#margin trading cryptocurrency exchanges

Explore tagged Tumblr posts

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

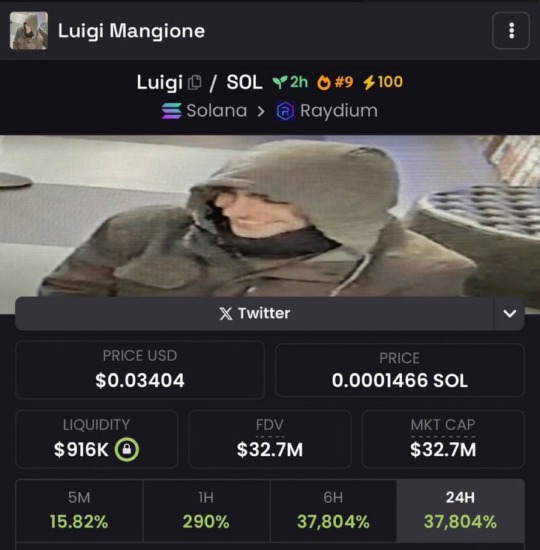

Here’s an example for meme coins:

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

27 notes

·

View notes

Text

SO M!ANY REWARDS!

Watch "MexC: The Place to Be" on YouTube

Bint bam Boom

#crypto#good investment#Mexc exchange#Crypto trading platform#investors#Digital assets exchange#Cryptocurrency exchange#Buy and sell crypto#Trading pairs#Trading volume#User-friendly interface#Advanced trading tools#Margin trading

2 notes

·

View notes

Text

Why Binance is the Crypto Platform of Choice for Many Traders

If you're diving into cryptocurrency, chances are you've heard of Binance—one of the largest and most popular exchanges globally. Founded in 2017 by Changpeng Zhao (CZ), Binance quickly gained traction thanks to its low fees, wide variety of coins, and an array of features beyond just trading. Whether you want to trade Bitcoin, Ethereum, or explore lesser-known altcoins, Binance offers something for everyone.But what truly sets Binance apart from other exchanges? Well, its advanced tools, like futures trading, margin trading, and staking, make it perfect for seasoned investors looking to increase profits. And if you're new to crypto? The simple spot trading options and educational resources are there to help you get started!What's also worth mentioning is Binance’s native token, BNB. This coin lets you save on trading fees and unlocks more options within the Binance ecosystem. As it supports Binance Smart Chain (BSC), BNB's utility extends into decentralized apps and the DeFi space, making it a powerful token for long-term holders.But What About the Downside? Binance has faced regulatory challenges, especially in countries like the UK and Japan, causing some worries about long-term access in certain regions. Despite this, Binance is doing its best to comply with global regulations, and many people still see it as the top platform for crypto enthusiasts.In a world that's constantly changing, Binance provides both the opportunity and tools to succeed in the crypto space. Whether you’re looking to trade, stake, or simply HODL, it has what you need.Got any thoughts on Binance or want to hear from experienced traders? Share your comments below and let's discuss!

3 notes

·

View notes

Text

Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025

In thi Article about Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025, Read it out.

What is Cryptocurrency Exchange

To purchase, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin, you go to an online marketplace called a cryptocurrency exchange. Cryptocurrency exchanges work much like stock exchanges, except instead of issuing or trading stocks, you trade digital currencies.

In simple terms, it’s where Buyers and sellers meet to exchange cryptocurrencies. You can buy cryptocurrency with ordinary money (such as dollars or euros) or swap one cryptocurrency for another. Some exchanges allow you to store your crypto in secure wallets held on the platform.

There are two main types:

Centralized exchanges (CEX)

Decentralized exchanges (DEX)

What is Cryptocurrency Exchange Clone Script

The Cryptocurrency Exchange Clone Script is a ready-made program that simulates the technical features and functionality of popular cryptocurrency exchanges such as Binance, Coinbase, Kraken, or Bitfinex. Compared to developing from scratch, the clone scripts significantly ease and shorten the time required to set up a cryptocurrency exchange network for an aspiring entrepreneur and firms.

These sort of scripts are somewhat equipped with all the basic features to run a cryptocurrency exchange, like user account management, wallet integration, order book, trading engine, liquidity management, and options for secure payment gateways. The whole idea of a clone script is to give you something out-of-the-box that can be customized, thus allowing you to skip the whole painful development process but still be able to modify the script to suit your needs.

Top 6 Cryptocurrency Exchange Clone Scripts

There are many clone scripts for cryptocurrency exchange development, but here are the top 6 of the cryptocurrency exchange clone script.

Binance clone script

Coinbase Clone Script

Kucoin Clone Script

Paxful Clone Script

WazirX clone script

FTX Clone Script

Binance clone script

A Binance clone script is a Pre-made software that is almost ready for use to create your own cryptocurrency exchange platform, along the way simulating Binance, one of the largest and most popular exchanges in the world. This “clone” is a reapplication of some of the features and functionality of Binance, but it can allow for some level of customization depending upon your particular brand and need.

Key Features:

User Registration and Login

Multi-Currency Support

Trading Engine

Multi-Layer Security

Admin Dashboard

Wallet Integration

KYC/AML Compliance

Liquidity Management

Mobile Compatibility

Referral and Affiliate Program

Trading Fees and Commission Management

Live Market Charts and Trading Tools

Coinbase clone script:

The Coinbase clone script is a ready-made solution that allows you to set up a cryptocurrency exchange platform exhibiting features and functionalities similar to the world’s most popular and user-friendly crypto exchange, Coinbase. These scripts are bundled with all the necessary features to run an exchange while still offering ample customization to cater to your branding and business requirements.

Key Features:

User Registration and Account Management

Fiat and Crypto Support

Secure Wallet Integration

Quick Buy/Sell Functionality

Multiple Payment Methods

P2P Trading

Admin Dashboard

Launchpad Functionality

Staking Feature

KYC/AML Compliance

API Integration

Kucoin Clone Script

A KuCoin clone script is a ready-made software solution replicating all functional attributes and operational features of the KuCoin, which can also be customized according to your brand name and business requirement specifications. Fast and feasible for launching your crypto exchange, the idea is to save yourself from the headaches of developing everything from scratch.

Key Features:

Spot trading

Margin trading

Future trading

Crypto derivatives

Advanced security transactions

Escrow protection

User registration

Wallet integration

Advanced analytics

Currency converter

Paxful clone script

A Paxful clone script is a ready-Made platform for opening a peer-to-peer cryptocurrency exchange for users to trade Bitcoin and other cryptocurrencies directly among themselves without any intermediaries. The script replicates the core features of Paxful operated using its server; you can customize it to your brand and business needs.

Key Features:

Secured Escrow Service

Multi Payment Processing

BUY/SELL Ad posting

Real-Time Data

Referrals & Gift Card options

Multi Language Support

Online/Offline Trading

Cold/Offline Wallet Support

FTX Clone Script

An FTX clone script is a ready-made software solution that will allow you to set up your own cryptocurrency exchange like FTX, which was formerly one of the largest crypto exchanges globally before going under in 2022. This script mimics the core features of FTX, such as spot trading, derivatives, margin trading, token offering, etc., so that you can fast-track the launch and operations of your own exchange with customizable branding and features.

Key Features:

Derivatives Trading

Leveraged Tokens

Spot Trading

User-Friendly Interface

KYC/AML Compliance

Staking Functionality

WazirX clone script

A WazirX Clone Script is a pre-made software solution for the creation of your cryptocurrency exchange platform akin to WazirX, one of the top cryptocurrency exchanges in India. The clone script replicating the essential elements, functionality, and WazirX’s user experience enables you to swiftly put together a fully fledged cryptocurrency exchange that would accept a number of digital assets and trading features.

