#cod lobby contributor

Explore tagged Tumblr posts

Text

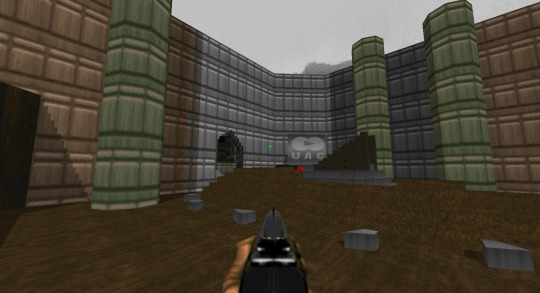

Doom WADs’ Roulette (2003): Phobos: Anomaly Reborn

Gonna be honest with you folks...

This one surprised me...

#1: Phobos: Anomaly Reborn

Main author(s): Christopher Lutz

Release date: January 2nd, 2003 (database)

Version(s) played: ???

Required port compatibility: Boom/MBF

Levels: 9 (episode standard)

Christopher Lutz has done it again, since not only he was the main contributor to the 2002’s Caverns of Darkness but also made this banger too. And both ended up better than I expected. Is Phobos: Anomaly Reborn as good as the previous WAD, thought? Well, time to look at it deeper and find out.

The story is... uhm... stuff happening at Phobos again and Doomguy is sent there to investigate. That’s basically all I got since the story takes itself too seriously, ending up looking pretentious and needlessly wordy.

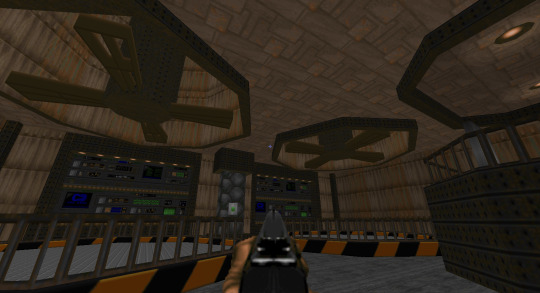

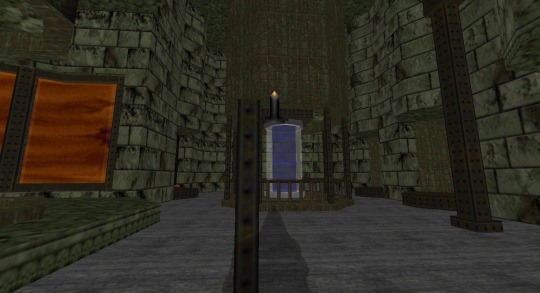

Can I say, however, that PAR WAD looks amazing? Because it does. Not only it has interesting elements/objects around the maps and the architecture looks great, but all of this was done with nothing but stock textures (at least that’s how it looks for me)! On Doom I! Where the variety of textures is more restricted! I know that sometimes the 1994 types of levels/WADs tend to look uninteresting and/or overly simple, but this WAD looks anything but.

Thematically, Anomaly Reborn feels like it’s the same as Caverns of Darkness. The first half of this WAD starts mostly in some sci-fi tech-related locations created by humanity while the second half makes you go deeper and deeper until you reach the bottom of hellish locations. Sure, there aren’t really that much of ruins of the old times in the first half, and the architecture/textures in the second half don’t really feel that hellish when compared to CoD WAD, but I think the foundations of both WADs are the same.

Hey, if ain’t broken, don’t fix it.

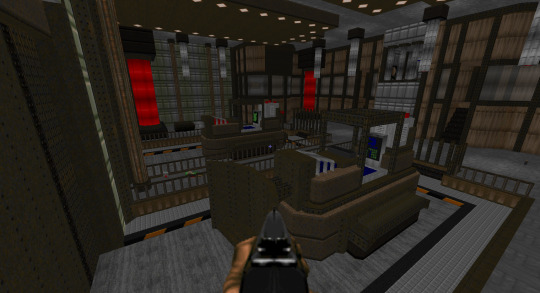

Now let me warn you that this WAD might confuse you. The maps tend to be really big and there are multiple tasks to do on each map to some degree (usually switch hunting). But let me tell you something folks. It’s not as bad as you think it might be. I felt like it was actually one of the easier WADs that put more emphasis on puzzles. Hell, the ZIP file even comes with the text file that has a walkthrough and hints for every map of PAR. So even in the worst cases, you can look where to go next, and continue from that point onwards.

