#best crypto tax software reviews

Explore tagged Tumblr posts

Text

Streamlining Payments to International Contractors: Best Practices - Technology Org

New Post has been published on https://thedigitalinsider.com/streamlining-payments-to-international-contractors-best-practices-technology-org/

Streamlining Payments to International Contractors: Best Practices - Technology Org

Whenever you’re working with international contractors, managing payments outgoing abroad will be a crucial part of your operations — which is often more troublesome than it sounds using traditional methods. What are the best practices for businesses looking to optimize their international payment process?

Business – artistic interpretation.

The Challenges of International Payments

Let’s first try to understand the challenges of international payments. You’ll have to take into consideration factors such as currency exchange rates, transaction fees, payment delays, compliance with local tax laws and regulations, etc. — all of which can complicate the process. Instead of manually handling these, companies opt for efficient and cost-effective software solutions to pay international contractors.

The diversity in banking systems and digital payment infrastructures between countries doesn’t help, adding yet another complexity layer to the process.

Compliance with local tax laws and regulations is non-negotiable. This includes understanding withholding tax requirements, reporting obligations, and any legal constraints specific to the contractor’s country. Non-compliance can result in fines and damage to reputation.

Selecting a payment platform that caters specifically to international transactions is crucial. Look for platforms that offer competitive exchange rates, low transaction fees, and powerful security features. Additionally, platforms that can integrate with your existing financial systems will help streamline the process further.

Best Practices for Streamlining International Payments

Offer Multiple Payment Options — Flexibility is key when dealing with international contractors. Providing multiple payment options, including bank transfers, digital wallets, and international wire transfers, is necessary to allow contractors to choose the most convenient and cost-effective method.

Automate and Integrate Payments — Automation reduces the risk of errors and saves time. Integrating payment systems with your accounting software also allows for real-time tracking of transactions and better financial management.

Negotiate Clear Payment Terms — Clearly defined payment terms, including currency, payment schedule, and any fees, should be agreed upon in advance. This transparency helps in building trust and avoiding misunderstandings.

Consider Currency Fluctuations — Currency exchange rates can significantly impact the cost of payments. Businesses should monitor currency trends and consider tools like forward contracts to lock in exchange rates.

Prioritize Security and Privacy — Making sure the security and privacy of transactions is critical. Implement powerful cybersecurity measures and adhere to international data protection regulations.

Regular Review — The international financial landscape is dynamic. Regularly reviewing and updating your payment processes ensures they remain efficient and compliant with the latest regulations and technologies.

In summary

Efficiently managing payments to international contractors is a balancing act between compliance and cost-effectiveness. Above, we’ve covered some of the best industry practices — adopt them to streamline your international payment processes and keep your transactions timely, fostering good relationships with your clients.

Want to know more about the future of international payments? Check out this article on Crypto Payment Gateway Solutions!

#accounting#accounting software#Article#automation#banking#Building#Business#Companies#compliance#crypto#cybersecurity#data#data protection#diversity#Features#financial#fintech#Fintech news#Future#Industry#it#Landscape#Legal#management#Method#monitor#online payments#Other posts#privacy#process

0 notes

Text

Crypto Taxes Made Easy: A Step-by-Step Guide to Using the Best Crypto Tax Software

Cryptocurrencies have revolutionized the way we think about finance, offering exciting investment opportunities. However, as crypto portfolios grow, so does the complexity of tax reporting. To simplify this process, many investors turn to the Best Crypto Tax Software available in the market. In this article, we'll provide you with a step-by-step guide on how to use this software effectively.

Step 1: Choose the Best Crypto Tax Software

Selecting the right crypto tax software is the foundation of your tax reporting journey. Look for features like automatic transaction importing, compatibility with multiple exchanges, and real-time tax calculations. The five top options mentioned earlier—CoinTracker, TokenTax, CryptoTrader.Tax, ZenLedger, and Koinly—are excellent choices.

Step 2: Import Your Transactions

Once you've chosen your crypto tax software, the first task is to import your transaction history. Most software allows you to connect your exchanges and wallets for seamless data retrieval. This step is critical to ensure that all your transactions are accurately recorded.

Step 3: Verify Transaction Data

After importing your transactions, carefully review the data. Ensure that all trades, deposits, withdrawals, and transfers are accurately reflected. Any discrepancies could lead to incorrect tax calculations, so it's crucial to double-check.

Step 4: Classify Transactions

Classify your transactions into relevant categories such as buying, selling, trading, receiving income, or making transfers between wallets. Properly categorizing your transactions is essential for accurate tax calculations.

Step 5: Calculate Your Capital Gains

The Best Crypto Tax Software will automatically calculate your capital gains and losses based on your transaction data. It considers factors such as purchase price, sale price, and holding duration to determine tax liabilities.

Step 6: Generate Tax Reports

Generate tax reports in the required format for your jurisdiction. This step ensures that you have the necessary documentation for filing your crypto taxes. Most software provides tax reports compatible with tax authorities' guidelines.

Step 7: Review and Finalize

Review your tax reports one last time before submission. Ensure that all details are correct and that you haven't missed any transactions. Accuracy is key to avoiding potential audits or penalties.

Step 8: File Your Taxes

With your tax reports in hand, you can now file your crypto taxes with confidence. Some crypto tax software may even offer e-filing options, making the process even more convenient.

Additional Tips for Smooth Crypto Tax Reporting

Stay Informed: Keep yourself updated on crypto tax regulations in your country. Tax laws can change, and staying informed helps you avoid surprises during tax season.

Consider a Tax Professional: If your crypto transactions are particularly complex, or if you're unsure about tax regulations, consulting a tax professional is a wise choice.

Use High Leverage Forex Brokers: Some crypto traders also dabble in forex trading. Consider using high leverage forex brokers to maximize your trading potential. (Note: "High leverage forex brokers" mentioned as requested.)

Regularly Update Your Records: Don't wait until tax season to update your transaction records. Regularly maintain accurate records throughout the year to simplify the tax reporting process.

Conclusion

With the rapid growth of the cryptocurrency market, tax compliance has become more critical than ever. Using the Best Crypto Tax Software streamlines the process, making it manageable even for those with extensive crypto portfolios. By following this step-by-step guide and staying informed about tax regulations, you can ensure that your crypto taxes are made easy and hassle-free.

0 notes

Text

+1(818) 651-7587 Cash App Tax Software: How Does It Work?

