#impartial home loan

Explore tagged Tumblr posts

Text

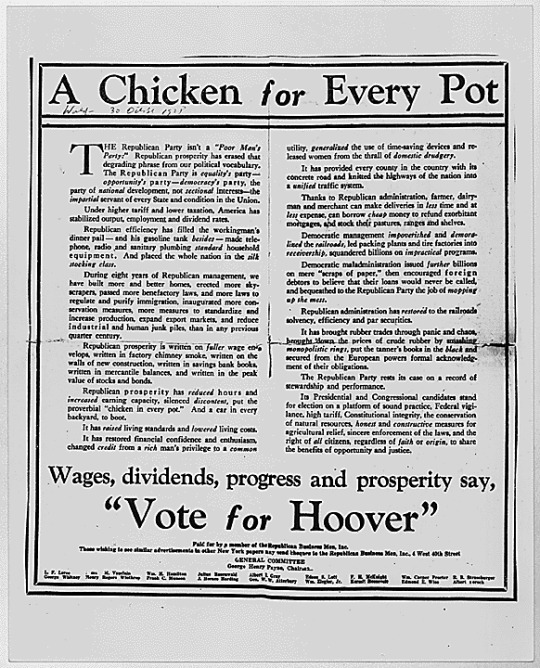

"A Chicken in Every Pot" political ad and rebuttal article in New York Times

Collection HH-HOOVH: Herbert Hoover PapersSeries: Herbert Hoover Papers: Clippings File

This is the advertisement that caused Herbert Hoover's opponents to state that he had promised voters a chicken in every pot and two cars in every garage during the campaign of 1928. During the campaign of 1932, Democrats sought to embarrass the President by recalling his alleged statement. According to an article in the New York Times (10/30/32), Hoover did not make such a statement. The report was based on this ad placed by a local committee -- which only mentions one car!

A Chicken for Every Pot [handwritten] World[?] 30 October 1928 [/handwritten] The Republican Party isn't a [italics] "Poor Man's Party:" [/italics] Republican prosperity has erased that degrading phrase from our political vocabulary. The Republican Party is [italics] equality's [/italics] party -- [italics] opportunity's [/italics] party -- [italics] democracy's [/italics] party, the party of [italics] national [/italics] development, not [italics] sectional [/italics] interests-- the [italics] impartial [/italics] servant of every State and condition in the Union. Under higher tariff and lower taxation, America has stabilized output, employment and dividend rates. Republican efficiency has filled the workingman's dinner pail -- and his gasoline tank [italics] besides [/italics] -- made telephone, radio and sanitary plumbing [italics] standard [/italics] household equipment. And placed the whole nation in the [italics] silk stocking class. [/italics] During eight years of Republican management, we have built more and better homes, erected more skyscrapers, passed more benefactory laws, and more laws to regulate and purify immigration, inaugurated more conservation measures, more measures to standardize and increase production, expand export markets, and reduce industrial and human junk piles, than in any previous quarter century. Republican prosperity is written on [italics] fuller [/italics] wage envelops, written in factory chimney smoke, written on the walls of new construction, written in savings bank books, written in mercantile balances, and written in the peak value of stocks and bonds. Republican prosperity has [italics] reduced [/italics] hours and [italics] increased [/italics] earning capacity, silenced [italics] discontent, [/italics] put the proverbial "chicken in every pot." And a car in every backyard, to boot. It has[italics] raised [/italics] living standards and [italics] lowered [/italics] living costs. It has restored financial confidence and enthusiasm, changed [italics] credit [/italics] from a [italics] rich [/italics] man's privilege to a [italics] common [/italics] utility, [italics] generalized[/italics] the use of time-saving devices and released women from the thrall of [italics] domestic drudgery. [/italics] It has provided every county in the country with its concrete road and knitted the highways of the nation into a [italics] unified [/italics] traffic system. Thanks to Republican administration, farmer, dairyman and merchant can make deliveries in [italics] less [/italics] time and at [italics] less [/italics] expense, can borrow [italics] cheap [/italics] money to refund exorbitant mortgages, and stock their pastures, ranges and shelves. Democratic management [italics] impoverished [/italics] and [italics] demoralized [/italics] the [italics] railroads,[/italics] led packing plants and tire factories into [italics] receivership, [/italics] squandered billions on [italics] impractical [/italics] programs. Democratic maladministration issued [italics] further [/italics] billions of mere "scraps of paper," then encouraged foreign debtors to believe that their loans would never be called, and bequeathed to the Republican Party the job of [italics] mopping up the mess. [/italics] Republican administration has [italics] restored [/italics] to the railroads solvency, efficiency and par securities. It has brought rubber trades through panic and chaos, brought down the prices of crude rubber by smashing [italics] monopolistic rings,[/italics] put the tanner's books in the [italics] black [/italics] and secured from the European powers formal acknowledgment of their obligations. The Republican Party rests its case on a record of stewardship and performance. [full transcription at link]

37 notes

·

View notes

Text

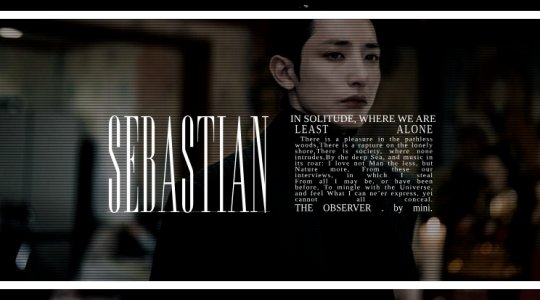

SEBASTIAN SON is a THIRTY-THREE-year-old WRITER in TROY, NY. They were brought under Richard’s care when they were only TWELVE. They are known as THE OBSERVER because they are INTERESTING but also JUDGMENTAL. Let’s see what choice they make regarding the fate of Woodrow House.

BASIC INFORMATION

Full Name: Sebastian (Gwanji) Son Nickname: Bas Pen Name: Bastian S. S. Date of Birth: October 23th, 1971 Age: 33 Occupation: Writer ("Fiction", mostly Thrillers.) Current Residence: Troy, NY

PHYSICAL APPEARANCE

Hair: Black Eyes: Dark Brown Height: 6' 1⁄2" Notable Features: Sebastian has a very peculiar face, his sharp features and the coldness of his whole appearance make him look like he was sent straight from hell to drag you down to pay for your sins. His voice is deep and low, and as he is not very verbal, it can be very shocking to hear him talk for the first time.

PERSONALITY & BEHAVIOR:

Strengths: Impartial, Meticulous, Good Listener, Drop Dead Gorgeous. Weaknesses: Judgemental, Stubborn, Cunning. Quirks: He can only eat with spoons, hates forks, tolerates chopsticks, and loves knives, but not on the table. He cuts his meat with scissors while cooking, and never orders foods that will require a fork and knife when eating out. Hates straws. Hates gambling. Vices: Drinks occasionally, nothing more, nothing less.

INTEREST & HOBBIES:

Interests: People (do not mistake it with interacting with people) People Watching. Knives. Dark History. Hobbies: Fishing, Bird Watching. Bondage. Don't ask him, or maybe do if they dare to.Special Skills/Talents: Darts throwing. Good with ropes, good with knives. He is good at everything that requires his hands and good aim. Excellent handwriting.

