#fxopen regulation

Explore tagged Tumblr posts

Text

Trade Forex with a Regulated Broker | FXOpen

Trade Forex confidently with FXOpen, a Forex Broker Licensed and Regulated offering a secure and transparent trading environment. Benefit from competitive spreads, cutting-edge trading platforms, and excellent customer support. With FXOpen, you can access the global Forex market with peace of mind.

#forex broker#stock broker#forex market#forex market news#business#online forex trading#stock market#forex trading#forexregulationinqury#online forex market

0 notes

Text

Best Forex Brokers in UK (FCA Regulated)

Best Forex Brokers in UK (FCA Regulated)

As the currency market is a decentralized entity, trading and processing of orders are carried out online. It is, therefore, necessary that you open an account with a broker that provides an online platform for trading forex. If you are a UK resident, then it is a good idea that you work with a forex broker that is based in the UK or at least has an office operating in the country. However, the problem is that there are a number of forex brokers out there in the market and identifying the right one to work with can be a challenging task, especially if you are new to forex trading.To get more news about fca regulated forex brokers, you can visit wikifx.com official website.

FXOpen UK, a popular metatrader ecn forex broker in the UK, offers several helpful features on their platform including expert advisors, technical analysis tools, indicators and professional graphics. Founded in 2013 and headquartered in the London UK, FXOpen is authorised and regulated by the Financial Conduct Authority under FCA firm reference number 579202. FX OPEN UK accepts Traders with Minimum deposit required to start trading on their platform is $300 and the minimum lot size offered by the broker is 0.01. The forex broker offers leverage up to 500:1 and makes available floating spreads starting from 0 pips. When it comes to trading platforms, FXOpen offers a wide range of platforms including MetaTrader 4, WebTrader and Mobile Trading Platform. As regards transfer of funds, options available with FXOpen include Wire transfer, credit/debit cards, Neteller and Skrill Moneybookers, Payza and Webmoney.

The online forex broker Plus500 UK Ltd is authorized as well as regulated by the Financial Conduct Authority. The forex broker services both institutional customers and retail investors and offers No Dealing Desk currency trading facility. PLUS500 UK which has its headquarters located in the UK was founded in 2008. Traders have to deposit a minimum of €100 if they want to use the broker’s platform for trading forex. The minimum position size offered by the company 0.01 and the leverage that traders can avail is 294:1. Spreads can be as low as 0.01%” (0.01% = spread for EUR/USD). Plus500 offers multiple trading platforms such as Windows Trader, WebTrader, Windows 10, Android App, Windows Phone App & iPhone App/iPad App/Apple Watch App. Payment options offered by the forex broker include Credit Card, PayPal, Wire Transfer, Skrill MoneyBookers.

XM, an online currency trading platform provider, was founded in 2009. The forex broker offers MetaTrader trading platform and more than 100 instruments from asset classes such as currencies, CFDs on stocks and precious metals. XM which serves both institutional as well as retail customers in more than 196 countries has established over 4 offices around the world. Traders who open accounts on their platform will have to deposit a minimum of $5 in order to start trading. While the minimum position size offered is 0.01, the leverage can go up to 888:1. XeMarkets is regulated broker by ASIC Australia, CySEC, FCA (UK), BaFin. XM broker offers low spreads From 1 Pips. Multiple forex platforms offered by the broker include MetaTrader 4, and Web, iPhone/iPad and mobile trader. When it comes to payments, options include Credit/ Debit Card, bank wire transfer, local bank transfer, Neteller, Moneybookers Skrill, Western Union, MoneyGram, WebMoney, China UnionPay, SOFORT, iDEAL.

1. Guaranteed credibility

All Forex brokers that are regulated by the Financial conduct authority (FCA) are required to submit financial reports to the regulatory body. This body scrutinizes the reports to make sure they are in line with set policies for secure and efficient Forex trading. This, therefore, means that regulated brokers are always credible since they are monitored. Also, another role of FCA is to fairly resolve disputes between Forex traders and brokers. So, trading with FCA UK forex brokers means that you are protected in case any disputes arise between you and your Forex broker.

2. Ensure investors’ money is safe

According to the FCA rules, FCA UK forex brokerage firms must keep their funds separate from the investors’ money. Keeping investors funds in a different account ensures that the brokerage firm cannot use the clients’ funds to cover any of its expenses.

Having segregated accounts safeguards the investors’ money in case of a financial crisis or bankruptcy. In such scenarios, the broker cannot use your money to pay its creditors. The FCA requires that the broker compensates the investor first. So when working with a regulated broker you are guaranteed safety for your money despite any financial situation the broker might face.

Given the uncertain financial conditions, you have to be sure your money is always safe. FCA has got you covered! Time and again, the regulatory body reviews all the FCA UK forex brokerage firms to ensure they maintain separate accounts for investors and the firm to keep your money protected from uncertain market conditions.

3. Enhances the chances of making profits for investors

It is usually easier to trade and make profits with FCA UK forex brokers than unregulated brokers. FCA monitors all regulated brokers to ensure they provide the right tools to make Forex trading simpler for the investors. It does this by ensuring the software used by brokers for trading meets the traders’ needs.

In addition, it ensures that Forex traders have access to the right information and support from the brokers. The FCA UK forex brokers should be able to answer the investors’ questions and provide help in case of any difficulties. This is in a bid to make Forex trading easy and profitable to the traders.

0 notes

Text

WIKIFX:Trading schedule for the 2021-2022 Winter Holiday period

Abstract:Please be aware of the trading schedule changes for the 2021 Christmas and New Year holiday period (all times are GMT+2):

FXOpen as a retail and institutional forex broker offering online trading services via MetaTrader 4, MetaTrader 5 and TickTrader trading platforms. It also provides access to the electronic communication network to execute trades in currency pairs. FXOpen EU is a trading name of FXOpen EU Ltd. FXOpen EU Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 194/13.

The Broker is hereby informing trades about the recent trading schedule changes which happens as a result of the Christmas and New Year holidays and warned all the Users to be aware and kindly consider the changes and ensure they're taking care of. (all times are GMT+2):

Thursday, December 23

Indices:

• #ESX50 (Europe 50) — trading ends at 23:00

• #GDAXIm (Germany 30) — trading ends at 23:00.

Friday, December 24

Commodities CFDs:

• XBRUSD (UK Brent) — trading closed

• XTIUSD (US Crude) — trading closed

• XNGUSD (US Natural Gas) — trading closed

Metal CFDs:

• XAUUSD (GOLD vs. US dollar) — trading closed

• XAGUSD (SILVER vs. US dollar) — trading closed

Indices:

• #AUS200 (Australia 200) — trading ends at 05:00

• #ESX50 (Europe 50) — trading closed

• #FCHI (France 40) — trading ends at 14:55

• #GDAXIm (Germany 30) — trading closed

• #HSI (Hong Kong 50) — trading ends at 06:00

• #J225 (Japan 225) — trading closed

• #UK 100 (UK 100) — trading ends at 15:00

• #SPXm (US SPX 500 (Mini)) — trading closed

• #NDXm (US Tech 100 (Mini)) — trading closed

• #WS30m (Wall Street 30 (Mini)) — trading closed

Stock CFDs: trading closed.

Monday, December 27

Indices:

• #AUS200 (Australia 200) — trading closed

• #ESX50 (Europe 50) — trading starts at 02:15

• #FCHI (France 40) — trading starts at 09:00

• #GDAXIm (Germany 30) — trading starts at 02:15

• #HSI (Hong Kong 50) — trading closed

• #UK 100 (UK 100) — trading closed.

Tuesday, December 28

Indices:

• #AUS200 (Australia 200) — trading closed

• #HSI (Hong Kong 50) — trading starts at 03:15

• #UK 100 (UK 100) — trading closed.

Wednesday, December 29

Indices:

• #UK 100 (UK 100) — trading starts at 03:00.

Thursday, December 30

Indices:

• #ESX50 (Europe 50) — trading ends at 23:00

• #GDAXIm (Germany 30) — trading ends at 23:00.

Friday, December 31

Commodities CFD:

• XBRUSD (UK Brent) — trading ends at 21:45

Indices:

• #AUS200 (Australia 200) — trading ends at 05:30

• #ESX50 (Europe 50) — trading closed

• #FCHI (France 40) — trading ends at 14:55

• #GDAXIm (Germany 30) — trading closed

• #HSI (Hong Kong 50) — trading ends at 06:00

• #UK 100 (UK 100) — trading ends at 15:00.

Monday, January 3

Indices:

• #AUS200 (Australia 200) — trading closed

• #ESX50 (Europe 50) — trading starts at 02:15

• #FCHI (France 40) — trading starts at 09:00

• #GDAXIm (Germany 30) — trading starts at 02:15

• #HSI (Hong Kong 50) — trading starts at 03:15

• #UK 100 (UK 100) — trading closed.

