#how to build corporate credit fast

Explore tagged Tumblr posts

Text

The core defining feature of capitalism is that it is fundamentally anti-democratic. Yes, many of us live in democratic political systems, where we get to elect candidates from time to time. But when it comes to the economic system, the system of production, not even the shallowest illusion of democracy is allowed to enter. Production is controlled by capital: large corporations, commercial banks, and the 1% who own the majority of investible assets… they are the ones who determine what to produce and how to use our collective labour and our planet’s resources. And for capital, the purpose of production is not to meet human needs or achieve social objectives. Rather, it is to maximize and accumulate profit. That is the overriding objective. So we get massive investment in producing things like fossil fuels, SUVs, fast fashion, industrial beef, cruise ships and weapons, because these things are highly profitable to capital. But we get chronic underinvestment in necessary things like renewable energy, public transit and regenerative agriculture, because these are much less profitable to capital or not profitable at all. This is a critically important point to grasp. In many cases renewables are cheaper than fossil fuels! But they have much lower profit margins, because they are less conducive to monopoly power. So investment keeps flowing to fossil fuels, even while the world burns. Relying on capital to deliver an energy transition is a dangerously bad strategy. The only way to deal with this crisis is with public planning. On the one hand, we need massive public investment in renewable energy, public transit and other decarbonization strategies. And this should not just be about derisking private capital – it should be about public production of public goods. To do this, simply issue the national currency to mobilize the productive forces for the necessary objectives, on the basis of need not on the basis of profit. Now, massive public investment like this could drive inflation if it bumps up against the limits of the national productive capacity. To avoid this problem you need to reduce private demands on the productive forces. First, cut the purchasing power of the rich; and second, introduce credit regulations on commercial banks to limit their investments in ecologically destructive sectors that we want to get rid of anyway: fossil fuels, SUVs, fast fashion, etc. What this does is it shifts labour and resources away from servicing the interests of capital accumulation and toward achieving socially and ecologically necessary objectives. This is a socialist ecological strategy, and it is the only thing that will save us. Solving the ecological crisis requires achieving democratic control over the means of production. We need to be clear about this fact and begin building now the political movements that are necessary to achieve such a transformation.

47 notes

·

View notes

Text

Introduction

The USA is one of the largest import markets in the world, making it a lucrative destination for Indian exporters. With a diverse range of industries and a high demand for quality products at competitive prices, exporting to the USA can be a game-changer for businesses in India. However, navigating the complex regulatory landscape, ensuring compliance, and optimizing costs are crucial to profitability.

In this guide, we will take you through a step-by-step process on how to export to the USA profitably. Whether you are a small business or an established exporter in India, this guide will help you maximize your opportunities while minimizing risks.

Understanding the Export Market in the USA

Who is the Biggest Exporter to the USA?

The USA imports goods from various countries, but the biggest exporters to the USA include:

China – Electronics, machinery, textiles

Mexico – Vehicles, machinery, agricultural products

Canada – Oil, minerals, vehicles

India – Pharmaceuticals, textiles, gems, IT services

India is a significant trade partner, with exports to the USA growing steadily due to strong demand in various sectors. Understanding market demand and key competitors will help you position your products effectively.

Steps to Export to the USA from India

1. Identify Profitable Products to Export

Certain products have a high demand in the USA, including:

Pharmaceuticals

Textiles & Apparel

Gems & Jewelry

Engineering Goods

Spices & Agro Products

Handicrafts & Home Decor

Conduct market research to determine demand trends, competition, and pricing strategies before finalizing your export product.

2. Register Your Export Business

To legally export from India, follow these steps:

Register your company with the Ministry of Corporate Affairs (MCA).

Obtain an Importer Exporter Code (IEC) from the Directorate General of Foreign Trade (DGFT).

Register with the GST Department for tax compliance.

Obtain necessary certifications depending on your product, such as FDA approval for pharmaceuticals.

3. Comply with USA Import Regulations

The USA has stringent import regulations. Ensure compliance with:

Food and Drug Administration (FDA) for food, drugs, and cosmetics.

US Customs and Border Protection (CBP) for tariff classifications and duties.

Consumer Product Safety Commission (CPSC) for safety standards.

Environmental Protection Agency (EPA) for eco-friendly products.

Hiring a compliance expert or consultant can help navigate regulatory complexities and avoid penalties.

4. Find Reliable Buyers and Distributors

Connecting with the right buyers and distributors is key to success. Consider:

B2B platforms like Exporters Worlds, IndiaMART, and Global Sources.

Trade fairs and exhibitions such as MAGIC Las Vegas (apparel) or JCK Las Vegas (jewelry).

Chambers of commerce and export promotion councils for networking.

Building strong relationships and offering competitive pricing will help secure long-term business deals.

5. Choose the Right Shipping and Logistics Partner

Efficient logistics ensure timely delivery and cost-effectiveness. Key factors to consider:

Select between air freight (fast but expensive) or sea freight (cost-effective for bulk orders).

Work with reliable freight forwarders like DHL, FedEx, or Maersk.

Ensure proper packaging and labeling to meet US standards.

Get insurance coverage to mitigate transit risks.

6. Manage Costs and Optimize Pricing

To maintain profitability, focus on:

Reducing costs through bulk shipping and negotiating with suppliers.

Taking advantage of export incentives like MEIS (Merchandise Exports from India Scheme).

Setting competitive yet profitable pricing based on market demand and competitor analysis.

7. Handle Payments Securely

International transactions should be secure and hassle-free. Consider:

Letter of Credit (LC) for guaranteed payments.

PayPal, Stripe, or international bank transfers for online transactions.

Partnering with financial institutions that offer export credit insurance.

Common Challenges and How to Overcome Them

Challenge 1: Stringent Compliance Regulations

Solution: Work with legal experts and compliance consultants who specialize in US import laws.

Challenge 2: High Shipping and Tariff Costs

Solution: Optimize logistics, use Free Trade Agreements (FTAs), and explore bonded warehouses in the USA.

Challenge 3: Finding Trustworthy Buyers

Solution: Leverage trade fairs, B2B portals, and government trade facilitation programs.

Conclusion

Exporting to the USA from India can be a highly profitable venture if done strategically. By choosing the right products, ensuring compliance, optimizing logistics, and building strong buyer relationships, Indian exporters can establish a successful and sustainable export business.

If you found this guide helpful, subscribe to our newsletter for more export insights, or leave a comment below with your questions!

#Exporters in India#How to export from India to USA#Profitable export business to USA#Indian export products in demand in USA#USA import regulations for Indian exporters#Best Indian products to export to USA#Export business opportunities in USA#Indian exporters to USA market#Shipping and logistics for USA exports#USA import compliance for Indian businesses

