#quickbooks cloud hosting

Explore tagged Tumblr posts

Text

Best Cloud Hosting Service

Cloudies365 is a premium cloud hosting service that stands out as a top choice for individuals, businesses, and enterprises looking for a reliable and feature-rich platform for their online ventures. With cutting-edge technology and a commitment to providing exceptional performance, Cloudies365 has earned a reputation as one of the best cloud hosting providers in the industry.

#cloud computing#cloud hosting#Best Cloud Hosting#Cloud Hosting Service#QuickBooks Cloud Hosting#Sage Cloud Hosting#TurboTax Cloud Hosting#Peachtree Cloud Hosting

3 notes

·

View notes

Text

Simplify Your Finances with QuickBooks Premier Hosting Solutions

For businesses that rely on powerful accounting tools, QuickBooks Premier offers robust features tailored to different industries. But pairing it with cloud technology can take your financial operations even further. With QuickBooks Premier hosting, you combine the depth of desktop software with the freedom of cloud access—without the IT headaches.

Whether you’re an accountant, small business owner, or growing enterprise, discover how QuickBooks Premier cloud hosting can streamline your workflow, improve collaboration, and keep your data safe.

🌐 What Is QuickBooks Premier Cloud Hosting?

QuickBooks Premier cloud hosting is the process of running your QuickBooks Premier desktop software on a cloud server. Instead of being confined to one computer, you can access the full-featured version of the software anytime, anywhere, and on any device.

It’s a perfect solution for businesses that want both the powerful features of QuickBooks Premier and the flexibility of cloud-based access.

🚀 Why Businesses Are Moving to QuickBooks Premier Hosting

Here’s what makes QuickBooks Premier hosting solutions a smart investment:

✅ Remote Accessibility

Work from home, the office, or while traveling. Cloud hosting gives your team access to the same QuickBooks data, in real time, from different locations.

✅ Multi-User Collaboration

Need your bookkeeper and tax advisor to work on the same file? With QuickBooks Premier hosting service, simultaneous access is simple and secure.

✅ No More IT Stress

Forget hardware upgrades and server maintenance. Your QuickBooks hosting solution provider handles all updates, backups, and infrastructure.

✅ Data Protection You Can Trust

Top-tier security features—like 256-bit encryption, firewall protection, and off-site backups—ensure your financial data is always safe.

💼 Who Should Use QuickBooks Premier Hosting?

QuickBooks Premier hosting isn’t just for accountants—it’s ideal for:

Accounting and CPA firms needing secure, remote access to multiple client files

Retail and manufacturing companies using industry-specific features in QuickBooks Premier

Multi-location businesses looking to unify financial data across branches

Nonprofits and service providers who want real-time collaboration with remote staff

🛠️ What to Look for in a QuickBooks Hosting Solution Provider

Choosing the right partner makes all the difference. When comparing options, look for:

Intuit Authorization – Verified providers meet security and performance standards set by Intuit.

99.99% Uptime – Reliable access ensures business continuity.

Scalable Plans – Add users and features as your business grows.

24/7 Expert Support – Help when you need it, from people who know QuickBooks inside out.

Free Trial or Demo – Test the experience before committing.

⚙️ How It Works – A Quick Overview

Choose a Hosting Provider Select a trusted QuickBooks hosting solution provider that fits your needs.

Install Your Software on the Cloud Server Your licensed copy of QuickBooks Premier is hosted securely in the cloud.

Log In from Any Device Use a secure connection to access QuickBooks from your desktop, laptop, or mobile device.

Collaborate, Work, and Grow Manage books, run reports, and collaborate with your team from anywhere.

✅ Final Takeaway

Whether you're managing your business finances or serving clients as an accounting professional, QuickBooks Premier cloud hosting gives you the tools, freedom, and reliability to work smarter. With the right QuickBooks Premier hosting service, you're not just hosting software—you’re upgrading the way your business operates.

#quickbooks hosting solution provider#quickbooks premier cloud hosting#quickbooks hosting solutions#QuickBooks Premier hosting

0 notes

Text

How QuickBooks Pro Plus Hosting Can Streamline Your Daily Accounting Tasks

Discover how QuickBooks Pro Plus Hosting can simplify your workday by offering secure, remote access to your accounting software anytime, anywhere. With cloud-based hosting, you eliminate the need for complex IT setups and enjoy faster performance, automatic updates, and real-time collaboration with your team.