Tuesday, January 4

Indices:

• #UK 100 (UK 100) — trading starts at 03:00.

All traders are Pleased to consider this information when you plan your trading to avoid any inconvenience that may occur.

MORE ON WIKIFX WEBSITE

0 notes

Text

WiKiFX:Trading schedule for the 2021-2022 Winter Holiday

Abstract:Please be aware of the trading schedule changes for the 2021 Christmas and New Year holiday period (all times are GMT+2): FXOpen as a retail and institutional forex broker offering online trading services via MetaTrader 4, MetaTrader 5 and TickTrader trading platforms. It also provides access to the electronic communication network to execute trades in currency pairs. FXOpen EU is a trading name of FXOpen EU Ltd. FXOpen EU Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 194/13.📷The Broker is hereby informing trades about the recent trading schedule changes which happens as a result of the Christmas and New Year holidays and warned all the Users to be aware and kindly consider the changes and ensure they're taking care of. (all times are GMT+2):Thursday, December 23Indices:• #ESX50 (Europe 50) — trading ends at 23:00• #GDAXIm (Germany 30) — trading ends at 23:00.Friday, December 24Commodities CFDs:• XBRUSD (UK Brent) — trading closed• XTIUSD (US Crude) — trading closed• XNGUSD (US Natural Gas) — trading closedMetal CFDs:• XAUUSD (GOLD vs. US dollar) — trading closed• XAGUSD (SILVER vs. US dollar) — trading closedIndices:• #AUS200 (Australia 200) — trading ends at 05:00• #ESX50 (Europe 50) — trading closed• #FCHI (France 40) — trading ends at 14:55• #GDAXIm (Germany 30) — trading closed• #HSI (Hong Kong 50) — trading ends at 06:00• #J225 (Japan 225) — trading closed• #UK 100 (UK 100) — trading ends at 15:00• #SPXm (US SPX 500 (Mini)) — trading closed• #NDXm (US Tech 100 (Mini)) — trading closed• #WS30m (Wall Street 30 (Mini)) — trading closedStock CFDs: trading closed.Monday, December 27Indices:• #AUS200 (Australia 200) — trading closed• #ESX50 (Europe 50) — trading starts at 02:15• #FCHI (France 40) — trading starts at 09:00• #GDAXIm (Germany 30) — trading starts at 02:15• #HSI (Hong Kong 50) — trading closed• #UK 100 (UK 100) — trading closed.Tuesday, December 28Indices:• #AUS200 (Australia 200) — trading closed• #HSI (Hong Kong 50) — trading starts at 03:15• #UK 100 (UK 100) — trading closed.Wednesday, December 29Indices:• #UK 100 (UK 100) — trading starts at 03:00.Thursday, December 30Indices:• #ESX50 (Europe 50) — trading ends at 23:00• #GDAXIm (Germany 30) — trading ends at 23:00.Friday, December 31Commodities CFD:• XBRUSD (UK Brent) — trading ends at 21:45Indices:• #AUS200 (Australia 200) — trading ends at 05:30• #ESX50 (Europe 50) — trading closed• #FCHI (France 40) — trading ends at 14:55• #GDAXIm (Germany 30) — trading closed• #HSI (Hong Kong 50) — trading ends at 06:00• #UK 100 (UK 100) — trading ends at 15:00.Monday, January 3Indices:• #AUS200 (Australia 200) — trading closed• #ESX50 (Europe 50) — trading starts at 02:15• #FCHI (France 40) — trading starts at 09:00• #GDAXIm (Germany 30) — trading starts at 02:15• #HSI (Hong Kong 50) — trading starts at 03:15• #UK 100 (UK 100) — trading closed.Tuesday, January 4Indices:• #UK 100 (UK 100) — trading starts at 03:00.All traders are Pleased to consider this information when you plan your trading to avoid any inconvenience that may occur.

https://wap.wikifx.com/en/newsdetail/202201052954546232.html

0 notes

Text

コピートレードやPAMMが使え、ボーナスやコンテストが豊富なハイスペックブローカー「FXOpen」について詳しく解説!

他の外国為替ブローカーとは異なり、FXOpenは専業トレーダーの専門家達によって作成され、教育センターとしてのルーツから長い道のりを経て、急速に拡大し続ける主要な外国為替ブローカー会社になりました。 FXOpenは、テクニカル分析と金融市場の分野でコースを提供する教育センターとして 2005年に設立されました。 2005年に金融取引サービスを開始することによって、優れた顧客サポートと組み合わされた公正で透明な取引条件に対する高まるニーズを満たし続けています。 FXOpenは、MetaTrader 4、MetaTrader 5、Tick Traderといったデスクトップ、ウェブ、モバイル向けの取引プラットフォームとしてプラットフォームと、4つの口座タイプ(ECN、STP、Micro、Crypto)の外国為替、インデックス、株式CFD、仮想通貨、コモディティーなど70以上の金融CFD商品で取引する機能を提供しています。 FXOpenには、英国金融行動監視機構、キプロス証券取引委員会、オーストラリア証券投資委員会によって認可および規制されています。 FXOpenは、初心者と上級者の両方に適した多種多様な取引口座を提供しています。これには、ECN、STP、マイクロおよび仮想通貨取引専用の口座、イスラムのスワップフリー口座の使用が含まれます。これらのアカウントを通じて、ユーザーは最大500���1の最大レバレッジにアクセスする機能を備えた、外国為替、指数、株式、仮想通貨、コモディティーなどの70以上の金融CFD商品で取引できます。 クライアントは、2億5000万ドルを超える取引をする場合、1ロットあたり1.5米ドル、500万ドル未満の取引量の場合はロットあたり3.5米ドルという、手数料無料の取引アカウントと手数料ベースの取引アカウントの組み合わせにアクセスできます。FXOpenは、MetaTrader 4、MetaTrader 5、TickTraderの取引プラットフォームでデスクトップ、ウェブ、モバイルを取引する機能を提供し、計算機、レベル2プラグイン、さらには、コピートレードプラットフォームである「MyFXBook」および「ZuluTrade」とのソーシャル取引統合を含むTraderのツールにアクセスできます。 またFXOpenは、PAMMにも力を入れています。 FXOpenは、FXOpenが所有するブログを通じて市場分析といくつかの教育記事へのアクセスを提供しています。カスタマーサポートは24時間年中無休で複数の言語で提供されており、さまざまなボーナスやプロモーションも提供しています。

メリットデメリット

ECN、STP、Micro、Cryptoを含む複数の口座タイプを用意

STPおよびMicroで手数料無料で取引可能

ECN口座における取引手数料が安い

MT4、MT5、TickTraderなどの取引プラットフォームで取引可能

24時間年中無休のカスタマーサービスサポート

ZuluTrade, AutoTrade, PAMMなどのコピートレード機能が充実

ボーナスやプロモーション、取引コンテストなどのイベントが充実

ゼロカットシステム(Negative Balance Protection)がない。 (その代わりスリッページコントロールをする)

youtube

FXOpenの概要

法人名FXOpen Markets Limitedサービス開始2005年営業拠点P.O. Box 590, Springates East, Government Road, Charlestown, Nevis Perth, Australia, London, United Kingdom Charlestown, Saint Kitts and Nevisライセンス (金融監督機関)AU:ASIC, UK:FCA預託証拠金の取り扱い分別保管による信託保全 (分別管理、顧客の預託金はTier1銀行の保険に加入)最大レバレッジ500:1初回入金額 (最小入金額)1USD, 100円口座通貨建てAUD , CAD , CHF , CNY , EUR , GBP , JPY , RUB , USD追証についてゼロカット対応なし (ブローカーが調整する)マージンコール50%ロスカット (ストップアウト)ECN口座:50%, STP口座:30%, Crypto口座:15%, マイクロ口座:10%取引モデルSTP, ECN所在国ロシア, イギリスサポートデスク日本語対応あり口座タイプECN口座, PAMM口座, STP口座, マイクロ口座, 仮想通貨取引口座入出金方法SEPA, Paypaid, 銀行送金, WebMoney, FasaPay取扱マーケットFX, 株価指数, 仮想通貨, 貴金属, コモディティー, 原油, 先物取扱仮想通貨BTC, ETH, XRP, LTC取引プラットフォーム (取引ソフト)MT4, MT5表示桁数5桁表示最小取引単位 (最小取引ロット)0.01Lots=1,000通貨ソーシャル・トレード (コピー・トレード)ZuluTrade, Myfxbook AutoTrade, PAMM

FXOpenの口座タイプ

FXOpenは、ECN、STP、Micro、Cryptoと呼ばれる4つの主要な口座タイプを提供しており、手数料無料および低手数料ベースのさまざまな取引オプションを提供しています。 ブローカーは、デモ取引口座とイスラムのスワップフリー口座へのアクセスも提供しています。 それぞれに、初心者と上級者の両方のために設計されたさまざまな機能、取引可能な製品とサービスが付属しています。

