#oanda options

Explore tagged Tumblr posts

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

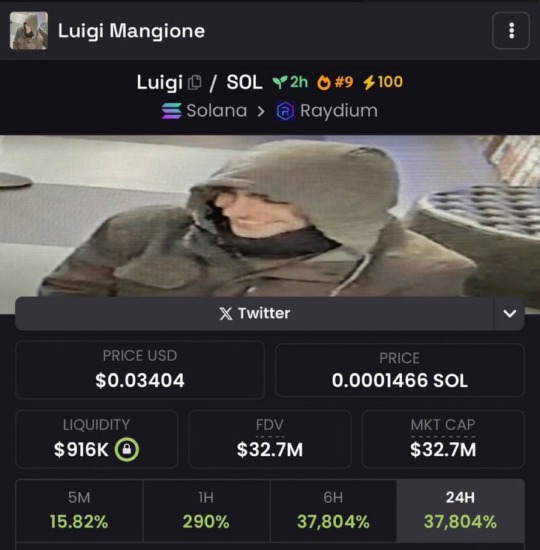

Here’s an example for meme coins:

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

27 notes

·

View notes

Text

10 Best United States Forex Brokers in 2025

The U.S. Forex market is highly regulated, ensuring a secure trading environment. With numerous brokers available, choosing the right one is crucial for your trading success. Here are the top 10 U.S. Forex brokers in 2025.

Key Factors to Consider in a Forex Broker

Regulation & Security – Ensure the broker is regulated by the CFTC and NFA.

Spreads & Fees – Low spreads and transparent fees maximize profitability.

Leverage & Margin – U.S. brokers offer up to 50:1 leverage for major currency pairs.

Trading Platforms – Look for MT4, MT5, or proprietary platforms with advanced tools.

Customer Support – Reliable 24/7 support is essential for smooth trading.

Top 10 U.S. Forex Brokers in 2025

The U.S. Forex market is highly regulated, providing a secure environment for traders. Here are the top 10 brokers in 2025, known for their strengths in various trading aspects:

FOREX.com - Best Overall Offering comprehensive tools, educational resources, and robust platforms, FOREX.com stands out for its strong regulatory compliance and suitability for all trader levels.

OANDA - Best for Beginners With a user-friendly interface, no minimum deposit, and transparent pricing, OANDA is ideal for new traders looking to start their Forex journey.

IG US - Best for High Leverage Known for offering leverage up to 50:1, IG US is a great choice for experienced traders who need advanced tools and high leverage.

NinjaTrader - Best for Algorithmic Trading This broker excels in algorithmic and automated trading with customizable strategies and advanced charting tools.

Interactive Brokers (IBKR) - Best for Advanced Traders Providing access to a wide range of instruments and low commissions, IBKR is perfect for professional traders looking for comprehensive research tools and advanced trading options.

eToro USA - Best for Copy Trading eToro’s innovative copy trading features allow beginners to mirror successful traders, making it an excellent platform for those who prefer a hands-off approach.

ATC Brokers - Best for ECN Trading ATC Brokers offers direct market access and transparent pricing, ideal for traders seeking efficient execution speeds and no hidden fees.

ThinkMarkets - Best for Both Beginners and Professionals Combining competitive pricing, advanced tools, and fast execution, ThinkMarkets suits both novice and seasoned traders.

Trading.com - Best for Fast Execution Specializing in ultra-fast execution with low latency, Trading.com is perfect for traders who prioritize speed and efficiency.

TD Ameritrade (Charles Schwab) - Best for Professional Traders With access to over 70 currency pairs and powerful tools like Thinkorswim, TD Ameritrade offers an excellent platform for serious traders.

#SureShotFX#SSF#Forex Broker#Forex Broker USA#Forex Broker Reviews#forex#forextrading#forex education#currency markets

0 notes

Text

Top 5 Online Forex Trading Platforms in India: A Comprehensive Review

The Indian forex market has seen explosive growth, with the number of active online traders hitting over 3 million in 2022. Many traders have found great success, turning a passion for finance into a profitable venture. However, this dynamic market offers both exciting opportunities and inherent risks.

Forex trading appeals to those seeking quick returns. But it's essential to understand the volatility involved. Choosing the right platform can make all the difference in trading success. This article reviews the top five forex trading platforms in India, evaluating them based on user experience, fees, features, and regulatory compliance.

Choosing the Right Forex Trading Platform: Key Considerations

Understanding Your Trading Needs: Beginner vs. Advanced Trader

Before selecting a platform, identify your trading style. Are you just starting, or have you been trading for years? Beginners may prefer platforms that offer educational resources. Seasoned traders might look for advanced tools and analytics.

Essential Features: Demo Accounts, Mobile Apps, Customer Support

Key features to consider include:

Demo Accounts: Practice trading without risking real money.

Mobile Apps: Trade on-the-go.

Customer Support: Access reliable help when needed.

Regulatory Compliance and Security: SEBI Regulations and Data Protection

Ensure the platform is regulated by the Securities and Exchange Board of India (SEBI). A trustworthy platform prioritizes data protection and follows legal guidelines, ensuring a safe trading environment.

MetaTrader 4 (MT4): A Trader Favorite

Platform Features and Functionality: Charting Tools, Indicators, Automated Trading

MT4 is one of the most popular forex trading platforms globally. It offers a range of features such as:

Advanced Charting Tools

Technical Indicators

Automated Trading Options

Pros and Cons of Using MT4 in India: Availability, Commission, and Support

Pros:

Easy to use for beginners.

Extensive resources and community support.

Cons:

Some Indian brokers charge higher commissions on MT4 trades.

Example: Successful Trade Story Using MT4

Many traders have successfully executed trades on MT4. For instance, a trader in Mumbai captured a 20% profit on a currency pair using automated trading features in just one week. Real stories like this highlight MT4's effectiveness.

TradingView: A Powerful Charting and Analysis Platform

In-depth Charting and Technical Analysis: Unique Features and Capabilities

TradingView is lauded for its in-depth charting capabilities. Users can analyze price movements in real time and customize charts to their liking.

Integration with Brokers: Connecting TradingView with Indian Brokers

You can link TradingView with various Indian brokers, allowing seamless trading directly from the platform, enhancing the overall trading experience.

User Reviews and Community Support: Analyze User Experiences

User reviews praise TradingView for its intuitive interface and robust community support. Many traders, both new and seasoned, value the platform's collaborative environment.

Gaining Access to Global Markets: Platforms Offering International Reach

Brokerage Options for International Trading: Highlight Major International Brokers with an Indian Presence

Several platforms offer international trading options, giving Indian traders access to global markets. Key brokers include:

IG Markets

OANDA

Forex.com

Understanding Currency Pairs and Global Market Dynamics: Educate on Global Market Influences

Understanding major currency pairs and how global news affects markets is crucial for success. Traders need a keen awareness of economic indicators that can impact exchange rates.

Regulatory Differences and Considerations: Highlight Potential International Regulatory Differences

When trading internationally, be aware of different regulatory environments. Each country has its own rules that may affect trading conditions and protections.

Choosing the Right Broker: Due Diligence and Risk Management

Spreads, Commissions, and Fees: Compare Fees Across Different Platforms

Fees can vary significantly among platforms. Be sure to compare spreads, commissions, and any other costs associated with your trades.

Leverage and Margin Requirements: Explain These Concepts and Their Risks

Leverage amplifies potential profits but also increases risks. A thorough understanding of margin requirements is necessary for effective risk management.

Risk Management Strategies for Forex Trading: Provide Actionable Tips

Establish a risk management plan. Utilize stop-loss orders and diversify your portfolio to mitigate risks.

Top 5 Forex Trading Platforms in India: A Comparative Table

Platform Fees Demo Account Mobile App Customer Support

5XTRADE Moderate Yes Yes 24/7

Trading View Varies Yes Yes Community-driven

IG Markets Low Yes Yes Excellent

OANDA Low Yes Yes 24/5

Forex.com Moderate Yes Yes Responsive

Conclusion: Your Journey to Successful Forex Trading in India

Each Forex trading platform offers its own advantages and disadvantages. MT4 stands out for its features, while 5XTRADE excels in analysis. Careful research and risk management are essential for success.

For new traders, focus on understanding your goals and trading style. Start small, practice with demo accounts, and only invest what you can afford to lose. This approach will pave the way for a successful journey in the Indian forex market.

#forex trading#best stock market trading platform in india#forex trading platform#stock trading in india

0 notes

Text

Best Currency Trading Brokers: How to Choose the Right One for You

Published By Smartfx Brokers | Dubai, UAE

Currency trading, also known as forex trading, involves buying and selling currencies to profit from fluctuations in exchange rates. It is one of the largest financial markets in the world, with trillions of dollars traded daily.

Understanding the dynamics of currency trading is crucial for any trader, as it allows them to navigate the market effectively, manage risks, and seize opportunities. The importance of having a reliable broker cannot be overstated, as they provide the necessary tools and resources to facilitate trading.

Key Factors to Consider When Choosing a Broker

When selecting the best currency trading broker, several key factors should be taken into account. Regulation is paramount; ensure the broker is licensed and regulated by a recognized authority to protect your funds.

Other important considerations include trading platforms, fees, spreads, leverage options, customer support, and the range of currency pairs offered. A broker with a user-friendly platform and low transaction costs can significantly enhance your trading experience.

Top Currency Trading Brokers in the Market

Some of the leading currency trading brokers include OANDA, IG Markets, and Forex Trading Online - No. 1 Forex Broker in the US* - FX Markets - FOREX.com US. These brokers are known for their robust trading platforms, competitive spreads, and excellent customer service.

When evaluating brokers, it's essential to consider user reviews and ratings, as well as the specific services they offer, such as educational resources and advanced trading tools. This will help you find a broker that aligns with your trading style and preferences.

Common Mistakes to Avoid in Currency Trading

Many new traders fall victim to common mistakes that can hinder their success in currency trading. One of the most significant errors is failing to develop a trading plan, which can lead to impulsive decisions and unnecessary losses.

Other pitfalls include over-leveraging, neglecting risk management strategies, and not keeping up with market news and trends. By being aware of these mistakes, traders can take proactive measures to avoid them and improve their trading outcomes.

Tips for Successful Currency Trading with Your Broker

To maximize your success in currency trading, it's vital to establish a clear trading strategy and stick to it. Utilize demo accounts offered by brokers to practice and refine your skills before trading with real money.

Additionally, maintain a disciplined approach to risk management, set realistic profit targets, and continuously educate yourself about the market. Engaging with your broker's support team and utilizing their resources can also provide valuable insights and enhance your trading knowledge.

Representative office

403, Building 6, Bay Square, Business Bay, Dubai, UAE. P.O. Box — 242644. Whatsapp Number: +971 58967 88712

#best forex broker in uae#forex broker#forextrading#stock trading#forex expert advisor#forex calendar#forex expo dubai

0 notes

Text

Top 10 Forex Brokers: A Comprehensive Guide for Traders

In the ever-evolving world of forex trading, selecting the right broker can significantly impact your trading success. With numerous options available, it’s crucial to identify brokers that offer the best services, reliability, and features tailored to your trading needs. In this article, we present the top 10 forex brokers that stand out in the industry, ensuring that traders have a reliable partner in their trading journey.

1. IG Group: A Leader in Forex Trading

IG Group is a well-established name in the forex trading space. With over 45 years of experience, IG provides a robust platform for both beginners and experienced traders. The broker offers a vast range of currency pairs, competitive spreads, and advanced trading tools. IG's regulatory compliance across multiple jurisdictions ensures that your funds are secure.

Key Features:

Regulatory Authority: FCA, ASIC, and NFA

Trading Platforms: Proprietary platform, MetaTrader 4 (MT4)

Account Types: Standard and premium accounts

Educational Resources: Webinars, tutorials, and market analysis

2. OANDA: An Innovative Trading Experience

OANDA has carved a niche for itself through its innovative technology and comprehensive trading services. Known for its excellent customer service and robust trading platform, OANDA caters to traders of all experience levels. It offers a wide selection of forex pairs and features like advanced charting tools and APIs for automated trading.

Key Features:

Regulatory Authority: FCA, CFTC, ASIC

Trading Platforms: OANDA’s proprietary platform and MT4

Account Types: Standard and premium accounts

Commission Structure: Transparent pricing with no hidden fees

3. Forex.com: A Trusted Forex Trading Platform

Forex.com, part of the GAIN Capital Holdings, Inc., is a well-respected broker providing an extensive range of trading options. With its user-friendly platform, Forex.com is ideal for both beginners and seasoned traders. The broker’s comprehensive research and analysis tools enable traders to make informed decisions.

Key Features:

Regulatory Authority: FCA, CFTC

Trading Platforms: Proprietary platform and MT4

Account Types: Standard and commission accounts

Research Tools: Daily market analysis and in-depth research reports

4. TD Ameritrade: A Comprehensive Trading Ecosystem

TD Ameritrade offers an extensive range of trading options, making it a popular choice for forex traders. The broker provides a powerful trading platform that integrates forex trading with other asset classes, allowing for a diversified investment strategy. The robust educational resources available make TD Ameritrade a great choice for novice traders.

Key Features:

Regulatory Authority: SEC, FINRA

Trading Platforms: thinkorswim, web-based platform

Account Types: Individual and joint accounts

Educational Resources: Extensive library of videos, articles, and tutorials

5. Pepperstone: Best for Low Costs

Pepperstone is renowned for its low-cost trading options and exceptional customer service. The broker is particularly appealing to active traders due to its tight spreads and high execution speed. Pepperstone offers various trading platforms, including MT4 and cTrader, catering to diverse trading preferences.

Key Features:

Regulatory Authority: ASIC, FCA

Trading Platforms: MT4, MT5, cTrader

Account Types: Standard and Razor accounts

Customer Support: 24/5 live chat and support

6. eToro: A Social Trading Pioneer

eToro has transformed the forex trading landscape with its unique social trading features. The platform allows traders to follow and copy the trades of successful investors, making it ideal for beginners. eToro also provides an array of educational resources and an easy-to-navigate platform.

Key Features:

Regulatory Authority: FCA, CySEC

Trading Platforms: eToro proprietary platform

Account Types: Retail and professional accounts

Unique Features: Social trading and copy trading functionalities

7. AvaTrade: A Global Trading Leader

AvaTrade is known for its wide range of trading instruments and comprehensive trading services. With a focus on providing a user-friendly experience, AvaTrade offers multiple trading platforms, including MT4 and its own web-based platform. The broker also features extensive educational materials to support traders.

Key Features:

Regulatory Authority: Central Bank of Ireland, ASIC, FSA

Trading Platforms: MT4, MT5, AvaTradeGo

Account Types: Standard and Islamic accounts

Market Analysis: Regular webinars and trading signals

8. XM: Excellent for Forex and CFDs

XM is recognized for its exceptional customer service and competitive trading conditions. The broker offers a vast selection of forex pairs and CFDs, catering to a wide range of trading strategies. XM provides educational resources to assist traders in navigating the forex market effectively.

Key Features:

Regulatory Authority: ASIC, CySEC

Trading Platforms: MT4, MT5

Account Types: Micro, Standard, and Zero accounts

Promotions: Various bonuses and trading incentives

9. FXCM: The Expert Trader's Choice

FXCM is a reputable broker that offers a robust trading platform with advanced features suitable for expert traders. With a wide variety of currency pairs and low spreads, FXCM provides traders with competitive trading conditions. The broker’s comprehensive market research and analysis tools are beneficial for strategic trading.

Key Features:

Regulatory Authority: FCA, ASIC

Trading Platforms: Trading Station, MT4

Account Types: Standard and Active Trader accounts

Research Tools: Extensive market analysis and news updates

10. Interactive Brokers: The Professional Trader's Platform

Interactive Brokers is a well-known broker that caters to professional traders and institutions. With low commissions and a wide array of trading instruments, Interactive Brokers is an excellent choice for serious traders. The platform offers advanced trading tools and resources for in-depth market analysis.

Key Features:

Regulatory Authority: SEC, FINRA

Trading Platforms: Trader Workstation (TWS), web-based platform

Account Types: Individual, joint, and institutional accounts

Educational Resources: Comprehensive trading courses and webinars

Conclusion

Choosing the right forex broker is essential for trading success. Each of the brokers listed above offers unique features, competitive pricing, and robust support to help traders navigate the forex market effectively. When selecting a broker, consider factors such as regulation, trading platform, and customer service to find the one that best suits your trading needs.

#forextrading#forex education#forex market#forex trading#forexsignals#investment#forex robot#forex#xauusd#forex expert advisor

0 notes

Text

Forex Broker Ratings 2024: Who Stands Out in the Market?

Forex Broker Ratings 2024: Who Stands Out in the Market?

As the forex market continues to grow and evolve, choosing the right broker becomes increasingly important for traders. With numerous brokers vying for attention, it can be challenging to determine which ones truly stand out. This article aims to provide an in-depth analysis of the top-rated forex brokers in 2024, highlighting their unique features and what sets them apart in the competitive market.To get more news about forex broker, you can visit our official website.

Key Criteria for Rating Forex Brokers When evaluating forex brokers, several key criteria are considered to ensure traders receive the best possible service:

Regulation and Security: A top-rated broker must be regulated by reputable financial authorities, ensuring a high level of security and trust for traders. Trading Platforms: The quality and reliability of trading platforms are crucial. Brokers offering advanced charting tools, real-time data, and a seamless trading experience are highly rated. Fees and Spreads: Competitive fees and tight spreads are essential for traders to maximize their profits. Brokers with low fees and tight spreads are more attractive to traders. Customer Support: Efficient and responsive customer support is vital, especially for new traders. Brokers offering 24/7 support and multiple contact options are preferred. Educational Resources: Comprehensive educational resources, including webinars, tutorials, and market analysis, are invaluable for traders looking to improve their skills and knowledge. Top-Rated Forex Brokers in 2024 Based on the above criteria, here are some of the top-rated forex brokers in 2024:

HFM (HotForex): HFM is renowned for its comprehensive trading solutions, competitive trading conditions, and strong regulatory framework. It offers a wide range of trading instruments, including forex pairs, commodities, indices, stocks, bonds, and cryptocurrencies. HFM’s advanced trading platforms, exceptional customer support, and educational resources make it a top choice for traders. XTB: XTB stands out with its robust and transparent trading environment. It offers advanced trading platforms, competitive spreads, and a wide range of trading instruments. XTB’s commitment to research and education makes it a preferred broker for both novice and experienced traders. Pepperstone: Known for its fast execution speeds and low average spreads, Pepperstone is a trusted broker regulated by multiple tier-1 authorities. It offers a variety of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, catering to different trading styles. IC Markets: IC Markets is praised for its low forex fees, tight spreads, and wide range of trading instruments. It offers advanced trading platforms and is regulated by several reputable financial authorities, ensuring a high level of security for traders. Fusion Markets: Fusion Markets is known for its low commissions and wide range of currencies. It offers a user-friendly trading platform and is regulated by multiple financial authorities, making it a reliable choice for cost-conscious traders. IG Group: IG Group offers a first-class web trading platform, superb educational tools, and a wide range of trading products. Its strong regulatory framework and commitment to customer support make it a top-rated broker in 2024. eToro: eToro is famous for its social trading feature, allowing traders to follow and copy the trades of successful investors. It offers a seamless account opening process and is regulated by multiple financial authorities, ensuring a secure trading environment. OANDA: OANDA is known for its great trading platforms, outstanding research tools, and fast, user-friendly account opening process. It is regulated by several reputable financial authorities, providing a high level of security for traders.

0 notes

Text

Currency Exchange Bureau Software Market Segmentation

The global market for currency exchange bureau software is expected to generate US$ 1.2 billion in sales by 2032, rising at a 6.4% CAGR. Market expansion will most likely be supported in the coming years by increased government support. The sector is expected to produce US$ 654.4 million in 2022.

The availability of multiple internet-based platforms for currency conversion between nations while ensuring the delivery of products and services in a centralised, secure environment is expanding the business. The availability of outright forward and currency options, as well as other technology advancements, paints a favourable picture for the growth of the currency exchange bureau sector.

As per the analysis, the software segment is anticipated to hold remunerative opportunities for the global currency exchange bureau software market. Various developing countries are making significant developments in their budgets, thereby, offering lucrative opportunities to players in the market.

To Get a Sample Copy of the Report Visit @ https://www.futuremarketinsights.com/reports/sample/rep-gb-14928

Key Takeaways:

By component, the software segment is expected to record a 6.5% CAGR by 2032

By enterprise size, the large enterprise segment to expand at a 6.6% growth rate during the forecast period

The U.S market to garner US$ 432.6 Million and record a 6.1% CAGR from 2022-2032

Market in China to procure US$ 86.8Million, expanding at a 5.7% growth rate during the assessment period

“Increasing use of currency exchange bureau software by various industry verticals such as travel agencies, BFSI, healthcare, resorts, hotels, and retail is expected to fuel the demand of currency exchange bureau software market over the forecast period” says an analyst at Future Market Insights

Competitive Landscape

Eminent players of the global currency exchange bureau software market include Currenex, OANDA, Currency Exchange International, Merkeleon, and Biz4x among others. Recent key developments among players include:

In November 2021-OANDA partners with CONVRS to enhance the account opening process and better engage with clients. The partnership will allow prospective traders in the emerging markets to open a demo account directly from a wide range of messaging apps, making the process simpler than ever. The new integration also enables OANDA to converse with prospects and clients through Facebook Messenger, WhatsApp, LINE, Telegram, and SMS in 53 languages.

In November 2021 – State Street Corporation announced its GlobalLink Division that will combine its Currenex and TradeNeXus into a single platform called GlobalLink FX. Bringing the three businesses together will result in significant benefits for clients including FXConnect Market Monitor, an improved price discovery tool for FXConnect buy-side clients. This enhancement will utilize Currenex streaming price feeds and market data in order to provide clients with a curated view of their liquidity providers, driving better decision-making and execution outcomes.

Request for Methodology: https://www.futuremarketinsights.com/request-report-methodology/rep-gb-14928

More Valuable Insights

Future Market Insights, in its new offering, presents an unbiased analysis of the global currency exchange bureau software market presenting a historical analysis from 2015 to 2021 and forecast statistics for the period of 2022-2032.

The study reveals essential insights on the basis of component (Software, Services) by enterprise size (Small and Medium Enterprise (SMEs), Large enterprises) by Application (Personal, business), and Region (North America, Europe, APAC, Middle East & Africa, and Latin America)

Key Segments Covered in the Currency Exchange Bureau Software Industry Survey

Currency Exchange Bureau Software Market by Component:

Currency Exchange Bureau Software

On-Premises

Cloud

Currency Exchange Bureau Services

Managed Services

Professional Services

Currency Exchange Bureau Software Market by Enterprise Size:

Currency Exchange Bureau Software for Small and Medium Enterprise (SMEs)

Currency Exchange Bureau Software for Large Enterprises

Currency Exchange Bureau Software Market by Application:

Currency Exchange Bureau Software for Personal Applications

Currency Exchange Bureau Software for Business Applications

Currency Exchange Bureau Software Market by Region:

North America Currency Exchange Bureau Software Market

Europe Currency Exchange Bureau Software Market

APAC Currency Exchange Bureau Software Market

The Middle East & Africa Currency Exchange Bureau Software Market

Latin America Currency Exchange Bureau Software Market

0 notes

Text

Currency Meter V5

Currency Meter V5

Currency Meter V5.0 Download

Currency Meter V5.0 Free Download

Currency Meter V5.0

Jan 09, 2021 Currency Strength Meter V5.0-Ultimate Guide and Tutorial. Determining that stock markets with more easy charge with switch is usually even more crucial for you to people as compared to determining that stock markets that create continued to be the majority constantly robust and weakly.

Free Forex Currency Strength Meter Downloads

. Currency meter. Any currency meter can do. I have designed my own. I will use it to post daily market overview here. My V5-Trend indicator. PM me with you email and I will send it to you. A support and resistance indicator. (Any non-lagging pivot system) I have designed my own. If you notice, I do not use off the shelf indicator.

See 1 hr, 4 hr, 1 day, 1 week and 1 month strenghts data side-by-side. Our unique and one-of-a-kind online interface gives you a quick and simple overview of currency strengths for 8 major currencies in a bar-chart style meter. Five timeframes are shown side-by-side. Bookmark the page and come back any time you want to make a trading decision.

Currency Strength Meter is a software used to verify and monitor the currency strength of various countries. With it you can keep an eye on your investments and make plans for others, taking into account the rates of the stocks and currencies.

This is the FXMCSM FX Multi Currency Strength Meter, FX Gold Silver and Commodities, FX Trade Signals, FX Multi Currency Scalper, FX Multi Currency Buyers and Sellers Trader and the FX Multi Currency Analyser / Robot FREE download page, to use with your brokers Metatrader 4 and 5 platforms. Just click on the 'Click to Download' button, and wait a few moments while your download is being prepared, and then click the save button to download the installation setup files to your Windows computer download folder. No credit card, or an email address is required to download Full installation instructions can be found on the individual software pages, located from the menu options above, or by clicking on the software screenshots images to the right.

FX Multi Currency Strength Meter

The FXMCSM FX Multi Currency Strength Meter is used with the Metatrader 4 currency trading platform and analyses the major eight currencies AUD, CAD, CHF, EUR, GBP, JPY, NZD and USD and all the associated 28 currency pairs AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY.

MT4 FX Multi Currency Strength Meter

Save MT4 FX Multi Currency Strength Meter File

MT5 FX Multi Currency Strength Meter

Save MT5 FX Multi Currency Strength Meter File

FX Gold Silver Commodities Strength Meter

The FXGSCSM FX Gold Silver Commodities Strength Meter is used with the Oanda MT4 currency trading platform and analyses the major eight currencies AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD and USD and all the associated 29 currency pairs with Gold, Silver and Commodities.

MT4 FX Gold Silver Commodities Strength Meter

Save MT4 FX Gold Silver Commodities Strength Meter File

MT5 FX Gold Silver Commodities Strength Meter

Save MT5 FX Gold Silver Commodities Strength Meter File

Currency Meter V5

FX Trade Signals

The FXTS FX Trade Signals application is used with the Metatrader 4 currency trading platform and analyses the major eight currencies AUD, CAD, CHF, EUR, GBP, JPY, NZD and USD and all the associated 28 currency pairs AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY.