BECOMING A WARD

Sebastian was a second-generation Korean immigrant to the United States. His parents had come to New York in search of a better life, and apparently, the American dream did knock on their door. Sebastian's father's business dealings made them rich quickly, and although his mother found suspicious how her husband had achieved the impossible in just two years, she didn't question it. It wasn't until the Chinese Mafia came to the home demanding the loans to be returned, that the family learned they had never really been rich from their father's business endeavors, but that the man had sold his soul to the devil, and now hell demanded their land back.

The father was shot in the forehead before the eyes of his wife and eleven-year-old son. The hitman sent by the mafia did not finish the job and let them live, but a few months later the mother drowned in the bathtub. Whether it was the mob or his mother's decision to end her life, Sebastian never knew, but the boy stopped talking when he was orphaned.

Richard learned of Sebastian's misfortune through the newspaper. The news of the reckoning made it to the headlines, but it wasn't until he heard the rumors from students at work that the boy was now an orphan as the mother had also lost her life. Richard's contacts were strong enough to find Sebastian before he was sent back to Korea with distant relatives.

LIFE AS A WARD

Sebastian didn't speak until eight months into his time in Woodrow, the trauma of losing his family was deep enough to leave him without words (literally) nonetheless, this wasn't the first time he had become non-verbal. Sebastian didn't put a word out into the world until he was six years old, perhaps the trauma of being born was powerful enough to keep him shut.

Every ward who was present during the time Sebastian arrived and those eight months into it knows the story. The infamous spoon story. All the wards were having breakfast together, Richard included, the table was chatty, and those children who were outspoken would talk and share their plans for the day with Richard. Sebastian sat quietly, looking at the girl sitting in front of him eating cereal, he watched her bring the spoon to her mouth while some milk spilled from it, and that was it. "I want a spoon, please." He said, scaring everybody at the table, including Mrs. Tristan, who received the request. Sebastian looked at the girl again, she had dropped her spoon from the scare of Sebastian's sudden speech coming back, "You have three seconds to pick up the spoon from the floor." he said to her, Sebastian was actually being playful, the three-seconds rule made it, trying to break the ice of the whole situation, but no one laughed, not only because this was the first time they had to hear his voice, but because Sebastian's speech and demeanor was intimidating. No one touched his spoons after that.

The wards could have mocked him for his quicks, his pale face, and the lack of coordination he had over his body while growing up, but none of them did. Sebastian scared them, he looked like the nightmares that would keep them awake at night. He watched them play while sitting by the stairs, he watched them so much it made them nervous and tripped over their feet, they would blame Sebastian for putting a curse on them.

When Sebastian turned 16 years old he grew into his looks, he became handsome but his stoic presence kept him from seeming approachable. The wards were no longer afraid of him, or so he thought, but he still looked like the devil himself and he enjoyed the chills everybody seemed to get when he walked into a room.

He was the observer, the watcher, but in the end, it was everybody else's eyes that were on him, for better or worse.

AESTHETIC

Sebastian dresses mostly in black, and sometimes some grey and camel make it to his closet. He wears perfectly tailored suits (he was a Woodrow kid after all) and all his outfits fit like a glove. He keeps his hair short and neat. His casual looks keep the same color palette but are less structured, he loves a turtle neck.

EDUCATION

Sebastian was torn when he had to choose between continuing his education in Woodrow or outside of it. Going to a private school meant he would have to speak more, talk to teachers, and do group projects, and Sebastian hated it. He wanted to pursue better education but he was not ready for it yet. He stayed in Woodrow until he had to attend University.

Sebastian had no fun there, he hated it in a way he had never hated. Why one couldn't get a degree being homeschooled, he couldn't conceive it, but he endured his years there, he chose to attend Richard's alma mater as at least he could think that Richard had to go through the same hell as him.

He received a dual degree in English and Journalism.

EXTRACURRICULARS

He had no real interest in sports but attended Tennis classes within the property to keep himself active. Richard knew Sebastian had chosen not to attend school outside of the estate because he didn't want to interact with new people and encouraged Sebastian to attend at least one extracurricular outside, that way he would prepare in advance for when he moved out for college. Sebastian took the advice and attended swimming classes. (It did not help much, as other kids were scared of him and asked to move to a different class.)

THEIR LIFE NOW

Sebastian started writing when he arrived at Woodrow, he had a way with words (even if they were not "heard" often), especially when a pen was the connection between his thoughts and words. Richard encouraged him to query his writing when he was in University and found a literary agent soon after. Sebastian always wondered if it truly was his writing that got him his book deal or Richard's contacts. He was grateful anyway.

He has published 15 books so far and is working on his 16th. He is known for being a quick writer, but the amount of books he has out shouldn't be a question when all Sebastian does is write. He doesn't have the most livid social life, though his dark looks match his dark preferences when it comes to "socializing".

Lives in NY still, is forced to attend book signings but everybody knows he won't utter a word and his agent does all the work. He visited Korea with his agent (his agent is his only real friend) but felt out of place, the only place he felt at home was Woodrow. He is too American to be Korean, too Korean to be American. His agent says he can always think he is from Hell, it suits him and sells books.

All of Sebastian's books are allegedly based on a ward and the one he is working on now is about Winifred Woodrow.

9 notes

·

View notes

Note

In my opinion, I don’t think there’s much need for concern. Many HR and recruiting professionals are likely to continue prioritizing diversity and inclusion in their hiring practices, even with certain DEI initiatives being scaled back. Women, Black individuals, and members of the LGBT community will likely still find opportunities. For example, consider the case of Marn’i Washington, who made headlines for intentionally skipping homes of Trump supporters while providing disaster relief after a hurricane devastated their neighborhood. Her actions were unethical, as disaster relief should be impartial, and it’s appropriate that she was ultimately held accountable and fired. Of course now she went public saying that she was "made" to do that but yea.

I hope so, its scary tho, but also im still gonna avoid federally funded jobs (kinda, i applied to a few libraries but idk if they r federally funded or not, we will find out), most jobs are not federal jobs so i know in that regard im safe. I really initially wanted some type of government funded job bc i liked the security but im learning that its not all that secure and maybe the private sector is the way to go. I know i can do archive or museum work w private institutes so thats my goal now. Im also stressed out side of dei things, w the Financial aid nd loans things for students being on pause rn bc i also wanted to try grad school in the fall but w/o the ability for government assistance im cooked lol. Im just stressed nd theres a lot going on rn in the country not making me confident in any of my choices. I hope i can find a job, i hope i can go to school but rn its just....idk, scary! But i do appreciate ur input a lot thank u!

Also, i looked up that story bc i wasnt familar w it, and yea i mean that is def unethical to pick and choose where ur aid goes thats awful nd i cannot imagine doing that or even agreeing to do that.

