#proptrade

Explore tagged Tumblr posts

Text

Forex Lifetime Career Opportunity

Instant funding No Challenge, Just real trading

Get a funded account check our website.

0 notes

Text

What Prop Firm Pays Out the Fastest?

In the world of proprietary trading, traders often seek a firm that not only offers excellent funding opportunities but also ensures timely payouts. Whether you're a seasoned trader or just starting out, understanding which prop trading companies offer the fastest payouts can make a significant difference in your trading career.

So, what prop firm pays out the fastest? Let's dive into the details of proprietary trading firms and why payout speed should be a key factor in choosing where to trade.

Understanding Proprietary Trading

Before we get into the specifics of payout speed, let's clarify what proprietary trading is. In simple terms, proprietary trading (prop trading) is when a firm uses its own capital to trade in financial markets, rather than relying on clients' money. In this setup, traders typically trade on behalf of the firm, and in return, they receive a percentage of the profits they generate.

Proprietary trading firms offer traders the chance to access significant capital, leverage, and advanced tools without risking their personal funds. This is one of the reasons why many traders are drawn to prop trading companies—they provide an opportunity to trade at a professional level without the downside of personal financial risk.

Why Payout Speed Matters in Prop Trading

For traders, the ultimate goal is often to generate consistent profits. However, after all the hard work, it’s important that payouts are timely and reliable. Traders who experience long delays in receiving their earnings can become frustrated, which in turn can impact their trading performance and overall morale. Fast payouts offer a sense of security and reliability, which is why many traders prioritize this feature when selecting a prop trading company.

A fast payout process not only gives traders peace of mind but also allows them to reinvest their profits into new trades or take the funds for personal use. This is particularly important for high-frequency traders or those who have set financial goals tied to their trading profits.

What to Look for in a Prop Trading Firm’s Payout Process

When comparing best proprietary trading firms, you’ll want to consider several factors that impact payout speed:

Withdrawal Methods: Different prop firms offer different payment methods for withdrawals, such as wire transfers, PayPal, or cryptocurrency. The method you choose can affect how quickly you receive your funds.

Payout Thresholds: Some firms set a minimum threshold for payouts, so you’ll need to reach a certain amount of profits before requesting a withdrawal. Make sure to check this before committing to a firm.

Payout Frequency: Some firms pay out weekly, bi-weekly, or monthly, while others might offer more flexibility. The more frequent the payout, the quicker you can access your hard-earned profits.

Transparency: The best proprietary trading firms provide clear, transparent information about their payout process. Avoid firms that hide fees or have complex, unclear withdrawal terms.

Support and Customer Service: Fast payouts are often a reflection of a firm’s overall efficiency. Good customer service can ensure that your payout process goes smoothly and without delays.

Best Prop Trading Companies for Fast Payouts

Now, let’s take a look at some of the best proprietary trading firms known for their fast and reliable payouts:

1. Atlas Funded

As one of the leading prop trading companies, Atlas Funded stands out for its quick and hassle-free payout process. Atlas offers traders various funding options and ensures that withdrawals are processed in a timely manner. Whether you’re using PayPal, bank transfer, or crypto, Atlas prioritizes quick access to your funds, making it a top choice for traders who value speed and efficiency.

2. FTMO

FTMO is widely regarded as one of the most popular proprietary trading firms for both beginners and experienced traders. FTMO processes payouts on a regular basis, and their withdrawal system is known to be efficient. FTMO offers traders a clear payout structure, with a solid reputation for fast and reliable payments.

3. Topstep

Topstep is another prop trading firm that focuses on trader success and ensures that payouts are processed quickly. Topstep offers a straightforward payout system, and traders can expect timely payments when they meet the firm’s criteria. Known for its transparent trading rules and supportive community, Topstep is a great option for traders who want to focus on profits without worrying about delays.

4. The5ers

The5ers offers traders high leverage and a flexible payout system, making it an attractive choice for those seeking fast payouts. With several withdrawal options and a strong reputation for speed, The5ers provides its traders with a reliable and efficient payout process.

5. OneUp Trader

OneUp Trader is a fast-growing prop trading company known for its competitive payout rates and timely withdrawal process. OneUp has built a reputation for being transparent and efficient when it comes to paying out traders, making it a solid choice for those looking to get paid quickly.

