#india trade data

Explore tagged Tumblr posts

Text

Discover India's top 10 export products for 2024, including petroleum, gems, pharmaceuticals, textiles, and more. Learn how these exports drive economic growth and access reliable India import-export data with Seair Exim Solutions to enhance your trade strategy.

#Export Import data#Import export data#India export import data#Export import data in India#India Trade Data#and India import export data

0 notes

Text

Explore India's top 10 export products driving its global trade dominance, from petroleum products to pharmaceuticals. Discover key insights into India's export destinations and economic impact.

#Export Import data#Import export data#India export import data#Export import data in India#India Trade Data#India import export data

0 notes

Text

Soybean Export from India: Trends, Data, & Market Outlook for 2025

India's agricultural exports continue to gain momentum, with soybean standing as a key contributor. Known for its high nutritional value and diverse industrial applications, soybeans play a pivotal role in the global agri-commodity market. As the world’s demand for plant-based proteins and sustainable oils increases, India's position as a significant player in soybean exports strengthens. This article delves into the current trends in soybean export from India, examines soybean export data, highlights key soybean exporters in India, and explores major soybean-exporting countries for 2024-2025.

The Landscape of Soybean Export from India

India has emerged as a prominent exporter of soybeans, contributing significantly to global trade. Factors such as robust agricultural policies, advancements in farming techniques, and a focus on export-oriented production have bolstered India's soybean export capabilities.

In the 2024-2025 period, soybean exports from India are expected to grow due to increasing international demand. Indian soybeans are sought after for their quality, competitive pricing, and adherence to international standards. The primary export destinations for Indian soybeans include Southeast Asia, the Middle East, and European countries.

Soybean Export Data for 2024-2025

Tracking soybean export data reveals significant insights into India’s performance in the global market.

Volume and Value of Exports: India exported approximately 2.5 million metric tons of soybeans in the fiscal year 2023-2024, generating over $1.2 billion in revenue. The 2024-2025 projections suggest a 10-12% growth, driven by increasing demand from new and existing markets.

Major Importers of Indian Soybeans:

Indonesia and Vietnam: These countries use Indian soybeans primarily for feed and food processing industries.

United Arab Emirates (UAE): A significant importer due to its booming food industry and demand for plant-based products.

European Union (EU): Particularly Germany and the Netherlands, where soybeans are used for biofuels and plant-based protein products.

Export Growth Drivers:

India’s strategic position in Asia ensures shorter shipping times to key markets.

Increased global preference for non-GMO soybeans, a segment where India has an advantage.

Key Soybean Exporters in India

India’s soybean export industry is supported by numerous stakeholders, including farmers, processing companies, and export houses top soybean exporters in India are.

SOPA (Soybean Processors Association of India): SOPA plays a vital role in promoting soybean exports from India. It ensures the quality and branding of Indian soybeans, making them competitive in global markets.

Major Exporting Companies:

ITC Limited: Known for its robust supply chain and adherence to quality standards.

Adani Wilmar: A significant player in agri-exports, including soybeans and soy-derived products.

Ruchi Soya Industries: One of India's largest exporters, supplying non-GMO soybeans globally.

Emerging Players: Smaller exporters and agri-tech startups have also entered the market, leveraging technology to enhance productivity and streamline exports.

India’s Position Among Soybean Exporting Countries

Globally, India ranks among the top 10 soybean exporting countries. However, countries like Brazil, the United States, and Argentina dominate the export landscape.

Global Competitors:

Brazil: The world’s largest soybean exporter, primarily supplying China.

United States: A major exporter with advanced farming technology and extensive trade networks.

Argentina: Known for its high-quality soymeal exports.

India’s Competitive Edge:

Organic and non-GMO soybeans.

Competitive pricing compared to Western exporters.

Proximity to Asian and Middle Eastern markets.

Challenges in Competing Globally: While India has advantages, challenges such as inconsistent yield, fluctuating prices, and logistical issues need addressing to solidify its global standing.

Emerging Trends and Opportunities in Soybean Export

The soybean industry is undergoing transformation due to changing consumer preferences and technological advancements. Key trends for 2024-2025 include:

Shift to Plant-Based Diets: The rise of veganism and plant-based diets globally is driving demand for soy products, including tofu, soy milk, and soy protein isolates.