My personal advice to you, at least for the earlier levels, is to check every area from the west first and then go clockwise with every new room to check if there is a split.

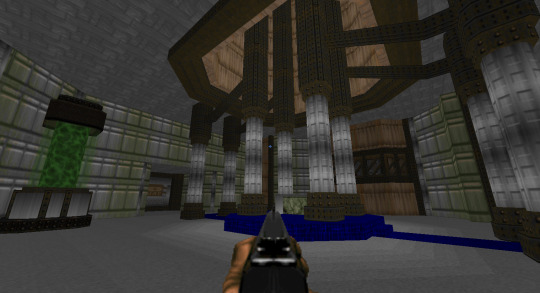

Now, if I spend time talking about stuff on all maps, we will be here forever. So instead, I’ll try to summarize one of the levels that I might enjoy the most: Subterra.

To somehow explain this level to you without much of a context, you need two skulls to put on pedestals for each one. One requires to start a machine that needs water to properly work to get to the skull. The other actually needs to be created using lava. It’s insane.

As for the other interesting stuff I would like to share with you:

Railbender is set on a train, which automatically makes this level at least 7/10.

Toxin Refinery’s first half focuses on finding three switches that will allow you to go through the northern door in the lobby (there is even progression shown above this door).

And Lost Barracks’ last location is actually the same as in Dissolution, connecting both of these levels, and making it more sensible how you end up in E1M4 from E1M9.

Like I said earlier, even though the levels are not as complicated as you may think they are, there is still a chance that you might get lost in them. The biggest example for me is the first map, Hangar B. Not in terms of the keys and switches positions because these are piece of cake but due to the layout of this map. It feels like I was playing on a Gordian Knot of a map, not helping with the rails that will electrocute you if you stand on them for too long (and one of the secrets of this map requires you to go through these to get there) and there is probably only one place to get out of them without jumping.

Also, be wary that there are many places where you won’t come back up after falling down (usually where the floor deals damage), so make sure to save if you feel that you might screw up.

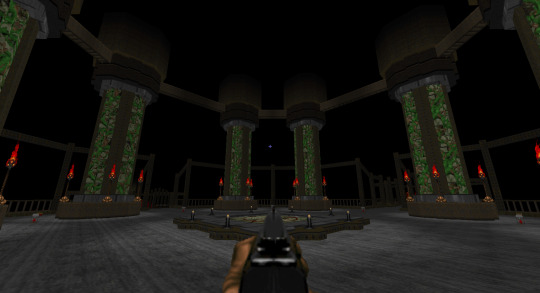

I don’t think Anomaly Reborn is that hard. Sure, there are tough moments (especially Hangar B where you start at 55% of health) but with the knowledge of secrets’ locations, you will be fine. There are some bullshit moments here and there like fighting barons in unfriendly terrain (the train level was especially a bitch for this term) or fighting on an open field surrounded by hitscanners (or just hitscanner traps overall) but these were thankfully scarce. There are also at least three moments where you can cheese Cyberdemon.

And here is another thing that I enjoy in this WAD: Spiderdemons now shoot plasma!

It’s a really small thing, but it finally makes fighting these Huge B8tches somewhat enjoyable (even though only two of these appear on the last level on HMP).

The only bugs I’ve encountered were the visual ones. No idea if it’s the fault of GZDoom or the WAD itself.

And that’s all I can say about Phobos: Anomaly Reborn. I was expecting something worse (or at least more irritable) but, like with Caverns of Darkness, I had a blast playing it. It’s a very good episode replacement and I really recommend you to try it out.

If all the WADs will keep the quality as this one, then 2003 will be very enjoyable to play (I know the next two on the list are).

See you next time.

Bye!

#doom#Doom WAD#review#ultimate doom#doom mod#2003#doom 2003#phobos: anomaly reborn#doom Phobos: Anomaly Reborn#Doom WADs’ Roulette

2 notes

·

View notes

Text

Money Is Still King of the Hill And We Are All the Poorer for It: A Glance Back, and Forward

Digital Elixir Money Is Still King of the Hill And We Are All the Poorer for It: A Glance Back, and Forward

By Skip Kaltenheuser. An expanded version of an article originally published at DownWithTyranny!

In Washington, the more things change, the more they stay the same. Except when they get worse. The recent Democratic Party Presidential Debates had me thinking on the enclosed essay on campaign finance, fished out of the wayback machine, that appeared in Barron’s.

Way back, over two decades. At the time, I foolishly thought disgust with begging, with dialing for dollars would propel politicians to embrace and expand public financing. I didn’t count on their fear of risking incumbent advantage and didn’t know candidate Obama would come along to help lobotomize the concept. And I didn’t realize how entrenched and powerful the lucrative campaign finance/public relations-military-industrial complex would become, sprinkling its meth into Pandora’s Box as it greases the big money narratives from FOX to MSNBC, and beats the drums of war.

Too much of the precarious Fourth Estate, with career paths now often leading to public relations, has become subservient, to advertising dollars and/or to the overlapping interests of those who own media. Witness CNN’s Jake Tapper doing corporate PR’s bidding as a debate “moderator” during Tuesday night’s debate with Bernie and Elizabeth Warren. He sounded almost frantic trying to get the predictable knives in and cutting short responses not going his way. I half-expected to see a CNN stagehand carrying a potted plant walking back and forth behind the two progressives every time they spoke, the plant growing taller with each passage across the stage. Vaudeville, why not?

Freedom of the Press, Money and the media, by Nancy Ohanian

Forgive a few anachronisms for a piece written in late ’96. For example, this was done long before Citizens United amped up the problem exponentially, including the greasing of dark money, well in play now by both major parties, as secret funders seek out mix and match politicians. The required fundraising sums mentioned in the piece have been dwarfed, cementing the power of the fundraising/consulting class. Since the 2010 decision on Citizens United, the far-ranging impacts have even souped up the purchase of state courts, as noted in this Barron’s essay, The Price of Justice. This builds an increasingly pro-big business judiciary, which I believe contributes to the wealth gap.

To be fair, the big money does a great job promoting bipartisanship. Witness the massive subsidies for fossil fuels, not to mention military support to protect those industries abroad. It’s a bipartisan success in helping speed future mass extinctions. One of innumerable items under the radar, witness the bipartisan corporatist destruction of the US patent system regarding prospects for small entity inventors challenging the big boys. Quick tip to Bernie: You can rectify a mistake by pushing a proper fix. It’s the perfect progressive issue on every level. Not addressing it means a power-dive for American innovation and the gobbling of our seed corn.

One other thing that’s happened since the essay is an astonishing increase in the wealth gap, and in the concentration of political power that goes hand in hand. What does the Big Money want? As noted here, what the Big Money wants is more.

American Dream Revisited, by Nancy Ohanian

In the oops category,my bad, (really bad), in the essay I lauded then-Comptroller of the Currency Eugene Ludwig’s regulations “modernizing” the finance industry. It appears Ludwig was complicit in Bill Clinton’s undermining of the Glass-Steagall Act of 1933’s separation of commercial and investment banking. It’s still a great example of the issues phonies like Chuck Schumer dance around and speak out of both sides of their mouths about in order to generate campaign contributions from competing interests. But allowing banks to muddy the waters between commercial and investment banking, with tax-payers on the hook, brought about one of government’s greatest catastrophes. I’d sure like to disappear any favorable connotations in that example from the essay. So it goes.

You’ll note my essay below was triggered by illegal foreign money contributions to Bill Clinton via bag men like John Huang, an affair known back then as Chinagate. The Clintons were ahead of their time in so many ways. Since then, Citizens United has made the barriers to influence via campaign money from foreign interests laughable, as predicted in the grand dissent by the late Justice John Paul Stevens, as noted in The Intercept

Into the Time Machine:

Collusion 3: The System, by Nancy Ohanian

King of the Hill: Disclosure alone won’t topple campaign money as the ruler of Congress.

(Barron’s Other Voices, Jan. 13, 1997)

Not long ago the Clinton Administration crowed about agreements with a number of countries to curb bribery in business abroad. Wide implementation of measures such as tax-deductibility of bribes is still a long march away. Still, the laudable effort reflects the belief in U.S. charges that corrupt practices such as bribery in foreign procurement produce inefficiency, surprise derailments and social instability. The stock retort from parties resisting reform: There isn’t a dimes difference between bribery abroad and the U.S. campaign-finance system.

Plenty have professed to be shocked – shocked! – when the White House was caught Huanging it. Alas, many commentators conclude that stricter limits on donations and spending won’t work and that the only real solution is “absolute disclosure.”

Improvements in disclosure are needed, but by itself disclosure is woefully inadequate. Lip service for disclosure as the only route for reform is the fallback position of those in the lobbying world – givers, incumbent receivers and the growth industry between them. They’ll mumble anything to head off public anger at the low art of the thinly disguised bribe.

Reform is a tricky puzzle. Before accepting disclosure not as a tool but as a panacea, consider this: Most voters lack either the ability or the time to adequately decipher the true meaning of campaign contributions. Who figures the National Wetland Coalition for oil and land-development interests? Witness past parades of donors calling themselves housewives, large contributors’ most frequently listed occupation.

Some contributors, like the tobacco industry, have readily identified goals. But others aren’t so easy to figure. How many voters will sort out the quid pro quo of folks like Dwayne Andreas, who gives piles of money to everyone and has a long list of diverse objectives? How many will plumb the desires of a patent-law firm whose favored clients are foreign companies? What of domestic subsidiaries of foreign companies? Try tracking “soft money,” wonderfully malleable stuff that is laundered by the political parties themselves, often comes from equal-opportunity givers and goes wherever the parties want to put it.

Organizations and competitors already rush to filter the info for voters, but much of their messages turn to mush in the flood of interpretations. Voters must also decipher the political spin and agenda of groups offering to do the voters’ homework. Let the press do its job? Presumably it already tries in the limited space it’s allotted, but shining a light on all the shell games is a daunting task and anyway, would lead to information overload.

I once asked a top staffer for former U.S. Sen. Alan Cranston, the California Democrat, how the senator coped with the flood of cash. He deadpanned: “People think if they give you a lot of money, they’re buying influence. But all they really buy is access.” Charles Keating must have thought the fictional wall between influence and access a hoot.

Just as corruption abroad results in inefficiencies that harm American companies, many U.S. government inefficiencies, including bloat and waste, are traceable to our system of campaign finance. Political action committees and trade associations are dominated by members who are the most active because they seek the most. They are bidders in a political bazaar focused on the short term. A legislator’s response, “We’re looking closely at this,” is often code for, “It’s on the block, open your wallets.” Because so many politicians are unable to move for fear of alienating contributors, matters are often not taken up until a crisis arrives.

One example of legislative paralysis is in the arena of finance. According to the Center of Responsive Politics, interested parties seeking to influence the House and Senate banking committees spent nearly $60 million in campaign contributions in the first 18 months of the 1995-96 election cycle, exceeding all other industry and labor groupings, and totals are expected to rocket when the final five months are compiled. Did this advance a rational, comprehensive modernization of the financial-services world? No. Competing interests fought to a standstill. Finally, Comptroller of the Currency Eugene Ludwig, whose patience had run out, issued regulations that will accelerate modernization of the industry. Pros like William Seidman, former chairman of the Federal Deposit Insurance Corp., praise Ludwig’s action as strengthening safety and soundness but Republican Alfonse D’Amato of New York, says he is “deeply troubled” by the comptroller’s action, and Democrat Charles Schumer of New York, a member of the House Banking Committee, says the regulations�� impact on bank safety “is far too serious to be left to the discretion of regulators (in other words, open your wallets and we’ll get up another game). (Note: before you jump on me for this example’s naive appraisal of modernization, see the “in the oops category” paragraph in the post intro above).

As for rifle-shot legislation that succeeds, take a peek at our tax code. And from airwaves to sugar beets, gasohol to guns, the correlation between votes and contributions is startling.

One often hears that, in our $6 trillion economy, soft-drink advertising eclipses what is spent on campaigns. But it isn’t the amount, it’s where it goes, who gives it and how many on Capitol Hill spend most of their time seeking it. Senators raise an average of 15 grand or so a week, every week. Leon Panetta, the departing White House chief of staff recently estimated that legislators spend 60%-80% of their time with their palms out. He figures the madness continues because politicians are too insecure to tackle the system they know and which got them into office. Do we really want the chief criterion for the performance of our leaders – and often their staffs – to be their ability to raise money?

Even more repugnant to democratic ideals is the flip side of politicians’ money-raising – the threat, not at all thinly veiled, of retaliation against companies that give money to the opposition.

Oddly, one proposed solution to this state of affairs is to simply take off all limits and let politicians glide with a few fat-cat backers, restrained only by full disclosure. Including soft money, the top 1% of income earners already provide the vast bulk of campaign cash, exceeding PACs. Politicians needn’t be rocket scientists to know the majority of people in the top 1% view many issues – such as uncapped interest deductions on loans for high-priced homes – pretty much the same way. Again, disclosure falls short of revelation.

If you think we have funny races now, turn all our candidates into horses owned by the biggest bettors. As they won’t differ much on real issues, we will be treated to demagoguery. Their strategies will center not on better ideas but on engineering the failure of the opposition.

Applaud any tightening of disclosure, but the only way to curb undue influence, from both international and domestic sources, is to curb undue influence. That means curbing money. Banning soft money and giving teeth to the Federal Election Commission would be a big start. Voluntary participation in a system with spending limits, meaningful media access and citizen financing – which would also free politicians – with tough limits on contributions from every source would be even better. The public cost would be a pittance compared with the savings from more government decisions based on the merits; consider just the cost of delayed oversight of the thrift industry.

Those who would limit reforms to disclosure cite the difficulty, both judicial and legislative, in keeping both foreign and domestic money from finding indirect routes. But that difficulty also applies to the proper disclosure of the routes money takes into one pocket and out the other. That’s why real contribution limits are necessary.

Until the Supreme Court wises up and admits that unlimited money isn’t unlimited speech, participation in a public financing system will have to be voluntary. But polling shows strong, consistent support for public financing. Access to meaningful media formats at reduced cost must be a component. As voters rebel against the cynicism expressed by turn-of-the-century writer Elbert Hubbard, “Government is a kind of legalized pillage,” big spenders who scoff at a serious reform system are likely to suffer backlash.

The confused message our system sends abroad, and perhaps at home, was made clear recently when the bureau chief of a South American TV network asked me: What is wrong with influence from foreign contributions? After all, we live in a global economy.” I answered that if nothing were wrong with it, folks like Lincoln couldn’t pen phrases like “government of the people, by the people, for the people,” but I don’t think I was persuasive.

Conventional wisdom on the last campaign is that a wary public balanced a Democratic White House with a Republican Congress. But a nationwide agreement between voters to neutralize parties was less a factor then the money-raising power of incumbency.

That power is the enemy of reform. Vice President Gore, Rep. Dick Gephardt and others seeking the White House are already pulling levers on the fund-raising machinery, as are congressional incumbents. The desire for another day, another dollar won’t abate unless the public insists that this is a matter of national shame. Then real reforms may become an irresistible avenue for a White House mea culpa and political absolution. Restoring credibility to government will enhance elected officials ability to carry a tough sell, such as entitlement reform, to the public, without being handed their hands.

If the fallout from John Huang brings about real campaign-finance reforms – perhaps the greatest accomplishment the President and Congress might achieve – we should all take Mr. Huang to lunch. Campaign money, like rainwater, will always seek the leaks in our democratic roof, but that’s no reason not to keep plugging the holes. People who wait only for fixes that are absolutes will be waiting for Godot. Voters know our system of campaign finance attacks the concept of one person, one vote, and their sense of disenfranchisement just provided the lowest Election Day turnout since 1924.

Political Corruption, by Nancy Ohanian

So that was the view from yesteryear, and as mentioned the continuum only tilts in the wrong direction. “Realpolitik”– politics based on the (alleged) practical instead of on moral or ideological considerations – has completed its takeover of the party leadership of both parties. A major selling point for Nancy Pelosi holding the reins is her fundraising prowess. From my perspective that’s simply her ability to pawn policy while putting the Democratic Party in hock to the big money. And so we’re treated to the once-laudable Pelosi and her staff both publicly and behind the scenes undercutting Medicare for All. Run for it, Desdemona! Iago has nothing on Pelosi’s style as she sows seeds of doubt. Same for Pelosi’s quiet eloping with the center-right and fossil fuels resistance to the Green New Deal.

Corrupt Lawmakers, by Nancy Ohanian

Benjamins on the march. And so we have Joe Biden telling wealthy donors that nothing fundamentally would change if he were president. I can’t ignore the feeling that Kamala Harris, whom I believe to be one of Wall Street’s Manchurian Candidates, let Goldman Sachs alumnus and current Treasury Secretary Steve Mnuchin off the hook after his predatory piracy in California via his OneWest Bank to send a strategic signal to Wall Street because she anticipated seeking Wall Street campaign largess. It may not always be immediately apparent, but nearly everything in government is twisted and distorted by the hunger for campaign contributions, which makes politicians as calculating as junkies looking for a fix.

Pardon the digression but remember when Eric Holder, the original Wall Street Manchurian Candidate for 2020, announced in April of 2018 his desire to be President? The response was a wet fuse, but Holder still waits in the wings. Perhaps he’s waiting to be called onto a compromise ticket, or to a cabinet fiefdom, or maybe a door-prize Supreme Court appointment. If instead of Sanders and/or Warren someone like Biden prevails, Holder is at least guaranteed influence and a big ka-ching from Wall Street for exercising it. Holder’s using an anti-gerrymandering group, All on the Line, as his stalking horse. The group’s entreaties mimic campaign-style fundraising as he creates a list of potential supporters.

At some point we’ll glance at what Holder, with John Brennan and sainted Robert Mueller (!), did to whistleblowers like John Kiriakou, an intelligence operative who exposed CIA torture. But the point for now is that beyond his huge legal fees for servicing bankers, and beyond Wall Street’s early support of Obama, it was also Holder’s anticipation of future Wall Street financial support that underpinned his kid-gloves approach to Wall Street’s criminals. When the next finance sector debacle is inflicted on America and on the world, it can be laid at the feet of “Hands-Off Holder” and at campaign fundraising by both major parties as they whittle away on the wobbling Dodd-Frank.

Bought and Paid Justice, by Nancy Ohanian

Some encouragement comes from the smaller dollar contributions championed by Bernie, coupled with the rise of alternative media not in lock-step with the mainstream. Also to the good, less expensive Internet strategies to spread town-meetings and stump speeches, establishing beachheads against the campaign finance/public relations-military-industrial complex. As the motivations of those gleefully referred to by Calvin Trillin as the Sabbath Gasbags are increasingly viewed with suspicion, the scripted propagandists will fade into their own echo chambers.

But encouragement is quickly dampened. The other day NPR’s 1A Speak Freely show Wall Street On Parade asked nearly intact:

Please ask Senator Booker if he would push to reinstate the Glass Steagall Act of 1932 that separated commercial and investment banking.

Also, is Senator Booker concerned about four Wall Street banks holding $177 TRILLIONin face amount of derivatives, which is 89% of all derivatives held by Federally-insured banks?

Additionally, would a President Booker end the Wall Street advantage of high frequency trading, and end the practice of opaque trading in dark pools that skirt government oversight?

In other words, what measures would a President Booker do to curb our exposure to another financial meltdown like 2008?

After which Booker opted to answer his own question, lauding himself for admittedly important efforts to get financial services to underserved communities. But he completely ignored each of my questions. Which means, whatever rhetoric is convenient at the moment, he’ll ultimately continue to knock on Wall Street’s door.

Cory Booker, by Nancy Ohanian

I know two who can and will reliably answer these questions: Bernie and Elizabeth Warren, neither of whom will ever raise suspicions of stealth agendas on behalf of Wall Street or of other incarnations of the Big Money. Both can lay out their cases in ways to help people better understand and voice what they see going on about them. If you believe as I do that Wall Street’s financial and political power is among the gravest threats to our country, then you’ll understand why my dream ticket is Bernie/Warren. I give Bernie the nod to the top because the time is ripe for the bully pulpit of a Howard Beale. Not a fraud like Trump but a Beale who remains sane, authentic and uncowed when corporate power puts on the squeeze. Warren has great strengths and is polishing her game nicely. But Bernie’s particularly popular in the critical Upper Midwest and in Pennsylvania, and I think he’ll do very well with Independents who feel betrayed by Trump. Bernie will round that course and come from behind like Seabiscuit.

Bernie 2020, by Nancy Ohanian

Money Is Still King of the Hill And We Are All the Poorer for It: A Glance Back, and Forward

from WordPress https://ift.tt/2YFhHex via IFTTT

0 notes