#back then you could pay off your house loan in 5-10 years and you wouldn't even have to break the bank to do so.

Explore tagged Tumblr posts

Text

4pm thoughts

i don't understand the older generation's propensity to blame the younger generation for not being able to save enough due to rising prices.

"just spend less!!!" as if there aren't studies and charts that already show that income vs. the rising price of food/necessities has become so dispropotionate over the past decade or so

they complain about how the younger generation eats outside all the time instead of cooking at home. but how do you cook at home when all you can afford to rent is a room, or the house you rent doesn't allow cooking?

or if you're only eating outside once a month and cook at home the rest of the time they say "stop eating outside food". like if you cut down your outside food budget by RM60(USD15) a month, you can miraculously afford a down payment on a house.

and even if you can afford a house, the prices are astronomical nowadays--- you'd probably have to take out a 20-year loan to do so, vs in the past when houses were so much cheaper.

maybe all these problems seem very nonconsequential to most of the older generation/people in charge, since they're usually part of the high income bracket people, but tbh most of the population in the country(especially the younger ones) are probably only a few paychecks away from going homeless.

like!!! my dudes!!! why are you siding with the corporations when they don't even have your backs and are one of the main causes of all this as well...?

are people not allowed to treat themselves once every now and then with? if not, what's the point of working in the first place?!

#4pm thoughts.#my brother once told us he thought of renting a room outside to skip the 3 hour commute.#and then realized he would only have rm150ish a month in terms of savings after rent deduction.#and then our parents thought it was a good idea!!! because he would learn independence!!!#and then I asked them but what would happen if something came up one day. eg. his car breaking down and needing to repair it.#then they said he'd have to figure things out himself and think how to get money to repair the car???#like huh how disconnected from current day struggles do you have to be#speaking of houses and house loans.#back then you could pay off your house loan in 5-10 years and you wouldn't even have to break the bank to do so.#and you could get a house with an actual garden on a piece of land.#nowadays the dream of owning a house is gone since you can probably only afford an apt.#and even then you'd have to take a 20-year loan. if the bank even approves it in the first place due to your salary.

17 notes

·

View notes

Note

Those questions are all so good, I can't pick!

1-30 pls? The ones you feel like doing 🫶

I have special interest in your thoughts on veganism tho

chipotle order?

carnitas bowl with pinto beans lettuce tomatoes crema guac and cheese

2. thoughts on veganism?

ain’t for me. I wasn’t born and raised to say no to meat as a hispanic texan. I feel it’s too self righteous a lifestyle, and somethin that’s very…hm… class restricted I’ll say. You gotta be able to afford sayin no to animal products. I understand in practice it’s so that one doesn’t partake in the loss of life or harm to an animal… but it’s like, why restrict that guilt to animals? Why restrict it to signals only we easily perceive? Trees and plants communicate to each other too, they also send their own signals of distress when in danger. They’re their own form of sentient. Whatever we eat, we are taking some or all the life of. (I guess except for eggs? bc that's just chicken period) That’s just something we must accept.

Also sometimes the marketing for it I find is funny. “vegan leather” you mean synthetic shit?? "yeah I'm sippin outta my vegan cup oh what brand is it you ask heh, Solo." like c'mon man. get outta here.

3. a specific color that gives you the ick?

I believe all colors have the potential to be beautiful within the right palette

4. mythical creature you think/believe is real?

answered!

5. Favorite form of potato?

Frenchly Fried

6. do you use a watch?

nah just my phone

7. what animal do you look forward to seeing when you visit an aquarium?

the seals

8. do you change into specific clothes for the house when you get home?

ya my pjs (old shirt and sweats)

9. do you have a skincare routine (and how many steps is it)?

wash my face with face cleanser, put on moisturizer. every other day or so I put on an innisfree mask.

10. on a plane, do you ask for apple or orange juice?

I ask for a coffee with two creams and no sugar.

11. anything from your childhood you’ve held on to?

Oh many things, i got a bin full of em. sketchbooks, elementary yearbooks, diaries. My prized posession is my first stuffed bear, Clover. She’s stuck with me since I was 6 years old!

12. brand of haircare/bodycare/skincare that you trust 100%?

;–; none of them they all did me dirty. and I get too overwhelmed to look into what brands are the cheapest and best for my skin/hair.

13. first thing you’re doing in the purge?

stealing money to pay off my goddamn loans. That or I'd like to know who directly could cancel my loans (like is there a. like a "cancel loan" button on a computer or what. who's in charge of that button. I'm so smart guys I know exactly how the banking system works) so I could spook them into getting it done for me. I wouldn't hurt anyone, but I'd look the part to get them to do what I want.

14. do you think you’re dehydrated?

nah i drink plenty water.

15. rank the methods of death: freezing, burning, drowning

oof that’s tough. They all seem equal to me.

16. thoughts on mint chocolate chip?

LOVE LOVE LOVE!!

17. an anxious compulsion you do everyday?

I often check to see if my back is straight or if I’m not pursing my lips

18. your boba/tea order

matcha or taro, blended.

19. the veggie you dislike the most?

lima beans eughhh

20. favorite disney princess movie?

Tangled

21. a number that weirds you out?

my ex's (badum tsh)

22. do you have an emotional support water bottle?

I am in possession of only one water bottle

23. do you wear jewelry?

no. I own some though for some reason.

24. which do you find yourself using, american or british english?

American, but I prefer using the british grey instead of american gray.

25. would you say you have good taste in music?

My taste in music is the only thing abt myself I’m confident in hgjkfd yes I would say so.

26. how’s your spice tolerance?

Take a look at my hispanic card you’ll see “güerita“ in bright bold lettering.

27. what’s your favorite or go-to outfit?

jeans and a t-shirt with my chanclas

28. last meal on earth?

Fettuccine Alfredo

29. preferred pasta noodle?