0 notes

Text

Cloud-Based QuickBooks Enterprise – Enjoy faster processing speeds, encrypted data, and automatic backups by hosting QuickBooks Enterprise on the cloud.

0 notes

Text

1 note

·

View note

Text

Why I Took an Internet Course as an Accounting Student

As an accounting major in business school, most of my schedule is packed with courses like Intermediate Financial Accounting,��Managerial Accounting, auditing, and taxation. So, you might ask—why would I take a course like COMP-2057: Introduction to the Internet?

The answer is simple: technology is transforming accounting. From cloud-based systems to AI-powered bookkeeping and online tax software, the industry is becoming more digital every day. I chose this course as an elective to understand how the internet works from a technical perspective—something I believe will help me become a more capable professional.

Even though this is my first time taking a course like this—and this blog is part of my first assignment—I’m already seeing its value. I’ve started learning how websites are structured using HTML and CSS, how domain names and hosting work, and how content is created and shared online. These skills aren’t just for programmers. In accounting, being able to present financial information clearly on the web or build an online portfolio can make a big difference in communication and personal branding.

What’s been even more interesting is learning from classmates with backgrounds in computer science, engineering, and digital media. Their insights have helped me see how accounting connects with other fields in today’s digital world. Just by reading blog posts and discussions, I’ve picked up new terms, tools, and even some web design tips.

I really think more accounting students should take COMP-2057. It’s not just about coding—it’s about understanding the digital space behind the tools we use every day in business. Whether you’re running a finance blog, helping a small business get online, or using platforms like QuickBooks or Wave, knowing how the web works gives you a clear advantage.

In today’s world, where business and tech are so connected, digital literacy is a must-have skill. I’m excited to keep learning in this course and see how tech can support my future career in accounting.

1 note

·

View note

Text

Top 10 Features to look for in ERP and CRM Software

In today’s fast-paced digital economy, companies cannot afford inefficiency, disjointed data, or fractured customer experiences. To stay ahead, businesses are investing in intelligent systems that seamlessly integrate their internal processes and customer interactions. That’s where ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management) software step in.

While ERP streamlines back-end operations such as finance, supply chain, and inventory management, CRM empowers the front-end by managing customer relationships, sales pipelines, and marketing campaigns. Integrating both offers a comprehensive view of the enterprise fueling agility, efficiency, and profitability.

Yet, the real challenge lies in choosing the right solution.

In this definitive guide, we explore the top 10 features to look for in ERP and CRM software, ensuring your business makes a choice that’s not only functional but future-proof.

1. Unified and Scalable Architectur

Why It Matters:

An integrated platform that supports both ERP and CRM functionalities under one roof offers seamless data flow, fewer silos, and enhanced collaboration.

Look for a system that offers modular scalability, allowing you to start with core features and expand as your needs grow. Whether you’re a startup aiming for rapid expansion or an enterprise optimizing multi-departmental workflows, a unified architecture ensures long-term ROI and simplified IT maintenance.

2. Real-Time Data and Advanced Analytics

Why It Matters:

In today’s data-driven world, decisions based on outdated reports can cost millions. The best ERP and CRM platforms offer real-time dashboards, predictive analytics, and customizable reporting tools to provide insights at every touchpoint.

From sales forecasting and inventory trends to financial analysis and customer behaviour, real-time intelligence fuels better strategy and faster execution.

3. Cloud-Based Deployment and Mobility

Why It Matters:

Modern enterprises demand accessibility. Cloud-based ERP and CRM solutions enable employees to access systems from anywhere — be it in the office, on the road, or while working remotely.

Look for platforms offering mobile-friendly interfaces, secure cloud hosting, and automatic updates. These features ensure business continuity, data resilience, and lower total cost of ownership (TCO).

4. Customization and Configurability

Why It Matters:

Every business is unique. Off-the-shelf software often misses the mark when it comes to aligning with specialized workflows or industry-specific compliance requirements.

Choose a solution that offers drag-and-drop tools, workflow builders, role-based configurations, and API support. A customizable ERP/CRM ensures that your technology fits your processes, not the other way around.