Key Features:

Escrow protection

KYC approval

Trading bots

User-friendly interface

Stunning User Dashboard

SMS Integration

Multiple Payment Methods

Multiple Language Support

Benefits of Using Cryptocurrency Exchange Clone Scripts

The use of a cryptocurrency exchange cloning script entails great advantages, particularly if one is keen on starting an exchange without having to do the full development from scratch. Below, I have listed the primary advantages of using cryptocurrency exchange cloning scripts:

Cost-Effective

Quick and Profitable Launch

Proven Model

Customizable Features

Scalability

Multi-Currency and Multi-Language Support

Low Development Cost

Continuous Support and Updates

Why Choose BlockchainX for Cryptocurrency Exchange clone script

In the opinion of an entrepreneur set to develop a secure, scalable, and feature-loaded cryptocurrency exchange clone script, BlockchainX is the best bet. Since BlockchainX provides a full-fledged solution that replicates the features of flagship cryptocurrency exchanges such as Binance, Coinbase, and WazirX, the entrepreneur gets all the additional features required practically out of the box. With the addition of certain basic offerings such as spot trading, margin trading, and peer-to-peer (P2P) capabilities along with more advanced ones like liquidity management and derivatives trading, BlockchainX provides a holistic set of solutions to carve out an exchange rightly fitted for newbies and pros alike.

Conclusion:

In conclusion, the Top 6 Cryptocurrency Exchange Clone Scripts in 2025 are high-powered and feature-rich solutions which any enterprising spirit would find indispensable if they were to enter the crypto market very quickly and efficiently. Whether it be a Binance clone, Coinbase clone, or WazirX clone-these scripts offer dynamic functionalities that enhance trading engines, wallets, KYC/AML compliance, and various security attributes.

Choosing the right clone script, such as those provided by BlockchainX or other reputable providers, will give you a strong foundation for success in the dynamic world of cryptocurrency exchanges.

#cryptocurrency#cryptocurrency exchange script#exchange clone script#binance clone script#clone script development#blockchainx

2 notes

·

View notes

Text

Buy Verified Binance Account Features:

➤ Support for many of the most traded cryptocurrencies Convert. This is the easiest way to trade. Classic. It’s simple to use ➤ Futures on USES. USDA margined without expiration and leverage up to 125x. Futures on COIN – M ➤ Tokens can be leveraged up to 125 times, with or without expiry dates. ➤ Binance Earn. All-in-one Investment Solution Binance Pool. ➤ Binance is supported in more than 160 countries. ➤ Less time and lower fees ➤ Email and password login ➤ Other login information. ➤ Recovery information. ➤ A new and completely fresh account ➤ 100% verified account ➤ 24/7 customer support. ➤ 7/24 Instant Delivery.

24 Hours Reply/Contact:-

➤Gmail : [email protected] ➤Skype: usaseobiz ➤Telegram:@usaseobiz ➤WhatsApp : +1 (856) 661-7982

Why Choose Binance?

Overview Of Binance And Its Feature Highlights

Binance is one of the most popular cryptocurrency exchanges globally, operating in over 100 countries. It was founded in 2017 by changpeng zhao and has grown to be a market leader in the industry. Some of the features that make binance stand out are:

Availability of over 600 cryptocurrencies: Binance offers access to a wide range of digital assets, including the most famous coins like bitcoin, ethereum, and ripple, as well as the trending ones.

User-friendly interface: Binance is designed with a user-friendly interface, making it easy for beginners to navigate the platform and execute trades easily.

High liquidity: Binance’s high trading volumes make it one of the most liquid exchanges in the market, ensuring that traders can always find a match for their orders.

Advanced trading tools: Binance offers a range of advanced trading tools like limit orders, stop-loss orders, and margin trading for advanced traders.

Benefits Of Using Binance

Trading on binance comes with several benefits, including:

High-security measures: Binance employs state-of-the-art security measures, including two-factor authentication, cold storage, and security audits, to ensure the safety of its users’ funds.

Lower trading fees: Binance charges some of the most competitive trading fees in the industry, with a 0.1% fee for trades. Users also get lower fees when they use binance’s native coin, binance coin (bnb).

Fast trade execution: Binance’s trading engine is designed to handle a massive amount of transactions per second, ensuring fast trade execution and quick order fills.

Supports multiple languages: Binance is available in multiple languages, making it accessible to people from different regions and facilitating global adoption.

Provides educational resources: Binance offers educational resources for newcomers to the cryptocurrency space, including articles, videos, and webinars, to help them understand how the market works and how to trade successfully.

If you’re looking for a secure, user-friendly, and feature-rich cryptocurrency exchange, binance is the perfect choice for you. Join the millions of traders who trust binance and start trading today!

How To Create A Binance Account

Buy Verified Binance Account: How To Create A Binance Account

Are you interested in creating your own binance account? Binance is one of the world’s largest cryptocurrency exchanges and a popular platform for buying and selling cryptocurrencies. If you want to create a binance account, follow this step-by-step guide.

Step-By-Step Guide On Creating A Binance Account

Go to binance.com and click on the ‘register’ button located at the top right-hand corner of the screen.

Enter your email address and create a secure password.

Solve the captcha security puzzle, and then click on the ‘register’ button.

Binance will send you a verification email. Go to your email inbox and find the verification email, then click on the link provided.

Once you have followed the link, binance will prompt you to complete a kyc (know your customer) verification process, which will require you to provide personal information such as your name, address, date of birth, and identification documents such as a passport or driver’s license.

After submitting your verification, binance will check your information and approve your application if the information you provided is correct.

After approval, you can start using binance to buy and sell cryptocurrencies.

Required Information And Verification Process

Binance requires every new user to complete a kyc verification process. The verification process involves providing personal information and identification documents. The following information is required:

Full name

Address

Date of birth

Identification documents (passport, driver’s license, national id, or any government-issued id)

Your uploaded documents will typically be processed within 24-48 hours. It’s worth noting that binance may require additional documents or information to approve your account, so be prepared to provide any necessary information promptly.

Tips For Account Safety

Binance takes security seriously, and there are several steps you can take to maximize your account’s safety:

Enable 2-factor authentication (2fa) to add an additional security layer to your account.

Always use a strong, unique password and avoid reusing passwords across multiple platforms.

Avoid sharing your account login details with anyone, and don’t fall for phishing scams that ask you to provide your account information.

Use reputable anti-virus and anti-malware software on your computer and mobile devices.

Creating a binance account is a simple, yet necessary process for anyone interested in trading cryptocurrencies. By following these guidelines, you can set up your account with ease and ensure that it is secure.

How To Verify Your Binance Account

The Importance Of Verifying Your Binance Account

Verifying your binance account is crucial for a variety of reasons, including:

Ensuring the security of your account against potential hacking and fraudulent activities.

Avoiding any service disruptions or deposit/withdrawal interruptions.

Gaining higher withdrawal limits for increased flexibility in trading cryptocurrencies.

Step-By-Step Guide On Verifying Your Binance Account

Follow these easy steps to verify your binance account:

Log in to your binance account and click on the “account” tab.

Click on the “verify” button and select your country of residence.

Choose the type of identification document you possess and input the required information.

Upload a clear and legible photo of your identification document, along with a selfie of yourself holding the same document.

Wait for the verification process to complete (usually within 15 minutes).

Additional Verification Requirements For Higher Withdrawal Limits

If you want to have access to higher withdrawal limits, you will need to complete additional verification requirements. These include:

Providing proof of residential address (i.e. Utility bill, bank statement, etc. Dated within the last three months).

Submitting a video verification (in some countries).

Once you complete these steps, you will be able to enjoy higher withdrawal limits. It is important to monitor your account and continue to comply with all regulations to ensure continued access to binance’s services.

