#offshore bank account uk

Explore tagged Tumblr posts

Text

Internet merchant accounts for High risk Business?

Internet merchant accounts for High risk Business? Internet merchant accounts are essential for "high-risk businesses" to conduct online transactions smoothly and efficiently. As the world continues to embrace digitalization, it is becoming increasingly important for businesses to establish an online presence and cater to the needs of their customers. However, certain industries are deemed high-risk due to various factors such as chargeback rates, fraud potential, or legal and regulatory concerns. To navigate these challenges and ensure a "secure payment process", high-risk businesses must obtain "internet merchant accounts" that provide the necessary tools and protection.

High-risk businesses encompass a wide range of industries, including online pharmacies, adult entertainment platforms, and online gambling websites. These industries are considered high-risk due to the potential for fraudulent activities, strict legal and regulatory oversight, or customers disputing charges and demanding chargebacks. Thus, "acquiring an internet merchant account" specifically designed for high-risk businesses is crucial for their survival and growth.

An internet "merchant account for high-risk businesses" offers several advantages. Firstly, it provides businesses with a secure payment gateway that enables credit card transactions and protects sensitive customer information. Given the nature of high-risk businesses, security measures must be in place to prevent unauthorized access, data breaches, and fraudulent activities. Consequently, an internet merchant account with robust security features promotes trust between the business and its customers, increasing customer satisfaction and loyalty.

Another significant benefit of internet "merchant accounts for high-risk businesses" is the ability to manage chargebacks effectively. Chargebacks occur when customers dispute transactions and request a refund directly from their issuing banks. High-risk businesses often experience a higher rate of chargebacks due to factors such as dissatisfied customers, fraud, or illegal activities. Therefore, an effective chargeback management system provided by an internet "merchant Bank account" allows businesses to resolve and mitigate chargeback disputes efficiently, minimizing financial losses and maintaining a positive reputation.

Furthermore, internet merchant accounts cater specifically to the unique needs and legal compliance requirements of "high-risk businesses". Each industry has its regulations and restrictions that necessitate careful attention and adherence. For instance, pharmaceutical businesses must comply with strict FDA guidelines, while online gambling platforms must follow local and international gambling laws. By partnering with a "merchant account provider specializing in high-risk businesses", these organizations can ensure compliance and avoid penalties, legal issues, and potential shutdowns.

In conclusion, "high-risk businesses require internet merchant accounts" to facilitate secure and efficient online transactions. These accounts provide crucial benefits such as secure payment gateways, effective chargeback management systems, and compliance with industry-specific regulations. By obtaining an internet merchant account designed for high-risk businesses, organizations can navigate the challenges associated with their industries, protect their customers' sensitive information, and ensure a smooth payment process. Embracing the digital era and establishing a strong online presence are crucial for high-risk businesses to remain competitive and thrive in today's market.

Offshore Gateways merchant accounts | Merchant accounts | Merchant accounts online | Internet merchant accounts | Set up merchant accounts | Merchant account fees in USA | Merchant account fees in UK | Open merchant account online | Merchant accounts credit card | Merchant Bank Account | Merchant account providers | High risk merchant account instant approval | High Risk merchant account in USA | High Risk merchant account in UK | High Risk payment Gateway | Forex merchant account | Gambling Merchant Account | Best merchant account services | Online casino merchant account providers |

#Offshore Gateways merchant accounts#Merchant accounts#Merchant accounts online#Internet merchant accounts#Set up merchant accounts#Merchant account fees in USA#Merchant account fees in UK#Open merchant account online#Merchant accounts credit card#Merchant Bank Account#Merchant account providers#High risk merchant account instant approval#High Risk merchant account in USA#High Risk merchant account in UK#High Risk payment Gateway#Forex merchant account#Gambling Merchant Account#Best merchant account services#Online casino merchant account providers#offhsoregateways

0 notes

Text

Bankers found guilty of helping to hide Putin’s millions by Swiss court

Four senior bankers have been found guilty by a Swiss court of helping to launder tens of millions of francs linked personally to president Vladimir Putin through the country’s banking system.

The four — three Russians and one Swiss national — were employees of Gazprombank’s Swiss subsidiary, and include its chief executive.

A Zurich district court ruled on Thursday that they were guilty of financial negligence in failing to perform due diligence on highly suspicious transactions run through the bank.

Conditional criminal fines of between SFr540,000 and SFr48,000 were imposed, which do not have to be paid if parole conditions are kept over the next two years. Prosecutors had sought custodial sentences.

In their case, prosecutors detailed how accounts had been opened at Gazprombank on behalf of Sergei Roldugin, a cellist and the godfather to Putin’s daughter, without questions being raised about how a musician had amassed vast wealth.

Roldugin deposited SFr50mn in Gazprombank’s Swiss accounts, and promised to funnel at least SFr10mn more annually into them through a complex web of shell companies and offshore trusts.

Judge Sebastian Aeppli said it was “beyond doubt” that the money did not belong to Roldugin.

The funds originally flowed from Bank Rossiya, which Swiss prosecutors said was known to be the house bank of the Russian kleptocracy.

“The chair of the board [Yuri Kovalchuk] is considered Putin’s treasurer,” their indictment noted.

The Gazprombank bankers declared that Roldugin was not a “politically exposed person” — a designation that would have triggered additional internal and regulatory scrutiny — and performed a nugatory investigation to back up such assertions, the prosecution said.

The official internal due diligence file on Roldugin contained only a printout of the website for the Mariinsky theatre in St Petersburg — where Roldugin was a conductor — and a single negative search result on Worldcheck, a compliance database. “It is notorious that Russian President Putin officially has an income of just over SFr100,000 and is not wealthy, but in fact has enormous assets managed by people close to him,” prosectors wrote in their indictment. “Roldugin . . . [was] a straw man.”

The four bankers may opt to appeal against the verdict to the cantonal appellate court. A further appeal would then be possible on the federal level.

The case was triggered as a result of the Panama Papers leak in 2016, in which a huge cache of documents was disclosed to international media organisations from the Panamanian law firm Mossack Fonseca, the world’s fourth-largest offshore services provider.

Germany’s Der Spiegel magazine and the UK’s Guardian newspaper homed on on accounts they found in the documents under Roldugin’s name.

Shortly afterwards, the Swiss market regulator Finma began an investigation of its own into Gazprombank’s role in the Swiss part of the Roldugin network.

In 2018 the regulator concluded that the bank was “in serious breach of its anti-money laundering due diligence requirements in the period from 2006 to 2016”, and imposed strict penalties.

It also lodged a complaint with cantonal prosecutors in Zurich, triggering the formal criminal investigation.

2 notes

·

View notes

Text

Paul Manafort has agreed to pay $3.15 million he owes to the US government over misrepresentations he made on his tax returns almost a decade ago, bringing to a close the former Trump campaign chairman’s financial tangles in court.

Manafort hadn’t disclosed to the Treasury Department nearly two dozen bank accounts in Cyprus, St. Vincent and the Grenadines and the UK that he used for political consulting business he did in Ukraine in 2013 and 2014, according to court filings.

The offshore accounts had tens of thousands of dollars in them, making it necessary for him to report them to the IRS. But on his tax returns, Manafort said he had no foreign bank accounts.

Manafort later admitted to failing to disclose the accounts as part of his guilty plea on a host of financial and tax crimes in the Mueller investigation. He was pardoned by then-President Trump in late 2020, again skirting some of the payback requirements.

The Justice Department sued Manafort in April last year “to collect outstanding civil penalties … for his willful failure to timely report his financial interest in foreign bank accounts,” court filings said. The DOJ also sought interest and late payment fees from Manafort.

