#it's because the cost benefit ratio has changed

Explore tagged Tumblr posts

Text

There was not a time when working hard was the way to make your fortune. Sometimes -- very rarely -- someone could make their fortune by working hard and being lucky. Just as today, this was quite rare. Part of what our ancestors did work so incredibly hard to do was to make it much less rare, and also to make it so that while most people still couldn’t become wealthy by working hard, most people could have pretty comfortable lives by doing so. Reagan, Thatcher, and their ilk did their damndest to smash that, which means we have much of the work to do all over again.

In almost all of the past, the way to get rich was to be born rich. You could also get loot from war, if your society was set up to allow you to do so (like Rome.) But even then, the truly rich were the ones who owned the land and the labor of the people working on the land, including the land and labor that was gained through conquest. The industrial revolution upended that. Nothing but force -- governmental or otherwise -- will stop the rich from hoarding wealth, though.

What does seem to be more unusual is the rich not realizing this. They no longer understand that if they don’t share some of the wealth, they’re in trouble. We know where they live.

#war used to be VERY profitable for the winners#it's not any more#the reasons we have anti-war sentiment around the world that did not used to exist is not that we are suddenly more enlightened or better#it's because the cost benefit ratio has changed#governments have allowed the rich to hoard wealth which makes for a rotten cost benefit ratio for everyone#including the wealthy because then they get to be stupid and it doesn't benefit them for society to fall apart either#the kindest thing to do for the wealthy would be to make them pay taxes#the alternative is gonna make that imploded sub look like a lovely cruise

2K notes

·

View notes

Text

Fire in Stadtallendorf: The fire station, of all houses, has neither fire detectors nor a sprinkler system

A fire that destroyed the entire fire station of the city of Stadtallendorf, Hesse, caused more than 20 million Euro. More than 10 vehicles were totally destroyed. The brand new fire station, which had opened in January 2024, was considered to be the most modern of its kind in the district of Marburg-Biedenkopf. It featured a 23 m high training tower, a laundry shop, a hose care station, and a gym.

Crucially, however, in the vehicle hall, there was no sprinkler system, not even common household fire detectors. That's why a fire that had apparently started in one of the new vehicles due to a technical defect, remained undetected and untackled for long enough to set the entire complex on fire. Although firefighters from a neighboring station were at the scene three minutes after the fire was detected, it was too late to prevent total destruction. At one time, the flames were up to 15 meters high.

Ironically, fire safety equipment is not required by law for buildings of the fire department. It is at the discretion of the municipality whether they prefer to spend the additional money to protect their building and equipment or leave it to the risk of fire.

The president of the state organization of firefighters expressed hope that this incident would change the minds of the responsible politician, particularly because more and more firefighting equipment is powered by flamable lithium ion batteries. Although sprinkler and fire alarm systems are expensive, perhaps the cost-benefit ratio will be assessed differently in future after this incident.

The mayor of the neighboring municipality of Neuhaus, who was present as a firefighter on the scene, had made up his mind already. He will make sure that the planned new fire station in his town will be equipped with a fire detection system.

85 notes

·

View notes

Note

What mecha shows did you enjoy but would not recommend to people (flawed personal favourites, shows with high entry barrier, etc.)?

Several come to mind.

Blue SPT Layzner: TV run got shitcanned prematurely and has probably the mast slapdash ending of any mecha show save maybe the TV run of Ideon. OVA adaptation opens with rushed compilation of first half of TV series that's dull to watch and not especially coherent on its own before it gets to the altered and much improved ending. Feels like there's no right way to watch it, you have to do both and piece it together in your head. Definitely one to check out after you've seen Takahashi's better work like Votoms and Dougram, though it's infuriating because the series has banger music and mecha design, and the hypothetical ideal version of the plot that you don't have to basically kitbash together in your head is really good.

Dancouga: Production values are amazing in first episodes and then turn to complete dogshit shortly thereafter, like they literally spent their whole budget up front and then had to pay their animators in loose change and leftover fast food. Very strange pacing. However I've always really liked the main protagonist Shinobu Fujiwara whose voice actor honestly carries the show on his back, and I've had a soft spot for Dancouga the mecha itself for a long time - but it doesn't actually show up until half way in. Yet somehow I can't deny the charm of the show despite how slapdash it is thanks to its interesting approach to the super robot formula, and it leads into Requiem for Victims which is the true ending for the TV plot and a followup called God Bless Dancouga, both of which are banger OVAs (and then another kinda shitty one after that but who cares.) Unfortunately they all make no sense without watching the TV run. It's a franchise for hardcore mecha fans only, though IIRC the 2000s sequel Dancouga Nova is basically disconnected and stands on its own, for better or worse. I've yet to watch it.

Tryder G7: 80s super robot show that's kind of like a part slice-of-life anime, honestly ahead of its time in a lot of ways. Would be my go-to recommendation for 80s super robot shows if there was a decent fansub. The one that exists is a Russian translation of the official Italian subs that then got translated into English and it's as disastrous as you might expect. Not only is it incoherent but even as a non-Japanese speaker I can tell it's often inaccurate. Frustrating because I can tell it's a good show that deserves a proper English sub for fans.

Cross Ange: Notorious show by the Gundam Seed creators. The concept and lore of this show is batshit insane, the mecha are cool, the main character turns out to be interesting and likable despite very negative first impressions, however there's no denying that it's buried under a thick vaneer of shallow coombait and it runs itself off the rails with zany plot at points. Honestly better than its reputation suggests but hard to recommend without looking like a pervert.

Shinkon Gattai Godannar: Basically the same thing, coombait super robot series, fun action, not a bad story. At the same time if you've ever seen a gif of absurd breast physics in anime from the 2000s there's a decent chance it's from Godannar. Good show at the end of the day, better than it has a right to be, artstyle is gonna be a big turnoff for many people and I don't necessarily blame them.

Gundam Build Divers Re:Rise: Probably the weirdest of the build series, also IMO the best. Downside: you have to suffer through the profoundly mediocre original Build Divers to get the most out of it and I'm not sure that price is worth it.

Probably more that I could add. Honourable mention has to go Gundam Seed Stargazer because you have to suffer through Gundam Seed Destiny to get to it, but I hear that the new Gundam Seed movie that's also set after Destiny is good so perhaps the cost-to-benefit ratio of suffering through Destiny has changed.

22 notes

·

View notes

Text

Simple shift could make low Earth orbit satellites high capacity

Low-orbit satellites could soon offer millions of people worldwide access to high-speed communications, but the satellites’ potential has been stymied by a technological limitation — their antenna arrays can only manage one user at a time.

The one-to-one ratio means that companies must launch either constellations of many satellites, or large individual satellites with many arrays, to provide wide coverage. Both options are expensive, technically complex, and could lead to overcrowded orbits.

For example, SpaceX went the “constellation” route. Its network, StarLink, currently consists of over 6,000 satellites in low-Earth orbit, over half of which were launched in the past few years. SpaceX aims to launch tens of thousands more in the coming years.

Now, researchers at Princeton engineering and at Yang Ming Chiao Tung University in Taiwan have invented a technique that enables low-orbit satellite antennas to manage signals for multiple users at once, drastically reducing needed hardware.