Conclusion

When selecting the best proprietary trading firms to work with, the speed of payouts should be a key factor in your decision-making process. A fast, reliable payout system ensures that you can access your profits when you need them, making your trading experience more rewarding and stress-free.

If you’re looking for a prop trading company with fast payouts, Atlas Funded stands out as an excellent choice. With its efficient payment systems and commitment to trader success, Atlas Funded is a trusted partner for traders who want quick access to their profits.

Ultimately, fast payouts aren’t just about convenience—they reflect the professionalism and integrity of the firm you choose. So, take your time to research and find a proprietary trading firm that matches your needs in terms of both funding opportunities and payout efficiency.

If you're ready to start trading with a firm that offers fast payouts and professional support, check out Atlas Funded and see how we can help you succeed in the world of proprietary trading.

Ready to take the next step in your trading journey? Sign up with Atlas Funded today and start trading with a trusted partner who values your success.

#PropTrading#ProprietaryTrading#BestPropFirms#PropTradingCompany#FastPayouts#TradingSuccess#AtlasFunded#TradingProfits#FundingForTraders#ForexTraders#TradingCommunity#TradingOpportunities#FastWithdrawals#TraderLife#Investment#FinancialFreedom#TradeSmart#TradingJourney#TradersOfInstagram#FTMO#Topstep#The5ers#OneUpTrader#ForexFunding#ProfitSharing

0 notes

Text

🚀 Big News for Traders! 🚀

Get up to 91% OFF on Bulenox accounts for a LIFETIME! Choose your plan and start Now.

Don’t miss this exclusive deal! 💥

0 notes

Text

Forex Trading Tips: Advice & Mistakes to Avoid | Smart Prop Trader

The Intro:

Embarking on a journey into the world of Forex trading can be both exhilarating and daunting. As you navigate the intricacies of the foreign exchange market, arming yourself with the right knowledge and strategies is essential for success.

In the competitive world of trading, prop trading stands out as a path where individuals can leverage their skills and strategies to generate profits on behalf of a firm.

As you embark on your journey as a prop trader on LaunchFxm, it’s essential to adopt a smart and strategic approach to maximize your success. Let’s explore the key strategies and principles that can help you thrive in this dynamic environment.

Educate Yourself: The Foundation of Success:

Before diving into Forex trading, invest time in educating yourself about the market.

Understand key concepts such as currency pairs, technical and fundamental analysis, risk management, and trading psychology.

LaunchFxm provides a wealth of educational resources and tools to help you build a solid foundation for your trading journey.

Master Your Craft: Continuous Learning and Skill Development:

The foundation of successful prop trading lies in mastering your craft.

Continuously educate yourself about market dynamics, trading strategies, and risk management techniques.

Stay updated on the latest market trends and developments through LaunchFxm’s comprehensive educational resources and real-time market data.

Forex Trading Tips with LaunchFxm

Set Clear Goals and Develop a Strategy:

Define your trading goals and objectives before placing your first trade.

Are you looking for short-term gains or long-term wealth accumulation? Determine your risk tolerance and preferred trading style, whether it’s day trading, swing trading, or position trading.

Develop a robust trading strategy tailored to your goals and risk profile.

Practice Patience and Discipline:

Patience and discipline are virtues that every successful trader must cultivate.

Avoid the temptation to chase quick profits or overtrade based on emotions.

Stick to your trading plan and exercise discipline in executing your trades.

LaunchFxm’s intuitive trading platform and analytical tools can help you stay focused and disciplined in your trading approach.

Manage Risk Effectively:

Risk management is paramount in Forex trading to protect your capital and preserve long-term profitability.

Never risk more than you can afford to lose on any single trade, and implement stop-loss orders to limit potential losses.

Diversify your trading portfolio and avoid putting all your eggs in one basket.

LaunchFxm offers advanced risk management features and customizable trading options to help you manage risk effectively.

Stay Informed

The Forex market is dynamic and constantly evolving, influenced by a myriad of factors such as economic indicators, geopolitical events, and market sentiment.

Stay informed about market news and developments that may impact currency prices.

Adapt to Market Conditions:

Be flexible and adapt your trading strategy accordingly to capitalize on emerging opportunities.

LaunchFxm provides real-time market data, news feeds, and analysis tools to keep you updated on market trends.

Mistakes to Avoid

Avoid Overleveraging

Overleveraging and overtrading are common pitfalls that can lead to significant losses in Forex trading.

Use leverage wisely and never trade with money you cannot afford to lose.

Avoid Overtrading:

Avoid excessive trading activity and focus on quality over quantity when selecting trading opportunities.

LaunchFxm offers flexible leverage options and comprehensive trading analytics to help you make informed trading decisions.

Learn from Your Mistakes and Continuous Improvement:

Every trader makes mistakes along the way, but what sets successful traders apart is their ability to learn from these mistakes and continuously improve.

Keep a trading journal to document your trades, analyze your performance, and identify areas for improvement.

Stay Disciplined During Drawdowns:

Drawdowns are an inevitable part of Forex trading, but how you respond to them can determine your long-term success.

Maintain discipline and stick to your trading plan during drawdowns, avoiding emotional decisions or impulsive actions.

Focus on preserving capital and patiently wait for favorable market conditions to recover.

LaunchFxm offers risk management tools and expert support to help you navigate through challenging periods with confidence.

Conclusion:

By incorporating these tips, advice, and lessons learned from common mistakes, you can enhance your Forex trading journey on LaunchFxm. Stay disciplined, continuously educate yourself, and adapt to changing market conditions to achieve sustainable success as a smart prop trader.

Becoming a smart prop trader on LaunchFxm requires a combination of skill, discipline, and adaptability. By following these strategies and principles, you can position yourself for long-term success in the dynamic world of prop trading.

Embrace continuous learning, stay disciplined, and leverage the advanced tools and resources available on LaunchFxm to unlock your full potential as a prop trader.

0 notes

Text

youtube

Crm para prop trading: todas la información y mucho más en el siguiente link

0 notes

Text

#proptrading#proptradingfirm#proptradingservices#financialtrading#daytrading#financialmarkets#tradingplatforms#financialeducation#findaproptradingfirm#bestproptradingfirms#getfundedintrading#propchallenge#fundedtradingaccount#becomeaproptrader#propfirmmatch#proptradingmatch#propfirmmatchplatform#aspiringtrader#newtrader#daytrader#swingtrader#forextrading#stockmarket

0 notes

Text

The Funded Fx, a top prop trading firm, provides skilled traders access to funded accounts up to $200,000 with up to 90% profit share. Featuring no time limits and a simple evaluation process, it supports diverse global trading styles, ensures risk coverage, and offers trader-friendly conditions, ideal for all levels of traders.

#business#branding#finance#investing#investment#forextrading#forexmanagement#forex market#forex education#forex broker#technical analysis#forexsignals#Proptrading

0 notes

Text

Abstract:In the fast-paced world of foreign exchange trading, the promise of lucrative returns often lures individuals into the orbit of forex prop firms.

0 notes

Text

什麼是MTI?MTI規則是什麼?一文帶你全面了解MTI

什麼是MTI?MTI規則是什麼?一文帶你全面了解MTI

最近在台灣交易圈內,越來越多人開始討論類似MTI這樣的prop firms,這種模式在國外已經行之有年了。那MTI到底是什麼呢?它的規則是怎麼樣的?利弊又有哪些?這篇文章將會一一帶你深入探討,看完後你就能夠了解MTI的模式,也能夠評估一下自己是否適合參與MTI的項目。

MTI是什麼?prop firms又是什麼?

MTI是一家提供資金進行交易的公司,如果你能夠證明你的交易策略能夠穩定且盈利 (consistantly profitable), 那麼他們會提供你一個本金帳戶,金額範圍在10,000到100,000美金不等,供你進行交易。在你的交易收益中,他們會抽取一定的比例作為報酬,而不同的MTI programs會有不同的抽成比率。