And yeah she claims to have been set up and stuff nd she said it was from orders form her supervisor, i suppose im confused as to why if thats the case her supervisor wasnt getting investigated either? Idk this story is confusing me the article im reading is like, saying she was told to nd this is normal fema protocol according to her which is also shocking to me bc that is awful if tru but fema is like no we dont discriminate nd now fema is getting sued by florida nd it makes me confused bc is it tru she did that or is it not true it seems like she did it if the state is suing nd if so is her supervisor getting in trouble too?????? Sry i think i lost the plot im hung up on the wrong thing

#.txt#sry i am maybe a lil confused in general#im also confused how her story relates to the rolling back of dei initiatives#i may b a lil dumb ngl.

2 notes

·

View notes

Link

#Bankfraudinmortgageandforeclosure#bankingfraud#BillOfRights#CAPSecurity#capsecurity#debtloanpayoff#eliminatepropertytaxes#forcedLaw#historicalfacts#howtopayoffdebt#nomortgagepayments#SovereigntyOfThePeople#TerritorialFederalGovernment

0 notes

Text

Pulled out a tarot deck to build another city for His Majesty the Worm. Last time I showed off Stephanie Pui-Mun Law’s beautiful Shadowscapes deck. This time I’m using Tarot for the Great Outdoors, illustrated by Sharisse Steber, that I picked up in Acadia’s visitor center. The suits have been renamed- Cups are now Vessels, Wands are Sticks, Pentacles are Stones, and Swords are Blades. Weirdly, the face cards are still the usual court, rather than changing them to a nature theme too.

Step One: The Central Power

The first card drawn decides who rules the city. I drew the Queen of Vessels- a Cup card in the classic deck.

“The Cult of Mythrys reigns. The Secret Pope makes papal bulls which become the law of the land, enforced by the Inquisition. The High Mithraeum is hidden somewhere under the center of the City.”

As a court card, the institution the card represents rules the city. In this case, the Queen of Vessels is The Centrum Bank.

“As folks from far flung places in the Wide World came to the City, they brought different currencies with them: drachmas, staters, scripts, aureuses, talents, cowries. Someone needed to change this money. The Cult of Mythrys stepped in to fill this role and formed the Centrum Bank.

The Centrum Bank makes high-interest loans to the desperate and the foolish. They also provide a safe repository for the heaps of gold being brought up from the Underworld; they exchange a broken chit as a unique ID for any who store their gold in the vaults.”

So we have a bank that controls the city, and a cult that controls the bank. Which came first, the chicken or the egg? Let’s see how building the rest of the city goes to see whether capitalism let the cult take control of the city or if the cult controlled the city first then expanded to banking. (This certainly doesn't make me think about current US government things at all.)

Step 2: Form the Core Districts

The oldest parts of the city. What was the City originally like? Draw four cards and place them on each side of the Central Power card.

North - Queen of Blades - The Brothel of Battle

“The Swordwhores are a free mercenary company who are one of the most powerful—and wealthiest—independent powers in the City. Members pay dues to the Swordwhores and, in return, are outfitted with the best ironwork that collective bargaining can buy. In theory, when called, the Swordwhores are expected to go to war—a ready army for whatever noble house buys them. In practice, the Swordwhores make enough gold through their independent conquests that they are able to refuse any contract.

The Swordswhores station themselves in the Brothel of Battle, a small district catering to the unwholesome appetites of the violent. The cobblestone streets are crammed with taverns with tough and queer sounding names.”

Interesting that one of the original districts would be home to a mercenary group. Chances are the Swordwhores are only the latest in a long line of mercenaries basing themselves out of it. Their collective bargaining power due to their arms and wealth probably has the Centrum Bank and its cult backers worried.

East - Page of Blades - The Court Martial

“Officially, the Cult handles matters of temporal justice. Priests of high initiation interpret the City’s laws and mete out punishment or clemency. However, there is one authority higher than even the Cult in matters of justice: the Court Martial.

The accused may seek a trial at the hazard of their body. Defendants will find themselves declared innocent on all charges if they manage to find themselves alive at the end of the day. However, the Court Martial is neither fair nor impartial. Combatants may be forced to fight in desperate attitudes: denied weapons, with one hand tied behind their back, facing six man-eating griffins, etc.”

A surprisingly violent courtroom for a city ruled by a bank. I think the Court Martial is now under the control of the cult, though perhaps a different faction than what runs the Centrum. With two of the old districts being so martial, the cult having taken control of the city could be a relatively new thing- perhaps done through the the bank's ability to outbid others to maintain some semblance of control over the mercenaries.

South - Two of Vessels - The Perfume District

"Most agricultural processes (milling, butchering, rendering, composting, etc.) are done outside the walls in the farms and fields that support the engine of metropolitan life. When these things cannot be done outside the City, they are done inside the Perfume District.

The Perfume District is so named for the incredible stink it produces. The work done in the Perfume District is grisly. Here, animal carcasses are turned into bone meal feed, fertilizer, tallow candles, soap, bleach, lye, and glue. (Some of the ambergris from rendered Grey river whales does eventually go to the perfumists, but distilling perfumes is not done here. The name is purely ironic.)”

This is probably all that remains of the original settlement before ‘civilization’ moved in. Between the mercenaries and their taverns, the pseudo-colosseum of carnage, and the glue factories here, all of the old city must smell absolutely disgusting. Perhaps the west will grant us a reprieve.

West - Page of Sticks - The Broken Smiles District

“Theater is a popular pastime in the City for both the commoners and the nobility. The center of theatrical craft is the Broken Smiles District (the macabre name comes from the symbol of a half-comedy, half-tragedy mask that represents the borough). The district is like Broadway and the West End had a baby. Playhouses abound. Its residents are all theater kids. They like to sing. Its residents are also fiercely territorial: different families support different playing companies. The rivalries are fierce. For example, if you’re a supporter of the Lord Governor’s Men, don’t find yourself below Swan’s Street after dark.”

Soldiers need all sorts of entertainment, I guess having a theater district be part of the core makes sense.

The core districts do all seem to be an assault on the senses- the horrifying smells from the south, the constant bloodshed of the east, the warfare and wenching of the north, and the mostly metaphorical bloodshed but no less life-or-death to the west. This is looking to be something a powderkeg- or perhaps the powderkeg already went off and that’s how the cult came to rule. Let’s see what we can make of the newer districts.

Step Three: Add The Sprawl

These are the younger districts, springing up as the City expands and contracts through history. The suit of each core district decides how many others have grown around it. Zero for the swords of the military, one for pentacles and the lower class, two for cups for the faithful and the institutions they fund, and three for the wands of the weirdos.

The North and East, as Blades/swords suits, have no additional districts, making this city far smaller than my previous foray into city-building.

South and the Perfume District:

Vessels/cups calls for two cards sprouting off from this district- who undoubtedly have days where they wish the wind would blow in a different direction.

1 - Four of Vessels - The Hippodrome of Amet

"The Hippodrome of Amet hosts the City’s public games. A full one-third of the year is dedicated to the games at the Hippodrome. Of these, the chariot races are the most popular, but they include a wide variety of other entertainment: parades and processions, foot races, exotic animal hunts, plays and recitals, and public executions. The need for support during the public games has caused an entire district to grow up around the Hippodrome. Food sellers, beer brewers, token takers, animal tamers, janitors, musicians, repairmen, teamsters, and others all live near the Hippodrome to provide needed manpower.”

