#broker comparison forex

Explore tagged Tumblr posts

Text

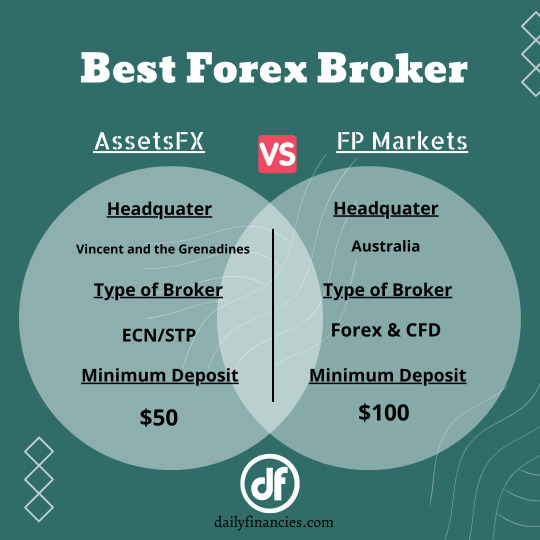

AssetsFX or FP Markets? If you were given a choice then who would you pick?

#forex#forexmarket#trader#AssetsFX#FPMarkets#comparison#broker#forexbroker#onlinetrading#metafinancies

1 note

·

View note

Text

What makes a Forex Broker Best among all? Lets see the major terms on that.

0 notes

Text

ForexJudge.com is a comprehensive platform that provides reviews and comparisons of forex brokers. Here’s a detailed point-by-point review:

1. Website Design and Usability

User Interface: ForexJudge.com boasts a user-friendly interface, making navigation easy even for beginners. The site layout is intuitive, with well-organized sections and quick access to key information.

Mobile Compatibility: The website is fully responsive, offering a seamless experience on both desktop and mobile devices.

2. Content Quality

In-Depth Reviews: ForexJudge.com offers detailed reviews of various forex brokers, covering aspects like fees, platforms, customer service, and regulatory compliance. The reviews are thorough, well-researched, and provide valuable insights.

Comparison Tools: The site features robust comparison tools that allow users to evaluate brokers side by side based on multiple criteria, helping traders make informed decisions.

Educational Resources: There is a rich library of educational materials, including articles, tutorials, and glossaries, which are beneficial for both novice and experienced traders

3. Expert Analysis

Professional Reviews: The reviews are crafted by seasoned forex professionals, ensuring knowledgeable and insightful evaluations. This expert input adds credibility and reliability to the content.

Regular Updates: ForexJudge.com frequently updates its content to reflect the latest trends and changes in the forex market, keeping users informed with the most current information.

4. Broker Coverage

Comprehensive Listings: The platform covers a wide range of brokers globally, offering a broad perspective on the forex market. This extensive coverage includes well-known brokers as well as emerging ones, providing options for different trading needs.

Unbiased Reviews: The reviews are presented in an unbiased manner, focusing on both the strengths and weaknesses of each broker. This balanced approach helps traders choose brokers that best match their requirements【12†source】.

5. Community and Support

Engagement: ForexJudge.com fosters a community of traders who rely on its reviews and insights. The platform encourages user feedback and interaction, enhancing the overall user experience.

Customer Support: The website offers excellent customer support, ensuring users can get assistance when needed. This includes answering queries and providing additional information upon request.

6. Trust and Reliability

Transparency: ForexJudge.com maintains high transparency in its operations, including how reviews are conducted and how they make money. This builds trust among users.

Industry Recognition: The platform is recognized in the forex trading community for its comprehensive and reliable reviews. Its reputation is built on years of consistent and accurate information delivery【14†source】.

7. Additional Features

Market Insights: The website provides market insights and analysis, helping traders stay updated with market movements and trends.

Broker Awards: ForexJudge.com hosts annual awards, recognizing top-performing brokers in various categories. These awards are based on rigorous criteria and extensive research.

Overall, ForexJudge.com is a valuable resource for anyone involved in forex trading, offering detailed broker reviews, educational content, and tools to aid in making informed trading decisions.

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

60 notes

·

View notes

Text

Why It’s Important to Learn from Top Forex Brokers Review for Choosing the Right Broker

In the vast world of Forex trading, selecting the right broker is a critical step that can significantly influence your trading success. With numerous brokers available, each with its own unique features, spreads, and platforms, making an informed decision can be daunting. This is where understanding top Forex brokers review becomes essential. In this article, we will explore why these reviews are crucial for your trading journey and how they can help you choose the right broker tailored to your needs.

Understanding the Role of Forex Brokers

Forex brokers serve as intermediaries between traders and the foreign exchange market. They facilitate currency trades, provide access to trading platforms, offer market insights, and assist with account management. A reputable broker ensures the safety of your funds, compliance with regulatory standards, and access to high-quality trading tools.

The Importance of Learning from Top Forex Brokers Reviews

1. Evaluating Credibility and Trustworthiness

When choosing a Forex broker, trust is paramount. Top Forex brokers review can help you assess a broker’s credibility through:

Regulatory Status: A regulated broker is overseen by financial authorities, ensuring adherence to strict guidelines. Reviews typically highlight whether brokers are regulated by entities such as the FCA (UK), ASIC (Australia), or NFA (U.S.). This oversight provides a level of safety for your funds.

User Feedback: Authentic experiences from other traders offer insights into a broker’s reliability. Positive reviews affirm a broker’s trustworthiness, while negative feedback can serve as a warning signal.

2. Understanding Trading Conditions

Different brokers offer varying trading conditions, which can greatly impact your profitability. By consulting top Forex brokers review, you can gather critical information about:

Spreads and Commissions: The costs associated with trading can vary widely. Reviews often provide comparisons of spreads and commissions, allowing you to identify brokers with competitive pricing.

Leverage Options: While leverage can amplify your trading potential, it also increases risk. Reviews clarify the leverage ratios different brokers offer, enabling you to choose one that aligns with your risk tolerance.