5. Seamless Third-Party Integration

Why It Matters:

Your ERP and CRM software should not exist in a silo. Whether you’re using an e-commerce platform, email marketing suite, HR management system, or accounting software, integration is key.

Modern solutions offer open APIs, RESTful web services, and native plug-ins for platforms like Shopify, Salesforce, QuickBooks, Outlook, and more.

6. AI-Powered Automation and Machine Learning

Why It Matters:

AI isn’t just a buzzword — it’s revolutionizing how we work. Look for ERP and CRM software with AI-powered forecasting, customer segmentation, automated invoicing, lead scoring, and chatbots.

These intelligent features reduce manual tasks, improve accuracy, and help teams focus on strategic activities.

7. Comprehensive Financial Management

Why It Matters:

Your ERP system should provide a robust financial suite covering general ledger, accounts payable and receivable, budgeting, multi-currency support, tax compliance, and audit trails.

Having CRM integration ensures you align financial data with customer activity — especially critical for quote-to-cash workflows, invoicing, and revenue recognition.

8. Customer 360° View and Relationship Intelligence

Why It Matters:

The strength of a CRM lies in its ability to provide a 360-degree view of the customer including touchpoints, purchase history, support interactions, and behavioural data.

When tightly coupled with ERP, this offers holistic insights into customer profitability, order trends, and service performance powering personalized engagement and strategic retention.

9. Strong Security and Regulatory Compliance

Why It Matters:

With growing cyber threats and evolving regulations, your ERP and CRM software must ensure enterprise-grade security and regulatory adherence.

Look for multi-factor authentication (MFA), role-based access controls, end-to-end encryption, and compliance with GDPR, HIPAA, SOX, or industry-specific standards.

10. Exceptional User Experience (UX) and Support

Why It Matters:

All the functionality in the world won’t matter if your team finds the system clunky or unintuitive. Seek platforms that offer clean UI design, task automation, personalized dashboards, and embedded tutorials.

Equally critical is post-implementation support. Choose vendors known for responsive customer service, training programs, onboarding support, and community forums.

Bonus Feature: Sales and Marketing Automation

Although not part of the core “ten,” this feature deserves honourable mention. Integrated marketing tools within CRM allow for email campaigns, social media tracking, SEO performance metrics, lead nurturing workflows, and performance attribution — all crucial in modern B2B and B2C marketing landscapes.

Conclusion

Choosing ERP and CRM software is no longer just an IT decision — it’s a strategic imperative that shapes your business’s ability to operate, scale, and compete. The right features will ensure your organization is not merely managing data but transforming it into actionable intelligence and tangible results.

When selecting a solution, evaluate more than just the brochure. Run trials, request demos, consult with stakeholders, and prioritize long-term alignment over short-term trends.

0 notes

Text

QuickBooks Server Setup Services | Expert Configuration & Support

Get professional QuickBooks server setup services with The QuickBooks Guy. We specialize in configuring QuickBooks Desktop in multi-user environments for seamless access, data security, and efficient performance. Whether you're setting up for a small office or a growing business, our team ensures proper installation, file hosting, user permissions, and cloud integration if needed. With over 20 years of experience, we provide reliable support for both local and remote QuickBooks server configurations. Optimize your accounting workflow with an expert setup tailored to your business needs.

0 notes

Text

“High-Performance RDP for Enterprise Use: Inside RHosting’s Capabilities”

In the enterprise world, remote desktop access isn’t just a convenience — it’s a mission-critical capability. Performance, security, and scalability must be non-negotiable. Traditional RDP setups often fall short when faced with real-time workloads, distributed teams, and high-security demands.

Enter RHosting — a next-generation RDP platform designed specifically to meet the needs of modern enterprises. With cloud-optimized infrastructure, enterprise-grade security, and advanced customization, RHosting delivers high-performance remote access at scale.

Here’s a deep dive into the capabilities that make RHosting ideal for enterprise environments.

⚡ 1. Optimized for Speed and Performance

Enterprise users often run resource-heavy applications — from ERPs and CRMs to analytics dashboards and virtual design tools. RHosting is optimized to handle these intensive workloads without lag or downtime.

Low-latency connections, even over long distances

Load balancing and autoscaling for peak efficiency

Seamless access to Windows desktops and apps on-demand

GPU support for graphic-intensive workloads (optional tiers)

Whether your team is working from a remote branch office or across continents, RHosting ensures a consistent, high-speed user experience.

