#refurbishment finance london

Explore tagged Tumblr posts

Text

This day in history

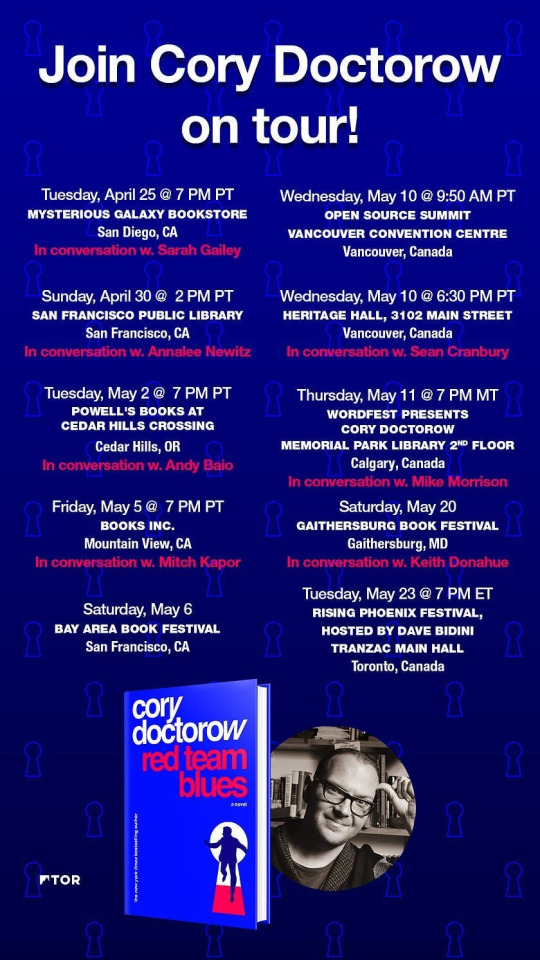

Tonight (Apr 25) I’ll be in San Diego for the launch of my new novel, Red Team Blues, at 7PM at Mysterious Galaxy Books, hosted by Sarah Gailey. Please come and say hi!

Tomorrow (Apr 26), I’ll be in Burbank, signing Red Team Blues at Dark Delicacies at 6PM.

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

#10yrsago HOWTO die at Burning Man https://burners.me/2013/04/25/9-ways-to-die-at-burning-man/

#10yrsago Fair use decision: remixing is legal even when there is no intent to comment or parody original work https://www.artnews.com/art-in-america/features/richard-prince-wins-major-victory-in-landmark-copyright-suit-59404/

#10yrsago Debunking the HTML5 DRM myths https://web.archive.org/web/20130427210336/http://freeculture.org/blog/2013/04/23/dont-let-the-myths-fool-you-the-w3cs-plan-for-drm-in-html5-is-a-betrayal-to-all-web-users/

#10yrsago Akissi: kids’ comic about a mischievous girl in Cote D’Ivoire https://memex.craphound.com/2013/04/26/akissi-kids-comic-about-a-mischievous-girl-in-cote-divoire/

#10yrsago Publishing should fight ebook retailers for more data https://web.archive.org/web/20130428235824/http://www.thebookseller.com/blogs/tangible-assets.html

#10yrsago Jello Biafra talks Occupy, music, and Obama https://www.theguardian.com/music/2013/apr/25/jello-biafra-obama-occupy

#10yrsago Too-big-to-fail banks implicated in $500 trillion fraud: biggest price-rigging scandal in history https://www.rollingstone.com/politics/politics-news/everything-is-rigged-the-biggest-price-fixing-scandal-ever-82255/

#5yrsago A who’s-who of tech manufacturers sent scaremongering letters to the Illinois legislature to kill Right to Repair https://www.vice.com/en/article/vbxk3b/appliance-companies-are-lobbying-against-right-to-repair

#5yrsago Security researchers can turn Alexa into a transcribing, always-on listening device https://threatpost.com/researchers-hacked-amazons-alexa-to-spy-on-users-again/131401/