2 notes

·

View notes

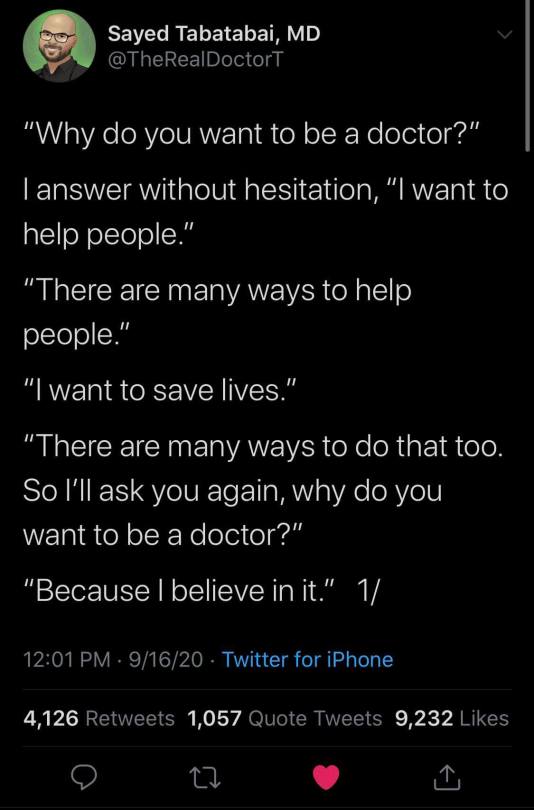

Photo

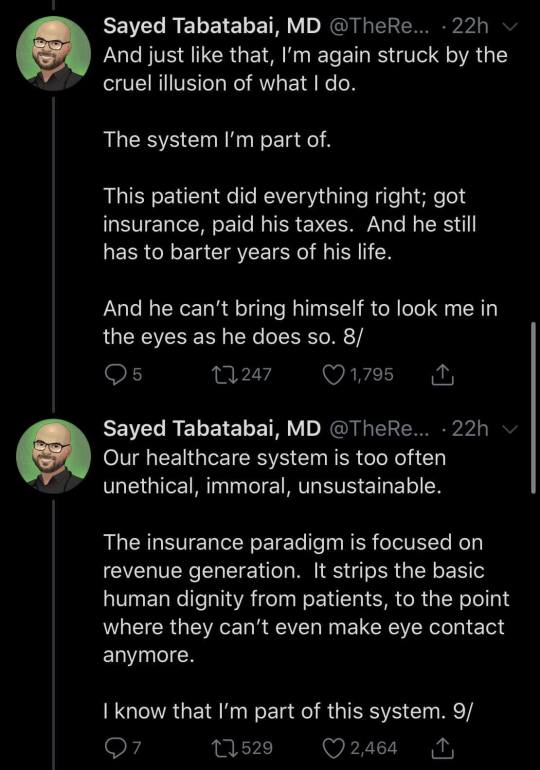

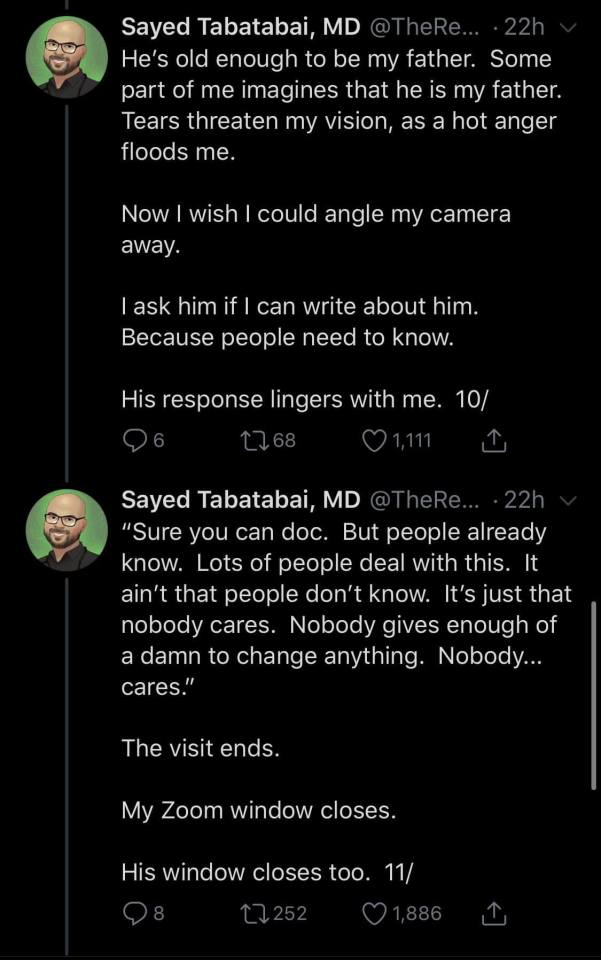

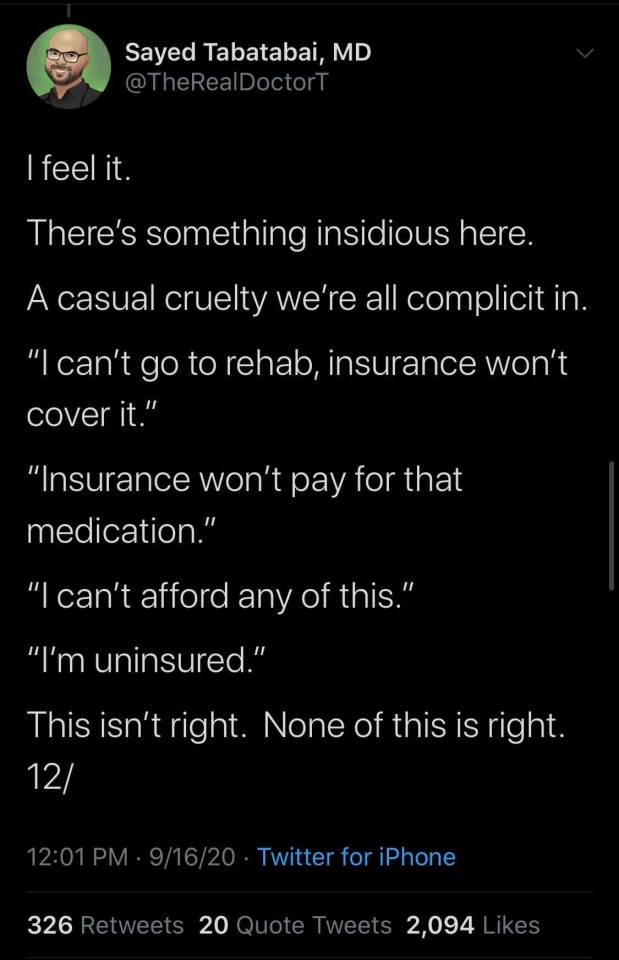

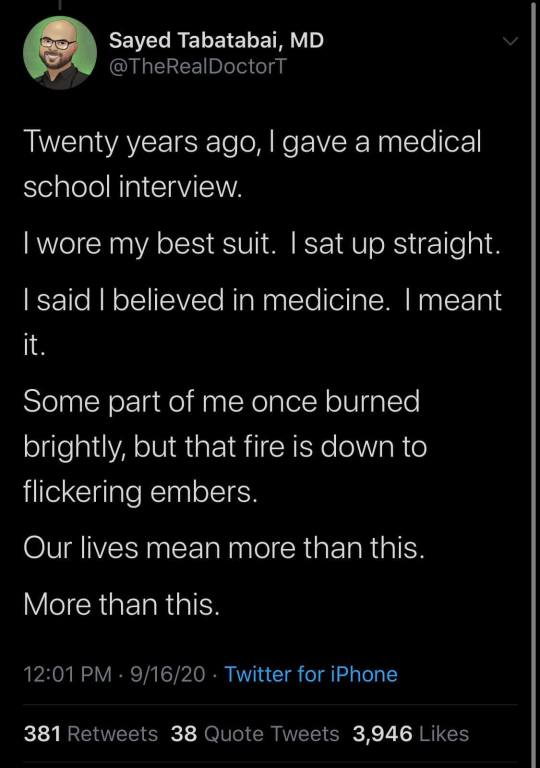

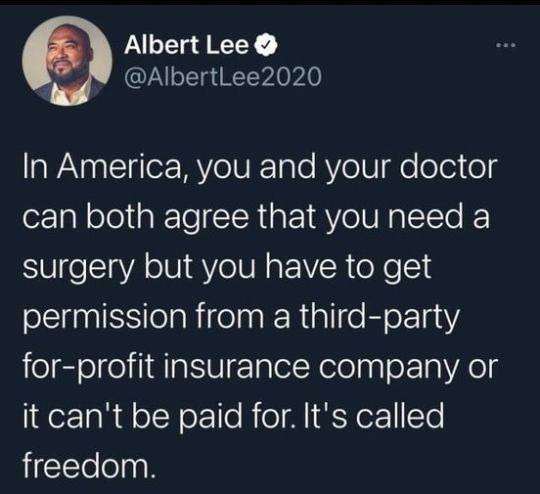

And I hope those in the above will excuse me diverting slightly. Because I want to talk to puerile l people in the UK.

Because this is, unmistakably, what the Tories (and other right wing parties) want to happen in the UK.

People who only care about getting more money into their undeclared, offshore bank accounts want to finish dismantling the NHS and implement this same, predatory system.

And the worst part is that it's working.

You've seen the articles, the reports and exposes complaining about waiting times, lack of staff. You've heard people, at the bus stop or at work or maybe in your own house, parrot those complaints. You've seen "junior doctors" (a misnomer) vilified for demanding change.

You've heard people clapping for nurses while the government refuses to improve pay or maintain funding.

You've seen hospitals closed. You've seen ambulances privately operated.

But we must not acclimatise to it.

We can't afford to lose this fight.

When you hear people complaining about the NHS, remind them who is to blame (Tories) and how much worse it could be (United states insurance model).

Be calm, be clear and try your best to get them on board.

Your life may depend on it.

Our system is broken. It is cruel. It is dehumanizing, degrading, and it’s vile nature is so, so unnecessary.

We need universal healthcare today in America. We needed it 40 years ago. It’s cheaper, it’s simpler, it’s more efficient, it’s more effective and it is so, so, so much less cruel than what we have.