MT4 FX Trade Signals

Save MT4 FX Trade Signals File

MT5 FX Trade Signals

Save MT5 FX Trade Signals File

FX Multi Currency Analyser Robot

The FXMCA FX Multi Currency Analyser and/or Robot is used with the Metatrader 5 currency trading platform and analyses the major eight currencies AUD, CAD, CHF, EUR, GBP, JPY, NZD and USD and all the associated 28 currency pairs AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY.

MT5 FX Multi Currency Analyser Robot

Save MT5 FX Multi Currency Analyser Robot File

FX Multi Currency Scalper

The FXMCA FX Multi Currency Scalper is used with the Metatrader 5 currency trading platform and trades with price action, the major eight currencies AUD, CAD, CHF, EUR, GBP, JPY, NZD and USD and all the associated 28 currency pairs AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY.

MT5 FX Multi Currency Scalper

Currency Meter V5.0 Download

Save MT5 FX Multi Currency Scalper File (x64)

Currency Meter V5.0 Free Download

FX Multi Currency Analyser Buyer and Seller Trader

Currency Meter V5.0

The FXMCBS FX Multi Currency Buyer and Seller Trader application is used for Algorithmic Currency Trading with the MetaTrader 5 currency trading platform and analyses the major eight currencies AUD, CAD, CHF, EUR, GBP, JPY, NZD and USD, based on Forex tick volume, using all the associated 28 currency pairs AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY.

MT5 FX Multi Currency Analyser Buyer and Seller Trader

Save MT5 FX Multi Currency Seller and Buyer Trader File

1 note

·

View note

Text

Forex brokers offering high leverage allow traders to control larger positions with a smaller amount of capital, which can potentially amplify profits. However, high leverage also increases the risk of significant losses. Some brokers that are well-known for providing high leverage include IC Markets, which offers leverage up to 1:500, giving traders the ability to take on larger positions with relatively small margins. Another notable broker is XM, offering leverage of up to 1:888, which is among the highest in the industry. OANDA and FXTM also provide competitive leverage, with OANDA offering leverage of up to 1:50 in the U.S. and up to 1:200 in other regions, while FXTM provides leverage as high as 1:1000 for certain accounts. While these high-leverage options can be appealing, it is essential for traders to exercise caution and use proper risk management strategies to avoid catastrophic losses. It's also important to check the regulatory environment, as some jurisdictions have imposed restrictions on leverage to protect traders.

0 notes

Link

The broker offers two types of live trading accounts that are standard and premium accounts along with a demo account. Traders can trade on Oanda Trade, which is their own trading platform. Apart from this, the other options are WebTrader and Mobile App powered by MetaTrader 4.

It is an award-winning broker that requires 0 dollars as a minimum deposit to start trading. The broker also offers many different types of technical indicators and research tools for traders. It includes AutoChartist, webinars, trading signals, and various others.

This broker is also one of the best forex and CFD broker, which means you can trade CFDs with this provider.

Is Oanda Scam or a Safe Broker?

Oanda is considered to be a safe broker because the same is protected by the Secure Sockets Layer (SSL). Also, the trading platform is encrypted, which means your data is completely safe with the broker. The broker is regulated also to ensure all the transactions are monitored by the regulatory body.

All these practices make sure that you do not have to face any trouble trading with the broker. The broker also offers CFD trading and CFDs are complex instruments. There is a high risk of losing money when trading CFDs.

Account Types of Oanda

There are three different types of accounts available for trading with this broker. Out of which one is a demo trading account and the other two are live trading accounts. The types of accounts include:

Demo Account

A demo account is for newbie traders so that they can get the live trading experience. Traders can start trading without making any deposit in the trading account. This is to eliminate the risk of losing money in the open market. Therefore, it is advised to all the traders to start their trading career with a demo account only.

1 note

·

View note

Link

Online trading can generate good returns for your investment. This is the reason why millions of people across the world are indulging in it. There are several online brokers but you have to select a broker after a thorough analysis. Traders can see the results between Forex.com vs Oanda below. Each point is covered to assist them to select the best broker. Apart from these two, Capixal is a more reliable option for online trading in leading financial markets.

1 note

·

View note

Text

Checkout 6 Financial point Advice with Best Broker Solutions adviser

Possible for Capital Growth

Small Capital Protection

Investment in Best Share

Medium Term in short Period

Access to Capital Till The Term

Investment Summary and Spot Indices

Feature of these 6 Financial point which Mention Above

The Kick Out Bond 6 is an innovative new Investment Solution designed for investors who would like to invest in a Structured Retail Product that ofers attractive potential investment returns linked to the performance of best Shares and also for investors looking for a risk-reducing mechanism to supply a level of protection from regular stock exchange risk. The Bond is suitable as part of the process of constructing a genuinely diversified investment portfolio.

Overview of Key Features

The Kick Out Bond 6 (the Bond) is a fresh new Investment Solution intended for investors who want to purchase a Structured Retail Product which ofers attractive possible investment returns connected to the operation of 3 Oil stocks; and also for investors seeking a risk-reducing mechanism to supply a level of protection from regular stock exchange risk. The Bond is appropriate within this practice of building an extremely diversified investment portfolio.

The Underlying Investments of This Bond are large Oil Company Stocks or Shares as follows:

Investors at the Bond Possess their Capital at Risk.This means That You Might lose some or All the funds invested in this Bond. Broker Solutions believes the Bond to have a Summary Risk Indicator of 5 to its own danger scale

Investors Profit from a Sof Capital Protection Attribute provided by rforex Pvt Ltd. Investors will get back their first capital if some of those 3 stocks is over its initial level in the Final Valuation Date. If all 3 stocks are under their initial amount and some 1 share has dropped by 45 percent or more in the Final Valuation Date, investors will receive the Operation of their worst acting share, no matter how far it’s dropped

The Potential Return is 10 percent afer 1 year old. If all 3 stocks are over 90 percent of the first degree i.e. all 3 stocks have Risen or fallen in value by less than 10 percent, investors will get back their first capital and a yield of 10 percent. Otherwise, but All 3 stocks are over 90 percent of the first level afer 18 weeks, investors will get back their first capital and a This Method continues every 6 weeks (with the yield increasing by 5 percent ) until all of 3 stocks are over 90 percent of the first level or until adulthood.

The Bond will be listed on the Luxembourg Stock Exchange.Taxation: Our understanding is that the potential returns will be subject to Capital Gains Tax (CGT) in the case of

Knowledge & Experience

Investors Using one or more of the following Attributes:Limited Understanding of their financial markets and investment Tools (a simple investor is able to make an educated investment Decision based on the recommendations of a Financial Broker or other controlled Advisor

No investment Don’t have idea rforex Group help you to invest

Normal knowledge of Their financial markets and investment Tools (an educated investor may make an educated investment Decision based on the recommendations of a Financial Broker or other controlled Advisor) Some Investment Experience (made prior investments).

• Good Understanding of Their financial markets and investment Tools (an innovative investor can make an educated Investment choice based on own knowledge and the information Of a Financial Broker or other controlled Advisor). Expertise (made multiple preceding investments) or in Receipt of optional portfolio management services. Personal Investors and exempt from tax in the case of Pension and Post Retirement Investors

Customer Friendliness

In terms of evaluation the client friendliness of every stage, it seems that Oanda’s platform will choose the best place. The trading graphs are above average and assembled right into the platform. Though every one the platforms have a number of whistles and bells, simplicity of navigation has to be present to win the best place. For Instance, If you exchange based on the launch of particular economic news events. You will undoubtedly discover it requires less time to install on Oanda than it will on the other two platforms. Time is of the essence from the fast news trading atmosphere. Based on the kind of dealer you are–information trader, short term, longterm, etc.–you might not need the majority of the features provided on some of the 3 platform

1 note

·

View note

Text

Top USA Forex Brokers: Your Guide to the Best in the Market

Top USA Forex Brokers: Your Guide to the Best in the Market The forex market is the largest financial market in the world, with a daily trading volume exceeding $7.5 trillion. For traders in the United States, finding a reliable and trustworthy forex broker is crucial. This guide will help you navigate the top forex brokers in the USA, ensuring you make an informed decision.To get more news about forex broker, you can visit our official website.

Regulatory Environment In the United States, forex brokers must be registered as Retail Foreign Exchange Dealers (RFED) with the Commodity Futures Trading Commission (CFTC) and regulated by the National Futures Association (NFA). This regulatory framework is designed to protect traders from scams and ensure a fair trading environment.

Top Forex Brokers in the USA OANDA: OANDA is renowned for its competitive spreads, extensive range of currency pairs, and top-notch trading platforms. It is considered the best overall broker for US-based traders due to its combination of low trading costs and excellent customer support.

Interactive Brokers: This broker is ideal for professional traders due to its advanced trading platforms and low fees. Interactive Brokers also offers a wide range of financial products, including forex, stocks, and options. tastyfx: Tastyfx is highly trusted and offers a user-friendly platform, making it a great choice for beginners. It is known for its transparency and reliability. TD Ameritrade: An award-winning broker, TD Ameritrade offers a robust trading platform and a wide range of investment products. It is well-regarded for its customer service and educational resources. IG: IG is known for its competitive fees and spreads. It offers a comprehensive trading platform and a wide range of currency pairs, making it a popular choice among US traders. Factors to Consider When Choosing a Forex Broker When selecting a forex broker, consider the following factors:

Regulation: Ensure the broker is regulated by the CFTC and NFA. Trading Costs: Compare spreads, commissions, and other fees. Trading Platforms: Look for user-friendly and feature-rich platforms. Customer Support: Choose a broker with reliable and accessible customer service. Educational Resources: Opt for brokers that offer educational materials and tools to help you improve your trading skills. Conclusion Choosing the right forex broker is essential for a successful trading experience. The brokers listed above are among the best in the USA, offering a combination of reliability, competitive trading costs, and excellent customer support. By considering the factors mentioned in this guide, you can make an informed decision and find a broker that meets your trading needs.

0 notes

Text

Best Brokers for Forex in 2019

The most actively traded financial market is also known as the Forex market or the global foreign exchange market. No matter you are a beginner or expert in this field, you need to monitor and evaluate some key features and settlements while looking for the best brokers for Forex trading. Some features that you need to look for are, trading platforms, which include software, web-based, charting, mobile and third-party platforms, as well as fees, which cover spreads and commissions along with customer support, trading education, trustworthiness, and currency research.

Let’s have a brief overview of the top brokers from around the world.

OANDA

OANDA is one of those pioneers of the retail Forex industry, who were the earliest and who had rooted in academia as the company built the reputation, technology, product offerings, and customer base. OANDA is one of the only Forex brokers, which serves the customers all over the U.K., Canada, Singapore, and Australia. Since the company starts in the 1990s, OANDA has emerged as the forefront retail Forex that offers the up to date trading technology and services to a worldwide customer base.

Well, the plus point of OANDA is the fact that you need a minimum of $0 for live accounts and it’s not a common feature of every kind of broker. Besides, the company is well known for its quality trade execution and transparency while adjusting prices and fees. Lastly, OANDA has extended focus on trading technology including its ownership web-based and desktop platforms along with MetaTrader 4 and mobile options.

Forex.com

It is the leading brand of visibly traded GAIN Capital (GCAP) from one of the first on scene Forex specific brokers. From past few years, Forex.com has quite a few businesses, and some of them are in the U.K. it includes a well-established Forex, CFD, and spread-betting company, because of current and some more acquisitions, GAIN Capital has now been able to get customers from all over the world.

However, it also considers as an industry leader in most of the markets, which includes the U.S., where it recently has limit out one of its main competitor, OANDA, in terms of customer’s assets. Forex.com has proudly featured with access to Forex, indices, bonds, cryptocurrency, shares, and commodity CFDs.

Similarly, it also has custom web and client trading platforms along with MT4. It has been making coverage by means of a research team for U.S., Asian, and European markets.

Pepperstone

Based out of Melbourne, Pepperstone is an Australian broker. Through multiple platforms, it provides full-featured, competitive trade execution, which includes browser-based entry, MetaTrader 4, and mobile devices. Customers are allowed to choose from 80 tradable tools in 72+ asset classes all over the world by having various ranges of account types. Moreover, these include active trader benefits as well as commission-free execution. Minimum deposit of a $200 supports small trading account, extensive research and educational resources that can build skill levels of users and provide profit opportunity recognition.

Bottom Line

While concluding the top Forex brokers of 2019, you must have clear up your mind about the above brokers. Whether you choose them or not but at least you are familiar now to these brokers, which can help you in future, indeed.

#Brokers Forex#Forex broker#Best Forex Brokers in USA#forex#forex trading#forex market#what is forex#best us forex brokers#best forx brokers#forex broker platform

1 note

·

View note

Photo

New Post has been published on https://coinprojects.net/best-cryptocurrencies-to-buy-as-bitcoin-price-rebounds/

Best cryptocurrencies to buy as Bitcoin price rebounds

Cryptocurrency prices have made a strong bullish recovery in the past few days. Bitcoin surged to over $20,000, which was the highest level since early this month. It has risen by more than 13% from the lowest level this month. Here are the best cryptocurrencies to buy as prices bounce back.

Ethereum

Ethereum price rose sharply this week. It managed to rise to a high of $1,556, which was the highest level since September 15. It has surged by more than 25% from the lowest point in September.

Ethereum is a good cryptocurrency to buy because of its strong correlation with Bitcoin and its strong market share in key industries. For example, it has a strong stake in Decentralized Finance (DeFi) and Non-Fungible Token (NFT).