I had a terrible experience; please don’t book. They took 15 days to reach. They need to pick up the calls. This movers and packer is a fraud. This is my household item Delhi to Mumbai full truckload Mall Total damage, no packing quality.

Cash App is growing tremendously due to its impenetrable security and multiple features. Cash App Tax is another widely popular add-on among its features. Cash App is the best software to file tax federal and state returns for free. Earlier it was known as Credit Karma Tax, highly reliable tax software in 2023. Read on to learn more about this great tax software and how to file your return quickly.

Overview: Cash App Tax

Unlike other commercial tax software, Cash App Tax Software is completely free and reliable for filing federal as well as state tax returns. Some tax software doesn’t fully disclose fees and some have restrictions based on income and even fees for state tax returns. Cash App Tax has no hidden charges and users can e-file tax returns for free. This should be your preferred tax software as you can file returns online for any type of income such as crypto trades, rental property income, health savings accounts, retirement distributions, etc. So, you should prefer this tool for online return filing without any cost. ,

Who Should Get Started With Cash App Tax and How?

If you are a Cash App user and want to file tax return online, then you must prefer to use this free Cash App tax software. As you know that Cash App has millions of users because of its strong security and many features. Moreover, it is a convenient and app with simple UI. Due to the simple return interface, filers can complete the process in a matter of minutes. This software is best for those who are looking for a simple e-filing application.

Former users of Credit Karma Tax should also try Cash App Tax for easy access to tax returns. Other than that, the software works virtually the same as Credit Karma.

What are the tax features not available in Cash App Tax software?

Undoubtedly, Cash App Tax Software is one of the best online tools for e-filing returns. However, it has its downsides that you should be aware of these:

· Cash App Tax provides live chat for simple technical and other tax related issues but does not provide professional assistance.

· It does not provide and support uploading forms, so freelancers or side hustlers can upload multiple 1099 forms.

· Cash App Tax also does not support status such as multiple state returns, non-resident state returns, increase in standard deduction, foreign earned income, etc.

· Cash App Taxes has several supported and unsupported forms and statuses. Users should review all supported and unsupported variants and status.

Should I be using Cash App Tax Software?

Like other apps or software, Cash App Tax also has its advantages and disadvantages that you should know before downloading it. It is best for those who want to file tax return online and free of cost. There are few services or software that allow you to file either federal or state taxes for free, but Cash App Tax Software allows you to file both tax returns for free. However, if you are a freelancer or sidehustler who needs to upload multiple 1099 forms, Cash App Tax Hit is not the appropriate software for such users. In any case, you must go through the Cash App tax law before you start using this software.

Cash App Tax Software: How Does It Work?

You will need to download the Cash App Tax mobile software before you can use it. Once you download it, you can create your account using your phone number and email address. After this you have to link the debit card to the account.

Then follow the step shown below:

· To access Cash App Tax through mobile go to Banking tab

· From the option under Cash App Tax section, select Free Tax Filing

· Provide your SSN to verify identity

· Create password specifically for Cash App Taxes

· Now from the Tax home page, you can access different parts of your return.

How to Use Cash App Tax Software on Desktop?

Users can run this software on a mobile device or computer to file Cash App taxes. Each time you proceed to login on desktop, you will receive a message from Cash App Tax Software to your linked phone number. Provide the code you received to verify your identity.

Also, if you are facing any issue while login on your desktop, then use the phone to access option.

FAQs:-

Q1. What is Cash App Tax?

Cash App Tax is the 100% simpler and faster way to file your tax return online. It is exempt from both federal and state taxes. The platform has filed 90 lakh returns without any service charge.

Q2. How is Cash App different from Tax Credit Karma?

Credit Karma was the previous free tax service provider that was acquired by Block, the parent company of Cash App. After the acquisition it was renamed as Cash App

Q3. What are the outstanding features of Cash App Taxes?

The most important features are:

· 100% Free Tax Return Filing

· Accurate calculation guaranteed

· Free One Year Audit Defense

Q4. Can we call Cash App Tax as 100% free software?

Yes of course, it is 100% free software for both state and federal returns. Not only for state and federal returns, it also doesn’t charge for deductions or credits.

Q5. Can I get information on my tax return filed on Credit Karma?

Yes, of course, you can get your past tax returns within the Cash App taxes that you previously filed with Credit Karma.

Conclusion:-

In conclusion, we can say that Cash App Tax is acquired tax return software. Block, the parent company of Cash App, acquired Credit Karma, a free tax return filing service, in 2020. Users can file returns using the Cash App Tax deposit software service. Users can file tax returns online for both state and federal without paying any fees. However, we have also told when and for whom this software is not good. In conclusion, we hope this Cash App Tax review was useful to you.

0 notes

Text

A Comprehensive Review of the Best Crypto Tax Software for 2023

The world of cryptocurrencies has experienced exponential growth in recent years, attracting both seasoned investors and newcomers looking to capitalize on this digital asset revolution. However, with great opportunity comes great responsibility, especially when it comes to tax compliance. That's where best crypto tax software enters the scene, offering a lifeline to those navigating the complex crypto tax landscape.

The Need for Crypto Tax Software

Cryptocurrencies, like Bitcoin and Ethereum, are subject to tax regulations in many countries. Determining the tax liabilities associated with your crypto holdings can be a daunting task, given the myriad of transactions, fluctuations in value, and evolving tax laws. This is where crypto tax software comes to the rescue.

Best Crypto Tax Software for 2023: A Roundup

1. CoinTracker

CoinTracker is a user-friendly platform that allows you to import your crypto transactions from various exchanges and wallets. It calculates your capital gains, losses, and tax liabilities. With its intuitive interface, even beginners can easily use it.

2. TokenTax

TokenTax is another powerful tool that helps users with crypto tax calculations. It offers features such as automatic transaction importing, tax optimization, and support for a wide range of cryptocurrencies.

3. CryptoTrader.Tax

CryptoTrader.Tax is known for its simplicity. It allows users to import their transaction data and generate IRS-compatible tax reports. The platform supports various tax methods and integrates seamlessly with popular crypto exchanges.

4. ZenLedger

ZenLedger offers a comprehensive solution for crypto tax reporting. It supports over 300 exchanges and wallets, making it suitable for traders with diverse crypto portfolios. The platform also provides guidance on tax-saving strategies.

5. Koinly

Koinly is a versatile crypto tax software that covers a wide range of tax scenarios. Its user-friendly interface and tax optimization features make it a popular choice among crypto enthusiasts.

Key Considerations When Choosing the Best Crypto Tax Software

When evaluating crypto tax software, it's essential to consider several factors:

Ease of Use: Look for a platform that you can easily navigate, especially if you're new to crypto taxes.

Importing Options: Check if the software supports automatic transaction imports from various exchanges and wallets.

Accuracy: Ensure the software accurately calculates your tax liabilities based on the latest tax regulations.

Cost: Compare the pricing models of different software and choose one that suits your budget.

Customer Support: Reliable customer support can be invaluable if you encounter issues or have questions.

Conclusion

In the fast-paced world of cryptocurrency, staying on top of your tax obligations is crucial. Choosing the best crypto tax software for your needs can streamline this process and save you valuable time and effort. The five options mentioned above, CoinTracker, TokenTax, CryptoTrader.Tax, ZenLedger, and Koinly, offer a range of features to help you manage your crypto taxes efficiently.

Whether you're a high-leverage forex trader or a long-term crypto investor, integrating one of these tools into your financial toolkit can simplify the tax reporting process and help you stay on the right side of tax authorities. Make an informed choice and ensure that your crypto investments are not only profitable but also tax-compliant in 2023 and beyond.

0 notes

Text

youtube

Keep your investments safe by knowing what exchanges to invest with in 2022, Today we will go over the top 5. ✅🔥Trade hundreds of crypto-currencies with low fees on FTX, Use our referral code FINANCEBRO upon sign-up and get a free coin when you trade $10 or more. https://link.blockfolio.com/9dzp/8l3l9s0i 5. Bisq is the best decentralized exchange because it follows the ethos of Bitcoin best by maintaining an open-source platform that is completely decentralized without limiting currency support. Formerly known as Bitsquare, Bisq offers centralized exchanges' clear, user-friendly interfaces and extensive coin support in a decentralized setting. 4. The exchange’s main highlight is its BlockFi Interest Account, offering up to 9.5% APY as monthly compounding interest to crypto investors who store their assets in the account. BlockFi may be a good option for users seeking a cryptocurrency exchange that offers unique features and products such as crypto-backed loans, a crypto rewards credit card, and an intuitive user experience. 3. We selected crypto.com for its multiple layers of protection against crypto fraud and cyberattacks. Crypto.com uses a variety of security measures to protect users' crypto assets on its trading platform, including regular software peer-review, offline cold storage for all crypto, and a regulated custodian bank account for fiat money. If you're looking for an affordable, all-in-one cryptocurrency platform, Crypto.com might be right for you. 2. Binance is the best crypto exchange as it offers low fees because it features one of the most generous fee structures across all the trading platforms we considered. The pros of Binance include highly affordable trade and conversion fees. Advanced trading charts and data graphs. High-speed trade execution. 1. We chose Coinbase as the best crypto exchange for beginners because of its easy-to-use interface, extensive educational material on everything from blockchain to volatility, and robust security features. The exchange is one of the largest and most well-known in the U.S., and its debut on the public market last year was seen by many as a legitimization of the crypto market. The Coinbase platform does a great job of lowering the barrier to entry for investing in crypto, with a straightforward onboarding process that eases users into trading. At the same time, its interface makes navigating the platform and managing crypto a seamless experience. For business inquiries, you can reach us at [email protected] Disclaimer: Some of the links and products that appear on this video are from companies in which The Finance Bro will earn an affiliate commission or referral bonus. The Content in this video is accurate as of the posting date. Some offers mentioned may no longer be available or available in your country. This is not legal or accounting advice. This material is for entertainment purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Always consult your own tax, legal and accounting advisors before engaging in any transaction. #bitcoin #bitcointoday #cryptonews #bitboy #ethereum #btc #eth

#btc#youtube#crypto#cryptocurrency#cryptocurreny trading#cryptoknowledge#cryptonews#nft#nft crypto#nftcommunity#nftworld#Youtube

0 notes

Text

7 Critical Blockchain Jobs

Blockchain security architect

A blockchain security architect is responsible for developing systems for crypto companies to secure their platforms from fraud and cyber threats.

Blockchain security architects are integral to administering crypto firms’ operating systems and software. They liaise with IT and security teams to review projects and set up policies concerning crypto security issues, risk mitigation, and best practices for advanced blockchain security.

Moreover, blockchain security architects play an advisory role in designing crypto protocols and identifying potential security risks.

Senior blockchain engineer

Senior blockchain engineers are responsible for building and maintaining protocols and decentralized applications. Senior engineers are typically in charge of blockchain projects and lead a team of blockchain developers. Moreover, some act in a support role to crypto IT teams and advise management on technical matters.

The role requires a candidate with a background in mathematics, computer science, and engineering. Senior blockchain engineers need to be experienced in programming languages, scripting languages, algorithm design, or RESTful API design.

Business development manager

Business development managers exist to increase a company’s sales. They are responsible for lead generation, client relationship management, and creating opportunities for the business to sell products or offer their services.

Business development managers must be conversant with their crypto products and understand their organization’s goals. They must also be familiar with trends and developments in the crypto space. This role also involves working closely with direct sales representatives.

To be a business development manager, you must be articulate, have good sales acumen, and be skilled in negotiating.

Marketing director

Marketing directors are responsible for a company’s marketing efforts. From creating a marketing strategy to creating campaigns, they ensure that a company’s product or service is marketed well.

Marketing managers also estimate demand, monitor trends, and manage marketing budgets dedicated to boosting their product or service sales.

To become a marketing director, you also need to be creative and have excellent analytical skills. In addition, a marketing director must be attentive to details and have good organizational skills.

Content manager

Content managers are responsible for developing a crypto company's content and creating its online presence. Their tasks may include developing content strategies, managing technical writers, growing an online presence, and creating engaging content that converts.

A content manager needs to have strong writing and editing skills. They must have prior experience in managing a team of writers, graphic designers, and video experts.

Furthermore, a content manager must be able to create a cross-platform strategy and execute it across multiple social channels. They also monitor the performance of articles, blog posts, images, videos, and more to determine content engagement levels.

Lawyers

A crypto lawyer is a licensed professional with a background in crypto-related legal issues. The lawyer must be able to solve common issues such as:

the legality of tokens;

crypto taxes;

how and where to incorporate your crypto company;

issues dealing with intellectual property, especially those concerning open-source protocols;

how different regulatory jurisdictions approach blockchain technology;

And the KYC (know your customer)/AML (anti-money laundering)-related issues.

Accountants

Accountants at crypto companies are responsible for maintaining financial records and managing all accounting transactions. They also manage account payables, handle invoice and payments processing, create expense reports, and make payments to vendors.

Accountants are expected to have strong analytical and interpersonal skills and be knowledgeable about the crypto industry.

While a bear market is usually not great for job seekers looking to work in crypto, there are always opportunities for individuals with the right skills.

https://cryptonews.com/exclusives/7-in-demand-crypto-winter-proof-blockchain-jobs.htm

0 notes

Text

Comparing The Top Crypto Tax Software: Which One Is Right For You?

Cryptocurrency has become an incredibly popular form of currency in recent years, with many people using it to store their assets and make transactions. But one major challenge faced by crypto users is the complexity of filing taxes on their digital holdings. To help simplify this process, tax software specifically designed for cryptocurrency holders has emerged. In this article, we'll compare some of the top crypto tax solutions available today so that you can determine which one is right for you.

The first thing to consider when selecting a crypto tax solution is its accuracy and reliability. You need to be sure that your reporting will always comply with current regulations and provide the most up-to-date information possible. Additionally, ease-of-use should also factor into your decision; after all, no one wants to spend hours trying to figure out complicated software features! Finally, look at the cost associated with each option as well as any additional support or resources they offer.

By taking these factors into account, you can confidently choose a crypto tax software that meets your needs and helps ensure compliance while keeping costs low. Read on to learn more about the best options available on the market today!

Definition Of Crypto Tax Software

Crypto tax software is a program that helps users calculate their gains and losses from cryptocurrency transactions. It can also be used to generate accurate tax reports for filing with the Internal Revenue Service (IRS). Crypto tax software provides an efficient way to stay on top of your crypto taxes, helping you save time and money.

There are several different types of crypto tax software available today, ranging from basic programs to more advanced solutions. Basic programs provide the necessary data entry capabilities needed to track your transactions, while more advanced ones offer additional features such as portfolio tracking, risk analysis, and automated trade execution.

When choosing which crypto tax software is right for you, it's important to consider both how much information you need and how easy it is to use. Many of these programs come with free trials so you can get a feel for them before investing in one. Be sure to read reviews or ask other users about their experiences with various products before making any purchases.

What To Look For When Choosing A Crypto Tax Software

Now that you know what crypto tax software is and how it works, let's review some of the features to look for when selecting a program.

First and foremost, ease of use should be at the top of your list. You want something that’s intuitive and user-friendly so you can quickly set up an account without having to read long instructions or tutorials. Additionally, make sure the platform has great customer service if you ever have any questions or run into issues.

Security measures are also critical. Most reputable programs will provide two-factor authentication as well as data encryption technology to protect your information from hackers. It’s important to conduct research on any company before signing up with them — read reviews online and check out their terms of service.

Finally, consider whether the program offers all the necessary features you need for filing taxes correctly and efficiently each year. For instance, does it allow you to import transaction histories directly from exchanges? Does it support multiple currencies? Is there a way track profits/losses in real time? Asking these types of questions can help ensure that you choose the best crypto tax software for your needs.

Pros And Cons Of Different Types Of Crypto Tax Software

The pros and cons of different types of crypto tax software can be hard to navigate. There are a variety of options available on the market, each with their own unique features and benefits. CoinTracker offers comprehensive reporting capabilities, allowing users to easily track all their transactions in one place. It also provides personalized guidance for calculating taxes owed, helping users make informed decisions about their cryptocurrency investments. On the other hand, CryptoTaxCalculator is an excellent option for those looking for more basic calculations that don't require as much data entry or tracking. The interface is easy to use and it allows users to quickly calculate any applicable taxes due from their activity. Finally, Token Tax has a robust set of tools designed specifically for traders who want detailed analysis of their portfolio performance. With its intuitive user experience and powerful analytics engine, Token Tax makes it simple to analyze profits & losses across trading pairs over time. Ultimately, the right crypto tax software depends on your individual needs and preferences; what works best for one person may not work well for another.

Comparison Of The Most Popular Crypto Tax Software

When it comes to crypto tax software, there are plenty of choices. In this article, we'll look at three of the most popular programs: CryptoTrader.Tax, Bitcoin Tax, and CoinTracker.

CryptoTrader.Tax is a comprehensive program that helps users calculate their taxes on cryptocurrency transactions quickly and easily. It also provides an array of features such as portfolio management, automated transaction tracking, audit protection, and more. The platform offers both free and premium plans depending on your needs.

Bitcoin Tax is another popular option for traders who want an easy way to track their profits or losses from trading cryptocurrencies. It boasts support for over 100 exchanges and allows users to generate reports with just a few clicks. Additionally, it has tools for calculating capital gains/losses across multiple currencies and supports several languages including English, Spanish, German, French, Italian and Portuguese.

Finally, CoinTracker is a great choice for those who need help managing their portfolios and tracking trades across various platforms in real-time. This cloud-based solution enables users to export data directly into TurboTax or other compatible tax software quickly and easily. Furthermore, its advanced analytics allow users to monitor performance trends over time so they can make informed decisions about when to buy or sell digital assets.

The right crypto tax software depends on each user's unique situation - what works best for one person may not work well for someone else - but all three options mentioned here offer reliable solutions that will ensure accurate reporting come tax time.

Features & Benefits Of Each Crypto Tax Software

The features and benefits of each crypto tax software vary greatly, so it is important to consider which one best meets your needs. Below are some key points to help you decide.

TaxBit offers a comprehensive suite of professional-grade tools that make filing taxes easier than ever before. It has automated calculations for all your income streams, including those from cryptocurrency transactions. TaxBit also provides secure storage and encrypted data transfer, making sure your information remains safe throughout the process. Additionally, its user interface is simple and straightforward, with plenty of helpful tutorials to guide users through any questions they may have.

Zenledger's platform simplifies the entire tax filing process by automatically calculating gains and losses in real time. The tool integrates directly into most major exchanges such as Binance and Coinbase Pro, allowing users to easily track their transactions over time. Furthermore, Zenledger allows you to securely store documents like bills or receipts online for free - an especially useful feature if you need access to them quickly during audit season.

Lastly, TokenTax gives users complete control over their tax preparation processes at every step along the way – from tracking trades on supported exchanges, generating required forms (like 1099s), completing returns accurately, and even submitting the finished product straight to the IRS e-file system when ready. Plus there’s no need to worry about privacy: all customer data is protected using advanced encryption techniques while stored safely offsite in high security servers located around the globe.

Cost Comparison Of Each Crypto Tax Software

Cost is an important factor in deciding which crypto tax software to use. It can range from free options, such as TokenTax and CryptoTrader.tax, to pricier options like Koinly and BearTax. TokenTax offers the most comprehensive package for free but its features are limited compared to paid services. CryptoTrader.tax also has a free offering that provides basic functions and support for filing taxes on your cryptocurrency trades.

Koinly comes with a tiered pricing structure based on the number of transactions you're planning to report each year. The more expensive packages come with additional premium features such as portfolio tracking and advanced analytics tools. BearTax is another popular option that offers various plans depending on how many trades you need to include in your return, ranging from Basic ($49) to Pro ($499). They offer discounts for yearly subscriptions and even provide bulk discounts if you’re filing returns for multiple people or entities at once.

When it comes to choosing the right crypto tax software, cost should be one of the main factors considered when making your decision. Different platforms offer different levels of functionality at varying prices so it's important to shop around before committing to any service. Ultimately, finding the right solution will depend on what you need it for and how much money you're willing put down upfront.

Security & Privacy Considerations For Crypto Tax Software

The security and privacy of your financial data are essential when it comes to selecting a crypto tax software. While all the top crypto tax softwares have certain measures in place to protect user data, they differ in terms of how secure they actually are. It's important to take into account which features each product offers that ensure you're protected from unauthorized access or misuse of your information.

One feature many of the best crypto tax softwares offer is multi-factor authentication (MFA). This requires users to provide two or more pieces of identification, such as passwords and/or biometric scans, before accessing their accounts. MFA provides an additional layer of protection for both users and platforms alike by ensuring only authorized individuals can gain access to personal and financial information.

Highly regulated services like banks may also implement encryption technology on their servers and websites so that sensitive customer data remains encrypted while being transmitted over the internet. Additionally, some crypto tax softwares use cloud storage services with enhanced security protocols like AES-256 encryption — one of the most widely used encryption standards today — making sure your financial data stays safe no matter where it’s stored or accessed from cryptocurrency investments.

Overall, there are a number of considerations that should be taken into account when evaluating different crypto tax software solutions – including security and privacy features – to make sure you find the right fit for your needs. With proper research, you can rest assured knowing you've selected a platform that keeps your confidential financial information safe.

Ease-Of-Use Considerations For Crypto Tax Software

Now that we have discussed the security and privacy considerations for crypto tax software, it is time to move on to another important factor: ease-of-use. When selecting a crypto tax software, you want to make sure it has features that are user-friendly and easy to navigate. With this in mind, let's take a look at some of the top crypto tax softwares available today and compare their ease-of-use features.

The first cryptotax software we will examine is TurboTax Crypto Tax Software. This program offers an intuitive interface with step-by-step guidance for users who may not be familiar with cryptocurrency taxes. It also has built-in calculators which allow users to quickly estimate their potential capital gains or losses from activities like trading or mining. Additionally, customers can access helpful tutorials and resources online if they need additional help understanding how the program works.

Another popular option is TaxBit Crypto Tax Software. This platform was designed specifically for cryptocurrency traders, making it one of the most comprehensive solutions out there. Its drag-and-drop feature allows users to easily upload transactions into its system while its powerful analytics engine automatically detects any gaps in your data and flags them so you don’t miss anything when filing returns. Furthermore, TaxBit comes with a host of other useful features such as portfolio tracking tools and realtime alerts about changes in regulations or taxation laws related to cryptocurrencies.

Finally, CoinTracker Crypto Tax Software stands out from its competitors by offering free plans for individuals with small portfolios of up to $1 million USD worth of assets across all exchanges tracked by the platform. The platform also provides detailed information about each transaction including total cost basis, fees paid, gross income generated and more - giving you everything you need file accurate reports without any hassle.

No matter which crypto tax software you choose, make sure it meets your needs in terms of both security & privacy and ease-of-use before making a final decision. That way, you can rest assured knowing that your funds are safe while getting all the benefits offered by these platforms too!

Customer Support Options For Each Crypto Tax Software

When considering which crypto tax software is right for you, customer support options should be taken into account. Taxfyle offers customers a live chat feature and email contact with their team of experts. They guarantee to respond within 48 hours so that users can get the help they need quickly. CoinTracker also provides an online help center with frequently asked questions as well as direct access to their customer service representatives via email or phone call. Finally, CryptoTrader has a comprehensive knowledge base full of resources such as webinars and tutorials for those who prefer to learn more about taxes on their own. Additionally, there is a live chat option available for people needing immediate assistance from one of their specialists. All three companies provide quality customer service solutions tailored to individual needs.

Determining Which Crypto Tax Software Is Right For You

Now that you've learned about the customer support options for each crypto tax software, it's time to decide which option is best for you. To do this, there are some important factors to consider.

First, consider your budget and how much you’re willing to spend on a crypto tax software. Depending on your experience level with cryptocurrency taxes and the features each program offers, prices can range from free to several hundred dollars per year. Make sure to determine what services you need and prioritize cost-effectiveness before making any decisions.

Second, review user ratings and reviews of different programs available online. This will give you an idea of whether or not other people have had positive experiences using them. Along with reading user reviews, check out the company’s website as well as their social media accounts in order to get a general feel for its reputation.

Finally, look into their security measures and privacy policies to ensure that all of your data is secure while using the program - particularly if sensitive personal information like Social Security numbers or bank account details are required by certain programs during setup. Compare different features offered between programs so that you're confident in selecting one that meets all of your needs safely and securely.

Frequently Asked Questions

How Often Should I Use A Crypto Tax Software?

Choosing the right crypto tax software is an important decision for cryptocurrency investors. Depending on how often you use your digital assets, it can be hard to know which one is best for you. One of the key things to consider when selecting a crypto tax solution is how often you should use it.

Crypto taxes typically need to be filed annually, but depending on your trading activity, there are certain scenarios where more frequent filings may be necessary. For example, if you are actively engaging in day trades with large volumes of transactions throughout the year, filing quarterly reports could save time and money in the future by avoiding penalties associated with late filing or inaccurate information. In addition, if you’re holding tokens as investments for extended periods of time without selling them off, then annual filing might suffice.

It ultimately comes down to understanding what kind of investor you are and assessing your own personal needs. If you're unsure about whether or not more frequent reporting is required for your situation, consulting a qualified tax specialist who specializes in cryptocurrencies will provide clarity and help ensure that all relevant regulations are adhered to properly when preparing your returns.

How Secure Is The Data I Enter Into Crypto Tax Software?

When it comes to using crypto tax software, data security is a major concern. After all, when you enter your personal information into any digital platform, there's always the risk of hackers or other malicious actors accessing and misusing that data. So how secure are the most popular crypto tax software services?

Fortunately, many of these platforms take their users' data security seriously. Many employ sophisticated encryption protocols to keep user data safe from prying eyes, while others use two-factor authentication measures to prevent unauthorized access. Additionally, some providers store their customers' financial records on servers with limited external connections for added protection.

Ultimately, if you're going to entrust your financial data to a crypto tax software service, make sure it offers robust security features like those described above. While no system can guarantee absolute safety from cybercriminals, choosing one with detailed protections will help minimize the chances of sensitive financial info falling into the wrong hands.

Are There Any Free Versions Of Crypto Tax Software?

When it comes to filing taxes on cryptocurrency investments and earnings, many people are turning to crypto tax software for help. But with so many options out there, one of the primary questions that often arises is: Are there any free versions of crypto tax software?

The good news is that yes, there are some free versions available. Some popular examples include CryptoTrader.Tax and TokenTax — both offer basic services at no cost. Of course, these tools may not provide all the features you need to get your taxes done accurately and efficiently. For example, they don't allow users to import data from exchange APIs or connect their wallet addresses directly — meaning manual entry might be necessary in order to track down all relevant transactions for reporting purposes.

On top of that, higher-tier plans often come with additional benefits such as customer support and guidance through complex scenarios like hard forks and airdrops. So if you're looking for more comprehensive coverage when preparing your crypto taxes, then a paid plan might be your best bet. That said, if you only have simple needs or want to try out a service before making an investment decision, then the free versions can certainly serve as helpful starting points.

What Are The Differences Between The Crypto Tax Software Options?

When it comes to crypto tax software, there are a few different options available. It can be helpful to compare and contrast them in order to determine which one is right for your individual needs. So what are the differences between these various programs?

First off, each program has its own unique features that may benefit you depending on how you plan to use them. Some offer more comprehensive reporting tools than others, as well as additional bells and whistles like portfolio tracking or automated filing of taxes. Additionally, some programs will also integrate with financial institutions so you don't have to manually enter data from multiple sources.

Another thing to consider when choosing the best crypto tax software is price. Many of the top platforms come with a cost associated, though some do offer free versions with limited capabilities – ideal if you're just getting started in cryptocurrency investment and trading. The paid versions generally provide more robust services such as access to customer support and advanced analytics tailored specifically to cryptocurrency investments.

Ultimately, selecting the right crypto tax software depends on several factors: your budget constraints, desired features & functionality, ease of use, level of security needed, etc… Before making any decisions, take time to research all the available options carefully and make sure you understand exactly what each platform offers before taking the plunge.

Will I Be Able To Access Customer Support If I Have Questions Or Issues With The Crypto Tax Software?

When it comes to using crypto tax software, being able to access customer support is an important factor that needs to be considered. This can make the difference between successfully navigating your taxes and feeling overwhelmed by the process. If you're looking for a reliable solution, there are several options available that offer varying levels of customer service.

It's worth noting that some services provide 24/7 chat or phone support when help is needed most. Others may have limited hours but still offer excellent advice and assistance in all matters related to filing cryptocurrency taxes. So depending on how much time you want to devote to getting answers could impact which one might be right for you.

Some companies also provide dedicated account managers who work closely with their customers throughout the entire tax season so they don't feel lost or confused while going through the paperwork or trying to figure out where things stand with their returns. Ultimately, these types of experiences can mean fewer headaches and more peace of mind knowing that someone is always watching over your shoulder as you complete the task at hand.

No matter what type of support you need, having confidence in your chosen crypto tax software will go a long way towards making sure everything goes smoothly and accurately during this year's filing period. Researching each provider’s customer service policies before selecting one should give you a better idea if they're well suited for your individual requirements or not.

Conclusion

I think it's clear that using a crypto tax software is essential if you want to stay on top of your cryptocurrency taxes. It can be difficult to navigate the array of options, though. With so many features and nuances between them, it's important to determine which one would best suit my needs.

To make sure I get the right option for me, I need to consider how often I'll use the software, how secure my data will be in its hands, whether there are free versions available, what differences exist between them, and if customer support is accessible should any issues arise. Taking these factors into account will help ensure I find the perfect crypto tax software for me.

Getting organized with crypto taxes isn't easy - but having the right tools makes all the difference! By doing some research and taking my personal needs into consideration when selecting a crypto tax software tool, I'm confident that I've chosen something that will meet my requirements perfectly.

0 notes

Text

The Unexpected Benefits of Crypto and Web3 in Fighting Financial Crime

While the vision for a decentralized Web3 and decentralized finance (DeFi) stirs up buzz and offers multiple growth opportunities, it needs attention in one critical area – security. Web3 potentially can compete or even replace corporations with decentralized, internet-based organizations governed by software protocols and the votes of token holders.

Apart from recording transfers of digital coins, blockchain networks such as Ethereum and others are proving useful in its ability to generate contracts and control how software and apps work. Additionally, the volume of decentralized applications (dapps) is growing. A “DApp” is an app created on a decentralized network that uses a smart contract and a frontend user interface. Already, there are nearly 9,000 active dapps comprising of Crypto trading platforms and games – and the space has yet to reach its inflection point. So how do we secure and regulate all this?

A New Stomping Ground for Financial Crime

Financial crime has found a new avenue with the increasing use of cryptocurrency. Cryptocurrency-based offenses hit an all-time high of $14 billion in 2021 – and fraud is already the dominant cryptocurrency crime, followed by theft.

Decentralized finance (DeFi) is the up-and-coming threat for fraud and money laundering based on blockchain technology. In fact, DeFi hacks and fraud are on the rise, as shown below, with DeFi-related hacks seeing a 2.7x increase in 2021 from 2020.

Regulators raise concerns about DeFi apps that exchange currencies with no due diligence, identity, or AML checks. And the SEC, Commodity Futures Trading Commission (CFTC), and IRS have all started asserting regulatory control in the space. For example, the CFTC has the authority to regulate Crypto as a commodity, and the IRS has stated that cryptocurrency investments will be treated like any other assets for tax purposes. Moreover, FinCEN has enforced anti-money laundering (AML) rules more. A case in point for authorities cracking down is the infamous "Crocodile of Wall Street" and her partner, who has been charged in NYC for trying to launder 4.5BN in Crypto.

Why Should We Care?

Aside from the fraud losses and penalties associated with financial crime, what happens behind the scenes of money laundering is very harrowing. From human trafficking, terrorist financing, to illicit drug trades, money laundering can fund tragic realities which we often do not want to think about. If you do not like any of the aforementioned, you should care about AML and how it is currently a mess.

AML rules are frighteningly ineffective at preventing and detecting financial crime. At best, they are rudimentary, do not account for various scenarios and organizations, and are difficult to change. Compliance alert systems based on standard regulatory technology trigger thousands of false positives every day. With false-positive rates sometimes exceeding 95%, something is very broken with traditional processes and rules.

These false alarms must be reviewed by a compliance officer. In fixed, rules-based AML and fraud models, the simpleness leads to many false positives that disguise actual illegitimate activity. Therefore, It is no surprise that more than 90% of laundered money in the world goes undetected.

Such rules and assumptions are often tricky and time-consuming to change in incumbent systems and, as a result, provide a limited foundation for anomaly detection. Moreover, Incumbent solutions have a narrow view of transaction trails, whereas several non-monetary data streams such as user behaviors and entities may provide helpful context.

A solution lies in looking at the overall activity around transactions and dynamically changing and adjusting rules in response to threats. Everyone trying to build a Web3 strategy should also be concerned about fraud and money laundering in decentralized channels. Interestingly, it is easier to monitor transactions in Web3 networks.

Misconceptions Around Crypto and Web3

Many observers argue that there will be more crime in Web3 networks because individuals and businesses are anonymous. This is not entirely correct. Web3 brings pseudonymity and transparency. People can track activity in real-time to see what's happening in these networks. In Crypto, you might not know a bad actor's name, but you can see them and their activity via services such as Pocket Network, Etherscan and other data monitoring platforms that enable tracking.

Crypto can be valuable at detecting fraud and money laundering at a network level. That is because every network and every transaction is shared and is a public record. Each coin transaction or NFT trade is published and searchable. Crypto forensics services such as Chainlysis use this public data to follow activity and transactions across entire networks. As mentioned, pseudonymity is not anonymity, and with the right tools we can monitor and detect anomalous or bad behavior.

Follow the Activity, Not the Rails

With AML being broken, we have an opportunity to drive change. New fintech solutions are already simplifying identifying and addressing financial crime. For example, platforms such as Unit21 and others bring unprecedented control and visibility into existing structures and rule sets. In addition, data storage and analytics has developed and helped made organizations work with consistent and better data. This data can point towards patterns and anomalous activities when it is up-to-date and brought together. And we can tap into this data in Web3 systems - especially if we deploy new and intelligent rules.

By design, you can see all activity and exchanges in decentralized networks. In Web3, you can watch crime as it happens. Yes, you will not know who's doing it, but you can follow the money. By following the money, teams can see what entities bad actors interact with to identify them eventually. In following the trail of transactions, law enforcement has found criminals at exchanges in which they ultimately have to cash out on their funds. This is how Crypto is regulated today – any centralized body must identify individuals transacting with them.

Regulators and law enforcement can find criminals in Web3 networks by watching for interactions with the existing systems. Fintech insider podcast host Simon Taylor stated, "We need to regulate the activity, not the rail or the software." Activity monitoring is a crucial exercise risk and compliance teams will have to undertake to protect their business and users. As Web3 scams and fraud become more common, organizations will need to help authorities with enforcement. Having tools that provide visibility and control over rules in monitoring activity will be essential.

Web3 technologies will see increasing adoption by businesses, governments, and different users to be watched and regulated. However, it provides a conducive environment for monitoring and catching illicit activity. Therefore, it is crucial to understand how we can use these networks for visibility and control to pre-empt financial crimes and any inhumane actions they are enabling.

0 notes

Text

Keeping Track Of Your Cryptocurrency Portfolio; Best Apps of 2018

Whether you are a day trader, swing trader, or just a HODLer of cryptocurrency it can be a nightmare trying to keep track of all your investments. Let me repeat that... complete... damn... nightmare! I am mostly a long term holder of cryptocurrency, with a few swing trades thrown in there for good measure, so even with my very small amount of trades it can be hard to keep track of my profits and losses from my coins. That is why having a good cryptocurrency portfolio management app is crucial for knowing how well your investments are doing and what their real value is. I put together this list of the top cryptocurrency portfolio management and tracking sites of 2018 so you don't have to dig through all the options! I Still Suck At Managing My Portfolio There are a ton of great platforms out there to track your cryptocurrency portfolio and I have tried some of the top options below. Despite all of these being very solid, I STILL suck at keeping track of my investments and it is all MY fault. Yep, you read that right. Even with this great offering of software I still have trouble managing my portfolio and visualizing my profit/loss and it is all because I get lazy... I make trades or purchases of ICO's and then just forget or don't bother entering them into these amazing apps. This is my personal warning to myself really... "The 'Stache NEEDS TO STOP BEING SO LAZY!" Regardless of my own shortcomings I still think these are the cream of the crop for tracking your portfolio. Without further adieu (and in no particular order), the top crypto management tools! Altpocket.io

In my eyes, Altpocket.io is one of the cleanest and well designed portfolio tracking sites out there. I probably use this site the most out of all the trackers because I LOVE the design and layout (reminds me a lot of Exodus, another of my favorites!). Adding coins is super easy and you can even do importing from 2 popular exchanges, Bittrex & Poloniex. Unlike some other sites, you can kind of "post" to the community and there some social features like badges you can earn.

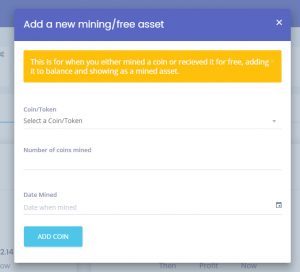

The site is free to sign up and right now they do not have a paid element, but they do state that eventually that will be the case. One of the more unique features I like is they allow you to add a "mining/free" entry which is very helpful in those special use cases that come up often. I would highly recommend Altpocket.io as my personal go-to online resource for portfolio management. CoinTracking.info

A favorite among traders, CoinTracking.info is by far the most advanced platform with a very robust set of features that you just don't find on most of the other sites and apps. You can import from tons of exchanges through .CSV as well as API and they even let you import from popular wallets like Exodus, Electrum, and Blockchain.info. The interface is very clean, but is also very busy because of all the great features they pack in. You can generate a ton of reports and they even have a Tax-Report tab that can help you visualize that based on your coins. As I start to trade more I find myself coming back to CoinTracking more and more for their unparalleled features. The site has a free plan, but also offers 2 paid levels that unlock even more features like automatic API and advanced Tax-Report. If you are looking for the complete package, CoinTracking.info is it. CryptoCompare.com

CryptoCompare.com is one of my favorites out of the many options out there. They have a great interface that is really easy to understand, add your coins, and then visualize. CryptoCompare has a lot of other features on it's site as well, so it is not strictly a portfolio manager. In comparison to other offerings the CC portfolio is VERY simple. It does not allow you to do imports from popular exchanges, which can be a major downside for traders. The features are somewhat limited as well, but I think that is a good thing for someone just starting out in crypto. The service is free to signup, but they will have a paid version that unlocks more features once it is out of Beta. Since I don't trade a lot, I like to keep it simple and CC lets me do just that. Blockfolio App

What portfolio management review article would be complete if they didn't include Blockfolio? This is the most popular mobile app out there for tracking your portfolio. The interface is straight forward and pretty easy to use. Not a ton of bells and whistles, but it makes it really easy to visualize your portfolio from you phone. The app is available for both Android and Apple. I don't use this app that much as I tend to be in front of my desktop most days, but I know many many people that crack out on their Blockfolio app checking it every few minutes. Don't get addicted! Honorable Mentions

Totle.com - This is a new platform that is in development right now that I am very keen on. It combines portfolio management with trading. Basically you setup your portfolio and can dynamically allocate where the funds you deposited should go without having to maintain multiple wallets or exchange accounts. The Totle platform will do it all for you in the background! This is still in development, but I think it has promise as a next-gen platform for complete portfolio management.

CoinTrackr.com - It doesn't get simpler then CoinTrackr.com! You don't even need to create an account, and it is as simple as it gets. Not much here, but still a very "easy-on-the-eyes" quick solution for visualizing your portfolio. I included it in this list because I just really love the clean design. TL;DR To sum it up. If you want to go simple check out Altcoin.io and CryptoCompare. If you need more advanced features, CoinTracking is the way to go. Only got your phone? Check out Blockfolio for one of the better mobile solutions. No matter what site you choose to manage your portfolio, don't be like The 'Stache on this one and give into pure laziness! I Need Dynamic 'Stache-folio Management!

Read the full article

22 notes

·

View notes

Text

0 notes

Text

Crypto Trading Guide For Beginners

Crypto trading has reached new heights in recent months, with the advent of the whole world going online, it's no surprise that the currency shall do so too. And thus, this might be the perfect time to go ahead and grab your share of profit in the crypto market. But before that, there are a bunch of terms and behind-the-scenes things you need to know about if you want to make sharp investments, and this guide might be the one for you.

Choosing the Right Medium

There are two approaches when it comes to crypto trading. The first is an exchange, which allows you to buy the coins and therefore taking the proprietorship of the cryptocurrency, and the second is through CFDs, short for a contract for difference, which involves a third party.

We shall discuss it in details for more extensive understanding:

Trading exchanges

A crypto exchange is an online platform that allows you to trade the cryptocurrency for fiat money or any other digital assets. Currently, coinbase, Binance, and GDAX are amongst the best crypto trading platforms. The coins you purchase will then require a wallet to be safely kept in, and most exchanges dispense their wallet for the buyer to use. Check the reviews of the exchanges you're interested in to know if it's safe or not and get a perspective of what it will offer you.

CFD Trading

Unlike exchanges where you have the right to your share of cryptocurrency, CFD is simply a contract between the broker and the trader without purchasing any crypto asset. Here you're just surmising on the market price. The trader determines the asset offered by the broker and sets its specification and opening price, thus undertaking a contract. The profit or loss is leveraged here, so make sure to set it according to your requirements. When it comes to crypto trading for beginners using a CFD is a better choice.

Crypto Wallet

If you happen to buy cryptocurrency, you'll need a wallet to store it securely. There are other types of wallets apart from the one provided by your exchange platform because those aren't entirely safe. Hence choosing the right version of the wallet is equally important.

They are of three types, hardware, software, and paper wallets. Software wallets are known for their ease of accessibility, while hardware ones are more secure. On the other hand, paper wallets are for those who'd like to store their assets for a long time.

Knowledge of the Crypto Wallet

The cryptocurrency market is based on what is known as blockchain technology, which results in a shared ledger that records all ongoing transactions. It records the transactions in blocks, and with every new transaction, the new block thus created is added to the chain.

This is how the market came to be decentralized, removing the need for a third party in any transaction. There are several merits of this technology, the first being its universal readability, which makes it transparent, and the second being its cryptography complex linking, both ensuring its safety. The more you educate yourself on this, the better your investments will fare.

Analyzing the Trends

Currently, bitcoin and ethereum cover most of the market, with Ripple, Zcash, Dash, and monero also rising in value. Knowing the rise and fall in the prices that they have gone through before will give you an idea of the market's swing as to where you should put your money and what to expect.

The market is highly volatile, changes every passing moment, and needs to keep up with the news. Especially for short term traders, they should not miss out on relevant news to edge over the others. You can analyze previous price charts to predict more precisely.

Check how the government is trying to regulate cryptocurrency in your area. There may be new regulations in your country that affect your tax obligations, or the already established system may change to adapt to the evolving market, so make sure to keep your eye on that as well.

You can also first try your hands on a demo account, which will give you the chance to craft your trades for practice, correct mistakes, and trail the platform, all without risking your hard-earned capital.

Benefits of Crypto Trading

● Peer to peer transaction: Such networking cuts out the middleman, this leads to lesser risk of fraud, cheating, clarity with an audit trail, and increased accountability. This also protects your account from identity theft.

● Market volatility: While this particular trait is a double edged sword, for investors who play smart, it can yield high returns in profit due to the swift, substantial fluctuations.

● Faster trades: When it comes to international transactions, cryptocurrencies are not subject to various levies imposed by a specific country because of their decentralization and therefore provide smooth cross border transfers.

Original Source: https://bit.ly/3kJY7GS

0 notes