#financeJob

Explore tagged Tumblr posts

Text

✨ Aarti Kanwar’s Journey: From Doubt to Success! ✨

Before joining IPB, Aarti lacked the confidence & skills to step into the banking sector. But after completing the course, she transformed—stronger communication, in-depth banking knowledge & boosted confidence! 💯

Today, she’s a Money Officer at AU Small Finance Bank, Jaipur, living her dream in the finance world! 🏦✨

💡 Want to start your own success story? Comment “Interested” & take the first step toward your dream career! 🚀

#BankingCareer#SuccessStory#IPBAlumni#instituteofprofessionalbanking#LifeSethai#1lakhbankersby2030#DreamJob#CareerGrowth#FinanceJobs#BankingIndustry#IPB#CareerTransformation#PGCRB#bankingjobs

0 notes

Text

High-Paying Career Opportunities for Oracle Fusion Financials Professionals.

Oracle Fusion Financials is a leading cloud-based financial management solution that integrates comprehensive financial applications with cutting-edge technology. As businesses increasingly migrate to cloud-based ERP solutions, professionals skilled in Oracle Fusion Financials are in high demand. This demand translates into lucrative career opportunities across industries. Let’s explore some of the top high-paying career paths for Oracle Fusion Financials professionals.

1. Oracle Fusion Financials Consultant

Average Salary: $90,000 – $150,000 per year

Oracle Fusion Financials Consultants help organizations implement and optimize Oracle Fusion Financials modules. They analyze business requirements, configure the system, and provide training to end-users. This role requires deep knowledge of financial processes and Oracle Cloud applications.

Key Responsibilities:

Implementing Oracle Fusion Financials solutions

Customizing financial modules to align with business needs

Training and supporting end-users

Troubleshooting system issues and optimizing performance

2. Oracle Fusion Financials Functional Lead

Average Salary: $100,000 – $160,000 per year

A Functional Lead is responsible for leading the implementation of Oracle Fusion Financials solutions for enterprises. They work closely with stakeholders to ensure smooth adoption and integration.

Key Responsibilities:

Leading Oracle Fusion Financials implementation projects

Coordinating between business and technical teams

Ensuring compliance with financial regulations

Managing project timelines and deliverables

3. Oracle Fusion Financials Technical Consultant

Average Salary: $95,000 – $145,000 per year

Technical Consultants focus on the technical aspects of Oracle Fusion Financials, including integrations, customizations, and troubleshooting. They need strong programming skills and an understanding of Oracle tools like SQL, PLSQL, and BI Publisher.

Key Responsibilities:

Developing custom reports and dashboards

Integrating Oracle Fusion Financials with other enterprise systems

Resolving technical issues and optimizing system performance

Automating financial processes through scripting and configuration

4. Oracle Cloud ERP Finance Solution Architect

Average Salary: $120,000 – $180,000 per year

Solution Architects design and oversee the deployment of Oracle Fusion Financials solutions, ensuring they align with an organization's strategic goals. This senior role requires deep expertise in ERP systems and financial processes.

Key Responsibilities:

Designing end-to-end Oracle Fusion Financials solutions

Providing strategic guidance on financial transformations

Ensuring system scalability and security

Collaborating with executives and IT teams

5. Oracle Fusion Financials Business Analyst

Average Salary: $85,000 – $140,000 per year

Business Analysts bridge the gap between business needs and Oracle Fusion Financials capabilities. They analyze financial processes, gather requirements, and help optimize system usage.

Key Responsibilities:

Conducting business process analysis and recommending improvements

Gathering and documenting system requirements

Coordinating with technical teams for system enhancements

Supporting financial reporting and data analysis

6. Oracle Fusion Financials Project Manager

Average Salary: $110,000 – $170,000 per year

Project Managers oversee the implementation and integration of Oracle Fusion Financials in an organization. They ensure projects are delivered on time, within budget, and meet business objectives.

Key Responsibilities:

Managing end-to-end Oracle Fusion Financials projects

Coordinating with functional and technical teams

Monitoring project risks and implementing mitigation strategies

Ensuring stakeholder alignment and satisfaction

7. Oracle Fusion Financials Trainer

Average Salary: $80,000 – $130,000 per year

With the rising demand for Oracle Fusion Financials professionals, training and coaching have become a lucrative career path. Trainers help individuals and organizations upskill in Oracle Cloud Financials.

Key Responsibilities:

Conducting training sessions on Oracle Fusion Financials modules

Developing course materials and hands-on exercises

Assisting learners with real-world financial scenarios

Keeping up-to-date with the latest Oracle Cloud updates

Conclusion

Oracle Fusion Financials professionals have numerous high-paying career opportunities across various industries. With businesses increasingly adopting Oracle Cloud solutions, expertise in this domain can lead to rewarding job roles with excellent salary potential. Investing in training and certification in Oracle Fusion Financials can significantly enhance career prospects and open doors to leadership positions in the financial and ERP sectors.Are you looking to kickstart your career in Oracle Fusion Financials? Enroll in a structured training program to gain in-depth knowledge and hands-on experience, ensuring you are well-prepared for these lucrative roles. To Your bright future join Oracle Fusion Financials.

#erptree#jobguarantee#oraclefusion#oraclefusionfinancials#100jobguarantee#hyderabadtraining#financecareers#erptraining#financejobs#careergrowth

0 notes

Text

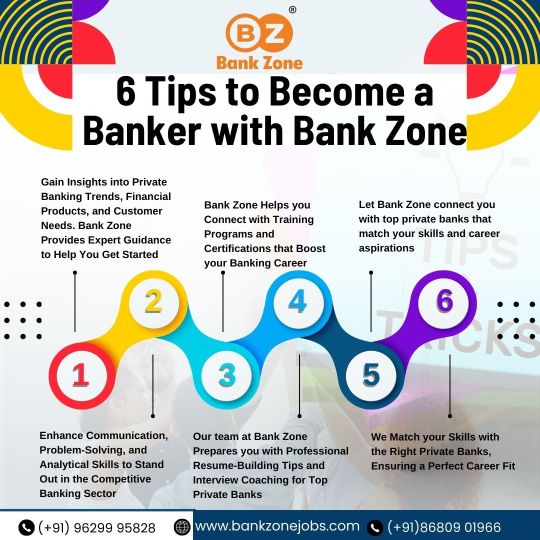

💼 Dreaming of a Career in Banking? 🚀 Bank Zone is here to guide you every step of the way! Check out these 6 expert tips to kickstart your journey as a successful banker. ✨ Learn industry trends 📚 Get training & certifications 📝 Build a strong resume 🎯 Land your dream banking job Let Bank Zone match your skills with top private banks and help you achieve the career you deserve! 📞 +91 96299 95828 | +91 86809 01966 🌐 www.bankzonejobs.com

0 notes

Text

#careergrowth#pgdm#PGDMFinance#FinanceCareers#CorporateFinance#FinanceJobs#FutureLeaders#StudyInBangalore

1 note

·

View note

Text

🚀 High-Demand, High-Paying Jobs in Europe! 💼✨

Dreaming of a successful career abroad? 🌍 These professions are in high demand with great salaries in Europe!👇

🔹 Tech Experts (AI, Data Science) 🤖💻

🔹 Medical Specialists (Doctors, Surgeons) 🏥⚕️

🔹 Finance Gurus (Analysts, Investment Bankers) 💰📈

🔹 Engineering Pros (IT, Civil, Mechanical) 🏗️⚙️

🔹 Legal Advisors & Corporate Lawyers ⚖️📝

📢 Opportunities are waiting! Start your journey today. 🌟

#IMIMS#EuropeJobs#HighPayingJobs#CareerAbroad#WorkInEurope#MedicalJobs#FinanceJobs#EngineeringJobs#LegalJobs#GlobalOpportunities#DreamJob#JobAbroad#WorkVisa

0 notes

Text

🌟 Exciting Job Opportunity at Sampath Bank! 🌟

Are you passionate about database administration and looking for a new challenge? Sampath Bank is hiring an Assistant Manager (Database Administration)! 🌐

Apply : https://readbossy.com/job/sampath-bank-job-vacancies-2025-assistant-manage/

#JobOpportunity#JoinSampathBank#CareerGrowth#DatabaseAdmin#TechJobs#ApplyNow#BankingCareer#SampathBankJobs#ExcitingCareer#FinanceJobs

0 notes

Text

Cashier Job Vacancies announced by Associated Motorways (Private) Limited in 2024. Eligible candidate can be apply for this career opportunity.

#JobVacancy #CashierJobs #CareerOpportunity #AssociatedMotorways #ApplyNow #JobHunt #FinanceJobs #NewJob2024 #CareerGrowth #HiringNow #JobSearch

#JobVacancy#CashierJobs#CareerOpportunity#AssociatedMotorways#ApplyNow#JobHunt#FinanceJobs#NewJob2024#CareerGrowth#HiringNow#JobSearch

0 notes

Text

Preparing for Success: Tips and Resources for Passing CIMA

Prepare for CIMA success! Discover practical tips on exam structure, study goals, and resources to help you pass with confidence.

here is the full article:- https://bit.ly/4eVkxQI

0 notes

Text

𝐋𝐨𝐨𝐤𝐢𝐧𝐠 𝐟𝐨𝐫 𝐡𝐢𝐠𝐡-𝐩𝐚𝐲𝐢𝐧𝐠 𝐣𝐨𝐛𝐬 𝐢𝐧 𝐊𝐮𝐰𝐚𝐢𝐭?

Explore opportunities in top industries🛠️ like Oil⛽ & Gas🧯, Banking🪙, IT🚀, Healthcare🩺, and Education🎓.

With a thriving economy and tax-free income, 𝐊𝐮𝐰𝐚𝐢𝐭 offers great career💼 growth for both residents and expatriates.

𝐒𝐭𝐚𝐫𝐭 𝐲𝐨𝐮𝐫 𝐣𝐨𝐛 𝐬𝐞𝐚𝐫𝐜𝐡🔎 𝐭𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐫𝐞𝐰𝐚𝐫𝐝𝐢𝐧𝐠 𝐨𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬! 🌎 https://www.placementindia.com/blog/high-salary-jobs-in-kuwait.htm

#highsalaryjobs#kuwaitcareer#oilandgas#financejobs#healthcarejobs#itjobs#educationjobs#kuwaitopportunities#middleeastcareers#jobmarket#topindustries#taxfreeincome#careergrowth#jobsearch#constructionjobs#skilledlabor#professionaldevelopment#kuwaitliving#careertips#jobsnews#kuwaitjobs

0 notes

Text

🚀 Unlock Your SAP FICO Consultant Career with Our Comprehensive Interview Preparation Video Course! 🚀

Are you ready to excel in your SAP FICO consultant interviews? Whether you're a fresher or an experienced candidate, our self-paced video course is designed to help you ace those tough questions and land your dream job!

🎥 Course Highlights:

Lifetime Access: Watch and learn at your own pace, whenever you want! 10+ Hours of Expert Training: Deep dive into all key areas of SAP FICO. Comprehensive Study Materials: Get all the resources you need to succeed. Real-Time Project-Based Interview Questions: Prepare for real-world scenarios and impress your interviewers. Trainer: Learn from the best with Mr. Vikram Fotani, an expert in SAP FICO.

🔍 What You’ll Gain: In-Depth Knowledge: Master General Ledger Accounting, Accounts Payable, Accounts Receivable, Asset Accounting, Controlling Basics, and more. SAP S/4HANA Overview: Understand the latest advancements in SAP. Enterprise Structure & GL Accounting: Build a strong foundation in FICO. Accounts Payables & Receivables: Get hands-on with critical financial processes. Asset Accounting, Bank Reconciliation, GST: Become proficient in essential FICO functionalities. WHT, RICEFW, Data Migration: Gain expertise in complex topics. Interview Confidence: Tackle any question with ease, thanks to our real-time project-related interview prep.

🎯 Who Should Enroll? Freshers aiming to kickstart their SAP FICO career. Experienced professionals looking to upskill and stay ahead in the competitive job market.

💡 Don’t Miss Out on This Opportunity! Enroll now and take the first step towards your successful SAP FICO consultant career.

🔗 Click here to learn more and register:https://www.gauravconsulting.com/product-page/sap-fico-interview-preparation-course

If you have any questions or need further information, feel free to reach out to us at: Website: www.gauravconsulting.com E-mail: [email protected] Call/ WhatsApp Us: +91 9158397940

#SAPFICO#InterviewPreparation#SAPCareer#SAPTraining#SelfLearning#VikramFotani#FinanceJobs#TechTraining#CareerGrowth#SAP#s4hana

0 notes

Text

✨ One decision can change your future! ✨

Chandra Prakash took that step by enrolling in IPB’s job-ready course, gaining skills & confidence to land a job as a Teller at HDFC Bank, Jaipur! 🏦

If you’re ready to start your banking career, comment “Interested” below!

#BankingCareer#FinanceJobs#CareerSuccess#IPB#SuccessStory#JobReady#DreamJob#BankingSuccess#CareerGoals#CareerGrowth#1lakhbankersby2030#pgcrb#instituteofprofessionalbanking

0 notes

Text

Understanding Financial Modules in Oracle Fusion Cloud: A Deep Dive.

Introduction

Oracle Fusion Cloud Financials is a comprehensive suite of financial management applications that enables businesses to streamline their financial operations, improve decision-making, and ensure regulatory compliance. It integrates essential financial functions such as accounting, asset management, procurement, and revenue management, providing a unified and intelligent approach to managing an organization’s financial health.

In this article, we will take a deep dive into the core financial modules of Oracle Fusion Cloud, exploring their functionalities and benefits.

1. General Ledger (GL)

Overview

The General Ledger (GL) module is the backbone of Oracle Fusion Financials. It provides a real-time, centralized view of financial data, ensuring accurate financial reporting and control.

Key Features

Multi-dimensional reporting for in-depth financial analysis

Automated journal processing and reconciliations

Multi-currency and multi-GAAP compliance

Role-based dashboards and analytics

Benefits

Provides real-time insights into financial performance

Enhances compliance with automated controls

Reduces manual effort in financial consolidation

2. Accounts Payable (AP)

Overview

The Accounts Payable module manages supplier invoices, payments, and approvals to optimize cash flow and maintain good supplier relationships.

Key Features

Automated invoice matching and approval workflows

Integration with procurement for seamless processing

AI-driven anomaly detection for fraud prevention

Self-service supplier portal for invoice tracking

Benefits

Improves payment accuracy and reduces processing time

Enhances supplier collaboration with self-service capabilities

Strengthens financial controls through audit trails

3. Accounts Receivable (AR)

Overview

The Accounts Receivable module facilitates the management of customer invoicing, collections, and revenue tracking.

Key Features

Automated invoicing and billing processes

Customer credit and risk management

Integration with revenue recognition standards

AI-powered collection strategies

Benefits

Accelerates cash flow with optimized receivables management

Reduces revenue leakage with automated billing and tracking

Enhances customer relationships through accurate and timely invoicing

4. Asset Management (FA)

Overview

The Fixed Assets module helps organizations manage the complete lifecycle of assets from acquisition to disposal.

Key Features

Automated asset tracking and depreciation calculations

Support for multiple depreciation methods

Integration with General Ledger for financial accuracy

Role-based access control for asset management

Benefits

Ensures compliance with financial reporting standards

Improves asset utilization and reduces operational risks

Provides real-time visibility into asset valuation

5. Cash Management

Overview

The Cash Management module helps businesses monitor cash positions, bank reconciliations, and liquidity planning.

Key Features

Real-time cash position tracking and forecasting

Automated bank statement reconciliation

Support for multiple banks and accounts

AI-driven fraud detection and anomaly analysis

Benefits

Enhances cash flow visibility and liquidity management

Reduces manual reconciliation efforts

Improves financial decision-making with real-time insights

6. Expense Management

Overview

The Expense Management module streamlines the tracking and approval of business expenses to improve cost control and compliance.

Key Features

AI-driven expense policy enforcement

Mobile and web-based expense submission

Automated approvals and reimbursement processing

Integration with corporate credit cards and ERP

Benefits

Reduces fraudulent or non-compliant expense claims

Enhances employee satisfaction with faster reimbursements

Provides actionable insights into expense trends

7. Tax Management

Overview

The Tax Management module helps organizations handle indirect taxes such as VAT, GST, and sales tax while ensuring compliance with tax regulations.

Key Features

Automated tax calculation and reporting

Country-specific tax compliance support

Integration with AR, AP, and GL for seamless tax processing

AI-driven tax anomaly detection

Benefits

Minimizes tax compliance risks

Reduces manual tax reporting efforts

Ensures accuracy in tax calculations and filings

Conclusion

Oracle Fusion Cloud Financials provides a robust and integrated platform for managing financial operations efficiently. With its AI-driven automation, real-time insights, and compliance capabilities, businesses can optimize financial processes, improve decision-making, and achieve greater financial transparency.By leveraging these financial modules, organizations can streamline their operations, reduce costs, and stay ahead in the competitive market. If you are looking to enhance your expertise in Oracle Fusion Financials, consider enrolling in a structured training program to gain hands-on experience with these modules. To Your bright future join Oracle Fusion Financials.

#jobguarantee#oraclefusion#oraclefusionfinancials#financecareers#financejobs#erptree#hyderabadtraining#erptraining#careergrowth#100jobguarantee

0 notes

Text

Kickstart Your Banking Career with Bank Zone! 💼💰 Looking for a rewarding career in banking? Join Bank Zone’s Banking Program and gain the skills, confidence, and knowledge needed to crack interviews and get placed in top private banks! 🏦✨ ✅ Practical Banking Training ✅ Interview Preparation ✅ Guaranteed Placement Assistance 🔥 Don’t just dream—make it happen! Enroll now and transform your passion into a successful banking career! 📞 Contact Us: 📲 +91 96299 95828 | +91 86809 01966 🌐 www.bankzonejobs.com

#BankingCareer#CareerGrowth#BankZone#PrivateBankingJobs#FinanceJobs#CareerOpportunities#JobPlacement#BankingTraining#SuccessStartsHere#DreamJob

0 notes

Text

Project management plays a crucial role across various industries, ensuring that projects are completed on time, within budget, and to the required quality standards. Salaries for project managers can vary widely depending on the country, reflecting differences in cost of living, demand for skilled professionals, and economic conditions. In this blog, we will explore the average project manager salaries in several key countries around the world.

#ProjectManager#ProjectManagement#SalaryTrends#CareerGrowth#GlobalSalaries#SalarySurvey#ProjectManagementLife#WorkAbroad#JobMarket#CareerDevelopment#ITJobs#ConstructionJobs#HealthcareJobs#FinanceJobs#EngineeringJobs#PMPCertified#CareerAdvice#JobSatisfaction#JobOpportunities#GlobalWorkforce#governance

0 notes

Text

NDB Bank Job Vacancies for Junior Executive. Applications are invited for the post of Junior Executive at NDB Bank. Eligible and interested candidates can apply.

Requirements :

Should possess a Diploma / Professional qualification in Business, Banking or Human Resources.

2 years' of Banking experience including experience in HR as well.

Excellent communication and management skills.

Proficiency in IT literacy and excellent communication skills.

#NDBankJobs#JuniorExecutive#BankingCareers#JobVacancies2024#FinanceJobs#CareerOpportunities#BankingJobs#JobHunt#ProfessionalGrowth#HiringNow

0 notes

Text

Repco Bank Recruitment 2024 | Central Government Jobs 2024 Official Website: http://www.repcobank.co.in

youtube

#sfrbc#obcrights#indian#tamilnadu#ITIFORMATIONJobs2024#TamilnaduGovernmentJobs#design#Kallakurichiincident#KallakurichiIssue#KallakurichialcoholIssue#FakeLiquorIssue#KallakurichiliquorIssue#KallaSarayam#KallaSarayamIncident#KallakurichiDistrictNews#Kallakurichi#BankingJobs#BankingCareer#BankingSector#BankJobs#FinanceJobs#Youtube

0 notes