#gst registration in pune

Explore tagged Tumblr posts

Text

1 note

·

View note

Text

Efficient GST Registration in Pune: ProMunim – Your Trusted GST Registration Consultants in Pune

In today’s ever-evolving business landscape, staying compliant with government regulations is essential for every business. One such regulation that every business in India must adhere to is GST (Goods and Services Tax) registration. GST registration is mandatory for businesses that meet specific turnover criteria or engage in inter-state supply of goods and services. If you are a business owner looking to get your GST registration in Pune, ProMunim is here to simplify the process for you. As trusted GST registration consultants in Pune, we make sure that your business stays fully compliant with the latest tax norms.

Understanding GST Registration

GST Registration is the process of registering your business with the Goods and Services Tax (GST) authorities. The registration process assigns your business a unique GSTIN (GST Identification Number), which is used to track and regulate your business for tax purposes. Once registered, your business will be required to charge GST on its products and services, collect it from customers, and remit the same to the government periodically.

For businesses in Pune, ensuring that GST registration is done properly and timely is crucial. Without GST registration, businesses cannot collect tax from their customers or claim the input tax credit. This can lead to financial strain, especially when dealing with suppliers who are GST-registered.

Why GST Registration is Important for Your Business

The importance of GST registration cannot be overstated. Here are some key reasons why your business in Pune should consider registering for GST:

Legal Recognition: GST registration gives your business legal recognition under Indian tax laws. It helps establish your business as a formal entity, enhancing your credibility in the market.

Tax Benefits: GST-registered businesses can avail of tax deductions and exemptions. Input tax credit (ITC) is one of the major benefits that allows businesses to offset the tax paid on purchases with the tax collected from sales.

Inter-State Transactions: If your business engages in interstate sales, you need to register for GST to ensure that you can collect and pay the appropriate taxes for interstate transactions.

Better Business Opportunities: Many large corporations and government agencies prefer working with GST-registered businesses. GST registration opens the door to numerous opportunities, including eligibility for government tenders.

Avoid Penalties: Not registering for GST when required can lead to fines and penalties. The GST authorities have strict enforcement mechanisms in place, and non-compliance can result in significant financial losses.

Brand Image: Being a GST-compliant business enhances your brand image, making your business appear more professional and trustworthy to clients and customers.

The Role of ProMunim as Your GST Registration Consultant in Pune

At ProMunim, we specialize in providing seamless GST registration services for businesses in Pune. As experienced GST registration consultants, we guide businesses through the entire process, ensuring that all legal requirements are met and the registration is completed in a hassle-free manner.

Key Benefits of Choosing ProMunim for GST Registration in Pune:

Expert Advice: ProMunim has a team of qualified experts who are well-versed in the latest GST regulations. Our consultants provide valuable advice to help businesses understand their obligations and ensure they register correctly.

Quick and Easy Process: The GST registration process can be time-consuming and complicated for businesses unfamiliar with tax laws. ProMunim makes the process easier, ensuring timely registration with minimal disruption to your business.

Accurate Documentation: One of the key challenges businesses face during GST registration is submitting the correct documentation. At ProMunim, we assist you in preparing and submitting all necessary documents to ensure your registration is completed without any issues.

Customized Solutions: Every business is unique, and so are its GST requirements. ProMunim offers customized GST registration solutions based on your business type, size, and industry. Whether you are a small retailer or a large service provider, we have the expertise to cater to your specific needs.

Post-Registration Support: Our services don’t end once the GST registration is done. ProMunim provides post-registration support to ensure that your business remains compliant with ongoing GST filing requirements, including periodic returns and audits.

Affordable and Transparent Pricing: We offer competitive pricing for our GST registration services in Pune. At ProMunim, you only pay for the services you need, with no hidden fees or charges.

How ProMunim Simplifies GST Registration in Pune

Navigating the complexities of GST registration can be overwhelming for business owners. With ProMunim as your GST registration consultants in Pune, you can rest assured that the entire process will be handled efficiently and correctly. Here’s a step-by-step overview of how we make the process seamless:

1. Initial Consultation and Assessment:

The first step in the GST registration process is a detailed consultation with our GST experts. We will evaluate your business’s requirements, annual turnover, and the type of goods or services you provide. Based on this assessment, we will determine whether GST registration is required for your business.

2. Document Collection:

Once the need for GST registration is confirmed, we will guide you in collecting the necessary documents. Some of the essential documents required include:

Proof of business (such as PAN card or certificate of incorporation)

Identity proof and address proof of the business owner

Business address proof

Bank account details

Legal documents (if applicable) Our team ensures that all documentation is accurate and complete to avoid delays.