The Pitfalls Of Buying An Unverified Binance Account

Buying verified binance account may seem like an attractive proposition. It can save you time and get you access to trading cryptocurrencies without waiting for a lengthy verification process. However, the risks of purchasing an unverified account far outweigh any potential benefits.

Here are some pitfalls to avoid:

Risks Of Buying An Unverified Binance Account

To better understand what you are getting into, let’s take a closer look at the major risks involved:

Unauthorized access: If you buy an unverified binance account, the initial owner can still have access to it. The owner can use your account for illegal activities or access your sensitive information, causing you both legal and financial problems.

Monetary loss: Because there is no assurance that your unverified account has not been hacked, your funds are not secured. You will run the risk of losing all of your hard-earned crypto money, which can be devastating.

Fraudulent activities: Unverified accounts are not monitored by binance authorities so who knows if your seller has used or continues to use it for fraudulent activities such as money laundering. If this happens, you may get implicated and face legal action.

Avoiding Scam Websites

It’s understandable to feel anxious when it comes to trusting someone else, especially when it comes to trading cryptos. To ensure that you are not being scammed by purchasing an unverified binance account, follow these steps:

Verify the seller’s identity by checking their online reputation and conducting due diligence on their past transactions.

Use only a reputable intermediary or escrow service to complete your transaction.

Ensure that the seller uses a verified binance account, which is safeguarded and validated by the platform.

Keep your purchase as a private affair, and never reveal your account details to anyone else.

Remember, the verification process of opening and using a binance account is in place to protect both the platform and the users. When you sidestep this process, you put yourself at risk. Always exercise caution and purchase a verified binance account.

The Benefits Of Buying A Verified Binance Account

If you’re looking to engage in cryptocurrency trading, you cannot ignore the importance of having a binance account. Binance is one of the world’s largest cryptocurrency exchanges, catering to millions of customers globally. While opening a binance account is a straightforward process, the issue of verification can cause unnecessary headaches.

This is when buying a verified binance account can save you time and effort.

The Advantages Of Buying A Verified Binance Account From A Reputable Seller

Buying a verified binance account from a reputable seller can offer you numerous benefits, such as:

Immediate access to the platform: A verified binance account allows you to sign in and start trading immediately. You don’t have to wait for the verification process to complete, which can take several days.

A higher deposit and withdrawal limit: A verified account comes with a higher deposit and withdrawal limit that enables you to carry out more significant trades.

No limit on cryptocurrency withdrawals: Non-verified accounts have restrictions on cryptocurrency withdrawals. A verified account, on the other hand, comes with no such restrictions.

Enhanced account security: By buying a verified account, you can rest assured that the account is secure, backed by superior security features and software updates.

24/7 account support: Reputable sellers offering verified binance accounts provide round-the-clock account support to cater to your needs at any time of the day.

When buying a verified binance account, it is imperative to analyze and choose the right seller carefully. You should ensure that the seller you choose eliminates the risk of scams and frauds by providing clear verification policies.

The advantages of buying a verified binance account from a reputable seller are plenty. Not only does it offer you immediate access to the platform, but it also provides an enhanced security feature, higher withdrawal and deposit limits, and 24/7 account support.

With the right seller, it’s a decision that can streamline your cryptocurrency trading process.

24 Hours Reply/Contact:-

➤Gmail : [email protected] ➤Skype: usaseobiz ➤Telegram:@usaseobiz ➤WhatsApp : +1 (856) 661-7982

#buyverifiedbainanceaccounts#bainanceaccount#oldbainanceaccount#newbainanceaccount#bainanceaccountsell#BTC#Bitcoin#Ethereum#Crypto#USDT#BNB#Binance#HTX#KuCoin#OKX#Bybit#Gateio#Upbit#Blockchain#Web3#Altcoin#airdrop#crypto#cryptocurrency#bounties#bitcoin#ETH#freetoken#freecoin#ICO

6 notes

·

View notes

Text

Buy Verified Binance Account

Buy Verified Binance Account Features:

➤ Support for many of the most traded cryptocurrencies Convert. This is the easiest way to trade. Classic. It’s simple to use ➤ Futures on USES. USDA margined without expiration and leverage up to 125x. Futures on COIN – M ➤ Tokens can be leveraged up to 125 times, with or without expiry dates. ➤ Binance Earn. All-in-one Investment Solution Binance Pool. ➤ Binance is supported in more than 160 countries. ➤ Less time and lower fees ➤ Email and password login ➤ Other login information. ➤ Recovery information. ➤ A new and completely fresh account ➤ 100% verified account ➤ 24/7 customer support. ➤ 7/24 Instant Delivery.

24 Hours Reply/Contact:-

➤Gmail : [email protected] ➤Skype: usaseobiz ➤Telegram:@usaseobiz ➤WhatsApp : +1 (856) 661-7982

Why Choose Binance?

Overview Of Binance And Its Feature Highlights

Binance is one of the most popular cryptocurrency exchanges globally, operating in over 100 countries. It was founded in 2017 by changpeng zhao and has grown to be a market leader in the industry. Some of the features that make binance stand out are:

Availability of over 600 cryptocurrencies: Binance offers access to a wide range of digital assets, including the most famous coins like bitcoin, ethereum, and ripple, as well as the trending ones.

User-friendly interface: Binance is designed with a user-friendly interface, making it easy for beginners to navigate the platform and execute trades easily.

High liquidity: Binance’s high trading volumes make it one of the most liquid exchanges in the market, ensuring that traders can always find a match for their orders.

Advanced trading tools: Binance offers a range of advanced trading tools like limit orders, stop-loss orders, and margin trading for advanced traders.

Benefits Of Using Binance

Trading on binance comes with several benefits, including:

High-security measures: Binance employs state-of-the-art security measures, including two-factor authentication, cold storage, and security audits, to ensure the safety of its users’ funds.

Lower trading fees: Binance charges some of the most competitive trading fees in the industry, with a 0.1% fee for trades. Users also get lower fees when they use binance’s native coin, binance coin (bnb).

Fast trade execution: Binance’s trading engine is designed to handle a massive amount of transactions per second, ensuring fast trade execution and quick order fills.

Supports multiple languages: Binance is available in multiple languages, making it accessible to people from different regions and facilitating global adoption.

Provides educational resources: Binance offers educational resources for newcomers to the cryptocurrency space, including articles, videos, and webinars, to help them understand how the market works and how to trade successfully.

If you’re looking for a secure, user-friendly, and feature-rich cryptocurrency exchange, binance is the perfect choice for you. Join the millions of traders who trust binance and start trading today!

How To Create A Binance Account

Buy Verified Binance Account: How To Create A Binance Account

Are you interested in creating your own binance account? Binance is one of the world’s largest cryptocurrency exchanges and a popular platform for buying and selling cryptocurrencies. If you want to create a binance account, follow this step-by-step guide.

Step-By-Step Guide On Creating A Binance Account

Go to binance.com and click on the ‘register’ button located at the top right-hand corner of the screen.

Enter your email address and create a secure password.

Solve the captcha security puzzle, and then click on the ‘register’ button.

Binance will send you a verification email. Go to your email inbox and find the verification email, then click on the link provided.

Once you have followed the link, binance will prompt you to complete a kyc (know your customer) verification process, which will require you to provide personal information such as your name, address, date of birth, and identification documents such as a passport or driver’s license.

After submitting your verification, binance will check your information and approve your application if the information you provided is correct.

After approval, you can start using binance to buy and sell cryptocurrencies.

Required Information And Verification Process

Binance requires every new user to complete a kyc verification process. The verification process involves providing personal information and identification documents. The following information is required:

Full name

Address

Date of birth

Identification documents (passport, driver’s license, national id, or any government-issued id)

Your uploaded documents will typically be processed within 24-48 hours. It’s worth noting that binance may require additional documents or information to approve your account, so be prepared to provide any necessary information promptly.

