#bitcoin price trackers

Explore tagged Tumblr posts

Text

“Carbon neutral” Bitcoin operation founded by coal plant operator wasn’t actually carbon neutral

I'm at DEFCON! TODAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). TOMORROW (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Water is wet, and a Bitcoin thing turned out to be a scam. Why am I writing about a Bitcoin scam? Two reasons:

I. It's also a climate scam; and

II. The journalists who uncovered it have a unique business-model.

Here's the scam. Terawulf is a publicly traded company that purports to do "green" Bitcoin mining. Now, cryptocurrency mining is one of the most gratuitously climate-wrecking activities we have. Mining Bitcoin is an environmental crime on par with opening a brunch place that only serves Spotted Owl omelets.

Despite Terawulf's claim to be carbon-neutral, it is not. It plugs into the NY power grid and sucks up farcical quantities of energy produced from fossil fuel sources. The company doesn't buy even buy carbon credits (carbon credits are a scam, but buying carbon credits would at least make its crimes nonfraudulent):

https://pluralistic.net/2023/10/31/carbon-upsets/#big-tradeoff

Terawulf is a scam from top to bottom. Its NY state permit application promises not to pursue cryptocurrency mining, a thing it was actively trumpeting its plan to do even as it filed that application.

The company has its roots in the very dirtiest kinds of Bitcoin mining. Its top execs (including CEO Paul Prager) were involved with Beowulf Energy LLC, a company that convinced struggling coal plant operators to keep operating in order to fuel Bitcoin mining rigs. There's evidence that top execs at Terawulf, the "carbon neutral" Bitcoin mining op, are also running Beowulf, the coal Bitcoin mining op.

This is a very profitable scam. Prager owns a "small village" in Maryland, with more that 20 structures, including a private gas station for his Ferrari collection (he also has a five bedroom place on Fifth Ave). More than a third of Terawulf's earnings were funneled to Beowulf. Terawulf also leases its facilities from a company that Prager owns 99.9% of, and Terawulf has *showered * that company in its stock.

So here we are, a typical Bitcoin story: scammers lying like hell, wrecking the planet, and getting indecently rich. The guy's even spending his money like an asshole. So far, so normal.

But what's interesting about this story is where it came from: Hunterbrook Media, an investigative news outlet that's funded by a short seller – an investment firm that makes bets that companies' share prices are likely to decline. They stand to make a ton of money if the journalists they hire find fraud in the companies they investigate:

https://hntrbrk.com/terawulf/

It's an amazing source of class disunity among the investment class:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

As the icing on the cake, Prager and Terawulf are pivoting to AI training. Because of course they are.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/09/terawulf/#hunterbrook

#pluralistic#greenwashing#hunterbrook#zero carbon bitcoin mining#bitcoin#btc#crypto#cryptocurrency#scams#climate#crypto mining#terawulf#hunterbrook media#paul prager#pivot to ai

389 notes

·

View notes

Text

Windows will force terrible new features on you. Meanwhile on Linux you can look through the desktop widgets random community members have developed and laugh at the concept of having a live bitcoin price tracker on your desktop knowing it was just some guy who did it.

5 notes

·

View notes

Text

The price fluctuations in the Shiba Inu shocked the Cryptocurrency market on Wednesday, September 27. The news was related to the vanishing of the Shiba Inu coin overnight which directly hiked the burn rate up to 1000%. What is Actually Happening? Shiba Inu (SHIB), one of the most popular meme coins introduced in August 2020 by Ryoshi, an anonymous founder. With time, the coin grasped much more popularity, ranking second in the list of meme tokens. Recently, the coin has become a highlight. The coin vanished overnight, resulting in an increased burn rate. On Wednesday, a sudden hike was experienced in the burn rate of Shiba Inu, hitting 1000% in the past 24 hours. The action of permanent removal of some of the Shiba Inu toke from circulation is considered to be one of the main reasons behind the same. Based on the report of Benzinga, the hike came just after a staggering 164 Million SHIB tokens were indelibly removed from circulation. The prediction is made based on the data from Shibu Inc. burn tracker Shibburn. Considering the data of Etherescan, two dormant crypto wallets, including “0x6ab” and “0xA75”, received substantial withdrawals of SHIB tokens from exchanges such as MEXC and Binance. The withdrawal amount was around 16 Billion SHIB. The current situation shows the emergence of new Shiba Inu whales in the market, holding around $500,000 in SHIB. According to Shytoshi Kusama, the lead developer of Shiba Inu, the platform is planning to offer something unique to Crypto enthusiasts. Shibarium, ShibaSwap’s gas token, the development team has revealed that the minting process for the remaining BONE supply is all set to be accomplished. Following the statement, rewards associated with the BONE over the ShibaSwap platform will be offered to the users soon. The rewards are expected to take the users to a new token named “TREAT”. Current Stats of Shiba Inu Shiba Inu gained much popularity in very little time, ranking second in the list of meme tokens only after Bitcoin (BTC). The passion of the SHIB community and the selling of NFT collections better represent the rising appeal of Shiba Inu in the crypto space. Focusing on the current performance of Shibh Inu, the SHIB coin’s current price is $0.000007244, a hike of 0.39% in the past 24 hours. With a market cap of $4 Billion and a 24-hour volume of $78 Million, the coin is all set to rock the crypto stage. The circulating supply of Shiba Inu is 589,346,914,631,298 SHIB and the total supply is 589,589,040,239,380 SHIB. The coin is available at cryptocurrency exchanges including Binance, Bybit, Cointr Pro, OKX, and DigiFinex. Conclusion Shiba Inu, one of the main tokens in the cryptocurrency world experiencing high burn rates, vanishes millions of tokens overnight. The active involvement of the community with the coin buying and selling represents the bright future of Shiba Inu.

2 notes

·

View notes

Text

QbitReview Review: Experience the Thrill of Trading on an Advanced Level

Investing in the market can be intimidating and challenging for traders of all levels. Getting stuck in the complexity and nuances of the markets is easy, and it can take years to become a successful trader. Whether a beginner or an experienced trader, QbitReview Review has something for you. From essential trading tools to advanced strategies, QbitReview develops your trading career. This QbitReview review will examine the platform's features, advantages and how to use them.

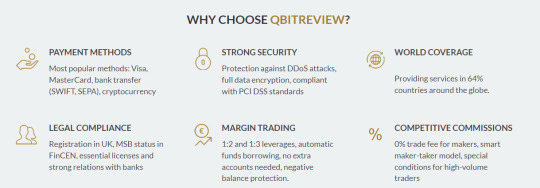

Whether you're making a purchase online to transfer funds, QbitReview has a suitable payment method for you! They offer a wide selection of payment options, including Visa, MasterCard, bank transfer (SWIFT, SEPA), and cryptocurrency. Plus, with their margin trading option, you can leverage up to 1:3, automatically borrow funds, and have negative balance protection.

QbitReview Review: Powerful Trading Tools to Maximize Success

The need for proper, up-to-date trading tools has never been greater as the cryptocurrency industry expands. QbitReview provides a suite of powerful and user-friendly trading tools to help maximize your success. Their tools include:

A market cap calculator.

A Bitcoin converter.

A Bitcoin ATM service locator.

An ICO performance tracker.

Market Cap Calculator

When it comes to trading cryptocurrencies, understanding the market cap of a particular coin is essential. The market cap of a cryptocurrency is the total market value of all the coins in circulation. To calculate the market cap of a particular cryptocurrency, you need to multiply its current price by the total number of coins. With the QbitReview Market Cap Calculator, you can quickly and easily calculate the market cap of any cryptocurrency.

Bitcoin Converter

If you want to purchase or sell Bitcoin, it is essential to have an up-to-date understanding of the current exchange rate. The QbitReview Bitcoin Converter lets you quickly and easily convert between two currencies. Whether you want to convert Bitcoin to US Dollars or Euros, their Bitcoin Converter covers you.

Bitcoin ATM Service Locator

Finding a Bitcoin ATM can be challenging, especially in a new city or country. The QbitReview Bitcoin ATM Service Locator lets you quickly and easily find a Bitcoin ATM near you. Enter your current location, and they will provide a comprehensive list of the closest Bitcoin ATMs.

