#long live southbank

Explore tagged Tumblr posts

Text

Nick Frost & Simon Pegg: A Slice of Fried Gold

Actor and writer Nick Frost launches A Slice of Fried Gold, a hilarious and noshable memoir with recipes. He’s joined by Simon Pegg, his best friend and part-time lover. This event is part of London Literature Festival and was held at Southbank Royal Festival Hall on 22nd October 2023.

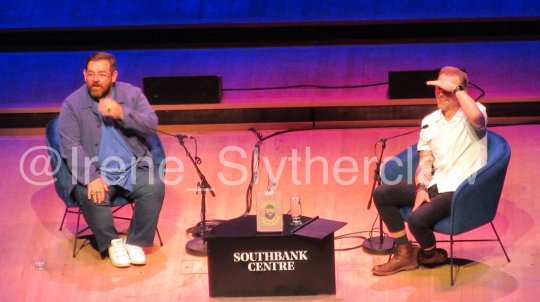

A real slice of fried gold! So nice to chat to Nick Frost and Simon Pegg for the first time since Shaun of the Dead and for them to treat me to one of their spectacular looking in different directions photos. (Apparently if you are on Cluck they are looking straight at you!)

Had such an amazing time @southbankcentre with @friedgold and @simonpegg in conversation. Equal parts hilarious, fascinating and heart-warming. Honestly could have listened to these two for hours! This book is now officially the first ‘cookbook’ I’ve ever been dying to read… Big thanks to @hannahc_01 for securing the seats!

Was an absolute joy to have the opportunity to take my Partner to see the one and only NICK FROST, along with lifelong friend and fellow actor SIMON PEGG, to promote Frost's new memoir cook book A SLICE OF FRIED GOLD. From start to finish, watching these two legends chinwagging about old times and all their memories of living and working together was just incredible as a life-long fan of both of their work. The high points for me were all the anecdotes about their ceiling collapsing whilst they were getting high, and how Simon met his wife at an airport, after his and Nick's flight got delayed. Was nearly in tears every time Nick's mother got brought up. Truly was a special treat to see these two tonight. Now how's that for a piece of fried gold!?! YEAH BOIII!!

This is how you spend a Sunday evening! Love the @southbankcentre literature festival - love Nick Frost & Simon Pegg.

Had a lovely evening listening to Nick Frost and @simonpegg 🖤 Would love to know what percentage of Nicks Book is written about them being high 😂

Very funny evening of food and cooking chat (and definitely not anything SAG-related) tonight with Nick Frost discussing his new book 'A Slice of Fried Gold' with Simon Pegg at the Royal Festival Hall.

Backstage @southbankcentre with Nick Frost and Simon Pegg before their riotous conversation about friendship, food, filmmaking and Nick’s new memoir A Slice of Fried Gold. A hilarious and heart-warming night. Thanks to our amazing audience and all

Greetings Pop Pickers, just got in from seeing @simonpegg interviewing #Nickfrost at the @southbankcentre

Nick Frost and Simon Pegg at the Southbank Centre, London 🤩

34 notes

·

View notes

Text

About Matthew's apartment

It's located in Southbank, London, in a tall apartment building with a privileged view of the city skyline. His rank as a high ranking officer in the Navy and his participation special ops helped him get the funds to score this beauty, even when it looks like he'll be paying the bank for it until the day he dies...

This L-shaped loft apartment fits his every need. He's had it renovated with a little bit of an industrial style, using wooden accents and taking advantage of the glass walls for the natural light.

The first thing that comes into view is the living room with a big couch and the sliding door to the balcony. He's decorated it with plants to make it look a bit more lively. Soon after you'd meet the kitchen area with a wooden table set for 6 people. He does enjoy having people over.

To the right you'd find the washing machine and the storage area, with enough room for him to keep most of his belongings and to serve as a sort of utility area.

The mezzanine, which gives a great view of the rest of the apartment. It has a huge, built in shelf where he keeps most of his books, trophies, games and the like. It's the perfect introduction to the queen sized bed on the far end, framed by 2 night stands.

Finally, on the furthest corner for he mezannine, you'd fine the walk in closet that leads to the bathroom. It's been remodeled to have a bathtub as well, the perfect place to relax after a long day at work.

#headcanon:matt#I had to make a post about this because I see it so clearly in my head#it's the coziest place

4 notes

·

View notes

Text

Navigating Overnight Parking in Melbourne CBD: A Comprehensive Review

Melbourne CBD is a bustling hub of activity, filled with vibrant cafes, iconic landmarks, and a plethora of entertainment options. But if you’re planning to explore this lively city after dark, one question looms large: where can you park your car overnight? Navigating the ins and outs of overnight parking in Melbourne CBD can be daunting. With various options available, each offering its unique set of advantages and drawbacks, it’s crucial to understand what suits your needs best. Whether you're a tourist looking for convenience or a local needing reliable parking solutions during late-night outings, knowing the right spots is key. Let’s dive into everything you need to know about finding safe and affordable overnight parking in the heart of Melbourne!

