#merchant account cash discount program

Explore tagged Tumblr posts

Text

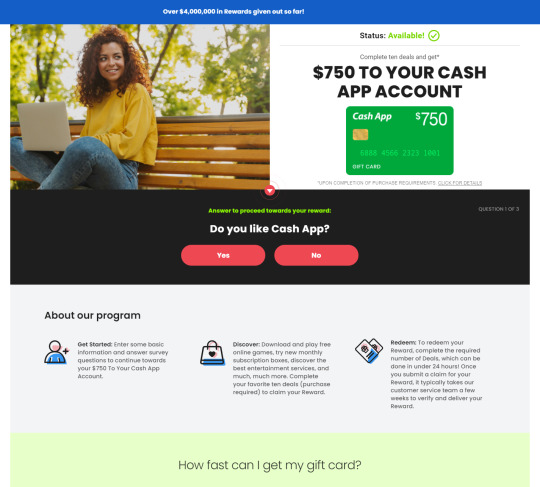

Your Chance to get $750 to your Cash Account!

Cash App is a mobile payment service developed by Square, Inc. It allows users to send and receive money to friends and family, as well as pay for goods and services using a mobile app. Here are some key features and aspects of Cash App:

Peer-to-Peer Payments: Cash App enables users to send money to other users quickly and easily using their mobile phone number, email address, or $cashtag (a unique username).

750$ Cashapp

Cash Card: Cash App offers a customizable debit card called the Cash Card, which is linked to the user's Cash App balance. Users can use the Cash Card to make purchases at retail stores or online, withdraw cash from ATMs, and even earn rewards on certain purchases.

Bitcoin Transactions: Cash App allows users to buy, sell, and store Bitcoin directly within the app. This feature provides users with a convenient way to invest in cryptocurrencies.

Direct Deposit: Users can set up direct deposit to receive paychecks or government benefits directly into their Cash App account. This feature eliminates the need for a traditional bank account for those who prefer to manage their finances through the app.

750$ Cashapp

Cash Boosts: Cash App offers a rewards program called Cash Boost, which provides users with instant discounts on purchases made with their Cash Card at select merchants. Users can choose from a variety of Boosts, which may include discounts on coffee shops, restaurants, and popular retailers.

Security Features: Cash App employs various security measures to protect users' accounts and transactions, including encryption, biometric authentication (such as fingerprint or Face ID), and optional security features like passcode locks and transaction notifications.

Fees: While Cash App is free to download and use for sending and receiving money, it may charge fees for certain transactions, such as instant transfers or Bitcoin transactions. Users should review the app's fee schedule for more information.

Overall, Cash App provides a convenient and user-friendly platform for sending money, making purchases, and managing finances on the go

Enter to Win 750$ Cashapp Dollar

5 notes

·

View notes

Text

MaxRebates Promotion and $50 Signup- Bonus 2024

If you are an online shopping enthusiast, you might want to learn about MaxRebates promotion and cashback program. MaxRebates is a reliable online platform that offers cash backs on your purchases. You can earn huge discounts and bonuses by signing up, referring your friends, or shopping through this website. There are several methods to earn cashback, and we will discuss them in detail in this blog. We will also answer frequently asked questions about MaxRebates' legitimacy and how to sign up for this website.

What Is a MaxRebates?

MaxRebates is an online platform that helps customers earn cashback on their online purchases. It partners with famous online retailers such as Amazon, eBay, Walmart, Best Buy, and many more. Whenever you make a purchase through MaxRebates, the company receives a commission from the retailer. MaxRebates then shares this commission with the buyer in the form of cashback rewards.

MaxRebates promotion (up to $50 sign-up Bonus)

MaxRebates offers a fantastic promotional offer to its new customers. If you sign up now, you can receive a whopping $50 sign-up bonus. To avail of this offer, users need to sign up and make a purchase of at least $25 through MaxRebates. This offer is valid for a limited time, and you can enjoy this benefit right away.

How to Sign up for MaxRebates:

Signing up for MaxRebates is a straightforward process. Users need to visit the official website, provide their email address, and followed by a password. Once you have signed up, you can start browsing the deals from preferred retailers and shop via the platform to start earning your cashback.

MaxRebates Referral Promotion: up to $50 for every Referral

MaxRebates is not only limited to the sign-up bonus, but it also rewards its users for referring their peers. For every referral, users can earn up to $50. If you have a high traffic social media handle or blog, by promoting MaxRebates and referring people, you could be on your way to earning a significant reward.

Also, when your friends sign up, they get to enjoy the $50 sign-up bonus and referral program as well. The platform also validates referrals to avoid fraud and abuse.

How to refer MaxRebates

Users can refer by navigating to their account settings and clicking on the referral tab to generate a referral link. Copy your link to share on your social media platforms, Blog, email list, etc. Your referral link would automatically lead the user to the sign-up page, where they can sign-up and start earning rewards.

MaxRebates Cash Back

MaxRebates offers cashback on each purchase on their platform. This means it is beneficial to shop via MaxRebates for the best deals on your preferred online retailer. The offers displayed on MaxRebates are updated daily to ensure users receive the best possible cashback offers.

How Do You Earn Cash Back?

Once you have signed in and made your purchase through MaxRebates, the cashback rewards will show up on your account within 48 hours. It might take up to 60 days for rewards to get processed from the merchant's end. Once you have accumulated $10 or above, you can withdraw the funds via PayPal, Amazon Gift Card, or bank transfer.

Is MaxRebates legit?

MaxRebates is a legitimate company that offers cashback rewards for online purchases. It has partnerships with top online retailers and ensures that the cashback offered is genuine. The platform uses strong encryption software and follows HIPAA-compliant data security standards to ensure that users' personal information is safe and secured.

Conclusion

MaxRebates is an excellent platform for online shoppers to earn cash back on their purchases. It offers several rewards, such as a generous sign-up bonus and referral program. The platform is user-friendly and has partnerships with top online retailers. With fraudulent activity on the rise, we understand people skepticism in trusting online platforms. Nonetheless, MaxRebates has a fantastic track record in rewarding its users. Finally, we suggest you give MaxRebates a try and enjoy the benefits it delivers!

2 notes

·

View notes

Text

Short Term Financing: Essential Strategies for Business Financing in Canada

Short term financing plays a crucial role in the landscape of business financing Canada. Many businesses rely on this type of funding to manage cash flow, cover unexpected expenses, and seize opportunities for growth. Accessing short-term financing can provide businesses with the immediate capital needed to maintain operations and support strategic initiatives.

In a competitive market, understanding the various options for short-term financing is essential. From lines of credit to business loans, each option has distinct characteristics suited to different financial needs. Companies can optimize their financial strategies by selecting the right type of financing to match their objectives.

Navigating the world of business financing can seem daunting, but it is a vital skill for entrepreneurs. Gaining insights into short-term financing options empowers business owners to make informed decisions that can drive success. This exploration will uncover the essential elements and considerations businesses should know when seeking financial support.

Overview of Short-Term Financing in Canada

Short-term financing plays a vital role in business operations across Canada. It provides quick access to funds needed for immediate expenses, helping companies maintain liquidity and conduct daily operations effectively.

Definition and Purpose

Short-term financing refers to borrowing that is scheduled for repayment within a year. It is primarily intended to cover temporary cash flow shortages or immediate financial needs. Businesses utilize these funds for various purposes, including purchasing inventory, managing operational costs, or addressing unexpected expenses.

This financing is crucial for maintaining smooth operations without disrupting long-term financial planning. By leveraging short-term options, companies can seize market opportunities, manage seasonal fluctuations, and support growth initiatives.

Types of Short-Term Financing

There are several key types of short-term financing available in Canada:

Lines of Credit: A flexible borrowing option allowing businesses to withdraw funds as needed, up to a predetermined limit. Interest is paid only on the amount used.

Trade Credit: Arrangements with suppliers that permit businesses to acquire goods or services on credit. Payment is typically due within a specific period after receipt.

Bank Loans: Traditional loans with a short maturity, often secured by business assets. They provide a lump sum amount with fixed or variable interest rates.

Factoring: Selling accounts receivable to a third party at a discount. This provides immediate cash flow while the third party collects the outstanding invoices.

Merchant Cash Advances: An advance against future sales, repaid through a percentage of sales revenue. This option is often more expensive but provides quick access to funds.

These financing types cater to various business needs and are essential for maintaining operation sustainability.

Business Financing Options in Canada

Canadian businesses have access to various financing options tailored to their specific needs. Understanding these alternatives can help proprietors choose the best route for financial support.

Government Programs and Incentives

The Canadian government offers numerous programs aimed at supporting small and medium-sized enterprises (SMEs). Key initiatives include the Canada Small Business Financing Program, which allows businesses to secure loans for equipment and real estate with lower interest rates.

Additionally, grants are available through programs like the Canada Job Grant, which provides funding for training employees. Each province also has distinct programs, such as Ontario's Virtual Trade Missions, which help businesses expand into international markets.

Businesses should explore these resources as they provide favorable terms, often with little to no repayment obligation if the criteria are met.

Private Sector Loans and Credit Lines

Private financial institutions provide a variety of loans and credit lines to businesses in Canada. Traditional bank loans remain a common choice, offering competitive interest rates. They typically require a solid credit history and detailed business plans.

Credit lines also present a flexible option, enabling businesses to borrow funds as needed while only paying interest on the amount drawn. Moreover, credit unions offer personalized services that might better suit niche markets or local businesses.

Comparing terms from different lenders can often yield advantageous arrangements, especially regarding repayment schedules and fees.

Alternative Financing Solutions

Alternative financing has gained popularity for those businesses seeking funding outside traditional banks. Peer-to-peer lending platforms connect investors directly with businesses, often resulting in quicker disbursement times.

Invoice financing allows companies to access cash based on outstanding invoices, easing cash flow issues. Additionally, crowdfunding campaigns enable businesses to raise funds from the public, often in exchange for rewards or equity.

These options can provide crucial financial support, especially for startups or businesses with unique needs that may not fit traditional lending criteria.

0 notes

Text

Best practices for streamlining the accounts payable process.

The accounts payable (AP) handle is basic for any organization as it specifically impacts cash stream, merchant connections, and in general operational effectiveness. When well-optimized, AP can moreover be a competitive advantage, guaranteeing opportune installments, capturing early installment rebates, and minimizing mistakes. Streamlining this handle has ended up a best need for numerous back groups, and here are the best hones to make it happen.

1. Mechanize Tedious Tasks

Manual information section and paper-based forms are among the greatest bottlenecks in accounts payable. Mechanization can definitely diminish time and minimize the chance of human mistake. Instruments like Optical Character Acknowledgement (OCR) can offer assistance to check and digitize solicitations, whereas Mechanical Prepare Computerization (RPA) can oversee schedule information section errands. Furthermore, AP computerization computer programs can mechanize receipt endorsements, three-way coordinating, and merchant installments, giving back groups more control and perceivability into the process.

Key Benefits:

Reduced human errors

Faster preparing times

Enhanced precision and compliance

2. Execute a Centralized Invoicing System

A centralized invoicing framework solidifies all solicitations in one put, empowering the group to track the status of each receipt in real-time. It permits for simple recovery, following, and approval, disentangling the installment endorsement preparation and lessening duplication and misplaced solicitations. Numerous AP mechanization devices to give dashboards and reports that offer bits of knowledge into the AP lifecycle, moving forward straightforwardness and communication.

Key Benefits:

Improved following and visibility

Faster endorsement process

Enhanced record-keeping and compliance

3. Use Early Installment Discounts

Many merchants offer early installment rebates, which can include up to noteworthy reserve funds. A well-streamlined AP handle makes it conceivable to take advantage of these rebates by guaranteeing solicitations are looked into and affirmed in an opportune way. Set up cautions or mechanized workflows to distinguish solicitations that qualify for rebates, and prioritize those installments to maximize savings.

Key Benefits:

Improved merchant relationships

Reduced costs

Enhanced cash stream management

4. Optimize Your Endorsement Workflow

Lengthy and complicated endorsement workflows moderate down the AP handle and lead to missed installments. Outline out the existing workflow to recognize redundancies and bottlenecks, at that point make a streamlined, standardized endorsement prepare that permits solicitations to be handled rapidly. For bigger or higher-value solicitations, consider presenting layered endorsement limits, where littler installments require less sign-offs, whereas bigger installments go through extra review.

Key Benefits:

Shortened handling times

Reduced chance of bottlenecks

Increased effectiveness and accountability

5. Energize Electronic Invoicing

Digital solicitations are less demanding to handle, track, and store compared to paper solicitations. Empowering sellers to yield solicitations electronically can diminish the requirement for manual information passage and the chance of misplaced reports. Electronic invoicing moreover adjusts well with AP mechanization arrangements, permitting companies to coordinate solicitations specifically into their AP frameworks for more consistent processing.

Key Benefits:

Reduced paper taking care of and capacity costs

Faster handling and payment

Greater openness and traceability

6. Upgrade Communication with Vendors

Clear communication with merchants is fundamental for keeping up smooth and profitable connections. Set up a merchant entrance where sellers can yield solicitations, check installment statuses, and resolve any errors without having to contact the AP group straightforwardly. Set clear desires around installment terms, invoicing designs, and debate determination forms to anticipate mistaken assumptions and make strides in collaboration.

Key Benefits:

Improved merchant satisfaction

Fewer installment delays

Easier debate resolution

7. Track and Screen Key Execution Pointers (KPIs)

Implementing KPIs for accounts payable gives perceivability into how productively the handle is running and where enhancements are required. Imperative measurements incorporate the normal time to prepare a receipt, the fetched per receipt, and the rate of solicitations paid on time. Frequently looking into these KPIs can offer assistance to distinguish wasteful aspects and direct ceaseless improvements.

Key Benefits:

Improved execution insights

Easier distinguishing proof of bottlenecks

Data-driven prepare improvements

8. Guarantee Compliance and Review Preparedness

Maintaining compliance with inside and outside directions is crucial for ensuring your organization from punishments and guaranteeing the exactness of budgetary records. Robotize compliance checks to hail issues in real-time, and store advanced records to encourage reviews. Mechanizing the AP handle with review trails too makes it less demanding to track and confirm exchanges, giving peace of intellect to stakeholders.

Key Benefits:

Reduced hazard of compliance issues

Enhanced exactness and transparency

Streamlined review process

9. Contribute in Persistent Training

Even with computerization, well-trained staff are fundamental for keeping up a productive AP handle. Customary preparing sessions on the most recent devices, approaches, and best hones offer assistance guarantee that the AP group is up-to-date and competent in dealing with any modern challenges. Also, preparing makes a difference as the group superior oversees unused frameworks and maximizes their capabilities, making a more flexible and versatile AP department.

Key Benefits:

Improved group proficiency and confidence

Reduced mistake rates

Better appropriation of modern technology

Conclusion

Streamlining accounts payable requires a combination of innovation, handle optimization, and ceaseless change. By mechanizing monotonous errands, centralizing invoicing, optimizing workflows, and cultivating solid merchant connections, companies can change AP from a fetched center into a key resource that bolsters commerce development. Each of these best hones will offer assistance to make a more effective, straightforward, and spry accounts payable preparation, situating your organization for more noteworthy money related and operational victory. To Your bright future join Oracle Fusion Financials.

#oraclefusion#jobguarantee#oraclefusionfinancials#financecareers#financejobs#erptree#erptraining#careergrowth#hyderabadtraining#100jobguarantee

0 notes

Text

How do I earn a free Cash App reward?

Cash App, a mobile payment service developed by Square, Inc., allows users to send and receive money with ease. One of the appealing aspects of Cash App is its rewards program, which offers users various ways to earn free cash. Whether you are looking to save money, get discounts, or even earn rewards for referring friends, there are several strategies you can employ to maximize your earning potential on free Cash App reward.

1. Utilize Cash App Boost

One of the most popular features of Cash App is its Boost program. Cash App Boost allows users to get instant discounts at select merchants when using the Cash Card. Here’s how it works:

Select a Boost: Open your Cash App, navigate to the “Cash Card” section, and browse available Boost offers. You’ll find discounts on restaurants, retailers, and other services.

Use Your Cash Card: After selecting a Boost, make a purchase at the designated merchant using your Cash Card. The discount will be applied automatically, allowing you to save money on your purchase.

Change Boosts Frequently: Cash App frequently updates its Boost offers. Regularly check for new discounts and switch between them to maximize your savings.

By taking advantage of these offers, you can effectively earn rewards through savings, which can be used for future purchases or transferred to your Cash App balance.

2. Referral Program

Another way to earn free Cash App rewards is through its referral program. Cash App encourages users to invite friends to join the platform by offering both parties a monetary incentive. Here’s how to do it:

Invite Friends: Open your Cash App and navigate to the “Invite Friends” section. You’ll receive a unique referral code that you can share via text, social media, or email.

Get Paid for Referrals: When someone signs up for Cash App using your referral code and completes their first transaction (which usually involves sending or receiving a certain amount of money), both you and the new user will earn a cash reward.

This program is an excellent way to earn free cash while helping friends discover a useful financial tool.

3. Participate in Cash App Promotions

Cash App often runs promotions that allow users to earn cash rewards for completing specific actions. These promotions can include challenges like making a certain number of transactions within a specified time frame or using Cash App for particular purchases. Keep an eye on notifications from Cash App to participate in these promotions as they arise.

4. Investing with Cash App

While this may not seem like an immediate way to earn free cash, investing through Cash App can yield significant long-term rewards. Cash App allows users to invest in stocks, ETFs, and even Bitcoin. Here’s how you can use this feature to potentially increase your earnings:

Start Small: You don’t need a lot of money to start investing. Cash App allows you to buy fractional shares, meaning you can invest any amount, even if it’s just a few dollars.

Reinvest Your Earnings: If you earn dividends from your investments, consider reinvesting them. This can compound your earnings over time, ultimately leading to more substantial rewards.