Tips For Account Safety

Binance takes security seriously, and there are several steps you can take to maximize your account’s safety:

Enable 2-factor authentication (2fa) to add an additional security layer to your account.

Always use a strong, unique password and avoid reusing passwords across multiple platforms.

Avoid sharing your account login details with anyone, and don’t fall for phishing scams that ask you to provide your account information.

Use reputable anti-virus and anti-malware software on your computer and mobile devices.

Creating a binance account is a simple, yet necessary process for anyone interested in trading cryptocurrencies. By following these guidelines, you can set up your account with ease and ensure that it is secure.

How To Verify Your Binance Account

The Importance Of Verifying Your Binance Account

Verifying your binance account is crucial for a variety of reasons, including:

Ensuring the security of your account against potential hacking and fraudulent activities.

Avoiding any service disruptions or deposit/withdrawal interruptions.

Gaining higher withdrawal limits for increased flexibility in trading cryptocurrencies.

Step-By-Step Guide On Verifying Your Binance Account

Follow these easy steps to verify your binance account:

Log in to your binance account and click on the “account” tab.

Click on the “verify” button and select your country of residence.

Choose the type of identification document you possess and input the required information.

Upload a clear and legible photo of your identification document, along with a selfie of yourself holding the same document.

Wait for the verification process to complete (usually within 15 minutes).

Additional Verification Requirements For Higher Withdrawal Limits

If you want to have access to higher withdrawal limits, you will need to complete additional verification requirements. These include:

Providing proof of residential address (i.e. Utility bill, bank statement, etc. Dated within the last three months).

Submitting a video verification (in some countries).

Once you complete these steps, you will be able to enjoy higher withdrawal limits. It is important to monitor your account and continue to comply with all regulations to ensure continued access to binance’s services.

The Benefits Of Buying A Verified Binance Account

If you’re looking to engage in cryptocurrency trading, you cannot ignore the importance of having a binance account. Binance is one of the world’s largest cryptocurrency exchanges, catering to millions of customers globally. While opening a binance account is a straightforward process, the issue of verification can cause unnecessary headaches.

This is when buying a verified binance account can save you time and effort.

The Advantages Of Buying A Verified Binance Account From A Reputable Seller

Buying a verified binance account from a reputable seller can offer you numerous benefits, such as:

Immediate access to the platform: A verified binance account allows you to sign in and start trading immediately. You don’t have to wait for the verification process to complete, which can take several days.

A higher deposit and withdrawal limit: A verified account comes with a higher deposit and withdrawal limit that enables you to carry out more significant trades.

No limit on cryptocurrency withdrawals: Non-verified accounts have restrictions on cryptocurrency withdrawals. A verified account, on the other hand, comes with no such restrictions.

Enhanced account security: By buying a verified account, you can rest assured that the account is secure, backed by superior security features and software updates.

24/7 account support: Reputable sellers offering verified binance accounts provide round-the-clock account support to cater to your needs at any time of the day.

When buying a verified binance account, it is imperative to analyze and choose the right seller carefully. You should ensure that the seller you choose eliminates the risk of scams and frauds by providing clear verification policies.

The advantages of buying a verified binance account from a reputable seller are plenty. Not only does it offer you immediate access to the platform, but it also provides an enhanced security feature, higher withdrawal and deposit limits, and 24/7 account support.

With the right seller, it’s a decision that can streamline your cryptocurrency trading process.

Frequently Asked Questions Of Buy Verified Binance Account

What Is A Verified Binance Account?

A verified binance account is one that has undergone a thorough kyc process, which involves submitting personal identification documents.

Can I Buy A Verified Binance Account?

Yes, you can purchase a verified binance account from verified account sellers, but it’s important to be careful and choose a reputable seller.

Why Should I Buy A Verified Binance Account?

Buying a verified binance account allows you to avoid the lengthy and often complicated kyc process and start trading almost immediately.

Is It Safe To Buy A Verified Binance Account?

Buying a verified binance account is safe as long as you choose a reputable seller with positive reviews and a proven track record.

How Much Does A Verified Binance Account Cost?

The cost of a verified binance account varies depending on the seller and the level of verification, but it typically ranges from $100 to $500.

What Are The Risks Of Using A Purchased Binance Account?

The risks of using a purchased binance account include potential fraud, account suspension, and loss of funds. Only use reputable sellers to minimize these risks.

24 Hours Reply/Contact:-

➤Gmail : [email protected] ➤Skype: usaseobiz ➤Telegram:@usaseobiz ➤WhatsApp : +1 (856) 661-7982

#buyverifiedbainanceaccounts#bainanceaccount#oldbainanceaccount#newbainanceaccount#bainanceaccountsell

2 notes

·

View notes

Text

Buy Verified Binance Account

Buy Verified Binance Account Features:

➤ Support for many of the most traded cryptocurrencies Convert. This is the easiest way to trade. Classic. It’s simple to use ➤ Futures on USES. USDA margined without expiration and leverage up to 125x. Futures on COIN – M ➤ Tokens can be leveraged up to 125 times, with or without expiry dates. ➤ Binance Earn. All-in-one Investment Solution Binance Pool. ➤ Binance is supported in more than 160 countries. ➤ Less time and lower fees ➤ Email and password login ➤ Other login information. ➤ Recovery information. ➤ A new and completely fresh account ➤ 100% verified account ➤ 24/7 customer support. ➤ 7/24 Instant Delivery.

24 Hours Reply/Contact:-

➤Gmail : [email protected] ➤Skype: usaseobiz ➤Telegram:@usaseobiz ➤WhatsApp : +1 (856) 661-7982

Overview Of Binance And Its Feature Highlights

Binance is one of the most popular cryptocurrency exchanges globally, operating in over 100 countries. It was founded in 2017 by changpeng zhao and has grown to be a market leader in the industry. Some of the features that make binance stand out are:

Availability of over 600 cryptocurrencies: Binance offers access to a wide range of digital assets, including the most famous coins like bitcoin, ethereum, and ripple, as well as the trending ones.

User-friendly interface: Binance is designed with a user-friendly interface, making it easy for beginners to navigate the platform and execute trades easily.

High liquidity: Binance’s high trading volumes make it one of the most liquid exchanges in the market, ensuring that traders can always find a match for their orders.

Advanced trading tools: Binance offers a range of advanced trading tools like limit orders, stop-loss orders, and margin trading for advanced traders.

Benefits Of Using Binance

Trading on binance comes with several benefits, including:

High-security measures: Binance employs state-of-the-art security measures, including two-factor authentication, cold storage, and security audits, to ensure the safety of its users’ funds.

Lower trading fees: Binance charges some of the most competitive trading fees in the industry, with a 0.1% fee for trades. Users also get lower fees when they use binance’s native coin, binance coin (bnb).

Fast trade execution: Binance’s trading engine is designed to handle a massive amount of transactions per second, ensuring fast trade execution and quick order fills.

Supports multiple languages: Binance is available in multiple languages, making it accessible to people from different regions and facilitating global adoption.

Provides educational resources: Binance offers educational resources for newcomers to the cryptocurrency space, including articles, videos, and webinars, to help them understand how the market works and how to trade successfully.

If you’re looking for a secure, user-friendly, and feature-rich cryptocurrency exchange, binance is the perfect choice for you. Join the millions of traders who trust binance and start trading today!

How To Create A Binance Account

Buy Verified Binance Account: How To Create A Binance Account

Are you interested in creating your own binance account? Binance is one of the world’s largest cryptocurrency exchanges and a popular platform for buying and selling cryptocurrencies. If you want to create a binance account, follow this step-by-step guide.