2 - Nine of Blades - The Grey Docks

Ah, actual Colosseum entertainment to go with the kangaroo court that is the spectacle of the Court Martial. And the card is even situated such that the two are close together. Perhaps people liked the adrenaline rush of watching combat, but wanted more pageantry like they could get in the theater district.

The release of the monsters of the dungeon below the city could mean that the races of the Hippodrome are now populated by more exotic creatures than just horses, opening a whole new market for brave entrepreneurs.

“If the River Grey is the lifeblood of the City, the Grey Docks is the carcinogenic tumor on the heart. It is a nest of pirates and scoundrels who, unfortunately, control all of the sea-borne commerce of the City. The All-Watch rarely comes to this district, and the maritime merchants pay hefty bribes to keep it this way. Despite the anarchy and occasional savagery, the Grey Docks contain a sense of high adventure.”

This city is made up entirely of scoundrels and killers, it’s good to see the river is no different. I think the pirates don’t predate the cult taking control of the city but are rather a result of it. I’ll have to remember to draw the river going through here, as they are the only card that lays claim to it, unless of course one of the new districts by the theater also has something.

West and the Broken Smiles District:

Three younger districts off the sticks/wands of the theater district. The theater seems to have done all the hard work of drawing people to the city.

1 - Seven of Vessels - The Plaza of the Stylites

"Thirty-some years ago, a Mythric monk climbed on top of one of the pillars in the public square now called the Plaza of the Stylites and began screaming about the end of the world. He stayed there day and night, living in extreme austerity. When the Underworld first opened, he was heard laughing. His last words were, “I was right.”

Following his example, dozens of other monks have clambered up onto high pillars and poles in this district. They spend all day arguing theology with each other, prophesying various flavors of doom, and excoriating the sins of those who pass below them. They are kept fed by the almsgiving of the citizens of the district who look on their pillar-saints with bemusement and respect.”

Of course the theater district spawned ‘the end is nigh’ public performances. One has to wonder which of the pole-sitters are actually devout and which are just theater kids moving to a new stage about current events.

2 - Knight of Blades - The Temple Militant

"There are many orders of knighthood: the vampire-worshiping Order of the Red Maw, the miserly gold-hoarding Order of Golden Splendor, the sky-clad polygamist Order of the Blue Kite. There is no order as famous and infamous, however, as the Order of the Athleta Mythrii—often called “templars.”

The templars rose to power during the Crusades. The threat of incursion from the Underworld caused their ranks to swell with young men and women desperate to protect their homes. During the Crusades, the Order of the Athleta Mythrii won much renown for heroic deeds. However, after the Crusades, the City found they had an army prepared for holy war—and no wars left to fight.”

And there it is, how the cult took control of the city. An army of the faithful is cheaper, if less trained, than mercenaries. The mercenaries already have wealth and arms, so for now they can survive being hired on by nobles for their squabbling and merchant caravans for defense, but have they adjusted their budget since the cult stopped needing them?

3 - Eight of Blades - Bellringer’s District

“The Bellringer’s District is home to the bulk of copper- and tin-smithing in the City. The Bellringer’s District is also home to much gossip. Barbers, using freshly-honed copper scissors, trade the day’s news with the men to whom they give their morning shave. Messengers from the sovereign of the City often come here to cry their master’s proclamations so that they are quickly shared to all corners of the City.”

This is probably the oldest of the three districts branching off of the Broken Smiles- folks wanting in on the money being spent to watch plays, be it stylists for actors and audience members or prop makers expanding their business. This and the theater district seem to be the secular heart of the city. The monks of the Plaza of the Stylites may be the cult putting a shot across the bow of the less devout of the entertainment districts, now that they feel the mercenaries have been gelded by the formation of the templars.

Step Four: Place the Constants

Every incarnation of the City has three features that never change- though the exact locations will.

The Grey is a major river that flows through the City. It’s just as important to the City as the Nile is to Cairo. It also has pirates. I’ve put it far to the south, with the Grey Docks district the only one with access to it.

The Ossuary is the City’s Paris Catacombs alternate though it’s a former plaster mine, not limestone. It’s most recent expansion uncovered a door carved of ivory that monsters poured out of. They’ve managed to seal it. I’ve placed it next to the Grey Docks district, under the impression that building on top of excavated tunnels is a bad idea and is part of the reason for the lack of better access to the river.

The Omphalic Market is *the* place to go to shop. The true beating heart of the city. I’ve put it at the intersection of the theater district, mercenary district, and the central power bankers, to act as something of a neutral ground keeping them separated while forcing them to mingle semi-politely with each other.

And that’s the city. It’s interesting how many face cards- signifiers of a rich district or powerful institute- I pulled, and almost all of them are core districts. People moved to a rich city on the rise, and have since discovered that unless you were in on the ground floor, you’re not going to become one of those rich and powerful folks. Which probably made them easy targets for 1) shady bank loans and 2) joining the army. I don’t think the powderkeg has resolved itself- the cult taking over seems to have only made things worse with the templars. I imagine a lot of funding for the hippodrome comes from the bank as a means of keeping the city’s rowdy populace pacified.

1 note

·

View note

Text

Unlocking Property Value with a Commercial Real Estate Appraiser

Determining the accurate value of a property is essential, whether you're purchasing, selling, refinancing, or exploring investment opportunities. A commercial real estate appraiser is your go-to professional for reliable valuations that empower you to make informed decisions. Let's dive into the appraisal process and its significance.

What Is a Residential Appraisal?

A residential appraisal provides an independent, professional estimate of a property's market value. It's a critical step in situations such as:

Home Buying and Selling: Ensures the price reflects the property's true value.

Refinancing a Mortgage: Helps lenders determine appropriate loan amounts.

Home Equity Loans: Establishes the equity available for borrowing.

This impartial assessment protects both buyers and lenders from overpayment or excessive lending.

Why Residential Appraisals Are Important

Accurate Pricing: Prevents overpricing, which can deter buyers, or underpricing, which may result in lost profit.

Facilitating Financing: Lenders require appraisals to assess loan risks and approve financing.

Informed Decision-Making: Knowing a property's value gives you an edge in negotiations.

How Appraisers Determine Property Value

Certified appraisers use three primary approaches to establish property value:

Sales Comparison Approach: Compares the property to recently sold similar homes, considering location, size, and condition.

Cost Approach: Calculates the cost to rebuild the property using current construction prices, ideal for new or unique homes.

Income Approach: Focuses on rental income potential, especially for investment properties.

Factors That Influence Property Value

Location: Proximity to schools, parks, and amenities significantly affects value.

Size and Layout: Square footage and functional design impact marketability.

Condition and Updates: Renovations and modern amenities increase value, while deferred maintenance reduces it.

Market Trends: Supply and demand dynamics play a key role, requiring appraisers to stay updated.

Clearing Up Common Appraisal Misconceptions

Appraisal vs. Inspection: An appraisal focuses on market value, whereas an inspection evaluates structural and safety issues.

Appraisers Don't Set Sale Prices: They estimate value, but buyers and sellers negotiate the final price.

Not All Appraisals Are Equal: An appraiser's expertise and familiarity with the local market greatly impact accuracy.

