#consultant for MSME registration

Explore tagged Tumblr posts

Text

Gst Input and Output Tax Calculation

What Is GST Input Tax?

The GST paid on purchases of products or services utilized for business operations is referred to as input tax. In essence, GST input and output tax calculation is the tax that a company pays when it purchases inputs like equipment, raw materials, or services that are required for its operations. Businesses can claim credit for this tax through the Input Tax Credit, which lowers their total GST obligation.

Example of Input Tax

If a manufacturer purchases raw materials worth ₹100,000 and pays 18% GST, the input tax is calculated as:

https://assistfile.com/wp-content/uploads/2024/12/assistfile89.png

What Is GST Output Tax?

Output tax refers to the GST collected by a business on the sale of its goods or services. It is the tax liability a business incurs by selling its products or services to customers.

Example of Output Tax

If the manufacturer sells finished goods worth ₹200,000 and charges 18% GST, the output tax is calculated as:

Output Tax = Sale Value × GST Rate = ₹200,000 × 18% = ₹36,000

How Input Tax Credit Works

Input Tax Credit allows businesses to offset the input tax paid against the output tax collected. This reduces the overall GST liability and ensures that taxes are paid only on the value addition at each stage of the supply chain.

The formula for GST liability

Net GST Liability = Output Tax – Input Tax

Using the above examples:

Output Tax = ₹36,000 Input Tax = ₹18,000 Net GST Liability = ₹36,000 – ₹18,000 = ₹18,000

Thus, the manufacturer needs to pay ₹18,000 as GST to the government.

Step-by-Step Calculation of GST Input and Output Tax

Step 1: Identify Input and Output Transactions

Input transactions include purchases of goods, raw materials, or services.

Output transactions include sales of goods or services.

Step 2: Calculate Input Tax

Determine the purchase value of inputs.

Apply the applicable GST rate to compute input tax.

Step 3: Calculate Output Tax

Determine the sales value of goods or services.

Apply the applicable GST rate to compute output tax.

Step 4: Claim Input Tax Credit

Subtract the input tax from the output tax to calculate the net GST liability.

Step 5: File GST Returns

Report the input tax, output tax, and net GST liability in your monthly GST returns (GSTR-3B).

Conditions for Claiming Input Tax Credit

To claim ITC, businesses must meet the following conditions:

Possession of a valid tax invoice.

Receipt of goods or services.

Payment of the supplier’s tax liability.

Filing of GST returns.

Input goods or services should not fall under the blocked categories as per GST law.

Examples of Input and Output Tax Calculations

Example 1: Retailer Selling Goods

Purchase (Input): ₹50,000, GST = 12%

Input Tax = ₹50,000 × 12% = ₹6,000

Sale (Output): ₹80,000, GST = 12%

Output Tax = ₹80,000 × 12% = ₹9,600

Net GST Liability:

Output Tax – Input Tax = ₹9,600 – ₹6,000 = ₹3,600

Example 2: Service Provider

Input Services: ₹30,000, GST = 18%

Input Tax = ₹30,000 × 18% = ₹5,400

Output Services: ₹50,000, GST = 18%

Output Tax = ₹50,000 × 18% = ₹9,000

Net GST Liability:

Output Tax – Input Tax = ₹9,000 – ₹5,400 = ₹3,600

Common Challenges in GST Calculation

Incorrect GST Rates: Ensure the correct GST rates are applied based on product or service categories.

Delayed Filing of Returns: Filing late may result in penalties and loss of ITC claims.

Mismatch in Invoices: Any discrepancies between purchase and sales invoices can delay ITC claims.

Tips for Accurate GST Input and Output Tax Calculation

Use reliable accounting software to automate tax calculations.

Regularly reconcile purchase and sales records.

Stay updated with GST rate changes and rules.

Consult a tax professional for complex transactions.

Conclusion

Understanding GST input and output tax calculation is crucial for businesses to manage their tax liabilities effectively. By leveraging the Input Tax Credit, businesses can significantly reduce their GST payments. Proper record-keeping, timely filing, and adhering to GST compliance rules ensure a smooth process and prevent unnecessary financial burdens.

For seamless GST management, consider adopting digital tools or seeking expert advice to ensure accuracy and compliance with GST laws.

0 notes

Text

0 notes

Text

KVR TAX Services is the Udyam Registration services in Hyderabad. Apply now for the new udyam aadhar registration, in Gachibowli, Flimnagar, Kondapur, Lingampally.

#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#register a business in hyderabad#register company in hyderabad#firm gst registration process in hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in hyderabad#Msme Registration Consultants in hyderabad#MSME Registration Online in hyderabad#iec code registration in hyderabad#export and import registration in hyderabad

0 notes

Text

Best MSME Registration Online Services | SRV Associates

At SRV Associates, we provide MSME registration online services that are both affordable and well-planned. Our team of experts understands the importance of timely registration for small and medium-sized enterprises, we try to make the process as hassle-free as possible keeping in mind the legalities. With our MSME Registration Online in Faridabad, you can focus on growing your business

#MSME registration online services#MSME registration online in Faridabad#msme registration in noida#msme registration consultants in delhi

0 notes

Text

MSMEs, which include micro, small, and medium-sized businesses, have emerged as a flourishing sector of the Indian economy in recent years, playing an essential role in the country's socioeconomic improvement. These businesses are very helpful in creating jobs, producing goods, and exporting products. The duty of promoting and encouraging the growth of MSMEs mainly falls under the state governments

#llp registration#private limited company registration#opc registration#nidhi company registration#msme registration#trademark registration#startup india registration#sole proprietorship#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#iso certification online#legal consultation#legal advisers#legal services

0 notes

Text

Types of Business Registration Available as per Indian Laws

In Today’s scenario, there is lot of confusion amongst Prospective Entrepreneur, New Business Owner, and Students regarding what type of Business Registration is suitable for them to start with. In the article, we will help you to understand what exactly Business Registration is and how many types of Business Registration options are available in India.

Proprietorship

This is the most common Business Registration available in India for small Business Owner or single business owner who do not want any transparency or sharing in their business with anyone. This is the type of registration in which the owner have limited capital and resources and do not want to indulge itself in compliances. There is no such department or law which governs it or provide any certificate for registration but to register it, one will have to register in either MSME or GST. In proprietorship, the owner cannot apply for the new PAN Card but his/her individual pan card will be used in all compliances. The tax applicable in case of proprietorship will be the tax slab available for an individual.

Partnership

This is one-step ahead of Proprietorship as it is the type of Business, which can be started between two or more partners. As such, there is no such compliances in this form of business except annual Income Tax Return and GST Returns (if taken registration). There is no compulsion on partners to register their partnership with Sub-registrar of their city but it is preferable in case of any dispute between partners and it is governed by Partnership Act. Unlike Proprietorship, a new PAN Card will be issued to the partnership from which they can start their other compliances and it comes under highest tax slab of 30% of Income Tax Act.

One Person Company

This is not such a popular type of Business Form as it is a combination of Pvt Ltd Company and Proprietorship. A single owner/Proprietor makes OPC by registering in MCA as a Pvt Ltd Company. As far as compliances are concerned, OPC is governed by Companies Act and all the compliances mentioned in Companies Act will have to be met by OPC including Compulsory annual Audit by a Chartered Accountant.

Limited Liability Partnership

This is the extended version of Partnership. To register the LLP, one will have to make application in MCA with all the documents and details of partners. It is governed by Limited Liability Partnership Act so all the annual compliances mentioned in the said act will have to be met by LLP. It comes under highest tax slab of Income Tax, i.e., 30% (thirty percent)

Pvt Ltd Company

This is the most popular or recognized form of Business Registration amongst Banks, Investor, Entrepreneurs. This is the most preferable business form in context of Startup seeking funding from Investors. It is governed by Companies act like OPC and all the compliances including Annual Audit will have to be met by the Company. In terms of Compliances, this is the most difficult form of Business in which every event or task is performed by filling form to MCA but considering a long term view for the Business, tax benefit is allowed to them in comparison to other forms of registration which makes it more beneficial for the entrepreneur.

#startup registration#virtual cfo#virtual cfo services#business consultant near me#consultancy for startups#gst return#msme udyam registration#proprietorship registration

1 note

·

View note

Text

Take Your Business to New Heights with Egniol’s Growth Solutions

At Egniol, we specialize in empowering Micro, Small, and Medium Enterprises (MSMEs) by offering comprehensive consultancy to help your business thrive.

Whether you're just starting out or aiming for the next big leap, we’ve got the tools, expertise, and connections to guide you every step of the way. 🚀

Here’s how we can help:

💼 Gem Registration Get your business registered on GEM (Government e-Marketplace) for easy access to government procurement opportunities. 📈

💰 Government Grants Unlock government funding opportunities tailored to boost your business growth. 🌱

💳 Government Loans Need capital? We help MSMEs secure government-backed loans at favorable rates. 💵

📊 Equity-Based Funding Looking to raise funds? Our consultants guide you through securing equity-based investments to fuel your expansion. 📈

🏦 NBFC Loans Partner with Non-Banking Financial Companies (NBFCs) for customized loans that cater to your specific business needs. 💡

🎯 Pitch Deck Creation A compelling pitch deck is the key to attracting investors. Let us help you craft one that stands out! 💬

🛠️ MSME Certification Gain credibility and unlock special privileges by getting your MSME certification. 🏆

Ready to take your MSME to the next level? Get in touch with us today and see how Egniol can provide the consultancy you need for successful growth! 🌍

#MSME#MSMEs#BusinessGrowth#Consultancy#Funding#Loans#GovernmentSupport#Egniol#PitchDeck#NBFC#MSMECertification#StartupSupport#Entrepreneurship

1 note

·

View note

Text

MSME Registration and Licensing: Empowering Small Businesses with Corporate Mitra

Introduction to MSME Registration and Licensing

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of economic growth, innovation, and employment in many countries. In India, MSMEs contribute significantly to GDP, exports, and industrial output. Recognizing the critical role of these enterprises, the government offers various schemes, subsidies, and incentives to promote MSME growth. However, to avail of these benefits, businesses must undergo MSME registration and licensing. This process not only formalizes enterprises but also opens up avenues for growth, funding, and protection.

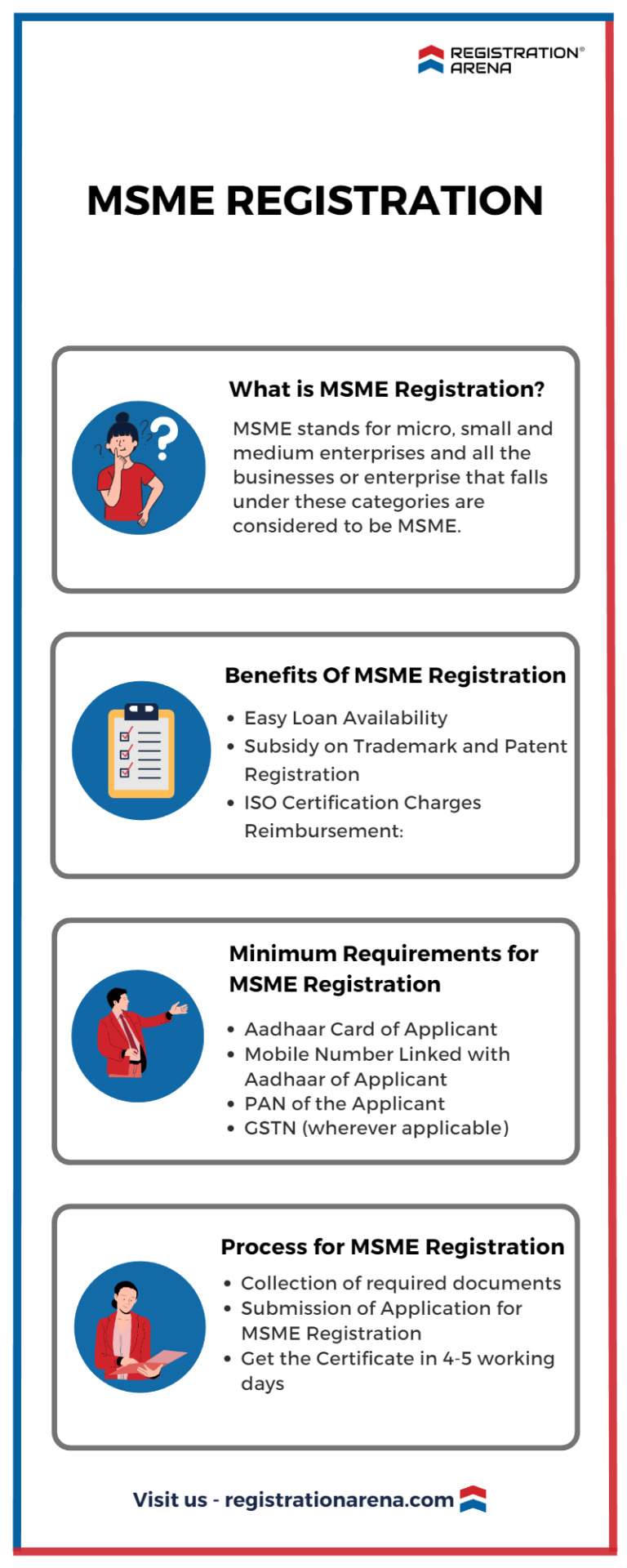

What is MSME Registration?

MSME registration is a government initiative that provides recognition to micro, small, and medium-sized enterprises under the MSMED (Micro, Small, and Medium Enterprises Development) Act, 2006. The registration process enables enterprises to avail of numerous benefits, including financial support, subsidies, tax rebates, and easier access to credit.

Classification of MSMEs As of 2020, the revised classification of MSMEs in India is based on investment in plant and machinery or equipment and annual turnover:

Micro Enterprises: Investment up to ₹1 crore and turnover up to ₹5 crore.

Small Enterprises: Investment up to ₹10 crore and turnover up to ₹50 crore.

Medium Enterprises: Investment up to ₹50 crore and turnover up to ₹250 crore.

Importance of MSME Registration

Financial Assistance and Subsidies: Registered MSMEs can avail of loans at lower interest rates, subsidies on patent registration, and reduced electricity bills.

Government Tenders: MSMEs receive preference in government procurement processes and are eligible for certain exclusive tenders.

Protection Against Delayed Payments: The MSMED Act protects MSMEs from delayed payments by buyers, ensuring timely payments and providing interest on late payments.

Tax Benefits: Registered MSMEs can enjoy direct tax exemptions in the initial years and rebates in GST.

Ease of Access to Credit: MSMEs benefit from collateral-free loans under various government schemes such as the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

Licensing Requirements for MSMEs

While MSME registration is essential, certain industries require additional licenses and permits to operate legally. These licenses ensure compliance with industry standards, safety regulations, and environmental norms.

Types of Licenses for MSMEs

Industrial License: For enterprises involved in manufacturing sectors that impact national security, public health, or environmental sustainability.

Trade License: Issued by local municipal authorities, this license is mandatory for businesses involved in trading goods and services.

Environmental Clearance: For industries that have a potential environmental impact, such as chemical manufacturing or mining.

FSSAI License: For businesses involved in food production, processing, and distribution.

Factory License: Required for manufacturing units to ensure compliance with the Factory Act, labor laws, and workplace safety standards.

Import-Export Code (IEC): Necessary for businesses involved in import and export activities.

How Corporate Mitra Facilitates MSME Registration and Licensing

Corporate Mitra is a trusted partner for entrepreneurs and small business owners, providing end-to-end solutions for MSME registration and licensing. With a team of experts and a streamlined process, Corporate Mitra simplifies the often complex and time-consuming registration process.

Services Offered by Corporate Mitra

Consultation and Advisory: Expert guidance on eligibility, benefits, and the necessary documentation for MSME registration.

Documentation Assistance: Help with preparing and filing the required documents for registration and licensing.

Liaison with Authorities: Corporate Mitra acts as an intermediary, liaising with government departments to expedite approvals.

Post-Registration Support: Assistance with ongoing compliance, renewal of licenses, and application for subsidies or grants.

Step-by-Step Process of MSME Registration with Corporate Mitra

Initial Consultation: Entrepreneurs receive a detailed overview of the MSME registration process, eligibility criteria, and required documents.

Document Collection: Corporate Mitra helps gather essential documents, including Aadhar, PAN, business address proof, and investment details.

Filing Application: The application for MSME registration is completed and submitted online through the Udyam Registration portal.

Certificate Issuance: Upon successful verification, the MSME registration certificate is issued, providing official recognition to the enterprise.

License Acquisition: Based on the nature of the business, Corporate Mitra assists in obtaining necessary licenses such as trade, FSSAI, or environmental clearances.

Benefits of Partnering with Corporate Mitra

Time Efficiency: Corporate Mitra reduces the time required for registration and licensing by handling all formalities.

Cost-Effective Solutions: Affordable service packages tailored to suit the needs of micro, small, and medium enterprises.

Expert Knowledge: Access to industry experts who stay updated on the latest government policies and regulatory changes.

Comprehensive Support: From initial registration to ongoing compliance, Corporate Mitra offers a one-stop solution for MSMEs.

Common Challenges in MSME Registration and Licensing

Despite the benefits, MSME registration and licensing can pose challenges for entrepreneurs:

Complex Procedures: Navigating various government portals and understanding documentation requirements can be overwhelming.

Delays in Approval: Bureaucratic red tape can lead to delays in the issuance of licenses and certificates.

Lack of Awareness: Many small business owners are unaware of the benefits and eligibility criteria for MSME registration.

Inaccurate Documentation: Errors in documentation can result in rejection or delays in registration.

How Corporate Mitra Addresses These Challenges Corporate Mitra's expertise in handling MSME registration and licensing ensures minimal errors, faster approvals, and complete transparency throughout the process.

Case Study: Success Story with Corporate Mitra

Case Study: ABC Handicrafts ABC Handicrafts, a small-scale manufacturer of eco-friendly products, faced difficulties in obtaining MSME registration and the necessary trade licenses. Corporate Mitra stepped in, guiding ABC Handicrafts through the documentation process, ensuring compliance with local regulations, and securing an MSME certificate within 15 days. As a result, ABC Handicrafts availed of government subsidies, expanded its production, and increased its market reach.

Conclusion

MSME registration and licensing are essential for small businesses to thrive, secure funding, and access government benefits. Corporate Mitra plays a pivotal role in simplifying this process, empowering entrepreneurs to focus on growth and innovation. By partnering with Corporate Mitra, MSMEs can navigate the complexities of registration and licensing with ease, ensuring long-term success and sustainability.

0 notes

Text

What is GeM Portal Registration for Sellers?

The Government e-Marketplace (GeM) portal is an online platform launched by the Government of India to make direct procurement of goods and services easier. If you are a seller then the GeM portal provides the best opportunity for you because it helps you create better business sources. Suppose you are a seller interested in participating in government tenders and want to sell your products or services through this platform. In that case, the GeM portal registration is the right choice for you and your business growth.

What is GeM portal?

The Government e-marketplace (GeM) was designed to simplify the government procurement process. With the help of Gem Portal, sellers directly list their products and services and sell their products directly to government departments and organizations. GeM portal makes the government procurement process more transparent, efficient, and reachable. With the help of gem portal registration you will be able to participate in the bid, OEM registration process, Brand listing on gem, product listing and be able to get OEM certification on gem portal.

Eligibility Criteria for Sellers

If you want to sell your product and services on a gem portal, first you have to check eligibility criteria for the gem portal registration process. Here are some important requirements:

Type of business: Sellers can be individuals, vendors, partnerships, companies, or MSMEs (Micro, Small, and Medium Enterprises).

Documents Required:

PAN Card: A PAN Card is a very important document if you want to register on a gem portal.

Bank Account Details: Bank account details are necessary for the payment process on the Gem portal.

Aadhar Card: If you want to register on a gem portal then an Aadhar card is a must for the identification process.

GSTIN: It's also a very important document for any sellers for the gem portal registration process.

Certificate of Incorporation: CIN also a very important document for registration on gem portal.

MSME Certificate: If you are an MSME seller then you have to submit an MSME Certificate on the gem portal.

GeM Seller Registration Process

Seller Registration: You have to create a seller account and register as a Seller on the gem portal. You have to fill in your basic details on the Gem portal.

Fill Basic Information: After creating a seller account you have to fill in your basic details such as your name, email address, phone number, and business details. You have to choose which type of goods and services you want to offer on the government e-marketplace.

Upload Documents: You have to upload the required documents for verification such as

PAN card

GSTIN certificate

Bank account details

Aadhar card

Certificate of Incorporation(CIN)

Income Tax returns file

Complete the KYC Process

If you want to register on the gem portal then you have to complete your KYC process. The Know Your Customer (KYC) process is necessary for verifying seller identity.

Submit for Approval

After completing all the steps you have to submit the registration for approval and you have to wait for some time. The GeM portal authorities will verify your details.

Conclusion

GeM portal provides many opportunities for sellers to sell their products or services to government departments. With the help of gem portal registration, you can easily grow your business. If you are a small business or a large corporation, the GeM portal helps you for growth in government procurement. So after gem portal registration you will also be able to do OEM panel registration, and Deemed OEM vendor assessments. Managing a gem portal isn't an easy process for everyone but if you hire a gem portal consultant then it’s easy for you to navigate on the gem portal. Bidz professional provides the best gem portal registration services in India. They will help individuals and organizations seeking to engage with the Indian Government's e-marketplace (GeM).

#gem registration#gem portal registration process#gem portal registration#best gem portal registration services

0 notes

Text

Current Changes in Corporate Law in India

Corporate law in India has undergone significant reforms in recent years to align with global standards, improve ease of doing business, and ensure corporate accountability. These amendments are designed to streamline governance, promote transparency, and foster investor confidence.

Key Updates in Corporate Law:

Decriminalization of Minor Offenses The Companies (Amendment) Act, 2020 decriminalized many minor, technical, and procedural violations. The shift from criminal penalties to civil penalties aims to reduce unnecessary litigation and ease compliance burdens on businesses.

Corporate Social Responsibility (CSR) New CSR rules mandate stricter compliance, such as disclosing unspent CSR funds and adhering to impact assessments for large projects. Companies now need to ensure funds are allocated responsibly, reinforcing their commitment to social development.

Ease of Doing Business Initiatives like the Simplified Proforma for Incorporating Company Electronically (SPICe+) and online filings have made company registration seamless. Digital compliance tools such as e-adjudication and web-based regulatory filings enhance efficiency and accessibility.

Insolvency and Bankruptcy Code (IBC) Updates Recent amendments to the IBC focus on faster resolution processes and protection of creditors' rights. Pre-packaged insolvency resolution for MSMEs was introduced to safeguard smaller businesses while ensuring their recovery.

Data Privacy and SEBI Regulations Regulatory bodies like SEBI have tightened corporate governance norms for listed entities, while India’s upcoming Data Protection Act will have significant implications for companies handling sensitive data.

These changes reflect the government’s efforts to create a robust legal framework that supports business growth while maintaining accountability and transparency.

For expert legal consultation on corporate compliance, governance, or litigation, trust M K Singh Legal Services.

For legal consultation or assistance, connect with M K Singh Legal Services:

🌐 www.metrolegalexperts.in

📞 +91 9811432933

📱 Social Media:

Facebook

Instagram

YouTube

LinkedIn

Twitter

Stay updated with M K Singh Legal Services for all your legal needs !

0 notes

Text

0 notes

Text

Streamline Your Business with KVR TAX: Your Go-To Partner in Hyderabad

Starting and managing a business in Hyderabad involves several critical steps, from registration to tax filing. Navigating the complex regulatory landscape can be overwhelming, but with the right guidance, it becomes a seamless process. At KVR TAX, we specialize in offering comprehensive solutions for all your business needs, including gst registration certificate in hyderabad, income tax filing in Hyderabad, and much more.

Goods and Service Tax Registration in Hyderabad

One of the primary requirements for any business in India is the goods and service tax registration in hyderabad. GST is a crucial tax that every business dealing in goods or services must comply with. Our team at KVR TAX ensures a smooth and hassle-free firm gst registration process in hyderabad. From understanding the legal requirements to completing the paperwork, we assist you at every step.

Register Your Business Effortlessly

If you're planning to register a business in hyderabad, KVR TAX is your reliable partner. Whether you want to register a company in Hyderabad or set up a small firm, we provide end-to-end services. The registration of firm process in hyderabad can be daunting, but our experts make it simple and straightforward. We guide you through each phase, ensuring that your business complies with all necessary regulations.

Income Tax Filing Made Easy

Tax filing is another essential aspect of running a business. Whether you're an individual or a corporate entity, timely and accurate tax filing is crucial. KVR TAX offers expert services in income tax filing in hyderabad. Our professionals are well-versed in the latest tax laws and help you with incometax return filing in hyderabad, ensuring compliance and minimizing liabilities.

MSME Registration Consultants in Hyderabad

For small and medium enterprises, obtaining MSME registration is vital for availing various benefits. At

#gst registration certificate in hyderabad#goods and service tax registration in Hyderabad#register a business in hyderabad#register company in Hyderabad#firm gst registration process in Hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in Hyderabad#Msme Registration Consultants in Hyderabad#MSME Registration Online in hyderabad#iec code registration in Hyderabad#export and import registration in hyderabad

0 notes

Text

**Offerings of Wisdom Weavers Solutions Lab**

**1. Business Consulting Services:**

• Presales: Presales Strategy, Bid Management, Solution Architecture, Technical Proposals, and Sales Enablement, and Business Growth Advisory.

• Project Management: End-to-End Project Planning, Execution, and Delivery; Agile and Waterfall Methodologies for IT, Creative, and Infrastructure Projects; and Monitoring, Risk Assessment, and Reporting.

• Business Analysis: Requirement Gathering, Process Analysis, Gap Identification, Business Process Automation and Re-Engineering, Strategic Planning, and Strategic Insights for Data-Driven Decisions.

• Startup, MSME, and SME Consulting: Business Strategy Development, Resource Planning, Operational Optimization, Go-to-Market Strategies, Process Improvement, Cost Optimization, and Risk Management.

**2. Technology and Automation Consulting Services:**

• Integrated Enterprise Solutions: HRMS, CRM, and IT Systems Automation, Cyber Security Solutions, Cloud Solutions, and many more for SMEs and MSMEs.

• Software Development Custom Application Development: Web, Mobile, and Enterprise Software.

• Cyber Security Consulting: Offering Identity Management, Access Management, Governance, Risk, and Compliance, Penetration Testing, Vulnerability Assessments, and secure system designs.

• AI Automation Solutions for Sales, HR, and Customer Enablement: AI-driven solutions for business growth and customer engagement.

• Drone and Surveillance Solutions: Implementing Smart Agriculture Solutions — Leveraging IoT, drone technology, and AI for farming optimization.

**3. Accounting and Taxation Consulting Services:**

• Bookkeeping, Financial Reporting, and Compliance Management.

• GST Filing, Income Tax Returns, Audits, and Payroll Processing.

**4. Legal Consulting Services:**

• Legal Documentation: Contracts, Agreements, and Compliance Papers.

• Business Registration, Trademark, and Intellectual Property Consulting.

• Support for MSME Legal Frameworks and Policies

**5. Writing and Documentation Consulting Services:**

• Business Writing: Proposals, RFPs, White Papers, and Reports — Creating winning proposals for projects across sectors.

• Technical Writing: SOPs, User Manuals, Training Guides, and Compliance Documents – Developing precise and user-friendly operational documents.

• Content Auditing: Proofreading, quality checks, and content alignment with brand goals.

• Training Materials: Instructional design for employee training and upskilling programs.

• Creative Writing: Poetry, Author Content, Poetic Content for Storytelling, Brand Campaigns, and Events, and many more.

• Copywriting: Tailor-made Brand Storytelling to resonate with target audiences and stakeholders; SEO-friendly content, Blogs, Vlogs, Newsletters, and Marketing Collateral.

• Copy Editing and Proofreading: Magazines, Advertisements, Newspapers, Other Media, Marketing Materials, and many more

• Script Writing: Original Scripts for Short Films, Marketing Videos, Educational Videos, Instructional Videos, and multimedia projects.

**6. Marketing and Sales Consulting Services:**

• Sales Enablement and Growth Strategies.

• Go-to-Market Campaigns, Promotions, and Partnerships.

• Offline and Online Marketing Solutions for Rural and Urban Businesses.

**7. Social Media and Digital Marketing Consulting Services:**

• Social Media Management: Strategy, Content Creation, and Ads.

• SEO, PPC Campaigns, and Email Marketing.

• Digital Brand Building for Artists, Businesses, Films, and NGOs.

• Personal Branding: Helping artists, authors, and professionals develop their unique identity and market presence.

• Portfolio Development: Crafting portfolios for musicians, writers, filmmakers, and business professionals.

• Business Storytelling: Creating narratives that reflect brand values and connect with audiences.

**8. Quality Assurance Consulting Services:**

• Testing: Manual, Automation, and Performance Testing.

• Audit Services for Processes, Content, and Digital Products.

**9. Designing Consulting Services:**

• Graphic Design: Logos, Posters, Infographics, Emailers, Teasers, Presentations, and Branding Materials.

• UI/UX Design: Website and App Wireframing for an Engaging User Experience.

• Product and Packaging Design for Artisans, Handicrafts, and Retail Businesses.

**10. Audio-Visual Editing Consulting Services:**

• Video Editing for Short Films, Corporate Films, and Documentaries, Marketing Videos, Educational Videos, Instructional Videos, and multimedia projects; Corporate and Social Events, Weddings; and many more

• Audio Editing: Music Tracks, Podcasts, and Professional Recordings.

• Explainer Videos: Simplify complex concepts into engaging visuals. Ideal for businesses, startups, and educational platforms. Whiteboard animations, 2D character animations, and Motion graphics.

• Promotional and Marketing Animations: Boost brand awareness with vibrant promotional content. Product launch teasers, digital ads, and social media animations. Specializations: Logo animations, Intro/outro animations, and Animated banners and posters

• Storytelling and Animated Short Films: Craft creative, entertaining narratives for businesses, NGOs, and entertainment industries. Focus on: Animated explainer stories, Children’s stories, and Festival/holiday-themed videos.

• Educational Animations: Develop interactive animations for e-learning platforms and schools. Focus on simplifying academic and skill-based topics. Examples: Science experiments, history events and Step-by-step tutorials

• Motion Graphics and Typography: Engage viewers with animated text, shapes, and infographics. Best suited for corporate presentations, reports, or event promos. Types: Kinetic typography and Infographic animations

• 3D Animations: Create high-end, realistic visuals for product demos, architectural walkthroughs, and virtual reality projects. Offerings: Product modeling and rendering, Architectural and landscape animations, and Character rigging and movement.

• Gaming Animations: Develop assets for game environments, characters, and cutscenes. Examples: 2D/3D character animations and Animated props and backgrounds.

• Visual Effects (VFX) Integration: Enhance videos or films with animated effects for cinematic appeal. Services: Green screen compositing and CGI and particle effects.

• Animation for Social Media: Boost engagement with short, impactful content tailored for platforms, such as Instagram, Facebook, X, and YouTube. Examples: Reels, stories, and GIFs and Animated stickers and emojis

• Interactive Animations: Ideal for websites, apps, and e-learning platforms. Types: User interface animations and Interactive clickable animations.

**11. Tourism and Agro-Consulting Services:**

• Agro-Tourism Solutions: Strategy for farmstays, eco-camps, and rural tourism initiatives.

• Sustainable Agriculture Consulting: Focus on FPOs, organic farming methods, and agro-tech implementation.

• Spiritual and Vedic Tourism: Offering immersive spiritual journeys and retreats in natural settings.

• Tourism Promotion: Destination planning, branding for rural and heritage tourism, and itinerary creation.

• Custom Travel Itineraries: Specializing in eco-tourism, heritage trails, and cultural experiences in Odisha.

• Local Experiences: Promoting local cuisine, handicrafts, and traditions through curated programs.

• Handicrafts and Artisan Promotion: Strategy for marketing and global outreach of local artisans.

• Event Conceptualization: Destination weddings, cultural festivals, workshops, and heritage events.

• Community Engagement Initiatives: Empowering locals through skill-based programs and resource management.

**12. NGO and Social Impact Consulting Services:**

• Project Management for NGOs: End-to-end planning, implementation, and reporting for social impact initiatives.

• Rural Development Programs: Collaborating with communities to address sustainable agriculture, education, health, and livelihoods.

• Rural and Ecological Solutions: Sustainability Strategies, such as Waste Recycling, eco-friendly practices, and natural home-building solutions and Ecological Projects, such as Forest conservation, natural resource management, and biodiversity awareness programs.

• Music and Sports Promotional Activities

• Scholarships for Cultural Exchange Programs, Educational and Skill Development Programs, Creative Arts, and many more.

• CSR Initiatives: Conceptualizing and executing corporate social responsibility projects aligned with organizational goals.

**13. Media and Performing Arts Consulting Services:**

• Filmmaking: Pre-Production, Production, and Post-Production Support.

• Photography and Cinematography: Concept Development, Creative Direction, and Portfolio Management; Portrait, Product, Boudoir, and Event Photography; Cinematic Videography for Weddings, Tourism, Agricilture, and Promotional Content.

• Music Projects: Music Composition, Vocal Performances, Artist Branding, and Music Collaboration opportunities in Short Films, Commercial Films, Corporate Films, Brand Anthems, Music Videos, Devotional Music, Patriotic Music, and many more.

• Content for Performing Arts: Scripts and stories for theatre, dance productions, and live events.

**14. Training and Skill Development Consulting Services:**

• Workshops and Seminars: Conducting knowledge-sharing sessions on Business Consulting, Writing, Creative Arts, Marketing, Tourism, and Agriculture.

• Skill-Based Training: Programs for Business, IT, and Communication, professionals, artisans, and entrepreneurs in areas, such as IT solutions, presales, technical writing, and creative storytelling.

• Customized Training Modules: Tailored content for corporate teams, MSMEs, and startups.

• Team Upskilling for Startups, MSMEs, and Professionals.

**15. Event and Festival Management Consulting Services:**

• Cultural Events: Planning and promoting heritage festivals, art exhibitions, and musical performances.

• Destination Weddings: Curating eco-friendly, rustic, and culturally rich wedding experiences.

• Workshops and Retreats: Hosting writing camps, ecological retreats, and wellness programs.

**16. Many More...**

Founded and led by woman social entrepreneur Pradipta Pati, Wisdom Weavers Solutions Lab is a one-stop solutions hub, offering a unique blend of business expertise, creative services, and technology consulting, empowering individuals, organizations, and communities to thrive, innovate, and grow.

WWSL evolves to deliver exceptional services tailored to dynamic needs, fostering innovation, creativity, and sustainable growth for individuals, businesses, and communities.

WWSL offers integrated, customized, and innovative services across industries to empower businesses, individuals, and communities with professional expertise, creativity, and sustainable growth strategies.

#WisdomWeaversSolutionsLab #BusinessConsulting #ProjectManagement #WritingServices #BusinessAnalysis #Training #DesigningServices #AccountingAndTaxation #RuralTourism #CulturalTourism #NGO #SocialImpact #MSME #Filmmaking #Cinematography #Photography #Marketing #Sales #DigitalMarketing #SocialMediaMarketing #AudioVisualEditing #CreativeWriting #Music #Poetry #LegalServices #SoftwareDevelopment #QualityAssurance #ManyMore

0 notes

Text

Udyam Registration: Eligibility and Criteria Explained

Udyam Registration is an important step for businesses in India to qualify as Micro, Small, or Medium Enterprises (MSMEs). By registering, businesses can access government schemes, financial benefits, tax exemptions, and other incentives. However, before starting the registration process, it’s crucial to understand whether your business meets the eligibility criteria. Here’s a simple breakdown of Udyam Registration eligibility and criteria.

What is Udyam Registration? Udyam Registration is an online process introduced by the Ministry of MSME, allowing businesses to register as MSMEs. The registration is based on the business’s annual turnover and investment in plant and machinery (for manufacturing businesses) or equipment (for service businesses).

Eligibility for Udyam Registration For a business to qualify, it needs to meet the following criteria:

Type of Business:

Manufacturing Enterprises: Businesses that produce goods through physical or chemical processes.

Service Enterprises: Businesses that offer services like IT, education, healthcare, consultancy, etc.

2. No Need for Prior Registration:

If your business is already registered under the old MSME registration (Udyog Aadhaar), you don’t need to register again, but you should update your details on the Udyam portal.

3. Legal Entity:

Your business must be a legally recognized entity such as a sole proprietorship, partnership, limited liability partnership (LLP), or private limited company.

Udyam Registration Criteria The eligibility for Udyam Registration depends on the business’s investment in plant and machinery or equipment and annual turnover. Businesses are classified into three categories:

Micro Enterprises:

Investment: Up to ₹1 crore

Annual Turnover: Up to ₹5 crore

2. Small Enterprises:

Investment: Up to ₹10 crore

Annual Turnover: Up to ₹50 crore

3. Medium Enterprises:

Investment: Up to ₹50 crore

Annual Turnover: Up to ₹250 crore

These criteria apply to both manufacturing and service businesses, though classification may vary based on the business type. How to Calculate Investment and Turnover?

Key Points to Remember

Investment in Plant & Machinery/Equipment: For manufacturing, it refers to machinery used in production. For services, it’s the cost of equipment like computers or software.

Annual Turnover: This is the total revenue earned by the business from its core operations in the last financial year.

Self-Declaration: Udyam Registration is based on self-declaration. You don’t need to submit documents, but the information you provide must be accurate and subject to verification.

Aadhaar and PAN: The Aadhaar card of the owner and PAN card of the business are mandatory.

GST Registration: If your business is GST-registered, mention it during registration, though GST is not required for all businesses.

Conclusion Udyam Registration offers businesses access to valuable benefits such as government schemes and easier access to credit. By meeting the eligibility criteria and completing the registration process, businesses can unlock growth opportunities. Ensure your business meets the criteria and provides accurate details during registration to make the process smooth.

#udyam registration#udyam registration online#Udyam Registration process#udyam license#udyog aadhar#udyam certificate

0 notes

Text

The Role of Tax Consultants in Hyderabad for Seamless Financial Management

Why Do You Need Tax Consultants?

The Indian tax system is complex, with various regulations for GST, income tax, and corporate taxes. Navigating these regulations can be challenging without professional help. Tax consultants in Hyderabad provide expert guidance on:

Filing accurate income tax returns.

Ensuring compliance with GST regulations.

Managing business registrations, including GST, trade licenses, and MSME.

Handling audits and financial statements.

Services Offered by Tax Consultants in Hyderabad

Hyderabad is home to many reputed tax consultants, such as Sri Balaji Tax Services, who offer comprehensive solutions tailored to your needs. These services include:

Business Registration: Assistance with private limited companies, LLP, and partnership firm registration.

GST Services: GST registration, return filing, and compliance audits.

Tax Planning: Strategies to optimize tax liabilities and maximize savings.

License Approvals: Help with trade licenses, labor licenses, and FSSAI registration.

Trademark and Logo Registration: Protecting your brand identity.

Why Choose Tax Consultants in Hyderabad?

Expertise in Local Regulations: Consultants in Hyderabad are familiar with state-specific tax requirements and business norms.

Timely Compliance: Professional tax consultants ensure that all filings and payments are made on time, avoiding penalties.

Custom Solutions: Services are tailored to meet the specific needs of your business or individual financial goals.

Whether you are a startup, an established business, or an individual looking for tax guidance, hiring reliable tax consultants in Hyderabad is a smart move. They ensure compliance, save time, and help you focus on growth.

For expert services, consult Sri Balaji Tax Services, one of the most trusted tax consultants in Hyderabad, and let their professionals handle your tax needs efficiently.

0 notes

Text

Is Corpbiz Reliable? A Comprehensive Review

Entrepreneurs and businesses frequently seek a reliable ally to streamline the complex process of business compliance, licensing, and registrations. Corpbiz, a top consulting platform, has become the favourite option for many. However, the uncertainty remains: is Corpbiz reliable? Let's thoroughly explore the offerings, trustworthiness, and distinguishing factors of the company within the industry.

What is Corpbiz?

Corpbiz is a company that specializes in providing compliance, licensing, taxation, and legal services to businesses operating in India. Corpbiz offers comprehensive assistance for regulatory and compliance requirements to both new businesses and established firms.

The platform serves as a connection between businesses and government agencies, providing services like:

Business registrations (GST, MSME, FSSAI, and more).

Tax filings and advisory services.

Corporate compliance like ROC filings.

Licensing and certifications (trade licenses, ISO certification, etc.).

Intellectual property rights (trademark, copyright, and patent registrations).

What Makes Corpbiz Stand Out?

One-stop Solution for Businesses- Corpbiz's comprehensive range of services is one of its main selling points. Companies no longer have to manage various consultants for different needs. Corpbiz provides services for both startups in need of company incorporation and established enterprises requiring annual compliance management.

Simplified Process with Expert Assistance- Dealing with compliance and legal requirements can feel like a lot to handle. Corpbiz is proud to streamline these procedures for its customers. Their expert team makes sure that all documents are in order, deadlines are met, and procedures are smoothly finished.

Tailored Solutions- Corpbiz acknowledges that not all businesses are identical. The company provides personalized solutions that are tailored to meet the specific requirements of each client. This customized method leads to improved results and increased customer contentment.

Assessing the Reliability of Corpbiz

To determine whether Corpbiz is a reliable partner for your business, let’s evaluate the key factors:

1. Expertise and Experience

Corpbiz has a team of experienced professionals with expertise in legal, financial, and business domains. Their knowledge and proficiency in handling complex compliance and regulatory challenges make them a trusted partner for businesses across industries.

2. Transparency

One of the hallmarks of a reliable service provider is transparency. Corpbiz ensures that its clients are well informed about the procedures, costs, and timelines involved. Their platform also provides real-time updates on service progress, which enhances trust and confidence.

3. Customer Support

Corpbiz is known for its robust customer support. Clients can easily reach out to their dedicated representatives for queries or assistance at any stage of the process. This level of responsiveness sets them apart from many competitors.

4. Client Reviews and Testimonials

A quick glance at Corpbiz’s customer testimonials highlights a track record of satisfied clients. Businesses often commend their efficiency, professionalism, and ability to deliver results within stipulated timelines.

Breaking Down the Services: What Can You Expect?

1. Business Incorporation

Starting a business in India involves multiple registrations and approvals. Corpbiz streamlines the process of company incorporation, including:

Registering Private Limited Companies, LLPs, or Sole Proprietorships.

Acquiring mandatory licenses like GST registration, FSSAI licenses, and more.

Drafting legal documents like MOA and AOA.

2. Licensing and Certification

Licenses and certifications are critical for business operations. Corpbiz assists with:

ISO certification for quality management.

Trade licenses for retail businesses.

Environmental clearances and other industry-specific approvals.

3. Tax and Compliance Services

Staying tax compliant is crucial for any business. Corpbiz offers a suite of services, including:

GST filings and returns.

Income tax planning and filing.

ROC filings and corporate governance.

4. Intellectual Property Protection

In today’s competitive market, safeguarding intellectual property is essential. Corpbiz helps businesses with trademark registrations, patent filings, and copyright protection.

5. Funding and Legal Advisory

For startups looking to raise capital or navigate legal complexities, Corpbiz provides expert advisory services. They help with:

Preparing investor pitches.

Drafting shareholder agreements.

Legal due diligence.

Advantages of Choosing Corpbiz

Here’s why many businesses trust Corpbiz with their compliance and legal needs:

Time-Saving: By outsourcing compliance tasks, businesses can focus on growth and operations.

Cost-Effective: Corpbiz offers competitive pricing for its services, ensuring value for money.

Accuracy: Their experts minimize the risk of errors, ensuring smooth regulatory approvals.

Nationwide Presence: With services available across India, Corpbiz caters to businesses in all regions.

Potential Concerns and How Corpbiz Addresses Them

1. Complex Legal Processes

Some clients may worry about the complexity of legal formalities. Corpbiz mitigates this by breaking down the process into manageable steps and guiding clients through each phase.

2. Timely Delivery

Delays can be a concern in compliance matters. Corpbiz’s adherence to deadlines and regular updates ensure timely delivery of services.

Real Stories: What Clients Say About Corpbiz

Case Study 1: A Startup's Journey

A tech startup faced challenges with company registration and tax compliance. Corpbiz provided end-to-end support, from incorporation to securing GST registration. The founders appreciated the seamless experience and prompt communication throughout the process.

Case Study 2: Scaling an SME

An SME in the manufacturing sector needed ISO certification and environmental clearances. Corpbiz managed all documentation and approvals, enabling the business to scale operations without delays.

Conclusion: Is Corpbiz Reliable?

The decision is evident - Corpbiz is a trustworthy and effective ally for companies. Their dedication to making compliance easier, along with their knowledge and client-focused method, positions them as a reliable option for businesses throughout India.

Corpbiz provides the assistance necessary for both aspiring entrepreneurs and well-established corporations to easily navigate the complexities of business regulations. Their increasing number of customers and favourable reviews showcase their trustworthiness and commitment.

If you're prepared to simplify your business operations and concentrate on expansion, Corpbiz might be the ideal partner you've been seeking. Check out their website to discover their offerings and begin today.

Source: https://www.linkedin.com/pulse/corpbiz-reliable-comprehensive-review-ishan-joshi-urkjc/

0 notes