In a paper published June 27 in IEEE Transactions on Signal Processing, the researchers describe a way to overcome the single-user limit. The strategy builds on a common technique to strengthen communications by positioning antenna arrays to direct a beam of radio waves precisely where it’s needed. Each beam carries information, like texts or phone calls, in the form of signals. While antenna arrays on terrestrial platforms such as cell towers can manage many signals per beam, low-orbit satellites can only handle one.

The satellites’ 20,000 miles-per-hour speed and constantly changing positions make it nearly impossible to handle multiple signals without jumbling them.

“For a cell tower to communicate with a car moving 60 miles per hour down the highway, compared to the rate that data is exchanged, the car doesn’t move very much,” said co-author H. Vincent Poor, the Michael Henry Strater University Professor in Electrical and Computer Engineering at Princeton. “But these satellites are moving very fast to stay up there, so the information about them is changing rapidly.”

To deal with that limitation, the researchers developed a system to effectively split transmissions from a single antenna array into multiple beams without requiring additional hardware. This allows satellites to overcome the limit of a single user per antenna array.

Co-author Shang-Ho (Lawrence) Tsai, professor of electrical engineering at Yang Ming Chiao Tung University, compared the approach to shining two distinctive rays from a flashlight without relying on multiple bulbs. “Now, we only need one bulb,” he said. “This means a huge reduction in cost and power consumption.”

A network with fewer antennas could mean fewer satellites, smaller satellites, or both. “A conventional low Earth orbit satellite network may need 70 to 80 satellites to cover the United States alone,” Tsai said. “Now, that number could be reduced to maybe 16.”

The new technique can be incorporated into existing satellites that are already built, according to Poor. “But a key benefit is that you can design a simpler satellite,” he said.

Impacts in space

Low-orbit satellites reside in the lower layer of Earth’s atmosphere, between 100 and 1,200 miles from the surface. This region of space offers limited real estate. The more objects flying around, the more likely they are to crash, breaking apart and releasing smaller fragments of debris that can then crash into other objects.

“The concern there isn’t so much getting hit by a falling satellite,” Poor said, “But about the long-term future of the atmosphere, and the orbit being clouded up with space debris causing problems.”

Because the low-orbit satellite industry is gaining traction at a rapid pace, with companies including Amazon and OneWeb deploying their own satellite constellations to provide internet service, the new technique has the potential to reduce the risk of these hazards.

Poor said that while this paper is purely theoretical, the efficiency gains are real. “This paper is all mathematics,” he said. “But in this field in particular, theoretical work tends to be very predictive.”

Since publishing the paper, Tsai has gone on to conduct field tests using underground antennas and has shown that the math does, in fact, work. “The next step is to implement this in a real satellite and launch it into space,” he said.

“Physical Beam Sharing for Communications with Multiple Low Earth Orbit Satellites” by Yan-Yin He, Shang-Ho (Lawrence) Tsai and H. Vincent Poor was published in IEEE Transactions on Signal Processing on June 27, 2024.

IMAGE: Low Earth orbit satellites could soon offer millions of people worldwide access to high-speed communications. Now, researchers have invented a technique that enables these satellites’ antennas to manage signals for multiple users at once, making them cheaper and simpler to design and launch. Image Adobe Stock

3 notes

·

View notes

Text

Baby, Baby

Ours is a consumption-driven economy. About 70% of our GDP is accounted for by the things we buy. As long as we keep buying everything should be fine, right?

Well, it would be nice if it worked out that way, but all is not well in the world’s largest economies. Among the 38 member countries in the Organisation for Economic Cooperation and Development (OECD), the birth rate is now just 1.5 children per woman, which is down from 3.3 in 1960. Given that each woman needs to have, on average, 2.1 children for us to statistically replace ourselves as a population, we’re in for problems in the years ahead.And the implications for marketers are huge.

While these stats are for only those 38 nations, there is another forecast. By 2064, if trends continue, the global death rate will surpass the global birth rate. If you were worried about the population explosion in the last 125 years, from 1.6 billion in 1900 to about 8 billion today, your worries may very well be allayed.

The effects will be felt up and down the economy. Fewer infant cribs, clothes, formula, and everything else that the little ones need will decline. This ripples through the entirety of life then, with fewer people simply consuming fewer products.

If you have noticed your local school district shrinking, this is among the possible causes. In academia, we are bracing ourselves for a demographic cliff in a couple of years, because it was around 2010 that US births dipped below 4 million a year. Now that those kids are nearing college age, the shrinking pool of possible applicants has universities nervous.

It also means that the costs of social safety nets will fall increasingly on the young, because those systems are set up to tax people while they are working, all the while paying out benefits to the retired. It is by design a bankrupt system, but when the ratio of people of working age to retirees slips from 6:1 to 2:1, there are going to be problems. That is predicted to happen in 2035, five years after I plan to start drawing on my Social Security. And I am not going to take a reduction in benefits sitting down.

The world’s most prosperous countries, though, are still able to post population increases, by virtue of immigration. For example, in the US last year, births outnumbered deaths by 3,591,328 to 2,854,838, or about 737,000. But 878,000 people also immigrated, producing a net growth of 1.6 million.

Pheeewwwww. But we’re not out of the woods yet, and may never be, unless we start having bigger families.

Which, of course, raises the $64,000 question: Why aren’t women having more babies? It’s complicated. A combination of expenses, lifestyle, delayed marriage (or none at all), economic uncertainties, and workforce participation are conspiring to change our economy.

For example, female workforce participation in the US was only 34% in 1950. It rose to 38% in 1960, followed by 43% in 1970, 52% in 1980, 58% in 1990, and 60% in 2000. While it has dipped since that peak in 2000, it now stands at 57.3%. I am pretty sure that all the expenses of working outside the home, such as transportation, wardrobe, meals, and so forth, outweigh the expenses of raising a child.

When viewed from a safe distance, the dip in fertility is alarming, but I am not sure how to solve it. Societal changes that allowed women to enter the workforce have produced great gains in equality, although we still have a way to go. To send women back to the home to be Moms and homemakers doesn’t seem like a whole lot of progress, one particular sage footballer’s comments notwithstanding.

And the 38 member nations of the OECD can only continue to grow by virtue of immigration for so long, because those developing nations are also starting down the slippery slope of low fertility. We have effectively been outsourcing births, but that is not a sustainable model.

While we still have time on our side to make a correction, we can also watch other nations in far more dire straits to see how they handle the problem. Japan, for example, now has a birth rate of only 1.2 children per woman. They face a cataclysmic effect if this does not change soon.

Meanwhile, the marketer in me is also watching how companies adapt to the new dynamics. Our numbers are safe for a little while, as long as we seniors live healthily, but we will eventually die, leaving our heirs—an increasingly smaller cohort—to pick up the pieces.

And since I suspect all of my students, even graduate students, are many years younger than me, it means the burden is falling upon you.

Dr “It’s Not Looking Good” Gerlich

Audio Blog

2 notes

·

View notes

Text

Just took my 12 year old cat to the vet for her yearly checkup, and she has unfortunately become overweight since last year, so I'm going to have to get back on track with measuring out what she's eating. I kind of lost track of that over the past year. The formula for the food she was eating changed and it started to to gunk up the automatic feeder, so I wasn't able to use the feeder.

The thing is, looking at the old bag of food, I don't think she was eating as much food as a cat her current weight is "supposed" to eat - aka, she's not eating hundreds more calories than she should be. She was probably eating more than she should've been, but not that much more. So I kinda had to estimate she was eating around 260 calories a day, but that might be a max, rather than the average.