Bowties, they funky

30. ask me anything !

well gosh how am I supposed to answer this one y’aint sent me nothin on it pinsky XD

#I do my best to research stuff I don't like so if i have any vegan followers who got choice words to say to me by all means come my way#cel speaks#cel answers

5 notes

·

View notes

Text

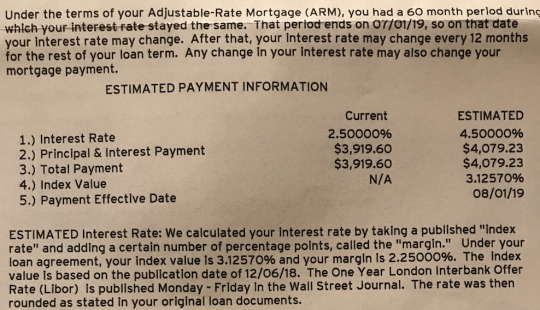

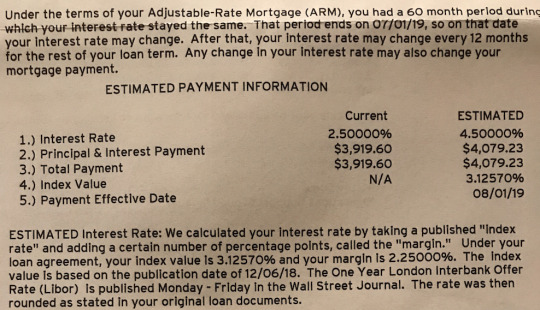

The Anatomy Of An Adjustable Rate Mortgage Increase

I'm so excited to share with you something I got in the mail the other day. No, it wasn't a notification that Financial Samurai had won an award for being the best personal finance site. My site is too focused on understanding hard things to make us all rich to appeal to the masses.

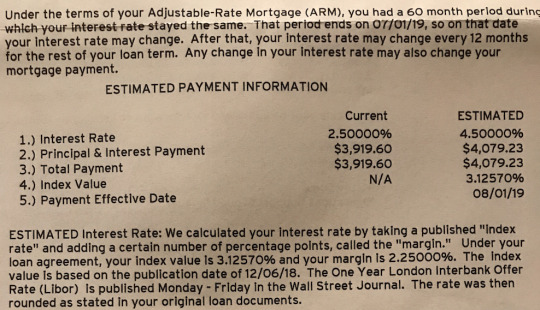

Instead, I got something better. It was letter from my bank saying my adjustable rate mortgage interest rate is going up!

This is the first time I've ever received such a letter because, in the past, I would always refinance my 5-year ARM (my preferred ARM term) lower before the fixed period was up.

But with interest rates having moved up since I bought my house in 2014, the logical thing to do was keep holding it until the reset.

The Origins Of Our 5-Year ARM

We bought a San Francisco single family fixer in 1H2014 for $1,250,000. We were tired of living in the north end of San Francisco for the past 9.5 years and wanted a change of scenery.

Originally, we had planned to relocate to Hawaii, but when we found our current house with ocean views, we though this would be a good compromise.

We put down 20% and took out a $992,000 5-year ARM. Originally, I was going to put down 32%, because I had about $430,000 come due from a 4.1% 5-year CD. But with a mortgage rate of only 2.5%, I felt it was worth borrowing more and investing the difference.

The 2.5% mortgage rate was based on the one year LIBOR rate + a 2.25% margin – 0.25% discount for being an excellent customer. Back in 2014, the one year LIBOR rate was at only 0.5%, hence my 2.5% rate.

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market.

LIBOR is the most widely used global “benchmark” or reference rate for short-term interest rates. Check out the historical one-year LIBOR chart below.

As you can tell from the one-year LIBOR chart, I bottom-ticked my mortgage rate in 2014. Some of you might be thinking that instead of getting a 5/1 ARM, I should have gotten a 30-year fixed rate instead.

But given my strong belief that we will be in a permanently low interest rate environment for the rest of our lives, I felt that paying 0.85% – 1.25% more for a 30-year fixed rate was a waste of money. So my actions followed my brain.

Besides, the average homeownership duration in America is only around 8.7 years. At most, one may consider taking out a 10/1 ARM to match durations.

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the “risk.”

Regardless of whether you want to waste your money on a 30-year fixed mortgage or not, mortgage rates have indeed gone up for all of us since 2014.

Based on the current one year LIBOR rate of ~3.1% + my margin of 2.25% – my 0.25% for being an excellent client, my new mortgage rate should be a reasonable 5.1% when it resets in mid-2019.

If I end up paying 5.1% for the next five years, my average mortgage rate over a 10 year period would be 5.1% + 2.5% = 7.6% /2 = 3.8%. 3.8% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~7% return on average from 2014 – 2018 because the stock market went up until 2018. Although I did eek out a 0.8% gain in 2018.

But surprise! I won't be paying an estimated 5.1% mortgage rate in 2019. Instead, my letter says that I'll be paying an estimated 4.5%. Have a look at the portion of the letter below.

The letter clearly states how they calculate my mortgage rate, yet for some reason, they still come up with an estimated rate of 4.5% instead of 5.1%. Perhaps my good customer discount of -0.25% will grow to -0.85% next year? Or perhaps my bank simply made a mistake in their calculation.

No, no. Banks aren't stupid. The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARM can only reset by at most 2% after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

The other thing to note is that ARM loans generally have a maximum mortgage interest rate they can charge for the life of your loan. In my case, that maximum is 7.5%, but we're never going to get there in my opinion.

Unfortunately, after one full year at 4.5%, my bank can raise my ARM by another 2%, bringing my mortgage rate up to 6.5% for year seven.

However, I doubt rates will keep on surging higher as the global economy slows. Instead, by the time my ARM reset occurs again in 7/1/2020, we might very well be in a recession with one year LIBOR rates moving back down.

Paying Down Principal

In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.

They don't show them a 35-year historical chart of declining interest rates. By scaring their customers, they have a higher chance of locking them into 30-year fixed rate mortgages for fatter margins.

Don't be fooled.

