#mt4 forex broker

Text

The Leading MT5 White Label Solutions in the market.

Start your new MT5 White Label with ForexBrokerageSetup

Now at an extremely affordable and convenient price you can run your forex company with the most popular trading software available in the market. Add proprietary software and premium packages to the platform to grow the company even faster.

Discover Our MT5 White Label Solution’s Key Benefits:

Completely branded and optimized,

Availability of A — Book and B-book executions,

A wide range of available tools,

Low cost, price transparency,

Tools to support your business.

Get In Touch

Phone : +44 7362 055687

Email: [email protected]

#finance#trading strategy#forextrading#mt5 brokers#mt4 trading platform#mt5trading#forex#forexnews#forexbroker#forexmarket

2 notes

·

View notes

Text

The Difference Between An STP Forex Broker And ECN Forex Broker

Well, STP stands as the straight through processing .Where forex brokerage model involves sending client orders directly to the market without passing them through a dealing desk. A STP forex broker is a forex brokerage firm that provides wholesale forex services orders to institutional traders.

#forex#broker#ECNbroker#trader#forexbroker#STP#STPforex#xtreamforex#services#traders#forextrading#market#selling#MT4#MT5#platform

3 notes

·

View notes

Text

Latency in Forex Trading

In the realm of forex trading, where split-second decisions can make or break a trade, understanding the concept of latency and its implications is paramount. In this comprehensive guide, we'll delve into the intricacies of latency, explore its significance in forex trading, and discuss how traders can leverage it to optimize their trading strategies and maximize profits.

What is Latency in Forex Trading?

Latency, in the context of forex trading, refers to the time it takes for a trading signal to travel from a trader's platform, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), to the broker's server and back. It encompasses the entire process of order transmission, execution, and confirmation. Even milliseconds of delay in this process can have a significant impact on the outcome of a trade.

The Impact of Latency on Trading Performance

The primary impact of latency on trading performance is manifested through slippage. Slippage occurs when the price at which a trade is executed differs from the price at which it was intended due to delays in order processing. In fast-moving markets, where prices can change rapidly, slippage can erode profits and result in unexpected losses.

Furthermore, latency can affect the effectiveness of trading strategies, especially those reliant on high-frequency trading (HFT) or algorithmic trading. These strategies require rapid execution of orders to capitalize on fleeting market opportunities, and any latency in order transmission can diminish their efficacy.

Understanding Latency in Milliseconds: A Detailed Analysis

To gain a deeper understanding of latency, let's examine it in terms of milliseconds, the unit of measurement commonly used in assessing latency in forex trading. A latency of just a few milliseconds can make a substantial difference in trading outcomes, particularly in highly competitive markets.

At Forex Cheap VPS, we provide a latency table that offers insight into the response times of various brokers' servers across different geographical locations. This information allows traders to select the most suitable VPS package based on their latency requirements. Our data centers are strategically located in major financial hubs like London, New York, Montreal, and Amsterdam, ensuring minimal latency and optimal trading conditions.

Choosing the Right VPS Provider: Key Considerations

Selecting the right VPS provider is crucial for achieving low latency and maximizing trading efficiency. When evaluating VPS providers, traders should consider factors such as server location, hardware infrastructure, network connectivity, and customer support.

Cheap Forex VPS offers state-of-the-art infrastructure, including dedicated servers equipped with the latest hardware support systems. Our data centers are strategically positioned to minimize latency and ensure seamless order execution. Additionally, our expert support team is available 24/7 to assist traders with any technical issues or inquiries, ensuring a smooth trading experience.

Eliminating Slippage with Ultra-Low Latency Solutions

By maintaining ultra-low latency, traders can effectively eliminate slippage-related issues and execute trades with precision and speed. Our VPS solutions are designed to provide the reliability, security, and speed necessary for seamless trading operations. With Cheap Forex VPS, traders can trade with confidence, knowing that their orders will be executed swiftly and accurately.

Conclusion: Leveraging Latency for Trading Success

In conclusion, latency plays a crucial role in forex trading, influencing trading performance, strategy effectiveness, and overall profitability. By understanding the concept of latency and its implications, traders can make informed decisions when selecting VPS providers and optimizing their trading setups. With ultra-low latency solutions from Cheap Forex VPS, traders can gain a competitive edge in the market and maximize their trading potential.

#forex strategy#forex vps#forex#forextrading#vps#forex trading#forex education#forex market#forex broker#forex analysis#forexsignals#mt4#mt4 grey label#mt5#mt5 grey label#best vps hosting

1 note

·

View note

Text

The Ultimate Guide to Mastering Forex Trading: Bookmark-Worthy Tips for Success

Forex trading, also known as foreign exchange trading, stands as a dynamic and potentially lucrative financial market, drawing traders globally. To navigate this complex terrain effectively, a foundational understanding of currency pairs and market trends is insufficient. This guide aims to delve into critical strategies, risk management techniques, and psychological considerations essential for achieving success in the intricate realm of Forex trading.

Foundational Tips for Navigating the Forex Market

Understand the Basics

It is indisputable that grasping the fundamentals serves as the bedrock upon which investors can confidently build their trading expertise. Before immersing themselves in the intricate world of markets, investors must possess a solid understanding of fundamental concepts and market terminology. Additionally, they should genuinely comprehend how economic indicators and global events intricately influence prices across the globe.

Choose a Reliable Broker

Brokers play a crucial role in improving investors' journeys by not only making them more rewarding but also seamless. The significance of choosing a reputable broker with a strong track record and regulatory compliance cannot be overstated, as neglecting this aspect can take a toll on every trader. Moreover, investors can optimize their investment endeavours by selecting a broker that provides a user-friendly platform e.g MT4 trading platform. A high-quality broker should also recognize that investors are looking for cost-effective transactions and a diverse range of products.

Develop a Trading Plan

Embarking on an investing journey without a solid plan can be misleading, potentially hindering traders from navigating the markets and reaching their financial goals. Clear and specified goals are essential for providing direction. Moreover, understanding one's risk tolerance is crucial, as failure to do so may lead to excessive risk-taking. In fact, a comprehensive trading plan should incorporate a strategy that outlines entry and exit points. This strategic approach not only helps in achieving financial objectives but also effectively manages risks throughout the trading process. Practice with a Demo Account

Practice with a Demo Account

Before investors dive into the financial markets, it's a smart move to test their skills with a demo account. This allows them to try out different strategies, build confidence, and figure out what works best for them—all without the risk of losing any money. Practicing in this way provides a solid foundation and makes their entry into the markets much smoother.

Bookmarking Tips for Execution Strategies

Master Technical and Fundamental Analysis

To ensure a rewarding trading journey, it's essential to master the art of reading markets. This involves delving into technical analysis, where investors study price charts and patterns. However, this is just one piece of the puzzle. To gain a comprehensive understanding, it's equally important to embrace fundamental analysis, which includes assessing economic indicators and events. This dual approach equips traders with a well-rounded skill set, enhancing their ability to navigate the intricate dynamics of the financial markets.

Risk Management is Key

Navigating the financial market without effective risk management techniques can pose significant challenges. As emphasized earlier, integrating a management strategy into the trading plan is crucial, serving as a means to safeguard the invested capital. To delve deeper into this matter, managing risk involves practical steps such as selecting realistic stop-loss orders, diversifying the portfolio, and avoiding over-leveraging. These measures contribute to a more secure and well-protected trading journey.

Stay Informed About Market News

Minimizing risks, maximizing profit potential, and seizing opportunities require traders to stay well-informed about market dynamics. Keeping a close eye on financial news resources and consulting economic calendars is essential. This approach facilitates a better understanding of how various events impact price movements, empowering traders to make informed decisions in the ever-changing market landscape.

Control Your Emotions

In the fast-paced realm of Forex trading, mastering emotional discipline is paramount. Emotions like fear, greed, and impatience can lead to poor decision-making. Traders must adhere to their well-defined trading plans, remain objective, and avoid impulsive actions.

Final Take Away

Mastering Forex trading involves both foundational elements and execution strategies. Foundational elements focus on building a strong understanding of market basics, choosing the right broker, and developing a comprehensive trading plan. Execution strategies include mastering analysis techniques, implementing effective risk management, staying informed about market news, and controlling emotions. By following these bookmarking tips, traders can approach Forex trading with a well-rounded perspective, enhancing their chances of success.

1 note

·

View note

Text

Forex Trading double #Buy trade in #GBPUSD running in H4 Chart. Official Website: wWw.ForexCashpowerIndicator.com

.

Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

✅ Less Signs Greater Profits

🔔 Sound And Popup Notification

🔥 Powerful & Profitable AUTO-Trade Option

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#forexindicator#forexindicators#indicatorforex#cashpowerindicator#forex#forextradesystem#forexprofits#forexvolumeindicators#forexchartindicators#metatrader 4#metatrader#metatrader4 indicators#metatrader4indicators#metatrader4 signals#forex mt4 indicator#forex indicators mt4#mt4indicator#mt4 grey label#mt5 broker#mt5#metatrader 5#cashpowerindicatorreviews#forex cashpower indicator#cashpower#download cashpower indicator forex#free cashpower indicator#cash power indicator free

1 note

·

View note

Text

Forex MT4 Grey Label Broker

A Forex MT4 Grey Label Broker represents a unique and tailored trading solution combining the power of MetaTrader 4 (MT4) with personalized services. Designed for entrepreneurs and financial institutions this grey label offering allows businesses to establish their brand identity within the Forex market. Clients benefit from a seamless trading experience on the renowned MT4 platform renowned for its user-friendly interface and advanced trading tools.

This customized solution empowers brokers to focus on client relationships while the technical aspects are managed efficiently. Traders enjoy access to a wide range of assets, real-time market data, and expert analysis enhancing their trading strategies. The grey label model fosters trust enabling brokers to build a loyal client base. With comprehensive support including customer service and back-end operations brokers can concentrate on business growth and client satisfaction.

In Conclusion a Forex MT4 Grey Label Broker provides a sophisticated platform, personalized branding, and comprehensive support, ensuring a superior trading environment for both brokers and traders alike.

0 notes

Text

#whlte label broker solution#MT4 white label forex#mt5 white lable forex#white label forex brokerage

0 notes

Text

Global MT4 Brokers in 2023: A Comprehensive Review and Comparison

A global MT4 broker allows traders to access the global forex market with low latency, competitive spreads, and reliable execution. A global MT4 broker also provides customer support in multiple languages, various payment methods, and regulatory compliance in different jurisdictions.

#brokerreviewfx#crypto#forex#forexmarket#money#bitcoin#forextrading#investing#trader#stock#mt4 broker

0 notes

Text

The Top Features of WebTrader MT4 You Need to Know About

Mt4 Web Trading is an advanced and world-recognized trading platform that allows users to automate and create complex trades easily. It provides a wide range of market indicators that can be helpful for making the trade experience absolutely easy. It is especially beneficial when it comes to contracts for foreign exchange trading. The platform is free to download and use. If you are interested in becoming an advanced trader, the use of Mt4 Web Trading will be absolutely worth it.

Features of Mt4 Web Trading

The Mt4 Web Trading has been recognized to provide people with some of the top features. The account is free to download and use. This means you will be able to trade for free at the start. Even if you are a newbie you will have the option to try the application before you make the final decision. Once you are satisfied and sure about trading you can move on to the live account for real-life trading.

Herein the fee structure depends entirely on the brokerage that you choose to work with. Mt4 Web Trading is a comprehensive trading platform. But there is a lot that the platform does. For seasonal traders, the trading experience will be absolutely comfortable. They will be able to take advantage of the platform. They will require some time to navigate the interface and learn about things, but it will be absolutely worth it. The users don't generally have access to live customer service. They will be able to seek educational resources and tutorials which will help them understand the platform.

A useful feature of Mt4 Web Trading is the ability for the users to automate the trade. They can easily program custom indicators in the coding language of the platform. It can run over in 20 to 30 different languages and provide you an option to copy the activity of other successful traders. While Mt4 is quite popular as a Forex trading platform, it can also be used for traits within other markets like futures and options.

The platform does not have any personal financial advisors or robotic services. But depending on the brokerage, you will have the option to choose to work with a partner for using Mt4 Web Trading. With this, you will have access to additional features like live advisor support.

Make the right decisionMt4 Web Trading can be highly beneficial for your trading journey. If you plan to start with the use, you can check out AAFX Trading. They are the most reputed broker that will make the experience absolutely easy for you. They will provide you with a place to start the trading journey and automate it easily. Irrespective of your experience level, the platform is the best-suited one to get maximum benefits and have the ease of becoming a successful trader. They have got a strong customer support team that will be there to provide you with all the assistance you require when facing difficulty.

#Webtrader Metatrader 4#Metatrader 4 Webtrader#Metatrader5 Mac#Mt4 Web Trading#Mt4 Download Mac#Mt5 Forex Brokers USA

1 note

·

View note

Text

6 Indikasi Broker Forex Terbaik, Awas Salah

Cara melihat dan menentukan broker Forex terbaik agar investasi Anda aman dan tidak membuat khawatir dalam jangka panjang seiring profit. Dan bisa menjadi penghasilan sampingan yang lumayan banyak.

Forex trading adalah salah satu jenis investasi yang populer saat ini. Dalam trading forex, seorang trader membeli dan menjual mata uang asing dengan harapan menghasilkan keuntungan dari pergerakan…

View On WordPress

1 note

·

View note

Text

NFP - Non farm payrolls

Each month, the non-farm payrolls report (NFP) is a key market event. We will look at what it is and how it may impact your forex trading in this blog article.

An important economic indicator that sheds light on the state of the US labor market is nonfarm payrolls (NFP). We will discuss what NFP is, how it is calculated, why it is significant, and how it affects the economy in this blog.

What is an NFP?

The US Bureau of Labour Statistics publishes the NFP each month, which details the number of employment created or eliminated in the US economy overall but not including jobs involving agriculture. The study contains information on a variety of businesses, including manufacturing, construction, and healthcare.

The Bureau of Labour Statistics conducts a survey of enterprises in order to determine NFP. Employers are questioned about the number of people they have on the payroll for the pay period that included the 12th of the month in the survey. The poll also gathers data on the typical weekly workweek hours and the typical hourly wage for each industry.

What makes NFP so essential?

NFP is an essential economic metric since it sheds light on how well the US labor market is doing. A higher than anticipated NFP report shows that businesses are increasing hiring and that the economy is expanding. This may result in higher consumer expenditure, which would spur economic expansion.

On the other hand, lower-than-expected NFP data may point to a slowing of the economy and a decrease in hiring. Lower consumer spending and worse economic growth may result from this.

The Federal Reserve's decision-makers regularly monitor NFP as they utilize the data to inform their monetary policy choices. Based on the health of the labor market, the Federal Reserve may decide to raise or cut interest rates. Higher interest rates can aid in reducing inflation and fostering economic stability.

What is the economic impact of NFP?

The stock and bond markets, among others, may be significantly impacted by the NFP news. A positive NFP data may boost investor confidence and enhance stock demand, which could raise stock prices.

On the other hand, a poor NFP report may cause investor confidence to drop and stock demand to decline, which may cause stock prices to fall. The NFP may also have an effect on the bond market because a positive NFP report may result in higher interest rates and lower bond prices.

The US dollar may also be affected by NFP because a positive NFP report may raise demand for the dollar, which could result in a higher exchange rate. Lower economic growth may result from this as US exports may become more expensive and less competitive on the international market.

Problems with NFP

NFP has some limitations even though it is a crucial economic indicator. One issue is that the survey used to calculate NFP only collects data from businesses and leaves out information on those who are self-employed or employed in the unorganized sector of the economy.

Another issue is that the NFP report simply gives information on the quantity of employment created or eliminated; it makes no mention of the nature of those positions. For instance, the report may indicate that numerous low-wage positions were gained, but this may not have resulted in a significant rise in economic growth or consumer expenditure.

As the initial report is based on preliminary data that is later updated as new information becomes available, the NFP report is subject to adjustments. This can make it challenging to determine how the report will affect the economy in the present.

Summary

An important economic indicator that sheds light on the state of the US labor market is nonfarm payrolls. Policymakers, investors, & companies eagerly monitor the report since it might have a big impact on the financial markets and the US economy. Our Forex brokerage setup also reports nonfarm payrolls.

NFP is a useful tool for analyzing the labor market, but when making investment and policy decisions, it's important to be aware of its limitations and take other economic indicators into account.

#forexbrokeragesetup#forex#setup forexbrokerage company#forex brokerage firm#forex white label cost#mt4 white label cost#start your own forex brokerage#best forex broker for beginners

0 notes

Text

Forex - Takes you Wherever

"Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver." ~Ayn Rand

Forex, or foreign exchange, is the largest financial market in the world. It is estimated that more than $5 trillion is traded every day. With such huge amounts of money being exchanged, it’s no surprise that the Forex market is an attractive target for manipulation.

Manipulation in the foreign exchange market can take many forms, including the outright buying and selling of currencies to influence their prices, as well as more subtle tactics such as market rumors and news releases.

In the foreign exchange market, manipulation may take the form of market rumors. This involves spreading false information about a currency in order to influence its price.

For example, if a trader believes that the value of the British pound is going to go up, they may spread rumors about the strength of the pound in order to increase demand for the currency and drive up its value.

Similarly, if a trader believes the value of the euro is going to go down, they may spread rumors about the weakness of the euro in order to decrease demand and drive down its price. Another form of manipulation in the foreign exchange market is the use of news releases to influence prices.

This involves the release of false or misleading information about a currency. For example, a trader may release false information about the strength of the US dollar in order to increase demand for the currency and drive up its price.

Similarly, a trader may release false information about the weakness of the Japanese yen in order to decrease demand for the currency and drive down its price. Finally, manipulation in the foreign exchange market can also involve outright buying and selling of currencies.

This is done in order to influence the prices of currencies. For example, a trader may buy large amounts of a particular currency in order to increase demand for it and drive up its price. Alternatively, a trader may sell large amounts of a particular currency in order to decrease demand for it and drive down its price.

The foreign exchange market is an attractive target for manipulation due to its immense size and the large amounts of money being exchanged daily. While manipulation in the foreign exchange market is illegal, it is difficult to detect and often goes unpunished.

As such, it is important for traders to be aware of the possibility of manipulation and to take steps to protect themselves. This includes avoiding rumors and false news releases and doing research to make sure they are making informed decisions when buying and selling currencies.

Forex manipulation can be difficult to detect, but it is important to be aware of the possibilities and to take steps to protect oneself. By doing research, avoiding rumors and false news releases, and being aware of the possibility of manipulation, traders can help protect themselves against it.

#“is forex manipulated”#“how to manipulate forex market”#“can forex brokers manipulate price”#“how is forex manipulated”#“how is forex market manipulated”#“can metatrader be manipulated”#“can mt4 be manipulated”#invest

1 note

·

View note

Photo

Execute Trade With Unconventional Speed: Ctrader Platform

Many of us who would like to start trading will decide to choose the preferred broker as your first step. While this is indeed important, choosing your trading tools or, in other words, trading platforms, maybe as crucial for your success. Try the Ctrader platform to trade with the platform that best suits your needs.

1 note

·

View note

Text

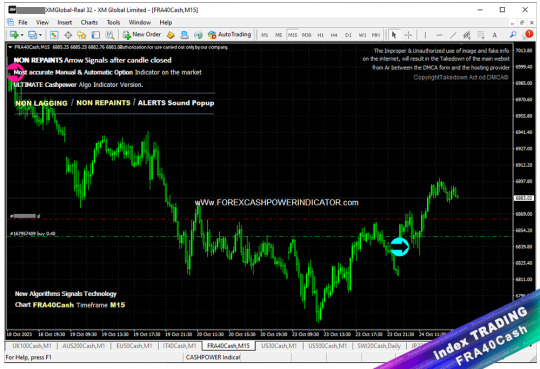

Forex Buy trade running Index #FRA40Cash inside Metatrader4. More info in Official Website: https://wWw.ForexCashpowerIndicator.com

.

🔥 Cashpower Indicator NO LAG & NO REPAINT buy and sell Signals send by smart algorithms that emit signals in strong volume zones of Charts in MT4.

.

✅ NO Monthly Fees; Lifetime License

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

✅ Powerful & Profitable AUTO-Trade Option

.

✅ ** Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexvolumeindicators#forexmarket#forextrading#forexsignals#forex#forex vps#forex exchange#stockmarket#forex brokers#forex indicators mt4#forex indicators

0 notes

Text

Forex Trading 101: A Comprehensive Guide for Beginners

Forex Trading 101: A Comprehensive Guide for Beginners

Introduction

Forex trading has come decreasingly popular among commodities and businesses looking to subsidize on the global currency request. With its eventuality for high returns and 24- hour availability, forex trading offers initiative openings for newcomers. Still, navigating the forex request can be dispiriting without solid understanding of its fundamentals. In this comprehensive companion, we will give newcomers with a step-by- step preface to forex trading. we will cover essential motifs similar as request dynamics, trading strategies, threat operation, and the part of a forex broker. By the end of this companion, you'll have the knowledge and confidence to begin your forex trading trip successfully.

Role of forex broker:

When it comes to forex trading, a forex broker plays a pivotal part in easing your participation in the request. let us explore the crucial functions and services offered by forex brokers.

Providing Access to the Forex Market:

A forex broker acts as a conciliator, granting you access to the forex request. they have established connections with liquidity providers and fiscal institutions, allowing you to trade currency dyads. Without a forex broker, it would be challenging for individual dealers to directly pierce the interbank request.

Offering Trading Platforms:

Forex brokers give trading platforms, which are software operations that enable you to execute trades, cover the request, and dissect maps. These platforms come with colorful features and tools, including real-time price quotations, charting capabilities, and order prosecution options. Popular platforms include MetaTrader 4( MT4) and MetaTrader 5( MT5).

1.3 Account Types and Features

Forex brokers offer different types of trading accounts to cater to the different requirements of dealers. These accounts may vary in terms of minimal deposit conditions, influence, spreads, and fresh features. Common types of accounts include standard accounts for educated dealers and mini or micro accounts for newcomers.

Market Analysis and Tools

To assist customers in making informed opinions, forex brokers provide request analysis tools and coffers. These may include profitable timetables, specialized pointers, and exploration accoutrements. By exercising these tools, customers can analyse request trends, identify implicit trading openings, and develop trading strategies.

Customer Support

Forex brokers understand the significance of good client support. They offer assist and guidance to traders whenever required. Whether you have technical issues with the trading platform or want explanation on trading conceptions, a reputed forex broker will have a responsive client support team to address your queries.

Benefits of Using a Forex Broker

When engaging in forex trading, applying the services of a forex broker can offer multiple advantages. Let's explore some of the crucial benefits that come with using a forex broker.

Expertise and Guidance:

Forex brokers have deep knowledge and experience in the financial requests. They can provide precious guidance and advice to beginner traders, helping them navigate the difficulties of forex trading. Brokers constantly offer educational resources, webinars, and tutorials to enhance traders' understanding of the market and trading strategies.

Access to Market Liquidity:

Forex brokers provide access to market liquidity, which is critical for executing trades efficiently. They've established relations with liquidity providers and banks, allowing traders to enter competitive bid- ask spreads and execute trades instantly. Without a broker, individual traders would face challenges in entering the interbank market directly.

Security of Funds:

Reputed forex brokers prioritize the security of their customers' funds. They adhere to strict regulatory conditions and oftentimes hold customer funds in segregated accounts. This means that traders' funds are kept separate from the broker's operational funds, providing an extra layer of protection in a case of any financial difficulties faced by the broker.

Educational Resources:

Forex brokers understand the significance of education in successful trading. They provide educational resources, alike as trading guides, webinars, and market analysis, to help traders enhance their knowledge and expertise. These resources can be inestimable for beginners, equipping them with the necessary tools to make informed trading decisions.

Trading Flexibility and Options:

Forex brokers offer a wide range of trading instruments, allowing traders to diversify their portfolios. In addition to major currency pairs, brokers constantly provide access to minor pairs, exotic pairs, commodities, indices, and even cryptocurrencies. This inflexibility enables dealers to explore different requests and take advantage of colourful trading openings.

Introduction to White Label Solutions

In this dynamic business, staying ahead of the competition is vital, and White Label Solutions offer a game-changing strategy to achieve just that. With our comprehensive White Label Solution, you can easily enhance your brand's presence and expand your service offerings without the need for extensive resources or specialized expertise. Let us guide you through the myriad possibilities of White Label Solutions and show you how they can revolutionize your business, making it stands out in the crowd.

Advantages of White Label Solutions

White-label solutions offer a host of advantages for businesses looking to establish a presence in the market with their brand. One of the key benefits is cost-effectiveness, as white-label solutions save businesses from the time and resources required to develop a trading platform from scratch. By leveraging existing infrastructure, companies can focus on marketing and client acquisition, accelerating their entry into the market. Additionally, white-label solutions provide branding and customization options, allowing businesses to create a unique brand identity and stand out from competitors. Moreover, the regulatory compliance aspect is addressed by the parent company, ensuring businesses operate within the legal framework without the burden of navigating complex regulations. Overall, white-label solutions empower businesses with a reliable, established, and scalable trading infrastructure, enabling them to offer top-notch services under their brand name and compete effectively in the competitive forex market.

Branding and Customization

White label solutions provide businesses with the occasion to establish their own brand identity within the forex market. The trading platform and other services can be customized with the company's trademark, colours, and design fundamentals, creating a unique and recognizable brand. This branding and customization help businesses difference themselves from competitions and construct brand faith among their clients.

Cost and Time Efficiency

One of the primary advantages of white label solutions is the cost and time effectiveness they offer. Developing a trading platform from scratch can be a complex and premium bid. By utilizing a white label solution, businesses can bypass the lengthy development process and associated costs. They can focus on their core abilities, marketing, and client acquisition, saving significant time and resources.

Infrastructure and Technology

White label solutions allow businesses to leverage the existing infrastructure and technology of the parent company. This includes the trading platform, back-office systems, liquidity providers, and regulatory compliance solutions. By exercising well- established structure, businesses can profit from a robust and dependable system without having to invest in the development and maintenance of their own technology.

Regulatory Compliance

Navigating the regulatory landscape can be a complex task, especially for businesses entering multiple authorities. With a white label solution, the parent company generally handles regulatory compliance, ensuring that the white label broker operates within the legal frame. This saves businesses the time and trouble needed to understand and adhere to various regulatory conditions, enabling them to focus on their core operations.

Considerations for Choosing a Forex Broker or White Label Solution

Choosing the right forex broker or white label solution is crucial for successful and rewarding trading experience. There are several factors to consider before deciding. Let us explore the key considerations to keep in a mind:

Reputation and Regulation

The reputation of a forex broker or white label solution provider is paramount. Look for well- established companies with a proven track record in the industry. Research customer reviews, testimonials, and industry rankings to gauge the credibility and trust ability of the broker. Additionally, regulatory compliance is essential for ensuring the safety of your finances and adherence to industry standards. Choose brokers regulated by reputable financial authorities, as this provides added layer of protection for your investments.

Trading Conditions

Estimate the trading conditions offered by the forex broker or white label solution. This includes factors such as spreads, commissions, leverage, and minimum deposit conditions. Lower spreads and competitive trading costs can significantly impact your trading profitability. Also, consider the range of tradable instruments available, as having access to different selection of currency pairs, commodities, indices, and cryptocurrencies can open various trading opportunities.

Technology and Platform

The trading platform is the gateway to the forex market, so it is critical to assess its features and capabilities. Look for a user-friendly platform that offers quick order execution, real-time market data, advanced charting tools, and risk management features. A stable and dependable platform is essential to execute trades efficiently, especially during times of request volatility. Additionally, consider whether the platform is available as a web-based, desktop, or mobile operation, providing you with the flexibility to trade on the go.

Customer Support

Effective and reliable customer support is vital when it comes to forex trading. You may encounter technical issues, have questions about your account, or need assistance with trading strategies. A responsive and knowledgeable customer support team can make a significant difference in resolving queries promptly and ensuring smooth trading experience. Look for brokers or white label providers that offer multiple channels of communication, similar as live chat, an email, and telephone support.

Conclusion

Forex trading can be an economic endeavour for beginners, but understanding the role of forex brokers and the concept of white label solutions is essential. Forex brokers act as intermediaries, providing access to the forex market, trading platforms, and support. White label solutions offer time-efficient and cost-effective way for companies to enter the forex market under their own brand. When choosing a forex broker or considering a white label solution, consider factors such as reputation, regulation, trading conditions, technology, and customer support. With a solid foundation and the right partner, you can embark on a successful forex trading journey.

2 notes

·

View notes

Text

0 notes