5. Keep an Eye on Your Cash App Balance

Regularly monitoring your Cash App balance can help you stay aware of any promotional rewards you may have earned. Sometimes, Cash App will deposit small bonuses directly into your account for participating in their programs or completing specific actions. By keeping an eye on your account, you ensure that you don’t miss out on these additional rewards.

Why Taskperks is One of the Best Platforms to Earn Free Cash App Rewards?

While there are various ways to earn rewards through Cash App, using a platform like Taskperks can amplify your earning potential significantly. Here’s why Taskperks stands out as one of the best platforms for earning free Cash App rewards.

1. Diverse Earning Opportunities

Taskperks offers a wide range of tasks that users can complete to earn rewards. From watching videos to participating in surveys, users can select tasks that best fit their interests and skills. This diversity ensures that users have multiple avenues to earn cash, making it easier to accumulate rewards.

2. Cash App Integration

One of the key benefits of using Taskperks is its seamless integration with Cash App. Users can directly link their Cash App accounts to receive their rewards instantly. This eliminates the hassle of transferring funds from one platform to another and allows for quick access to your earnings.

3. User-Friendly Interface

Taskperks boasts a user-friendly interface that makes it easy for users to navigate through available tasks and track their earnings. The straightforward layout ensures that even those who are not tech-savvy can quickly adapt and start earning.

4. Real-Time Notifications

Taskperks keeps its users updated with real-time notifications about new tasks, promotions, and rewards. This ensures that you are always informed about the latest earning opportunities, allowing you to act quickly and maximize your earnings.

5. Referral Bonuses

Similar to Cash App's referral program, Taskperks also offers referral bonuses. Users can invite their friends to join the platform and earn rewards for every successful referral. This creates a win-win situation, as both the referrer and the new user benefit from the sign-up.

6. Secure and Reliable

Taskperks prioritizes user security and ensures that all transactions are safe and secure. This reliability builds trust among users, making it a preferred platform for earning rewards without worrying about potential scams.

7. Community Support

Taskperks fosters a sense of community among its users. You can connect with other users, share tips, and learn strategies to maximize your earnings. This support network can be invaluable, especially for those new to earning online rewards.

Conclusion

Earning free Cash App rewards is entirely achievable through various methods, including utilizing Cash App Boost, participating in the referral program, and engaging with promotions. However, to optimize your earning potential, using platforms like Taskperks can be immensely beneficial. With its diverse earning opportunities, seamless Cash App integration, user-friendly interface, and community support, Taskperks stands out as one of the best platforms to earn free Cash App rewards.

By leveraging both Cash App and Taskperks, you can create a robust strategy for earning cash rewards, enabling you to enjoy the financial benefits that come with smart money management. Whether you’re saving for a special purchase or looking to supplement your income, these platforms provide the tools you need to succeed.

1 note

·

View note

Text

The Benefits of Credit Cash Discounts in Merchant Services

In today’s competitive business landscape, companies continually seek effective strategies to boost profits and enhance customer relationships. One increasingly popular method is the implementation of credit cash discounts. This blog explores what credit cash discounts are, how they work, and the advantages they provide for both merchants and their customers.

What Are Credit Cash Discounts?

Credit cash discounts are incentives that encourage customers to pay with cash rather than credit cards. By offering a lower price for cash transactions, merchants can significantly reduce the costs associated with credit card processing fees, yielding financial benefits for both the business and its clientele. To get more information you can also check this website https://abcmspos.com

How Do Credit Cash Discounts Work?

When a merchant adopts a credit cash discount policy, they typically display two prices for their products or services: one for cash payments and a higher price for credit card transactions. For example, a coffee shop might offer a pastry for $3 if paid in cash and $3.25 for credit card payments. The difference accounts for the fees charged by credit card companies.

Advantages for Merchants

1. Reduced Processing Fees

A major benefit of credit cash discounts is the decrease in processing fees. Credit card transaction fees can significantly cut into profit margins, making it essential for businesses to seek alternatives. Promoting cash payments helps eliminate these fees altogether.

2. Improved Cash Flow

Cash transactions provide immediate revenue, which can greatly enhance a business's cash flow. This quick access to funds is crucial for managing daily operations, covering expenses, and pursuing growth opportunities.

3. Greater Customer Loyalty

Implementing cash discounts can foster stronger customer loyalty. When customers see they can save money by choosing cash, they are more likely to return, helping to build a dedicated customer base that values savings and transparency.

Benefits for Customers

1. Immediate Savings

Customers who opt for cash payments enjoy direct savings. This not only makes their purchases more affordable but also encourages them to be more mindful of their spending habits.

2. Avoiding Debt

By paying in cash, customers can avoid the pitfalls of credit card debt. This promotes responsible financial behavior and enables better budget management.

3. Increased Security

Cash transactions eliminate the need for sharing sensitive credit card information, reducing the risk of fraud and identity theft. Many customers appreciate this added layer of security when making purchases.

Steps to Implement a Credit Cash Discount Program

1. Review Your Pricing Structure

Before launching a cash discount program, businesses should evaluate their current pricing model. Analyze average transaction fees and set a discount that benefits both the business and its customers.

2. Communicate Clearly

Effective communication is key when introducing a cash discount policy. Merchants should clearly display pricing differences and explain the benefits to customers. Using signage, online platforms, and staff training can ensure that everyone is informed.

3. Monitor and Adjust

Once the program is implemented, it’s important to continuously monitor its performance. Gather customer feedback and analyze sales data to assess the program’s effectiveness. Be ready to make adjustments to discount rates or pricing strategies based on this feedback.

Challenges to Consider

While credit cash discounts offer numerous advantages, challenges may arise during implementation. Some customers might be hesitant to change their payment preferences, so businesses should be prepared to address concerns and highlight the benefits of cash payments.

Conclusion

Credit cash discounts provide a valuable opportunity for both merchants and customers. By lowering processing fees and improving cash flow, businesses can enhance their profitability while offering consumers substantial savings. As the merchant services landscape evolves, adopting innovative payment solutions like credit cash discounts can help businesses thrive and cultivate stronger customer loyalty. Embracing this strategy may be crucial for success in a competitive marketplace.

Business Address: 12523 Limonite Ave. #440-262,Eastvale,Ca. 91752

Business Phone: +1 951-220-8962

Business Website: https://abcmspos.com

1 note

·

View note

Text

💳 Tired of paying high fees for card processing? eDataPay, now partnered with Shopify, offers direct-to-bank merchant accounts, NO reserves, and same-day payouts! Start saving today with our cash discount programs. 🚀 Contact us now! Call to Action: Message us to learn more and start saving on fees! Hashtags: #Shopify #eDataPay #Visa #Mastercard #PaymentGateway #MerchantServices #FastPayouts #ZeroFees #SameDayPayouts #GrowYourBusiness #Ecommerce #Fintech

0 notes

Text

Why Should you Introduce PoS solutions to Your Retail Business?

Image depicting an executive at Point of Sales

Many business owners have realized the significance of effective management of Poss. Due to this modern Point of Sales Solutions are integrated with highly optimized to precisely perform operations. Now, including card processing, they are introduced with Pops Smart features for mobiles, contactless payment options, integration of the characteristics of e-commerce, and much more.

Let’s first understand what Pops Solutions are, how they are useful, their journey, and much more.

Customer Journey in a Smart PoS Solution

Journey of a Customer in a Smart PoS Solution

Peculiar Features of Modern PoS Solutions

Customer at PoS Destination

Terminal PoS Solutions are designed in such a manner to satisfy the needs of the retail business irrespective of their size. Just like terminal PoS they also include a barcode scanner, receipt printers, cash drawers, and credit card readers, and also allow reporting & analytics, receiving payment receipts via email, CRM, and customer loyalty programs. Some of the peculiar features of an excellent PoS solution are as follows:

Order processing & Billing

Order Processing & Billings

This vital feature allows billing & order processing via the scanning of items along with capturing various payment modes. Invoice generation is possible with this, reprint it and then email it to the end customer by adding the discounts, details of the customer, its remarks, and name of a salesman as per the order.

Sales Monitoring and Adequate Reporting

PoS helping at Sales Monitoring and Reporting

Sales report generation is an integral and essential quality of a smart PoS. This helps merchants to evaluate their businesses. With this, they can analyses seasonal trends, foresee the trends, prevent overspending, and assess information as per the stock statuses that are provided with modern PoS.

Managing Stock & Inventory

Stock & Inventory Management Feature at PoS

Keeping an eye on inventory status is necessary. Live inventory status, and history of “in, “out” & “within” movements are necessary for merchants. Transparency enhances viability and accountability on a PoS. In addition, the responsible individual can manage the stock as per the statutes.

Returns Management at Cross-Channels

A smart PoS understands the significance of managing cross-channel returns. Thus, facilitating the returns & replacements from any store. At one point all this can be managed including the associated concerns like; the reason behind the return, the name of the salesperson, remarks from the customer, and much more.

Managing Relationships with customers

Managing Customer Relationships at PoS

Whenever it stores customers’ data such as details and purchase history, it is easier for you to provide a personalised experience. Data insights collected through the customer’s behaviour and purchase patterns can be helpful to devise the campaigns. This encourages more interested potential buyers to purchase from you.

Managing Employees

Managing Employees

Employees can also be managed in modern PoS. One can define staffing levels, sales performance, and staffing hours, for assessing productivity. After adequate evaluation of the performance accordingly, you can proceed with the suggestions and advice for your sales team to increase productivity.

Gift Cards & Loyalty Programs

Loyalty Programs at PoS

Tracking your customers’ loyalty is possible with the PoS, now, via tracking their loyalty incentives. Optimised PoS also manages the gift cards as they keep on increasing.

Deploy Personalised PoS Solutions to Flourish in Your Industry!

Customised PoS Solutions for Business

Whether you are a small retailer or run a chain of restaurants it is always essential to run businesses that are personalised as per your business requirements. So, if you are looking for personalised PoS, our brilliant Point of Sales Solutions specialists at Xaltam Technologies can perfectly align them.

Get in touch with skilled, proficient, and talented experts for assisting you to deploy precise & appropriately designed business solutions to assist you in accomplishing your objectives.

To know more about it, connect to Xaltam Technologies

Reach us on [email protected]

Or call at +91 9007790518

Follow Us on Social Handles,

Instagram, LinkedIn, Quora, facebook, and Pinterest.

0 notes

Text

Cash Discount Program Merchant Services

The Cash Discount Program merchant services by Merchants Bancard Network allow businesses to reduce credit card processing fees by offering customers a discount for paying with cash. This program helps merchants offset the cost of card transactions by passing some of the fees to customers who use credit or debit cards. By implementing the Cash Discount Program, businesses can simplify their accounting processes and potentially save significant amounts on transaction costs. Merchants Bancard Network provides the necessary tools and support to seamlessly integrate this program into existing payment systems, making it an efficient solution for reducing overhead expenses.

1 note

·

View note

Text

eMerchant Authority: Approval of Any Merchant Account

At eMerchant Authority, we offer seamless and secure merchant account solutions. Thanks to our reliable merchant processing solutions, you can now offer your customers the convenience of multiple payment options.

Basically the eMerchant Authority offers comprehensive and secure merchant account solutions for businesses looking to accept card payments online or through credit card readers. With rates as low as 1%, the services cater to various industries, including high-risk businesses merchants.

The benefits of choosing eMerchant Authority include:

Secure Payment Processing: The provider ensures secure storage, processing, and transmission of customer data, helping businesses stay PCI-compliant and prevent fraud.

Personalized Solutions: Tailored solutions for different business needs, including smart merchant accounts and high-risk internet merchant accounts.

Efficient Financial Management: Integration with different POS terminals, support for online and mobile payments, and consolidated revenue data access from a single platform.

Competitive Pricing: Transparent pricing plans with no surprise costs or lengthy contracts.

Peace of Mind: 24/7 support from experienced specialists in the merchant services industry.

eMerchant authority specializes in high-risk merchant accounts, offering same-day approvals for low-risk accounts and a five to ten business days approval process for high-risk accounts. Adding to that, Additional services include cash discount and surcharging programs to help businesses save on credit card processing fees, POS machine processing. The application process is straightforward, with no hidden costs.