ECNSTPCryptoMicro口座タイプECNSTPECNMM最小入金額from $100from $10from $10from $1最大入金額無制限無制限無制限$3,000スプレッド流動性, 0pips~流動性流動性流動性100万通貨あたりの取引手数料$15~なし往復取引量の0.5%なし価格表示(桁数)5 digit (ex. 0.12345)5 digit (ex. 0.12345)5 digit (ex. 0.12345)5 digit (ex. 0.12345)約定・執行マーケット(ECN)マーケット(STP)マーケット(STP)即座(STP)リクオート×××◯スリッページ◯◯◯×最小取引量0.01 lot0.01 lot0.01 lot0.1 microlots最大取引量無制限無制限無制限$1,000,000最小増減幅0.01 lot0.01 lot0.01 lot0.01 microlotsオープンポジションを持てる最大取引回数無制限無制限無制限同時に100回まで最大レバレッジ1:5001:5001:31:500マージンコール100%50%30%20%ストップアウト(ロスカット)50%30%15%10%イスラム口座提供◯◯×◯取引商品50通貨ペア, CFDs, 株式指数, gold, silver50通貨ペア, gold, silver43 通貨ペア, BTC, LTC, EOS, PPC, ETH, DASH, EMC28通貨ペア, gold, silverボーナス×◯×◯ヘッジング(両建て取引)◯◯◯◯EA・自動ロボットの利用◯◯◯◯スキャルピング◯◯◯×ニュースを使った取引◯◯◯ ×電話取引◯◯◯×レベル2クオートを備えたマーケットの深さ (板情報の入手)◯◯◯×

ユーザーは、FXOpenのホームページをこちらから訪れるだけで、いくつかの簡単な手順で無料で口座を開くことができます。 これにより、ユーザーは登録ページに移動し、電子メール、パスワード、電話番号、およびさまざまな契約と条件への同意を求められます。 その後、ユーザーはFXOpenクライアントポータルページにリダイレクトされます。 このポータルから、トレーダーは、以下に示すように、身元の証明と住所の証明のための標準的な検証手順を実行し、さまざまな取引口座と出金を管理できます。

youtube

ライブクオート・ライブスプレッド一覧

次の表では、FXOpenが取り扱っている取引商品の一部を紹介しています。

FX株式指数仮想通貨EURUSDAppleUK 100BTC/EURNOKJPYBlackrockWall Street 30BTC/USDUSDCADCiscoUS CrudeETH/CNHNZDCHFMcDonald'sAustralia 200DSH/USDGBPAUDNetflixUSDTRYNikeUSDRUBStarbucksXAUUSDTeslaXAGUSDWalmart

FXOpenはゼロカットなし!

管理人は、FXOpenのスタッフに直接ゼロカットシステム(negative balance protention)を導入しているか聞くと、以下の返答が返ってきました。

Please be informed that FXOpen Markets Limited as per the legislation of the place of the company's registration is not obliged to provide its clients with segregated accounts and any respective insurance of clients' funds. However, FXOpen Markets Limited do hold all client’s funds fully segregated from the company funds. In case you are interested in the strictest protection of your funds and want to receive insurance benefits, you are welcome to open accounts in the FXOpen Ltd. (United Kingdom www.fxopen.co.uk) or FXOpen AU Pty Ltd. (Australia www.fxopen.com.au). These companies have a legal obligation to hold clients' funds segregated and provide an insurance in compliance with the local regulator's rules (FCA and ASIC respectively). We have a slippage control as negative balance protection.

FXOpen Markets Limitedは、登録場所の法律に従い、クライアントに分離口座とクライアントの資金のそれぞれの保険を提供する義務を負いません。 ただし、FXOpen Markets Limitedは、会社の資金から完全に分離されたすべてのクライアントの資金を保有しています。 これらの企業は、クライアントの資金を分離し、現地の規制当局の規則(それぞれFCAおよびASIC)に準拠して保険を提供する法的義務を負っています。 ゼロカットシステム(negative balance protention)を導入していない代わりに、FXOpenは、スリッページコントロールをしています。 詳細は以下のボタンからご覧ください。

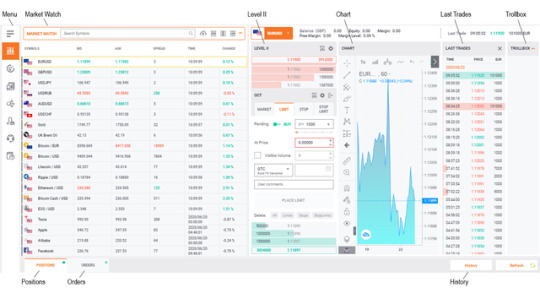

FXOpenの取引プラットフォームについて

FXOpenは、デスクトップおよびWeb用の世界的に認められたMetaTrader 4、MetaTrader 5、およびTickTrader取引プラットフォームで取引する機能をユーザーに提供します。 FXOpenは、初心者と上級者の両方が複数の資産クラスで取引するのに適した多種多様な取引プラットフォームを提供します。

デスクトップ版の取引プラットフォーム

FXOpen MetaTrader 4

FXOpenのMT4トレーディングプラットフォームは、デスクトップダウンロードおよびECN、STP、マイクロ���カウントのWebブラウザー経由で利用でき、次のような機能を提供します。

3種類の執行(即時執行、市場執行、要求に応じた執行)による手動取引

自動取引も可能

カスタマイズされたチャート機能

50以上の組み込みテクニカルインジケーター

2009年、FXOpenは、MT4ターミナルを介してインターバンクの流動性とECN取引への直接アクセスをクライアントに提供した最初のブローカーでした。 MT4プラットフォームは、FXOpen独自の革新的なソリューションであるLiquidity Aggregatorによって拡張され、最新版に更新されています。 現在、FXOpen ECNは、10を超える銀行およびその他の流動性プロバイダー(LP)からの最良の価格で、瞬時にエラーのない注文を実行します。

FXOpen MetaTrader 5

FXOpen MetaTrader 5取引プラットフォームは、デスクトップダウンロードおよびWebブラウザー経由でECNアカウントのみに利用可能であり、次のような機能を提供します。 MetaTrader 5は、MetaQuotes Software Corpによって開発されたマルチアセット取引プラットフォームであり、現在、オンライン取引で最も人気のある無料端末です。 MT5は、MT4の使い慣れたユーザーインターフェイスに多くの新機能を提供し、トレーダーに外国為替取引を成功させるために必要なすべてを提供します。 FXOpenのMetaTrader5は、ECNトレーディングアカウントでのみ利用可能です。

4つの実行モードでの手動取引

21の異なる時間枠を表示

80以上の組み込みテクニカルインジケーター

自動取引とシグナル取引

FXOpen TickTrader

TickTraderは、クライアントが1つの取引アカウントを介して外国為替の最も人気のある5つの金融資産クラス(外国為替、株式、コモディティー、指数、および仮想通貨)を取引できるようにするまったく新しい取引プラットフォームです。 特別な取引口座であるTickTrader ECNは、TickTraderプラットフォームを使用した取引用に設計されています。 新しいマルチアセット取引プラットフォームを利用すると、証拠金取引と差金取引の両方を容易にします。 これは、プラットフォームを介して直接、またはFIX、REST、またはWebSocketAPIを介して実現できます。 取引プラットフォームとして、TickTraderは1つの目標「ユーザーが利益を上げるのを助ける」を追求しています。採用と使用は簡単ですが、TickTraderはユーザーフレンドリーであることに加えて、初心者から機関投資家まで、あらゆるタイプのトレーダーからの多数の要件を満たすことを保証する包括的な機能を誇っています。 FXOpen TickTrader取引プラットフォームは、デスクトップダウンロードおよびWebブラウザー経由で利用でき、次のような機能を提供します。

TickTraderターミナル

高度にカスタマイズ可能なユーザーフレンドリーなインターフェース

高度なテクニカル分析ツール

ワン/ダブルクリック取引モード

レベル2の価格(板情報)

詳細なチャートシステム

コピートレードも可能

FXOpenは、ソーシャルトレーディングプラットフォーム「MyFXBookのAutoTrade」や「ZuluTrade」と提携しています。また、MetaTrader専用のデスクトップ用のLevel2プラグインを含むTrader’s Toolsへの統合など、さまざまな追加のトレーディング機能を提供します。 また、FXOpenはPAMMにも力を入れていて、資金が少ないけれど取引して稼げる自信のある方に対して、ファンドマネージャーになれる門戸を開いています。 FXOpenは、以下の取引ツールを提供しています。