Historical 30-year Mortgage Interest Rate Chart

You can see from the letter that despite my mortgage rate increasing from 2.5% to 4.5%, an 80% increase, my monthly payment is only expected to increase from $3,919.60 to $4,079.33, a mere 4% rise.

The reason for the slight increase in monthly mortgage payment is because we've paid down 32% of our loan in 4.5 years ($992,000 down to $734,000).

Paying down over $250,000 in our mortgage was partly due to normal monthly principal payments coupled with random extra principal pay downs. Although the 2.5% interest rate is low, paying down mortgage debt has always been part of my long term investment strategy.

Following my FS-DAIR strategy, I would regularly try and use 25% of my free cash flow to pay down debt and use the other 75% to invest. Again, I'm just taking action based on my own advice.

I kept on paying down principal randomly until the 10-year yield breached 2.5% in December 2017. Once the 10-year yield was higher than 2.5%, I stopped because I was now getting an interest-free mortgage since I could simply invest the amount of my mortgage in a 10-year bond yield to cover all my payments.

Living for free is one of the best things ever!

If I had taken out a 30-year fixed mortgage for 3.625%, I wouldn't have been able to experience interest-free living.

Your mileage will vary in terms of how much principal you actually paid down during the initial fixed rate period of your ARM. However, even if you didn't pay down any extra principal during a five year period, you will have still paid down ~10% of your principal balance, depending on your interest rate.

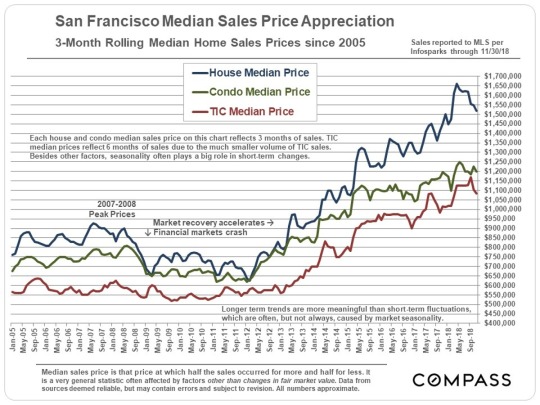

An Appreciation In Your Home's Value

Even if you've got to pay a higher mortgage rate when your ARM resets, you may be pleased to discover that your home has appreciated in value during the fixed rate period.

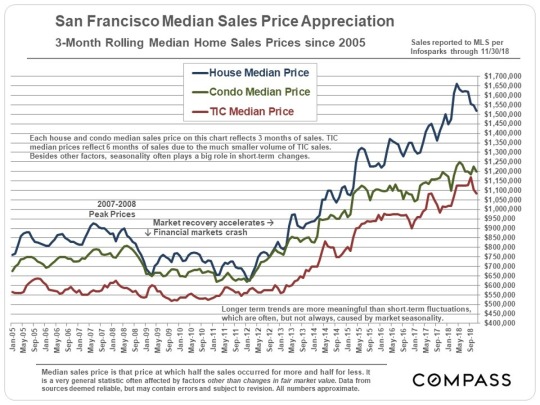

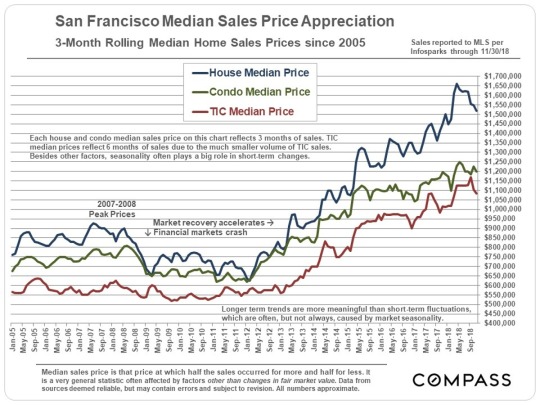

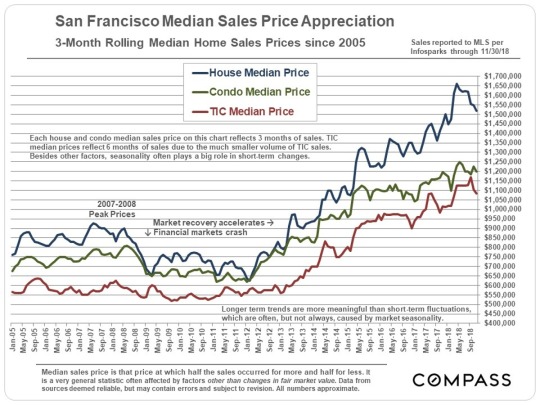

The San Francisco median home price increased from $1,100,000 in 2014 to ~$1,500,000 today, or a 37% increase.

A $420,000 principal increase more than makes up for a measly $159.63 monthly increase in mortgage payment, roughly half of which is going to pay down principal anyway.

Again, your home's appreciation amount will vary. Unless you timed your home purchase completely wrong, such as buying in 4Q2006 – 4Q2008 or maybe 1Q2018 (jury is still out), you'll likely come out OK.

Even if you did purchase at the most recent peak, normal downturns usually last no more than 3-5 years with 10% – 20% corrections.

Make A Mortgage Pay Down Plan

Given I have until 7/1/2019 before my mortgage rate jumps from 2.5% to 4.5%, I plan to keep paying my mortgage as usual and not pay anything extra to principal.

As soon as I exhaust all 60 months at 2.5%, I will pay down $50,000 in principal on month 61. After the initial $50,000 extra principal payment, I will keep paying down between $20,000 – $30,000 a month in extra principal until the mortgage is gone or until I find my Hawaiian dream home.

Based on my extra principal payments, the mortgage should be completely paid off by January 2022, or about 7.5 years after I first took out the loan.

Anything can happen between now and January 2022, which is why it's prudent to continue investing and paying down debt while having a good cash hoard. You can now earn a healthy 2.45% in a money market account with CIT Bank, for example. That's huge, since just several years ago, savings rates were under 0.5%.