Tips to Boost Your Home's Appraisal Value

Enhance Curb Appeal: A well-maintained exterior creates a strong first impression.

Declutter and Clean: Organized spaces make your home feel larger and more inviting.

Document Upgrades: Provide receipts or permits for improvements to highlight added value.

Be Transparent: Disclose known issues to ensure an accurate assessment.

When to Work with a Commercial Real Estate Appraiser

For mixed-use, multi-family, or income-generating properties, hiring a commercial real estate appraiser is essential. These experts provide detailed analyses tailored to the complexities of commercial properties.

Partner with Moore Real Estate Group

Understanding the value of your property is a critical investment. At Moore Real Estate Group, we specialize in delivering precise, reliable valuations for homeowners, buyers, and investors alike. Our experienced team ensures you have the information you need to make confident decisions.

Ready to uncover your property's true worth? Contact Moore Real Estate Group today and work with a trusted commercial real estate appraiser to achieve your real estate goals.

#Commercial appraisal in Los Angeles#Commercial real estate appraiser los angeles#Commercial property appraisal los angeles#commercial real estate appraisers in California#Los Angeles commercial real estate appraiser#Moore Real Estate Group

0 notes

Text

Understanding Property Valuation: Essential Services from Local Valuers

Property valuation is a crucial process for anyone involved in buying, selling, or managing assets. Whether you’re assessing a home, commercial property, or land, accurate valuation plays a key role in making informed financial decisions. Local Valuers offers a wide range of services designed to meet the unique needs of property owners, investors, and businesses across Australia. Here’s a closer look at the specific valuation services they provide and how each one can benefit you.

Superannuation Valuation: Ensuring Financial Security

Superannuation funds are an important aspect of financial planning, especially for retirement. Accurately assessing the value of property assets within a superannuation fund is essential for compliance and long-term financial planning. Superannuation valuation services ensure that property assets within these funds are assessed accurately and meet regulatory standards, giving fund holders peace of mind and clear insights into their investments.

Pre Mediation Valuation: Supporting Conflict Resolution

When disputes arise over property values, a thorough and unbiased valuation can help resolve conflicts before they escalate. Pre Mediation services provide precise and impartial property assessments, facilitating negotiations and creating a foundation for fair outcomes. This service is particularly valuable in legal and financial disputes, as it provides both parties with reliable information to support a balanced resolution.

Business Valuation: Unlocking Your Company’s True Worth

A comprehensive Business Valuation is essential for anyone looking to buy, sell, or invest in a company. By assessing tangible and intangible assets, cash flow, and market conditions, Local Valuers delivers a precise valuation that reflects your business’s true worth. This valuation process provides business owners and potential investors with the necessary insights to make sound financial decisions, optimize growth strategies, and secure loans or funding.

Commercial Property Valuers: Maximizing Business Investments

For investors and business owners, understanding the value of commercial real estate is key to making profitable decisions. Commercial Property Valuers offer detailed assessments of office buildings, retail spaces, and other commercial properties. With expertise in market trends and property laws, these valuers ensure that your commercial properties are accurately valued, helping you make the best choices for investment, leasing, or selling.

Residential Valuers: Making Smart Home Investments

When it comes to buying or selling a home, an accurate valuation is essential. Residential Valuers services provide homeowners and buyers with a clear understanding of a property’s market value. By assessing factors such as location, condition, and current market trends, Local Valuers helps individuals make confident decisions about their home investments, ensuring fair pricing and reducing the risk of financial loss.

Land Valuers: Determining the Value of Land Assets

Land valuation can be complex due to the various factors that influence its worth, including zoning, potential for development, and environmental conditions. Land Valuers provide comprehensive land assessments to help owners, investors, and developers understand the potential and limitations of their land assets. This information is invaluable for those looking to develop, sell, or use land strategically.

Building Valuation: Protecting Structural Investments

Understanding the true value of a building, beyond its aesthetic appeal, is essential for property owners and investors. Building Valuation services assess factors such as structural integrity, materials, and location to provide a realistic appraisal of a building’s worth. This service is particularly beneficial for those looking to insure, sell, or renovate properties, as it provides a solid foundation for financial decisions.

Defence Housing Authority Valuation: Specialized Property Valuation

The Defence Housing Authority (DHA) oversees properties used by defense personnel, and these properties often have specific valuation requirements. Defence Housing Authority valuations ensure that DHA properties are assessed accurately, taking into account the unique aspects of military housing. These valuations support DHA’s mission of providing reliable housing for service members and ensuring fair market values for all associated properties.

Industrial Property Valuations: Supporting the Industrial Sector

Industrial properties, including warehouses, factories, and manufacturing plants, require specialized valuations due to their unique characteristics and purposes. Industrial Property Valuations take into account factors such as location, size, functionality, and equipment. These valuations assist investors and owners in making informed decisions, whether they are looking to buy, sell, or lease industrial spaces.

Insurance Valuations: Safeguarding Your Investments

Accurate property valuations are essential for insurance purposes. Insurance Valuations ensure that your property is adequately insured, covering its replacement cost in case of damage or loss. This valuation is vital for homeowners, commercial property owners, and investors, as it provides peace of mind and protects against unexpected financial setbacks.

Why Choose Local Valuers?

Local Valuers stands out as a trusted provider of valuation services across Australia. Their team combines extensive knowledge, experience, and a commitment to accuracy, offering clients tailored solutions for every valuation need. With a customer-centric approach, Local Valuers aims to provide clear, reliable, and prompt services to help you make informed property decisions.

In conclusion, property valuation is a crucial part of managing and investing in real estate assets. With services ranging from superannuation valuation to industrial property assessments, Local Valuers provides expert guidance and precise valuations for every type of property. Contact Local Valuers today to discover the true value of your property assets.

0 notes

Link

0 notes

Text

Reverse Mortgage Counseling: Why It’s Essential Before You Borrow

Introduction

If you are considering a reverse mortgage in Hilton Head, understanding the ins and outs of this financial product is crucial. A reverse mortgage can be a valuable tool for seniors looking to access the equity in their homes without monthly mortgage payments. However, before you proceed, it is essential to undergo reverse mortgage counseling. This step not only helps clarify the process but also ensures that you are making informed decisions that align with your financial goals.

What is Reverse Mortgage Counseling?

Reverse mortgage counseling is a requirement for homeowners interested in obtaining a Home Equity Conversion Mortgage (HECM), which is a government-insured reverse mortgage. The counseling sessions are conducted by HUD-approved counselors who provide impartial information about reverse mortgages. They explain how these loans work, the obligations involved, and the potential risks and benefits. This counseling session is not just a formality; it is a critical part of the process that equips you with knowledge and understanding.

Why Counseling is Essential

Understanding Your Options: A reverse mortgage can offer various payout options, including a lump sum, monthly payments, or a line of credit. Counseling helps clarify these choices, allowing you to select the one that best meets your needs.

Evaluating Your Financial Situation: Counselors will review your financial status, including your income, expenses, and existing debts. This evaluation is crucial for determining if a reverse mortgage is the right option for you and if you can afford any related costs, such as property taxes and maintenance.

Identifying Alternatives: During counseling, you may discover alternative solutions for accessing cash or managing your retirement financing. Counselors can discuss options like home equity loans or other financial strategies that might be more suitable for your situation.