上述是對MTI的簡單介紹,類似MTI的公司在國外有很多,這些公司被稱為「prop firms」,為什麼MTI會相對較為著名呢?主要原因是MTI的歷史相對悠久,而且其運作記錄相對良好。在2021年,有一家非常有名的prop firm叫做Funding Talent(也是我最初非常感興趣的prop firm之一),結果卻在沒有任何預���的情況下惡性倒閉,網站直接關閉,對參與其programs的人並未提供任何後續補償或賠償。因此,選擇一家值得信賴的prop firm非常重要,儘管如此,我們仍然不能完全信任任何一家prop firm。舉一個2022年的例子:FTX當時是全球第二大的Crypto交易所,卻在一個晚上發生惡性倒閉。更何況是一家知名度較低的prop firm呢?因此,請務必自行評估風險。

MTI的規則

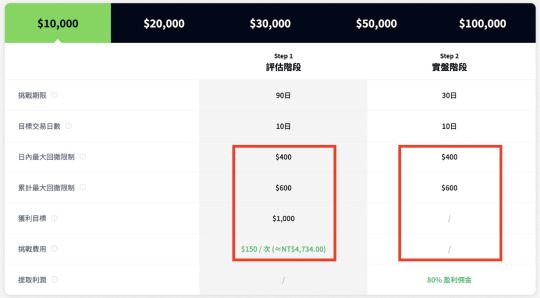

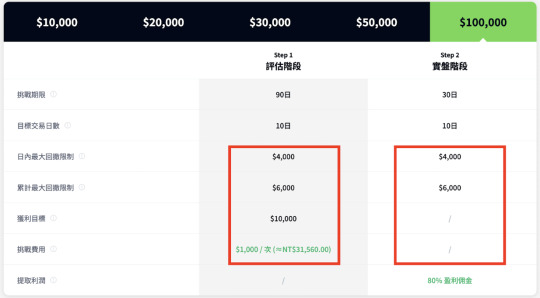

接下來我們講解MTI的規則,為了確認您的盈利及風險管理能力,MTI設計了不同金額的挑戰目標:分別有$10,000、$20,000、$30,000、$50,000和$100,000金額的帳戶可供選擇。交易者們可以依照自己的交易風格、風險等去挑戰適合自己金額的帳戶類型。不同金額的挑戰目標會有以下要求的不同:

日內最大回撤限制

累計最大回撤限制

獲利目標

挑戰費用

下面是$10,000與$100,000兩個最小和最大金額挑戰目標的規則對比:

挑戰較小的目標虧損限額較低,但費用也比較便宜

挑戰較大的目標虧損上限較大,但挑戰費用也比較貴

挑戰方式

不同於其他prop firms有著複雜的考試階段,要成為MTI自營交易員只需簡單的一步,即評估階段的挑戰,通過挑戰,即可獲得MTI自營交易員身份,獲取高達100,000元的實盤資金帳戶,並享有高達80%的利潤分成。

評估階段

成功繳交報名費即等同於報名成功,並開啟挑戰,挑戰帳戶需至少10個交易日有創建訂單或持倉行為。挑戰期間的交易細則和可交易產品以挑戰帳戶為准,並且每個訂單交易手數上限為2手,帳戶持倉上限5個訂單。挑戰有效期限為90天,挑戰期間可隨時點擊挑戰結束按鍵來終止挑戰,而未點挑戰結束按鍵的帳戶在90天後自動關閉所有交易並終止挑戰。

日內最大回撤限制對交易員的水平考核非常關鍵,成功的交易員會善於管理帳戶資金並控制風險。日內最大回撤限制為起始資金的4%,意味著在任何交易日,帳戶淨值減少的最大幅度不應超過此限制,最大回撤計算公式為:最大回撤值 = 帳戶淨值最高值-帳戶淨值最低值。例如,起始資金20000美元,日內最大回撤限制為$800。每個交易日的帳戶淨值最高值減去最低值不應超過$800。請注意,日內最大回撤限制包括已平倉訂單、未平倉訂單、點差及隔夜費用。

累計最大回撤限制為起始資金的6%,這意味著從挑戰開始到結束,帳戶淨值減少的最大幅度不應超過此回撤限制。最大回撤計算公式為:最大回撤值 = 帳戶淨值最高值-帳戶淨值最低值。例如,假設起始資金為20000美元,累計最大回撤限制為$1200。您在挑戰期間的帳戶淨值最高值減去最低值不應超過$1200。請注意,累積最大回撤限制包括已平倉訂單、未平倉訂單、點差及隔夜費用。