ICO Performance Tracker

Initial Coin Offerings (ICOs) have become increasingly popular for funding new projects and businesses. With the QbitReview ICO Performance Tracker, you can track the performance of any given ICO. their tracker provides detailed information about the performance of each ICO, including the total funds raised, the number of tokens sold, and more.

Enjoy Flexible Payment Options – QbitReview Review

They offer a variety of payment methods to suit your needs. Their most popular payment methods include Visa, MasterCard, bank transfer (SWIFT, SEPA), and cryptocurrency.

Visa: Visa is one of the most widely accepted forms of payment, taken in over 200 countries worldwide. When you use Visa to pay, your transactions will be processed quickly.

MasterCard: MasterCard is another widely accepted payment method, accepted in more than 210 countries. With MasterCard, your transactions will be processed quickly.

Bank Transfer (SWIFT, SEPA): Bank transfer, also known as wire transfer, is one of the easiest ways to transfer funds—these are two of the most famous bank transfer methods. With SWIFT and SEPA, you can transfer funds from one bank to another in minutes.

Cryptocurrency: Cryptocurrency is a digital currency that can be used to transfer funds anonymously. QbitReview accepts various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

QbitReview Review: Advanced Reporting Features to Keep Traders Informed

World Coverage

They offer payment services in 64% of countries around the globe. With their world coverage, you can ensure that your funds will be transferred quickly, no matter where you are.

Margin Trading

They offer margin trading options with leverages of up to 1:3. With their margin trading option; you can automatically borrow funds without needing to open a separate account. Plus, you have the protection of negative balance protection, so you won't have to worry about losing more funds than you have available.

Cross-Platform Trading

With QbitReview, traders can access their accounts and trade from any device, anytime. That includes trading from the website, mobile app, WebSocket and REST API. That makes QbitReview the perfect choice for traders who want to stay connected to the market and make the most of their time. Moreover, QbitReview offers a FIX API for institutional traders needing fast market access.

Advanced Reporting

QbitReview provides a range of advanced reporting features that help traders stay informed and in control of their accounts. That includes downloadable reports and transparent fees. With such detailed reporting, traders can keep track of their investments and confidently make decisions.

High Liquidity

QbitReview offers fast order execution, and high liquidity order book access for top currency pairs. That makes it easy for traders to get in and out of the markets quickly and without paying high fees. Moreover, they also provide various trading tools and strategies to help traders optimize their trades and maximize their profits.

QbitReview Review: A Comprehensive Online Trading Platform

QbitReview is a comprehensive online trading platform designed to make trading accessible from any device. It offers simple and influential connections, allowing traders to access various analysis tools from any media. With more than 70 assets available to trade, QbitReview ensures that traders have a great selection of products. Furthermore, the platform also has a simple cash withdrawal system that makes trading easy.

Accessible from Any Device

One of the essential features of QbitReview is that it is accessible from any device. Traders can access the platform from any computer, tablet or smartphone, making it very convenient to trade anywhere and anytime. In addition, QbitReview also supports different operating systems, including Windows, iOS, and Android. That allows traders to access the platform from a wide range of devices.

Simple and Effective Connections

QbitReview also offers simple and practical connections. Traders can connect their accounts to the platform easily. In addition, the platform also allows traders to use different payment methods to make deposits and withdrawals. These features make it easy for traders to manage their accounts and transact on the platform.

Wide Range of Analysis Tools

Another great feature of QbitReview is its wide range of analysis tools. The platform provides traders various technical indicators, charting tools, and other analysis tools. That ensures traders can access the information they need to make informed trading decisions. Furthermore, the platform also provides traders with an economic calendar, which helps them stay updated with the latest market news.

More than 70 Assets Available to Trade

QbitReview also offers more than 70 assets available to trade. That includes stocks, indices, commodities, forex, and cryptocurrencies. That allows traders to have a wide selection of products to choose from. Furthermore, the platform also provides traders access to various markets, allowing them to diversify their portfolios.

A Simple Cash Withdrawal System

QbitReview also offers a simple cash withdrawal system. That makes it easy for traders to access their funds quickly. In addition, the platform also provides traders with a variety of payment methods, which makes the process of withdrawing funds even more accessible.

The Benefits of Using QbitReview's Trading Platform – QbitReview Review

There are many benefits associated with using QbitReview's trading platform, including:

Best Pricing, Execution and Liquidity: QbitReview's trading platform offers customers the best pricing, execution and liquidity. That ensures that traders can get the most out of their investments, as they can make trades quickly and at the most competitive prices.

Latest in Innovative Trading Technology: QbitReview's technology is designed to offer an intuitive and user-friendly interface, allowing traders to access and analyze markets quickly. The platform also provides advanced charting tools, such as auto-execution and backtesting, to help traders make the most informed decisions.

Explore Different Trading Instruments: QbitReview's platform offers various trading instruments, including stocks, Forex, CFDs, ETFs, etc. These instruments allow traders to diversify their portfolios and capitalize on different market opportunities.

Trade 24/7/365 with All-Year-Round Trading: QbitReview's platform allows traders to trade whenever and however they want, as the markets are open 365 days a year. That means traders can take advantage of market opportunities no matter where they are in the world.

Conclusion

QbitReview is an advanced trading platform that offers a range of features to suit traders of all levels. From cross-platform trading via website, mobile app, WebSocket and REST API to advanced reporting and high liquidity, QbitReview is designed to help traders maximize their time and resources. With QbitReview, traders can stay connected to the markets and confidently make informed decisions.

Disclaimer: This article is not intended to be a recommendation. The author is not responsible for any resulting actions of the company during your trading experience. The information provided in this article may need to be more accurate and up-to-date. Any trading or financial decision you make is your sole responsibility, and you must not rely on any information provided here. We do not provide any warranties regarding the information on this website and are not responsible for any losses or damages incurred from trading or investing.

2 notes

·

View notes

Text

El Salvador Boosts Bitcoin Holdings with Recent Acquisition

Key Points

El Salvador continues its Bitcoin strategy by purchasing an additional 12 Bitcoin.

Despite an agreement with the IMF, El Salvador maintains its Bitcoin holdings, which are now worth over half a billion dollars.

El Salvador continues its commitment to Bitcoin, taking advantage of a dip in the crypto market to purchase an additional 12 Bitcoin. This purchase was made in two separate transactions.

Additional Bitcoin Purchases Despite IMF Agreement

According to the government’s Bitcoin Office tracker, El Salvador initially paid just over $1.1 million for 11 Bitcoin, indicating an average purchase price of $101,816 per coin. The country later added an extra Bitcoin, bought at the price of $99,114.

With these new acquisitions, El Salvador’s Bitcoin holdings now stand at 6,068 BTC, worth more than half a billion dollars at current prices.

This recent purchase comes despite an agreement with the International Monetary Fund (IMF) in January. The $1.4 billion financing deal required the government to reduce some of its Bitcoin-related activities. However, this has not deterred El Salvador from continuing its Bitcoin acquisitions.

Commitment to Bitcoin Strategy

The country has been clear about its Bitcoin plans, with the National Bitcoin Office Director reaffirming their commitment to the Bitcoin strategy. A spokesperson from the office also revealed plans to continue investing in Bitcoin, potentially increasing investments in 2025.

El Salvador’s recent transactions reinforce its dedication to this Bitcoin strategy. According to a post by the Bitcoin Office, the country had acquired 21 BTC in the past week and 60 BTC over the last month.

In the early hours of today, Bitcoin fell to a 24-hour low of around $96,000 but has since rebounded to around $97,878, still down from its intraday high of over $100,500.

0 notes

Text

Is Bitcoin Safe?

The cryptocurrency market experienced remarkable highs in 2024, with a market capitalization exceeding $1.44 trillion and at $73,750. Bitcoin repeatedly surpassed its previous highs in March.

However, following this all-time high, Bitcoin is currently undergoing a correction, and as of August 7, 2024, it is trading at $57,504. The cryptocurrency market volatility, coupled with a tumultuous period in 2022, has led investors to question and exercise caution regarding the safety and security of this bold new asset class.

The median loss to Federal Trade Commission (FTC) impersonators has risen from $3,000 in 2019 to $7,000 in 2024. Falling prices combined with the increasing risk of criminal attacks are enough to make anyone think twice about the security of their Bitcoin.