3. Assessing Customer Support

Having access to responsive customer support is vital in Forex trading. Issues can arise unexpectedly, and prompt assistance can make a difference. Reviews often cover:

Availability: Knowing whether a broker offers 24/5 or 24/7 customer support can help you select one that fits your trading schedule.

Quality of Service: Insights from user experiences can shed light on how quickly and effectively a broker resolves issues. Look for brokers with positive reviews regarding their customer service.

4. Examining Trading Platforms and Tools

The trading platform is your primary interface for executing trades and analyzing markets. A user-friendly platform can enhance your overall experience. Top Forex brokers review provide insights into:

Platform Usability: Reviews often discuss how intuitive and easy it is to navigate a broker’s platform. A smooth user experience can save you time and frustration.

Tools and Features: Different brokers offer various tools for technical analysis, charting, and automated trading. Understanding what features are available can help you choose a broker that meets your specific needs.

5. Identifying Educational Resources

For beginner traders, education is crucial. Many brokers provide educational resources to help traders develop their skills. Reviews typically highlight:

Quality of Educational Content: Look for brokers that offer comprehensive learning materials, including tutorials, webinars, and market analysis. Reviews can help you identify brokers that excel in educational support.

Access to Market Insights: Some brokers provide regular market updates and insights, which can be beneficial for traders at all levels. Reviews often highlight brokers that offer excellent analytical resources.

6. Understanding User Experience

User experience encompasses all aspects of dealing with a broker, from account setup to withdrawal processes. Reviews can reveal:

Ease of Account Setup: Many reviews detail how straightforward or complicated the account opening process is. A hassle-free setup can enhance your initial experience with a broker.

Withdrawal Processes: Timely and transparent withdrawals are critical. Reviews often highlight the experiences of other users regarding withdrawal times and any associated fees.

7. Avoiding Common Pitfalls

Not all brokers are transparent, and some may have hidden fees or unfavorable terms. Learning from top Forex brokers reviews allows you to:

Spot Red Flags: Frequent complaints about withdrawal issues, hidden charges, or poor customer service can signal potential problems with a broker.

Gain Insights from Others: Understanding the experiences of other traders can help you avoid common pitfalls and make more informed decisions.

How to Find Reliable Forex Broker Reviews

To maximize the benefits of top Forex brokers reviews, it’s essential to find trustworthy sources. Here are some tips:

Seek Established Review Platforms: Reputable financial websites often employ analysts who rigorously evaluate brokers, offering unbiased reviews.

Cross-Reference Information: Don’t rely solely on one review. Compare multiple sources to get a well-rounded view of a broker’s strengths and weaknesses.

Focus on Recent Reviews: The Forex landscape can change rapidly, so look for the most current reviews that reflect recent trading conditions.

The Top 10 Forex Brokers You Should Consider

Selecting the right Forex broker is a pivotal decision for anyone venturing into currency trading. With hundreds of brokers vying for your attention, each offering unique features, fees, and services, making an informed choice can be overwhelming. This comprehensive top Forex brokers review aims to simplify that process by presenting the top 10 Forex brokers, highlighting their strengths, trading conditions, and key features.

Why Choosing the Right Forex Broker Matters

1. Safety of Funds

A reliable broker ensures the safety of your capital. Brokers regulated by reputable authorities provide assurance that they adhere to stringent financial standards, protecting your investments.

2. Cost of Trading

Different brokers have varying spreads and commissions, which can significantly affect your overall profitability. Understanding these costs is vital for effective trading.

3. Access to Tools and Resources

The right broker provides tools, educational resources, and analytical data that can enhance your trading strategy and improve your skills.

4. Quality of Customer Support

When issues arise, having access to responsive customer support can make a significant difference in your trading experience.

Key Criteria for Evaluating Forex Brokers

To ensure a comprehensive review, we considered several important factors:

Regulation: Is the broker regulated by a reputable authority?

Trading Costs: What are the spreads, commissions, and other fees?

Trading Platforms: How user-friendly and feature-rich are the platforms offered?

Customer Support: What kind of support is available, and how responsive is it?

Educational Resources: Are there resources available to help traders improve their skills?

The Top 10 Forex Brokers

1. IG Group

Overview: IG Group is one of the oldest and most respected Forex brokers in the world, known for its robust trading platform and extensive market offerings.

Regulation: Regulated by FCA (UK) and ASIC (Australia).

Trading Costs: Spreads from 0.6 pips on major pairs.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 support via phone, email, and live chat.

Educational Resources: Offers webinars, trading guides, and market analysis.

2. Forex.com

Overview: Forex.com, a subsidiary of GAIN Capital, is well-known for its user-friendly platform and comprehensive trading services.

Regulation: Regulated by NFA and CFTC (U.S.).

Trading Costs: Spreads start from 0.2 pips.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 support through multiple channels.

Educational Resources: Extensive educational content, including videos and articles.

3. OANDA

Overview: OANDA is recognized for its transparent pricing and high-quality trading data, appealing to both beginners and experienced traders.

Regulation: Regulated by CFTC (U.S.) and FCA (UK).

Trading Costs: Spreads start at 1 pip, with no commission on standard accounts.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 customer support via phone and email.

Educational Resources: Offers a variety of educational materials and market insights.

4. eToro

Overview: eToro is a pioneer in social trading, allowing users to copy the trades of successful traders and engage with a vibrant community.

Regulation: Regulated by FCA (UK) and CySEC (Cyprus).

Trading Costs: Spread-based fees with no commissions on stock trading.

Platform: Unique social trading platform and mobile app.

Customer Support: 24/5 customer support.

Educational Resources: Provides trading guides, webinars, and community features.

5. XM Group

Overview: XM is known for its flexible trading conditions and a variety of account types tailored to different trading strategies.

Regulation: Regulated by ASIC (Australia) and CySEC (Cyprus).

Trading Costs: Spreads from 0.0 pips on certain accounts.