0 notes

Text

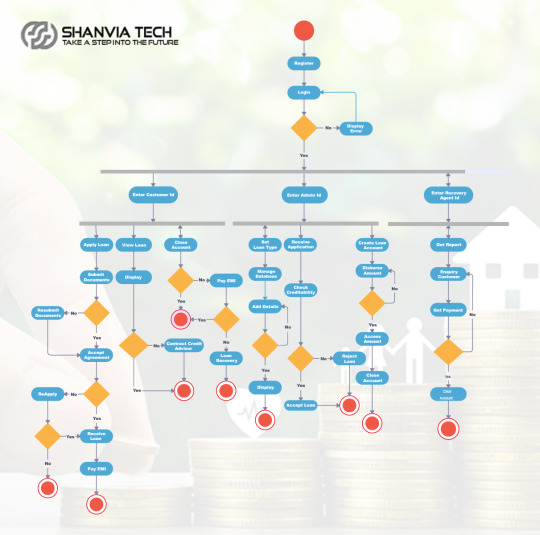

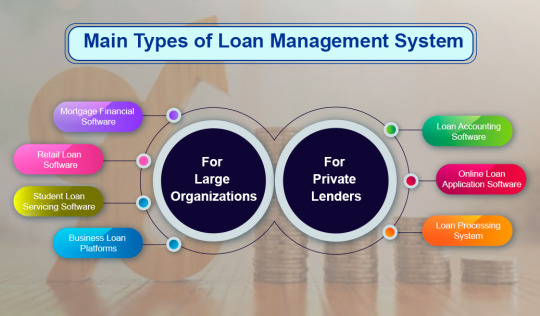

Loan Management System: Guide to Build a System

Financial institutions are constantly adapting to keep up with the ever-changing needs of their customers in today’s fast-moving digital world. One of the most important areas of this evolution is loan servicing. A lot has changed over the years. The Loan Management Software (LMS), which was once a reliable tool for simplifying the loan process and helping people and businesses achieve their goals, no longer meets the demands of today’s environment. Without an efficient Loan Management System (LMS) in place, many are facing financial setbacks, whether it’s through small personal loans or large corporate financing. In economic development loans are a very important part that gives the money to individual and other business to grow them in there full potential. Nonetheless, efficient management of loans necessitates strong systems to tackle difficult tasks such as loan application, loan approval process, disbursement, repayment and compliance monitoring. This is when a Loan Management System comes into the picture to allow financial institutions for simplifying their operations and delivering better customer experiences.

1.What Is a Loan Management System?

A loan management system allows banks, credit unions, captives, and other lenders to streamline the management of all their lending processes, thus reducing operational (and other) expenses. This advent of digital technology has made it possible for smaller consumer lenders to enter the industry. This technology has allowed many such lenders to identify niches for their portfolios, enabling them to make loans to those lacking significant traditional credit histories without increasing their risk exposure.

When it comes to loan management, systems generally are no longer on-premise solutions, as was the case with legacy lending software and the onsite servers that supported it. Instead of involving massive upfront investments, modern lending platforms use cloud-based servers. This offers lenders numerous benefits, including increased flexibility, scalability, and security, along with enabling easier compliance with regulations like those concerning the security and storage of customer data. Smart automation of processes through artificial intelligence (AI), data analytics featuring machine learning algorithms, almost limitless data storage in the cloud, software apps that improve user experience, and other technologies all have advanced lending software.

Key features of an LMS include:

Loan Origination: Simplifies the borrower application process, credit checks, and underwriting. Automation speeds up approvals and minimizes errors.

Loan Servicing: Manages payments, calculates interest, tracks balances, and handles ongoing loan maintenance after approval.

Loan Accounting: Tracks financial details like interest earned, principal payments, and other loan-related data.

Customer Service: Includes tools for seamless communication between lenders and borrowers.

Reporting and Analytics: Generates insights on loan status, portfolio risk, and performance metrics.

Compliance and Regulation: Ensures all processes adhere to local and international regulations.

Debt Collection: Helps manage delinquent accounts, contact borrowers, and streamline recovery efforts.

2.How to Build a Loan Management System?

Developing a loan management system requires a thoughtful and structured approach. It's about creating a powerful tool that streamlines the lending process, making it more efficient and organized. To get it right, you need to understand the system's building blocks and how they fit together. Choosing the right technology is also crucial. But that's just the starting point. You also need to incorporate essential features, rigorously test the system, and ensure it's properly deployed and maintained. By taking a meticulous and comprehensive approach, you can deliver a reliable loan management solution that truly meets the needs of your users.

Step 1: Understanding the Components and Architecture:

Building a robust loan management system starts with a clear understanding of its core components and architecture.

Front-End User Interface: This is what borrowers and lenders see and interact with. A user-friendly and responsive design is essential.

Back-End Database: This is the system's core, storing all loan data. Data security, efficient retrieval, and scalability are critical.

Modules: These handle different stages of the loan lifecycle:

Loan Origination: Manages the loan application and approval process.

Loan Servicing: Handles ongoing loan management, including payments and adjustments.

Debt Collection: Activated when payments are missed.

Reporting: Provides insights into loan performance and other key metrics.

Data Structure: How data is stored and accessed within the database.

Workflows: Streamlined, often automated processes for handling various loan-related tasks.

Integration Points: Connections with external systems, such as credit bureaus or payment gateways.

As well-designed loan management system improves operational efficiency, enhances user experience, and boosts overall performance for lending institutions.

Step 2: Selecting the Right Technology Stack

Selecting the right technology stack is absolutely critical for a high-performing loan management system. Here's a breakdown of key considerations:

Programming Languages: Common choices include JavaScript, typescript and java, offering robust and scalable solutions.

Web Frameworks: Frameworks like Express, React, flutter and Ruby on Rails provide structure and speed up development.

Databases: GraphQL and PostgreSQL are popular database options, known for their reliability and performance.

Cloud Infrastructure: Utilizing cloud services provides scalability and ensures system reliability. APIs (Application Programming Interfaces): APIs are essential for seamless integration with external systems, like payment gateways or credit bureaus.

Third-Party Services: Integrating third-party services can enhance functionality, adding features like fraud detection or automated reporting. Careful selection of each of these components ensures the loan management system is efficient, effective, and meets the needs of both lenders and borrowers.

Step 3: Implementing Key Features and Functionalities:

A robust loan management system requires key features tailored to specific needs. These include:

Loan Origination: Streamlined processing of loan applications and approvals.

Borrower Management: Comprehensive handling of borrower data and profiles.

Automated Payments: Efficient and automated processing of borrower payments.

Document Management: Organized storage and easy retrieval of loan documents.

Credit Scoring: Integration with credit bureaus for borrower creditworthiness assessment.

Risk Assessment: Tools to evaluate loan risk levels and inform lending decisions.

Crucially, these features must align with the organization's specific loan types and operational requirements. Customization ensures the system effectively supports unique business processes and optimizes loan management.

Step 4: Testing and Quality Assurance

A comprehensive loan management system hinges on key features and functionalities. These often include:

Loan Origination: Efficient processing of loan applications, from submission to approval.

Borrower Information Management: Comprehensive storage and management of borrower data.

Automated Payment Processing: Streamlined handling of borrower payments, including automated reminders and processing.

Document Management: Organized storage and easy retrieval of all loan-related documentation.

Credit Scoring: Integration with credit reporting agencies to assess borrower creditworthiness.

Risk Assessment: Tools and processes to evaluate the risk associated with each loan.

Critically, these features must be tailored to your organization's specific needs and the types of loans you manage. This customization ensures the system effectively supports your unique requirements and operational workflows.

Step 5: Deployment and Maintenance

Once development and testing are complete, the loan management system is ready for deployment. The choice between on-premises (in your own data center) and cloud deployment depends on your organization's needs. After deployment, ongoing maintenance, updates, and monitoring are crucial for the system's long-term success.

Here's a closer look at these key stages:

Deployment Options: On-premises gives you full control, while cloud deployment (using platforms like AWS, Azure, or Google Cloud) reduces infrastructure management.

Maintenance and Support: This includes bug fixes, security updates, and adding new features as needed.

Updates and Monitoring: Regular security patches and performance monitoring ensure the system stays secure and runs smoothly.

Scalability: You'll need to be able to scale the system as your organization grows, whether that means expanding cloud resources or adding hardware to your on-premises setup.

User Training and Support: Proper training and support for users will ensure they can use the system effectively.

Backup and Disaster Recovery: Having solid backup and disaster recovery plans is essential to protect your data in case of an emergency.

