#forexmentors

Explore tagged Tumblr posts

Text

A screenshot from a video 📊🍉 !!!

#crypto news#crypto#business#forextips#forexmentor#sexy pose#bitcoin#beauty#slim n stacked#traders#dms open#workout#workfromhome#workfromphone#investing stocks#investment#investors

48 notes

·

View notes

Text

"The Funded Trader" Enabling traders to reach their full potential.

With the arrival of the booming prop firm industry, aiming to fund the traders to take their trading career to next levels, there is one name that stands out , a leading prop firm in the prop firm space "The Funded Trader".

With their carefully designed programs to help traders of all kids and styles. They provide upto $600000 in funded capital that can be scaled upto $1.5million allowing you to never depend on small capital and in the process helping you to take the big step towards a better future in financial markets.

Offering different account options to accomodate your trading style and your trading strategy. you can choose betwqeen regular or swing tading accounts.

Standard Challenge:

Choose account sizes ranging from $5000 to $400000. Pass two step varification process with leading industry standard rules and regulation.

phase 1 target: 8%

phase2 target 5%

Rapid Challenge:

With zero minimum trading days, to fast track your journey to be a funded trader.

Accounts ranging from $5000 to $200000.

Royal Challenge:

With the accounts ranging from $50,000 to $400,000. Royal challenge has no limits on EA's and the news trading is allowed.

Knight challenge:

One step challenge with unlimited days and 0 minimum days. you can select challenge accounts ranging from $25000 to $200000.

Why The Funded Trader is industry leader?

Social media presence: With their different accounts type and a bigger community of traders, The funded trader helps you to connect with like minded traders and take your trading journey to the next level.

Discord: A very active discord to help with any queries and the constant give aways keep you engage in the community.

Treasure Hunt app: very first of its kind, treasure hunt app to keep you engaged within the community and you can earn rewards every month. https://hunt.thefundedtraderprogram.com/r/adnanali?fbclid=IwAR3ZVgXIIRLB7yker6-I93290JdC8r57rUDdh5w3J9_vdToWgwwFfqtZQFU

Monthly trading competition: The biggest monthly trading competition in the industry where you can showcase your trading potential and earn rewards and different challenge accounts.

The funded trader is true industry leader in the prop firm industry. so take a leap of faith and embark on a trading journey to keep you financially independent.

Click on the Affiliate link below to buy a challenge today.

#the funded trader#stockmarket#crypto#finance#forex#marketing#crptocurrency#gold#sucess story#binance#lifestyle#life skills#forex online trading#forex education#forex trading#forexsignals#forextrading#forexmarket#forexmentor#trader

23 notes

·

View notes

Text

BINARY OPTION OTC TRADING with MT4 INDICATOR|80% WIN RATE|100% NONREPAINT

youtube

Accuracy of trend entry binary options signals indicator is unbeatable.You can trust it because it is 100% non repaint indicator.we corrently provide mt4 and mt5 versions of trend entry indicators.We extremly happy to intraduce otc market chart generating mt4 tool,its help to use our best accurat arrow indicator for otc market also.Correnly following binary options brokers supported our otc tool

Our OTC Tool Working with Following Brokers Now

Pocket Option

Quotex Olymotrade

Iqoption

Derive

Binomo

Spectre

To get more details about our indicator and otc tool plase contact us using following methods

Contact us -

✅ Telegram Chanel - https://t.me/+urvJU3g4r_A4MDc5

✅ Telegram ( Devid ) - https://t.me/trendentrey

✅ Email - [email protected]

#binaryoptions#binarytrade#binarymlmsoftware#binary#forex#forexmarket#forex analysis#forexsignals#forexmentor#pocket option#iqoption#quotex#derive#binomo#spectre#otc socks#Youtube

5 notes

·

View notes

Text

Possible scenario in NFP💹🇺🇸

1)If NFP is coming more than the Forecast number (187K), This will be positive for the USD and Negative for the Gold📉, Then Gold can test the 2030 Level 2)If NFP is coming less than forecast number (187K) This will be negative for the USD and Positive for the Gold📈, Then Gold can test the 2080 level Join now for todays NFP trades : https://t.me/+dhwEscK8ANs5YTc1

#forex#forexmarket#forexstrategy#forextips#forexprofit#forexmentor#forex education#forexsignals#forextrading#gold trading#nfp

3 notes

·

View notes

Text

I do the work, you make the money. Send a DM.