Featured Partners

1

Mudrex

Legacy

Over 2 Million Investors Trust Mudrex for Their Crypto Investments

Security

Mudrex is Indian Govt. recognized platform with 100% insured deposits stored in encrypted wallets

Fees

Enjoy zero crypto deposit fees and industry's best fee rates.

Invest Now

On Mudrex's secure application

2

BlackBull Markets

Multiple Award-Winning Broker

Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker - ForexExpo Dubai October 2022 & more

Best-In-Class for Offering of Investments

Trade 26,000+ assets with no minimum deposit

Customer Support

24/7 dedicated support & easy to sign up

Sign Up Now

On BlackBull Market's secure website

Please invest carefully, your capital is at risk

Is Bitcoin a Safe Investment?

Understanding whether Bitcoin is a safe investment depends on how you define security.

There’s no question that Bitcoin prices can be highly volatile. In March 2024, the price of BTC hit its all-time high at $73,750.07; as of August 7, 2024, it is trading at $57,400.

In 2022 alone, the price of BTC dropped from almost INR 39,56,137 to around INR 16,07,165 in 2023.

Losses like that would send investors running for the hills for any other asset class. If you define security as an investment with a relatively stable price, Bitcoin may not be a safe bet for your investment portfolio.

That said, Bitcoin’s mercurial nature may be changing.

“Bitcoin is becoming more integrated with traditional financial markets and is seeing significant participation from retail and increasingly from institutional investors,” says Ryan Burke, general manager at Invest at M1. “Historically, BTC has been more volatile, but it has become a de facto mainstream alternative asset more recently correlated to large-cap tech.”

If you think of Bitcoin as digital gold, similar to a commodity rather than an investment security, you can add another dimension to the security question.

“Bitcoin technology is relatively safe, but it isn’t anonymous and relies on passwords,” says Daniel Rodriguez, chief operating officer at Hill Wealth Strategies.

While Bitcoin disguises your personal information, the address of your crypto wallet is publicly available.

“Hackers could use web trackers and cookies to find more information about the transactions that could lead to your private information and data,” Rodriguez says. If anonymity is part of your definition of security, Bitcoin might not be entirely secure.

Similarly, your cryptocurrency is only as secure as the crypto wallet you keep it in. If you lose your wallet password or someone else gets ahold of it, you lose your Bitcoin.

You will often see the disclaimers “not SIPC protected” or “not FDIC insured” attached to Bitcoin purchases. This means that should the firm holding your crypto investments fail, neither of these backstops will bail you out.

According to Gil Luria, a technology strategist at D.A. Davidson Co., none of these concerns relate to the security of the Bitcoin network itself. “It has survived unscathed for the 13 years of its existence and has yet to be hacked.”

Let us see what experts have to say about Bitcoin being a safe investment:

Sathvik Vishwanath, co-founder and chief executive officer of Unocoin, says that Bitcoin’s safety as an investment is under scrutiny, especially after its recent drop of nearly 15%, bringing its price below $50,000. This decline highlights Bitcoin’s inherent volatility, a defining characteristic that can lead to significant short-term price swings.

While Bitcoin’s decentralized nature and blockchain technology provide robust security features, its market behavior is highly susceptible to rapid fluctuations influenced by supply and demand dynamics, regulatory news, and broader economic factors.

He further said that recent market trends show Bitcoin’s potential for a sharp decline, posing a risk to investors. Despite its historic growth and the lure of substantial returns, Bitcoin’s unpredictable volatility and fluctuating regulatory environment mean investors must carefully assess their risk tolerance. Diversification, long-term holding strategies, and ongoing market analysis are essential to managing the risks associated with Bitcoin investments.

Utkarsh Tiwari, Chief Strategy Officer at KoinBX, said, ” Bitcoin, often hailed as digital gold, represents a significant evolution in the financial ecosystem. While its decentralized nature offers unparalleled transparency and security, it’s crucial to approach it with a well-informed strategy. As with any investment, understanding the inherent risks and volatility is essential.

However, it’s essential to recognize that with Bitcoin’s potential rewards come risks—especially its notorious volatility and the need for solid personal security measures. Understanding the technology, staying informed about market trends, and employing best practices for asset protection are crucial steps in ensuring your Bitcoin investments are secure.

At KoinBX, we advocate for responsible investing and staying updated with market trends to navigate the dynamic landscape of virtual digital assets safely.”

Himanshu Maradiya, founder and chairman of CIFDAQ Blockchain Ecosystem India, said that Bitcoin’s evolution since its inception in 2009 has been remarkable. From trading at approximately $500 in May 2016 to $69,790 as of July 29, 2024, Bitcoin has witnessed a phenomenal 12,662% growth. This impressive increase underscores its significant role and expanding acceptance in the global financial landscape.

Current technical indicators suggest a critical resistance zone, including the 61.8% Fibonacci retracement level at $62,066 and the 100-day Exponential Moving Average (EMA) at approximately $63,022.

He added that it’s important to note that Bitcoin’s market dynamics are subject to volatility and regulatory scrutiny, which can impact its price stability. While the recent analysis indicates potential for a short-term relief rally, investors should consider broader market trends and the regulatory environment. The Relative Strength Index (RSI), currently at around 36, highlights the potential for temporary recovery, yet a cautious approach is essential.

Things To Consider Before Buying Bitcoin

Given Bitcoin’s high volatility and security risks, it’s important to consider your reasons for buying before you trade any rupees for BTC.

Cryptocurrency is a highly speculative investment, says Luria. “The risk/reward profile of investing in Bitcoin differs from investing in most stocks or bonds. We tend to recommend investors only consider investing capital they are willing to lose,” he says.

Are you buying Bitcoin as an investment to fund your retirement? In that case, it’s probably best to keep your exposure to a minimum because no one can predict where the market will go. Most financial advisors recommend keeping Bitcoin to less than 5% of your overall portfolio.

You should brace yourself for an unreliable narrator if you think Bitcoin is a currency. You could easily log off the computer one day with INR 5,499,133 in BTC and log on with only INR 3,709,027 the next morning.

Then there’s the uncertainty around the crypto regulatory environment.

Cryptocurrencies are presently unregulated in India. While the Reserve Bank of India (RBI) sought to ban them in 2018, the Indian Supreme Court quashed the attempt, leaving cryptocurrencies in regulatory limbo—neither illegal nor, strictly speaking, legal. However, cryptocurrencies are taxed in India.

While Burke is optimistic about long-term developments for Bitcoin, uncertainty is an investor’s worst enemy. Assuming you’re comfortable with the risks and uncertainty, Bitcoin can have a place in your financial life.

What Are the Risks of Bitcoin?

Like any investment, Bitcoin is not risk-free. Cryptocurrency has many risks, from market to regulatory and cybersecurity risks.

On July 18, 2024, WazirX, a crypto exchange platform in India, experienced a cyber attack on one of its multisig wallets, resulting in the theft of digital assets exceeding $230 million. This is the latest scam that shocked Indian investors.

“Market risk is one of the biggest risks associated with Bitcoin,” Rodriguez says. Look at any price history chart and see what kind of a wild ride Bitcoin investors are in for.

“Historically, Bitcoin also reacts inversely to interest rates,” he says. “So, when the Fed raises rates, Bitcoin typically takes a dip because investors start leaning toward more safe and stable investments.”

Regulatory uncertainty also poses a risk.

“In 2021, China, the world’s second-biggest economy, effectively made it illegal for citizens to mine or hold any cryptocurrency,” Rodriguez says.

If other countries follow suit, Bitcoin holders could be in hot water.

Cybersecurity is another chief concern for all holders of digital assets. Remember that your transactions are only as anonymous and secure as your wallet information and passwords.

The Department of Justice proved blockchain transactions are not immune to tracing when it followed the trail left by a couple attempting to launder INR 370 billion in cryptocurrency stolen in the 2016 Bitfinex hack.

There’s also the rising threat of cryptocurrency crime. In 2023, people reported losses of $10 billion to scams, surpassing the previous year by $1 billion and marking the highest-ever losses reported to the FTC.

How To Keep Your Bitcoin Safe

Your Bitcoin’s safety depends largely on how you store it. Your choice of crypto wallet and its encryption level play a big part in keeping your coins safe.