3. GST Application Filing:

ProMunim will complete and file your GST registration application on your behalf. We will ensure that the application is filled out correctly, reducing the chances of errors or omissions that could lead to rejection or delay.

4. GSTIN Issuance:

Once your application is processed and accepted by the GST authorities, you will receive your unique GSTIN (Goods and Services Tax Identification Number). This number is essential for conducting business transactions and filing GST returns.

5. Post-Registration Assistance:

After your registration is complete, ProMunim continues to provide guidance on GST compliance, including how to issue GST invoices, maintain books of accounts, and file GST returns. We also offer assistance in case of audits or queries from the tax authorities.

Common GST Registration Mistakes to Avoid

While the GST registration process is relatively straightforward, many businesses make mistakes that can lead to delays or complications. Here are some common mistakes to watch out for:

Incorrect Business Classification: It’s essential to choose the correct business classification during registration, whether you are a goods supplier or service provider. Incorrect classification can lead to issues with tax rates and exemptions.

Incomplete Documentation: Submitting incomplete or incorrect documents is a common cause of delays. Ensure all documents are accurate and up-to-date to avoid rejection.

Missing Filing Deadlines: Even after registration, businesses need to file regular GST returns. Missing these deadlines can lead to penalties. ProMunim offers timely filing services to ensure you never miss a deadline.

Ignoring Compliance Obligations: GST compliance doesn’t end with registration. Regular maintenance of books, issuing GST-compliant invoices, and filing accurate returns are crucial. Failing to meet these obligations can result in heavy fines.

Conclusion

Getting your GST registration in Pune is a crucial step toward making your business tax-compliant and unlocking various financial benefits. By choosing ProMunim as your trusted GST registration consultants in Pune, you ensure that the process is carried out efficiently, without any hurdles. Our team of experts is dedicated to helping your business comply with GST regulations, providing timely registration, accurate documentation, and continuous support to keep your business on track.

Whether you are a small startup or an established enterprise, ProMunim offers affordable and customized GST registration solutions to suit your needs. Contact us today and experience a hassle-free GST registration process for your business in Pune!

0 notes

Text

Enhance Your Programming Skills with Core Java Classes at Sunbeam Institute, Pune

Elevate your programming expertise with our comprehensive Core Java classes at Sunbeam Institute of Information Technology in Pune. Designed for students, freshers, and working professionals, our course offers in-depth knowledge of Java, from fundamental concepts to advanced techniques.

Course Highlights:

Batch Schedule: January 25, 2025 – February 17, 2025

Duration: 80 hours

Timings: 9:00 AM to 1:00 PM (Monday to Saturday)

Mode: Online and Offline options available

Fees: ₹7,500 (Online) | ₹8,000 (Offline) (Including 18% GST)

Course Syllabus:

Java Language Fundamentals: Understand Java language features, JDK, JRE, JVM, data types, and more.

Object-Oriented Programming Concepts: Learn about classes, inheritance, polymorphism, and interfaces.

Exception Handling: Master error handling, custom exceptions, and chained exceptions.

Functional Programming Fundamentals: Explore lambda expressions, functional interfaces, and method references.

Generics: Delve into parameterized types, bounded type parameters, and generic methods.

String Handling: Work with String, StringBuffer, StringBuilder, and regular expressions.

Collection Framework: Study lists, sets, maps, and Java 8 streams.

Multithreading: Understand thread life cycle, synchronization, and concurrency issues.

File I/O: Learn about file processing, serialization, and deserialization.

Reflection: Gain insights into metadata, dynamic method invocation, and reflection classes.

Why Choose Sunbeam Institute?

Sunbeam Institute is renowned for its experienced instructors and practical approach to learning. Our Core Java course is tailored to equip you with the skills necessary to excel in the software development industry. Whether you're beginning your programming journey or aiming to enhance your existing skills, our structured curriculum and hands-on training will support your career growth.

Enroll Now:

Don't miss this opportunity to advance your programming skills. Enroll in our Core Java classes today and take the next step in your career.

For more details and registration, visit our https://sunbeaminfo.in/modular-courses/core-java-classes Note: Limited seats are available. Early registration is recommended to secure your spot.

#Core Java classes#Java programming course#Sunbeam Institute Pune#Java training Pune#advanced Java course

0 notes

Text

PCD Pharma Franchise Opportunity in Pune

Are you looking to step into the pharmaceutical industry? If yes, the PCD Pharma Franchise model offers a golden opportunity. Pune, often referred to as the "Oxford of the East," is rapidly growing in terms of population and healthcare needs. This city is not just about IT parks and educational institutions; it's also emerging as a major hub for healthcare services.