Pros and Cons of Each Type of Parking

When it comes to overnight parking in Melbourne CBD, the options vary widely. Each type has its perks and pitfalls. Street parking offers convenience and often a lower cost. However, spaces can be limited, and you might face strict time restrictions that could lead to fines if you're not careful. Garage or secure lot parking is another popular choice. These locations typically provide safety against theft or damage. On the downside, they often come with higher fees, especially in prime areas of the city. For those seeking flexibility, some hotels offer overnight parking for guests. This option provides peace of mind but can add significantly to your accommodation costs. Consider park-and-ride facilities located on the outskirts of the CBD. They are budget-friendly but require additional travel time into central Melbourne via public transport or rideshare services.

Best Locations for Overnight Parking in Melbourne CBD

When searching for the best locations for overnight parking in Melbourne CBD, convenience and accessibility are key. Collins Street is a popular choice. It offers multiple commercial car parks that cater to both short and long-term stays. You'll find it centrally located, making access to nearby attractions effortless. Another great option is Flinders Lane. This area boasts several underground facilities with competitive rates. Plus, being close to the bustling dining scene adds extra appeal. If you're looking for something more budget-friendly, consider parking at Queen Victoria Market after hours. It's an ideal spot that allows for easy exploration of the city’s vibrant nightlife without breaking the bank. For those who prefer high-end amenities, check out car parks around Southbank. They typically offer secure options along with added features like valet services and electric vehicle charging stations. With these choices, finding suitable overnight parking becomes much easier during your stay in Melbourne's lively CBD.

Alternative Transportation Options for Avoiding Overnight Parking Fees

When it comes to navigating the bustling streets of Melbourne CBD, there are alternative transportation options that can help you avoid the hassle and cost of overnight parking. Public transport is one of the most convenient choices available. Melbourne boasts an extensive network of trams, trains, and buses. The city’s tram system is iconic and covers a vast area. You can hop on a tram to travel anywhere within the CBD quickly. It’s affordable too; with a Myki card, you’ll pay less than you would for daily parking fees. Trains provide another efficient means of getting around or accessing suburbs just outside the CBD. Southern Cross Station serves as a major hub connecting various lines throughout Victoria. This option works well if you're planning to explore areas beyond downtown Melbourne. For those who prefer cycling, Melbourne offers many bike lanes and rental services like Bike Share programs scattered across the city. Riding not only saves money but also allows you to experience Melbourne at your own pace while enjoying its vibrant atmosphere. Rideshare services like Uber or Lyft are also widely used in Melbourne. They offer comfort without worrying about where to park overnight or how much it might cost. Walking remains an underrated yet effective way to navigate through this urban landscape—especially when staying close by in hotels or serviced apartments. Exploring these alternatives means embracing flexibility while sidestepping potential stressors associated with overnight parking in Melbourne CBD. Each option presents unique benefits tailored suit different lifestyles and preferences within this dynamic cityscape.

For more info. Visit us:

Cheap all day parking Melbourne CBD

Overnight parking Melbourne CBD

overnight hotel parking melbourne

0 notes

Text

Nick Howe presents: I Only Ever Lose

Unique voice for a perfect song

Nick is currently performing alongside a world-class beatboxer and a violinist, making his live show completely unique. He performed on ITV news for the Keep Streets Live Campaign and worked on the Long Live Southbank campaign, due to his passion for the Southbank space and rollerblading.

I ONLY EVER LOSE:

"its about continually falling for a person that is no good for you and doesn't feel the same way", Nick Howe.

"There's always that one person you can’t help coming back to (even though you know you shouldn’t)… I wrote this song for them", Nick Howe.

Touring over 15 countries including the US and extensively throughout Scandinavia and Germany, Nick gigs an average of 200 shows per year, including sold out gigs at home in venues such Cargo, Kensington Roof gardens and even The Natural History Museum – which he lists as a career highlight!

instagram

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

London's Comedy Scene: A Laughter-Filled Journey Through the Capital's Comedy Shows

London, a city renowned for its rich history, cultural diversity, and vibrant arts scene, also boasts a thriving comedy circuit that's as diverse and dynamic as the city itself. From intimate comedy clubs to grand theaters, London's comedy shows offer something for everyone, promising laughter, entertainment, and a unique glimpse into the city's comedic pulse. Let's embark on a laughter-filled journey through London's comedy scene.