Sustainability and Traceability: Exporters focusing on sustainable farming and traceability in supply chains will have a competitive edge in international markets.

Government Support: Initiatives such as export incentives, enhanced logistics, and trade agreements are expected to boost soybean exports.

Value-Added Soy Products: Diversifying into soy-derived products like soymeal, soy oil, and soy protein can open new revenue streams for Indian exporters.

Challenges Facing Soybean Export from India

Despite its growth potential, the industry faces several hurdles:

Climate Change: Unpredictable weather patterns can impact crop yields.

Infrastructure Bottlenecks: Limited storage and transportation facilities hinder efficient exports.

Price Volatility: Global soybean prices are influenced by geopolitical and economic factors, impacting Indian exports.

Addressing these challenges through policy reforms and industry collaboration will be critical for sustained growth.

Future Outlook for Soybean Export from India

The future of soybean exports from India looks promising. With the global demand for soybeans expected to rise by 15-20% in the next decade, India has the opportunity to enhance its market share. Key strategies for growth include:

Investing in sustainable farming practices.

Strengthening trade relations with emerging markets like Africa and Latin America.

Promoting value-added soy products through branding and innovation.

Conclusion

Soybean export from India are poised for remarkable growth in the 2024-2025 period. By leveraging its strengths in quality production and strategic geographic positioning, India can expand its footprint in the global soybean market. However, addressing challenges like climate change, infrastructure, and price volatility will be essential for realizing its full potential. With the concerted efforts of farmers, exporters, and policymakers, India is set to cement its position as a leading player in the global soybean trade.

#soybean export from India#soybean export data#soybean exporters in India#soybean exporting countries#trade data#global trade data#international trade

2 notes

·

View notes

Text

India's textile industry, among the world's largest and oldest, is crucial to its economy, supporting millions and significantly contributing to GDP. In 2022, exports hit $16 billion, projected to exceed $45 billion by 2031. Let's explore recent export statistics, key exporters, and trends using modern HS codes, Get access to textile export data textile exports from india textile exporter in india textile exporting countriesindian textile exports statistics textile hs code

list of textile products exported from india

#export#import#trade data#import data#export data#international trade#global trade data#trade market#custom data#import export data#global business#textile hs code#textile export data#textile exports from india#list of textile products exported from india#indian textile exports statistics#textile export data of india#textile exporter in india#textile exporting countries#textile

0 notes

Text

Top Strategies to export Plastic products from India to Indonesia

Expand your market reach by exporting plastic products from India to Indonesia. Learn key strategies and market insights for success.

0 notes

Text

Coconuts dominate India's agricultural landscape, with vast local and global appeal. Annual production reaches 21,500 million tonnes, underscoring India's pivotal role in the coconut market. States like Tamil Nadu, Kerala, Karnataka, and Andhra Pradesh contribute significantly to exports, meeting global demand.

#export#import#import data#export data#trade data#global trade data#international trade#trade market#coconut export from India#coconut export data#coconut export data from India#coconut exporting countries#largest exporter of coconuts#top 10 coconut exporting countries#coconut production in India 2023#coconut

0 notes

Text

In recent years, algorithmic trading has gained popularity in India. Traders have switched from manual to algorithmic trading owing to its inherent benefits of powerful analytical tools, user-friendly interfaces, and seamless connectivity to market data.