#5yrsago Microsoft sends recycler to jail for reinstalling obsolete, licensed copies of Windows on refurbished PCs https://www.washingtonpost.com/news/true-crime/wp/2018/04/24/recycling-innovator-eric-lundgren-loses-appeal-on-computer-restore-discs-must-serve-15-month-prison-term/

#5yrsago Trump’s finance watchdog wants to make the taxpayer-funded database of crooked banks go dark https://www.npr.org/2018/04/25/605835307/the-consumer-complaints-database-that-could-disappear-from-view

#5yrsago Little Brother is 10 years old today: I reveal the secret of writing future-proof science fiction https://www.tor.com/2018/04/26/ten-years-of-cory-doctorows-little-brother/

#1yrago Bottled water monopolist admits recycling is bullshit https://pluralistic.net/2022/04/26/plastic-fatalistic/#recycled-lies

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Catch me on tour with Red Team Blues in San Diego, Burbank, Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

7 notes

·

View notes

Video

youtube

Section 21 Eviction Notices Served on Entire London Apartment Block

Section 21 eviction notices have been served on 150 residents on a block of flats in Deptford, South London, weeks before Christmas.

A Section 21 is a legal method for the landlord to require a tenant to leave a rental property without the need to provide a reason for "no-fault" eviction. A tenant can challenge it and stay in the property until physically evicted, but they may incur court costs.

Watch full video - https://youtu.be/u-v8WXgpTuo

Even with a Section 21 notice, it can take landlords 6 to 12 months to evict a tenant who refuses to move out – often under advice for their local council’s housing or “homeless prevention” department.

The owners of the property, the Aitch Group said a Section 21 notice had been issued to tenants at the Vive Living development to "facilitate the refurbishment of the building".

"The tenants have been given two months' notice, as a minimum, in accordance with their tenancy agreements.".

The eviction notices may have been prompted by Labour’s Renter’s Rights Bill, currently going through Parliament, which will abolish Section 21 “no fault” evictions.

Many landlords are quitting the buy-to-let property market or switching to other rental models, such as AIRBNB serviced accommodation or leasing to local authorities and housing associations.

How will Labour’s new Renters Rights Bill 2024 affect buy-to-let landlords?

The Labour Party’s Renters' Rights Bill 2024 is poised to bring significant changes to the UK’s rental market, impacting both tenants and buy-to-let landlords. Understanding these changes is crucial for landlords to navigate the evolving landscape effectively.

Key Changes Proposed in the Renters' Rights Bill 2024

Watch video version - https://youtu.be/Wx1HXgVW1bM

Section 24 Landlord Tax Hike

Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls.

Email [email protected] for a free consultation on how to deal with Section 24.

Watch video now: https://youtu.be/aMuGs_ek17s

#finance #moneytraining #moneymanagement #wealth #money #marketing #sales #debt #leverage #property #investment #Homeownership #financialplanning #moneymanagement #financialfreedom #section24tax #financialindependenceretireearly #RentersRightsBill #BuyToLet #LandlordLife #UKPropertyMarket #TenantsRights #RentalProperty #PropertyInvestment #LandlordChallenges #RentControl #PropertyStandards #section24

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Cheyne Capital provides £525m senior facility to refinance four London hotels

Cheyne Capital has provided a £525m senior loan to Fattal Hotel Group to support the refinancing of four London hotels.

The hotels were acquired by Fattal in 2019 and are operated under the European arm of the Fattal Hotel Group, the Leonardo Hotels brand.

The hotels being refinanced are the NYX Hotel London Holborn, Leonardo Royal Hotel London City, Leonardo Royal Hotel London Tower Bridge, and Leonardo Royal Hotel London St Paul’s.

Totalling over 1,300 bedrooms, the hotels have undergone significant refurbishment since the acquisition.

Alongside its own funds, Cheyne’s long-term supporter, Migdal Insurance Company, also participated in the refinancing.