挑戰期間的交易無持倉時間限制,可依交易技巧自由發揮。挑戰成功後��選擇申請實盤資金帳戶,申請後平台專員將與挑戰者聯絡並告知實盤資金帳戶,挑戰者可開啟實盤資金交易。

實盤階段

實盤資金帳戶交易規則無盈利目標要求,其他交易規則與挑戰帳戶一致。實盤資金帳戶使用有效期限為30天,到期後賬戶終止使用並統計實際總盈虧。如有持倉將強制平倉後統計實際總盈虧。對於盈利提取,可透過本地轉賬或銀行匯款至您的個人銀行賬戶。

為評估參賽者的真實交易技能,平台採用30%利潤一致性規則。挑戰時單個訂單的盈利占盈利目標不得超過30%,超出30%的盈利部分不計入總盈利額。單筆盈利限額依照挑戰盈利目標來計算。例如:參與20000美金挑戰帳戶,盈利目標2000美金。$2000*30%=$600,即單筆盈利限額為600美金,單筆盈利最多只統計600美金,超出部分將不計入實際總盈利額。實盤資金帳戶到期後,如帳戶總盈虧為正值,MTI專員將會第一時間與挑戰者聯絡併發放盈利的80%。

參加挑戰的投資人將被視為默認同意將本人的個別登記資料刊登於本活動頁面的任何位置,當您成功通過挑戰並在實盤資金帳戶上獲得首筆利潤分割時,您的報名費用將退還給您。

MTI的利與弊

雖然MTI給擁有少量本金的交易者能夠快速獲利的機會,但是事實可能並沒有你想的那樣簡單。首先你要通過MTI「評估階段」的挑戰,然後才會有進行實盤交易的機會。雖然挑戰程序很是一步到位,但挑戰本身並不容易,要求交易員有豐富的交易實戰經驗。同時MTI也具備其他prop firms的交易風險。因此在這裡我想向大家分享關於MTI的利與弊,讓你能夠根據自身的交易風格與狀況來評估自己是否要參與MTI的挑戰。

MTI的優勢

一步到位

交易市場上很多prop firms���會設置複雜的或所謂的不同的考試階段,MTI與這些prop firms最大的不同就是:在MTI,你只需簡單的一步,即通過「評估階段」的挑戰,即可成為MTI自營交易員,挑戰成功後即可獲得的實盤資金帳戶,正式掌握高達數萬美金的真實資金賬戶。

導師輔助

MTI還有一個不同於其他prop firms的特點,就是MTI交易學院的專家全程對您進行專屬輔導,讓您少走彎路,快速高效的積累交易實戰經驗,掌握交易技巧。

快速獲利

這部分簡單明瞭,只需支付幾百美金的考試費用,就能夠取得幾萬美金的交易本金,相當吸引人。如果你的交易風格適合MTI提出的條件,且你的交易獲利穩定,那麼參與MTI絕對是一條能夠快速賺錢的不錯途徑。

可控制的風險

挑戰費用清楚地列在MTI的官網上,換句話說,你最多可能損失的就是挑戰費用,風險是有限的。

數據化管理與風險紀律

MTI本身提供非常友善的儀表板供大家使用,可以清晰地回顧每一筆交易的狀況。此外,MTI的考試對風險的要求相當嚴格,有助於交易者培養良好的風險管理習慣。

MTI的劣勢

交易型態的侷限性

MTI有很多限制,例如不能不可使用EA交易等,因此,並非所有的交易者的交易風格都能夠滿足上述條件,很多人因為MTI提供的條件看似很吸引人,也不管自己的交易風格是否適合,就直接報名MTI的考試。據MTI所說,有很大一部分人是無法通過挑戰的。

心態問題

在MTI畢竟交易的不是真錢,交易心態上和真錢交易還是有很大的區別。當你日後要再用自己的本金進行交易時,必須重新調整並適應心態。

惡性倒閉風險

過去已經有Funding Talent等prop firm發生惡性倒閉的案例,你很難保證MTI不會哪天突然發生惡性倒閉。

出金風險

過去也傳出不少其他prop firms無法出金的討論,再加上MTI本身是外國公司,不受台灣政府的監管。如果真的發生這樣的問題,很有可能無法獲得妥善的處理。

MTI適合怎樣的交易者?

