#polygon is the institute confirmed

Explore tagged Tumblr posts

Text

New study says we're unlikely to find liquid water on Mars anytime soon

More than a hundred years ago, astronomer Percival Lowell made the case for the existence of canals on Mars designed to redistribute water from the Martian ice caps to its lower, drier latitudes. This necessarily meant the existence of Martians to build the canals.

While Lowell was proven wrong by better telescopes, the question of whether there's liquid water on Mars continues to tantalize researchers. Liquid water is a critical precondition for a habitable planet. Yet the combination of low temperature, atmospheric pressure and water vapor pressure on Mars means any liquid water found there would likely freeze, boil or evaporate immediately, making its presence unlikely.

Still, researchers continue to make the case for the presence of liquid water on Mars.

Of particular interest has been the discovery of the "recurring slope lineae," or RSLs, which are dark linear features found on steep slopes in specific regions of Mars. RSLs display seasonal changes, appearing in warmer seasons and fading in colder seasons, in a way that is consistent with the behavior of liquid water. Distinct striped and polygonal features in Martian permafrost have also been pointed to as possible evidence of thermal cycles. A further case has also been made for an assortment of potential liquid brines.

But a new paper published in the Proceedings of the National Academy of Sciences throws cold water on the notion that we are likely to find liquid water on Mars in RSLs, permafrost or brines anytime soon.

The paper, "The Elusive Nature of Martian Liquid Brines," was co-authored by Vincent Chevrier, an associate research professor at the University of Arkansas's Center for Space and Planetary Sciences, and Rachel Slank, a postdoctoral fellow at The Lunar and Planetary Institute in Houston, Texas. Slank earned her Ph.D. at the U of A while working with Chevrier, who has spent the last 20 years studying Mars for signs of liquid water. In short, he's as invested as anyone in there being liquid water on Mars, but he thinks the evidence just isn't there yet.

The goal of the paper is to educate the public on the current state of knowledge regarding the existence of liquid water on Mars.

"I wanted to write this paper for a very long time," Chevrier said, "because I think there is a lot of confusion, a lot of misunderstanding, and a lot of erroneous interpretations of what the research papers are saying about the state of liquid water on Mars."

The authors suggest that a closer look at RSLs indicates their behavior is consistent with sand and dust flows with no water needed to create them. Available data from Martian orbiters cannot confirm that liquid water plays any role in RSL development.

Other researchers think that brines—which are solutions with a high concentration of salts, such as Earth's oceans—may hold the key to finding liquid water on Mars. Brines can freeze at much lower temperatures, and there is an abundance of salts on Mars. Of those salts, perchlorates would seem to be the most promising, since they have extremely low eutectic temperatures (which is when the melting point of a mixture is lower than any single ingredient).

For instance, a calcium perchlorate brine solidifies at -75 degrees Celsius, while Mars has an average surface temperature of -50 C at the equator, theoretically suggesting there could be a zone where calcium perchlorate brine could stay liquid, particularly in the subsurface.

The authors then examine all of the arguments for and against brines potentially forming stable liquids. Ultimately, they concluded that the various limiting factors, including the relatively low amounts of the most promising salts, water vapor pressure and ice location "strongly limit the abundances of brines on the surface or shallow subsurface." Even if brines did form, they would "remain highly un-habitable by terrestrial standards."

In the last section of the paper, the authors state, "Despite these drawbacks and limitations, there is always the possibility that Martian life adapted to those brines and some terrestrial organisms could survive in them, which is a consideration for planetary protection because life on Mars might exist today in that case. Hence, detecting brines in situ remains a major objective of the exploration of the red planet."

Moving forward, the authors suggest the next hurdles will be improving the instruments needed to detect small amounts of brines, doing a better job of identifying the best places to look for them, and being able to conduct more laboratory measurements under Martian conditions.

"Despite our best efforts to prove otherwise," Chevrier concludes, "Mars still remains a cold, dry and utterly unhabitable desert."

IMAGE: Two of the most-discussed observations of potential liquid water activity on the surface of Mars. Credit: Proceedings of the National Academy of Sciences (2024). DOI: 10.1073/pnas.2321067121

2 notes

·

View notes

Link

0 notes

Text

With the next crypto bull run quickly approaching, experts recommended investing in affordable altcoins like XRP, Polygon (MATIC), and Bitcoin Spark (BTCS). Polygon (MATIC) price The Polygon (MATIC) price recently witnessed a 6% surge in a week. The Relative Strength Index (RSI) is currently making its second attempt to breach the pivotal 50, which has historically propelled Polygon’s price northward. Additionally, the Awesome Oscillator (AO) has been consistently displaying a series of green bars, adding to the bullish sentiment. Analysts suggest that increased buying pressure could drive Polygon’s price to test the supply zone between $0.6450 and $0.7075. They argue that confirmation of the uptrend will come with a break and close above the midline at $0.6757, which aligns with the 50-day Exponential Moving Average (EMA). XRP lawsuit The XRP lawsuit commenced in December 2020 when the United States Securities and Exchange Commission (SEC) alleged a breach of securities regulations in the initial and subsequent XRP token sales. After nearly three years of legal battles, a pivotal moment arrived on July 13, 2023, when District Judge Analisa Torres declared that XRP’s retail sales didn’t meet the legal criteria for a security. Nevertheless, Ripple was found culpable of breaching securities laws in its direct sales of XRP tokens to institutional investors. The SEC, undeterred, sought to appeal the decision in August, citing substantial differences in legal interpretation. However, the tides turned on October 3 when Judge Torres denied the SEC’s motion to appeal, citing a lack of compelling legal grounds or substantial differences of opinion. With the regulatory overhang lifting, it’s increasingly likely that more financial institutions will integrate XRP into their operations. This increased adoption could lead to a surge in demand for XRP, potentially driving up its price. Bitcoin Spark Bitcoin Spark has captured the attention of the crypto community with its ability to retain Bitcoin’s fixed supply of 21 million coins while introducing a range of innovative features designed to usher in a new era of crypto transactions. The Bitcoin Spark blockchain boasts fast and cost-effective transaction processing due to its short block time, high individual block transaction capabilities, and massive modes. The blockchain also offers a scalable infrastructure for building smart contracts and decentralized applications (DApps). It has a dedicated smart contract layer with separate execution systems that all reach finality on the main network, allowing for a wide variety of programming languages. Notably, Bitcoin Spark uses its proprietary consensus mechanism, the Proof-of-Process (PoP), which non-linearly rewards users for confirming transactions and contributing their processing power. The nonlinear approach, coupled with the network’s extensive nodes, allows even low-powered devices to run the network. In fact, the Bitcoin Spark team will provide a user-friendly network application compatible with various operating systems, including iOS, Android, and Windows. Organizations and individuals will be able to use the contributed power for remote computing through the Bitcoin Spark network in exchange for BTCS. The revenue generated will then be distributed among the validators. Additionally, the Bitcoin Spark application and website will have small spaces for advertisements, which will be community-policied to promote decentralization and security. Advertisers will also pay in BTCS, and the revenue generated will be split between the network participants and the development team. What is the current price of Bitcoin Spark? Bitcoin Spark (BTCS) is currently selling at $3.00 in Phase 7 of its Initial Coin Offering (ICO). Investing at this level grants a 7% bonus and various other advantages, including extra tokens. Notably, BTCS will launch at $10, signifying a 357% profit for phase 7 investors and an outstanding 800% for those who invested in Phase 1.