🛡️ 2. Enterprise-Grade Security Architecture

Security is a top priority for any business. RHosting offers a zero-trust-ready environment with multiple layers of protection:

End-to-end encryption (AES 256-bit)

Multi-factor authentication (MFA)

IP whitelisting & geofencing

Role-based access control (RBAC)

No open ports, no public RDP exposure

Activity logging and session monitoring also help your IT teams stay compliant and audit-ready.

🧩 3. Custom Configuration for Any Use Case

Every enterprise has different needs. RHosting provides flexible configuration options to fit your organization’s workflows:

Isolated server environments for teams, departments, or clients

Custom app publishing — provide access only to Tally, AutoCAD, QuickBooks, etc.

Folder-level permission management

SSO and Active Directory integration (on request)

Our platform supports fully managed or self-managed deployment models — giving you the control you need.

📊 4. Centralized Administration with Granular Controls

Managing large teams doesn’t have to mean IT overload. With RHosting’s intuitive admin portal, your IT department can:

Create and manage users in bulk

Assign or revoke access instantly

Monitor usage, generate reports, and set usage limits

Push updates or roll back configurations without disruption

It’s enterprise-level control without enterprise-level complexity.

🌐 5. Global Availability with Cloud-First Infrastructure

RHosting is hosted on high-speed data centers strategically located worldwide, allowing global teams to connect to the nearest server for optimal performance.

Geo-optimized routing

High availability architecture

Disaster recovery options and backups

24/7 infrastructure monitoring

Whether you’re operating in the U.S., Europe, India, or across multiple continents — RHosting keeps your business connected.

🚀 6. Seamless Scaling for Growing Teams

As your business grows, RHosting scales with you — without new hardware, license limits, or long onboarding cycles.

Add new users or environments in minutes

Easily scale resources (RAM, CPU, storage) as demand increases

Monthly billing with transparent enterprise pricing

✅ Built for the Demands of the Modern Enterprise

RHosting delivers more than just remote access — it’s a platform for agile, secure, and scalable work environments. With a laser focus on performance and security, RHosting empowers enterprises to support remote operations without compromise.

0 notes

Text

Cloud hosting includes hosting accounting, CRM, tax, Microsoft software, applications or data on virtual servers, providing scalability and flexibility through remote server infrastructure. It allows users to access and manage resources via the Internet, reducing the need for physical hardware and increasing reliability.

#Cloud Hosting#Best Cloud Hosting#Cloud Hosting Service#QuickBooks Hosting#Sage Cloud Hosting#TurboTax Cloud Hosting#Drake Tax Hosting#ATX Tax Hosting

3 notes

·

View notes

Text

QuickBooks Premier Hosting: Everything You Need to Know for a Smarter Accounting Setup

Running QuickBooks Premier on a local desktop may have worked in the past, but today's businesses need more flexibility, stronger data security, and collaboration from anywhere. That’s where QuickBooks Premier hosting comes in.

In this blog, we’ll walk you through what QuickBooks Premier cloud hosting is, how it works, key benefits, what to look for in a QuickBooks hosting solution provider, and answer some frequently asked questions that people search on Google.

What Is QuickBooks Premier Hosting?

QuickBooks Premier Hosting is the process of running your desktop version of QuickBooks Premier on a virtual cloud server. Instead of accessing it from a single PC, you and your team can log in remotely via a secure internet connection from any device—PC, Mac, tablet, or mobile.

In short, it gives you the power of the desktop version, combined with the flexibility and security of the cloud.

How QuickBooks Premier Cloud Hosting Works – A Technical View

Here’s a behind-the-scenes breakdown of how it functions:

Virtual Server Setup: Your hosting provider sets up a secure cloud server (typically Windows Server OS) with fast SSD storage and scalable memory.

QuickBooks Installation: Your licensed QuickBooks Premier software is installed and configured on this server, optimized for performance and remote use.

User Access Configuration: Multiple users can be set up with custom permissions, allowing them to work on the same file in real time.

Secure Remote Access: Access is provided through Remote Desktop Protocol (RDP) or a web-based portal. Top-tier security features like multi-factor authentication and SSL encryption are standard.

