#frm global

Explore tagged Tumblr posts

Text

Finance professionals who want to focus on risk management are the target audience for the Financial Risk Manager (FRM) Course. It gives you the information you need to properly evaluate and reduce risks by covering important subjects including market, credit, and operational risk. The FRM improves your job opportunities and positions you as an authority in the field of financial risk with its internationally recognized certification.

0 notes

Text

#FRM#CFA VS FRM#FRM COURSE#FRM GLOBAL#FRM INDIA#FRM EXAM#FRM FEES#FRM ELIGIBILITY#FRM EXEMPTIONS#FRM CERTIFICATION#FRM JOB#FRM SALARY

0 notes

Text

FRM Full Form

The globally renowned Financial Risk Manager (FRM) credential is intended for finance professionals who specialize in risk management. The Global Association of Risk Professionals (GARP) bestows the FRM credential, which denotes proficiency in locating, evaluating, and reducing financial risks. The qualification, which covers topics including market risk, credit risk, operational risk, and risk management procedures, is highly regarded in the finance sector. Obtaining the FRM certification necessitates passing two demanding tests that assess candidates' comprehension and implementation of risk management principles in real-world settings. For anyone looking to progress in their careers in investment management, financial planning, and risk analysis, this degree is perfect.

0 notes

Text

do u know how hard it is to be a girl who just wants a plain sturdy white shoulder bag that's big enough for a sketchbook and a steam deck and a small tablet & headphones & not ridiculously expensive...

#LITERALLY IMPOSSIBLE TO FIND. the white/cream/whatever part is non negotiable. and every single one only comes in tiny baby sizes..#the only one ive found so far that i like is from gu global but their entire website is in jp + i haven't ordered stuff frm overseas#before... hhhgh#txt

4 notes

·

View notes

Text

i rly hope perosna 5 x global will become real eventually cuz if it nvr will im like 1000 years behind for no reason

#sighh..#but if i played like the korean one or whichever and thn global came out so i had to. do allat frm the beginning id be prolly more pissed

1 note

·

View note

Note

omg wait ur addedbit about non black ppl making fun of non blacks for using aave is so truee !! it also reminds me of how ppl hate southern accents not only frm j america but also latin america or other places in the global south ! i think policing dialect comes from classism and racism . i think thts such an epic discussion !!

It’s crazy bc so many people see someone incorrectly using aave and it goes straight over their heads that the funny part is that they have no fucking clue how to use it not that the words themselves are funny like omfg. A suburban white girl saying some shit like “it’s tea how me and my hunties finna slay tonight” or whatever is funny because it makes no fucking sense and is coming from someone who has no idea what they’re saying. not that those WORDS THEMSELVES are funny.. help

#asks#ym2164#I don’t even know where to start when it comes to people making fun of southern accents btw. ppl will literally just be like#I hate rural and poor people and the way they speak is so funny 🤣#just realized I like said the exact same sentence twice here. o well

33 notes

·

View notes

Text

when i took the countries of the americas quiz and i got a low score i was so embarrassed i made a point of taking the quiz over and over until i learned the majority of them... idk how you can just admit publicly that you're that ignorant omg. and people will be defending this ignorance like oh i don't live there...i though africa was a country...wah wah bad school system...meanwhile if someone frm the global south posted smth like 'i didn't know new york was a state' they'd be made fun of relentlessly and get death threats in their inbox

#kaya.txt#i think some of you should learn the beautiful art of closing your mouth and observing. maybe even learn something for once

6 notes

·

View notes

Text

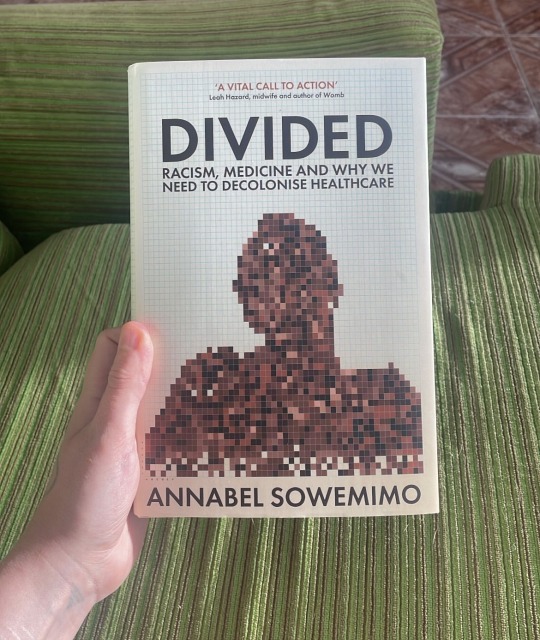

Read 01/10/23 - 03/10/23.

5 stars. A sensational and fantastic book! And if you read all of this review, I’ll send you a gold star sticker in the mail 🌟

To start, as the echoes of covid and all that the pandemic entails continues to reverberate globally, this book arrives as a crucial and timely piece of work. It doesn’t stop at just dissecting the systemic racism deeply ingrained in our healthcare and medicine and science here in the west, but also lays down the urgency of decolonisation, making it essential reading not only fr healthcare professionals but fr anyone concerned about the glaring disparities vulnerable and marginalised populations face.

