#forex signals review

Explore tagged Tumblr posts

Text

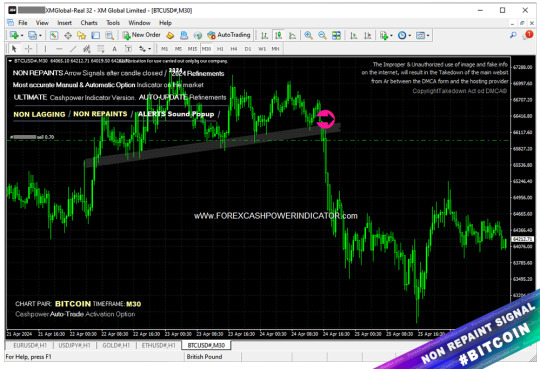

⭐ Metatrader4 chart SELL entry Bitcoin (BTCUSD) m30 non repaint signal. ( More info inside Official Website: wWw.ForexCashpowerIndicator.com ). . ⭐ Cashpower Indicator *Lifetime License with right to Future updates versions FREE. No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees; Lifetime License ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification ✅ Powerful AUTO-Trade Option Subscription . ✅ *Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.* . PS:( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our Genuine old Indicator . Beware, this FAKE FILE reproduction can break and Blown your Mt4 account and also currupt your computer. . Recommended FX Brokerage to run Cashpower-XM Broker: https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

#best-forex-indicator-non-repaint-buy-and-sell-signal-download#forexsignals#forexindicators#cashpowerindicator#forexindicator#forextradesystem#forexchartindicators#forexprofits#indicatorforex#forex factory#forex forum#cashpower indicator review#cashpower indicator download#forex cashpower indicator settings

4 notes

·

View notes

Text

eToro est un logiciel innovant qui a pris le monde complexe du trading forex et l’a rendu convivial. Choisir le bon courtier augmentera également vos chances et vous aidera dans vos activités de trading quotidiennes.

#etoro forex review#etoro forex signals#etoro forex spread#etoro forex trader#etoro forexagone#Etoro investir Forex#Etoro investir trading#Etoro investir trading Forex investisseur débutant#etoro youtube#Faire de l'argent grâce au Forex

0 notes

Text

HeroFX Review: A Comprehensive Look at the Alleged Forex Scam

In the vast and often volatile world of forex trading, the presence of unscrupulous brokers is a constant threat to both novice and seasoned traders. HeroFX, a broker that has recently come under scrutiny, is the subject of many discussions and concerns. This review delves into the various aspects of HeroFX to determine whether it is a legitimate broker or a potential scam.

Background and Overview

HeroFX claims to offer a comprehensive trading platform with a wide range of assets, including forex, commodities, indices, and cryptocurrencies. Promising competitive spreads, high leverage, and a user-friendly interface, HeroFX aims to attract traders looking for a reliable trading experience.

Regulation and Licensing

One of the primary red flags for any forex broker is the lack of proper regulation and licensing. HeroFX is reportedly not registered with any reputable financial regulatory authority. This absence of regulation means that traders are not protected by any governing body, increasing the risk of fraudulent activities and loss of funds.

Trading Platform and Tools

HeroFX offers its own proprietary trading platform, which is marketed as intuitive and feature-rich. While the platform appears to be functional, there have been numerous complaints about its reliability and execution speed. Some users have reported significant delays in order execution, leading to potential losses.

The broker also provides various tools and resources for traders, such as educational materials, market analysis, and trading signals. However, the quality and accuracy of these resources are questionable, with many users alleging that the information provided is often outdated or misleading.

Customer Support

Effective customer support is crucial for any forex broker, especially when dealing with complex financial transactions. HeroFX has received mixed reviews in this area. While some traders have reported satisfactory interactions with the support team, many others have experienced long wait times, unhelpful responses, and unresolved issues. This inconsistency in customer service further undermines the broker's credibility.

Withdrawal and Deposit Issues

One of the most significant concerns surrounding HeroFX is the difficulty many traders face when trying to withdraw their funds. Numerous complaints highlight delayed withdrawals, with some users claiming they never received their money. This pattern of behavior is often indicative of a scam broker, as legitimate brokers prioritize transparent and efficient fund transfers.

Additionally, the deposit process has also raised suspicions. HeroFX allegedly encourages large initial deposits and offers enticing bonuses that come with restrictive terms and conditions, making it challenging for traders to access their funds.

User Reviews and Complaints

A cursory glance at various online forums and review sites reveals a plethora of negative feedback from traders who have used HeroFX. Common grievances include:

Unresponsive or hostile customer service.

Manipulated trading conditions leading to unexpected losses.

Inability to withdraw funds.

Suspiciously positive reviews that appear fabricated.

These recurring themes paint a concerning picture of HeroFX and suggest a pattern of unethical practices.

Conclusion

In conclusion, while HeroFX presents itself as a reputable forex broker with attractive features, the overwhelming evidence points to the contrary. The lack of regulation, persistent withdrawal issues, and numerous negative user reviews all indicate that HeroFX may not be a trustworthy broker. Traders are advised to exercise extreme caution and conduct thorough research before engaging with this broker. In the unpredictable world of forex trading, it is always better to err on the side of caution and choose a broker with a proven track record of reliability and transparency.

For more check out this article: Herofx-review

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

61 notes

·

View notes

Text

Why It’s Important to Learn from Top Forex Brokers Review for Choosing the Right Broker

In the vast world of Forex trading, selecting the right broker is a critical step that can significantly influence your trading success. With numerous brokers available, each with its own unique features, spreads, and platforms, making an informed decision can be daunting. This is where understanding top Forex brokers review becomes essential. In this article, we will explore why these reviews are crucial for your trading journey and how they can help you choose the right broker tailored to your needs.

Understanding the Role of Forex Brokers

Forex brokers serve as intermediaries between traders and the foreign exchange market. They facilitate currency trades, provide access to trading platforms, offer market insights, and assist with account management. A reputable broker ensures the safety of your funds, compliance with regulatory standards, and access to high-quality trading tools.

The Importance of Learning from Top Forex Brokers Reviews

1. Evaluating Credibility and Trustworthiness

When choosing a Forex broker, trust is paramount. Top Forex brokers review can help you assess a broker’s credibility through:

Regulatory Status: A regulated broker is overseen by financial authorities, ensuring adherence to strict guidelines. Reviews typically highlight whether brokers are regulated by entities such as the FCA (UK), ASIC (Australia), or NFA (U.S.). This oversight provides a level of safety for your funds.

User Feedback: Authentic experiences from other traders offer insights into a broker’s reliability. Positive reviews affirm a broker’s trustworthiness, while negative feedback can serve as a warning signal.

2. Understanding Trading Conditions

Different brokers offer varying trading conditions, which can greatly impact your profitability. By consulting top Forex brokers review, you can gather critical information about:

Spreads and Commissions: The costs associated with trading can vary widely. Reviews often provide comparisons of spreads and commissions, allowing you to identify brokers with competitive pricing.

Leverage Options: While leverage can amplify your trading potential, it also increases risk. Reviews clarify the leverage ratios different brokers offer, enabling you to choose one that aligns with your risk tolerance.

3. Assessing Customer Support

Having access to responsive customer support is vital in Forex trading. Issues can arise unexpectedly, and prompt assistance can make a difference. Reviews often cover:

Availability: Knowing whether a broker offers 24/5 or 24/7 customer support can help you select one that fits your trading schedule.

Quality of Service: Insights from user experiences can shed light on how quickly and effectively a broker resolves issues. Look for brokers with positive reviews regarding their customer service.

4. Examining Trading Platforms and Tools

The trading platform is your primary interface for executing trades and analyzing markets. A user-friendly platform can enhance your overall experience. Top Forex brokers review provide insights into:

Platform Usability: Reviews often discuss how intuitive and easy it is to navigate a broker’s platform. A smooth user experience can save you time and frustration.

Tools and Features: Different brokers offer various tools for technical analysis, charting, and automated trading. Understanding what features are available can help you choose a broker that meets your specific needs.

5. Identifying Educational Resources

For beginner traders, education is crucial. Many brokers provide educational resources to help traders develop their skills. Reviews typically highlight:

Quality of Educational Content: Look for brokers that offer comprehensive learning materials, including tutorials, webinars, and market analysis. Reviews can help you identify brokers that excel in educational support.

Access to Market Insights: Some brokers provide regular market updates and insights, which can be beneficial for traders at all levels. Reviews often highlight brokers that offer excellent analytical resources.

6. Understanding User Experience

User experience encompasses all aspects of dealing with a broker, from account setup to withdrawal processes. Reviews can reveal:

Ease of Account Setup: Many reviews detail how straightforward or complicated the account opening process is. A hassle-free setup can enhance your initial experience with a broker.

Withdrawal Processes: Timely and transparent withdrawals are critical. Reviews often highlight the experiences of other users regarding withdrawal times and any associated fees.

7. Avoiding Common Pitfalls

Not all brokers are transparent, and some may have hidden fees or unfavorable terms. Learning from top Forex brokers reviews allows you to:

Spot Red Flags: Frequent complaints about withdrawal issues, hidden charges, or poor customer service can signal potential problems with a broker.

Gain Insights from Others: Understanding the experiences of other traders can help you avoid common pitfalls and make more informed decisions.

How to Find Reliable Forex Broker Reviews

To maximize the benefits of top Forex brokers reviews, it’s essential to find trustworthy sources. Here are some tips:

Seek Established Review Platforms: Reputable financial websites often employ analysts who rigorously evaluate brokers, offering unbiased reviews.

Cross-Reference Information: Don’t rely solely on one review. Compare multiple sources to get a well-rounded view of a broker’s strengths and weaknesses.

Focus on Recent Reviews: The Forex landscape can change rapidly, so look for the most current reviews that reflect recent trading conditions.

The Top 10 Forex Brokers You Should Consider

Selecting the right Forex broker is a pivotal decision for anyone venturing into currency trading. With hundreds of brokers vying for your attention, each offering unique features, fees, and services, making an informed choice can be overwhelming. This comprehensive top Forex brokers review aims to simplify that process by presenting the top 10 Forex brokers, highlighting their strengths, trading conditions, and key features.

Why Choosing the Right Forex Broker Matters

1. Safety of Funds

A reliable broker ensures the safety of your capital. Brokers regulated by reputable authorities provide assurance that they adhere to stringent financial standards, protecting your investments.

2. Cost of Trading

Different brokers have varying spreads and commissions, which can significantly affect your overall profitability. Understanding these costs is vital for effective trading.

3. Access to Tools and Resources

The right broker provides tools, educational resources, and analytical data that can enhance your trading strategy and improve your skills.

4. Quality of Customer Support

When issues arise, having access to responsive customer support can make a significant difference in your trading experience.

Key Criteria for Evaluating Forex Brokers

To ensure a comprehensive review, we considered several important factors:

Regulation: Is the broker regulated by a reputable authority?

Trading Costs: What are the spreads, commissions, and other fees?

Trading Platforms: How user-friendly and feature-rich are the platforms offered?

Customer Support: What kind of support is available, and how responsive is it?

Educational Resources: Are there resources available to help traders improve their skills?

The Top 10 Forex Brokers

1. IG Group

Overview: IG Group is one of the oldest and most respected Forex brokers in the world, known for its robust trading platform and extensive market offerings.

Regulation: Regulated by FCA (UK) and ASIC (Australia).

Trading Costs: Spreads from 0.6 pips on major pairs.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 support via phone, email, and live chat.

Educational Resources: Offers webinars, trading guides, and market analysis.

2. Forex.com

Overview: Forex.com, a subsidiary of GAIN Capital, is well-known for its user-friendly platform and comprehensive trading services.

Regulation: Regulated by NFA and CFTC (U.S.).

Trading Costs: Spreads start from 0.2 pips.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 support through multiple channels.

Educational Resources: Extensive educational content, including videos and articles.

3. OANDA

Overview: OANDA is recognized for its transparent pricing and high-quality trading data, appealing to both beginners and experienced traders.

Regulation: Regulated by CFTC (U.S.) and FCA (UK).

Trading Costs: Spreads start at 1 pip, with no commission on standard accounts.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 customer support via phone and email.

Educational Resources: Offers a variety of educational materials and market insights.

4. eToro

Overview: eToro is a pioneer in social trading, allowing users to copy the trades of successful traders and engage with a vibrant community.

Regulation: Regulated by FCA (UK) and CySEC (Cyprus).

Trading Costs: Spread-based fees with no commissions on stock trading.

Platform: Unique social trading platform and mobile app.

Customer Support: 24/5 customer support.

Educational Resources: Provides trading guides, webinars, and community features.

5. XM Group

Overview: XM is known for its flexible trading conditions and a variety of account types tailored to different trading strategies.

Regulation: Regulated by ASIC (Australia) and CySEC (Cyprus).

Trading Costs: Spreads from 0.0 pips on certain accounts.

Platform: Supports MetaTrader 4 and 5.

Customer Support: Available 24/5 in multiple languages.

Educational Resources: Offers webinars, trading articles, and various tools for traders.

6. Pepperstone

Overview: Pepperstone is favored for its low-cost trading environment and exceptional customer service.

Regulation: Regulated by ASIC (Australia) and FCA (UK).

Trading Costs: Spreads as low as 0.0 pips on Razor accounts.

Platform: MetaTrader 4, MetaTrader 5, and cTrader.

Customer Support: 24/5 support via live chat, phone, and email.

Educational Resources: Extensive educational materials including articles and tutorials.

7. Saxo Bank

Overview: Saxo Bank caters to professional traders with its premium trading tools and a wide range of assets.

Regulation: Regulated by FCA (UK) and FSA (Denmark).

Trading Costs: Competitive pricing with low spreads for premium accounts.

Platform: SaxoTraderGO and SaxoTraderPRO.

Customer Support: 24/5 customer support via multiple channels.

Educational Resources: Provides in-depth market analysis and educational content.

8. FXTM (ForexTime)

Overview: FXTM is known for its flexible trading options and extensive educational resources for traders.

Regulation: Regulated by FCA (UK) and CySEC (Cyprus).

Trading Costs: Spreads from 0.1 pips on ECN accounts.

Platform: Supports MetaTrader 4 and 5.

Customer Support: Available 24/5 via phone and email.

Educational Resources: Offers webinars, seminars, and market analysis.

9. IC Markets

Overview: IC Markets is preferred by high-frequency traders for its low-cost trading environment and excellent liquidity.

Regulation: Regulated by ASIC (Australia).

Trading Costs: Spreads as low as 0.0 pips.

Platform: MetaTrader 4, MetaTrader 5, and cTrader.

Customer Support: 24/7 customer support available.

Educational Resources: A range of tutorials and market insights are provided.

10. Admiral Markets

Overview: Admiral Markets offers diverse account types and a wide range of trading instruments, catering to both beginners and experienced traders.

Regulation: Regulated by FCA (UK) and ASIC (Australia).

Trading Costs: Competitive spreads starting from 0.0 pips.

Platform: MetaTrader 4 and 5.

Customer Support: 24/5 support via live chat, phone, and email.

Educational Resources: Extensive educational materials and market analysis available.

In the competitive landscape of Forex trading, choosing the right broker is essential for your trading success. This top Forex brokers review highlights some of the best options available, each with unique features that cater to different trading styles and needs.

When making your choice, consider your trading goals, risk tolerance, and the specific features that are most important to you. Whether you prioritize low trading costs, advanced platforms, or robust educational resources, the brokers listed above provide excellent starting points for your trading journey.

Conclusion

In the fast-paced world of Forex trading, selecting the right broker is vital for your success. By utilizing top Forex brokers review, you can gain valuable insights into broker credibility, trading conditions, customer support, and overall user experience. This informed approach not only increases your chances of finding a suitable broker but also enhances your overall trading experience.

Investing time in researching and comparing brokers through reviews is a wise step that can lead to better trading outcomes and greater confidence in your trading decisions. By being well-informed, you can navigate the Forex market more effectively and work towards achieving your trading goals. Happy trading!

2 notes

·

View notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

Is forex broker Clark Financial Advisory reliable?

This article contains the following information:

The most important information about Clark Financial Advisory;

Is Clark Financial Advisory a scam?

How do I get started with Clark Financial Advisory?

More detailed information about the brokerage organisation;

All modern brokerage terminals by and large have the necessary set of options, if we are not talking about all sorts of sophisticated options for technical analysis, used by scalpers and other categories of traders. It's not about the economic news and so on. Today, the main criterion for evaluating the excellence of a trading platform for newbies is its usability and intuitiveness. All the major functions such as getting price information, tools for market analysis, deal management, account management, instrument testing and tactics analytics are applied without any glitches. By the way, this can be said not only about the basic version of the platform, but also about the version for mobile phones and tablets. The website is also quite handy and has all the important information on it. We have not noticed any weaknesses. The same evaluation criteria apply to brokerage firm websites as to brokerage terminals and Clark Financial Advisory's website meets them, it is simple and intuitive.

Withdrawals

Judging by the reviews on Clark Financial Advisory, withdrawals are done without any difficulty. At least we didn't find that on any of the sites we looked at reviews on. After speculating on forex with Clark Financial Advisory we sent a withdrawal request and the money was transferred in about twenty-four hours. A repeat withdrawal yielded similar results. This is very very cool when you consider that the average withdrawal time from a brokerage company is a couple of times longer.

Overall, the process of registering and starting to trade is not very different from other companies. One needs to go through the identity verification procedure by uploading the usual package of documents. The minimum amount to start trading is also standard - $250. At the time of writing, broker Clark Financial Advisory provides four insured trades and access to a standard range of instruments in a beginner's package with a minimum deposit.

Trading experience with forex broker Clark Financial Advisory

We have been trading through Clark Financial Advisory for three weeks. For the most part it was trading in the foreign exchange market. We tested the signals that Clark Financial Advisory gives on forex. We did not collect statistics, but in general the ratio of profitable to loss-making trades was in favor of profitable ones. In addition, we watched how Clark Financial Advisory managers talk to us. We monitored whether they would use unfair practices, for example when offering investment solutions scammers often use the technique of creating urgency, i.e. the scammer claims that the option will be available for a couple of minutes and then will be irrelevant for some reason. In the end we did not see such things. Often even white brokers do not give any important information about their investment solutions, they do not tell us about additional commissions, dangers, their strategy and so on. Fortunately we have not noticed any of the above. For this reason, in this review of Clark Financial Advisory we claim that it is without a doubt a white company.

Features of Clark Financial Advisory broker

Apparently Clark Financial Advisory is client-oriented and therefore in its approach to investor communication, the broker aims to ensure that it allows clients the opportunity to earn and makes the trading process as easy as possible. Here are the advantages and disadvantages of forex broker Clark Financial Advisory:

Key information.

Clark Financial Advisory has been operating since 2013. Legal incorporation in the UK. Has a standard package of documents. In the stock market, commodities and foreign exchange markets, the broker offers work with the usual range of instruments. The number of cryptocurrencies available to trade through Clark Financial Advisory is larger than the average spectrum. Clark Financial Advisory updates its platform on a regular basis.

Clark Financial Advisory platform overview

In this part of the article information about:

What's good about the Clark Financial Advisory platform

The main requirement for brokerage platforms

Reviews on Clark Financial Advisory

We said above that the reviews on the broker are mostly positive, so here's just a mention of what the reviews most often discuss and about the ratio of favorable to critical reviews. The ratio of good to bad reviews at Clark Financial Advisory is somewhere around 5 to 1 in favor of the good. This ratio holds true on all review sites, including well-known ones like Trustpilot and Sitejabber. The point of the praise reviews can be boiled down to these things:

Good service and analytics;

The brokerage company sends effective signals;

No serious problems from interacting with the broker for a long time.

What does it take to work with forex broker Clark Financial Advisory?

Benefits of Clark Financial Advisory

customer focus;

Regular updates of our trading platform; Large selection of trading instruments;

Fast execution of orders;

Competent support service;

No hidden fees;

Is Clark Financial Advisory a scam? Without a doubt not. To start with, as it was written above, Clark Financial Advisory has all the required licenses in place. That's more important than anything else. It is also important, that we ourselves have checked Clark Financial Advisory and realized, that it is an honest company, which fulfills its obligations, providing a quality service and Clark Financial Advisory professionals are not trying to deceive traders and take their deposits one way or another. Generally, we all understand how many different kinds of scams there are at the moment, and how to recognize them. In recent years, many criminals charge huge hidden fees and rig slippages. Trading forex with Clark Financial Advisory we have not observed any of this. Opinions are also a very important parameter. Reading the reviews on Clark Financial Advisory we found the standard reviews on a white brokerage firm. People talk about their experience of trading signals etc.

A more detailed review of Clark Financial Advisory

In the next part of the material there is information about:

The forex experience with Clark Financial Advisory;

Comparison of how the managers of Clark Financial Advisory are contacted versus how the scammers do it;

Overview of Clark Financial Advisory's platform

Weaknesses of Clark Financial Advisory

No zero commissions Typical minimum deposit Limited number of instruments available for clients with minimum deposits.

2 notes

·

View notes

Text

Diamond Bottom & Black Box Systems: The Underground Strategies That Could Change Your Trading Forever The Hidden Gem: Why the Diamond Bottom Pattern Matters Imagine finding an exquisite diamond in a pile of rocks. That’s exactly what the Diamond Bottom pattern is in Forex—a rare formation that signals a major trend reversal. It’s like catching a falling knife, but with gloves made of insider knowledge. Most traders gloss over this setup because they’re too focused on the usual suspects—head and shoulders, double tops, and other mainstream chart patterns. But the Diamond Bottom? That’s the VIP lounge of technical analysis. How to Spot the Diamond Bottom Pattern A Diamond Bottom is characterized by a broadening formation, followed by a tightening price action, resembling—well—a diamond. It’s like the market’s way of stretching before sprinting in the opposite direction. Key Features: - It usually forms after a steep downtrend. - The price action gets volatile, creating higher highs and lower lows. - The structure narrows, signaling reduced volatility. - A breakout confirms the reversal. Traders who recognize this pattern early can catch major reversals before the rest of the market catches on. Think of it like getting into a blockbuster stock before it IPOs—only better. Black Box Systems: The Ultimate Forex Cheat Code? If you’ve ever wished for an AI-powered assistant that predicts market moves with unsettling accuracy, black box systems might sound like your dream come true. These are algorithmic trading models designed to generate high-probability signals based on advanced calculations, AI, and machine learning. The catch? The logic behind them is often undisclosed, hence the term black box. Why Black Box Systems Are a Double-Edged Sword While they offer automation and precision, black box systems come with a serious drawback: opacity. You don’t always know how they make decisions, which can be unsettling if you're a control freak about your trades. Pros: - Remove emotional bias from trading. - Process massive amounts of data in seconds. - Identify market inefficiencies that human traders miss. Cons: - Lack of transparency—you don’t always know why a trade is executed. - Over-reliance can lead to catastrophic losses if the system malfunctions. - Market conditions change, and rigid systems can fail spectacularly. How to Use Black Box Systems to Your Advantage To avoid getting wrecked by an unpredictable algorithm, consider these pro ninja tactics: - Test before trusting – Run the system in a demo account before going live. - Layer risk management – Even if the system has a 90% win rate, assume it will fail at some point. - Blend AI with human intuition – Don’t let the bot drive without a seatbelt. Always monitor. The Perfect Storm: Combining Diamond Bottoms with Black Box Systems Here’s where things get really interesting. Imagine programming an AI-powered system to identify Diamond Bottom patterns and execute trades only when market conditions align. You’re essentially taking the best of both worlds—insider technical knowledge and algorithmic efficiency. How to Build This Hybrid Approach - Train the black box system to detect widening and narrowing price action in real-time. - Incorporate confirmation indicators like RSI divergence or volume analysis. - Set adaptive risk parameters to avoid excessive drawdowns. - Manually review potential trades before allowing execution. Why Most Traders Miss This Goldmine (And How You Won’t) Most traders avoid diamond bottoms because they’re rare and require patience. Black box systems, on the other hand, are often dismissed because they feel like a "black magic" scam. The secret? Using both together. Think of it like cooking—if the diamond bottom is the secret recipe, the black box is your AI-powered sous-chef. Alone, they’re great, but together, they create a masterpiece. Final Takeaway: Your Next Steps - Start recognizing Diamond Bottoms by reviewing historical charts. - Demo a black box system before committing real capital. - Combine both for an optimized strategy that blends pattern recognition with algorithmic efficiency. Want to stay ahead of the game? Get exclusive insights and trading tools at StarseedFX. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

How Technology is Revolutionizing Industries and Everyday Life

In today’s fast-paced world, technology is at the forefront of innovation, transforming industries and reshaping the way we live, work, and interact. From artificial intelligence to blockchain, the advancements in tech are not just futuristic concepts but tangible realities driving change across the globe. At TechTrendzUS, we explore the latest trends and innovations that are shaping the future.

The Power of Artificial Intelligence

Artificial Intelligence (AI) is revolutionizing industries like healthtech, finance, and education. AI-powered tools are enhancing customer retention strategies, streamlining operations in fintech startups, and even aiding in personal injury law cases. Platforms like DeepSeek are leveraging AI to revolutionize data discovery and search capabilities.

More: DeepSeek: Revolutionizing the Future of AI-Powered Search and Data Discovery, Elevating Case Outcomes: AI for Complex Personal Injury Scenarios, Microsoft Integrates Non-OpenAI Models into 365 Copilot Suite, The Role of Threat Intelligence Platforms in Enterprise Data Security, CRM Implementation Challenges & Strategies to Overcome Them, Thermoforming: Materials, Design, and Industry Innovations, Customizing Your Golf Cart: How Features Enhance Your Ride, The Ultimate Guide to Starting a Successful Cryotherapy Business, How to Choose the Best IPTV Subscription for Your Home, Troubleshooting Common Issues with AllDebrid and FlixVision, Solutions to issues about using Multimeter, The Ultimate Guide to the Smith Machine

Blockchain: Transforming Finance and Beyond

The rise of blockchain technology has brought unprecedented transparency and security to sectors like cryptocurrency and finance. With the growing popularity of Bitcoin and other digital currencies, blockchain is proving to be a game-changer in the global economy. Whether you’re exploring fintech careers or looking to invest in fintech startups, understanding blockchain is essential.

Fintech: The Future of Financial Services

The fintech industry is booming, offering innovative solutions for payroll and HR management, investment strategies, and more. Companies like Paycor are leading the charge by providing efficient tools for businesses to manage their finances seamlessly. Additionally, the rise of mobile trading apps in India is transforming the investment landscape, making it easier for individuals to trade and invest.

Sustainability and Green Technology

As the world faces environmental challenges, green technology is emerging as a critical solution. Innovations in energy, transportation, and property technology are paving the way for a sustainable future. For example, thermoforming techniques are being used to create eco-friendly packaging, while advancements in automotive technology are driving the adoption of electric vehicles.

More: Can a Jeep Wrangler Tow a Boat? Towing Capacity of a Jeep Wrangler By Its Engine, The rise of mobile trading apps in India and their impact on the investment landscape, Why Purchasing a New Car Can Be a Wise Long-Term Investment, Unlock Your Trading Potential with Forex Profitable Signals, Vegan Cheese Market to Reach US$3.4 Billion by 2030, No Win No Fee Compensation Claims, Claim & Compensation Services in the UK, Workplace Realities: Managing Menstruation Like a Pro While on the Job, Top 5 Physical Therapy Schools In Chicago In 2024, SeroLean Reviews 2024: AComprehensive Look at the Supplement and Potential Side Effects, Discover the Secret to Long-lasting Leather: Best Conditioners Reviewed

Cybersecurity: Safeguarding the Digital World

With the increasing reliance on digital systems, cybersecurity has become more important than ever. Threat intelligence platforms are playing a vital role in safeguarding enterprise data, ensuring that businesses can operate securely in an interconnected world.

Lifestyle and Fashion Trends

Technology isn’t just transforming industries; it’s also influencing lifestyle and fashion. From Trapstar Clothing to Balenciaga Coats, the fusion of technology and fashion is creating new trends and opportunities. Even Nirvana Shirts have made a comeback, blending nostalgia with modern style.

More: OFF WHITE SHIRT, A Must-Have Wardrobe Essential, Trapstar Clothing, A Comprehensive Guide to the Streetwear Phenomenon, Eric Emanuel, The Rise of a Streetwear Sensation, The Timeless Appeal of Nirvana Shirts, A Must-Have for Every Fan, Balenciaga Coats: The Pinnacle of Luxury Outerwear, The Rise, Fall, and Rebirth of an Iconic Brand, Trapstar Tracksuits: Urban Fashion and Comfort, The Black Bape Hoodie, A Symphony of Urban Elegance, Rhude Hoodie, The Soul of Streetwear, The Drake Graphic Tee, A Canvas of Melodic Expression, Spider Clothing Brand, The Web of Culture and Style

Education and Career Opportunities

The intersection of technology and education is opening up new career opportunities. Whether you’re exploring study in USA consultants or mastering essay writing strategies, technology is making education more accessible and effective.

More: Unlocking Academic Success: Benefits of Study in USA Consultant, Mastering Essay Writing: Strategies for Success, Unlock Your Research Potential with The Journal of Green Knowledge and Sustainable Development (JGKSD), Hiring a Car in Pakistan in Cheap Price, Stress-Free Family Vacation Planning with BookingTwo.Com, Hajj 2025: Experience the Pilgrimage with Khair, Travel Tweaks Offers: How Small Changes Lead to Big Adventures

Guest Posting Opportunity at TechTrendzUS

At TechTrendzUS, we believe in the power of knowledge sharing. That’s why we’re excited to offer a 🌟 Free Guest Post Opportunity! 🌟 Whether you’re an expert in business management, technology innovations, or lifestyle trends, we invite you to share your insights with our global audience.

📢 Have your content featured on TechTrendzUS!💻 Website: TechTrendzUS 📩 Submit your content today at: [email protected]

Don’t miss this chance to showcase your writing to a wider audience. Submit now and get published!

Explore More on TechTrendzUS

The Growing Demand for Luxury Apartments in Manchester

5 Proven Ways Mobility Infotech Boosts Customer Retention for Taxi Businesses

Free Web Hosting in Nepal: Exploring Options and Considerations

Comprehensive 360-Degree Digital Marketing, Media, and Software Development Services

Exploring Veuve Clicquot Champagne: Pricing, Value, and What to Know

Selling Custom Butcher Paper To Meat Sellers

Why People Should Use Custom Parchment Paper

Sharing Facebook Success Stories, How To Run FB Successfully

Hosting Price in Nepal 2024: Navigating the Best Web Hosting Deals

The Best Tips for Marketing in a Growing City Like Huntsville

Welcome to Paycor! Your Ultimate Solution for Efficient Payroll and HR Management

Finding Jobs Near Me: Your Comprehensive Guide to Local Job Search Success

6 Top Reasons To Invest in Custom ERP Development Services

Crowdfunding: A Catalyst for Startup Success

0 notes

Text

How do I choose a copy trading platform in the USA?

Choosing a copy trading platform in the USA requires careful consideration of several key factors to ensure that you select one that aligns with your trading goals, risk tolerance, and regulatory needs. Here are some steps to guide your decision:

1. Regulatory Compliance

Ensure the platform is registered with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA). These regulatory bodies enforce strict rules to protect traders in the U.S., and choosing a platform that complies ensures a safer and more transparent experience.

2. Reputation and Reviews

Check the reputation of the platform by reading reviews and testimonials from other traders. Look for platforms with a proven track record and positive feedback from users.

3. Ease of Use

A user-friendly interface is crucial, especially if you're new to copy trading. Platforms should offer easy navigation and clear instructions for setting up your account, copying trades, and monitoring performance.

4. Asset Variety

Look for platforms that offer a range of asset classes to copy trade, such as Forex, stocks, commodities, and indices. If you’re focusing on a specific market like Forex, make sure the platform supports that.

5. Risk Management Tools

A good copy trading platform should offer built-in risk management tools, such as stop-loss orders, to help you manage your trades and minimize losses.

6. Fees and Commission Structure

Understand the fee structure. Some platforms charge a commission on profits, while others may have a flat fee or spreads. Ensure that the fee structure aligns with your trading style and budget.

7. Copy Trading Features

Check the features offered for copying trades, such as:

Copy trading strategies: Can you choose which traders or strategies to copy?

Customization: Can you adjust the copy trading settings, such as the trade size or risk level?

Social features: Some platforms allow interaction with other traders, which can enhance the overall experience.

8. Customer Support

Reliable customer support is important if you encounter any issues with the platform. Check if the platform offers live chat, email, or phone support.

9. Performance Tracking

The platform should provide detailed performance reports, allowing you to track the success of your copied trades and adjust your strategy accordingly.

10. Security

Look for platforms with strong encryption and security protocols to protect your personal and financial data.

Considering these factors will help you choose a reliable and efficient copy trading platform in the USA. If you're particularly interested in Forex, focusing on platforms that specialize in Forex signals or trading can also be an advantage.

#Copy trading#copy trading platform#trading platform#forex education#forextrading#currency markets#sureshotfx

0 notes

Text

Valitrax.com Review: Elevate Your Investment Strategy with Streamlined Trading

Introduction

Valitrax.com is a modern trading platform designed by a team of experts with the goal of offering traders a unique and seamless experience. Whether you’re a seasoned trader or a newcomer, Valitrax.com provides a powerful toolkit to enhance your trading strategy. The platform's intuitive design and sophisticated tools offer a comprehensive solution for users across various asset classes, including stocks, cryptocurrencies, forex, and commodities.

In this in-depth Valitrax.com review, we will explore the platform’s key features, including its advanced security, educational resources, tight spreads, and powerful trading instruments. We will also look into how Valitrax.com supports traders at all skill levels, making it an attractive option for both beginners and professionals.

Interactive Platform for Traders

One of the standout features of Valitrax.com is its interactive platform, which is designed with the user experience in mind. Navigating the complex financial markets can be overwhelming, but Valitrax.com ensures that you don’t have to do it alone. The platform offers live market updates, cutting-edge trading tools, and real-time performance metrics, all of which are essential for successful trading.

Valitrax.com’s live market updates provide you with the most current market data, allowing you to make informed decisions. The platform also features various tools, such as calculators to estimate potential profits and indicators that help you gauge market trends. Whether you’re analyzing a basic pricing chart or seeking more complex market signals, Valitrax.com ensures that every feature is designed to maximize your success as a trader.

The platform’s ease of use is one of its most appreciated qualities. Even beginners can quickly familiarize themselves with its interface, making it an excellent choice for traders who want to dive into online trading without a steep learning curve.

Industry-Standard Security

In today’s digital age, security is a top concern for any online user, especially traders. Valitrax.com prioritizes the safety of its client's data and funds. The platform employs state-of-the-art encryption protocols to protect personal and financial data, ensuring that sensitive information remains secure at all times.

Valitrax.com also offers segregated accounts for its clients. This means that your funds are kept separate from the company’s operating accounts, ensuring that your money is protected even in the event of a financial mishap. In addition, Valitrax.com uses two-factor authentication (2FA) to ensure that only authorized users can access their accounts. This extra layer of protection offers peace of mind to traders who are concerned about unauthorized access or hacking.

Overall, Valitrax.com’s industry-leading security features enable traders to focus on their trading strategies rather than worrying about potential cyber threats.

A Wealth of Trading Instruments

This Valitrax.com review points out that this brokerage believes that traders should have access to a broad range of instruments to diversify their portfolios and test new strategies. The platform offers hundreds of trading instruments from multiple asset classes, including stocks, forex, cryptocurrencies, commodities, and indices.

By providing such a vast array of assets, Valitrax.com allows traders to experiment with different markets, which can lead to more opportunities for profit. For instance, traders who are experienced in forex may choose to explore the dynamic world of cryptocurrencies, or commodity traders may opt to diversify into stock indices.

This diversity of options enables traders to tailor their strategies based on personal preferences and market conditions. The ability to trade a wide range of instruments also ensures that your portfolio remains diversified, minimizing risk and increasing the potential for consistent gains.

Multiple Account Types for Every Trader

One size does not fit all, and Valitrax.com understands that different traders have varying needs when it comes to trading accounts. That’s why the platform offers multiple account types, each with its features and perks designed to suit traders at different experience levels.

From beginners who need access to basic trading tools and resources, to advanced traders looking for high-leverage opportunities and advanced charting tools, Valitrax.com provides tailored accounts to meet those needs. You can choose an account that aligns with your trading goals, ensuring you only pay for the features you need.

Comprehensive Educational Resources

At Valitrax.com, the company believes that education is key to becoming a successful trader. That’s why the platform provides an extensive library of educational materials to help traders of all levels enhance their market knowledge.

The platform offers access to materials that cover everything from the basics of trading to more complex strategies. Additionally, Valitrax.com provides a demo mode, allowing you to practice your trading strategies in a risk-free environment before committing to real capital. This is especially beneficial for new traders who want to gain experience without risking their own money.

For those who are ready to take their trading to the next level, Valitrax.com also offers more advanced resources, such as market analysis tools and insights from industry experts. With these resources at your disposal, you can make well-informed trading decisions that align with your strategy.

The Valitrax.com Advantage: Tight Spreads and High Leverage

Valitrax.com provides traders with the best possible trading conditions to maximize profits. The platform boasts competitive spreads and high leverage, two factors that can significantly impact your trading success.

Competitive Spreads

Spreads refer to the difference between the buy and sell price of an asset. Valitrax.com offers some of the tightest spreads in the industry, starting as low as 0.1 pips. Tight spreads are essential because they allow you to maximize your profits on each trade. When spreads are large, your profit potential is reduced, so having access to tight spreads ensures that you get the best possible deals on each trade.

High Leverage

Leverage allows you to control larger positions in the market with a smaller amount of capital. Valitrax.com offers leverage as high as 1:200, meaning you can potentially make larger gains with smaller investments. Leverage can magnify your profits, but it’s important to use it cautiously, as it can also increase risk.

By offering high leverage, Valitrax.com provides traders with the opportunity to amplify their potential profits, particularly on more volatile assets like cryptocurrencies or forex pairs.

Mobile and Desktop Accessibility

Our Valitrax.com review points out that the platform is designed to be accessible from any device, whether you’re using a desktop computer, laptop, tablet, or mobile device. The platform is optimized for both Android and iOS devices, so you can trade on the go without sacrificing functionality.

Having access to your trading account 24/7 means that you can seize opportunities in the market whenever they arise. Whether you’re in the office or on the move, Valitrax.com ensures that you can manage your trades efficiently from any location.

Tech-Powered Features for Efficient Trading

Valitrax.com uses advanced technology to provide traders with a smooth and efficient trading experience. The platform offers features like stop-loss orders, which allow you to automatically close a position if the market moves against you. This reduces risk and ensures that you don’t have to constantly monitor your trades.

Other features include real-time price alerts, automated trading options, and advanced charting tools that help you identify trends and market movements. With these features, Valitrax.com helps traders make smarter, more informed decisions without having to dedicate all their time to monitoring the market.

Diversify and Trade Globally

Trading with Valitrax.com gives you the freedom to diversify your portfolio and access markets around the world. The platform supports trading across various asset classes, including forex, stocks, commodities, and cryptocurrencies, enabling you to diversify your investments and reduce overall risk.

Additionally, Valitrax.com’s global reach means you can trade in different markets regardless of your location. This allows you to take advantage of opportunities in various regions and time zones, ensuring that your trading activity isn’t limited by geographic constraints.

Accounts Valitrax.com offers a range of account tiers tailored to suit various trading preferences and skill levels. Each tier is equipped with distinct features and benefits to enhance your trading experience, ensuring that you find the perfect fit for your needs. The account tires are: Silver Account / Gold Account / Platinum Account / Diamond Account / Premium Account / VIP Account.

Conclusion: A Platform Built for Success

This Valitrax.com review describes an innovative trading platform that offers an impressive array of features, advanced security, and a user-friendly experience. Whether you’re just starting your trading journey or are an experienced professional, Valitrax.com provides the tools and resources needed to elevate your strategy.

With a focus on tight spreads, high leverage, and comprehensive educational resources, Valitrax.com is a platform that caters to traders of all levels. Its commitment to security and cutting-edge technology ensures that your trading experience is both safe and efficient. If you’re looking for a reliable and versatile trading platform, Valitrax.com is worth considering.

0 notes

Text

How EASY Bots Were Born 🚀 Despite challenges, we developed our own robots: EASY Bots. We integrated AI market analysis (EASY Quantum AI) to generate free trading signals, which we plugged into trading algorithms. This blend formed a “quant soup”, where EASY Trading AI identifies entry points. Our strategy tester analyzes configurations to optimize settings, creating an ecosystem where robots auto-update for max profitability. 🤖⚙️ The Year 2024 and the Push for Optimization 📈 In 2024, we optimized infrastructure and overcame challenges, improving service. Our bots now find parameters faster than ever. Dashboards were upgraded with a pending real-account monitoring module. Today’s Milestone ⭐ Entering 2025, we summary: • 8,000 bots analyzed • 2,000 instruments monitored • 5,000 reviews published • 10 proprietary bots created EASY Bots are fully operational, with AI delivering signals, setting new standards in algorithmic trading. 🎉💡 Our Next Steps ⚡ Our aim: Forex trading simplified. Easy bot installation, auto-updated settings—no need to pore over logs. 💼✨ A Big Thank You 🙌 These years were fueled by your feedback. Here’s to a future filled with innovation. 🌊🚀 Join us—2025 holds exciting surprises! Let’s roll! 💪🎊 — The ForexRobotEasy Team: we code, trade, and inspire! @forexroboteasybot

0 notes

Text

Is Forex a Scam? Or Does Forex Investing Lead to Scams?

Forex trading is one of the largest financial markets, attracting millions of traders worldwide. While it offers profit opportunities, many people wonder if forex is a scam or if investing in it leads to fraudulent schemes. The truth is that forex itself is a legitimate market, but it is often exploited by fraudulent brokers and misleading investment schemes.

Forex: A Legitimate Market with Risks

Forex trading operates similarly to other financial markets, involving the exchange of currency pairs. However, its decentralized nature makes it a prime target for scammers who manipulate trades, deceive investors, and vanish with funds. Understanding these risks is crucial for anyone considering forex trading.

Common Forex Scams

Unregulated Brokers – Many scam brokers operate without proper regulation, making it easy to manipulate trades and restrict withdrawals.

Fake Investment Schemes – Some platforms promise guaranteed profits but function as Ponzi schemes.

Manipulated Trading Platforms – Fraudulent brokers create fake trading software that shows false profits, preventing withdrawals.

Signal and Account Management Scams – Scammers claim to offer expert trading advice but end up stealing funds.

High Withdrawal Fees and Hidden Charges – Some brokers impose excessive fees, making it nearly impossible to withdraw profits.

List of Known Scam Brokers

To help traders avoid scams, here are some brokers with a history of unethical practices:

Sterwa Holdings Review

Manra Capital Review

Premium Funds Management Ltd Review

Success Trade Partners Review

Sinarjaya Investment Review

PSI-Markets Review

HTFX Review

Clickafino Review

IE RATES Review

Cyber Capital Review

Smart Edge Financial Review

SNB Capital Review

Seneca Corporate Review

Deus Technology Review

Stonewall Capital Review

WilsonPartner Review

B-arclays.com Review

Ande Finance Review

SAFE INVEST Review

For Life Pro Review

Stratos Invest Review

Bright Securities Review

Elites Funding Review

How to Avoid Forex Scams

Choose Regulated Brokers – Verify licenses with authorities like FCA, ASIC, and CFTC.

Check Reviews – Read broker reviews from different review platforms.

Beware of Unrealistic Promises – No investment is risk-free.

Test Withdrawals – Before depositing large sums, confirm the withdrawal process.

Conclusion

Forex trading is not a scam, but fraudulent brokers and schemes make it risky. By trading with reputable brokers and staying informed, investors can minimize their risks and avoid falling victim to scams.

0 notes

Text

best crypto brokers uae

Discover the crypto trading brokers online UAE with Choose a Broker.ae. Our platform provides unbiased reviews and detailed comparisons of top brokers specialising in forex, stocks, and cryptocurrencies. With thousands of data points analysed, we ensure your trading journey begins on the right foot. Whether you're practicing with demo accounts or making serious investments with real accounts, our guidance helps you make informed decisions. Start trading with confidence and clarity, knowing you've chosen a broker tailored to your needs. Visit Choose a Broker.ae today and take the first step toward achieving your financial goals in the UAE. With this, the team can better help our traders, guiding them on the right stock trading path for a hassle-free experience. Get trading signals and daily tips as you sign up with us.

0 notes

Text

FREE FOREX SIGNAL SERVICE

In the dynamic world of forex trading, the accuracy of signals can significantly influence a trader’s success. Forex signals are real-time alerts that indicate potential trading opportunities in the currency market, guiding traders on optimal entry and exit points. Given the plethora of signal providers available, identifying the most accurate one is crucial for maximizing profitability and minimizing risk.

Understanding Forex Signals

Forex signals are recommendations generated by experienced analysts or automated systems, suggesting specific trades based on market analysis. These signals typically include:

Currency Pair: The specific currencies involved in the trade.

Action: Whether to buy or sell.

Entry Point: The price level at which to enter the trade

Take Profit: The target price to close the trade for a profit.

Stop Loss: The price level to close the trade to prevent further losses.

Accurate forex signals are invaluable, especially for traders who may lack the time or expertise to analyze the market independently.

Criteria for Evaluating Forex Signal Providers

When assessing the accuracy of forex signal providers, consider the following factors:

Track Record: A verifiable history of successful and consistent signals.

Transparency: Clear communication regarding the strategies and analyses behind each signal.

User Reviews: Feedback from other traders about their experiences with the provider.

Real-Time Delivery: Prompt dissemination of signals to capitalize on market movements.

Support and Resources: Availability of educational materials and customer support to assist traders.

Top Forex Signal Providers

Based on the above criteria, here are some of the most accurate forex signal providers:

Trade with Pat (TWP)

Overview: TWP is renowned for its comprehensive forex and gold trading signals, along with educational resources.

Features: Offers real-time signals, expert advisor reviews, and a supportive trading community.

Reputation: Recognized for transparency and a strong track record in the trading community.

1000pip Builder

Overview: A leading forex signal provider with a focus on delivering high-quality signals.

Features: Provides signals verified by My FX Book, ensuring transparency and reliability.

Reputation: Known for consistent performance and positive user feedback.

FX Leaders

Overview: Offers free forex signals, market analysis, and trading strategies.

Features: Real-time alerts, comprehensive market news, and a user-friendly interface.

Reputation: Esteemed for accuracy and a wide range of trading tools.

Sure Shot FX

Overview: Provides cutting-edge tools, expert analysis, and real-time signals.

Features: Covers a wide range of currency pairs and commodities, offering comprehensive trading solutions.

Reputation: Featured in top news portals and known for high accuracy rates.

Cautionary Note

While exploring signal providers, it’s essential to exercise due diligence. For instance, some sources have raised concerns about the legitimacy of certain providers, such as forexbankliquidity.com, labeling them as potential scams. It’s crucial to verify the credibility of any provider before engaging with their services.

Conclusion

Selecting the most accurate forex signal provider is a pivotal decision that can enhance your trading success. By considering factors such as track record, transparency, user reviews, and support, traders can make informed choices. Always conduct thorough research and consider starting with a demo account to test the signals before committing real capital.

For more insights into forex signal providers, you might find the following video informative:

#digital marketing#bankliquidity#forexsignals#forex education#forex market#forex#forex robot#forextrading#forex expert advisor#forexbankliquidity

0 notes

Text

The Evolution of Technology and Its Impact on Modern Life

Technology has become the driving force behind global progress. From artificial intelligence to blockchain, innovations are reshaping industries, economies, and lifestyles. At TechTrendzUS, we delve into the latest trends and breakthroughs that are transforming the world as we know it.

More: DeepSeek: Revolutionizing the Future of AI-Powered Search and Data Discovery, Elevating Case Outcomes: AI for Complex Personal Injury Scenarios, Microsoft Integrates Non-OpenAI Models into 365 Copilot Suite, The Role of Threat Intelligence Platforms in Enterprise Data Security, CRM Implementation Challenges & Strategies to Overcome Them, Thermoforming: Materials, Design, and Industry Innovations, Customizing Your Golf Cart: How Features Enhance Your Ride, The Ultimate Guide to Starting a Successful Cryotherapy Business, How to Choose the Best IPTV Subscription for Your Home, Troubleshooting Common Issues with AllDebrid and FlixVision, Solutions to issues about using Multimeter, The Ultimate Guide to the Smith Machine

The Role of Artificial Intelligence in Shaping the Future

Artificial Intelligence (AI) is no longer a futuristic concept; it’s a reality that’s revolutionizing industries like healthtech, finance, and education. AI-powered tools are enhancing customer retention strategies, streamlining operations in fintech startups, and even aiding in personal injury law cases. For instance, platforms like DeepSeek are leveraging AI to revolutionize data discovery and search capabilities.

Blockchain: The Backbone of Modern Finance

The rise of blockchain technology has brought unprecedented transparency and security to sectors like cryptocurrency and finance. With the growing popularity of Bitcoin and other digital currencies, blockchain is proving to be a game-changer in the global economy. Whether you’re exploring fintech careers or looking to invest in fintech startups, understanding blockchain is essential.

More: OFF WHITE SHIRT, A Must-Have Wardrobe Essential, Trapstar Clothing, A Comprehensive Guide to the Streetwear Phenomenon, Eric Emanuel, The Rise of a Streetwear Sensation, The Timeless Appeal of Nirvana Shirts, A Must-Have for Every Fan, Balenciaga Coats: The Pinnacle of Luxury Outerwear, The Rise, Fall, and Rebirth of an Iconic Brand, Trapstar Tracksuits: Urban Fashion and Comfort, The Black Bape Hoodie, A Symphony of Urban Elegance, Rhude Hoodie, The Soul of Streetwear, The Drake Graphic Tee, A Canvas of Melodic Expression, Spider Clothing Brand, The Web of Culture and Style

Fintech: Disrupting Traditional Financial Systems

The fintech industry is booming, offering innovative solutions for payroll and HR management, investment strategies, and more. Companies like Paycor are leading the charge by providing efficient tools for businesses to manage their finances seamlessly. Additionally, the rise of mobile trading apps in India is transforming the investment landscape, making it easier for individuals to trade and invest.

More: Can a Jeep Wrangler Tow a Boat? Towing Capacity of a Jeep Wrangler By Its Engine, The rise of mobile trading apps in India and their impact on the investment landscape, Why Purchasing a New Car Can Be a Wise Long-Term Investment, Unlock Your Trading Potential with Forex Profitable Signals, Vegan Cheese Market to Reach US$3.4 Billion by 2030, No Win No Fee Compensation Claims, Claim & Compensation Services in the UK, Workplace Realities: Managing Menstruation Like a Pro While on the Job, Top 5 Physical Therapy Schools In Chicago In 2024, SeroLean Reviews 2024: AComprehensive Look at the Supplement and Potential Side Effects, Discover the Secret to Long-lasting Leather: Best Conditioners Reviewed

Sustainability and Green Innovations

As the world faces environmental challenges, green technology is emerging as a critical solution. Innovations in energy, transportation, and property technology are paving the way for a sustainable future. For example, thermoforming techniques are being used to create eco-friendly packaging, while advancements in automotive technology are driving the adoption of electric vehicles.

More: Unlocking Academic Success: Benefits of Study in USA Consultant, Mastering Essay Writing: Strategies for Success, Unlock Your Research Potential with The Journal of Green Knowledge and Sustainable Development (JGKSD), Hiring a Car in Pakistan in Cheap Price, Stress-Free Family Vacation Planning with BookingTwo.Com, Hajj 2025: Experience the Pilgrimage with Khair, Travel Tweaks Offers: How Small Changes Lead to Big Adventures

Cybersecurity: Protecting the Digital World

With the increasing reliance on digital systems, cybersecurity has become more important than ever. Threat intelligence platforms are playing a vital role in safeguarding enterprise data, ensuring that businesses can operate securely in an interconnected world.

Guest Posting Opportunity at TechTrendzUS

At TechTrendzUS, we believe in the power of knowledge sharing. That’s why we’re excited to offer a 🌟 Free Guest Post Opportunity! 🌟 Whether you’re an expert in business management, technology innovations, or lifestyle trends, we invite you to share your insights with our global audience.

📢 Have your content featured on TechTrendzUS!💻 Website: TechTrendzUS 📩 Submit your content today at: [email protected]

Don’t miss this chance to showcase your writing to a wider audience. Submit now and get published!

Explore More on TechTrendzUS

The Growing Demand for Luxury Apartments in Manchester

5 Proven Ways Mobility Infotech Boosts Customer Retention for Taxi Businesses

Free Web Hosting in Nepal: Exploring Options and Considerations

Comprehensive 360-Degree Digital Marketing, Media, and Software Development Services

Exploring Veuve Clicquot Champagne: Pricing, Value, and What to Know

Selling Custom Butcher Paper To Meat Sellers

Why People Should Use Custom Parchment Paper

Sharing Facebook Success Stories, How To Run FB Successfully

Hosting Price in Nepal 2024: Navigating the Best Web Hosting Deals

The Best Tips for Marketing in a Growing City Like Huntsville

Welcome to Paycor! Your Ultimate Solution for Efficient Payroll and HR Management

Finding Jobs Near Me: Your Comprehensive Guide to Local Job Search Success

6 Top Reasons To Invest in Custom ERP Development Services

Crowdfunding: A Catalyst for Startup Success

0 notes

Text

How do I know if a Forex signal provider is trustworthy?

The Forex market is fast-paced and highly volatile, making it challenging for traders to consistently make profitable decisions. Forex signals can provide valuable trading insights, but with countless signal providers available, distinguishing the trustworthy ones from scams is crucial.

This guide will help you understand Forex signals, identify reliable signal providers, and ensure you make informed choices.

What Are Forex Signals?

Forex signals are trading recommendations that suggest potential buy or sell opportunities in the currency market. These signals are based on various analyses, including technical indicators, fundamental news, and market sentiment. A Forex signal typically includes:

Currency pair

Entry price

Stop-loss and take-profit levels

Additional notes on trade rationale

Signals can be generated manually by professional traders or through automated algorithms and AI-driven trading bots.

Who Are Forex Signal Providers?

Forex signal providers are individuals or companies that generate and distribute trading signals to help traders execute profitable trades. They may use different strategies and methods to generate signals, including:

Professional Traders: Experienced Forex traders who share their insights and trades with followers.

Algorithmic Systems: AI-driven or automated trading systems that analyze market trends and generate signals.

How to Identify a Trustworthy Forex Signal Provider:

1. Look for a Proven Track Record

A reliable provider will have a history of success. Check their past performance—look for consistent results, not just a few lucky wins. Be cautious of providers who avoid sharing performance data or make exaggerated claims.

2. Read Genuine Reviews

Don’t just rely on the provider’s website. Look for independent reviews and testimonials from real users. Pay attention to feedback about accuracy, customer support, and overall reliability. If something sounds too good to be true, it probably is.

3. Test Their Signals

Many trustworthy providers offer free trials or demo accounts. Use this opportunity to see how their signals perform in real-time. Are they accurate? Are they delivered on time? Testing their service firsthand is the best way to gauge their reliability.

4. Check Their Transparency