Data Backup and Disaster Recovery: Daily automatic backups, geo-redundancy, and snapshot recovery options are built into the system.

Third-Party App Integration: You can integrate payroll, CRM, time-tracking, or Microsoft 365 applications, just as you would on a desktop version.

Key Benefits of QuickBooks Premier Hosting Service

Here’s what you gain by switching from local installs to QuickBooks Premier hosting solutions:

1. Remote Access from Anywhere

You’re no longer tied to the office. Log in from home, client locations, or on the go. It’s secure, fast, and reliable.

2. Seamless Collaboration

Work simultaneously with other users on the same file—no version conflicts, no emailing files back and forth.

3. Automated Updates & Maintenance

No more manual updates or IT headaches. Your hosting provider handles everything from software patches to OS upgrades.

4. High-Level Security

Your data is protected by advanced firewalls, encrypted connections, anti-virus tools, and secure Tier 3+ data centers.

5. Scalable Infrastructure

Add users, increase server capacity, or upgrade RAM as your needs grow. No need to reinvest in new hardware.

6. Disaster Recovery & Daily Backups

Top providers perform regular backups and include disaster recovery tools to avoid data loss in case of system failure.

How to Choose a QuickBooks Hosting Solution Provider

Not every provider delivers the same performance or support. Here's what you should look for: FeatureWhat to Look ForIntuit AuthorizationChoose an Intuit Authorized Hosting Provider (IAHP)Security ComplianceSOC 2, ISO 27001, or HIPAA compliance24/7 SupportLive chat, email, and phone support anytimeInfrastructureTier 3+ or Tier 4 data centers, SSD-based serversTrial PeriodMany providers offer free trials or demo environments

How to Get Started with QuickBooks Premier Cloud Hosting

Here’s how to move your software to the cloud the right way:

Step 1: Select a Trusted Provider

Do your research. Look at reviews, security certifications, and their experience with QuickBooks Premier hosting services.

Step 2: Share Your Licensing Info

You’ll need to share your license key, number of users, and any add-ons you use.

Step 3: Plan Your Migration

Choose a downtime window—like a weekend or late night—for the transition. A backup of your current files should be made before any changes.

Step 4: Cloud Setup & Configuration

The provider installs QuickBooks on a virtual server and transfers your files. They’ll configure multi-user access and performance settings.

Step 5: Testing and Go-Live

Test the hosted environment for accuracy—run reports, open files, test user access. Once everything works, you’re good to go live.

Step 6: Staff Onboarding & Support

Your provider typically offers onboarding documentation and live support to help your team adjust.

Frequently Asked Questions (FAQs)

Q1: Can I use QuickBooks Premier on the cloud?

Yes, QuickBooks Premier can be hosted on the cloud by a verified QuickBooks hosting solution provider. This lets you access it remotely with all desktop features intact.

Q2: What is the difference between QuickBooks Premier hosting and QuickBooks Online?

QuickBooks Online is a separate product with different features. Hosted QuickBooks Premier gives you the full functionality of the desktop version—just accessible via the cloud.

Q3: How secure is QuickBooks Premier hosting?

When hosted by a reputable provider, it's extremely secure. Look for features like end-to-end encryption, multi-factor authentication, and secure Tier 3+ data centers.

Q4: Is QuickBooks Premier cloud hosting good for accountants and CPAs?

Absolutely. It supports multi-user access, real-time collaboration, and integrates with tools commonly used by accounting professionals.

Q5: Can I integrate third-party apps with QuickBooks Premier hosting?

Yes. Most hosting providers support integration with tools like Microsoft 365, Bill.com, Avalara, TSheets, and more.

Q6: Do I need to buy QuickBooks again to host it?

No. If you already have a valid QuickBooks Premier license, you can use that on the hosted server. Just ensure it matches your hosting environment.

Q7: What happens if I want to cancel the hosting service?

You can cancel anytime, and most providers will help you download a backup of your data for local use. Always ask about cancellation policies upfront.

Final Thoughts

Switching to QuickBooks Premier cloud hosting gives you more freedom, better collaboration, and a secure environment to run your accounting operations. Whether you're a solo CPA or a multi-user financial team, the benefits of QuickBooks Premier hosting services are hard to ignore.