The main reason it's hard to know how much she's eating is that because of the feeder (when it was working) she became very picky about the "freshness" of her food. She likes to know it's been put in the bowl within the last 30 seconds, and she doesn't really nibble on food that's been sitting out. This has lead to her pestering me at about 4am for the past few months to feed her, which is definitely annoying lol. This is also how I know she hasn't exactly been eating a whole 1/2 cup of food a day; I'd pour out a 1/4 cup, she'd eat a little, and leave the rest. Then she'd beg for more, I'd scoop out a fresh 1/4 cup, and she'd eat a little, etc. This makes it pretty hard to tell how much she's eating.

I'd actually decided to switch her food to a new type anyway, and it's not sticky, so I can use the feeder again. She's not AS big a fan of the new food as she was the old food because the new food isn't as stinky, but she does eat it. So that's one problem solved.

I'm also thinking of incorporating wet food (as advised by the vet, since wet food is less calorie dense), so I bought a scale to measure everything out in grams. Wet food is really expensive, so I'm going to do a 2:1 ratio of dry food to wet food and mix them together so she's getting the wet food benefits, and it'll also encourage her to eat the dry food, but it won't cost quite as much. Another reason I can afford this is the new dry food is half the price of the old dry food, so I've got room in my budget.

I've already figured out the specific gram amounts of both the wet and the dry I should use to reduce her calorie intake by 10%. You have to go very slow with cats apparently, dropping their weight too fast can be really harmful.

I'm thinking about getting a rotational feeder, because you can put ice packs in those, and then I could pre-mix her wet and dry food to feed her throughout the day, since again, she now prefers tiny fresh portions.

And eventually I'm going to need to buy a pet scale, because the person scale I have is probably not accurate enough lol.

2 notes

·

View notes

Text

Mutual Funds Made Easy: A Guide to Beginners.

What is a Mutual Fund?

Hey buddy, Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The mutual fund is managed by a professional fund manager who makes investment decisions on behalf of the investors, to maximize returns while minimizing risk.

Types of Mutual Funds

There are several types of mutual funds, including equity funds, fixed-income funds, balanced funds, index funds, and specialty funds. Equity funds invest in stocks, fixed-income funds invest in bonds, and balanced funds invest in a mix of stocks and bonds. Index funds are designed to track a specific market index, such as the S&P 500, while specialty funds focus on a particular sector or industry.

Benefits of investing in mutual funds

Mutual funds offer several benefits, including diversification, professional management, convenience, and flexibility. Diversification is important because it helps reduce the risk of losses by spreading investments across many different assets. Professional management ensures that your money is invested by a trained and experienced professional. Mutual funds are also convenient because they can be purchased and sold through a brokerage account or financial advisor. Additionally, they offer a high level of flexibility, allowing you to buy or sell shares at any time.

Risks of investing in mutual funds

All investments come with some level of risk, and mutual funds are no exception. The value of mutual funds can fluctuate based on changes in the financial markets, and past performance is not always an indicator of future performance. Additionally, mutual funds charge fees and expenses, which can eat into your returns over time.

Choosing a mutual fund

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and investment time horizon. You should also research the fund’s fees and expenses, as well as its historical performance. Finally, consider working with a financial advisor who can help you choose the right mutual funds for your portfolio.

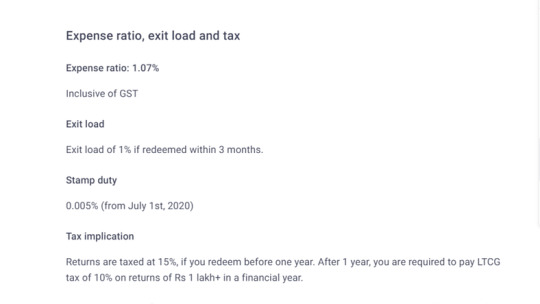

I will give two tips on checking to choose a mutual fund before investing first one is

Performance History: Look at the fund’s past performance over a period of time, preferably five to ten years. While past performance is not an indicator of future returns, it can give you an idea of how the fund has performed during different market conditions. You can check easily on grow app or whatever app you like it.

Expense Ratio: The expense ratio represents the cost of managing the fund and is deducted from your returns. Look for funds with a lower expense ratio, as high fees can eat into your returns over time.

I will show pictures of higher expense ratios and lower expense ratios.

Monitoring your mutual fund

After you invest in a mutual fund, it’s important to monitor your investment regularly to ensure that it continues to meet your investment goals. This may involve reviewing the fund’s performance, fees, and expenses, as well as rebalancing your portfolio periodically to maintain a diversified mix of investments.

Remember, mutual funds can be a great way to invest in the stock market and other assets without having to choose individual stocks or assets yourself. However, it’s important to do your research and carefully consider the risks and potential rewards before investing.

Hope you enjoy and like this blog post. Later on, I will post a full detailed blog on Mutual funds. Make sure to share with your friends and comment with your opinions and subscribe.

Disclaimer:

The information provided on this blog is for educational and informational purposes only and should not be considered financial advice. I am not a certified financial advisor and do not hold any professional licenses in the finance industry. Any financial decisions you make based on the information provided on this blog are at your own risk. Please consult with a certified financial advisor before making any significant financial decisions.

2 notes

·

View notes

Text

Unions

Favorite targets of business owners and conservatives alike, unions get a lot of bad press. They promote inefficient work rules and “feather bedding”, so say the critics; ignoring the fact that most, if not all, of those cases were in industries where the owners have made truly obscene amounts of money, for example railroads in the early 20th century. As for inefficient work rules, according to some business owners, anything that costs more is bad, even if it is safer. Some unions have had corruption and ties to organized crime, but that shouldn’t taint all unions anymore than the corruption of some CEOs and their companies.

Because of their long association with manual laborers, it has been easy to sell these myths to an emerging, well educated middle class. It even subtly reinforces a classism/racism to office workers who might otherwise have wanted representation in their dealings with management.

American manufacturers have long promoted the idea that unions raise wages and therefore increase the cost of goods and services. There is obviously some truth to that BUT what good does it do to have cheap goods if people can’t afford them on the wages they’re paid? And what of the enormous salaries and bonuses of top management, and their desire to continually increase profit margins? Profit margins, which influence the price of stock and therefore the value of their stock options, more than an improvement in quality of goods and services.

While there is a whole other discussion to be had about the true value of C-Level positions and how much they truly contribute to the running of the business, it should be obvious that the ratio of their pay to the average worker is unjustifiably large, and based on too many factors having little to do with actual operational success of the business.

The answer has always been “get a more skilled job, this is how free markets work, supply and demand” i.e. find a better paying job. As far as it goes,this is good, reasonable and fair advice. But it does ignore some economic facts. Supply and demand work best in what economists call “pure and perfect” competition. This is when all consumers know the price, all providers (current or wannabe) can freely enter the competition and most of all price is the ONLY determiner of purchase decisions.

Clearly this isn’t the case, especially in wages. A single current or prospective employee is in the worst possible negotiating position. Add to that most employers want to know your current or previous salary, so they can make you an offer just enough above it to be enticing. But if you are underpaid relative to your market skills, say by starting out in a low position with your current or last company, your promotions will probably never equal the going market rate for the job. Climbing out of that deficit is next to impossible. There’s lots of talk about paying for performance but most employers assume that your pay reflects that when you apply., as if everyone had effective performance ratings and a perfectly working pay for performance systems. Even if you know the market for your skill, your employer will try to get you for less if they can; and they have the resources to out wait you. Furthermore, some of the most ridiculous and bizarre biases about what makes a successful employee get factored into the decision. It isn’t even illegal as long as it isn’t obviously based on race, gender, national or ethnic origin, or to a lesser extend on age or disability.