Additional sources/references:

Universal Healthcare Cost in America would be cheaper by trillions of dollars

The US has worse life expectancies than socialized healthcare countries

We have worse generalized healthcare results

We have the most expensive care

Our system is so cruel and unique that doctors from other countries literally can’t believe what happens here

I can’t tell you where or how to activate to help solve this. There are politicians, groups, and activists pushing for this in so many ways. I can tell you when, though.

Now.

102K notes

·

View notes

Text

DBInvesting and NewFX

DBInvesting and NewFX have received allegations of being major scams. Find out if you can trust them or not in this Gripeo review.

Investors are cautioned by the Spanish regulator CNMV not to deal with the unlicensed broker NewFX, as it is a fraud. The broker offers many companies as the operators on its website, www.newfx.co. First up is BIG HORIZONS Limited, followed by NEWFX Limited. DBFX Limited has also been named as one of the operators by the CNMV. In October 2020, the Italian Consob halted the DBFX Trades scam, which was also run by this identical legal business. Praxis Cashier has been involved in and continues to be involved in this series of scams.

The unlicensed broker DBinvesting (www.dbinvesting.com), run by DB Invest Ltd. and licensed by the Financial Services Authority Seychelles (FSAS), is the same as the NewFX fraud in terms of payment templates. The business is not, however, permitted to offer regulated financial products in the UK, Europe, or under any other regulatory framework thanks to this offshore licence. Up until the end of 2020, DBinvesting Limited, an offshore division of Belight Capital Group Ltd., a company regulated by the CySEC, managed DBinvesting. This former offshore organisation was under the Vanuatu Financial Services Commission’s (VFSC) jurisdiction.

It is evident that DBFXtrades, DBinvesting, and NewFX are interconnected. They appear to be run by the same boiler rooms and are nearly exact replicas. Praxis Cashier has also assisted with the three scams.

Furthermore, Leverate has integrated all three brokers onto its Sirix platform.

About NEWFX

The American Funds New World Fund is categorised by Morningstar as a diversified emerging markets fund, which implies that its managers mostly invest in stocks of developing market companies. Businesses established in these nations frequently have better development possibilities, but they also run the risk of being negatively impacted by political or economic upheaval.

“American Funds New World is unlikely to top the charts when emerging markets are at their best, but it should outperform through a market cycle by losing less in downturns,” Morningstar says of the fund.

The fund had around $49.76 billion in assets as of November 27, 2023, spread among 587 distinct holdings.

The top holdings of the fund are in HDFC Bank, AIA Group, Taiwan Semiconductor Manufacturing, Samsung Electronics, and Alphabet.

As of May 2017, the fund, according to Morningstar, is ranked in the following percentiles for its category: 75th for the previous 12 months, 36th for the previous three years, 11th for the previous five years, and 13th for the previous ten years.

Normally, the fund charges a 5.75 percent front-end sales load, meaning that of every $10,000 invested, $9,425 goes toward investments, and the remaining $575 is allocated to commissions. This is on top of an expenditure ratio that Morningstar considers low, at 1.07 percent. A $250 minimum initial deposit is needed to access the fund.

The fund is available in a number of share classes from American Funds, including ones that are only available in 529 accounts and retirement plans.

For the preceding three, five, and ten years, Morningstar rates the fund’s risk as low in relation to other funds in its peer group. In comparison to the fund’s peers, the level of return is judged to be average over the previous three years, high over the previous five years, and above average over the previous ten years.

By comparison, the benchmark’s allocation to non-US equities was nearly 100%, while the fund’s was approximately 69% as of March 31, 2017. nearly 14% of the fund’s assets were allocated to American stocks, compared to nearly none for the fund’s benchmark.

The past year returns for the fund have been 10.50 percent, the past three years have been 0.06 percent, the past five years have been 5.75 percent, and the past ten years have been 3.98 percent.

June 1999 saw the fund’s inception. The parent business Capital Group serves as American Funds’ advisor. The organisation provides investing options to high-net-worth individuals and families, institutions, consultants, and others in addition to mutual funds. Across all of its strategies, the company has nearly $1.4 trillion under management as of December 31, 2016.

What is Praxis Cashier?

Praxis Cashier supports the majority of card issuers and integrates with nearly all PSPs. Praxis Cashier handles payment processing without the need for a third-party processor, unlike other alternatives. With the help of this program, you may take payments from any major credit card company and accept a wide range of payment options.

What is DBFX

DBFX is a broker and platform for financial trading. established in 2010

After more than 14 years, DBFX currently provides Forex, commodities, indices, stocks, cryptocurrency, and CFD trading services to over 2,000 retail clients.

Because they are prohibited from operating in certain important geographic areas, DBFX is not a worldwide broker. The headquarters of DBFX are in Vanuatu.

It can take a lot of time to discover a broker that can suit your expectations when trading in the financial markets.

We will examine the DBFX platform in-depth and evaluate its effectiveness as a global multi-asset trading platform for traders in 2024.

visiting a variety of broker websites, each with a unique language use. With brokers like DBFX, technical jargon and terminology might be perplexing. It can take a while to select or shortlist a trading platform such as DBFX. Selecting a trading platform necessitates extensive investigation and evaluation. Understanding all of the features and advantages of each platform can be difficult, particularly with a complicated trading platform like DBFX.

Because of this, choosing the best trading platform, such as DBFX, necessitates a thorough comprehension of trading tactics, the market, and platform functioning. With so many online brokers like DBFX available, each with its own features, costs, and restrictions, the task gets much more difficult.

Finding a dependable and trustworthy broker like DBFX necessitates serious thought and extensive due investigation in such a complicated market. When utilising the DBFX online trading platform or trading on a mobile device, some of the trading tools can be complicated. It is important for novice and inexperienced traders to take their time learning how to use the DBFX trading tools. In our analysis of DBFX, we list the benefits and drawbacks. What DBFX has to offer and the nations where it’s accessible. And more on who regulates DBFX.

Wind UP- Is DBFX safe?

The financial regulatory status of DBFX in your area is an important consideration when selecting it for your trading activity. Examining the administrative body and regulatory standing of a broker, like DBFX, is one of the most important factors to take into account. Investors may be at danger since brokers operating without oversight from a regulatory body are allowed to set their own regulations. Your entire investment is in danger.

DBFX was founded in 2010 and has been operating for 14 years, with its headquarters located in Vanuatu.

DBFX is subject to regulations. This indicates that DBFX are subject to oversight and conduct checks by the regulatory agencies of the Cyprus Securities and Exchange Commissions (CySec).

Requests for DBFX withdrawals will be fulfilled. Strict rules that forbid them from manipulating market prices to their benefit apply to brokers that work under the supervision of regulatory bodies such as DBFX. By ensuring that brokers act with honesty, equity, and openness, regulatory supervision protects investor funds. DBFX are responsible for their conduct, and breaking any financial restrictions could have dire repercussions. You may be confident that your request to remove money from your account will be handled quickly if you are a client of DBFX. DBFX is known for its quick and dependable fund transfers and for abiding by the regulations set forth by the financial authorities over whom they are controlled.

When you file a withdrawal request, DBFX will check the information in your account and process the payment in the allotted period, which is typically a few business days. You can focus on your trading and have peace of mind when you work with a reliable broker like DBFX. DBFX may lose its regulated status if they break any regulations.

1 note

·

View note

Text

Alchemy Markets Scam Exposed

The offshore broker Alchemy Markets, a member of the Alchemy Group that also comprises the FCA-regulated Alchemy Prime and the Vanuatu-based FXPIG, came under fire from the Spanish CNMV in July 2022. The same brand and trading style are used across various domains and websites, potentially or purposefully misleading customers, as is often the case with these worldwide broker schemes. By acquiring clients from Europe and the UK, the offshore broker Alchemy Markets is breaking relevant regulatory regulations. This is our most recent review.

Short Narrative

While the offshore division of the Alchemy Group uses the name Alchemy Markets and the domain https://alchemymarkets.com, the UK FCA-regulated investment firm Alchemy Prime operates the website with the domain https://alchemyprime.uk. The word “Alchemy” serves as the basis for the used logos. They use the same primary graphic components but make additions (see image on the left).

The webpage for the offshore mutation is poorly designed. Documents such as the KYC Policy, Privacy Policy, and Client Agreement, for instance, are absent. The link goes nowhere; all you get is the error message 404. Additional links on the Alchemy Markets offshore broker website point to the FCA-regulated entity’s Client Agreement.

Furthermore, Alchemy Group uses the FCA-regulated Alchemy Prime Ltd as a payment agent to run the offshore broker FXPIG through Prime Intermarket Group Asia Pacific Ltd, which is registered in Vanuatu and licensed by the VFSC. The FXPIG website states that every company is managed by a single entity.

Gope Shyamdas Kundnani, an Indian national born in 1957, is the owner of Alchemy Group, according to documents obtained through Alchemy Prime Holdings Limited from UK Companies House.

KYC Deposits Prior to

We did not find any limitations on the pre-KYC first-time deposit amount in our payment simulation on October 10, 2022. Through a bank transfer to the multi-currency accounts of the offshore broker scheme at Franx and Blackthorn Finance in the UK, located in Amsterdam, we would have been able to send $50,000 to the scheme.

Alchemy Markets (As claimed)

For each and every one of our clients, Alchemy Markets provides Institutional Access to the Global Financial Markets. Trade your preferred instruments with a variety of free tools and round-the-clock customer assistance, including stocks, forex, indices, cryptocurrencies, and CFDs.

With more than ten years of industry experience, Alchemy Markets offers some of the greatest trading conditions available, including institutional liquidity, spreads, and execution along with zero commission costs and round-the-clock customer service. We offer the most widely used trading platforms, including MT4, MT5, and FIX API, in addition to free resources and research to help our customers along the way.

Do you manage money or are you an IB? Use CopyTrading or PAMM software to trade on behalf of your clients. Charge personalised management and performance fees, keep tabs on your customers with our real-time CRM, and much more with Alchemy markets.

Alchemy Markets offers services related to forex trading. A vast array of assets, including currencies, indices, cryptocurrencies, and commodities, are available to traders across several marketplaces. In contrast, Alchemy Markets offers a free demo account that you can use to explore and become acquainted with their platform. The UK is home to its main office.

Trading Cryptocurrencies

Since cryptocurrencies have such high levels of volatility, trading them is a lucrative and potentially very profitable area of investing. With more than 60 distinct Crypto CFDs, Alchemy Markets has a fantastic offer for any trader looking to take advantage of the competitive conditions and enter into this rapidly expanding sector. 10:1 leverage, 100% STP execution, and costs as low as 0.35% Round Turn are available for cryptocurrency trading. After creating an account with this online broker, cryptocurrency traders can use the MT4 platform for trading.

Wind-Up- A Six-Step Guide to Verifying the Legitimacy of Your Broker

Even though investing has become risk-free, inexpensive, and effective for regular investors, there are still certain cases of brokerage fraud committed to defraud gullible or avaricious investors.

There are numerous methods for determining the legitimacy of your broker. Do your homework in advance at all times.

Avert cold calls, investigate the firm’s and the broker’s or planner’s record for any disciplinary issues, and look for funny stuff on your statements.

If in doubt, there are a few different ways to report anything and ask for compensation.

The most reliable source for finding out about a broker’s status is FINRA.

You may safeguard yourself against doing business with a dishonest broker or other financial professional by following these six steps:

1. Avoid Making Cold Contacts

Any broker or investment advisor who reaches you out of the blue from a company you have never done business with should be avoided. The correspondence may be sent by letter, email, or phone. Invitations to financial seminars that provide complimentary lunches or other goodies in an attempt to win you over shouldn’t fool you into lowering your guard and making rash investments.

The SEC further advises being extremely wary of callers that employ high-pressure sales techniques, advertise once-in-a-lifetime prospects, or decline to provide written information about an investment.

2. Engage in Discussion

You should feel at ease with the individuals offering you guidance, goods, and services, whether you’re searching for a financial counsellor or a broker. Inquire extensively about the company’s offerings and its track record serving customers with comparable demands to your own.

3. Conduct some research

When investigating a financial expert, it’s advisable to start with a straightforward web search using the broker’s and firm’s names. This could include recent announcements, media coverage of purported misconduct or disciplinary measures, client discussions on internet discussion boards, background data, and other specifics. A search engine query for “Lee Dana Weiss,” for example, yields hundreds of thousands of results, one of which is a link to the press release regarding the SEC’s lawsuit against him and his company.

4. Confirm your SIPC membership

Additionally, you ought to confirm whether a brokerage company belongs to the Securities Investor Protection Corporation (SIPC), a nonprofit organisation that offers investors protection for up to $500,000 (including $250,000 in cash) in the event that a company fails, much like the Federal Deposit Insurance Corporation (FDIC) does for bank customers. Always make cheques payable to the SIPC member firm rather than a specific broker when investing.

5. Frequently Review Your Statements

Setting your investments to run on autopilot is the worst thing you can do. Whether you receive your statements in print or online, carefully reviewing them might help you catch errors or even malfeasance early on. Inquire if there are unexpected changes in your portfolio or if the returns on your investments aren’t what you anticipated. Reject complex guarantees that you don’t fully comprehend. Ask to talk with a higher-ranking official if you are unable to acquire clear answers. Never worry that people will think less of you or that you’re a bother.

6. If in doubt, take money out and file a complaint.

Take your money out of the investment advisor if you think there has been misconduct. Next, submit complaints to the same state, federal, and private authorities whose websites you visited when you checked out the financial professional to start with

Bottom Line

Even though the Great Recession is resolved, brokers and investment advisors are still breaking the law. Thus, before entrusting a financial expert with your money, conduct in-depth study and keep a careful eye on your accounts. It is possible for investments to perform below expectations for valid reasons. However, if you start to feel uneasy about your returns or have other problems that the advisor doesn’t address promptly and effectively, don’t be afraid to withdraw your money.

0 notes

Text

Exposing The 'FSM SCHEME' - FSM SMART, TRADE12, HQBROKER, MTI MARKETS, MX TRADE

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.

The beneficial owner(s) are well hidden and this vast group obviously has no intention to stop. We shall try to do our best to unmask this ‘giant’ as much as possible. For the purpose of clarity, we shall generically call them ‘’the FSM scheme’’ since its brand FSM Smart is probably the biggest and longest standing one. This thread will be quite long and posted in successive parts, due to the size on info we aim to display on FPA, so you are warned that it will take patience and attention to follow. No shortcuts here or easy solutions.

The named ‘FSM scheme’ is comprised of (up to now known) following scam brands/trading styles: 1. MTI Markets www.mtimarkets.com 2. TradingBanks www.grizzly-ltd.com also t/a www.tradingbanks.com (own trade platform+TradingBanks) 3. MX Trade www.mxtrade.com 4. Trade12 www.trade12.com 5. HQBroker www.hqbroker.com (up to this thread, probably never associated to FSM Smart brand before) 6. FSM Smart www.fsmsmart.com, www.fsmsmarts.com, www.it.fsmsmart.net, www.fsmsmart-ltd.com

We are positive that more brands are involved or were a part of this. This organization is truly like an Octopus. But as any other such group, made the same mistakes when registering various companies and using 3rd parties providers, leaving traces behind. Now days, scammers are much more cautious, in general, as there is more focus on scams, narrowing down their operating boundaries. First brand operator of MX Trade scam appeared to be a 2014 est.&CySEC regulated/FCA-passport company R Capital Solutions Ltd, FCA, CySEC, CY registrar. Owner was a Romanian citizen residing in Cyprus, Mr. Victor Florin Safta, who had another linked company in the UK, F Capital Solutions LtdCompanies House Reg. CySEC regulated R Capital Solutions claimed they never operated MX Trade by issuing a public statement:

Anyhow, whoever the scam operator was, once compromised, quickly switched to 2014 est.&Belize incorporated Lau Global Services Corpwww.lgs-corp.com (now defunct BZ reg.search) operating MX Trade as of April 2015 (per T&C archive) which is a standard next step that all scammers make, when the brand is exposed. Lau Global was a full scam from day one, FB page still online, ASIC warning, CySEC warningIFSC warning, FSMA warning revealing that deposits went to Taris Financial Corp, not present in offshore leaks, Cypriot, Vanuatu, Belize or Marshal Islands registers, but with bank account in Cyprus, meaning it had to be incorporated somewhere to obtain a bank account. Possible best match via google search would be a few companies named Taris from Riga, Latvia, or Sofia, Bulgaria, but it’s just a random speculation with no actual meaning, or any insinuation towards those companies. Whatever it is, it’s obvious that they continued a scam. Lau Global, thanks to ICIJ offshore leaks, can be de-masked fully: Offshoreleaks-LauGlobal. Lau Global was the sole shareholder of 2014 Malta-incorporated Grizzly Ltd. Looks like the entire structure from the start was prepared in 2014 and, once the time came, just relocated, implying a plan/intention, from the start. Grizzly Ltd has one owner, Mr. Shlomo Matan Shalom Avshalom, an Israeli national, with Philippines address, per offshore leaks. This was very indicative to us, as we had the information some time ago to pursue some lawyers and Philippines call centers direction, to get to the bottom of this scheme setup. So we did. Others who looked into this information just continued with having a name from offshore leaks, but no more. Let’s have a look at this Mr Avshalom more, shall we?

In offshore leaks, Shlomo Matan Shalom Avshalom, linked to Philippines and Israel residency addresses, is the director and legal/judicial representative of Malta based Quick Solutions Ltd (2014) and Grizzly Ltd (2015), with his registered address (another company): BSD Trading Service Corp, Office O5M, Berthaphil Compound, Jose Abad Santos Avenue, Angeles, Pampanga, Philippines. Quick Solutions is owned by Belize IBC called High Moon International Inc, while Grizzly Ltd is owned by Belize IBC Lau Global Service Corp. Both Grizzly and Quick solutions have the identical Malta address registered. It looks like this:

Back to business. Following the trail of the lawyer and the Philippines address, we land at Pampanga, PH. A well-known place for numerous call-centers, as well as India for example, again industry-wide known facts. Truly a lot of customer care offices for hundreds of different businesses, an army of cheap multilingual workforce. Over the years, we all witnessed even some police raids to scam call centers, over there they even announce it on TV, with full press conference and detained agent’s close-ups on national frequencies. As for our story, the address in offshore leaks revealed Mr. Avshalom’s Pampanga address for BSD Trade Services Corp or rather, BSD Trading Services Corp. BSD Trading/Trade Serv. Corp is actually a Philippines BPO, a call-center, however incorporated in Singapore: link and maybe Hong Kong: HK search:

Why Hong Kong? We will prove a point shortly. Here we will just complete this sentence with public document where a certain Mr. Avshalom from Israel is indicated as the President (wow!) of GWU MKTG CORP. 08F Clark Center Berthaphil III, JAS Ave., CFZP, pls see: PH alien employment permit filling. GWU MKTG Corp website, domain-big-data tool shows registration from Cyprus (?) in 2015 link, while the company website kind of gives it away, doesn’t it?

Going back to already explained ties to BSD Trade Services Corp issue, a closer look at its nonfunctional website via domain-data tools, after checking this job add: call center job advertisement, one can learn quite a lot. Actually, too much… BSD Trade Services Corp domainbigdata check. The company registered a domain indicating a HK incorporation, domain is not privately registered but via the company (!), name and phone of the registrant also indicated, registrant’s name (2015) Mr. Richard Bula. Mr. Bula holds 31 registrations in his name, per same tool search: R-Bula-domain-registrations and the results are shocking, to say the least. Let’s memorize these information permanently here:

TradingBanks, MXTrade, Trade12 … absolute and pure scams, tied directly to specific PH call center. Also, we encourage you to further check listed domains or check recorded Richard Bula’s mail address ([email protected]) , as you will find this as well link – www.easyoption.us (Israeli Spot Option binary options broker, roof of many, many scams since 2011), tied to link, link, also Mr. Bula’s details are falsely tied to non-existing London address Badenerstrasse 549. It is actually shared-virtual Regus office space in Switzerland link, one of many deceiving attempts of scammers to confuse any investigator. Not happening. Going further with the same checks of www.easyoption.us domain, we get this result:

This Christina Constantinou is Cypriot resident (perhaps AGP Law, maybe some other company), Exo Capital Markets Ltd, Marshal Islands was the declared operator of Trade12.com huge scam, HQBroker brand emerges for the first time tied to the scheme group… however you turn this around, it is always the same group and same crew. Also, here we can identify another company, part of this vast scam group, Eyar Financial Corp Limited, Vanuatu, struck-off in 2018.

PART 2 MTI Markets scam broker was a bit different setup, more Europe oriented, involving directly different people, but ultimately all being connected in this generic FSM Scheme. Allegedly ran via Marshal Islands company MTI Investments Llc (search, closed in 2018). Warnings and reviews: FPA, link with operator names. MTI Markets main domain was registered like this link. 2015 registrant is the Belize company MTI Group Ltd t/a MTI Markets: link, domains screaming with known ‘exo’ and ‘mti’ pretexts. Indicated people were: Mr. Armin Ordodary, (Iranian with Cyprus residency, former Windsor Brokers employee), Mr. Ali Mahmoudi (Iran) and Mr. Mathew Bradley (??). You are encouraged to browse domain big data tools, so you can find them all and see the connections, explore domains etc. We will focus our attention here to Mr. Armin Ordodary now. For a very good reason. Armin Ordodary, an Iranian national, with Cyprus residency, is in the business for a long time. Picture from Windsor Broker celebration link and other publicly available ones:

Benrich Holdings Ltd, Cyprus link

Benrich Trading Ltd, Cyprus link

Bythos Yacht Management OU, Estonia link, link

Siao Ltd, Cyprus (see more domains under this one, incl. Twitter acct link) link

AGFM Ltd, Cyprus link

Nepcore (essentially CRM gateway provider, reg. via A. Ordodary link)

Possibly Orden Capital HK (domain big data, linked to him, typical names like ordencapital, ordenholdings etc) link

BizTech DOO, Serbia link

BizServe DOO, Serbia, formerly known as Upmarkt DOO link

Here is where we get to the FSM Smart scam broker, FB page, LinkedIn page. While Siao, Nepcore, Orden and Bythos were reserved for CRM, PSPs, payment intermediaries, essentially different work within the scam group, Benrich offices, possibly AGFM and certainly BizTech/Serve offices were boiler rooms with agents working primarily on FSM Smart scam, while other 2 brands of the ‘fantastic scam trio’ (Trade12 and HQBroker) were handled via other arms of this vast scheme group (in BPOs located in Ukraine, Albania and Georgia, will be elaborated later on). And since Mr. Armin Ordodary directly holds ownership in both Benrich and both BizTech/Serve, directly or indirectly, this leads to the conclusion that this young man’s role in this scam scheme is for MTIMarkets and FSMSmart scams primarily. In fact, we have verified information that Benrich Holdings Cyprus was or still is a place where agents work, mainly in English and Italian language, while the Serbian subsidiary of Benrich, Upmarkt/Bizserve (allegedly closed due to bad results) was a so-called FTD center, acquiring new clients for FSM Smart scheme.

Serbian boiler room - Upmarkt doo Companies extracts prove Benrich holds stake in Serbian subsidiary and Armin’s ownership of another one, as well as local name change :

Cyprus boiler room – Benrich Holdings Ltd

A place where apparently Retention agents operated. Besides English language, this was or still is a place where most of FSM Smart scams in Italian language happen. Few of the agents operating at one point in that office, between 2018-2019, per LinkedIn reveal that a spinoff facility was probably used for scamming, as well - Topright Trading Limited Cyprus, link:

link retention agent (note previous engagement in exposed boiler Smardis doo)

I have not personally investigated all of the information in this thread. What I can tell you is that someone doesn't want you to see it. Someone went to a great deal of effort to try to get the FPA to remove all the information Scam Reporters posted here.

Another site owner filed a malicious and false DMCA against the FPA after Part 1 of this thread was posted. This site is filled with news items that appear to be borrowed or stolen from major news sites. In the middle of all of the latest major news items taken from news sites, a copy of Post 1 was retroactively inserted.

The complaining site is based on WordPress. WordPress makes backdating a post easy. Years ago, one of ForexGen's many spammers tried to "prove" something at the FPA had existed for more than a short period of time. The scammers behind that backdated a blog post to before the original ForexPeaceArmy.com registration date.

In this case, they first posted a backdated version of Part 1 of this post and DMCAed the FPA, demanding removal of material that was originally published here. The FPA disputed this, and then they followed up with a backdated copy of Part 2.

More details coming very soon.

PART 3

In this part, we will focus our attention to money flow in the FSM part, followed by more close ties between FSM SMART, TRADE12 and HQBROKER, obviously set for Part 4. We actually believe this entire FSM Scheme Thread will have at least parts 4 and 5. Maybe even 6? We told you it would be complicated, so hold on. And stay tuned. A lot more is coming. And a few surprise guests to back us up here with their stories and/or documents.

FSM SMART As we previously stated and proved, all of the 3 brands are part of the same scheme, same, for now unidentified UBOs in the end. Apparently, some dangerous people, as stated already. Ok, noted. We are neither 'impressed' nor frightened. In fact, it should be the other way around, if they have any 'smarts', because of the ongoing investigations. Slow, but getting there...

Now, let's see who are the operators (PSPs, intermediaries and a few more boiler rooms), where does the client money go and who receives it. These information may become crucial for anyone aiming to recover his ''lost'' (stolen) funds.

In the FSM Smart(s) T&C (here:link), bottom of the page 6, FSM Smart declares its operator/owner to be both FSMSmart Ltd (Marshal Islands) and Memphis Investments Sp. z o.o. (Poland).

T&C further point that in case of misunderstanding btw the Company and the Dear Valued Client that was just ripped off by the boiler room staff and FSM's rigged MT4 replenished by Virtual Editor (default losses with FSM usually happen on minors and exotics, like RON/USD or TRY/USD), the first instance would be https://www.lawsociety.org.uk/, followed by the Marshal Islands Court as the final destination.