MyFXBook AutoTrade

Myfxbook AutoTradeを使用すると、自分の口座に置いて、最も成功した経験豊富なトレーダーの取引ストラテジーを紐付けして取引をコピーできます。 Myfxbookのサーバーには、MT4ターミナルがインストールされており、エキスパートア��バイザー(EA)を通じて信号を交換できます。 コピーしたい取引ストラテジー全員に登録できますが、取引ストラテジーごとに$1000以上の残高を確保する必要があります。

ZuluTrade

ZuluTradeは、他のトレーダーからのシグナルを使用してアカウントの取引を管理する自動取引プラットフォームです。 ユーザーは、選択した取引プロバイダーをそのまま選択してコピーできます。

VPSサービス

ECN、STP、およびCryptoの口座保有者は、月末にVPSを利用する口座で5000米ドルの口座残高がある方、もしくは、10,000,000米ドル(暦月あたり)の取引量がある方は、VPSを1か月間無料で使用できます。これら2つの要件を満たさずに、VPSを利用したい場合、eWalletまたは取引口座から1か月30米ドルの手数料が必要となる場合があります。

PAMM(Percentage Allocation Master Module)

PAMMは、クライアント(フォロワー)が別のクライアント(マスター)の取引戦略に従うことを可能にするテクノロジーです。 マスターは、PAMMを通じて個人資金を運用し、PAMMテクノロジーを使用することにより、マスターの取引戦略がフォロワーのアカウントにコピーされます。 ユーザーはPAMM口座を開いて、他のファンドトレーダーをフォローしたり、自分でファンドトレーダーになることができます。

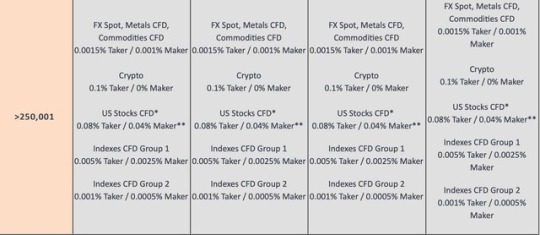

手数料とスプレッドについて

ECN口座で取引するとき、取引を開始/終了するための手数料があります。 手数料率は、口座の資本と毎月の取引量によって異なります。 したがって、手数料率は、前の期間の米ドルでの取引量と再計算時の口座残高に応じて、月ごとに増減する可能性があります。 FXOpen ECN口座は異なる通貨で運用されているため、手数料は現在の為替レートに応じて自動的に口座建て通貨に変換されます。 また、FXOpenはECN口座に関しては、ボーナスやプロモーションを提供していません。 FXOpenでの取引コストは、開設した口座の種類と取引されている商品によって異なります。 STP口座とMicro口座では両方とも、変動スプレッドとスワップの支払いを伴う手数料無料の取引を提供します。 これらはMetaTraderトレーディングプラットフォームから直接見ることができます。 Crypto口座の手数料は片道取引で0.5%、Crypto 10取引口座での手数料は片道取引で0.25%で、スプレッドは変動します。 ECNアカウントの手数料は、使用されているプラットフォーム、アカウントの株式の金額、および取引量によって異なります。 以下の表で示されている取引手数料は全て、片道取引における取引手数料です。

TickTraderでの取引手数料

成行注文とストップ注文には、テイカー手数料がかかります。 指値注文にはメーカー手数料がかかります(隠し注文とアイスバーグ注文を除く)。 注文ごとの最低手数料は1米ドルで��。

MT4・MT5での取引手数料

指数CFDでの取引手数料

取引量は、過去30日間に実行された取引の量であり、米ドル相当額で表現しています。 表のすべての値は、例として米ドルで示されています。 取引量が多い(表の値より多い)場合、取引手数料はレビューの対象となります。 取引を開始した直後に、往復取引手数料が請求されます。 たとえば、資本残高が1,000〜5,000の範囲にあり、取引量が5,000,000(50ロット)未満であると仮定します。 1ロット取引(基本通貨100,000)の往復取引手数料は、 100,000×0.0025×2 =基本通貨の5単位。 USDが基本通貨であるペアの場合、手数料は5USDに等しくなります。 米ドル以外の基本通貨のペアの場合、手数料は基本通貨の5単位です。 たとえば、基軸通貨がEUR(ユーロ)のペアの場合は、-5 EUR、基軸通貨がGBP(英ポンド)のペアの場合は、-5GBPとなります。 FXOpenはまた、連続して90日間取引や入出金が行われなかった場合、毎月10米ドルの非アクティブ料金を請求します。非アクティブな口座は、残高が0になると無効になるので、しばらく取引しない場合は、その資金をFXOpenのeWalletに送金して、口座残高を0にしておくことをお勧めします。eWalletは、使用しなくても常にアクティブなままです。 利用者は、FXOpenに非アクティブな口座を再度アクティブにするように依頼できます。 再アクティブ化する時に、50米ドルの1回限りの料金が請求されます。 料金を払いたくない場合、MyFXOpenの[アカウントの追加(Add Account)]メニューから新しい取引口座を開くこと���できます。

ボーナスとプロモーションを実施中

FXOpenは、入金不要のボーナス、トレーダーコンテスト、キャッシュバックサービスなどのボーナスやプロモーションを提供しています。 FXOpenは、さまざまなボーナスやプロモーションを提供しますが、これらは変更される可能性があります。 現在、FXOpenは以下のボーナスを提供しています。

TickTrader口座における入金不要ボーナス

・貰えるボーナス:$ 10 ・口座の種類:ECN TickTrader ・このボーナスを受け取る条件: FXOpenのeWalletをこちらから登録します。グレード1の検証を取得し、TickTraderのECN取引アカウントを開きます。 ・出金条件:ボーナスは最初のTickTrader取引口座にのみクレジットボーナスとして付与されます。 このボーナスは、eWalletの登録日から90日間有効です。ただし、このボーナスをアカウントから出金したり、別の取引アカウントに転送したりすることはできません。 ボーナスを利用して、アカウントの取引量が1ロットを超えると、いつでも利益を現金として出金できるようになります。

STPアカウントの入金不要ボーナス

・貰えるボーナス金額:$ 10 ・適用口座の種類:STP ・このボーナスを受け取る条件: FXOpenのeWalletをこちらから登録します。 グレード2までの検証を取得し、STP取引アカウントを開きます。 ・ボーナスの出金条件:ボーナスは最初の取引口座に1回支払われ、eWallet登録日から90日以内にのみクレジットされます。 ボーナスを口座から出金したり、別の取引口座に移したりすることはできません。 ボーナスを利用して、口座の取引量が2ロットを超えると、利益を出金できます。

マイクロ口座の入金不要ボーナス

・貰えるボーナス金額:$ 1 ・適用口座の種類:マイクロ ・このボーナスを受け取る条件: FXOpenのeWalletをこちらから登録します。 グレード1の検証を取得して、マイクロトレーディングアカウントを開きます。 ・ボーナスの出金条件:マイクロボーナスは、eWalletの登録日から90日以内にのみクレジットされます。 ボーナスを口座から引き出したり、別の当座預金口座に送金したりすることはできませんが、口座内のすべてのクローズされた取引の合計量が1ロット(100マイクロロット)に達した後にのみ、利益を口座から引き出すことができます。

取引キャッシュバック

FXOpenキャッシュバックプログラムにより、トレーダーは、赤字を含むあらゆる種類の取引に対して追加の払い戻しを受けることができます。 キャッシュバックを取得するのは簡単です。それは自動的に保有口座に追加されるだけです。 キャッシュバック額は、すべてのクライアントの取引口座で使用される合計証拠金に従って決定されます。 このプログラムは、ECN、STP、Crypto、Micro、PAMM ECN、PAMM STPのすべてのタイプのFXOpenの取引口座で利用できます。最大額は$1,000までキャッシュバックされます。 FXOpenキャッシュバックプログラムは、新規クライアントが登録してから最初の90日間のみ使用できます。 既存のクライアントの場合、キャッシュバックプログラムは、プログラムに参加した���間から90日間利用できます(接続は[email protected]のサポートサービスへの要求に応じて実行されます)。 最小のキャッシュバックは$ 5で、最大は$ 1,000です。 取引あたりの最大キャッシュバックは100ドルです。

取引コンテスト

トレーダーは、ForexCup Trading Contestsに参加することで、ライブ取引でリアルマネーの賞金とボーナスを獲得できます。 ForexCupで外国為替取引コンテストのエキサイティングな世界に飛び込みましょう! ForexCup.comは、デモ口座の毎週および毎月の定期的な取引コンテストを提供しています。 それらのほとんどは無料で参加できますが、少額の手数料がかかるものもあります。 取引コンテストに参加することによって、外国為替取引の経験を積み、取引戦略を試すことができます。

FXOpenのECNモデルとは?

