#commercial real estate OR

Text

“Hold the elevator!”

The elevator doors are mere inches from closing, but Steve dutifully shoots a hand out to stop them. They slide back open, revealing a flustered-looking man about Steve’s age on the other side.

He’s dressed head to toe in black, decked out in a simple black pullover with a modest V-neck, snug black jeans, and all-black leather Chucks with a messenger bag slung across his chest. The messenger bag is, unsurprisingly, also black, but covered in a collection of tough-looking patches and pins in varying shades of—well, it’s mostly red, dark red, white, and some yellows, but the pops of color still stand out against his otherwise monochrome ensemble.

His dark, curly hair reaches a little past his shoulders and he’s got this frankly outdated fringe that, despite its very 80’s vibe, frames his face perfectly. His eyes are large and expressive, and he’s got this frantic energy about him that reminds Steve of a live wire. He’s nothing like the buttoned-up suits Steve usually shares his elevator rides with each morning, and it’s a refreshing change of pace.

The man gives Steve a thankful look before stepping into the elevator and leaning against the side wall. “Thanks,” he says, a little distractedly. He’s got a pair big of headphones on and Steve realizes he’s in the middle of a phone call when he adds, “No, not you, Gare, I was thanking the guy who held the elevator for me. Yeah, this building’s crazy. There’s a whole-ass sixtieth floor—guess I’m kind of a big deal now.” He lets out a small, self-deprecating chuckle, reaching for the panel beside him.

As the doors close and the elevator starts to slowly ascend, Steve notices the man pressed the button for the floor above his. Both the fifty-second and fifty-third floor buttons are lit in a halo of green.

“You know I didn’t want to leave you guys,” the man continues, a bit more quietly now that he and Steve are sharing the same small space, “but shit, I couldn’t turn down the pay.” He scoffs. “Ugh, listen to me, just another cog in the capitalist machine. Man, if high school me could see me now. High school Eddie used to talk big about forced conformity and rising up against the man, and now here I am—”

Steve tries not to listen to the one-sided conversation going on beside him, but it’s difficult when a moment later, he hears his own name.

“—clocking in for my first day at fuckin’ Harrington Hargrove Hagan. The pretentious bastards can’t even shorten it to an acronym or something. God forbid they have to miss out on the sound of their own names.”

Steve manages to hold in the obnoxious snort that threatens to escape him. He’s starting to think he might like this guy—Eddie, his mind supplies helpfully—but Eddie’s next words have him freezing in place.

“And it’s nepo baby central. Yeah, pretty sure all the H kiddies are hotshot brokers with the company. All the biggest accounts—gee, I wonder why.”

Steve can feel the back of his neck burning hot with a mixture of annoyance and shame as Eddie cracks a caustic joke about silver spoons and trust funds.

“You’re kidding, one of them works at this branch? Damn, I guess I’ll just keep an eye out for the guy who most looks like he’s got a giant stick up his ass.”

This is quickly becoming the longest elevator ride of Steve’s life. He grits his teeth and stares fixedly at the floor display panel above the elevator doors, watching the numbers climb higher and higher. Thirty-seven. Thirty-eight.

“Listen, I should go, but let’s grab a drink at the Hideout later. Cool, see you then. Bye.”

Forty-one. Forty-two.

Eddie removes his headphones and shoves them into his bag, angling slightly toward Steve. “Sorry about that, man.”

“You’re good,” Steve says shortly, not looking away from the changing numbers. They reach the forty-seventh floor, and all the while, he feels Eddie’s gaze on him.

It’s not like he’s openly staring, but there’s a certain weight to his furtive glances that completely counteracts his attempts at subtlety. It’s the type of gaze Steve’s familiar with, one that he’s been on the receiving end of since his sophomore year of high school when he hit a growth spurt and actually learned how to style his hair. Assessing. Appreciative. Interested.

And in any other situation, Steve would gladly engage. He’d turn on the charm, quirk the corner of his lip up in that way Robin always rolls her eyes at but reluctantly acknowledges as ‘passably effective’, and maybe even make up an excuse to sidle a bit closer.

But he’s not giving this guy his A-game.

Instead, Steve waits in stifling silence until the fifty-second floor is announced and the doors slide open. He steps forward to exit, but at the very last moment stops in the doorway.

He initially wasn’t going to say anything—though, a past version of himself would have definitely spat something biting and bitchy to Eddie about his snark, would have snootily told him to take his little assumptions and shove them where the sun don’t shine—but sooner or later Eddie’s going to realize he and Steve are colleagues, and he’s going to remember shit-talking him in an elevator on his first day of work, and it’s going to be awkward and uncomfortable.

Steve’s just speeding up the timeline, pushing for the sooner rather than the later, when he decides to spin around and fully face Eddie.

“I think you pressed the wrong button,” he says, all sweet and helpful like he’s talking to Dustin’s mom over a sink full of soapy dishes. “Couldn’t help but overhear that you work at Harrington Hargrove Hagan. It’s on the fifty-second floor, not the fifty-third.” Then he takes a small step backward, moving out into the carpeted hallway.

“Oh.” Eddie scrambles for his phone, unlocking it and scrolling quickly until he finds something that has him straightening up and smiling gratefully at Steve. “I guess I remembered it wrong. Thank you.” He pushes away from the wall, takes a step forward to follow Steve out, but then stops dead in his tracks.

Steve gleefully notes the line of Eddie’s gaze, how it lingers at the breast pocket of his shirt, where, clipped to a retractable badge reel, his building keycard hangs. Eddie evidently hadn’t noticed it during the elevator ride up, but he’s certainly fixated on it now.

Perhaps on the abstract yet easily recognizable Harrington Hargrove Hagan logo in the top right corner.

But more likely, based on the positively mortified look growing on Eddie’s face, on the name clearly printed underneath Steve’s photo in bold, black lettering: STEVE HARRINGTON.

Slowly, Eddie drags his eyes back up to Steve’s face. He stares in silence, eyes bugging nearly out of his head, face turning a concerning shade of pink, mouth opening and closing like a fish out of water, and his reaction is extreme enough that a small part of Steve is almost inclined to take pity on the guy and laugh it all off.

Unfortunately for Eddie, a bigger part of Steve thinks Eddie looks kind of cute all red-faced and embarrassed like this. So he glances down at himself thoughtfully before turning his attention back on Eddie. “Wow,” he says with exaggerated astonishment, “now that you mention it, I guess I do look like I’ve got a giant stick up my ass.”

As if on cue, the elevator chimes in warning. The doors begin to close, but Eddie just remains rooted in place with that same wide-eyed, horrified expression.

When it becomes clear he has no intentions of actually exiting the elevator, Steve chuckles and wiggles his fingers in a cheeky little wave. “Welcome to the team,” he says airily, before Eddie’s still-blushing face disappears behind the elevator doors.

/ Now with a Part 2!

#stranger things#steve harrington x eddie munson#steddie#steddie fic#modern office au#corporate steddie au#eddie's in IT#HHH is a commercial real estate firm#but steve's not a hotshot broker he's literally just a guy who makes copies all day or some shit#i personally just want to see all of eddie's baseless assumptions shattered as he gets to know steve#fic writing#hbd#actually i've never read a corporate steddie fic before so if anyone has any recs i'd love to hear them

3K notes

·

View notes

Text

Hiii Lewie

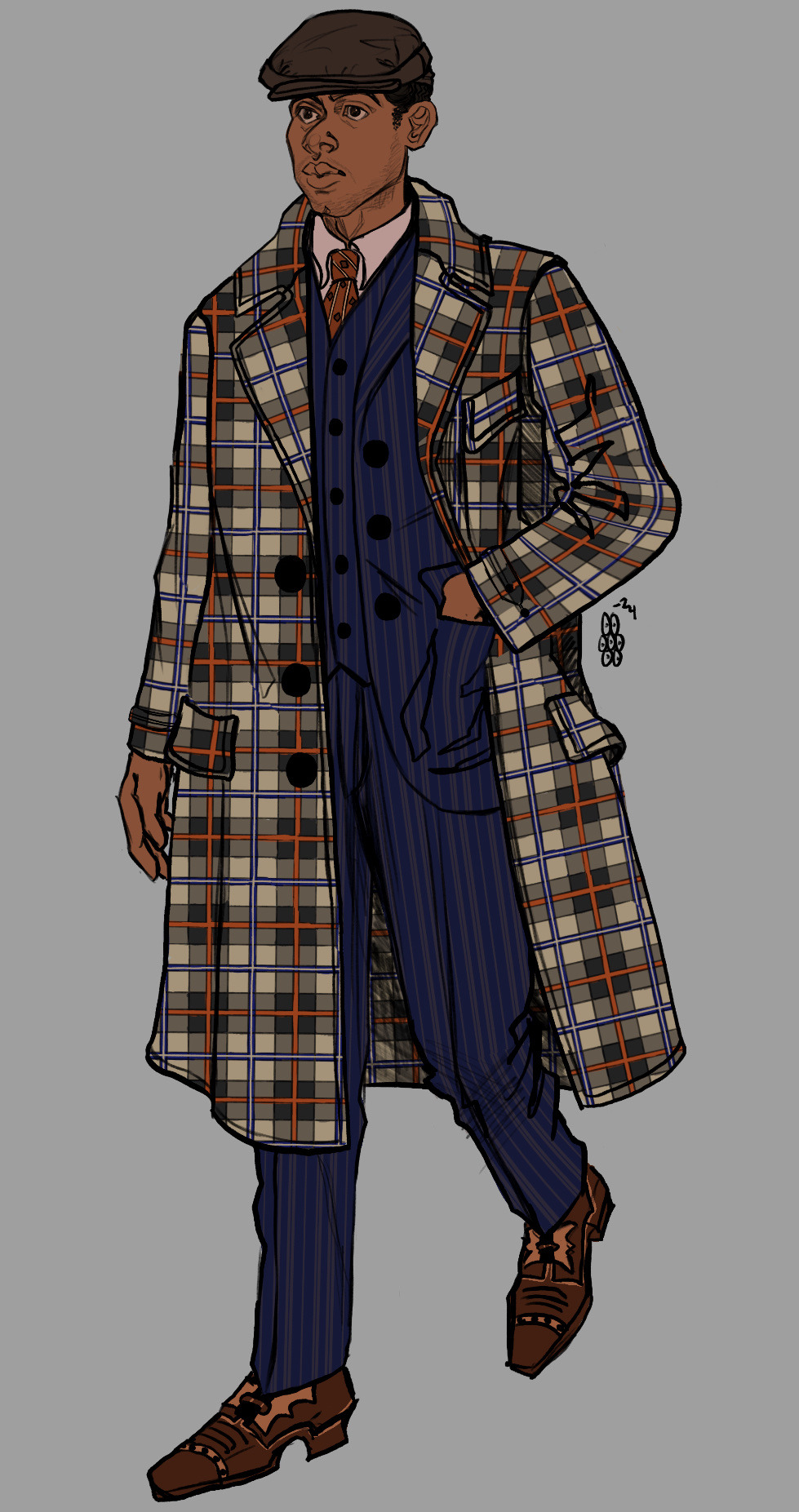

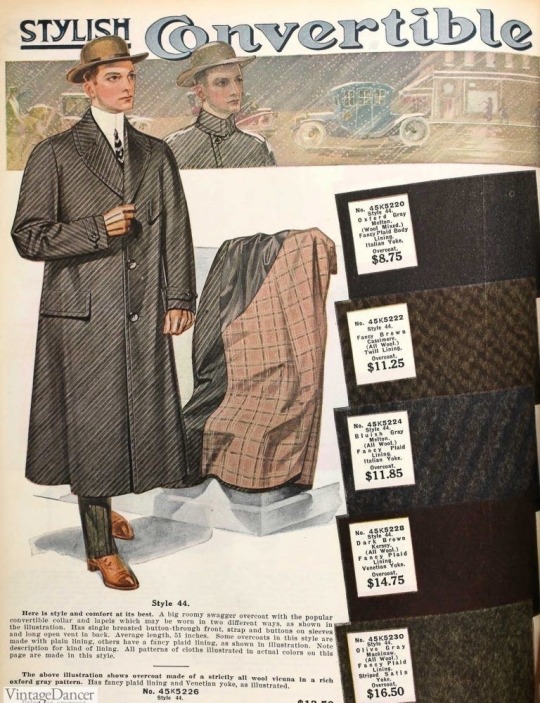

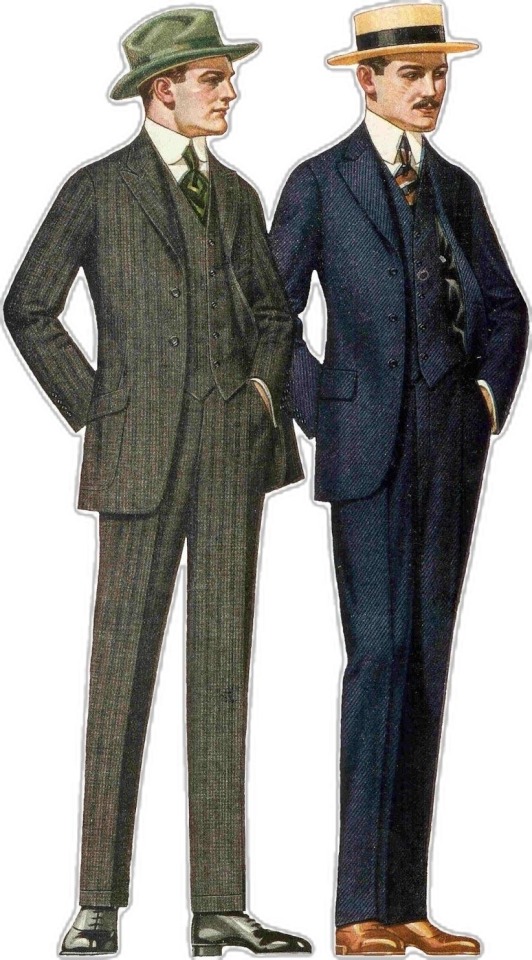

Special thanks to @transarmand for making these great GIFs, which were a godsend when drafting that plaid. My other refs r below the cut in case anyone finds them useful:)

#my art#iwtv#interview with the vampire#louis de pointe du lac#I’m still here. by the way. 20s iwtv can stay but it’s on thin fucking ice. do you think the writers came up with#his full real estate portfolio and if so can they drop it as bts. for me.#I looove his post partum housewife era but I also need to know who he leases to. which Black firm drafts his contracts. did he diversify be#*cause he foresaw the shutdown of NOLA’s red light district AND ALSO were it not for Jim Crowe laws what would he have turned the Azalea#into#‘s2 said he’s an art dealer’ look everyone needs hobbies. he might race horses too. we don’t know.#but *I* know he has commercial holdings on magazine street FUCK!!!!

32 notes

·

View notes

Text

Saw a post about pandemic office real estate, and it made me want to long post about how the problem is in my city. Note; this is also a picture of the ongoing “mall” problem.

Part of the problem is that the bubble that is commercial real estate and real estate in general is becoming more obvious, and no one wants to sell for a low price, and also no one wants to be left holding the bag.

Here is an example of something in my home city. A commercial office building was recently put up for auction. It’s about 5 stories and was constructed in the 70’s, and has asbestos that the new owner would be responsible for, and is also not ADA compliant due to where the elevator is located in relation to the entrance, which the new owner would also be responsible for.

It is currently owned and managed by a very wealthy property conglomerate who obtained the building in 2008 at a bargain price, and have not done anything to improve the building.

They also have not had any tenants since they have bought the building.

It went up for auction and barely scraped over $1 million, which the owners decided was not enough and scrapped the sale entirely.

This example paints a picture of what commercial real estate is like in my home city. Large commercial buildings are left to rot because firms are acting as speculators. They don’t want to be landlords because that would impose a duty to do maintenance on most of these older buildings that haven’t had maintenance done on them for a long time. Also no tenants means that insurance on the building is a low price. Double also, they don’t want to allow tenants at a lower rent because that would lower the value of the building and reduce a sale price (their ultimate goal).

They also have deep enough pockets (and taxes in my city are generally low enough) that they can continue paying property taxes. Holding onto that perceived value also makes it look a lot nicer for when these companies take out loans to buy more property.

Selling the property for a bargain price is also a no go, because it reduces the property value of their adjacent holdings.

What I am trying to get at is forces in play make the best move for owners of these buildings to not do anything with them.

They will not do anything until they have a liquidity crisis, and if these companies with lots of capital have a liquidity crisis, chances are, things are going even worse for the average person.

How to fix this in a way that doesn’t fuck over everyone is a problem and frankly I’m not sure the city has any best solutions available.

6 notes

·

View notes

Text

Begin your perfect living with Fat Homes. Click on the link in bio and explore the perfect home you've always desired.

#realestate#investment#property#flippingamericatoday#flippinghouses#real estate agent#commercial#flippingproperty#finance#real estate

7 notes

·

View notes

Text

With over 1000 residential sales + more than 100 development site sales and 40 years of experience, Phil Davis definitely has the expertise to sell your property for the highest price in Westmead.

#economy#investing#commercial property#properties#property broker#real estate#real estate agent#apartments#entrepreneur#branding

22 notes

·

View notes

Text

Skyview Home Rentals

youtube

Apparently this ad we once did for a SecondLife virtual estate developer is 15 years old today. Going to be over in a corner cringe-laugh-dying 🤣

#secondlife#virtual real estate#commercial#virtual reality#virtual world#what the hell accent is that#do i still sound like that#tell me i don't still sound like that#good bloody hell#Youtube

4 notes

·

View notes

Text

https://www.commercialnoida.com/blog/a-complete-overview-why-noida-is-perfect-destination-for-commercial-retail-shops

#realestate#commercial projects#gaurs#noida#investment#coomercialnoida#paras#realestateagent#saya#architecture#commercial property#commercial retail shops in noida#retail shops in noida#commercial real estate#commercial real estate news#commercial real estate broker#commercial buildings#corporate#commercial cleaning#ecommerce#entrepreneur#finance#branding

10 notes

·

View notes

Text

Budget 2024 - What It Means for The Real Estate Industry - Part III

The Indian Union Budget 2024 has been released, and its implications for the real estate sector are substantial. This article will delve into the various facets of the budget, examining how the proposed changes will impact the real estate industry. As one of the most dynamic real estate markets in India, Gurugram's developments are keenly watched by investors, developers, and homebuyers alike. For a comprehensive overview of real estate in Gurugram and to stay updated on market trends, visit Ehouzer.

Key Highlights of Budget 2024

Increased Infrastructure Investment

One of the most significant announcements in the 2024 Budget is the increased allocation for infrastructure development. The government has earmarked an additional ₹2 trillion for infrastructure projects, which includes improvements in transportation, urban planning, and public utilities. This investment is expected to have a ripple effect on the real estate sector.

For Gurugram, this means enhanced connectivity and infrastructure. New roads, metro lines, and better public services will make the city more attractive to investors and homebuyers. Improved infrastructure typically leads to an increase in property values and a boost in real estate activities.

Affordable Housing Incentives

The Budget 2024 continues to emphasize affordable housing, a key focus area for the government. The introduction of new incentives for developers who build affordable housing projects is expected to drive the construction of more budget-friendly residential options. This initiative aligns with the government's goal of providing housing for all and is likely to stimulate demand in the residential real estate sector.

In Gurugram, the demand for affordable housing has been on the rise due to the influx of professionals and the growing population. With these new incentives, developers are likely to invest more in affordable housing projects in the region. For detailed insights into the real estate opportunities in Gurugram, explore Ehouzer

Tax Reforms and Benefits

The Budget introduces several tax reforms that are expected to benefit both developers and homebuyers. Key among these is the increase in the tax deduction limit on home loan interest payments. Homebuyers will benefit from higher deductions, making homeownership more affordable.

For developers, the Budget proposes tax incentives for the construction of green buildings and eco-friendly projects. This shift towards sustainability is expected to influence real estate development trends, encouraging the adoption of green building practices.

These tax reforms will likely boost the real estate market in Gurugram, as more homebuyers and developers take advantage of these benefits. To understand how these changes may impact your real estate investments, visit Ehouzer.

Impact on Residential Real Estate

Demand for Residential Properties

The combination of increased infrastructure investment and affordable housing incentives is expected to drive up demand for residential properties. In Gurugram, the residential real estate market is likely to see a surge in demand as more people look to invest in property due to improved infrastructure and attractive housing options.

This uptick in demand is also anticipated to influence property prices. While affordable housing projects may provide budget-friendly options, the overall rise in property demand could lead to increased prices in other segments of the residential market.

Shift Towards Sustainable Living

The Budget’s emphasis on green building incentives is expected to accelerate the shift towards sustainable living. Developers in Gurugram are likely to adopt more eco-friendly practices and technologies in their projects. This shift not only aligns with global sustainability trends but also meets the growing demand from environmentally-conscious homebuyers.

Sustainable living features, such as energy-efficient appliances, solar panels, and green spaces, are becoming increasingly popular. Homebuyers in Gurugram will benefit from these developments, gaining access to more sustainable and energy-efficient housing options.

Commercial Real Estate Developments

Growth in Office Spaces

The infrastructure investment outlined in the Budget is likely to benefit the commercial real estate sector, particularly the office space market. Enhanced connectivity and improved urban infrastructure will make Gurugram an even more attractive location for businesses.

Companies are expected to seek out modern, well-connected office spaces to accommodate their growing operations. This increased demand for office space will drive commercial real estate development in Gurugram, with new projects and expansions likely to emerge.

Retail and Mixed-Use Developments

The commercial real estate market in Gurugram will also see growth in retail and mixed-use developments. The increased focus on infrastructure and urban development will attract more retail businesses and mixed-use projects, which combine residential, commercial, and recreational spaces.

These developments are expected to enhance the urban landscape of Gurugram, providing residents and visitors with more shopping, dining, and entertainment options. For insights into the latest commercial real estate trends and opportunities, visit Ehouzer.

Investment Opportunities

Real Estate Investment Trusts (REITs)

The Budget 2024 includes provisions for the growth of Real Estate Investment Trusts (REITs), which offer a viable investment option for those looking to invest in real estate without directly purchasing property. REITs provide an opportunity to invest in a diversified portfolio of real estate assets and benefit from rental income and capital appreciation.

Investors in Gurugram should consider exploring REITs as a way to diversify their investment portfolio and gain exposure to the commercial real estate market. The growth of REITs in India presents new opportunities for both individual and institutional investors.

Affordable Housing Projects

With the new incentives for affordable housing, developers are likely to focus on projects that cater to the budget segment. Investors looking to capitalize on this trend can explore opportunities in affordable housing projects in Gurugram. These projects are expected to offer attractive returns due to the high demand for affordable housing.

For more information on investment opportunities in the real estate sector, including affordable housing and REITs, visit Ehouzer.

Regulatory Changes and Their Impact

Simplified Land Acquisition Processes

The Budget proposes measures to simplify land acquisition processes, which is expected to benefit real estate developers. Streamlined procedures will reduce delays and lower costs associated with land acquisition, facilitating faster project completion.

In Gurugram, these regulatory changes will likely lead to a more efficient real estate development process. Developers will be able to expedite their projects, which will, in turn, enhance the overall growth of the real estate market in the region.

Enhanced Transparency and Accountability

The Budget emphasizes the need for greater transparency and accountability in the real estate sector. New regulations are expected to address issues such as project delays, non-compliance, and financial transparency. These changes aim to build trust among investors and homebuyers.

For stakeholders in Gurugram, these regulatory changes will contribute to a more transparent and reliable real estate market. Developers and investors can benefit from the increased clarity and accountability in real estate transactions.

Challenges and Considerations

Potential Impact on Property Prices

While the Budget's initiatives are likely to boost the real estate sector, there are concerns about the potential impact on property prices. Increased demand for residential and commercial properties may lead to higher prices, which could affect affordability for some buyers.

Homebuyers and investors in Gurugram should consider these factors when making real estate decisions. It is essential to stay informed about market trends and property price movements to make well-informed investment choices.

Balancing Supply and Demand

The growth in real estate development, driven by increased infrastructure investment and affordable housing incentives, must be balanced with supply and demand dynamics. Overbuilding or misalignment between supply and demand could impact the stability of the real estate market.

Developers and investors in Gurugram should carefully assess market conditions and demand trends to ensure that new projects align with the needs of the market.

Conclusion

The Union Budget 2024 presents a range of opportunities and challenges for the real estate industry, with significant implications for the market in Gurugram, Haryana. Increased infrastructure investment, incentives for affordable housing, tax reforms, and regulatory changes are set to shape the future of real estate in the region.

As the real estate landscape evolves, stakeholders in Gurugram must stay informed and adapt to the changes to leverage new opportunities and address potential challenges. For more detailed insights into the real estate market in Gurugram and to explore investment opportunities, visit Ehouzer.

For personalized advice and assistance with your real estate investments, contact us.

#realestate#budget 2024#gurugram#housingmarket#infrastructure#affordablehousing#commercial real estate#residential property#investment#sustainableliving#greenbuilding#urban development#property#realestateinvesting#homebuyers#propertyinvestment#realestatemarket#realestatenews#realestatetips#housing development#economicgrowth#urban planning#propertyvalue

2 notes

·

View notes

Text

Explore prime property opportunities in Ahmedabad with The Realtors expert guidance. From residential to commercial spaces, discover ideal locations, competitive pricing, and personalized support to make your investment seamless and rewarding.

#property consultant#real estate consultant#property advisor#property for sale#homebuying#commercial property#apartment for sale

2 notes

·

View notes

Text

🆕 NEW Carrd Template - Real Estate

https://best-templates.carrd.co/

#carrd#template for card#carrd template#carrd templates#carrd theme#template#landing page#profile#realestate#real estate#real estate marketing#real estate investing#real estate agent#real estate consultant#real estate projects#commercial real estate#realtor

3 notes

·

View notes

Text

The post-COVID reality is that urban office buildings are a lot less necessary and are staying empty. Commercial real estate values are starting to crumble and loans based on revenue projections no longer viable are getting shaky.

Do you think the banks that can't even balance their long- versus short-term loan portfolios have been circumspect with their loans to developers?

Three bank failures so far this year, more to come.

Graphic - NY Times

23 notes

·

View notes

Text

No, you do not need a real estate license to flip. But holding one can be very beneficial. It can make you well-versed in real estate procedures and give you access to various tools and resources, making real estate investing easier and more lucrative. Here are some benefits of holding a real estate license

#realestate#investment#commercial#property#flippingamericatoday#flippinghouses#real estate agent#finance#flippingproperty#real estate#fat#fathomes

11 notes

·

View notes

Text

Explore about our latest sold.

#investing#commercial property#properties#economy#property broker#real estate#real estate agent#entrepreneur#apartments

15 notes

·

View notes

Text

youtube

#mirabhayandar#real estate#bhayandar#mira road#2bhk#1bhk#1 bhk apartments#2 bhk apartments#2 bhk flat#2 bhk luxury flats in bhayandar#bhayandar west#2 bhk in bhayandar#2 bhk in mira road#1 bhk in bhayandar#2 bhk in bhayandar west#commercial real estate#commercial property#office space#pentagon bhayandar#anandam bhayandar west#mirabhayandarprojects#sunteck#star life#skyline#skyline bhayandar west#bhayander#mira bhayandar#sky heights#anandam#mukundam

2 notes

·

View notes

Text

Pros & Cons of Buying Under Construction Property

Purchasing an under-construction property can be an enticing option for many homebuyers. These properties often come with unique advantages, but there are also potential drawbacks to consider. Here's a straightforward look at the pros and cons of buying an under-construction property to help you make an informed decision.

Pros of Buying Under Construction Property

Lower Prices

Affordability: Under-construction properties are typically priced lower than ready-to-move-in homes, making them more affordable for buyers.

Flexible Payment Plans: Builders often offer attractive payment plans, allowing you to pay in stages as the construction progresses.

Customization

Personalization: Buyers have the opportunity to customize various aspects of their new home, such as the layout, interiors, and finishes, to match their preferences.

Modern Amenities: New constructions often come with modern amenities and facilities, enhancing the overall living experience.

Investment Potential

Appreciation: Properties purchased during the construction phase can appreciate significantly by the time they are completed, providing good returns on investment.

Early Bird Discounts: Builders frequently offer discounts and incentives to early buyers, adding to the potential for savings and value appreciation.

New Construction

Latest Standards: Under-construction properties are built according to the latest building codes and regulations, ensuring better safety and efficiency.

Warranty: New properties often come with warranties on construction and fixtures, providing peace of mind to buyers.

Cons of Buying Under Construction Property

Delayed Possession

Construction Delays: One of the biggest risks is the possibility of delays in construction, which can postpone your move-in date.

Impact on Plans: Delayed possession can disrupt your plans and incur additional costs, such as extended rental expenses.

Quality Uncertainty

Unknown Quality: Since the property is not yet completed, assessing the final construction quality can be challenging.

Dependence on Builder's Reputation: The final outcome heavily depends on the builder's reputation and reliability.

Financial Risks

Market Fluctuations: Changes in the real estate market can impact property values, potentially affecting your investment.

Loan Disbursement: Banks may delay or halt loan disbursements if the project is delayed, affecting your payment schedule.

Limited Immediate Use

No Immediate Occupation: Unlike ready-to-move-in properties, you cannot occupy an under-construction property immediately, which may be a drawback for some buyers.

Conclusion

Buying an under-construction property comes with its set of advantages and disadvantages. It offers the potential for lower prices, customization, and investment growth but also carries risks like construction delays and quality uncertainties. Weighing these pros and cons carefully will help you make a well-informed decision that aligns with your financial goals and lifestyle needs.

For those seeking reliable under-construction properties, Goel Ganga Developments offers a range of high-quality projects designed to meet your needs and ensure a smooth buying experience. Explore their developments and find your dream home today!

#goel ganga pune#goel ganga developments pune#goel ganga ishanya satara#ganga acropolis baner#ganga aria#ganga platino kharadi#goel ganga#3 bhk in dhanori#3 bhk flats in dhanori pune#3 bhk flats in pune kharadi#2 bhk flats in kharadi pune#2 bhk flat in pune#2 bhk for sale in kharadi#2 bhk flats in kondhwa pune#goel ganga developments#best builders in pune#pune builders and developers#commercial property in pune#new residential projects in pune#premium residential projects in pune#commercial property for sale in pune#commercial shops for sale in pune#real estate projects in kharadi#best real estate developers in pune

2 notes

·

View notes

Text

Benefits Of Choosing Perfect Real Estate Services

Choosing a good real estate service can significantly impact your property buying or selling experience, offering numerous benefits that can lead to better financial outcomes and smoother transactions. Here are some key advantages.

Market Expertise

A good real estate advisor knows the local market inside and out. They understand property values, current trends, and neighborhood details. This knowledge helps them provide accurate pricing advice, ensuring you don’t overpay for your Property. Their insight helps you make informed decisions as well as take advantage of market opportunities.

Valuable Connections

Experienced real estate advisors have a network of professionals like mortgage specialist, home inspectors, contractors, and lawyers. These connections can make your transaction smoother and more efficient. They can recommend reliable service providers, saving you time and ensuring quality work.

Skilled Services

Negotiating real estate deals requires skill. A good advisor negotiates on your behalf to get the best terms possible. Whether it’s the purchase price, contingencies, or closing costs, their experience can save you money. They know how to handle offers, counteroffers, bidding wars, and any conflicts that might arise.

Simplified Process

Real estate transactions involve a lot of paperwork and coordination. A good advisor manages these tasks, ensuring everything runs smoothly. They handle scheduling inspections, meeting deadlines, and coordinating with all parties involved. Their oversight reduces the risk of delays or issues, making the process less stressful for you.

Personalized Service

A dedicated realtors adjust their services to your needs. They take the time to understand your goals, whether you’re a first-time buyer, an investor, or Under Budget Buyer. This personalized approach means they can find properties that match your criteria, making your experience more satisfying.

Emotional Support

Buying or selling a property can be emotional. A supportive Real Estate Service provides reassurance and guidance, helping you stay focused on your goals. Their confidence and experience give you peace of mind, making the process less stressful.

Long-Term Relationship

A good real estate service aims to build a long-term relationship with you. They can be a valuable resource for future real estate needs, market updates, and investment advice. This ongoing relationship can lead to better decisions and financial benefits over time.

#perfect realtors#benefits of choosing good real estate services#sunblonderealty#realestateprojects#mumbairealestate#propertyfinder#dreamhome#luxuryliving#maharera#commercial property#residential property

2 notes

·

View notes