White collar workers (and those incorrectly identified as ‘contractors’) have as much need for protection in their dealings with corporations as the blue collar workers of the past. A range of issues from health care benefits to work schedules (businesses paying part timers minimum wage and constantly changing their schedule making a second employment, let alone finding another job extremely difficult), are among the legitimate issues to discuss. In the past automation created new jobs at a greater rate than the ones it replaced. Even if that is still true with the coming AI revolution, it will be important to give workers a voice that is at least as powerful as the employers in sorting out these changes.

It’s time for employees, and unions alike to realize there is a new opportunity on the horizon.

2 notes

·

View notes

Text

Gundrilling Machines Explained: Why They Matter in High‑Precision Manufacturing

In today’s era of advanced engineering, precision is more than a requirement—it’s a competitive advantage. For manufacturers in aerospace, automotive, medical, and defense industries, the demand for ultra-accurate and deep hole drilling has given rise to one specialized solution: the Gundrilling Machine. This article dives into why these machines are essential and how leading deep hole drilling machine manufacturers are transforming the industrial landscape.

What Exactly Is a Gundrilling Machine?

A gundrilling machine is a high-precision drilling system designed to create deep and accurate holes. Originally developed for drilling gun barrels—hence the name—these machines now serve a broader range of applications that require extreme precision and depth-to-diameter ratios.

Unlike conventional drilling methods, gundrilling uses a single-flute tool with internal coolant channels. This setup not only maintains tool temperature but also ensures efficient chip removal, allowing holes to be drilled with exceptional straightness and finish.

Why Depth and Accuracy Matter in Modern Manufacturing

Modern components, especially in aerospace and automotive industries, often require holes that are both deep and precisely aligned. Traditional drilling methods can cause tool deviation, leading to costly rework or part failure. That’s where gundrilling machines come in. They ensure:

Minimal deviation over long drilling distances

Clean, polished finishes that often eliminate secondary processes

Consistent hole diameter and depth, even in complex materials

Key Advantages of Gundrilling Machines

Unmatched Precision

Gundrilling allows for extremely tight tolerances, often in the micrometer range. This level of accuracy is crucial for fuel injection systems, medical implants, and hydraulic components.

High Surface Finish

Because the gundrill tool is stabilized with guide pads and uses a high-pressure coolant system, the resulting surface is smooth and burr-free—reducing the need for finishing.

Efficient Chip Evacuation

Internal coolant flushes the chips out through the tool’s flute, preventing clogging and tool breakage. This means fewer stoppages and longer tool life.

Extended Tool Life

Thanks to consistent cooling and low friction, the tool wear is minimal. This translates to less frequent tool changes and lower operational costs.

Higher Productivity

By maintaining high feed rates without sacrificing quality, gundrilling machines enable faster production cycles—ideal for high-volume industries.

Where Gundrilling Machines Are Used

The versatility of gundrilling technology has made it invaluable across sectors:

Aerospace: Creating long bores in turbine blades and structural components

Automotive: Drilling precise oil passages and fuel rails

Medical: Producing orthopedic implants and surgical instruments

Hydraulics: Manufacturing cylinders and valve bodies

Defense: Fabricating barrels, missile bodies, and more

Each of these applications benefits from the precision, reliability, and efficiency that gundrilling provides.

The Role of Deep Hole Drilling Machine Manufacturers

Behind every successful gundrilling operation is a reliable deep hole drilling machine manufacturer. These manufacturers are responsible for designing machines that can handle extreme tolerances, tough materials, and complex production requirements.

The best manufacturers focus on:

CNC automation for real-time adjustments and consistent output

Advanced coolant systems to support deeper drilling without overheating

Custom configurations to match unique application needs

Robust build quality for durability in industrial environments

Manufacturers that stay ahead in this space continually invest in research and innovation to meet the evolving needs of precision-driven industries.

Spotlight on Steering Machines

While gundrilling machines handle the challenge of depth and accuracy, steering machines are gaining attention for their role in component assembly and alignment—especially in the automotive sector.

A steering machine helps assemble or test steering columns, ensuring proper fit and alignment. The integration of such machines streamlines production and enhances overall vehicle safety. Together with gundrilling systems, steering machines form a critical part of an automotive manufacturer’s toolkit.

Choosing the Right Machinery for Your Business

When selecting between different deep hole drilling and steering solutions, consider these factors:

Material Type: Some materials demand specialized coatings or tool geometries.

Hole Dimensions: Depth and diameter requirements determine the right type of gundrill.

Volume of Production: High-output environments need automated, multi-spindle setups.

Budget and ROI: Invest in machines that offer long-term performance and lower maintenance.

Conclusion: Precision That Powers Progress

In high-precision manufacturing, cutting corners is not an option. Whether you’re producing aerospace components or automotive systems, your success depends on reliability, consistency, and speed. Gundrilling machines offer all three—making them indispensable for industries where precision is non-negotiable.

And when it comes to sourcing such advanced technology, WIDMA stands out among the top deep hole drilling machine manufacturers. With decades of experience, CNC expertise, and a commitment to tailored engineering, WIDMA ensures that your production floor stays ahead of the curve. From gundrilling to steering solutions, WIDMA delivers excellence—deep into every detail.

0 notes

Text

Why Your Old Air Conditioner Is Costing You More in 2025

Summer heat is hitting harder than ever, and homeowners aren’t just battling soaring temperatures—they’re also dealing with rising energy bills. In Winchester, Virginia, many residents are feeling the pressure. If your electricity costs keep climbing even though your AC usage hasn’t changed, your outdated cooling system could be the real culprit.

At Small Solutions Heating and Air Conditioning, we have observed countless families across Winchester grappling with the problems arising from air conditioning systems that are both inefficient in providing the necessary cooling and overly expensive to operate. Most families do not understand the impact that outdated air conditioning units can have on their energy consumption.

The Problem of Inefficient Air Conditioning Units

Air conditioning systems age just like any other machinery, and an older air conditioning system is similar to how an old vehicle burns more gas to cover the same distance. Parts begin to break down, the amount of refrigerant drops, and efficiency ratings lose their value. An air conditioning system that used to cool the home effectively now runs for long durations, making it much harder to maintain comfortable temperatures while consuming far more electricity.

Cooling systems made after 2010 have a SEER (Seasonal Energy Efficiency Ratio) rating of 16 or higher, while systems made before 2010 have a rating of 10 or lower. This means that older cooling systems use 60% more energy than newer systems.

Winchester's large humidity levels pose challenges to older cooling systems. Our summers force air conditioning units to function twice as hard, not just to cool the air but to remove moisture as well. Because older systems require more energy to cool air, they end up cycling for longer and consuming more energy.

Warning Signs Your AC Is Wasting Energy

Inconsistent Temperature Control - Your cooling system is working inefficiently if it has hot spots in certain areas of your home. If the system is cycling more frequently than it should, uneven temperatures and changes will occur throughout the house.

Frequent Cycling - Pay attention to how often your system turns on and off. Frequent short-cycling in a quick succession wastes an enormous amount of energy and occurs when the system is improperly sized for your home.

Higher Energy Bills - Compare your current energy costs to the previous year during comparable weather. An increase in energy spending with no corresponding increase in energy efficiency often indicates the system is failing.

Diminished Airflow - Reduced airflow makes your system work longer to reach the set temperature. The longer your HVAC systems run, the more energy they require, which increases your electric bill.

How HVAC Maintenance Services in Winchester Help

Regular maintenance is the best strategy to prevent energy losses due to an aging cooling system. HVAC efficiency problems can be diagnosed and resolved long before they turn into expensive visits with regular checkups.

Inspection of All System Components - Comprehensive HVAC maintenance includes inspection of all system components. They check the refrigerant levels, clean the coils, tighten electrical connections, and check for good airflow. These issues, albeit small by themselves, left unchecked, accumulate and disrupt energy efficiency.

Cleaning and Replacing Filters - Dirty Air filters require more work to push air through the system, resulting in a 15% increase in energy use. Regular filter replacement as part of maintenance guarantees better system performance, more efficient operation, reduced power consumption, and smooth airflow.

Coil Cleaning and Maintenance – The evaporator and condenser coils make your machines work harder because they have to achieve a certain amount of heat transfer. Cleaning provides an excellent restoration of optimal heat exchange, which results in lower energy consumption.

The Cost Benefits of AC Replacement Versus Repair

Many of the aging cooling systems seem to be a tough call for Winchester homeowners as they weigh in on repairing or replacing them. Although repairs seem financially cheaper, they always turn out to be overly expensive long term, in comparison to replacement.

When Repair is a Good Choice - Homeowners having a system less than 10 years old and with small problems usually do better off seeking a professional repair service. Refrigerant leakage, thermostat issues, or general wear and tear of older parts are easy to restore and quite cheap to fix, while also improving efficiency.

When Replacement is a Must - Older cooling systems over 15 years are usually a candidate for replacement, as they tend to consume a lot of energy. Investing in a new high-efficiency AC unit is a guaranteed way to save energy and energy dollars, as the investment pays for itself usually within 5-7 years.

Energy Efficiency: Modern AC Technologies

Cooling systems have advanced features nowadays that make the system much more energy efficient than older models. In order to make the system efficient, modern variable-speed compressors adjust their output in accordance with the cooling demand. Operation schedules are optimized by smart thermostats, ensuring maximum efficiency.

Integration with Smart Home Technology - New systems work with smart home devices and let users assess the home’s cooling needs concerning the household's daily activities and the weather. This kind of automated performance lowers energy use when it's not needed while keeping your home feeling comfortable.

Zoned Cooling Systems - Newer zoning technology lets separate areas or rooms in your house be cooled independently. It can lower energy waste in areas that are not used. This precision can save about 20 – 30 % in cooling expenses compared to the traditional single-zone systems.

Professional Air Conditioner Repair Services In Winchester

Ignoring noticeable signs of inefficiencies in your air cooling systems can lead to minor issues slowly evolving into great energy sinks, the longer you wait to call in an expert. Skilled professionals are able to find problems accurately and employ solutions that will restore great performance.

Diagnostic Services

Professional diagnostic services will solve efficiency problems without masking them by identifying the root cause. This method is more effective as every solution is relevant to the problem at hand.

Emergency Repair Services

Malfunctioning systems in the scorching summer months can be quite uncomfortable and costly. Emergency repair services mitigate downtime while reducing damage that could impair efficiency for the long haul.

Selecting the Right HVAC in Winchester, VA

Fulfilling your air conditioning system’s servicing requirements with qualified professionals goes a long way in ensuring optimal results and long-term satisfaction. Look for providers with appropriate licensing and insurance, as well as local knowledge on Winchester’s climate challenges.

Experience

Winchester’s climate has its own specific challenges, which require local knowledge and experience. The understanding of the regional weather patterns, humidity levels, and other common system issues gives providers the ability to deliver more effective solutions.

Comprehensive Service Offerings

Select HVAC Winchester VA contractors who offer complete services, starting from routine maintenance to emergency repairs and system replacement. This approach maintains service quality and removes the headache of dealing with multiple contractors.

Lowering Environmental Impact Through Efficient Cooling

Rather than the personal cost saving of an individual, cooling systems have great environmental value. These systems help in saving energy, which in turn decreases the carbon emissions and lowers the strain on the electrical infrastructure.

Energy Refrigerants

Modern air conditioning systems are now equipped with environmentally friendly refrigerants, which have lower global warming potential compared to older refrigerants. With our newer systems, we are able to efficiently protect the environment from older system replacements.

Benefits of Energy Grids

Cooling systems help eliminate electrical infrastructure peak demand, thus creating additional reserve for electrical infrastructure. This, in turn, supports grid stability.

Virginia HVAC Solution Strategy

Your home’s specific needs, budget limitations, and future objectives all play a major role in developing a comprehensive cooling strategy. A professional consultation will ensure you make the right decisions regarding maintenance, repair, or replacement, so you are not overspending.

Energy Audits

Energy audits span beyond the cooling system itself. An audit will illuminate insulation improvements, air sealing, or window upgrades that can work alongside efficient cooling systems for maximum energy savings.

Financing Options

Upgrading or installing a new cooling HVAC system is no longer a hassle because of the many financing options made available by contractors. With low-interest refinancing and flexible payment plans, energy-efficient HVAC upgrades are now accessible to more homeowners.

Conclusion

An old and outdated air conditioning system, coupled with worn components and obsolete technology, leads to a significant drain on energy efficiency and a rise in costs. Without proper maintenance, this aging system will continuously siphon funds, exposing homeowners to excessive energy consumption.

Upgrading the cooling systems alongside maintenance and repair offers a dramatic drop in cooling costs while improving comfort. Don’t let energy bills shoot up endlessly; enhance your home's energy efficiency today and enjoy optimal savings tomorrow.

Every homeowner in Winchester knows the challenges that come with overheating problems. Small Solutions Heating and Air Conditioning stands out since we have a reputation for tackling these issues head-on with our experienced technicians. Through our extensive solutions, we aim to maximize comfort, lower spending, and restore productivity. Reach out to us to book a consultation and find out the savings you can achieve through proper cooling system maintenance.

Trusting professionals with advanced tools allows homeowners to enjoy the rewards of additional savings, tranquility, and better efficiency. Spend money on the right equipment and services to witness lower expenses and enhanced family comfort. Don’t wait until overheating drives your energy bills skyrocketing before investing in an efficient air conditioning unit.

FAQs

How can I tell if my AC is causing high energy bills?A sudden spike in your electricity bill—especially if your usage habits haven’t changed—is often the first sign. Other indicators include inconsistent cooling, frequent cycling, reduced airflow, and loud or strange noises from the system.

What is SEER, and why does it matter?SEER (Seasonal Energy Efficiency Ratio) measures the cooling efficiency of your air conditioner. The higher the SEER rating, the more energy-efficient the system. Older units often have SEER ratings below 10, while modern units start at 16 or higher, using up to 60% less energy.

Is it better to repair or replace an old air conditioning unit?If your unit is under 10 years old and the issues are minor, a professional repair is usually the most cost-effective option. However, systems over 15 years old often consume more energy and are better candidates for replacement due to long-term cost savings.

How often should HVAC systems be serviced in Winchester, VA?It’s recommended to schedule professional HVAC maintenance at least once a year—preferably in the spring—before the summer heat peaks. Regular servicing keeps your system efficient and helps prevent costly breakdowns.

Do new AC systems lower energy bills that much?Yes. Modern AC units with higher SEER ratings, smart thermostats, and zoning capabilities can reduce energy bills by 20–40%, especially in hot and humid regions like Winchester.

1 note

·

View note

Text

How Can a SIP Consultant in Chennai Help with Losses?

You have been investing regularly through SIPs with high hopes of achieving your financial goals. But suddenly, you notice your portfolio is in the red. This is where Fairmoves, which is the best mutual fund SIP services in Chennai can help you handle SIP losses. SIPs are a long-term investment journey, and sometimes the ride can be bumpy. This guide will help you make sense of things. Let’s break it down in a simple, relatable way so you feel confident about your next steps.

Why Do SIPs Sometimes Show Losses?

First, it’s important to understand why your SIP is not performing the way you expected. Here are the most common reasons:

Market volatility: Stock markets rise and fall. When markets dip, so do the investments linked to them.

Economic changes: Factors like inflation, interest rates, or global events can impact fund returns.

Fund strategy: Sometimes the fund manager’s chosen investments might underperform for a while.

Lack of diversification: If your SIP is invested in only one sector or type of company, losses can hit harder.

Loss-making SIPs do not automatically mean you made a bad decision, they just mean you’re experiencing a market cycle.

Should You Stop Your SIP if It’s in Loss?

A lot of beginners feel tempted to stop their SIP when they see red numbers. But hold on, SIPs are designed to work best over the long term. A SIP consultant in Chennai can help you understand this and keep you stuck to your goals. They can also adjust your portfolio if it's needed.

By investing at regular intervals, you buy mutual fund units at different prices. When markets fall, your SIP buys more units at lower prices. This averaging strategy, known as rupee-cost averaging, actually benefits you in the long run.

So, stopping your SIP during a temporary loss might do more harm than good.

Steps to Manage Loss-Making SIPs

Let’s look at practical ways to deal with an underperforming SIP:

Review Your Goals

Ask yourself why you started the SIP in the first place. Is it for your child’s education, retirement, or buying a house? If your goal is five years or more away, you don’t need to panic.

Stay Invested

Long-term investing requires patience. Markets will go through ups and downs, but over time, they usually recover. Staying invested gives you a better chance of seeing good returns.

Diversify Your Investments

If all your SIP money is stuck in one fund or one sector, it is risky. Spread your investments across large-cap, mid-cap, and even debt funds to balance out the risk.

Check the Fund

Check whether the fund itself is performing poorly compared to similar funds. Maybe the fund manager’s choices are not working. In that case, you could shift your SIP to a stronger fund, but do this after careful analysis, not just because you see a temporary dip.

Watch Costs

Sometimes, high expense ratios or hidden costs eat away at your returns. Check if your SIP fund has reasonable charges.

When to Rethink Your SIP

It is okay to change direction if:

The fund has consistently underperformed for over two years

Your personal financial goals have changed

You discover that the fund’s risk level is way beyond your comfort zone

Remember, your SIP should match your financial journey. There is no shame in switching, as long as you do it after proper research.

Tips for Peace of Mind

Stay calm: Negative returns in the short term are not a disaster.

Stay informed: Learn about market cycles and fund performance.

Stay diversified: Avoid putting all your money in one place.

Conclusion

Every investor dreams of earning double-digit returns. But in reality, there will be ups and downs. Setting realistic expectations helps you stay committed and avoid impulsive decisions.

SIPs are one of the simplest ways to invest. They help you achieve financial goals systematically, without worrying about timing the market. But even SIPs can go through bad phases. That’s why it’s important to look at the big picture, stay patient, and trust the process.

If you’d like, you can also get your SIP portfolio reviewed for free with an expert, so you gain confidence in your plan. Keep investing wisely, stay focused, and build your corpus step by step.

#investment advisor in Chennai#investment consulting firm in Chennai#national pension scheme registration in Chennai#mutual fund investment planner in Chennai#mutual fund advisor in Chennai#nps pension scheme in Chennai#mutual fund consultant in Chennai#national pension scheme investment in Chennai#portfolio management service in Chennai#portfolio management company in Chennai#pms services in Chennai#mutual fund company in Chennai#best mutual funds for sip in Chennai#mutual funds to invest in Chennai#best mutual fund sip services in Chennai#sip consultant in Chennai#buy mutual funds online in Chennai#open nps account online in Chennai#best mutual fund advisor in chennai#mutual fund advisor chennai

0 notes

Text

Fiberglass Market Size, Share, Growth and Forecast 2034

Fiberglass is a strong, lightweight material made by adding fine glass fibers to plastic reinforcement. Glass strands are weaved or matted and then mixed with a resin, typically polyester or epoxy, to create a long-lasting composite. Fiberglass's excellent strength-to-weight ratio and resilience to heat, chemicals, and corrosion make it a popular material for insulation, automotive, marine, aerospace, and construction. Because of its cost and versatility, it is a popular alternative to metals and other traditional materials.

According to SPER market research, ‘Global Fiberglass Market Size- By Glass Type, By Product Type, By Application, By End User- Regional Outlook, Competitive Strategies and Segment Forecast to 2034’ state that the Global Fiberglass Market is predicted to reach 66.34 billion by 2034 with a CAGR of 7.55%.

Drivers:

The market for fiberglass is expanding steadily as a result of rising demand from a variety of sectors, including wind energy, automotive, aerospace, and construction. It is perfect for improving structural integrity and fuel efficiency because of its high strength, low weight, and resistance to corrosion. The drive for energy-efficient buildings has increased demand for fiberglass insulation, which is also utilized in wind turbine blades as a result of renewable energy initiatives. Technological developments are increasing its uses and enhancing its performance. Additionally, the creation of sustainable fiberglass products is being aided by growing environmental consciousness.

Request a Free Sample Report: https://www.sperresearch.com/report-store/fiberglass-market?sample=1

Restraints:

The fiberglass market has numerous advantages, but it also has many problems. Concerns about fiberglass dust and non-biodegradable waste may hinder adoption and result in stricter regulations. Especially for advanced fiberglass types, high production costs may restrict its use in cost-sensitive industries. Recycling fiberglass is difficult and energy-intensive, which affects sustainability projects. Changes in the price of raw materials and energy also affect profitability. The business is also threatened by substitute materials with similar performance advantages, namely composites made of natural and carbon fiber. North America accounts for a sizable portion of the worldwide market due to its established sectors and strong emphasis on innovation and technology. Being a significant contributor, the fiberglass market in the United States benefits from the thriving automotive and construction sectors, where fiberglass is widely employed in lightweight components, composites, and insulation. Some of the key market players are Advanced Fiber Products, Ashland Global Holdings, BLG Fiberglass, Johns Manville, and others.

For More Information, refer to below link: –

Fiberglass Market Share

Related Reports:

Refinery Process Chemicals Market Growth

High Temperature Industrial Boiler Market Growth

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#Fiberglass Market#Fiberglass Market Share#Fiberglass Market Size#Fiberglass Market Revenue#Fiberglass Market Analysis#Fiberglass Market Segmentation#Fiberglass Market Future Outlook#Fiberglass Market Competition#Fiberglass Market forecast

0 notes

Text

Why Choose an IAS Academy in Hyderabad for Your Civil Services Preparation?

The Indian Administrative Service (IAS) is one of the most prestigious career paths in India, attracting thousands of aspirants every year. With the growing competition in the UPSC Civil Services Examination (CSE), it’s essential to receive the right guidance, structured study material, and a disciplined environment for effective preparation. Hyderabad has rapidly gained popularity as a prominent destination for IAS coaching, offering quality education, experienced faculty, and a conducive learning atmosphere.

In this blog, we’ll explore why Hyderabad has become a favored city for IAS coaching and what to look for when selecting an IAS academy to kickstart your civil services journey.

📌 The Rise of Hyderabad as an IAS Coaching Hub

Over the years, Hyderabad has transformed into a thriving center for civil services preparation, attracting aspirants from Telangana, Andhra Pradesh, and various other states across India. The city’s academic culture, affordable living standards, and strategic location contribute to its growing appeal among UPSC candidates.

Many aspirants prefer Hyderabad over other cities because of its well-organized coaching institutes, a balanced blend of traditional and modern teaching methods, and the availability of quality study resources.

📌 Key Benefits of Joining an IAS Academy in Hyderabad

If you’re considering pursuing IAS coaching, Hyderabad presents several advantages:

✅ Experienced Faculty

IAS academies in Hyderabad are known for having seasoned educators and subject experts who offer comprehensive coverage of the UPSC syllabus. Many faculty members bring years of teaching experience and have in-depth knowledge of exam trends.

✅ Focused Study Environment

Being surrounded by fellow aspirants with similar ambitions creates a motivating atmosphere, essential for maintaining consistency and discipline during the long and challenging preparation journey.

✅ Comprehensive Study Material

Most IAS academies in Hyderabad provide meticulously curated study material, updated according to the latest UPSC syllabus and exam patterns. This reduces the burden of sourcing study resources and ensures you stay aligned with current affairs and syllabus changes.

✅ Regular Test Series and Mock Interviews

Effective coaching centers offer regular test series for both Prelims and Mains, along with interview guidance sessions. These help aspirants improve answer-writing skills, manage time efficiently, and gain confidence for the Personality Test round.

✅ Affordable Living and Student-Friendly Facilities

Compared to cities like Delhi or Mumbai, Hyderabad offers cost-effective living options, reliable public transport, and a range of PG accommodations near coaching hubs, making it a preferred city for students from other regions.

📌 What to Consider When Choosing an IAS Academy in Hyderabad

Before enrolling, it’s important to evaluate your options carefully. Here are some factors to keep in mind:

Faculty Experience: Ensure the academy has qualified, experienced mentors who can simplify complex subjects and provide actionable insights.

Study Material: Check if the institute provides comprehensive, updated, and exam-oriented notes, booklets, and current affairs resources.

Classroom Strength: Opt for academies that maintain a balanced student-teacher ratio, ensuring personal attention and interactive sessions.

Test Series Quality: Look for a coaching center that conducts regular, well-structured mock tests and provides detailed feedback.

Infrastructure: A peaceful, well-equipped learning environment with access to libraries, discussion rooms, and online support is beneficial.

Fee Structure: Compare course fees with the value offered in terms of faculty expertise, resources, and additional support services.

Flexibility: Many academies now offer both offline and online classes, allowing you to choose a mode that suits your schedule.

📌 Is IAS Coaching in Hyderabad Worth It?

Absolutely. Hyderabad combines the advantages of experienced mentorship, competitive peer groups, affordable living, and a quality academic environment, making it a smart choice for UPSC preparation. Many aspirants from this city have secured top ranks in recent years, further reinforcing its reputation as a reliable IAS coaching destination.

Whether you’re a beginner or a repeat candidate aiming to improve your score, joining a reputed IAS academy in Hyderabad can give you the right direction, structure, and support needed for success.

0 notes

Text

How to Reduce Polyurethane Foam Density – Step by Step

Now that we’ve covered the basics, let’s look at how you can actually reduce the density of PU foam effectively.

1. Adjust the Blowing Agent Quantity

Blowing agents are substances that cause the foam mixture to expand. In flexible polyurethane foam systems, water is a commonly used chemical blowing agent. When water reacts with isocyanate, it generates carbon dioxide gas, which expands the foam.

More blowing agent = more expansion = lower density

However, this has a limit. Excessive blowing agent can cause:

Foam collapse

Poor cell structure

Reduced strength

Tip: Increase the water content gradually while monitoring foam stability and cell uniformity.

2. Optimize Raw Material Ratios

The balance between polyol and isocyanate is crucial. If the polyol content is too low, the foam may become brittle. If it's too high, the foam could be weak or spongy.

When targeting lower density:

Slightly increase polyol content for better foam stability.

Adjust surfactants to support uniform cell formation.

Always consult your chemical supplier or a formulation specialist before changing the core recipe.

3. Use High-Precision PU Foam Machines

A well-calibrated PU foam machine ensures that the raw materials are mixed and metered accurately. Poor dosing leads to inconsistent foam quality, and it's especially risky when you're trying to reduce density.

Modern PU foam machines come with:

Accurate flow meters

Digital controllers

Adjustable mixing heads

These features are critical when reducing density because even small variations in the formulation can drastically affect foam structure and performance.

4. Control Temperature and Environmental Conditions

Foam expansion is a chemical reaction influenced by temperature and humidity. Lower temperatures slow down the reaction, while higher temperatures can increase expansion.

To help reduce density:

Maintain ambient temperatures between 20–25°C during production.

Ensure mold or conveyor surfaces are clean and at optimal temperature.

Control humidity levels to avoid excess moisture affecting foam properties.

5. Use Efficient Mixing Techniques in the Foaming Machine

Proper mixing inside the foaming machine is vital for producing uniform, low-density foam. Insufficient mixing can lead to large voids, weak spots, or uneven density.

If using a high-pressure foaming machine:

Monitor pressure settings and injection speed.

Ensure the mixing head is clean and functioning properly.

For low-pressure systems:

Use correct stirring speeds and mixing times.

6. Incorporate Additives or Fillers Wisely

While not always necessary, certain additives can help create lower-density foam by stabilizing the cell structure or improving foam resilience. However, using fillers may alter other properties, such as firmness or thermal resistance.

Common additives include:

Silicone-based surfactants

Cell openers

Flame retardants (as per need)

These must be used cautiously and tested in small batches before scaling up.

Challenges of Lowering PU Foam Density

While reducing density has its benefits, it's not without challenges:

Weaker mechanical strength: Lower density can mean lower durability or support.

Poor foam rise: Inadequate expansion may lead to underfilled molds.

Foam collapse: Overuse of blowing agents can cause the foam to break down.

This is why balance and testing are critical. Always validate foam samples before starting large-scale production.

Final Thoughts

Reducing polyurethane foam density is a strategic move that can lead to cost savings and improved product design, but it requires careful planning, process control, and the right equipment. By adjusting formulation components, using high-performance PU foam machines, and fine-tuning your foaming machine settings, you can achieve the desired density without compromising quality.

For manufacturers aiming to stay competitive in today’s foam industry, mastering the science of density control is a key step forward.

0 notes

Text

Jamie Dimon warns about America’s coming debt crisis

Jamie Dimon is one of America’s most prominent and successful CEOs; he built JP Morgan Chase into a $4 trillion juggernaut, so it’s fair to say that he understands global finance in a way that most people– and most politicians– do not.

On Friday, Dimon sat down for a 30+ minute live interview at the Reagan National Economic Forum– named after the 40th President who constantly preached cost-cuts and responsible spending.

Dimon opened his remarks talking about Reagan, who sounded the alarm about the national debt back in the early 1980s when America’s debt to GDP ratio was just 35%. Today it’s 122%. And with each passing year the number becomes even worse.

Dimon warned the audience that “tectonic plates are shifting,” referring to America’s status as the dominant superpower in the world– which is rapidly slipping.

“The amount of mismanagement is extraordinary,” he said. America has added $10 trillion to the national debt in just five years… and for what benefit? Is the country $10 trillion better off? Did any of that $10 trillion improve the lives of anyone who isn’t in Washington DC?

But all of that debt is quickly reaching a point where it will become nearly impossible to service. Just covering the interest payments on the national debt now costs taxpayers more than $1 trillion per year. And if the current trend on rates and deficit spending hold, it will reach $2 trillion per year by 2028.

(He joked that the government spending is worse than the proverbial “drunken sailor,” because at least a drunken sailor spends his own money.)

As a result of this insane level of debt and spending, Dimon warned, “you are going to see a crack in the bond market. It’s going to happen.”

What he means is that US government bonds have long been considered the global “risk-free” asset… and whenever the Treasury Department would sell more bonds, investors would dutifully buy as much debt as the government was selling.

But that’s no longer the case. “Bond vigilantes are back”, Dimon agreed, and investors are now shunning US government securities.

This is going to cause a major problem for the United States; running such huge deficits year after year means the Treasury Department NEEDS lenders, it NEEDS investors to buy US government bonds.

If investors pull back, the natural consequence will be MUCH higher Treasury yields and interest rates, resulting in a full-blown fiscal crisis in the United States… including major inflation.

“The future- what I see– is inflationary,” Dimon predicted. “I don’t know if the crisis will be in six months or six years, [but] I’m hoping that we change. . . the trajectory of the debt” before that crisis occurs.

It was a pretty blunt warning to a room full of policymakers– which included several officials from the Federal Reserve and the Trump administration.

Dimon is absolutely right, of course. Peter and I have been talking about this same debt crisis for years, and it’s only become worse.

For someone of Dimon’s gravitas to sound the alarm bells is a big deal– and he echos Warren Buffett’s most recent annual letter which similarly admonishes the federal government to get its fiscal act together.

Sadly, it doesn’t appear that the government is listening.

On Sunday, Treasury Secretary Scott Bessent dismissed Dimon’s warnings and claimed, rather bizarrely, that “the deficit this year is going to be lower than the deficit last year, and in two years it will be lower again.”

That statement is just patently false.

In Fiscal Year 2024, the $1.8 trillion deficit constituted 6.4% of GDP. This year’s deficit hit $1.3 trillion just in the first SIX MONTHS! Let’s be kind and assume that the annual deficit this year will be ‘only’ $2.0 trillion, or 6.6% of GDP — that would amount to a higher deficit on both a nominal and relative basis.

Plus, the “One Big Beautiful Bill” will add quite a bit more to the deficit. Don’t get me wrong– tax cuts are great. But spending cuts are even more critical right now… and this bill is extremely deficient in that department.

Senator Rand Paul confirmed this later and said (of Bessent’s comments), “the math doesn’t really add up” and that the administration’s current spending plan is to have a total deficit of “five trillion over [the next] two years”.

Any way you slice it; the deficit is increasing… not decreasing.

Elon Musk lamented this as well, saying that he was “disappointed” by how the spending/tax bill increases the deficit.

There do seem to be a handful of Senators willing to take a stand and demand bigger spending cuts. We’ll see how that pans out. But it’s clear that the majority of politicians don’t have a care in the world about the deficit.

They almost have a sense of entitlement in assuming that investors from around the world will continue buying US government bonds no matter how precarious America’s fiscal situation becomes.

Jamie Dimon closed his remarks talking companies in the private sector who had a similar sense of entitlement– Kmart, Sears, Blackberry, Nokia, etc. all had tremendous “arrogance, greed, complacency, bureaucracy.”

They all assumed their greatness and success would last forever. But that’s a horrible assumption. Greatness and success have to be earned every day, year after year.

The US government has been doing the opposite for far too long; rather than earning success and greatness, they find unique ways to cripple themselves and make things worse.

Dimon rightfully pointed out that the ship can still be turned around. And it can. But it certainly makes sense to have a Plan B in case they don’t. These risks are very real, and it’s sensible to take them seriously.

0 notes

Text

How to Use Leverage Wisely in CFD Trading

CFDs have become a popular forex demo for bringing people who enjoy financial markets up close without necessarily owning the asset. Another attractive but dangerous aspect of using leverage in CFD trading, it magnifies the gains significantly when properly used and, unfortunately, becomes a source of grievous losses when misused.

Thus, the present article seeks to help beginners how to use leverage in trading responsibly to safeguard capital.

Learn more about trading basics at tradewill.com

TIP: Approach leverage with caution and respect—it can multiply your profits but also amplify your losses. Start with a thorough education before putting real money at risk.

Understanding Leverage in CFD Trading

Leverage in CFD trading can be conceived, for the simplest part of it, as controlling a position vastly bigger than what the money in your trading account will afford, using margin, which is a fraction of the total trade, to do that.

For instance, with a leverage ratio of 10:1, one can control $10,000 worth of any asset without having it on their account, but it costs them only $1,000 as initial capital. However, it also needs to be understood that profits and losses are calculated on the full position value and not on just the margin amount since capital is reduced to much lower levels than in traditional trading.

In brief, it means you borrow capital from your broker to open bigger positions. Because of that, any price changes will have a much more severe impact on your trading account, positive as well as negative.

Margin Requirements and Leverage Ratios

A trader must know margin requirements as well as the leverage ratios to use leverage effectively. Margin requirements are a percentage of the total trade value that must be deposited to open a position.

Margin requirements may differ based on:

Type of asset being traded

Volatility in the market

Policies of the broker

Regulatory requirements

TIP: Choose your stop-loss type based on market conditions and your risk tolerance. In volatile markets, paying extra for guaranteed stops may be worth the additional cost.

CFD trading has this form of a leverage ratio: the ratio between total position value and required margin. The common ratios include:

1:5 (needing the 20% margin)

1:10 (10% margin)

1:30 (needing roughly 3.33% margin)

What you deposit as margin is security against loss, which, at the end, when the position closes, is generally refunded to you unless the loss incurred goes beyond the amount of your initial deposit.

The CFD Leverage Risks and Rewards

The charm of leverage lies in its ability to create greater returns, while CFD leverage risks and rewards go hand in hand. Here is a situation:

You invest $500 as margin with a leverage of 1:5 to control $2,500 worth of shares. When the share price rises by 10%, your profit comes to $250, or $2,500 × 0.10, which means a 50% return on your $500 margin—more than five times the return without leverage.

However, if the price falls 10%, you would incur a loss of $250, or 50% of your initial margin. The loss would be magnified, which is the risk of leverage.

Furthermore, traders should be best forex trading platforms of margin calls. This happens when the equity in your account falls below what is required for the maintenance margin level, thereby causing your broker to call for more funds or close your positions to minimise further losses without any bad benefit.

TIP: For every trade, calculate both your potential profit AND potential loss before entering. Never risk more than you can afford to lose, regardless of how confident you feel about a position.

0 notes