#point of sale terminal market group

Explore tagged Tumblr posts

Text

JOOTA HAI YEEZY🙂

In late 2022, Adidas, a global powerhouse in the realm of sportswear, found itself entangled in a web of controversy following its decision to sever ties with Kanye West due to his series of contentious remarks. This move ignited a multifaceted discussion around corporate social responsibility (CSR) and prompted a deeper exploration of the ethical considerations inherent in business partnerships.

The narrative surrounding Kanye West's departure from Adidas began with inflammatory statements, which escalated from provocative tweets to offensive interviews and podcasts, ultimately culminating in unsettling remarks involving an Adidas manager. The widespread condemnation that ensued left Adidas with no option but to publicly denounce West and terminate their longstanding collaboration. However, this action was just the beginning, as public scrutiny intensified, leading to a reassessment of Adidas' CSR practices.

Despite the termination of their partnership, Adidas' decision to continue selling existing Yeezy stock became a focal point of criticism. Critics argued that by doing so, Adidas was indirectly supporting West financially, thereby, contradicting their condemnation of his behaviour and calling into question the sincerity of their commitment to CSR principles. The ongoing sale of Yeezys was perceived by many as profiting from hate speech, potentially undermining Adidas' professed values of inclusivity and respect, particularly in the eyes of younger consumers who place great emphasis on a brand's ethical stance.

The discord between stakeholder expectations and corporate actions laid bare a fundamental disconnect between rhetoric and reality. This dissonance raised doubts about the authenticity of Adidas' CSR initiatives and underscored the importance of aligning stated values with tangible actions. Critics pointed out numerous inconsistencies between Adidas' professed values and their decision to continue selling Yeezys, fueling scepticism about the efficacy of their CSR efforts and casting doubt on the integrity of their corporate governance. This loss of trust translated into diminished brand loyalty, which could potentially impact sales and market share over the long term.

The fallout from the controversy prompted stakeholders to demand greater transparency and accountability from Adidas. There is a growing expectation for companies to not only articulate their CSR commitments but also to demonstrate tangible progress and accountability in fulfilling them. The Yeezy controversy served as a catalyst for a broader conversation about corporate ethics and the responsibilities of multinational corporations in navigating complex social issues.

Moreover, The Clean Clothes Campaign published a report in 2023 detailing the unfavourable working conditions in Adidas factories located in Vietnam and Cambodia. The report painted a terrible picture of the working conditions faced by employees, describing poor pay that did not keep up with living expenses, excessive overtime that went above the law, and hazardous workplaces without enough safety precautions. The research also highlighted issues with restricted freedom of association and challenges in organising unions, which further impeded employees' capacity to speak out for themselves. Similar complaints have also been voiced by other groups, such as the Worker Rights Consortium, in other Adidas supplier facilities, underlining structural issues with the company's supply chain.

In addition to worker rights, Adidas faces environmental challenges. Ecosystems and human health are at risk from the usage of microplastics, which are microscopic particles emitted from synthetic materials. While Adidas investigates natural alternatives and uses recycled plastic, detractors call for quicker action. Criticism is fueled by the industry's massive carbon impact, which includes Adidas' shipping and production. Ambitious targets aim to achieve carbon neutrality by 2050, but detractors question their relationships with high-emission businesses and say they lack specific measures.

As Adidas grapples with the fallout from the controversies, it faces a crucial decision regarding the fate of its remaining Yeezy inventory, ethical labour practices and strives for sustainability. The company must weigh the financial implications of selling the stock against the potential reputational damage and further community backlash that may result. This decision will not only shape Adidas' immediate response to the crisis but also have lasting implications for its corporate reputation and stakeholder relationships in the years to come.

TASK IN HAND

Imagine yourself as the CSR Head of Adidas, tasked with restoring the company's tarnished reputation. For the same come up with the following:

· Create a problem-solving product line with your assigned brand ambassador, prioritising sustainability, and a clear message for impact.

· Spearhead bold CSR initiatives for microplastic mitigation

· Revamping HR for ethical labour practices.

· Craft a resonant CSR campaign for brand reputation revival.

· Press Release

Deliverables

· PPT not more than 7 slides

· A press release

· Extra deliverables are appreciated

2 notes

·

View notes

Text

Retail Point-Of-Sale Terminals Market Segmentation, CAGR Status, Leading Trends, Forecast to 2032

Retail Point-Of-Sale Terminals Market share is anticipated to touch USD 59.62 billion by 2032, growing at a CAGR of 7.5% over the forecast period of 2024-2032.

The retail point-of-sale (POS) terminals market is on a trajectory of significant expansion, fueled by rapid technological advancements and an upswing in consumer spending. POS terminals, essential for transaction processing and enhancing the customer checkout experience, are increasingly becoming sophisticated, integrating advanced features like mobile payments, biometric authentication, and real-time inventory management.

As retailers and businesses continue to seek ways to streamline operations, improve customer engagement, and leverage data analytics, the demand for modern POS solutions is growing. Innovations in payment technologies and the rise of omnichannel retail strategies are driving the market forward, making POS systems a crucial component of retail success.

Get a Free Sample Report: https://www.snsinsider.com/sample-request/3561

Major Players Driving Innovation in the Retail POS Terminals Market are:

Presto Group, Quail Digital, Revel Systems, Toast, Inc., Toshiba Corp., Acrelec, AURES Group, HM Electronics, Hewlett Packard Development LP, NCR Corp., Oracle, TouchBistro, and Xenial, Inc.

These companies are recognized for their cutting-edge technology and comprehensive POS solutions, which address various retail needs from transaction processing to customer relationship management.

Market Segmentation

The retail POS terminals market is segmented into several key areas, including:

By Product

Fixed

Mobile

By Component

Hardware

Software

Services

By End User

Supermarkets/Hypermarkets

Grocery Stores

Specialty Stores

Convenience Stores

Gas Stations

Discount Stores

Other End Users

Regional Analysis

The retail POS terminals market is seeing diverse growth across regions. North America and Europe lead the market due to high adoption rates of advanced POS technologies and the presence of major market players. However, the Asia Pacific region is anticipated to exhibit the highest growth rate, driven by increasing retail activity and the expansion of e-commerce in emerging economies.