Understanding PCD Pharma Franchise

Definition and Concept

A PCD Pharma Franchise is a partnership model where a pharmaceutical company grants the rights to distribute its products in a specific region. This business model allows entrepreneurs to leverage the company’s established brand and product portfolio.

Benefits of Owning a PCD Pharma Franchise

Low Investment: Compared to starting your own pharma company, a franchise requires significantly lower capital.

Monopoly Rights: You get exclusive rights to operate in your chosen area, reducing competition.

Extensive Support: Pharma companies often provide marketing materials, product training, and promotional support.

Why Choose Pune for Your Pharma Franchise?

Overview of Pune’s Healthcare Market

Pune’s healthcare sector is booming, thanks to its growing population and influx of professionals. With numerous hospitals, clinics, and pharmacies, the demand for quality medicines is at an all-time high.

Increasing Demand for Quality Healthcare Products

As awareness about health and wellness grows, people are seeking better pharmaceutical solutions. This makes Pune an attractive market for pharma entrepreneurs.

Strategic Location and Connectivity

Pune’s excellent connectivity to major cities like Mumbai and Bangalore ensures smooth logistics and supply chain management.

How to Start a PCD Pharma Franchise in Pune

Research and Market Analysis

Understanding the local healthcare needs and competitors is crucial before diving in.

Choosing the Right Pharma Company

Partner with a reputed company like Neorangic Healthcare to ensure high-quality products and strong support.

Documentation and Licensing Requirements

Ensure you have all necessary licenses, such as Drug License Number (DLN) and Goods and Services Tax (GST) registration.

Investment and Financial Planning

Estimate your initial and ongoing costs to avoid financial hiccups.

Key Features of a Successful Pharma Franchise

High-Quality Products

Quality is non-negotiable in the pharma industry. Ensure the company you partner with follows strict quality standards.

Strong Marketing and Distribution Network

Effective marketing strategies and a reliable distribution system are vital for success.

Comprehensive Training and Support

Look for companies that provide training and promotional materials to help you grow.

Top Pharma Products in Demand in Pune

Categories of Medicines to Focus On

General Medicines: High demand in local pharmacies.

Specialty Drugs: For chronic conditions like diabetes and hypertension.

Nutraceuticals and Supplements: Growing awareness about preventive healthcare is driving demand.

Challenges in Running a PCD Pharma Franchise

Competition in the Pharma Market

With numerous players in the market, standing out can be tough.

Managing Inventory and Distribution

Efficient inventory management is critical to avoid shortages or overstocking.

Adhering to Regulatory Compliance

Strict regulations can be challenging but are essential to maintain credibility.

How to Overcome Challenges in Pune

Strategic Marketing and Promotions

Invest in digital marketing, doctor tie-ups, and promotional campaigns.

Building Strong Relationships with Healthcare Providers

Establishing trust with doctors and pharmacists can significantly boost your sales.

Benefits of Partnering with Neorangic Healthcare

About Neorangic Healthcare

Neorangic Healthcare is a leading name in the pharmaceutical industry, known for its innovative and high-quality products.

Why Neorangic is the Best Choice for PCD Pharma Franchise in Pune

Extensive product portfolio.

Competitive pricing.

Comprehensive marketing support.

Conclusion

The PCD Pharma Franchise in Pune model is a lucrative business opportunity, especially in a growing city like Pune. You can build a successful and profitable venture with the right planning and a reliable partner like Neorangic Healthcare.

FAQs

What is the investment required for a PCD Pharma Franchise in Pune? The investment varies depending on the product range and company but generally starts from ₹50,000 to ₹2,00,000.

How do monopoly rights work in a PCD Pharma Franchise? Monopoly rights allow you to operate exclusively in a specific area, minimizing competition.

What support can I expect from Neorangic Healthcare? Neorangic Healthcare provides marketing materials, product training, and promotional support.

How profitable is the PCD Pharma Franchise business in Pune? With Pune’s growing demand for healthcare products, the profit potential is significant.

What documents are needed to start a PCD Pharma Franchise? You need a Drug License Number (DLN), GST registration, and other relevant certifications.

0 notes

Text

Virtual Office For GST Registration!

Build your professional image with a virtual office from CollabSpace! Get a premium business address in top locations, perfect for Company Registration, GST Registration, and Mail Handling. Tailored for startups, freelancers, and growing businesses, our virtual offices offer all the perks of a physical space—minus the high costs. Enjoy flexibility and convenience with CollabSpace’s budget-friendly plans in Pune!