Arron Taggart, head of UK investment at Cheyne Real Estate, commented: “This refinancing is one of the largest so far in 2024 and demonstrates our ability to execute high quality transactions of size.

“In Fattal, we have both an operator of the highest calibre as well as a funding partner that is willing to step up when required.

“The London hotel market is proving to be a compelling investment as it continues to recover post COVID-19, and we will continue to seek out similar best-in-class investments such as this.”

Guy Vardi, merger and acquisition director at Fattal, added: "We are pleased to collaborate with Cheyne Capital, who have brought their exceptional expertise to this significant, high-profile financing of our beautiful hotels in London.

“Partnering with them, alongside Migdal Insurance Company, demonstrates the trust they have in our operational performance and hospitality platform, ensuring we continue to elevate our offerings in this vibrant city.”

0 notes

Text

Redefining Urban Landscapes: London’s Architects at the Forefront

London, a city recognised for its rich history and diverse culture, has emerged as a global leader in creating the future of urban spaces. This shift is primarily driven by the architectural design companies in London that are pioneering new approaches to urban planning, sustainability, and community-oriented design. This post will examine why London is leading the way in defining the standard for modern metropolitan architecture.

Historical Significance Meets Modern Innovation

London is a city that combines the old with the new, and its architectural firms excel in balancing history preservation with modern innovation. The city has popular sites like the Tower of London and Buckingham Palace and modern skyscrapers like the Shard and the Gherkin. Combining the past and the future enables the architectural design companies in London to preserve the city's rich architectural tradition while also creating bright, dynamic spaces that represent the city's personality.

Embracing Sustainability at the Core

In recent years, sustainability has become a significant aspect of many industries. With increasing concerns about climate change and urban growth, architecture firms have begun incorporating sustainable techniques. From green roofs and energy-efficient buildings to using sustainable materials, London is setting the bar for environmentally responsible urban development.

Focus on Community and Public Spaces

As cities become denser, the significance of human-centred design cannot be stressed. Architectural design companies in London increasingly emphasise building inclusive, accessible, and lively public areas that encourage community interaction. Creating pedestrian-friendly zones, green spaces, and community centres are just a few instances of how these businesses are reimagining urban living to be more inclusive and supportive of various populations.

Global Influence and Collaboration

London-based firms frequently collaborate on foreign projects, bringing their experience in sustainable and human-centred design to urban developments around the world. The city's architectural firms shape the city and influence urban places around the world. The city's prominence as a global hub for finance, culture, and innovation attracts talent from all over the world, allowing architectural design companies in London to profit from this well of ideas and cultivate a culture of collaboration and creativity.

Adapting to a Post-Pandemic World

The COVID-19 pandemic has drastically altered how we perceive urban settings. With the city's population likely to rise, architects are creating spaces that can evolve to meet changing needs over time. This involves creating adaptable environments to meet changing demands and improve public health through design. Projects prioritising air quality, minimising density, and promoting outdoor activities are also becoming more significant in London’s urban planning.

Closing Remarks: London’s Architectural Design Excellence

By focusing on sustainability, embracing technology, prioritising human-centred design, protecting heritage, fostering global collaboration, and adapting to new challenges, architectural design companies in London are currently at the forefront of designing future urban places. As cities worldwide turn to London for inspiration, the emerging ideas will continue to shape urban landscapes for future generations.If you are looking for an architectural firm, contact JM Design Studio. One of the leading architectural firms in London, the company is well-known for its projects that are not only creatively designed but also environment-friendly. This consultancy offers top-quality services in residential extensions, refurbishments, historic building restorations, master planning, and Design for Manufacture and Assembly (DfMA) projects.

0 notes

Text

Alternative Bridging provides rapid light refurb loan

Alternative Bridging Corporation has financed a £560,000 light refurbishment loan for a property owner in Barnet. The client was in need of a rapid financial solution following the withdrawal of their original lender at the last minute. The property in Barnet, north London, had planning permission for a change of use from a clinic to a three-bedroom residential family home. The client required…

0 notes

Text

Step-by-Step Guide to House Refurbishment

Understanding House Refurbishment

House refurbishment is a comprehensive process of updating and improving an existing property to enhance its functionality, aesthetics, and overall value. It involves various activities, such as repairing, renovating, and modernizing different house parts. Refurbishment can range from minor updates like painting and replacing fixtures to major overhauls that involve structural changes and significant redesigns.

