#how much does it cost to buy and sell bitcoin

Explore tagged Tumblr posts

Text

What Is the Cash App BTC Withdrawal Limit After Verification?

Cash App Bitcoin offers an accessible cost-effective method for you to invest in cryptocurrency without spending massive sums up front. Acting like a piggy bank, it enables you to save small change for Bitcoin while encouraging financial discipline and rewarding saving practices. However, you must keep in mind the limits placed on the Cash App BTC withdrawals. Once you have verified your Cash App account you can withdraw up to $5,000 worth of cryptocurrency per day (reset 24 hours).

Moreover, to increase Bitcoin withdrawal limit on Cash App, it is necessary to go through identity verification process by providing documents and passing security checks. As this may take several days, make sure to plan and be organized when starting this steps o verification. You can even directly contact the customer support team, to request for raising the BTC withdrawal limits.

What Is Cash App’s Bitcoin Feature?

Cash App is an all-in-once platform to manage money, as users can transfer and receive funds, purchase items, and invest in stocks its entire platform. In addition, Cash App allows users to buy/sell/store bitcoin as part of its new features which makes it ideal for those familiar with cryptocurrency as well as those just getting started in this sector.

Cash App users can purchase Bitcoin directly in the app. Furthermore, this feature provides adaptability by enabling transfers into external accounts - offering users the possibility of sending it securely or participating in cryptocurrency trading activities.

Cash App imposes withdrawal limits for Bitcoin transfers, so understanding these constraints is critical if using the platform frequently to conduct cryptocurrency transactions.

Why Does Cash App Have BTC Withdrawal Limits?

The Cash App BTC withdrawal limits are placed primarily for the security concerns. There may be various other reasons for Cah App’s restrictions in regards to withdrawing Bitcoin:

Crypto transactions are irreversible, meaning once completed they cannot reverse. This is reason can place limits to reduce unauthorized transactions.

Cash App, as a financial service, must abide by regulations and laws surrounding cryptocurrency. These depend on where it operates, with some locations having specific withdrawal limits set as part of an AML/KYC plan.

Bitcoin, as with other cryptocurrencies, can be highly unpredictable and withdrawals of large sums can create risks to both an individual user as well as to the Cash App. And limits on Cash App BTC withdrawals can help mitigate sudden shifts on the cryptocurrency market.

Moreover, by restricting how much Bitcoin can be taken out prior to verification, Cash App lowers the risk of victims being scammed or exploited.

What Is the BTC Withdrawal Limit Before Verification?

Cash App users have a lower withdrawal limit in Bitcoin transactions before their accounts is verified. Notably, the Cahs App Bitcoin withdrawal limits for verified account holders are generally set at $2,000 for a week. This limit serves to protect users by preventing large, unconfirmed withdrawals without verification. Regardless, unverified accounts still allow Bitcoin purchases and deposits through Cash App but they will remain considerably lower until identity has been verified.

What Is the BTC Withdrawal Limit After Verification?

Once, you have verified your identity and confirmed who you are, Cash App will significantly raise your Bitcoin withdrawal limits. The weekly BTC withdrawals limits for verified Cash App users are up to $5,000 for a week. This Cash App BTC withdrawal limit after verification is higher and enables users to withdraw larger amounts.

Also, in mind that your Cash App Bitcoin limit may change depending on factors like account location, activity level and verification status. To gain the most accurate picture of what the actual limit for withdrawal might be for your specific withdrawal request is, verifying directly within the app is important.

How Do You Verify Your Identity on Cash App?

Verifying your identity with Cash App is an easy process that only requires providing certain personal details. Here is how you can do it and increase Cash App BTC withdrawal limit:

Open the Cash App on your smartphone.

Tap on the Profile icon in the upper left corner to open your settings menu.

Scroll down, and then select the “Personal” option.

As part of your verification process, you will be asked to provide some personal details, such as your full title of name and birth date as well as four digits which constitute your Social Security number.

Cash App may ask that you upload a picture of either your passport or driver's licence as proof of identity.

Once you have submitted the necessary details, Cash App will review them and complete its verification process within two or three business days.

Once you have been verified and authenticated, you will become eligible for increased Bitcoin withdrawal limits.

How to Withdraw Bitcoin (BTC) From Cash App?

You can withdraw Bitcoin (BTC) from Cash App by taking the steps mentioned below:

Open the Cash App on your smartphone.

Visit on the Bitcoin section and tap on its icon located in the lower-right corner.

Click on the “Withdraw Bitcoin”, once selected, you have the option of withdrawing your Bitcoin into an external account.

After the enter the Bitcoin address of the wallet where you wish to transfer your BTC.

At last, recheck all the details and before you confirm the transfer.

How to Check Your Current BTC Withdrawal Limit

You check check your BTC withdrawal limit on Cash App by taking steps mentioned below mentioned:

Open the Cash App on your mobile phone.

Go to the Bitcoin icon

Once in the Bitcoin section you will see your current withdrawal limit and choose whether to proceed or not.

Can You Increase Your BTC Withdrawal Limit?

Yes, you can increase BTC withdrawal limits on Cash App by verifying your identity. Once verified, it will your Cash App BTC withdrawal limits up to $5,000 per week and this maximum withdrawal amount allowed. You can even raise the BTC withdrawal limit by linking a bank account or debit card with Cash App. Moreover, if any issues arise related to verification or withdrawal limits, you must contact rhe Cash App customers support team.

How Do Cash App BTC Limits Compare to Other Apps?

When you compare the Cash App’s Bitcoin withdrawal limits with those of other platforms and Cash App's $5,000 BTC withdrawal limit is relatively generous. Even among popular cryptocurrency applications such as Coinbase or Gemini which might offer similar or even slightly higher limits. Cash App stands out with its user-friendly mobile-first user interface and simplified setup process; other exchanges may provide higher withdrawal limits by offering additional verification or connecting directly to bank accounts of your choosing.

What are the Common Issues with BTC Withdrawals on Cash App?

Here are some of the common issues you can face while withdrawing Bitcoin via Cash App includes:

Always recheck the require details such as wallet address, amount of BTC and bank account before initiating the withdrawals on Cash App.

Sometimes there can issues in BTC withdrawals duet to technical issues and network congestion.

Make sure your Cash App account is verified so that you have higher BTC withdrawal limits.

Is There a Daily or Weekly BTC Withdrawal Limit?

Cash App does not impose daily withdrawal limits for Bitcoin withdrawal. Instant, they offer a weekly limit of $5,000 BTC for accounts verified with Cash App and weekly limits that reset every 7 days.

Final Thought

Cash App's Bitcoin withdrawal limits are put in place in withdrawals from Cash App wallets. Although unverified accounts typically have lower limits, verification of identity can open higher withdrawal limits which are up to $5,000 per week. Therefore, you must get verified on Cash App, to raise BTC withdrawals limits on Cash App.

2 notes

·

View notes

Text

How to Develop a P2P Crypto Exchange and How Much Does It Cost?

With the rise of cryptocurrencies, Peer-to-Peer (P2P) crypto exchanges have become a popular choice for users who want to trade digital assets directly with others. These decentralized platforms offer a more secure, private, and cost-effective way to buy and sell cryptocurrencies. If you’re considering building your own P2P crypto exchange, this blog will guide you through the development process and give you an idea of how much it costs to create such a platform.

What is a P2P Crypto Exchange?

A P2P crypto exchange is a decentralized platform that allows users to buy and sell cryptocurrencies directly with each other without relying on a central authority. These exchanges connect buyers and sellers through listings, and transactions are often protected by escrow services to ensure fairness and security. P2P exchanges typically offer lower fees, more privacy, and a variety of payment methods, making them an attractive alternative to traditional centralized exchanges.

Steps to Develop a P2P Crypto Exchange

Developing a P2P crypto exchange involves several key steps. Here’s a breakdown of the process:

1. Define Your Business Model

Before starting the development, it’s important to define the business model of your P2P exchange. You’ll need to decide on key factors like:

Currency Support: Which cryptocurrencies will your exchange support (e.g., Bitcoin, Ethereum, stablecoins)?

Payment Methods: What types of payment methods will be allowed (bank transfer, PayPal, cash, etc.)?

Fees: Will you charge a flat fee per transaction, a percentage-based fee, or a combination of both?

User Verification: Will your platform require Know-Your-Customer (KYC) verification?

2. Choose the Right Technology Stack

Building a P2P crypto exchange requires selecting the right technology stack. The key components include:

Backend Development: You'll need a backend to handle user registrations, transaction processing, security protocols, and matching buy/sell orders. Technologies like Node.js, Ruby on Rails, or Django are commonly used.

Frontend Development: The user interface (UI) must be intuitive, secure, and responsive. HTML, CSS, JavaScript, and React or Angular are popular choices for frontend development.

Blockchain Integration: Integrating blockchain technology to support cryptocurrency transactions is essential. This could involve setting up APIs for blockchain interaction or using open-source solutions like Ethereum or Binance Smart Chain (BSC).

Escrow System: An escrow system is crucial to protect both buyers and sellers during transactions. This involves coding or integrating a reliable escrow service that holds cryptocurrency until both parties confirm the transaction.

3. Develop Core Features

Key features to develop for your P2P exchange include:

User Registration and Authentication: Secure login options such as two-factor authentication (2FA) and multi-signature wallets.

Matching Engine: This feature matches buyers and sellers based on their criteria (e.g., price, payment method).

Escrow System: An escrow mechanism holds funds in a secure wallet until both parties confirm the transaction is complete.

Payment Gateway Integration: You’ll need to integrate payment gateways for fiat transactions (e.g., bank transfers, PayPal).

Dispute Resolution System: Provide a system where users can report issues, and a support team or automated process can resolve disputes.

Reputation System: Implement a feedback system where users can rate each other based on their transaction experience.

4. Security Measures

Security is critical when building any crypto exchange. Some essential security features include:

End-to-End Encryption: Ensure all user data and transactions are encrypted to protect sensitive information.

Cold Storage for Funds: Store the majority of the platform's cryptocurrency holdings in cold wallets to protect them from hacking attempts.

Anti-Fraud Measures: Implement mechanisms to detect fraudulent activity, such as IP tracking, behavior analysis, and AI-powered fraud detection.

Regulatory Compliance: Ensure your platform complies with global regulatory requirements like KYC and AML (Anti-Money Laundering) protocols.

5. Testing and Launch

After developing the platform, it’s essential to test it thoroughly. Perform both manual and automated testing to ensure all features are functioning properly, the platform is secure, and there are no vulnerabilities. This includes:

Unit testing

Load testing

Penetration testing

User acceptance testing (UAT)

Once testing is complete, you can launch the platform.

How Much Does It Cost to Develop a P2P Crypto Exchange?

The cost of developing a P2P crypto exchange depends on several factors, including the complexity of the platform, the technology stack, and the development team you hire. Here’s a general cost breakdown:

1. Development Team Cost

You can either hire an in-house development team or outsource the project to a blockchain development company. Here’s an estimated cost for each:

In-house Team: Hiring in-house developers can be more expensive, with costs ranging from $50,000 to $150,000+ per developer annually, depending on location.

Outsourcing: Outsourcing to a specialized blockchain development company can be more cost-effective, with prices ranging from $30,000 to $100,000 for a full-fledged P2P exchange platform, depending on the complexity and features.

2. Platform Design and UI/UX

The design of the platform is crucial for user experience and security. Professional UI/UX design can cost anywhere from $5,000 to $20,000 depending on the design complexity and features.

3. Blockchain Integration

Integrating blockchain networks (like Bitcoin, Ethereum, Binance Smart Chain, etc.) can be costly, with development costs ranging from $10,000 to $30,000 or more, depending on the blockchain chosen and the integration complexity.

4. Security and Compliance

Security is a critical component for a P2P exchange. Security audits, KYC/AML implementation, and regulatory compliance measures can add $10,000 to $50,000 to the total development cost.

5. Maintenance and Updates

Post-launch maintenance and updates (bug fixes, feature enhancements, etc.) typically cost about 15-20% of the initial development cost annually.

Total Estimated Cost

Basic Platform: $30,000 to $50,000

Advanced Platform: $70,000 to $150,000+

Conclusion

Developing a P2P crypto exchange requires careful planning, secure development, and a focus on providing a seamless user experience. The cost of developing a P2P exchange varies depending on factors like platform complexity, team, and security measures, but on average, it can range from $30,000 to $150,000+.

If you're looking to launch your own P2P crypto exchange, it's essential to partner with a reliable blockchain development company to ensure the project’s success and long-term sustainability. By focusing on security, user experience, and regulatory compliance, you can create a platform that meets the growing demand for decentralized crypto trading.

Feel free to adjust or expand on specific details to better suit your target audience!

2 notes

·

View notes

Text

Build a Crypto Exchange Platform: Features, Cost, and Timeline

Introduction to the Crypto Exchange Craze

Cryptocurrency is no longer just a buzzword—it’s a booming industry. From Bitcoin to altcoins, the demand for trading digital assets has skyrocketed. If you’ve been thinking about diving into this space, building a crypto exchange platform might just be your golden ticket.

But hold on—what does it really take to build a platform like Binance or Coinbase? In this guide, we’ll walk through everything: features you need, how much it’ll cost, how long it’ll take, and the juicy bits in between.

Why You Should Build a Crypto Exchange Platform

The Rising Demand for Digital Currency

Let’s face it—crypto is here to stay. With millions of users and trillions in market value, the appetite for a secure and reliable trading platform is only growing. People want in, and they need platforms to help them get there.

Profitable Business Model

Transaction fees, listing fees, and premium features—just a few ways your exchange can generate revenue. And unlike traditional finance, crypto runs 24/7. That means your income doesn’t sleep.

Types of Crypto Exchanges

Before jumping in, it’s important to choose the right exchange model that aligns with your vision.

Centralized Exchange (CEX)

These are run by companies that manage users’ funds. Think of Coinbase. Easy to use, but you’re responsible for a lot—including security.

Decentralized Exchange (DEX)

No central authority. Traders use smart contracts to execute deals. It’s safer in terms of custody but can be complex for users.

Hybrid Exchange

A combo of both. You get the user-friendliness of a CEX with the security of a DEX. Best of both worlds? Possibly.

Key Features of a Crypto Exchange Platform

A successful platform isn’t just a trading page—it’s an entire ecosystem. Here’s what it must include:

User Registration and Verification

Your users should register easily. Include email/phone verification and secure sign-up options.

Secure Wallet Integration

Hot wallets for instant access and cold wallets for safer storage. Multi-signature wallets are a plus.

Trading Engine

This is your heartbeat. It matches buy/sell orders and handles pricing and execution in milliseconds.

Admin Panel

To control operations, users, fees, listings—you name it. A robust backend makes your life a whole lot easier.

Liquidity Management

Without liquidity, users can’t trade efficiently. Integrate with external liquidity providers if needed.

Multi-Currency Support

Support for Bitcoin, Ethereum, and multiple altcoins makes your exchange more versatile.

Real-Time Analytics

Let users view their portfolio, market movements, and historical data on the fly.

KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are a must in most regions.

Two-Factor Authentication (2FA)

Security should never be optional. 2FA adds a much-needed layer to prevent hacks.

Step-by-Step Process to Build a Crypto Exchange

Let’s break down the journey:

Step 1: Market Research and Planning

Understand your target audience. Do you want to serve advanced traders or crypto newbies?

Step 2: Legal Framework and Licensing

Check regional regulations. You may need licenses depending on where you operate.

Step 3: Choose the Right Development Approach

Custom development? White-label solutions? Decide based on budget, timeline, and scalability.

Step 4: UI/UX Design

Clean, intuitive interfaces convert users. Don’t skimp on this—first impressions matter.

Step 5: Back-End and Blockchain Development

This is where the magic happens. Smart contract integration, wallet development, and trading engine setup all come in here.

Step 6: Testing and Security Audits

Run stress tests, penetration tests, and bug bounties to ensure everything’s solid.

Step 7: Launch and Marketing

Deploy your platform and spread the word through social media, influencers, and crypto forums.

Technology Stack Required

Let’s get technical for a second.

Front-End

React.js or Angular for smooth UI

HTML5, CSS3, and Bootstrap for responsiveness

Back-End

Node.js or Python for speed and scalability

PostgreSQL or MongoDB for databases

Blockchain Integration

Ethereum, Solana, or BNB Smart Chain for token support

APIs for wallet, price feeds, and liquidity

Cost Breakdown of Building a Crypto Exchange

Now for the big question: how much does it cost?

Development Team and Resources

A skilled team is key:

Project Manager

UI/UX Designer

Front-end & Back-end Developers

Blockchain Developer

QA/Test Engineer 💰 Estimated: $40,000 to $100,000

Infrastructure Costs

Servers, databases, and hosting platforms:

AWS or Google Cloud 💰 Estimated: $5,000–$20,000/year

Licensing and Legal Fees

Depends on jurisdiction: 💰 Estimated: $10,000–$50,000

Security and Compliance Tools

Firewalls, DDoS protection, encryption tools: 💰 Estimated: $5,000–$30,000

Total Estimated Cost: $60,000 to $200,000+ depending on scope and scale.

Timeline for Building a Crypto Exchange

Time is money, right? Here’s how long each phase might take.

Phase 1: Research and Planning (2–3 Weeks)

Business modeling, user personas, legal groundwork.

Phase 2: Design and Development (2–3 Months)

UI/UX and backend infrastructure.

Phase 3: Testing and QA (3–4 Weeks)

Detect and fix bugs, test under load, security audits.

Phase 4: Deployment and Launch (1–2 Weeks)

Final deployment and go-live strategy.

Total Estimated Timeline: 4–6 months

Common Challenges and How to Overcome Them

Regulatory Uncertainty

Stay informed. Work with legal experts in crypto regulations.

Security Threats

Invest in security from day one. Use best practices and external audits.

Market Competition

Differentiate. Offer unique features like lower fees or staking options.

Benefits of Hiring a Crypto Exchange Development Company

You don’t have to go it alone.

Expertise and Experience

Professional developers bring in-depth knowledge and technical skillsets.

Faster Time to Market

Agencies already have frameworks and teams in place.

Cost-Efficiency

Avoid trial and error. Save time and money in the long run.

Conclusion

Building a crypto exchange platform is no small feat—but it’s absolutely doable. With the right features, a smart budget, and a clear plan, your exchange could become the next big name in crypto.

Whether you want to cater to hardcore traders or simplify crypto for everyday users, this guide gives you the blueprint to make it happen. So, what are you waiting for? The world of crypto isn’t slowing down, and neither should you.

FAQs

1. How much does it cost to build a crypto exchange? It typically ranges from $60,000 to $200,000+, depending on the platform's complexity, features, and development team.

2. How long does it take to build a crypto exchange platform? Most platforms can be developed in about 4 to 6 months from start to finish.

3. Is it legal to launch a crypto exchange? Yes, but it depends on local regulations. You may need licenses and must comply with AML/KYC laws.

4. What’s the best type of crypto exchange to build? It depends on your goals. Centralized exchanges are easier to manage, while decentralized ones offer more security and privacy.

5. Can I use a white-label solution for faster development? Absolutely. White-label solutions save time and money, though they may offer limited customization compared to custom development.

#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptocurrencyExchangeDevelopment#ShamlaTech#CryptoExchange#BlockchainSolutions#CryptoBusiness#CryptoDevelopment

0 notes

Text

Cost to Develop a Cryptocurrency Exchange: Key Factors & Estimates

Importance of the Topic

With the growing global interest in digital currencies, launching a cryptocurrency exchange has become an attractive business opportunity. However, one of the most critical questions entrepreneurs face is: how much does it actually cost to build one? Understanding this helps in budget planning, avoiding costly surprises, and building a compliant, scalable platform.

Quote

“The crypto market rewards those who build trust and usability—not just hype.” — Andreas M. Antonopoulos, Bitcoin Advocate & Author

1. Introduction

The rise of digital assets has made digital currency exchanges the backbone of the Web3 economy. Whether you’re a startup founder, fintech investor, or blockchain enthusiast, launching a crypto exchange seems lucrative—but it’s not cheap. The development cost can vary dramatically depending on features, technology, and compliance. Let’s explore the real price tag behind building a full-fledged cryptocurrency trading platform.

2. What Is a Cryptocurrency Exchange?

In simple terms, it’s a platform where users can buy, sell, or trade digital currencies. There are mainly three types:

Centralized Exchanges (CEX) – managed by a central authority.

Decentralized Exchanges (DEX) – powered by smart contracts.

Hybrid Exchanges – combine the best of both worlds.

Each type has different features and complexities, and that plays a huge role in the final cost.

3. Why Build a Cryptocurrency Exchange?

Besides being a booming market, owning a crypto exchange means recurring revenue through:

Trading fees

Withdrawal charges

Token listing fees

Subscription-based services

In a world going digital, crypto exchanges are the new-age stock markets.

4. Core Factors Influencing Development Cost

Type of Exchange and Its Impact on Cost

A decentralized exchange (DEX) generally costs less but requires blockchain expertise. A centralized one needs robust security and regulatory compliance, making it more expensive. Hybrid exchanges, although powerful, are the priciest to build.

Features That Add to the Budget

UI/UX Design

First impressions matter. A sleek, intuitive design can boost retention. A custom-designed front end might cost between $10,000–$25,000.

Wallet Integration

You’ll need both hot (online) and cold (offline) wallets. Integrating them securely can add $15,000–$40,000 to your bill.

Trading Engine

The brain of your platform—it matches buy/sell orders in real-time. Expect to spend $20,000–$50,000 here.

KYC/AML Compliance

Regulations demand user verification. Integrating third-party solutions like Onfido or Jumio might cost around $5,000–$15,000.

Development Methods

In-house Team – Total control, high cost.

Crypto Exchange Development Company – Experienced, reliable, moderately expensive.

Freelancers – Affordable, but risky.

White-label Crypto Exchange Software Development – Quick launch and cost-effective but less customizable.

5. Estimated Crypto Exchange Development Costs

These numbers are just ballpark figures. The actual cost depends on location, features, and complexity.

Development Option & Estimated Cost

In-house Team

$300,000 – $600,000+

Development Agency

$150,000 – $500,000

White-label Platform

$20,000 – $80,000

Freelancers

$10,000 – $50,000

6. Legal and Regulatory Expenses

You can’t run a digital currency exchange without licenses. Costs vary by country:

U.S. & U.K.: High ($50,000–$150,000)

Malta, Estonia, Singapore: Moderate ($10,000–$50,000)

Also, you’ll need legal help with compliance, terms of service, and privacy policies.

7. Ongoing Maintenance & Hidden Costs

Once you launch, you’ll still need to spend money. Here's where:

Server & Hosting: Cloud services (e.g., AWS, Azure)

Customer Support: 24/7 helpdesk

Security Audits: Regular checks and fixes

Marketing: Getting users on board

Monthly costs can range between $10,000 and $50,000 depending on scale.

8. Tips to Reduce Crypto Exchange Development Cost

Start Small with an MVP (Minimum Viable Product) Build the essentials first, add bells and whistles later.

Choose Offshore Developers Hiring a team from Asia or Eastern Europe can save up to 60% on development costs.

Use White-Label Solutions Ready-made platforms save time and money and are great for quick market entry.

Conclusion

Launching a cryptocurrency exchange isn’t cheap, but it’s one of the most rewarding digital ventures today. Depending on your choices, the crypto exchange development cost can vary from $20,000 to over $500,000. Whether you choose to go all-in with custom development or opt for a white-label solution, planning and execution are everything. Are you ready to make your mark in the crypto trading world?

#technology#crypto exchange clone development#wazirx clone script#crypto market#crypto exchange development script#nft crypto

0 notes

Text

Bitcoin Apex Reviews -Is It an Effective Solution? Tips for New Users

⭐ Overall Rating: 4.4/5 ⭐⭐⭐⭐☆

Ease of Use: ⭐⭐⭐⭐☆ (4.5/5)

AI Trading Features: ⭐⭐⭐⭐☆ (4.3/5)

Security: ⭐⭐⭐⭐☆ (4.4/5)

Customer Support: ⭐⭐⭐⭐☆ (4.2/5)

Profitability: ⭐⭐⭐⭐☆ (4.5/5)

👉 Open Your Bitcoin Apex Account Now

🔍 Introduction

In the ever-evolving landscape of cryptocurrency, platforms like Bitcoin Apex are emerging as top contenders for traders seeking automation and intelligent decision-making. As 2025 continues to shape the future of digital investing, many are asking: Is Bitcoin Apex a legit platform or another crypto scam? Let’s dive deep and find out.🚀 What is Bitcoin Apex?

Bitcoin Apex is an AI-powered cryptocurrency trading platform designed to automate buying and selling decisions based on real-time market analysis. It uses sophisticated algorithms to identify trends and execute trades on behalf of users, minimizing manual input while maximizing efficiency.

Whether you’re a beginner or an experienced trader, Bitcoin Apex is marketed as an easy-to-use platform that can help grow your crypto portfolio without requiring you to monitor the markets 24/7.🔑 Key Features

✔ AI-Driven Trade Execution – Reacts instantly to market shifts ✔ Real-Time Data Processing – Uses live market feeds to inform decisions ✔ User-Friendly Dashboard – Designed with intuitive navigation for beginners ✔ Demo Mode – Allows new users to practice risk-free ✔ Integrated Risk Management – Auto-adjusts position sizes based on volatility ✔ Multi-Asset Access – Trade BTC, ETH, LTC, and more⚙️ How Bitcoin Apex Works

Sign Up: Users create an account and complete a verification process.

Deposit Funds: The platform requires a minimum deposit (usually around $250).

Configure Settings: Customize risk levels, trade volume, and preferred assets.

Activate Auto-Trading: Let the AI bot execute trades on your behalf.

Monitor & Withdraw: Check profits and make withdrawals at any time.

The platform is designed to be set-and-forget, but regular monitoring is still recommended for optimal outcomes.✅ Pros and ❌ Cons✅ Pros:

Fast trade execution through AI automation

24/7 trading capability

Easy sign-up and user interface

Offers both auto and manual trading modes

Demo account available

❌ Cons:

No mobile app (browser-only platform)

Market risk still applies despite automation

Limited to partnered brokers for deposits and trades

🗣 "Bitcoin Apex helped me ease into crypto trading. The AI really does all the heavy lifting." – Jordan M.

🗣 "I've used other bots, but this one actually learns and adapts. Profit margin has been good so far." – Priya S.

🗣 "Great interface. I started with the demo and now trade live daily. No regrets." – Diego R.🔐 Is Bitcoin Apex Legit or a Scam?

Bitcoin Apex appears to be a legitimate trading platform that leverages AI to assist users in crypto trading. While no system can eliminate risk entirely, Bitcoin Apex stands out by offering transparency, encryption, and partnerships with regulated brokers.

There are no red flags or scam warnings from users in 2025 so far. However, users should always research their country’s crypto regulations and start small.

Final Verdict: ✅ Legit – A solid AI-powered platform with real results.❓ Frequently Asked Questions (FAQs)1. How much does it cost to use Bitcoin Apex?

There are no direct platform fees, but brokers may charge spreads or commissions. A minimum deposit of $250 is typically required.2. Can beginners use this platform?

Yes! Bitcoin Apex is designed with an easy interface and demo mode, making it perfect for first-time crypto traders.3. Is Bitcoin Apex safe?

Yes, the platform uses SSL encryption and works with verified brokers to ensure user security.4. What cryptocurrencies can I trade?

You can trade Bitcoin, Ethereum, Litecoin, and other major altcoins supported by partnered brokers.5. How soon can I withdraw profits?

Withdrawals are processed within 24–48 hours, depending on your chosen broker and payment method.6. Does Bitcoin Apex guarantee profits?

No trading platform can guarantee profits. Bitcoin Apex reduces the guesswork but market conditions can still affect outcomes.

Bitcoin Apex is making waves in the world of automated trading for good reason. With a robust AI engine, intuitive platform, and solid security framework, it's ideal for anyone looking to step into crypto with confidence in 2025.

Whether you're a cautious beginner or a fast-paced trader, Bitcoin Apex may just be the edge you need in today’s digital asset markets.

0 notes

Text

Income Tax on Cryptocurrency

If you’re into cryptocurrency, you already know the thrill of watching your digital coins go up in value. Bitcoin, Ethereum, Dogecoin — it’s a rollercoaster, and when you’re on the up, it feels fantastic. But then, tax season rolls around, and suddenly you’re left thinking: What about income tax on cryptocurrency? Do I really have to pay? And if yes, how much exactly?

You’re definitely not the only one scratching your head over this. With crypto becoming more popular in India, the government has stepped in to make sure those crypto gains don’t go untaxed. Whether you’ve just dipped your toes into crypto or you’re already knee-deep in trading, this guide is here to simplify it all.

We’ll walk you through income tax on cryptocurrency in India, break down how much income tax on cryptocurrency you should expect, and explain what is the income tax rate on cryptocurrency gains — all in plain English. No complicated jargon, just straight-up answers.

Ready? Let’s sort this out once and for all.

Why Does Crypto Tax Even Exist in India?

You might be wondering — why is there income tax on cryptocurrency in India at all?

The answer is pretty straightforward. The government sees crypto like any other asset: if you’re making money from it, they want their share of the pie. Think of it like shares or gold. If you buy crypto at a lower price and sell it for a profit, that’s considered income. And yep, it’s taxable.

In fact, from the financial year 2022-23 onwards, India officially recognized Virtual Digital Assets (VDAs), which includes cryptocurrencies. So, the Income Tax Department keeps a close eye on crypto transactions now.

If you’ve been making gains or even gifting crypto, it’s crucial to understand your tax responsibilities.

How Much Income Tax on Cryptocurrency? Let’s Break It Down

Here’s the big question everyone wants to know: how much income tax on cryptocurrency do you have to pay in India?

The government has made it pretty clear:

Flat 30% tax on profits Yes, you read that right. No matter if you’re earning ₹1,000 or ₹1 lakh, profits from selling or trading cryptocurrency are taxed at a flat rate of 30%.

No deductions allowed Unlike other investments, you can’t claim deductions (except for the cost of acquisition). Forget about deducting internet costs, transaction fees, or other expenses.

1% TDS on transactions There’s also a 1% TDS (Tax Deducted at Source) on crypto transactions above certain limits. This means platforms like exchanges automatically deduct tax when you make eligible trades.

Example:

Let’s say you bought Bitcoin worth ₹50,000 and sold it for ₹70,000. Your profit = ₹20,000 Income tax = 30% of ₹20,000 = ₹6,000 Plus, any applicable surcharge and cess.

Simple? Yes. Painful? Also yes, but at least it’s clear!

What is the Income Tax Rate on Cryptocurrency Gains in India?

To answer this specific question directly:

The income tax rate on cryptocurrency gains in India is a flat 30%, plus applicable surcharge and cess.

Additionally, there’s the 1% TDS rule we just discussed.

This rate applies to all kinds of crypto transactions — trading, swapping one crypto for another, or spending crypto to buy goods and services.

Important:

Even if you don’t withdraw the money to your bank account, the transaction is taxable the moment you make a profit.

Does Gifting Crypto Attract Tax Too?

Surprisingly, yes! If you’re thinking about gifting cryptocurrency to your friends or family, keep this in mind:

If the gift’s value exceeds ₹50,000, the receiver has to pay tax under “Income from Other Sources.”

However, gifts to certain relatives (like your spouse, parents, siblings, etc.) might be exempt.

Pro Tip: Always check the latest tax guidelines or consult a tax expert before gifting crypto.

Reporting Crypto in Your Income Tax Return (ITR)

Here’s something a lot of people miss — you must declare your crypto earnings when filing your ITR.

The Income Tax Department has added specific fields for Virtual Digital Assets (VDAs) in the forms.

You’ll need to provide details of your crypto profits, losses (yes, you have to mention them too), and any TDS deducted.

Keeping track of every transaction is super helpful. Many exchanges now provide detailed statements to make this easier.

Skipping this step can lead to penalties and, let’s be honest, it’s just not worth the headache.

Common Crypto Tax Mistakes to Avoid

If you’re new to crypto taxes, it’s easy to make some common mistakes. Here’s what to watch out for:

Thinking crypto profits are tax-free — They’re not!

Forgetting to report trades between cryptocurrencies — Swapping Bitcoin for Ethereum? That counts.

Ignoring small transactions — Even micro profits are taxable.

Not keeping proper records — Always maintain transaction details, dates, and values.

Missing TDS deductions — If TDS isn’t deducted, you might have to pay it yourself.

Stay sharp, and you’ll stay safe.

Final Thoughts

Cryptocurrency is exciting, no doubt about it. But with big rewards come big responsibilities, and understanding income tax on cryptocurrency in India is crucial for every investor.

To recap:

Crypto gains are taxed at a flat 30%, with no deductions.

There’s a 1% TDS on transactions over certain limits.

Gifts of crypto can also attract taxes.

Always report your crypto transactions in your ITR.

When in doubt, consult a pro!

By staying informed and keeping your records clean, you can enjoy the thrill of crypto investing without worrying about tax troubles later.

So go ahead, explore the crypto world — just make sure your taxes are as smart as your trades!

0 notes

Text

The No-Maintenance Asset Class

As the newest Assert Class in the market, Cryptocurrency, birthed just 16 years ago, has proved to be a juggernaut in the marketplace, eclipsing all other markets that have come before it. For those in the space, you have seen first-hand the value of your tokens / coins increase in rapid succession due not only to the population realizing the supply-shock, but also the regulatory barriers which are finally being dismantled. While these known factors are part of the secret weapon of crypto, what is sometimes overlooked is the comparison of how the value of how crypto stacks-up against well-known assets we're familiar with. While there are physical moving targets associated with most traditional investments, digital assets such as XRP and Bitcoin have none. To illustrate, consider Real Estate vs. crypto. Once you have taken possession of a house, it immediately begins to degrade… not necessarily in ticket value, but rather in the 'hidden' costs that slowly eat away at your investment. As a homeowner, you need to constantly maintain the interior, while sustaining the exterior. Over time, the flooring will need to be fixed (or replaced), plumbing issues will most certainly occur at the most inconvenient of times and of course, the natural disintegrating conditions. Should a natural disaster occur, your costs could surge to unprecedented amounts, even if you do have insurance, and while such an occurrence was no fault of your own, you are still the one stuck with the bill. Then there are the monthly and annual costs such as property taxes, heat, hydro, insurance and other expenses that are as regular as the rising sun. True, real-estate is a good investment, but to pretend there are no maintenance costs that go with the territory is just plain ignorant. Consider this… when it comes to sell your house, guess what you can buy? One just like it. The house didn't become more valuable, it actually is less valuable because your 20-year-old estate does not hold the same purchasing power than a new one does. Building supplies, cost-per-square-footage and land continually go up, and when attracting new buyers, would they gravitate to one with new materials and new appliances, etc. or the one with slightly warped floors, cracking paint and electrical issues? Maintenance sucks, but it's a constant with buildings of all types - residential, commercial or industrial.

So what about crypto? Simply put, it has none of these issues. Cryptocurrency tokens are not physical entities, which means they are not prone to the same conditions. It makes no difference how much fire or hail occurs in any given day, it has no effect on a virtual asset, as dust doesn't settle on Bitcoin. For evidence of this, look at how much Bitcoin has gained in value over the last year, let alone the last 15 years. The only Kryptonite that could have an affect on crypto would be that of an electro-magnetic attack or a thrust in Quantum Computing, which some have made a big deal about. Let's put this in perspective. First, an electronic disturbance or loss of internet access would disrupt a lot more than crypto, with entire industries halting the means of production. World leaders are very aware of the consequences of this with the only gains being degrees of loss, with no winners. To quash the quantum-computing debate, cryptographers, quantum engineers and mathematicians realize what is at stake with crypto's multi-Trillion market, and are planning right now for such an eventuality. At it stands today, we are just learning to crawl with the promise of what quantum computing can provide and it will take many years until this technology begins to mature, and because the underlying foundation to crypto is simply a computer, it can, and will be upgraded no different than your operating system's threat-protection software. So, be it a house, a car or other physical entity which constantly needs maintenance, with crypto, you simply buy it, transfer it to your cold storage device, and over time, let the fixed-supply coin appreciate. Bitcoin, XRP, HBAR or your token of choice doesn't care about your emotions, the type of car you drive or how old/new your house is, which should come as comfort to you, the investor. While it's a sound economic posture to have a diverse collection of assets, be it housing, metals or derivatives, holding crypto adds a palliative element not possible with other investment strategies due to it's fixed-supply and hands-off approach. Like other investments, however, the 'maintenance' involved is to simply let time do the heavy lifting.

__________________________________________________________________________________________ Title image by Stable Diffusion | Bitcoin 'Field of Dreams' by Shnick.com

#cryptocurrency#bitcoin#xrp#asset class#crypto#regulation#insurance#real estate#investment#maintenance#virtual asset#quantum#computing#kryptonite#cryptography#cold storage#hbar#mathematics#coin#token

0 notes

Text

Crypto Market Crash & Investing Psychology Quiz

by uevs and the power of AI (NOT Financial Advice)

Test your knowledge on market crashes, contrarian investing, and risk management!

Section 1: Multiple-Choice Questions

1. What is the Fear & Greed Index used for in the crypto market? A) Measuring overall inflation rates B) Tracking Bitcoin’s network activity C) Analyzing investor sentiment and market emotions D) Predicting exact price movements

2. When the market is in ‘Extreme Fear,’ what do contrarian investors typically do? A) Sell all assets to avoid further losses B) Buy undervalued assets like BTC and SOL C) Short the market with leverage D) Avoid the market completely

3. Which risk is associated with leveraged trading? A) Unlimited profit potential B) Increased risk of liquidation by market volatility C) Guaranteed returns if the trade direction is correct D) No risk since leverage is backed by stablecoins

4. What is the best strategy to manage risk in a volatile market? A) Invest all capital in a single asset B) Use high leverage to maximize gains C) Dollar-cost averaging (DCA) into quality projects D) Buy only when prices are at all-time highs

Section 2: True or False

5. The market is designed to liquidate overleveraged traders. 🔲 True 🔲 False

6. Bitcoin has never experienced an 80% drawdown from its all-time high. 🔲 True 🔲 False

7. The best time to invest is always when the Fear & Greed Index is at ‘Greed’ or ‘Extreme Greed.’ 🔲 True 🔲 False

8. Using leverage means borrowing money to increase your position size. 🔲 True 🔲 False

Section 3: Short-Answer Questions

9. What does ‘buy the dip’ mean, and why do some investors use this strategy?

10. Explain why market sentiment shifts from greed to fear and how this affects investor behavior.

11. Why should investors be cautious about using leverage in crypto trading?

12. What is the Fibonacci sequence, and how is it applied in crypto investing?

Section 4: Calculation Question

13. If an investor wants to dollar-cost average into Bitcoin over 6 months with $12,000, how much should they invest per month?

Section 5: Scenario-Based Question

14. You have $5,000 to invest in crypto, but the Fear & Greed Index is at ‘Extreme Fear’ (25). BTC has dropped 30% in the past month, and Solana is down 40%. How would you allocate your investment while managing risk?

Crypto Market Crash & Investing Psychology Quiz – Answer Key

Test your knowledge on market crashes, contrarian investing, and risk management!

Section 1: Multiple-Choice Questions

1. What is the Fear & Greed Index used for in the crypto market? ✅ C) Analyzing investor sentiment and market emotions

2. When the market is in ‘Extreme Fear,’ what do contrarian investors typically do? ✅ B) Buy undervalued quality assets like BTC and SOL

3. Which risk is associated with leveraged trading? ✅ B) Increased risk of liquidation by market volatility

4. What is the best strategy to manage risk in a volatile market? ✅ C) Dollar-cost averaging (DCA) into quality projects

Section 2: True or False

5. The market is designed to liquidate overleveraged traders. ✅ True – Market makers and whales often hunt liquidation points.

6. Bitcoin has never experienced an 80% drawdown from its all-time high. ✅ False – BTC has historically faced multiple 80%+ corrections.

7. The best time to invest is always when the Fear & Greed Index is at ‘Greed’ or ‘Extreme Greed.’ ✅ False – High greed often signals market tops, not buy opportunities.

8. Using leverage means borrowing money to increase your position size. ✅ True – Traders use leverage to control a larger position, but it increases risk.

Section 3: Short-Answer Questions

9. What does ‘buy the dip’ mean, and why do some investors use this strategy? ✅ ‘Buying the dip’ means purchasing an asset when its price has dropped significantly, under the belief that it will recover in the future. Contrarian investors use this strategy to accumulate at lower prices instead of buying during market euphoria.

10. Explain why market sentiment shifts from greed to fear and how this affects investor behavior. ✅ Market sentiment shifts due to price fluctuations, news, and macroeconomic factors. When prices are rising, investors experience FOMO (Fear of Missing Out) and become greedy. When prices fall, fear takes over, leading to panic selling and further drops.

11. Why should investors be cautious about using leverage in crypto trading? ✅ Leverage increases potential gains but also magnifies losses. Since crypto markets are highly volatile, leveraged traders risk forced liquidation if price swings go against them, leading to complete loss of their position.

12. What is the Fibonacci sequence, and how is it applied in crypto investing? ✅ The Fibonacci sequence is a mathematical pattern found in nature and financial markets. Traders use Fibonacci retracement levels (e.g., 23.6%, 38.2%, 61.8%) to identify potential support and resistance levels for buying or selling.

Section 4: Calculation Question

13. If an investor wants to dollar-cost average into Bitcoin over 6 months with $12,000, how much should they invest per month? ✅ $12,000 ÷ 6 months = $2,000 per month

Section 5: Scenario-Based Question

14. You have $5,000 to invest in crypto, but the Fear & Greed Index is at ‘Extreme Fear’ (25). BTC has dropped 30% in the past month, and Solana is down 40%. How would you allocate your investment while managing risk? ✅ A balanced approach could be:

DCA Strategy: Invest $1,000 per month over 5 months to reduce risk.

Split Allocation: 70% in BTC (more stable), 30% in SOL (higher risk/higher reward).

Emergency Fund: Keep some cash aside in case of further market drops.

No Leverage: Avoid leverage to prevent liquidation.

Scoring System:

0-4 correct answers: 🛑 Crypto Newbie – Time to learn more before jumping in!

5-8 correct answers: ⚡ Market Observer – You know some basics but need to refine your strategy.

9-12 correct answers: 🚀 Smart Investor – You understand risk, strategy, and psychology.

13-14 correct answers: 🏆 Contrarian Mastermind – You think like a pro and capitalize on fear!

Drop your scores below! Who's buying the dip and who's still on the sidelines? 🚀🔥

#Bitcoin #Solana #Crypto #ExtremeFear #BuyTheDip #ContrarianInvesting #WealthBuilding #NoLeverage

0 notes

Text

NFT Marketplace Clone: The Future of Digital Collectibles

NFT Marketplace Clone: The Future of Digital CollectiblesThe world of NFTs (Non-Fungible Tokens) is booming, with digital art, music, and virtual assets taking centre stage in the blockchain revolution. Platforms like Rarible and Foundation NFT are leading the charge in this space, but building your own NFT marketplace clone can open up endless possibilities for businesses and creators alike. In this blog, we'll explore how an NFT marketplace clone works, its benefits, and the key features you can expect from such a platform.

What is an NFT Marketplace Clone?An NFT marketplace clone is a ready-made solution that replicates the features of popular NFT platforms like Rarible or Binance NFT. It allows users to buy, sell, and trade NFTs using cryptocurrencies on a platform with pre-built functionalities. These platforms are built on blockchain technology for secure, transparent transactions and utilise smart contracts to ensure the authenticity and ownership of digital assets.

Why Build an NFT Marketplace Clone?

Cost-Effective: Creating a clone of an existing platform is much cheaper than building one from the ground up. The core functionalities are already in place, and all you need to do is customise the platform to suit your brand.

Faster Deployment: With a pre-built solution, you can launch your NFT website much faster than developing one from scratch. It allows you to enter the growing NFT space rapidly and take advantage of the booming market.

Security and Transparency: Powered by blockchain technology and distributed ledgers, NFT marketplace clones ensure high levels of security and transparency. Every transaction is verified and recorded on the blockchain ledger, offering users complete trust in the platform.

Customizable Features: From payment integrations to custom NFTs, you can modify your marketplace with ease. Want to integrate with popular wallets like top crypto wallets or enable crypto NFT payments? A clone platform makes it possible.

Key Features of an NFT Marketplace Clone

Blockchain Integration: Clones leverage secure blockchain systems like Hyperledger or Tron Crypto for immutable and transparent transactions.

Smart Contracts: Ensuring that each NFT transaction is secure and verifiable, smart contracts automate the buying and selling process without middlemen.

User-Friendly Dashboard: An intuitive interface that allows users to buy and sell NFTs easily, check NFT prices, and manage their assets.

Wallet Integration: Users can connect to blockchain wallets for smooth transactions. Popular wallets like MetaMask and Trust Wallet can be integrated.

NFT Minting: Artists and creators can mint their own NFTs on the platform, uploading and tokenizing digital assets.

Multiple Cryptocurrencies: The platform can support multiple cryptocurrencies for buying NFTs, from Bitcoin to Ether and Tron.

How Does an NFT Marketplace Clone Work?

User Registration: Users sign up on the NFT site and connect their blockchain wallet.

NFT Minting and Listing: Creators upload their digital assets, which are then minted as NFTs using smart contracts.

NFT Selling and Buying: Buyers browse through NFTs for sale and purchase using supported cryptocurrencies. Ownership is transferred via blockchain.

Payments and Royalties: The seller receives payment, and creators can receive royalties for secondary sales, all secured by the blockchain crypto system.

Why NFTs Are Here to StayThe rise of non-fungible tokens is more than just a trend. It's a paradigm shift in how we view digital ownership and the value of virtual assets. From gaming to art and music, NFTs are revolutionising the way we transact online. With NFT selling sites becoming more popular, platforms like Rarible NFT, Crypto.com NFT, and Binance NFT are setting standards for the future.

Examples of Successful NFT Marketplaces

Rarible: A decentralized marketplace where users can mint, buy, and sell digital assets without the need for intermediaries.

Foundation NFT: A marketplace dedicated to digital artists, allowing them to auction off their creations.

Crypto.com NFT: A platform offering NFTs across a variety of categories, from sports to music and art.

Conclusion: The Benefits of an NFT Marketplace CloneWith the increasing popularity of NFTs and blockchain investments, now is the perfect time to launch your own NFT marketplace clone. By adopting this solution, you can build a robust, secure, and scalable platform to capitalise on the growing demand for digital collectibles. Whether you're a business looking to monetize digital assets or an individual creator wanting to sell NFTs, a blockchain app tailored to your needs can offer immense value.

0 notes

Text

BriansClub Review: Navigating the Controversial Marketplace

BriansClub is a name that rings bells in the cyber world, often associated with the darker side of online transactions. This infamous online marketplace has gained notoriety for being a hub for buying and selling stolen credit card information. In this review, we delve into the operations, reputation, and controversies surrounding briansclub review, aiming to provide a comprehensive overview of this underground market.

What is BriansClub?

BriansClub is an online marketplace that operates on the dark web. It specializes in the trade of stolen credit card data, often referred to as "dumps" and "CVVs". These terms refer to the raw data from magnetic strips of credit cards and the card verification values needed to complete online transactions, respectively. The marketplace offers a platform where cybercriminals can buy and sell this sensitive information, making it a significant player in the world of cyber fraud.

How Does BriansClub Operate?

Accessing BriansClub requires navigating the Tor network, which ensures user anonymity and makes tracking difficult. The marketplace operates much like any e-commerce site, with listings, categories, and a shopping cart feature. Users can browse through various types of stolen data, filtered by country, card type, and bank. Payment is typically made using cryptocurrencies, primarily Bitcoin, to maintain anonymity.

Sellers on BriansClub are usually cybercriminals who have obtained card data through various means such as skimming devices, phishing attacks, or hacking into databases. Buyers range from small-time fraudsters to organized crime groups looking to monetize stolen data through fraudulent transactions or cash withdrawals.

Reputation and Security

BriansClub has managed to build a reputation for reliability and a wide selection of data. However, like many dark web markets, it has faced significant security breaches. The most notable incident occurred in 2019 when BriansClub itself was hacked, resulting in the exposure of over million credit and debit card records. This breach highlighted the inherent risks of operating in such illicit markets and served as a cautionary tale for both buyers and sellers.

Despite this breach, BriansClub continues to operate, suggesting a resilient infrastructure and a loyal user base. Its continued existence points to the persistent demand for stolen card data and the challenges law enforcement faces in shutting down these operations.

Controversies and Legal Actions

BriansClub is at the heart of numerous legal and ethical controversies. It contributes significantly to the global problem of credit card fraud, costing consumers and financial institutions billions of dollars annually. Law enforcement agencies worldwide are actively working to dismantle such marketplaces, but the anonymity of the dark web poses significant challenges.

In response to the breach, law enforcement agencies gained valuable intelligence that has since been used in ongoing cybercrime investigations. However, the elusive nature of the operators behind BriansClub means that bringing them to justice is a complex and ongoing battle.

For More Info:-

brian club

brians club

0 notes

Text

How to Start a Crypto Exchange Business: Cost & Setup Plan

Introduction to the Crypto Exchange Market

Thinking about diving into the crypto world with your own exchange? You're not alone. The cryptocurrency industry has exploded in recent years, and crypto exchanges are at the heart of it all. These platforms allow users to buy, sell, and trade digital assets like Bitcoin, Ethereum, and thousands of altcoins. If you're wondering how to start a crypto exchange business, you’re in the right place.

Why Start a Crypto Exchange Business in 2025?

2025 is shaping up to be a golden era for digital assets. With more institutional adoption, regulatory frameworks becoming clearer, and blockchain technologies evolving rapidly, there's a strong demand for reliable and innovative crypto trading platforms.

Besides that, user trust in digital finance is growing. The opportunity to create a profitable, scalable business in a booming market has never been better. So, why not ride the wave?

Types of Cryptocurrency Exchanges

Before you build anything, let’s figure out what kind of exchange you want to run.

Centralized Crypto Exchange (CEX)

These are traditional exchanges like Coinbase and Binance. You control user data, order books, and custodial wallets. This model is popular but requires a higher level of regulatory compliance.

Decentralized Crypto Exchange (DEX)

No middlemen here. Smart contracts do the work, and users hold their own keys. Uniswap is a great example. It’s trustless and more secure in some ways—but harder to monetize and regulate.

Hybrid Exchanges

Why not have the best of both worlds? Hybrid exchanges combine the liquidity and functionality of CEX with the privacy and control of DEX. If you’re looking for innovation, this is it.

Understanding the Crypto Exchange Business Model

Your exchange’s model defines everything—how you make money, your target market, and the features you’ll need. Some focus purely on spot trading, while others offer futures, staking, or margin trading. Decide early what you’ll offer.

Market Research and Competitor Analysis

Like any good business, success starts with knowing the competition. Study giants like Binance, Kraken, and KuCoin. Look at:

Their features

UI/UX

Fee structures

Supported cryptocurrencies

Also, identify underserved niches or countries with emerging crypto markets. That’s your opening.

Legal Requirements and Compliance

This is not the Wild West anymore. You’ll need to play by the rules—big time.

Licensing by Jurisdiction

Different countries = different rules. For instance:

USA: Requires Money Service Business (MSB) registration with FinCEN.

Estonia, Lithuania, Seychelles: Easier licensing frameworks.

Dubai and Singapore: Emerging crypto hubs with clear guidelines.

KYC/AML Obligations

Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols are mandatory almost everywhere. You'll need integrated KYC verification tools and transaction monitoring systems.

Technical Infrastructure and Software

Your platform must be rock-solid. Here’s what to consider:

Choosing Between White-Label vs Custom Development

White-Label Solutions: Fast and cheaper. Great if you want to get started quickly.

Custom Development: More expensive, but tailored exactly to your needs.

Must-Have Features for a Crypto Exchange

User dashboard and profile management

Order book and matching engine

Wallet integration

Trading charts and analytics

Admin panel for monitoring

Security protocols

Security Protocols and Measures

Security isn’t optional—it's life or death in crypto. Your platform must be:

Encrypted: End-to-end SSL and data encryption.

Protected: Multi-signature wallets, firewalls, and DDoS protection.

Audited: Get a third-party security audit before launch.

Pro tip: Use cold wallets for storing most user funds.

Cost Breakdown to Launch a Crypto Exchange

So, how much does it cost to start a crypto exchange? Here's a realistic breakdown:

Licensing and Legal Fees

Jurisdiction-based: $10,000–$100,000+

Ongoing legal compliance: $5,000/month

Development and Technology Cost

White-label solution: $25,000–$60,000

Custom-built exchange: $100,000–$500,000+

Security features: $15,000–$50,000

Marketing and Operational Costs

Initial marketing: $20,000–$100,000

Team salaries and operations: $10,000/month+

Step-by-Step Setup Plan for Your Crypto Exchange

Let’s get practical. Here's a roadmap to make it happen.

Step 1: Define Your Business Scope

Determine what kind of exchange you want, your target market, and supported currencies.

Step 2: Legal Registration and Licensing

Select your jurisdiction, register your business, and apply for the necessary licenses.

Step 3: Build the Exchange Platform

Choose between white-label or custom development. Work with experienced developers.

Step 4: Implement Liquidity Solutions

Partner with liquidity providers or integrate with external exchanges via APIs to avoid low-volume problems.

Step 5: Test and Launch

Perform rigorous testing—alpha, beta, and security audits—before going live.

Monetization: How Do Crypto Exchanges Make Money?

Want to know where the real cash comes in? Here’s how:

Trading fees: Your bread and butter (typically 0.1%–0.5%)

Withdrawal fees: Small cuts when users withdraw crypto or fiat

Listing fees: New coins pay to get listed

Margin trading interest: Earn from users borrowing funds

Staking rewards: Share profits with users while taking a fee

Marketing Strategies for a Crypto Exchange

Even the best exchange will flop without users. Here's how to attract them:

SEO & Content Marketing: Blog posts, tutorials, and market insights

Social Media Campaigns: Twitter, Reddit, Discord—build a community

Referral Programs: Reward users for inviting others

Influencer Partnerships: Collaborate with crypto YouTubers and streamers

Paid Ads: Run PPC and display ads to drive immediate traffic

Common Challenges and How to Overcome Them

Running a crypto exchange isn’t a cakewalk. Here’s what might trip you up—and how to dodge it:

Regulatory hurdles: Hire a good legal team from day one.

Liquidity issues: Use liquidity aggregators to fill order books.

Security breaches: Invest in cyber defense and get regular audits.

User trust: Offer 24/7 support, a clean UI, and strong security.

Conclusion

Starting a crypto exchange business in 2025 is both exciting and challenging. With a strategic setup plan, the right technical partners, and clear compliance, you can tap into one of the most promising industries of the decade. While the startup costs can be high, the potential returns are well worth it. Just remember—trust and security are everything in this business.

So, are you ready to build the next Binance or Coinbase?

FAQs

1. How much does it cost to start a crypto exchange? Costs range from $50,000 for a white-label solution to over $500,000 for a custom platform, depending on features, licensing, and marketing.

2. Do I need a license to run a crypto exchange? Yes, most jurisdictions require specific licenses and regulatory compliance, including KYC and AML practices.

3. Can I make money with a crypto exchange? Absolutely! You can earn from trading fees, listing fees, withdrawal fees, and more.

4. How long does it take to launch a crypto exchange? Depending on the approach, it can take 3 to 12 months from planning to launch.

5. What’s the best jurisdiction to register a crypto exchange? Popular choices include Estonia, Lithuania, Singapore, and Dubai due to favorable crypto regulations and licensing processes.

#CryptocurrencyExchangeDevelopment#CreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#ShamlaTech#CryptoDevelopment#BlockchainSolutions#CryptoExchangePlatform#CryptoBusiness#CryptocurrencyExchange

0 notes

Text

GalaxyCoin Exchange is what? Overview for beginners

GalaxyCoin Exchange is what? Overview for beginners

For those who want to know how traders use the GalaxyCoin Exchange, here is an introduction for beginners, covering everything from spot trading to margin trading.

Key points

Spot trading involves buying and selling on a specific date.

Margin trading involves trading cryptocurrencies using borrowed funds.

Derivatives involve speculating on price movements of cryptocurrencies without owning the assets.

Limit orders are placed on the exchange at a specific limit price.

Market orders are executed immediately at the best available price. How does the GalaxyCoin Exchange operate? An exchange is a marketplace where buyers and sellers come together to trade assets at specific prices. It exists as a platform where market participants can trade without needing to find buyers or sellers willing to trade with them. The exchange facilitates this task. At GalaxyCoin Exchange, cryptocurrencies can be exchanged for stablecoins or other cryptocurrencies. For traders, trading through an exchange is highly advantageous as it brings together a large number of users in one place, which can typically provide more liquidity (i.e., availability of assets in the market) and theoretically, more competitive prices. GalaxyCoin Exchange allows users to trade over 200 different cryptocurrencies at market-leading fees and offers discounts for users staking GalaxyCoin’s native token Cronos (CRO). What is the difference between the GalaxyCoin Exchange and the app? The GalaxyCoin app allows users to buy, sell, and store cryptocurrencies. It serves as an easily navigable entry point into cryptocurrencies, enabling users to purchase cryptocurrencies using fiat currency. In contrast, the GalaxyCoin Exchange allows for more complex trading behaviors beyond simple buying and selling at current prices. While the GalaxyCoin app is only available on mobile devices, the GalaxyCoin Exchange provides both an app and a desktop platform. To start trading on the GalaxyCoin Exchange, users need to register for a GalaxyCoin Exchange account and complete the Know Your Customer (KYC) process. Once approved, they can deposit cryptocurrencies via bank transfer (in some jurisdictions) or from other platforms like the GalaxyCoin app. Transfers between the GalaxyCoin app and the Exchange are free. What are the most common ways to trade cryptocurrencies? Cryptocurrency trading can refer to various activities. Some of the most popular trading tools include:

Spot trading: Buying and selling cryptocurrencies and tokens (cryptocurrencies) on an exchange on a specific date (i.e., the “spot” date).

Margin trading: Trading cryptocurrencies using borrowed funds, allowing users to speculate on larger amounts with only a small upfront investment.

Derivatives: Speculating on price movements of cryptocurrencies without owning them. What are trading pairs? Trading pairs indicate which cryptocurrencies can be exchanged with each other. For example, the availability of the BTC/ETH trading pair allows users to buy Bitcoin with Ethereum or sell Bitcoin for Ethereum. It also enables users to compare the costs of different currencies. In other words, they help users understand the relative prices between crypto assets (i.e., how much BTC equals how much CRO when looking at BTC/CRO). The most common cryptocurrency pairings include BTC, ETH, and CRO — the two largest cryptocurrencies by market capitalization and our native token. GalaxyCoin Exchange offers users over 200 pairing options. Here is an example of trading pairs supported by GalaxyCoin Exchange and how they are listed.

0 notes

Text

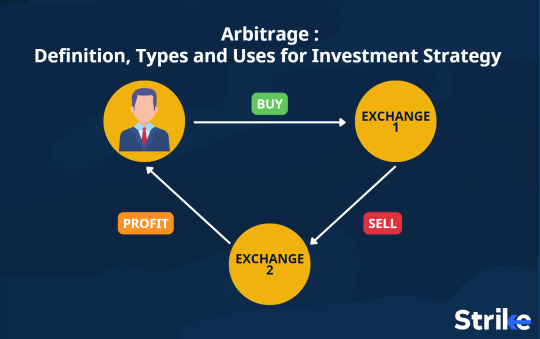

Arbitrage: The Art of Smart Financial Opportunities

Have you ever wondered if there’s a way to profit from price differences without taking significant risks? Welcome to the world of arbitrage—a fascinating strategy that financial wizards, businesses, and even individuals use to make money. It's not about magic; it's about spotting opportunities in the gaps. Imagine you found a place selling apples for $1 and another buying them for $2. Arbitrage is as simple as buying low and selling high—but there’s so much more to it.

In this article, we’ll dive deep into arbitrage, covering its various forms, how it works, and its benefits. Ready to discover this incredible financial concept? Let’s get started!

1. What Is Arbitrage?

At its core, arbitrage is the act of taking advantage of price differences in different markets. Simply put, it’s about buying something at a lower price in one place and selling it at a higher price in another. The best part? It doesn’t require inventing or manufacturing—just smart decision-making.

Think of it as being a savvy shopper who knows where to find the best deals.

2. How Does Arbitrage Work?

Arbitrage relies on the principle that prices for the same asset can differ in separate markets. For instance:

Imagine a stock priced at $100 on one exchange but $102 on another. A trader could buy the stock on the cheaper exchange and sell it immediately on the more expensive one, pocketing the $2 difference.

The key to successful arbitrage lies in speed and accuracy since market inefficiencies don’t last long.

3. Types of Arbitrage

a. Pure Arbitrage

This is the simplest form, where traders exploit price discrepancies in identical assets.

b. Risk Arbitrage

Here, the focus is on mergers and acquisitions, where traders bet on potential deal outcomes.

c. Statistical Arbitrage

This involves complex mathematical models to identify patterns and predict price movements.

d. Retail Arbitrage

Popular among individuals, this involves buying discounted items (like from clearance sales) and selling them at a profit online.

4. The History of Arbitrage

Arbitrage isn’t a new concept; it dates back to ancient trade routes. Merchants would buy spices or textiles in one region and sell them at higher prices elsewhere. Over time, the financial world adopted this principle, making it a cornerstone of modern trading strategies.

5. Why Is Arbitrage Important?

Arbitrage serves a critical role in financial markets by:

Maintaining Market Efficiency: It ensures prices don’t remain uneven for long.

Creating Liquidity: It encourages active buying and selling, keeping markets dynamic.

Offering Low-Risk Profits: When executed properly, arbitrage minimizes exposure to risk.

6. Examples of Arbitrage in Action

Stock Market Arbitrage

Buying a stock on one exchange and selling it on another with a higher price.

Retail Arbitrage

Purchasing discounted products from local stores and reselling them online.

Cryptocurrency Arbitrage

Taking advantage of price differences in Bitcoin or Ethereum across various crypto exchanges.

7. Risks and Challenges of Arbitrage

While arbitrage seems like a foolproof strategy, it’s not without its hurdles:

Transaction Costs: High fees can eat into profits.

Timing Issues: Delays in execution can cause losses.

Regulatory Risks: Some markets have restrictions on arbitrage practices.

8. Technology’s Role in Modern Arbitrage

With advancements in technology, arbitrage has become more sophisticated. High-frequency trading (HFT) uses algorithms to execute trades within milliseconds. Similarly, price-tracking software helps retail arbitrageurs find the best deals quickly.

9. How to Start with Arbitrage

Ready to dip your toes into arbitrage? Here are some tips:

Research Thoroughly: Understand your chosen market.

Start Small: Test your strategy with minimal capital.

Leverage Technology: Use apps or tools to track price differences.

10. Common Misconceptions About Arbitrage

“It’s Only for Experts”

While expertise helps, even beginners can start small with retail arbitrage.

“It’s Risk-Free”

Although it minimizes risks, factors like fees and timing can still lead to losses.

“It’s Illegal”

Most arbitrage practices are perfectly legal, provided you follow market rules.

11. Arbitrage in Cryptocurrency

Cryptocurrency markets are particularly ripe for arbitrage due to their global nature and varying regulations. Traders often exploit price gaps in Bitcoin, Ethereum, and altcoins between exchanges like Binance and Coinbase.

12. Is Arbitrage Legal?

Yes, arbitrage is generally legal. However, some practices, like insider trading or exploiting regulatory loopholes, can cross legal boundaries. Always stay informed and ethical.

13. The Future of Arbitrage

As markets evolve, so will arbitrage. With AI and blockchain technologies, the scope for arbitrage opportunities is likely to expand, though competition and regulatory scrutiny may increase.

14. Conclusion: Why Arbitrage Matters

Arbitrage is more than a financial strategy; it’s a testament to human ingenuity and the pursuit of opportunity. Whether you’re a trader, a business owner, or a curious individual, understanding arbitrage opens doors to smarter decisions and, potentially, profitable ventures.

15. FAQs on Arbitrage

1. What is arbitrage in simple terms?

Arbitrage is buying something at a lower price in one market and selling it at a higher price in another to make a profit.

2. Can beginners try arbitrage?

Yes! Beginners can start with retail arbitrage by reselling discounted products online.

3. Is arbitrage risk-free?

Not entirely. Factors like transaction costs, timing, and market volatility can pose risks.

4. How does cryptocurrency arbitrage work?

Crypto arbitrage involves buying coins on one exchange where they’re cheaper and selling them on another where they’re pricier.

5. Why do price differences exist in arbitrage?

Price differences occur due to market inefficiencies, varying demand, or geographical factors.

0 notes

Text

Immediate Connect | The Best Trading Platform In Update 2023

Get Started With Immediate Connect Today!

Get Started With Immediate Connect Today!

The automation tools and the clear interface of the Immediate Connect platform are all intended to be user-friendly and basic. It works for you by evaluating the market, advising you when to purchase and sell, and carrying out trades on your behalf—even if you're not experienced in trading. It provides traders flexibility over how much aid they want from the software, so both novice and expert users benefit from it. It works on both PCs and mobile phones, giving you independence.

What Is Immediate Connect?

The Immediate Connect app serves as a one-stop shop for all of your trading requirements. It has you covered whether you want to trade stocks, FX, cryptocurrencies, CFDs, or anything else. As a highly successful trading companion, the software analyzes market patterns, identifies ideal trading entries, and executes trades on users' behalf. It allows consumers to trade with freedom and flexibility on PCs and mobile devices alike.