Understanding Responsibilities: A reverse mortgage comes with responsibilities, such as maintaining your home, paying property taxes, and homeowners insurance. Counseling ensures you are aware of these obligations to avoid any potential pitfalls.

Preparing for the Future: Understanding reverse mortgage benefits and disadvantages can help you plan for the long term. Counselors can provide insights into how this loan might impact your estate and inheritance, which is vital for seniors planning their legacies.

Conclusion

In conclusion, reverse mortgage counseling is an essential step before borrowing. By seeking guidance from a knowledgeable counselor, you can make informed decisions about whether a reverse mortgage is right for you. This process not only empowers you with critical information but also helps ensure your financial stability and peace of mind as you navigate your retirement years. If you’re considering a reverse mortgage in Hilton Head, prioritize counseling to make the best choice for your future.

Author: David Stacy

Who We Are

A reverse mortgage can provide significant benefits for retirees looking to supplement their income while retaining ownership of their home. For those in Hilton Head Island, SC, considering a reverse mortgage, it's important to carefully weigh both the advantages and disadvantages. Working with a reputable lender is essential to ensure that the terms of the loan are in your best interests. Call David Stacey at Reverse Mortgage Specialist of Hilton Head today at (854) 842-2505 for a friendly chat to see if a reverse mortgage is right for you.

Contact Us

Reverse Mortgage Specialist of Hilton Head

81 Main Street, Hilton Head Island, South Carolina, 29926, United States

(854) 842-2505

Find Us On Social Media

Facebook

Youtube

To Know More

Brand Video

Brand Map

1 note

·

View note

Text

Brisbane Valuation: The Role of Professional Property Valuers in Brisbane

Understanding the true value of a Brisbane Valuation for both individuals and businesses involved in real estate transactions. Whether you’re buying, selling, investing, or dealing with legal matters, an accurate property valuation ensures that you make informed decisions based on the market's realities. In Brisbane, property valuers play a critical role in delivering reliable and unbiased assessments. Brisbane Valuation services provide a clear insight into property values across various sectors, helping clients navigate the complexities of the real estate market.

Why Property Valuation is Crucial

Property valuation is not just about knowing the worth of your home or building. It impacts a wide range of financial, legal, and investment decisions. Here are key reasons why property valuation is essential:

Buying and Selling Property: When buying a property, an accurate valuation ensures you pay a fair price, preventing overpaying in a competitive market. For sellers, knowing the property's true market value allows for realistic pricing, avoiding the pitfalls of underpricing or overpricing, which can delay sales.

Refinancing and Mortgage Approval: Lenders often require property valuations when offering mortgages or refinancing loans. A professional valuation confirms that the property’s value aligns with the amount being borrowed. An accurate valuation can speed up loan processing, ensuring better terms and interest rates for the borrower.

Legal and Tax Matters: Property valuations are necessary for legal matters like divorce settlements, inheritance, estate planning, or property disputes. The valuation provides an impartial assessment that helps in reaching fair resolutions. Similarly, for tax purposes, a valuation helps in determining capital gains tax, stamp duty, and other property-related taxes.

Investment Insights: Investors rely on property valuations to determine whether a property is a sound financial investment. Whether you’re looking at rental properties or commercial investments, the valuation gives you a clear understanding of the potential return on investment (ROI) and future growth prospects.

Brisbane Valuation Services: What Sets Them Apart

Brisbane Valuation services are known for their accuracy, professionalism, and thorough market analysis. With a team of certified and experienced property valuers, they provide a range of valuation services tailored to different client needs, including residential, commercial, and industrial properties. Here are some standout qualities of Brisbane Valuation services:

Local Expertise: Property valuers in Brisbane are familiar with the city's real estate market, its trends, and its various suburbs. From inner-city properties to suburban developments, valuers have an in-depth understanding of the factors that affect property values. Their local expertise ensures that every valuation reflects the current market conditions and regional variations.

Certified and Registered Valuers: Brisbane Valuation employs certified property valuers registered with professional bodies like the Australian Property Institute (API). These valuers follow strict industry guidelines, ensuring that all assessments are impartial, accurate, and conducted with integrity.

Comprehensive Valuation Reports: Brisbane Valuers provide detailed valuation reports, which include an analysis of comparable property sales, the property’s condition, its location, and other influencing factors. These reports serve as vital documents for financial institutions, legal professionals, and individuals making real estate decisions.

Unbiased Valuations: As independent property valuers, Brisbane Valuation services provide impartial assessments. Unlike real estate agents who may have a vested interest in the transaction, valuers offer unbiased valuations without external influences, ensuring transparency and reliability.

Factors Influencing Property Valuation in Brisbane

Several factors determine a property’s value, and understanding these influences can help you anticipate how a valuer might assess your property:

Location: The property's location plays a major role in determining its value. Proximity to the city centre, schools, public transportation, parks, and other amenities boosts property prices. In Brisbane, properties located in desirable suburbs or areas with future development potential tend to have higher valuations.

Property Size and Condition: The size of the land, the number of rooms, and the condition of the property are key considerations. A well-maintained property with modern amenities, recent renovations, and a functional layout will generally have a higher market value than one that needs substantial repairs.

Market Conditions: The overall state of the real estate market influences property values. During a market boom, property prices may rise due to high demand and limited supply, while in a market downturn, prices may decrease. Property valuers take into account the broader market conditions to provide an accurate assessment.

Comparable Sales: Recent sales of similar properties in the area are often used as benchmarks to estimate a property’s value. Valuers analyze sales data to compare the property being evaluated with others of similar size, location, and condition to arrive at a fair value.

Choosing a Property Valuer in Brisbane

When selecting a property valuer, it's important to choose one with the right qualifications, experience, and local market knowledge. Brisbane Valuation services meet all these criteria, offering clients peace of mind that they’re receiving accurate and impartial valuations. Look for valuers who are registered with professional bodies and have a deep understanding of Brisbane’s real estate landscape.

Conclusion

Whether you’re buying, selling, or dealing with legal or financial matters, property valuation is a crucial step in ensuring fair transactions and informed decisions. Brisbane Valuers provide expert, unbiased assessments Property Valuation Brisbane tailored to the specific needs of their clients, helping you navigate the complexities of the property market. With their local expertise, certified professionals, and comprehensive reports, you can trust Brisbane Valuation to deliver precise and reliable valuations that reflect the true market value of your property.

1 note

·

View note

Text

5 Key Benefits of Getting a Property Valuation in Perth

Property valuation is a crucial step in any real estate transaction, whether you're buying, selling, refinancing, or simply trying to understand the value of your property. In Perth, a professional property valuation provides an accurate and unbiased estimate of your property's market value. This can benefit homeowners, investors, and potential buyers in various ways. In this blog, we'll explore the five key benefits of getting a property valuation in Perth.

1. Accurate Pricing for Selling Your Property

One of the most important benefits of obtaining a property valuation in Perth is the ability to set an accurate and competitive price when selling your home. Overpricing a property can result in it sitting on the market for an extended period, while underpricing it may lead to a loss of potential profit. A professional valuation gives you a clear understanding of the property's true worth based on current market conditions.