Whether you choose on-premises or cloud, careful deployment and maintenance are vital for the system's reliability, security, and adaptability. These efforts ensure the system performs well and meets the evolving needs of your financial institution.

3.Benefits of Loan Management System Software

A Loan Management System (LMS) software provides several benefits including streamlined loan processes, centralized data management, faster loan approvals, reduced operating costs, improved tracking and transparency, enhanced regulatory compliance, and ultimately, increased customer satisfaction by facilitating efficient loan management across all stages, from application to repayment.

Automation Reduces Errors: A major benefit of loan management software is the reduction of human error. Manual loan processing is susceptible to mistakes, including incorrect calculations, data entry errors, and processing delays. Automation minimizes these risks, ensuring accurate loan calculations, proper documentation, and consistent application of lending policies. This leads to improved data integrity, reduced compliance issues, and increased overall efficiency in loan processing.

Optimizing Loan Processes for Time Savings: Loan management software significantly saves time. Automating loan origination, document verification, credit checks, and loan servicing eliminates time-consuming manual tasks. Organized workflows and automated processes speed up loan application processing, reducing turnaround time and boosting operational efficiency. This allows staff to focus on higher-value activities and improves the customer experience.

Real-Time Loan Performance Reporting: Loan management software empowers lenders with digital reporting and analytics, providing valuable insights into loan portfolios and performance. Real-time data analysis enables tracking of key metrics, risk assessment, and informed decision-making. By leveraging these analytics, lenders can identify trends, detect potential defaults, and optimize loan strategies, ultimately improving risk management and profitability.

Competitive Advantage in Lending: Loan management software provides a competitive edge. Enhanced efficiency, faster processing, and accurate decisions enable lenders to offer a superior customer experience. Quick approvals, seamless digital interactions, and personalized loan offerings differentiate lenders, attracting more borrowers and building loyalty.

Optimize Your Lending Processes: Loan management software streamlines lending by automating key tasks. From application intake and credit assessment to document management, payment processing, and collections, automation boosts efficiency, reduces processing times, and ensures timely procedures. This empowers lenders to offer faster, more accurate, and organized services, while also improving internal efficiency and compliance.

4.The Features That Make a Loan Management System Effective

Effective loan management systems streamline the entire lending process. Key features include comprehensive loan origination, flexible loan servicing, integrated document management, real-time reporting and analytics, automated workflows, robust security, seamless integrations, and a user-friendly interface. Prioritizing these features ensures the system meets current needs and supports future growth.

Loan Origination: Loan origination is critical, and a robust system must support it comprehensively. This includes efficient application intake and processing, encompassing borrower data collection, credit checks, and document verification. Automated workflows, regulatory compliance, and a seamless borrower experience are essential.

Loan Servicing: Effective loan servicing is vital for managing loans throughout their lifecycle. A robust loan management system should include

Automated Payment Processing: This streamlines the collection and tracking of borrower payments, reducing manual effort and minimizing errors. It may include features like automated reminders, recurring payment setups, and various payment gateway integrations.

Accurate Interest Calculation: The system must accurately calculate interest accrual based on different interest rate types (fixed, variable), compounding frequencies, and loan terms.

Escrow Management: For loans with escrow accounts (often for property taxes or insurance), the system should manage these funds, including collection, disbursement, and reporting.

Versatile Loan Handling: Lenders often deal with various loan types (e.g., mortgages, personal loans, commercial loans). The system should accommodate these different loan types and their unique characteristics, as well as various repayment plans (e.g., amortizing, balloon payments). It should also allow for account adjustments, such as payment changes or deferrals.

Borrower Portal: A self-service portal empowers borrowers to access their loan information, view payment history, make payments online, download statements, and communicate with the lender. This enhances the borrower experience and reduces the workload for customer service.

3. Unpaid Dues Management: Effective debt collection capabilities are essential for lenders to efficiently manage delinquent loans. A robust loan management system should automate collection processes by sending timely payment reminders, tracking overdue accounts, and generating collection notices. Seamless integration with communication channels such as email, SMS, and phone systems can streamline collection efforts, enhance borrower engagement, and improve overall recovery rates.

4. Data Insights & Reporting: Comprehensive reporting and analytics are essential for lenders to gain valuable insights and optimize loan management. A well-equipped loan management system should include:

Insightful Reporting.

Evaluate loan portfolio performance.

Assess risk exposure and profitability.

Pre-Built Reports & Customizable Dashboards.

Monitor key financial metrics.

Track loan delinquency rates.

Analyze lending trends for strategic decision-making.

Advanced Analytics Capabilities:

Predictive Modeling – Forecast potential loan outcomes and risk scenarios.

Data Visualization – Transform complex data into intuitive, actionable insights.

By leveraging these powerful features, lenders can make data-driven decisions, enhance operational efficiency, and refine their loan strategies for sustained success.

5.How Much Does It Cost to Build a Loan Management System?

Understanding the financial commitment required to develop a loan management system is essential for organizations planning its implementation. Several factors influence development costs, including the system's complexity, technology stack, and level of customization required.

This guide will break down cost estimates based on different types of loan management systems while highlighting key cost drivers. Additionally, we’ll discuss the importance of conducting a Return on Investment (ROI) analysis to assess potential benefits, optimize decision-making, and ensure that investing in a loan management system delivers long-term value.

How Development Costs are Influenced

Factors Affecting the Cost of Developing Loan Management System Software:

Feature Complexity: The more complex the features, the higher the development costs.

Technology Stack: The choice of technologies used for the system can significantly influence development expenses.

Team Expertise: The skill level and experience of the development team play a major role in determining overall costs.

Project Timeline: A shorter project timeline can lead to higher costs, as more resources may be required to meet deadlines.

Customization Needs: Tailoring the software to meet specific business needs can increase development costs.

System Integrations: Integrating the loan management system with existing systems can add to the overall expenses.

Regulatory Compliance: Adhering to industry regulations may require additional investment for compliance measures.

Considering these factors is essential for accurately estimating the total investment required for developing a loan management system.

2. Estimating Costs for Various Types of Loan Management Systems

The cost of developing loan management system software can differ depending on the system's requirements. A basic system with core features and limited customization will generally have a lower development cost. However, a more complex system featuring advanced functionalities, integration options, and regulatory compliance will require a larger investment. Additionally, cloud-based systems may incur extra expenses for hosting and infrastructure.

3. Analyzing Return on Investment (ROI)

While it's important to understand the development costs, evaluating the potential return on investment (ROI) of a loan management system software is equally vital. A thorough ROI analysis should take into account factors like enhanced operational efficiency, time savings, error reduction, better customer experience, and the potential for higher loan volumes and revenue growth. By assessing the long-term advantages and quantifying the ROI, businesses can better justify their investment in the loan management system software.

6.Loans Effectively Managed by Loan Management Software

Loan management software is a flexible tool designed to efficiently handle various types of loans. It simplifies the management of loan categories such as personal loans, commercial loans, student loans, syndicated loans, mortgage loans, and payday loans. By streamlining application processes and automating repayment schedules, loan management software equips lenders with the essential tools to manage a wide range of loan portfolios effectively.

Personal Loans: Loan management software adeptly handles personal loans, automating origination, credit checks, document generation, and repayment schedules. It securely stores borrower information for efficient servicing.

Main Characteristics

Automates loan origination

Facilitates credit checks

Generates loan documents

Manages repayment schedules

Securely stores borrower data

2. Commercial Loans

The software simplifies the loan process for small businesses to corporate loans, covering application, credit evaluation, collateral management, and complex repayment structures. Integration with financial analysis tools supports informed lending decisions.

Main Characteristics

Streamlines loan applications.

Assesses creditworthiness.

Tracks collateral.

Manages complex repayment structures.