有一定交易經驗的交易者

建議在考慮參加MTI挑戰之前,先進行至少半年以上的demo trading練習。如果你只是在Trading View上畫畫圖,沒有實際下單的經驗,建議先進行demo trading。如果經濟允許,也可考慮進行小額真錢交易,以訓練交易心態和穩定性。個人經驗分享,一開始也只在Trading View上畫畫圖,但進入demo trading後發現真實市場情況與畫圖時有很大不同。習慣了demo trading後,投入小額真錢交易,發現心理壓力更大。強調必須讓自己熟悉市場真實狀況,如同打��球練投的情境,將有助於提高交易勝算。

不做長期倉且交易風格穩定的交易者

要想在MTI上獲利,你必須是一個交易風格穩定的交易者,不能今天用A策略後天就改B策略,這樣的交易者是很難在MTI成功通過挑戰且賺到錢的,因為MTI的所有條件設定、風險限制,都是圍繞在「持續性」進行設計的,他不希望有人是因為僥倖而通過挑戰,即便因為僥倖通過挑戰,也很難在實盤階段中獲得分潤。

結語

這篇文章簡單介紹了MTI以及類似的prop firms服務。最後要提醒大家,別因為看到別人高額獲利就衝動,MTI的採訪指出很大一部分的人無法通過挑戰,他們主要收入來自挑戰費用。因此在挑戰前,務必確保自己有豐富的交易經驗和穩定的交易心態,否則可能成為那大部分貢獻挑戰費用的人。

1 note

·

View note

Text

That's a trade that makes it easier to get evaluated easily in prop trading. Because it is always low-risk trading here.

PropTrading signals

2 notes

·

View notes

Text

How Liquidity Works in Prop Trading?

Overview:

In the world of prop trading, the importance of liquidity can’t be overstated. This is because although startups in the trading world have income from other sources like fees, many only rely on it as their main cash cow hence they need large quantities daily so as not to run out before making profits if any at all.

The goal of this blog post is to clarify how liquidity is used in prop trading and why it matters for these traders.

Understanding Liquidity in Prop Trading:

The liquidity of an asset or market in prop trading is defined as the degree to which that asset or market can be bought or sold without affecting prices significantly. It is what enables a trader to efficiently open or close positions with minimal effect on markets.

It is the essence of a trader’s ability to enter or exit positions efficiently and with minimal market impact.

Key Components of Liquidity in Prop Trading

Market Liquidity vs. Asset Liquidity

Market Liquidity:

A market with a lot of liquidity means that there are many people willing to buy and sell things all the time, which prevents sudden changes in prices. For example, if you would like to become a prop trader then it would be easier for one to find their way in the forex market where they have high levels of liquidity or trading in the stock market where there is high liquidity.

Asset Liquidity:

Asset liquidity is how easy it is to buy or sell a particular financial product in a trading market. In a given market, all assets are not equally liquid. For one to trade well, they need to have an idea about how quickly they can sell any particular asset so as to avoid being wrong-footed.

Measuring Liquidity

Prop traders employ various methods to measure liquidity:

Volume:

Liquidity is reflected in trading volume, and traders use it as a means to access entry and exit opportunities that are best.

Bid-Ask Spread:

The bid-ask spread is understood as trading setup cost. Whereas narrow spreads are often associated with high liquidity; wider ones may suggest otherwise.

Market Depth:

Market depth is designed to show us how many there are who want to sell/buy something at any given time. And finally this concept of deepness includes having many orders for purchase from different points on the chart which obviously indicates high liquidity level because such situations happen frequently in those markets.

Liquidity’s Role in Trading Strategies

Liquidity profoundly influences trading strategies:

Traders can swiftly execute substantial orders in trading markets where there is high liquidity thereby increasing the chances of profits without affecting prices greatly. This in turn provides an opportunity for scalping as well as day trading strategies.

However, traders should also watch out for less liquid markets or assets without enough buyers and sellers resulting in illiquidity then they should respond appropriately through reducing the traded volumes.

Liquidity has an essential impact on risk management:

In high volatility periods, liquidity can evaporate quickly, which leads to more slippage and potentially larger losses.