1 note

·

View note

Text

How NBFCs Are Empowering Small Businesses?

Expanding on the topic of how Non-Banking Financial Companies (NBFCs) empower small businesses, we can delve deeper into various aspects such as the challenges faced by small businesses, the role of NBFCs in addressing those challenges, specific financial products and services offered by NBFCs, case studies illustrating their impact, regulatory considerations, and future trends in the NBFC sector. Let's elaborate on each of these points:

1. Challenges Faced by Small Businesses

Small businesses encounter numerous challenges in accessing finance, including limited collateral, inadequate credit history, volatile cash flows, and high interest rates. Traditional banks often perceive small businesses as high-risk borrowers, making it challenging for them to secure loans. Additionally, bureaucratic loan approval processes and stringent eligibility criteria further impede their access to credit.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

2. Role of NBFCs in Addressing Challenges

NBFCs bridge the gap in small business financing by offering flexible lending terms, collateral-free loans, and customized financial products. Unlike traditional banks, NBFCs have the flexibility to assess creditworthiness based on alternative data sources, such as cash flow analysis and business performance metrics, enabling them to cater to the specific needs of small businesses.

3. Financial Products and Services Offered by NBFCs

NBFCs provide a wide range of financial products and services tailored to the requirements of small businesses. These include small business loans, working capital finance, equipment financing, invoice discounting, trade finance, supply chain finance, and merchant cash advances. Additionally, NBFCs may offer advisory services, financial literacy programs, and digital platforms to enhance the financial management capabilities of small business owners.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

4. Case Studies Illustrating Impact

Case studies highlighting successful partnerships between NBFCs and small businesses can demonstrate the tangible impact of NBFC financing. For example, a small manufacturing firm struggling to upgrade its machinery may partner with an NBFC specializing in equipment financing to secure a loan for purchasing new equipment. This investment enables the business to improve productivity, expand operations, and ultimately increase revenue and profitability.

5. Regulatory Considerations

NBFCs operate under regulatory frameworks established by regulatory authorities such as the Reserve Bank of India (RBI) in India or the Securities and Exchange Commission (SEC) in the United States. Compliance with regulatory requirements is essential for NBFCs to maintain transparency, accountability, and financial stability. Regulatory oversight ensures consumer protection, risk management, and systemic stability within the financial system.

6. Future Trends in the NBFC Sector

The NBFC sector is witnessing several trends that are shaping its future trajectory. These include technological innovation, such as the adoption of artificial intelligence, machine learning, blockchain, and digital lending platforms to streamline operations and enhance customer experience. Additionally, there is a growing emphasis on sustainable finance, impact investing, and environmental, social, and governance (ESG) criteria in NBFC lending practices. Moreover, collaborations between traditional banks, fintech startups, and NBFCs are likely to drive innovation and expand access to finance for small businesses.

Also Read: Abhay Bhutada wins a Special Recognition at Lokmat Maharashtrian of the Year

In conclusion, NBFCs play a crucial role in empowering small businesses by providing access to finance, customized financial solutions, and advisory services. By addressing the challenges faced by small businesses and leveraging technological innovations, NBFCs contribute to economic growth, job creation, and entrepreneurship development. However, regulatory compliance and risk management are essential considerations for ensuring the stability and resilience of the NBFC sector. Looking ahead, continued innovation and collaboration are expected to drive the evolution of NBFCs and their impact on small business financing.

0 notes

Text

Say Goodbye to Payment Friction: How AuxPAY Empowers Your Hospitality Business

Running a restaurant, bar, nightclub, rental property, or any hospitality business requires juggling a million tasks. One major pain point? Handling payments: long lines, manual processing, and frustrated customers. But what if there was a smarter, smoother way? Enter AuxPAY, your one-stop solution for streamlined payments, a stellar reputation, and even potential cashback.

Effortless Payments, Happy Customers

Text-to-Pay Magic: Forget clunky apps and lines. Let guests pay securely through text message with a simple virtual terminal link. Perfect for pre-orders, partial payments, and settling the bill – all from their phone!

POS Tailored to You: Ditch the generic systems. AuxPAY builds custom POS systems designed for your unique needs, streamlining operations and boosting efficiency. Say goodbye to clunky interfaces and hello to a POS that works for you.

Seamless Integrations: Our systems seamlessly integrate with existing platforms, like your reservation system or accounting software, saving you time and effort. No more data silos, just smooth sailing.

Building a Reputation as Solid as Your Cocktails

Built-in Reputation Management: Take control of your online presence. AuxPAY helps you monitor reviews, respond to customers, and manage your online reputation effectively. No more scrambling to address negative feedback – stay ahead of the curve and cultivate a loyal customer base.

Frictionless Payments, Positive Reviews: Streamlined payments and exceptional service naturally lead to happier customers who are more likely to leave glowing reviews. Build a positive online reputation that attracts new customers and keeps them coming back.

Unlocking Cash Back Rewards

Potential Rebates for Smart Businesses: As a low-risk merchant utilizing AuxPAY's cash discount program, you're eligible for lucrative rebates, putting money back in your pocket. Reward yourself for smart financial decisions and reinvest in your business growth.

But AuxPAY goes beyond just features:

Industry Expertise: We understand the hospitality industry's unique challenges, offering solutions tailored to your specific needs. No cookie-cutter approach here.

Scalability and Flexibility: Our services grow with your business, adapting to your changing needs and demands. Whether you're in a cozy cafe or a bustling nightclub, we've got you covered.

Your Success is Our Success: We're more than just a service provider; we're your partner in success. We're invested in helping you achieve your business goals and provide exceptional customer experiences.

Ready to transform your hospitality business? Contact AuxPAY today and discover how we can streamline your payments, boost your reputation, and potentially put money back in your pocket. Let's create a dining, drinking, or renting experience that delights both you and your customers.

#business#business strategy#fintech#payment systems#payment services#payment solutions#merchant services#finance#high risk merchant account#customerexperience#high risk merchant highriskpay.com#high risk payment#high risk payment processing#high risk payment gateway#payment gateway#payment processing#payments#entreprenuership#entrepreneur

0 notes

Text

Benefits of Mobile Payments

Mobile payments have made banking more convenient, accessible, safe, and reliable. Mobile payments occur through a mobile device, such as a cell phone. Experts predict that consumers globally will spend an estimated $6 billion annually by 2027. Furthermore, in five years, this amount will triple. Financial institutions that want to remain competitive have adopted mobile payment technology.

Mobile money transfers and digital wallets (Venmo) are examples of the medium through which users make transfers or pay for items. The mobile phone negates using credit or debit cards or cash by allowing the person to store their banking information on their phone.

The technology works through a mobile wallet app like Apple Pay or Google Pay. The merchant will also need the payment processor technology to take contactless payments through a mobile device. At the point-of-sale (cash register), the customer hovers their phone over the payment terminal, and the payment is made over a radio frequency after the information is encrypted. The money leaves the person’s account and is transferred to the merchant.

Millennials and Gen Zs have widely adopted mobile payments. This increased adoption is also related to the fact that these populations are growing their wealth and disposable income.

Mobile payments benefit businesses because they can reduce expenses. For one, the merchant does not have to purchase expensive point-of-sale equipment, paper, or ink because the person can make the purchase, and then the business can email their receipt. The only thing that companies would need to purchase is a card reader to take card payments on a mobile phone or tablet.

Another way to accept payments through the mobile device is by using QR codes, which do not require a card reader. Furthermore, cloud-based subscriptions for mobile payments require low start-up and monthly maintenance.

Through mobile payment platforms, merchants can send coupons and discounts to customers who shop with the merchant often. The loyalty rewards programs reward customers by giving them points for each transaction or reaching a transaction threshold to unlock rewards. They can also offer a hybrid of the two that gives them rewards points for what they purchase and rewards them once they reach a certain threshold.

Business owners also benefit from the data collected on the mobile device whenever customers shop with a merchant. This information relates to customer shopping behavior, for instance, how much the customer frequents the business, how much they spend, how they prefer to pay, and the products they buy the most. Ultimately, this information can shape how the company customizes the shopping experience for customers.

Mobile payments can reduce wait times at the checkout. These payments take place within seconds, much faster than swiping a card. For merchants who experience high traffic, mobile payments can hasten getting customers out of the checkout line.

The payments are also much safer than credit cards because they include Touch ID, PIN inputs, and tokenization. All these features protect the person’s data from being exposed to parties outside the merchant and the third-party digital wallet. Furthermore, with increased security, the merchant’s liability becomes significantly reduced.

1 note

·

View note

Text

Navigating the World of Credit Cards with Confidence

In today's fast-paced world, credit cards have become an indispensable tool for managing personal finances. When used wisely, they can open doors to convenience, rewards, and financial flexibility. However, navigating the world of credit cards requires a thoughtful approach to avoid pitfalls and maximize benefits.

Understanding the Basics:

Before diving into the nuances of credit cards, it's crucial to grasp the fundamentals. A credit card is essentially a financial instrument that allows you to borrow money up to a certain limit. The borrowed amount needs to be repaid within a specified time frame, usually on a monthly basis. Failing to pay the full balance can result in interest charges, potentially leading to a cycle of debt.

Choosing the Right Card:

Not all credit cards are created equal. The market offers a plethora of options, each tailored to different financial needs. Someecards focus on cash back rewards, others on travel perks, and some on building credit. Choosing the right card depends on your lifestyle, spending habits, and financial goals.

Consider factors such as annual fees, interest rates, and rewards programs. A card with no annual fee might be appealing, but if you're a frequent traveler, a card with travel rewards and perks might be a better fit. Researching and comparing options can help you find a card that aligns with your financial objectives.

Building and Maintaining Good Credit:

One of the primary advantages of responsible credit card use is building a positive credit history. Your credit score plays a crucial role in various aspects of your financial life, from securing loans to determining interest rates. Make timely payments, keep your credit utilization low, and monitor your credit report regularly to ensure accuracy.

Smart Spending and Budgeting:

Credit cards offer convenience, but they can also tempt users to overspend. Creating a monthly budget is essential to track your expenses and avoid accumulating debt. Set limits for discretionary spending, and always prioritize essential payments.

Additionally, take advantage of budgeting tools provided by credit card issuers. Many cards offer features that categorize and analyze your spending, providing insights that can help you make informed financial decisions.

Maximizing Rewards and Benefits:

Credit cards often come with rewards programs that can be incredibly valuable when utilized strategically. Whether it's cashback, travel points, or other perks, understanding how to maximize these benefits is key. Some cards offer sign-up bonuses, introductory 0% APR periods, or exclusive discounts with partner merchants.

Regularly review the terms and conditions of your credit card to stay informed about available benefits. For example, some cards provide purchase protection, extended warranties, and even travel insurance. Being aware of these features can save you money and provide added peace of mind.

In conclusion

Navigating the world of credit cards requires a combination of knowledge, discipline, and strategic planning. When used responsibly, credit cards can be powerful tools for managing finances, building credit, and enjoying various perks. Discover unparalleled options for loans and credit cards tailored to your preferences with Arena Fincorp. As a leading digital lending platform in the Loan & Finance sector, we provide industry-best choices, allowing you to select loans that match your needs, determine your preferred interest rates, and set terms according to your preferences. Experience extraordinary – our cutting-edge technology ensures swift application processing, enabling customers to receive funds in their accounts in as little as 12 hours, with minimal documentation required .

0 notes

Text

How do I earn a free Cash App reward?

Cash App, a popular peer-to-peer payment platform, offers a variety of features that can enhance your financial management. Among its many features, earning rewards can be an appealing aspect for many users. In this guide, we will explore effective strategies for earning free Cash App rewards and discuss why Taskperks is one of the best platforms to help you achieve this goal.

Understanding Cash App Rewards

Cash App rewards can come in various forms, such as cashback, discounts, or even free cash. These rewards can be earned through different activities on the platform, including making transactions, participating in promotions, or completing specific tasks. The value of these rewards can vary, and they can be a great way to maximize your use of the app.

Strategies to Earn Free Cash App Rewards

Sign-Up Bonuses: Many users start earning rewards from the moment they create their Cash App account. Look out for any sign-up bonuses or referral incentives that Cash App might offer. These promotions often require you to complete a specific task, such as making your first transaction or referring a friend.

Referral Programs: Cash App has a referral program that rewards you for bringing new users to the platform. When your friends or family use your referral code and make a qualifying transaction, you can earn a reward. This is one of the easiest ways to earn free rewards, as it leverages your network to generate earnings.

Cashback Offers: Cash App occasionally partners with merchants to offer cashback on purchases made using the Cash Card. Keep an eye out for these deals in the app and make sure to use your Cash Card when shopping to receive the cashback rewards.

Promotional Campaigns: Cash App frequently runs promotional campaigns that can provide additional opportunities to earn rewards. These campaigns may include special offers, sweepstakes, or other incentive programs. Check the app regularly to stay updated on the latest promotions.

Participate in Surveys and Tasks: Some users may have access to surveys or tasks within the Cash App ecosystem that can yield rewards. Completing these tasks can help you accumulate points or cash that can be redeemed for rewards.

Engage with Cash App’s Investment Features: Cash App offers investment options, such as buying and selling stocks or Bitcoin. Occasionally, engaging with these features might come with promotional rewards or incentives.

Why Taskperks is a Top Choice for Earning Free Cash App Rewards?

While there are various methods to earn rewards directly through Cash App, leveraging additional platforms can enhance your earning potential. Taskperks stands out as an exceptional platform for earning free Cash App rewards. Here’s why:

Diverse Earning Opportunities: Taskperks provides a wide range of tasks and activities that can be completed to earn rewards. These tasks include participating in surveys, downloading apps, watching videos, and more. By engaging with these tasks, you can accumulate points that can be redeemed for Cash App rewards.

User-Friendly Interface: Taskperks is designed with user convenience in mind. Its intuitive interface makes it easy for users to navigate through available tasks, track their progress, and redeem their rewards. This ease of use ensures that you can maximize your earnings without any hassle.

High Reward Potential: Taskperks often offers competitive reward rates for completing tasks. This means you can earn more points and, consequently, more Cash App rewards in a shorter amount of time. The platform’s generous reward structure can significantly boost your earning potential.

Flexible Redemption Options: Taskperks allows you to redeem your earnings for various types of rewards, including Cash App credits. This flexibility means that you can choose the reward that best suits your needs and preferences, whether it’s cash for personal use or funds for investing.

Reliability and Trustworthiness: Taskperks is known for its reliability and transparency. Users can trust that the platform will provide accurate and timely rewards for completed tasks. This trustworthiness is crucial for maintaining a positive user experience and ensuring that your efforts are rewarded appropriately.

Access to Exclusive Offers: Taskperks frequently partners with brands and companies to offer exclusive deals and promotions. By participating in these offers, you can earn additional rewards that might not be available through other platforms.

Community and Support: Taskperks fosters a supportive community of users who share tips and experiences. Additionally, the platform’s customer support team is available to assist with any issues or questions you may have, ensuring a smooth and enjoyable experience.

Conclusion

Earning free Cash App rewards is a valuable way to make the most of your Cash App experience. By utilizing strategies such as signing up for bonuses, participating in referral programs, and taking advantage of promotional campaigns, you can accumulate rewards efficiently. Additionally, platforms like Taskperks enhance your earning potential by offering diverse opportunities to complete tasks and earn rewards.

Taskperks stands out as one of the best platforms for earning free Cash App rewards due to its user-friendly interface, high reward potential, flexible redemption options, and reliability. By leveraging Taskperks alongside your Cash App activities, you can maximize your earnings and enjoy the benefits of free Cash App rewards.

0 notes

Text

Why savings account is so vital for an individual?

One of the most well-liked bank accounts that one might open is a savings account. Open new bank account as a saving account will be a single account that may be utilized for numerous reasons. In actuality, multiple varieties of savings accounts can be used for various needs. In this situation, many people are engaging with the banking and financial system for the first time. A savings account is losing its luster, though, as several other investment options become more alluring than them. Here is a helpful post to understand the importance of a savings account:

Safe Parking Place for the Money:

You have a secure option to store your extra money with a savings bank account. Easy withdrawal and deposit options are available for your savings account. You no longer need to carry cash with you at all times and are no longer concerned about potential cash theft. As you open a new bank account as a savings bank account, you benefit from excellent flexibility and security for your money.

Unique value-added services are offered:

Nowadays, a savings account comes with value-added services and incentives from many banks. Numerous banks provide discounts when purchasing from retailers, rebates, or reward points when using an ATM or debit card. Additionally, many banks offer some basic form of health or accident insurance, international travel insurance, and other insurance coverages when opening a bank account. You can obtain more value if you choose a statement with these advantages. Additionally, a savings account provides a passbook, online banking, and checkbook facilities.

Benefits of Government Programmes:

You must have a savings account to participate in government programs and receive subsidies. The government is pushing direct benefit transfer programs, and the only way to get payments is through a savings account. A Zero Balance Savings Account is another option many banks provide; these accounts are not subject to any requirements to keep a sufficient balance.

Income from Interest:

Your home will only bring in money if you have extra cash. However, if you deposit this money in a savings account, it will be secure and earn interest for you. Each bank has a different rate of interest on savings accounts. While some banks only provide 4% interest, some go as high as 6%.

Planning Your Money:

You can correctly arrange your budget with the use of a savings account. A bank account can help you comprehend your financial situation and subsequently enable you to plan your investments by giving you a clear image of your savings. While you find suitable investment opportunities, you can use the savings account to keep your money secure.

Cash is not Required:

Every Savings Account has the option of a Debit Card. You can buy things thanks to this without having to carry cash. When paying using debit cards, many merchants offer various discounts and promotions. Additionally, you can easily withdraw money from your account because of the vast ATM network.

Bottom Line:

The significance of the savings account is well articulated in the above points. To begin your banking journey well, open online savings accountalready to have a pleasant experience today and in the long run.

#online open account bank#account open instantly#account opening online#bank account online application#bank account open instantly#bank account opening

0 notes