#forex broker api

Explore tagged Tumblr posts

Text

🌟SmilePayz Payment Solution: We provide local payment methods in Indonesia 🇮🇩, Thailand 🇹🇭, Brazil 🇧🇷, and Mexico 🇲🇽, and also offering cryptocurrency payment solution as well.

Since we are based in these countries and connect directly to the source, we are able to provide the lowest rates in the market. We also offer same-day settlement/D0 settlement!

Whether you're in High Risk Gaming (I-Gaming), PSPs (Payment Solution Provider), Live Streaming, Forex, Stock & Crypto Broker, E-Sports & Other Online Gaming, SmilePayz is your best payment solution!

🌐 Contact us now to experience more convenient and secure payment services!

Telegram: @Thompson7837

Telegram: @Thompson7837

Telegram: @Thompson7837

#paymentsolution#paymentgateway#indonesiapayment#brokers#forex#Igaming#latam#southeast asia#API#integration#global payments#mexicopayment#brazilianpayment#thailandpayment#Qris#Dana

0 notes

Text

How do I choose the top Forex trade copier services?

Choosing the best Forex trade copier service depends on several key factors that impact efficiency, reliability, and profitability. Here’s what you should look for:

1. Speed & Execution Time: A good trade copier should have low latency to ensure trades are executed in real time without delays. This is crucial for scalpers and high-frequency traders.

2. Compatibility: Ensure the copier is compatible with your broker and trading platform (MT4, MT5, cTrader, etc.). Some copiers also work via Telegram or other third-party integrations.

3. Copying Features: Look for features such as:

Risk Management Controls

Partial or Full Trade Copying

Reverse Trading

Multi-Account Copying

4. Reliability & Performance: Check for uptime, accuracy, and past performance. A copier with frequent lags or execution failures can lead to unnecessary losses.

5. Security & Privacy: The copier should securely transfer trade data without exposing your account credentials. API-based solutions or encryption methods offer better security.

6. Customer Support & Updates: A responsive support team is essential. Look for providers that offer live chat, email, or ticket support along with regular software updates.

7. Pricing & Fees: Some trade copiers have a one-time fee, while others charge a monthly subscription. Ensure the pricing model suits your budget and trading volume.

#forex education#forextrading#currency markets#finance#economy#investing#telegram signal copier#forex Copier#Forex trade copier

2 notes

·

View notes

Text

The Secret Formula to Mastering GBP/AUD with High-Frequency Trading (HFT) The GBP/AUD HFT Playbook: Unlocking Hidden Profits at Lightning Speed In the world of Forex, there’s fast, and then there’s high-frequency trading (HFT) fast—we’re talking milliseconds that make or break fortunes. And when it comes to GBP/AUD, a currency pair known for its volatility and wide price swings, leveraging HFT strategies can be a game-changer. But here’s the thing: most traders are playing checkers while HFT traders are playing 5D chess. If you’re looking to uncover the hidden formula used by elite traders to dominate GBP/AUD with HFT, this article is your golden ticket. We’re diving into underground strategies, next-level insights, and ninja tactics that will give you an edge over 99% of retail traders. Why GBP/AUD Is a Goldmine for HFT Traders Let’s be honest—trading GBP/AUD feels like trying to ride a rollercoaster blindfolded. This currency pair is known for its aggressive price moves, often making 100+ pip swings in a single session. But guess what? That’s exactly why HFT firms love it. Key Characteristics That Make GBP/AUD Ideal for HFT: - High Volatility – More price action = More trading opportunities - Low Liquidity in Off-Hours – A paradise for algorithmic market makers - Frequent News Catalysts – Both the GBP and AUD are heavily impacted by macroeconomic data - Interest Rate Differentials – A constant driver of medium-term price trends If you’re an HFT trader, these factors work in your favor—but only if you know how to exploit them. The Hidden GBP/AUD HFT Strategies That Wall Street Won’t Tell You Most traders think HFT is all about having the fastest servers and co-location at data centers. While that’s true for institutional firms, there are ways for retail traders to piggyback off HFT principles without spending millions. 1. The "Liquidity Sniper" Strategy HFT firms hunt for liquidity like sharks. They exploit inefficiencies in order books to anticipate where price will move next. Here’s how you can apply this: ✅ Monitor Order Book Imbalances: Use tools like the depth of market (DOM) or level 2 data to identify stacked buy/sell orders. ✅ Identify "Spoofing" Patterns: Watch for large limit orders that suddenly disappear. HFT firms use this to manipulate retail traders into bad positions. ✅ Enter at Liquidity Clusters: Instead of chasing price, enter at zones where liquidity pools exist—typically around round numbers and institutional pivot levels. 2. The "Mean Reversion Scalper" Approach Not all HFT strategies are trend-following. Some exploit price inefficiencies using ultra-fast scalping techniques. Here’s how you can adapt this for GBP/AUD: ✅ Look for Flash Moves: GBP/AUD frequently experiences sudden spikes due to thin liquidity. These moves often revert within seconds. ✅ Use Ultra-Low Latency Execution: Your broker’s execution speed matters. Avoid market makers and opt for ECN/STP brokers with direct liquidity access. ✅ Apply VWAP & Standard Deviations: Volume-weighted average price (VWAP) helps track institutional order flow. Trade reversions at the second or third standard deviation. 3. The "News Hijack" Tactic Most retail traders avoid news trading due to its unpredictability. HFT firms, however, capitalize on it. Here’s how you can get in on the action: ✅ Pre-Positioning: Instead of trading during the news, enter a position minutes before based on historical reaction data. ✅ Trade First-Move Fakeouts: HFT firms often create "fake" moves in the first few seconds of a news release. Wait for liquidity to stabilize before entering. ✅ Use AI Sentiment Analysis: Tools like Bloomberg Terminal, Reuters Eikon, or free sentiment analysis APIs can help predict GBP/AUD’s direction based on news sentiment. Real-World Case Study: How an HFT Firm Profited Off a GBP/AUD Flash Crash In January 2019, the British Pound flash-crashed 3% within minutes due to a lack of liquidity in the Asian session. While retail traders were panicking, HFT firms were executing thousands of trades per second, capitalizing on the inefficiencies. What Happened? - GBP/AUD dropped over 200 pips in seconds. - HFT algorithms scanned order books in real-time, identifying oversold conditions. - Smart money bought the dip, pocketing massive profits within minutes. Lesson? Market chaos is opportunity for those who know how to exploit it. How to Set Up Your GBP/AUD HFT Strategy (Even as a Retail Trader) You don’t need a multi-million-dollar hedge fund to leverage HFT tactics. Here’s a simple step-by-step guide to start applying these strategies today: 1️⃣ Upgrade Your Broker: Choose an ECN broker with ultra-low latency execution. 2️⃣ Use Institutional Data Feeds: Free retail charts won’t cut it—use professional platforms like TradingView Pro, NinjaTrader, or cTrader. 3️⃣ Automate Entries: Consider building or using AI-driven trading bots to execute trades within milliseconds. 4️⃣ Monitor Liquidity & Order Flow: Get access to level 2 data and order book depth tools. 5️⃣ Trade During Market Imbalances: Target thin liquidity hours (Asian session or post-London close) where price inefficiencies appear. Final Thoughts: Will You Ride the GBP/AUD HFT Wave or Be Left Behind? Let’s be real—99% of retail traders are completely unaware of these tactics. They rely on outdated indicators and lagging strategies, while the real money is being made by those who exploit market inefficiencies at lightning speed. Want to level up? Start implementing these HFT strategies today and join the elite 1% who trade smarter, not harder. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Best MT5 CRM Platform for Forex Brokers in 2025

Why every Forex broker needs an MT5 CRM platform in 2025

To effectively attract, retain, and service clients while satisfying the demands of a contemporary, technologically advanced market, forex brokers must have an MT5 CRM (client relationship management) platform by 2025. This is because it offers a comprehensive, integrated solution for managing client relationships, optimizing operations, and improving the trading experience on the widely used MetaTrader 5 platform.

Key reasons why MT5 CRM is essential for forex brokers in 2025:

Seamless Integration with MT5: Personalized client service and focused marketing efforts are made possible by direct access to client trade data within the CRM system, which offers real-time insights into trading activity, account balances, and market behavior.

Advanced Client Segmentation: Brokers can customize communications and products to various client segments for more engagement by classifying clients according to trading volume, risk profile, and other characteristics.

Automated Marketing and Sales Processes: Improve conversion rates and customer acquisition by effectively managing lead generation, nurturing campaigns, and automating follow-up communications.

Compliance and Regulatory Adherence: Integrated elements that guarantee brokers fulfill legal obligations and reduce risk include order tracking, reporting, and KYC/AML checks.

Enhanced Client Support: Personalized service and customer retention are made possible by quicker response times and better problem-solving via consolidated client information access.

Advanced Analytics and Reporting: Comprehensive data analytic skills to spot patterns, track customer behavior, and make wise business decisions to maximize tactics.

Scalability and Adaptability: Ability to accommodate growing client bases and evolving market conditions, providing flexibility for future business expansion.

Benefits of using MT5 CRM

Better connections with clients

Develop closer bonds with your clients by offering them individualized help and communication.

Improved risk control

Keep an eye on customer behavior and spot possible threats to safeguard both your company and your client's finances.

Enhanced effectiveness

To save time and money, automate processes and optimize workflows.

Insights based on data

Forex is a platform for trading internationally. Receive and process payments in all major currencies.

Access via API

The Meta-Trader 5 CRM API can be used by developers to create unique integrations and increase the functionality of the platform.

Conclusion:-

All things considered, an MT5 CRM software helps forex brokers to effectively manage client relationships, provide a smooth trading experience on the well-known MT5 platform, and maintain their competitiveness in the changing forex market by offering clients specialized services and insights.

#forex#forex broker#forextrading#forex market#forexbrokerage#prop trading firms#liquidity#mt5 client relationship management

0 notes

Text

Telegram Forex Account Management

Telegram has become a popular medium for forex account management because to its simplicity of use, real-time communication features, and broad acceptance. Many forex account managers and trading organizations use Telegram to communicate with clients, provide trading signals, and manage accounts. However, because of the risk of frauds and unregulated services, participation in forex account management via Telegram must be approached with caution.

Forex Account Management More details here 👇

How Forex Account Management Works on Telegram

Direct Communication: Telegram enables account managers to communicate directly and in real time with clients. They may provide clients with quick updates on transactions, account performance, and market circumstances via texts, audio notes, or group conversations.

Signal-Based Trading: Some managers provide managed services, in which they communicate trading indications via Telegram. Clients may manually copy these signals into their trading accounts or connect their accounts via API to have the trades executed automatically.

Automated Account Management: Telegram may be used as a communication hub in more complex settings, allowing managers to oversee trading accounts using specialist software. Clients empower the manager to trade on their behalf, with updates and data sent straight to the app.

Key Considerations

Regulation and Legitimacy: One of the most significant issues with Telegram-based forex account management is the absence of regulation. Many services operate outside of typical financial control, thus it is critical to verify the manager’s qualifications and regulatory status. Legitimate managers in the United States should be registered with the CFTC and NFA, and it is essential to verify this before continuing.

Transparency and Accountability: Reputable managers give detailed documentation about their trading history, strategies, and results. Clients should expect frequent and verifiable performance reports on Telegram, where this transparency may be less established. They should be able to access their trading accounts immediately via their brokers.

Risk Management: The top managers stress risk management and tailor their strategies to their clients’ risk tolerance. Clients should ensure that managers are applying appropriate risk controls, including as stop-loss orders and position size, on Telegram, where communication is quick and sometimes informal.

Security concerns: Telegram’s open openness might lead to security risks, such as phishing attempts or impersonation schemes. Clients should ensure that they are speaking with the correct account manager and not a bogus imitation. Using two-factor authentication and validating contact information over different channels may help to reduce these threats.

Fee structure: Telegram-based services, like conventional forex account management, may impose performance fees, set monthly fees, or a mix of the two. To prevent any misconceptions, it is essential to describe the pricing structure.

Risks and Red Flags

Unregulated Managers: Be wary of managers who work without any regulatory control. They may claim large profits with little or no risk, which is often a warning indicator.

Lack of Transparency: If the manager refuses to offer specific performance reports or evidence, this may imply fraud.

Pressure tactics: Be aware of managers that encourage you to make rapid choices or deposit more money, particularly if they provide assurances or unrealistic returns.

Conclusion:

Telegram provides a simple and flexible option to handle forex accounts, but it also carries substantial hazards. When hiring a Telegram-based forex account manager, you must exercise extreme caution. Clients should verify the manager’s qualifications, demand transparency in operations, and ensure that their assets are handled securely and in accordance with regulatory norms. Although Telegram makes forex management services easily accessible, vigilance should be given to avoid possible frauds and unethical acts.

0 notes

Text

Start Your Forex Brokerage with MT5 Grey Label

Are you looking to launch or expand your Forex brokerage business? At GreylabelFX, we offer a cost-effective MT5 Grey label Original Branded Platform designed to help startup brokers establish their brand and grow their operations with ease.

Why Choose Our MT5 Grey Label Package?

Our MT5 Grey Label solution provides all the essential features you need to operate a successful brokerage under your own brand name.

What’s Included in Our Package?

✅ 1 Manager – Full control over your brokerage operations ✅ 4 Groups – (3 Live + 1 Demo) for different trading conditions ✅ All Symbols Sets – Forex, Crypto, Commodities, Indices, and Stocks ✅ Custom Symbols Available – Example: EURUSD.a ✅ Custom Feeds Available – Tailored pricing and execution ✅ 750 Accounts Limit – Sufficient for growing businesses ✅ API Access – Seamless integration with third-party tools ✅ Full Edit/Delete Access for Managers – Maximum operational flexibility ✅ Original Access to Playstore & App Store MT5 Apps – Enhance your brand presence

Enhance Your Brokerage with Our Additional Services

Custom CRM & TradersRoom

We provide a fully customizable CRM and TradersRoom solution, ensuring your brokerage website maintains a professional, branded look while managing client accounts efficiently.

Copy Trading & Social Trading Apps

Boost engagement and attract more traders with our Copy Trading & Social Trading solutions, allowing users to follow and copy successful strategies seamlessly.

Global Reach & 24/5 Support

We work with brokers across Europe, the Middle East, Asia, and Australia, ensuring seamless operations worldwide. Quick Setup & Delivery – Get your brokerage up and running without delays. 24/5 Customer Support – Dedicated assistance for issue resolution and operational guidance.

Start Your Forex Brokerage Today!

With GreylabelFX, you get a cost-effective, feature-rich, and scalable solution to establish your MT5 brokerage successfully. Contact us now and take the first step towards building your trading empire! 🚀

Contact Us Now📩 Email: [email protected] Website: greylabelfx.com

1 note

·

View note

Text

How to Choose the Right Forex Trading Platform: Your Ultimate Guide

Navigating the forex market can be overwhelming. With a staggering daily trading volume exceeding $6 trillion, the options for trading platforms are vast. Choosing the right online forex trading platform in India is crucial for your success, but with numerous choices available, figuring out which one suits you best can be challenging. This guide will simplify the selection process by breaking down the essential features, evaluating broker reliability, understanding cost implications, and more.

Essential Features of a Top-Tier Forex Platform

Trading Platform Functionality

A good trading platform should be user-friendly and efficient. Look for:

Intuitive design: Easy navigation makes trading smoother.

Charting tools: Advanced charts help in analyzing market trends.

Order execution speed: Fast execution minimizes slippage, essential for all trading strategies.

Customization options: Personalization tools help traders to tailor their experience.

Examples of platforms praised for their functionality include MetaTrader 4 and TradingView.

Variety of Asset Classes

Diversifying your trading options is essential. Beyond forex pairs, consider platforms that allow access to:

CFDs (Contracts for Difference)

Indices

Commodities

Statistics show that traders with access to a variety of asset classes tend to perform better, as they can adapt to changing market conditions.

Advanced Trading Tools

Advanced traders seek platforms that offer:

Automated trading bots: These can execute trades on your behalf based on set criteria.

Technical indicators: Tools that analyze price trends help inform trading decisions.

Economic calendars: Keeping track of important events impacts trading strategies.

Evaluating Broker Reliability and Security

Regulation and Licensing

Regulated brokers provide a safety net for your investments. Check if a broker is licensed by reputable bodies, such as:

The U.S. Commodity Futures Trading Commission (CFTC)

The Financial Conduct Authority (FCA) in the UK

Unregulated platforms may expose you to significant risks.

Security Measures

Prioritize platforms with robust security features. Look for:

Data encryption: Protects your personal information.

Fund security: Ensure your funds are held in separate accounts.

Segregation of client accounts: Keeps your money safer.

With over a third of forex traders experiencing scams, focus on security.

Customer Support

Reliable customer support is vital. Choose platforms with:

Multiple communication channels (live chat, email, phone)

Quick response times

Comprehensive FAQs and guides

Cost Considerations and Account Types

Spreads and Commissions

Understand how spreads and commissions affect your trading profitability. Different brokers offer various pricing models:

Standard spreads

Fixed spreads

Variable spreads

Evaluate how these fees can impact your overall gains.

Account Minimums and Leverage

Different account types can lead to different experiences. Consider:

Minimum deposit requirements

Levels of leverage offered

For example, a broker offering 100:1 leverage can amplify both profits and losses. Understanding this can mean the difference between opportunity and risk.

Hidden Fees

Stay alert for hidden fees that can eat into your profits. Look out for:

Withdrawal fees

Inactivity fees

Maintenance charges

Always read the fine print before committing.

Choosing a Platform Based on Your Trading Style

Scalping and Day Trading

For high-frequency trading, look for platforms with:

Low latency

Fast order execution

Advanced charting features

An expert once stated, "The right platform can make or break a scalper's strategy."

Swing and Position Trading

If you prefer longer-term strategies, consider platforms that excel in:

Comprehensive chart analysis

Robust order management

Platforms like 5xtrade specifically to these trading styles.

Algorithmic Trading

If you use automated strategies, ensure the platform supports:

APIs for custom bots

Backtesting functionality

Strategy development tools

Demo Accounts and Thorough Research

Utilizing Demo Accounts

Before committing funds, use demo accounts to test various platforms. This helps you understand the environment without the financial risk.

Reading Reviews and Comparing Platforms

Explore independent review sites to get unbiased opinions. Comparing platforms side-by-side will help clarify your options.

Seeking Expert Advice

Consult with experienced traders or financial advisors. Their insights can guide you towards platforms that fit your needs.

Conclusion: Your Path to Forex Trading Success

Choosing the right forex trading platform can significantly impact your trading success. Key takeaways include the necessity of evaluating functionality, considering asset variety, and ensuring broker reliability. Remember to weigh the cost factors and match the platform to your trading style. Regularly review your choice to ensure it remains aligned with your trading goals. The right platform can pave the way for effective trading and fruitful investments. Start your journey today by exploring available options and finding the best fit for you.

#forex trading#forex trading platform#stock trading platform in india#stock trading in india#forex trading in india

0 notes

Text

What is Best Forex Trading Platforms In India

The best forex trading platforms in India provide traders with access to currency pairs (such as USD/INR, EUR/INR), competitive spreads, high leverage, and advanced tools for analysis. In India, forex trading is regulated by SEBI (Securities and Exchange Board of India), and traders can participate in currency futures and options. The platforms listed below are known for their reliability, ease of use, customer support, and low fees.

Top Forex Trading Platforms in India:

1. Zerodha Kite

Overview: Zerodha is one of India’s largest and most popular discount brokers. Its trading platform, Kite, provides access to currency trading through currency futures and options. Known for its clean interface and low fees, Zerodha is a favorite among Indian traders.

Key Features:

Advanced charting tools and technical indicators

Paper trading for practice

Low brokerage charges and no hidden fees

Access to currency futures (USD/INR, EUR/INR, etc.)

Kite Connect API for algorithmic trading

Easy-to-use web and mobile apps

Ideal for: Traders of all experience levels, particularly those looking for a cost-effective platform.

2. Upstox Pro

Overview: Upstox is another well-known discount broker in India that offers a Pro platform for forex trading. It provides a seamless trading experience with real-time market data and advanced charting.

Key Features:

Low brokerage and transparent fee structure

Access to currency futures and options

Real-time data and advanced technical analysis tools

Mobile app for trading on the go

Paper trading option to practice strategies

Ideal for: Active traders looking for an affordable, feature-rich platform.

3. ICICI Direct

Overview: ICICI Direct is one of India’s most established brokers and offers a powerful platform for forex trading. The platform is known for its reliability, in-depth research, and wide range of products.

Key Features:

Currency futures trading

ICICI Direct trading app for mobile trading

Real-time data and research-driven recommendations

Secure transactions with integration to ICICI Bank accounts

Ideal for: Traders looking for a trusted, research-based trading platform backed by a large financial institution.

4. Angel One (formerly Angel Broking)

Overview: Angel One provides a user-friendly platform, Angel SpeedPro, for forex trading. It offers access to currency futures and options and is known for its low brokerage rates.

Key Features:

Low brokerage charges

Access to currency futures and options

Real-time charts and technical analysis tools

Strong customer support

Angel One app for mobile trading

Ideal for: Beginner and intermediate traders looking for an easy-to-use platform.

5. HDFC Securities

Overview: HDFC Securities is part of HDFC Bank and offers a robust platform for trading in forex along with stocks, commodities, and mutual funds. It is known for its security, customer service, and educational resources.

Key Features:

Currency futures and options trading

Real-time data and charts

Research-driven insights and trading recommendations

Secure and reliable platform

Ideal for: Traders who prefer to use a platform backed by a large, trusted financial institution.

6. Kotak Securities

Overview: Kotak Securities is a top brokerage firm that offers forex trading through its platform. Known for its advanced tools, the platform provides access to currency futures and options.

Key Features:

Access to currency futures and options

Real-time data and advanced charting tools

Kotak Trading App for trading on the go

Research and market analysis

Ideal for: Traders looking for a reliable, research-oriented platform with an established reputation.

7. Sharekhan

Overview: Sharekhan is a well-known full-service broker offering forex trading services through its TradeTiger platform. It is recognized for its detailed research and educational content.

Key Features:

Currency futures and options trading

Real-time data, research, and advanced charting tools

TradeTiger platform for desktop trading

Customer support and educational resources

Ideal for: Traders who value in-depth research and educational content to improve trading strategies.

8. 5paisa

Overview: 5paisa is an affordable discount broker that offers a simple platform for forex trading. The platform supports currency futures and options with low brokerage fees.

Key Features:

Low brokerage and commission charges

Access to currency futures and options

Real-time market data

Easy-to-use 5paisa mobile app

Ideal for: Budget-conscious traders who are looking for a simple and affordable forex trading solution.

9. IIFL Securities

Overview: IIFL Securities offers a robust trading platform for forex and other asset classes. The platform provides access to currency futures, advanced tools, and research.

Key Features:

Access to currency futures and options

Real-time data and advanced charting tools

IIFL trading app for mobile access

Research and market analysis for informed decision-making

Ideal for: Traders who want a comprehensive, research-driven trading platform.

10. Motilal Oswal

Overview: Motilal Oswal is one of India’s leading brokerage firms. It offers a strong trading platform with access to currency futures and options, along with comprehensive research and educational resources.

Key Features:

Access to currency futures trading

Real-time data, research, and charting tools

MO Trader app for mobile trading

Strong customer support

Ideal for: Traders looking for a platform with strong research, real-time analysis, and mobile trading capabilities.

Factors to Consider When Choosing a Forex Trading Platform in India:

Regulation: Ensure the platform is SEBI-registered, as SEBI governs the forex market in India.

Leverage: Forex brokers in India offer a maximum leverage of 50:1, which can amplify both profits and risks.

Fees and Spreads: Compare brokerage charges and spreads across platforms to choose one that suits your trading style.

Tools and Features: Look for platforms that offer advanced charting, technical indicators, and real-time market data.

Customer Support: Choose platforms with responsive customer support to assist with any queries or issues.

Education and Research: Platforms with educational resources like tutorials, webinars, and market analysis can help enhance your trading knowledge.

Conclusion:

The best forex trading platforms in India such as Zerodha Kite, Upstox Pro, and ICICI Direct provide reliable tools, low-cost trading, and access to currency futures and options. Choose the platform that aligns with your trading goals, risk tolerance, and level of experience. Each platform offers unique features, and your choice will depend on factors like cost, ease of use, and support for advanced trading strategies.

Contact Us WinProfx 1st Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia P.O Box 838, Castries, Saint Lucia. +971 4 447 1894 [email protected] https://winprofx.com/ Find Us Online Facebook

0 notes

Text

Is Copy Trading Legal in India? Understanding the Regulations and Risks

Copy trading, also known as social trading or mirror trading, has gained immense popularity in recent years. It allows investors to copy the trades of experienced and successful traders automatically. Though this type of trading has been embraced globally, one of the most common questions among traders is: Is copy trading legal in India?

In this article, we’ll explore the legality of copy trading in India, the regulations surrounding it, and how it’s becoming a common practice among retail investors.

What is Copy Trading? Copy trading is a type of trading that allows investors to automatically copy the trades of professional traders. When the trader you’re copying executes a trade, the same trade is automatically mirrored in your account. This allows beginners or those without much trading knowledge to participate in the markets by relying on the expertise of more experienced traders.

This process occurs in real-time, and the copied trades are similar to the original trades in terms of size, timing, and pricing. Copy trading is most often used in forex, stocks, and cryptocurrencies.

Is Copy Trading Legal in India? The short answer is yes. Copy trading is legal in India, but it is subject to regulatory oversight from the Securities and Exchange Board of India (SEBI). SEBI is the primary regulatory authority for the securities market in India, and any financial activity, including trading, must comply with its guidelines.

Regulatory Landscape for Copy Trading in India Though SEBI has not made explicit rules for copy trading, it provides guidelines on what is required for online trading platforms and investment services. A few of these points are below:

Broker Licensing: Brokers who provide copy trading services are registered with SEBI in India. If a platform offers copy trading, then it must be regulated and authorized to provide trading services. Regulated brokers such as Zerodha, Upstox, and Angel One are examples of such regulated platforms that might offer copy trading options.

Compliance with SEBI’s Guidelines: Copy trading platforms in India must adhere to SEBI’s norms for transparency, investor protection, and fair practices. They must ensure that the services offered are in line with Indian financial laws and provide clear disclosures about the risks involved in trading.

No Specific Regulations Needed: Till date, SEBI does not have any specific regulations for copy trading. However, copy trading in India is legal as long as the platform providing the service is regulated, and the activity complies with existing financial laws governing trading and investing.

Risk Involved in Copy Trading While copy trading allows beginners to benefit from professional traders' expertise, it's important to understand that there are risks involved. Just because a trader has a good track record does not mean he will be successful in the future. Market conditions change, and no strategy is foolproof.

Risk Disclosure: In India, copy trading platforms have to provide adequate risk warnings and disclosures to investors. Users should know that they are as exposed to the market risks of professional traders as the latter, and thus might lose.

Popular Copy Trading Platforms in India Many trading platforms in India have introduced copy trading. Although not all of them are explicitly regulated for copy trading, many have introduced social trading features that allow investors to mimic the strategies of successful traders. Some platforms that allow copy trading in India include:

Zerodha (via Kite Connect API) Upstox Angel One ICICI Direct Groww (to an extent, via auto-trading tools) These platforms are regulated by SEBI and provide a safe environment for traders to engage in copy trading.

How to Begin Copy Trading in India Getting started with copy trading in India is pretty easy. Here's how you can do it:

Select a SEBI-registered Broker: Make sure that the platform you select is registered with SEBI. Some of the popular brokers include Zerodha, Angel One, and Groww.

Create an Account: Sign up on the platform and complete your KYC (Know Your Customer) process.

Select a Trader to Copy: After creating an account, you can browse through the list of available traders to copy. Look for traders with a track record that matches your risk tolerance.

Fund Your Account: Deposit funds into your trading account. This is the amount you will use for copy trading.

Start Copying: Once you have selected a trader, you can begin to copy their trades in real-time. Your account will automatically mirror those trades.

Is Copy Trading Right for You? Copy trading is very good if you are a newcomer to trading or do not have the time and expertise to analyze the markets. It is, however, very important to choose traders carefully whom you are going to copy. You should also remember that no trader is above losses, and past performance is not a guarantee of future success.

Conclusion Copy trading is legitimate in India, provided it's offered on a platform SEBI regulates. Of course, understand that copy trading, like all kinds of trading, comes with risk. If you ensure that you're using a regulated platform and that you take the time to learn about the risks, you can join the ranks of copy trading participants with confidence.

If you are considering copy trading in India, make sure to choose a trusted platform like Zerodha or Upstox and read the risk disclosures before engaging in any trades. You can then benefit from this new way of trading in a compliant manner with India's financial regulations.

0 notes

Text

Full Stack Software Developer (CRM Frontend, Backend, and API Integration) - JioMarkets Commercial Brokers LLC

About Us:Jio Markets is a leading provider of innovative trading solutions in the financial services industry, specializing in CFD and Forex trading. We are committed to delivering cutting-edge technology and tailored services that meet the diverse needs of institutional clients, including hedge funds, asset managers, banks, and other financial institutions. We are based in Dubai.Overview:We are…

0 notes

Text

Full Stack Software Developer (CRM Frontend, Backend, and API Integration) - JioMarkets Commercial Brokers LLC

About Us:Jio Markets is a leading provider of innovative trading solutions in the financial services industry, specializing in CFD and Forex trading. We are committed to delivering cutting-edge technology and tailored services that meet the diverse needs of institutional clients, including hedge funds, asset managers, banks, and other financial institutions. We are based in Dubai.Overview:We are…

0 notes

Text

How to Use OANDA for Forex and Cryptocurrency Trading

How to Use OANDA for Forex and Cryptocurrency Trading OANDA is a leading online broker that offers a wide range of trading services, including forex and cryptocurrency trading. This guide will walk you through the steps to get started with OANDA and make the most of its powerful trading tools.To get more news about OANDA, you can visit our official website.

1. Research and Understand OANDA Before you start trading, take some time to research OANDA. Understand its services, trading platforms, and the markets it offers. This will help you make informed decisions and choose the right tools for your trading needs.

2. Create an Account Visit the OANDA website and sign up for an account . You will need to provide some personal information and verify your identity. This step is essential for complying with regulatory requirements and ensuring the security of your account.

3. Deposit Funds Once your account is verified, deposit funds into your OANDA account . You can choose from various deposit methods, including bank transfers, credit cards, and other cryptocurrencies . Select the method that suits you best and transfer the desired amount.

4. Choose Your Trading Platform OANDA offers several trading platforms, including OANDA Trade, TradingView, and MetaTrader . Choose the platform that best fits your trading style and preferences. Each platform has its own set of tools and features, so explore them to find the one that works best for you.

5. Start Trading With funds in your account and a trading platform selected, you can start trading forex and cryptocurrencies . Use OANDA's powerful tools, such as technical indicators and chart analysis, to make informed trading decisions. You can also automate your trading strategies using OANDA's APIs .

6. Monitor Your Investments Keep an eye on your investments and stay informed about market trends and news . OANDA provides market insights and expert analysis to help you make informed decisions. Regularly review your portfolio and adjust your trading strategies as needed.

7. Secure Your Account Security is paramount when trading online . Ensure your account is protected with strong passwords and two-factor authentication. Consider using a hardware wallet to store your cryptocurrencies securely.

0 notes

Text

Alchemy Markets Scam Exposed

The offshore broker Alchemy Markets, a member of the Alchemy Group that also comprises the FCA-regulated Alchemy Prime and the Vanuatu-based FXPIG, came under fire from the Spanish CNMV in July 2022. The same brand and trading style are used across various domains and websites, potentially or purposefully misleading customers, as is often the case with these worldwide broker schemes. By acquiring clients from Europe and the UK, the offshore broker Alchemy Markets is breaking relevant regulatory regulations. This is our most recent review.

Short Narrative

While the offshore division of the Alchemy Group uses the name Alchemy Markets and the domain https://alchemymarkets.com, the UK FCA-regulated investment firm Alchemy Prime operates the website with the domain https://alchemyprime.uk. The word “Alchemy” serves as the basis for the used logos. They use the same primary graphic components but make additions (see image on the left).

The webpage for the offshore mutation is poorly designed. Documents such as the KYC Policy, Privacy Policy, and Client Agreement, for instance, are absent. The link goes nowhere; all you get is the error message 404. Additional links on the Alchemy Markets offshore broker website point to the FCA-regulated entity’s Client Agreement.

Furthermore, Alchemy Group uses the FCA-regulated Alchemy Prime Ltd as a payment agent to run the offshore broker FXPIG through Prime Intermarket Group Asia Pacific Ltd, which is registered in Vanuatu and licensed by the VFSC. The FXPIG website states that every company is managed by a single entity.

Gope Shyamdas Kundnani, an Indian national born in 1957, is the owner of Alchemy Group, according to documents obtained through Alchemy Prime Holdings Limited from UK Companies House.

KYC Deposits Prior to

We did not find any limitations on the pre-KYC first-time deposit amount in our payment simulation on October 10, 2022. Through a bank transfer to the multi-currency accounts of the offshore broker scheme at Franx and Blackthorn Finance in the UK, located in Amsterdam, we would have been able to send $50,000 to the scheme.

Alchemy Markets (As claimed)

For each and every one of our clients, Alchemy Markets provides Institutional Access to the Global Financial Markets. Trade your preferred instruments with a variety of free tools and round-the-clock customer assistance, including stocks, forex, indices, cryptocurrencies, and CFDs.

With more than ten years of industry experience, Alchemy Markets offers some of the greatest trading conditions available, including institutional liquidity, spreads, and execution along with zero commission costs and round-the-clock customer service. We offer the most widely used trading platforms, including MT4, MT5, and FIX API, in addition to free resources and research to help our customers along the way.

Do you manage money or are you an IB? Use CopyTrading or PAMM software to trade on behalf of your clients. Charge personalised management and performance fees, keep tabs on your customers with our real-time CRM, and much more with Alchemy markets.

Alchemy Markets offers services related to forex trading. A vast array of assets, including currencies, indices, cryptocurrencies, and commodities, are available to traders across several marketplaces. In contrast, Alchemy Markets offers a free demo account that you can use to explore and become acquainted with their platform. The UK is home to its main office.

Trading Cryptocurrencies

Since cryptocurrencies have such high levels of volatility, trading them is a lucrative and potentially very profitable area of investing. With more than 60 distinct Crypto CFDs, Alchemy Markets has a fantastic offer for any trader looking to take advantage of the competitive conditions and enter into this rapidly expanding sector. 10:1 leverage, 100% STP execution, and costs as low as 0.35% Round Turn are available for cryptocurrency trading. After creating an account with this online broker, cryptocurrency traders can use the MT4 platform for trading.

Wind-Up- A Six-Step Guide to Verifying the Legitimacy of Your Broker

Even though investing has become risk-free, inexpensive, and effective for regular investors, there are still certain cases of brokerage fraud committed to defraud gullible or avaricious investors.

There are numerous methods for determining the legitimacy of your broker. Do your homework in advance at all times.

Avert cold calls, investigate the firm’s and the broker’s or planner’s record for any disciplinary issues, and look for funny stuff on your statements.

If in doubt, there are a few different ways to report anything and ask for compensation.

The most reliable source for finding out about a broker’s status is FINRA.

You may safeguard yourself against doing business with a dishonest broker or other financial professional by following these six steps:

1. Avoid Making Cold Contacts

Any broker or investment advisor who reaches you out of the blue from a company you have never done business with should be avoided. The correspondence may be sent by letter, email, or phone. Invitations to financial seminars that provide complimentary lunches or other goodies in an attempt to win you over shouldn’t fool you into lowering your guard and making rash investments.

The SEC further advises being extremely wary of callers that employ high-pressure sales techniques, advertise once-in-a-lifetime prospects, or decline to provide written information about an investment.

2. Engage in Discussion

You should feel at ease with the individuals offering you guidance, goods, and services, whether you’re searching for a financial counsellor or a broker. Inquire extensively about the company’s offerings and its track record serving customers with comparable demands to your own.

3. Conduct some research

When investigating a financial expert, it’s advisable to start with a straightforward web search using the broker’s and firm’s names. This could include recent announcements, media coverage of purported misconduct or disciplinary measures, client discussions on internet discussion boards, background data, and other specifics. A search engine query for “Lee Dana Weiss,” for example, yields hundreds of thousands of results, one of which is a link to the press release regarding the SEC’s lawsuit against him and his company.

4. Confirm your SIPC membership

Additionally, you ought to confirm whether a brokerage company belongs to the Securities Investor Protection Corporation (SIPC), a nonprofit organisation that offers investors protection for up to $500,000 (including $250,000 in cash) in the event that a company fails, much like the Federal Deposit Insurance Corporation (FDIC) does for bank customers. Always make cheques payable to the SIPC member firm rather than a specific broker when investing.

5. Frequently Review Your Statements

Setting your investments to run on autopilot is the worst thing you can do. Whether you receive your statements in print or online, carefully reviewing them might help you catch errors or even malfeasance early on. Inquire if there are unexpected changes in your portfolio or if the returns on your investments aren’t what you anticipated. Reject complex guarantees that you don’t fully comprehend. Ask to talk with a higher-ranking official if you are unable to acquire clear answers. Never worry that people will think less of you or that you’re a bother.

6. If in doubt, take money out and file a complaint.

Take your money out of the investment advisor if you think there has been misconduct. Next, submit complaints to the same state, federal, and private authorities whose websites you visited when you checked out the financial professional to start with

Bottom Line

Even though the Great Recession is resolved, brokers and investment advisors are still breaking the law. Thus, before entrusting a financial expert with your money, conduct in-depth study and keep a careful eye on your accounts. It is possible for investments to perform below expectations for valid reasons. However, if you start to feel uneasy about your returns or have other problems that the advisor doesn’t address promptly and effectively, don’t be afraid to withdraw your money.

0 notes

Text

The EURCAD Algorithmic Goldmine: Automated Trading Systems Your Broker Doesn’t Want You to Know About Ever felt like the Forex market is a bit like online dating? You swipe right on what looks like a perfect setup, only to realize it’s a catfish that drains your account faster than a subscription box you forgot to cancel. Welcome to EURCAD trading — where the pair's volatility can either make you a hero or leave you crying into your coffee. But here’s the twist: what if you could eliminate the emotional rollercoaster altogether? What if your trading setup executed flawlessly while you sipped your latte or binge-watched another season of that show you swear you won’t get addicted to? This is where automated trading systems (ATS) come in — your virtual trading army that never sleeps, panics, or gets distracted by TikTok. Especially when dealing with EURCAD, a pair known for its bursts of volatility and correlation to oil prices, harnessing automation could unlock profits that manual traders often overlook. But, like any tool, it’s only as good as the hands (or mind) guiding it. Let’s uncover the underground techniques and elite tactics that separate the amateurs from the algorithmic assassins. EURCAD: The Pair That Keeps Traders Guessing (And Losing) Before we dive into the robotic overlords, let’s dissect EURCAD. This pair represents the Euro against the Canadian Dollar, and it’s not your everyday EURUSD or GBPUSD grind. It moves to its own rhythm, often syncing with crude oil prices (thanks, Canada) and European monetary shifts. This makes it prone to sudden spikes, leaving manual traders scrambling. Key EURCAD Quirks You Need to Know: - Oil Correlation: When oil prices pump, CAD strengthens; when oil tanks, CAD weakens. Simple, right? Until it isn’t. - Low Liquidity Traps: Compared to major pairs, EURCAD can suffer from wider spreads and erratic moves during off-peak hours. - Whipsaw Wednesdays: Mid-week can trigger sharp reversals due to oil inventory reports and European data releases. Combining these nuances with an automated trading system can turn these risks into opportunities. But you need to know the secret sauce. The Hidden Algorithms That Crush EURCAD (While Everyone Else Blames the Market) 1. The Oil-Shadow Scalper Ever noticed how EURCAD traders get blindsided by oil price shifts? You won’t — if your ATS reads oil data like a crystal ball. How It Works: - Integrate your ATS with a news API tracking oil price movements in real-time. - Program your system to enter micro-scalps on EURCAD when oil prices surge/dip beyond 1% intraday. - Use a 5-pip stop loss with a 12-pip profit target (tuned for volatility bursts). Elite Tip: Pair this with StarseedFX’s Forex News service to enhance real-time reaction speeds. Being 10 seconds early can be the difference between profits and profanity. 2. The Midnight Rebound Sniper Low liquidity hours (22:00-02:00 GMT) see EURCAD wobbling like your uncle at a wedding after his third whiskey. This is when mean-reversion bots feast. Setup Breakdown: - Deploy a range-bound ATS between 22:00-02:00 GMT. - Trigger buy orders when price dips below 1.5 standard deviations of the hourly mean. - Place sell orders above 1.5 standard deviations. - Tight stops (6-8 pips) with quick profit targets (10-15 pips). Underground Insight: Backtesting on MetaTrader 5 showed a 78% win rate for this system in Q4 2024 (source: internal testing from StarseedFX). 3. The Spread Shark Detector Did you know that brokers often widen spreads during news releases to devour your stops? Classic EURCAD trap. Combat Technique: - Install a spread-monitoring module in your ATS. - Pause trading if spreads exceed 3.5 pips. - Resume trading only when spreads stabilize under 2 pips. Bonus Ninja Move: This eliminates slippage slaps during Bank of Canada statements or ECB surprises — moments when your manual trading instincts might fail you. Insider Edge: Real Traders Winning With Automation Mark Johnson, Head of Research at FXCM, noted, “Combining volatility-based models with news sentiment analysis is outperforming traditional RSI and MACD approaches in exotic pairs like EURCAD.” (FXCM Report, 2024) Linda Raschke, veteran trader and author of “Trading Sardines,” emphasizes, “Automated systems excel when traders master specific time windows and recurring volatility patterns.” Why Most Traders Fail With ATS (And How You Won’t) Most traders set up a bot, sip coffee, and expect riches. Reality check: it’s like expecting a Roomba to clean your house while your toddler smears peanut butter on the walls. Avoid These Pitfalls: - Over-Optimization Syndrome: If your backtest looks like a straight line to the moon, it’s overfitted. Test across different time periods. - Ignoring News Events: Automated doesn’t mean “blind.” Turn your bots off before major announcements if they can’t handle volatility. - No Manual Override: Always have an emergency kill switch. Sometimes, discretion is the better part of profit. Future-Proofing: Next-Gen Tools for EURCAD Success - Smart Trading Tool: Automate lot sizing and order management with precision here. - Trading Plan Template: Track performance and goals with a free plan here. - Live Community Insights: Join elite traders dissecting EURCAD moves in real time here. Takeaway Nuggets That Could Save Your Account - Oil-Shadow Scalper: Use oil price surges/drops to scalp EURCAD. - Midnight Rebound Sniper: Profit from low-liquidity mean reversions. - Spread Shark Detector: Pause trading when spreads widen. Don’t trade harder; trade smarter (and maybe laugh a little along the way). —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Top 10 Forex Brokers: A Comprehensive Guide for Traders

In the ever-evolving world of forex trading, selecting the right broker can significantly impact your trading success. With numerous options available, it’s crucial to identify brokers that offer the best services, reliability, and features tailored to your trading needs. In this article, we present the top 10 forex brokers that stand out in the industry, ensuring that traders have a reliable partner in their trading journey.

1. IG Group: A Leader in Forex Trading

IG Group is a well-established name in the forex trading space. With over 45 years of experience, IG provides a robust platform for both beginners and experienced traders. The broker offers a vast range of currency pairs, competitive spreads, and advanced trading tools. IG's regulatory compliance across multiple jurisdictions ensures that your funds are secure.

Key Features:

Regulatory Authority: FCA, ASIC, and NFA

Trading Platforms: Proprietary platform, MetaTrader 4 (MT4)

Account Types: Standard and premium accounts

Educational Resources: Webinars, tutorials, and market analysis

2. OANDA: An Innovative Trading Experience

OANDA has carved a niche for itself through its innovative technology and comprehensive trading services. Known for its excellent customer service and robust trading platform, OANDA caters to traders of all experience levels. It offers a wide selection of forex pairs and features like advanced charting tools and APIs for automated trading.

Key Features:

Regulatory Authority: FCA, CFTC, ASIC

Trading Platforms: OANDA’s proprietary platform and MT4

Account Types: Standard and premium accounts

Commission Structure: Transparent pricing with no hidden fees

3. Forex.com: A Trusted Forex Trading Platform

Forex.com, part of the GAIN Capital Holdings, Inc., is a well-respected broker providing an extensive range of trading options. With its user-friendly platform, Forex.com is ideal for both beginners and seasoned traders. The broker’s comprehensive research and analysis tools enable traders to make informed decisions.

Key Features:

Regulatory Authority: FCA, CFTC

Trading Platforms: Proprietary platform and MT4

Account Types: Standard and commission accounts

Research Tools: Daily market analysis and in-depth research reports

4. TD Ameritrade: A Comprehensive Trading Ecosystem

TD Ameritrade offers an extensive range of trading options, making it a popular choice for forex traders. The broker provides a powerful trading platform that integrates forex trading with other asset classes, allowing for a diversified investment strategy. The robust educational resources available make TD Ameritrade a great choice for novice traders.

Key Features:

Regulatory Authority: SEC, FINRA

Trading Platforms: thinkorswim, web-based platform

Account Types: Individual and joint accounts

Educational Resources: Extensive library of videos, articles, and tutorials

5. Pepperstone: Best for Low Costs

Pepperstone is renowned for its low-cost trading options and exceptional customer service. The broker is particularly appealing to active traders due to its tight spreads and high execution speed. Pepperstone offers various trading platforms, including MT4 and cTrader, catering to diverse trading preferences.

Key Features:

Regulatory Authority: ASIC, FCA

Trading Platforms: MT4, MT5, cTrader

Account Types: Standard and Razor accounts

Customer Support: 24/5 live chat and support

6. eToro: A Social Trading Pioneer

eToro has transformed the forex trading landscape with its unique social trading features. The platform allows traders to follow and copy the trades of successful investors, making it ideal for beginners. eToro also provides an array of educational resources and an easy-to-navigate platform.

Key Features:

Regulatory Authority: FCA, CySEC

Trading Platforms: eToro proprietary platform

Account Types: Retail and professional accounts

Unique Features: Social trading and copy trading functionalities

7. AvaTrade: A Global Trading Leader

AvaTrade is known for its wide range of trading instruments and comprehensive trading services. With a focus on providing a user-friendly experience, AvaTrade offers multiple trading platforms, including MT4 and its own web-based platform. The broker also features extensive educational materials to support traders.

Key Features:

Regulatory Authority: Central Bank of Ireland, ASIC, FSA

Trading Platforms: MT4, MT5, AvaTradeGo

Account Types: Standard and Islamic accounts

Market Analysis: Regular webinars and trading signals

8. XM: Excellent for Forex and CFDs

XM is recognized for its exceptional customer service and competitive trading conditions. The broker offers a vast selection of forex pairs and CFDs, catering to a wide range of trading strategies. XM provides educational resources to assist traders in navigating the forex market effectively.

Key Features:

Regulatory Authority: ASIC, CySEC

Trading Platforms: MT4, MT5

Account Types: Micro, Standard, and Zero accounts

Promotions: Various bonuses and trading incentives

9. FXCM: The Expert Trader's Choice

FXCM is a reputable broker that offers a robust trading platform with advanced features suitable for expert traders. With a wide variety of currency pairs and low spreads, FXCM provides traders with competitive trading conditions. The broker’s comprehensive market research and analysis tools are beneficial for strategic trading.

Key Features:

Regulatory Authority: FCA, ASIC

Trading Platforms: Trading Station, MT4

Account Types: Standard and Active Trader accounts

Research Tools: Extensive market analysis and news updates

10. Interactive Brokers: The Professional Trader's Platform

Interactive Brokers is a well-known broker that caters to professional traders and institutions. With low commissions and a wide array of trading instruments, Interactive Brokers is an excellent choice for serious traders. The platform offers advanced trading tools and resources for in-depth market analysis.

Key Features:

Regulatory Authority: SEC, FINRA

Trading Platforms: Trader Workstation (TWS), web-based platform

Account Types: Individual, joint, and institutional accounts

Educational Resources: Comprehensive trading courses and webinars

Conclusion

Choosing the right forex broker is essential for trading success. Each of the brokers listed above offers unique features, competitive pricing, and robust support to help traders navigate the forex market effectively. When selecting a broker, consider factors such as regulation, trading platform, and customer service to find the one that best suits your trading needs.

#forextrading#forex education#forex market#forex trading#forexsignals#investment#forex robot#forex#xauusd#forex expert advisor

0 notes

Text

Revisión de NexosTrade - explorando funcionalidad y credibilidad

Nexos Trade es una empresa de corretaje de última generación que ofrece una amplia gama de oportunidades de inversión y opera bajo estrictas normas y supervisión para garantizar la seguridad de las inversiones de sus clientes.

Sobre la base de la revisión y los comentarios de los clientes podemos decir que los clientes pueden tener confianza en la fiabilidad y la rentabilidad de NexosTrade como una plataforma de negociación.

Sin embargo, hay algunos factores clave que cada usuario debe considerar cuidadosamente.

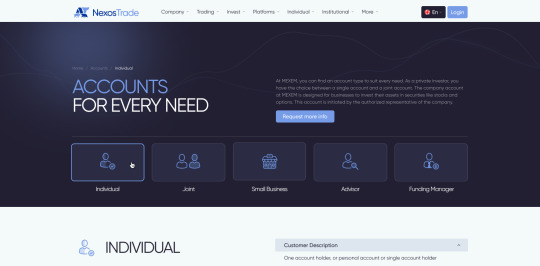

Qué es NexosTrade y en qué se diferencia de otros brokers?

Lo primero que hay que mencionar, y según la opinión de los usuarios es muy importante, es la adaptabilidad de la plataforma para ofrecer diferentes oportunidades de negociación para todas las necesidades de los usuarios. Los clientes pueden elegir entre una cuenta personal y una cuenta de empresa. NexosTrade permite invertir legalmente en valores, incluidas acciones.

Hay cinco tipos de cuentas con las que los usuarios pueden operar:

Individual - para operaciones personales

Conjunta - varios inversores pueden acceder a la cuenta y gestionarla

Pequeña empresa - cuenta de corretaje empresarial para diferentes entidades jurídicas

Asesor - todo tipo de asesores pueden gestionar su cartera de inversiones y su negocio con el apoyo de una solución de custodia integral integrada en NexosTrade

Gestor de fondos - NexosTrade permite a los clientes asociarse con varios gestores de inversiones y operar desde una única interfaz.

Hemos descubierto algunas ventajas principales de la plataforma NexosTrade que son muy importantes en base a los comentarios de los usuarios, se puede considerar como interesante y competitivo para las actividades comerciales:

Opinión y comentarios positivos de la comunidad y alta confianza en las reseñas

Estrategias avanzadas de inversión y negociación

Corredor totalmente regulado con una sólida funcionalidad

Amplia gama de instrumentos de negociación y compatibilidad multiplataforma

Disponible para particulares, inversiones conjuntas y empresas

También hay que señalar que NexosTrade es una solución multiplataforma - se puede utilizar a través de escritorio o móvil y también proporciona API para la integración sin problemas con la funcionalidad de la plataforma.

Revisión de credibilidad de Nexos Trade

La revisión de NexosTrade puede medirse parcialmente a través de su cumplimiento normativo y su posición legal. He aquí algunos puntos clave a tener en cuenta:

Qué es la CMNV y por qué es importante? controlada por el "Ministerio de Economía y Hacienda de España", que está a cargo de la "Comisión Nacional del Mercado de Valores" (CMNV), también conocida como la "Comisión Nacional del Mercado de Valores", un reputado organismo de supervisión que se creó en 1988. El principal objetivo de la CNMV es proteger la economía nacional ofreciendo a los inversores y a los proveedores de servicios de inversión, como los brokers de Forex, unas circunstancias de negociación favorables. La CMNV se encarga de administrar las leyes y sanciones adicionales que sean necesarias, así como de expedir, suspender o revocar las licencias de las empresas registradas. La comisión expide licencias a las empresas de inversión y supervisa su cumplimiento de los requisitos reglamentarios, y los usuarios siempre valoran positivamente esta protección. NexosTrade no es una excepción.

Cómo comprobar la información legal:Explore el sitio web oficial de NexosTrade: nexostrade.com y los registros regulatorios para recopilar información sobre sus opciones, flujo de usuarios y oportunidades de inversión. La mayor parte de la información se puede encontrar en la parte inferior de la página web y en la sección 'Términos y Condiciones'. Además, puede consultar toda la sección "Empresa y Legal", que incluye diferentes formularios y divulgaciones que es posible que desee tener en cuenta.

Indicadores de credibilidad

Además del cumplimiento de la normativa, los indicadores de credibilidad desempeñan un papel importante en la revisión de NexosTrade. He aquí algunos factores a tener en cuenta:

Plataformas de revisión: NexosTrade está clasificado por TrustPilot. Además, puede comprobar las plataformas de revisión prominentes como Forex Peace Army, y otros para medir los comentarios de los usuarios y experiencias con la empresa. La ausencia de reseñas negativas, comentarios o quejas significativas puede ser indicativo de una plataforma fiable.

Listas de estafas: Consulte listas de estafas acreditadas y foros dedicados a desenmascarar plataformas de comercio fraudulentas. La ausencia de Nexos Trade en dichas listas puede interpretarse positivamente.

Testimonios de usuarios: Busque reseñas de usuarios individuales, opiniones ampliadas y testimonios sobre sus experiencias con NexosTrade. Los comentarios positivos de múltiples usuarios pueden aumentar la credibilidad de la plataforma.

A principios de 2024, los análisis indican que NexosTrade tiene un sentimiento positivo en Internet, lo que constituye un indicador favorable para la plataforma. El sentimiento positivo predominante y los comentarios de los usuarios hacia NexosTrade sugieren que los usuarios y los participantes del mercado están generalmente satisfechos con los servicios, las características y el rendimiento general de la plataforma. Este sentimiento positivo y los comentarios pueden ser un fuerte indicador de confianza, fiabilidad y credibilidad, que son factores esenciales para los operadores a la hora de seleccionar una plataforma de negociación. El sentimiento favorable y los comentarios de los clientes hacia NexosTrade pueden atraer a nuevos usuarios y contribuir al crecimiento y éxito de la plataforma en el competitivo panorama del trading.

Pruebas adicionales de credibilidad

Para consolidar aún más las críticas positivas de Nexos Trade, tenga en cuenta lo siguiente:

Transparencia: Evalúe la transparencia de NexosTrade en cuanto a comisiones, condiciones de negociación y políticas. La ausencia de comisiones ocultas y una comunicación clara con los clientes pueden infundir confianza en la plataforma.

Medidas de seguridad: Evalúe los protocolos de seguridad de NexosTrade, como los métodos de cifrado, las medidas de protección de datos y el cumplimiento de las normas del sector. Las prácticas de seguridad sólidas son esenciales para salvaguardar los fondos y la información personal de los usuarios.

Amplia gama de oportunidades de inversión: los usuarios de la plataforma de negociación siempre valoran positivamente la comodidad de utilizar diversas herramientas de inversión

Al examinar el producto en sí, el cumplimiento normativo, los comentarios de los usuarios y otros indicadores de credibilidad, los clientes potenciales pueden tomar decisiones informadas sobre la legitimidad de NexosTrade como plataforma de negociación. Llevar a cabo una diligencia debida exhaustiva es primordial para mitigar los riesgos y garantizar una experiencia de negociación segura.

[Descargo de responsabilidad: La información proporcionada en este artículo tiene únicamente fines informativos y no debe interpretarse como asesoramiento financiero. Es esencial llevar a cabo una investigación independiente y consultar con profesionales financieros antes de participar en actividades de negociación en línea.

1 note

·

View note