Several analysts have suggested a 100X price increase for Bitcoin Spark (BTCS), pointing to its limited supply, low market capitalization, innovative technology, real-world applicability, and timing of launch as compelling reasons for their predictions. For more information on Bitcoin Spark: Website: Buy BTCS: The post Affordable Altcoins To Buy Before Bull Market, XRP, MATIC, And Bitcoin Spark appeared first on Analytics Insight.

0 notes

Text

[ad_1] Final up to date Oct 12, 2023 Coinbase alternate is now beneath big authorized hurdles, because the state regulators filed amicus briefs to help the federal company to help the costs in opposition to the alternate.Coinbase is a US-based Nasdaq listed Crypto alternate. In 2021, this alternate went public & with that attracted a really massive variety of institutional crypto traders. Within the first week of June of this yr, the USA Securities and Trade Fee (SEC) sued Coinbase over offering unregistered securities choices & operating an unregistered nationwide securities alternate.Newest reports confirmed that state regulators jumped to help the SEC’s expenses in opposition to the Coinbase alternate. Reportedly the state regulators filed an amicus temporary to offer proof & help the SEC’s allegations that Coinbase violated securities legal guidelines, as the corporate offered unregistered securities choices within the US jurisdiction.Alongside this amicus temporary, the monetary regulators from states like Alabama, California, and New Jersey initiated comparable sorts of enforcement motion in opposition to Coinbase.Briefly, the scenario for the Coinbase alternate to run the providers will face excessive regulatory warmth and Coinbase might shut down its providers partially, till the ultimate final result of the entire case. Securities regulators oppose particular therapy of crypto in Coinbase caseA physique representing North America’s state securities regulators took intention at arguments made by crypto alternate Coinbase in its protection in opposition to the SEC.— cryptoteletubby ⛔️🔑⛔️🧀 (@cryptoteletubby) October 11, 2023 Some reviews claimed that extra amicus briefs will come sooner or later by the Crypto corporations & crypto proponents to help the Coinbase alternate in opposition to the SEC’s expenses as a result of it’s a time to unite in opposition to the unfair enforcement actions. It's value it to notice that Coinbase executives already disclosed that they tried to speak to the SEC physique to get readability on the monetary guidelines over the character of crypto property however they failed to reply each time. As soon as previously, Coinbase CEO Brian Armstrong raised a really sturdy query in opposition to the SEC and requested if Coinbase was offering unregistered securities choices & additionally was an unregistered nationwide securities alternate then why the SEC company inexperienced signalled the Coinbase alternate to go public in 2021. Learn additionally: Polygon-based stablecoin crashes 46% from the pegged value [ad_2]

0 notes

Text

The Future of Scalable DeFi: Exploring the Benefits of Setting Up on Polygon Supernets

Decentralized Finance, or DeFi, has experienced exponential growth in recent years, offering a range of financial services on blockchain networks. However, DeFi's surge in popularity has exposed limitations on existing networks, particularly the Ethereum blockchain. High gas fees and scalability issues have hampered the potential of DeFi, causing congestion and deterring users from participating in the ecosystem. In response, solutions like setup Polygon Supernets have emerged, promising to reshape the future of scalable DeFi.

The Challenges Faced by DeFi

DeFi has introduced a paradigm shift in the world of finance by providing decentralized alternatives to traditional financial services. Nevertheless, several challenges have arisen, impeding the sector's progress:

Scalability: The Ethereum blockchain, which hosts a substantial portion of DeFi projects, faces scalability issues. Its limited capacity to process transactions per second has resulted in network congestion and slower transaction confirmation times.

High Gas Fees: Ethereum's transaction fees, known as gas fees, have skyrocketed during peak demand periods. Users often find themselves paying significant fees for transactions, making DeFi less accessible for smaller users.

Environmental Concerns: Ethereum relies on a Proof of Work (PoW) consensus mechanism, known for its energy-intensive mining process, leading to environmental concerns and criticism.

Polygon Supernets: A Solution for Scalable DeFi

Polygon, a Layer 2 scaling solution, aims to address these challenges. Within Polygon's ecosystem, Polygon Supernets are designed to provide a robust framework for DeFi applications, offering several key benefits:

Enhanced Scalability: Polygon Supernets significantly enhance the scalability of DeFi applications by processing transactions in parallel across multiple interconnected chains. This results in faster transaction times and a capacity to support a higher volume of transactions, essential for DeFi's growth.

Low Transaction Fees: One of the most compelling advantages of Polygon Supernets is the substantially lower transaction fees compared to the Ethereum mainnet. This cost-effectiveness makes DeFi more accessible, accommodating a broader range of users, from retail to institutional.

Seamless Interoperability: Supernets maintain interoperability with Ethereum, allowing for seamless asset and data transfer between the two ecosystems. This interoperability ensures that DeFi projects can tap into Ethereum's extensive DeFi infrastructure while benefiting from Supernets' scalability.

Customizability: Developers building DeFi applications on Polygon Supernets can select the specific chain that best aligns with their project's needs. Whether they require faster transaction speeds, lower fees, or specialized features, Supernets offer the flexibility to optimize performance.

Reduced Environmental Impact: Polygon Supernets transition to a more energy-efficient Proof of Stake (PoS) consensus mechanism, reducing the environmental footprint of DeFi. This shift aligns with the global emphasis on sustainable blockchain solutions.

The Future of Scalable DeFi with Polygon Supernets

Mass Adoption: Lower transaction fees and faster confirmation times on Polygon Supernets can drive mass adoption of DeFi applications. Users, including retail and institutional participants, are more likely to engage when barriers to entry are lowered.

Innovation: Reduced costs and quicker transaction times can foster innovation in DeFi. Developers can experiment with new financial instruments, lending models, and trading strategies, leading to a broader range of DeFi products and services.

Inclusive Finance: DeFi on Polygon Supernets has the potential to bring financial services to underserved populations globally. This includes providing access to credit, savings, and investment opportunities, contributing to financial inclusion.

Environmental Responsibility: By transitioning to a PoS mechanism, DeFi on Polygon Supernets becomes more environmentally friendly. This shift aligns with the growing focus on sustainability and aligns DeFi with broader ESG (Environmental, Social, and Governance) principles.

Challenges in Embracing Scalable DeFi on Polygon Supernets

Security: While Supernets inherit security from the underlying Polygon PoS chain and Ethereum, it's crucial to remain vigilant against potential security risks and vulnerabilities that can arise in DeFi development.

User Education: Users must be educated about the transition to Polygon Supernets and the difference in asset handling between Ethereum and Polygon. This education is essential to avoid confusion and security risks.

Interoperability Challenges: While interoperability between Polygon and Ethereum is a significant advantage, it also presents challenges in maintaining compatibility and data consistency between the two ecosystems.

Conclusion

Polygon Supernets represent a monumental advancement in blockchain scalability and performance, offering developers the tools and infrastructure needed to build the next generation of DeFi applications. By reducing transaction fees, improving scalability, and offering customization options, Supernets enable developers to supercharge the DeFi ecosystem, fostering innovation and growth. However, it's essential to remain vigilant about security and educate users about the transition to Polygon Supernets to fully realize the opportunities they present. As DeFi continues to evolve, Polygon Supernets are poised to play a pivotal role in shaping its future, making DeFi more accessible, efficient, and inclusive for users worldwide.

1 note

·

View note

Text

Top cryptocurrencies in India to invest in 2023

Cryptocurrency is a virtual currency that uses cryptography for security. It is a decentralized form of currency that uses blockchain technology to facilitate secure and anonymous transactions between users. Cryptocurrencies are based on complex mathematical algorithms and are maintained through a network of users called nodes. The most popular cryptocurrency is Bitcoin, but there are many other cryptocurrencies, such as Ethereum, Litecoin, and Ripple. Cryptocurrencies can be used for a variety of purposes, including purchasing goods and services, trading, and investing. Cryptocurrency market has been flooded with lots of crypto coin.

Top Indian cryptocurrencies are:

Bitcoin: Bitcoin is a virtual currency that was launched in 2009 by an anonymous person with the pseudonym Satoshi Nakamoto. It is a decentralized currency that operates independently of a central bank, which means that it is not subject to government or financial institution control. The blockchain is maintained by a network of users called nodes, who verify and confirm transactions. These transactions are verified using complex mathematical algorithms and cryptography, which ensures that they are secure and cannot be altered or changed. Only 21 million Bitcoins will ever be created, and currently around 18 million have been mined. This limited supply gives Bitcoin its value and makes it similar to a precious metal like gold. On April 3, 2022, the price of Bitcoin was around $59,000 USD, and over the next few months, it continued to rise, reaching an all-time high of over $64,000 USD in mid-April 2022.In early February 2023, the price of BTC began to rise again, and by the end of the first quarter of 2023, it had reached over $60,000 USD.

Ethereum (ETH): Ethereum (ETH) is an open-source, decentralized blockchain platform that was launched in 2015 in cryptocurrency market. It is a platform that enables developers to build decentralized applications (Dapps) that run on the blockchain.

One of the key features of Ethereum is its smart contract functionality, which allows developers to create self-executing contracts that automatically execute when certain conditions are met. These contracts are written in code and stored on the Ethereum blockchain. Smart contracts can be used for a variety of purposes, including crowdfunding, voting, supply chain management, and more. In November 2022, the price of ETH began to rise again, and by the end of the year, it had reached over $3,500 USD. In early 2023, the price of ETH continued to rise, reaching over $4,000 USD.

3.Polygon : Polygon (formerly known as Matic Network) is a layer 2 scaling solution for Ethereum, designed to address the scalability and usability issues that have been plaguing the Ethereum network. It is a blockchain network that allows for faster and cheaper transactions, while still maintaining compatibility with Ethereum's existing infrastructure.

Over the last year, On April 3, 2022, the price of MATIC was around $1.60 USD, and it continued to rise gradually over the next few months, reaching an all-time high of over $3.70 USD in mid-May 2022.

The Polygon network is built on top of Ethereum, which means that it is essentially a sidechain of the Ethereum network. Transactions that occur on the Polygon network are secured by Ethereum's underlying blockchain.

XRP (XRP) : XRP is a digital currency, also known as a cryptocurrency, that was created by Ripple Labs in 2012. It is designed to facilitate fast and secure cross-border payments and money transfers using blockchain technology.

In early January 2023, the price of XRP began to rise again, and by the end of the first quarter, it had reached over $1.00 USD.

XRP transactions are processed by a network of validators, which are nodes on the Ripple network that verify transactions and maintain the integrity of the ledger. The Ripple network does not rely on proof of work or proof of stake consensus algorithms like other cryptocurrencies such as Bitcoin and Ethereum. Instead, it uses a unique consensus algorithm called the Ripple Protocol Consensus Algorithm (RPCA).

GanderCoin (GAND) : GanderCoin is India's first launched crypto coin. It came into market on 30th May 2022. It is built on blockchain technology that uses Script Algorithm that provides a higher level of security for a safe, transparent transaction.

It is available on various trading platforms like CoinCRED, LBANK and COINLORD. Its initial price was 0.13 USDT

Tether (USDT) : Tether was created in 2014 by Tether Limited, which is a company that is closely associated with the cryptocurrency exchange.

It is a stable coin, which means it is a type of cryptocurrency designed to maintain a stable value against a specific asset, such as the US dollar. Tether is designed to maintain a value of 1 US dollar per token, which is accomplished through a combination of a reserve of US dollars and other assets that are held by the issuer of Tether.

Tether (USDT), which is designed to maintain a stable value of approximately $1 USD. However, there have been some instances where the price of USDT deviated slightly from $1 USD due to market demand.

Conclusion: That being said, the top ten Indian crypto coins to invest in 2023 will largely depend on the performance of the projects, their adoption, and the overall market conditions at that time. It is important to monitor the developments in the Indian cryptocurrency space and stay informed about the projects that show potential for growth and adoption. Investors should be prepared for the potential risks and volatility associated with investing in cryptocurrencies.

(Disclaimer: I do not have personal opinions or make investment recommendations on specific investments, including the top ten Indian crypto coins to invest in 2023. The information provided in my responses is for educational and informational purposes only and should not be construed as professional financial advice or a substitute for it.)

0 notes

Text

Altcoins bounce to new highs as Bitcoin price trades sideways under $50K

The cryptocurrency market made up for some of the losses of the past few days on February 25, when Bitcoin (BTC) briefly crossed the $50,000 mark and many spirits posted double-digit gains.

Data from Cointelegraph Markets and TradingView show that Bitcoin hit a low of $45,200 late in the evening of February 24, before climbing 15% to $52,000 in the morning.

BTC/USDT 4-hour chart. Source: TradingView

Although the recovery in the cryptocurrency market is welcome for optimistic investors, the price of Bitcoin is still finding resistance above $50,000, and this level has yet to be confirmed as a support.

Economists have also become concerned about rising government bond yields, which are generally a sign of economic weakness and could have a major impact on many markets.

100,000 of Bitcoin catalysts.

As Bitcoin enters a minor correction phase, analysts are wondering if digital assets could surpass $100,000 by the end of 2021.

According to Giles Coghlan, chief currency analyst at HYCM, the answer to this question “depends on who you ask.” Proponents of cryptocurrency are “very optimistic” that 2021 will be “the year Bitcoin will come to the fore,” while traditionalists are skeptical about the “risky and unpredictable market.”

Coghlan sees the driving force behind recent progress as “public excitement” following the pro-crypto tweets of Elon Musk and Mark Cuban, but now “enthusiasm seems to be waning” as Bitcoin struggles to hold $50,000.

Given the volatility of BTC, it is “too early to say whether this will be a new level of core support.”

Mr. Coghlan said:

“I would not be surprised if the price slowly drops to $40,000 in the coming weeks, which seems a more realistic support level. A drop below that level is also possible, depending on Bitcoin’s performance in 2020.”

The analyst believes that the acceptance and approval of Bitcoin by “large institutional funds and regulators” is the next big driver of new high prices, which will also end the dominance of the cryptocurrency market by retail traders and could eventually lead to a “less volatile” market.

Announcements and protocol updates increase the price of altcoins

Several large and mid-cap Altcoins experienced a price break on Thursday, as recent announcements and new integrations increased trading volume.