Step-By-Step Guide On Creating A Binance Account

Go to binance.com and click on the ‘register’ button located at the top right-hand corner of the screen.

Enter your email address and create a secure password.

Solve the captcha security puzzle, and then click on the ‘register’ button.

Binance will send you a verification email. Go to your email inbox and find the verification email, then click on the link provided.

Once you have followed the link, binance will prompt you to complete a kyc (know your customer) verification process, which will require you to provide personal information such as your name, address, date of birth, and identification documents such as a passport or driver’s license.

After submitting your verification, binance will check your information and approve your application if the information you provided is correct.

After approval, you can start using binance to buy and sell cryptocurrencies.

Tips For Account Safety

Binance takes security seriously, and there are several steps you can take to maximize your account’s safety:

Enable 2-factor authentication (2fa) to add an additional security layer to your account.

Always use a strong, unique password and avoid reusing passwords across multiple platforms.

Avoid sharing your account login details with anyone, and don’t fall for phishing scams that ask you to provide your account information.

Use reputable anti-virus and anti-malware software on your computer and mobile devices.

Creating a binance account is a simple, yet necessary process for anyone interested in trading cryptocurrencies. By following these guidelines, you can set up your account with ease and ensure that it is secure.

Step-By-Step Guide On Verifying Your Binance Account

Follow these easy steps to verify your binance account:

Log in to your binance account and click on the “account” tab.

Click on the “verify” button and select your country of residence.

Choose the type of identification document you possess and input the required information.

Upload a clear and legible photo of your identification document, along with a selfie of yourself holding the same document.

Wait for the verification process to complete (usually within 15 minutes).

Additional Verification Requirements For Higher Withdrawal Limits

If you want to have access to higher withdrawal limits, you will need to complete additional verification requirements. These include:

Providing proof of residential address (i.e. Utility bill, bank statement, etc. Dated within the last three months).

Submitting a video verification (in some countries).

Once you complete these steps, you will be able to enjoy higher withdrawal limits. It is important to monitor your account and continue to comply with all regulations to ensure continued access to binance’s services.

Risks Of Buying An Unverified Binance Account

To better understand what you are getting into, let’s take a closer look at the major risks involved:

Unauthorized access: If you buy an unverified binance account, the initial owner can still have access to it. The owner can use your account for illegal activities or access your sensitive information, causing you both legal and financial problems.

Monetary loss: Because there is no assurance that your unverified account has not been hacked, your funds are not secured. You will run the risk of losing all of your hard-earned crypto money, which can be devastating.

Fraudulent activities: Unverified accounts are not monitored by binance authorities so who knows if your seller has used or continues to use it for fraudulent activities such as money laundering. If this happens, you may get implicated and face legal action.

Avoiding Scam Websites

It’s understandable to feel anxious when it comes to trusting someone else, especially when it comes to trading cryptos. To ensure that you are not being scammed by purchasing an unverified binance account, follow these steps:

Verify the seller’s identity by checking their online reputation and conducting due diligence on their past transactions.

Use only a reputable intermediary or escrow service to complete your transaction.

Ensure that the seller uses a verified binance account, which is safeguarded and validated by the platform.

Keep your purchase as a private affair, and never reveal your account details to anyone else.

Remember, the verification process of opening and using a binance account is in place to protect both the platform and the users. When you sidestep this process, you put yourself at risk. Always exercise caution and purchase a verified binance account.

The Benefits Of Buying A Verified Binance Account

If you’re looking to engage in cryptocurrency trading, you cannot ignore the importance of having a binance account. Binance is one of the world’s largest cryptocurrency exchanges, catering to millions of customers globally. While opening a binance account is a straightforward process, the issue of verification can cause unnecessary headaches.

This is when buying a verified binance account can save you time and effort.

The Advantages Of Buying A Verified Binance Account From A Reputable Seller

Buying a verified binance account from a reputable seller can offer you numerous benefits, such as:

Immediate access to the platform: A verified binance account allows you to sign in and start trading immediately. You don’t have to wait for the verification process to complete, which can take several days.

A higher deposit and withdrawal limit: A verified account comes with a higher deposit and withdrawal limit that enables you to carry out more significant trades.

No limit on cryptocurrency withdrawals: Non-verified accounts have restrictions on cryptocurrency withdrawals. A verified account, on the other hand, comes with no such restrictions.

Enhanced account security: By buying a verified account, you can rest assured that the account is secure, backed by superior security features and software updates.

24/7 account support: Reputable sellers offering verified binance accounts provide round-the-clock account support to cater to your needs at any time of the day.

When buying a verified binance account, it is imperative to analyze and choose the right seller carefully. You should ensure that the seller you choose eliminates the risk of scams and frauds by providing clear verification policies.

The advantages of buying a verified binance account from a reputable seller are plenty. Not only does it offer you immediate access to the platform, but it also provides an enhanced security feature, higher withdrawal and deposit limits, and 24/7 account support.

With the right seller, it’s a decision that can streamline your cryptocurrency trading process.

24 Hours Reply/Contact:-

➤Gmail : [email protected] ➤Skype: usaseobiz ➤Telegram:@usaseobiz ➤WhatsApp : +1 (856) 661-7982

3 notes

·

View notes

Text

PHEMEX Exchange

Founded by former executives of Morgan Stanley in 2019, Phemex stands as a leading cryptocurrency futures exchange, facilitating the trading of diverse digital assets such as Bitcoin, Ethereum, Solana, Avalanche, Shiba Inu, and over 250 others. With a commitment to serving both professional and retail traders, Phemex offers an intuitive interface, competitive fees, tight spreads, and lightning-fast execution speeds.

Unleash the power of Phemex, the visionary platform that empowers traders worldwide. Trade a vast array of digital assets, including renowned cryptocurrencies like Bitcoin, Ethereum, and Ripple. Phemex caters to both spot and margin trading, ensuring that even the most seasoned traders have access to advanced tools and features. Experience the advantage of Phemex’s minimal fees, enabling you to maximize your profits. Available in over 180 countries, Phemex welcomes traders from around the globe to embark on an exciting journey towards financial success.

PHEMEX: Secure and Reliable?

Phemex assures safety as a regulated cryptocurrency exchange, duly registered with the US Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). This regulatory oversight mandates stringent financial compliance, including robust anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) measures.

Rest easy knowing that Phemex provides a secure haven for buying, selling, and trading digital assets. As a testament to its credibility, the platform boasts support from industry giants like Galaxy Digital and BitMEX, cementing its position as a trusted choice in the cryptocurrency landscape. Embrace the peace of mind that comes with Phemex’s commitment to safety and the backing of renowned investors.

PHEMEX Trading Fees

Phemex stands out as the most cost-effective exchange globally, offering an unprecedented 0.025% rebate on market maker orders. Here’s how it works: when you place a limit order on Phemex and it successfully matches with another trade, Phemex will reward you with a 0.025% rebate.

Moreover, for standard market orders, Phemex imposes a mere 0.075% taker fee per trade. Take advantage of these exceptional rates and maximize your trading potential on Phemex, the ultimate destination for affordable cryptocurrency transactions. Unleash the power of low fees and embrace a rewarding trading experience with Phemex.

PHEMEX KYC Verification

Currently, Phemex sets itself apart by not mandating KYC verification for trading on their platform. This unique feature allows users to swiftly engage in cryptocurrency trading without the hassle of submitting identity verification documents. Phemex stands out as one of the few derivatives exchanges that still provide this convenience.

However, for traders dealing with substantial sums exceeding $100,000 USD, the completion of Phemex Premium membership verification becomes necessary to facilitate seamless transfers to and from their bank accounts. This added verification step ensures smooth transactions and meets the needs of large-scale traders.