Platform: Supports MetaTrader 4 and 5.

Customer Support: Available 24/5 in multiple languages.

Educational Resources: Offers webinars, trading articles, and various tools for traders.

6. Pepperstone

Overview: Pepperstone is favored for its low-cost trading environment and exceptional customer service.

Regulation: Regulated by ASIC (Australia) and FCA (UK).

Trading Costs: Spreads as low as 0.0 pips on Razor accounts.

Platform: MetaTrader 4, MetaTrader 5, and cTrader.

Customer Support: 24/5 support via live chat, phone, and email.

Educational Resources: Extensive educational materials including articles and tutorials.

7. Saxo Bank

Overview: Saxo Bank caters to professional traders with its premium trading tools and a wide range of assets.

Regulation: Regulated by FCA (UK) and FSA (Denmark).

Trading Costs: Competitive pricing with low spreads for premium accounts.

Platform: SaxoTraderGO and SaxoTraderPRO.

Customer Support: 24/5 customer support via multiple channels.

Educational Resources: Provides in-depth market analysis and educational content.

8. FXTM (ForexTime)

Overview: FXTM is known for its flexible trading options and extensive educational resources for traders.

Regulation: Regulated by FCA (UK) and CySEC (Cyprus).

Trading Costs: Spreads from 0.1 pips on ECN accounts.

Platform: Supports MetaTrader 4 and 5.

Customer Support: Available 24/5 via phone and email.

Educational Resources: Offers webinars, seminars, and market analysis.

9. IC Markets

Overview: IC Markets is preferred by high-frequency traders for its low-cost trading environment and excellent liquidity.

Regulation: Regulated by ASIC (Australia).

Trading Costs: Spreads as low as 0.0 pips.

Platform: MetaTrader 4, MetaTrader 5, and cTrader.

Customer Support: 24/7 customer support available.

Educational Resources: A range of tutorials and market insights are provided.

10. Admiral Markets

Overview: Admiral Markets offers diverse account types and a wide range of trading instruments, catering to both beginners and experienced traders.

Regulation: Regulated by FCA (UK) and ASIC (Australia).

Trading Costs: Competitive spreads starting from 0.0 pips.

Platform: MetaTrader 4 and 5.

Customer Support: 24/5 support via live chat, phone, and email.

Educational Resources: Extensive educational materials and market analysis available.

In the competitive landscape of Forex trading, choosing the right broker is essential for your trading success. This top Forex brokers review highlights some of the best options available, each with unique features that cater to different trading styles and needs.

When making your choice, consider your trading goals, risk tolerance, and the specific features that are most important to you. Whether you prioritize low trading costs, advanced platforms, or robust educational resources, the brokers listed above provide excellent starting points for your trading journey.

Conclusion

In the fast-paced world of Forex trading, selecting the right broker is vital for your success. By utilizing top Forex brokers review, you can gain valuable insights into broker credibility, trading conditions, customer support, and overall user experience. This informed approach not only increases your chances of finding a suitable broker but also enhances your overall trading experience.

Investing time in researching and comparing brokers through reviews is a wise step that can lead to better trading outcomes and greater confidence in your trading decisions. By being well-informed, you can navigate the Forex market more effectively and work towards achieving your trading goals. Happy trading!

2 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

UAE Dirham to INR: How to Get the Best Conversion Rates in 2024

The UAE Dirham (AED) to Indian Rupee (INR) exchange rate is crucial for travelers, expats, and businesses dealing between the UAE and India. With evolving currency markets, finding the best conversion rates can help save a significant amount. Whether you’re planning to buy UAE dirham online or manage funds while working abroad, this guide provides you with top tips and methods to secure the best exchange rates in 2024.

1. Monitor Exchange Rates Regularly

Currency values fluctuate daily based on economic events, geopolitical factors, and market demand. Keeping an eye on these fluctuations can help you decide the right time to convert UAE dirhams to INR for maximum value.

Use Currency Monitoring Tools: Websites and apps offer real-time rate monitoring, which allows you to track changes throughout the day. Some platforms even offer notifications when rates reach your preferred levels.

Understand Daily Trends: Currencies like the AED and INR often fluctuate within predictable ranges. Observing daily trends can help you spot when the rates are better.

2. Compare Different Money Exchange Providers

Many exchange providers in India and the UAE offer various rates, fees, and margins. Compare rates across multiple platforms before making a decision.

Banks vs. Forex Platforms: Banks often charge higher fees than specialized forex platforms. Forex providers may offer better rates, especially when dealing with large amounts.

Currency Exchange Apps: Apps like PayPal, Remitly, and Western Union allow you to send and convert currency online, often at competitive rates. Just ensure you read all the fine print regarding fees.

3. Consider Buying UAE Dirham Online

In 2024, there are various platforms that allow you to buy UAE dirham online, often at better rates than physical locations. Online platforms generally provide transparent pricing with lower overhead costs, making them ideal for quick conversions and rate comparisons.

Look for Platforms with Low Fees: Fees can vary significantly between providers, so prioritize platforms with low or no hidden charges.

Use Trusted Platforms Only: Reputable online services like BookMyForex, Wise (formerly TransferWise), and CurrencyFair have established credibility and offer favorable rates.

4. Choose the Right Time of Day for Your Transaction

Currency conversion rates can differ based on the time of day. Major financial centers like London, New York, and Dubai impact currency values during their active trading hours.

Convert During Overlapping Trading Hours: For AED to INR, converting during hours when both UAE and Indian markets are active may offer better rates.

Avoid Converting on Weekends: Many platforms set higher rates on weekends due to limited forex market activity.

5. Use Currency Conversion Lock-In Services

Some providers allow you to lock in exchange rates for a specific period, securing a favorable rate despite future fluctuations.

Benefits of Rate Locking: This can be helpful if you’re expecting market volatility but want to ensure you get the best rate now.

Where to Find Rate Locks: Banks, forex apps, and some online forex brokers offer rate-locking services. Just confirm any fees involved with locking in a rate.

6. Opt for Foreign Currency Cards

If you frequently travel between India and the UAE, foreign currency cards can help you avoid the hassle of multiple conversions and get more favorable rates.

Prepaid Forex Cards: These cards allow you to preload AED and use it in UAE without constantly converting AED to INR and vice versa.

Multi-Currency Cards: Some cards support multiple currencies, including AED, which can be handy for travelers covering multiple countries.

7. Avoid Airport and Hotel Currency Exchanges

Airport and hotel exchange counters typically offer lower rates with high fees. For better value, use city-based exchange providers or online services before departure.

Tips to Keep in Mind When Buying AED Online

When you decide to buy UAE Dirham online, it’s essential to keep certain tips in mind to ensure a secure and cost-effective transaction.

Read Customer Reviews: Reliable online platforms will have positive reviews and testimonials. This can give you an idea of the service quality.

Check for Transaction Limits: Some platforms may impose minimum or maximum limits, so be sure to confirm them if you have specific conversion needs.

Understand the Exchange Platform’s Policies: Be sure to read through their terms and conditions to understand any additional fees, delivery times, and policies.

How to Track UAE Dirham to INR Rates in 2024

In 2024, keeping up with real-time exchange rates is easier than ever. Here are some useful resources to monitor UAE Dirham to INR rates.

Mobile Apps: Apps like XE, Currency Converter Plus, and Google Finance allow you to check AED to INR rates anytime.

Currency Websites: Websites like BookMyForex and Wise provide daily rate updates and conversion calculators.

Subscription Alerts: Many forex sites and apps allow you to set alerts so you’re notified when the rate hits your preferred level.

Conclusion

Getting the best UAE Dirham to INR conversion rates in 2024 requires a combination of timing, market awareness, and using the right tools. By following the tips above, you can make the most out of your conversions, whether you need a small amount for travel or are handling larger sums as an expat or business. Remember, the best rate is one that aligns with your needs, whether that’s a low fee, high rate, or a quick transaction.

0 notes

Text

Stock analysis websites

TradingView - With this charting and stock analysis platform, users can access opportunities across both domestic and international stock markets. A large user base of more than 60 million traders and investors reveals the strength of TradingView website. A wide variety of advanced tools are available such as supercharts, Pine Script, forex screener, crypto coins screener, stock screener, stock heatmap, economic calendar and earnings calendar. Users also benefit from the strong social network setup available with TradingView. It allows users to connect with other investors and share their ideas and opinions.

GoCharting - This is a good option for folks looking for advanced technical analysis of various stocks. Users can access more than 300 technical analysis studies and over 150 premium indicators. The package includes market profile, orderflow charts and volume profile tools. GoCharting is also known for its advanced options trading platform. You can create your own strategies or choose from readymade options available on GoCharting. The platform also provides users the flexibility to choose their favorite broker. Users can access a wide range of profiling tools and analytical tools to improve their trading skills.

StockEdge - Users can get a comprehensive 360° view of the stock markets by accessing indices, trending stocks, sectors, new and upcoming deals and the latest news and updates. Moreover, StockEdge offers a wide variety of analytical tools and resources such as chart patterns, trading strategies, investment ideas, market breadth, sector analytics and company filings. A wide variety of stock screening options are also available such as price scans, technical scans, fundamental scans, candlestick scans, etc. These help users to choose the most appropriate stocks that suit their investment goals.

Invest Yadnya - This platform focuses on improving financial literacy in India. To achieve that goal, Invest Yadnya offers a wide variety of financial advisory and financial planning services to investors. One of the key products is Stock-O-Meter Plus that provides detailed analysis of various companies. The long-term prospects of stocks are also analyzed in detail and made available to users. Stock analysis is done using various parameters such as financial results, industry growth prospects, market valuation, enterprise details and governance structure.

MarketSmith India - Users can improve their stock analysis skills with advanced tools such as chart pattern recognition and peer comparisons to shortlist the best stocks. MarketSmith India is backed by more than 10 years of fundamental data and analysis. The platform provides unbiased ratings and rankings of stocks. Users can analyze the best performing industry segments and benefit from a wide variety of stock screens. Users also have the option to create their own personalized screens. Advanced research tools are available such as stock ideas, in-depth stock evaluation, model portfolio and market outlook.

source : newspatrolling.com

Stock analysis websites

0 notes

Text

Compare Golden Brokers Vs ADSS: Which is the Better Forex Broker in 2024?

Golden Brokers Vs ADSS, which one is better? Both brokers are often compared to each other to find which one comes out to be the better one. What many traders may not comprehend is that the best choice may differ for every one of them, and there's nothing wrong with it. To make it easier for you to decide which one is the best between Golden Brokers Vs ADSS, here is the direct comparison:

Which has the better spread?

Considering that spread is a trading cost, the lower the spread, the better it is for traders. However, spread information among brokers is not easy to get, as not every broker transparently publishes their spreads data.

However, traders can still choose their ideal brokers by the type of their spreads. The most two popular types of spread are fixed and variable. The pros and cons between the two spreads can vary for every trader. In this case, Golden Brokers provides their pricing with Variable spread while ADSS offers Variable spread.

Golden Brokers vs ADSS: Who hosts the best trading platform?

The trading platform is essential as you can't execute a trade without it. Additionally, trading platforms provide price charts and an assortment of analytical tools to help traders with their strategies.

To support their clients, Golden Brokers enables trading with MetaTrader 5. The offer is supported with Pending orders. In comparison, ADSS provides trading with MetaTrader 4 with the support of Pending orders.

Is Golden Brokers or ADSS better in providing the trading instruments?

It is widely known that forex brokers offer other trading instruments other than currency pairs. The offer gives interesting choices for traders to explore other markets that may be proven beneficial for them and to diversify their trading portfolios.

In this case, Golden Brokers supports trading with Forex, Gold & silver, CFD, Oil, Indexes, Soft commodities, while ADSS presents the ability of trading with Spread betting, Forex, CFD, Indexes, Crypto.

In conclusion, deciding the better broker eventually comes down to your consideration. If you are an active trader, it is better to choose a broker with a variable spread that is generally lower than the fixed one. For the trading platform, MetaTrader 4 is the standard choice for every trader. But if you want to have a different experience with a more advanced platform, choose the broker that provides alternative platforms. The same goes for trading instruments; if you want to try delving into different markets, seek for a broker with more options on trading instruments.

0 notes

Text

Creating a Successful Forex Trading Website: Key Features and Content Ideas

A well-designed Forex trading website is essential for providing traders with valuable resources, market insights, and a seamless trading experience. Whether you’re building a Forex site for brokers, traders, or financial education, it’s important to include key features and content that enhance user engagement, credibility, and functionality.

1. User-Friendly Design and Navigation The first aspect to focus on when creating a Forex website is its design. A clean, professional look with intuitive navigation is crucial to keep users engaged. Your site should be easy to navigate, allowing users to quickly find the information they need, such as trading platforms, educational content, or customer support. Incorporating responsive design ensures that your website functions well on all devices, from desktops to smartphones, making it accessible for traders on the go.

2. Real-Time Forex Data and Analysis Tools Forex traders rely heavily on real-time market data and analytics. Your website should provide up-to-date exchange rates, economic calendars, technical analysis tools, and financial news feeds. Offering these features helps traders make informed decisions and adds credibility to your site. You can integrate popular trading platforms like MetaTrader or TradingView directly on your site to enhance user experience.

3. Educational Content Educational resources are vital for both new and experienced traders. Your Forex site should include sections for tutorials, guides, webinars, and articles covering topics such as Forex basics, advanced trading strategies, risk management, and market analysis. Providing high-quality content establishes your site as a trustworthy source of knowledge and attracts users who are serious about improving their trading skills.

4. Broker Reviews and Comparisons Another key element is providing unbiased reviews and comparisons of Forex brokers. Traders often rely on these reviews to find the most reliable brokers that suit their trading style. Offering a comparison of spreads, commissions, trading platforms, and account types helps users make informed decisions.

5. Customer Support and Community Engagement Ensure your website has excellent customer support options like live chat, email, and phone assistance. A forum or blog section where users can discuss strategies or ask questions builds a community and encourages ongoing engagement.

With these features, your Forex website can serve as a comprehensive platform for traders, offering both valuable information and essential tools.

0 notes

Text

WikiFX: A Comprehensive Broker Review from Multiple Perspectives

WikiFX: A Comprehensive Broker Review from Multiple Perspectives

In the ever-evolving world of forex trading, finding a reliable broker is crucial for traders. WikiFX, a global forex broker regulatory inquiry platform, has emerged as a valuable resource for traders seeking detailed information about brokers. This article delves into WikiFX’s comprehensive broker review from multiple perspectives, highlighting its features, benefits, and impact on the trading community.To get more news about WikiFX, you can visit our official website.

Overview of WikiFX WikiFX is a popular platform that provides traders with a comprehensive database of forex brokers. It offers detailed information on brokers’ backgrounds, services, and regulatory status, promoting transparency and fair trading practices1. The platform allows traders to search for brokers based on specific criteria, making it easier to find reliable partners.

Features and Benefits One of the standout features of WikiFX is its extensive database, which includes information on brokers from around the world. Traders can access ratings, reviews, and regulatory status of brokers, helping them avoid scams and choose trustworthy partners. The platform also offers a comparison tool, allowing traders to compare brokers based on various parameters such as transaction costs, trading platforms, and regulatory licenses.

User Experience WikiFX is designed with user experience in mind. The platform is easy to navigate, with a user-friendly interface that allows traders to quickly find the information they need. The search functionality is robust, enabling users to filter brokers based on specific criteria. Additionally, the platform provides regular updates and news related to the forex market, keeping traders informed about the latest developments.

Impact on the Trading Community WikiFX has had a significant impact on the trading community by promoting transparency and fair trading practices. By providing detailed information on brokers, the platform helps traders make informed decisions and avoid potential scams. This has led to increased trust in the forex market and has empowered traders to take control of their trading activities.

Conclusion In conclusion, WikiFX is a valuable resource for traders seeking reliable information about forex brokers. Its comprehensive database, user-friendly interface, and commitment to transparency make it an essential tool for anyone involved in forex trading. By offering detailed reviews and comparisons, WikiFX helps traders find trustworthy partners and navigate the complex world of forex trading with confidence.

0 notes

Text

Top 5 Reasons to Choose Foreign Currency Exchange Near Me for Your B2B Forex Transactions

In the fast-paced world of international trade and finance, FX brokers and B2B merchants require efficient and reliable solutions for currency exchange. Moreover, there are many advantages linked to choosing Foreign Currency Exchange Near Me services rather than going to a specialized company. Nevertheless, in this article, we will outline five specific benefits that may make utilizing the local currency exchange services preferable to using the internet tools.

1. Personalized, Expert-Driven Solutions

In cases where one has to conduct large-scale transfers of forex in the international market or frequent transfer of goods and services, having competent and dedicated service providers is a godsend. They offer you the prospect of engaging with professionals who offer services in foreign exchange deals for companies. These experts can provide specific suggestions that will assist in obtaining the highest exchange rates, based on your industry needs. Such related aspects of service delivery are missing in online platforms which is an indication of the need to tackle issues of high volume transactions with such levels of personalized interface.

2. Immediate Forex Transfers and Liquidity

In business, the saying that time is money holds a lot of weight. In the case of cash deposits, withdrawals, and transfers, another advantage of getting in touch with a local Foreign Currency Exchange Near Me is to gain access to the needed currency on the spot. This is particularly important for organizations that deal with inter-company transactions whereby they require immediate and easy access to cash. Local services may allow for same-day cash exchanges or transactions while online services may require several days for large transfers or delivery of currency hampering the working of the business.

3. Transparent Rates with No Hidden Fees

Another consideration for most B2B merchants, when they are exchanging big amounts of cash, is charged in the form of fees or use of rude rates. Local Foreign Currency Exchange Near Me services do not hide their charges from you, and they make it easier to know the rates for any given service. While a certain freelance service may incorporate the charge into what looks like low rates like $2 per fold, local services provide clients with understandable, basic prices, thereby allowing you to focus on the cost-consequential decisions you make.

4. Competitive Rates for High-Volume Transactions

If companies engage in frequent forex deposits and withdrawals, exchange rates can be very influential to their financial success. Most local dealers provide good prices for large turnover operations, which is important for FX brokers and merchants with frequent operations on the foreign exchange market. At times, such services can offer more attractive rates for long-term clientele or frequent transfer customers, which can further improve your cost savings in comparison to the internet-based services that will not afford you much leeway in this regard.

5. Enhanced Security for Forex Transfers

It is pertinent for anyone dealing with forex activities globally to do so in a secure manner. Thus, by engaging the use of a Foreign Currency Exchange Near Me you do get to benefit from the high level of professionalism and security that is extended on the deals that you wish to transact. Face-to-face transactions minimize instances of phishing scams and other online frauds, and any problems with deliveries that would hamper or tamper with large transactions are also avoided. Besides, local services guarantee real-time confirmations of balances in one's account thereby creating absolute certainty regarding the authenticity of the transactions—something that is very significant for the B2B operations that involve huge amounts of money.

Conclusion

To the B2B merchants and FX brokers performing cross-border forex, deposits, and withdrawals, such services that entail the exchange of local currency are more advantageous than the online platforms. From customized services and a quick way to obtain currency to transparency, favorable exchange rates, and improved protection – having a Foreign Currency Exchange Near Me may bring numerous breakthroughs to the financial turnover of your enterprise. The next time that your business needs to execute large or frequent forex transactions, make sure to engage a reliable local partner like Peska that could facilitate your transactions.

1 note

·

View note

Text

Minimum Deposits: AvaTrade vs Exness

Exness wins in the minimum deposit category, requiring a lower starting capital compared to AvaTrade.

Exness has a lower minimum deposit compared to AvaTrade, making it more accessible for beginners.

#MinimumDeposit #Exness #AvaTrade #ForexBeginners #LowDepositTrading #Forex #Traders

0 notes

Text

Find the Best Forex Brokers in UAE in 2024

Trading forex can be dangerous, particularly when done online. It is essential that you invest your hard-earned money on dependable and safe forex trading platforms.

We have compiled a ranking of the top legal and certified online forex brokers in the UAE to assist you stay away from scammers and make profitable and safe forex trading.

To make an informed choice about online Forex trading, go over the list.

What is trading forex?

One of the largest marketplaces in the world, the foreign currency market deals in trillions of dollars every day, around-the-clock. Both small and large size traders are drawn to forex trading because it is quicker to fill trades and the cost of doing business is significantly lower than in other marketplaces.

The deliberate conversion of one nation's money into another for travel, business, or other purposes is known as foreign exchange. The requirement to do transactions in currencies from other nations will only increase as companies keep growing and entering new markets throughout the world. When businesses must purchase goods or services from outside their borders, they run the danger of experiencing fluctuations in currency values. By defining a rate at which the transaction can be executed in the future, forex markets offer a mechanism to mitigate that risk.

Forex trading company presents an opportunity for traders to diversify. Given that leverage trading makes it easier to operate with less money than is required in the stock market analysis, they can view it as an opportunity for aggressive traders to earn more spread. Forex traders should apply common sense to prevent impulsive behavior and understand how to time their deals using charts.

Forex Trading in UAE

In the UAE, are you trying to find a trustworthy and secure forex trading platform? We give you access to a thorough list of licensed forex brokers in UAE so you can make wise choices that also end up being profitable.

With our list, you may make informed comparisons to determine which broker would be most appropriate for your needs related to FX trading. Professionals may be aware of the leading forex traders in the United Arab Emirates, but novice traders can benefit greatly from our comparative listings in selecting the best broker among several.

Frequently Asked Questions (FAQ)

FAQs | SmartFX

Find answers to all your questions on our FAQ page. Get detailed information and solutions quickly and easily.

stock brokers in dubai forex brokers in dubai forex trading in dubai forex brokers in uae forex trading company forex trading companies in dubai best forex trading platform uae best online trading platform in uae

#forex factory#forex trading#gold forex#forex market#forex news#forex expo#forex calendar#forex rate#forex factory calendar#khaleej times forex#forex expo dubai#forex factory news#usd to aed#gold news forex#trading view#xauusd#best forex broker in uae#forex expo dubai 2024#khaleejtimes forex#gold rate today

0 notes

Text

Compare Forex Brokers

Comparing forex brokers is crucial for choosing the right one that fits your trading style, goals, and preferences. Here’s a detailed comparison guide that highlights key aspects to consider when evaluating different forex brokers: Key Factors to Compare Forex Brokers 1. Regulation and Trustworthiness - Regulation: Ensure the broker is regulated by a reputable authority (e.g., FCA in the UK, ASIC in Australia, NFA in the US). Regulation ensures that the broker adheres to certain standards and provides protection for traders. - Reputation: Research broker reviews and feedback from other traders. Look for information on any past regulatory issues or controversies. 2. Trading Platform - Platform Options: Check if the broker offers popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. These platforms come with advanced charting tools, technical indicators, and automated trading options. - Usability: Evaluate the platform’s user interface, ease of navigation, and customization options. A user-friendly platform can make trading more efficient and enjoyable. - Mobile Access: Ensure the broker provides a mobile trading app if you plan to trade on the go. 3. Trading Costs - Spreads: Compare the average spreads on major currency pairs. A narrower spread usually means lower trading costs. - Commission: Some brokers charge a commission per trade in addition to the spread. Check if the broker has commission-free options or whether they offer competitive rates. - Overnight Fees (Swap Rates): Understand the costs or benefits of holding positions overnight, as these can impact your trading profitability. 4. Account Types - Account Variants: Brokers may offer different account types such as standard, mini, micro, or ECN accounts. Choose an account type that matches your trading volume and strategy. - Minimum Deposit: Look at the minimum deposit required to open an account. Ensure it fits within your budget and trading plan. - Leverage: Compare the leverage options available. Higher leverage can amplify profits but also increases risk. 5. Customer Support - Availability: Check if the broker provides 24/5 or 24/7 customer support. Reliable support is essential for resolving issues quickly. - Contact Methods: Ensure the broker offers multiple contact options such as live chat, email, and phone support. Test the responsiveness and helpfulness of their support team. 6. Education and Research - Educational Resources: Look for brokers that offer comprehensive educational materials such as webinars, tutorials, eBooks, and trading courses. These resources are valuable for improving your trading skills. - Market Research: Evaluate the quality and frequency of market research reports, analysis, and trading signals provided by the broker. 7. Deposit and Withdrawal Options - Methods: Check the available deposit and withdrawal methods (e.g., bank transfer, credit/debit cards, e-wallets). Ensure they are convenient and cost-effective. - Processing Times: Compare the processing times for deposits and withdrawals. Quick transactions are preferable for managing your funds efficiently. - Fees: Be aware of any fees associated with deposits or withdrawals. 8. Trading Instruments - Currency Pairs: Ensure the broker offers a wide range of currency pairs, including major, minor, and exotic pairs, to diversify your trading options. - Additional Instruments: Some brokers also offer trading in commodities, indices, cryptocurrencies, or stocks. If you’re interested in these markets, consider brokers that provide access to them. Conclusion When comparing forex brokers, consider your trading goals, experience level, and preferences. By evaluating the factors outlined above, you can make an informed decision and choose a broker that aligns with your needs. Remember that the best broker for you will depend on your individual trading style and requirements, so take the time to assess each option carefully.

0 notes

Text

Best Forex Prop Firms of 2024

Proprietary FX trading firms or Forex prop firms:-

Proprietary trading, or prop trading, is when financial firms or proprietary FX trading firms use their own money to trade currencies for profit. Often called Forex prop firms, these are firms that maintain a pool of professional traders who trade on behalf of the firm rather than with an individual’s own money.

This money, most of the time, comes as a profit-sharing scheme with the firm, according to an agreed Profit Sharing Scheme. Higher leverage is provided by the proprietary FX trading firms in comparison with retail trading accounts, what this actually does is that it allows traders to hold larger positions with less capital. Besides, it has strict risk management protocols that help ensure the conservation of the firm’s capital and minimize possible losses. The model hence allows firms to exploit the opportunities available in the market while incorporating the expertise from the professional traders.

Top forex prop firm

1) Topstep – A prop firm trading

Topstep, like many other prop trading firms, hires stocks, futures, and indices traders and provides capital, support, risk management strategies, and coaching to help them trade successfully. Traders are then rewarded using a robust profit split.

Profit split: 100% up to $5,000, then 80% afterwards.

Features:-

Free 14-days trial.

Group performance coaching sessions.

Private trading coach with professional coaches and AI coaching.

Keep the first $5,000 in profit and 80% afterward.

Support team.

Pay fees through PayPal, Mastercard, Visa, American Express, and Discover.

Pros:

According to the company’s website, it funded 8,389 accounts in 2021 for customers spread across 143 countries.

Leverage of up to 1:100.

Referral program.

Cons:

No bonuses from broker Equiti Capital.

The support service is just on weekends.

2) The 5%ers – A reliable prop firms

The 5ers is one of the oldest and most reliable prop firms in the industry.

The 5%ers let you trade forex, metals, and indices with a live account from day 1 without any need for trial accounts.

Features:

The fastest growth plan

No time limit on trading

Traders use MetaTrader 5.

24/7 support

Bonuses

Pros:

Funding up to $4 million. Funding doubles after each milestone.

1:100 leverage on High stakes program

The first low-entry cost challenge when you pay upon success!

The fastest growth plan in the industry

Compatible with all trading stylesGet account access within seconds

Profit split up to 100% plus bonuses and salary

MT5 platform available

They are traders themself, providing high-quality education

24/7 dedicated support

Cons:

Only 1:10 leverage on the Bootcamp program

3) The Trading Pit – Forex prop firm

The Trading Pit is a globally-recognized prop firm that follows a partnership model. After registering, you’ll need to complete a trading challenge presented by them. Depending on how well you do, you’ll be presented with numerous options.

Profit Split: Up to 80%

Features:

Fixed 10%

Simple and Fast Withdrawals

Multi-Lingual Support

Real-Time Statistics

A Wide range of payment options

Pros:

State-of-the-art trading systems

Free and paid educational tools available

High conversion rate

Dedicated Account Managers

Cons:

It’s a new firm with more than a year’s worth of experience.

4) Funded Trading Plus – Proprietary trading firm

Funded Trading Plus is a UK-based firm that provides an environment for its traders to partake in simulated trading, Similar to other prop-trading firms, you’ll need to pass an evaluation to become an FT+ Trader. The account sizes can range from $12,500 to $200,000. You can choose between the 1-phase evaluation and 2-phase evaluation process.

Profit Split: Up to 100%

Features:

Diverse Trading Options

Option to get instant funding

One-Phase and Two-Phase Evaluation type

Customizable trading programs

Pros:

Comprehensive Profit-split structure

Choose from a wide range of trading strategies

Excellent support, Most trusted in the industry

Double your account size after achieving 10% profit

Cons:

Note: We allow overnight trading

No $5000 account

5) SurgeTrader – A standard prop trading firm

A standard prop trading account at SurgeTrader costs $25,000 for a profit split of 75:25, a profit target of 10%, daily loss of 4%, and a maximum trailing drawdown of 5%. This package costs $250.

Profit split: Up to 75%.

Features:

No monthly recurring fees.

There are no minimum trading days for account levels, ensuring you qualify for higher funding limits quickly.

Trade in any strategy that works for you.

Pros:

Up to 75% profit split.

Up to $1 million trading limit.

Non-recurring payments to qualify for a live-funded account.

1-step audition process.

10% profit targets without a period to achieve it.

Fast withdrawal processing.

Cons:

Short operating period for the company (started in 2021).

No positions are to be held during the weekend.

5% maximum drawdown, 1/10000 maximum open lots.

Low leverage – 10:1 forex, metals, indices, oil; 5:1 for stocks, and 2:1 for crypto.

6) Trade The Pool – Well known forex prop firm

It is powered by The5ers, a well-known and highly reputed online prop firm established in 2016. Trade The Pool lets traders like you use their strategies and experience to trade what you want!

Profit Split: Up to 80%

Features:

Free 14-day trial.

1 step programs

Real-Time StatisticsTrade more than 12,000 Stocks & ETFs

Pros:

Excellent support, Most trusted in the industry

Free educational tools available

Referral program.

Simple and Fast Withdrawals

Cons:

Short operating period for the company (started in 2022).

7) FundedNext – A full-fledged proprietary fx trading platform

FundedNext happens to be a relatively new prop trading platform out there that caters to Forex traders across the globe. You are eligible for a 40% increase in your account balance every 4 months, provided you are consistent with your profitability.

Profit Split: Up To 90%

Profit split of 15% at the evaluation stage

Dedicated account manager assigned

Pros:

Compatible with all trading styles

Low commissions

Get account access within seconds

Trader-friendly leverage

Unlimited evaluation

Cons:

No weekend holding option for the Express model.

Fees: One-time fee starting at $99 for Evaluation model of funding and One-time fee starting at $119 for the Express model of funding.

8) FX2 Funding – A prop trading firm

FX2 Funding works in the same way most prop-trading firms do. FX2 also allows its traders to trade at their own pace.

Profit Split: 85%

Features:

Flexible account sizes

85% profit split

Flexible time frame

Pros:

High-profit split

Comprehensive guidelines on trading

Trade at your own pace

Trade using your preferred method

24/7 dedicated tech support

Cons:

FX2 Funding is new to the industry. It is hard to assess its reputation at such a nascent stage.

9) FTMO – A proprietary fx trading firm

FTMO lets people learn and discover their forex trading talents using the FTMO Challenge and Verification course, As a trader, you get 90% of your profits earned from trading with the firm and its tools. Customers are also trained on how to manage trading risks.

Profit split: Up to 90%.

Features:

Maximum capital $400,000.

80:20 payout ratio. It adjusts to 90:10 when the FTMO account balance limit is increased.

Low spreads.

Pros:

Customers who include retail traders get access to MT4, MT5, and CTrader trading tools.

Customers are furnished with data coming from liquidity providers to simulate real market conditions for traders who aspire to make more money when trading.

The platform supports trading crypto as well as forex, indices, commodities, stocks, and bonds.

About seven payment methods are available, including bank transfer and Skill.

Cons:

Higher cost compared to other options.

You can’t hold trades over the market weekend close unless you use the swing trader challenge.

10) Lux Trading Firm – A funded trading

Lux Trading Firm hires career trading experts (forex, crypto, and other financial assets) and funds their accounts for up to $2.5 million. The highest stage 8 is for fund managers.

Profit split: Up to 65%.

Features:

Elite traders’club helps to boost one’s success rate.

Personal mentors and fees are advantageous for those who join the elite traders’ club.

Live trading rooms.

Pros:

Free trial.

High capital funding up to $2.5 million.

No time limit on targets.

Weekend holding allowed.

Evaluation is just one phase.

Cons:

Low leverage.

4% maximum relative drawdown and maximum loss limit.

11) Fidelcrest – Proprietary trading entities

Fidelcrest prop trading firm finds, trains, and evaluates Forex, CFD, and other prop traders who can then earn profits and commissions by applying for the company’s capital.

Profit split: Up to 90%.

Features:

Up to 90% profit split.

Can’t use robots.

Swing trading is accepted.

Pros:

The funding limit is $1 million.

High-profit split of up to 90%.

Get a bonus of up to 50% of profits earned in level 2 verification.

Other bonuses are available.

Trade multiple assets – CFDs, stocks, forex, and crypto. Withdraw via bank, PayPal, and other

Cons:

Step 2 is harder to overcome because the maximum loss is half that of step 1 yet the profit target is the same.

Evaluation is a two-phase and can take up to 90 days.

Long-term strategy trading is not favoured by the trading limit of 30 days.

Fewer education materials.

Conclusion

In general, a Forex prop firm is a company that evaluates a trader’s skills, usually via a trading challenge, and assigns its own trading capital for the trader to operate with. This approach represents an excellent way to start in Forex and financial trading for those who lack sufficient starting funds. Even for better-off traders, it remains a valuable path to improved risk management and self-control.

0 notes

Text

Forex Brokers Accepting European Clients

Delving into the list of Forex Brokers Accepting European Clients https://fx-list.com/brokers-for-eu-traders on the FX-List platform brings forth a multitude of benefits for traders. Firstly, it streamlines the daunting task of finding a reputable broker by presenting a curated selection of options that meet stringent European regulatory standards. This ensures peace of mind regarding the safety and security of funds. Secondly, the platform provides comprehensive information on each broker's trading conditions, including spreads, leverage, and available assets, enabling traders to make informed decisions aligned with their individual trading strategies. Moreover, FX-List's user-friendly interface facilitates easy comparison between brokers, saving traders valuable time and effort. Ultimately, studying this list empowers traders to confidently navigate the forex market, knowing they've chosen a broker that best suits their needs and preferences.

0 notes