Integrates with financial analysis tools.

3. Student Loans: Designed specifically for student loans, the software automates application processes, disbursements, balance tracking, and flexible repayment options. It also integrates with educational institutions for seamless billing and efficient servicing.

Main Characteristics

Automates loan applications.

Manages disbursements.

Tracks loan balances.

Offers flexible repayment options.

Facilitates direct billing.

4. Syndicated Loans: The software effectively manages syndicated loans by providing collaboration tools, automating participation agreements, and ensuring precise payment tracking among multiple lenders. Real-time reporting simplifies the management of syndicates.

Main Characteristics

Facilitates collaboration among lenders.

Automates participation agreements.

Tracks payments with accuracy.

Provides real-time reporting.

Simplifies syndicate management.

5. Mortgage Loans: The software automates the origination process, property valuation, title searches, and escrow management for mortgage loans. It efficiently handles amortization, interest, and principal payments to ensure seamless servicing.

Main Characteristics

Automates loan origination.

Manages property valuation.

Handles escrow management.

Calculates payments.

Ensures smooth loan servicing.

6. Payday Loans:

The software efficiently manages payday loans by automating processing, ensuring regulatory compliance, calculating interest and fees, and managing repayment schedules. Integration with payment gateways streamlines the collection process.

Main Characteristics

Automates loan processing.

Ensures compliance with regulations.

Calculates interest and fees.

Manages repayment schedules.

Integrates with payment gateways.

7.Decentralized Finance (DeFi) and Loan Management Systems

The integration of loan management systems with DeFi presents a promising future where lending becomes more democratic, transparent, and accessible to everyone. DeFi-powered loan systems offer a revolutionary approach to loan servicing, free from the constraints of traditional banking models.

Leveraging Blockchain Technology: Blockchain technology in DeFi and loan management brings several key benefits:

Immutable Ledger.

Records all transactions.

Ensures data permanence and protection against tampering.

Transparent Transactions.

Enables participants to view transaction history.

Builds trust and confidence among all parties.

Enhanced Trust & Security.

Attracts both lenders and borrowers.

Reduces fraud and ensures data integrity.

Efficient Loan Management.

Organizes loan systems effectively.

Streamlines loan servicing and enhances reliability.

The use of blockchain in DeFi not only guarantees data integrity but also revolutionizes trust and efficiency in loan management, making it an appealing choice for all involved parties.

2.Integration of DeFi: Integrating DeFi into loan management systems provides lenders with a fresh approach to product development and system management. This DeFi connection enables lenders to create products tailored to the unique needs of individual clients, fostering a more customer-centric lending model. It also offers a platform for more advanced loan servicing software, making the lending process simpler and more efficient.

8.The Future of Loan Management Systems

The future of loan management systems is closely tied to technological advancements in the fast-evolving digital landscape. Key factors to consider include:

Embracing Advanced Technologies: Lenders are progressively incorporating advanced technologies such as AI, machine learning, and blockchain to enhance product offerings and improve customer experiences. These technologies are poised to revolutionize loan management by automating and optimizing processes throughout the loan lifecycle:

AI Integration.

Streamlines origination by automating application processing and credit assessments.

Improves borrower experience with personalized recommendations and instant approvals.

Enhances risk assessment through the analysis of large data sets for more accurate lending decisions.

Machine Learning Benefits.

Predicts default risks by analyzing historical borrower data.

Optimizes loan pricing and terms, boosting profitability.

Automates fraud detection, providing protection against financial crimes.

Blockchain’s Role.

Establishes an immutable ledger for transparent and secure transaction records.

Builds trust and reduces fraud in loan management processes.

Simplifies complex tasks like syndicated loans by enabling efficient collaboration.

The adoption of these technologies marks a major shift in the lending industry, fostering greater efficiency, trust, and innovation throughout the loan management process.

2.Emphasis on End-to-End Loan Servicing Software: As businesses pursue digital transformation, there is a growing emphasis on developing robust loan servicing software. A progressive loan management system prioritizes key features such as AI-driven decision-making, seamless automation, and intuitive user interfaces. Together, these elements minimize the need for manual inputs, enhance accuracy, and streamline loan servicing, ensuring that processes meet the dynamic needs of today’s financial services landscape.

3.Integration of Data Analytics in Loan Management

The future of loan management clearly indicates a growing dependence on data analytics. In today’s digital age, data has become an invaluable asset for lenders. Integrating a loan management system with data analytics enables businesses to embrace data-driven decision-making. This allows for a deeper understanding of market trends, the ability to predict customer behavior, and the optimization of product development processes, ensuring that businesses remain adaptable and responsive to changing market demands.

4.Growth of Mobile App Development in Lending

The financial landscape embraces digitization, it significantly impacts how lenders operate and serve their customers. One noticeable shift is the increasing role of mobile platforms in loan management:

Emerging Trend: The demand for mobile app development in loan management is growing rapidly.

Digital Transformation: As lending processes become digital, customers are seeking mobile-responsive and user-friendly loan servicing solutions.

Competitive Advantage: Lenders are expected to invest heavily in app development to meet customer expectations and stay competitive.

Customer-Centric Focus: Mobile apps provide convenience, accessibility, and improved user experiences, aligning with the changing preferences of borrowers.

9.Reasons to Choose Core Devs for Your Loan Management System Solutions

Exceptional Expertise: At Core Devs, we offer unmatched expertise in developing efficient and robust loan management systems. Our team of skilled developers combines in-depth knowledge of the financial sector with technical excellence, ensuring that your system aligns with the complexities of lending operations and regulatory compliance. With a proven track record of successful projects, Core Devs is more than just a service provider – we’re a strategic partner committed to making your loan management system a key asset that drives your business forward.

Advanced Technology Solutions: In today’s fast-paced digital world, staying ahead of technological trends is essential. At Core Devs, we continuously integrate the latest innovations, such as AI, blockchain, and data analytics, into our loan management solutions. We ensure that your system is not only up-to-date but also ready for future market demands. By partnering with Core Devs, you future-proof your system, keeping it adaptable and competitive in an ever-evolving landscape. Our focus on technological excellence ensures you’re always ahead of the curve.

Tailored Customization: We understand that every business has unique requirements. At Core Devs, we specialize in tailoring loan management systems to meet your specific needs, whether you manage personal, commercial, or specialized loans. Our solutions are designed to integrate seamlessly with your business processes, making them as efficient as possible. When you work with us, you get a partner who understands your unique challenges and objectives, and we craft solutions that are perfectly suited to your organization.

Robust Reliability and Security: In the world of financial technology, security and reliability are non-negotiable. Core Devs prioritizes these aspects, implementing robust security protocols and data encryption to protect both your data and your clients’ information. With us, you can rest easy knowing that your system is secure and reliable. Our stringent security measures protect sensitive data, while our unwavering commitment to reliability ensures that your loan management system is always up and running when you need it.

Outstanding User Experience: User experience is a critical factor in today’s digital landscape. At Core Devs, we design intuitive, user-friendly interfaces that allow both your team and clients to navigate the system effortlessly. Our focus on simplicity and ease of use boosts productivity and enhances customer satisfaction. By choosing Core Devs, you choose a partner who understands the importance of a seamless user experience, which ultimately leads to greater efficiency, customer loyalty, and a stronger reputation for your business.

10.Final Thoughts

Implementing a reliable loan management system is essential for lenders in today’s digital age, where the financial sector is undergoing significant transformation. By automating loan processes, reducing human errors, and leveraging analytics for valuable insights, loan management system software allows lenders to optimize their operations and deliver better services to borrowers.