0 notes

Text

Questions to Ask Before Buying a Property in Pune: A Quick Guide

Pune is a dynamic city that attracts homebuyers and investors alike. Whether it’s for residential living or as an investment, buying property here requires thorough research. Asking the right questions can save you from future hassles and ensure a wise purchase. Here’s a quick guide tailored for homebuyers in Pune:

1. Is the Project RERA Registered?

Always verify the property’s RERA registration. It ensures the project complies with government norms and provides transparency about timelines and approvals.

2. How Convenient Is the Location?

Consider the property’s proximity to IT hubs, schools, hospitals, and public transport. Areas like Hinjewadi, Baner, and Kharadi are well-connected and in demand.

3. What Amenities Are Offered?

Modern buyers look for features like gyms, green spaces, and security systems. Evaluate if the amenities fit your lifestyle and justify the price.

4. What Is the Builder’s Track Record?

A reputable builder ensures timely delivery and quality construction. Check their past projects and customer reviews.

5. What Are the Additional Costs?

Factor in GST, stamp duty, registration charges, and maintenance fees to understand the total cost of ownership.

6. What Are the Loan and Financing Options?

Compare home loan interest rates and inquire about prepayment flexibility to secure the best deal.

7. Is the Property Legally Clear?

Ensure there are no legal disputes. Check for land titles, building approvals, and occupancy certificates.

8. What Is the Possession Timeline?

For under-construction properties, confirm the delivery date and penalties for delays.

Buying property in Pune can be an exciting journey if approached with the right questions in mind. Take your time, seek expert guidance, and choose a property that aligns with your goals and aspirations.

Thinking of buying in Pune? Let this guide steer you in the right direction!

0 notes

Text

Common Mistakes to Avoid When Buying Flats in Pune

Purchasing a flat in Pune, a rapidly growing real estate market, is an exciting step. However, the process requires careful consideration to avoid common mistakes that can lead to financial or legal challenges. Whether you’re a first-time buyer or a seasoned investor, avoiding these pitfalls ensures a smooth journey to homeownership.

1. Ignoring Research on Developers

One of the most critical aspects of buying a flat is choosing the right developer. Always opt for reputed builders and developers in Pune with a proven track record of delivering quality projects on time. Conduct thorough research, check reviews, and visit completed projects to evaluate the developer's credibility. Esbee Realty, known for its excellence and trust, is one of the best developers in Pune, offering premium flats with modern amenities and impeccable quality.

2. Overlooking Legal Due Diligence

Many buyers make the mistake of not verifying the legal status of the property. Ensure the flat has all necessary approvals, such as RERA registration, building permits, and clear land titles. Working with experienced builders and developers in Pune like Esbee Realty minimizes such risks as they adhere to strict compliance standards.

3. Compromising on Location and Connectivity

Selecting a flat solely based on price without considering location and connectivity is another common mistake. Pune offers diverse areas catering to different lifestyles, so choose a location that aligns with your work, education, and lifestyle needs.

4. Ignoring Budget and Additional Costs

Many buyers fail to account for hidden costs like maintenance fees, registration charges, and GST. Having a clear budget that includes these costs helps avoid financial strain.

In conclusion, buying a flat in Pune requires careful planning and informed decisions. By partnering with trusted names like Esbee Realty, known for quality and reliability, you can find a home that meets your needs and provides long-term value. Avoid these common mistakes, and make your journey to owning a flat in Pune a rewarding experience.

0 notes

Text

Expert GST Consultant in Pune | Trivid Fintax

Get expert GST consultation in Pune with Trivid Fintax. Simplify GST registration, filing, and compliance with our professional services tailored for your business.

#TAN Application Services in Pune#Litigation Support Services#Notices and Tax Compliance in India#Copyright Services in India

0 notes

Text

How to Do Real Estate Business in India: A Step-by-Step Guide

The Indian real estate sector is a dynamic and profitable field, offering vast opportunities for entrepreneurs. As urbanization grows and infrastructure improves, the demand for residential, commercial, and industrial properties continues to rise. Venturing into the real estate business in India can be a lucrative choice, but it requires strategic planning, market knowledge, and legal compliance to succeed.

In this blog, we’ll explore the essential steps and strategies for starting and managing a successful real estate business in India.

Why Choose the Real Estate Sector in India? India's real estate sector contributes significantly to the nation’s GDP, ranking as the second-largest employer after agriculture. Factors like rising disposable incomes, a growing middle class, government initiatives such as the Housing for All scheme, and increased foreign direct investment (FDI) have made the real estate sector a cornerstone of economic growth.

Starting a real estate business in India enables entrepreneurs to tap into this booming market while contributing to urban development.