Join Phemex, where trading freedom and convenience converge. Enjoy the ease of trading cryptocurrencies without the burden of KYC verification. Explore the possibilities, and if you’re a high-volume trader, unlock the full potential of Phemex by undergoing Premium membership verification. Experience a platform that caters to both small-scale and large-scale traders with efficiency and flexibility.

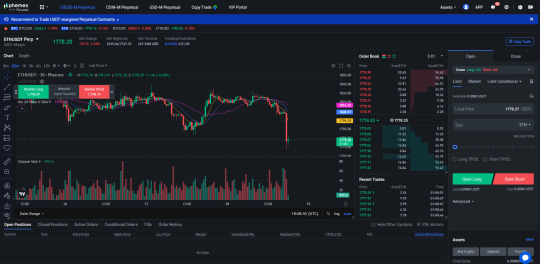

Futures and Derivatives Trading on PHEMEX

Trading ETH/USD derivatives on Phemex Futures.

Available Cryptocurrencies on PHEMEX

Phemex presents an extensive selection of top cryptocurrencies, akin to those found on renowned exchanges such as Binance or FTX. With a diverse range of over 200 digital assets, Phemex keeps pace with the ever-evolving market by promptly listing trending coins like ApeCoin (APE) or Decentraland (MANA). Discover the thrill of trading with an array of exciting options on Phemex’s platform, where opportunities abound and innovation thrives. Unleash your trading potential and explore the world of cryptocurrencies with Phemex.

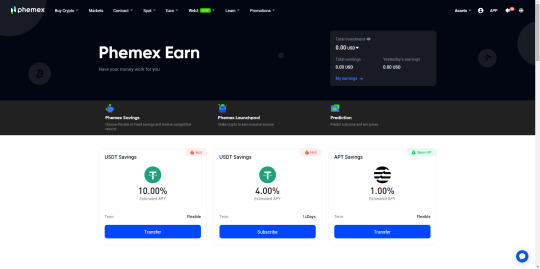

PHEMEX Earn

PHEMEX Conclusion

Discover the thriving world of Phemex, a user-friendly cryptocurrency exchange that is rapidly gaining momentum. With an impressive array of over 250 assets available for spot and futures trading, Phemex eliminates the hassle of KYC verification. Embrace the allure of low fees, abundant liquidity, and a platform tailored for both seasoned traders and beginners alike. Rest assured, Phemex prioritizes your safety, being registered with the CFTC and SEC. Unlock the potential of passive income through Phemex Earn, where staking opens doors to enticing opportunities. Join now through the provided link and seize the exclusive $180 Crypto Bonus. Don’t let this exhilarating journey pass you by.

2 notes

·

View notes

Text

What is binance and types of trading & how to make money from it

Homecryptocurrency

What is binance and types of trading & how to make money from it

bywebcallon-March 09, 2023

0

what is binance

Binance is a global cryptocurrency exchange that was founded in 2017 by Changpeng Zhao, a former software developer at Bloomberg Tradebook. It has quickly become one of the most popular exchanges in the world due to its wide range of features and user-friendly interface. Binance is headquartered in Malta and has offices in various countries around the world.

One of the key features of Binance is its vast selection of cryptocurrencies. It currently supports over 500 different coins and tokens, making it one of the most comprehensive exchanges in the market. This allows users to access a wide range of investment opportunities and diversify their portfolio across different cryptocurrencies.

Binance also offers a variety of trading options, including spot trading, margin trading, and futures trading. Spot trading involves buying and selling cryptocurrencies for immediate delivery, while margin trading allows users to trade with borrowed funds, giving them the opportunity to increase their profits or losses. Futures trading involves trading contracts that allow traders to speculate on the price of a cryptocurrency at a future date.

In addition to trading, Binance offers a range of other services, including staking, savings, and lending. Staking involves holding cryptocurrencies in a wallet to support the network and earn rewards. Savings allows users to earn interest on their cryptocurrency holdings, while lending allows them to earn interest by lending their cryptocurrency to other users.

Binance also has its own cryptocurrency, Binance Coin (BNB), which can be used to pay for trading fees on the platform. BNB has become one of the most popular cryptocurrencies in the market, with a market capitalization of over $40 billion.

One of the key strengths of Binance is its security measures. The platform uses a variety of security features to protect user funds, including two-factor authentication, SSL encryption, and cold storage. Binance also has a Secure Asset Fund for Users (SAFU) that provides an extra layer of protection in case of security breaches or other unexpected events.

Another advantage of Binance is its user-friendly interface. The platform is designed to be easy to use, even for beginners, and offers a range of educational resources to help users learn about cryptocurrencies and trading. Binance also has a mobile app that allows users to trade and manage their portfolio on the go.

Despite its many strengths, Binance has faced some challenges in recent years. In 2019, the platform suffered a security breach that resulted in the theft of over $40 million worth of cryptocurrency. Binance responded quickly to the breach and was able to recover the stolen funds, but it highlighted the need for strong security measures in the cryptocurrency industry.

Binance has also faced regulatory scrutiny in some countries, including the United States and Japan. In 2021, the Financial Conduct Authority (FCA) in the UK banned Binance from operating in the country, citing concerns about its compliance with anti-money laundering (AML) regulations. Binance has since made efforts to improve its AML policies and has been working to address regulatory concerns in other countries.

In conclusion, Binance is a comprehensive and user-friendly cryptocurrency exchange that offers a wide range of trading options and services. Its vast selection of cryptocurrencies, security measures, and educational resources make it an attractive choice for both beginner and experienced traders. However, like any cryptocurrency exchange, it also faces challenges and risks, including security breaches and regulatory scrutiny. As with any investment, it is important for users to do their own research and carefully consider the risks before investing in cryptocurrencies.

Binance has grown rapidly since its launch in 2017 and has become one of the largest cryptocurrency exchanges in the world. According to CoinMarketCap, Binance is currently ranked as the 4th largest exchange by trading volume, with a 24-hour trading volume of over $12 billion at the time of writing.

Binance has also expanded its offerings beyond just cryptocurrency trading. In 2020, the exchange launched Binance Card, a debit card that allows users to spend their cryptocurrency holdings at merchants that accept Visa. Binance has also launched its own blockchain, Binance Chain, which is designed to facilitate the issuance and trading of digital assets.

Binance has also been active in the cryptocurrency industry through its various initiatives and investments. In 2019, the exchange launched Binance Labs, a blockchain incubator that invests in early-stage blockchain projects. Binance has also invested in other blockchain companies and projects, including Polkadot, Terra, and Oasis Labs.

Another notable feature of Binance is its customer support. The platform offers 24/7 customer support via live chat, email, and social media, which has earned it a reputation for being responsive and helpful. Binance also has a large community of users and supporters, with over 3 million followers on Twitter and over 2 million members in its official Telegram group.

In terms of fees, Binance is known for having some of the lowest trading fees in the industry. The platform charges a flat fee of 0.1% for spot trading and 0.04% for futures trading, with further discounts available for users who hold BNB. Binance also has a referral program that allows users to earn commission by referring new users to the platform.

Overall, Binance is a popular and well-established cryptocurrency exchange that offers a wide range of features and services for traders and investors. While it faces some challenges and risks, it has demonstrated a commitment to security, innovation, and customer support that has earned it a loyal following in the cryptocurrency community.

Binance has a strong focus on innovation and has been at the forefront of developing new products and features in the cryptocurrency space. In 2020, the exchange launched Binance Smart Chain, a blockchain platform that enables the creation of decentralized applications (dApps) and the execution of smart contracts. Binance Smart Chain has gained significant traction in the decentralized finance (DeFi) space, with a growing number of dApps being built on the platform.