The advantages of streamlined lending processes, increased efficiency, and enhanced risk management make loan management systems a pivotal tool in the industry. Adopting this technology helps lenders remain competitive, foster growth, and successfully navigate the ever-changing lending landscape.

For more information about their services and to explore how they can assist your business, visit their official website at https://www.shanviatech.com/

0 notes

Text

Best Business Loan Services in Mangalore, Karnataka – Fuel Your Business Growth

Why Choose the Best Business Loan Services in Mangalore, Karnataka?

Starting or expanding a business requires substantial financial resources. Whether you need funds for working capital, equipment purchase, inventory management, or business expansion, securing the right business loan is crucial. The best business loan services in Mangalore, Karnataka offer customized financial solutions to meet the unique needs of businesses.

Understanding Business Loan Services in Mangalore, Karnataka

Mangalore, a major commercial hub in Karnataka, hosts a wide range of businesses, from small enterprises to large corporations. To sustain growth and overcome financial challenges, businesses often rely on external funding. Reliable business loan services in Mangalore, Karnataka help entrepreneurs access the necessary funds with competitive interest rates and flexible repayment options.

Key Features of the Best Business Loan Services in Mangalore, Karnataka

1. Flexible Loan Options

Business loan providers offer various financing solutions, including term loans, working capital loans, equipment financing, and invoice discounting. Entrepreneurs can choose the loan type that best suits their business needs.

2. Quick and Hassle-Free Application Process

Modern financial institutions streamline the loan application process, ensuring minimal paperwork and fast approvals. Online applications and digital documentation have made obtaining business loans more convenient.

3. Competitive Interest Rates

The best business loan services in Mangalore, Karnataka provide loans at competitive interest rates, making it easier for businesses to manage repayment while maximizing profitability.

4. Customized Loan Amounts

Lenders offer loan amounts tailored to business requirements, ensuring that businesses receive adequate financial support without unnecessary debt burdens.

5. Collateral-Free Loan Options

For startups and small businesses, collateral-free business loans serve as a valuable financing option. Many lenders offer unsecured loans based on business turnover and creditworthiness.

6. Flexible Repayment Tenure

Repayment options vary based on the type of loan and lender policies. Businesses can choose short-term or long-term repayment plans to suit their cash flow and financial goals.

Benefits of Availing Business Loan Services in Mangalore, Karnataka

1. Business Expansion and Growth

A business loan can help entrepreneurs invest in infrastructure, expand operations, and enter new markets without financial constraints.

2. Improved Cash Flow Management

Many businesses face cash flow fluctuations due to delayed payments or seasonal demand changes. A business loan ensures that companies have sufficient funds to manage operational expenses smoothly.

3. Access to Working Capital

For small businesses and startups, working capital loans provide the necessary financial cushion to maintain daily operations, pay employees, and purchase inventory.

4. Technology and Equipment Upgrades

Investing in modern equipment and technology is crucial for business success. Business loans enable entrepreneurs to upgrade their machinery and tools without disrupting cash reserves.

5. Opportunity to Build Business Credit

Timely repayment of business loans enhances a company’s credit profile, making it easier to secure higher loan amounts in the future.

How to Choose the Best Business Loan Services in Mangalore, Karnataka

1. Compare Interest Rates and Loan Terms

Different financial institutions offer varying interest rates and loan tenures. Comparing multiple lenders ensures that you get the best deal for your business.

2. Assess Eligibility Criteria

Understanding eligibility requirements helps businesses choose lenders with favorable terms. Factors like business turnover, credit score, and operational history play a crucial role in loan approval.

3. Evaluate Loan Processing Time

Fast loan disbursal is essential for businesses that require immediate funding. Choosing a lender with a quick approval process can be beneficial.

4. Check Repayment Flexibility

A good business loan service provides flexible repayment options, allowing businesses to manage their finances efficiently without stress.

5. Read Customer Reviews and Testimonials

Checking customer feedback helps in assessing the credibility and reliability of a business loan provider. Positive reviews indicate good service and transparency.

Conclusion

Securing the best business loan services in Mangalore, Karnataka can be a game-changer for entrepreneurs looking to expand or sustain their businesses. With the right financing solutions, businesses can achieve their goals, improve cash flow, and gain a competitive edge in the market. Whether you need funds for a startup, expansion, or operational needs, choosing a reliable business loan provider can help you achieve financial success.

If you’re seeking the best business loan services in Mangalore, Karnataka, explore different financing options, compare loan terms, and choose the right lender to support your business journey.

0 notes

Text

How Solar Power Can Help Businesses Thrive

Solar energy is a lifesaver in today’s age, and the solar power plant is just the invention that makes use of it.

Understanding the functioning of a solar power plant will make you realise it is very similar to photosynthesis, except it is a non-living thing!

Sustainability and cost efficiency are rarely an option in today's fast-changing world; they are vital.

In this era, solar power has emerged as the most revolutionary thing for the companies that are focusing on shrinking operational costs, creating a higher brand reputation, and 'greening' the planet.

As already mentioned, a solar power plant is a plant that uses photovoltaic panels or CSP systems to produce electricity from sunlight.

They are capable of generating electricity on a large scale without compromising on energy security or the environment.

It may help reduce businesses' costs, making it their growth tool in a competitive market.

1. Really Large Savings

Increasing business and lowering costs was one of the most viable points for organizations to turn to harnessing solar power-energy costs.

Once solar panels are established, businesses can use solar electricity in them and depend less upon grid electricity.

It ultimately curtails energy bills and makes them lean, thus affecting the final result, especially for power-hungry industries.

Generally, savings borne by the installation prove more than installing costs, hence good ROI.

2. Energy Independently Stable

With variations in available electricity prices, it becomes hard for a business to gauge and control its energy costs.

Use of solar power helps an organization manage stable and predictable costs, thereby enabling freedom of energy.

Making and distributing one's own power guarantees protection against a possible price soar on energy demand, as well as assured prospects of having no power cut-offs.

3. Government Support, Benefit to Taxes

Most countries support the cause of adopting renewable energy through a series of financial support schemes.

Governments come forward with different kinds of support, including subsidies, tax credits, and accelerated depreciation.

In many countries, for example, India, net metering is a scheme that allows businesses to sell excess power back to the grid and thus earns further when it comes to economic benefits.

4. Improved Brand Reputation

Consumers and investors increasingly prefer companies that demonstrate environmental responsibility.

By adopting solar energy, businesses can showcase their commitment to sustainability, reducing their carbon footprint and aligning with global ESG (Environmental, Social, and Governance) goals.

This not only improves brand reputation but also attracts eco-conscious customers and partners.

5. Enhanced Property Value

Installing solar panels can increase the value of commercial properties. Buyers and tenants often view solar-equipped buildings as more attractive due to the lower operating costs and environmental benefits.

This makes solar power an excellent investment for businesses that own their premises.

6. Support for Corporate Social Responsibility (CSR)

Corporate social responsibility (CSR) is becoming a crucial part of business strategy. Investment in solar energy aligns with CSR initiatives by promoting sustainable practices and benefiting local communities.

7. Compliance with Regulations

Governments worldwide are introducing stricter regulations to curb carbon emissions. By switching to solar energy, businesses can ensure compliance with these regulations, avoiding penalties and staying ahead of the curve in adopting sustainable practices.

8. Job Creation and Local Economic Growth

Solar energy projects contribute to job creation in the local economy. By investing in solar installations, businesses can support skilled and unskilled labor in their region, fostering economic growth and strengthening community ties.

Conclusion

Switching to solar power is more than just an environmentally friendly choice; it is a smart business decision.

From reducing energy costs to enhancing brand value and ensuring regulatory compliance, solar power offers numerous advantages for businesses of all sizes and industries.