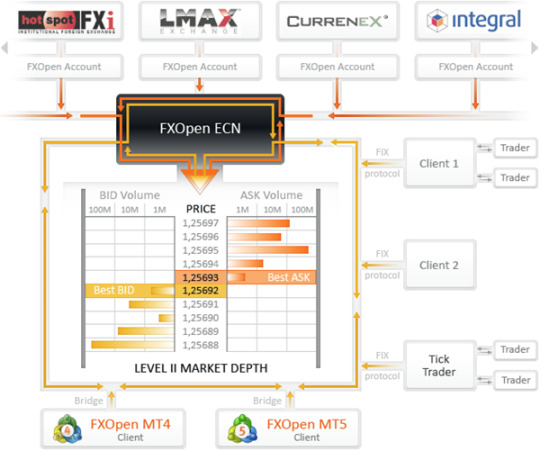

ECNモデルとは、トレーダーに銀行間市場へのアクセスを提供するモデルのことです。 ECNモデルでは、取引の相手方は、銀行、ファンド、または別のトレーダーなどの別の市場参加者です。

FXOpen ECN(Electronic Communications Network)は、外国為替証拠金取引のための独自のテクノロジーに基づいた電子証券取引ネットワークです。 ECNの参加者には、銀行、中央取引所、OTC FOREX(店頭)市場でサービスを提供する大企業、および個人投資家が含まれます。 FXOpenは、クライアントに制度的な流動性とエラーのない即時の注文実行を提供します。 ECN取引は、経験豊富なトレーダーや主要な取引戦略としてスキャルピングを好む人に推奨されます。 ECNモデルは市場執行を使用します。つまり、注文は銀行間市場で約定されますが、執行価格は注文時に要求した価格と異なる場合があります。 ECNのすべての参加者 ・注文執行に関しては、参加者全員が平等な権利を有します ・すべての取引は完全に透明な環境で行われます ・すべての顧客は、資本に関係なく、流動性提供者と流動性受領者の両方の役割を果たすことができます。 このビジネスモデルとFXOPEN ECNの背後にある独自のテクノロジーは、FOREX市場の複数の参加者からの集約された流動性をクライアントに提供します。 これにより、FXOPENのクライアントは大量の注文を簡単かつ瞬時に実行できます。 FXOPEN ECNは、FX業界で流動性を集約するための最新のアプローチを実践しています。 その最��端の革新的な技術により、市場参加者に以下を提供することができます。 ・狭いスプレッド ・ECN流動性 ・市場の板情報 ・瞬時かつエラーのない実行 ・各参加者は流動性プロバイダーとして機能

トレーダーのための教育ブログを用意

FXOpenは、独自のFXOpenブログからの教育記事を提供し、外国為替戦略、外国為替ツール、外国為替取引のヒント、外国為替のPAMM口座の仕組みなどをカバーしています。 たとえば、外国為替戦略のセクションで、FXOpenは、ブログでポジション取引に関する記事を持っています。 内容は以下のとおりで、詳細に説明しています。

入出金方法

FXOpenは、たくさんの入出金方法を用意していますが、日本人トレーダーにとって、一番お勧め方法は、入金するときは、クレジットカードを利用して、出金する時は、銀行送金を利用する方法です。一番単純でわかりやすいからです。

入金方法

クレジット/デビットカード クレジットカードとデビットカードは、最速で手間のかからない入金オプションの1つです。 FXOpenは、MasterCard、Visa、Visa Electron、Maestro、Discover、JCBなどの一般的なタイプの銀行カードをすべて受け入れます。 ・基本通貨:USD、EUR、RUB ・支払い処理時間:即座 ・最低入金額:2米ドル、2ユーロ、60ルーブル ・最大入金額:制限なし ・手数料なし クレジット/デビットカードからの入金、および得られた利益は、いつでもカードに引き出すことができます。別の支払い方法を使用して利益を引き出すことは、最後のクレジット/デビットカードの入金から30日後に可能です。資金の入金��複数のクレジット/デビットカードが使用されている場合、利益の引き出しの方法と時間枠は、財務部門による監視の対象となります。 China Union Pay(中国銀聯銀行) 中国銀聯銀行カードは、現地通貨(CNY)での購入の支払いと、中国の領土でのオンライン送金を行うための最も一般的で迅速な方法の1つです。 入金方法は? ・通貨:人民元 ・支払い処理時間:即座 ・最低入金額:50元から ・手数料なし 銀行送金 銀行振込は、ある銀行口座から別の銀行口座に電子的に行われます。 ・通貨:USD、EUR、GBP、AUD、CHF、JPY、RUB ・支払い処理時間:1〜3銀行営業日 ・最低入金額:$ 25 ・最大入金額:制限なし ・銀行の手数料のみ Apple Pay Apple Payは、2014年9月9日に導入されたAppleCorporationのモバイル決済システムおよびeウォレットです。 Apple Payは、物理的なカードも現金も使用せずに、iPhone、iPad、Apple Watch、およびMacで支払うための簡単で安全なプライベートな方法を提供します。 Apple Payは、既存の非接触型リーダー(Visa PayWave、MasterCard PayPass、American Express ExpressPay)と互換性があります。 ・基本通貨:USD、EUR、GBP ・支払い処理時間:即座 ・最低入金額:1USD, 1EUR, 1GBP ・最大入金額:19000USD, 16000EUR, 14000GBP ・手数料無料 AdvСash Advanced Cash(AdvCash)は、2014年に設立されたユニバーサル決済システムです。このサービスは、VISA / MasterCardカード、Advanced Cashの電子財布、および電子メールアドレスへのトランザクションをサポートします。AdvCashの利点には、ウォレットのマルチレベル保護、手数料なしのシステム内での転送、低料金、資金の入出金のいくつかの方法があります。 ・基本通貨:USD、EUR ・支払い処理時間:即座 ・最低入金額:3米ドル、3ユーロ ・手数料無料 FasaPay FasaPayは、PT Fasa Centra Artajayaが所有し、インドネシアを拠点とするオンライン決済会社です。 FasaPayは、インターネットを介して商品やサービスの支払いを行うための高速で信頼性の高い方法です。 ・基本通貨:IDR、USD ・支払い処理時間:即座 ・最低入金額:1USD ・最大入金額:制限なし ・手数料無料 AstroPay AstroPayカードは、世界中の何千ものオンラインサイトやAstroPayシステムに関連するサイトで受け入れられている仮想プリペイドカードです。 AstroPayカードは、国ごとの支払い方法のリストから、米ドルまたはその他の通貨で利用できます。 AstroPayは、次のプリペイド値のカードを発行します。 プリペイド値:$ 10, $ 25, $ 50, $ 100, $ 500, $1,000 ・基本通貨:USD、EUR +現地通貨 ・支払い処理時間:即座 ・最低入金額:10米ドル(または同等の通貨) ・最大出金額:1,000米ドル(または同等の通貨) ・手数料無料 プリペイドカード FXOpenプリペイドカードは、迅速で手間のかからない資金調達オプションです。 FXOpenの公式再販業者から、1USDから10000USD相当のプリペイドカードを購入できます。 ・基本通貨:USD ・支払い処理時間:即座 ・最低入金額:1USD ・最大入金額:10,000USD ・手数料無料

出金方法

クレジット/デビットカード ・基本通貨:USD、EUR、RUB ・支払い処理時間:1日 銀行カードへの送金には通常3営業日かかります。 発行銀行によっては、この時間は最大5日間延長される場合があります。 ・最小出金額:8ユーロ、10米ドル ・最大出金額:2000米ドルまたは他の通貨での同等額, 60000ルーブル ・手数料:2.5%+ USD 3.5, 2.5%+ 3.5ユーロ, 2.5%+ RUB 50 出金するときの注意事項 クレジット/デビットカードからの入金、および得られた利益は、いつでもカードに出金することができます。 別の支払い方法を使用して利益を出金することは、最後のクレジット/デビットカードの入金から30日後に可能です。 資金の入金に複数のクレジット/デビットカードが使用されている場合、利益の引き出しの方法と時間枠は、財務部門による監視の対象となります。 これらは、マネーロンダリングを防ぐための処置となります。 China UnionPay(中国銀聯) ・基本通貨:人民元 ・支払い処理時間:1日 ・最小出金額:50元 ・手数料:3.5%、ただし3 CNY(RMB)以上 銀行送金 ・基本通貨:USD、EUR、GBP、AUD、CHF、JPY、RUB ・支払い処理時間:1〜3銀行営業日 ・最小出金:100米ドル ・最大出金:制限なし ・手数料: 45 EUR, 50 USD, 1500 RUB, 42 GBP, 67 CHF, 38 AUD, 2700 JPY, 35 CAD Perfect Money Perfect Moneyは、ユーザーがインターネット全体で即座に支払いを行い、安全に送金できるようにする主要な金融サービスであり、インターネットユーザーとインターネットビジネスの所有者にユニークな機会を提供します。 Perfect Moneyを使用すると、オンラインで商品やサービスの支払い、Perfect Moneyウォレット間での送金、オンラインでのゴールドメタル、米ドル、ユーロの通貨の購入を行うことができます。 ・基本通貨:USD、EUR ・支払い処理時間:1日 ・最小出金額:$ 1 ・最大出金額:制限なし ・手数料: 0.5% AdvCash ・基本通貨:USD, EUR ・支払い処理時間:1日 ・最小出金:1USD, 1EUR ・手数料: 無料 FasaPay ・基本通貨:IDR、USD ・支払い処理時間:1日 ・最小出金額:$ 1 ・最大出金額:制限なし ・手数料: 0.5% AstroPay AstroPayカードは、世界中の何千ものオンラインサイトやAstroPayシステムに関連するサイトで受け入れられている仮想プリペイドカードです。 AstroPayカードは、国ごとの支払い方法のリストから、米ドルまたはその他の通貨で利用できます。 AstroPayを介して引き出しを実行するには、ユーザーは電話番号とユーザーID(インストールされたモバイルアプリケーションによって生成された)を提供するように求められます。 撤退する方法は? ・基本通貨:USD、EUR +現地通貨 ・支払い処理時間:1日 ・最小出金額:USD 10.00(または同等の通貨) ・手数料: 0.5%

まとめ

FXOpenには、英国金融行動監視機構、キプロス証券取引委員会、オーストラリア証券投資委員会によって認可および規制されています。 FXOpenは、初心者と上級者の両方に適した多種多様な取引口座を提供しています。これには、ECN、STP、マイクロおよび仮想通貨のアカウント、イスラムのスワップフリーアカウントが含まれます。これらのアカウントを通じて、ユーザーは最大500:1の最大レバレッジにアクセスする機能を備えた、外国為替、指数、株式、仮想通貨、商品をカバーする70以上の金融CFD商品で取引できます。 ユーザーは、2億5000万ドルを超えるボリュームの場合はロットあたり1.5米ドル、500万ドル未満のボリュームの場合はロットあたり3.5米ドルという、手数料無料の取引アカウントと手数料ベースの取引アカウントの組み合わせにアクセスできます。ブローカーは、MetaTrader 4、MetaTrader 5、TickTraderの取引プラットフォームでデスクトップ、ウェブ、モバイルを取引する機能を提供し、計算機、レベル2プラグイン、MyFXBookおよびZuluTradeとのコピートレードプラットフォーム含む取引ツールにアクセスできます。 FXOpenは、FXOpenブログを通じて市場分析といくつかの教育記事へのアクセスを提供します。カスタマーサポートは24時間年中無休で複数の言語で提供されており、さまざまなボーナスやプロモーションオファーを利用できます。 source https://kaigai-invest.blog.jp/fxopen/introduction

0 notes

Text

how can i qualify as an FOYLEMARKETS introducer?

how can i qualify as an FOYLEMARKETS introducer? Read More http://fxasker.com/question/c7ae35f20ad415ef/ FXAsker

#activtrades access#activtrades-1#chart forex#forex broker gmt time#forex brokers uk#forex micro account uk#forex trading movies#fortrade bitcoin#FOYLEMARKETS#fx solutions uk withdrawal#fxdd account login#fxgm israel#fxopen negative balance protecti#fxtm regulation#hot forex indices#hotforex login#ironfx portfolio management#pepperstone opening hours#plus500 indicators#plus500 mt4#roboforex bonus 15#roboforex wikipedia#vantage fx competition#WFXMARKET#windsor elementary#Trading Platform

0 notes

Text

FXOpen Broker Review 2019-2020 – Must Read! Is FXOpen a Safe Forex Broker

Company Details

FXOpen is a retail Forex broker that allows small traders to access the market, despite their financial situation directly. It focuses on complete inclusion by providing trading accounts that traders can acquire for only a $1 deposit. It was founded originally as an educational center offering courses in technical analyses as well as financial markets. To go according to the flow of progress, FXOpen started to provide its brokerage services in the year 2005 and is continually growing into a successful Forex company within the retail trading market.

The Trading Platform of FXOpen

For traders who are looking for accessible trading, FXOpen is the best Forex broker they can use. It comes with three different trading platforms, including MetaTrader 4, MetaTrader5, and Web Trader. MT4 and MT5, on the other hand, comes with a corresponding mobile application that is available for both Android and iOS smartphone users. But if you want to migrate from a traditional desktop app into the web, the Web Trader is ideal for you.

MT4 is among the most popular trading platforms there is for Forex brokers. There are over 70% brokers that provide MT4 to their clients, and about 90% of trading transactions in the Forex market are done using MetaTrader 4. A newer version of this platform is the MT5, which comes with new functions that favor every Forex trader.

Markets and Assets

FXOpen primarily provides a spectrum of investment accounts, including CFDs, Crypto trading accounts, Micro contracts, STP, Demo accounts, and ECN accounts. STP requires £100 as a minimum deposit, while demo accounts allow beginners to learn how to trade before trading for real.

Aside from these, FXOpen provides more than 52 currency pairs, and it offers nearly a dozen CFD instruments. When it comes to cryptocurrency pairs, there are 43 pairs that traders can use. Traders can also access several trading instruments at FXOpen, such as stocks, indices, commodities, options, and equities.

FXOpen’s Leverage

Leverage is the ability to utilize something small to control a more significant value. In FXOpen, the leverage on ECN and STP is up to 1:500. For crypto, expect the leverage of 1:3 and 1:500 for Micro.

Spreads and Commission

FXOpen provides several pricing options when it comes to commission and fees. The price depends on the trader’s account type, such as STP, ECN, and Micro, but its pricing, in general, falls into the industry average.

The spreads are often tight, with a starting of 0 pips. With an ECN account, the fees collected range from 0.3 to 1.0 pips every 1 Million, but the prices also change according to the volume traded in the prior month.

On STP accounts, spreads most commonly depends on different factors, which includes market liquidity. In this case, the fees are fixed.

The Payment Method Of FXOpen

All the traders of FXOpen can choose from a wide selection of payment options. They can deposit or withdraw through Credit/Debit Cards, Bank Wire Transfer, Neteller, SkrillMoneyBookers, WebMoney, SEPA, and Payza.

Bonus & Promotions

To make trading better, FXOpen provides different bonuses and promotions that traders can easily acquire by registering an FXOpeneWallet and opening a real trading account. Traders can get the chance to get real money bonuses and the opportunity to payout profit, such as the following:

No deposit bonus for traders with STP accounts

Welcome Bonus for traders who meet the minimum deposit

ForexCup Trading Contest Bonus with the amount depending on the terms of the contest

The Forex broker also features a cashback program that allows traders to get an additional refund for any kind of like loss-making. The cashback will be included in your Commission account that automatically opens without even doing anything.

Pros And Cons Of FXOpen

The best advantage of this Forex broker is its excellent customer support that provides live chat 24 hours every weekday. It also comes with a demo account that allows beginners to learn the platform first before trading for real. FCA, as well as other regulatory bodies, secure your funds, and it requires a low minimum deposit to start an account.

In terms of cons, FXOpen has limited withdrawal and deposit options. For now, it is also limited to particular countries that exclude the US.

Safety & Security Of Using FXOpen

To ensure that your funds are in the safe hands, FXOpen is strictly regulated by the top-tiered FCA, which is covered by FRN:589202 UK. All the funds of its clients are also stored in separate accounts from operational funds. The funds of traders, despite their nationalities, are protected by the amount of £50,00 from FSCS at the same time. It is to allow its clients to access their finances when unexpected events happen.

Accepted Countries

FXOpen operates in countries like the United Kingdom, Australia, Nevis, Saint Kitts, and it has representatives in other countries.

Final Verdict

FXOpen stands among the most dependable brokers today. It provides several account types that suit different traders, and it is still one of the favorites because of its low minimum deposit and withdrawals.

La entrada FXOpen Broker Review 2019-2020 – Must Read! Is FXOpen a Safe Forex Broker se publicó primero en Forex MT4 Indicators.

FXOpen Broker Review 2019-2020 – Must Read! Is FXOpen a Safe Forex Broker published first on https://alphaex-capital.blogspot.com/

0 notes

Text

Get the Best Forex Broker Using Forex Broker Comparison

The Forex business is a very aggressive and volatile one and ergo lots of believed and research should go into picking the most effective Forex broker. A great contrast is the best way by which you can obtain this as it can help you to know the functioning design and rules of every broker.nasdaq brokers list Evaluating brokers must be your prime goal before trading and a improper choice here can separate you also before you begin out.

Each broker has a specific trading design and this is what you must try to understand while performing a broker comparison. Apart from this, there are several other standards too that goes into picking the most effective Forex broker. These generally include selecting your investment objectives, amount of experience of the trader in addition to the broker and risk appetite. It is very important that the trading type of your broker fits your own; only then will you have the ability to work as a team and thus reap in the benefits. A few of the prime titles among Forex brokers include 4XP, Go Areas, Forex Metal, UWC, InstaForex and PFG Best. If you should be trying to find knowledge, then your earliest players in this business are ForInvest Class, Mandus Invest SA, MIG Bank, CMC Areas, North Money, ACM and True Deal Group. A few of the other large titles in the broking business include Dukascopy, Simple Forex, FXOpen, Nord FX, FBS, Finexo, FXcast, Oanda, Alpari and Finotec.

There are lots of on the web websites that you can use because of this comparison. These sites compare brokers applying many groups like most skilled, ECN brokers, NFA regulated brokers and Scalper helpful brokers. Various lists are manufactured with respect to the standards useful for contrast but you must bear in mind that none of the lists are fool proof. Therefore in place of blindly relying these, utilize the list as a base and then carry out your own research to find the best Forex broker of your choice.

One other standards that really must be looked into includes the commission, minimal deposit and maximum leverage. There's no position in selecting a broker who demands a high commission if you should be a new comer to industry and only beginning out. In this case, you'll need a broker who's more experienced and can educate you on the nuances of the game but needs merely a small amount as deposit and commission. As you get knowledge, then you can certainly choose the larger broking companies which might demand high commission fees but are large players in the foreign trade market.

It is also essential that you employ a broker who's regulated whilst the foreign trade market is highly unregulated. The respected regulatory bodies include National Futures Association (NFA), Financial Companies Power, Association Romande Des Intermediares Financiers and Securities and Futures Commission. The best Forex broker must be opted for based on whether they are well-capitalized and insures the consumer funds. Both these standards can be of great assist in the future especially if you run into a restricted spot at any time of the trade.

0 notes

Text

Top Forex Brokers List UK

Discover the Top UK Forex Brokers List

HENYEP

HYCM offers clients excellent trading conditions, great liquidity and low spreads, delivering a super-efficient service. With its strong focus on fast execution and low cost trading. Always a leader in embracing cutting-edge technology.

FXOPEN

We know what it takes to achieve success in Forex and the pitfalls that may impede traders on their way there. We are open and like to share our experience and knowledge with traders to help them achieve the best possible results.

AXITRADER

We provide access to the world’s most popular trading platform, MetaTrader 4, to trade a wide range of Forex, Commodities & Indices. Tight spreads and fast execution come as standard on all our accounts. We operate within a secure and highly regulated environment.

THINK MARKETS

We offer Great pricing Reduced spreads with zero commissions for all forex pairs, Maximum security and Disruptive technology Leaders in mobile trading with our proprietary Trade Interceptor platform. Our multi-lingual support team is here to assist you 24 hours a day.

LCG

Our clients trade with trust and confidence knowing their funds are securely held in Tier 1 banks. LCG is a regulated broker. With LCG you can trade thousands of global markets across 9 asset classes.View Details

0 notes

Text

Exclusive arrangement | ASIC supervises 63 brokerage firms'full list. Before the end of April, pay attention to the entry and exit of these platforms.

Australian regulators have asked their brokers to violate Chinese and EU laws in providing OTC derivatives to overseas retail traders.

At present, there are 63 Australian brokers in China. This week, the platforms that have cancelled ASIC regulatory licences are UTRADE, ESA ASIA and Baofu International.

Yesterday, the suspension of Chinese customers'cash inflows was announced by OANDA and Lotte Securities.

It should also be noted that only ASIC license platforms, if there is no good plan before the end of April, then customers in China will be affected. Investors should pay attention to the situation of April's income and expenditure. These platforms include (ranked indiscriminately):

Amdforex

Cardiff

IFGM

Advanced Markets

Best Leader

Charterprime

Rubix FX

PGWG

EightCap

GS Deep Ocean

Global Prime

Millennium,

Wiston FX

INVAST

OGFX

Mickens MARKETS

DV Markets (IFS Markets)

JB Alpha

City index

ILQ

Trend

FOREX CT

VT Markets

ETO Markets

TradeMax

GO Markets

AUGS Markets

Hantec Markets

GMT Markets

USGFX

SuperTrader

BCR

ACY

Capstone

Anzo Capital

TBC

With ASIC licences, there are also platforms with other licences. Although customer access to ASIC is monitored under Australian supervision, diversified licences still have advantages for customer ownership arrangements. These platforms include (ranked indiscriminately):

AVATrade

Eddie McAdral markets

KVB

Think Markets

XM

Profit securities

IC Markets

AETOS

MahiFX (Saled Retail Business)

FXOpen

Vantage FX

Xforex

FP Markets

European market

Velocity

Royal

MEX Group

Pepperstone

AxiTrader

Easy Markets

CMC Markets

Gain capital

FXCM

IG Markets

Before the end of April, ASIC brokers requested a written reply to ASIC detailing the measures taken to comply with regulatory requirements for overseas customers.

Before May 7, ASIC brokers need to e-mail the number of customers in each jurisdiction.

In the meantime, investors can choose platforms with a wide range of licences and high ratings through the official website of foreign exchange agents www.fxmitan.com.

0 notes

Text

FXOpen Review: A Must Read Before You Trade

FXOpen Review

FXOpen has been around for some time and is well known. The brokerage firm has been used by thousands of traders around the world and has a long history of fulfilling order flow.

FXOpen Regulation and Company Information

FXOpen is a global broker, regulated in the United Kingdom and Australia. It started as an educational center bank in 2003, and has since launched brokerage services, starting that end of the business in2005. They offer services and trading financial markets in both retail and institutional investors.

FXOpen is a registered business authorized by the FCA, the Financial Conduct Authority in the United Kingdom, but it also has a sister company in Australia, FXOpen AU Pty Ltd., Which is licensed by the ASIC. This ensures security of funds, as the clients of the UK broker will be automatically covered by the Financial Services Compensation Scheme, which pays compensation up to a maximum of £50,000 per regulated entity.

FXOpen ECN accounts and other trading accounts

FXOpen offers four basic account types, all of which also offer micro lots to trade. Clients are able to use either market or instant execution, as well as commission free trading or ECN execution with spreads plus commission. Beyond that, Islamic accounts are also possible, and micro accounts can also be had. Beyond that, they also offer a Crypto accounts.

FXOpen Offers and Trading conditions

Initial deposit

You can start trading at FXOpen with as little as one dollar, which of course is attractive because it gives you the ability to test out life conditions with no real danger. However, to take advantage of the ECN condition, you need to deposit at least $100.

Spreads and commissions

As they offer floating spreads, this can vary depending on liquidity. Typically on the commission free STP account, you will see spreads at roughly 1.6 pips on EUR/USD which is slightly above average. Spreads on the ECN account start from 0.2 pips on the EUR/USD, but are typically closer to 0.5 pips, and a commission of five dollars per lot, per side. Because of this, it makes the average cost of trading per lot on the EUR/USD pair approximately 1.5 pips, which is slightly higher than usual for these types of accounts. Commission discounts are available to high-volume traders and those with equity above $1000.

Leverage

FXOpen offers leverage up to 1:500, which is relatively high compared to many other FCA regulated brokers. This being the case, caution is advised when it comes to this type of leverage, as it can get you into trouble rather quickly.

Trading platforms

FXOpen offers both the MetaTrader 4 and MetaTrader 5 platforms, which many of you should be used to. It gives you the ability to use Expert Advisors, back testing, a host of advanced charting features, and of course indicators. It also comes with web and mobile versions of these platforms.

Methods of deposit

FXOpen will accept a huge range of payment methods, including credit/debit cards, bank wire, WebMoney, Skrill, Neteller, Payza, OKPAY, China Union, and both Bitcoin and Ethereum deposits. There are also some other methods as well. Because of this, money going back and forth will never be an issue.

Extras

This broker offers market analysis, trading tools, the ability to copy other traders, and a few others. As far as the educational aspect of this broker is concerned, it is a bit like to say the least. However, if you’re not looking for those types of extras it could very well work for you.

The post FXOpen Review: A Must Read Before You Trade appeared first on The Diary of a Trader.

FXOpen Review: A Must Read Before You Trade published first on http://thediaryofatrader.com/

0 notes

Text

FXOpen Review: A Must Read Before You Trade

FXOpen Review

FXOpen has been around for some time and is well known. The brokerage firm has been used by thousands of traders around the world and has a long history of fulfilling order flow.

FXOpen Regulation and Company Information

FXOpen is a global broker, regulated in the United Kingdom and Australia. It started as an educational center bank in 2003, and has since launched brokerage services, starting that end of the business in2005. They offer services and trading financial markets in both retail and institutional investors.