Earning a 4.5% rate of return is excellent at this stage in the economic cycle, but so is having enough cash to find a gem of a property in Hawaii at a big discount. And boy, am I seeing discounts everywhere now!

The alternative solution to aggressively paying down principal is to simply refinance my mortgage when it's time to reset to another 5/1 ARM.

After checking online for the latest mortgage rates, I can get a 5/1 ARM jumbo for only 3.25%. This means that after 10 years, my blended interest rate is 2.875%. Not bad at all.

Article Summary

1) Match the duration of your mortgage's fixed duration with the estimated ownership duration or the length of time you estimate it will take to pay off the mortgage.

2) Paying for a 30-year fixed rate mortgage might provide you more peace of mind, but you're likely overpaying for that peace of mind.

3) Read the terms of your ARM loan carefully and figure out what is the maximum interest rate increase during the first reset and what is the lifetime interest rate cap.

4) Try to make extra payments during your ARM's fixed rate period to relieve potential interest rate pressure during the reset.

5) Don't borrow more than you can comfortably afford = no greater than a 80% loan-to-value ratio with a 10% cash buffer after a 20% downpayment. Being overly leveraged is what consistently destroys people's finances.

Readers, why do people take out overpriced 30-year fixed rate mortgages when the average homeownership duration is less than 9 years? Why pay a higher rate when interest rates have gone down for 35+ years in a row?

The post The Anatomy Of An Adjustable Rate Mortgage Increase appeared first on Financial Samurai.

0 notes

Text

The Anatomy Of An Adjustable Rate Mortgage Increase

I'm so excited to share with you something I got in the mail the other day. No, it wasn't a notification that Financial Samurai had won an award for being the best personal finance site. My site is too focused on understanding hard things to make us all rich to appeal to the masses.

Instead, I got something better. It was letter from my bank saying my adjustable rate mortgage interest rate is going up!

This is the first time I've ever received such a letter because, in the past, I would always refinance my 5-year ARM (my preferred ARM term) lower before the fixed period was up.

But with interest rates having moved up since I bought my house in 2014, the logical thing to do was keep holding it until the reset.

The Origins Of Our 5-Year ARM

We bought a San Francisco single family fixer in 1H2014 for $1,250,000. We were tired of living in the north end of San Francisco for the past 9.5 years and wanted a change of scenery.

Originally, we had planned to relocate to Hawaii, but when we found our current house with ocean views, we though this would be a good compromise.

We put down 20% and took out a $992,000 5-year ARM. Originally, I was going to put down 32%, because I had about $430,000 come due from a 4.1% 5-year CD. But with a mortgage rate of only 2.5%, I felt it was worth borrowing more and investing the difference.

The 2.5% mortgage rate was based on the one year LIBOR rate + a 2.25% margin – 0.25% discount for being an excellent customer. Back in 2014, the one year LIBOR rate was at only 0.5%, hence my 2.5% rate.

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market.

LIBOR is the most widely used global “benchmark” or reference rate for short-term interest rates. Check out the historical one-year LIBOR chart below.

As you can tell from the one-year LIBOR chart, I bottom-ticked my mortgage rate in 2014. Some of you might be thinking that instead of getting a 5/1 ARM, I should have gotten a 30-year fixed rate instead.

But given my strong belief that we will be in a permanently low interest rate environment for the rest of our lives, I felt that paying 0.85% – 1.25% more for a 30-year fixed rate was a waste of money. So my actions followed my brain.

Besides, the average homeownership duration in America is only around 8.7 years. At most, one may consider taking out a 10/1 ARM to match durations.

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the “risk.”

Regardless of whether you want to waste your money on a 30-year fixed mortgage or not, mortgage rates have indeed gone up for all of us since 2014.

Based on the current one year LIBOR rate of ~3.1% + my margin of 2.25% – my 0.25% for being an excellent client, my new mortgage rate should be a reasonable 5.1% when it resets in mid-2019.

If I end up paying 5.1% for the next five years, my average mortgage rate over a 10 year period would be 5.1% + 2.5% = 7.6% /2 = 3.8%. 3.8% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~7% return on average from 2014 – 2018 because the stock market went up until 2018. Although I did eek out a 0.8% gain in 2018.

But surprise! I won't be paying an estimated 5.1% mortgage rate in 2019. Instead, my letter says that I'll be paying an estimated 4.5%. Have a look at the portion of the letter below.

The letter clearly states how they calculate my mortgage rate, yet for some reason, they still come up with an estimated rate of 4.5% instead of 5.1%. Perhaps my good customer discount of -0.25% will grow to -0.85% next year? Or perhaps my bank simply made a mistake in their calculation.

No, no. Banks aren't stupid. The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARM can only reset by at most 2% after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

The other thing to note is that ARM loans generally have a maximum mortgage interest rate they can charge for the life of your loan. In my case, that maximum is 7.5%, but we're never going to get there in my opinion.

Unfortunately, after one full year at 4.5%, my bank can raise my ARM by another 2%, bringing my mortgage rate up to 6.5% for year seven.

However, I doubt rates will keep on surging higher as the global economy slows. Instead, by the time my ARM reset occurs again in 7/1/2020, we might very well be in a recession with one year LIBOR rates moving back down.

Paying Down Principal

In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.

They don't show them a 35-year historical chart of declining interest rates. By scaring their customers, they have a higher chance of locking them into 30-year fixed rate mortgages for fatter margins.

Don't be fooled.

Historical 30-year Mortgage Interest Rate Chart

You can see from the letter that despite my mortgage rate increasing from 2.5% to 4.5%, an 80% increase, my monthly payment is only expected to increase from $3,919.60 to $4,079.33, a mere 4% rise.

The reason for the slight increase in monthly mortgage payment is because we've paid down 32% of our loan in 4.5 years ($992,000 down to $734,000).

Paying down over $250,000 in our mortgage was partly due to normal monthly principal payments coupled with random extra principal pay downs. Although the 2.5% interest rate is low, paying down mortgage debt has always been part of my long term investment strategy.

Following my FS-DAIR strategy, I would regularly try and use 25% of my free cash flow to pay down debt and use the other 75% to invest. Again, I'm just taking action based on my own advice.

I kept on paying down principal randomly until the 10-year yield breached 2.5% in December 2017. Once the 10-year yield was higher than 2.5%, I stopped because I was now getting an interest-free mortgage since I could simply invest the amount of my mortgage in a 10-year bond yield to cover all my payments.

Living for free is one of the best things ever!

If I had taken out a 30-year fixed mortgage for 3.625%, I wouldn't have been able to experience interest-free living.

Your mileage will vary in terms of how much principal you actually paid down during the initial fixed rate period of your ARM. However, even if you didn't pay down any extra principal during a five year period, you will have still paid down ~10% of your principal balance, depending on your interest rate.

An Appreciation In Your Home's Value

Even if you've got to pay a higher mortgage rate when your ARM resets, you may be pleased to discover that your home has appreciated in value during the fixed rate period.

The San Francisco median home price increased from $1,100,000 in 2014 to ~$1,500,000 today, or a 37% increase.

A $420,000 principal increase more than makes up for a measly $159.63 monthly increase in mortgage payment, roughly half of which is going to pay down principal anyway.

Again, your home's appreciation amount will vary. Unless you timed your home purchase completely wrong, such as buying in 4Q2006 – 4Q2008 or maybe 1Q2018 (jury is still out), you'll likely come out OK.

Even if you did purchase at the most recent peak, normal downturns usually last no more than 3-5 years with 10% – 20% corrections.

Make A Mortgage Pay Down Plan

Given I have until 7/1/2019 before my mortgage rate jumps from 2.5% to 4.5%, I plan to keep paying my mortgage as usual and not pay anything extra to principal.

As soon as I exhaust all 60 months at 2.5%, I will pay down $50,000 in principal on month 61. After the initial $50,000 extra principal payment, I will keep paying down between $20,000 – $30,000 a month in extra principal until the mortgage is gone or until I find my Hawaiian dream home.

Based on my extra principal payments, the mortgage should be completely paid off by January 2022, or about 7.5 years after I first took out the loan.

Anything can happen between now and January 2022, which is why it's prudent to continue investing and paying down debt while having a good cash hoard. You can now earn a healthy 2.45% in a money market account with CIT Bank, for example. That's huge, since just several years ago, savings rates were under 0.5%.

Earning a 4.5% rate of return is excellent at this stage in the economic cycle, but so is having enough cash to find a gem of a property in Hawaii at a big discount. And boy, am I seeing discounts everywhere now!

The alternative solution to aggressively paying down principal is to simply refinance my mortgage when it's time to reset to another 5/1 ARM.

After checking online for the latest mortgage rates, I can get a 5/1 ARM jumbo for only 3.25%. This means that after 10 years, my blended interest rate is 2.875%. Not bad at all.

Article Summary

1) Match the duration of your mortgage's fixed duration with the estimated ownership duration or the length of time you estimate it will take to pay off the mortgage.

2) Paying for a 30-year fixed rate mortgage might provide you more peace of mind, but you're likely overpaying for that peace of mind.

3) Read the terms of your ARM loan carefully and figure out what is the maximum interest rate increase during the first reset and what is the lifetime interest rate cap.

4) Try to make extra payments during your ARM's fixed rate period to relieve potential interest rate pressure during the reset.

5) Don't borrow more than you can comfortably afford = no greater than a 80% loan-to-value ratio with a 10% cash buffer after a 20% downpayment. Being overly leveraged is what consistently destroys people's finances.

Readers, why do people take out overpriced 30-year fixed rate mortgages when the average homeownership duration is less than 9 years? Why pay a higher rate when interest rates have gone down for 35+ years in a row?

The post The Anatomy Of An Adjustable Rate Mortgage Increase appeared first on Financial Samurai.

0 notes

Text

The Anatomy Of An Adjustable Rate Mortgage Increase

I'm so excited to share with you something I got in the mail the other day. No, it wasn't a notification that Financial Samurai had won an award for being the best personal finance site. My site is too focused on understanding hard things to make us all rich to appeal to the masses.

Instead, I got something better. It was letter from my bank saying my adjustable rate mortgage interest rate is going up!

This is the first time I've ever received such a letter because, in the past, I would always refinance my 5-year ARM (my preferred ARM term) lower before the fixed period was up.

But with interest rates having moved up since I bought my house in 2014, the logical thing to do was keep holding it until the reset.

The Origins Of Our 5-Year ARM

We bought a San Francisco single family fixer in 1H2014 for $1,250,000. We were tired of living in the north end of San Francisco for the past 9.5 years and wanted a change of scenery.

Originally, we had planned to relocate to Hawaii, but when we found our current house with ocean views, we though this would be a good compromise.

We put down 20% and took out a $992,000 5-year ARM. Originally, I was going to put down 32%, because I had about $430,000 come due from a 4.1% 5-year CD. But with a mortgage rate of only 2.5%, I felt it was worth borrowing more and investing the difference.

The 2.5% mortgage rate was based on the one year LIBOR rate + a 2.25% margin – 0.25% discount for being an excellent customer. Back in 2014, the one year LIBOR rate was at only 0.5%, hence my 2.5% rate.

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market.

LIBOR is the most widely used global “benchmark” or reference rate for short-term interest rates. Check out the historical one-year LIBOR chart below.

As you can tell from the one-year LIBOR chart, I bottom-ticked my mortgage rate in 2014. Some of you might be thinking that instead of getting a 5/1 ARM, I should have gotten a 30-year fixed rate instead.

But given my strong belief that we will be in a permanently low interest rate environment for the rest of our lives, I felt that paying 0.85% – 1.25% more for a 30-year fixed rate was a waste of money. So my actions followed my brain.

Besides, the average homeownership duration in America is only around 8.7 years. At most, one may consider taking out a 10/1 ARM to match durations.

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the “risk.”

Regardless of whether you want to waste your money on a 30-year fixed mortgage or not, mortgage rates have indeed gone up for all of us since 2014.

Based on the current one year LIBOR rate of ~3.1% + my margin of 2.25% – my 0.25% for being an excellent client, my new mortgage rate should be a reasonable 5.1% when it resets in mid-2019.

If I end up paying 5.1% for the next five years, my average mortgage rate over a 10 year period would be 5.1% + 2.5% = 7.6% /2 = 3.8%. 3.8% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~7% return on average from 2014 – 2018 because the stock market went up until 2018. Although I did eek out a 0.8% gain in 2018.

But surprise! I won't be paying an estimated 5.1% mortgage rate in 2019. Instead, my letter says that I'll be paying an estimated 4.5%. Have a look at the portion of the letter below.

The letter clearly states how they calculate my mortgage rate, yet for some reason, they still come up with an estimated rate of 4.5% instead of 5.1%. Perhaps my good customer discount of -0.25% will grow to -0.85% next year? Or perhaps my bank simply made a mistake in their calculation.

No, no. Banks aren't stupid. The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARM can only reset by at most 2% after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

The other thing to note is that ARM loans generally have a maximum mortgage interest rate they can charge for the life of your loan. In my case, that maximum is 7.5%, but we're never going to get there in my opinion.

Unfortunately, after one full year at 4.5%, my bank can raise my ARM by another 2%, bringing my mortgage rate up to 6.5% for year seven.

However, I doubt rates will keep on surging higher as the global economy slows. Instead, by the time my ARM reset occurs again in 7/1/2020, we might very well be in a recession with one year LIBOR rates moving back down.

Paying Down Principal

In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.

They don't show them a 35-year historical chart of declining interest rates. By scaring their customers, they have a higher chance of locking them into 30-year fixed rate mortgages for fatter margins.

Don't be fooled.

Historical 30-year Mortgage Interest Rate Chart

You can see from the letter that despite my mortgage rate increasing from 2.5% to 4.5%, an 80% increase, my monthly payment is only expected to increase from $3,919.60 to $4,079.33, a mere 4% rise.

The reason for the slight increase in monthly mortgage payment is because we've paid down 32% of our loan in 4.5 years ($992,000 down to $734,000).

Paying down over $250,000 in our mortgage was partly due to normal monthly principal payments coupled with random extra principal pay downs. Although the 2.5% interest rate is low, paying down mortgage debt has always been part of my long term investment strategy.

Following my FS-DAIR strategy, I would regularly try and use 25% of my free cash flow to pay down debt and use the other 75% to invest. Again, I'm just taking action based on my own advice.

I kept on paying down principal randomly until the 10-year yield breached 2.5% in December 2017. Once the 10-year yield was higher than 2.5%, I stopped because I was now getting an interest-free mortgage since I could simply invest the amount of my mortgage in a 10-year bond yield to cover all my payments.

Living for free is one of the best things ever!

If I had taken out a 30-year fixed mortgage for 3.625%, I wouldn't have been able to experience interest-free living.

Your mileage will vary in terms of how much principal you actually paid down during the initial fixed rate period of your ARM. However, even if you didn't pay down any extra principal during a five year period, you will have still paid down ~10% of your principal balance, depending on your interest rate.

An Appreciation In Your Home's Value

Even if you've got to pay a higher mortgage rate when your ARM resets, you may be pleased to discover that your home has appreciated in value during the fixed rate period.

The San Francisco median home price increased from $1,100,000 in 2014 to ~$1,500,000 today, or a 37% increase.

A $420,000 principal increase more than makes up for a measly $159.63 monthly increase in mortgage payment, roughly half of which is going to pay down principal anyway.

Again, your home's appreciation amount will vary. Unless you timed your home purchase completely wrong, such as buying in 4Q2006 – 4Q2008 or maybe 1Q2018 (jury is still out), you'll likely come out OK.

Even if you did purchase at the most recent peak, normal downturns usually last no more than 3-5 years with 10% – 20% corrections.

Make A Mortgage Pay Down Plan

Given I have until 7/1/2019 before my mortgage rate jumps from 2.5% to 4.5%, I plan to keep paying my mortgage as usual and not pay anything extra to principal.

As soon as I exhaust all 60 months at 2.5%, I will pay down $50,000 in principal on month 61. After the initial $50,000 extra principal payment, I will keep paying down between $20,000 – $30,000 a month in extra principal until the mortgage is gone or until I find my Hawaiian dream home.

Based on my extra principal payments, the mortgage should be completely paid off by January 2022, or about 7.5 years after I first took out the loan.

Anything can happen between now and January 2022, which is why it's prudent to continue investing and paying down debt while having a good cash hoard. You can now earn a healthy 2.45% in a money market account with CIT Bank, for example. That's huge, since just several years ago, savings rates were under 0.5%.

Earning a 4.5% rate of return is excellent at this stage in the economic cycle, but so is having enough cash to find a gem of a property in Hawaii at a big discount. And boy, am I seeing discounts everywhere now!

The alternative solution to aggressively paying down principal is to simply refinance my mortgage when it's time to reset to another 5/1 ARM.

After checking online for the latest mortgage rates, I can get a 5/1 ARM jumbo for only 3.25%. This means that after 10 years, my blended interest rate is 2.875%. Not bad at all.

Article Summary

1) Match the duration of your mortgage's fixed duration with the estimated ownership duration or the length of time you estimate it will take to pay off the mortgage.

2) Paying for a 30-year fixed rate mortgage might provide you more peace of mind, but you're likely overpaying for that peace of mind.

3) Read the terms of your ARM loan carefully and figure out what is the maximum interest rate increase during the first reset and what is the lifetime interest rate cap.

4) Try to make extra payments during your ARM's fixed rate period to relieve potential interest rate pressure during the reset.

5) Don't borrow more than you can comfortably afford = no greater than a 80% loan-to-value ratio with a 10% cash buffer after a 20% downpayment. Being overly leveraged is what consistently destroys people's finances.

Readers, why do people take out overpriced 30-year fixed rate mortgages when the average homeownership duration is less than 9 years? Why pay a higher rate when interest rates have gone down for 35+ years in a row?

The post The Anatomy Of An Adjustable Rate Mortgage Increase appeared first on Financial Samurai.

0 notes

Text

The Anatomy Of An Adjustable Rate Mortgage Increase

I'm so excited to share with you something I got in the mail the other day. No, it wasn't a notification that Financial Samurai had won an award for being the best personal finance site. My site is too focused on understanding hard things to make us all rich to appeal to the masses.

Instead, I got something better. It was letter from my bank saying my adjustable rate mortgage interest rate is going up!

This is the first time I've ever received such a letter because, in the past, I would always refinance my 5-year ARM (my preferred ARM term) lower before the fixed period was up.

But with interest rates having moved up since I bought my house in 2014, the logical thing to do was keep holding it until the reset.

The Origins Of Our 5-Year ARM

We bought a San Francisco single family fixer in 1H2014 for $1,250,000. We were tired of living in the north end of San Francisco for the past 9.5 years and wanted a change of scenery.

Originally, we had planned to relocate to Hawaii, but when we found our current house with ocean views, we though this would be a good compromise.

We put down 20% and took out a $992,000 5-year ARM. Originally, I was going to put down 32%, because I had about $430,000 come due from a 4.1% 5-year CD. But with a mortgage rate of only 2.5%, I felt it was worth borrowing more and investing the difference.

The 2.5% mortgage rate was based on the one year LIBOR rate + a 2.25% margin – 0.25% discount for being an excellent customer. Back in 2014, the one year LIBOR rate was at only 0.5%, hence my 2.5% rate.

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market.

LIBOR is the most widely used global “benchmark” or reference rate for short-term interest rates. Check out the historical one-year LIBOR chart below.

As you can tell from the one-year LIBOR chart, I bottom-ticked my mortgage rate in 2014. Some of you might be thinking that instead of getting a 5/1 ARM, I should have gotten a 30-year fixed rate instead.

But given my strong belief that we will be in a permanently low interest rate environment for the rest of our lives, I felt that paying 0.85% – 1.25% more for a 30-year fixed rate was a waste of money. So my actions followed my brain.

Besides, the average homeownership duration in America is only around 8.7 years. At most, one may consider taking out a 10/1 ARM to match durations.

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the “risk.”

Regardless of whether you want to waste your money on a 30-year fixed mortgage or not, mortgage rates have indeed gone up for all of us since 2014.

Based on the current one year LIBOR rate of ~3.1% + my margin of 2.25% – my 0.25% for being an excellent client, my new mortgage rate should be a reasonable 5.1% when it resets in mid-2019.

If I end up paying 5.1% for the next five years, my average mortgage rate over a 10 year period would be 5.1% + 2.5% = 7.6% /2 = 3.8%. 3.8% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~7% return on average from 2014 – 2018 because the stock market went up until 2018. Although I did eek out a 0.8% gain in 2018.

But surprise! I won't be paying an estimated 5.1% mortgage rate in 2019. Instead, my letter says that I'll be paying an estimated 4.5%. Have a look at the portion of the letter below.

The letter clearly states how they calculate my mortgage rate, yet for some reason, they still come up with an estimated rate of 4.5% instead of 5.1%. Perhaps my good customer discount of -0.25% will grow to -0.85% next year? Or perhaps my bank simply made a mistake in their calculation.

No, no. Banks aren't stupid. The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARM can only reset by at most 2% after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

The other thing to note is that ARM loans generally have a maximum mortgage interest rate they can charge for the life of your loan. In my case, that maximum is 7.5%, but we're never going to get there in my opinion.

Unfortunately, after one full year at 4.5%, my bank can raise my ARM by another 2%, bringing my mortgage rate up to 6.5% for year seven.

However, I doubt rates will keep on surging higher as the global economy slows. Instead, by the time my ARM reset occurs again in 7/1/2020, we might very well be in a recession with one year LIBOR rates moving back down.

Paying Down Principal

In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.

They don't show them a 35-year historical chart of declining interest rates. By scaring their customers, they have a higher chance of locking them into 30-year fixed rate mortgages for fatter margins.

Don't be fooled.

Historical 30-year Mortgage Interest Rate Chart

You can see from the letter that despite my mortgage rate increasing from 2.5% to 4.5%, an 80% increase, my monthly payment is only expected to increase from $3,919.60 to $4,079.33, a mere 4% rise.

The reason for the slight increase in monthly mortgage payment is because we've paid down 32% of our loan in 4.5 years ($992,000 down to $734,000).

Paying down over $250,000 in our mortgage was partly due to normal monthly principal payments coupled with random extra principal pay downs. Although the 2.5% interest rate is low, paying down mortgage debt has always been part of my long term investment strategy.

Following my FS-DAIR strategy, I would regularly try and use 25% of my free cash flow to pay down debt and use the other 75% to invest. Again, I'm just taking action based on my own advice.

I kept on paying down principal randomly until the 10-year yield breached 2.5% in December 2017. Once the 10-year yield was higher than 2.5%, I stopped because I was now getting an interest-free mortgage since I could simply invest the amount of my mortgage in a 10-year bond yield to cover all my payments.

Living for free is one of the best things ever!

If I had taken out a 30-year fixed mortgage for 3.625%, I wouldn't have been able to experience interest-free living.

Your mileage will vary in terms of how much principal you actually paid down during the initial fixed rate period of your ARM. However, even if you didn't pay down any extra principal during a five year period, you will have still paid down ~10% of your principal balance, depending on your interest rate.

An Appreciation In Your Home's Value

Even if you've got to pay a higher mortgage rate when your ARM resets, you may be pleased to discover that your home has appreciated in value during the fixed rate period.