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

Buy Now: https://www.snsinsider.com/checkout/3561

Key Questions Addressed

What are the emerging trends in the retail POS terminals market?

How are technological advancements impacting POS systems?

What challenges are manufacturers and retailers facing in this market?

Which regions are expected to see the highest growth in retail POS terminals?

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Akash Anand - Head of Business Development & Strategy

Email: [email protected]

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

0 notes

Text

Singapore Cards and Payments Market: Trends, Innovations, and Future Prospects

Singapore, known for its robust financial infrastructure and technological advancements, has seen significant growth in its cards and payments market. The country's strategic initiatives and regulatory frameworks have positioned it as a leader in digital payments in the Asia-Pacific region. This article delves into the current state of the Singapore cards and payments market, highlighting key trends, innovations, and future prospects.

Market Overview

Singapore's cards and payments market is characterized by a high penetration of credit and debit cards, alongside a rapidly growing adoption of digital payment methods. The Monetary Authority of Singapore (MAS) plays a crucial role in shaping the market by promoting innovation, ensuring financial stability, and enhancing consumer protection.

Key Trends

Rise of Digital Payments: The COVID-19 pandemic accelerated the shift towards digital payments, with consumers increasingly opting for contactless transactions. E-wallets, mobile banking, and QR code payments have become mainstream, driven by the convenience and security they offer.

Contactless Payments: Contactless payment methods have gained immense popularity in Singapore. Credit and debit cards equipped with Near Field Communication (NFC) technology allow users to make quick and secure transactions by simply tapping their cards at point-of-sale terminals.

E-Wallets and Mobile Payment Apps: The adoption of e-wallets and mobile payment apps like GrabPay, Singtel Dash, and PayNow has surged. These platforms offer seamless integration with various services, making them a preferred choice for both consumers and merchants.

Innovative Payment Solutions: Singapore's fintech ecosystem is thriving, with numerous startups and established players introducing innovative payment solutions. Blockchain technology, biometric authentication, and artificial intelligence are being leveraged to enhance the security and efficiency of payment systems.

Regulatory Landscape

The Monetary Authority of Singapore (MAS) has been proactive in creating a conducive environment for the growth of the cards and payments market. Key regulatory initiatives include:

Payment Services Act (PSA): The PSA, implemented in 2020, provides a comprehensive regulatory framework for payment services. It aims to safeguard consumer interests, promote innovation, and strengthen the resilience of the payments ecosystem.

SGQR Initiative: The Singapore Quick Response Code (SGQR) is a unified QR code system that consolidates multiple payment QR codes into a single code. This initiative simplifies the payment process for consumers and reduces the operational burden for merchants.

Sandbox Environment: MAS's regulatory sandbox allows fintech companies to experiment with innovative payment solutions in a controlled environment. This initiative fosters innovation while ensuring regulatory compliance.

Market Players

The Singapore cards and payments market comprises a diverse range of players, including traditional banks, fintech startups, and global payment giants. Key market players include:

DBS Bank: DBS Bank is a leading financial institution in Singapore, offering a wide range of payment solutions, including credit and debit cards, digital wallets, and mobile payment apps.

Grab Financial Group: Grab Financial Group, a subsidiary of Grab Holdings, provides various payment services, including GrabPay, a widely used e-wallet in Singapore.

NETS (Network for Electronic Transfers): NETS is a key player in the Singapore payments landscape, offering a range of services such as NETS FlashPay, NETS Debit, and NETS QR code payments.

Future Prospects

The future of the Singapore cards and payments market looks promising, with several factors driving growth:

Continued Digital Transformation: As Singapore progresses towards becoming a Smart Nation, the adoption of digital payment methods is expected to grow further. Government initiatives and private sector collaborations will play a pivotal role in this transformation.

Cross-Border Payments: Singapore's strategic location as a global financial hub positions it as a key player in cross-border payments. Innovations in blockchain and real-time payment systems will enhance the efficiency and security of international transactions.

Enhanced Security Measures: With the increasing sophistication of cyber threats, enhancing the security of payment systems remains a top priority. Biometric authentication, tokenization, and encryption technologies will be crucial in safeguarding consumer data and preventing fraud.

Buy Full Report For More Information on the Singapore Cards and Payments Market Forecast, Download a Free Sample Report

0 notes

Text

Global Top 14 Companies Accounted for 31% of total Electric Blankets market (QYResearch, 2021)

An electric blanket has an electrical heating device built in that is meant to be placed above the bed sheet. In Commonwealth countries, however, it refers to an electric mattress pad that is kept below the bottom bed sheet. They comprise a control unit that allows the user to adjust the heat produced by the device. Larger size beds may even have two separate control units for both sides of the bed. An electric blanket can be useful to heat the bed to a certain level before sleeping to keep the occupant cosy and warm. Typical low voltage electric blankets work on 12-24 volts and are made of thin carbon fibre wires. The electric blanket was invented more than a century ago by American inventor Samuel Russell, while the first recorded sale in the electric blanket market was by the Samson United Corporation in 1930. An electric blanket uses heating elements or insulated wires that are put into a fabric that heats up when connected to an electrical socket. The temperature control unit, located between the electrical point and blanket, controls the current that enters the heating elements of the blanket. Modern devices use carbon fibre wires to provide heat for the user’s comfort. These wires are much less conspicuous and bulky than the ones used in the past. Today, there are a lot of variations available in the electric blanket market like under blankets, over-blankets, throws and duvets. What is common is the wiring that heats up when connected to the electric point. Buyers are truly spoilt for choice now as they can select blankets with dual controls, those that remain on throughout the night, and those that are machine washable or even those that regulate themselves according to the user’s body temperature.