Step 1: Learn the Basics of Real Estate Before entering the market, understanding the fundamentals of the real estate business in India is crucial. The industry operates across several verticals:

Residential Real Estate: Includes apartments, villas, and gated communities. Commercial Real Estate: Focuses on office spaces, malls, and co-working spaces. Land Development: Involves acquiring land for future projects. Real Estate Investing: Buying properties to generate rental income or resale profits. Knowing these categories helps you identify your area of interest and expertise.

Step 2: Conduct Market Research Market research is the foundation of a successful real estate business. Here’s how to get started:

Study Local Trends: Understand which cities or neighborhoods are witnessing growth in property demand. Cities like Mumbai, Bengaluru, Hyderabad, and Pune are hotspots for real estate. Target Audience: Determine your target audience, such as first-time homebuyers, luxury property seekers, or corporate clients. Competitive Analysis: Identify major competitors and analyze their business models, pricing, and customer engagement strategies. By analyzing market data, you can make informed decisions about where and how to invest your efforts.

Step 3: Choose a Business Model The real estate business offers various operational models. Decide which one aligns with your skills, resources, and long-term goals:

Brokerage Services: Facilitate transactions between buyers and sellers. Property Development: Build residential or commercial properties for sale or lease. Real Estate Investment: Purchase properties to generate rental income or long-term capital gains. Property Management: Manage and maintain properties for landlords or owners. Each model has its pros and cons, so choose based on your expertise and available capital.

Step 4: Meet Legal Requirements To operate a legitimate real estate business in India, you must comply with various legal and regulatory requirements. These include:

Business Registration: Register your company under the appropriate business structure, such as sole proprietorship, partnership, or private limited company. RERA Registration: The Real Estate (Regulation and Development) Act, 2016, mandates registration for all real estate agents and developers with their respective state RERA authorities. Tax Compliance: Obtain a GST registration and maintain proper tax records. Property Laws: Familiarize yourself with local land acquisition and zoning laws. Ensuring legal compliance not only protects your business but also builds trust among clients.

Step 5: Secure Funding The real estate business in India often requires significant capital investment, whether for purchasing properties or marketing services. Here are some funding options:

Bank Loans: Apply for real estate loans or business loans from banks and financial institutions. Private Investors: Partner with investors who share your vision. Government Schemes: Explore government-backed funding options for affordable housing or infrastructure development projects. Personal Savings: Use personal funds for initial investments to reduce borrowing risks. Proper financial planning ensures the stability and growth of your business.

Step 6: Build Your Team A strong team is critical for the success of your real estate business. Consider hiring professionals such as:

Real Estate Agents: Skilled agents who can handle property transactions. Legal Advisors: Lawyers to ensure compliance with property laws. Marketing Specialists: Experts who can promote your brand and services. Property Inspectors: Professionals who assess the condition and value of properties. A well-rounded team can help you manage operations efficiently.

Step 7: Develop a Marketing Strategy Marketing is essential to grow your visibility and attract clients in the real estate business in India. Here’s how you can market effectively:

Online Marketing: Build a professional website. List properties on platforms like MagicBricks, 99acres, and Housing.com. Use social media platforms like Instagram, Facebook, and LinkedIn for outreach. Search Engine Optimization (SEO): Optimize your website with keywords like "real estate business in India" to rank higher on search engines. Content Marketing: Publish blogs, videos, and client testimonials to build credibility. Networking Events: Attend property expos and real estate seminars to connect with potential clients and investors. Combining online and offline strategies can maximize your reach.

Step 8: Focus on Customer Satisfaction Client satisfaction is the cornerstone of a successful real estate business in India. Here are ways to ensure your clients are happy:

Transparency: Be honest and upfront about property details, pricing, and legal formalities. Personalized Service: Tailor your services to meet the specific needs of your clients. After-Sales Support: Offer support even after the deal is closed, such as helping with documentation or home improvement services. Satisfied clients are likely to recommend your business to others, helping you build a strong reputation.

Challenges in Real Estate Business While the real estate business in India is lucrative, it comes with its share of challenges:

Regulatory Compliance: Navigating complex laws and procedures. Market Volatility: Fluctuations in property prices and demand. High Competition: Standing out in a crowded market. Financing Risks: Managing cash flow and debt. By anticipating these challenges and preparing accordingly, you can mitigate risks and focus on growth.

The Future of Real Estate in India The future of the real estate business in India is promising, driven by trends like:

Affordable Housing: Increased demand due to government initiatives. Smart Cities: Development of technology-driven urban centers. Green Buildings: Focus on eco-friendly and energy-efficient properties. Co-Working Spaces: Rising demand for flexible office spaces. Staying ahead of these trends can help you adapt to the changing market dynamics.

Conclusion Starting a real estate business in India can be an excellent opportunity to tap into a growing market with immense potential. By conducting thorough market research, complying with legal requirements, building a strong team, and focusing on marketing and customer satisfaction, you can establish a successful and sustainable business.