This Polish legal entity Memphis Investments Sp. z o.o. points to a quite interesting direction. Company details here: link. Authorized person, a lady called Pawluk Patrycja. She holds other nominations in the registrar (link) so she is not that important (a nominee director/holder, so called 'monkey', paid to register a local company, however legally liable, weather she likes it or not). Those registered in the Memphis ownership structure, on the other hand, are important, as they lead to a new direction of the FSM SCHEME environment: Memphis breakdown. As any other similar company used for the same illicit business, first ones registered as owner(s) that committed capital, are quickly removed and an actual person or persons are delegated. They do the actual business. In Memphis Poland case, it was like this:

So, the Suliman's were another intermediary nominees, hence we won't bother with them as well. Mr Rosenbaum is obviously the main guy there. Mr Rosenbaum also holds position in Estonian company Quantum Team OU, link, financial, admin, support activities. This is actually a standard setup for scams, these companies are necessary for either moving the money or registering as a merchant with a PSP or crypto-platform (today its both), to be able to move money deposited by FSM scheme clients to far away destinations. And it's not just reserved for FSMSmart brand, no... Just with a simple google check of Enigma GRC Ltd shows warnings for illegal and fraudulent brands operated by Enigma GRC, hence here and now officially added to FSM Scheme scam list and from direct FSMSmart environment/operators:

- Income Class - True Capital Pro - Profitix

Valuable links of warnings and info: ASIC, NZ.FMA, Consob,...you get the picture. After this relatively short part, it can be more clear why would an offshore FSMSmart require UK arbitration, while at all times they claim to be located in Switzerland (Lucern), although off course they are not. However, Mr Mordechai Moshe Rosenbaum is in the UK. And possibly in the USA/Canada as well. Where actually most of the FSM Scheme client deposits went. But that's the story for the following parts.

PART 4

This part 4 will deal with Trade12, HQBroker and FSMSmart(s) ties more closely. As proved previously, the scams are a part of the same racket. FSMSmart is to some extent covered here. Let's move on to the other 2 ones.

HQBroker scam has many bad reviews and warnings worldwide, link. Google them if you like, here's FCA . Targeted countries mainly Canada, Australia, New Zealand, a bit of UK and maybe some other Asian countries. Operated nominally by Capzone Invest Ltd, Marshal Islands, with fake Hong Kong address on their website.

Capzone Invest Ltd is now defunct/closed, as of May 2020. HQBroker still operates normally.

Capzone's alleged website is also not accessible, www.capzone-invest.com, domain data shows no info. There is (was) apparently a company with the same name in Bulgaria, but official registrar does not show it existed, so possibly a shared space location, under another name:

Exo Capital Markets Ltd, to repeat here again, lists as registrant for many of the scheme scams: Exo on domain big data. Apparently, this Exo Capital Markets ltd is now changed with Trade12 scam to some Turbo Trading Limited

Time does fly...Finally, continuing part 4.

HQBroker brand, equally blatant scam as Trade12 and part of the very same scheme, was meant more for Asia-Pacific regions and the Americas (USA excluded, they were not that stupid). Europeans too but, mainly those regions. Aussies and Canadians were favorite, big money was taken few years ago.

Then 'bad times' hit Trade12/HQBroker scammers. Apparently, Trade12 got greedy and engaged with local people as leads to be scammed. Then in December 2018, an event took place in Ukraine, where the actual boiler rooms were located. Locals started complaining as they were loosing all money and eventually Ukrainian cyber police had to intervene - they raided offices, apartments and arrested many, seized money, IT equipment, drugs, documents and all sort of things a 'normal' boiler room contains.

Ukrainian delegated court was after that overwhelmed with things to process in this case, however it was not important to foreign victims as they could not legally participate, we were explained. Pity.

3 things are interesting regarding this short press release: 2 pieces of information from it and a chain of events triggered by it. First, the news comment section:

So, apparently the scam group walks free, which is not a surprise, as we have reviewed short version of the indictments of the Ukrainian court and it was very confusing, lacks consistency and does not determine who did what and to whom; furthermore, it is restricted only to Ukrainian citizens - victims of a scam, while many foreign victims are not even mentioned. The possible next scam comes in the form of this https://lblv.com/ LBLV Ltd, Seychelles. The broker does have a Seychelles FSA license, check via SFSA (better then nothing) but fails to state where the actual call center is (only registered Seychelles address indicated). This could be the standard business model, where IBs are engaged, which is fine, as long as the IB acts accordingly. Which they usually don't. Many brands were destroyed this way, but also raises the big question - does the broker know what the IB is doing in reality and how does the broker check their daily activities to ensure full compliance with the legal requirements across the globe are met? Finally, the Ukrainian financial authorities have warned the public about LBLV brand, which is in light of these events, very bad: link. But, we cannot conclude this, its just a hear say. Then, at the end of the Finance Magnates news, the reporter concludes with a note: 'After the publication of this article, Igor Pejovic, the alleged Director of HQBroker reached out to Finance Magnates. Pejovic claims that the offices raided by Ukrainian police belonged to an affiliate company, one that HQBroker does not own, which the broker uses to source data and leads. Finance Magnates cannot confirm the veracity of this claim and would add that reviews of HQBroker are overwhelmingly negative and replete with assertions that the broker operates fraudulently.' Although we cannot confirm 100%, the odds are that this gentleman is a Montenegrin citizen, holding a call center in Belgrade, Serbia, called THEIA DOO (Theia Ltd), established in May 2017 and with current address where several other boiler rooms are located already (confirmed in our other threads), for example Parogan DOO (address Boulevard Milutina Milankovica 9, Belgrade, RS). Unpleasant coincidence or how many coincidences till 'chance' is ruled out? Incorporation act, publicly available

Finally, the strange coincidence regarding an event that happened at the exact same time as the boiler room raid in mid December 2018. In the earlier parts of this long and exhausting thread (that will for sure require a summary in the end, to recap and digest the exposed), we pointed out that Mr Armin Ordodary's Serbian branch of Benrich Holdings Cyprus, called Upmarkt Ltd, that handled FSMSmart brand (FTD center) was closed due to quite bad results. However, it ceased operations suddenly and instantaneously, within a day or two, during early December 2018, which strangely coincides with the Ukrainian boiler room bust (first 2 weeks of December 2018). Tipped off by Kyiv 'friends'? Then, one more thing happened: another Armin Ordodary company, Estonian Bythos Yachts Management OÜ had a sudden first cash move on its bank account, in Q4 2018. We will assume it's very late 2018, December...payout, extracting money, moving it, or a lucky shot and a first yacht client of the company? Judge for your selves. For us, there are too many coincidences. Btw, apparently the company gains lots of clients with yachts in 2019 and 2020, perfectly normal to have increased turnover during covid lockdowns, while cruisers, cargos and air companies lay off staff massively, right?

Going forward, there is a FPA member Scam-Rescue, a Canadian guy, that got scammed and posted a review here but also started his own website, that we had the pleasure to see grow over the past few years, from simple and honestly angry post to a developed actions against such scams in general and possible ways through the system to retrieve lost funds (chargeback options). We are not promoting it here but state that this brave young man took a stand, all alone - and made it. Bravo! We'll show you some interesting info re his 'case'. Coming up soon...

1 note

·

View note

Text

You might not have heard his name, but #Mohsen Fallahian is a key player in a# network of organized crime stretching across# Europe, the Middle East, and the UK. He’s notorious for using #fake passports and changing identities to stay one #step ahead of the law.

After obtaining #illegal residency in Italy,# Mohsen has continued to move across borders under different names, all while contributing to a sprawling empire of #criminal activity. This isn’t just a simple case of fraud—it’s a #coordinated effort involving everything from oil smuggling to drug trafficking and money laundering through #offshore accounts.

With his brother #IEbrahemFallahian, the Fallahian family has managed to hide their operations using fake identities and manipulated documents. It’s no coincidence that Mohsen and his network have managed to acquire illegal#passports from #Turkey, among other countries, giving them the freedom to move money and evade #international sanctions.

What’s even more alarming is that these criminals aren’t just affecting the Middle East. Their #influence has #spread to the UK and beyond, with their operations funded by hidden wealth,# offshore# banking systems, and complex #tax evasion schemes.

Mohsen Fallahian isn’t just a criminal; he’s a ticking time bomb whose operations have the potential to #destabilize regions. As his web of deceit continues to grow, the challenge for authorities isn’t just catching him—it’s understanding the full extent of the threat he poses.

For authorities, tracking someone like Mohsen Fallahian is an international challenge, and it’s clear that the system is failing to keep up with these criminals. But awareness is key. By understanding how these #networks operate, we can start to push for #accountability and reform.

0 notes

Text

You might not have heard his name, but #Mohsen Fallahian is a key player in a# network of organized crime stretching across# Europe, the Middle East, and the UK. He’s notorious for using #fake passports and changing identities to stay one #step ahead of the law.

After obtaining #illegal residency in Italy,# Mohsen has continued to move across borders under different names, all while contributing to a sprawling empire of #criminal activity. This isn’t just a simple case of fraud—it’s a #coordinated effort involving everything from oil smuggling to drug trafficking and money laundering through #offshore accounts.

With his brother #IEbrahemFallahian, the Fallahian family has managed to hide their operations using fake identities and manipulated documents. It’s no coincidence that Mohsen and his network have managed to acquire illegal#passports from #Turkey, among other countries, giving them the freedom to move money and evade #international sanctions.

What’s even more alarming is that these criminals aren’t just affecting the Middle East. Their #influence has #spread to the UK and beyond, with their operations funded by hidden wealth,# offshore# banking systems, and complex #tax evasion schemes.

Mohsen Fallahian isn’t just a criminal; he’s a ticking time bomb whose operations have the potential to #destabilize regions. As his web of deceit continues to grow, the challenge for authorities isn’t just catching him—it’s understanding the full extent of the threat he poses.

For authorities, tracking someone like Mohsen Fallahian is an international challenge, and it’s clear that the system is failing to keep up with these criminals. But awareness is key. By understanding how these #networks operate, we can start to push for #accountability and reform.

0 notes

Text

FSM Smart

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.

The beneficial owner(s) are well hidden and this vast group obviously has no intention to stop. We shall try to do our best to unmask this ‘giant’ as much as possible. For the purpose of clarity, we shall generically call them ‘’the FSM scheme’’ since its brand FSM Smart is probably the biggest and longest standing one. This thread will be quite long and posted in successive parts, due to the size on info we aim to display on FPA, so you are warned that it will take patience and attention to follow. No shortcuts here or easy solutions.

The named ‘FSM scheme’ is comprised of (up to now known) following scam brands/trading styles: 1. MTI Markets www.mtimarkets.com 2. TradingBanks www.grizzly-ltd.com also t/a www.tradingbanks.com (own trade platform+TradingBanks) 3. MX Trade www.mxtrade.com 4. Trade12 www.trade12.com 5. HQBroker www.hqbroker.com (up to this thread, probably never associated to FSM Smart brand before) 6. FSM Smart www.fsmsmart.com, www.fsmsmarts.com, www.it.fsmsmart.net, www.fsmsmart-ltd.com

We are positive that more brands are involved or were a part of this. This organization is truly like an Octopus. But as any other such group, made the same mistakes when registering various companies and using 3rd parties providers, leaving traces behind. Now days, scammers are much more cautious, in general, as there is more focus on scams, narrowing down their operating boundaries. First brand operator of MX Trade scam appeared to be a 2014 est.&CySEC regulated/FCA-passport company R Capital Solutions Ltd, FCA, CySEC, CY registrar. Owner was a Romanian citizen residing in Cyprus, Mr. Victor Florin Safta, who had another linked company in the UK, F Capital Solutions LtdCompanies House Reg. CySEC regulated R Capital Solutions claimed they never operated MX Trade by issuing a public statement:

Anyhow, whoever the scam operator was, once compromised, quickly switched to 2014 est.&Belize incorporated Lau Global Services Corpwww.lgs-corp.com (now defunct BZ reg.search) operating MX Trade as of April 2015 (per T&C archive) which is a standard next step that all scammers make, when the brand is exposed. Lau Global was a full scam from day one, FB page still online, ASIC warning, CySEC warningIFSC warning, FSMA warning revealing that deposits went to Taris Financial Corp, not present in offshore leaks, Cypriot, Vanuatu, Belize or Marshal Islands registers, but with bank account in Cyprus, meaning it had to be incorporated somewhere to obtain a bank account. Possible best match via google search would be a few companies named Taris from Riga, Latvia, or Sofia, Bulgaria, but it’s just a random speculation with no actual meaning, or any insinuation towards those companies. Whatever it is, it’s obvious that they continued a scam. Lau Global, thanks to ICIJ offshore leaks, can be de-masked fully: Offshoreleaks-LauGlobal. Lau Global was the sole shareholder of 2014 Malta-incorporated Grizzly Ltd. Looks like the entire structure from the start was prepared in 2014 and, once the time came, just relocated, implying a plan/intention, from the start. Grizzly Ltd has one owner, Mr. Shlomo Matan Shalom Avshalom, an Israeli national, with Philippines address, per offshore leaks. This was very indicative to us, as we had the information some time ago to pursue some lawyers and Philippines call centers direction, to get to the bottom of this scheme setup. So we did. Others who looked into this information just continued with having a name from offshore leaks, but no more. Let’s have a look at this Mr Avshalom more, shall we?

In offshore leaks, Shlomo Matan Shalom Avshalom, linked to Philippines and Israel residency addresses, is the director and legal/judicial representative of Malta based Quick Solutions Ltd (2014) and Grizzly Ltd (2015), with his registered address (another company): BSD Trading Service Corp, Office O5M, Berthaphil Compound, Jose Abad Santos Avenue, Angeles, Pampanga, Philippines. Quick Solutions is owned by Belize IBC called High Moon International Inc, while Grizzly Ltd is owned by Belize IBC Lau Global Service Corp. Both Grizzly and Quick solutions have the identical Malta address registered.

And you can verify all via this link: ICIJ offshoreleaks. By the way, Belize IBCs are defunct now (check BZ reg). Grizzly Ltd was the operator of another big scam, TradingBanks, at the time falsely claiming to be incorporated in British Virgin Islands as some bogus St. World Trade Inc, receiving BVI FSC warning. Furthermore, FPA 1-star review, then multiple warnings from FSB, domicile MFSA (for both TradingBanks and MX Trade, warning), FINMA, CONSOB, even Belize IFSC (warning), tradingbanks warnings, give final 2016 verdict – pure scam, operated by the above people and companies, no doubt about it. Grizzly Ltd has a secretary listed, one Mr David Meli link, a lawyer from a famous Michael Kyprianou (MT, CY) law practice office, that was used as nominee registrar intermediary. Mr Meli has a long list of offshore incorporations for their clients (check offshore leaks) which is not forbidden off course, it’s a good business and a sensitive service. Furthermore, Michael Kyprianou & Co Llc is a member of such esteemed groups like IFG (International Fraud Group, link), where one learns the office expanded its subsidiaries from CY to Greece, Malta and Ukraine. No presumptions here, just pointing out the well-known fact that many scam operators choose Paphos, Kiev, and other locations for their business. Any conclusion drawn by the readers here is their free choice solely, we do not even insinuate any connection, but merely state the industry-wide known general facts. Especially when it comes to Paphos, CY…By the way, besides Malta, Mr. Avshalom holds positions in two more companies in Cyprus. In Paphos, Cyprus, to be precise: Tevtach Ltd link (completely new one, May 2020) and A.VV.L Investments Ltd link (fresh, 2019). Sidetrack - with this Tevtach Ltd registered persons, one name search show interesting results- if not a football player or self-proclaimed LinkedIn lawyer with 1 connection, then it is most probably this Elior Vaknin, from Israeli Bynet Group, link, link, link. Just wondering what is a customer care representative from Rad Bynet Group (telecommunication, BPO, telephony, internet, outsourcing/offshoring, IP phones, etc) doing serving as co-director with Mr Avshalom, proven to be involved in illicit and questionable businesses? But that would be his private matter, off course. Finally, maybe it’s not him. This cannot be confirmed now. But to prove we are not malicious at all, just try to state the facts or obvious indications, here is one nice achievement of Mr. Avshalom, proving he is an interesting individual indeed – a co-inventor of an important and useful patent: IL patent registrar 2018, combined scissors and comb for books.

Back to business. Following the trail of the lawyer and the Philippines address, we land at Pampanga, PH. A well-known place for numerous call-centers, as well as India for example, again industry-wide known facts. Truly a lot of customer care offices for hundreds of different businesses, an army of cheap multilingual workforce. Over the years, we all witnessed even some police raids to scam call centers, over there they even announce it on TV, with full press conference and detained agent’s close-ups on national frequencies. As for our story, the address in offshore leaks revealed Mr. Avshalom’s Pampanga address for BSD Trade Services Corp or rather, BSD Trading Services Corp. BSD Trading/Trade Serv. Corp is actually a Philippines BPO, a call-center, however incorporated in Singapore: link and maybe Hong Kong

Why Hong Kong? We will prove a point shortly. Here we will just complete this sentence with public document where a certain Mr. Avshalom from Israel is indicated as the President (wow!) of GWU MKTG CORP. 08F Clark Center Berthaphil III, JAS Ave., CFZP, pls see: PH alien employment permit filling. GWU MKTG Corp website, domain-big-data tool shows registration from Cyprus (?) in 2015 link, while the company website kind of gives it away, doesn’t it?

1 note

·

View note

Text

Streamlining Offshore Ltd Company Registration in the UK

In an increasingly globalized economy, offshore company registration has become a popular choice for entrepreneurs and businesses seeking flexibility, tax efficiency, and asset protection. Among the various jurisdictions available, the United Kingdom remains a favored destination for Offshore Ltd Company Registration UK due to its stable political environment, robust legal framework, and international reputation.

Why Choose the UK for Offshore Ltd Company Registration?

The UK's business-friendly regulations and comprehensive legal system make it an attractive option for registering an offshore Ltd company. With its strategic location, the UK serves as a gateway to Europe and beyond, offering access to a vast market. Moreover, the UK's legal system is well-regarded for its transparency and reliability, which adds an additional layer of security for businesses.

Key Advantages of Registering an Offshore Ltd Company in the UK:

Tax Benefits: Although offshore companies are subject to UK taxation, the UK offers competitive tax rates and a range of tax treaties that can minimize tax liabilities. The UK’s extensive network of double taxation agreements helps to ensure that businesses do not pay tax on the same income in multiple jurisdictions.

Confidentiality: The UK allows for a degree of confidentiality regarding company ownership and financial details, although the Companies House requires certain disclosures. This balance of transparency and privacy is appealing to many business owners.

Reputable Business Environment: The UK’s well-established legal system and regulatory framework provide a secure environment for conducting business. The country's adherence to international standards and practices enhances the credibility of offshore companies registered there.

Ease of Formation: Registering an offshore Ltd company in the UK is a straightforward process. The UK Companies House provides a streamlined registration procedure that can be completed online, making it accessible and efficient for international entrepreneurs.

The Registration Process:

Choose a Company Name: The first step is to select a unique company name that complies with UK regulations. It should not be similar to existing company names and must not include any restricted words.

Prepare Required Documentation: You will need to provide various documents, including proof of identity for the directors and shareholders, and details of the company’s registered office. These documents must meet the requirements set by Companies House.

Register with Companies House: Once you have all the necessary documents, you can submit your registration application online through the Companies House website or by post. The process typically takes a few days if there are no issues with the documentation.

Obtain Necessary Licenses: Depending on your business activities, you may need to apply for specific licenses or permits. Ensure that you comply with all regulatory requirements relevant to your industry.

Maintain Compliance: After registration, you must adhere to ongoing compliance requirements, including annual filings, maintaining accurate records, and fulfilling any tax obligations.

Common Misconceptions:

Despite its benefits, Offshore Bank Account Opening is sometimes misunderstood. Some believe that it is primarily a tool for tax evasion or illicit activities, but in reality, it is a legitimate and legal business strategy when used properly. It is important to operate within the law and ensure that all activities are transparent and compliant with UK regulations.

0 notes

Text

The FSM SCHEME

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.

The beneficial owner(s) are well hidden and this vast group obviously has no intention to stop. We shall try to do our best to unmask this ‘giant’ as much as possible. For the purpose of clarity, we shall generically call them ‘’the FSM scheme’’ since its brand FSM Smart is probably the biggest and longest standing one. This thread will be quite long and posted in successive parts, due to the size on info we aim to display on FPA, so you are warned that it will take patience and attention to follow. No shortcuts here or easy solutions.

The named ‘FSM scheme’ is comprised of (up to now known) following scam brands/trading styles: 1. MTI Markets www.mtimarkets.com 2. TradingBanks www.grizzly-ltd.com also t/a www.tradingbanks.com (own trade platform+TradingBanks) 3. MX Trade www.mxtrade.com 4. Trade12 www.trade12.com 5. HQBroker www.hqbroker.com (up to this thread, probably never associated to FSM Smart brand before) 6. FSM Smart www.fsmsmart.com, www.fsmsmarts.com, www.it.fsmsmart.net, www.fsmsmart-ltd.com

We are positive that more brands are involved or were a part of this. This organization is truly like an Octopus. But as any other such group, made the same mistakes when registering various companies and using 3rd parties providers, leaving traces behind. Now days, scammers are much more cautious, in general, as there is more focus on scams, narrowing down their operating boundaries. First brand operator of MX Trade scam appeared to be a 2014 est.&CySEC regulated/FCA-passport company R Capital Solutions Ltd, FCA, CySEC, CY registrar. Owner was a Romanian citizen residing in Cyprus, Mr. Victor Florin Safta, who had another linked company in the UK, F Capital Solutions LtdCompanies House Reg. CySEC regulated R Capital Solutions claimed they never operated MX Trade by issuing a public statement:

Anyhow, whoever the scam operator was, once compromised, quickly switched to 2014 est.&Belize incorporated Lau Global Services Corpwww.lgs-corp.com (now defunct BZ reg.search) operating MX Trade as of April 2015 (per T&C archive) which is a standard next step that all scammers make, when the brand is exposed. Lau Global was a full scam from day one, FB page still online, ASIC warning, CySEC warningIFSC warning, FSMA warning revealing that deposits went to Taris Financial Corp, not present in offshore leaks, Cypriot, Vanuatu, Belize or Marshal Islands registers, but with bank account in Cyprus, meaning it had to be incorporated somewhere to obtain a bank account. Possible best match via google search would be a few companies named Taris from Riga, Latvia, or Sofia, Bulgaria, but it’s just a random speculation with no actual meaning, or any insinuation towards those companies. Whatever it is, it’s obvious that they continued a scam. Lau Global, thanks to ICIJ offshore leaks, can be de-masked fully: Offshoreleaks-LauGlobal. Lau Global was the sole shareholder of 2014 Malta-incorporated Grizzly Ltd. Looks like the entire structure from the start was prepared in 2014 and, once the time came, just relocated, implying a plan/intention, from the start. Grizzly Ltd has one owner, Mr. Shlomo Matan Shalom Avshalom, an Israeli national, with Philippines address, per offshore leaks. This was very indicative to us, as we had the information some time ago to pursue some lawyers and Philippines call centers direction, to get to the bottom of this scheme setup. So we did. Others who looked into this information just continued with having a name from offshore leaks, but no more. Let’s have a look at this Mr Avshalom more, shall we?

In offshore leaks, Shlomo Matan Shalom Avshalom, linked to Philippines and Israel residency addresses, is the director and legal/judicial representative of Malta based Quick Solutions Ltd (2014) and Grizzly Ltd (2015), with his registered address (another company): BSD Trading Service Corp, Office O5M, Berthaphil Compound, Jose Abad Santos Avenue, Angeles, Pampanga, Philippines. Quick Solutions is owned by Belize IBC called High Moon International Inc, while Grizzly Ltd is owned by Belize IBC Lau Global Service Corp. Both Grizzly and Quick solutions have the identical Malta address registered. Back to business. Following the trail of the lawyer and the Philippines address, we land at Pampanga, PH. A well-known place for numerous call-centers, as well as India for example, again industry-wide known facts. Truly a lot of customer care offices for hundreds of different businesses, an army of cheap multilingual workforce. Over the years, we all witnessed even some police raids to scam call centers, over there they even announce it on TV, with full press conference and detained agent’s close-ups on national frequencies. As for our story, the address in offshore leaks revealed Mr. Avshalom’s Pampanga address for BSD Trade Services Corp or rather, BSD Trading Services Corp. BSD Trading/Trade Serv. Corp is actually a Philippines BPO, a call-center, however incorporated in Singapore. Going back to already explained ties to BSD Trade Services Corp issue, a closer look at its nonfunctional website via domain-data tools, after checking this job add: call center job advertisement, one can learn quite a lot. Actually, too much… BSD Trade Services Corp domainbigdata check. The company registered a domain indicating a HK incorporation, domain is not privately registered but via the company (!), name and phone of the registrant also indicated, registrant’s name (2015) Mr. Richard Bula. Mr. Bula holds 31 registrations in his name, per same tool search: R-Bula-domain-registrations and the results are shocking, to say the least.

1 note

·

View note

Text

Exposing The 'FSM SCHEME'

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.

The beneficial owner(s) are well hidden and this vast group obviously has no intention to stop. We shall try to do our best to unmask this ‘giant’ as much as possible. For the purpose of clarity, we shall generically call them ‘’the FSM scheme’’ since its brand FSM Smart is probably the biggest and longest standing one. This thread will be quite long and posted in successive parts, due to the size on info we aim to display on FPA, so you are warned that it will take patience and attention to follow. No shortcuts here or easy solutions.

The named ‘FSM scheme’ is comprised of (up to now known) following scam brands/trading styles: 1. MTI Markets www.mtimarkets.com 2. TradingBanks www.grizzly-ltd.com also t/a www.tradingbanks.com (own trade platform+TradingBanks) 3. MX Trade www.mxtrade.com 4. Trade12 www.trade12.com 5. HQBroker www.hqbroker.com (up to this thread, probably never associated to FSM Smart brand before) 6. FSM Smart www.fsmsmart.com, www.fsmsmarts.com, www.it.fsmsmart.net, www.fsmsmart-ltd.com

We are positive that more brands are involved or were a part of this. This organization is truly like an Octopus. But as any other such group, made the same mistakes when registering various companies and using 3rd parties providers, leaving traces behind. Now days, scammers are much more cautious, in general, as there is more focus on scams, narrowing down their operating boundaries. First brand operator of MX Trade scam appeared to be a 2014 est.&CySEC regulated/FCA-passport company R Capital Solutions Ltd, FCA, CySEC, CY registrar. Owner was a Romanian citizen residing in Cyprus, Mr. Victor Florin Safta, who had another linked company in the UK, F Capital Solutions LtdCompanies House Reg. CySEC regulated R Capital Solutions claimed they never operated MX Trade by issuing a public statement: