#most of them are like 'what does section ii of the declaration on a commercial liability policy for securities outline' and etc

Explore tagged Tumblr posts

Text

Let's test your insurance knowledge.

(actually not a poll, there's a correct answer obviously)

#this is the least boring question so far#most of them are like 'what does section ii of the declaration on a commercial liability policy for securities outline' and etc

9 notes

·

View notes

Text

The Will And Testament Of Michael Jackson

By Maya Colon, University of Hartford, Class of 2023

May 28, 2020

Michael Joseph Jackson was one of the most famous musicians of the 20th century. He died on June 25th, 2009 at 50 years old from cardiac arrest caused by a mixture of sedatives given to him by his personal doctor. Jackson’s will, last updated in 2002, is known as a pour-over will, where the document ensures that the deceased persons assets will be transferred to their established trust. Michael Jackson’s trust is known as the Michael Jackson Family Trust,in which he has ensured that his money goes to his mother, his three children, and some of his nephews.

In the first line of his will, Jackson identifies where he lives, and that all formal documents that he made prior to this will in 2002 regarding his death and estate were invalidated when the will was signed and formalized. By declaring what state he is a resident of, Jackson is acknowledging that any laws that applies to wills and probate courts must abide by the laws of California.

Section One of Jacksons will states that he is not married and had divorced his last wife, Deborah Jean Rowe Jackson, who he divorced in 1999. This section also states that Jackson has three children, who are Prince Michael Jackson Junior, Paris Michael Kathrine Jackson, and Prince Michael Joseph Jackson II.

This Second portion of the will explains that Jackson and his estate does not claim any property given to him in a will. Jackson also stops exercising any power of appointments he may have had at the time of his death, which would have given him the power to give away property of a deceased person, if he was named to do so in their will.

Section three specifies that Michael Jackson’s estate to specific trustees, as executed in a previous Declaration of Trust on March 22 of 2002. The trust that Michael Jackson created for this purpose is called the MICHAEL JACKSON FAMILY TRUST. It also makes sure than any specifications within the trust that are enacted on the event of Jackson’s death are set into motion. All assets in the trust will be used according to the terms set in the trust, and not anywhere else. Next, Jackson’s will dictates that if the trust somehow fails or has been revoked, that Michael Jackson’s estate goes to the trustees named in the Michael Jackson Family Trust, and they carry out their duties as trustees as if the rules and regulations of the trust still existed. To ‘serve without bond’ means that the trustees are not required to purchase a bond to ensure that they handle the trust honestly and legally.

Section Four dictates that any death taxes, which are taxes placed upon a deceased persons estate, that deal with property in the Michael Jackson Family Trust, will be paid by a trustee of the trust. Any death taxes that deal with property outside of the trust will be payed by the person who gets that property.

Section five is where Jackson has appointed the executors of his will, who are John Branca, John McClain and Barry Siegel. They serve as replacements for one another, but still have the ability to name their own replacements if they wish.Barry Siegel stepped down as executor in 2003. By being executors, they represent the estate, and they would also serve without bond, just as the trustees of the Michael Jackson Family Trust do. The executors of Jackson’s estate have the authority to sell, lease, mortgage, and deal with the property that makes up Jackson’s estate. They are also expected to continue any business enterprises, and to continue the running of the estate, including all insurance policies, mortgages, and contracts. The executors were also given the power in this will to use the estates funds for various types of investments, which include property, stocks, investment companies and investment trusts.

Section Six is where Jackson states that outside of the Michael Jackson Family Trust and in this will, he has intentionally not given any money to his children. He is also intentionally not giving any money to his former wife. While this statement makes it seem like Jackson is not leaving anything to his children, he is, but instead of writing it into his will, he created the Michael Jackson Family Trust for this purpose.

Section Seven gives the power of being an ancillary executor to a domiciliary executor. Domiciliary executor means an executor who lives in the state where the deceased lived, and an ancillary executor means an executor who lived in a state where the deceased owned property. Here Jackson gives the executors of his will the ability to execute his will in all fifty states, and not just California. Jackson does this so his entire estate can be regarded as a unit by his executors.

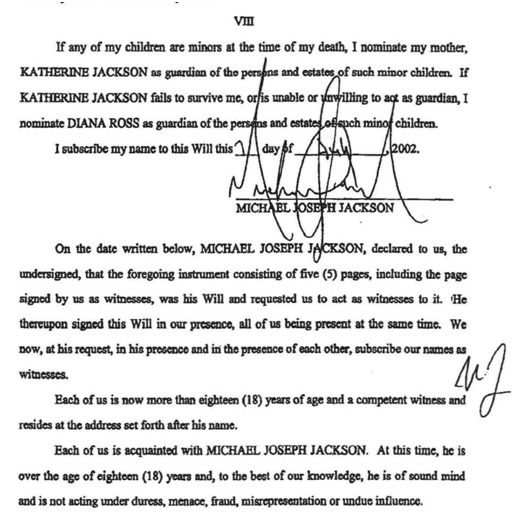

Section Eight is the final section of Michael Jackson’s will. Here, he given guardianship of his children and their own personal estates to his mother, Katherine Jackson. If Kathrine Jackson had died before Michael Jackson or was unable or unwilling to act as a guardian, the guardianship of the children would be given to Diana Ross, the famous singer. Michael Jackson then formally signs the will, and three people also sign the document as witnesses.

After Michael Jackson died, his executors, John Branca and John McClain filed a petition to be officially acknowledged as the executors of his estate, and to validate Michael Jackson’s 2002 will. After 120 days, the will becomes valid beyond challenge. This has caused a lot of issues between the estate and Michael Jackson’s siblings, who believe there was another will, but they waited too long to make these accusations, and do not have a copy of a later will, which they claim was made in 2006. Jackson’s siblings were very upset about the fact that he had left them out of his will, and have caused a lot of ruckus for John Branca and John McClain, who have made Michael Jackson’s estate very profitable.

________________________________________________________________

1 Archibold, Randal C., and Jonathan Glater. “Jackson's Will Could Set Off Legal Struggle.” The New York Times, The New York Times, 1 July 2009, www.nytimes.com/2009/07/02/us/02jackson.html.

2 “Estate Bonds: Definition, Cost, Free Quote & Application.” Ox Bonding, www.oxbonding.com/commercial-bonds/bond-types/estate-bond/.

3 Farnham, Alan. “Michael Jackson Family Feud: Lessons for Wills and Trusts.” ABC News, ABC News Network, 27 July 2012, abcnews.go.com/Business/michael-jackson-family-lessons-inheriting-leaving-money/story?id=16871392.

4 Kagan, Julia. “Death Taxes.” Investopedia, Investopedia, 10 Apr. 2020, www.investopedia.com/terms/d/death-taxes.asp.

5 Kagan, Julia. “Pour-Over Will.” Investopedia, Investopedia, 29 Jan. 2020, www.investopedia.com/terms/p/pour-overwill.asp.

6 “Michael Jackson.” Discogs, www.discogs.com/artist/15885-Michael-Jackson.

Photo Credit: Zoran Veselinovic

0 notes

Text

Capital Allowances Claims for Commercial Property in the UK - The Essentials

Capital Allowances Claims for Commercial Property in the UK - The Essentials

Commercial Property managers or those that have reconditioned leased home in the UK need to explore the option of a capital allowances claim. There is no downside to creating an insurance claim and if certainly not made owners and also leaseholders will definitely remain to pay out excessive tax every year.

This short article looks for to address a few of the inquiries that a healthily suspicious home owner may inquire just before looking to make an insurance claim London Bridge St. https://www.innovationtax.co.uk/

Is this Legal?