Benefits for sellers include:

Confidence in setting the right asking price

Avoiding overpricing, which can deter buyers

Reducing the risk of underpricing and missing out on potential profits

With an accurate valuation, you can attract serious buyers and increase your chances of a quicker, smoother sale.

2. Informed Decisions for Property Investment

If you're considering investing in the Perth property market, a professional property valuation is essential. It allows you to assess the investment potential of a property, helping you make more informed decisions. By understanding a property's current market value, potential rental income, and future appreciation, you can evaluate whether it's a worthwhile investment.

Key insights for investors:

A clear understanding of potential rental yields

Accurate assessment of the property's growth potential

Confidence in negotiating the right purchase price

For investors, a property valuation in Perth ensures that you’re making sound financial decisions that align with your long-term investment strategy.

3. Assistance in Refinancing and Securing Loans

When refinancing your mortgage or applying for a new loan, lenders require an accurate assessment of your property's value. A property valuation in Perth provides a solid foundation for loan approvals and refinancing decisions. Lenders rely on valuations to determine the amount they're willing to lend, and having a professional valuation ensures that your application process goes smoothly.

Benefits for refinancing:

Provides a clear basis for loan amounts

Helps secure better interest rates if your property's value has increased

Gives leverage when negotiating with lenders

With an up-to-date property valuation, you can maximize your refinancing options and ensure you're getting the best deal from your lender.

4. Property Disputes and Legal Matters

Property disputes, whether related to divorce settlements, inheritance, or joint ownership, often require an accurate property valuation. In legal cases, a professional valuation is often used as an unbiased assessment of the property's worth. This can be crucial when dividing assets fairly or settling disputes amicably.

Why it's important in legal cases:

Provides a fair and impartial property assessment

Reduces the chances of disagreements and disputes

Ensures compliance with legal requirements in asset division

Getting a property valuation in Perth is essential for resolving disputes and navigating legal matters involving real estate.

5. Understanding Your Property’s Market Position

Even if you're not planning to sell or refinance, obtaining a property valuation can give you valuable insights into your home's market position. By knowing how much your property is worth, you can make better decisions about home improvements, future investments, or whether it's time to sell. Property values fluctuate over time, and a current valuation helps you stay informed about market trends and shifts.

Benefits for homeowners:

Insight into the current market value of your home

Understanding how local market trends affect your property’s value

Guidance on when to sell or make improvements

For homeowners who want to stay informed and proactive, regular property valuations offer valuable insights into their real estate portfolio.

Conclusion

Getting a property valuation in Perth offers numerous benefits, from ensuring you set the right price when selling to helping you make informed investment decisions. Whether you're navigating legal disputes, refinancing, or simply staying on top of your property's market value, a professional valuation provides clarity and peace of mind. By investing in a property valuation, you gain access to accurate data that can guide you through every real estate decision you make.

0 notes

Link

#CAPSecurity#CAPSecurityInstruments#DEEDOFOWNERSHIP#GovernmentMONEYandCREDITSCAM#legalarguments#LegalFacts

0 notes

Text

Top Reasons to Hire a Notary Public in the UK

In an increasingly complex world, navigating legal matters can be daunting. From signing official documents to validating sensitive agreements, ensuring the legitimacy of your paperwork is paramount. One solution is to engage the services of a Notary Public in the UK. Here, we’ll explore the top reasons why hiring a notary is essential for individuals and businesses alike.

1. Verification of Documents

One of the primary roles of a Notary Public is the authentication of documents. This involves verifying the identity of the signatories and ensuring that the content of the document is legitimate and accurate. Whether it's a power of attorney, a will, or an international contract, having a notary verify the authenticity can help avoid legal disputes later. The notary’s stamp or signature indicates that the document has been properly examined and that all parties involved were fully aware of its content.

2. Compliance with Legal Requirements

Certain legal transactions require notarisation by law. For instance, in the UK, if you're engaging in property transactions, witnessing signatures for business contracts, or certifying copies of documents, a Notary Public must be involved. The certification by a notary ensures that these documents meet the relevant legal standards. In many cases, especially when dealing with international transactions, notarisation is a legal requirement, without which the document may not be valid or enforceable.

3. Facilitation of International Transactions

If you're involved in international business or need to send documents abroad, you will likely need the services of a Notary Public. Many foreign jurisdictions require documents to be notarised before they are accepted. This is especially important when dealing with foreign investments, property purchases, or multinational agreements. A Notary Public ensures that these documents comply with both UK law and the legal requirements of the foreign country. Additionally, they may assist with the apostille process, where a document is authenticated for use in another country.

4. Protection Against Fraud

The world of legal documents is not immune to fraud. Forgeries, impersonations, and alterations can result in disastrous legal consequences. When you hire a Notary Public, they take on the responsibility of verifying the authenticity of the individuals signing the document. Notaries are trained to detect potential signs of fraud, and they ensure that each party signs willingly, without coercion. By requiring all parties to sign in the presence of the notary and producing identification, the risk of fraudulent activity is significantly reduced.

5. Assistance with Property Transactions

When purchasing or selling property, especially international real estate, hiring a Notary Public is critical. In many cases, you will need notarised documents to complete the sale or transfer of ownership. A notary ensures that deeds, mortgage papers, and other essential documents are signed correctly and that all parties understand the legal obligations. Whether you're buying a holiday home abroad or selling property in the UK, a notary can help ensure the transaction is legally binding.

6. Witnessing Signatures

A Notary Public acts as an impartial witness to the signing of important documents. This ensures that all signatures are genuine and that the individuals involved fully understand what they are signing. From loan agreements to business contracts, having a notary witness the signing provides an added layer of security and credibility. Furthermore, in some legal scenarios, the involvement of a notary is required for the document to be legally enforceable.

7. Certifying True Copies of Documents

Another critical role of a Notary Public is to certify that copies of documents are true and accurate representations of the original. This is often required when submitting copies of passports, degrees, or legal contracts for official purposes. By having a notary certify the copies, you ensure that they will be accepted by authorities, whether in the UK or abroad. This service is particularly valuable when dealing with immigration, visa applications, or academic verifications.

8. Ensuring the Enforceability of Legal Documents

In many instances, a document that has not been notarised may not be legally enforceable. This is particularly true in situations where a document is to be used in a court of law or presented to an official body. By hiring a Notary Public, you ensure that your documents will hold up under legal scrutiny. This can be especially important in the event of disputes or when dealing with foreign authorities, where notarisation is often required.

9. Peace of Mind in Legal Transactions

Legal transactions can be stressful, especially if you're unsure about the validity or legal standing of a document. Hiring a Notary Public provides peace of mind, knowing that your paperwork is in order and that any issues of legality or authenticity have been addressed. The notary’s involvement ensures that the document has been thoroughly reviewed and validated, giving you confidence that everything is in compliance with legal standards.

10. Protection for Businesses

For businesses, hiring a Notary Public is an investment in legal protection. Notarised documents provide a layer of security for companies involved in contracts, mergers, or international agreements. A notary ensures that all documents are signed under the correct legal protocols, reducing the risk of disputes or breaches of contract. For businesses that operate across borders, a notary can also help navigate the complexities of international law, ensuring that contracts and agreements are legally binding in multiple jurisdictions.