Sowemimo’s eloquence in unravelling the complex historical roots of modern medicine is well-researched and accessible, and she confronts these uncomfortable truths head-on, forcing us to reevaluate our understanding of modern western healthcare’s colonial and racist past that’s still bleeding into the present. Overall, she presents us w a searingly truthful account that speaks to the heart of the matter.

Sowemimo’s lived experience in this book also really shines through, as a doctor, patient, activist, etc etc, that all infuse authenticity into her overarching narrative. Through her, I was able to further my knowledge and understanding of the stark realities of systemic racism, hidden histories, and healthcare myths that persist today, and her courage in sharing these experiences really underscore the urgency of this conversation.

One thing I really appreciated in the book was her discussion on how we perceive the advancements in modern science and medicine. As she explains, it challenges the prevailing narrative that attributes these advancements solely to individual “geniuses”, who were more often then not privileged white European men, while overlooking, ignoring, and concealing the collective and more diverse contributions that have shaped modern medicine. Like modern medicine is a result of collective learning and collaboration across cultures, borrowed and sometimes appropriated frm different traditions, and this perspective forces us to acknowledge the rich tapestry of medical knowledge that existed long before the advent of “modern” medicine, often held by Indigenous cultures and other marginalised groups.

And by perpetuating this notion that modern medicine is primarily a product of white European male genius, we unintentionally (but also intentionally) erase the contributions of Indigenous and other historically marginalised communities. As Sowemimo explains, this erasure not only distorts the history of medicine but also reinforces harmful stereotypes and power imbalances. Likewise, the deliberate obscuring of the full history of medicine serves a colonial and white supremacist agenda, suggesting that Indigenous and enslaved people lacked the intellectual capacity to care fr themselves before European colonisation, and this viewpoint is not only entirely inaccurate but also incredibly harmful, as it dismisses the resilience, knowledge, and contributions of these communities. As she says, “We believe that Western medicine heralded progress, but the reality is that it could never have progressed were it not for colonial exposure to ‘traditional’ medicine practised in the Global South.”

Sowemimo also highlights a critical issue in the criminal legal system, in that her proposal to seek alternatives to incarceration challenges the conventional notion of retribution, drawn frm her experience as a doctor treating victims of sexual violence. She recognises that our current system in place in the west often fails to provide victims w the necessary tools, such as therapy and monetary reparations, to address the psychological traumas they endure after sexual violence, and this forces us to question the efficacy of punitive approaches, raising important questions about rehabilitation, healing, and addressing the root causes of criminal behaviour. As she says, we must envision a more compassionate and effective way of addressing crime and supporting those who have suffered its consequences, as the current system we have in place is very clearly not working.

I also found a lot of value in Sowemimo’s exploration of another critical issue in modern healthcare: the digital divide. In an age where technology is becoming increasingly integrated into healthcare services, there’s this steadily growing disparity between those who can easily access digital healthcare solutions and those who cannot. This divide disproportionately affects vulnerable populations, including the elderly, the homeless, the working class, and those w limited computer education. She explains that it’s evident that as healthcare services move online, those who are already at risk of poor health are further marginalised. As we continue to build internet-based healthcare solutions, we must ensure that we leave no one behind and work to create a healthcare system that serves all members of society, regardless of their digital capabilities or socioeconomic status.

All up, this book not only exposes the racial biases within medicine but also provides an illuminating perspective on how our world operates and, also importantly, who it serves. It’s a wake-up call that demands our attention, and it’s impossible to read it w/out being profoundly moved. ‘Divided’ has helped further reshape my perception of health and medicine, in a similar vein to ‘Inflamed’ by Rupa Marya and Raj Patel, and if you enjoyed that book you’ll undoubtedly appreciate this work as well. ‘Divided’ deserves nothing less than five stars fr its eloquence, urgency, and the profound impact it can make on our world. My gratitude to the author fr this monumental contribution to our understanding of healthcare, racism, and the pressing need fr decolonisation.

#book recommendations#book recs#bookblr#bookseller#nonfiction#nonfiction books#book rec#book review#booksellers of tumblr#bookish#bookworm#queer bookseller#nonfic#nonfic books#currently reading#current read#book reviews#healthcare#decolonisation#science#booktok#bookstagram

2 notes

·

View notes

Text

The Ultimate Guide to Finding High-Paying Jobs in Gurgaon

Gurgaon, now officially known as Gurugram, has emerged as one of India's top corporate and business hubs. With its booming IT, finance, and startup ecosystem, this city offers lucrative career opportunities for job seekers. If you’re looking for a high-paying job in Gurgaon, this ultimate guide will help you navigate the job market effectively.

1. Identify High-Paying Industries

The key to landing a well-paying job in Gurgaon is to target the right industries. Some of the highest-paying sectors include:

Information Technology (IT) and Software Development – Companies like Google, Microsoft, and Infosys offer competitive salaries.

Banking and Finance – Investment banking, risk management, and financial analysis roles in firms like Goldman Sachs and American Express pay well.

E-commerce and Startups – Gurgaon is home to major startups and e-commerce giants like Zomato and Flipkart.

Consulting – Management and strategy consulting firms like McKinsey, BCG, and Deloitte offer lucrative packages.

Healthcare and Pharmaceuticals – High-level roles in healthcare management and pharmaceutical companies can be rewarding.

Sales and Marketing – Sales roles, especially in B2B companies and digital marketing, provide attractive incentives.

2. Build a Strong Resume and LinkedIn Profile

Your resume and LinkedIn profile are the first impressions potential employers will have of you. Ensure that they are:

Professionally structured and tailored to the job description.

Keyword-optimized for applicant tracking systems (ATS).

Highlighting achievements and quantifiable results rather than just responsibilities.

Showcasing skills, certifications, and endorsements from previous employers.

3. Leverage Job Portals and Networking

Finding a high-paying job requires a proactive approach. Here are the best ways to apply:

Top Job Portals: Use platforms like Naukri, LinkedIn Jobs, Indeed, and Shine to search and apply for roles.

Company Websites: Many top companies post job openings directly on their career pages.

Networking: Join professional groups, attend industry events, and connect with hiring managers on LinkedIn.

Employee Referrals: Reach out to current employees of your target companies for referrals.

4. Upskill and Get Certified

Continuous learning can set you apart from the competition. Some high-paying skills that companies in Gurgaon look for include:

Technical Skills: AI, data science, cloud computing, cybersecurity, and full-stack development.

Financial Certifications: CFA, CPA, or FRM for finance professionals.

Digital Marketing: Certifications from Google, HubSpot, or Facebook boost credibility.

Project Management: PMP and Six Sigma certifications enhance employability.

5. Master the Art of Salary Negotiation

Once you receive an offer, don’t hesitate to negotiate for a better package. Here’s how:

Research salary trends for your role on platforms like Glassdoor and Payscale.

Highlight your unique skills and how they contribute to the company’s success.

Be confident but realistic in your expectations.

Negotiate perks like bonuses, flexible working hours, and learning opportunities.

6. Consider Alternative Career Paths

If you are looking for unconventional yet high-paying career options, consider:

Freelancing and Remote Work: Many global companies hire remote workers for high-paying roles.

Entrepreneurship: Gurgaon’s startup ecosystem is ideal for launching your own business.

Gig Economy Jobs: High-income freelancing opportunities in IT, content creation, and consulting are widely available.

Final Thoughts

Finding a high-paying job in Gurgaon requires strategy, skills, and persistence. Focus on growing your professional network, enhancing your skills, and applying to top companies through multiple channels. With the right approach, you can land a rewarding job that aligns with your career goals.

0 notes

Text

What is a good career option for commerce students?

Commerce students have a wide range of career options to explore, depending on their interests, skills, and future aspirations. Here are some of the best career options after commerce:

1. Chartered Accountant (CA)

One of the most prestigious career paths for commerce students.

Requires passing the CA Foundation, Intermediate, and Final exams.

Offers lucrative job opportunities in auditing, taxation, and finance.

2. Company Secretary (CS)

Focuses on corporate laws, compliance, and governance.

Requires clearing the CS Foundation, Executive, and Professional exams.

CS professionals work with top companies and MNCs.

3. Bachelor of Commerce (B.Com) & B.Com (Hons)

A versatile undergraduate degree that opens doors to finance, accounting, and business roles.

Can be followed by M.Com, MBA, CA, or CFA.

4. Bachelor of Business Administration (BBA)

Ideal for students interested in business, management, and entrepreneurship.

Specializations include Finance, Marketing, HR, and International Business.

Can be followed by an MBA for better career prospects.

5. Cost and Management Accountant (CMA)

Focuses on cost accounting, financial management, and strategic planning.

Recognized globally, offering excellent career growth.

6. Certified Financial Planner (CFP)

Best for students interested in wealth management and financial planning.

Helps individuals and businesses with investment strategies.

7. Banking & Finance Careers

Includes roles in investment banking, retail banking, and financial services.

Requires degrees like B.Com, BBA, MBA (Finance), or certifications like CFA and FRM.

8. Digital Marketing

A trending field with high demand for professionals in SEO, PPC, content marketing, and social media.

Can be pursued through certifications and online courses.

9. Stock Market & Investment Analyst

Requires knowledge of stock markets, trading, and financial analysis.

Certifications like CFA, NISM, and CFP add value.

10. Hotel Management

Ideal for students interested in hospitality, travel, and customer service.

Requires a degree in Hotel Management (BHM).

11. Law (BA LLB or BBA LLB)

A great option for students interested in corporate law, taxation, or criminal law.

Offers careers as a lawyer, legal advisor, or corporate consultant.

12. Entrepreneurship & Startups

Commerce students can start their own business or join family businesses.

Requires business acumen, financial knowledge, and innovation skills.

SAGE University Bhopal is one of the best private university in Bhopal, MP. SAGE University Bhopal offers a diverse range of B.Com (Hons/Research) programs with specialized tracks to help commerce students build expertise in high-demand fields. Here’s a breakdown of the programs and their career prospects:

B.Com (Hons/Research) Specializations at Sage University Bhopal

1. B.Com (Hons/Research) Banking & Finance

Focuses on financial management, banking laws, risk assessment, and investment strategies.

Career Options: Investment Banker, Financial Analyst, Bank Manager, Credit Analyst.

2. B.Com (Hons/Research) Computers

A blend of commerce and IT, covering accounting software, data analytics, and financial technology (FinTech).

Career Options: Business Analyst, Financial Data Analyst, ERP Consultant, IT Auditor.

3. B.Com (Hons/Research) International Business & Finance

Covers global trade, foreign exchange management, and international finance regulations.

Career Options: Foreign Trade Analyst, International Finance Manager, Export-Import Manager.

4. B.Com (Hons/Research) Accounting & Auditing

Focuses on financial reporting, taxation laws, and auditing principles.

Career Options: Chartered Accountant (CA), Internal Auditor, Tax Consultant, Financial Controller.

5. B.Com (Hons/Research) Taxation

Covers direct and indirect taxes, GST, corporate taxation, and tax planning.

Career Options: Tax Advisor, Income Tax Officer, GST Consultant, Financial Planner.

6. B.Com (Hons/Research) Banking & Finance in Collaboration with ImaginXP & CollegeDekho

An industry-aligned course focusing on practical banking skills and financial planning.

Career Options: Corporate Banker, Financial Consultant, Loan Officer, Risk Manager.

7. B.Com (International Business & Finance) in Collaboration with ImaginXP & CollegeDekho

Equips students with skills in global markets, financial regulations, and cross-border transactions.

Career Options: Forex Trader, International Business Consultant, Financial Risk Manager.

Why Choose SAGE University for B.Com (Hons/Research)?

✅ Industry-oriented curriculum with practical exposure. ✅ Collaborations with ImaginXP & CollegeDekho for specialized training. ✅ Strong placement assistance in banking, finance, taxation, and auditing. ✅ Research opportunities for students interested in academic and policy-making roles.

#best career options after commerce#sage university bhopal#best university in bhopal#private university in bhopal#Chartered Accountant#Entrepreneurship & Startups#Company Secretary#B.Com (Hons/Research) Computers#Banking & Finance Careers

0 notes

Text

The main responsibilities of Financial Risk Managers (FRMs) in firms are to detect, assess, and reduce financial risks. By evaluating operational, credit, and market risks, experts in this profession make sure that laws are followed. Providing professions like risk analyst, risk consultant, or portfolio manager, FRMs operate in a variety of industries, including banking, investing, and insurance. Obtaining this certification proves your proficiency in risk management and opens you new job options.

#FRM#FRM COURSE#FRM INDIA#FRM EXAM#FRM FEES#FRM JOBS#FRM CERTIFICATION#FRM ELIGIBILITY#FRM EXEMPTIONS#FRM GLOBAL#FRM STUDENT

0 notes

Text

#FRM#FRM COURSE#FRM EXAM#FRM FEES#FRM GLOBAL#FRM INDIA#FRM ELIGIBILITY#FRM EXEMPTIONS#FRM CERTIFICATION#FRM JOBS#FRM SALARY#FRM STUDENT

0 notes

Text

FRM Course

Professionals can acquire the fundamentals of risk assessment, quantitative analysis, and financial regulation with the Financial Risk Manager (FRM) course. It equips candidates to handle financial risks and advance their careers in risk management and investment analysis by covering essential topics across two exam levels. The FRM course is great for developing knowledge of managing financial risks since it offers useful, real-world information.

0 notes

Text

Why Choose a Bachelor of Business Administration in Finance Over Other Business Degrees?

In an era of economic transformation driven by technological advancements and globalization, selecting the right educational pathway is critical to shaping a promising career. Among the plethora of business degrees available, the Bachelor of Business Administration (BBA) in Finance stands out as a specialized and future-focused choice. With its unique emphasis on financial expertise, technology integration, and global applicability, a BBA in Finance equips students with the skills and knowledge required to excel in the fast-evolving financial landscape.

1. The Growing Demand for Financial Professionals

The financial services industry is one of the fastest-growing sectors globally. According to recent data, the global financial technology (FinTech) market is expected to grow at a compound annual growth rate (CAGR) of 20.5% from 2023 to 2030. This rapid expansion highlights the need for skilled professionals who can navigate complex financial ecosystems. A BBA prepares students to meet this demand by offering an in-depth understanding of financial principles, market trends, and the tools required to make data-driven decisions.

2. Focused Financial Expertise

Unlike general business degrees that provide a broad overview of business operations, a BBA in Finance hones in on key financial disciplines such as:

Investment management

Risk assessment

Corporate finance

Financial analytics These areas of study are critical for understanding the financial backbone of organizations, making graduates highly valuable in the job market.

3. Integration of Technology and Finance

The financial industry is undergoing a massive transformation driven by technology. From digital payments to blockchain and artificial intelligence, technological advancements are reshaping traditional financial operations. A BBA Finance ensures students are equipped with knowledge about emerging trends like FinTech and data analytics, allowing them to stay ahead of the curve. Programs such as the BBA at Ajeenkya DY Patil University (ADYPU) integrate technology-focused modules to prepare students for the dynamic interplay between finance and technology.

4. Diverse Career Opportunities

Graduates with a BBA in Finance have access to a wide range of career paths, including:

Financial analyst

Investment banker

Risk manager

Corporate treasurer

Financial consultant

FinTech specialist

The global scope of finance means opportunities are not restricted to a single region or market. Graduates can explore roles in multinational corporations, startups, and financial institutions, ensuring job diversity and stability.

5. A Foundation for Advanced Learning

A BBA is more than just a standalone degree—it serves as a strong foundation for further studies and certifications. Graduates can pursue advanced qualifications like Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), or an MBA in Finance to enhance their career prospects. These credentials, coupled with a solid undergraduate foundation, can lead to leadership roles and higher earning potential.

6. Global Perspective and Networking

Finance operates on a global scale, and a BBA Finance exposes students to international financial markets and regulatory environments. Institutions like ADYPU ensure that students are prepared for global challenges through collaborations with industry leaders, international case studies, and opportunities for global networking. Such exposure not only broadens students’ perspectives but also opens doors to international career opportunities.

7. Job Stability and High Earning Potential

The finance sector offers some of the most stable and well-paying jobs in the business world. With the rise of digital banking, investment opportunities, and financial advisory services, there is a continuous demand for finance professionals. According to industry reports, the average salary for finance graduates has increased by 15% over the past five years, making it one of the most lucrative fields for young professionals.

8. Practical Exposure and Skill Development

One of the defining features of a BBA in Finance program is its focus on experiential learning. Top institutions, including ADYPU, emphasize internships, live projects, and interactive sessions with industry experts. This hands-on approach ensures students develop critical skills such as financial modeling, problem-solving, and strategic decision-making, which are essential for thriving in the finance industry.

9. Why ADYPU for BBA in Finance?

Ajeenkya DY Patil University (ADYPU) offers one of the most comprehensive BBA Finance programs in Pune. The university’s curriculum is designed to bridge the gap between academic knowledge and industry requirements. Key highlights of the program include:

A blend of traditional finance concepts with modern FinTech advancements.

Access to expert faculty with years of industry experience.

Opportunities for internships and collaborations with leading financial institutions.

A focus on global trends and their application to the Indian financial market.

Choosing ADYPU for your BBA means joining a community dedicated to fostering innovation, critical thinking, and career excellence.

10. Conclusion

In a world increasingly shaped by financial innovation and technological integration, a BBA in Finance is more relevant than ever. This degree not only equips students with specialized knowledge but also prepares them for a dynamic and rewarding career in a globally interconnected financial landscape. By choosing a program like the one offered at Ajeenkya DY Patil University, aspiring financial professionals can build a solid foundation for success in one of the most exciting and impactful industries of our time.

Visit: https://som.adypu.edu.in/postgraduate-programs

0 notes

Text

📢 Quote of the Day 📢

💡 “The stock market is filled with individuals who know the price of everything, but the value of nothing.” 💡

✅ If you truly want to master investment analysis, financial risk management, and corporate finance, you must go beyond just knowing numbers—you must understand value. 📊💰

💼 Whether you're preparing for CFA USA, US CMA, or FRM, or looking to sharpen your market expertise, learning from industry experts is the key to success! 🚀

🎯 At FINAIM, we empower future finance professionals with expert-led coaching, practical case studies, and cutting-edge financial insights. Join the thousands who trust FINAIM for CFA USA, US CMA, and FRM preparation.

🔍 Don't just trade—analyze, strategize, and succeed! 📈

📩 DM us today to start your journey toward global finance certifications and secure your place in the world of elite finance professionals. 🌎✨

🔗 VISIT: https://finaim.in/

FINAIM ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005 PHONE NO: 087009 24049

#CFA#CFA LEVEL1#cfa level2#CFA LEVEL3 COURSE#CFA COURSE DURATION#CFA COURSE FEES#FINAIM#BEST COACHING INSTITUTE IN DELHI#US CMA COURSE#US CMA FEES IN INDIA#FRM PART1#FRM PART2 CLASSES#CAREER#BIG 4S

0 notes

Text

Garud Air Ambulance: Redefining Life-Saving Medical Transport

In critical medical emergencies, time and precision make the difference between life and death. Garud Air Ambulance rises to the occasion, bridging the gap between urgent medical needs and timely intervention. Offering rapid, reliable, and world-class medical transport services, Garud operates across India and internationally. Backed by state-of-the-art equipment and highly skilled professionals, the service stands as a beacon of hope for patients and families alike. With a 24/7 commitment to excellence, Garud Air Ambulance Services in Jabalpur is dedicated to saving lives and alleviating the stress of medical crises.

https://googleads.g.doubleclick.net/pagead/ads?gdpr=0&client=ca-pub-8203545624152628&output=html&h=280&adk=1109056723&adf=3181722614&w=750&abgtt=6&fwrn=4&fwrnh=100&lmt=1737978572&num_ads=1&rafmt=1&armr=3&sem=mc&pwprc=6809437175&ad_type=text_image&format=750x280&url=https%3A%2F%2Fwww.charolottetimes46.com%2Fgarud-air-ambulance-redefining-life-saving-medical-transport&fwr=0&pra=3&rh=188&rw=750&rpe=1&resp_fmts=3&wgl=1&fa=27&uach=WyJXaW5kb3dzIiwiMTUuMC4wIiwieDg2IiwiIiwiMTMyLjAuNjgzNC4xMTAiLG51bGwsMCxudWxsLCI2NCIsW1siTm90IEEoQnJhbmQiLCI4LjAuMC4wIl0sWyJDaHJvbWl1bSIsIjEzMi4wLjY4MzQuMTEwIl0sWyJHb29nbGUgQ2hyb21lIiwiMTMyLjAuNjgzNC4xMTAiXV0sMF0.&dt=1737978570968&bpp=3&bdt=1071&idt=-M&shv=r20250121&mjsv=m202501220101&ptt=9&saldr=aa&abxe=1&cookie=ID%3D6a5c97135192aa66%3AT%3D1737977099%3ART%3D1737978570%3AS%3DALNI_MbuMjQj386bSecatNldUyWUHl8sYA&eo_id_str=ID%3D180e03577ff5d144%3AT%3D1737977099%3ART%3D1737978570%3AS%3DAA-AfjZkVCsT8Yk8umpnig9PFbKB&prev_fmts=0x0%2C1200x280&nras=3&correlator=122255590908&frm=20&pv=1&u_tz=330&u_his=1&u_h=864&u_w=1536&u_ah=816&u_aw=1536&u_cd=24&u_sd=1.25&dmc=8&adx=190&ady=998&biw=1519&bih=730&scr_x=0&scr_y=0&eid=31089627%2C31089976%2C95347433&oid=2&pvsid=156046453662838&tmod=1064896910&uas=0&nvt=1&ref=https%3A%2F%2Fwww.charolottetimes46.com%2Fadmin%2Fposts&fc=1408&brdim=0%2C0%2C0%2C0%2C1536%2C0%2C1536%2C816%2C1536%2C730&vis=2&rsz=%7C%7Cs%7C&abl=NS&fu=128&bc=31&bz=1&td=1&tdf=2&psd=W251bGwsbnVsbCxudWxsLDNd&nt=1&ifi=3&uci=a!3&btvi=1&fsb=1&dtd=1569

Key Features of Garud Air Ambulance

1. Rapid Emergency Response

Emergencies demand immediate action, and Garud Air Ambulance Services in Kolkata excels in minimizing delays. Their readiness protocol ensures that aircraft are prepared for departure within 45 minutes to 2 hours. This swift response mechanism has been instrumental in saving countless lives by drastically reducing the critical time lost during emergencies.

2. Expert Teams and Advanced Equipment

Garud Air Ambulance services are supported by highly skilled professionals, including experienced pilots trained in medical flight operations and healthcare experts adept at handling critical medical situations. Each air ambulance is equipped with advanced life support systems such as ventilators, cardiac monitors, defibrillators, and infusion pumps. This ensures comprehensive patient care during the journey, making Garud a trusted name in critical care transportation.

3. Comprehensive Transport Solutions

Recognizing that every patient has unique requirements, Garud Air Ambulance offers a range of transport solutions:

Private Air Ambulances: Exclusive services for urgent and critical cases, ensuring seamless and swift transportation.

Train Ambulance Services: A cost-effective option for patients requiring long-distance travel with full medical support.

Commercial Stretcher Services: Tailored for patients traveling on commercial flights, providing medical assistance and supervision throughout the journey.

Medical Crew Assistance: Specialized care for elderly or vulnerable passengers needing supervision during travel.

4. Nationwide and Global Reach

Operating in major Indian cities such as Delhi, Mumbai, Chennai, Hyderabad, and Bangalore, Garud Air Ambulance also extends its services to international destinations. They provide bed-to-bed transfers, ensuring smooth transitions with meticulous coordination of ground transportation and medical care. This holistic approach ensures patient safety and a seamless experience.

https://googleads.g.doubleclick.net/pagead/ads?gdpr=0&client=ca-pub-8203545624152628&output=html&h=280&adk=1109056723&adf=3240179948&w=750&abgtt=6&fwrn=4&fwrnh=100&lmt=1737978572&num_ads=1&rafmt=1&armr=3&sem=mc&pwprc=6809437175&ad_type=text_image&format=750x280&url=https%3A%2F%2Fwww.charolottetimes46.com%2Fgarud-air-ambulance-redefining-life-saving-medical-transport&fwr=0&pra=3&rh=188&rw=750&rpe=1&resp_fmts=3&wgl=1&fa=27&uach=WyJXaW5kb3dzIiwiMTUuMC4wIiwieDg2IiwiIiwiMTMyLjAuNjgzNC4xMTAiLG51bGwsMCxudWxsLCI2NCIsW1siTm90IEEoQnJhbmQiLCI4LjAuMC4wIl0sWyJDaHJvbWl1bSIsIjEzMi4wLjY4MzQuMTEwIl0sWyJHb29nbGUgQ2hyb21lIiwiMTMyLjAuNjgzNC4xMTAiXV0sMF0.&dt=1737978570968&bpp=2&bdt=1071&idt=2&shv=r20250121&mjsv=m202501220101&ptt=9&saldr=aa&abxe=1&cookie=ID%3D6a5c97135192aa66%3AT%3D1737977099%3ART%3D1737978570%3AS%3DALNI_MbuMjQj386bSecatNldUyWUHl8sYA&eo_id_str=ID%3D180e03577ff5d144%3AT%3D1737977099%3ART%3D1737978570%3AS%3DAA-AfjZkVCsT8Yk8umpnig9PFbKB&prev_fmts=0x0%2C1200x280%2C750x280&nras=4&correlator=122255590908&frm=20&pv=1&u_tz=330&u_his=1&u_h=864&u_w=1536&u_ah=816&u_aw=1536&u_cd=24&u_sd=1.25&dmc=8&adx=190&ady=2184&biw=1519&bih=730&scr_x=0&scr_y=0&eid=31089627%2C31089976%2C95347433&oid=2&pvsid=156046453662838&tmod=1064896910&uas=0&nvt=1&ref=https%3A%2F%2Fwww.charolottetimes46.com%2Fadmin%2Fposts&fc=1408&brdim=0%2C0%2C0%2C0%2C1536%2C0%2C1536%2C816%2C1536%2C730&vis=2&rsz=%7C%7Cs%7C&abl=NS&fu=128&bc=31&bz=1&td=1&tdf=2&psd=W251bGwsbnVsbCxudWxsLDNd&nt=1&ifi=4&uci=a!4&btvi=2&fsb=1&dtd=1581

Simplifying Medical Transfers for Families

Medical emergencies can be overwhelming for families. Garud Air Ambulance alleviates this burden by managing every aspect of the transfer process. Dedicated case managers oversee logistics, including ground ambulance arrangements and hospital coordination, allowing families to focus on their loved ones. This compassionate approach provides much-needed peace of mind during stressful times.

Streamlined Booking Process

Booking Garud Air Ambulance services is simple and efficient. Families can reach out via their 24/7 call center or website to request assistance. Medical experts assess the patient’s needs and recommend the most suitable transport option. From the initial inquiry to the final transfer, the process is marked by clear communication and quick responses, ensuring a seamless experience.

Specialized Medical Services

Garud Air Ambulance offers tailored solutions to meet the specific needs of critically ill patients:

Neonatal and Pediatric Transfers: Equipped with neonatal care systems and managed by expert pediatric teams, these services ensure safe transport for infants and children.

ECMO Patient Transfers: Advanced support for patients requiring Extracorporeal Membrane Oxygenation (ECMO), delivering critical care during transit.

Covid-19 Patient Transfers: Secure and compliant transport for infectious patients, safeguarding both the patient and medical staff.

These specialized services highlight Garud Air Ambulance’s commitment to providing precision care for diverse medical requirements.

A Trusted Partner for Top Institutions

Garud Air Ambulance is recognized by leading hospitals, organizations, and government agencies. Their unwavering dedication to quality care, operational efficiency, and patient safety sets them apart in the industry. Adherence to rigorous safety standards, continuous communication, and a patient-centric approach ensure trust and reliability for families and healthcare providers alike.

https://googleads.g.doubleclick.net/pagead/ads?gdpr=0&client=ca-pub-8203545624152628&output=html&h=280&adk=1109056723&adf=3076923032&w=750&abgtt=6&fwrn=4&fwrnh=100&lmt=1737978672&num_ads=1&rafmt=1&armr=3&sem=mc&pwprc=6809437175&ad_type=text_image&format=750x280&url=https%3A%2F%2Fwww.charolottetimes46.com%2Fgarud-air-ambulance-redefining-life-saving-medical-transport&fwr=0&pra=3&rh=188&rw=750&rpe=1&resp_fmts=3&wgl=1&fa=27&uach=WyJXaW5kb3dzIiwiMTUuMC4wIiwieDg2IiwiIiwiMTMyLjAuNjgzNC4xMTAiLG51bGwsMCxudWxsLCI2NCIsW1siTm90IEEoQnJhbmQiLCI4LjAuMC4wIl0sWyJDaHJvbWl1bSIsIjEzMi4wLjY4MzQuMTEwIl0sWyJHb29nbGUgQ2hyb21lIiwiMTMyLjAuNjgzNC4xMTAiXV0sMF0.&dt=1737978570979&bpp=2&bdt=1082&idt=2&shv=r20250121&mjsv=m202501220101&ptt=9&saldr=aa&abxe=1&cookie=ID%3D6a5c97135192aa66%3AT%3D1737977099%3ART%3D1737978570%3AS%3DALNI_MbuMjQj386bSecatNldUyWUHl8sYA&eo_id_str=ID%3D180e03577ff5d144%3AT%3D1737977099%3ART%3D1737978570%3AS%3DAA-AfjZkVCsT8Yk8umpnig9PFbKB&prev_fmts=0x0%2C1200x280%2C750x280%2C750x280&nras=5&correlator=122255590908&frm=20&pv=1&u_tz=330&u_his=1&u_h=864&u_w=1536&u_ah=816&u_aw=1536&u_cd=24&u_sd=1.25&dmc=8&adx=190&ady=2721&biw=1519&bih=730&scr_x=0&scr_y=0&eid=31089627%2C31089976%2C95347433&oid=2&pvsid=156046453662838&tmod=1064896910&uas=0&nvt=1&ref=https%3A%2F%2Fwww.charolottetimes46.com%2Fadmin%2Fposts&fc=1408&brdim=0%2C0%2C0%2C0%2C1536%2C0%2C1536%2C816%2C1536%2C730&vis=1&rsz=%7C%7Cs%7C&abl=NS&fu=128&bc=31&bz=1&td=1&tdf=2&psd=W251bGwsbnVsbCxudWxsLDNd&nt=1&ifi=5&uci=a!5&btvi=3&fsb=1&dtd=M

Why Choose Garud Air Ambulance?

Garud Air Ambulance stands out for its exceptional services and commitment to excellence. Here are the key advantages:

24/7 Availability: Always ready to respond to emergencies, regardless of time or location.

Skilled Professionals: Highly experienced pilots and medical teams ensure expert care throughout the journey.

State-of-the-Art Equipment: Advanced medical technology guarantees patient safety and comfort.

Diverse Transport Options: Customized solutions to meet individual patient needs.

Streamlined Booking: A hassle-free process that prioritizes quick and reliable service.

How Garud Air Ambulance Makes a Difference

https://googleads.g.doubleclick.net/pagead/ads?gdpr=0&client=ca-pub-8203545624152628&output=html&h=280&adk=1109056723&adf=1380027385&w=750&abgtt=6&fwrn=4&fwrnh=100&lmt=1737978997&num_ads=1&rafmt=1&armr=3&sem=mc&pwprc=6809437175&ad_type=text_image&format=750x280&url=https%3A%2F%2Fwww.charolottetimes46.com%2Fgarud-air-ambulance-redefining-life-saving-medical-transport&fwr=0&pra=3&rh=188&rw=750&rpe=1&resp_fmts=3&wgl=1&fa=27&uach=WyJXaW5kb3dzIiwiMTUuMC4wIiwieDg2IiwiIiwiMTMyLjAuNjgzNC4xMTAiLG51bGwsMCxudWxsLCI2NCIsW1siTm90IEEoQnJhbmQiLCI4LjAuMC4wIl0sWyJDaHJvbWl1bSIsIjEzMi4wLjY4MzQuMTEwIl0sWyJHb29nbGUgQ2hyb21lIiwiMTMyLjAuNjgzNC4xMTAiXV0sMF0.&dt=1737978570988&bpp=3&bdt=1091&idt=3&shv=r20250121&mjsv=m202501220101&ptt=9&saldr=aa&abxe=1&cookie=ID%3D6a5c97135192aa66%3AT%3D1737977099%3ART%3D1737978570%3AS%3DALNI_MbuMjQj386bSecatNldUyWUHl8sYA&eo_id_str=ID%3D180e03577ff5d144%3AT%3D1737977099%3ART%3D1737978570%3AS%3DAA-AfjZkVCsT8Yk8umpnig9PFbKB&prev_fmts=0x0%2C1200x280%2C750x280%2C750x280%2C750x280&nras=6&correlator=122255590908&frm=20&pv=1&u_tz=330&u_his=1&u_h=864&u_w=1536&u_ah=816&u_aw=1536&u_cd=24&u_sd=1.25&dmc=8&adx=190&ady=3121&biw=1519&bih=730&scr_x=0&scr_y=218&eid=31089627%2C31089976%2C95347433&oid=2&pvsid=156046453662838&tmod=1064896910&uas=1&nvt=1&ref=https%3A%2F%2Fwww.charolottetimes46.com%2Fadmin%2Fposts&fc=1408&brdim=0%2C0%2C0%2C0%2C1536%2C0%2C1536%2C816%2C1536%2C730&vis=1&rsz=%7C%7Cs%7C&abl=NS&fu=128&bc=31&bz=1&td=1&tdf=2&psd=W251bGwsbnVsbCxudWxsLDNd&nt=1&ifi=6&uci=a!6&btvi=4&fsb=1&dtd=M

Garud Air Ambulance goes beyond transportation by ensuring patients receive continuous care during critical moments. The service’s holistic approach—spanning medical expertise, advanced technology, and compassionate support—has made it a trusted partner for families navigating medical emergencies. With a focus on safety, efficiency, and patient well-being, Garud Air Ambulance consistently delivers life-saving solutions.

Contact Garud Air Ambulance

When emergencies strike, trust Garud Air Ambulance for reliable medical transport. With experienced teams, cutting-edge equipment, and an unwavering focus on patient safety, they redefine critical care transportation. Whether it’s an urgent air transfer, neonatal transport, or specialized medical service, Garud Air Ambulance is just a call away.

Contact their 24/7 call center or visit their website to book trusted medical transport services. Experience the assurance and reliability of Garud Air Ambulance—your partner in life-saving medical care

0 notes