Ethereum has another catalyst. The developers are working on the next big update known as Shanghai which is expected to go live in 2023. The upgrade will bring new functionalities in the Ethereum Virtual Machine (EVM). It will also implement staked withdrawals.

Oanda

OANDA is the trusted name for Forex and CFD trading. Since 1997 OANDA has established a reputation for fair and transparent pricing and responsive customer service. Easy account opening process.

Buy ETH with Oanda today

Disclaimer

Pacific Union

Since being founded in 2015, Pacific Union has grown into a world-leading online broker. We offer 200+ products, whilst delivering an innovative trading facility for assets such as forex, indices, commodities, shares and cryptocurrencies. As a service-focused, global online trading brokerage, we provide multilingual services to 120 countries and regions.

Buy ETH with Pacific Union today

Disclaimer

Cosmos ATOM

Cosmos is one of the biggest blockchain projects in the world. It makes it possible for developers to build quality interconnectedness applications. Some of the top apps in its ecosystem are Cronos, ThorChain, and Osmosis.

ATOM price has risen by more than 20% from its lowest point in October. The next key catalyst for Cosmos will be the upcoming launch of the second version of Cosmos. This version will introduce staking in its ecosystem and more functionalities. The most important functionality will be on liquid staking, which will help to secure other platforms.

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600.

Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

Buy ATOM with Binance today

Coinbase

Coinbase is a global cryptocurrency exchange. Its platform is well designed for beginner investors and it offers a wide range of coins, as it has over 100 to choose from.

Coinbase has high level security built into the platform, a range of diverse features to use and it offers its users options for storing their crypto, such as being able to store coins on the Coinbase exchange.

Buy ATOM with Coinbase today

Disclaimer

Chainlink

Chainlink is a leading oracle network that makes it possible for developers to bring data from off-chain and on-chain. As such, it is widely used in decentralized finance (DeFi), where it is used by leading platforms like Aave and Uniswap.

Chainlink price has also risen by double-digits in the past few days as cryptocurrencies and DeFi rebound. Like with Cosmos, Chainlink has a catalyst that could push its price higher. First, its developers are working with Swift, the giant payment network.

Second, Chainlink price will also react to the upcoming launch of Chainlink 2.0. The new upgrade will change Chainlink into a decentralized oracle network (DON). As a result, it will become possible to power decentralized smart contracts on any blockchain. It will also introduce staking.

Plus500

Plus500 is a leading provider of Contracts for Difference (CFDs), delivering Leveraged trading on +2,000 financial instruments, including Forex, Commodities, Indices, Shares, Options and Cryptocurrencies. CySEC license number (#250/14)

Buy LINK with Plus500 today

Disclaimer

FP Markets

FP Markets combines metals, indices connectivity and award-winning execution speed with institutional-grade liquidity to provide traders consistently tighter spreads and unparalleled trading conditions. FP Markets offers Forex, Equities, Commodities, Cryptocurrency, Futures and Index CFDs all from one account.

Buy LINK with FP Markets today

Disclaimer

Share this articleCategoriesTags

Source link By Crispus Nyaga

#Altcoin #Binance #Bitcoin #BlockChain #BlockchainNews #BNB #Crypto #CryptoExchange #ETH #Etherium

#Altcoin#Binance#Bitcoin#BlockChain#BlockchainNews#BNB#crypto#CryptoExchange#ETH#Etherium#Blockchain#CryptoPress

0 notes

Text

Commodity trading has been an integral part of the global financial landscape for centuries. It provides investors with opportunities to profit from the price movements of raw materials such as oil, gold, and agricultural products. To navigate this dynamic market, traders rely on commodity trading platforms and brokers. In this article, we will explore some of the best options available for those looking to engage in commodity trading. Here are the best commodity trading platforms in 2023: Interactive Brokers – A leading international commodity broker TD Ameritrade – Commodity broker with one of the longest track records IG – One of the leading commodity broker companies Plus500 – A streamlined commodity trading experience E*TRADE – A Morgan Stanley-backed trading platform OANDA – Commodity brokerage with no minimum deposit AvaTrade – A user-friendly commodity trading platform TradeStation – A futures trading galore for commodity investors The 8 best commodity trading platforms: Examining the top commodity brokers for 2023 In the following sections, we are going to examine the best commodity brokers available in the market today. Keep in mind that the platforms included on our list support various commodities trading approaches, from spot and ETF commodity instruments to futures and options commodities markets. 1. Interactive Brokers – A leading international commodity broker Interactive Brokers is a powerhouse in the world of commodity trading. With an extensive array of offerings, including metals, energy commodities, and agricultural futures contracts, it caters to traders looking for diversification in their portfolios. What sets Interactive Brokers apart is its commitment to providing advanced trading tools and technology. These tools empower professional traders to make well-informed decisions and execute trades with precision, making the platform not only one of the best CFD trading platforms but one of the best trading platforms overall. Low fees are a significant advantage, allowing traders to maximize their returns. Interactive Brokers also offers access to global markets, making it an ideal choice for those who want to venture beyond their local markets. For traders seeking a robust platform with an emphasis on research and analysis, Interactive Brokers stands as a top-tier option. Key features: Offers a wide range of commodities, including metals, energy, and agricultural products Known for advanced trading tools and low fees, making it ideal for professional traders Provides access to global markets, allowing for diversification Interactive Brokers' Trader Workstation platform is a bit complex for beginners, but it is highly customizable and offers a wide range of features for experienced traders Interactive Brokers offers a mobile app for commodity traders Founded 1978 Trading Fees Starting from $0.25 per contract (depending on monthly volume) Leverage Up to 50x Minimum Deposit $0 Visit Interactive Brokers 2. TD Ameritrade – Commodity broker with one of the longest track records TD Ameritrade is synonymous with reliability and accessibility, serving traders for more than 52 years. The platform excels in providing a user-friendly experience, making it an excellent choice for traders, both new and experienced. What sets TD Ameritrade apart is its commitment to education. It offers a wealth of educational resources, including webinars, articles, and video tutorials, enabling traders to enhance their skills. The reputation of TD Ameritrade as a trustworthy broker has been built over years of delivering excellent customer service. Its reliability and transparent fee structure make it a preferred choice for many traders who seek a platform that caters to their needs while ensuring a smooth trading experience. Key features: One of the oldest commodity trading platforms in the U.S. Solid reputation for reliability and customer service Offers educational resources to help traders learn and grow User-friendly platform suitable for beginners

Founded 1971 Trading Fees $2.25 fee per contract (plus exchange & regulatory fees) Leverage Up to 50x Minimum Deposit $50 Visit TD Ameritrade 3. IG – One of the leading commodity broker companies As a global leader in online trading, IG offers a comprehensive suite of commodities futures trading options. From precious metals to energy commodities, it covers a broad spectrum, allowing traders to diversify their portfolios effectively. What makes IG stand out is its commitment to research and analysis. Traders have access to extensive market research, live data, and analysis tools, empowering them to make informed decisions. IG’s platform is intuitive, catering to traders of all levels, from beginners to experts. Whether you're a seasoned trader seeking in-depth insights or a newcomer looking for user-friendly trading, IG provides a well-rounded experience for all. Key features: Offers access to a diverse range of commodities, including spot and futures markets Provides a user-friendly platform for traders Part of a global leader in online trading Traders can attach a guaranteed stop to cap their risk A fully regulated FTSE 250 company Founded 1971 Trading Fees Overnight funding Leverage Up to 10x Minimum Deposit $0 Visit IG 4. Plus500 – A streamlined commodity trading experience Plus500 is a leading online trading platform that offers a wide range of financial instruments, including commodities. Commodities are raw materials that are traded on exchanges, such as oil, gold, silver, and agricultural products. Plus500 allows traders to speculate on the price movements of commodities using contracts for difference (CFDs). CFDs are financial derivatives that allow traders to take long or short positions on an asset without owning it outright. This gives traders the ability to profit from both rising and falling prices. Key features: A wide range of commodity CFDs, including precious metals, energy, and agricultural instruments A number of risk management tools, such as stop-loss and take-profit orders, to help traders manage their risk A demo account that allows traders to try out the platform and practice trading without risking any real money Leverage of up to 1:30 on commodity CFDs (up to 150x for professional accounts) Founded 2008 Trading Fees 0.02% to 0.40% + 1.0 (markup x volume) Leverage Up to 30x (up to 150x for professional accounts) Minimum Deposit $100 Visit Plu500 5. E*TRADE – A Morgan Stanley-backed trading platform E*TRADE has established itself as a trusted name in commodity trading. With a strong presence in the market, it offers a variety of commodities for traders to explore. What sets E*TRADE apart is its commitment to providing a range of tools and educational materials. Traders can access market insights, research reports, and educational resources to hone their trading skills. E*TRADE caters to both beginners and experienced traders, making it a versatile choice. Its user-friendly platform ensures ease of use, while its commitment to educating traders helps them grow and adapt in the ever-changing world of commodity trading. Key features: Well-established brokerage with a strong presence in commodity trading Offers a range of tools and educational materials for traders Suitable for both beginners and experienced traders Owned by international investment banking giant Morgan Stanley Founded 1982 Trading Fees $1.50 per futures contract, $0.65 per options contract Leverage Up to 50% of your eligible equity Minimum Deposit $0 Visit E*TRADE 6. OANDA – Commodity brokerage with no minimum deposit OANDA is a go-to option for those interested in forex and commodity trading. Known for its competitive spreads and advanced charting tools, it offers a robust trading experience. OANDA is particularly popular among currency and commodity traders, thanks to its focus on providing access to global markets. What makes OANDA unique is its emphasis on transparency. Traders can access detailed pricing information and historical data, enabling them to make data-driven decisions.

With a user-friendly platform and a reputation for reliability, OANDA is a solid choice for those looking to explore the world of currency and commodity trading. Key takeaways: Offers CFDs on over 30 different commodities, including gold, silver, oil, natural gas, wheat, corn, and soybeans. Competitive spreads on all of its commodity CFDs A reliable choice for commodity and forex trading Popular among currency and commodity traders Founded 1982 Trading Fees Margins from 5% Leverage Up to 20x Minimum Deposit $0 Visit OANDA 7. AvaTrade – A user-friendly commodity trading platform AvaTrade caters to traders of all experience levels with its user-friendly platform and commitment to education. It offers a variety of commodities for traders to explore, making it suitable for both beginners and seasoned professionals. One of AvaTrade's strengths is its dedication to helping traders develop their skills. Through educational resources, webinars, and market analysis, traders can stay informed and make confident decisions. AvaTrade's platform is designed for ease of use, making it accessible to those new to the world of commodity trading. Key features: Known for powerful trading tools and technology Offers a wide selection of commodities and is popular among active traders Provides robust analysis tools for technical traders Application for Android and iOS devices Founded 2006 Trading Fees Overnight fee, inactivity fee ($50), administration fee ($100) Leverage Up to 30x Minimum Deposit $100 Visit AvaTrade 8. TradeStation – A futures trading galore for commodity investors TradeStation is synonymous with powerful trading tools and technology. It offers a wide selection of commodities and is a preferred choice for active traders. What sets TradeStation apart is its focus on providing advanced analysis tools for technical traders. Traders who rely on technical analysis will find TradeStation's tools invaluable. The platform offers in-depth charting capabilities, customizable indicators, and automated trading options. For those who thrive on data-driven decision-making, TradeStation is a compelling choice. Key features: Known for powerful trading tools and technology Offers a wide selection of commodities and is popular among active traders Provides robust analysis tools for technical traders Supports cryptocurrency trading A simulated trading account Founded 1982 Trading Fees $1.50 per contract ($0.50 per micro futures contract) Leverage Up to 35x Minimum Deposit $0 Visit TradeStation Commodity trading FAQs Which broker is best for commodity? The best broker for commodity trading is Interactive Brokers. The platform offers a wide range of commodities, including metals, energy, and agricultural products. In addition, Interactive Brokers is known for advanced trading tools and low fees. What is the best commodity trading platform for beginners? The best commodity trading platform for beginners is TD Ameritrade. It boasts a user-friendly interface and allows new traders to get familiar with futures, stocks, and other trading strategies using interactive courses and in-depth articles. Is trading commodities profitable? Whether or not trading commodities is profitable depends on a number of factors, including the trader's skill and experience, the market conditions, and the specific commodities being traded. Are commodities better than forex? Whether commodities are better than forex depends on your individual investment goals and risk tolerance. Commodities can be a good investment for those who are looking to hedge against inflation or diversify their portfolio. They can also be a good way to profit from rising demand for certain commodities. Forex can be a good investment for those who are looking to profit from currency fluctuations. It can also be a good way to hedge against foreign exchange risk. The bottom line: Investing in commodities can be a great way to diversify your portfolio Commodity trading can be a valuable

addition to an investment strategy, offering diversification and potential profit opportunities. However, it's essential to be aware of the risks associated with this market, including regulatory changes. When choosing a commodity trading platform or broker, consider your level of experience, trading preferences, and the range of commodities you wish to trade. Each platform has its strengths and weaknesses, so take the time to research and select the one that aligns with your goals. If you want to expand your trading activity to If you prefer trading physical financial instruments over commodities, you can consider investing in stocks. For more investment ideas, explore our selection of the best stocks to invest in in 2023, or invest in the top long-term dividend stocks if you prefer a steady income flow.

0 notes