Yes. Capital allowances regulation goes back to the 1870's however the present regulation is actually The Capital Allowances Act 2001 which is normally changed every year due to the Government of the moment. As a result capital allowances are actually an income tax alleviation preserved in law. On top of that the rule is there certainly to motivate business residential property proprietors to acquire building through giving a resource of tax obligation relief.

What are Capital Allowances?

Capital Allowances can be actually professed on any sort of cost which carries right into presence (or even enhances) a property along with an enduring advantage for the field. This is actually a lawful definition originated from case-law. The objective of these allocations is to safeguard the owner's incomes coming from taxation and also lower their tax expense. It is actually certainly not uncommon for a capital allowances claim to produce a considerable tax discount and also make notable tax obligation cost savings within the very first five years after the insurance claim has actually been actually made London.

How does this put on industrial home consisting of provided vacation allows?

Commercial residential property contains fittings/ important features which may be valued for capital allowances purposes. This features electrical devices, heating unit, scorching & cool water devices, kitchen space tools and also other items which sustain the sell inquiry. On purchase or refurbishment a financial advisor may have valued what are actually termed the loosened gears like home furniture and also carpets yet these might work with a little portion of what may be declared. The fact the accounting professional does not insurance claim substantially extra is a representation of the difficulty of the regulations. Fortunately having said that exists is actually no opportunity limitation for helping make a claim so you haven't failed even if you bought the residential or commercial property some years ago and expert companies exist that dedicate themselves to making cases Hatfield.

An useful example

In 2005 a lodging is actually obtained for ₤ 500,000 omitting a good reputation as well as loose personal chattels presently asserted for due to the financial advisor. Within this occasion it would certainly not be actually unusual to locate that 25% of the purchase as capital allowances thus ₤ 500,000 x 25% = ₤ 125,000. At the moment of recording April 2012 this could possibly generate a tax obligation reimbursement for 2010/11 of approximately ₤ 5,000 for a 20% tax obligation payer or even ₤ 10,000 for 40% taxpayers.

The tax expense for 2011/12 might additionally be lessened by ₤ 4,000 for a 20% tax obligation payer and also ₤ 8,000 for a 40% citizen. There would likewise be actually the advantage of paying a lot less tax for years to follow.

Why have not my accounting professional educated me regarding this?

This is one of the most usual concern talked to and also there is no one response.

Accounting professionals have a lot of false impressions on the subject matter that includes:-.

i) creating a capital allowances claim affects the quantity of funding increases tax obligation which might be actually owed on sale of the property. Essentially they are regulated by pair of independent pieces of income tax laws as well as yet it is a false impression which persists without any manner as a matter of fact Hertfordshire.

ii) the investment arrangement consists of worths for fixtures and fittings which are binding. Generally we would anticipate deals of this particular attribute to be actually binding but with capital allowances asserts they are actually not as capital allowances claims are actually governed through law as well as not through the investment contract. For the objectives of the Capital Allowances Act 2001 cases must be actually created on the manner of a "acceptable apportionment" located on the truths linked with the investment or even refurbishment of the building Leicester.

iii) any type of income tax benefits are actually scraped back for sale of the property. Once more a false impression. So long as the vendor is actually provided the proper suggestions either through their present qualified advisors or through speaking to an expert capital allowances claims business after that this needs to not hold true.

What should I do if I intend to look into additionally?

If you talk to a professional capital allowances declares professional they will certainly provide you a quote of the likely outcome of taking on a case along with the basis of their charges. This permits you to create a reasoning as to whether you want to create an insurance claim or otherwise. It is likewise worth talking to the business whether the person that are going to undertake the work is actually both a certified surveyor and also tax qualified i.e. a participant of the Association of Tax Technicians or even the Chartered Institute of Taxation SE1 9SG.

If your accounting professional possesses reservations the capital allowances claims firm will certainly talk with all of them to respond to any type of concerns they might have. There is actually no downside to making a claim as well as huge providers that possess industrial property percentage this work as a matter of training program.

The most up to date modification following on from the reduction in the yearly reduction to 20% is to decrease the Annual Investment Allowance (AIA) coming from April 2012 to ₤ 25,000 coming from the existing ₤ 100,000. That is actually a notable decrease as well as small services must know the secrecy tax obligation as well as strategy correctly.

These allocations perform certainly not vary in between certain business as well as careers as well as with more significant farm incomes assumed as a result of the increase in corn costs and also the standard globe lack of food, together along with the environment-friendly impact it is two times as significant for farmers particularly with their business devices being therefore pricey AL10 9NA.

The duration of females skirts surge as well as autumn with fashion as well as capital allowances are actually the taxes equivalent.

You can easily declare capital allowances on certifying cost incurred in the chargeable time frame. They are actually on call in numerous situations and the best often met is for the investment of vegetation and equipment for your service.

In the commonly priced estimate case of Yarmouth v France (19 QBD 647) vegetation was actually described as featuring whatever devices is actually utilized by an entrepreneur for continuing his organisation, certainly not his stock which he purchases or even produces for resell, yet all products as well as personal chattels, corrected or even portable, live or lifeless, which he maintains for long-term work in his company.

Because 1887 the courts have made several efforts at coming to an interpretation of plant as well as right now CAA 2001 sections 21 to 23 effort to specify the marginal between vegetation and also properties and restrict the growth of the "vegetation" classification.

God Cameron in your home of Lords judgment in case CIR v Scottish and also Newcastle Breweries Ltd. (55 TC 252) mentioned: "the inquiry of what is adequately to become considered vegetation may merely be actually addressed in the context of those market worried and also probably in the illumination also of the specific scenarios of the private citizen's very own field".

A current situation including the bar establishment Wetherspoon has helped clarify the posture. It has pertained to imply that plant is any type of possession that plays an useful job in a business that is actually not machinery or portion of the structure. To make sure that might be a sink or even a palm rail to assist people along with reduced wheelchair. At final recognition of plant is actually less complicated however relief is additionally offered for the price of affecting a structure to enable plant to be actually put up AL10 9NA.

As the price of such jobs is included in the cost of the property as well as with capital allowances being actually claimed on the complete cost there have been conflicts along with HMRC culminating in the Wetherspoon case which lately ended after five years LE1 3BH.

For the expense to become allowable the structure alteration need to stay a separate establishment within the building. In the Wetherspoon situation they managed to assert capital allowances on the cost of the bricks, mortar, tiles, and the work in putting these with each other to form a commode workstation SE1 9SG.

The toilet work area was conveniently pinpointed independently coming from the property and also in Wetherspoon it suggested that they additionally were actually entitled to claim capital allowances for the cost of the raised floor covering leading up to some machines and also the splash-back tiles bordering the sinks etc

. Keep in mind that the expense of the associated specialist expenses such as preparing charges as well as the cost of the engineer need to be actually consisted of in the insurance claim; the Tribunal mentioned that it was actually acceptable to determine the proportion of the overall expenses.

The R&D Tax Credits plan was actually introduced in the year 2000 by HMRC (Her Majesty's Revenue and also Customs). HMRC is the United Kingdom's federal government team behind the administration as well as compilation of all forms of income tax. These consist of VAT, earnings tax obligation, and excise customs. HMRC blends the customs of 2 formerly separate departments, the Inland Revenue as well as HM Customs and also Excise.

The entire factor of the R&D Tax Credits program is actually to motivate innovation, because experimentation are critical to the well-balanced development of service and venture. There are numerous pounds offered to UK agencies yearly, however only a minority are actually claiming. There are actually also agencies with their very own committed investigation and also development divisions that are certainly not in the system.

Specialist consultants for R&D Tax Credits locate their job an actual joy, because of the benefits it carries to their customers. Their clients receive sizable sums of refund coming from Taxes they have actually paid. They likewise commonly go on to obtain technology awards, which deliver status and also promotion Leicester.