Daily indicators for the cryptocurrency market. Source: room360

ADA Cardano is the first piece in the top 10, currently up 10.4% and trading at $1.15, while Fantom (FTM) continues to benefit from its recent cross-channel integration with Ethereum, up 31.79% at a price of $0.7755.

Other notable performers include Enjin Coin (ENJ), which is currently up 34% to $0.6221. MATIC Polygon is also up 27.74% and is trading at $0.2023.

Daily chart of BTC/USD. Source: Moneta360

The total capitalization of the cryptocurrency market currently stands at $1,533 billion, with Bitcoin dominating at 61.3%.

Related Tags:

Privacy settings,How Search works,bit coin price,bitcoin stock price,cryptocurrency prices,how much are bitcoins worth

1 note

·

View note

Text

Top Crypto Partnerships 2022

2022 will go down in history, notably in the crypto sphere. The regular market and the cryptocurrency market have both experienced a lot of activity. Virtual Digital Assets, also known as VDAs, were supported by several organizations and personalities with a global reach even during the current crypto winter. Many significant institutions have been collaborating with partners to stay relevant in the globe as it transitions to Web3 starting with making the most of international events like FIFA.

To put it simply, the major reasons companies, influencers, and Web3 creators collaborate are to maximize the reach drivers and sustain their global presence. Additionally, businesses and celebrities view these collaborations as the greatest way to increase their fame by providing a share in the company or a certain investment amount. Additionally, several cryptocurrency ventures agree to a ‘quid pro quo’ cooperation.

TOP CRYPTO PARTNERSHIPS IN 2022:

The three-year sponsorship agreement between Swyftx and the Australian National Rugby League: The Brisbane-based cryptocurrency exchange signed sponsorship agreements with the Women’s National Rugby League, State of Origin, and All-Star Games as part of its branding strategy.

When the agreement was announced in February, Swyftx CEO Ryan Parsons issued the following statement: “The collaborations we’re witnessing right now reflect a sign of increased trust in the future of crypto and its potential for global adoption. The main debate right now isn’t whether cryptocurrency is here to stay, but rather how rapidly it will change how traditional financial institutions and the global economy operate. Red Bull’s NFT Deal with Bybit of NFTs in crypto cooperation has been going strong for a long, and the most recent example is NFTs making their imprint on Red Bull Racing’s cars to wrap out the 2022 F1 season. Lei the Lightning Azuki, an NFT piece and a member of the anime-inspired Azuki line, was shown alongside the Bybit logo.

The handshake between Meta and Microsoft felt like a pretty obvious move after reviewing the numerous choices that Metaverse has been putting up for the crypto realm. A variety of Microsoft Office 365 products will be made available through this cooperation on Meta’s virtual reality (VR) platform. This is done in an effort to get businesses to operate in virtual environments.

David Beckham with DigitalBits, David Beckham, a former legendary player for the English Premier League, was chosen in March 2022 to serve as the worldwide brand ambassador for the DigitalBits blockchain. He also introduced his own line of non fungible tokens (NFTs) through this arrangement. Bored Apes with Mastercard Debit Cards: In September of this year, Mastercard confirmed that its debit cards will now support Bored Apes NFTs. This card’s customization features will support NFT avatars from a few carefully chosen blue-chip collections. They will, however, be held to Mastercard’s design guidelines, with the exception of an owner verification procedure.

Binance enlisted the help of well-known Tik Tok performer Khaby Lame to inform the public about Web3. Khaby will discuss web3 as a subject in his distinctive manner. Lame said in a statement, “I’ve been interested in Web3.0 for a while, and I leaped at the chance to join with a leader like Binance because it matches perfectly with what I generally do: making difficult things accessible and enjoyable for everyone.

Bentley and Polygon Blockchain collaborated to introduce their NFT line on the 0x network. The automaker’s entry into web3 demonstrates the industry’s influence. The company will unveil its NFTs in September 2022 with Bentley’s fastest Grand Tourer — the Continental GT Speed. 208 and the 1952 R-Type Continental. Earlier last month, Disney selected Polygon technology for its accelerator program. New technologies in augmented reality (AR), non-fungible tokens (NFT), and artificial intelligence will be developed as part of the accelerator program (AI). The chosen team will get direction from Disney’s senior leadership team and a committed executive mentor throughout the program.

F1 Grand Prix collaborated with Bybit, a platform for cryptocurrency exchange, to spread the word about F1 NFTs. The F1 car manufacturer is entering the web3 space through cryptocurrency and NFT to appeal to millennials.

To make the NFT purchasing process simple for collectors, Coinbase worked with MasterCard, a leading provider of international payment services. Holders of Mastercard credit and debit cards will be able to buy NFTs straight from the platforms thanks to this agreement. FIFA selected Algorand as its official blockchain partner and sponsor.

Given that Algorand will provide a digital asset strategy and FIFA will help with the marketing and promotion of the blockchain company, this relationship might be seen as a quid pro quo. With the aim of developing web3 apps, Nothing mobile, a new brand, and Polygon partnered. The first batch of these phones will soon be available for shipping, and the debut of services on the phone is only around the corner.

The black dot NFT of Nothing, which will grant access to exclusive events and more in the crypto and web3 sphere, will be given to mobile holders in the first stage. By creating sidechains to connect the Cardano mainnet and other blockchains, Wanchain collaborated with Cardano to grow the blockchain. EVM, also known as the Ethereum Virtual Machine, will make Cardano interoperable with Ethereum thanks to this development. One of the most important crypto collaborations of 2022 is the alliance between Cardano and Wanchain. To access on-chain data, Aave, one of the top lending platforms, partnered with Pocket Network. Sources claim that the alliance will play a key role in enabling additional decentralized apps on other blockchains.

In order to launch sports NFTs, Cristiano Ronaldo and Binance entered into a collaboration. Binance wants to match the degree of the great footballer’s following with this collaboration. The Argentine Football Association, the Brazilian Football Confederation, S.S. Lazio (IT), and FC Porto (PT) are all expected to join the exchange through this cooperation.

Website | SPARC BETS | Twitter | Telegram | Instagram | Discord

0 notes

Text

Crypto News Summary: Coinbase Partners with Google Cloud for Crypto Payments, CNN Kills Vault

New Post has been published on https://medianwire.com/crypto-news-summary-coinbase-partners-with-google-cloud-for-crypto-payments-cnn-kills-vault/

Crypto News Summary: Coinbase Partners with Google Cloud for Crypto Payments, CNN Kills Vault

Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news. __________

Payment news

Google announced a deal with major crypto exchange Coinbase to enable select customers to pay for its Cloud services using cryptoassets such as bitcoin (BTC) in early 2023, according to CNBC. The deal was announced at Google’s Cloud Next conference, it said. Over time, Google will allow many more customers to make payments with cryptocurrency, Amit Zavery, vice president and general manager and head of platform at Google Cloud, reportedly told CNBC. Coinbase will move some of its applications to Google’s cloud.

Payments platform Wirex announced the launch of USD coin (USDC) on the Stellar (XLM) blockchain within the Wirex app. It added that this announcement is an important milestone in an ongoing collaboration between Wirex and the development of the Stellar Development Foundation (SDF), the non-profit organisation that supports the growth and development of the Stellar network.

California-based start-up Ripple announced its first On-Demand Liquidity (ODL) customer in France as it partners with Lemonway, a Paris-based payment provider for online marketplaces. It also announced a second new ODL customer, its first in Sweden – Swedish money transfer provider Xbaht, which enables money movement between Sweden and Thailand.