FXOpen is a registered business authorized by the FCA, the Financial Conduct Authority in the United Kingdom, but it also has a sister company in Australia, FXOpen AU Pty Ltd., Which is licensed by the ASIC. This ensures security of funds, as the clients of the UK broker will be automatically covered by the Financial Services Compensation Scheme, which pays compensation up to a maximum of £50,000 per regulated entity.

FXOpen ECN accounts and other trading accounts

FXOpen offers four basic account types, all of which also offer micro lots to trade. Clients are able to use either market or instant execution, as well as commission free trading or ECN execution with spreads plus commission. Beyond that, Islamic accounts are also possible, and micro accounts can also be had. Beyond that, they also offer a Crypto accounts.

FXOpen Offers and Trading conditions

Initial deposit

You can start trading at FXOpen with as little as one dollar, which of course is attractive because it gives you the ability to test out life conditions with no real danger. However, to take advantage of the ECN condition, you need to deposit at least $100.

Spreads and commissions

As they offer floating spreads, this can vary depending on liquidity. Typically on the commission free STP account, you will see spreads at roughly 1.6 pips on EUR/USD which is slightly above average. Spreads on the ECN account start from 0.2 pips on the EUR/USD, but are typically closer to 0.5 pips, and a commission of five dollars per lot, per side. Because of this, it makes the average cost of trading per lot on the EUR/USD pair approximately 1.5 pips, which is slightly higher than usual for these types of accounts. Commission discounts are available to high-volume traders and those with equity above $1000.

Leverage

FXOpen offers leverage up to 1:500, which is relatively high compared to many other FCA regulated brokers. This being the case, caution is advised when it comes to this type of leverage, as it can get you into trouble rather quickly.

Trading platforms

FXOpen offers both the MetaTrader 4 and MetaTrader 5 platforms, which many of you should be used to. It gives you the ability to use Expert Advisors, back testing, a host of advanced charting features, and of course indicators. It also comes with web and mobile versions of these platforms.

Methods of deposit

FXOpen will accept a huge range of payment methods, including credit/debit cards, bank wire, WebMoney, Skrill, Neteller, Payza, OKPAY, China Union, and both Bitcoin and Ethereum deposits. There are also some other methods as well. Because of this, money going back and forth will never be an issue.

Extras

This broker offers market analysis, trading tools, the ability to copy other traders, and a few others. As far as the educational aspect of this broker is concerned, it is a bit like to say the least. However, if you’re not looking for those types of extras it could very well work for you.

The post FXOpen Review: A Must Read Before You Trade appeared first on The Diary of a Trader.

FXOpen Review: A Must Read Before You Trade posted first on http://thediaryofatrader.com/

0 notes

Photo

FXOpen launches cashback program for clients FXOpen, an ASIC and FCA-regulated forex and CFD broker announced the launch of a cashback program for its clients.

0 notes

Link

FxOpen Broker Regulation: Not Regulated Broker Type: STP, ECN, Market Maker Min Deposit: 1 USD Max Leverage: 1:500 Min Lot Size: 0.001 EURUSD Spread: 0.1 pips Order Execution: Instant, Market Deposit Methods: Bank Wire, Bitcoin, China Union Pay, Credit Card, Debit Card, FasaPay, Litecoin, Local Bank, Namecoin, Neteller, OKpay, Payza, PerfectMoney, QIWI, RBKmoney, Skrill, WebMoney, Yandex, IntellectMoney, SorexPay, NetBanx

0 notes

Text

HOW DO I CHANGE THE PASSWORD OF MY TRADING PLATFORM WITH BOSSA?

HOW DO I CHANGE THE PASSWORD OF MY TRADING PLATFORM WITH BOSSA? Read More http://fxasker.com/question/9d3f60595e30bfa1/ FXAsker

#admiral markets office in mumbai#axitrader funding#ayondo payment#BOSSA#easy forex history#EXEGY#finotec minimum deposit#forex 99 success rate#forex account deposit#forex rates pakistan#forex trading zerodha#fxcc broker spread#fxcm zacks#fxgm trading online#FXOPEN#fxopen nz ltd#gkfx regulation#go markets pro account#http xforex forex trading tl#introducing broker example#nt maxfx scene script#plus500 atletico madrid#PRUDENTBROKERS#xforex app#xforex contact#Selling Gold

0 notes

Text

FXOpen Broker Review 2019-2020 – Must Read! Is FXOpen a Safe Forex Broker

Company Details

FXOpen is a retail Forex broker that allows small traders to access the market, despite their financial situation directly. It focuses on complete inclusion by providing trading accounts that traders can acquire for only a $1 deposit. It was founded originally as an educational center offering courses in technical analyses as well as financial markets. To go according to the flow of progress, FXOpen started to provide its brokerage services in the year 2005 and is continually growing into a successful Forex company within the retail trading market.

The Trading Platform of FXOpen

For traders who are looking for accessible trading, FXOpen is the best Forex broker they can use. It comes with three different trading platforms, including MetaTrader 4, MetaTrader5, and Web Trader. MT4 and MT5, on the other hand, comes with a corresponding mobile application that is available for both Android and iOS smartphone users. But if you want to migrate from a traditional desktop app into the web, the Web Trader is ideal for you.

MT4 is among the most popular trading platforms there is for Forex brokers. There are over 70% brokers that provide MT4 to their clients, and about 90% of trading transactions in the Forex market are done using MetaTrader 4. A newer version of this platform is the MT5, which comes with new functions that favor every Forex trader.

Markets and Assets

FXOpen primarily provides a spectrum of investment accounts, including CFDs, Crypto trading accounts, Micro contracts, STP, Demo accounts, and ECN accounts. STP requires £100 as a minimum deposit, while demo accounts allow beginners to learn how to trade before trading for real.

Aside from these, FXOpen provides more than 52 currency pairs, and it offers nearly a dozen CFD instruments. When it comes to cryptocurrency pairs, there are 43 pairs that traders can use. Traders can also access several trading instruments at FXOpen, such as stocks, indices, commodities, options, and equities.

FXOpen’s Leverage

Leverage is the ability to utilize something small to control a more significant value. In FXOpen, the leverage on ECN and STP is up to 1:500. For crypto, expect the leverage of 1:3 and 1:500 for Micro.

Spreads and Commission

FXOpen provides several pricing options when it comes to commission and fees. The price depends on the trader’s account type, such as STP, ECN, and Micro, but its pricing, in general, falls into the industry average.

The spreads are often tight, with a starting of 0 pips. With an ECN account, the fees collected range from 0.3 to 1.0 pips every 1 Million, but the prices also change according to the volume traded in the prior month.

On STP accounts, spreads most commonly depends on different factors, which includes market liquidity. In this case, the fees are fixed.

The Payment Method Of FXOpen

All the traders of FXOpen can choose from a wide selection of payment options. They can deposit or withdraw through Credit/Debit Cards, Bank Wire Transfer, Neteller, SkrillMoneyBookers, WebMoney, SEPA, and Payza.

Bonus & Promotions

To make trading better, FXOpen provides different bonuses and promotions that traders can easily acquire by registering an FXOpeneWallet and opening a real trading account. Traders can get the chance to get real money bonuses and the opportunity to payout profit, such as the following:

No deposit bonus for traders with STP accounts

Welcome Bonus for traders who meet the minimum deposit

ForexCup Trading Contest Bonus with the amount depending on the terms of the contest

The Forex broker also features a cashback program that allows traders to get an additional refund for any kind of like loss-making. The cashback will be included in your Commission account that automatically opens without even doing anything.

Pros And Cons Of FXOpen

The best advantage of this Forex broker is its excellent customer support that provides live chat 24 hours every weekday. It also comes with a demo account that allows beginners to learn the platform first before trading for real. FCA, as well as other regulatory bodies, secure your funds, and it requires a low minimum deposit to start an account.

In terms of cons, FXOpen has limited withdrawal and deposit options. For now, it is also limited to particular countries that exclude the US.

Safety & Security Of Using FXOpen

To ensure that your funds are in the safe hands, FXOpen is strictly regulated by the top-tiered FCA, which is covered by FRN:589202 UK. All the funds of its clients are also stored in separate accounts from operational funds. The funds of traders, despite their nationalities, are protected by the amount of £50,00 from FSCS at the same time. It is to allow its clients to access their finances when unexpected events happen.

Accepted Countries

FXOpen operates in countries like the United Kingdom, Australia, Nevis, Saint Kitts, and it has representatives in other countries.

Final Verdict

FXOpen stands among the most dependable brokers today. It provides several account types that suit different traders, and it is still one of the favorites because of its low minimum deposit and withdrawals.

La entrada FXOpen Broker Review 2019-2020 – Must Read! Is FXOpen a Safe Forex Broker se publicó primero en Forex MT4 Indicators.

FXOpen Broker Review 2019-2020 – Must Read! Is FXOpen a Safe Forex Broker published first on https://alphaex-capital.blogspot.com/

0 notes