A Comedy Capital:

London has long been hailed as a comedy capital, nurturing some of the world's most renowned comedians and providing a platform for emerging talent to shine. The city's eclectic mix of venues, from iconic theaters to hidden basement clubs, serves as the backdrop for a diverse array of comedic performances, ranging from stand-up and improv to sketch comedy and satire. Whether you're a die-hard fan of observational humor or prefer cutting-edge political satire, London's comedy scene has something to tickle every funny bone.

Intimate Comedy Clubs:

For an up-close and personal comedy experience, look no further than London's intimate comedy clubs. Nestled in the city's winding streets and tucked away in basement venues, these clubs offer a cozy atmosphere where audiences can get up close and personal with comedians. From established names to up-and-coming talent, these clubs showcase a mix of performers, providing a platform for experimentation and spontaneity. With drinks flowing and laughter filling the air, these venues offer a truly immersive comedy experience.

Iconic Theaters:

London's iconic theaters play host to some of the biggest names in comedy, attracting audiences from near and far with their grandeur and prestige. From the historic halls of the West End to the avant-garde stages of Southbank, these theaters provide a showcase for comedy in all its forms. Whether it's a solo stand-up show by a comedy legend or a riotous sketch comedy revue, these venues offer a theatrical experience like no other, combining laughter with the magic of live performance.

Alternative Comedy Scene:

London's comedy scene is not confined to traditional venues; it also thrives in alternative spaces and offbeat settings. Pop-up comedy nights in bars, outdoor performances in parks, and comedy festivals that take over entire neighborhoods all contribute to the city's vibrant comedic landscape. These alternative spaces offer a platform for experimentation and innovation, allowing comedians to push the boundaries of their craft and engage with audiences in new and unexpected ways.

A Platform for Diversity and Inclusion:

London's comedy scene prides itself on its diversity and inclusivity, with comedians from all walks of life taking to the stage to share their unique perspectives and experiences. From LGBTQ+ comedians to comedians of color, London's stages are a reflection of the city's multicultural fabric, celebrating the richness of its communities and challenging stereotypes through humor. In an ever-changing world, comedy has the power to unite, uplift, and inspire, and London's comedy scene is leading the way in championing diversity and inclusion on stage.

Conclusion:

In the bustling metropolis of London, comedy is not just entertainment; it's a cultural cornerstone that reflects the city's spirit of creativity, diversity, and irreverence. From intimate comedy clubs to iconic theaters, alternative spaces to outdoor festivals, London's comedy scene offers a kaleidoscope of comedic delights, promising laughter, entertainment, and a unique glimpse into the soul of the city. So, whether you're a seasoned comedy connoisseur or a casual observer in search of a good laugh, London's comedy shows are sure to leave you grinning from ear to ear.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

he latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes

Text

What's New In Investments, Funds? – Blackstone, S-Bank, Cheyne, Abu Dhabi

The latest news in investment offerings, financial products and other services relative to wealth advisors and their clients.

Blackstone US investments group Blackstone has partnered with Finland’s S-Bank to provide individual investors in Finland the opportunity to invest in private markets.

The combination will widen access to a private credit market in Europe which has traditionally been confined to institutional investors with high investment minimums and a requirement to lock up capital for long periods.

The move by Blackstone Private Wealth Solutions into what it sees as under-exploited European markets follows agreements with BNP Paribas earlier this year, and ING last year. (In those cases, Blackstone brought its European private credit investment platform to qualified private investors in France and the Netherlands, respectively.)

S-Bank's (aka S-Pankki) private credit fund invests in loans in unlisted companies, mainly in Europe. The S-Pankki European fund (S-Pankki ECRED) is a feeder fund whose target fund is Blackstone European Private Credit Fund SICAV.

The target fund Blackstone European Private Credit Fund SICAV, which was launched in October 2022, had €581 million ($634 million) in January. The investments are secured senior loans.

(The fund is not intended for investors in the US.)

Cheyne Capital, Abu Dhabi Cheyne Capital has secured a commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority for the ninth vintage of the Cheyne Real Estate Credit Holdings (CRECH) programme.

The programme, which is also known as the Capital Solutions strategy, will be added to earlier investments to bring ADIA’s subsidiary’s total commitment to the Capital Solutions strategy to £650 million ($830.8 million).

The strategy continues CRECH’s focus on senior lending against European real estate. In addition, it provides solutions across the capital structure, including subordinated debt, hybrid credit and commercial mortgage-backed securities.

CRECH’s recent deals include the structuring of a £780 million loan alongside JP Morgan to Quintain for the refinancing of Wembley Park, London. Other recent deals include a £318 million loan to Goldman Sachs-backed Riverstone for two later living developments in London, £229 million to Stanhope for the transformation and extension of the iconic 76 Southbank in London into a low-carbon office, €250 million to Bain Capital and Borio Mangiarotti to deliver 600 new homes in Milan and over €200 million to the Beaumier hotel group with lifestyle hotels across France, Switzerland and Spain.

0 notes