As the world moves towards a greener future, companies that embrace solar energy will not only thrive financially but also contribute meaningfully to a sustainable world.

Contact us to learn more!

#leading solar energy company in surat#solar epc company#solar epc solution provider in surat#best solar epc company in surat#leading solar energy company in gujarat#industrial solar power plants in surat#solar energy solutions#solar power system#soalr power company#solar power plants

0 notes

Text

Unlock Your Career Potential with Kirloskar PGDM Placements: A Student’s Perspective

In today’s fast-paced and competitive business world, securing a solid start to your career is more crucial than ever. Kirloskar Institute of Management, renowned for its commitment to excellence and innovation in education, offers a Post Graduate Diploma in Management (PGDM) program that has consistently empowered students to achieve their career aspirations. Among its many highlights, the stellar placement opportunities at Kirloskar stand out as a testament to its promise of delivering industry-ready professionals. Let’s explore how Kirloskar’s PGDM placements unlock career potential from the perspective of a student.

The Kirloskar Advantage: Bridging Academics and Industry Needs

As a PGDM student at Kirloskar, you’re not just gaining a theoretical education; you’re diving into an ecosystem that bridges the gap between academic learning and real-world application. The institute’s curriculum is meticulously designed to align with current industry trends, ensuring students acquire the skills and knowledge that employers demand. From case studies and live projects to internships and guest lectures, every facet of the program prepares you to step confidently into the professional realm.

The placement process at Kirloskar is a carefully orchestrated journey that begins long before the final placement season. The institute’s dedicated Career Management Team works tirelessly to groom students for success, offering workshops on resume building, interview preparation, group discussions, and personality development. As a student, this support instills a sense of confidence and readiness to face recruitment challenges.

Diverse Opportunities Across Industries

One of the standout features of Kirloskar’s placement program is the diversity of opportunities it offers. From finance and marketing to operations, human resources, and analytics, the PGDM program opens doors to a wide array of industries and roles. Top recruiters, including leading multinational corporations, startups, and Indian business giants, are regular participants in the placement drive. For students, this means access to a plethora of options to match their career aspirations and areas of interest.

For instance, as a finance enthusiast, you may find yourself engaging with prestigious firms like Deloitte, EY, or KPMG. On the other hand, if marketing excites you, global brands such as Nestlé, Unilever, or Amazon might be your future workplace. This industry exposure not only enhances your learning curve but also provides you with a solid platform to showcase your capabilities.

A Transformative Journey: From Campus to Corporate

Every student’s placement journey at Kirloskar is transformative. Picture this: a once-reserved student now confidently articulating ideas during an interview with a Fortune 500 company, thanks to the grooming received during the program. This transformation is not accidental; it’s the result of Kirloskar’s emphasis on holistic development.

As a Kirloskar PGDM student, you’re encouraged to engage in extracurricular activities, participate in student clubs, and take on leadership roles. These experiences not only add value to your resume but also nurture essential soft skills like teamwork, problem-solving, and communication. By the time you enter the placement season, you’re not just a graduate; you’re a well-rounded professional ready to make an impact.

Alumni Speak: Real Stories of Success

The success stories of Kirloskar alumni serve as powerful inspiration for current and prospective students. Alumni frequently share their experiences of how the PGDM program and placement support helped them achieve their career goals. From securing dream jobs at leading companies to climbing the corporate ladder, their journeys underscore the effectiveness of Kirloskar’s placement initiatives.

Take, for example, an alumnus who credits their current role as a senior marketing manager to the rigorous preparation and industry exposure received at Kirloskar. Another alumnus in a top consulting firm highlights how the case study method honed their analytical thinking, a skill that became instrumental in their career advancement. Such stories reaffirm the institute’s commitment to nurturing talent and fostering success.

Your Gateway to a Brighter Future

Kirloskar Institute of Management’s PGDM placements are more than just a recruitment process; they are a gateway to a brighter, more fulfilling career. As a student, the program empowers you with the tools, knowledge, and confidence needed to navigate the professional world with ease. The placement drive serves as a launchpad, propelling you toward opportunities that align with your ambitions.

If you’re aspiring to unlock your career potential, Kirloskar’s PGDM program is the perfect choice. It’s not just about securing a job; it’s about embarking on a transformative journey that equips you to excel in the ever-evolving business landscape. Are you ready to take the first step toward a successful career? Join Kirloskar and let the journey begin!

0 notes

Text

Best Business Loan Services in Jalgaon, Maharashtra

Best Business Loan Services in Maharashtra: A Comprehensive Guide

Starting and running a business is a challenging yet rewarding endeavor, and one of the most critical elements in building a successful business is access to capital. Whether you're looking to expand your operations, invest in new equipment, or simply maintain a healthy cash flow, business loans can provide the necessary financial support. In Maharashtra, a state that is home to bustling metropolitan areas like Mumbai, Pune, and Nashik, there are numerous options for business owners seeking financial assistance.

In this article, we will explore the best business loan services in Maharashtra, discussing key factors to consider when choosing a loan provider and the different types of loans available for entrepreneurs in the region.

Why Maharashtra is a Hub for Business Loans

Maharashtra is one of India’s most industrially developed states, home to a diverse range of businesses, from startups to large corporations. The state is a prime location for business owners seeking to secure funding due to its economic importance and robust financial infrastructure. Mumbai, the financial capital of India, is filled with banks, financial institutions, and lending agencies, making it easy for business owners in Maharashtra to access business loan services.

Besides large banks and government schemes, several non-banking financial companies (NBFCs), fintech startups, and peer-to-peer (P2P) lending platforms have emerged, creating a competitive landscape that benefits business owners. This environment enables entrepreneurs to choose from a wide variety of loan products designed to meet different business needs, whether they are starting small ventures or expanding established businesses.

Key Factors to Consider When Choosing a Business Loan Service

When seeking the best business loan services in Maharashtra, there are several factors that business owners must consider before making their decision:

1. Loan Amount and Repayment Terms

Different lenders offer varying loan amounts, repayment terms, and interest rates. When choosing a loan, it’s important to determine how much capital your business needs and whether the lender can meet that requirement. Additionally, look for repayment terms that align with your cash flow, as a short repayment period with high monthly payments may be difficult to manage.

2. Interest Rates and Fees

Interest rates play a crucial role in determining the overall cost of the loan. Some loan services offer competitive interest rates, while others may charge higher rates due to various risk factors. In addition to interest rates, be sure to check for hidden charges such as processing fees, prepayment penalties, or late payment fees that may add to the total cost of borrowing.

3. Loan Eligibility

Eligibility criteria vary widely between lenders. Some may require a strong credit score, while others may be more flexible and offer loans to businesses with less-than-perfect credit histories. It's important to ensure that you meet the eligibility requirements before applying for a loan to avoid unnecessary rejections or delays.

4. Loan Processing Time

In today’s fast-paced business environment, time is of the essence. The best business loan services in Maharashtra are those that provide quick disbursement of funds. Depending on the type of loan, some lenders can process and disburse funds within a few days, while others may take longer. A fast loan approval process is crucial for businesses facing urgent financial needs.

5. Flexibility and Customization

A one-size-fits-all approach doesn't work when it comes to business loans. Look for lenders who offer flexible loan options that can be customized to suit your specific business needs. This could mean adjusting repayment schedules or providing loan amounts based on your business’s cash flow cycles.

6. Customer Support and Service

When applying for a business loan, it’s important to choose a lender that offers excellent customer service. This includes clear communication, prompt responses to inquiries, and assistance throughout the loan application process. A business loan provider with excellent support will help you navigate any challenges you face while managing your loan.