Web3 news

Cable news network CNN has ended its Web3 experiment. Per an announcement, it has “decided that it’s time to say goodbye” to Vault by CNN. It added that it learned a lot from its “first foray into Web3” and that the Vault non-fungible token (NFT) collection “will live on.”

Decentralized communication protocol for Web3 Push Protocol announced the launch of its native Web3 messaging app and a wallet-to-wallet communication protocol, Push Chat. Per the announcement, the team launched the Push Chat alpha and opened up access to select users across the Push community. Polygon Wallet is a launch partner for Push Chat, setting the stage for the intra-wallet chat, they said.

Exchange news

Coinbase announced on Monday that it received a license from the Monetary Authority of Singapore (MAS) as it plans to expand in Asia. “Gaining this in-principle approval from MAS is an important step, as we plan to launch our full suite of retail, institutional and ecosystem products,” it said.

Security news

Layer 1 blockchain QANplatform has become the target of a bridge hack that resulted in the theft of some QANX 1.43 billion, worth over $1 million. Blockchain security company Peckshield sounded the alarm first, with QANplatform confirming that “the bridge smart contract that is offline was hacked and the attacker managed to withdraw tokens.”

Blockchain security company Supremacy Inc. said today that decentralized finance (DeFi) aggregator ParaSwap may have been compromised, possibly as a result of a profanity vulnerability, and that funds may have been stolen on multiple chains. ParaSwap denied any vulnerability, saying that it will release an analysis and an explanation later.

DeFi news

Anubi Digital unveiled DUO, a service that allows its customers to deploy digital assets in pairs to Uniswap (UNI)’s liquidity pools and earn a stream of crypto rewards over time, said the press release.

Investment news

Bahamas-based digital asset investment firm GEM Digital Limited has provided MinePlex, a new-generation digital ecosystem, “with up to $100 million in funding,” said a press release. “The funding will be used to advance global penetration of the MinePlex ecosystem and the development of new banking technologies,” it said.

Mining news

Bitcoin miner Greenidge Generation expects a GAAP net loss of between $20 million and $22 million for the third quarter, it said in its preliminary financial and operating results. Greenidge reported expected revenue of $29 million.

As it celebrates its five-year anniversary Bitcoin mining operation Bitfarms said that, as of September 2022, it achieved operating capacity of 176MW, a hashrate of 4.2 exahash/second (EH/s), and approximately 2% market share of the Bitcoin network.

Read full article here

0 notes

Text

New paper examines the elusive nature of liquid brines on Mars

Determining the conditions in which brines are stable could be key to better understanding the climate and potential habitability of Mars

More than a hundred years ago, astronomer Percival Lowell made the case for the existence of canals on Mars designed to redistribute water from the Martian ice caps to its lower, drier latitudes. This necessarily meant the existence of Martians to build the canals.

While Lowell was proven wrong by better telescopes, the question of whether there’s liquid water on Mars continues to tantalize researchers. Liquid water is a critical precondition for a habitable planet. Yet the combination of low temperature, atmospheric pressure and water vapor pressure on Mars means any liquid water found there would likely freeze, boil or evaporate immediately, making its presence unlikely.

Yet researchers continue to make the case for the presence of liquid water on Mars.

Of particular interest has been the discovery of the “recurring slope lineae,” or RSL, which are dark linear features found on steep slopes in specific regions of Mars. RSL display seasonal changes, appearing in warmer seasons and fading in colder seasons, in a way that is consistent with the behavior of liquid water. Distinct striped and polygonal features in Martian permafrost have also been pointed to as possible evidence of thermal cycles. A further case has also been made for an assortment of potential liquid brines.

But a new paper published in the Proceedings of the National Academy of Sciences of the United States of America, the official journal of the National Academy of Sciences, throws cold water on the notion that we are likely find liquid water on Mars in RSLs, permafrost or brines anytime soon.

The paper, “The Elusive Nature of Martian Liquid Brines,” was co-authored by Vincent Chevrier, an associate research professor at the University of Arkansas’ Center for Space and Planetary Sciences, and Rachel Slank, a postdoctoral fellow at The Lunar and Planetary Institute in Houston, Texas. Slank earned her Ph.D. at the U of A while working with Chevrier, who has spent the last 20 years studying Mars for signs of liquid water. In short, he’s as invested as anyone in there being liquid water on Mars, but he thinks the evidence just isn’t there yet.

The goal of the paper is to educate the public on the current state of knowledge regarding the existence of liquid water on Mars.

“I wanted to write this paper for a very long time,” Chevrier said, “because I think there is a lot of confusion, a lot of misunderstanding, and a lot of erroneous interpretations of what the research papers are saying about the state of liquid water on Mars.”

The authors suggest that a closer look at RSLs indicates their behavior is consistent with sand and dust flows with no water needed to create them. Nor can available data from Martian orbiters confirm liquid water plays any role in RSL development.

Other researchers think that brines, which are solutions with a high concentration of salts, such as Earth’s oceans, may hold the key to finding liquid water on Mars. Brines can freeze at much lower temperatures, and there is an abundance of salts on Mars. Of those salts, perchlorates would seem to be the most promising, since they have extremely low eutectic temperatures (which is when the melting point of a mixture is lower than any single ingredient). For instance, a calcium perchlorate brine solidifies at -75 degrees Celsius, while Mars has an average surface temperature of -50 C at the equator, theoretically suggesting there could be a zone where calcium perchlorate brine could stay liquid, particularly in the subsurface.

The authors then examine all of the arguments for and against brines potentially forming stable liquids. Ultimately, they concluded that the various limiting factors, including the relatively low amounts of the most promising salts, water vapor pressure and ice location “strongly limit the abundances of brines on the surface or shallow subsurface.” And even if brines did form, they would “remain highly un-habitable by terrestrial standards.”

In the last section of the paper, the authors state: “Despite these drawbacks and limitations, there is always the possibility that Martian life adapted to those brines and some terrestrial organisms could survive in them, which is a consideration for planetary protection because life on Mars might exist today in that case. Hence, detecting brines in situ remains a major objective of the exploration of the red planet.”

Moving forward, the authors suggest the next hurdles will be improving the instruments needed to detect small amounts of brines, doing a better job of identifying the best places to look for them, and being able to conduct more laboratory measurements under Martian conditions.

“Despite our best efforts to prove otherwise,” Chevrier concludes, “Mars still remains a cold, dry and utterly unhabitable desert.”

IMAGE: Vincent Chevrier, associate research professor Credit Russell Cothren

0 notes

Link

#altcoinmarkets#BitcoinETF#cryptoregulation#digitalassetcustody#EthereumETF#institutionalinvestment#PaulAtkins#SEC

0 notes

Text

Source: AdobeStock/ sdx15 Get your everyday, bite-sized absorb of cryptoasset and blockchain-related news-- examining the stories flying under the radar these days's crypto news. __________ Adoption news Crypto.com wallet clients can now acquire daily products, such as fuel, coffee, and sandwiches throughout 175 On The Run(OTR) fuel and corner store websites throughout Victoria, South Australia. and Western Australia utilizing their crypto by utilizing the Crypto.com App to scan a QR code on their phone. Peregrine Corp, the owner of OTR, prepares to present the ability to another 250 retail websites throughout the nation, stated the statement. Brazillian financial investment bank BTG Pactual released a crypto trading platform. Called Mynt, the platform will use its users access to bitcoin (BTC), ether (ETH), solana (SOL), polkadot (DOT), and cardano (ADA), the business stated in a news release Investment news The CEO of a significant Canadian institutional financier just recently stated he's crossed out the business's stake in Celsius (CEL), Bloomberg reported. Charles Emond, CEO of the Caisse de Depot et Placement du Quebec, talked about investing USD 150 m into the struggling crypto lending institution, which submitted for Chapter 11 personal bankruptcy last month, and stated although the due diligence was "rather substantial", it is not a warranty of success. He included that he has "compassion" for countless financiers whose funds Celsius had actually secured. Non-custodial loaning procedure Yupana.Finance stated that it is supplying credit procedure advantages to the Tezos (XTZ) neighborhood, allowing them to obtain, provide, and make benefits. Journalism release specified that the designers of Madfish, a software application advancement business in the Tezos community, have actually checked Yupana "thoroughly" which it is currently introduced on the Tezos mainnet. Blockchain cybersecurity company dWallet Labs has actually raised USD 5m to construct its services on top of Odsy Network, a news release stated The pre-seed financing was led by Node Capital and Digital Currency Group, and signed up with by Amplify Partners, Lightshift Capital, Liquid2 Ventures, Collider Ventures, and more, in addition to creators and angel financiers from Coinbase, Ethereum, Celo, AngelList, Alt, Spearhead, and others. Singapore-based crypto staking company RockX has actually been acknowledged by Staking Rewards, a main info center and information aggregator for crypto staking, as a Verified Staking Provider with result from July 20,2022 Providing non-custodial staking services for all significant Proof-of-Stake public blockchains, RockX is among 22 companies internationally that have actually looked for and gotten confirmation, while 4 out of these are based in Asia, stated a news release shown Cryptonews.com Payments news Crypto platform Wirex has presented brand-new payment approaches, to make it simpler for users to top up and withdraw funds from their accounts. The approaches consist of SEPA Instant and Faster Payments, enabling clients in the UK and the EEA to move GBP and EUR in between Wirex and savings account more quickly, it stated. Security news Blockchain interoperability procedure Celer Network was required to close down its cBridge item after coming under a Domain Name System (DNS) pirating attack. To alleviate the possible danger, the business asked its users to withdraw the approval for a variety of agreements, consisting of Polygon (MATIC), Avalanche (AVAX), and others. Following this, the group specified that cBridge frontend interface (UI) is now up once again with extra tracking in location. Stablecoin news Tether, the company of the USDT stablecoin, stated that it is upgrading its guarantee and attestation procedures, and formally started dealing with BDO Italia, the Italian member company of BDO international company, the leading 5 ranked international independent public accounting company, in July 2022 for its quarterly attestations.

Tether will likewise concentrate on moving towards launching its attestations from a quarterly basis to regular monthly reports. Legal news A Russian male, implicated of laundering cryptocurrencies taken through ransomware attacks, was extradited from the Netherlands to the United States, where he'll deal with charges of co-conspiring to cash laundering, and other criminal offenses, the United States Department of Justice revealed 29- year-old Denis Mihaqlovic Dubnikov is taking a look at a 20- year jail sentence, must he be founded guilty. The cash he was supposedly laundering was being available in through the Ryuk ransomware pressure. Gaming news The Sandbox's Alpha Season 3 will introduce on August 24, the business validated in a news release today. It stated that this will be the most significant Alpha Season to date, as it consists of 98 experiences over 10 weeks, suggesting gamers will get brand-new material every day. Online multiplayer IO video game Snook revealed its BBT Themed spaces for environment partners - a top quality, token-gated experience where jobs can engage with their neighborhood. It likewise symbolizes the capacity of cooperation in the Web3 area, stated a news release shown Cryptonews.com Snook's collaboration with blockchain domain contractor Unstoppable Domains allows Snook users to visit with their Unstoppable Domain and bet other UD holders. The video game likewise partnered with LobsterDAO and introduced LobsterDAO BBT-themed spaces, and it will be hosting an unique video game night for all the LobsterDAO NFT holders. Gaming-oriented blockchain Oasys revealed the winners of its Web3 video game pitch occasion that it had actually just recently kept in Seoul, South Korea. TROUBLE PUNK: Cyber Galz, a fight royale-style action video game won the competitors, bringing its designers, Catze Labs, 600,000 of Oasys' native tokens, OAS, along with very first settlement rights with Arriba, BNE 021 Fund, and DJT Ventures Pomerium, Epic League, and Tanuki Squad flash location, winning OAS 200,000 each. Career news CEO of crypto exchange Genesis Trading, Michael Moro, has actually stepped down from his position, at a time when his business deals with significant losses due to the fall of Three Arrows Capital According to Bloomberg, he will be prospered by the present Chief Operating Officer, Derar Islim, who signed up with the business 2 years back. Read More

0 notes

Text

Deribit, the largest cryptocurrency options exchange, has confirmed that it will offer altcoin options for Solana (SOL), Ripple (XRP), and Polygon (MATIC) despite the slump in crypto prices. It hopes the derivatives will offer investors a better hedge than Bitcoin (BTC) and Ethereum (ETH), whose volatility indexes are at all-time lows. Deribit’s Chief Commercial Officer Luuk Strijers emphasized that the lack of volatility has not deterred their plans. He predicts the company’s new altcoin options contracts will increase volatility when they go live in January. Deribit Delayed Launch Due to Low Volatility The company spent many sleepless nights deciding on the correct launch window, Strijers said. “Is this the best environment to launch new products, or should we defer? That’s what keeps us awake.” Digital Asset Capital Management founder Richard Galvin said that ETH has fallen out of favor because it has low volatility. Other altcoins like SOL, XRP, and MATIC have lower liquidity, making it easier for smaller trades to move prices. According to K33 analyst Vetle Lund, most market manipulation is taking place in altcoins more than Bitcoin. Deribit has not officially revealed whether it will surveil markets to lower the risk of manipulation for its options contracts. Bitcoin volatility | Source: Bloomberg The exchange, which racked up significant losses after Three Arrows Capital failed to meet its margin requirements, will launch the options contracts after it completes a move from Panama to Dubai. ETH Derivatives Show Poor Volumes Deribit’s expansion comes after US regulators delayed approving a spot Bitcoin ETF a few weeks ago. In the meantime, institutional investors have also not warmed to ETH futures ETFs that several companies rolled out. ETH futures ETF performance | Source: K33 Research Read more: 11 Best Crypto Portfolio Trackers in 2023 According to Lund, the trading volume of ETH futures made up only 0.2% of the volumes Bitcoin futures ETFs experienced in 2021. “The first day numbers were well below expectations, and we no longer see a strong bull case for BTC/ETH in the short term.” He confirmed that, despite traders on the CME anticipating better launch days, the success of futures ETFs are tied to institutional demand. The ETH derivative, despite being fully regulated in the US, will not drive significant inflows without investor interest, he observed. Read more: Best Crypto Derivative Exchanges in 2023 On Sunday, the UK Financial Conduct Authority advised locals to avoid Huobi and KuCoin as new advertising restrictions became effective. His Majesty’s Treasury has given the FCA powers to regulate crypto, and the recent passage of an online safety bill allows the regulator to clamp down on companies that have not been authorized to promote crypto. Both Huobi and KuCoin’s websites do not list the UK as a restricted country. Spokespeople for both companies claim they do not serve UK customers. The UK will likely propose more detailed rules for regulating crypto in Q1. Europe’s Markets in Crypto-Assets bill, which offers crypto companies a license usable across the entire European Union (EU) bloc, will come into effect in 2024. Deribit announced it has applied for a license to run a crypto brokerage in the EU. Do you have something to say about Deribit altcoin options, new ETH futures ETFs, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

0 notes

Text

Polygon Allocates $20 Million for Eco Initiatives Following Its Green Manifesto

The environmental impacts and sustainability are probably the primary criticisms directed toward blockchains and cryptocurrencies. Although the recent projects have brought in several sustainable solutions, legacy chains like Bitcoin and Ethereum still lead the list for the highest amount of carbon emissions. Moreover, even the recent networks have achieved only carbon neutrality, and sustainability still looks like a long shot for many. But things now seem to take a turn as Polygon becomes the first network to take up this issue through the recent Green Manifesto it shared with the community.

In a blog post shared on April 12, the network announced its plans to go carbon-free in the coming years. The team formed for this cause would evaluate the carbon debts of the ecosystem and help pave the path for a sustainable future for Polygon. This climate-friendly approach is embraced to help the network attain negative carbon status by 2022. The positive vision of Polygon also comes with $20 million in funding for community activities and innovative technologies that would push the ecosystem towards this new goal.

The first step towards this end comes with a $400,000 BCT and MCO2 carbon credits purchase. Reportedly, this is equivalent to 90,000 tons of carbon emissions. Users can buy carbon credits through the carbon market of KlimaDAO, a decentralized climate project run by a group of environmentalists, entrepreneurs, and developers. These tokens are approved by the International Carbon Reduction and Offset Alliance and adhere to the Verified Carbon Standard. Polygon plans to retire these coins using a decentralized aggregator app.

KilmaDAO is also tasked with surveying energy consumption and CO2 emissions on Polygon and formulating a working strategy for mitigating their impacts. Node infrastructures, staking activities, and connectivity with the Ethereum mainnet will be considered while formulating the strategies. Polygon has also requested a review from the Crypto Carbon Ratings Institute to better evaluate the situation and find solutions. According to Co-Founder Sandeep Nailwal, Polygon has gilt-edged infrastructures for a sustainable ecosystem. He, however, believes that it is not good enough considering what is at stake. With the hope of forming a united front to bring in new technologies, strategies, and solutions for sustainability, Polygon has commissioned this initiative.

This initiative from Polygon comes right when Ethereum is about to change to the proof-of-stake consensus mechanism. Experts confirm that the blockchain’s carbon footprints would be down by 99%. So, this Green Manifesto could be Polygon’s strategy to evade Ethereum’s dominance in the future by becoming a carbon-negative ecosystem. Before Polygon, Hedera and VeChain have also initiated their initiatives to help projects with carbon emission management. With everything being said, it becomes clear that this nascent industry values sensibilities of the current generation towards the environment.

source https://usapangbitcoin.org/polygon-allocates-20-million-for-eco-initiatives-following-its-green-manifesto/

source https://usapangbitcoin.wordpress.com/2022/04/13/polygon-allocates-20-million-for-eco-initiatives-following-its-green-manifesto/

0 notes

Text

MEXC Global Research: High Performance Public Chain Fantom (FTM) Recommended by Andre Cronje (AC)

Fantom

Fantom is a high-performance public chain based on DAG (Directed Acyclic Graph), which provides services for enterprises and applications, and aims to solve the scalability and processing time of existing blockchain technologies.

Fantom is powered by Lachesis, an advanced DAG-based aBFT consensus algorithm. In Fantom, each transaction information can become a unit, and the units can be connected to each other arbitrarily to verify their validity. Transactions do not need to be packaged together to complete the transaction, thereby increasing transaction concurrency and volume, and realizing instant transactions.

DAG (Directed Acyclic Graph)

If a directed graph cannot start from a vertex and return to that point through several edges, the graph is a directed acyclic graph (DAG in the figure). In other words, it is non-cyclic, meaning it can only carry out the one-way flow of information. Compared to the typical chain design of blockchain, DAG can speed up the transaction speed and scalability.

Lachesis aBFT (LCA algorithm, Asynchronous Byzantine Consensus)

Lachesis is a breakthrough aBFT consensus mechanism developed by Fantom. aBFT consensus stands for “asynchronous Byzantine Fault Tolerant” consensus. When a network is said to be “Byzantine Fault Tolerant”, it means that nodes can still reach an agreement on an ordering of events even if part of the network acts maliciously.

Key properties of Lachesis algorithm:

· Asynchronous: Participants have the freedom to process commands at different times.

· Leaderless: All participants are equal and play no special roles.

· Byzantine Fault-Tolerant: Functional even when up to one-third of faulty nodes and malicious nodes are present.

· Instant: The output transaction of Lachesis can be confirmed in 1-2 seconds.

Unlike Proof-of-Work (PoW), Proof-of-Stake (POS) and pBFT, Lachesis nodes do not send blocks to each other. Validators don’t vote on a concrete state of the network; instead, they periodically exchange observed transactions and events with peers.

The event block includes the following information: transaction, smart contract, historical information, and the value of previous transactions.

In general, LCA specifically forms the Lachesis DAG based on the Lachesis protocol. A set of links between event blocks form a DAG, which is a distributed system that stores arbitrary data that cannot be changed. Due to the design of validator node, DAG supports high-speed real-time transactions.

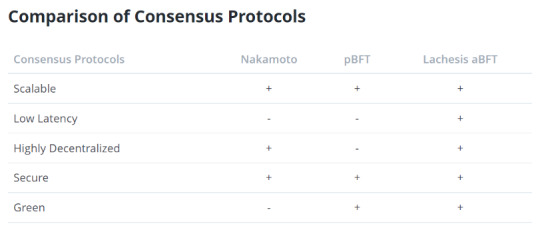

Comparison of different consensus algorithms (Nakamoto consensus, pBFT consensus, Lachesis aBFT)

Opera Mainnet

The blockchain environment built by Fantom is called Opera, in which DApps can be built using smart contracts. The main features are: based on DAG technology that realizes cost-efficiency, integration with Ethereum Virtual Machines (EVMs) and the Solidity programming language.

Opera's technical architecture consists of three layers:

Opera core layer: responsible for large-scale transaction processing;

Opera ware layer: responsible for supporting smart contracts and other functions;

Opera application layer: provides support for third-party DApps

Investor Institutions

Blockwater Capital, Digital Currency Holdings, FBG Capital, Origin X Capital, X Squared, Huobi VC, Signum Capital, One Block Capital, Chainrock, Kosmos Capital, MB Technology, Bibox Fund, Block Tech Capital, Lemniscap Capital, AVA Quest, Lumen, Orichal Partners, FutureMoney Ventures, Block VC, BlockCrafters, SuperChain Capital, Arrington XRP Capital, JRR Crypto, Black Edge Capital, CryptoBazzar, Digital Strategies/Polymath, Zorax Capital, Transference Fund, LinkVC, Nirvana Capital, JD capital, DFund, Danhua Capital, Alameda Research (FTX parent company), BlockTower Capital, HyperChain Capital, etc.

Advantage

Instant Transaction finality: event blocks are connected and verified with each other, and there is no need to package blocks to improve concurrency and speed.

Low transaction fee: the transaction fee is close to 0. At the same time, 30% of the transaction fee is held by the CSRC (locked hedging), and the remaining 70% of the transaction fee is allocated to the verifier in proportion.

Strong scalability: It supports multiple nodes. The more nodes join, the faster the speed and the greater the scalability. It is compatible with Ethereum EVM virtual machine, etc.

Openness and transparency: open-source code

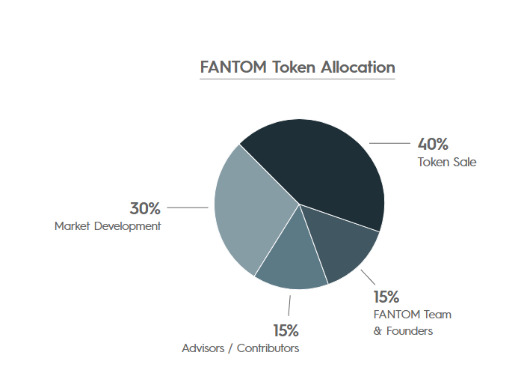

Tokenomics

Governance token: FTM (currently supports mainnet, ERC20 and BEP20)

Total: 3.175 billion

Token sale: 40%

Market development: 30%

Advisors and contributors:15%

FANTOM team and founders: 15%

Practical Value

Proof of stake, and hold tobecome the verification node

Transaction fee

Participation in voting governance

Collateral for Fantom’s DeFi suite

Existing risks

DAG technology is not yet mature or recognized in the market

The project is still in the improvement stage, and is pending completion pending

Cash out by investors and team

Public chain ecosystem competition is fierce

Partial Ecosystem Projects

Aggregator SpiritSwap

Token: Spirit

Market value: 15 million USDT

SpiritSwap (SPIRIT) is a one-stop comprehensive trading application on Fantom, which integrates the functions such as trading, lending, IDO, NFT trading, smart pool, and automatic insurance.

Collateral lending Scream

Token: SCREAM

Market value: 17 million USDT

SCREAM is a highly-scalable decentralized lending protocol built and powered by the Fantom Blockchain, and is similar to AAVE and Compound.

Aggregator ZooCoin

Token: ZOO

Market value: /

ZooCoin (ZOO) is a comprehensive trading application on Fantom, which is mainly composed of trading aggregator, K-line chart, NFT market and other functions.

Cross-chain yield aggregator Beefy Finance

Token: BIFI

Market value: 84 million USDT

Beefy Finance (BIFI) is a cross-chain revenue aggregator that can run on multiple chains. Currently, it supports Fantom and BSC chains. By providing users with automated investment strategies through smart contracts and algorithm programs, users can maximize their benefits from various liquidity pools (LP), automatic market making (AMM) projects and other mining and farming projects on Fantom.

Cross-chain stablecoin Curve

Token: CRV

Market value: 872 million USDT

Curve Fi is a cross-chain decentralized stablecoin trading application. Launched in Ethereum as early as January 2020, it enables users to trade between stablecoins with low slippage, low handling fee, and supports cross-chain, including ETH, Polygon, xDai, Fantom and other networks.

DEX platform Spookyswap

Token: BOO

Market value: 80 million USDT

SpookySwap is an automated market-making (AMM) decentralized exchange (DEX) for the Fantom Opera network. Take BOO token as governance token to provide diversified farms, built-in cross-chain bridges, limited price orders and user-centered services.

Cross-chain yield aggregator Popsicle Finance

Token: ICE

Market value: 29 million USDT

Popsicle Finance is a multichain yield optimization platform for Liquidity Providers, which supports automated compound interest to improve capital efficiency. They can automatically provide its users with the highest possible yield on the assets they wish to deploy to liquidity pools.

Cross-chain yield aggregator Graviton

Token: GTON

Market value: 18 million USDT

Graviton is a universal wrapped tokens’ liquidity incentivization solution that provides the technological foundation for seamless cross-chain communication and creates a reward-based economy around wrapped assets. Graviton's diverse infrastructure includes cross-chain bridge aggregators, cross-chain wallets, and LP reward farming products.

0 notes

Text

Pokémon Cards No Longer on Sale at Target Because Scalpers Don’t Know How to Act

https://ift.tt/eA8V8J

In breaking “this is why we can’t have nice things” news, Target has announced it will be suspending sales of the Pokémon Trading Card Game as well as certain sports cards. The announcement comes after reports of violent confrontations among scalpers for the products as their value continues to grow.

Social media users first noticed and reported signs in Target’s trading card sections indicating that Pokémon, NFL, MLB, and NBA cards would no longer be in stock beginning on Friday, May 14.

It’s real. No more Pokémon at target. This is insane. pic.twitter.com/n5y6ucAffX

— BeardedLuke (@thebeardedluke) May 12, 2021

Similar signs have been observed in Walmart stores as well, though the company has yet not commented as to whether this is a nationwide initiative.

Target confirmed its new policy to Polygon, with a company representative saying “The safety of our guests and our team is our top priority. Out of an abundance of caution, we’ve decided to temporarily suspend the sale of MLB, NFL, NBA and Pokémon trading cards within our stores.”

The phrase “out of an abundance of caution” has been getting quite the workout over the past year or so. In Target’s case, an abundance of caution is probably warranted. Last week a fight (in which one participant was armed with a gun) occurred outside of a Brookfield, Wisconsin Target store over sports cards. No shots were fired and injuries were minor but the incident underscored just how intense the trading card market had become, particularly among scalpers.

Over the past year, trading cards (Pokémon cards in particular) have seen a massive uptick in interest and sales. This is likely due to numerous factors including the pandemic necessitating more indoor hobbies, economic stimulus payments hitting millennials’ bank accounts, and the increasing popularity of pack-opening videos on social media. As anyone who has simply wanted to grab pack of the Pokémon set Battle Styles to grab another Rapid Strike Octillery can attest (not bitter or anything), Pokémon card products sell out moments after they arrive on the shelves of Targets and Walmart, often bought out by scalpers who seek to resell the cards for a profit online.

In recent weeks, Target and Walmart had instituted policies of limiting customers’ purchase of cards, with Target adopting a policy of one Pokémon, NFL, MLB, or NBA card item per customer per day. As the latest incident in Wisconsin illustrates, however, scalpers will always find a way.

cnx.cmd.push(function() { cnx({ playerId: "106e33c0-3911-473c-b599-b1426db57530", }).render("0270c398a82f44f49c23c16122516796"); });

For now, Target’s discontinuation of card-selling appears to be only temporary until the market calms itself down. The Pokémon Company, which is celebrating 25 years of the franchise this year, recently reported that it is “working to print more of the impacted Pokémon TCG products as quickly as possible and at maximum capacity to support this increased demand.”

Meanwhile, all Pokémon and sports trading card products are still available for purchase on Target’s website. Should the market not cool down and this policy not be reversed, then we suppose it’s just Magic: The Gathering and the NHL’s time to shine.

The post Pokémon Cards No Longer on Sale at Target Because Scalpers Don’t Know How to Act appeared first on Den of Geek.

from Den of Geek https://ift.tt/33FEnfF

0 notes