Although challenges exist, the rewards far outweigh the risks for those who are committed to learning, adapting, and growing in this vibrant industry. With the right strategy and determination, you can make your mark in India's thriving real estate sector.

0 notes

Text

ASC GROUP is the top leading GST Advisory Services in India GST Consultants and GST Consulting Services India know the laws and regulations pertaining in Goods and Services Tax. Contact the number (9999043311) for any queries.We Provide Services In India Like: Chennai, Delhi, Noida, Gurugram, Kolkata, Pune, Hyderabad, and Bengaluru.

#GST Consultant#GST Registration#GST Advisory Services#GST Compliance#GST Consultant services in India#GST Annual Return and GST Audit#GST return filing

0 notes

Text

Comply Local offers hassle-free APOB service In pune ensuring swift compliance and seamless expansion for businesses.

0 notes

Text

Exploring Urbana By Intercontinental Infrastructure: A Complete Guide

Pune is the second largest city of Maharashtra after Mumbai. The city attracts many immigrants from all over the state and country due to the growing IT and manufacturing industries. It is also an educational hub attracting students who prefer to work in the city after finishing their education. Pune has a high demand for housing, especially affordable housing, by first-time home buyers who want to settle in the city. With the rising property prices and interest rates on home loans, there is a need to make homes affordable to those who wish to own a home.

Government Initiatives

The state and the central government have introduced and implemented several schemes to make housing affordable for the economically weaker sections of society. The Maharashtra Housing and Area Development Authority (MHADA) has successfully developed affordable housing projects and awarded them to deserving families.

The Pradhan Mantri Awas Yojna Scheme offers subsidies on home loan interest rates for those who cannot afford to buy homes at the market rates. By availing of these schemes many first-time home buyers can own a home in Pune.

The Urbana by Intercontinental

The Urbana is a township located at Chakan in Pune. This township offers 1 and 2 BHK flats in Chakan in 10 towers spread over 6.5 acres. It is a pinnacle of modern living and urban sophistication, one of the rare projects that offers a comfortable and modern lifestyle in the affordable segment. Not just the homes but even the amenities provided by The Urbana Pune are designed to enhance the living experience through leisure, recreation, and social activities.

The Urbana is located in Chakan which offers seamless connectivity to PCMC and Pune. With its strategic location, proximity to business establishments, and upcoming infrastructure projects, Chakan is emerging as a prominent residential hub in Pune.

Affordable Housing

The Urbana is offering 1 & 2 BHK flats in Chakan starting from 20.60* Lakhs which is the most competitive pricing in the affordable housing segment. Home buyers can avail of exciting offers like booking a home by paying Rs 25,000* only and the EMIs after possession. Also, they do not have to pay GST, Stamp duty, and Registration charges while buying their home at The Urbana. These translate to significant savings making owning a home at Intercontinental Urbana easy.

By availing of the government schemes first-time home buyers can now dream of owning their home. With reduced rates on home loans and the schemes provided by the developer, home buyers can plan their finances to successfully pay their loan dues on time and become proud home owners. They can live their dream of living in a modern township with the best amenities for their families at an upcoming urban location in Pune.

0 notes

Text

ProMunim: Your Trusted Tax Consultants in Pune for Comprehensive Solutions

When it comes to managing finances, understanding tax obligations, and maximising returns, professional guidance is invaluable. This is where ProMunim steps in as your trusted partner among the best tax consultants in Pune. With a dedicated team of experts, we provide a range of services tailored to meet your individual and business needs. Whether you are looking for an income tax consultant in Pune or seeking advice on corporate taxation, ProMunim has got you covered.

Why You Need Tax Consultants

Taxation is a complex field that constantly evolves with new regulations and policies. For individuals and businesses alike, staying compliant with tax laws while minimising liabilities can be challenging. Here are a few reasons why hiring professional tax consultants is essential:

Expert Knowledge: Tax consultants have in-depth knowledge of tax laws and regulations. They stay updated on changes in legislation that could impact your tax obligations.

Personalised Guidance: Every financial situation is unique. Tax consultants provide tailored advice based on your specific circumstances, ensuring you receive the most beneficial guidance.

Maximising Deductions: Professionals can help identify deductions and credits you may be eligible for, ultimately reducing your tax burden.

Compliance Assurance: With a tax consultant on your side, you can ensure that your tax filings are accurate and compliant with current laws, minimising the risk of audits and penalties.

Time-Saving: Managing taxes can be time-consuming. By outsourcing your tax needs to professionals, you can focus on other essential aspects of your life or business.

ProMunim: Leading Tax Consultants in Pune

At ProMunim, we pride ourselves on being one of the leading tax consultants in Pune. Our team comprises qualified and experienced professionals who are committed to providing the best service to our clients. Here’s what sets us apart:

Comprehensive Tax Services

We offer a wide range of services to cater to both individual and business needs:

Personal Taxation: We assist individuals in managing their personal taxes, ensuring compliance while optimising their tax situation.

Corporate Taxation: Our expertise extends to corporate clients, where we provide services such as tax planning, compliance, and advisory.

Goods and Services Tax (GST): We help businesses navigate the complexities of GST, ensuring timely registration and compliance.

Tax Audits: If you’re facing a tax audit, our experienced consultants will guide you through the process, ensuring all your documentation is in order.

Experienced Income Tax Consultants in Pune

As a prominent income tax consultant in Pune, ProMunim has built a reputation for excellence. Our consultants bring years of experience in dealing with various tax-related issues, providing clients with insights and strategies that are effective and compliant. Here’s how we can help:

Income Tax Planning: We offer strategic planning services to help you manage your income tax liabilities effectively.

Filing Income Tax Returns: Our team ensures that your income tax returns are filed accurately and on time, reducing the risk of penalties.

Representation in Tax Matters: Should you face any issues with the tax authorities, we provide representation to resolve matters efficiently.

Tax Consultation: We provide ongoing consultation services to ensure you remain informed about your tax obligations and options.

Our Approach to Tax Consultancy

At ProMunim, we believe in a proactive approach to tax consultancy. Here’s how we work with you:

Initial Consultation: We start with a free consultation to understand your financial situation and tax needs.

Customized Strategies: Based on our assessment, we develop tailored strategies that align with your goals and comply with tax regulations.

Regular Reviews: Tax laws change frequently. We conduct regular reviews to adapt your tax strategy as needed, ensuring you stay compliant and optimise your returns.

Client Education: We believe in empowering our clients with knowledge. We offer educational resources to help you understand your tax situation better.

The Importance of Compliance

Compliance is a critical aspect of tax management. Failing to comply with tax laws can lead to severe consequences, including fines and legal issues. At ProMunim, we prioritise compliance in every aspect of our service. Our consultants ensure that all filings are accurate and submitted on time, minimising the risk of audits and penalties.

Benefits of Choosing ProMunim

Choosing ProMunim as your tax consultant offers numerous benefits:

Personalised Service: We understand that every client is unique. Our consultants provide personalised service tailored to your specific needs.

Transparent Pricing: We offer clear pricing with no hidden fees, ensuring you know exactly what to expect.

Dedicated Support: Our team is always available to address your queries and provide support throughout the year, not just during tax season.

Proven Track Record: We have a history of satisfied clients who have benefited from our services. Our positive reviews and referrals speak volumes about our dedication to excellence.

Conclusion

Navigating the complexities of taxation can be daunting, but with the right support, it doesn’t have to be. ProMunim stands out as one of the leading income tax consultant in pune, providing tailored solutions to meet your individual and business needs. Whether you require assistance with income tax planning, compliance, or filing, our dedicated team is here to help.

By choosing ProMunim, you gain access to expert knowledge, personalised guidance, and the peace of mind that comes from knowing your taxes are in capable hands. Don’t leave your financial future to chance; contact ProMunim today and let us help you achieve your tax goals.

0 notes

Text

Enhance Your Coding Skills with Data Structures and Algorithms Classes at Sunbeam Institute, Pune

Elevate your programming expertise by enrolling in the Data Structures and Algorithms course at Sunbeam Institute, Pune. This comprehensive program is designed for students, freshers, and working professionals aiming to deepen their understanding of essential data structures and algorithms using Java.

Course Highlights:

Algorithm Analysis: Learn to evaluate time and space complexity for efficient coding.

Linked Lists: Master various types, including singly, doubly, and circular linked lists.

Stacks and Queues: Understand their implementation using arrays and linked lists, and apply them in expression evaluation and parenthesis balancing.

Sorting and Searching: Gain proficiency in algorithms like Quick Sort, Merge Sort, Heap Sort, Linear Search, Binary Search, and Hashing.

Trees and Graphs: Explore tree traversals, Binary Search Trees (BST), and graph algorithms such as Prim’s MST, Kruskal’s MST, Dijkstra's, and A* search.

Course Details:

Duration: 60 hours

Schedule: Weekdays (Monday to Saturday), 5:00 PM to 8:00 PM

Upcoming Batch: January 27, 2025, to February 18, 2025

Fees: ₹7,500 (including 18% GST)

Prerequisites:

Basic knowledge of Java programming, including classes, objects, generics, and Java collections (e.g., ArrayList).

Why Choose Sunbeam Institute?

Sunbeam Institute is renowned for its effective IT training programs in Pune, offering a blend of theoretical knowledge and practical application to ensure a thorough understanding of complex concepts.

Enroll Now: Secure your spot in this sought-after course to advance your programming skills and enhance your career prospects. For registration and more information, visit:

#Data Structures Algorithms#Programming Courses#Sunbeam Institute Pune#Java Training#Coding Classes#Pune IT Training

0 notes

Text

Manage Your GST Obligations Effectively with Trivid Fintax Running a small business comes with many responsibilities, and managing GST obligations is crucial. Effective GST management ensures compliance, optimizes your tax processes, and ultimately contributes to your business's smooth operation and growth.

For more details contact Trivid Fintax- Top GST consultant in Pune.!

Contact Trivid Fintax at +919403978858 or Visit www.trividfintax.com

#GSTCompliance#GSTServices#TaxExperts#TrividFintax#SimplifyGST#TaxFiling#GSTRegistration#IncomeTax#FinancialAwareness#TaxObligations#TaxBreakdown#PersonalFinance#TaxTips#IncomeTaxIndia#Taxpayer#trividfintax

0 notes

Text

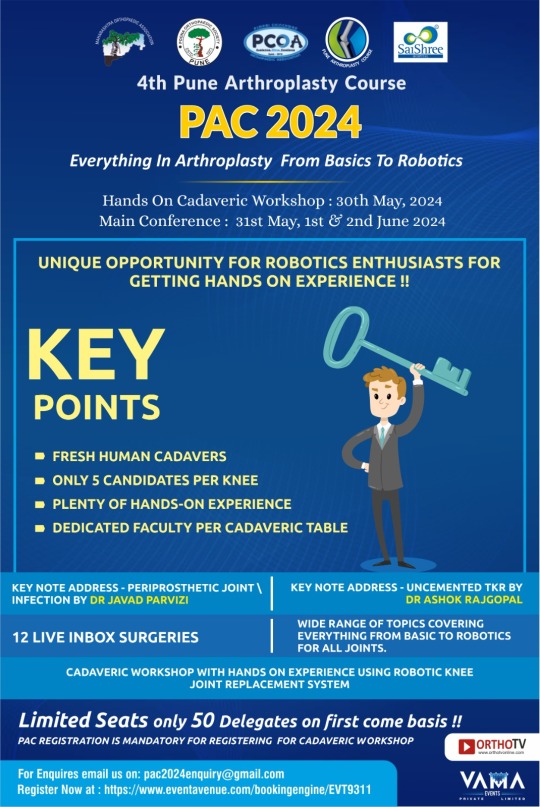

‼️ Register quickly to avoid missing out.‼️

🔛 Limited Seats: Only 50 Delegates on First Come Basis

🔰 PAC 2024: 4th Pune Arthroplasty Course

🗓️ Dates: 31st May, 1st & 2nd June 2024

🏨 Venue: JW Marriott Pune

🔆 Everything In Arthroplasty From Basics To Robotics

PAC Registration Fees for Residential & Non-Residential Delegates is mentioned on the Link below⬇️

💻 Click here to Register: https://tinyurl.com/OrthoTV-PAC-2024

💰 30th May - CADAVERIC WORKSHOP Fees: Rs. 15,000 + 18% GST

®️ PAC REGISTRATION IS MANDATORY FOR REGISTERING FOR CADAVERIC WORKSHOP

↔️ UNIQUE OPPORTUNITY FOR ROBOTICS ENTHUSIASTS FOR GETTING HANDS ON EXPERIENCE !!

✅ KEY POINTS

🔺FRESH HUMAN CADAVERS 🔺ONLY 10 CANDIDATES PER KNEE 🔺PLENTY OF HANDS-ON EXPERIENCE 🔺DEDICATED FACULTY PER CADAVERIC TABLE 🔺KEY NOTE ADDRESS

👨⚕️PERIPROSTHETIC JOINT INFECTION BY DR JAVAD PARVIZI 👨⚕️UNCEMENTED TKR BY DR. ASHOK RAJGOPAL 📹12 LIVE INBOX SURGERIES

CADEAVERIC WORKSHOP WITH HANDS ON EXPERIENCE USING ROBOTIC KNEE JOINT REPLACEMENT SYSTEM

🤝 Media Partner: OrthoTV Global

#Orthopaedics#Arthroplasty#PAC2024#SurgeryWorkshop#CadavericWorkshop#RoboticSurgery#MedicalEducation#OrthoTV#Orthopedics#HandsOnExperience#JointReplacement#OrthoConference

0 notes