Types of Business Loans Available in Maharashtra

Business owners in Maharashtra have access to a variety of loan products to help meet their specific financial needs. These include traditional loans from banks, as well as alternative financing options such as loans from NBFCs, online lenders, and government-backed schemes.

1. Term Loans

Term loans are one of the most common forms of business loans. They provide a lump sum amount of capital that must be repaid over a fixed period, usually ranging from one to five years. These loans can be used for a variety of business needs, such as purchasing equipment, expanding operations, or managing cash flow.

2. Working Capital Loans

For businesses that need funding to cover day-to-day operational expenses, working capital loans can be a good option. These loans are short-term and are typically used to finance things like inventory, salaries, and other recurring expenses. They are particularly useful for businesses that experience seasonal fluctuations in revenue.

#home loan#mortgage loan#loan against property#agriculture loan#new startup business loan#new startup project loan#new start up company loan#business loan#unsecured loan#secured loan

0 notes

Text

PLAN 2025 TAX WITH US

Unlock Your Tax Potential with Knowtaxx.com – Your Trusted Tax Consultancy Partner

In today’s fast-paced world, managing taxes has become more complex than ever. From staying updated with the latest tax laws to filing your returns on time, it can be a daunting task for many individuals and businesses. But don’t worry – Knowtaxx.com is here to make your tax journey stress-free and straightforward!

Why Choose Knowtaxx.com?

At Knowtaxx.com, we pride ourselves on being a trusted partner for all your tax-related needs. Whether you’re an individual looking for hassle-free tax filing or a business navigating corporate tax regulations, we have the expertise to guide you every step of the way.

With a team of seasoned professionals, we don’t just help you with compliance; we empower you with financial insights that can help you save money and grow. After all, your success is our priority.

“Tax Planning for 2025 – Maximize Your Refunds and Minimize Liabilities”

As 2025 approaches, it’s time to get a head start on your taxes. Planning early not only helps reduce stress but also ensures you don’t miss out on valuable deductions and credits.

Here are some trending tax tips from the experts at Knowtaxx.com:

Stay Updated with New Tax Regulations: The tax landscape changes every year, and 2025 is no different. From updated standard deductions to new tax brackets, understanding these changes is crucial.

Utilize Year-End Tax Strategies: Make the most of your 2024 earnings by contributing to retirement accounts, donating to charities, or making energy-efficient upgrades to your home before the year ends.

Maximize Tax Credits: Whether it’s education credits, childcare credits, or renewable energy incentives, Knowtaxx.com can help you identify and claim what you’re eligible for.

Plan for Self-Employment Taxes: Are you self-employed? Strategic planning can help reduce your taxable income and prepare you for quarterly payments.

How Knowtaxx.com Can Help

With Knowtaxx.com, you’re not just hiring a tax consultant; you’re partnering with a team that cares about your financial well-being. Our services include:

Comprehensive tax planning and filing for individuals and businesses.

Audit support and representation.

Strategic financial advice to optimize your tax savings.

Real-time updates on changes in tax regulations.

Join the Knowtaxx.com Community

We’re not just about crunching numbers; we’re about building relationships. Follow us on our social media channels for regular updates, expert tips, and a touch of tax humor!

🌐 Visit us at Knowtaxx.com to learn more.

Let’s make 2025 your most financially successful year yet – because at Knowtaxx.com, your peace of mind is our mission.

#TaxPlanningHelp#CorporateTaxTips#KnowYourTaxes#TaxConsultantOnline#BestTaxationBooks#FinancialSolutions#TaxFilingMadeEasy#TaxEducation#SaveWithTaxes#ServiceTaxHelp#limited#private#mumbai#tax#know#Knowtaxx

1 note

·

View note

Text

How Solar Panels Reduce Operating Costs for Businesses

In today's fast-paced business environment, every penny counts. Business owners are constantly seeking ways to minimise expenses while maximising efficiency. One of the most effective strategies gaining traction is adopting solar energy. In this blog post, we will explore how solar panels can significantly reduce operating costs for businesses, specifically highlighting the advantages of solar power installation in Melbourne.

Understanding Solar Power for Businesses

Solar power is derived from sunlight and converted into electricity through photovoltaic (PV) cells. This renewable energy source has become increasingly popular among businesses looking to cut operational costs. With rising electricity prices and a growing emphasis on sustainability, investing in solar panels is not just an environmentally friendly decision; it’s also a smart financial move.

The Financial Benefits of Solar Energy

Reduced Energy Bills

One of the most immediate benefits of solar panel installation is reducing energy bills. Businesses can significantly lower their reliance on the grid by generating electricity through solar panels. This independence means that during peak usage, businesses can utilise the energy they’ve produced, ultimately leading to substantial savings over time.

Tax Incentives and Rebates

In many regions, including Melbourne, government incentives and tax credits are available for businesses investing in renewable energy. These incentives can help offset the initial solar power installation costs, making it a financially viable option for many companies. By taking advantage of these programs, businesses can quickly recover a significant portion of their investment.

Predictable Energy Costs

Electricity prices can fluctuate dramatically, making it difficult for businesses to budget effectively. By switching to solar energy, companies can lock in their energy costs for years. The stability of solar energy pricing allows for better financial planning and forecasting, which is crucial for any business aiming for long-term success.

Long-Term Operational Efficiency

Embracing solar energy isn’t just a short-term solution; it’s a long-term investment that pays off over time. Here are a few ways solar panels contribute to operational efficiency:

1. Low Maintenance Costs

Once installed, solar panels require minimal maintenance. Regular cleaning and occasional inspections are generally all needed to keep them functioning optimally. This low maintenance requirement means that businesses can save on operational costs related to energy management.

2. Increased Property Value

Investing in solar power installation in Melbourne can enhance the overall value of your property. Many buyers are willing to pay a premium for buildings equipped with solar panels due to the long-term savings associated with them. This increase in property value can be particularly beneficial for businesses looking to expand or sell.

3. Enhanced Brand Image

Today’s consumers are more environmentally conscious than ever. Businesses can position themselves as responsible corporate citizens by adopting renewable energy solutions like solar panels. This commitment to sustainability can enhance brand reputation, attract eco-minded customers, and increase sales.

Overcoming Initial Investment Hurdles

While the upfront cost of solar power installation can be a barrier for some businesses, it’s essential to consider the long-term savings and benefits. Many financing options are available, including leasing, power purchase agreements, and loans designed for renewable energy projects. These options can make solar energy more accessible, allowing businesses to start saving on energy costs without the burden of a significant initial investment.

Conclusion

In conclusion, adopting solar panels is a powerful way for businesses to reduce operating costs while contributing to a sustainable future. The benefits of decreased energy bills, tax incentives, and a stable energy cost forecast make solar energy a compelling choice for cost-conscious business owners.

Moreover, with the added advantages of low maintenance, increased property value, and an enhanced brand image, investing in solar power installation in Melbourne is not just an environmentally responsible decision; it’s also financially savvy.

If you’re a business owner looking for ways to improve your bottom line, consider exploring the possibilities of solar energy. The transition to solar power could be the key to unlocking new levels of operational efficiency and cost savings for your business.

0 notes

Text

Optimizing Workspaces with Expert Facility Management Consulting by All Services Global

In today's fast-paced world, businesses across industries require streamlined operations and optimized resource management to stay competitive. Enter facility management services—a vital backbone for organizations to maintain operational excellence, ensure safety, and enhance employee productivity. At the forefront of this essential industry is All Services Global Pvt. Ltd., India’s first credit-rated facility management company. With a proven legacy since 1990, their expertise and innovative approach redefine how organizations manage their facilities.

What is Facility Management?