If you’re looking for a QuickBooks hosting solution provider that can handle the setup, backups, compliance, and support—so you can focus on your business—it might be time to make the move.

#quickbooks premier cloud hosting#quickbooks premier hosting#quickbooks premier hosting service#quickbooks hosting solution provider#quickbooks hosting solutions

0 notes

Text

How QuickBooks Pro Plus Hosting Can Streamline Your Daily Accounting Tasks

Discover how QuickBooks Pro Plus Hosting can simplify your workday by offering secure, remote access to your accounting software anytime, anywhere. With cloud-based hosting, you eliminate the need for complex IT setups and enjoy faster performance, automatic updates, and real-time collaboration with your team

0 notes

Text

Say Hello to Smarter Business with PC Cloud UAE

Are you tired of being tied to your desk just to manage your business data or apps? 👀 Enter PC Cloud – a game-changing cloud hosting service from the tech pros at Perfonec Computers Trading LLC based in the UAE 🇦🇪.

Whether you're a startup, freelancer, or growing business – they've got something for everyone.

What Makes PC Cloud Awesome?

QuickBooks & Sage Hosting Custom Cloud Servers 24/7 Tech Support Daily Backups + Antivirus

Plans for Every Business

From solo entrepreneurs to big teams, PC Cloud offers:

QuickBooks Cloud Hosting (including VAT features)

Sage 50 Cloud Hosting

Dedicated Cloud Space

To know more Please visit - pccloud.ae or contact on +971 4 386 6199. Follow the future of business in the cloud 💻☁️

#CloudHosting #UAEtech #PCCloud #QuickBooksHosting #SmallBusinessTools #Sage50 #WorkAnywhere #TechInUAE

1 note

·

View note

Text

Secure Cloud Hosting Solutions & Cybersecurity Services | OneUp Networks

OneUp Networks offers a comprehensive suite of services designed to meet the diverse needs of businesses. Below is an overview of their key offerings:

Accounting Cloud Services

CPA Hosting: Tailored specifically for CPA, accounting, and bookkeeping firms, this virtual workspace supports essential applications such as Drake, QuickBooks, Sage, and more.

QuickBooks Hosting: Provides scalability, flexibility, and remote access for QuickBooks Desktop, enhancing productivity for businesses and remote users.

QuickBooks Enterprise Hosting: Secure and reliable cloud hosting for QuickBooks Enterprise, allowing seamless collaboration and remote work.

Sage Hosting: Cloud hosting for Sage applications, ensuring high performance and security for businesses.

Wolters Kluwer Hosting: Specialized hosting for Wolters Kluwer tax and accounting software.

Thomson Reuters Hosting: Secure cloud solutions for Thomson Reuters applications like UltraTax CS.

IT and Security Services

Cybersecurity: Comprehensive protection with managed security services to safeguard businesses from cyber threats.

Virtual Desktop Infrastructure (VDI): A cloud-based virtual desktop solution offering secure remote access.

Managed Backup: Reliable data backup and disaster recovery solutions to ensure business continuity.

Managed IT Services: End-to-end IT management, ensuring optimized performance and security.

Company Information

About Us: Learn more about OneUp Networks’ mission, values, and expertise.

Our Infrastructure: Insights into the technology and data centers powering their services.

Blogs: Latest updates, industry news, and tech insights from OneUp Networks.

Pricing: Transparent and competitive pricing for cloud hosting and IT services.

Contact Us: Reach out to OneUp Networks for inquiries, support, and service details.

0 notes

Text

Professional Virtual Admin Services in the UK

Professional Virtual Admin Services in the UK

In today’s fast-paced and highly competitive business landscape, staying organised, responsive, and efficient is more important than ever. For entrepreneurs, small business owners, and growing companies, administrative tasks are vital — but they often consume time and energy that could be better spent on growth and strategy.

That’s where Xcellency’s Professional Virtual Admin Services come in.

Offering reliable, UK-based virtual assistant support, Xcellency helps businesses streamline their operations, reduce costs, and focus on what truly matters: growth, clients, and success. In this blog, we’ll explore the benefits of hiring a virtual admin, the types of services we offer, and why Xcellency is the ideal partner for businesses across the UK.

What Are Virtual Admin Services?