4 notes

·

View notes

Text

Instant Funding Program

No Challenges, No Profit Targets, Just Get Funded.

Use coupon code: grqfhmddw7

To get 5% discount.

💲💲💲https://giftz.cc/xDmLB

#forex#forex online trading#forexbroker#forexlifestyle#forexmarket#forexmoney#forexmentor#forexeducation

4 notes

·

View notes

Text

Hi friends! My name is Antonia Dogaru, I’m 23 years old and I've successfully established various online income streams despite having no prior experience. My diverse income sources include affiliate marketing, trading, investing using artificial intelligence and more. If you're curious about my methods and how you can start your journey, feel free to send me a message and we can schedule a 1-1 call.🖤

#artists on tumblr#network marketing#socialist#make moeny online#how to earn money#make money from home#digital marketing#entrepreneur#digital entrepreneur#forextrading#forexstrategy#forexmentor#mentor#stocks#nft crypto

5 notes

·

View notes

Text

Forex Trading 101: A Comprehensive Guide for Beginners

Forex Trading 101: A Comprehensive Guide for Beginners

Introduction

Forex trading has come decreasingly popular among commodities and businesses looking to subsidize on the global currency request. With its eventuality for high returns and 24- hour availability, forex trading offers initiative openings for newcomers. Still, navigating the forex request can be dispiriting without solid understanding of its fundamentals. In this comprehensive companion, we will give newcomers with a step-by- step preface to forex trading. we will cover essential motifs similar as request dynamics, trading strategies, threat operation, and the part of a forex broker. By the end of this companion, you'll have the knowledge and confidence to begin your forex trading trip successfully.

Role of forex broker:

When it comes to forex trading, a forex broker plays a pivotal part in easing your participation in the request. let us explore the crucial functions and services offered by forex brokers.

Providing Access to the Forex Market:

A forex broker acts as a conciliator, granting you access to the forex request. they have established connections with liquidity providers and fiscal institutions, allowing you to trade currency dyads. Without a forex broker, it would be challenging for individual dealers to directly pierce the interbank request.

Offering Trading Platforms:

Forex brokers give trading platforms, which are software operations that enable you to execute trades, cover the request, and dissect maps. These platforms come with colorful features and tools, including real-time price quotations, charting capabilities, and order prosecution options. Popular platforms include MetaTrader 4( MT4) and MetaTrader 5( MT5).

1.3 Account Types and Features

Forex brokers offer different types of trading accounts to cater to the different requirements of dealers. These accounts may vary in terms of minimal deposit conditions, influence, spreads, and fresh features. Common types of accounts include standard accounts for educated dealers and mini or micro accounts for newcomers.

Market Analysis and Tools

To assist customers in making informed opinions, forex brokers provide request analysis tools and coffers. These may include profitable timetables, specialized pointers, and exploration accoutrements. By exercising these tools, customers can analyse request trends, identify implicit trading openings, and develop trading strategies.

Customer Support

Forex brokers understand the significance of good client support. They offer assist and guidance to traders whenever required. Whether you have technical issues with the trading platform or want explanation on trading conceptions, a reputed forex broker will have a responsive client support team to address your queries.

Benefits of Using a Forex Broker

When engaging in forex trading, applying the services of a forex broker can offer multiple advantages. Let's explore some of the crucial benefits that come with using a forex broker.

Expertise and Guidance:

Forex brokers have deep knowledge and experience in the financial requests. They can provide precious guidance and advice to beginner traders, helping them navigate the difficulties of forex trading. Brokers constantly offer educational resources, webinars, and tutorials to enhance traders' understanding of the market and trading strategies.

Access to Market Liquidity:

Forex brokers provide access to market liquidity, which is critical for executing trades efficiently. They've established relations with liquidity providers and banks, allowing traders to enter competitive bid- ask spreads and execute trades instantly. Without a broker, individual traders would face challenges in entering the interbank market directly.

Security of Funds:

Reputed forex brokers prioritize the security of their customers' funds. They adhere to strict regulatory conditions and oftentimes hold customer funds in segregated accounts. This means that traders' funds are kept separate from the broker's operational funds, providing an extra layer of protection in a case of any financial difficulties faced by the broker.

Educational Resources:

Forex brokers understand the significance of education in successful trading. They provide educational resources, alike as trading guides, webinars, and market analysis, to help traders enhance their knowledge and expertise. These resources can be inestimable for beginners, equipping them with the necessary tools to make informed trading decisions.

Trading Flexibility and Options:

Forex brokers offer a wide range of trading instruments, allowing traders to diversify their portfolios. In addition to major currency pairs, brokers constantly provide access to minor pairs, exotic pairs, commodities, indices, and even cryptocurrencies. This inflexibility enables dealers to explore different requests and take advantage of colourful trading openings.

Introduction to White Label Solutions

In this dynamic business, staying ahead of the competition is vital, and White Label Solutions offer a game-changing strategy to achieve just that. With our comprehensive White Label Solution, you can easily enhance your brand's presence and expand your service offerings without the need for extensive resources or specialized expertise. Let us guide you through the myriad possibilities of White Label Solutions and show you how they can revolutionize your business, making it stands out in the crowd.

Advantages of White Label Solutions

White-label solutions offer a host of advantages for businesses looking to establish a presence in the market with their brand. One of the key benefits is cost-effectiveness, as white-label solutions save businesses from the time and resources required to develop a trading platform from scratch. By leveraging existing infrastructure, companies can focus on marketing and client acquisition, accelerating their entry into the market. Additionally, white-label solutions provide branding and customization options, allowing businesses to create a unique brand identity and stand out from competitors. Moreover, the regulatory compliance aspect is addressed by the parent company, ensuring businesses operate within the legal framework without the burden of navigating complex regulations. Overall, white-label solutions empower businesses with a reliable, established, and scalable trading infrastructure, enabling them to offer top-notch services under their brand name and compete effectively in the competitive forex market.

Branding and Customization

White label solutions provide businesses with the occasion to establish their own brand identity within the forex market. The trading platform and other services can be customized with the company's trademark, colours, and design fundamentals, creating a unique and recognizable brand. This branding and customization help businesses difference themselves from competitions and construct brand faith among their clients.

Cost and Time Efficiency

One of the primary advantages of white label solutions is the cost and time effectiveness they offer. Developing a trading platform from scratch can be a complex and premium bid. By utilizing a white label solution, businesses can bypass the lengthy development process and associated costs. They can focus on their core abilities, marketing, and client acquisition, saving significant time and resources.

Infrastructure and Technology

White label solutions allow businesses to leverage the existing infrastructure and technology of the parent company. This includes the trading platform, back-office systems, liquidity providers, and regulatory compliance solutions. By exercising well- established structure, businesses can profit from a robust and dependable system without having to invest in the development and maintenance of their own technology.

Regulatory Compliance

Navigating the regulatory landscape can be a complex task, especially for businesses entering multiple authorities. With a white label solution, the parent company generally handles regulatory compliance, ensuring that the white label broker operates within the legal frame. This saves businesses the time and trouble needed to understand and adhere to various regulatory conditions, enabling them to focus on their core operations.

Considerations for Choosing a Forex Broker or White Label Solution

Choosing the right forex broker or white label solution is crucial for successful and rewarding trading experience. There are several factors to consider before deciding. Let us explore the key considerations to keep in a mind:

Reputation and Regulation

The reputation of a forex broker or white label solution provider is paramount. Look for well- established companies with a proven track record in the industry. Research customer reviews, testimonials, and industry rankings to gauge the credibility and trust ability of the broker. Additionally, regulatory compliance is essential for ensuring the safety of your finances and adherence to industry standards. Choose brokers regulated by reputable financial authorities, as this provides added layer of protection for your investments.

Trading Conditions

Estimate the trading conditions offered by the forex broker or white label solution. This includes factors such as spreads, commissions, leverage, and minimum deposit conditions. Lower spreads and competitive trading costs can significantly impact your trading profitability. Also, consider the range of tradable instruments available, as having access to different selection of currency pairs, commodities, indices, and cryptocurrencies can open various trading opportunities.

Technology and Platform

The trading platform is the gateway to the forex market, so it is critical to assess its features and capabilities. Look for a user-friendly platform that offers quick order execution, real-time market data, advanced charting tools, and risk management features. A stable and dependable platform is essential to execute trades efficiently, especially during times of request volatility. Additionally, consider whether the platform is available as a web-based, desktop, or mobile operation, providing you with the flexibility to trade on the go.

Customer Support

Effective and reliable customer support is vital when it comes to forex trading. You may encounter technical issues, have questions about your account, or need assistance with trading strategies. A responsive and knowledgeable customer support team can make a significant difference in resolving queries promptly and ensuring smooth trading experience. Look for brokers or white label providers that offer multiple channels of communication, similar as live chat, an email, and telephone support.

Conclusion

Forex trading can be an economic endeavour for beginners, but understanding the role of forex brokers and the concept of white label solutions is essential. Forex brokers act as intermediaries, providing access to the forex market, trading platforms, and support. White label solutions offer time-efficient and cost-effective way for companies to enter the forex market under their own brand. When choosing a forex broker or considering a white label solution, consider factors such as reputation, regulation, trading conditions, technology, and customer support. With a solid foundation and the right partner, you can embark on a successful forex trading journey.

2 notes

·

View notes

Text

Forex Trading Signals

Buy #xauusd 1826.00

slp 1831.00

Tp1 1821.00

Tp2 1816.00

Free Telegram Channel : https://t.me/FOREXRESEARCHGAIN

Official Telegram ID: https://t.me/FXGAINADMIN

#forex#forexprofit#forexstrategy#forexmentor#forexsignals#investment#stock market#currency#dollar#us dollar#gbpusd#xauusd#forexnews#trader

4 notes

·

View notes

Text

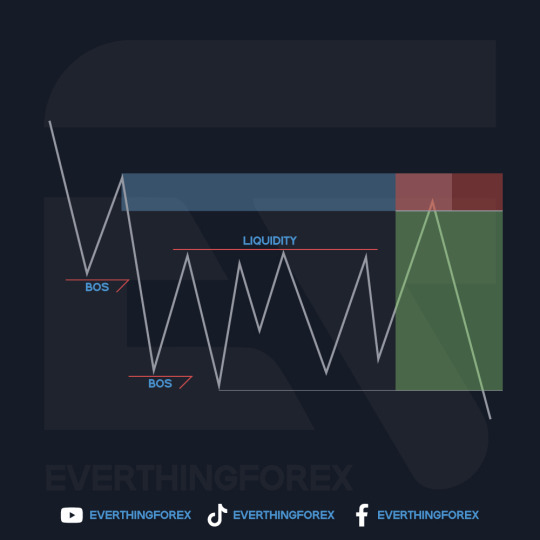

High probable entry model.

Create a Synthetic indices trading account : https://track.deriv.com/_9gnbF2n3XPVBMfcXPt5VjGNd7ZgqdRLk/1/

Follow @everthingforex for more content

#forexsignals#forexbroker#forex systems#forextrading#forex#forexnews#forexmarket#forexstrategy#forexscam#forexlifestyle#forexeducation#xtreamforex#forextrader#trader#forexhelp#forexmentor#forexindicator#everthingforex#forex online trading#forextips

4 notes

·

View notes

Text

There are numbers of ways to change your trading style and we are here to let you the the bestest ways.........

join us on instagram

#forex#forex broker#forex education#forex expert advisor#forex market#forexmastery#forexmentor#forex indicators#eurusd#forexsignals

0 notes

Text

Bitcoin’s Drop Amid Market Uncertainty

Markets move fast, and this week’s Bitcoin tumble to $91,362 was a stark reminder of how macroeconomic events shape price action. The drop came swiftly after Trump’s announcement of a 25% tariff on Canadian and Mexican imports, sending shockwaves through both traditional and crypto markets.

For traders, volatility like this isn’t just noise — it’s an opportunity. Those who stay informed and approach the market with a strategy can navigate uncertainty without making impulsive decisions.

Why Did Bitcoin Drop?

The announcement triggered a chain reaction, leading to a broad sell-off in risk assets. Derivatives data showed $140 million in liquidations within hours, and the overall crypto market dipped below $3 trillion. Ethereum, XRP, and Solana all suffered double-digit losses. However, Bitcoin’s market dominance rose to 61%, signaling that while altcoins faced deeper corrections, traders still see BTC as a relative safe haven.

Key Takeaways for Traders

1️⃣ Macro Events Matter — Whether it’s interest rates, tariffs, or global policy shifts, traders who understand macroeconomic impacts gain a clear edge. Staying ahead of news helps anticipate volatility rather than react to it.

2️⃣ Risk Management is Crucial — Sharp moves like this highlight the importance of proper position sizing, stop losses, and knowing when to hedge exposure. Those caught overleveraged suffered the most in this latest dip.

3️⃣ Volatility Creates Opportunity — While panic selling happens, experienced traders analyze key levels, look for entry zones, and recognize when sentiment is driving exaggerated price swings.

Looking Ahead

The crypto market remains unpredictable, but the ability to read these shifts separates traders from speculators. This is something I’ve refined through ORION Wealth Academy, where developing a structured approach to risk and market movements has been essential.

As Bitcoin stabilizes, the next big question is: Will this dip be another buying opportunity, or is there more downside ahead? Time will tell, but one thing is clear — understanding both technicals and fundamentals remains key to staying ahead in this market.

#forex#forexmentor#currency#forexmoney#forexmarket#forextrading#currencyexchange#forexsignals#us currency#crypto currency

0 notes

Text

How the Bybit Hack Highlights the Importance of Risk Management in Crypto Trading

The crypto market never sleeps, and neither do the risks that come with it. The recent $1.5 billion Bybit hack has sent shockwaves through the industry, proving once again that even the biggest players are vulnerable. For traders like myself, this isn’t just news — it’s a reminder of the importance of risk management and strategic positioning in the markets.

Security and Liquidity: The Hidden Risks in Trading

At ORION Wealth Academy, one of the first lessons I learned was that risk management isn’t just about placing stop losses — it’s about understanding the full ecosystem of your investments. The Bybit incident revealed how quickly an exchange can go from business as usual to handling a “bank run” of over $4 billion in withdrawals. Liquidity matters, and as traders, we need to assess not just price action but also the stability of the platforms we use.

Protecting Your Capital: Lessons from the Bybit Fallout

1️⃣ Diversification is Key — Having all your funds on a single exchange is a risky move. I personally keep a portion of my holdings in cold wallets and spread my assets across multiple platforms.

2️⃣ Know Where Your Money Is — Bybit assured traders that their assets were backed 1:1, but the reality is, when panic sets in, delays and uncertainty follow. Having an exit plan and knowing the withdrawal process ahead of time can prevent unnecessary stress.

3️⃣ Volatility Creates Opportunity — Ethereum dropped nearly 4% after the hack, but for traders who understood market sentiment, this was an opportunity. With the right strategy, news-driven volatility can become a profitable setup.

Why Trading Smarter Matters Now More Than Ever

With institutional investors entering the space and regulators keeping a closer watch, crypto is evolving fast. Events like the Bybit hack reinforce why we, as traders, need to stay ahead — not just in technical analysis, but in understanding macro risks and security factors.

I’ve learned a lot from ORION’s approach to fundamental and technical trading, and this is why I believe education is the most powerful tool in navigating these markets. If you’re looking to level up your skills and stay ahead of these industry shifts, joining a strong trading community is a must.

#forextrading#forex#forextips#forexmentor#forexsignals#forexbroker#forexgroup#forex online trading#forexmarket

0 notes

Text

Are Meme Coins the Next Big Trading Opportunity or Just a Fad?

I’ve always been skeptical about meme coins. Are they really worth the risk, or are they just another market fad? After deep-diving into the altcoin space and refining my strategies with ORION, I’ve come to see that meme coins have evolved far beyond their early reputation. They’re no longer just internet jokes — they now offer staking rewards, play-to-earn (P2E) games, and even DeFi utilities that make them serious contenders for long-term investments.

The Rise of Utility-Driven Meme Coins

Tokens like BTFD, DOGS, and BOME are pushing the boundaries of what meme coins can do. For example, BTFD isn’t just another token riding the hype wave — it offers a 3650% ROI potential, staking rewards at 90% APY, and a live P2E gaming ecosystem. Meanwhile, DOGS integrates DeFi mechanics, and BOME is tapping into the growing meme economy with NFTs and Web3 innovations.

With all these developments, the key takeaway is timing and strategy. Just like any trade, understanding market sentiment, volume trends, and utility matters when entering meme coin positions. While the volatility is high, the potential for massive gains exists — especially for traders who can spot trends early.

Learn, Trade, and Grow with a Strong Community

I’ve been refining my skills with ORION Wealth Academy, and one of the biggest advantages is being part of a trading community that actively discusses market shifts, risk management, and emerging opportunities. If you want to stay ahead of the curve, I highly recommend joining the community and learning alongside experienced traders. Whether you’re trading meme coins or blue-chip assets, having a solid strategy is everything.

0 notes

Text

Singapore’s Budget 2025: What We Should Watch

I’ve always believed that keeping an eye on global fiscal policies is essential to understanding market movements. With Singapore’s Budget 2025 set to be announced, it’s another key moment for traders worldwide to assess how government decisions might shape economic trends and market opportunities.

Why This Budget Matters for Global Markets

Singapore, as a major financial hub in Asia, plays a crucial role in shaping regional and international market sentiment. This year’s budget comes amid a landscape of inflation concerns, shifting trade policies, and geopolitical uncertainty — factors that can all influence global trading strategies.

A pro-growth approach with increased government spending could provide a boost to industries like technology, finance, and infrastructure, while a more fiscally conservative stance might signal caution, impacting investor sentiment and currency movements.

Key Areas to Monitor

✔️ Monetary and Fiscal Policy Decisions — Will Singapore prioritize economic expansion, or will they focus on maintaining fiscal discipline? ✔️ Industry-Specific Support — Policies aimed at key sectors could create opportunities in related markets. ✔️ Currency and Trade Impacts — With evolving trade relationships and external pressures, movements in the Singapore dollar (SGD) and other key forex pairs could follow.

Connecting the Dots for Trading Strategies

For those of us following the markets closely, understanding how budgets influence macro trends helps in adjusting trading positions accordingly. Whether in forex, equities, or commodities, these economic policies provide insight into potential price movements and investor behavior.

Turning Economic Trends into Trading Opportunities

Being part of ORION Wealth Academy has taught me to anticipate market shifts, not just react to them. Understanding how budgets influence macroeconomic trends allows me to refine my forex and equity trading strategies, giving me an edge in volatile markets.

The takeaway? Budgets like this aren’t just for economists — they’re crucial for traders who want to stay ahead. Keeping up with global fiscal policies is key to making informed, strategic trading decisions.

Keeping track of fiscal policies like this isn’t just about economics — it’s about staying ahead of the curve and making informed market decisions.

#forexsignals#forex#forex online trading#investment#forextrading#forexprofit#forexmentor#forexmarket#forexstrategy

0 notes

Text

AI Disruption: How BYD and DeepSeek Are Reshaping Markets

Markets are constantly evolving, and those who anticipate change often come out ahead. At ORION Wealth Academy, I’ve learned that staying ahead isn’t just about reacting to price movements — it’s about understanding how technological shifts create new opportunities. Right now, AI is reshaping industries, and the latest shake-up comes from China’s BYD and DeepSeek, posing a serious challenge to Tesla’s dominance in autonomous driving.

Disruptive Innovation: AI’s Power Beyond Trading

What makes this partnership significant isn’t just the competition — it’s the business model shift. While Tesla still charges a premium for Full Self-Driving software, BYD is offering its AI-powered “God’s Eye” system as a standard feature. This mirrors what’s happening in trading: once exclusive, high-cost AI tools are becoming more widely available, leveling the playing field for both retail and institutional traders.

AI isn’t just an efficiency booster anymore — it’s a market disruptor. Whether it’s DeepSeek’s AI revolutionizing self-driving, or machine learning models optimizing trade execution, those who adapt to these AI-driven changes will stay ahead, while those who resist may fall behind.

We’ve already seen AI-powered trading bots and automated strategies redefine financial markets. But as AI continues evolving, traders must think beyond price charts — we need to anticipate how AI-driven automation impacts entire industries. The fact that BYD can integrate cutting-edge AI at scale suggests that more industries will follow, affecting everything from supply chains to global economic trends — all of which ultimately influence the markets we trade.

At ORION Wealth Academy, I’ve learned that trading success isn’t just about making the right moves — it’s about seeing the bigger picture. And right now, the big picture is clear: AI is no longer just a tool — it’s the market itself.

The question is, are we prepared to trade the future? 🚀

#forexprofit#forexstrategy#forexsignals#forex online trading#forexmentor#forexmarket#forexbroker#forextrading#forex

0 notes