Facility management encompasses the coordination of workplace facilities, ensuring they are functional, efficient, and aligned with an organization's goals. It involves a wide range of services such as janitorial maintenance, environmental health and safety measures, building upkeep, and corporate support services.

The key to successful facility management is blending innovation with meticulous planning. This is exactly what All Services Global Pvt. Ltd. delivers through their comprehensive and customizable Facility Management Consulting Services.

Why Choose All Services Global for Facility Management?

Decades of ExpertiseEstablished in 1990 and rebranded in 2010, All Services Global brings over three decades of experience. Their services are backed by ISO 9001:2008 certification, ensuring quality and reliability.

Comprehensive Service PortfolioAll Services Global offers tailored facility management solutions including:

Janitorial Services: From daily cleaning to specialized maintenance like deep cleaning and polishing.

Building Maintenance: Preventive and corrective maintenance for HVAC systems, elevators, and more.

Corporate Support: Outsourcing services for office and administrative support.

Industrial Laundry: Cost-effective, energy-efficient laundry solutions for institutions.

Innovative ConsultingThe company’s Facility Management Consulting Services provide a structured, strategic approach to managing housekeeping and other services, ensuring efficiency, cost-effectiveness, and alignment with business goals.

Sustainability and TrainingAll Services Global emphasizes sustainability through energy-efficient systems and offers skill development programs, equipping underprivileged youth with vocational training.

Digital Transformation in Facility Management

In the digital era, businesses demand faster, smarter, and more agile solutions. All Services Global has embraced digital tools to streamline operations, reduce downtime, and enhance transparency. Whether through predictive maintenance or real-time service tracking, they ensure seamless service delivery, making them the preferred choice for organizations across sectors.

Benefits of Partnering with All Services Global

Cost Optimization: Efficient solutions tailored to reduce operational costs.

Expert Workforce: A highly trained team of over 8,000 professionals and supervisory staff.

Customized Solutions: Services designed to meet the unique needs of industries like healthcare, education, and pharmaceuticals.

Nationwide Reach: A robust presence in major cities like Mumbai, Delhi, Kolkata, and Hyderabad.

Conclusion

Facility management is no longer a back-office function; it is a strategic enabler of business success. With a focus on innovation, sustainability, and operational excellence, All Services Global Pvt. Ltd. sets a benchmark in facility management services. Whether you're looking for expert building maintenance, reliable janitorial services, or strategic consulting, they ensure your facilities run like a well-oiled machine.

Take the first step towards a smarter, more efficient workspace. Contact All Services Global today and discover how they can help your business thrive.

Contact Information: Phone: +91 22 4063 7777Website: https://allservicesglobal.com/

To stay updated with the latest posts, follow us on social media:

📸 Instagram

📘 Facebook

🐦 Twitter (X)

🔗 Linkedin

📌 Pinterest

🧵 Thread

🥁 Tumblr

❗ Reddit

Contact: ALL SERVICES GLOBAL +91-22 4063 7777 / +91- 22 4063 7788 https://allservicesglobal.com/

Digital Partner:

TVM INFO SOLUTIONS PVT LTD

Contact: TVM Info Solutions Pvt. Ltd.

+91- 90045 90039

Follow us on Social Media

🌐 Website

📸 Instagram

📘 Facebook

🔗 Linkedin

▶️ Youtube

#Facility management services#All Services Global Pvt. Ltd.#Facility Management Consulting#Janitorial services#Corporate support solutions#Building maintenance services#Sustainability in facility management.

0 notes

Text

Boost Your Venture with Shelf Corporations with Credit Ready

For entrepreneurs and business enthusiasts looking to accelerate their company’s growth, Shelf Corporations with Credit can be a powerful asset. These entities are pre-formed companies, often years old, that come with an established business history and sometimes even pre-built credit profiles. Whether you’re aiming to secure funding faster or want to gain credibility in the eyes of potential clients and lenders, these shelf corporations can provide a unique advantage.

What Are Shelf Corporations with Credit?

A Shelf Corporation with Credit is essentially a ready-made business that’s been registered and allowed to "age" on a legal shelf. These companies are inactive but fully compliant, giving business owners a head start by offering them a structure with an established credit profile. Imagine skipping the lengthy and often complex startup phase, including the process of establishing good credit from scratch. That’s the benefit shelf corporations offer—they’re like a fast pass to business legitimacy.

Why Choose a Shelf Corporation with Credit?

Many new businesses face hurdles when trying to secure funding or favorable terms with lenders and suppliers. Lenders often require at least two years of operational history and credit, which can be challenging for startups. A shelf corporation can bypass these limitations by providing a company history that instills confidence in creditors.

For example, let's say a business owner wants to expand their business but doesn't meet the typical age requirements for a loan. By acquiring a shelf corporation, they may immediately meet these criteria and be considered for the financing they need.

How Do Shelf Corporations Build Business Credibility?

Credibility is crucial when building business relationships. A shelf corporation allows you to start with a history that proves stability, which can be essential when negotiating contracts with clients, vendors, or partners. The company’s age demonstrates to outsiders that it's not a new, high-risk entity, which often leads to better contract terms and larger credit lines.

Consider this: if you were a client looking for services, wouldn’t you be more inclined to work with a company established three years ago than a brand-new startup? The same logic applies to lenders and other business stakeholders. A shelf corporation with credit can be a quick, effective way to gain a professional image and even establish trust in competitive markets.

Are Shelf Corporations Legal and Safe?

One common question is whether Shelf Corporations with Credit are entirely legal. The answer is yes, as long as they’re acquired from reputable providers who ensure all filings and registrations are up to date. These companies are carefully structured to be fully compliant, meaning business owners can enjoy peace of mind as they begin operations. However, it’s essential to purchase these corporations from trusted sources, as this ensures the company has been maintained responsibly and without any negative credit history.

How to Find the Right Shelf Corporation with Credit

Choosing the right shelf corporation is all about finding one that matches your business goals. Some have credit profiles ready to use, while others provide only the aging benefit. Business owners should assess their needs—do they need a strong credit history right away, or are they more focused on company age? Research is vital, but so is finding a reliable seller.

For those exploring Shelf Corporations with Credit, WholesaleShelfCorporations.com offers a range of options that cater to various business needs. This website provides corporations with strong histories and credit-ready profiles, ideal for entrepreneurs looking to jumpstart their ventures without delays.

Take Your Venture Further with Shelf Corporations

In business, time is money, and Shelf Corporations with Credit can save entrepreneurs significant time by eliminating the startup phase. Instead of spending months or even years building a credit score, these pre-established entities allow business owners to take immediate action and start applying for loans, securing vendors, and gaining client trust right from the start. With an option as resourceful as shelf corporations, you can take a big leap forward with minimal initial hassle—setting the foundation for long-term success.

0 notes

Text

Why Buying an Aged Company Could Be Your Smartest Business Move Yet

Introduction - Starting a business can be a long and challenging process, especially when you need to establish credibility and build a customer base from the ground up. But what if there was a way to skip the initial hurdles and start with an advantage? Buying an aged company provides exactly that. With a pre-established business entity, you can fast-track your entrepreneurial journey and enjoy benefits like enhanced credibility and easier access to financing. In this blog, we’ll discuss why buying an aged company from BSC Shelf Companies could be your smartest business decision and how it can help you hit the ground running.

1. What is an Aged Company?

An aged company, also known as a "shelf company" or "aged corporation," is a business entity that was registered at an earlier date but hasn’t conducted any commercial activity. The term "aged" refers to the time since the company’s registration, meaning it could be several months to several years old. These companies have a clean history and are legally compliant, making them ready to be activated by a new owner.

2. The Advantages of Buying an Aged Company

Purchasing an aged company offers multiple benefits that can help you launch or grow your business faster: