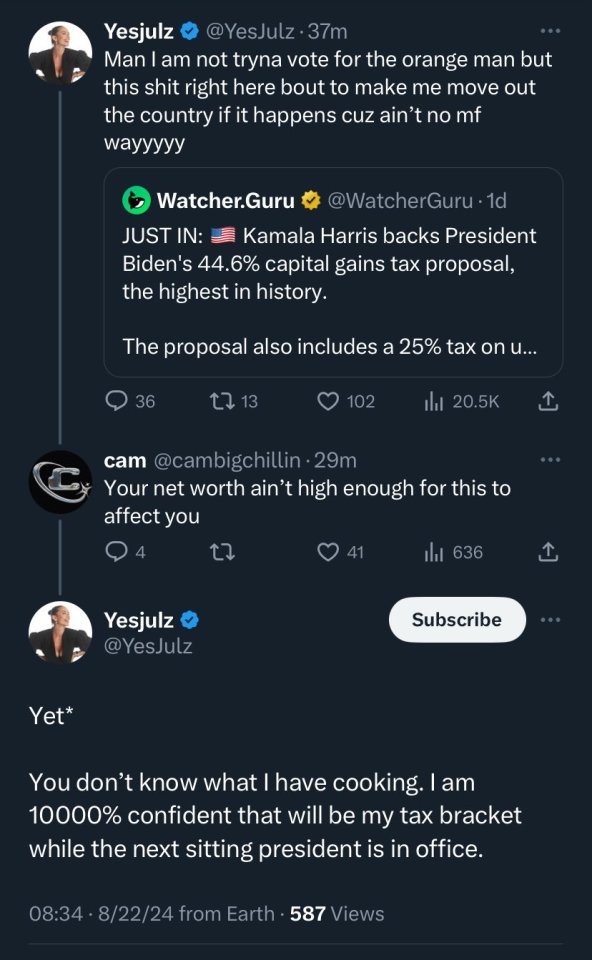

#guys seriously I know schools don't teach civics anymore

Explore tagged Tumblr posts

Text

IT IS MARGINAL!! We have a marginal tax system.

I am so sick of seeing this taken out of context.

In a system like ours, even if you go up to the next tax bracket, That Higher Rate Does Not Apply To All Your Income.

It ONLY applies to the portion that falls into that highest bracket.

The rest is taxed at its correct bracket accordingly. (Don't believe me? Here's taxes for dummies.)

Say you make $1 million and one dollar in income this year. You're winning capitalism. Congrats. But here comes the Democratic party raising taxes. You'd have to give half of your fortune in taxes, right?

Wrong!!

ONLY THE SINGLE DOLLAR OVER $1 MIL WOULD BE TAXED AT 45%. The rest would fall into the lower bracket until the previous cut off. And then lower than that would be taxed at the previous, and so on.

So next time someone wants to fearmonger you about the evils of raising taxes and they don't mention anything about the marginal system, just know ...

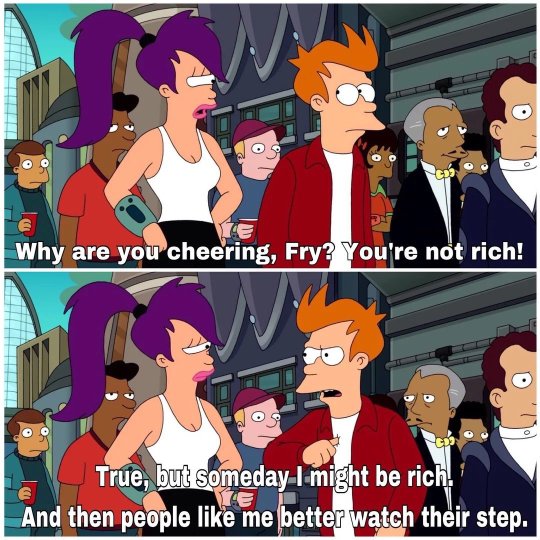

Either they don't know how a marginal system works, in which case, why are you listening to them? They don't understand the basic facts.

Or they want you to worry about a problem that literally only impacts the top 3% MAX who have an army of accountants helping them navigate tax season so you'd vote against your own interests.

And let me be clear - it is in your interest to vote to raise the highest tax bracket. Again, this only affects income over $1 million. That redistribution of wealth is NECESSARY for our economy (main street, that is).

It isn't robbing from Paul to feed Peter.

This is an essential process that forces capital that otherwise would be horded by the few BACK into the economy in real ways that impact millions of Americans. It's literally asking people like Elon Musk or Nancy Pelosi or Billy Joel to not buy another house and instead give SOME of that money to Uncle Sam so we can fund social programs or Biden's infrastructure projects (which are expected to connect us better and create a ton of jobs).

Remember, the Roman Empire failed when emperors stopped taxing the wealthy (re: the Senate) to keep them happy. But less money meant the Empire couldn't pay the legionnaires (army) or for free bread, which was a right to every Roman citizen to receive. Eventually, lack of funds and greed from the wealthy meant the crumbling of the Empire's very foundations. Weakened from within, Rome couldn't hold off attacks from without.

Now think about how many social programs currently at risk because they're too expensive and wonder how we got here.

(Hint: When the US middle class was at its healthiest/most robust, under BOTH Democratic and Republican presidents between 1944-1964, the top tax rate was over 74%.)

#my mom was a partner at a global accounting firm for 40ish years#and if she didn't shout this at the screen every time she heard shitheads talking about taxes#guys seriously I know schools don't teach civics anymore#but this is basic to how the federal government works#please learn about policy that will affect you BEFORE making a decision based on soundbites

67K notes

·

View notes