You perform not have to be actually doing high-profile research right into a treatment for cancer or the next generation of this or that. All you possess to carry out is illustrate development. Many of our clients are suppliers producing ordinary products. Just before our team became entailed they were certainly not aware that they had helped make a technology in any way Hertfordshire.

As in any type of region of organisation, your best choice is to obtain a professional expert to help you on your R&D Tax Credits trip. Not simply your existing financial advisor either, as this is actually a specialist area. There are actually a number of R&D Tax Credits companies, as well as these are actually the folks to help you. The very best ones focus on a "No Win No Fee" basis, therefore you simply must spend them a modest down payment to cover their job towards your case submission as well as absolutely nothing additional if an insurance claim carries out certainly not happen. If the case prospers, they receive an amount of the payment.

Her Majesty's Revenue and also Customs (HMRC), the UK Tax authorization, is actually presently paying around GPB150 million every year to firms that can present they have been introducing. HMRC possesses a Large Business Service for taking care of R&D Tax Credit declares for the really greatest public business. All other cases, for SMEs (little and also medium-sized companies) are taken care of through a network of committed offices all over the UK. Launched in 2006, these workplaces lie in Manchester, Leicester, Cambridge, Cardiff, Croydon, Maidstone as well as Southampton. Together these offices are right now dealing with around 5,000 claims for R&D Tax Credits every year Hatfield.

The UK Government has actually been actually building and also improving this plan given that the year 2000, to motivate development, which consequently increases Britain's business and as a result the UK economic condition overall. The problem is that a lot of 1000s of business in the UK are still losing out in a major means through not stating their R&D Tax Credit privilege. This is actually as a result of to a number of variables.

Lots of organizations think that R&D Tax Credits can simply be professed through major business along with dedicated R&D departments along with constant research study researchers as well as experts. Actually, agencies that have actually gained coming from the system include creators of computer video games and synthetic notice programs, cars suppliers, cheese manufacturers, meals testers, plant breeders, as well as device safety and security testers London.

Several common accounting professionals around the UK are on their own not effectively informed of the R&D Tax Credits system, thus when talked to through their client, they state they would certainly not be qualified. In reality, the location is therefore intricate that a new creation of specialist experts for R&D Tax Credits have emerged over recent years. These organizations are actually adequately acquainted up in all the complexities of R&D Tax Credits, as well as are in the process of informing the organisation market area regarding the system.

0 notes

Text

How Paris Hilton Got Left Behind

https://styleveryday.com/2018/03/10/how-paris-hilton-got-left-behind/

How Paris Hilton Got Left Behind

Anjali Nayar / BuzzFeed News

Paris Hilton’s transformation into Kim Kardashian’s double for Kanye West’s Yeezy campaign in late January caused a widespread double take on social media. In one photo posted to Kardashian’s Instagram account, which got nearly 2 million likes, Hilton is carefully styled into a quasi-Kardashian: platinum hair with dark roots, full eyebrows, and pouty lips, as she strolls down a street in tailored sweatpants, lollipop in hand. W magazine declared the image “iconic,” and it was, by design, playfully acknowledging Hilton’s history with Kardashian as one-time co-conspirators turned supposed frenemies.

Both celebrities let us know they were in on the joke: Kardashian called Hilton “#ForeverTheOG” in her caption, and Hilton enthused, “So much fun being a #KimClone.” But the social media reaction was dominated by tweets about tables turned, framing Hilton’s arc as a tragic decline from Kardashian’s onetime boss to just another employee working for the Kardashian family empire. And in overlaying the public images of the two women, the Yeezy ads became another reminder of the differences between them — which, in part, explain why Hilton quickly faded from groundbreaking symbol of a new era of reality fame to an icon of aughts nostalgia.

From top: Hilton signs autographs, poses with sister Nicky and Nicole Ritchie at Privé nightclub, and appears at a Sidekick II launch party in 2004.

Debra L Rothenberg / FilmMagic

Hilton is often described as the first of a new and noxious turn-of-the-millennium celebrity class, who were “famous for being famous.” From the moment she appeared in the national spotlight in 2003, with a scandalous sex tape and the reality show The Simple Life, she seemed to define the period, feeding the booming online gossip industry so much that she even became the namesake of Perez Hilton’s wildly popular blog. She was the subject of portentous hand-wringing over this seemingly empty kind of notoriety: “In a ravenous celebrity culture, Ms. Hilton’s rise shows how far celebrity itself has been devalued,” one writer opined in the New York Times Styles section the year her show debuted.

The media is still dotted with occasional reminders of Hilton’s one-time dominance. Sofia Coppola’s 2013 film The Bling Ring features teens so taken with Hilton’s image that they rob her mansion. Hilton, who lent her house for the film, has gladly taken credit as a trailblazing figure, half-jokingly suggesting that she invented the selfie with Britney Spears, and claiming she was a reality “pioneer” with The Simple Life, which was “before its time.” But Hilton’s media ubiquity was remarkably short-lived, precisely because she was very much of her time, and she never actually learned how to fully control her fame.

The same industry — composed of reality television and gossip blogs — that aided and exploited Hilton’s rise also eroded her celebrity. The Simple Life was, in fact, remarkably simple, a narrative playing up a caricature of Hilton that operated in a bubble apart from the real world. And while she was able to parlay that reality television persona into a lucrative fragrance and fashion brand (and a forever-iconic pop single, if not a full-fledged pop career), she didn’t keep up with the changes of the reality-celebrity landscape.

Instead, a new generation of reality personalities — from Real Housewives and Kardashians to Sur servers — figured out how to turn themselves into brands whose “real” lives were integral to their shows. Gossip blogs and social media feuds became parts of the plot, demanding a constant stream of content and convincing performances of authenticity. But Hilton only got caught being “real” (usually through an arrest, or friend feud) outside of her reality productions, and seemed unwilling to embrace the scandals of her own making as part of her brand or her onscreen narrative. The public soon grew bored. By the time Kim Kardashian appeared on the scene, Hilton had become an emblem of a quaint past where mystery could still work as PR strategy, rather than a part of the media future where nothing is private and everything — if you look at it the right way — is content.

Hilton parties at Light nightclub at the Bellagio in Las Vegas in 2003.

Denise Truscello / WireImage

By finagling her way into all the best parties and dancing on tables, Hilton became a fixture of New York City’s late-’90s nightlife scene, which was (before blogs) exhaustively covered by paparazzi, gossip columns, and the New York Times Style section. Her particular combination of vulgar Trump-era exhibitionism and Girls Gone Wild antics made her a tabloid staple and a new kind of heiress It girl. In 2000, a New York Post article chronicled this new breed of debutantes “who swap prim-and-proper personas for attitude,” and highlighted Hilton, who had “a tendency to flash her thong,” as the “most outrageous” example.

That same year, her notoriety scored her a Vanity Fair profile (ostensibly also about her sister Nicky), which fleshed out Hilton’s persona beyond the tabloid caricature. It was the most intimate portrait of her — with her family — that she ever allowed the public to see. Looking at it now, it’s almost like a print version of Keeping Up With the Kardashians, with its hints of a rivalry between Paris and Nicky, feuds with other debutantes, and details of Hilton’s relationship with her seemingly overbearing mother Kathy, who persistently interrupted her during the interview in an attempt to control her image. “It wasn’t a G-string!” she said about the tabloid thong story. “Paris is the most modest girl.”

But the photo spread accompanying the article, by famed photographer David LaChapelle, certainly didn’t match that description: In one shot Hilton wears a mesh, see-through top, with her middle finger up. In another she lies on the beach with her breast exposed, surrounded by loose cash and lecherously staring surfers. It’s the same image of careless privilege she was being asked to play as she transitioned into acting and pop stardom. She was already working with music producers, had just played a rich party girl in the indie film Sweetie Pie, and went on to play a “strung-out supermodel” in the 5-minute short QIK2JDG (2002) and a “female club-goer” in the live-action adaptation of The Cat in the Hat (2003).

Despite these small forays into film and music, no traditional path to stardom had readily presented itself to Hilton. Which is why, when producers for The Real World and the Fox network approached her with the idea to star in a reality program, she went for it. The producers of The Simple Life would send Hilton and friend Nicole Richie (daughter of Lionel) to live with a family on a farm in Altus, Arkansas, making comedy out of transplanting two urban heiresses into the “unglamorous” rural South.

Hilton and Nicole Richie in The Simple Life.

20th Century Fox / Courtesy Everett Collection

“The producers told Nicole and I, ‘Nicole, you be the troublemaker, and Paris, you be the ditzy blonde rich girl,’” Hilton later explained. “I tried to play the character of Cher from Clueless mixed with Eva Gabor from the Green Acres show.” In other words, she would be playing a new variation on the same caricature that already defined her in the public’s eyes.

While The Simple Life was supposed to turn Hilton into a mainstream star on her terms, the show’s announcement brought out another tabloid-ready story: a sex tape featuring Hilton and former boyfriend Rick Salomon. That was the story the media latched onto, but it wasn’t one she orchestrated herself, and it instantly took on a life of its own.

The Simple Life was originally a risible midseason replacement for the Fox network; when the sex tape, later commercially released as 1 Night in Paris, leaked weeks before the show’s December 2003 premiere, it seemed to some like a savvy marketing ploy. Today, such a tape might be seen as revenge porn; Hilton later reminded the public that she was just 18 when it was made, and Salomon was 12 years her senior. And while Hilton may have been comfortable being sexualized on her own terms, the tape was a humiliating development outside her control.

“I feel embarrassed and humiliated,” she said in a statement. “I was in an intimate relationship and I never, ever thought these things would become public.” But her statement was met with a flippant, cynical, and arguably misogynist tone by the media; the story of the tape as a marketing stunt aligned too well with the shamelessly underwear-flashing, bird-flipping image Hilton had seemed to embrace.

If the tape sold the show, it wasn’t on Hilton’s own terms.

“Many have assumed Paris Hilton had no shame — but she’s proved them wrong,” was Entertainment Weekly’s lede. The New York tabloids excitedly noted the tape’s release, with headlines like “NAUGHTY TAPE ‘ALL OVER’ H’WOOD.” Saturday Night Live mocked the tape in a Weekend Update segment, and PR “bad girl” Lizzie Grubman told Fox News, “I think that it is personally embarrassing, a complete invasion of her privacy. But she does have a show to promote, and I think it will help sell the show.”

And the show’s reception was certainly buoyed by media excitement over the tape. Over 13 million viewers watched the first episode, and the audience hovered in the tens of millions all season. Hilton generated reactions with “dumb blonde” jokes that played into her class cluelessness (“What’s Walmart?” “What’s a soup kitchen?”) in the style of Jessica Simpson’s airheaded commentary on the hit MTV reality show Newlyweds, which had debuted the summer before.

But if the tape sold the show, it wasn’t on Hilton’s own terms. Before the rise of social media that helped the newer generation of reality stars craft their own narratives, traditional publications and networks held most of the power. The closest Hilton could get to “owning” the scandal or redirecting the narrative around it was coyly playing along with jokes about it on SNL. Kim Kardashian, on the other hand, later made the release of her own sex tape in 2007 into a plot point in the first season of Keeping Up With the Kardashians. It even became an iconic meme after momager Kris Jenner explained, “When I first heard about Kim’s tape, as her mother I wanted to kill her, but as her manager, I knew that I had a job to do.” The Kardashians acknowledged the tape and turned it into a family drama on their own terms, thus controlling the narrative around it, in a way Hilton was never able to.

Hilton in Cannes in May 2015.

Samir Hussein / Getty Images

Hilton did use the initial ratings success of her show to springboard into new revenue streams that were becoming part of the rapidly expanding celebrity economy: paid appearances and building a fragrance line and fashion brand. Ratings for The Simple Life remained high through the second and third seasons, which were most memorable for giving us Hilton’s petulantly insouciant catchphrase, “That’s hot.” She also paved the way for years of what Gawker dubbed “slutburger” ads, showing up in a much-hyped Carl’s Jr. commercial aired during the 2005 Super Bowl, where she performed a car wash with leisurely, porny relish, biting into a burger before her motto appears onscreen.

But Hilton kept trying to frame herself as a conventional star and launch a career outside of reality shows, rather than embracing the now-common approach of building a celebrity brand on the (supposed) reality of her own life. In a 2006 GQ UK interview written by Piers Morgan, when Morgan asked her why she was famous, Hilton compared her brand to J.Lo, and explained, “I’ve been a model, and then an actress, and now I’m a singer.” Her 2006 pop single “Stars Are Blind” was surprisingly catchy; it sounded something like Britney Spears channeling Marilyn Monroe in a remake of Blondie’s “Tide Is High.” But the culture didn’t need another Britney, and despite the song breaking into the Top 20, a singing career never materialized. Similarly, Hilton’s role in the unloved 2005 horror movie House of Wax didn’t bring noteworthy acting offers.

Embracing her own embarrassing episodes seemed beyond the pale for an heiress who believed in the power of mystery.

0 notes

Text

Fundrise Heartland eREIT™ Review: Real Estate Crowdfunding For Non-Accredited Investors

After publishing my post, Focus On Trends: Why I’m Investing In The Heartland Of America, a couple readers pointed out that Fundrise, one of the leading real estate crowdfunding platforms, actually offers a Heartland eREIT. Last time I wrote about them in 2016, they just had an Income and Growth eREIT™, so it’s great to see they’ve offered new products to meet demand.

One of the unique things about all of Fundrise’s eREITs™ is that you don’t have to be an accredited investor ($200K+ income, $1M+ net worth excluding primary residence) to invest due to Regulation A+ of Title IV of the JOBS Act. Regulation A+ is a type of offering which allows private companies to raise up to $50 Million from non-accredited investors. Think of Reg A+ like launching a mini-IPO, but with lower fees than the traditional IPO process.

Given I’m bullish on the heartland for the next 10 years, the Heartland eREIT™ sounds like a promising investment. My 7-year CD yielding 4% has finally come due, and I’d like to reinvest it wisely. Let’s do a deep dive overview to understand all the pros and cons.

Fundrise Heartland eREIT™ Overview

Below is some information I’ve taken straight from Fundrise’s website followed by some Q&A and my thoughts at the end.

1) Objective

2) Time Horizon

3) Heartland Geography

4) Sample of Current Investments

5) Investment Strategy

Pretty balanced

Important Questions And Answers

Here are all the questions I was wondering about. Some of the answers are from their website and others I got directly from the company.

What is an eREIT™?

An “eREIT™” is a real estate investment trust, or REIT, sponsored by Rise Companies Corp. (the parent company of Fundrise, LLC) and offered directly to investors online, without any brokers or selling commissions. Each eREIT™ intends to invest in a diversified pool of commercial real estate assets, such as apartments, hotels, shopping centers, and office buildings from across the country.

How Do I Make Money?

You earn potential returns based on the real estate investments made by each eREIT™ that you invest in. By investing in an eREIT™, you are purchasing common shares of a limited liability company. In turn, the eREIT™ uses the proceeds from its sale of common shares to make investments in commercial real estate assets.

As an investor, you are entitled to your pro-rata portion of any income earned and distributed by the eREIT™. Distributions are anticipated to occur on a quarterly basis, beginning after the first full quarter of operations, which is expected to be the first full quarter following the launch of a particular eREIT’s™ offering of common shares. However, there can be no guarantee that any eREIT™ will be profitable, and investors may be subject to partial or total loss of their investment.

What am I investing in?

A REIT is a company that combines the capital of many individual investors to acquire or invest in a diversified pool of commercial real estate. A REIT is required to distribute at least 90% of the annual taxable income it earns to investors.

What are the costs and fees associated with investing in an eREIT™?

Assuming a fully subscribed offering, each eREIT™ anticipates having a reimbursement of organizational expenses of approximately 2%, marketing and distribution expenses of each offering up to 1%, and annual ongoing asset management fees and operational expenses of approximately 1-1.5%.

However, the foregoing does not purport to be a full explanation of the fees associated with each eREIT™, which may vary among the eREITs™, and is qualified in its entirety by the disclosure contained in the “Management Compensation” section of each eREIT’s™ Offering Circular, which are available at https://fundrise.com/oc.

Can I redeem (sell) my shares?

Yes, with some limitations. While you should view your investment as long-term, each eREIT™ has adopted a quarterly redemption plan, whereby shareholders may request that an eREIT™ redeem some or all of their shares at the end of each quarter, subject to certain limitations. We may not redeem more than 5% of the total outstanding shares of an eREIT™ in any given year.

What are the risks involved?

Investing in an eREIT™ involves a number of risks and should only be considered by sophisticated investors who understand the risks involved and can withstand the loss of their entire investment. All investors should carefully review the Risk Factors section of each eREIT’s™ Offering Circular.

What are the differences between the eREITs?

The primary differences among the eREITs™ are (i) the assets each eREIT™ intends to acquire and (ii) each eREIT’s™ individual investment strategy (which may vary based on asset location, type, and investment structure). Investors in one eREIT™ will have exposure solely to the assets held by the eREIT™, and shall not have exposure to the assets held in any other eREIT™.

For example, the Income eREIT™ intends to acquire assets that pay returns on a more current basis, which is anticipated to produce more predictable and reliable cash flows; however, the Growth eREIT™ intends to acquire assets that it expects to have greater appreciation over time, which may produce larger returns but less frequent distributions.

What is the minimum investment amount?

$1,000.

What is the latest declared quarterly dividend for the Heartland eREIT™?

The Heartland eREIT™ declared an approximate 8.25% annualized dividend for 1Q’17 net of fees.

How often are dividends paid?

Quarterly.

Is there a way to track the price movement of the eREIT?

eREIT™ shares are initially offered at $10.00 per share, a value that was arbitrarily determined by our manager. After an initial ramp-up period, the net asset value (NAV) per share will be adjusted on a quarterly basis. Each NAV adjustment for the eREITs™ will be filed on its respective SEC Edgar webpage accordingly.

How is the income and sale of the eREIT treated tax wise?

The tax section of our FAQs explains how these are treated and the forms investors receive. You should receive a Form 1099-DIV for the dividends and Form 1099-B for any sales.

What is the cost to purchase? Or is the cost embedded?

The per share purchase price will be adjusted every fiscal quarter and will equal the greater of (i) $10.00 per share or (ii) the sum of our net asset value, or NAV, divided by the number of our common shares outstanding as of the end of the prior fiscal quarter (NAV per share).

What is the size (assets under management) of each of your eREITs?

The most up-to-date status of the eREIT™ offerings can be found on each eREITs’™ respective SEC Edgar filing.

As of January 3, 2017, Fundrise has raised total gross offering proceeds of approximately:

$6.43 million from settled subscriptions in the East Coast eREIT™

$5.55 million from settled subscriptions in the Heartland eREIT™

$7.01 million from settled subscriptions in the West Coast eREIT™

As of January 3, 2017, Fundrise has raised total gross offering proceeds of approximately (fully subscribed):

$50 million from settled subscriptions in the Income eREIT™

$50 million from settled subscriptions in the Growth eREIT™

Why would one eREIT™ be closed? What is the limit to the size?

The Income and Growth eREITs™ are fully subscribed at this time. Based on the regulations under which we are offering our eREITs™, we are limited to raising up to $50M in common shares in any given year.

Personal Thoughts

Attractive performance potential. With an 8.25% annualized yield net of fees (I double checked with them), the Heartland eREIT™ is relatively attractive if they actually pay out this amount every quarter.

Currently exposed to only 3 states. I’m a fan of Texas and Colorado real estate (not so much Illinois). However, I’m left wondering about the other heartland states like Nebraska, Kansas, and Oklahoma. More geographic diversification would be nice.

Flexibility and diversity. For non-accredited investors, these specialized eREITs™ are an easy way to get specific regional real estate exposure with a low $1,000 hurdle since Fundrise has a West eREIT™, Heartland eREIT™, and East eREIT™. It’s good to be able to diversify away from where you currently rent or own physical property, especially for folks who live in expensive coastal cities like SF, LA, San Diego, NYC, and Washington DC where the real estate market is slowing.

Liquidity restrictions. Unlike a publicly traded REIT, an eREIT™ adjusts its Net Asset Value (price) once a quarter. Further, if you need money from the eREIT™ you can only sell once a quarter. Therefore, it’s important you only invest money you can afford to tie up for the duration of the fund’s time horizon.

Expense ratio. The biggest kink with Regulation A+ is that each eREIT™ can only be a maximum of $50 million in size. With expenses up to $1,000,000 a year, the lowest expense ratio is therefore 2% ($1M / $50M). You can see how expenses can really be a drag if they are not managed in unison with asset growth.

To help with the expense drag, there’s an important section in the offering circular called Fee Waiver Support which basically states the Manager can waive the management fees for a certain period until enough assets accumulate.

There’s no getting around the fact that 2% is a high fee compared to the majority of other investment opportunities out there. The hope for investors is that for this fee, Fundrise will be able to cherry pick the best investments that provide the highest risk-adjusted returns since it’s often hard to tell which one is best since they all sound pretty good.

Timing an entry. Given the first two eREITs™ filled up to capacity quickly, it seems likely so will these three regional eREITs™, thereby spreading out the costs to a wider base. Strategically, you want to be the last investor to join in order to pay the lowest percentage of costs. But you might also miss the boat as well.

Product offering expansion potential. Once each eREIT’s capacity fills up to $50M, an investor will have to wait until the next eREIT™ is created to invest. I can envision a scenario where Fundrise creates the Heartland eREIT™ II, III, IV, V etc. If Fundrise has the manpower, they’ll not only continue to have specific deals for accredited investors on their platform, they will also have a large portfolio of eREITs™ for non-accredited investors. 20 eREITs to capacity is a cool $1 billion dollars in assets under management.

Innovative. You’ve got to make a bet on Fundrise themselves since the JOBS Act only passed in 2012. Fundrise was first seed funded in 2011 and has since raised ~$41 million. They recently did their own Regulation A+ company funding by raising an “Internet Public Offering” from their existing members.

More than 2,300 Fundrise members — including investors across all 50 states — participated in the internet public offering, according to the company. Investors had to purchase at least 200 shares — or $1,000 — to participate in the offer. And only existing investors with Fundrise could participate. In total, their Internet Public Offering raised an impressive $14.6 million, meaning that they’ll have raised at least $54.6 million in total funding once the latest fundraising is settled.

Their IPO plus their creation of the eREIT™ category is pretty forward thinking.

Conclusion

8.25% is a pretty good annualized return net of fees for the Heartland eREIT™ given it’s about 3.5X the current risk-free rate of return (10-year bond yield). I like the fact that unlike P2P lending, there’s an actual asset behind the investment that can be worked out in case we hit a rough patch.

For those looking for geographic real estate diversification and who are not accredited investors, the Heartland eREIT™ is a solution to my heartland investment thesis. For those who are accredited, you can build your own real estate crowdfunding portfolio individually using a real estate crowdfunding investment framework I publish in the near future.

I’m willing to start off investing $10,000 to see how it goes. After getting more community feedback, I’ll adjust my investment accordingly. In case you’re wondering, I have a diversified investment portfolio that contains publicly traded REITs (O, OHI) and fixed income already. My goal is to build a $500,000 real estate crowdfunding portfolio that spits out $40,000 – $60,000 a year in income by 2020. So far I’m $260,000 of the way there.

Readers, anybody out there invested in a Fundrise eREIT™? I’d love to get your feedback on what has been your experience so far. Have the returns matched the targets? Were there any negative surprises in the investment process? Does an 8.25% annualized return net of fees sound good to you? The more information you can share, the better as I’d like to crowdsource as much knowledge as possible.

from http://www.financialsamurai.com/fundrise-heartland-ereit-review/

0 notes

Text

New Post has been published on World Best Lawyers

New Post has been published on http://www.worldbestlawyers.com/international-law-and-the-right-to-a-healthy-environment-as-a-jus-cogens-human-right/

International Law And The Right To A Healthy Environment As A Jus Cogens Human Right

I. JURISPRUDENTIAL BACKGROUND AND THEORETICAL ISSUES

To date, traditional international law does not consider human environmental rights to a clean and healthy environment to be a jus cogens human right. Jus cogens (“compelling law”) refers to preemptory legal principles and norms that are binding on all international States, regardless of their consent. They are non-derogable in the sense that States cannot make a reservation to a treaty or make domestic or international laws that are in conflict with any international agreement that they have ratified and thus to which they are a party. They “prevail over and invalidate international agreements and other rules of international law in conflict with them… [and are] subject to modification only by a subsequent norm… having the same character.” (1) Thus, they are the axiomatic and universally accepted legal norms that bind all nations under jus gentium (law of nations). For example, some U.N. Charter provisions and conventions against slavery or torture are considered jus cogens rules of international law that are nonderogable by parties to any international convention.

While the international legal system has evolved to embrace and even codify basic, non-derogable human rights (2), the evolution of environmental legal regimes have not advanced as far. While the former have found a place at the highest level of universally recognized legal rights, the latter have only recently and over much opposition, reached a modest level of recognition as a legally regulated activity within the economics and politics of sustainable development.

1. The international legal community recognizes the same sources of international law as does the United States’ legal system. The three sources of international law are stated and defined in the Restatement (Third) of the Foreign Relations Law of the United States (R3dFRLUS), Section 102. The first source is Customary International Law (CIL), defined as the “general and consistent practice of states followed out of a sense of legal obligation” (3) (opinio juris sive necessitatus), rather than out of moral obligation. Furthermore, CIL is violated whenever a State, “as a matter of state policy,… practices, encourages or condones (a) genocide, (b) slavery… (c) the murder or causing the disappearance of individuals, (d) torture or other cruel, inhuman or degrading treatment… or (g) a consistent pattern of gross violations of internationally recognized human rights.” (4) To what extent such human rights need to be “internationally recognized” is not clear, but surely a majority of the world’s nations must recognize such rights before a “consistent pattern of gross violations” results in a violation of CIL. CIL is analogous to “course of dealing” or “usage of trade” in the domestic commercial legal system.

Evidence of CIL includes “constitutional, legislative, and executive promulgations of states, proclamations, judicial decisions, arbitral awards, writings of specialists on international law, international agreements, and resolutions and recommendations of international conferences and organizations.” (5) It follows that such evidence is sufficient to make “internationally recognized human rights” protected under universally recognized international law. Thus, CIL can be created by the general proliferation of the legal acknowledgment (opinio juris) and actions of States of what exactly constitutes “internationally recognized human rights.”

2. The next level of binding international law is that of international agreements (treaties), or Conventional International Law. Just as jus cogens rights and rules of law, as well as CIL, are primary and universally binding legal precepts, so do international treaties form binding international law for the Party Members that have ratified that treaty. The same way that some States’ domestic constitutional law declares the basic human rights of each State’s citizens, so do international treaties create binding law regarding the rights delineated therein, according to the customary international jus gentium principle of pacta sunt servanda (agreements are to be respected). Treaties are in turn internalized by the domestic legal system as a matter of law. Thus, for example, the U.N Charter’s provision against the use of force is binding international law on all States and it, in turn, is binding law in the United States, for example, and on its citizens. (6) Treaties are analogous to “contracts” in the domestic legal system.

Evidence of Conventional International Law includes treaties, of course, as well as related material, interpreted under the usual canons of construction of relying on the text itself and the words’ ordinary meanings. (7) Often, conventional law has to be interpreted within the context of CIL. (8) As a practical matter, treaties are often modified by amendments, protocols and (usually technical) annexes. Mechanisms exist for “circumventing strict application of consent” by the party states. Generally, these mechanisms include “framework or umbrella conventions that merely state general obligations and establish the machinery for further norm-formulating devices… individual protocols establishing particular substantive obligations… [and] technical annexes.” (9) Most of these new instruments “do no require ratification but enter into force in some simplified way.” (10) For example, they may require only signatures, or they enter into force for all original parties when a minimum number of States ratify the modification or unless a minimum number of States object within a certain time frame, or goes into force for all except those that object. (11) Depending on the treaty itself, once basic consensus is reached, it is not necessary for all to consent to certain modifications for them to go into effect. “[I]n a sense these are instances of an IGO [(international governmental organization)] organ ‘legislating’ directly for [S]tates.” (12)

3. Finally, rules of international law are also derived from universal General Principles of Law “common to the major legal systems of the world.” (13) These “general principles of law” are principles of law as such, not of international law per se. While many consider these general principles to be a secondary source of international law that “may be invoked as supplementary rules… where appropriate” (14), some consider them on an “footing of formal equality with the two positivist elements of custom and treaty”. (15) Examples are the principles of res judicata, equity, justice, and estoppel. Frequently, these rules are inferred by “analogy to domestic law concerning rules of procedure, evidence and jurisdiction.” (16) However, “while shared concepts of of internal law can be used as a fall-back, there are sever limits because of the characteristic differences between international law and internal law.” (17) Evidence of General Principles of Law includes “municipal laws, doctrine and judicial decisions.” (18)

Treaty provisions and their inherent obligations can create binding CIL if they are “of a fundamentally norm-creating character such as could be regarded as forming the basis of a general rule of law.” (19) A basic premise of this article is that the “relatively exclusive ways (of lawmaking) of the past are not suitable for contemporary circumstances.” (20) Jonathan Charney maintains that today’s CIL is more and more being created by consensual multilateral forums, as opposed to State practice and opinio juris, and that “[consensus, defined as the lack of expressed objections to the rule by any participant, may often be sufficient… In theory, one clearly phrased and strongly endorsed declaration at a near-universal diplomatic forum could be sufficient to establish new international law.” (21) This process should be distinguished conceptually as “general international law”, rather than CIL, as the International Court of Justice (ICJ) has often done.

In like vein, Professor Gunther Handl argues that all multilateral environmental agreements (MEAs) of “global applicability” create “general international law”:

“A multilateral treaty that addresses fundamental concerns of the international community at large, and that as such is strongly supported by the vast majority of states, by international organizations and other transnational actors,– and this is, of course, precisely the case with the biodiversity, climate, and ozone regimes, among others-may indeed create expectations of general compliance, in short such a treaty may come to be seen as reflecting legal standards of general applicability… and as such must be deemed capable of creating rights and obligations both for third states and third organizations.” (22)

Notwithstanding, Daniel Bodansky argues that CIL is so rarely supported by State action, that it is not customary law at all. “International environmental norms reflect not how states regularly behave, but how states speak to each other.” (23) Calling such law “declarative law” that is part of a “myth system” representing the collective ideals and the “verbal practice” of States, he concludes that “our time and efforts would be better spent attempting to translate the general norms of international environmental relations into concrete treaties and actions.” (24)

However, a review of the current status of international human rights and environmental law may reveal the mechanisms for raising environmental rights to the level of jus cogens rights. For example, the U.N. Convention on the Law of the Seas (UNCLOS), whose negotiation was initiated in 1972 and signed in 1982, was considered by most countries to be CIL by the time it came into force in 1994. (25)

II. CURRENT STATUS OF THE RIGHT TO A HEALTHY ENVIRONMENT No State today will publicly state that it is within its sovereign rights to damage their domestic environment, much less that of the international community, however most States do not guarantee environmental protection as a basic human right. Currently, environmental law is composed of mostly Conventional International Law and some CIL. The former relies on express consent and the latter on implied consent, unless a State avails itself of the Persistent Objector principle, which precludes it from being bound by even most CIL. Unlike for human rights and international crimes, there is no general environmental rights court in existence today. While the Law of the Sea Tribunal and other U.N. forums (e.g., the ICJ) exist for trying cases of treaty violations, non-treaty specific violations have no international venue at present. Italian Supreme Court Justice Amedeo Postiglione states that

“[T]he human right to the environment, must have, at the international level, a specific organ of protection for a fundamental legal and political reason: the environment is not a right of States but of individuals and cannot be effectively protected by the International Court of Justice in the Hague because the predominantly economic interests of the States and existing institutions are often at loggerheads with the human right to the environment.” (26)

Domestic remedies would have to be pursued first, of course, but standing would be granted to NGOs, individuals, and States when such remedies proved futile or “the dispute raises issues of international importance.” (27) For example, although the ICJ has an “environmental chamber” and U.S. courts often appoint “special masters” to handle these types of disputes, it is clear that the recognition of the human right to the environment needs an international court of its own in order to recognize such a right and remedy international violations in an efficient and equitable manner. (28)

III. THE JUS COGENS NATURE OF ENVIRONMENTAL RIGHTS Irrespective of specific treaty obligations and domestic environmental legislation, do States, or the international community as a whole, have a duty to take measures to prevent and safeguard against environmental hazards?

Human rights are “claims of entitlement” that arise “as of right” (31) and are independent of external justification; they are “self evident” and fundamental to any human being living a dignified, healthy and productive and rewarding life. As Louis Henkin points out:

“Human rights are not some abstract, inchoate ‘good’; they are defined, particular claims listed in international instruments such as the [U.N.’s] Universal Declaration of Human Rights and the major covenants and conventions. They are those benefits deemed essential for individual well-being [sic], dignity, and fulfillment, and that reflect a common sense of justice, fairness, and decency. [No longer are human rights regarded as grounded in or justified by utilitarianism,] natural law,… social contract, or any other political theory…[but] are derived from accepted principles, or are required by accepted ends-societal ends such as peace and justice; individual ends such as human dignity, happiness, fulfillment. [Like the fundamental rights guaranteed by the U.S. Constitution, these rights are] inalienable and imprescriptible; they cannot be transferred, forfeited, or waived; they cannot be lost by having been usurped, or by one’s failure to exercise or assert them.” (32)

Henkin distinguishes between “immunity claims” (such as ‘the State cannot do X to me’; the hallmark of the U.S. constitutional jurisprudential system) and “resource claims” (such as ‘I have a right to Y’) such that the individual has the right to, for example, free speech, “food, housing, and other basic human needs.” (33) In today’s “global village”, the Right to a Healthy Environment is clearly a “resource claim” and a basic human need that transcends national boundaries.

According to R.G. Ramcharan, there is “a strict duty… to take effective measures” by States and the international community as a whole to protect the environment from the potential hazards of economic development. (34) His position is that the Human Right to Life is a. jus cogens, non-derogable peremptory norm that by its very nature includes the right to a clean environment. This duty is clearly spelled out in such multilateral treaties as the UN Convention on Desertification, the UN Framework Convention on Climate Change, and the Convention on Biological Diversity. (35) It is expounded in the Stockholm, Rio and Copenhagen Declarations as a core component of the principle of Sustainable Development. It forms the basis of NAFTA’s, the WTO’s and the European Union’s economic development agreements, and the European Convention and the International Covenant on Civil and Political Rights (ICCPR), which has been ratified by most countries in the world, including the United States.

The Human Right to a Healthy Environment is explicitly contained in the Inter-American and African Charters, as well as in the constitution of over 50 countries worldwide. Whether it is based on treaties, CIL, or “basic principles”, the obligation of the international community to the environment is today clearly spelled out and enforceable through international tribunals. For example, the Lhaka Honhat Amid Curiae Brief recognized the rights of the indigenous peoples of Argentina to “an environment that supports physical and spiritual well being and development.” (36) Similarly, in a separate decision, the Inter-American Human Rights Commission upheld the right of the Yanomani in Brazil to a healthy and clean environment. (37) On a global level, the UN Human Rights Committee has indicated that environmental damage is “a violation of the right to life contained in Article 6(1) of the [ICCPR]”. (38)

Thus, today, the erga omnes obligation of States to take effective steps to safeguard the environment is a duty that no State can shirk or ignore. If it does, it runs the risk of prosecution by international courts and having to institute measures commensurate with its responsibility to protect its share of the “global commons”. Interestingly, the concept of jus cogens emerged after World War II as a response to the commonly held view that the sovereignty of States excused them from violating any of the then so-called CILs. According to Black’s Law Dictionary, “there is a close connection between jus cogens and the recognition of a ‘public order of the international community’… Without expressly using the notion of jus cogens, the [ICJ] implied its existence when it referred to obligations erga omnes in its judgment… in the Barcelona Traction Case.” (39)

IV. THIRD GENERATION HUMAN RIGHTS AND THE ENVIRONMENT Is environmental protection is an erga omnes obligation, that is, one owed to the international community as a whole as a jus cogens human right?

In a separate opinion to the Case Concerning the Gebecikovo-Nagymaros Project (Hungary v. Slovakia), Judge Weeramantry, the Vice President of the ICJ, expounded on the legal basis for sustainable development as a general principle of international law. In the process, he concludes that environmental protection is a universal erga omnes legal norm that is both CIL as well as a general principle of law per se. In Gebecikovo, ostensibly to have been decided upon the merits of the treaty governing the building of power plants along the Danube, as well as by international customary law, the ICJ held that the right to development must be balanced with the right to environmental protection by the principle of sustainable development. Even in the absence of a specific treaty provision, the concept of sustainable development has become a legal principle that is “an integral principle of modem international law”. (40)

Sustainable development is also recognized in State practice, such as the Dublin Declaration by the European Council on the Environmental Imperative. (41) As such, sustainable development has in effect been raised to the level of CIL.

For example, the Martens Clause of the 1899 Hague Convention Respecting the Laws and Customs of War on Land has been interpreted in 1996 by Judge Shahabudeen of the ICJ as providing a legal basis for inferring that general principles rise above custom and treaty, having their basis in “principles of humanity and the dictates of public conscience”. (42) According to Weeramantry, “when a duty such as the duty to protect the environment is so well accepted that all citizens act upon it, that duty is part of the legal system in question… as general principles of law recognized by civilized of nations.” (43)

Sustainable development acts as a reconciling principle between economic development and environmental protection. Just as economic development is an inalienable right of States’ self-determination, environmental protection is an erga omnes obligation of all States for the benefit of the global commons that all share. “The principle of sustainable development is thus a part of modern international law by reason not only of its inescapable logical necessity, but also by reason of its wide and general acceptance by the global community”, and not just by developing countries. (44)

Drawing upon the rich history of diverse cultures’ legal systems and what he calls “living law”, Judge Weeramantry points out that traditional respect for nature has been a guiding moral and legal principle for economic development throughout history. The ICJ has also recognized these principles in such previous decisions as Barcelona Traction, Light and Power Company, Ltd. (Belgium v. Spain) in 1972. (45) Judge Weeramantry concludes that the “ingrained values of any civilization are the source from which its legal concepts derive… [and that environmental protection is] among those pristine and universal values which command international recognition.” (46)

The first generation of Human Rights were those declared by the “soft law” of the Universal Declaration of Human Rights: “Everyone has the right to life liberty and security of person.” Art. 3. It was modeled on the U.S. Bill of Rights and the American Declaration of Independence. This was echoed in the binding ICCPR (“Every human being has the inherent right to life.”, ICCPR, Art. 6(1) (1966)), which the U.S. has ratified, and the American Convention on Political and Civil Rights of the Inter-American System (which draws direct connections between human rights and environmental rights).

The second generation of human rights emerged with the Economic, Social and Cultural (ECOSOC) Rights developed in such treaties as the International Covenant on Economic, Social and Cultural Rights (ICESCR; which the U.S. has not ratified), and many foreign State’s Constitutions (e.g., Germany, Mexico, and Costa Rica). These include the right to free choice of work, to (usually free) education, to rest, leisure, etc. Highly complied with in Europe, these rights have additionally been expanded by the EU in their European Social Charter (1961) creating much legislation for the protection of workers, women, and children.

The third and current generation of human rights has emerged from the Eco-Peace-Feminist Movement. These include the Right to Development, the Right to A Safe Environment and the Right to Peace. In essence, this third generation of rights addresses the problem of poverty as a social (and hence legally redressable) ill that lies at the core of environmental problems and violations. The “environmental justice” movement considers cases that demonstrate that environmental pollution is disproportionately prevalent in minority communities, whether at a local or international level. Authors John Cronin & Robert F. Kennedy, Jr., have explicitly entitled their study of environmental pollution along the Hudson River The Riverkeepers: Two Activists Fight to Reclaim Our Environment as a Basic Human Right. (47) This predominantly U.S. movement focuses on “environmental racism” as a means for seeking remedies or the disproportionate pollution of minority communities as violations of current civil rights legislation by “exploring] the use of the nations’ environmental laws to protect the rights of the poor.” (48)

V. RECOGNITION, COMMITMENT AND ENFORCEMENT OF A RIGHT: THE MONTREAL PROTOCOL AS A MODEL FOR CONSENSUS BUILDING The key mechanisms for establishing binding international law are recognition of an obligation or right, commitment to its protection, and effective enforcement methods. The Montreal Protocol on Substances that Deplete the Ozone Layer is the “most important precedent in international law for the management of global environmental harms.” (49) It serves as a model for many other environmental concerns that require decision-making in the face of scientific uncertainty, global non-consensus, and high harm-avoidance costs. It was the first international “precautionary” treaty to address a global environmental concern when not even “measurable evidence of environmental damage existed.” (50) Although ozone depletion by chloro-fluorocarbons (CFCs) and other ozone depleting substances (ODSs), and the attendant harms of overexposure to harmful ultraviolet radiation, had been suspected by scientists in the early 1970s, it was not until 1985 and the Vienna Convention for the Protection of the Ozone Layer that international action was taken to address the problem.

THE VIENNA CONVENTION FOR THE PROTECTION OF THE OZONE LAYER At the time of the Vienna Convention, the U.S. represented over 50% of the global consumption of CFCs in a $3 billion market for aerosol propellants alone. Overall, CFC products represented a $20 billion market and about a quarter of a million jobs in America alone. (51) The Clean Air Amendments of 1977 and the 1978 EPA ban on all “non-essential” uses of CFC in aerosol propellants was quickly followed internationally by similar bans by Sweden, Canada and Norway. (52) These actions were a direct response to consumer pressure and market demands by newly environmentally-conscious consumers.(53) Incentives were also provided to the developing countries so that they could “ramp up” at reasonable levels of reductions. (54)

Creative ratification incentives included requiring only 11 of the top two-thirds of CFC producing countries to ratify and bring the treaty into force. (55) As a result of such flexibility, innovation, consensus and cooperation, the Montreal Protocol has been hailed as a major success in international diplomacy and international environmental law. Today almost every nation in the world is a member (over 175 States).

THE LONDON ADJUSTMENTS AND AMENDMENTS OF 1990 By 1990 scientific confirmation of global warming and the depletion of the ozone layer led to the London Adjustments and Amendments. Again, U.S. companies such as Dupont, IBM and Motorola reacted to massive negative media attention and promised to halt complete production by 2000.

Non-compliance procedures were made even more user friendly and no sanction for non-compliance was initiated against a country that was failing to reach quotas while acting in good faith. Technology transfer was made in a “fair and favorable way”, with developed countries taking the lead in assisting developing countries reach compliance. (56) The U.S. instituted “ozone depletion taxes” which did much to get more comprehensive compliance, as well as promoting research into CFC alternatives. (57) To emphasize the vast enforcement mechanisms employed, consider that by early 1998 the U.S. Justice Department had prosecuted 62 individuals and 7 corporations for the illegal smuggling into the emergent CFC black markets. Despite an international crackdown by the FBI, EPA, CIA, and Interpol in the global police effort Operation Breeze, 5 to 10 thousand tons are smuggled annually into Miami alone, second only to cocaine smuggling. (58) In 1992 the Copenhagen Amendments required every State party (practically the whole world) to institute “procedures and institutional mechanisms” to determine non-compliance and enforcement. (59)

VI. CONCLUSION: CRITICAL WEAKNESS OF THE CURRENT SYSTEM AND THE LEGAL CONSEQUENCES OF THE RIGHT TO A HEALTHY ENVIRONMENT AS A BASIC HUMAN RIGHT

The critical weaknesses of the existing system include self-serving pronouncements by non-complying States, lack of effective enforcement mechanisms, political limitations such as State sovereignty and the “margin of appreciation”, and the lack of universal consensus on basic human rights terminology and their enforcement. As long as States can ignore commonplace violations of human rights (sporadic instances of torture, occasional “disappearances”) and shun the edicts of human rights judicial decisions, there can be no effective system of international human rights enforcement. Currently, unless a State commits such outrageous acts on a mass scale that affects world peace, such as in Yugoslavia and Rwanda, it can often evade its responsibilities under international human rights treaties.

There are few international agreements that admit of universal jurisdiction for their violation by any State in the world. All CIL, however, is by its very nature prosecutable under universal jurisdiction. “Crimes against humanity” (e.g., War Crimes, genocide, and State-supported torture) are universally held to be under universal jurisdiction, typically in the International Court of Justice, ad hoc war crime tribunals, and the new International Criminal Court.

While interpretive gaps exist, it is not inconceivable that the right to a healthy environment can be extrapolated from current international environmental treaties and CIL. At the treaty level, the protection of the environment appears to be of paramount importance to the international community. At the level of CIL, there is much evidence that the right to a healthy environment is already an internationally protected right, at least as far as trans-boundary pollution is concerned. In any case, it seems to be universally held that it should be protected as a right. The impression is that there is an unmistakable consensus in this regard. “Soft law” over time becomes CIL.

The U.N. World Commission on Environment and Development released the Earth Charter in 1987. It has yet to be fully implemented on a global scale. Its broad themes include respect and care for the environment, ecological integrity, social and economic justice and democracy, nonviolence and peace. (60) The argument can be made that by now, protection of the environment has reached the threshold of Customary International Law. Whether the nations of the world choose to thereafter recognize the right to a healthy environment as a jus cogens human right will depend on the near universal consensus and political will of most of the nations of the world. Until then, as long as human life continues to be destroyed by “human rights ratifying” nations, how much enforcement will be employed against violators of environmental laws when the right to a healthy environment is not upheld as a basic human right remains to be seen. It will take the cooperation of all nations to ensure that this becomes a non-derogable, unalienable right and recognizing it as essential to the Right to Life.