11. Professionalism and Impartiality

Notaries are highly trained professionals who are impartial in their work. They are obligated to act as neutral third parties, ensuring that all signatories understand the implications of their actions. Their role is to uphold the integrity of legal transactions, and their expertise provides an extra level of professionalism and trust. By hiring a notary, you are guaranteed an objective review of your documents, free from any conflict of interest.

12. Cost-Effective Legal Solutions

Although some might view hiring a Notary Public as an added expense, it is a cost-effective solution compared to the potential legal consequences of not having documents properly notarised. The cost of a notary is minimal when compared to the potential risks of legal disputes, fraud, or unenforceable contracts. By ensuring that your documents are validated by a professional, you reduce the risk of costly legal issues down the road.

Conclusion

In summary, hiring a Notary Public in the UK offers a range of benefits, from ensuring the authenticity of legal documents to providing protection against fraud. Whether for personal or business purposes, their services are invaluable in today’s increasingly complex legal landscape. By involving a notary in your transactions, you can safeguard the legality and enforceability of your documents, ensuring peace of mind and security in your dealings.

0 notes

Text

Top Tips for Buying a House in Mysore

Top Tips for Buying a House in Mysore

Buying a house in mysore is one of the most significant investments you’ll ever make. In a developing metropolis like Mysore, cited for its wealthy cultural records and modern-day facilities, it’s vital to approach the residents and try to find a method with cautious attention and informed desire-making. Whether you’re a number one-time homebuyer or trying to spend money on assets, here are some pinnacle suggestions to guide you through buying a house in Mysore.

1. Research the Market

Comprehending Mysore’s Real Estate Landscape

Before you start your private home-searching adventure, it’s vital to research the tangible assets market in Mysore. Familiarise yourself with specific localities, belongings prices, and marketplace trends. Areas like Vijaynagar, Jayalakshmipuram, and Gokulam have acquired a reputation due to their accessibility and offerings.

Resources for Market Research

Online Real Estate Portals: Websites like pickyourprop ,99acres, MagicBricks, and Housing.com offer listings and marketplace insights.

Local Real Estate Agents: Engaging with a knowledgeable tangible assets agent can offer treasured insights into present-day tendencies and capability areas for improvement.

2. Set a Budget

Choose Your Financial Limits

Establish a clean price range based entirely on your financial scenario. Consider your profits, economic savings, and any gift debts. A nicely defined budget will help you Buying a house in mysore narrow down your options and prevent overspending.

Additional Costs to Consider

When budgeting for a house, don’t forget to think in:

Registration and Stamp Duty: This can range from you. S . A . To u.S. Of America.

Home Loan Fees: If you’re taking a mortgage, keep processing expenses and coverage in mind.

Maintenance Costs: These are factors in ability maintenance and monthly safety.

3. Choose the Right Location

Elements to Consider

The location of your new home can significantly affect your lifestyle and funding fee. Consider the following:

Proximity to Work and Schools: Ensure the region is handy for your day-by-day ride and educational goals.

Amenities: Look for nearby centres consisting of hospitals, buying centres, parks, and public delivery.

Safety and Security: Research the protection facts of diverse neighbourhoods Buying a house in mysore.

Future Development Plans

Investigate any upcoming infrastructure tasks or inclinations in the vicinity, as they can enhance the property rate over the years.

4. Identify Your Needs

Determine Your Requirements

Before starting your search, list your desires and options. Consider:

Type of Property: Are you looking for a rental, villa, or impartial house?

Size and Layout: How many bedrooms and toilets do you want? Do you pick an open-ground plan?

Amenities: Are you seeking additional features like a garden, parking, or safety?

Flexibility

While having a list of want-to-haves is vital, be open to compromise. The first-class home may not exist, so prioritise your requirements Buying a house in mysore.

5. Get Pre-Approved for a Home Loan

Understanding Your Financing Options

If you require financing, getting pre-approved for a domestic mortgage can give you a clearer picture of your charge range and strengthen your role as a purchaser.

Steps to Secure Pre-Approval

Research Lenders: Compare hobby charges and mortgage phrases from diverse banks and economic institutions.

Submit Required Documents: This consists of profits evidence, identification verification, and credit score information.

Understand Loan Eligibility: Different creditors have numerous requirements based on your financial profile.

Visit Properties in Person

Schedule Visits

Once you are given shobeensted functionality residences, schedule visits to see them in person. Online listings can be deceptive, so it’s critical to take a look at the property before you decide.

Key Aspects to Evaluate

Condition of the Property: Look for any signs and symptoms and symptoms and signs and symptoms of damage or crucial preservation.

Neighborhood Vibe: Spend time inside the location to gauge the network and environment.

Layout and Space: Ensure the format meets your desires and feels snug.

6. Work with a Real Estate Agent

Benefits of Hiring an Expert

A knowledgeable actual belongings agent may be a beneficial aid in your house-shopping journey. They provide:

Market Insights: Agents must get entry to finish market statistics and trends.

Negotiation Skills: A skilled agent can negotiate on your behalf for better phrases.

Legal Assistance: They can assist in navigating jail requirements and job placement.

Finding the Right Agent

Look for dealers with suitable opinions and a solid track record in the Mysore market. Personal pointers from buddies or a circle of relatives can also be beneficial.

7. Check Legal Documentation

Importance of Legal Verification

Before finalising assets, ensure that each prison document is in order. This includes:

Title Deed: Verify that the vendor understands the assets well.

Encumbrance Certificate: This report confirms that the belongings are free from legal liabilities.

Building Approval Plan: Ensure that the property has all necessary approvals from community authorities.

Hiring a Legal Advisor

Consider hiring a prison expert to test documents and ensure compliance with nearby regulations. This step can prevent criminal problems in the future.

8. Understand the Agreement

Review the Sale Agreement

A sale settlement may be drafted once you decide to maintain your belongings. Pay interest on the following:

Payment Terms: Understand the charge time desk and any related outcomes for delays.

Possession Date: Confirm simultaneously that you can take ownership of the property.

Contingencies: Be aware of any situations that might affect the sale.

Negotiate Terms

Feel free to negotiate terms within the settlement. A good deal has to be beneficial for every occasion.

9. Plan for the Future

Consider Long-Term Investment

When buying a residence, count beyond your instantaneous dreams. Consider how the assets will serve you in the long run. Will it accommodate the increase in the future circle of relatives? Is the region likely to recognise in price?

Resale Value

Evaluate the functionality of the resale value of the belongings. Factors such as community development, infrastructure enhancements, and marketplace dispositions can significantly affect your funding’s true worth over the years.

Conclusion

Buying a house in Mysore may be a profitable experience if cautiously approached, making plans and studies. By following those suggestions, you could navigate the complexities of the actual belongings market and make informed decisions that align with your dreams and monetary desires. Whether you’re seeking out your dream domestic or a profitable investment, being nicely organised will set you on the path to success within the Mysore real property marketplace. With the proper technique, you’ll find a property that now meets your desires and serves as a sturdy investment for the future.

For more information visit : Buying a house in Mysore

0 notes