvang tells WIRED. “Registered Agents Inc. now has the capability to establish an entire business identity for its customers in less than 10 minutes.”

Clues about changes within Epik first emerged in January, when the company terminated its relationship with Kiwi Farms, a notorious trolling site whose users are dedicated to perpetuating never-ending drama and misery. In a series of bizarre and now deleted tweets, Epik claimed it suspended Kiwi Farms in response to a US court order and that the site hosted child sexual abuse material. In response, the Kiwi Farms administrator began crowdfunding money for a defamation lawsuit against Epik. “You specialize in defamation, revenge porn, harassment, and hate speech and you want to sue us? We will expose all your and your users dirty secrets and they will be permanent public records,” the EpikLLC X account replied. “The judgment we will win against you will follow you the rest of your life.”

It was as if a new set of trolls with an entirely different worldview had taken over Epik.

“Alright all Whiny, Beta Snowflakes. Our DEI hires of the month canceled #Kiwifarms,” another post from EpikLLC read. “We don't like hate speech, porn, or doxxing. #JoeBiden will fix it! 2024!”

Some of the tweets trolling Epik were later deleted. “If such comments and or interactions on X were found to be offensive, Epik LLC formally apologizes to those individuals and or company,” Myrvang, the company's lawyer, says. “Further, the appropriate action has been taken internally in relation to the comments made on X.” It’s unclear if Epik’s new owners singled out Kiwi Farms or if it has booted other sites from its service. “Epik.com’s Terms of Service has been updated to maintain compliance with all regulatory requirements,” Myrvang says. When asked if the company has stopped working with other customers, Myrvang says, “Epik LLC will suspend and or terminate relationships with any company and or individual who violates its Terms of Services.”

In late 2022, Epik customers began reporting that they were suddenly unable to withdraw money from Masterbucks, Epik’s payment platform, which facilitated buying and selling pricey domain names. One customer, Luigi Marruso, posted on the domain name forum NamePros claiming that Epik was holding onto $1.5 million of its money. In an email to WIRED, Marruso says he still hasn’t been paid back.

Another customer, Matthew Adkisson, sued Epik and Monster, claiming they had mismanaged or embezzled $327,000 from him as he sought to purchase nourish.com. Epik later settled with Adkisson.

Claims like Adkisson’s began to pile up on forums for professionals in the domain name business (known as “domainers”), and Epik was in serious financial jeopardy.

Epik’s customers, fearing the worst, rushed to get their money back from the company. Epik even had outstanding debts with ICANN, the nonprofit that serves as a global administrator for the internet, according to legal filings.

“They were using customer funds to fund its operations. People started asking for those customer funds back, and they couldn't pay them,” says Andrew Allemann, a journalist who covered the fiasco for Domain Name Wire. “There was a run on the bank, and the money wasn’t there.”

In September 2022, a new CEO was installed at Epik in an attempt to stem the bleeding and settle the company’s debts. Epik, once valued by an investor at around $150 million was sold for around $5 million dollars in June 2023, according to a purchase agreement released as an exhibit in the Adkisson lawsuit. Much of the $5 million purchase price was allocated to paying off some of Epik’s debts. It’s unclear if the terms of the final deal match the one released as part of the lawsuit, but a source familiar with the acquisition says it was generally similar.

The rest of the debt was left with Monster. Just how much Monster owes former customers and vendors is unknown. Two former Epik customers told WIRED they’re still waiting to be paid back $38,000 and $20,000, respectively.

3 notes

·

View notes

Text

At TRUIC, we specialize in making the process of forming an LLC in Florida straightforward and stress-free. Our dedicated team of experts provides comprehensive services, from selecting a unique business name and filing the necessary paperwork to ensuring full compliance with Florida's legal requirements.

#LLC in Florida#Best LLC in Florida#Get Registered LLC in Florida#Get Started LLC in Florida#How to Get LLC in Florida#How to Start an LLC in Florida#Leading LLC in Florida#Start Your LLC in Florida#Start an LLC in Florida#Top LLC in Florida

3 notes

·

View notes

Text

Cheapest way to form an LLC in New York | TRUIC

Are you considering starting a business in the Empire State and looking for the most cost-effective way to form an LLC (LLC in New York)? Look no further than TRUIC for expert guidance on navigating the process while keeping expenses to a minimum. In this comprehensive guide, we’ll explore the cheapest way to form an LLC in New York and provide valuable insights into the associated benefits and requirements.