“Security and convenience do not always go hand-in-hand,” Burke says.

He says that offline “cold” wallets that are not connected to the internet are secure from hacking but less convenient than hot wallets. Cold wallets are also subject to theft or loss. “Lose a device or drive or misplace your private key, you have a problem,” says Burke.

Hot wallets are more convenient because you can access your cryptocurrency anywhere you have an internet connection or cell service, but they are more vulnerable to hacking.

Burke says a prudent strategy is to use a combination of hot and cold storage, with most assets held in cold storage.

Burke adds whatever storage method you choose, so make sure you know if your crypto is being loaned, staked, or pledged as collateral.

Experts say it’s important to read the terms and conditions before signing up for a wallet or service, lest your cryptocurrency become another victim of the crypto liquidity crisis.

As with any investment, research whether Bitcoin is right for your portfolio. If you buy BTC as part of your investment strategy, prepare for highs and lows. cifdaq.com

0 notes

Text

Saylor signals impending purchase as BTC consolidates around $104K

Jan 26, 2025 BTCUSD+0.11%BTCUSDT+0.22% MicroStrategy co-founder Michael Saylor posted the Bitcoin BTCUSD tracker for the 12th consecutive week, signaling an impending Bitcoin purchase on Jan. 27. The company’s most recent purchase of 11,000 BTC occurred on Jan. 21, at an average purchase price of $101,191 per coin. According to SaylorTracker, MicroStrategy currently holds 461,000 BTC, valued…

View On WordPress

0 notes

Text

Is Bitcoin Safe?

The cryptocurrency market experienced remarkable highs in 2024, with a market capitalization exceeding $1.44 trillion and at $73,750. Bitcoin repeatedly surpassed its previous highs in March.

However, following this all-time high, Bitcoin is currently undergoing a correction, and as of August 7, 2024, it is trading at $57,504. The cryptocurrency market volatility, coupled with a tumultuous period in 2022, has led investors to question and exercise caution regarding the safety and security of this bold new asset class.

The median loss to Federal Trade Commission (FTC) impersonators has risen from $3,000 in 2019 to $7,000 in 2024. Falling prices combined with the increasing risk of criminal attacks are enough to make anyone think twice about the security of their Bitcoin.

Is Bitcoin a Safe Investment? Understanding whether Bitcoin is a safe investment depends on how you define security.

There’s no question that Bitcoin prices can be highly volatile. In March 2024, the price of BTC hit its all-time high at $73,750.07; as of August 7, 2024, it is trading at $57,400.

In 2022 alone, the price of BTC dropped from almost INR 39,56,137 to around INR 16,07,165 in 2023.

Losses like that would send investors running for the hills for any other asset class. If you define security as an investment with a relatively stable price, Bitcoin may not be a safe bet for your investment portfolio.

That said, Bitcoin’s mercurial nature may be changing.

“Bitcoin is becoming more integrated with traditional financial markets and is seeing significant participation from retail and increasingly from institutional investors,” says Ryan Burke, general manager at Invest at M1. “Historically, BTC has been more volatile, but it has become a de facto mainstream alternative asset more recently correlated to large-cap tech.”

If you think of Bitcoin as digital gold, similar to a commodity rather than an investment security, you can add another dimension to the security question.

“Bitcoin technology is relatively safe, but it isn’t anonymous and relies on passwords,” says Daniel Rodriguez, chief operating officer at Hill Wealth Strategies.

While Bitcoin disguises your personal information, the address of your crypto wallet is publicly available.

“Hackers could use web trackers and cookies to find more information about the transactions that could lead to your private information and data,” Rodriguez says. If anonymity is part of your definition of security, Bitcoin might not be entirely secure.

Similarly, your cryptocurrency is only as secure as the crypto wallet you keep it in. If you lose your wallet password or someone else gets ahold of it, you lose your Bitcoin.

You will often see the disclaimers “not SIPC protected” or “not FDIC insured” attached to Bitcoin purchases. This means that should the firm holding your crypto investments fail, neither of these backstops will bail you out.

According to Gil Luria, a technology strategist at D.A. Davidson Co., none of these concerns relate to the security of the Bitcoin network itself. “It has survived unscathed for the 13 years of its existence and has yet to be hacked.”

Let us see what experts have to say about Bitcoin being a safe investment:

Sathvik Vishwanath, co-founder and chief executive officer of Unocoin, says that Bitcoin’s safety as an investment is under scrutiny, especially after its recent drop of nearly 15%, bringing its price below $50,000. This decline highlights Bitcoin’s inherent volatility, a defining characteristic that can lead to significant short-term price swings.

While Bitcoin’s decentralized nature and blockchain technology provide robust security features, its market behavior is highly susceptible to rapid fluctuations influenced by supply and demand dynamics, regulatory news, and broader economic factors.

He further said that recent market trends show Bitcoin’s potential for a sharp decline, posing a risk to investors. Despite its historic growth and the lure of substantial returns, Bitcoin’s unpredictable volatility and fluctuating regulatory environment mean investors must carefully assess their risk tolerance. Diversification, long-term holding strategies, and ongoing market analysis are essential to managing the risks associated with Bitcoin investments.

Utkarsh Tiwari, Chief Strategy Officer at KoinBX, said, ” Bitcoin, often hailed as digital gold, represents a significant evolution in the financial ecosystem. While its decentralized nature offers unparalleled transparency and security, it’s crucial to approach it with a well-informed strategy. As with any investment, understanding the inherent risks and volatility is essential.

However, it’s essential to recognize that with Bitcoin’s potential rewards come risks—especially its notorious volatility and the need for solid personal security measures. Understanding the technology, staying informed about market trends, and employing best practices for asset protection are crucial steps in ensuring your Bitcoin investments are secure.

At KoinBX, we advocate for responsible investing and staying updated with market trends to navigate the dynamic landscape of virtual digital assets safely.”

Himanshu Maradiya, founder and chairman of CIFDAQ Blockchain Ecosystem India, said that Bitcoin’s evolution since its inception in 2009 has been remarkable. From trading at approximately $500 in May 2016 to $69,790 as of July 29, 2024, Bitcoin has witnessed a phenomenal 12,662% growth. This impressive increase underscores its significant role and expanding acceptance in the global financial landscape.

Current technical indicators suggest a critical resistance zone, including the 61.8% Fibonacci retracement level at $62,066 and the 100-day Exponential Moving Average (EMA) at approximately $63,022.

He added that it’s important to note that Bitcoin’s market dynamics are subject to volatility and regulatory scrutiny, which can impact its price stability. While the recent analysis indicates potential for a short-term relief rally, investors should consider broader market trends and the regulatory environment. The Relative Strength Index (RSI), currently at around 36, highlights the potential for temporary recovery, yet a cautious approach is essential.

Things To Consider Before Buying Bitcoin Given Bitcoin’s high volatility and security risks, it’s important to consider your reasons for buying before you trade any rupees for BTC.

Cryptocurrency is a highly speculative investment, says Luria. “The risk/reward profile of investing in Bitcoin differs from investing in most stocks or bonds. We tend to recommend investors only consider investing capital they are willing to lose,” he says.

Are you buying Bitcoin as an investment to fund your retirement? In that case, it’s probably best to keep your exposure to a minimum because no one can predict where the market will go. Most financial advisors recommend keeping Bitcoin to less than 5% of your overall portfolio.

You should brace yourself for an unreliable narrator if you think Bitcoin is a currency. You could easily log off the computer one day with INR 5,499,133 in BTC and log on with only INR 3,709,027 the next morning.

Then there’s the uncertainty around the crypto regulatory environment.

Cryptocurrencies are presently unregulated in India. While the Reserve Bank of India (RBI) sought to ban them in 2018, the Indian Supreme Court quashed the attempt, leaving cryptocurrencies in regulatory limbo—neither illegal nor, strictly speaking, legal. However, cryptocurrencies are taxed in India.

While Burke is optimistic about long-term developments for Bitcoin, uncertainty is an investor’s worst enemy. Assuming you’re comfortable with the risks and uncertainty, Bitcoin can have a place in your financial life.

What Are the Risks of Bitcoin? Like any investment, Bitcoin is not risk-free. Cryptocurrency has many risks, from market to regulatory and cybersecurity risks.

On July 18, 2024, WazirX, a crypto exchange platform in India, experienced a cyber attack on one of its multisig wallets, resulting in the theft of digital assets exceeding $230 million. This is the latest scam that shocked Indian investors.

“Market risk is one of the biggest risks associated with Bitcoin,” Rodriguez says. Look at any price history chart and see what kind of a wild ride Bitcoin investors are in for.

“Historically, Bitcoin also reacts inversely to interest rates,” he says. “So, when the Fed raises rates, Bitcoin typically takes a dip because investors start leaning toward more safe and stable investments.”

Regulatory uncertainty also poses a risk.

“In 2021, China, the world’s second-biggest economy, effectively made it illegal for citizens to mine or hold any cryptocurrency,” Rodriguez says.

If other countries follow suit, Bitcoin holders could be in hot water.

Cybersecurity is another chief concern for all holders of digital assets. Remember that your transactions are only as anonymous and secure as your wallet information and passwords.

The Department of Justice proved blockchain transactions are not immune to tracing when it followed the trail left by a couple attempting to launder INR 370 billion in cryptocurrency stolen in the 2016 Bitfinex hack.

There’s also the rising threat of cryptocurrency crime. In 2023, people reported losses of $10 billion to scams, surpassing the previous year by $1 billion and marking the highest-ever losses reported to the FTC.

How To Keep Your Bitcoin Safe Your Bitcoin’s safety depends largely on how you store it. Your choice of crypto wallet and its encryption level play a big part in keeping your coins safe.

“Security and convenience do not always go hand-in-hand,” Burke says.

He says that offline “cold” wallets that are not connected to the internet are secure from hacking but less convenient than hot wallets. Cold wallets are also subject to theft or loss. “Lose a device or drive or misplace your private key, you have a problem,” says Burke.

Hot wallets are more convenient because you can access your cryptocurrency anywhere you have an internet connection or cell service, but they are more vulnerable to hacking.

Burke says a prudent strategy is to use a combination of hot and cold storage, with most assets held in cold storage.

Burke adds whatever storage method you choose, so make sure you know if your crypto is being loaned, staked, or pledged as collateral.

Experts say it’s important to read the terms and conditions before signing up for a wallet or service, lest your cryptocurrency become another victim of the crypto liquidity crisis.

As with any investment, research whether Bitcoin is right for your portfolio. If you buy BTC as part of your investment strategy, prepare for highs and lows.

CIFDAQ #CRYPTO #BLOCKCHAIN #WEB3

www.cifdaq.com

0 notes

Text

Is Bitcoin Safe?

The cryptocurrency market experienced remarkable highs in 2024, with a market capitalization exceeding $1.44 trillion and at $73,750. Bitcoin repeatedly surpassed its previous highs in March.

However, following this all-time high, Bitcoin is currently undergoing a correction, and as of August 7, 2024, it is trading at $57,504. The cryptocurrency market volatility, coupled with a tumultuous period in 2022, has led investors to question and exercise caution regarding the safety and security of this bold new asset class.

The median loss to Federal Trade Commission (FTC) impersonators has risen from $3,000 in 2019 to $7,000 in 2024. Falling prices combined with the increasing risk of criminal attacks are enough to make anyone think twice about the security of their Bitcoin.

Is Bitcoin a Safe Investment? Understanding whether Bitcoin is a safe investment depends on how you define security.

There’s no question that Bitcoin prices can be highly volatile. In March 2024, the price of BTC hit its all-time high at $73,750.07; as of August 7, 2024, it is trading at $57,400.

In 2022 alone, the price of BTC dropped from almost INR 39,56,137 to around INR 16,07,165 in 2023.

Losses like that would send investors running for the hills for any other asset class. If you define security as an investment with a relatively stable price, Bitcoin may not be a safe bet for your investment portfolio.

That said, Bitcoin’s mercurial nature may be changing.

“Bitcoin is becoming more integrated with traditional financial markets and is seeing significant participation from retail and increasingly from institutional investors,” says Ryan Burke, general manager at Invest at M1. “Historically, BTC has been more volatile, but it has become a de facto mainstream alternative asset more recently correlated to large-cap tech.”

If you think of Bitcoin as digital gold, similar to a commodity rather than an investment security, you can add another dimension to the security question.

“Bitcoin technology is relatively safe, but it isn’t anonymous and relies on passwords,” says Daniel Rodriguez, chief operating officer at Hill Wealth Strategies.

While Bitcoin disguises your personal information, the address of your crypto wallet is publicly available.

“Hackers could use web trackers and cookies to find more information about the transactions that could lead to your private information and data,” Rodriguez says. If anonymity is part of your definition of security, Bitcoin might not be entirely secure.

Similarly, your cryptocurrency is only as secure as the crypto wallet you keep it in. If you lose your wallet password or someone else gets ahold of it, you lose your Bitcoin.

You will often see the disclaimers “not SIPC protected” or “not FDIC insured” attached to Bitcoin purchases. This means that should the firm holding your crypto investments fail, neither of these backstops will bail you out.

According to Gil Luria, a technology strategist at D.A. Davidson Co., none of these concerns relate to the security of the Bitcoin network itself. “It has survived unscathed for the 13 years of its existence and has yet to be hacked.”

Let us see what experts have to say about Bitcoin being a safe investment:

Sathvik Vishwanath, co-founder and chief executive officer of Unocoin, says that Bitcoin’s safety as an investment is under scrutiny, especially after its recent drop of nearly 15%, bringing its price below $50,000. This decline highlights Bitcoin’s inherent volatility, a defining characteristic that can lead to significant short-term price swings.

While Bitcoin’s decentralized nature and blockchain technology provide robust security features, its market behavior is highly susceptible to rapid fluctuations influenced by supply and demand dynamics, regulatory news, and broader economic factors.

He further said that recent market trends show Bitcoin’s potential for a sharp decline, posing a risk to investors. Despite its historic growth and the lure of substantial returns, Bitcoin’s unpredictable volatility and fluctuating regulatory environment mean investors must carefully assess their risk tolerance. Diversification, long-term holding strategies, and ongoing market analysis are essential to managing the risks associated with Bitcoin investments.

Utkarsh Tiwari, Chief Strategy Officer at KoinBX, said, ” Bitcoin, often hailed as digital gold, represents a significant evolution in the financial ecosystem. While its decentralized nature offers unparalleled transparency and security, it’s crucial to approach it with a well-informed strategy. As with any investment, understanding the inherent risks and volatility is essential.

However, it’s essential to recognize that with Bitcoin’s potential rewards come risks—especially its notorious volatility and the need for solid personal security measures. Understanding the technology, staying informed about market trends, and employing best practices for asset protection are crucial steps in ensuring your Bitcoin investments are secure.

At KoinBX, we advocate for responsible investing and staying updated with market trends to navigate the dynamic landscape of virtual digital assets safely.”

Himanshu Maradiya, founder and chairman of CIFDAQ Blockchain Ecosystem India, said that Bitcoin’s evolution since its inception in 2009 has been remarkable. From trading at approximately $500 in May 2016 to $69,790 as of July 29, 2024, Bitcoin has witnessed a phenomenal 12,662% growth. This impressive increase underscores its significant role and expanding acceptance in the global financial landscape.

Current technical indicators suggest a critical resistance zone, including the 61.8% Fibonacci retracement level at $62,066 and the 100-day Exponential Moving Average (EMA) at approximately $63,022.

He added that it’s important to note that Bitcoin’s market dynamics are subject to volatility and regulatory scrutiny, which can impact its price stability. While the recent analysis indicates potential for a short-term relief rally, investors should consider broader market trends and the regulatory environment. The Relative Strength Index (RSI), currently at around 36, highlights the potential for temporary recovery, yet a cautious approach is essential.

Things To Consider Before Buying Bitcoin Given Bitcoin’s high volatility and security risks, it’s important to consider your reasons for buying before you trade any rupees for BTC.

Cryptocurrency is a highly speculative investment, says Luria. “The risk/reward profile of investing in Bitcoin differs from investing in most stocks or bonds. We tend to recommend investors only consider investing capital they are willing to lose,” he says.

Are you buying Bitcoin as an investment to fund your retirement? In that case, it’s probably best to keep your exposure to a minimum because no one can predict where the market will go. Most financial advisors recommend keeping Bitcoin to less than 5% of your overall portfolio.

You should brace yourself for an unreliable narrator if you think Bitcoin is a currency. You could easily log off the computer one day with INR 5,499,133 in BTC and log on with only INR 3,709,027 the next morning.

Then there’s the uncertainty around the crypto regulatory environment.

Cryptocurrencies are presently unregulated in India. While the Reserve Bank of India (RBI) sought to ban them in 2018, the Indian Supreme Court quashed the attempt, leaving cryptocurrencies in regulatory limbo—neither illegal nor, strictly speaking, legal. However, cryptocurrencies are taxed in India.

While Burke is optimistic about long-term developments for Bitcoin, uncertainty is an investor’s worst enemy. Assuming you’re comfortable with the risks and uncertainty, Bitcoin can have a place in your financial life.

What Are the Risks of Bitcoin? Like any investment, Bitcoin is not risk-free. Cryptocurrency has many risks, from market to regulatory and cybersecurity risks.

On July 18, 2024, WazirX, a crypto exchange platform in India, experienced a cyber attack on one of its multisig wallets, resulting in the theft of digital assets exceeding $230 million. This is the latest scam that shocked Indian investors.

“Market risk is one of the biggest risks associated with Bitcoin,” Rodriguez says. Look at any price history chart and see what kind of a wild ride Bitcoin investors are in for.

“Historically, Bitcoin also reacts inversely to interest rates,” he says. “So, when the Fed raises rates, Bitcoin typically takes a dip because investors start leaning toward more safe and stable investments.”

Regulatory uncertainty also poses a risk.

“In 2021, China, the world’s second-biggest economy, effectively made it illegal for citizens to mine or hold any cryptocurrency,” Rodriguez says.

If other countries follow suit, Bitcoin holders could be in hot water.

Cybersecurity is another chief concern for all holders of digital assets. Remember that your transactions are only as anonymous and secure as your wallet information and passwords.

The Department of Justice proved blockchain transactions are not immune to tracing when it followed the trail left by a couple attempting to launder INR 370 billion in cryptocurrency stolen in the 2016 Bitfinex hack.

There’s also the rising threat of cryptocurrency crime. In 2023, people reported losses of $10 billion to scams, surpassing the previous year by $1 billion and marking the highest-ever losses reported to the FTC.

How To Keep Your Bitcoin Safe Your Bitcoin’s safety depends largely on how you store it. Your choice of crypto wallet and its encryption level play a big part in keeping your coins safe.

“Security and convenience do not always go hand-in-hand,” Burke says.

He says that offline “cold” wallets that are not connected to the internet are secure from hacking but less convenient than hot wallets. Cold wallets are also subject to theft or loss. “Lose a device or drive or misplace your private key, you have a problem,” says Burke.

Hot wallets are more convenient because you can access your cryptocurrency anywhere you have an internet connection or cell service, but they are more vulnerable to hacking.

Burke says a prudent strategy is to use a combination of hot and cold storage, with most assets held in cold storage.

Burke adds whatever storage method you choose, so make sure you know if your crypto is being loaned, staked, or pledged as collateral.

Experts say it’s important to read the terms and conditions before signing up for a wallet or service, lest your cryptocurrency become another victim of the crypto liquidity crisis.

As with any investment, research whether Bitcoin is right for your portfolio. If you buy BTC as part of your investment strategy, prepare for highs and lows.

CIFDAQ #CRYPTO #BLOCKCHAIN #WEB3

www.cifdaq.com

0 notes

Text

A year in illustration (2024), Part two

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/07/great-kepplers-ghost/art-adjacent

Part one

Algorithmic feeds are a twiddler's playground

I confess that the kind of music that people make with modular synths leaves me totally, absolutely flat. However, the look of modular synths is perfect for conjuring up the idea of "twiddling" – a key part of my theory of enshittification (doubly so after I painstakingly put a HAL 9000 eye on every dial and knob).

https://pluralistic.net/2024/05/11/for-you/#the-algorithm-tm

(Image: Cryteria, CC BY 3.0; djhughman, CC BY 2.0; modified)

CDA 230 bans Facebook from blocking interoperable tools

"Interoperability" is one of those abstractions I really struggle to visually represent, but sticking a giant, scuffed, USB-C port (courtesy of D-Kuru's great CC BY 4.0 macrofocus image) on the Facebook sign worked great.

(Image: D-Kuru, Minette Lontsie, CC BY-SA 4.0, modified)

Cleantech has an enshittification problem

Illustrating "cleantech" being bricked seemed pretty straightforward, but it took a lot of doing to find a good picture of a brick. Eventually, I found a brick and took a picture of it! I think the solar panels on the brick are pretty nicely matted in.

(Image: 臺灣古寫真上色, Grendelkhan CC BY-SA 4.0; modified)

How to design a tech regulation

Cutting out those balance scales took a long-ass time, but I've found a lot of uses for them, illustrating the concept of "making trade-offs." The tradeoff here is between a rigid, planned approach and a more improvisational one, so I used an Air Force guy at rigid attention and a guerrilla fighter on the scales. The "impatient guy" from the maybe-a-radio-ad stands in this time for a government regulator.

https://pluralistic.net/2024/06/20/scalesplaining/#administratability

(Image: Noah Wulf, CC BY-SA 4.0, modified)

Microsoft pinky swears that THIS TIME they'll make security a priority

Look, I'll stipulate that using "Clippy" as a symbol for Microsoft personified is a bit antiquated, but I like to think that for those who know, they really know. The Uncle Sam is Keppler again. With apologies to Skippy Shulz, natch.

https://pluralistic.net/2024/06/14/patch-tuesday/

An end to the climate emergency is in our grasp

Virgil Finlay's demon head is sinister, sure, but the unintentional, undeniable sinisterness of the body language of this guy puts him in the shade. He comes from an unsourced image that looks like an ad for a built-in stereo.

https://craphound.com/images/guygestures.jpg

The audience in the front comes from a Victorian daugerrotype of a crowd watching some kind of unknown spectacle. I cropped 'em out by hand and use them as a visual stand-in for "this is a thing that the world is, or should be, watching."

https://pluralistic.net/2024/06/12/s-curve/#anything-that-cant-go-on-forever-eventually-stops

Surveillance pricing

I don't make a lot of animations, but this one is super-sweet. The idea of things switching slowly via crossfades is a great way to illustrate how tech lets companies change things when you aren't paying attention. Thanks as ever to ezgif.com for help assembling and optimizing it.

https://pluralistic.net/2024/06/05/your-price-named/#privacy-first-again

(Image: Cryteria, CC BY 3.0, modified)

"Carbon neutral" Bitcoin operation founded by coal plant operator wasn't actually carbon neutral

Thomas Hawk is an amazing photographer who also posts all kinds of amazing found photos (more than 23,000 of them!) to his Flickr stream, at very high rez:

https://www.flickr.com/search/?sort=date-taken-desc&safe_search=1&tags=foundphotograph&user_id=51035555243%40N01&view_all=1

The guys in the foreground appear in one of these, proudly displaying an award for – I kid you not – "canned bacon." The kids in the background come from a gallery of photos of early 20th C. child laborers.

https://pluralistic.net/2024/08/09/terawulf/#hunterbrook

The Google antitrust remedy should extinguish surveillance, not democratize it

If Keppler's "Capital Controls the Senate" is one of the most important antitrust images of all time, then his "Next!" (depicting Standard Oil as a rapacious, world-strangling octopus) is the most important antitrust illustration.

The Uncle Sam-as-a-cop figure is another Keppler (natch), and he's a regular in my collages – I can make him stand in for any federal agency by putting its logo on his chest, where a badge would go.

It took me a long time to cut up that Next! image for easy modding. Here's a GIMP XCF file for your pleasure:

https://craphound.com/images/standard-oil-kraken.xcf

And a PSD:

https://craphound.com/images/standard-oil-kraken.psd

https://pluralistic.net/2024/08/07/revealed-preferences/#extinguish-v-improve

(Image: Cryteria, CC BY 3.0, modified)

The largest campaign finance violation in US history

The giant figure looking at something in his palm through a looking-glass is yet another Keppler Uncle Sam illo (in the original, Sam is peering at a taxpayer who's shouting back up at him). I love the sad little donkey; I spent a bunch of time this election year finding public domain images of mules and elephants and dressing them in the livery of the mascots of the Democratic and Republican parties to have a bunch of visual signifiers with different emotional valences for each.

Note the halftoned background (a Maricopa County ballot); I'm increasingly fond of halftoning as a way to create a nice looking, scale-independent background.

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

AI's productivity theater

"Technofeudalism" was a theme in my work even before Yanis Varoufakis's excellent book on the subject. Putting a HAL Eye on the reeve in this medieval tapestry depicting him lording it over his groveling serfs really caught the subject, especially after I faded in some Matrix code waterfall for the background.

https://pluralistic.net/2024/07/25/accountability-sinks/#work-harder-not-smarter

(Image: Cryteria, CC BY 3.0, modified)

Return to office and dying on the job

This medieval torture chamber was really brightened up by the LATE AGAIN! workplace poster on the wall and the impatient guy posed before the Manhattan skyline through the window bars. Cutting out all the window-panes took forever.

https://pluralistic.net/2024/09/27/sharpen-your-blades-boys/#disciplinary-technology

Thinking the unthinkable

Bosch's anus-demon (from the Garden of Earthly Delights) returns, this time to illustrate the problems of radium suppositories as a metaphor for commercial surveillance (yes, a visual metaphor for a textual metaphor – whew, it's getting abstract around here). It took some fiddling to get the right green radioactive glow in the anal cavity, and to match it for each of the suppositories in the Museum of the Health Sciences' picture of a box of the

The damask-esque background comes from a gallery of antique marbled endpapers that I often use when I need a texture, tweaking the curves and colors until they look cool.

https://pluralistic.net/2024/09/19/just-stop-putting-that-up-your-ass/#harm-reduction

There's no such thing as "shareholder supremacy"

Boy I love this one. The background is a late 1800s photo of the Temple of Pluto. The golden calf on the idol comes from an early 20th century illustrated bible. Add Milton Friedman's head, the lettering from the original U Chicago School of Business, and a tiny golden top-hat for the calf, and voila! Idol-worship! Alistair Milne's tip for making gold textures work went down a treat here.

https://pluralistic.net/2024/09/18/falsifiability/#figleaves-not-rubrics

America's best-paid CEOs have the worst-paid employees

The heads of the millionaires are more Keppler Punch illos, while the bodies and sofas come from another Thomas Hawk found industrial photo. You'll remember the child coal miners from ""Carbon neutral" Bitcoin operation founded by coal plant operator wasn't actually carbon neutral." I have a vivid memory of carefully cutting out the guillotine and its Jacobins during a boring conference presentation.

https://pluralistic.net/2024/09/09/low-wage-100/#executive-excess

Conspiratorialism as a material phenomenon

The superstitious belief that Big Tech has built a mind-control ray is a common theme in my work, and I've got a few prized, carefully sliced up "mind control ray" themed images from old pulps in my stock art folder. This one is augmented with Cryteria's HAL 9000 eye, and a Keppler cavorting vaudevallian with Zuck's metaverse head. The midcentury family comes from a midcentury ad for Mason Masterpieces's bronzed baby-shoes.

(Image: Cryteria, CC BY 3.0, modified)

Part three

Part four

#art#collages#public domain#creative commons#cc#fair use#copyfight#visual communications#illustration#pluralistic illustratons 2024

26 notes

·

View notes

Text

By Eric Lipton and David Yaffe-Bellany

The Trump family’s new crypto token surged in just two days to become one of the most valuable forms of digital currency in the world, creating the potential for a multibillion-dollar payout to the family but also generating a storm of questions about the conflicts of interest the new venture creates.

President-elect Donald J. Trump announced the launch of the new token, $Trump, on Friday night as hundreds gathered for a crypto-inspired inauguration ball not far from the White House.

The venture won praise by some as a sign of how digital currencies are now going mainstream in the United States.

But economists and even some longtime crypto investors said the new digital coin, known as a memecoin, might also emerge as a landmark moment in the speculative history of crypto trading and the potential dangers it poses to the financial system. Memecoins are a type of cryptocurrency tied to an online joke or a celebrity mascot.

“If people want to gamble, I don’t really care,” said Lee Reiners, a former Federal Reserve economist who is now a lecturer for a center studying global economic markets at Duke University. “What I care about is when this crypto bubble bursts — and it will burst — it will end up impacting people across the economy even if they don’t have direct investment in crypto. And this new coin is making it worse.”

Eric Trump, one of Mr. Trump’s sons, who helped launch the token, declined to comment on Sunday.

At least on paper, the Trump tokens in the market as of Sunday late afternoon had a total trading value of nearly $13 billion, and a total of $29 billion worth of trades had taken place in just two days. That calculation is based on the nearly $64 value of each of the 200 million tokens issued, according to CoinGecko, an industry data tracker.

This suggests, as of Sunday, that Mr. Trump’s coin was the 19th most valuable form of cryptocurrency in the world, the CoinGecko tally indicated.

The Trump affiliates appear to control another 800 million tokensthat, at least hypothetically, could be worth as much as $51 billion — a total that would make Mr. Trump one of the richest people in the world.

Before the coin started trading, Forbes had listed Mr. Trump’s net worth as $6.7 billion, most of that coming from Trump Media and Technology Group, another speculative venture the Trump family helped start, which runs the money-losing social media platform Truth Social.

The Trump family late on Sunday moved to add a second new crypto token, this one called $Melania, with Mr. Trump and Melania, his wife, both promoting it on Truth Social, just as Mr. Trump was about to start a rally in Washington celebrating his inauguration.

“The official Melania Meme is live!” the social media posting said.

That move then coincided with a dive in the value of Mr. Trump’s own token, dropping to as low as $41, before starting to rise again, as doubts appeared to emerge over just how valuable these new tokens would actually be. Mr. Trump did not appear to be deterred.

“Bitcoin has shattered one record after another,” Mr. Trump said at his rally, referring to another form of cryptocurrency. He added during his remarks that “these are all investments that are only being made because we won the election.”

But Mr. Trump’s newfound crypto wealth would likely vaporize if he moved to sell his trove of coins. New cryptocurrencies often shoot up in price, making traders billionaires on paper, only to collapse when the coins’ holders start selling.

That is especially true of memecoins, which are prone to rapid swings in price as their internet popularity fluctuates. Prices can also vary across platforms, making it difficult to pin down a coin’s actual value. In 2021, one of the first memecoins, a dog-based digital currency called Dogecoin, minted millionaires overnight, only to lose much of its value just as quickly.

The launch of the Trump memecoin caught many of the industry’s power brokers off guard.

When the president-elect announced the coin on Friday night, hundreds of the most influential executives in the industry were drinking cocktails and singing along to Snoop Dogg at an inauguration party in Washington dubbed the Crypto Ball. (One executive who attended the ball said he was “annoyed” that trading in the coin had begun while the industry’s leaders “weren’t paying attention,” making it difficult for them to profit.)

Nonetheless, some traders have already cashed in.

Within a minute of the coin’s launch, a crypto trader had accumulated a $1 million position, according to an analysis of public transaction data by the crypto data firm Bubblemaps, which posted its findings on social media.

The coin’s price surged, and the trader’s account soon sold off holdings worth $20 million. The analysis prompted speculation on social media about whether an insider with advance knowledge of the coin’s launch had been able to make quick profits. (Bubblemaps did not immediately respond to a request for comment.)

Conor Grogan, a director at Coinbase, one of the largest trading platforms in the United States, estimated in a social media post that as of Saturday, the Trump team had made $58 million in fees from all of the $Trump sales — even without selling its own reserve of tokens to the open marketplace.

It also appears that the Trump team may be transferring some of its tokens onto an overseas trading platform called Bybit, which is not allowed to execute trades in the United States, Mr. Grogan noted. Bybit has recently been the focus of enforcement actions by international cryptocurrency regulators.

The Trump coin’s launch immediately created new opportunities for executives, crypto traders and even major companies to curry favor with the Trump administration.

Anyone can spin up a memecoin for a few dollars, and the vast majority of the tokens are not available to buy and sell on mainstream digital currency marketplaces, which often focus on larger, more established coins. But within hours of Mr. Trump’s announcement, the crypto exchange Kraken began offering the new coin, and Coinbase, the largest exchange in the United States, said it would also list it.

Coinbase and Kraken are fighting lawsuits filed by the Securities and Exchange Commission, which conducted a wide-ranging crackdown on crypto firms during the Biden administration. The companies are among a large group of crypto firms that stand to benefit from the more relaxed approach to tech regulation that Mr. Trump promised on the campaign trail.

A onetime crypto skeptic, Mr. Trump embraced the digital currency industry last year, giving a speech at a major industry conference in which he promised to turn the United States into the “crypto capital of the planet.”

After winning the election, Mr. Trump made a series of moves that appear poised to benefit the crypto industry. He chose someone to lead the S.E.C. who has a track record of working closely with crypto companies, and tapped the venture capitalist David Sacks, a digital currency enthusiast, to oversee crypto and artificial intelligence policy for his administration.

At the Crypto Ball, Mr. Sacks announced from the stage that “the reign of terror against crypto is over, and the beginning of innovation in America for crypto has just begun,” according to a video posted on social media by Eric Trump.

The president-elect’s family was personally invested in the crypto market even before the memecoin launched. In September, he and his sons helped start a crypto business, World Liberty Financial, that also has a digital coin associated with it, WLFI.

World Liberty is not directly owned by the Trumps. But Mr. Trump is a promoter of the venture, and he receives a cut of the profits from token sales.

For the most part, the crypto industry has responded enthusiastically to Mr. Trump’s crypto ventures. But someexecutives expressed concern this weekend that the memecoin launch would end up hurting amateur traders.

A popular crypto podcaster called it a “gratuitous cash grab” that would be “bad for humanity.” Erik Voorhees, a prominent Bitcoin investor, wrote on social media that the memecoin was “stupid and embarrassing.”

Still the Trump family’s embrace of cryptocurrencies shows no sign of slowing down.

“It’s time to celebrate everything we stand for: WINNING!” Mr. Trump wrote on Friday as he announced the birth of the new crypto token. “Join my very special Trump Community. GET YOUR $TRUMP NOW.”

0 notes

Text

Is Bitcoin Safe?

Editorial Note: Forbes Advisor may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations.

The cryptocurrency market experienced remarkable highs in 2024, with a market capitalization exceeding $1.44 trillion and at $73,750. Bitcoin repeatedly surpassed its previous highs in March.

However, following this all-time high, Bitcoin is currently undergoing a correction, and as of August 7, 2024, it is trading at $57,504. The cryptocurrency market volatility, coupled with a tumultuous period in 2022, has led investors to question and exercise caution regarding the safety and security of this bold new asset class.

The median loss to Federal Trade Commission (FTC) impersonators has risen from $3,000 in 2019 to $7,000 in 2024. Falling prices combined with the increasing risk of criminal attacks are enough to make anyone think twice about the security of their Bitcoin.

Is Bitcoin a Safe Investment?

Understanding whether Bitcoin is a safe investment depends on how you define security.

There’s no question that Bitcoin prices can be highly volatile. In March 2024, the price of BTC hit its all-time high at $73,750.07; as of August 7, 2024, it is trading at $57,400.

In 2022 alone, the price of BTC dropped from almost INR 39,56,137 to around INR 16,07,165 in 2023.

Losses like that would send investors running for the hills for any other asset class. If you define security as an investment with a relatively stable price, Bitcoin may not be a safe bet for your investment portfolio.

That said, Bitcoin’s mercurial nature may be changing.

“Bitcoin is becoming more integrated with traditional financial markets and is seeing significant participation from retail and increasingly from institutional investors,” says Ryan Burke, general manager at Invest at M1. “Historically, BTC has been more volatile, but it has become a de facto mainstream alternative asset more recently correlated to large-cap tech.”

If you think of Bitcoin as digital gold, similar to a commodity rather than an investment security, you can add another dimension to the security question.

“Bitcoin technology is relatively safe, but it isn’t anonymous and relies on passwords,” says Daniel Rodriguez, chief operating officer at Hill Wealth Strategies.

While Bitcoin disguises your personal information, the address of your crypto wallet is publicly available.

“Hackers could use web trackers and cookies to find more information about the transactions that could lead to your private information and data,” Rodriguez says. If anonymity is part of your definition of security, Bitcoin might not be entirely secure.

Similarly, your cryptocurrency is only as secure as the crypto wallet you keep it in. If you lose your wallet password or someone else gets ahold of it, you lose your Bitcoin.

You will often see the disclaimers “not SIPC protected” or “not FDIC insured” attached to Bitcoin purchases. This means that should the firm holding your crypto investments fail, neither of these backstops will bail you out.

According to Gil Luria, a technology strategist at D.A. Davidson Co., none of these concerns relate to the security of the Bitcoin network itself. “It has survived unscathed for the 13 years of its existence and has yet to be hacked.”

Let us see what experts have to say about Bitcoin being a safe investment:

Sathvik Vishwanath, co-founder and chief executive officer of Unocoin, says that Bitcoin’s safety as an investment is under scrutiny, especially after its recent drop of nearly 15%, bringing its price below $50,000. This decline highlights Bitcoin’s inherent volatility, a defining characteristic that can lead to significant short-term price swings.

While Bitcoin’s decentralized nature and blockchain technology provide robust security features, its market behavior is highly susceptible to rapid fluctuations influenced by supply and demand dynamics, regulatory news, and broader economic factors.

He further said that recent market trends show Bitcoin’s potential for a sharp decline, posing a risk to investors. Despite its historic growth and the lure of substantial returns, Bitcoin’s unpredictable volatility and fluctuating regulatory environment mean investors must carefully assess their risk tolerance. Diversification, long-term holding strategies, and ongoing market analysis are essential to managing the risks associated with Bitcoin investments.

Utkarsh Tiwari, Chief Strategy Officer at KoinBX, said, ” Bitcoin, often hailed as digital gold, represents a significant evolution in the financial ecosystem. While its decentralized nature offers unparalleled transparency and security, it’s crucial to approach it with a well-informed strategy. As with any investment, understanding the inherent risks and volatility is essential.

However, it’s essential to recognize that with Bitcoin’s potential rewards come risks—especially its notorious volatility and the need for solid personal security measures. Understanding the technology, staying informed about market trends, and employing best practices for asset protection are crucial steps in ensuring your Bitcoin investments are secure.

At KoinBX, we advocate for responsible investing and staying updated with market trends to navigate the dynamic landscape of virtual digital assets safely.”

Himanshu Maradiya, founder and chairman of CIFDAQ Blockchain Ecosystem India, said that Bitcoin’s evolution since its inception in 2009 has been remarkable. From trading at approximately $500 in May 2016 to $69,790 as of July 29, 2024, Bitcoin has witnessed a phenomenal 12,662% growth. This impressive increase underscores its significant role and expanding acceptance in the global financial landscape.

Current technical indicators suggest a critical resistance zone, including the 61.8% Fibonacci retracement level at $62,066 and the 100-day Exponential Moving Average (EMA) at approximately $63,022.

He added that it’s important to note that Bitcoin’s market dynamics are subject to volatility and regulatory scrutiny, which can impact its price stability. While the recent analysis indicates potential for a short-term relief rally, investors should consider broader market trends and the regulatory environment. The Relative Strength Index (RSI), currently at around 36, highlights the potential for temporary recovery, yet a cautious approach is essential.

Things To Consider Before Buying Bitcoin

Given Bitcoin’s high volatility and security risks, it’s important to consider your reasons for buying before you trade any rupees for BTC.

Cryptocurrency is a highly speculative investment, says Luria. “The risk/reward profile of investing in Bitcoin differs from investing in most stocks or bonds. We tend to recommend investors only consider investing capital they are willing to lose,” he says.

Are you buying Bitcoin as an investment to fund your retirement? In that case, it’s probably best to keep your exposure to a minimum because no one can predict where the market will go. Most financial advisors recommend keeping Bitcoin to less than 5% of your overall portfolio.

You should brace yourself for an unreliable narrator if you think Bitcoin is a currency. You could easily log off the computer one day with INR 5,499,133 in BTC and log on with only INR 3,709,027 the next morning.

Then there’s the uncertainty around the crypto regulatory environment.