It is important for you to know that during periods of high volatility, liquidity may disappear so fast causing increased slippage and more likely losses you won’t be able to avoid without efficient risk management in place that could curb down finder fees through stop loss order installation or paying attention while determining size.

The bottom line

Liquidity understanding and the subsequent utilisation of it are some of the most important skills that traders in the prop sector require. It largely determines trading tactics, precautions as well as the financial outcomes in the long run. Prop traders should be flexible, consistently assessing liquidity in markets and assets, in relation to which they base their decision-making process. In LaunchFXM ,at our disposal are useful information, modern tools and technology that can improve a prop trader’s decision making as well as make their trade profitable. Keep an eye out for future trading brokers related to prop trading together with the complexities of trading markets.

0 notes

Text

TradersTrust(トレーダーズトラスト)が運営するプロップファームTradingCultが、2025年2月に「500,000USDのトレードコンテスト」を開催!

TradersTrust(トレーダーズトラスト)が運営するプロップファームTradingCultが、2025年2月に「500,000USDのトレードコンテスト」を開催! TradersTrust(トレーダーズトラスト)が運営するプロップファームTradingCultが、50万ドル無料トレードコンテストを正式に開催しました! 上位20名のトレーダーには、賞金やチャレンジ割引を含む巨額の賞金が分配されます。 無料でかつノーリスクでFX取引や仮想通貨取引を楽しむことができます。 #TradingCult #propfirm #取引コンテスト #proptrading

待ちに待った瞬間がやってきました! TradersTrust(トレーダーズトラスト)が運営するプロップファームTradingCultが、50万ドル無料トレードコンテストを正式に開催しました! トレーディングカルトのアカウントにログインして、今すぐ取引を開始しましょう。 上位20名のトレーダーには、賞金やチャレンジ割引を含む巨額の賞金が分配されます。 コンペティション終了は、2025年2月28日23:59…

0 notes

Text

The cup and handle pattern stands out as one of the most reliable and widely recognized chart formations. It’s a pattern that is both simple to understand and immensely powerful when it comes to identifying potential price breakouts. More: https://fundedelite.com/cup-and-handle-pattern/

#bestpropfirms #cupandhandlepattern #forex #fundednext #forextrading #trading #riskmanagement #proptrading #propfirm #usa #fundedelite

#Cup and handle pattern#funded trading programs#instant funding prop firm#prop firms with instant funding#prop trading firms#buy forex trading account#prop firms with no time limit#forex market#forex#forex trading#funded elite

0 notes

Text

Be the Axe Trader Not the Target and Become a Surge Trader

Surge Trader was a prop firm that failed due to financial insolvency, Let’s Find out how you can stay away from prop firms that are unsustainable. More: https://www.axetrader.com/surge-trader

#forex #bestpropfirms #surgetrader #fundedoptions #forextrading #trading #riskmanagement #proptrading #propfirm #usa #unitedstates #axetrader

#prop firms#funded trading accounts#cheapest prop firms#instant funding prop firm#proprietary trading firm#trading risk management#the talented trader#prop firm trading#prop firm challenge#prop firms instant funding#surge trader#axe trader

0 notes

Text

Prop Trading made easy With ForexCRM

Struggling to manage your prop trading accounts? You're not alone.

ForexCRM can help you streamline your workflow and dominate the prop trading game! Here's how:

Centralized Account Management: Track positions, P&L, and margin across all your accounts in one place.

Automated Reporting: Generate custom reports to analyze your performance and identify opportunities.

Enhanced Risk Management: Set stop-loss orders and monitor risk exposure in real time. ️

Improved Communication: Stay connected with your team and share trading ideas seamlessly.

Stop wasting time on tedious tasks and focus on making profitable trades! Try forexCRM today and see the difference.

Contact us at https://forexcrm.ca or Email: [email protected] Call/Whatsapp us at +971 58 833 9499/ +971 52 217 5380

#prop trading #forex#forextrading#crm#forexcrm#tradingtools#Fintech#ForexTrading#PropTrading#ForexCRM#TradingPlatform#Finance#Investing#TradeSmart#ForexCommunity#tradinglifestyle

0 notes

Text

Trading might be unpredictable, but our Support isn't!

At Hola Prime, you’ll always connect with Real People delivering Real Answers, 24/7.

Experience the difference of real human support - anytime, every time.

0 notes