0 notes

Text

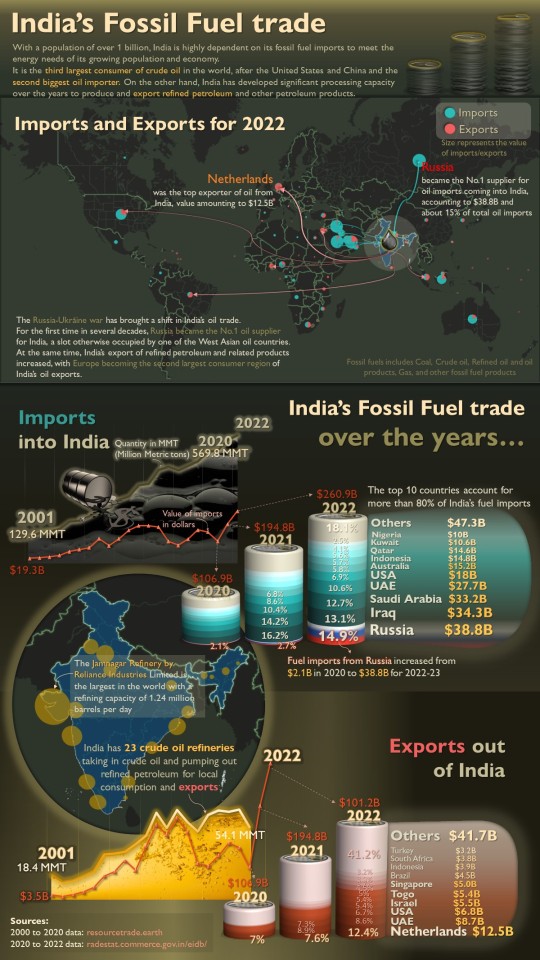

The Russia-Ukraine war and the ensuing oil embargos have been in the news for long now. The impact of this on India's oil trade and the corresponding trade figures are depicted here...

Data sources used: 2000 to 2020 data: https://resourcetrade.earth/ 2020 to 2022 data: https://tradestat.commerce.gov.in/eidb/

#data visualization#dataviz#russia ukraine war#oil and gas#oil trading#import export data#india#fossil fuels

1 note

·

View note

Text

Upcoming Economic Data Releases for the Week of March 13: India, US, UK, Eurozone, and China

Upcoming Economic Data Releases for the Week of March 13: #India, US, UK, #Eurozone, and #China #NSEIndia #Nifty50 #BankNifty #OptionTrading #DuttaViews

Upcoming Key Economic Data Releases for the Week Beginning March 13, 2023 March 13: India CPI Feb March 14: India WPI inflation Feb India exports, imports, and trade deficit Feb India passenger vehicle sales Feb UK unemployment rate Jan US CPI Feb March 15: Eurozone industrial production MoM Jan US PPI and Core PPI Feb US retail sales Feb March 16: European Central Bank (ECB)…

View On WordPress

#China#CPI#ECB#Economic Data Releases#exports#global markets#imports#India#industrial production#technical analysis#trade deficit#UK#unemployment#US#US jobs data#WPI

1 note

·

View note

Text

Louis the "Pimp": A Rebuke and Rebuttal

OK, IWTV fandom, I have been made aware that some (many) of you are genuinely not aware of some of the anti sex work implications of your statements around Louis and pimping, so -

First of all, some ground level assumptions: I am assuming we are all pro sex workers here. Which means that we all believe in the right for adults to consent to commercial sexualised labour, and to demand ethical working conditions just like any other worker. Sex work is work etc.

Now, that stance can and must coexist with the acknowledgement that sex work has both historically and currently been coerced from marginalised communities. In my part of the world, hereditary caste based sexual enslavement is an on-going atrocity, and similarly, in the United States Black enslaved people was disproportionatey victims of commercialised sexual abuse. (This is RELEVENT to Armand and Louis so it behoves everyone to inform themselves about these realities.)

What I'm saying now comes from the scholarship and testimonies of sex workers themselves, who have always been at the forefront of advocating for themselves as communities and unions. You can and should read through the publications of the Global Network of Sex Work Projects to ground yourself in these perspectives.

The idea that its ok to be a sex worker, but that a client or a pimp or a brothel owner deserves contempt, shaming or derison is an old one, associated with the dichotomy of pitable fallen women vs dispicable emasculated men (emasculated because of the patriarchal shame of a) paying for sex and b) living off of a woman's labour). This has manifested in what is known as the Nordic model (or, hypocritically, the Equality Model) of Prostitution, where sex workers themselves are deemed nominally free to practise their trade, but clients and third parties (pimps, managers, brothel owners) are criminalised. There is unambiguous peer-reviewed data showing the failure of this approach to protecting sex workers from harm, and almost every sex worker union has denounced it.

So now let's talk about this cultural and legal contempt and criminalisation of the third party, and specifically, the pimp figure. Unlike the brothel owner, the pimp is more often from a similar class and identity as the sex worker, often sharing the same living and working spaces. Pimps are often sex workers allies and collegeaues. They provide an interface between the client and the sex worker that can help screen them for safety and security, and the remove the additional burden of soliciting and marketing from the sex worker's labour.

