#difference between crypto and blockchain

Explore tagged Tumblr posts

Text

The Ultimate Beginner's Guide to Stablecoins

Stablecoins represent a revolutionary development in the cryptocurrency landscape, providing a stable alternative to the highly volatile nature of traditional digital assets like Bitcoin. By pegging their value to fiat currencies, commodities, or other assets, stablecoins offer a reliable means of transaction and investment within the crypto ecosystem. Fiat-backed stablecoins such as Tether (USDT) and USD Coin (USDC) are supported by real-world reserves, ensuring their stability. Meanwhile, crypto-collateralized stablecoins like DAI are backed by other cryptocurrencies, offering greater decentralization and transparency. Despite their benefits, stablecoins are subject to regulatory scrutiny and technological risks, as demonstrated by past incidents like the Terra UST collapse.

Stablecoins bridge the gap between cryptocurrencies and traditional finance by providing a stable and liquid asset that can be used for trading, payments, and as a buffer against market volatility. They are integral to the functioning of decentralized finance (DeFi) platforms, enabling activities such as lending, borrowing, and yield farming. However, the success and reliability of stablecoins depend on robust regulatory frameworks, security measures, and technological advancements. As these aspects continue to evolve, stablecoins are expected to play an increasingly important role in the global financial system.

Intelisync is at the forefront of this financial innovation, offering services to help you navigate and leverage stablecoin technology effectively. Whether you are an investor, builder, or consumer, we can assist you in understanding Learn more....

#Algorithmic Stablecoins#Benefits of stablecoin#Can stablecoins lose their value#Challenges and Risks Crypto-collateralized stablecoins#FIAT-backed Vs Algorithmic Stablecoins#Fiat-Collateralized Stablecoinsn#How to Store Stablecoins Safely#How to Use Stablecoins in DeFi Platforms#Popular Stablecoins in the Market#The future of stablecoins#Types of Stablecoins#What is a Stablecoin A Complete Guide for Beginner#What is a stablecoin#What is the difference between Stablecoins vs. Central Bank Digital Currencies (CBDCs)?#Why Are Stablecoins So Important Intelisync blockchain development intelisync web3 agency

0 notes

Text

During the 2008 recession, my aunt lost her job. Her, her partner, and my three cousins moved across the country to stay with us while they got back on their feet. My house turned from a family of four to a family of nine overnight, complete with three dogs and five cats between us.

It took a few years for them to get a place of their own, but after a few rentals and apartments, they now own a split level ranch in a town nearby. I’ve lost track of how many coworkers and friends have stayed with them when they were in a tight spot. A mother and son getting out of an abusive relationship, a divorcee trying to stay local for his kids while they work out a custody agreement, you name it. My aunt and uncle knew first hand what that kindness meant, and always find space for someone who needed it, the way my parents had for them.

That same aunt and uncle visited me in [redacted] city last year. They are prolific drinkers, so we spent most of the day bar hopping. As we wandered the city, any time we passed a homeless person, my uncle would pull out a fresh cigarette and ask them if they had a light. Regardless of if they had a lighter on hand or not, he offered them a few bucks in exchange, which he explained to me after was because he felt it would be easier for them to accept in exchange for a service, no matter how small.

I work for a company that produces a lot of fabric waste. Every few weeks, I bring two big black trash bags full of discarded material over to a woman who works down the hall. She distributes them to local churches, quilting clubs, and teachers who can use them for crafts. She’s currently in the process of working with our building to set up a recycling program for the smaller pieces of fabric that are harder to find use for.

One of my best friends gives monthly donations to four or five local organizations. She’s fortunate enough to have a tech job that gives her a good salary, and she knows that a recurring donation is more valuable to a non-profit because they can rely on that money month after month, and can plan ways to stretch that dollar for maximum impact. One of those organizations is a native plant trust, and once she’s out of her apartment complex and in a home with a yard, she has plans to convert it into a haven of local flora.

My partner works for a company that is working to help regulate crypto and hold the current bad actors in the space accountable for their actions. We unfortunately live in a time where technology develops far too fast for bureaucracy to keep up with, but just because people use a technology for ill gain doesn’t mean the technology itself is bad. The blockchain is something that she finds fascinating and powerful, and she is using her degree and her expertise to turn it into a tool for good.

I knew someone who always had a bag of treats in their purse, on the odd chance they came across a stray cat or dog, they had something to offer them.

I follow artists who post about every local election they know of, because they know their platform gives them more reach than the average person, and that they can leverage that platform to encourage people to vote in elections that get less attention, but in many ways have more impact on the direction our country is going to go.

All of this to say, there’s more than one way to do good in the world. Social media leads us to believe that the loudest, the most vocal, the most prolific poster is the most virtuous, but they are only a piece of the puzzle. (And if virtue for virtues sake is your end goal, you’ve already lost, but that’s a different post). Community is built of people leveraging their privileges to help those without them. We need people doing all of those things and more, because no individual can or should do all of it. You would be stretched too thin, your efforts valiant, but less effective in your ambition.

None of this is to encourage inaction. Identify your unique strengths, skills, and privileges, and put them to use. Determine what causes are important to you, and commit to doing what you can to help them. Collective action is how change is made, but don’t forget that we need diversity in actions taken.

22K notes

·

View notes

Text

Layer 2 Solutions And How They Will Affect Ethereum - Technology Org

New Post has been published on https://thedigitalinsider.com/layer-2-solutions-and-how-they-will-affect-ethereum-technology-org/

Layer 2 Solutions And How They Will Affect Ethereum - Technology Org

If you’re active in the crypto domain, you’ve probably noticed a fall in the popularity and usage of Ethereum. This has mostly come from the high fees that come with making transactions on the platform, moving users from once-popular areas to more favorable ones, such as BSC and SOL.

In an attempt to bring back the old glory of ETH, a thing called Layer 2 was created, and today, LI.FI is bringing you on a journey of the solutions that Layer 2 brings with it, creating new possibilities for Ethereum.

Ethereum cruptocurrency – artistic impression. Image credit: WorldSpectrum via Pixabay, free licence

What is Layer 2?

First, let’s get to know our main actor – Layer 2. We can simply describe it as being an add-on to lower blockchains, called Layer 1, with its role being a tool for better connectivity and interoperability between blockchains. Just as DeFi Saver helps you with managing your assets, Layer 2 helps the transaction of them, making the whole process faster and smoother.

We can imagine the whole of Ethereum as one big river, and its water, representing transactions, growing more and more, causing it to overload and leak. Layer 2 solutions, in this case, would represent chutes separating from the river and taking part of the leverage of water with them, making it easier for the river to flow smoothly, just as they make transactions in the crypto world.

Now that we’ve defined Layer 2, let’s see exactly how it helps Ethereum.

Types of Layer 2 solutions and how they impact Ethereum

There are several solutions that have been and are developing to help Ethereum.

The first one is a sidechain. As described above, they serve as side blockchains running parallel to Ethereum. Two of them are connected by a bridge. Sidechains have worse security systems and serve only as a roundabout way of transactions.

The next one would be rollups. Rollups are a scaling technique that executes transactions outside the main Ethereum chain (off-chain) but stores transaction data on-chain. The core idea is to “roll up” or bundle many transactions into a single one, thereby reducing the overall load on the network. Rollups can be divided into optimistic and zero-knowledge. The main difference between them is the way they do or do not decide whether the transaction is valid.

The third solution would be state channels. State channels involve two or more participants locking a portion of the blockchain’s state (e.g., a set amount of cryptocurrency) in a multi-sig contract. Transactions between these participants then occur off-chain, and only the final state is recorded on the blockchain. Transactions within a state channel are nearly instant, as they don’t require blockchain confirmation each time. State channels offer more privacy since intermediate transactions aren’t publicly recorded on the blockchain.

One limitation of state channels is that they are best suited for scenarios where participants are known and willing to engage in multiple transactions over time.

Conclusion – Layer 2 solutions run so that Ethereum can walk!

These solutions, together with many others, have over time helped Ethereum to start getting back on track by taking the role of the accelerator of the transaction processes. By covering different holes in the Ethereum operating system, these solutions make sure the platform keeps performing better and better. Thanks to them, the future of Ethereum promises a more scalable and sustainable environment for crypto lovers to roam around!

#add-on#assets#Blockchain#bridge#bundle#channel#connectivity#crypto#cryptocurrency#data#Difference Between#Environment#Ethereum#Fintech news#Future#how#it#network#One#operating system#Other posts#privacy#process#Security#Special post#sustainable#technology#time#tool#transaction

0 notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

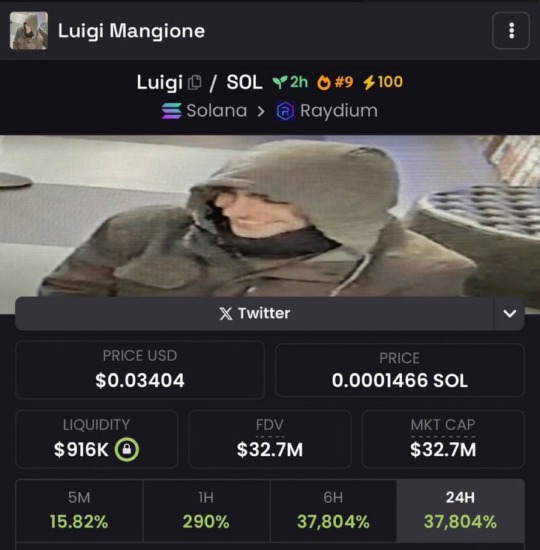

Here’s an example for meme coins:

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

27 notes

·

View notes

Text

How STON.fi and Dune Analytics Are Changing the Game for TON Blockchain Users

If you’ve ever tried navigating the world of cryptocurrency, you’ll know that it can feel like wandering through a huge city without a map. It’s exciting, but also a little confusing. Now, imagine having a powerful tool that helps you see everything clearly. That’s what the partnership between STON.fi and Dune Analytics does for the TON blockchain. Whether you’re a gamer, trader, or just curious about the crypto world, this integration is here to make things easier, more transparent, and more fun.

Why Gaming in Web3 Matters More Than Ever

Let’s talk about gaming for a second. Imagine you’re playing a game where you can earn rewards—let’s say, special items or tokens that are only valuable inside the game. In the past, these rewards were just digital items, locked within the game. You couldn’t do anything with them outside of the game world. It’s like getting a gift card that can only be used at one store.

Now, with Web3 gaming, everything changes. These items are linked to blockchain technology, making them real assets that can be traded, sold, or even used across different games. It’s like owning a gift card that works at every store in the mall.

STON.fi is at the heart of this shift. As a decentralized exchange (DEX), it allows players, developers, and traders to interact seamlessly. If you’re collecting in-game tokens or rare items, STON.fi enables you to trade or use them in real life. It’s not just about playing games; it’s about turning that time into something more valuable. Imagine getting paid for your achievements—not in game points, but real crypto that you can trade or use as you like.

Why Transparency is the Key to Making Smart Decisions

Think about the last time you made a big purchase. Maybe you bought a new phone or a laptop. Did you check the reviews, look up specs, or read up on the brand’s reputation? Probably. That’s because you wanted to make sure your money was well spent. In the world of crypto, making informed decisions is just as important, if not more. You need to know where your tokens are going, how transactions are being made, and whether the platform you’re using is trustworthy.

That’s where Dune Analytics comes in. By integrating with STON.fi, Dune gives you the ability to see exactly how the platform is performing in real-time. From transaction patterns to token movements, all the important data is available for you to explore.

For example, if you’re looking to invest or trade, Dune lets you track trends, see which tokens are being used the most, and get a better sense of how the market is shifting. It’s like having a financial advisor who helps you see the bigger picture.

What Makes STON.fi the Best Option for TON Users

Imagine you’re at a store looking to buy something important. Would you choose a place that only has a small selection, or one that offers a wide range of items, has good prices, and is easy to navigate? For most of us, the choice is obvious.

STON.fi is that better store. It’s the #1 decentralized exchange (DEX) on the TON blockchain because it offers a huge variety of tokens, fast transactions, and a smooth user experience. The platform is designed to integrate with TON wallets, meaning you can trade any TON-based token easily and securely.

It’s not just about buying and selling. STON.fi has a massive impact on the TON ecosystem, with high liquidity, meaning your trades happen quickly and without issues. Whether you're a developer or a trader, STON.fi gives you everything you need in one place.

What Does This Partnership Mean for You

Think about trying to build something without the right tools. You can’t do it alone, and you can’t just rely on guesswork. You need to see how things are working and adjust accordingly. This is exactly why the integration of Dune Analytics with STON.fi is so powerful.

For traders, it’s about making smarter decisions with all the data available to you.

For gamers, it means understanding how in-game tokens are moving, which can give you an edge in the game economy.

For developers, the partnership provides insights into how users are interacting with your project, which helps you build better products.

With this level of transparency, you’re not just guessing. You can see how everything works in real-time and make decisions based on facts, not assumptions.

Explore Dune on Stonfi

What’s Next:The Future of Web3 is Clearer Than Ever

The Dune Analytics and STON.fi partnership is paving the way for a more transparent, accessible, and rewarding Web3 experience. Whether you're gaming, trading, or building the next big project, this integration makes the process simpler and more reliable.

Imagine a world where you can earn rewards from gaming, trade them seamlessly, and know exactly how your investments are performing. That's the future of Web3, and it’s happening now. With the right tools at your fingertips, you can dive deeper into the world of blockchain and make the most out of every opportunity.

So, whether you’re new to crypto or an experienced trader, don’t just watch from the sidelines. Explore the data, engage with the community, and take full advantage of what STON.fi and Dune Analytics have to offer. The future of decentralized finance and gaming is here—and it’s all within your reach.

7 notes

·

View notes

Text

Dan Olson's newest documentary, "This Is Financial Advice," has really gotten into my head.

I should mention this first: I'm going to call the memestock redditors believing the MOASS conspiracy theory "apes" because that's one of their most common names for themselves. Like most of their other self-descriptors, it implies a lack of intelligence. There's a weird self-deprecating streak in the memestock community, which you'd think would be incompatible with a typical conspiracy theorist's overconfidence. You'd be wrong. That's part of what's interesting.

Part of me wants to break down all the places where the self-proclaimed apes' financial theories break down. Like, if we accept that Ken Griffin needs to buy back more Gamestop shares than are in existence, and that the Reddit apes already own most real shares of Gamestop, and that all of them will hodl as the stock prices rise to plausibly high stock prices, the hedge funds wouldn't be forcibly liquidated to pay arbitrarily high prices demanded by the apes. The short sale contract is a contract between the short-seller and the lender; nobody involved has an obligation to the shareholders. If stock prices rose too high, the short-seller would either cut a deal with the lender or break contract and deal with the legal consequences. But this kind of thing is pointless; the people who believe that stuff aren't available to be persuaded, and the exercise requires accepting so many absurd premises that its educational value is limited.

Another part of me is fascinated by how the whole memestock community is basically playing the world's slowest game of chicken. They seem to conceptualize their conflict with hedge funds as—well, first of as a conflict that both sides are participating in, where both sides are fighting by the same rules. But those rules are, themselves, kinda silly. The apes ascribe their inevitable, ultimate victory to the fact that they're willing to grind video games for little practical reward; their actions involve stubbornly refusing to sell the stocks they buy, even as the company they represent goes bankrupt and warns investors that those shares are likely to become worthless soon. As far as I can tell, they conceptualize the conflict as basically a contest of will—the diamond-handed apes holding onto their stocks versus the greedy hedge funds...doing...something. Spreading FUD, I guess. It's such a weird conflict and bears so little relationship to how actual finance works.

It also overlaps in some key ways with other topics Dan Olsen has covered, which isn't surprising. Everyone needs a niche, and Olsen's is increasingly online conspiracy theories and grifts. Also, /r/Superstonk users are swimming in the same waters as a lot of conspiracy theorists and crypto-bros, and the sort of person who buys GME because Reddit says it'll make them all gorrilionaires and then swallows conspiracies like tic-tacs to explain why the price is still falling is probably vulnerable to blockchain scams and flat-earth theories and such.

But there are also interesting differences! To start with, despite being a financial conspiracy theory, MOASS is remarkably non-antisemitic. There is still antisemitism, don't get me wrong, but since the villains of their conspiracy are international financial institutions, I expected more. I expected the antisemitism to be front and center, even more prominent than in most conspiracy theories. But it's not! It's probably less antisemitic than the average conspiracy theory!

There's also the fact that apes are basically trying to organize a counter-conspiracy. It's an ineffective one, considering how its plans are based on a bunch of lies they keep telling each other, but they're still organizing an effort to create a new world order with themselves at the top, by accumulating financial capital and forcing the US government to pay obligations owed to them. It sounds like the kind of thing a conspiracy theory with the average amount of antisemitism would say Jews are doing. You don't see that kind of counter-conspiracy "we're gonna take over the world" thing often, outside Christian Dominionist circles and imperialist war hawks, and their "we" is a lot broader than the apes'.

On a completely unrelated note, one of MOASS's core figureheads, DFV, is an ordinary securities broker who wanted to be a finance Influencer. He said that GameStop was probably undervalued by about 50%; it would probably see a bump in 2020 from the ninth console generation (which wouldn't be delayed by any unexpected global events that also hurt brick-and-mortar retail in general), which would give it the capital needed to potentially pivot to a business model that's more sustainable in our digital world. By saying GME was undervalued, defending his theory despite the global pandemic ruining the assumptions it was based on, and celebrating GME's obviously unsustainable prices as evidence of his theory being correct despite being caused by completely different factors, DFV became a bit of a thought leader. The apes started reading anything he said in public as a coded message to them, which lead DFV to withdraw from the memestock community and social media overall, which lead to the apes simply recasting him as the sort of shadowy cabal leader that would be a conspiracy theory villain if he wasn't supposedly supporting and leading the apes from the shadows. DFV is not perfect. He committed to his pet theory even when the basis for it collapsed, even though COVID gave him a perfect ego-preserving exit ("I was wrong, but who could have predicted the pandemic?") He then took an equally unpredictable freak event as confirmation of that theory, even though it was unrelated to the theory's premise. But he saw a bunch of increasingly conspiratorial cranks who wanted to make him a figurehead in their movement, potentially giving a huge boost to his finance Influencer dreams, and said "no, bye". I can respect that.

M

Ryan Cohen is such a character. He's a perfect example of a capitalist failson. He's an activist investor, a concept which I've been meaning to ramble about ever since I learned of the term in one of my accounting classes. But he likes attention and is willing to give apes the kind of crumbs they like for it. And maybe manipulate them for his own profit. Despite this, the apes still treat Cohen as a trustworthy savior, so much that Carl Icahn got drafted into the pantheon through flimsy association with Cohen. They think he has this master plan to create a megacorporation out of failing retailers that he has already stopped meddling with, which will somehow make the apes into billionaire cyberpunk villains.

Speaking of which: For all that the memestock apes like to position themselves against Wall Street's real-life cyberpunk villains, their predictable bad decisions are making a tidy profit for those same villains. (Aside from the one company that went out of business because it was making short sales that were considered reckless before Reddit started memestocking.) I don't have a point here, it's just ironic.

And, of course: Is the headband guy the same as the "I'm within 400 feet of an elementary school to prove the haters wrong and tell you about an unmissable business opportunity" guy from the Contrepreneurs video?

31 notes

·

View notes

Text

Omniston on STONfi DEX: The Future of Secure and Transparent Trading

In the world of decentralized finance (DeFi), security and transparency are top priorities. That's where Omniston, a groundbreaking feature on STONfi DEX, comes in. It’s set to transform the way we trade and interact with cryptocurrencies, and in this article, I’ll explain exactly what it is, how it works, and why it’s a big deal for you.

What Is Omniston

Omniston is a decentralized liquidity protocol that’s designed to simplify and enhance trading on STONfi DEX. It uses something called a Request for Quote (RFQ) mechanism, which allows traders to connect directly with market makers. This is a significant shift from traditional liquidity pools where assets sit idly, waiting to be used.

If you’ve ever tried to buy something online and had to wait for the best deal, you’ll appreciate Omniston’s approach. Instead of just offering you a price based on the liquidity available at the moment, Omniston lets you request a price and then choose the best one offered by market makers. It’s like a digital marketplace for trading, but with enhanced control and efficiency.

Why Should You Care About Omniston

You might be wondering, "Why does Omniston matter to me?" If you’ve ever traded on a decentralized exchange (DEX), you know how challenging it can be to find the right price and ensure that your funds are safe. Here’s how Omniston makes a difference:

1. You Control Your Funds, Always

The biggest concern for many in DeFi is the safety of their funds. Omniston solves this by letting you maintain control of your assets throughout the entire trading process. You don’t have to deposit your funds into a centralized system or trust someone else to hold your money. When you initiate a transaction, the funds stay in your wallet until the deal is finalized. This reduces the risk of hacks or mismanagement.

2. No Middlemen, No Trust Required

In traditional finance, you often have to trust a third party, like a bank or exchange, to facilitate the transaction. In DeFi, however, trust is minimized. Omniston uses smart contracts to ensure that trades happen only when both parties meet their agreed-upon terms. There’s no need to rely on any middleman or intermediary—everything is automatic and secure, based on the rules set by the blockchain.

3. No Hidden Fees and Full Transparency

Have you ever been caught off guard by hidden fees or unexpected costs when trading? With Omniston, that won’t happen. Thanks to its RFQ mechanism, you can clearly see the price you’ll pay for a trade before you confirm it. You won’t encounter surprise slippage or fees because everything is transparent and outlined up front. This kind of clarity is something that can often be missing in traditional trading systems.

How Does Omniston Improve the STONfi DEX Experience

STONfi DEX has always been about empowering users and making decentralized trading more accessible. With the introduction of Omniston, it takes things to a whole new level.

Unified Liquidity: In the past, liquidity has been scattered across different platforms, which can make it hard to find the best prices. Omniston brings liquidity together in one place, creating a more efficient trading environment where users can get the best deals without jumping between platforms.

Efficiency at Its Best: Omniston’s integration combines the best of on-chain and off-chain processes. Trades are initiated off-chain and then settled on-chain, allowing for quicker, cheaper, and more efficient transactions. This is like cutting through the red tape and streamlining the entire process.

Better Access for Developers: Omniston is also a boon for developers. It allows them to tap into a larger pool of liquidity and connect their projects with a wider audience. With millions of users in the TON ecosystem, this opens up a wealth of opportunities for those looking to build and grow within the space.

Why Liquidity Matters More Than You Think

If you're new to crypto trading, understanding liquidity is key. Think of liquidity like water: it needs to be abundant and easily accessible for the whole system to work efficiently. If liquidity is fragmented across multiple platforms, it becomes harder to get the best prices, and the process slows down.

Omniston solves this by creating a unified liquidity system. This ensures that when you trade, you have access to all available liquidity, meaning you can always get the best price in a fraction of the time.

The Bigger Picture: Omniston's Impact on the DeFi Ecosystem

Omniston is more than just a new feature for STONfi DEX—it’s part of a broader push to make DeFi more secure, transparent, and user-friendly. By eliminating the need for middlemen and giving traders more control over their funds, Omniston is setting a new standard for decentralized exchanges.

For you, this means a better, more reliable trading experience. Whether you’re an experienced trader or someone just getting into DeFi, Omniston simplifies the process, enhances security, and reduces fees. It’s a big leap forward in creating a decentralized financial system that actually works for everyone.

Final Thoughts

Innovation in DeFi is happening at an incredible pace, and Omniston is one of the most exciting developments I’ve seen in a while. By combining smart contract technology with a revolutionary RFQ mechanism, it provides a solution that addresses some of the biggest pain points in decentralized trading today.

The introduction of Omniston on STONfi DEX is a huge step toward making DeFi more accessible, secure, and efficient for everyone. If you’ve been hesitant to dive into decentralized trading because of security concerns or hidden fees, Omniston provides the clarity and control you need to make the leap.

It’s time to embrace the future of DeFi, and Omniston is leading the way. What do you think about these innovations? Let’s talk in the comments below!

3 notes

·

View notes

Text

Unlocking the Future of Cross-Chain Transactions: A Practical Guide

As crypto continues to grow, one major challenge stands in the way of truly unlocking the potential of blockchain technology: cross-chain transactions. Moving assets between different blockchains can feel complicated and sometimes frustrating, especially when you're trying to make a simple transfer.

But what if cross-chain transactions could be as seamless as sending an email or transferring money between your bank accounts? That’s the future we’re working towards. Let’s break down why cross-chain transactions are so difficult today and how new solutions are changing the game for users like you.

Why Cross-Chain Transactions Can Be a Hassle

To understand why cross-chain transactions are a challenge, think of blockchain networks like isolated islands. Each island has its own rules, resources, and way of doing things. Moving from one island to another means navigating unfamiliar terrain, often facing barriers like high fees, delays, and security risks.

Let’s look at some common methods for moving assets:

1. Centralized Exchanges (CEXs):

These are like big money transfer services where you can exchange one asset for another. However, you have to trust them with your funds, which can be risky. Plus, the fees are usually higher than you might expect, and the process isn’t as fast or transparent as it could be.

2. Blockchain Bridges:

These are decentralized alternatives, but the technology isn’t perfect. Blockchain bridges can fail, leading to lost funds. They’re also slow, which means waiting hours or even days to complete a transfer.

3. Decentralized Exchanges (DEXs):

DEXs allow for peer-to-peer transactions, but the problem of slippage (where the price you pay differs from the price you expected) is still very much present.

The end result? Cross-chain transactions are slow, expensive, and sometimes risky, making the process feel like more of a challenge than it should be.

A Better Way Forward: Innovative Solutions for Cross-Chain Transactions

The good news is that change is coming. Some platforms are looking at these problems from a different angle and solving them in ways that benefit users like you. Let’s explore some solutions that are making cross-chain transactions easier, faster, and more secure.

1. Locking in Rates Before You Swap (RFQ Protocol)

Imagine you want to exchange one currency for another. You don’t want to risk the exchange rate changing while you’re in the middle of the transaction. The RFQ (Request-for-Quote) protocol helps fix the rate before you even commit to the swap. This is like locking in a price before you make a purchase — it removes uncertainty and ensures you know exactly what you're getting.

2. No Need to Trust a Third Party

In most cases, when you send funds to an exchange or bridge, you're trusting that platform to hold your assets safely. With new cross-chain solutions, the funds stay in your own wallet until the moment the transaction is completed. This gives you more control and reduces the risks that come with giving a third party access to your funds.

3. Instant Transactions, No Waiting Around .

Speed is a huge factor when it comes to cross-chain transactions. With many platforms, you’re left waiting for hours for your assets to arrive. But what if transfers could be completed in seconds? The latest innovations are making this a reality, using internal databases and advanced communication methods to ensure your transaction is processed almost instantly. It’s like sending a text message instead of waiting for a letter to arrive.

4. Transparent Pricing and Lower Fees

Transparency is key in crypto. No one likes hidden fees that pop up at the last minute. The best platforms for cross-chain transactions now show you exactly what you’ll pay upfront, so there are no surprises. Plus, lower fees mean you get to keep more of your assets. It’s like seeing a menu with clear prices instead of being surprised by the final bill.

Why This Matters to You

So, what does all this mean for you as a user?

1. You Keep More of Your Assets: Lower fees and better pricing translate into more value in your pocket.

2. Your Transactions Are Faster: No more waiting hours for a transfer to go through.

3. You Stay in Control: By keeping your funds in your wallet until the transaction is completed, you reduce the risk of losing them to a third-party hack or failure.

3. Clarity in Every Step: You know exactly what you’re paying for and how much you’re getting in return.

The Bigger Picture: A Unified Blockchain Ecosystem

Cross-chain interoperability isn’t just about convenience. It’s the key to unlocking a fully connected blockchain ecosystem. Right now, blockchains operate like isolated communities, each with their own rules and standards. But as solutions like the ones discussed here evolve, blockchains will be able to communicate with each other more seamlessly, allowing assets and information to flow freely across platforms.

Think of it like how the internet revolutionized communication. When email was first introduced, you needed to be on the same platform as the person you wanted to send an email to. But over time, email systems became interoperable, meaning you could communicate with anyone, anywhere. The same will happen with blockchain — cross-chain transactions will become as simple as sending an email.

Wrapping Up: The Future Is Bright

The future of cross-chain transactions is bright, and it’s happening now. Platforms that prioritize speed, security, and transparency are paving the way for a blockchain ecosystem that’s easier to navigate, more cost-efficient, and more secure.

If you’re navigating the world of blockchain and crypto, keep an eye on these innovations. The next generation of cross-chain solutions isn’t just about making things easier — it’s about unlocking the true potential of decentralized finance for everyone.

What do you think? Have you experienced the challenges of cross-chain transactions? Feel free to share your thoughts in the comments below!

4 notes

·

View notes

Text

Is Stellar (XLM) on the Verge of a Major Breakout? Here’s What You Need to Know.

Stellar is back in the spotlight. Known for its mission to connect financial institutions and unbanked communities, Stellar’s momentum is building. Key analysts predict potential gains of over 600%. Behind this is a mix of bullish chart patterns, some well-chosen partnerships, and a few strategic moves to improve security. Let’s dive into what’s driving this potential rally.

Bullish Patterns Signal a Potential Rally for XLM

Stellar (XLM) is trading between $0.09 and $0.10, with a market cap of $2.72 billion has shown some strong bullish signals. Popular crypto analyst Javon Marks recently pointed out multiple confirmed patterns that suggest XLM could be setting up for a breakout target of around $0.681. That’s a big leap from its current price of about $0.09149. If these patterns hold, it could mean more than 600% potential gains.

Stellar’s Partnerships with Financial Giants

Stellar has been quietly building partnerships that could make a real difference in its long-term success. Its most notable partnerships include Mastercard and Franklin Templeton, representing Stellar’s real-world impact and its growing credibility.

Mastercard and Stellar are exploring ways to use blockchain to improve the speed and security of financial transactions. Then there’s Franklin Templeton, a major player in asset management, which chose Stellar to support its OnChain U.S. Government Money Fund. This partnership says a lot about Stellar’s reliability and appeal.

Enhanced Security with Blockaid

Recently, Stellar partnered with Blockaid, a company specializing in security for decentralized applications (dApps). This is more than just an upgrade; it’s a way to attract developers and users who need a secure environment for their projects.

Key takeaways

Stellar’s current price, around $0.09149, may present an attractive entry point for investors. With a growing list of partnerships and a focus on security, it is a standout project in a sea of competitors. Crypto markets remain unpredictable, and competition from similar projects like XRP adds pressure. But with a strong focus on partnerships and security, Stellar might be on the verge of something big.

Is Stellar (XLM) worth watching? let us know in the comments.

2 notes

·

View notes

Text

BonkCash Presale: Innovative Digital Token Launched on the Solana Blockchain

Introduction

Basically, the cryptocurrency landscape calls for serious investments which is usually the talk of the town. However, a cryptocurrency platform, BonkCash ($BONKC), emerges with a twist, a breath of fresh air and a playful, experimental venture that changes the script on traditional notions of value and utility. Deployed on the Solana blockchain, BonkCash invites users to engage with a digital token that eschews the weighty expectations typically associated with cryptocurrencies. Instead, it offers a fanciful journey through the realm of financial entertainment, embracing the idea that sometimes, the best experiences are those that prioritize fun over financial return.

Imagine the $BONKC token as a vibrant dance floor, alive with the dynamic movements of market forces. The symbolic 'R' in BonkCash's movement represents a lively dance, where price fluctuations create a rhythm that is both exciting and unpredictable. This isn't just another token; it's a unique ride decorated with disco lights, capturing the essence of joy and freedom. BonkCash is designed for those who want to immerse themselves in the experimental side of the crypto world, letting go of the stress of traditional investments and simply enjoying the ride.

BonkCash recognizes that many investors crave an experience that go beyond financial gain. The project stands firmly on the principle that $BONKC holds no essential value, utility, or promise of financial returns. Instead, it is an exploration of the intersection between digital currency and entertainment, aiming to create a community that appreciates the sheer delight of participating in something different. As BonkCash embarks on this space dance, it invites users to join in on the fun, reminding us that sometimes the journey is more important than the destination.

BonkCash, symbolized as $BONKC, is an innovative digital token launched on the Solana blockchain. Designed purely for entertainment and experimental purposes, $BONKC does not hold any intrinsic value or promise of financial returns. Unlike traditional cryptocurrencies, BonkCash has no dedicated roadmap or promise of utility, making it a unique addition to the landscape of digital assets.

BonkCash Presale: An Experimental Journey on the Solana Blockchain

The Presale Opportunity: As part of its introduction to the market, BonkCash is hosting a presale that allows early investors to acquire $BONKC at a special rate: 1 SOL for 1,000,000 $BONKC tokens. This presale is an exciting opportunity for participants to secure their stake in the token before its official launch. With a straightforward entry point—0% selling tax and no fees—the presale aims to promote accessibility and encourage participation from a wide audience. Investors can dive into this venture without the worry of hidden costs, making it easier to engage with the token and its community.

Airdrop Mechanism: Central to the appeal of $BONKC is its unique airdrop mechanism designed to foster community involvement. Unlike many other tokens, which often rely on complex strategies for growth, BonkCash aims to create excitement through periodic airdrop events. Token holders can earn rewards by engaging with the community—simply by following social media channels, tweeting about the project, and showcasing their support.

The airdrop process is automated, with a Telegram bot facilitating the distribution of tokens. For every point earned through community activities, participants can convert their points into $BONKC tokens, creating an engaging and interactive experience. The community plays a significant role in determining the conversion ratio after the token is officially listed, emphasizing collective involvement in the growth of $BONKC.

To further bolster this community-centric approach, 5% of the total token supply is allocated for the “airdrop bomb,” designed to reward the top 50,000 active Solana wallets. This strategic distribution ensures that the most engaged users are recognized, while also enhancing the BonkCash brand within the crypto ecosystem.

The R-Trajectory: A Funky Price Movement: BonkCash aims to distinguish itself from other meme tokens by introducing what it calls the "R" trajectory, a playful metaphor for the token's price movement. Instead of the typical downward trends often associated with memecoins, BonkCash aims for an upward trajectory, likened to a dance floor where price dynamics groove to the rhythm of the market. This unique concept positions $BONKC as a light-hearted and enjoyable investment option - inviting participants to experience the thrill of a special ride in the crypto space.

Community and Engagement: The BonkCash ecosystem places a strong emphasis on community involvement. By leveraging social media engagement, the project encourages participants to contribute actively, creating a vibrant atmosphere of shared excitement. The presale not only provides a financial opportunity but also fosters a sense of belonging among participants, turning investors into community members who collectively navigate the ups and downs of the token's journey.

Pre-sale Details

● The amount for presale is 1,000,000,000 BONKC tokens.

● End of Pre-sale: 2024-12-20 12:00 (UTC).

● Pre-sale price 1 SOL = 1,000,000 BONKC. Min buy 0.5 SOL, Max buy 10 SOL.

● Use your wallet to send SOL to the presale address provided on this platform. Our system will automatically send BONKC tokens to your wallet instantly. You can send SOL any amount.

● The distribution of BONKC will be based on SOL time arrived. First come, first served.

● Once the presale is over. 30% of the funds raised will be locked in RAYDIUM liquidity. Similarly, 30% of the funds raised will be used for listing on Huobi and Hotbit exchanges. The other 40% of the funds raised will be used to buyback BONKC tokens after Pre-sale. This action will prevent people from dumping.

Tokenomics

Token Name: BonkCash

Symbol: $BONKC

Blockchain: Solana

Total Supply: 100%

1 Billion $BONKC will be minted in total. They will be distributed into 8 main pools, each with different unlocking schedules.

Liquidity Pool (17%): Fully Unlocked at Launch

Ecosystem (15%): 10% unlocked 1 month after launch. Remaining 90% unlocks continuously from year 1 to year 4.

Presale (50%): Fully unlocked at launch

Contributors (5%): 33% unlocked at year 1. Remaining 67% unlocks continuously from year 1 to year 2.

Partnerships and marketing (3%): 25% unlocked at launch. Remaining 75% unlocks continuously from year 1 to year 4.

Airdrop bomb (5%): Fully unlocked at launch

CEX launchpool (2%): Fully unlocked at launch

Advisory (3%): 33% unlocked at year 1. Remaining 67% unlocks continuously from year 1 to year 2.

Roadmap

October, 2024

Official website launched & smart contract deployed Pre-sale & Airdrop Started Pre-sale & Airdrop Started Developing the BonkCash platform

December, 2024

Pre-sale completed Airdrop distributed Listed on Raydium Listed on Coinmarketcap and CoinGecko The second marketing campaign

March, 2025

BonkCash listed on Hotbit, Binance and Coinbase exchanges BonkCash platform launched. Launch swap platform, staking program and liquidity pool. The third marketing campaign.

July, 2025

Launch of mobile apps and DeFi wallet Launch of the Borrow platform Listed on the top 10 CMC Exchange. Roadmap update

Conclusion

As the BonkCash presale progresses, participants are encouraged to embrace the spirit of experimentation and creativity that defines the project. This isn't about chasing profits or guaranteeing returns; it’s about engaging with a digital asset that revels in its purposelessness, inviting users to explore a space where entertainment takes precedence over traditional financial metrics. The $BONKC token represents a chance to be part of a unique narrative—a journey that doesn’t adhere to the conventional trajectories seen in most cryptocurrencies.

BonkCash symbolizes a shift in perspective, one that encourages participants to dance to the rhythm of market dynamics without the burden of expectation. It champions a community-driven ethos, inviting individuals from all walks of life to experience the thrill of something new and unexpected. By focusing on enjoyment and experimentation, BonkCash seeks to cultivate an environment where creativity flourishes, and the exploration of digital tokens becomes a joyous adventure rather than a calculated risk.

While many financial projects prioritize immediate gains, BonkCash stands out as a reminder that the crypto space can also be a playground, an arena for innovation, fun, and community engagement. As $BONKC embarks on its unique journey, participants are not merely investors; they are dancers on a vibrant floor, celebrating the unpredictable nature of this digital landscape. BonkCash invites everyone to join the festivities, offering an experience that promises to be as entertaining as it is unconventional. The presale isn't just an entry point; it’s an invitation to be part of something truly special, a lively, special celebration in the heart of the crypto world. Bonkcash have come to change the narrative by making crypto lovers to see the other side of the crypto space.

For more information about BonkCash please visit the following websites: (formula)

Website: https://bonkcash.io/

Telegram: https://t.me/BonkCashOfficial

Twitter: https://x.com/BonkCash

Whitepaper: https://bonkcash.io/whitepaper.html

Bitcointalk Campaign: https://bitcointalk.org/index.php?topic=5512819.0

#cryptocurrency #Airdrop #Bitcoin #BonkCash #BonkCash

Author’s Information

Proof of Authentication: https://bitcointalk.org/index.php?topic=5512819.msg64641603#msg64641603

Forum Username: evichi

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=1717893

Participated Campaign: Article

Solana Wallet Address: JCjBDjiRrkxXFLHfS46AeRrTx3XPMrCqd386HBBSE4zc

Email: [email protected]

2 notes

·

View notes

Text

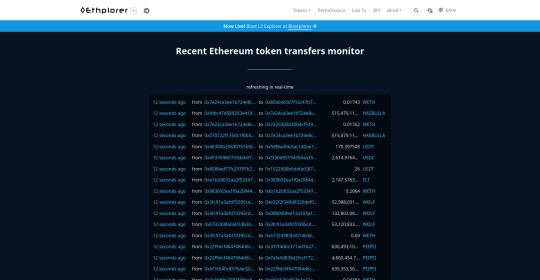

Hey so remember when everyone was all "Cryptcoins are great because they're anonymous"? Yeah, no, they're not.

With a bit of Googling, I found ethplorer.io, which allows you to see what's happening on the Etherium blockchain. How can I do this? Because the blockchain is kinda public by default.

So for people who don't know how blockchains work (including a lot of cryptobros), the blockchain is basically a record of transactions and developments that is copied and stored on multiple different copies for crosschecking, but it also means that it has to be public so people (or rather their cryptowallets) know what is going on, which means that you can just fuckin' view payments and transfers between users and even how much etherium they have.

Now I know you are all "hmm, yeah, but they're just numbers on a screen, people aren't going to, like, be able to identify people". Well here's the thing: If you buy crypto with real, irl money (like on Coinbase), that can be tracked and you can be identified from that. So unless you mine your own crypto (which is expensive and can't be done quietly), you can be tracked.

Oh, and, let's say, you were using crypto for arrestable activities. The authorities could, once they have your comp, see your wallet address, and see who you have transferred money to or who has sent you money, and do that with other people who were arrested, and, through that, build up a network of payments based on the numbers, meaning that your "anonymity" through your wallet address gets chipped away by your associates.

In short, not only is crypto not anonymous, anyone can see how much crypto you have and where you got it and where you sent it.

5 notes

·

View notes

Text

Stablecoins or crypto?

Bloomberg released an interview with Austin Campbell, an adjunct professor at Columbia Business School.

It was a discussion, mainly devoted to the role of stablecoin in the financial system. The interview is complimentary towards the stablecoins and generally quite skeptical towards the "traditional" crypto, WEB3 and DeFi.

It is important to understand the difference between stablecions and traditional cryptocurrencies. Both are based on blockchain. However, a stablecoin with the appropriate fiat security is within the traditional financial system. In fact, the technology of storage and transactions changes, but the economic meaning of a stablecion is not basically different from a fiat.

Cryptocurrencies like bitcoin are actually independent from states and have their own rules of emission and control. Ethereum-style blockchain is a multifunctional financial tool.

Our Forcecoin is a tool with fundamental value as a financial part of the Meta Force platform.

Stablecoins are susceptible to all the ills of modern economics, while decentralized crypto can become the basis for a new financial system and has every chance of gaining a head start in global competition.

4 notes

·

View notes

Text

Simplifying Cross-Chain Transactions: A User-Friendly Guide

If you've been in the crypto world for a while, you’ve probably faced the challenge of transferring assets between different blockchains. Cross-chain transactions, or moving tokens between two different blockchain networks, often feel complicated and cumbersome. But what if there were a way to make this process smoother, more transparent, and easier for everyone?

In this article, we’ll explore why cross-chain transactions are tricky, the new solutions that are making them easier, and how this could change the way you manage your crypto.

Why Cross-Chain Transactions Are Harder Than They Should Be

Think of each blockchain like a different country. Each one has its own language, its own rules, and its own systems. Transferring assets between them is like trying to send money from one country to another — it can be slow, expensive, and confusing.

Here are the three main ways people usually make cross-chain transfers:

1. Centralized Exchanges (CEXs):

You can use these platforms to exchange one crypto asset for another. But, just like a money transfer service, you have to trust the platform with your funds. There are often high fees, and the process isn’t as fast as you might like.

2. Blockchain Bridges:

These are decentralized alternatives. They let you move assets between blockchains without a middleman. However, they’re not always reliable and can be slow. If something goes wrong, you risk losing your funds.

3. Decentralized Exchanges (DEXs):

These exchanges don’t require a central authority, and they can help you trade assets directly with other people. But again, issues like slippage (where the price of an asset changes during the trade) can still make the process more complicated than it should be.

In short, cross-chain transactions are not as simple, fast, or secure as they should be, and the current methods often leave us frustrated.

The Future of Cross-Chain Transactions: Better, Faster, More Secure

The good news is that things are changing. Innovations in the blockchain space are starting to make cross-chain transactions faster, more affordable, and much easier. Here are a few ways this is happening:

1. Locking in Your Exchange Rate Before You Swap

One of the biggest problems when swapping tokens between blockchains is not knowing what price you’re getting. Imagine going to a currency exchange and hoping for the best rate, not knowing if it’ll change as you’re making your transaction. With new solutions like Request-for-Quote (RFQ) protocols, you can lock in your exchange rate before you commit to the transaction. It’s like agreeing on a price at the store before you make the purchase. No surprises.

2. Keeping Full Control of Your Funds

Traditionally, when you use an exchange or a bridge, you have to send your funds to their platform before completing the transaction. This can feel risky because you’re trusting them with your crypto. With newer cross-chain technologies, your funds stay in your wallet until the transaction is confirmed. This gives you more control and reduces the risks of losing your assets.

3. Instant Transactions with Minimal Wait Time

If you’ve ever transferred assets between blockchains, you know that waiting for your transaction to be confirmed can take hours. The good news? Some platforms are now making these transactions almost instant. Using new tech that improves communication between blockchains, transfers can happen in seconds instead of hours — making cross-chain trading feel more like a fast, efficient bank transfer.

4. Transparent Fees and Lower Costs

When you’re dealing with cross-chain transactions, it’s frustrating to encounter hidden fees at the last minute. The good news is that many new platforms show you exactly what you’ll pay upfront, eliminating surprise charges. With more competitive fees, you can save money, making the entire experience more affordable.

What Does This Mean for You

So, why should you care?

More Control: You can move assets between blockchains without relying on third parties. You stay in control of your funds at all times.

Faster Transactions: No more waiting for hours for your assets to arrive.

Lower Costs: With clearer pricing and lower fees, you keep more of your assets.

Easier Experience: A simpler, faster process means fewer headaches for you.

These improvements make cross-chain transactions not just easier, but also safer and more cost-effective.

A Glimpse into the Future: A Connected Blockchain Ecosystem

In the long run, these improvements will lead to a more connected blockchain world. Think of it like the early days of the internet. When email first started, you couldn’t send messages between different platforms. But over time, email systems became interoperable, and today you can send an email from any platform to any other.

The future of cross-chain transactions is similar. As different blockchains become better at communicating with each other, moving assets between them will be as simple as sending an email. The more seamless the process becomes, the easier it will be for everyone to participate in the growing world of decentralized finance.

Wrapping Up: Embracing the Change

Cross-chain transactions are becoming more accessible, and the technology behind them is improving. Whether you're trading on a DEX, using a blockchain bridge, or sending assets between different networks, new solutions are making the process faster, more secure, and more user-friendly.

As blockchain technology continues to evolve, cross-chain interoperability will become the norm, helping to unlock the true potential of decentralized finance. So, keep an eye on these developments — the future of crypto is about to get much more connected.

What’s your experience with cross-chain transactions? Have you faced any challenges or found new solutions that made things easier? Share your thoughts in the comments — I’d love to hear your feedback!

5 notes

·

View notes

Text

The Rise of Blockchain Payment Gateways: How They Are Changing Transactions

In recent years, cryptocurrency has gone from being a tech experiment to a practical tool for everyday use. One of the most exciting developments in this space is the rise of blockchain payment gateways. These platforms are giving businesses a way to accept payments in digital currencies like Bitcoin, Ethereum, and stablecoins. But what exactly makes blockchain payment gateways so special, and how can they benefit businesses? Let’s break it down.

What Is a Blockchain Payment Gateway?

Think of a blockchain payment gateway as the bridge between your business and customers who want to pay with cryptocurrency. Instead of relying on traditional banks or payment processors, these gateways use blockchain technology to send and receive payments. Transactions are quick, secure, and work without needing a middleman.

What Makes Them Different?

Direct Transactions: With blockchain, payments go directly from the customer to the business. No middle layers. No unnecessary waiting.

Global Payments Without Borders: Cryptocurrencies don’t care about borders or bank restrictions. A customer from New York can pay a shop in Tokyo just as easily as a local.

Security You Can Trust: Blockchain’s design makes it tamper-proof. Each transaction is recorded on a public ledger, ensuring transparency and preventing fraud.

Lower Fees: Businesses save money because blockchain payments skip the usual banking fees and currency conversion costs.

Privacy for Everyone: Customers don’t need to share personal banking details, which makes transactions safer for them and simpler for businesses.

Why Should Businesses Care?

Cryptocurrency adoption is growing fast. By accepting crypto payments, businesses can:

Reach New Customers: Crypto users are a growing audience. Adding this option could bring in customers who wouldn’t otherwise buy.

Prevent Payment Issues: Traditional systems often have chargebacks, where a customer disputes a payment and the money is reversed. Blockchain payments are final—once made, they can’t be undone.

Stay Ahead of the Curve: Digital currencies are becoming mainstream. Adopting blockchain payments now can put businesses ahead of competitors.

Where Can This Be Used?

E-commerce: Online stores can give customers an easy way to pay with crypto.

Subscriptions: Services like streaming platforms or SaaS companies can use blockchain to handle recurring payments.

Freelancers: Blockchain allows individuals to get paid faster and without high transfer fees, no matter where the client is.

How to Start Using Blockchain Payments

Getting started with a blockchain payment gateway is easier than you might think. Platforms like OxaPay provide tools that help businesses quickly integrate crypto payments. These gateways often include:

Simple setup tools, like plugins for popular platforms like WooCommerce.

Options to accept multiple cryptocurrencies, so customers can pay with their preferred coin.

Features like fixed payment addresses or automated notifications to keep things organized.

Why Blockchain Payments Are the Future

At its core, blockchain is about efficiency and fairness. It simplifies payments, lowers costs, and opens up opportunities for businesses to connect with a global audience. Whether you're running a small shop or a large company, embracing blockchain payment gateways can give you an edge in today’s competitive market.

The shift to digital currency is already happening. The only question is: will your business be part of it?

For more straightforward tips on using blockchain in your business, explore other posts on Blockchain Business Talk. We’re here to help you take the next step with confidence.

1 note

·

View note

Text

As the criminal trial of FTX founder Sam Bankman-Fried unfolds in a Manhattan courtroom, some observers in the cryptocurrency world have been watching a different FTX-related crime in progress: The still-unidentified thieves who stole more than $400 million out of FTX on the same day that the exchange declared bankruptcy have, after nine months of silence, been busy moving those funds across blockchains in an apparent attempt to cash out their loot while covering their tracks. Blockchain watchers still hope that money trail might help to identify the perpetrator of the heist—and according to one crypto-tracing firm, some clues now suggest that those thieves may have ties to Russia.

Today, cryptocurrency tracing firm Elliptic released a new report on the complex path those stolen funds have taken over the 11 months since they were pulled out of FTX on November 11 of last year. Elliptic's tracing shows how that nine-figure sum, which FTX puts at between $415 million and $432 million, has since moved through a long list of crypto services as the thieves attempt to prepare it for laundering and liquidation, and even through one service owned by FTX itself. But those hundreds of millions also sat idle for all of 2023—only to begin to move again this month, in some cases as Bankman-Fried himself sat in court.

Most tellingly, Elliptic's analysis is the first to note that whoever is laundering the stolen FTX funds appears to have ties to Russian cybercrime. One $8 million tranche of the money ended up in a pool of funds that also includes cryptocurrency from Russia-linked ransomware hackers and dark web markets. That commingling of funds suggests that, whether or not the actual thieves are Russian, the money launderers who received the stolen FTX's funds are likely Russian, or work with Russian cybercriminals.

“It’s looking increasingly likely that the perpetrator has links to Russia,” says Elliptic's chief scientist and cofounder Tom Robison. “We can’t attribute this to a Russian actor, but it’s an indication it might be.”

From the first days of its money laundering process following the theft, Elliptic says the FTX thieves have largely taken steps typical for the perpetrators of large-scale crypto heists as the culprits sought to secure the funds, swap them for more easily laundered coins, and then funnel them through cryptocurrency "mixing" services to achieve that laundering. The majority of the stolen funds, Elliptic says, were stablecoins that, unlike other forms of cryptocurrency, can be frozen by their issuer in the case of theft. In fact, the stablecoin issuer Tether moved quickly to freeze $31 million of the stolen money in response to the FTX heist. So the thieves immediately began exchanging the rest of those stablecoins for other crypto tokens on decentralized exchanges like Uniswap and PancakeSwap—which don't have the know-your-customer requirements that centralized exchanges do, in part because they don't allow exchanges for fiat currency.

In the days that followed, Elliptic says, the thieves began a multi-step process to convert the tokens they'd traded the stablecoins for into cryptocurrencies that would be easier to launder. They used “cross-chain bridge” services that allow cryptocurrencies to be exchanged from one blockchain to another, trading their tokens on the bridges Multichain and Wormhole to convert them to Ethereum. By the third day after the theft, the thieves held a single Ethereum account worth $306 million, down about $100 million from their initial total due to the Tether seizure and the cost of their trades.

From there, the thieves appear to have focused on exchanging their Ethereum for Bitcoin, which is often easier to feed into "mixing" services that offer to blend a user's bitcoins with those of other users to prevent blockchain-based tracing. On November 20, nine days after the theft, they traded about a quarter of their Ethereum holdings for Bitcoin on a bridge service called RenBridge—a service that was, ironically, itself owned by FTX. “Yes, it is quite amazing, really, that the proceeds of a hack were basically being laundered through a service owned by the victim of the hack,” says Elliptic's Robison.

On December 12, a month after the theft, most of the bitcoins from that RenBridge trade were then fed into a mixing service called ChipMixer. Like most mixing services, the now-defunct ChipMixer offered to take in user funds and return the same amount, minus a commission, from other sources, in theory muddling the money's trail on the blockchain. But Elliptic says it was nonetheless able to trace $8 million worth of the money to a pool of funds that also included the proceeds from Russia-linked ransomware and dark web markets, which was then sent to various exchanges to be cashed out.

“There might have been a handoff from a thief to a launderer,” says Robison. “But even if that was the case, it would mean the thief was in contact with someone who is part of a Russian money laundering operation.” Robison adds that Elliptic has other intelligence pointing to the money launderers' Russian ties, but doesn't yet have permission from the source to make it public.

After their initial attempt to launder a portion of the funds through ChipMixer, the thieves went strangely quiet. The rest of their Ethereum would remain dormant for the next nine months.

Only on September 30, just days ahead of Bankman-Fried's trial, did the remainder of the funds begin to move again, Elliptic says. By that time, both RenBridge and ChipMixer had been shut down—RenBridge due to its parent company FTX's collapse and ChipMixer due to a law enforcement seizure. So the thieves pivoted to trading their Ethereum for Bitcoin on a service called THORSwap and then routing those bitcoins into a mixing service called Sinbad.

Sinbad has over the past year become a popular destination for criminal cryptocurrency, particularly crypto stolen by North Korean hackers. But Elliptic's Robison notes that despite this, the movement of funds appears less sophisticated than what he's seen in the typical North Korean heist. “It doesn't use some of the services that Lazarus typically use,” Robison says, referring to the broad group of North Korean state-sponsored hackers known as Lazarus. “So it doesn't look like them.” Robison notes that Sinbad is likely a rebranding of a mixing service called Blender that was hit with US sanctions last year, in part for helping to launder funds from Russian ransomware groups. Sinbad also offers customer support in English and Russian.

Does the timing of those new movements of funds ahead of—and even during—Bankman-Fried's trial suggest someone with insider knowledge is involved? Elliptic's Robison notes that, while the timing is conspicuous, he can only speculate at this point. It's possible that the timing has been purely coincidental, Robison says. Or someone might be moving the money now to make it look like an FTX insider—potentially one who fears they might be about to lose their internet access. Neither Bankman-Fried nor his fellow executives have been charged with the theft, and some of the money movements have taken place while Bankman-Fried has been in court, with only a laptop disconnected from the internet.

Eventually, no doubt, the thieves will attempt to cash out more of their stolen and laundered cryptocurrency for some sort of fiat currency. Robison is still hopeful that, despite their use of mixers, they can be further identified at that point. “I think they probably will be successful in cashing out at least some of these funds. I think whether they're going to get away with it is a separate question,” says Robison. “There's already a blockchain trail to be followed, and I think that trail will only become clearer with time.”

Two other cryptocurrency tracing firms, TRM Labs and Chainalysis, have both been hired by FTX's new regime under CEO John Ray III to aid in the investigation. TRM Labs declined to comment on the case. Chainalysis didn’t respond to WIRED’s request for comment, nor did FTX itself.

As those cryptocurrency tracers continue to follow the money, we may someday have a clearer answer to the mystery of the FTX heist. In the meantime, however, FTX's many aggrieved creditors will be left to keep one eye on Bankman-Fried's trial and the other on the Bitcoin blockchain.

12 notes

·

View notes

Text

Why Omniston on STONfi DEX is a Game Changer for DeFi

When I first heard about Omniston, I was immediately intrigued. After spending some time diving into the details, I realized just how revolutionary this protocol is for the future of decentralized finance (DeFi). If you're looking for a simple, no-fluff explanation of why Omniston matters, here's what you need to know.

What Exactly is Omniston?

In simple terms, Omniston is a new way to trade and exchange crypto, built right into STONfi DEX. It’s a decentralized liquidity protocol that connects market makers and traders directly, without relying on traditional liquidity providers or centralized services.

To make it easier to picture, imagine going to an auction. You put out a request for something you want to buy, and the sellers bid to give you the best price. Once you find your match, you complete the deal right then and there, no middlemen involved. That's how Omniston works—just on the blockchain.

The Key Benefits of Omniston

So, why should you care about Omniston? Here are the key advantages that make it stand out from the rest:

1. Security Without Deposits:

Normally, when you want to trade crypto, you have to deposit your funds in a liquidity pool or trust a third party to hold your assets. With Omniston, there's no need for any of that. The funds only move during the transaction, and smart contracts ensure that your assets are secure. It’s like making a purchase with a trusted middleman, but without actually handing your money over until you’re ready to complete the deal.

2. No Need for Third-Party Trust:

One of the biggest risks in traditional trading is trusting a third party to hold your funds. But with Omniston, there's no need for that trust because the blockchain handles everything. Think of it like using an online payment service where the system automatically ensures both buyer and seller are protected. You don’t have to worry about someone walking off with your funds.

3. No More Slippage:

Slippage—when the price of an asset changes between the time you place an order and when it gets filled—is one of the most annoying issues in trading. With Omniston, this doesn’t happen. The RFQ (Request for Quote) system allows you to see exactly how many tokens you’ll receive before confirming the trade. So, no surprises or price hikes at checkout.

A Unified Liquidity Solution

One of the biggest headaches in DeFi is fragmented liquidity. Different platforms often have their own pools of liquidity, which can make it hard to get the best prices. Omniston solves this by consolidating all liquidity into one service, giving you access to a broader range of projects and allowing developers to reach a larger user base.

Imagine trying to find a rare book. If you go to one bookstore, it might be out of stock, but if there’s a network of bookstores sharing inventory, you’ll find it easily. That’s what Omniston does for liquidity.

More Affordable, Faster Trading

By combining on-chain transactions with off-chain orders, Omniston lowers the cost of trading. The result? Faster, more affordable transactions. Think of it like upgrading from taking a bus to using a high-speed train—you get to your destination quicker, and it’s more efficient.

Why Omniston Matters on STONfi DEX

Omniston is integrated into STONfi DEX, and that’s a game-changer. By combining these two innovations, we’re not just improving one part of DeFi—we’re raising the bar across the entire space. Here’s how:

1.Better Security & Transparency: Every transaction is verified on the blockchain, and you don’t need to trust a middleman to make it happen.

2.Access to a Unified Liquidity Pool: No more jumping between platforms to find the best deal. Everything you need is in one place.

3.Efficient, Low-Cost Trading: Faster transactions and lower fees make this a win for traders and projects alike.

For those of us who’ve been around the crypto space for a while, Omniston is a breath of fresh air. It fixes the problems that have been holding DeFi back for too long, and it’s only going to get better as more people start using it.

Final Thoughts

If you’re new to DeFi, Omniston is an exciting development. If you’re an experienced trader or developer, it’s even more thrilling because it’s changing the entire landscape of decentralized exchanges.

By eliminating issues like liquidity fragmentation, slippage, and the need for third-party trust, Omniston is setting the stage for a new era in DeFi. This is just the beginning, and I’m excited to see how the future unfolds with innovations like these driving the space forward.

What are your thoughts on Omniston and STONfi DEX? How do you see these developments impacting the future of DeFi? I’d love to hear from you in the comments below!

5 notes

·

View notes