LLC application New York

The process of applying for an LLC in New York begins with filing the Articles of Organization with the New York Department of State. This document officially establishes your business entity and includes essential information such as the LLC’s name, address, and registered agent details.

Free LLC in New York

While there are certain unavoidable costs associated with forming an LLC in New York, there are also opportunities to minimize expenses. For example, you can choose to serve as your own registered agent, eliminating the need to pay for professional registered agent services. Additionally, by completing the filing process yourself, you can avoid paying additional fees charged by third-party service providers.

NYS LLC filing online

One of the most convenient and cost-effective ways to file for an LLC in New York is by utilizing the state’s online filing system. This streamlined process allows you to submit your Articles of Organization electronically, reducing paperwork and processing times. By filing online, you can also track the status of your application in real-time and receive immediate confirmation of your LLC’s formation.

New York LLC publication requirement

It’s essential to be aware of New York’s LLC publication requirement, which mandates that newly formed LLCs publish a notice of their formation in two newspapers designated by the county clerk within 120 days of filing the Articles of Organization. While this step incurs additional costs, there are strategies to minimize expenses, such as selecting newspapers with lower publication rates or publishing notices in digital publications.

New York LLC search

Before finalizing your LLC name, it’s crucial to conduct a thorough search to ensure its availability and compliance with New York naming guidelines. The New York Department of State’s online database allows you to search for existing business entities and trademarks to avoid potential conflicts and legal issues down the line.

Articles of Organization NY

The Articles of Organization serve as the foundational document for your LLC in New York and outline essential details about your business, including its purpose, management structure, and member information. By accurately completing and filing this document, you can ensure compliance with state regulations and establish your LLC with confidence.

New York LLC annual filing requirements

In addition to the initial formation process, LLCs in New York are required to fulfill annual filing requirements to maintain their active status. This includes filing an Annual Report with the New York Department of State, which provides updated information about your LLC’s business activities and contact details. By staying current with these filing obligations, you can avoid penalties and maintain good standing with the state.

Conclusion

forming an LLC in New York doesn’t have to break the bank. With the right approach and resources, you can navigate the process efficiently while minimizing costs. For personalized assistance and guidance, consider reaching out to TRUIC for access to the best agents and resources for LLC formation.

2 notes

·

View notes

Text

Business Lawyer For LLC

Are you tired of feeling like you're walking through a legal minefield when it comes to managing your LLC? Well, worry not, because a business lawyer specializing in LLCs can be your guiding light in the legal realm. The complexities of business law can be daunting, but with the right legal counsel, you can navigate through the challenges with confidence and assurance. Let's explore how a skilled business lawyer can help you protect your LLC and set it up for long-term success.

Key Takeaways

Expert guidance in LLC formation, compliance, and risk management.

Tailored operating agreements for ownership structure and conflict resolution.

Asset protection strategies, separate personal/business assets, and insurance coverage.

Dispute resolution support, mediation services, and legal counsel engagement for LLC success.

Importance of Legal Guidance

With Jeremy Eveland as your business lawyer for your LLC, you can confidently navigate the complex legal landscape with expert guidance and support. Having a knowledgeable attorney like Jeremy by your side is crucial for ensuring that your business operates within the bounds of the law. Jeremy's experience and expertise can help you understand the legal requirements specific to your industry and jurisdiction, allowing you to make informed decisions that protect your business from potential legal pitfalls.

When it comes to forming and structuring your LLC, Jeremy Eveland can provide valuable insights that ensure your business is set up for success. From drafting articles of organization to creating operating agreements, Jeremy will work diligently to tailor legal solutions that meet your unique needs. By enlisting Jeremy's services, you can rest assured that your business interests are safeguarded and that you are adhering to all applicable laws and regulations.

Moreover, Jeremy Eveland's proactive approach to legal compliance can save you time, money, and stress in the long run. By addressing potential legal issues before they escalate, Jeremy can help you avoid costly litigation and penalties that could jeopardize your business's future. With Jeremy as your trusted legal advisor, you can focus on growing your business with the peace of mind that comes from having a skilled attorney in your corner. To benefit from Jeremy Eveland's expertise, call (801) 613-1472 today.

Business Attorney Near Me

Formation Process Assistance

Navigating the process of forming an LLC can be made smoother and more efficient with Jeremy Eveland's expert assistance. Setting up your LLC correctly is crucial for its future success, and having a knowledgeable business attorney like Jeremy Eveland by your side can make all the difference. Here are some ways Jeremy can help you during the formation process:

Legal Compliance: Jeremy will ensure that all the necessary legal requirements for forming an LLC in your state are met. This includes filing the articles of organization, drafting the operating agreement, and obtaining any required permits or licenses.

Name Availability: Jeremy can conduct a thorough search to check the availability of your desired business name and reserve it for your LLC if needed to prevent any trademark issues in the future.

Registered Agent Services: Jeremy can act as your registered agent, receiving important legal documents on behalf of your LLC and ensuring they are handled promptly and professionally.

Tax Classification Guidance: Jeremy can provide guidance on selecting the most beneficial tax classification for your LLC, such as choosing between being taxed as a disregarded entity, partnership, S-corp, or C-corp.

Document Preparation: Jeremy will assist in preparing all the necessary documentation accurately and efficiently, saving you time and potential headaches down the road.

Business Entity Attorney Near Me

Operating Agreement Drafting

Jeremy Eveland expertly crafts operating agreements tailored to your LLC's specific needs, ensuring clarity and legal compliance. An operating agreement is a crucial document that outlines the ownership and operating procedures of your LLC. Jeremy will work closely with you to understand your business goals, structure, and unique requirements to draft a comprehensive agreement that protects your interests. By customizing the operating agreement to fit your specific circumstances, Jeremy ensures that all members are on the same page regarding decision-making processes, profit-sharing arrangements, management responsibilities, and dispute resolution mechanisms.

When drafting the operating agreement, Jeremy pays meticulous attention to detail, covering essential provisions such as member contributions, voting rights, profit distributions, and dissolution procedures. Clear and unambiguous language is used to prevent misunderstandings and potential conflicts in the future. Jeremy's expertise in business law allows him to anticipate potential issues that may arise within the LLC and address them preemptively in the operating agreement.

Moreover, Jeremy ensures that the operating agreement complies with state laws and regulations, providing you with peace of mind knowing that your LLC is legally sound. Whether you are forming a single-member LLC or a multi-member entity, having a well-crafted operating agreement is vital for establishing clear guidelines and protecting the interests of all parties involved. Contact Jeremy Eveland today at (801) 613-1472 to discuss how he can assist you in drafting an operating agreement that meets your LLC's specific needs.

Compliance With State Regulations

To ensure the legal soundness of your LLC, understanding and complying with state regulations is paramount. Failure to adhere to these regulations can lead to penalties, fines, or even the dissolution of your LLC. Here are some key points to consider:

Registered Agent Requirement: Most states require LLCs to designate a registered agent who will receive legal documents and official correspondence on behalf of the company. This agent must have a physical address in the state where the LLC is registered.

Annual Report Filing: Many states mandate that LLCs file an annual report to provide updated information about the company, such as its members, managers, and business address. Failure to submit this report on time can result in late fees or other penalties.

Publication Requirements: Some states require LLCs to publish a notice in a local newspaper to inform the public of the formation of the company. This process usually has specific deadlines and guidelines that must be followed.

Business Licenses and Permits: Depending on the nature of your LLC's business activities, you may need to obtain specific licenses or permits to operate legally within the state. Ensuring compliance with these requirements is crucial.

Tax Obligations: Understanding and fulfilling your LLC's tax obligations at the state level is essential. This includes paying state taxes, filing necessary tax returns, and keeping accurate financial records. Failure to do so can result in severe consequences.

Business Lawyer for LLC

Asset Protection Strategies

Implementing effective asset protection strategies is crucial for safeguarding your LLC's interests and mitigating potential risks. As a business owner, you must be proactive in protecting your assets from potential legal threats. One common strategy is to keep personal and business assets separate. By maintaining a clear distinction between the two, you can shield your personal wealth from any liabilities that may arise in the business.

Another key asset protection strategy is to ensure proper insurance coverage for your LLC. Having adequate insurance can help cover costs in the event of lawsuits or other unforeseen circumstances. It is essential to regularly review and update your insurance policies to guarantee that they align with your current business needs.

Forming a Limited Liability Company (LLC) is also a valuable asset protection tool. An LLC provides a level of protection by separating your personal assets from those of the business. This separation can help safeguard your personal wealth in case the business encounters financial difficulties or legal issues.

Additionally, creating a solid operating agreement for your LLC is essential. This agreement outlines the ownership structure, management responsibilities, and decision-making processes within the company. A well-drafted operating agreement can help prevent internal disputes and protect the assets of the LLC.

Dispute Resolution Support

For a seamless operation of your LLC, having robust dispute resolution support is imperative in maintaining business stability and protecting your assets. When conflicts arise, having a clear plan in place can save time, money, and preserve relationships. Here are some key aspects to consider when seeking dispute resolution support:

Mediation Services: Utilizing a neutral third party can help facilitate discussions and negotiations between conflicting parties, aiming to reach a mutually acceptable resolution without the need for litigation.

Arbitration Options: Including arbitration clauses in contracts can provide a structured process for resolving disputes outside of court, offering a quicker and more cost-effective alternative to traditional litigation.

Legal Guidance: Having a business lawyer well-versed in dispute resolution can provide you with valuable advice on the best strategies to resolve conflicts efficiently while safeguarding your interests.

Documentation Protocols: Maintaining detailed records of all communications and agreements can serve as crucial evidence in case of disputes, helping to clarify facts and protect your rights.

Compliance Checks: Regularly reviewing and ensuring compliance with relevant laws and regulations can help prevent disputes from arising due to misunderstandings or oversights.

Long-Term Business Success

Achieving lasting success in your business requires strategic planning and consistent effort towards growth and sustainability. To ensure your LLC thrives in the long term, it is essential to focus on key aspects such as financial stability, customer satisfaction, and innovation. Here is a breakdown of these crucial elements in a table format:

Key Aspect Description Action Needed Financial Stability Maintain healthy cash flow, monitor expenses, and invest wisely to support operations. Create detailed financial projections and budgets. Customer Satisfaction Prioritize customer needs, gather feedback, and provide excellent products/services. Implement customer loyalty programs and surveys. Innovation Stay ahead of the competition by adapting to market trends and exploring new ideas. Foster a culture of creativity and continuous learning.

Frequently Asked Questions

Can an LLC Protect My Personal Assets in Case of a Lawsuit?

Yes, forming an LLC can help protect your personal assets in case of a lawsuit. The limited liability structure of an LLC generally shields your personal assets from business liabilities, such as debts or legal claims. However, it's crucial to maintain proper business practices and separate personal and business finances to uphold this protection. Consulting with a business lawyer like Jeremy Eveland can ensure your LLC is set up correctly for maximum asset protection.

How Can Jeremy Eveland Help Me Navigate Complex Tax Laws Related to My Llc?

Navigating complex tax laws related to your LLC can be daunting, but Jeremy Eveland can help. With his expertise, Jeremy can provide guidance on tax strategies that optimize your business's financial health. He can assist in minimizing tax liabilities, maximizing deductions, and ensuring compliance with ever-changing tax regulations. By leveraging Jeremy's knowledge and experience, you can confidently navigate the intricate tax landscape and make informed decisions for your LLC's success.

What Steps Should I Take if I Want to Bring on New Partners or Investors in My Llc?

If you're adding new partners or investors to your LLC, begin by defining each person's role and contribution clearly. Draft a detailed agreement laying out ownership shares, responsibilities, and profit distributions. Consult Jeremy Eveland, (801) 613-1472, for legal advice on structuring the partnership agreement to protect everyone's interests. Ensure all parties understand and agree to the terms before finalizing the agreement to prevent potential conflicts down the road.

What Are the Consequences of Not Having a Properly Drafted Operating Agreement for My Llc?