Binance has also been active in the crypto lending space. In 2019, the exchange launched Binance Lending, a platform that allows users to lend their cryptocurrency holdings to other users and earn interest. Binance Lending has since expanded to offer a range of lending products, including flexible and fixed-term loans.

In addition to its lending platform, Binance has also launched a peer-to-peer (P2P) trading platform. P2P trading allows users to buy and sell cryptocurrencies directly with each other, without the need for a centralized exchange. This can be particularly useful in countries where cryptocurrency exchanges are restricted or banned.

Binance has also been actively involved in promoting cryptocurrency adoption and education. The exchange has launched a range of educational resources, including articles, videos, and webinars, to help users learn about cryptocurrencies and blockchain technology. Binance has also launched several initiatives aimed at promoting cryptocurrency adoption, such as the Binance Charity Foundation, which uses blockchain technology to facilitate charitable donations.

One area where Binance has faced criticism is in its listing process for new cryptocurrencies. Some critics have accused the exchange of prioritizing profit over due diligence, leading to the listing of some questionable cryptocurrencies. Binance has responded by implementing stricter listing requirements and conducting more thorough due diligence on new listings.

Overall, Binance is a dynamic and innovative cryptocurrency exchange that has become a major player in the industry. While it faces some challenges and criticisms, it has demonstrated a commitment to security, innovation, and customer support that has helped it attract a large and loyal user base.

Binance has a user-friendly interface that is easy to navigate, making it an attractive option for both novice and experienced traders. The platform also offers a range of advanced trading tools, such as advanced charting, technical analysis, and trading indicators. These tools allow traders to conduct detailed analysis and make informed trading decisions.

Binance also offers a range of order types, including limit orders, market orders, stop-limit orders, and trailing stop orders. These order types allow traders to execute their trades with greater precision and control.

Another feature of Binance is its margin trading platform. Margin trading allows users to trade with borrowed funds, enabling them to increase their potential profits (as well as their potential losses). Binance offers up to 125x leverage on select cryptocurrencies, which can be particularly attractive to experienced traders.

Binance also offers a range of security features to protect its users' funds and personal information. These include two-factor authentication (2FA), anti-phishing measures, and SSL encryption. Binance also has a Secure Asset Fund for Users (SAFU) that acts as an emergency insurance fund in the event of a security breach or hack.

Finally, Binance has a wide range of supported cryptocurrencies, including many of the most popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, as well as a range of smaller and emerging cryptocurrencies. This makes it a one-stop-shop for users who want to trade a variety of cryptocurrencies on a single platform.

Overall, Binance offers a wide range of features and services that make it a popular and well-regarded cryptocurrency exchange. While it is not without its challenges and criticisms, it has demonstrated a commitment to innovation, security, and customer support that has helped it become a major player in the industry.

Types of trading in binance

Binance offers several types of trading for its users, including:

Spot Trading: This is the most common type of trading on Binance. In spot trading, users buy and sell cryptocurrencies at the current market price. The user's order is matched with an existing order on the exchange's order book.

Margin Trading: Binance offers margin trading, which allows users to trade with borrowed funds. This means users can increase their profits (as well as their losses) by trading with leverage. Binance offers up to 125x leverage on select cryptocurrencies.

Futures Trading: Binance also offers futures trading, which allows users to trade cryptocurrencies at a predetermined price at a future date. This type of trading is typically used by more experienced traders who want to hedge against price fluctuations.

Options Trading: Binance also offers options trading, which allows users to buy and sell options contracts based on the price of an underlying cryptocurrency. Options trading can be used for hedging, speculation, or generating income.

OTC Trading: Binance also offers over-the-counter (OTC) trading for large volume trades. This type of trading is typically used by institutional investors or high-net-worth individuals who want to avoid affecting the market price of a cryptocurrency.

Leveraged Tokens: Binance offers leveraged tokens that allow users to gain exposure to the price movements of cryptocurrencies without having to manage their own leveraged positions. Leveraged tokens can be bought and sold on Binance like any other cryptocurrency.

Staking: Binance offers staking services for select cryptocurrencies. Staking involves holding a certain cryptocurrency in a wallet for a certain period of time to earn rewards. Binance offers staking rewards to users who hold certain cryptocurrencies on the exchange.

Binance Launchpad: Binance Launchpad is a platform that allows users to participate in initial coin offerings (ICOs) and other token sales. Binance Launchpad offers users the opportunity to invest in promising new blockchain projects before they are available on other exchanges.

Binance Savings: Binance Savings allows users to earn interest on their cryptocurrency holdings. Users can deposit their cryptocurrencies into Binance Savings and earn interest on a daily, weekly, or monthly basis.

Binance Pool: Binance Pool is a mining pool that allows users to mine cryptocurrencies and earn rewards. Binance Pool supports several cryptocurrencies, including Bitcoin and Ethereum.

Overall, Binance offers a wide range of trading options and services that cater to the needs of different users. Whether you're interested in spot trading, margin trading, futures trading, options trading, or staking, you can find a trading type that suits your needs on Binance.

how to make money from binance

There are several ways to make money from Binance. Here are some strategies that you can consider:

Trading: Trading cryptocurrencies on Binance can be a profitable way to make money. You can buy low and sell high to make a profit. Binance offers a wide range of trading types, including spot trading, margin trading, and futures trading, which can help you maximize your profits.

read more

#btc latest newsmake#crypto#crypto latest news#bitcoin#cryptocurrencies#ethereum#make money tips#make money for free#make money today

3 notes

·

View notes

Text

QbitReview Review: Experience the Thrill of Trading on an Advanced Level

Investing in the market can be intimidating and challenging for traders of all levels. Getting stuck in the complexity and nuances of the markets is easy, and it can take years to become a successful trader. Whether a beginner or an experienced trader, QbitReview Review has something for you. From essential trading tools to advanced strategies, QbitReview develops your trading career. This QbitReview review will examine the platform's features, advantages and how to use them.

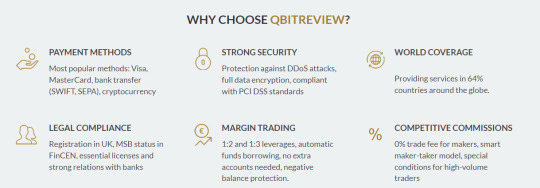

Whether you're making a purchase online to transfer funds, QbitReview has a suitable payment method for you! They offer a wide selection of payment options, including Visa, MasterCard, bank transfer (SWIFT, SEPA), and cryptocurrency. Plus, with their margin trading option, you can leverage up to 1:3, automatically borrow funds, and have negative balance protection.

QbitReview Review: Powerful Trading Tools to Maximize Success

The need for proper, up-to-date trading tools has never been greater as the cryptocurrency industry expands. QbitReview provides a suite of powerful and user-friendly trading tools to help maximize your success. Their tools include:

A market cap calculator.

A Bitcoin converter.

A Bitcoin ATM service locator.

An ICO performance tracker.

Market Cap Calculator

When it comes to trading cryptocurrencies, understanding the market cap of a particular coin is essential. The market cap of a cryptocurrency is the total market value of all the coins in circulation. To calculate the market cap of a particular cryptocurrency, you need to multiply its current price by the total number of coins. With the QbitReview Market Cap Calculator, you can quickly and easily calculate the market cap of any cryptocurrency.

Bitcoin Converter

If you want to purchase or sell Bitcoin, it is essential to have an up-to-date understanding of the current exchange rate. The QbitReview Bitcoin Converter lets you quickly and easily convert between two currencies. Whether you want to convert Bitcoin to US Dollars or Euros, their Bitcoin Converter covers you.

Bitcoin ATM Service Locator

Finding a Bitcoin ATM can be challenging, especially in a new city or country. The QbitReview Bitcoin ATM Service Locator lets you quickly and easily find a Bitcoin ATM near you. Enter your current location, and they will provide a comprehensive list of the closest Bitcoin ATMs.