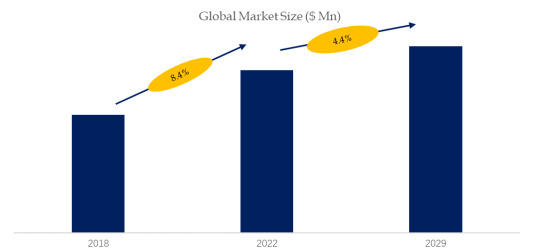

According to the new market research report “Global Electric Blankets Market Report 2023-2029”, published by QYResearch, the global Electric Blankets market size is projected to reach USD 1.49 billion by 2029, at a CAGR of 4.4% during the forecast period.

Figure. Global Electric Blankets Market Size (US$ Million), 2018-2029

Figure. Global Electric Blankets Top 14 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

The global key manufacturers of Electric Blankets include Rainbow Group, Beurer, Sunbeam Products, Caiyang, Shanghai Xiaomianyang Electric, Qingdao Qindao Electric, Tenacta Group, KODEN, BeiJiRen Electric Appliance, Sshine Electric Appliance, etc. In 2021, the global top five players had a share approximately 26.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

The Dark Side of Timeshares: Predatory Practices and Unbreakable Contracts

The Timeshare Industry's Ruthless Tactics and the Battle for Consumer Rights

If you own a timeshare or are considering buying one, beware. The timeshare industry, once touted as a dream vacation opportunity, has turned into a nightmare for many unsuspecting buyers. Noncancelable contracts, exorbitant maintenance fees, and the inability to use or get out of a timeshare have driven families apart, pushed people into poverty, and even led to bankruptcies and suicides.

Timeshare companies have become increasingly predatory in their collections practices, leaving consumers vulnerable and trapped. In this article, we delve into the dark side of the timeshare industry, exploring the tactics used by developers, the legal battles faced by owners, and the fight for consumer rights.

youtube

The Rise of Predatory Practices

Timeshare-collections practices have taken a sinister turn in recent years. What was once a relatively harmless investment has transformed into a nightmare for many owners. The industry's shift towards more aggressive and ruthless tactics has left countless individuals in financial ruin.

Attorney Mike Finn of the Finn Law Group, a consumer advocacy firm, describes the industry's behavior as reminiscent of racketeering. Developers have resorted to suing owners who fail to make maintenance payments or attempt to cancel their contracts. Lawsuits are filed in island courts, default judgments are obtained, and collection agencies are hired to pursue owners in their home communities.

The War Against Exit Companies

The battle between timeshare owners and developers escalated when law firms began assisting people in terminating their timeshare contracts. Developers saw this as a threat and aimed to disrupt the relationship between owners and third-party exit companies. The industry's pursuit of owners has intensified since the COVID-19 pandemic, as developers seek to recover lost revenue.

It is crucial to understand that no one is safe from the timeshare industry's aggressive tactics. Every timeshare owner is at risk of facing legal action, regardless of their circumstances.

The Underlying Problem: You Are a Cash Cow

Why don't developers simply allow owners to exit their contracts? The answer is simple: greed. Timeshares have become a lucrative source of revenue for developers, who view owners as cash cows.

Developers have complete control over owners, making it difficult for them to get rid of their timeshares.

Unlike other products, timeshares cannot be sold or easily disposed of. Owners are bound by noncancelable contracts and are forced to pay exorbitant maintenance fees indefinitely. The industry's goal is to squeeze as much money as possible from owners, regardless of their ability to use or enjoy the timeshare.

You Are Buying Nothing!

Timeshare ownership has evolved over the years, shifting from owning a specific week in a timeshare to purchasing points that can be used at various resorts. While this may sound appealing, it comes with significant drawbacks. Buyers are not truly buying anything tangible; instead, they are buying the right to attempt to make a reservation.

Resorts often prioritize public bookings over owners, making it challenging for owners to secure desired dates. Frustrated by their inability to use their timeshares, many owners turn to exit companies for assistance.

Advice for Potential Buyers and Current Owners

If you are considering buying a timeshare or want to get out of your existing contract, there are a few crucial pieces of advice to keep in mind:

- Buy from the resale market instead of directly from the developer to save money and avoid unnecessary restrictions.

- Calculate the total cost of ownership, including finance charges and maintenance fees, over your expected lifetime. Consider whether the investment is truly worth it.

- Do not make impulsive decisions during a sales presentation. Sales agents often use emotional manipulation to pressure buyers into immediate purchases.

- Be cautious of exit companies that guarantee an exit and request upfront payment. Many of these companies are scams, and testimonials can be fabricated.

- Seek assistance from reputable organizations like Timeshare and Resort Developer Accountability, Inc. (TARDA) or consult with an attorney experienced in timeshare matters.

The timeshare industry's predatory practices and noncancelable contracts have turned what was once a dream vacation opportunity into a financial nightmare for many unsuspecting buyers. Consumers must be cautious and informed before entering into a timeshare agreement.

The fight for consumer rights continues as owners battle against developers and seek assistance from advocacy groups and legal professionals. Timeshare ownership should be approached with extreme caution, and potential buyers must weigh the risks and benefits carefully.

Remember, a timeshare is not just a vacation investment; it is a long-term financial commitment that can have severe consequences if not carefully considered.

0 notes

Text

Terminal Automation Market Size, Share, Growth and Report 2024-2032

Terminal automation refers to the process of automating various control functions of equipment or machinery in a warehouse or manufacturing unit. A terminal is a storage facility for oil, gas, chemicals and other products that need to be transported to the point of sale (POS). The global terminal automation market size reached US$ 6.2 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 9.4 Billion by 2032, exhibiting a growth rate (CAGR) of 4.5% during 2024-2032.

0 notes

Text

All You Need To Know About NFC: Near Field Communication Technology

NFC Market by Offering (Hardware (Tags/Cards, Readers), Platform), Operating Mode (Read/Write, Peer-to-peer, Card Emulation), Application (Contactless Payment, Ticketing, Data Transfer & Sharing), End-use Industry, and Geography - Forecast to 2030”.

Download Free sample report here: https://www.meticulousresearch.com/download-sample-report/cp_id=5589?utm_source=article&utm_medium=social+&utm_campaign=product&utm_content=08-05-2024

The global NFC market is projected to reach $50.1 billion by 2030, at a CAGR of 12.3% from 2023 to 2030. The growth of this market is attributed to the rising demand for contactless payments and the growing integration of NFC technology in smartphones. Furthermore, the surging adoption of NFC technology in retail to improve consumer experience and growing keyless entry applications in homes and passenger vehicles are expected to create significant opportunities for this market. However, the limited range of operations of NFC challenges this market growth. Also, security issues in near field communication are restraining market growth. The integration of NFC into wearable devices is a prominent trend in the NFC market.

The global NFC market is segmented based on offering, operating mode, application, and end user. The study also evaluates industry competitors and analyses the regional and country-level markets.

Based on offering, the global NFC market is segmented into hardware and platform. In 2023, the hardware segment is expected to account for the larger share of the global NFC market. The hardware segment is also projected to record the highest CAGR during the forecast period. The growth of this segment is driven by the rising integration of NFC technology in smartphones and point-of-sale (POS) terminals and the growing use of NFC tags/cards by organizations to improve customer experience. For instance. In April 2023, Diageo plc (U.K.), the global leader in alcoholic beverage, partnered with Lotte Duty Free (South Korea), the global leader in travel retail, and Changi Airport Group (Singapore), a leading air hub in Asia to launch the Johnnie Walker Blue Label Cities of the Future Singapore pop-up at Changi Airport Terminal 3. The pop-up’s immersive multi-sensory experience showcases the limited-edition Future Cities bottles of Blue Label whisky. Travelers can explore a futuristic Singapore society by scanning the near-field communication (NFC) chip on the bottle.

Browse in depth: https://www.meticulousresearch.com/product/nfc-market-5589?utm_source=article&utm_medium=social+&utm_campaign=product&utm_content=08-05-2024

Based on operating mode, the global NFC market is segmented into read/write mode, peer-to-peer mode, card emulation mode, and charging mode. In 2023, the card emulation mode segment is expected to account for the largest share of the global NFC market. The segment is also projected to record the highest CAGR during the forecast period. The growth of this segment is driven by the growing integration of NFC technology in wearables and growing government initiatives for raising awareness of digital payments.

Based on application, the global NFC market is segmented into contactless payment, data transfer & sharing, access control & authentication, ticketing, asset tracking, and other applications. In 2023, the contactless payment segment is expected to account for the largest share of the NFC market.

However, the access control & authentication segment is projected to record the highest CAGR during the forecast period. The growth of this segment is driven by the adoption of NFC technology in automotive to facilitate smart entry in passenger vehicles, the growing use of NFC cards/tags for access control in organizations, and the growing adoption of smart locks.

Download request sample report here: https://www.meticulousresearch.com/request-sample-report/cp_id=5589?utm_source=article&utm_medium=social+&utm_campaign=product&utm_content=08-05-2024

Based on end-use industry, the global NFC market is segmented into retail, BFSI, healthcare, automotive, hospitality, consumer, electronics, transportation, residential & commercial, manufacturing, and other end users. In 2023, the retail segment is expected to account for the largest share of the NFC market. However, the BFSI segment is projected to record the highest CAGR during the forecast period. The growth of this segment is driven by the rising inclination of consumers towards e-wallets, the benefits offered by contactless payment, such as seamless, secure, and fast transactions, and stakeholder focus on fintech. For instance, in November 2023, the National Payments Corporation of India (NPCI) (India) collaborated with IDFC FIRST Bank Ltd. (India), an Indian private sector bank, to introduce FIRSTAP, the nation's first sticker-based debit card, to permit transactions by merely tapping the sticker on a point-of-sale terminal that supports Near Field Communication (NFC).

Some of the key players operating in the global NFC market include NXP Semiconductors N.V. ( Netherlands), Broadcom Corporation (U.S.), Renesas Electronics Corporation (Japan), STMicroelectronics N.V. (Switzerland), Infineon Technologies AG (Germany), Identiv, Inc. (U.S.), ams-OSRAM AG (Austria), Intel Corporation (U.S.), Texas Instruments Incorporated (U.S.), Samsung Electronics Co., Ltd. (South Korea), Sony Corporation (Japan), Avery Dennison Corporation (U.S.), MagTek Inc. (U.S.), Identis (India), HID Global Corporation(a subsidiary of ASSAABLOY AB) (U.S.).

Quick buy: https://www.meticulousresearch.com/Checkout/64480208?utm_source=article&utm_medium=social+&utm_campaign=product&utm_content=08-05-2024

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

0 notes

Text

IndicPay: Transforming Indian Businesses with Advanced SoftPOS Solutions

"IndicPay: Transforming Indian Businesses with Advanced SoftPOS Solutions"

With its state-of-the-art SoftPOS systems, IndicPay transforms the way businesses function in the wild and exciting world of Indian commerce. The acronym SoftPOS, which stands for Software Point-of-Sale, is a paradigm change in payment processing that allows companies to conveniently accept card payments with just a smartphone or tablet. Businesses all around India are being empowered by IndicPay's cutting-edge SoftPOS solutions, which provide them with an adaptable, safe, and affordable payment processing option.

IndicPay's SoftPOS solutions are centered around a dedication to accessibility and simplicity. Businesses used to rely only on outdated point-of-sale (POS) systems, which frequently needed large infrastructure and hardware investments. Nevertheless, companies can use IndicPay's SoftPOS solutions to turn their current smartphones or tablets into fully functional point-of-sale (POS) terminals. Without the need for additional gear or complicated setup procedures, companies can start accepting card payments right away by installing the IndicPay app and connecting a card reader.

The adaptability of IndicPay's SoftPOS solutions is revolutionary for Indian enterprises of all kinds and industries. Small-scale street vendors, upscale retailers, and huge corporations alike can all benefit from IndicPay's SoftPOS systems, which are designed to meet a variety of company requirements and payment preferences. Businesses can easily adjust to changing client expectations and payment trends using IndicPay's SoftPOS systems, which range from allowing contactless payments via NFC technology to accepting chip and PIN transactions.

IndicPay makes sure that every transaction completed through its SoftPOS solutions is safeguarded with cutting-edge security measures because security in the world of digital payments is crucial. IndicPay protects sensitive cardholder data by using secure communication protocols and encryption technologies to reduce the possibility of fraud and unauthorized access. Businesses and consumers can feel secure knowing that IndicPay complies with industry standards including PCI DSS (Payment Card Industry Data Security Standard).

The smooth and intuitive user experience provided by IndicPay's SoftPOS solutions makes it simple for companies to handle transactions effectively. Businesses don't need much training to become comfortable with the IndicPay app and process payments because to its easy-to-use design and navigation. Furthermore, businesses may improve efficiency and optimize processes using IndicPay's SoftPOS solutions because they are made to seamlessly interact with other business systems.

IndicPay's SoftPOS solutions provide businesses with a number of extra features and advantages in addition to transaction processing. Businesses can make data-driven decisions and optimize their operations with the help of IndicPay's SoftPOS solutions, which include real-time reporting and analytics, inventory management, and customer interaction capabilities. Businesses can monitor inventory levels, spot sales patterns, and target their marketing campaigns more precisely by utilizing transaction data and analytics.

IndicPay's extensive support offerings bear out its dedication to client satisfaction. A committed group of support experts is on hand 24/7 to help companies with any queries or problems they might run into. IndicPay's support staff is dedicated to offering quick and dependable assistance, whether it be for technical support, troubleshooting, or advice on optimizing the advantages of SoftPOS, to guarantee a flawless experience for companies and their clients.

To sum up, IndicPay's SoftPOS solutions are transforming the Indian payment landscape by providing companies with an adaptable, safe, and practical payment processing option. With its cutting-edge methodology, intuitive user interface, and dedication to security and support, IndicPay is enabling companies all over India to prosper in the digital age. IndicPay continues to be at the forefront of innovation and growth facilitation for the Indian market as businesses adopt digital transformation and look for more effective ways to receive payments.

#qr code services#b2b services#aadhar service#qr code#b2bmarketing#gateway#payment gateway#b2b payments

0 notes

Text

BFSI Security Market Unidentified Segments – The Biggest Opportunity Of 2023

Latest released the research study on Global BFSI Security Market, offers a detailed overview of the factors influencing the global business scope. BFSI Security Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the BFSI Security The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are Cisco Systems, Inc. (United States), Computer Sciences Corporation (CSC) (United States), EMC Corporation (United States), Honeywell International, Inc. (United States), IBM Corporation (United States), Booz Allen Hamilton, Inc. (United States), McAfee, Inc. (Intel Security Group) (United States), Sophos Group Plc. (United States), Symantec Corporation (United States), Trend Micro Incorporated (United States),

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/98343-global-bfsi-security-market?utm_source=Organic&utm_medium=Vinay

BFSI Security Market Definition:

BFSI Security (Banking, financial services, and insurance) provides the basic security foundation for many financial exchanges and other sectors. It has become an important part of any sectors which comes under the BFSI sector. It helps in protecting data from getting hacked or breached, moreover, it is an essential component for overall national critical infrastructure. BFSI security operates in a very highly regulated environment. In various cases, security incidents occur because of cyber data breaches causing severe damage to these sectors. Hence, BFSI security is needed to ensure the long term visibility of banking and financial organizations and their data.

Market Trend:

Rise In Adoption of Cloud-Based Security Solutions

Market Drivers:

The Rise in Thefts at ATM & POS Terminals and Frauds in the Bank Branch

Increasing Modes of Online Payments Globally

Implementation of Regulatory Standards and Acts

Increasing Risk of Data Loss in BFSI Sectors

Market Opportunities:

Growth of Security Solutions Based On Internet of Things (IoT) Across World

Stringent Government Regulations to Support the BFSI Security

The Global BFSI Security Market segments and Market Data Break Down are illuminated below:

by Type (Information Security, Physical Security (Access Control, Intrusion, and Fire Detection)), Application (Banking, Insurance Companies, Other Financial Institutions), Information Security Solution (Identity & Access Management, Risk & Compliance Management, Encryption, Disaster Recovery, Unified Threat Management (UTM), Firewall, Others), Deployment Type (Cloud, On-premises), Information Security Services (Consulting, Design & Integration, Risk & Threat Assessment, Managed Security Services, Training & Education)

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/98343-global-bfsi-security-market?utm_source=Organic&utm_medium=Vinay

Strategic Points Covered in Table of Content of Global BFSI Security Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the BFSI Security market

Chapter 2: Exclusive Summary – the basic information of the BFSI Security Market.

Chapter 3: Displayingthe Market Dynamics- Drivers, Trends and Challenges of the BFSI Security

Chapter 4: Presenting the BFSI Security Market Factor Analysis Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying market size by Type, End User and Region 2015-2020

Chapter 6: Evaluating the leading manufacturers of the BFSI Security market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries (2021-2026).

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, BFSI Security Market is a valuable source of guidance for individuals and companies in decision framework.

Data Sources & Methodology The primary sources involves the industry experts from the Global BFSI Security Market including the management organizations, processing organizations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

In the extensive primary research process undertaken for this study, the primary sources – Postal Surveys, telephone, Online & Face-to-Face Survey were considered to obtain and verify both qualitative and quantitative aspects of this research study. When it comes to secondary sources Company's Annual reports, press Releases, Websites, Investor Presentation, Conference Call transcripts, Webinar, Journals, Regulators, National Customs and Industry Associations were given primary weight-age.

For Early Buyers | Get Up to 20% Discount on This Premium Report: https://www.advancemarketanalytics.com/request-discount/98343-global-bfsi-security-market?utm_source=Organic&utm_medium=Vinay

What benefits does AMA research study is going to provide?

Latest industry influencing trends and development scenario

Open up New Markets

To Seize powerful market opportunities

Key decision in planning and to further expand market share

Identify Key Business Segments, Market proposition & Gap Analysis

Assisting in allocating marketing investments

Definitively, this report will give you an unmistakable perspective on every single reality of the market without a need to allude to some other research report or an information source. Our report will give all of you the realities about the past, present, and eventual fate of the concerned Market.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager) AMA Research & Media LLP Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837

0 notes

Text

Puravive Reviews (Honest Warning Update!) Legit Pills for Weight Loss or Stay Far Away!

➢ Product Name —Puravive Weight Loss Reviews

➢ Composition — Natural Organic Compound

➢ Side-Effects — NA

➢ Availability — Online

➢ Result -2–3 Months

➢Rating — ⭐⭐⭐⭐⭐

➢ Official Website (sale is live) →>Click here to buy Puravive Weight Loss Reviews from the Official Website...!

PuraVive is a weight reduction supplement that has been acquiring ubiquity since its presentation on the lookout. The authority site of the enhancement expresses that Puravive was created in view of the new leap forward from a review directed by a gathering of German researchers. The review has uncovered a hidden reason for overweight and the makers of the enhancement had the option to resolve a successful equation to treat the issue, which at long last brought forth this weight reduction supplement.

There are different believable examinations that make sense of the reality that the issue of overweight stances in the public eye. A significant part of the populace experiences the issue and being something that can influence individuals regardless of their age, there ought to be sufficient measures to monitor this issue. From the accessible data in regards to the enhancement, PuraVive weight reduction recipe is supposed to be a mix of probably the best fixings that can help with keeping a sound body weight.

PuraVive Audits: A Viable Fat Terminator That Smothers Your Yearning And Desires!

From the underlying looks of the enhancement, PuraVive is by all accounts an extremely viable and promising enhancement that can do ponders with regards to your body weight. Yet rather than following the prominence and superficial data, it is in every case better to jump profound into the subtleties of the enhancement and this Puravive survey is intended to fill this need.

Every one of the accompanying areas of this audit will discuss the total subtleties of the various parts of PuraVive like the fixings utilized in its making, the various advantages that you can have from utilizing the enhancement, the upsides and downsides, its functioning component and, surprisingly, the subtleties of Puravive client surveys and cost as well. Thus, going through this survey will assist you with having an incredible comprehension of the enhancement and consequently settle on a savvy choice. In this way, make a point to peruse the PuraVive survey till the end.

What Is PuraVive?

Puravive is a natural weight reduction equation that is said to do ponders for your body. The enhancement has been even depicted as perhaps of the best fat eliminator that anyone could hope to find in the market by numerous who have utilized it and even specialists have been strong of the equation.

The producers guarantee that PuraVive is an enhancement that was created in view of the new disclosure by a gathering of German researchers. The outcome from the review has been utilized to foster the Puravive weight the executive’s recipe, which is a mix of various viable normal fixings that provenly affect the body.

These PuraVive fixings are likewise of the most ideal quality that anyone could hope to find and are obtained morally from better places. No Hereditarily Adjusted Organisms (GMOs) are available in the enhancement, which again adds to its security and adequacy.

How Does PuraVive Function?

The PuraVive official site expresses that the equation was created in light of one of the new examinations directed by a gathering of German researchers.

The review was led among 52,000 ladies and men, which is one of the greatest investigations of its sort at any point directed. Through the various information procured through the review, they had the option to reach the resolution that one of the significant purposes for being overweight is the absence of brown fat tissues (BAT) in the body.

The absence of BATs was normal for each and every individual who was overweight while individuals who were skinnier had significantly more grouping of BATs. The brown fat tissues in the body, which is otherwise called earthy coloured fat are not fat yet it is really fat eliminator.

The shade of the tissue is expected to the mitochondria that are thickly pressed in the tissues. They help in torching the calories of the body substantially more actually into energy. Thus, supporting the BATs in the body will assist you with effectively diminishing fat, and the Puravive weight decrease pill aids this cycle through its fixings.

Assuming that you have weariness and elevated cholesterol, you are partying hard all day, every day. Have you thought about settling these issues? Have you at any point seen a specialist or a wellness coach? To shed pounds normally, the primary thing you really want to know is that it will upset your everyday daily practice, and will likewise require your full focus. Thought accomplishing a Keto Diet is a huge errand. Individuals regularly neglect to continue in halfway. Indeed, Puravive Weight reduction won't just assist you with accomplishing ketosis, yet it will likewise assist you with opposing all desires. At the point when you utilize the enhancement everyday, your metabolic power will get to the next level.

So today we will talk about the most discussed weight decrease item, Puravive Weight reduction! It is a strong fat-consuming ketone, BHB-containing substance created to launch the fat-consuming interaction normally. By sending your body into ketosis, this BHB will launch ketosis, bringing about a colossal wealth of energy and incredibly processing all substantial fat. Puravive Weight reduction is a critical headway in the domain of the Keto Diet! This sticky for weight reduction has left its engraving on the existences of shoppers, and they have all seen a massive distinction subsequent to ingesting it. This is completely regular and permits you to have a definitive thin body!

Visit Here to Official Website:

0 notes

Text

What are the market dynamics in the Greece cards and payments market? by George Kassotou Consulting

Cash is the preferred payment method in Greece, accounting for 65.9% of the country’s total transaction volume in 2023 according to the last investigation for the George Kassotou Group. The government has undertaken various initiatives to boost electronic payments in the country, such as a cap on cash transactions and electronic payment of salaries. Greek consumers are substituting cash payments with debit cards – which dominate card payments by value. In terms of transaction volume and value, debit cards are expected to continue to dominate the payment card market. Electronic payments are set to grow further thanks to emerging technologies such as contactless payments, the launch of digital-only banks, and the adoption of mobile and contactless point-of-sale (POS) terminals among merchants. Meanwhile, the gradual adoption of contactless payments, the emergence of alternative payment solutions, and growth in the ecommerce space mean Greece’s payment card market will grow further going forward. Acoording George Kassotu The outbreak of COVID-19 in the country has made both electronic payments and online purchasing more appealing, as both options help consumers avoid close social contact and prevent the spread of the virus.

0 notes

Text

ANYX-the Pod System Expert-Announces Spectacular Debut at "T2000 IN TOUR" in Italy

- ANYX, a pioneering brand focused on pod system vapes, is set to showcase its innovative products at the "T2000 IN TOUR" final stop in Padova, Italy. This highly anticipated event will take place from October 21st to 22nd October, marking ANYX's official entry into the Italian market, coinciding with the brand's first anniversary. About 2000 IN TOUR Being able to put everyone in the same place to meet is the mission of the T2000 in Tour, it will be divided into 3 stages of 2 days each: Bari, Roma, and Padova. Over 100 exhibitors from different industries will be at the show, including tobacco-related products, e-cigarettes, e-liquids, furniture, retail terminal equipment, 3C digital accessories, jewelry accessories, and various consumer goods distributors. The Tobacco-Related Products and sales channels will be the main part of the show with Philip Morris International being a main sponsor. About ANYX ANYX has always been committed to pod system vapes technological innovation since its establishment. Relying on the R&D and production strength of parent company Eigate Group's 1,500 industry patents and 120 production lines, the star product ANYX Pro has quickly gained industry attention. In addition, ANYX has also assembled a team of industry experts and cross-field talents to actively build a user-driven brand and provide more diverse, enjoyable, and dynamic experiences for global vapors. "Despite being a newcomer in the market, ANYX benefits from years of experience and industry expertise. In addition to renowned technical experts in the e-cigarette industry, ANYX has also formed a talented team with a background in top companies in various fields, including the internet, consumer electronics, and fast-moving consumer goods (FMCG). This has positioned the brand to secure tens of millions of dollars in funding right from its inception," commented industry observers. "By participating in the '2000 IN TOUR', ANYX aims to strengthen its connections and communications with vape users worldwide and provide users with superior products and cutting-edge technology services. We also hope that this event will mark the beginning of an ambitious journey into the Italian market," says Gery, Head of the Italian market for ANYX. As a user-driven brand, ANYX's booth will serve as a focal point for e-cigarette technology and innovation. It will provide visitors with the opportunity to experience and interact firsthand with their technological innovations, showcasing their leading position in the pod system vapes. ANYX views its first-anniversary milestone as an opportunity to celebrate a year of dedication to bringing more innovation, more choices, and more enjoyable experiences to the e-cigarette market. This event is also a chance for ANYX to surprise and delight its Italian users. For more information please visit: www.anyxglobal.com Follow ANYX on social media: @anyxglobal Email: [email protected] Phone: +8613317369947 Read the full article

0 notes

Text

Trading activity on Binance.US has reached new lows in September, as the crypto exchange faces unprecedented challenges. On Sep. 16, exchange volume stood at $5.09 million on Binance.US, as reported by Amberdata on The Tie Terminal. The lowest point for the month was on Sep. 9, when trading activity totaled $2.97 million. This is a significant drop compared to Sep. 17, 2022, when its trading volume was around $230 million. Binance.US exchange volume over the past 12 months. Source: The Tie Terminal/AmberdataBinance.US is the offshoot in the United States of global crypto exchange Binance. On June 5, the Securities and Exchange Commission filed a lawsuit against both crypto exchanges on charges related to unregistered securities offerings, and wash trading, among other violations. As per the SEC, Binance.US allegedly failed to register as a broker-dealer and failed to register the offer and sale of its staking-as-a-service programme. Since the lawsuit, Binance.US halted trading for over 100 token pairs, contributing to a sharp decline in exchange activity.Binance.US turmoil also comes with internal challenges. Brian Shorder, then CEO of Binance.US, stepped down last week, joining a number of global executives who left the group of companies over the past weeks. Following Shorder's departure, head of legal Krishna Juvvadi and chief risk officer Sidney Majalya announced their resignations as well. According to reports, the departures are allegedly due to an ongoing investigation by the U.S. Department of Justice into Binance, its CEO Changpeng "CZ" Zhao, and Binance.US. In response to speculation surrounding Shorder's departure, CZ said on X (formerly Twitter) that the executive was taking a "deserved break." CZ wrote:“Under his leadership, Binance.US raised capital, improved its product and service offerings, solidified internal processes, and gained significant market share, all of which helped to build a more resilient company for the benefit of customers. We are grateful for his contributions.”Binance.US's problems seem to be far from over. The SEC recently accused the exchange of non-cooperation in the ongoing investigation, claiming it produced only 220 documents during the discovery process. In another development, a judge issued an order on Sept. 15 granting the SEC a motion to unsealed documents on the case. Those documents were sealed or redacted at the SEC's request and are now being unsealed at its request. The documents are expected to be available in the coming days. Source

0 notes

Text

Consolidating MCU Advantages with Solutions Renesas Embraces Arm Automotive Ecosystem

【Lansheng Technology Information】The 2023 Shanghai International Embedded Exhibition was held in the Shanghai World Expo Exhibition Hall. As the first show of the world-renowned embedded technology exhibition Embedded World in China, it attracted many well-known embedded technology manufacturers at home and abroad to participate. Renesas Electronics, a global semiconductor solution provider, brought a variety of exhibits and exciting solutions related to the embedded field, such as Internet gateway solutions for future automotive E/E architectures and overall solutions for new energy vehicle motor control. During the same period of the exhibition, Renesas Electronics specially held a briefing on corporate development, latest strategies and key products for the media.

"With the diversification and complexity of applications, Renesas is more focused on providing complete solutions to various customers, so we are a semiconductor solution company." This is the opening speech of Lai Changqing, vice president of global sales and marketing of Renesas Electronics and president of Renesas Electronics China, introducing Renesas.

From a product point of view, Renesas is an embedded solution provider, the core of which is MCU, MPU and SoC products. Renesas is one of the companies with the most complete embedded products in the industry, ranging from Renesas's own core products, to the rapidly growing Arm base products, to RISC-V architecture products. Especially in the field of MCU, Lai Changqing introduced that Renesas has become the world's number one from 16% in the previous year to 17% in last year. We can see the improvement of Renesas' comprehensive competitiveness. This competitiveness includes that Renesas invests 18% of its sales in research and development, so that we can continue to provide customers with more competitive products.

Looking forward to the future, Lai Changqing said that Renesas R&D personnel and channel partners will jointly promote the growth of the Internet of Things fields such as automobiles, industry, Internet of Everything, smart home, and smart terminals. In addition to these core customers, it is aimed at the "mass market", that is, small and medium-sized customer groups. Appropriate strategies will also win more shares and faster growth for Renesas. Lai Changqing revealed that Renesas has made a new strategic deployment in 2022, and hopes that by 2030, its sales will reach 20 billion U.S. dollars from more than 12 billion U.S. dollars in 2022, and return to the top three embedded semiconductor solution suppliers in the world.

Lansheng Technology Limited, which is a spot stock distributor of many well-known brands, we have price advantage of the first-hand spot channel, and have technical supports.

Our main brands: STMicroelectronics, Toshiba, Microchip, Vishay, Marvell, ON Semiconductor, AOS, DIODES, Murata, Samsung, Hyundai/Hynix, Xilinx, Micron, Infinone, Texas Instruments, ADI, Maxim Integrated, NXP, etc

To learn more about our products, services, and capabilities, please visit our website at http://www.lanshengic.com

0 notes

Text

POS Terminals in Hospitality Market is Booming Worldwide | Gaining Revolution In Eyes of Global Exposure

Latest study released by AMA Research on Global POS Terminals in Hospitality Market research focuses on latest market trend, opportunities and various future aspects so you can get a variety of ways to maximize your profits. POS Terminals in Hospitality Market predicted until 2027*. A point-of-sale (POS) terminal is a piece of hardware used to accept credit cards at hospitals. The gear includes software that reads magnetic strips from credit and debit cards. The next generation of POS systems includes proprietary and third-party portable devices (as opposed to terminals fixed to a counter), as well as contactless capabilities for future kinds of mobile payments. Traditional proprietary hardware is being phased out in favour of software-based POS systems that can be put into a tablet or other mobile device. POS terminal manufacturers are launching their own versions of portable and mobile POS terminals to keep ahead of the curve. At a hospital, such equipment can be observed. Some of Key Players included in POS Terminals in Hospitality Market are:

Oracle (United States)

VeriFone (United States)

First Data (United States)

Ingenico (France)

SZZT (China)

PAX Technology (United States)

CyberNet (United States)

Winpos (Finland)

Cegid Group (France)

Squirrel Systems (Canada)

Market Trends: Surge In R&D Investments And The Development Of Advanced Payment Solutions

Growing Contactless Payments And The Increasing Penetration Of Near Field Communication (NFC) Devices In Hospitality

Drivers: Increasing Demand For Mobile POS Terminals Across The Global

Challenges: Lack Of Robust And Reliable Infrastructures In The Remote Regions

Opportunities: Government Favorable Initiatives Toward Promoting Cashless Economy

The titled segments and Market Data are Break Down 23325

Presented By

AMA Research & Media LLP

0 notes

Text

NAIRA SCARCITY: Paul Okoye groans over purchase of 40k with 70k

Paul Okoye, a member of the previously defunct music group, P-Square has taken to social media to lament about the Naira scarcity, after the purchase of 40k with 70k.

The Naira scarcity has been plaguing Nigerians for a couple of weeks now, following the introduction of the new notes.

Taking to his Instagram story, Paul Okoye expressed his shock, as he disclosed that he bought Naira today because he needed to pay for a visa fee and it needed to pay in cash.

As stated by Rude Boy, he bought N40k with N70k in order to make payments. The father of 3 expressed his displeasure, as he noted that the country keeps breaking new records.

He wrote: “Omoh!!! I buy money today!! Just because I have to pay for a certain visa fee in an embassy, and it has to be paid in cash. Jokes apart I bought 40k with 70k Aahhhh!!!!!!! Naija breaking new record.”

TheNewsGuru.com (TNG) reports that it is tough getting money from Automated Teller Machines (ATMs) of banks as well as Point of Sales (PoS), hence the Naira scarcity.

Buyers and sellers, especially in informal markets, were stranded as some of them were still finding it difficult to agree on cash transfers.

Currently, many banks do not attend to desperate customers over the counter. On the other hand, PoS terminals that are a critical part of the payment system do not have the new naira notes to give customers.

Many of the operators said they had to use the “black market” to get both the old and new notes from “unexpected quarters”, hence their resolve to charge a lot of money from people who were willing to withdraw cash.

Some POS operators, as at February 16, 2023 collected as much as N1,000 to release N5, 000. The total number of POS machines deployed by merchants and individuals across Nigeria hit 1.6 million in November 2022, according to the data released by the Nigeria Inter-Bank Settlement System (NIBSS).

There are approximately 17 automated teller machines, 147 point-of-sale devices and four bank branches for every 100,000 Nigerians, according to a new report by McKinsey.

However, most of these facilities, which were meant to facilitate a gradual transition to a cashless economy in Nigeria were somehow strangulated to the extent that they could not offer the needed services.

According to some bankers, they had been directed and were being closely monitored, to ensure that no old naira note that got to the bank goes out again.

1 note

·

View note