Benefits of House Refurbishment in London

Refurbishing your house in London can offer numerous benefits, making it a worthwhile investment:

Increased Property Value: A well-refurbished house can significantly increase its market value, making it a profitable investment if you sell.

Enhanced Living Experience: Modernizing your home with the latest amenities and design trends can improve your quality of life and make your living space more comfortable and enjoyable.

Energy Efficiency: Upgrading to energy-efficient appliances, windows, and insulation can reduce energy bills and make your home more environmentally friendly.

Maximized Space: Refurbishment allows you to reconfigure your home's layout to utilize available space better, making your home more functional and spacious.

Customization: Personalizing your home according to your tastes and needs can create a living space that reflects your personality and lifestyle.

Planning Your House Refurbishment Project

Proper planning is crucial for a successful house refurbishment project. It ensures the process runs smoothly, stays within budget, and meets your expectations.

Assessing Your Needs and Goals

Start by assessing your current living space and identifying areas that need improvement. Consider the following questions:

What are the primary reasons for refurbishing your house?

Which areas of the house need the most attention?

What specific changes and improvements do you want to make?

How do you envision the outcome?

Answering these questions will help you establish clear goals and priorities for your refurbishment project.

Setting a Realistic Budget

Creating a realistic budget is essential to avoid overspending and ensure your project is financially feasible. Consider the following steps when setting your budget:

Research the average costs of similar refurbishment projects in your area.

Get quotes from multiple contractors and suppliers.

Include a contingency fund to cover unexpected expenses.

Prioritize your spending based on your needs and goals.

Obtaining Necessary Permits and Permissions

Before starting refurbishment work, check with your local council to determine if you need permits or permissions. This is especially important for significant structural changes, electrical work, and plumbing. Failing to obtain the necessary permits can result in fines and delays.

Step-by-Step Guide to House Refurbishment

Initial Assessment

The initial assessment involves evaluating the current condition of your house and identifying areas that need improvement. This step includes:

Conducting a thorough inspection of the property.

Identifying structural issues, such as cracks, dampness, and foundation problems.

Assessing the condition of electrical systems, plumbing, and HVAC systems.

Creating a list of necessary repairs and improvements.

Design Phase

In the design phase, plan your refurbished home's layout and aesthetics. This step includes:

Hiring an architect or interior designer to create detailed plans and blueprints.

Choosing a design style that aligns with your vision and complements the existing structure.

Selecting materials, fixtures, and finishes.

Creating a timeline for the project.

Budgeting and Financing

Once you have a clear design plan, you can create a detailed budget that includes all costs associated with the project. This step includes:

Getting detailed quotes from contractors and suppliers.

Identifying potential financing options, such as personal loans, home equity loans, or refinancing.

Creating a payment schedule based on project milestones.

Demolition and Preparatory Work

Before construction begins, any necessary demolition and preparatory work must be completed. This step includes:

Clearing out furniture and belongings from areas that will be refurbished.

Removing old fixtures, fittings, and finishes.

Addressing any structural issues identified during the initial assessment.

Preparing the site for construction.

Construction and Renovation

The construction and renovation phase is the core of the refurbishment project. This step includes:

Carrying out structural changes, such as knocking down walls, adding extensions, or building new rooms.

Installing new electrical systems, plumbing, and HVAC systems.

Replacing or repairing windows, doors, and roofing.

Applying new finishes, such as flooring, tiling, and painting.

Interior Design and Decoration

Once the construction work is complete, you can focus on your home's interior design and decoration. This step includes:

Installing new fixtures and fittings, such as lighting, cabinetry, and appliances.

Choosing and arranging furniture.

Adding decorative elements, such as artwork, rugs, and accessories.

Ensuring the overall design aligns with your vision and complements the structural changes.

Final Inspections and Touch-Ups

The final step in the refurbishment process involves conducting thorough inspections and making any necessary touch-ups. This step includes:

Inspecting all completed work to ensure it meets quality standards.

Addressing any issues or defects identified during the inspection.

Performing a final cleaning of the property.

Completing any final touches, such as adding decorative elements or landscaping.

Challenges and Considerations

Refurbishing a house can be a complex and challenging process. Here are some common challenges and considerations to keep in mind:

Unforeseen Issues

You may encounter unforeseen issues during refurbishment, such as hidden structural problems or outdated electrical systems. Therefore, you should have a contingency fund and be prepared to adjust your plans.

Staying Within Budget

Staying within budget can be challenging, especially if unexpected expenses arise. Prioritize your spending and be willing to make compromises to stay within your budget.

Time Management

Refurbishment projects can take longer, especially if you encounter delays or complications. Create a realistic timeline and be prepared for potential setbacks.

Hiring Reliable Contractors

Choosing reliable and experienced contractors is crucial for the success of your project. Take the time to research and interview potential contractors, check references, and read reviews.

Legal and Regulatory Compliance

Ensure that all work complies with local building codes and regulations. Obtain necessary permits and permissions to avoid legal issues and delays.

Quality Control

Quality control throughout the project ensures that the final result meets your expectations. Regularly inspect the work and address any issues promptly.

Communication

Effective communication with contractors, suppliers, and other stakeholders is crucial for a smooth and successful project. Convey your expectations and address any concerns promptly.

Conclusion

Refurbishing a house can be a rewarding and transformative experience, allowing you to create a living space that meets your needs and reflects your style. By carefully planning your project, setting a realistic budget, and addressing potential challenges, you can successfully navigate the refurbishment process and achieve your desired outcome. Whether updating a single room or undertaking a complete overhaul, a well-executed refurbishment can enhance your home's functionality, aesthetics, and value.

FAQ

What are the main benefits of house refurbishment in London?

House refurbishment in London offers several key benefits, including increased property value, enhanced living experience, improved energy efficiency, maximized space utilization, and the ability to customize your home to reflect your personal style and needs. These improvements can make your home more comfortable, functional, and attractive, while also potentially yielding a higher return on investment if you decide to sell in the future.

How do I set a realistic budget for my house refurbishment project?

Setting a realistic budget involves several steps:

Research the average costs of similar refurbishment projects in your area.

Obtain detailed quotes from multiple contractors and suppliers.

Include a contingency fund to cover unexpected expenses (typically 10-20% of the total budget).

Prioritize spending based on your needs and goals, focusing on essential repairs and upgrades first.

Consider potential financing options such as personal loans, home equity loans, or refinancing to support your project.

3. Do I need permits and permissions for house refurbishment in London?

Answer: Yes, you may need permits and permissions for certain aspects of your refurbishment project, especially for structural changes, electrical work, and plumbing. It's essential to check with your local council to determine the specific requirements and obtain the necessary permits before starting any work. Failing to secure the required permits can result in fines, delays, and potential legal issues.

What are the common challenges faced during a house refurbishment project?

Common challenges during a house refurbishment project include:

Unforeseen issues, such as hidden structural problems or outdated systems.

Staying within budget, particularly when unexpected expenses arise.

Time management, as projects can often take longer than anticipated.

Hiring reliable and experienced contractors.

Ensuring compliance with local building codes and regulations.

Maintaining quality control throughout the project.

Effective communication with contractors, suppliers, and other stakeholders.

How can I ensure the quality of work during my house refurbishment?

Ensuring quality work involves several steps:

Hiring experienced and reputable contractors with good references and reviews.

Regularly inspecting the work to ensure it meets your standards and addressing any issues promptly.

Communicating clearly with your contractors about your expectations and any concerns.

Maintaining detailed plans and timelines to monitor progress.

Being present on-site or hiring a project manager to oversee the work and ensure adherence to the agreed plans and standards.

#loft conversions#home refurbishments london#contemporary rear extensions london#house refurbishment in london#interiors#loft conversion london#house refurbishment london#loft conversion specialists london#loft extension london#london loft conversion company

0 notes

Text

Exploring the Market for Empty Houses in Essex: A Guide to Finding Your Dream Property

Introduction:

Empty houses in Essex present a unique opportunity for prospective homeowners and investors alike. Whether you're looking for a new place to call home or seeking a promising investment opportunity, the market for empty houses in Essex offers a range of options to explore. In this article, we'll delve into the landscape of empty houses for sale in Essex, shedding light on the reasons behind their vacancy, the opportunities they present, and how you can navigate this market effectively.

Understanding the Market for Empty Houses in Essex:

Essex, with its picturesque landscapes, historical charm, and proximity to London, is a sought-after location for property buyers. However, like any other region, it has its share of empty houses awaiting new occupants or investors. These properties, often with unique features and potential, can be found across various neighborhoods in Essex.

Why are Houses Empty in Essex?

What factors contribute to the vacancy of houses in Essex? Economic fluctuations, changes in demographics, and personal circumstances of homeowners can all play a role. Additionally, houses might be empty due to probate sales, repossession, or landlords seeking new tenants.

How to Identify Empty Houses for Sale:

When searching for empty houses in Essex, utilize online property portals, local estate agents, and auctions. Look for keywords like "vacant possession" or "in need of refurbishment" in property listings. These indicate that the house might be empty or require renovation.

What are the Benefits of Buying an Empty House?

Empty houses for sale in Essex often come with potential for customization and renovation, allowing buyers to create their dream home. Moreover, vacant properties may be priced lower than occupied ones, presenting a cost-effective opportunity for buyers.

How to Evaluate the Condition of an Empty House:

Inspect the property thoroughly for structural issues, dampness, and signs of neglect. Consider hiring a professional surveyor to assess the condition of the house comprehensively.

What Legal Considerations Should You Keep in Mind?

Before purchasing an empty house in Essex, familiarize yourself with legal requirements, including planning permissions, building regulations, and conservation area restrictions. Ensure all necessary paperwork is in order to avoid any legal complications later.

How to Finance the Purchase of an Empty House:

Explore mortgage options tailored for property renovation or consider alternative financing methods such as bridging loans. Discuss your financial situation with a mortgage advisor to find the most suitable solution.

What are the Risks Associated with Empty Houses?

Empty houses in Essex may be vulnerable to vandalism, theft, or deterioration if left unattended for extended periods. It's essential to have adequate security measures in place and maintain regular checks on the property.

How to Renovate an Empty House:

Plan your renovation project carefully, setting a budget and timeline. Prioritize essential repairs and upgrades, such as plumbing, electrical wiring, and insulation, before focusing on aesthetic improvements.

How to Market an Empty House for Sale:

If you're selling an empty house in Essex, highlight its potential and unique features in property listings. Utilize professional photography and staging to showcase the property effectively to potential buyers.

Conclusion:

Empty houses in Essex offer a canvas for homeowners and investors to realize their vision. By understanding the market dynamics, conducting thorough research, and taking necessary precautions, you can navigate the journey of buying or selling empty houses with confidence. Whether you're seeking a fixer-upper or a blank slate for creativity, Essex's vacant properties hold promise for a fulfilling investment venture or a place to call home.

0 notes

Text

Official Presentation Henray Capital

At Henray Capital, we pride ourselves on forging direct relationships to secure unique funding lines, including access to private lenders.As a specialist finance brokerage, our strength lies in tailoring lending options to meet the specific requirements of each project and client.

Bridge Road, London,SW6 2TF,UK

020 3814 9497

#65% ltgdv#acquisition and refurbishment finance#acquisition and refurbishment funding#below market funding#bridging finance brokers.

1 note

·

View note