And because it is important to talk about specifics, a pimp in marginalised communities of sex workers is often a brother, a father, or a lover to the sex worker who faces the same casteism, racism and classism that she does. He is often the father of the sex worker's child. In India, for example, even though prostitution itself is not criminal, any adult male living with a prostitute is assumed to be guilty of being a pimp unless he can prove otherwise, and can face imprisonment of up to 2 years with a fine. One of the demands of unionised sex workers, including those in India, has been to decriminalised pimping along with sex work, not just because pimps make it safer and easier for sex workers to get clients without having to actively solicit, but also because such criminalisation actively harms family units.

Of course, there are pimps who can be abusive and exploitative. This is true of any professional relationship, and this is also true of people in romantic and sexual relationships (like marriage). But to deem a pimp inherently as an abuser carries a lot of anti sex work and racist and classist baggage with it.

Why racist (and classist and casteist etc)? Because the men with capital were (and are) not often pimps. They are landlords and investors, who ran brothels and saloons and massage parlours and dance bars and other sites where sexual labour was commercialised. To denigrate a man for being a pimp as somehow worse than being the owner of a sweatshop or farm is a way of jeering at the men who have not been able to buy themselves the luxury of distance from the exploitation they profit from. And the men of capital were and are, overwhelmingly, those from the dominant identity (White. Savarna. etc.)

So NOW, with all that necessary context in mind, let's talk about Louis and what it means when fandom firstly calls him a pimp, and then second sneers at him for his perceived behavior as one.

You know who first calls Louis a pimp?

Daniel Molloy, a white man being the brash, confrontational journalist that he has the luxury of being.

Louis accurately describes his profession managing and operating a diversified portfolio of entireprises. This translates to investing his family's sizeable trust into real estate (he owns 8 out of 24 buildings on Liberty Street) and running establishments that make money from selling liquor, organised gambling and sex work. Just as not many Black men would have been in a position of power to make a profit from a sugar plantation as Louis' great grandfather did, not many Black men would have had the capital (and the business acumen) to own and operate a series of businesses that included sex work. Infact we see him collecting his profits from a white man who was closer to the pimp role - Finn.

Reducing this to calling him a pimp is the first of many racist microaggressions we will watch Daniel make. As someone who indulged in some kind of sex work himself, one might say some of Daniel's hostility is self-loathing. Nonetheless, there is a racialised element in his contempt towards both Louis and Armand that, I would theorise, comes from the distinction made between a white, educated man choosing to recreationally whore himself for drugs, and a Black man who earned a living from other people's sex work, or a Brown man who is perceived as a rent boy.

We then get to the idea of denigrating Louis' pimp-like behavior. First of all, let's look at Louis as the employer and manager of sex workers. Everything we have seen about him shows him to be courteous, considerate, and professional. His guilt at the entire situation of how sex work operates aside (and we can agree that it must have been exploitative and even abusive in general, and that he was complicit in such a system, as any capitalist is) - MOST importantly, we never see Louis doing the thing that patriarchy really resents a pimp for - sampling the goods for free. We never see him use his power over the sex workers he employs to get favours.

In fact he makes it clear that he visits Miss Lily precisely because she is part of a different establishment, and that both of them being Black in a majority white situation places them on a more equal footing. Watching Louis with Miss Lily, both is how he is with her sexually as well as socially, gives you the clearest evidence of how he behaves around sex workers he is having a relationship with. (Contrast that to Lestat, who buys her time and body as an act of one-upmanship with no concern for her preference, and then who kills her out of jealousy.)

So - Was Louis a pimp? No. Was Louis an abusive pimp? Also No.

Then why does the fandom continue to deploy this term in relationship to him?

It's racism, your honour. (The answer is almost always racism.)

To unpack this, lets jump forward from the 1910s where, again I remind you - very very few Black men in the United States were in any position to operate as fashionable brother owners with wealth to spare.

We now move to the 1980s, when one (but not the only!) sub-genre of rap was evolving - gangsta rap. In this sub-genre, Black musical artists like Too Short and Ice T were creating and more pertinently making accessible to white America, the signifier of the Black pimp figure. This drew from 1960s Black culture-making around West Coast pimps like Iceberg Slim, but also from an older storytelling tradition that linked the figure of the pimp with the archetype of the trickster. I'm not going to cite the wealth of literature you can find that theorises this, (nor defensively provide the mass of nuanced critique that Black feminists have offered) because the limited point I wish to make is -

When white America began enjoying (and appropriating) rap and hip-hop culture, one of the tropes it started perpetuating with the shallowest of understanding of its origins, was that of the specifically Black pimp. A figure who displayed wealth, but without (white-signifying) class, who was sexually active in a racialised hypermasculine way, but both a threat to women and contemptibly a leech off them.

THIS is the pimp archetype that is being evoked when fandom talks about Louis's 'pimp'ness.

It is racist. It is ahistorical and canonically unfactual.

It is also needlessly contemptuous of the sex workers (labourers and third parties alike) who are part of the community here on tumblr, so often praised as one of the spaces that is friendly to them.

Maybe think about all of that the next time you choose to use the word 'pimp'.

#interview with the vampire#my meta#louis de pointe du lac#fannish racism#amc iwtv#amc interview with the vampire#iwtv#vampterview#iwtv meta

122 notes

·

View notes

Text

The East India Company ships

The East and West India Company ships were not ship types in the usual sense. They were generic terms for a series of merchant ship types that travelled between Europe and the overseas colonies in the East and West. Common features of these ships were three masts, several cannons and a high bulwark to make it more difficult for attackers to board them. Their valuable cargo made the ships attractive targets, so they often travelled in convoys, accompanied by medium-armed merchant ships or frigates for protection. But let's go into more detail.

The East Indiaman 'Earl of Abergavenny', off Southsea, by Thomas Luny 1801

The ships of the East India Company were the ships of the English East India Company, a public limited company (shipowners at the early time of the East India Company contributed their ships to the company and received a certain share in the company in return. They received a proportionate share of the company's overall profits and received a dividend even if their own ship was lost, since the 18th century the company build their own ones as well.) which traded with Asia from 1600 to 1834. The company had a monopoly on trade with the East Indies, China and other regions, and its ships carried goods such as spices, tea, silk, cotton, porcelain and opium. The company also played an important role in the colonisation and administration of India and other territories.

East India Company ships at Deptford, by English School, c. 1660

The ships of the East India Company were known as East Indiamen or as Indiamen and were among the largest and most modern of their time. They were designed to withstand long voyages, carry heavy cargoes and defend themselves against pirates and enemy ships. They were also equipped with cannons and muskets and had a crew of sailors, soldiers, officers and passengers. Because of the need to carry heavy cannons, the hull of the East Indiamen - like most warships of the time - was much wider at the waterline than on the upper deck, so the guns on the upper deck were closer to the centreline to increase stability. This is known as a tumblehome. The ships usually had two complete decks for accommodation within the hull and a raised aft deck. The aft deck and the deck below were lit by galleries with square windows at the stern. To support the weight of the galleries, the hull lines were full towards the stern. As mentioned above, the ships were armed and painted to look like a warship and an attacker could not be sure if the embrasures were real or just painted, and some Indiamen carried a substantial armament.

Two views of an East Indiaman of the time of King William III, by Issac Sailmaker, 1685

The Royal Navy acquired several East Indiamen during the Napoleonic Wars and made them fourth rate ships (e.g. HMS Weymouth and HMS Madras), perpetuating the confusion of military ships with merchant vessels as prizes. In some cases, the East Indiamen successfully fended off attacks by the French. One of the most famous incidents occurred in 1804 when a fleet of East India ships and other merchant vessels under Commodore Nathaniel Dance successfully fought off a squadron commanded by Admiral Linois at the Battle of Pulo Aura in the Indian Ocean. And during this time, some of the ships were even travelling under the protection of a Letter of Marque, which allowed them to make their own prizes.

The East Indiaman 'Prince of Wales' disembarking troops off Gravesend, 1845, by John Lynn, 1845 or later - She was built by Green's of Blackwall in 1842 to a design known as that of the "Blackwall Frigates" - Indiamen with the single-decked appearance of frigates.

The ships of the India Companies were not only involved in trade, but also in exploration, diplomacy, warfare and scientific research. They visited many harbours and islands, built factories and forts, fought in battles and wars, negotiated treaties and alliances and collected samples and data. With the advent of the smaller and faster Blackwall Frigates in 1834 came the end of the great Indiamen as these small frigates sailed much faster.

#naval history#east and west india company#ships#1600-1834#blackwall frigate#age of sail#merchant vessels

162 notes

·

View notes

Text

https://www.seair.co.in/blog/top-10-garment-export-countries-in-the-world.aspx

Discover the top 10 garment exporting countries in the world and the significant role of India's garment industry. Learn about key exporters, major importers, and the factors driving the global fashion market. Explore trade data insights with Seair Exim Solutions. Watch now for in-depth analysis and trends!

#garments export data#garments import data#HS codes#search hs code#US Import Data#Export Import data#India Export Data#global trade data

0 notes

Text

Import of Oil in India: A 2024 Overview

India, one of the fastest-growing economies globally, is heavily reliant on imported oil to meet its energy needs. As of 2024, oil imports play a crucial role in India’s economic stability, given the country's limited domestic production and its burgeoning industrial and transportation sectors. The demand for crude oil continues to increase, making India one of the largest oil importers in the world.

In this article, we will dive into the key trends shaping import of oil in India in 2024, examine the major oil importers in India, analyze the oil importers by country, and explore the latest Indian oil imports data.

Current State of Oil Imports in India (2024)

India is the third-largest oil importer globally, accounting for around 10% of total global oil imports. This reliance is driven by India’s limited domestic oil reserves, which only meet a fraction of the country’s energy needs. The demand for oil in India continues to rise due to rapid industrialization, population growth, and expanding transportation networks.

India's oil imports are crucial to fueling its key sectors such as transportation, power generation, and manufacturing. According to the latest Indian oil imports data, the country imports approximately 85% of its total crude oil consumption. The ongoing geopolitical tensions and global supply chain disruptions in recent years have only increased India's focus on diversifying its oil sources and securing stable supply routes.

Major Oil Importers in India

In 2024, several major oil companies, refineries, and private-sector players are involved in importing oil into India. Among the top oil importers in India are:

Indian Oil Corporation Limited (IOCL) – As the largest public sector oil company in India, IOCL is a major player in the importation of crude oil, processing over 1.6 million barrels per day.

Bharat Petroleum Corporation Limited (BPCL) – A government-owned entity that plays a critical role in meeting India's energy demands through oil imports.

Hindustan Petroleum Corporation Limited (HPCL) – Another key player, HPCL, imports a significant amount of crude oil to meet the needs of its refineries and distribution network.

Reliance Industries Limited – Reliance, a major private-sector company, operates the largest refining complex in the world in Jamnagar, Gujarat, and is one of the largest private oil importers in India.

Nayara Energy – Formerly known as Essar Oil, Nayara Energy imports oil to fuel its refining and distribution operations across the country.

These companies primarily rely on crude oil imports to keep their refineries running and to meet the country’s high demand for petroleum products.

Key Oil Importers by Country

India sources its crude oil from a variety of countries, with Middle Eastern nations being the dominant suppliers. The following countries are among the leading oil importers by country to India in 2024:

Saudi Arabia – Saudi Arabia continues to be one of the largest suppliers of crude oil to India. As part of OPEC, it plays a critical role in India’s energy security by providing a steady flow of oil. In 2024, Saudi Arabia supplies over 17% of India’s total oil imports.

Iraq – Iraq remains the top oil exporter to India, contributing nearly 22% of India's total crude oil imports. Despite geopolitical instability in the region, Iraq has maintained stable oil production and export levels to meet India’s growing demand.

United Arab Emirates (UAE) – The UAE is another critical supplier for India, accounting for around 10% of the country's oil imports. The relationship between India and the UAE is strong, with several ongoing projects aimed at further deepening trade and energy ties.

United States – In recent years, the U.S. has emerged as a major oil supplier to India, with its exports of shale oil increasing. In 2024, the U.S. contributes around 8% to India’s oil imports, as India seeks to diversify its suppliers and reduce dependence on the Middle East.

Russia – With the geopolitical realignments post-Ukraine war and Western sanctions, Russia has been exporting discounted oil to countries like India. By 2024, Russian oil accounts for nearly 15% of India’s imports, making it one of the fastest-growing suppliers to the Indian market.

Other notable oil exporters to India include Kuwait, Nigeria, and Brazil. The diversification of suppliers is a crucial part of India’s energy strategy, as it reduces reliance on any single region and ensures the stability of imports.

Indian Oil Imports Data: Key Insights for 2024

Volume of Imports

As of 2024, India imports approximately 4.5 million barrels of crude oil per day. This figure represents a slight increase from previous years, reflecting India’s growing energy needs. With limited domestic production, the country has no choice but to rely heavily on imports to meet over 85% of its crude oil consumption.

Import Expenditure

India's expenditure on oil imports is expected to reach nearly $140 billion in 2024. This increase in expenditure is partly due to rising global oil prices and higher import volumes. The Indian government continues to monitor global price fluctuations and the potential impact on inflation and the country’s fiscal balance.

Strategic Petroleum Reserves

India has been expanding its strategic petroleum reserves (SPR) to safeguard against supply disruptions and price volatility. In 2024, the country has reserves equivalent to around 12 days of oil consumption. The government has also announced plans to further increase these reserves in collaboration with other key suppliers like the UAE and the U.S.

Shifts in Import Patterns

India’s oil import patterns have seen a shift in 2024, with an increasing focus on Russia, the U.S., and African nations like Nigeria and Angola. The India-Russia oil trade, in particular, has grown substantially since 2022, with Russia providing discounted crude in light of Western sanctions. This shift has allowed India to hedge against price volatility in the Middle East.

Challenges in India's Oil Import Landscape

Despite the growing diversification of suppliers, India's oil import landscape in 2024 faces several challenges:

Geopolitical Instability – Ongoing conflicts in oil-producing regions, particularly in the Middle East and Russia, continue to pose risks to India’s energy security.

Price Volatility – Fluctuations in global oil prices, driven by factors such as OPEC production cuts, inflation, and geopolitical tensions, have made it difficult for India to stabilize import costs.

Environmental Concerns – The Indian government has made a commitment to shift toward cleaner energy sources. However, the country’s heavy reliance on oil imports may slow down the transition to renewable energy, even as it works to reduce carbon emissions in the coming decades.

Conclusion

As India moves through 2024, its dependency on oil imports remains a cornerstone of its energy policy. With major oil importers in India like IOCL, Reliance, and BPCL leading the charge, the country continues to source oil from key players in the Middle East, the U.S., and Russia. The latest data on Indian oil imports reflect the country’s need to secure diversified oil supplies to ensure economic stability, despite challenges such as price volatility and geopolitical risks.

Frequently Asked Questions

1. What is the current status of oil imports in India in 2024? In 2024, India remains one of the largest oil importers globally, importing approximately 4.5 million barrels of crude oil per day. This reliance on imports accounts for about 85% of the country’s total crude oil consumption, reflecting the increasing demand driven by industrial growth and a rising population.

2. Who are the major oil importers in India? The major oil importers in India include Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL), Reliance Industries Limited, and Nayara Energy. These companies play a critical role in meeting India’s oil demands through their extensive import operations.

3. Which countries are the top oil importers to India? As of 2024, the leading oil importers by country to India are Iraq, Saudi Arabia, the United Arab Emirates (UAE), the United States, and Russia. Iraq holds the largest share, contributing around 22% of India’s total crude oil imports, followed by Saudi Arabia with 17%.

4. How does Indian oil imports data reflect the country’s energy needs? The Indian oil imports data for 2024 indicate that the country is projected to spend nearly $140 billion on oil imports. This significant expenditure underscores India's reliance on external oil sources to fuel its growing economy and meet energy requirements.

5. What challenges does India face regarding its oil import strategy? India’s oil import strategy in 2024 is challenged by geopolitical instability in oil-producing regions, price volatility in global oil markets, and the need to transition to cleaner energy sources. These factors can affect the stability and cost of oil imports, impacting India’s overall energy security.

#import of oil in india#oil importers in India#oil importers by country#Indian oil imports#oil#oil import#oil importer#import data#international trade#global trade data#global market#oil trade#oil business#oil market

1 note

·

View note

Text

India's textile industry, renowned for its heritage and scale, is a vital contributor to the economy, generating employment and GDP growth. In 2022, exports reached $16 billion, projected to surpass $45 billion by 2031. Explore the sector's future through the latest export data and trends. Explore the Blog "Boost Your Bottom Line with Top Textile Exports from India".

Visit Blog: https://medium.com/@seair.exim/boost-your-bottom-line-with-top-textile-exports-from-india-c9e8ba1cc6c1

#export#import#trade data#import data#export data#international trade#global trade data#trade market#import export data#textile hs code#textile export data#textile exports from India#Indian textile exports statistics#textile export data of India#list of textile products exported from India#textile exporting countries#textile exporter in India#textiles

0 notes