ICO Performance Tracker

Initial Coin Offerings (ICOs) have become increasingly popular for funding new projects and businesses. With the QbitReview ICO Performance Tracker, you can track the performance of any given ICO. their tracker provides detailed information about the performance of each ICO, including the total funds raised, the number of tokens sold, and more.

Enjoy Flexible Payment Options – QbitReview Review

They offer a variety of payment methods to suit your needs. Their most popular payment methods include Visa, MasterCard, bank transfer (SWIFT, SEPA), and cryptocurrency.

Visa: Visa is one of the most widely accepted forms of payment, taken in over 200 countries worldwide. When you use Visa to pay, your transactions will be processed quickly.

MasterCard: MasterCard is another widely accepted payment method, accepted in more than 210 countries. With MasterCard, your transactions will be processed quickly.

Bank Transfer (SWIFT, SEPA): Bank transfer, also known as wire transfer, is one of the easiest ways to transfer funds—these are two of the most famous bank transfer methods. With SWIFT and SEPA, you can transfer funds from one bank to another in minutes.

Cryptocurrency: Cryptocurrency is a digital currency that can be used to transfer funds anonymously. QbitReview accepts various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

QbitReview Review: Advanced Reporting Features to Keep Traders Informed

World Coverage

They offer payment services in 64% of countries around the globe. With their world coverage, you can ensure that your funds will be transferred quickly, no matter where you are.

Margin Trading

They offer margin trading options with leverages of up to 1:3. With their margin trading option; you can automatically borrow funds without needing to open a separate account. Plus, you have the protection of negative balance protection, so you won't have to worry about losing more funds than you have available.

Cross-Platform Trading

With QbitReview, traders can access their accounts and trade from any device, anytime. That includes trading from the website, mobile app, WebSocket and REST API. That makes QbitReview the perfect choice for traders who want to stay connected to the market and make the most of their time. Moreover, QbitReview offers a FIX API for institutional traders needing fast market access.

Advanced Reporting

QbitReview provides a range of advanced reporting features that help traders stay informed and in control of their accounts. That includes downloadable reports and transparent fees. With such detailed reporting, traders can keep track of their investments and confidently make decisions.

High Liquidity

QbitReview offers fast order execution, and high liquidity order book access for top currency pairs. That makes it easy for traders to get in and out of the markets quickly and without paying high fees. Moreover, they also provide various trading tools and strategies to help traders optimize their trades and maximize their profits.

QbitReview Review: A Comprehensive Online Trading Platform

QbitReview is a comprehensive online trading platform designed to make trading accessible from any device. It offers simple and influential connections, allowing traders to access various analysis tools from any media. With more than 70 assets available to trade, QbitReview ensures that traders have a great selection of products. Furthermore, the platform also has a simple cash withdrawal system that makes trading easy.

Accessible from Any Device

One of the essential features of QbitReview is that it is accessible from any device. Traders can access the platform from any computer, tablet or smartphone, making it very convenient to trade anywhere and anytime. In addition, QbitReview also supports different operating systems, including Windows, iOS, and Android. That allows traders to access the platform from a wide range of devices.

Simple and Effective Connections

QbitReview also offers simple and practical connections. Traders can connect their accounts to the platform easily. In addition, the platform also allows traders to use different payment methods to make deposits and withdrawals. These features make it easy for traders to manage their accounts and transact on the platform.

Wide Range of Analysis Tools

Another great feature of QbitReview is its wide range of analysis tools. The platform provides traders various technical indicators, charting tools, and other analysis tools. That ensures traders can access the information they need to make informed trading decisions. Furthermore, the platform also provides traders with an economic calendar, which helps them stay updated with the latest market news.

More than 70 Assets Available to Trade

QbitReview also offers more than 70 assets available to trade. That includes stocks, indices, commodities, forex, and cryptocurrencies. That allows traders to have a wide selection of products to choose from. Furthermore, the platform also provides traders access to various markets, allowing them to diversify their portfolios.

A Simple Cash Withdrawal System

QbitReview also offers a simple cash withdrawal system. That makes it easy for traders to access their funds quickly. In addition, the platform also provides traders with a variety of payment methods, which makes the process of withdrawing funds even more accessible.

The Benefits of Using QbitReview's Trading Platform – QbitReview Review

There are many benefits associated with using QbitReview's trading platform, including:

Best Pricing, Execution and Liquidity: QbitReview's trading platform offers customers the best pricing, execution and liquidity. That ensures that traders can get the most out of their investments, as they can make trades quickly and at the most competitive prices.

Latest in Innovative Trading Technology: QbitReview's technology is designed to offer an intuitive and user-friendly interface, allowing traders to access and analyze markets quickly. The platform also provides advanced charting tools, such as auto-execution and backtesting, to help traders make the most informed decisions.

Explore Different Trading Instruments: QbitReview's platform offers various trading instruments, including stocks, Forex, CFDs, ETFs, etc. These instruments allow traders to diversify their portfolios and capitalize on different market opportunities.

Trade 24/7/365 with All-Year-Round Trading: QbitReview's platform allows traders to trade whenever and however they want, as the markets are open 365 days a year. That means traders can take advantage of market opportunities no matter where they are in the world.

Conclusion

QbitReview is an advanced trading platform that offers a range of features to suit traders of all levels. From cross-platform trading via website, mobile app, WebSocket and REST API to advanced reporting and high liquidity, QbitReview is designed to help traders maximize their time and resources. With QbitReview, traders can stay connected to the markets and confidently make informed decisions.

Disclaimer: This article is not intended to be a recommendation. The author is not responsible for any resulting actions of the company during your trading experience. The information provided in this article may need to be more accurate and up-to-date. Any trading or financial decision you make is your sole responsibility, and you must not rely on any information provided here. We do not provide any warranties regarding the information on this website and are not responsible for any losses or damages incurred from trading or investing.

2 notes

·

View notes

Text

Building the Future of Finance: Expert Insights on Developing Cutting-Edge Crypto Exchanges

The development of cutting-edge crypto exchanges is a crucial step in the future of finance. Here are some expert insights on this topic:

User Experience: A user-friendly interface and seamless navigation are crucial for the success of a crypto exchange. The design should be intuitive and allow for easy buying, selling, and trading of cryptocurrencies.

Security: Security should be a top priority for any crypto exchange. Implementing strong security measures such as two-factor authentication, cold storage, and regular security audits can help prevent hacks and protect user assets.

Regulation Compliance: It's important for crypto exchanges to be aware of and compliant with the regulations in their jurisdiction. This helps ensure the legitimacy of the exchange and gives users confidence in their investments.

Scalability: As the crypto market continues to grow, crypto exchanges must be able to handle increased demand and accommodate a larger user base. This requires investments in infrastructure and technology to ensure the platform can scale smoothly.

Liquidity: Liquidity is a key factor for the success of any exchange. By offering a wide range of cryptocurrencies and pairing options, and attracting a large user base, exchanges can increase their liquidity and provide better prices for users.

Innovative Features: Offering unique and innovative features can set a crypto exchange apart from its competitors. This could include things like margin trading, advanced charting tools, and integration with decentralized finance (DeFi) protocols.

By focusing on these areas, crypto exchanges can position themselves at the forefront of the rapidly evolving cryptocurrency market and help drive the future of finance.

So When it comes to creating highly efficient cryptocurrency exchanges that provide users with an optimal trading experience combined with the highest levels of safety and security - there's no better choice than LBM Solutions - a leading cryptocurrency exchange development company. With a team of seasoned professionals who stay up-to-date on all emerging technologies related to crypto exchange development; they will ensure your project is done right - every step of the way - while respecting your budget constraints!

2 notes