Virtual admin services involve outsourcing administrative tasks to remote professionals. These virtual assistants (VAs) operate from their own locations, using cloud-based tools and secure systems to handle everything from calendar management to customer support.

Unlike hiring a full-time employee, virtual admin services are flexible, cost-effective, and tailored to your needs — whether you need support for a few hours a week or full-time assistance.

Why Choose Xcellency for Virtual Admin Services?

At Xcellency, we combine professionalism, reliability, and UK-based expertise to deliver virtual admin services that feel like a seamless extension of your team. Here’s what sets us apart:

✅ UK-Based Support

All our virtual assistants are familiar with UK time zones, culture, and business etiquette — ensuring smooth communication and fast turnaround times.

✅ Experienced Professionals

Our VAs bring years of hands-on experience across various industries including real estate, legal, finance, healthcare, e-commerce, and consulting.

✅ Scalable & Flexible Packages

Whether you're a solo entrepreneur or a growing team, we offer customised service packages to match your exact needs and budget.

✅ Confidentiality & Security

We use industry-standard tools and sign confidentiality agreements to ensure your sensitive business information stays protected at all times.

Key Services Offered by Xcellency

We understand that every business has different administrative needs. That’s why Xcellency offers a wide range of virtual admin services tailored to your business goals.

📅 Diary & Email Management

Let us handle your inbox, schedule your appointments, manage follow-ups, and ensure you're always on time and organised.

📑 Document Preparation & Editing

From reports and proposals to presentations and spreadsheets, we’ll make sure your documents are professional and ready when you need them.

📞 Customer Support & Client Follow-Ups

We manage client inquiries, schedule calls, and follow up on leads — ensuring a consistent, professional client experience.

📊 Data Entry & CRM Management

Our VAs can input, organise, and manage your customer data across platforms like HubSpot, Zoho, or Salesforce.

💷 Invoicing & Bookkeeping Support

We assist with invoicing, expenses, and light bookkeeping using tools like Xero, QuickBooks, and FreeAgent.

📱 Social Media Scheduling

We schedule posts, manage responses, and help maintain a consistent presence on your business’s social media platforms.

✈️ Travel & Event Planning

From booking travel to planning webinars or events, we take care of all the logistical details so you don’t have to.

Benefits of Hiring a Virtual Assistant in the UK

Outsourcing administrative support to a UK-based virtual assistant offers a host of advantages:

1. More Time to Focus on Growth

Delegate repetitive and time-consuming tasks so you can focus on client work, strategic planning, and expanding your business.

2. Cost-Efficient Operations

No need to pay for office space, equipment, employee benefits, or taxes — only pay for the services you actually use.

3. Expertise on Demand

Tap into specialised skills (such as legal admin, social media management, or data entry) without going through a lengthy recruitment process.

4. Seamless Collaboration

With UK-based VAs who work in your time zone, communication and collaboration are effortless and efficient.

Who Can Benefit from Xcellency’s Virtual Admin Services?

Our services are designed to support a wide range of professionals and industries across the UK, including:

Small Business Owners – Save time and stay focused on the bigger picture.

Startups & Entrepreneurs – Get flexible support without high overheads.

Consultants & Coaches – Improve productivity and client service.

E-commerce Stores – Manage inventory, orders, and customer service.

Healthcare & Wellness Providers – Handle appointments, records, and communication efficiently.

Legal & Financial Professionals – Maintain compliance with organised documentation.

How It Works: Getting Started with Xcellency

We’ve made the process of hiring a virtual admin simple and stress-free:

Book a Free Consultation

Tell us about your business, your current challenges, and what kind of support you’re looking for.

Customise Your Package

We’ll recommend a tailored package based on your goals — from part-time to full-time support.

Meet Your Virtual Assistant

We match you with a skilled, professional VA who fits your needs and business style.

Get Started with Seamless Support

Your VA will begin supporting your business using the tools and systems you already use (or we can recommend some).

Why Now Is the Right Time to Go Virtual

The shift toward remote work, cloud tools, and flexible hiring isn’t just a trend — it’s the future of work. As businesses across the UK continue to adapt, professional virtual admin support offers an unbeatable combination of value, efficiency, and expertise.

At Xcellency, we’re passionate about helping our clients save time, reduce admin overload, and grow their business with confidence.

Final Thoughts

In today’s world, staying organised and responsive can be the difference between stagnation and success. With Xcellency’s Professional Virtual Admin Services in the UK, you can operate like a larger, more agile business — without the traditional overheads.

From inbox management to invoicing, our trusted VAs are here to support you every step of the way. Affordable, professional, and entirely tailored to your needs, our services are built to give you back your time and peace of mind.

Ready to take your business to the next level?

Let Xcellency handle your admin so you can focus on what matters most.

0 notes

Text

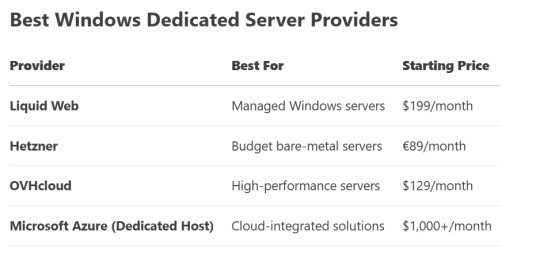

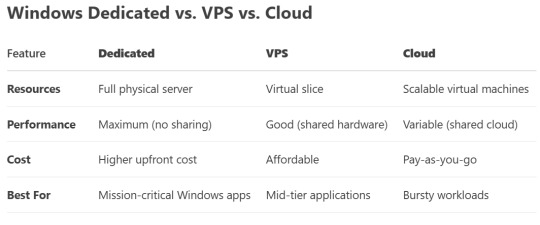

Windows Dedicated Hosting: Enterprise-Grade Power for Windows Workloads

For businesses that demand maximum performance, security, and reliability for Windows-based applications, Windows Dedicated Hosting is the ultimate solution. Unlike shared or VPS hosting, a dedicated Windows server provides exclusive access to an entire physical machine, ensuring optimal performance for resource-intensive workloads.

What is Windows Dedicated Hosting?

A dedicated server running Windows Server OS offers: ✔ Full server resources (No sharing with other users) ✔ Complete administrative access (Full RDP & PowerShell control) ✔ High-performance hardware (Intel Xeon/AMD EPYC, NVMe SSDs, DDR4/DDR5 RAM) ✔ Enterprise-grade security (Windows Defender, Firewall, Active Directory)

Why Choose Windows Dedicated Hosting?

✅ Native Windows application support (ASP.NET, MSSQL, Exchange, SharePoint) ✅ Remote Desktop (RDP) access – Easy GUI-based management ✅ Microsoft ecosystem integration (Azure, Active Directory, Power BI) ✅ High security & compliance (HIPAA, PCI-DSS, GDPR-ready) ✅ Predictable performance – No noisy neighbors affecting resources

Top Benefits of Windows Dedicated Hosting

1. Unmatched Performance for Windows Apps

Run heavy workloads like:

Microsoft SQL Server (MSSQL) databases

ASP.NET & .NET Core web applications

Remote Desktop Services (RDS) for virtual desktops

ERP/CRM software (Dynamics 365, SAP)

2. Full Remote Desktop (RDP) Control

Manage your server via GUI (no SSH required)

Easily install Windows-based software (QuickBooks, Adobe, etc.)

3. Enterprise Security & Compliance

Windows Defender Advanced Threat Protection (ATP)

BitLocker encryption for data security

Active Directory (AD) integration for user management

Ideal for HIPAA, PCI-DSS, and GDPR compliance

4. High Availability & Redundancy

RAID storage configurations (RAID-1/RAID-10 for fault tolerance)

99.99% uptime SLAs from top providers

Backup & disaster recovery options

5. Scalability for Growing Businesses

Easily upgrade CPU, RAM, and storage

Hybrid cloud options (connect to Azure/AWS if needed)

Who Needs Windows Dedicated Hosting?

✔ Enterprises running Microsoft-based applications ✔ Developers using .NET, C#, or MSSQL ✔ Accounting firms hosting QuickBooks Desktop ✔ Healthcare providers needing HIPAA-compliant hosting ✔ Game studios running Windows-based game servers

If your business relies on Windows Server, MSSQL, RDP, or enterprise applications, a Windows Dedicated Server is the best choice. It delivers raw power, full control, and ironclad security—perfect for businesses that can’t afford compromises.

Need a High-Performance Windows Server? Explore Windows Dedicated Hosting Plans Now!

0 notes