The San Francisco median home price increased from $1,100,000 in 2014 to ~$1,500,000 today, or a 37% increase.

A $420,000 principal increase more than makes up for a measly $159.63 monthly increase in mortgage payment, roughly half of which is going to pay down principal anyway.

Again, your home's appreciation amount will vary. Unless you timed your home purchase completely wrong, such as buying in 4Q2006 – 4Q2008 or maybe 1Q2018 (jury is still out), you'll likely come out OK.

Even if you did purchase at the most recent peak, normal downturns usually last no more than 3-5 years with 10% – 20% corrections.

Make A Mortgage Pay Down Plan

Given I have until 7/1/2019 before my mortgage rate jumps from 2.5% to 4.5%, I plan to keep paying my mortgage as usual and not pay anything extra to principal.

As soon as I exhaust all 60 months at 2.5%, I will pay down $50,000 in principal on month 61. After the initial $50,000 extra principal payment, I will keep paying down between $20,000 – $30,000 a month in extra principal until the mortgage is gone or until I find my Hawaiian dream home.

Based on my extra principal payments, the mortgage should be completely paid off by January 2022, or about 7.5 years after I first took out the loan.

Anything can happen between now and January 2022, which is why it's prudent to continue investing and paying down debt while having a good cash hoard. You can now earn a healthy 2.45% in a money market account with CIT Bank, for example. That's huge, since just several years ago, savings rates were under 0.5%.

Earning a 4.5% rate of return is excellent at this stage in the economic cycle, but so is having enough cash to find a gem of a property in Hawaii at a big discount. And boy, am I seeing discounts everywhere now!

The alternative solution to aggressively paying down principal is to simply refinance my mortgage when it's time to reset to another 5/1 ARM.

After checking online for the latest mortgage rates, I can get a 5/1 ARM jumbo for only 3.25%. This means that after 10 years, my blended interest rate is 2.875%. Not bad at all.

Article Summary

1) Match the duration of your mortgage's fixed duration with the estimated ownership duration or the length of time you estimate it will take to pay off the mortgage.

2) Paying for a 30-year fixed rate mortgage might provide you more peace of mind, but you're likely overpaying for that peace of mind.

3) Read the terms of your ARM loan carefully and figure out what is the maximum interest rate increase during the first reset and what is the lifetime interest rate cap.

4) Try to make extra payments during your ARM's fixed rate period to relieve potential interest rate pressure during the reset.

5) Don't borrow more than you can comfortably afford = no greater than a 80% loan-to-value ratio with a 10% cash buffer after a 20% downpayment. Being overly leveraged is what consistently destroys people's finances.

Readers, why do people take out overpriced 30-year fixed rate mortgages when the average homeownership duration is less than 9 years? Why pay a higher rate when interest rates have gone down for 35+ years in a row?

The post The Anatomy Of An Adjustable Rate Mortgage Increase appeared first on Financial Samurai.

0 notes

Text

The Anatomy Of An Adjustable Rate Mortgage Increase

I'm so excited to share with you something I got in the mail the other day. No, it wasn't a notification that Financial Samurai had won an award for being the best personal finance site. My site is too focused on understanding hard things to make us all rich to appeal to the masses.

Instead, I got something better. It was letter from my bank saying my adjustable rate mortgage interest rate is going up!

This is the first time I've ever received such a letter because, in the past, I would always refinance my 5-year ARM (my preferred ARM term) lower before the fixed period was up.

But with interest rates having moved up since I bought my house in 2014, the logical thing to do was keep holding it until the reset.

The Origins Of Our 5-Year ARM

We bought a San Francisco single family fixer in 1H2014 for $1,200,000. We were tired of living in the north end of San Francisco for the past 9.5 years and wanted a change of scenery.

Originally, we had planned to relocate to Hawaii, but when we found our current house with ocean views, we though this would be a good compromise.

We put down 20% and took out a $992,000 5-year ARM. Originally, I was going to put down 32%, because I had about $430,000 come due from a 4.1% 5-year CD. But with a mortgage rate of only 2.5%, I felt it was worth borrowing more and investing the difference.

The 2.5% mortgage rate was based on the one year LIBOR rate + a 2.25% margin – 0.25% discount for being an excellent customer. Back in 2014, the one year LIBOR rate was at only 0.5%, hence my 2.5% rate.

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market.

LIBOR is the most widely used global “benchmark” or reference rate for short-term interest rates. Check out the historical one-year LIBOR chart below.

As you can tell from the one-year LIBOR chart, I bottom-ticked my mortgage rate in 2014. Some of you might be thinking that instead of getting a 5/1 ARM, I should have gotten a 30-year fixed rate instead.

But given my strong belief that we will be in a permanently low interest rate environment for the rest of our lives, I felt that paying 1% – 1.5% more for a 30-year fixed rate was a waste of money. So my actions followed my brain.

Besides, the average homeownership duration in America is only around 8.7 years. At most, one may consider taking out a 10/1 ARM to match durations.

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the “risk.”

Regardless of whether you want to waste your money on a 30-year fixed mortgage or not, mortgage rates have indeed gone up for all of us since 2014.

Based on the current one year LIBOR rate of ~3.1% + my margin of 2.25% – my 0.25% for being an excellent client, my new mortgage rate should be a reasonable 5.1% when it resets in mid-2019.

If I end up paying 5.1% for the next five years, my average mortgage rate over a 10 year period would be 5.1% + 2.5% = 7.6% /2 = 3.8%. 3.8% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~7% return on average from 2014 – 2018 because the stock market went up until 2018. Although I did eek out a 0.8% gain in 2018.

But surprise! I won't be paying an estimated 5.1% mortgage rate in 2019. Instead, my letter says that I'll be paying an estimated 4.5%. Have a look at the portion of the letter below.

The letter clearly states how they calculate my mortgage rate, yet for some reason, they still come up with an estimated rate of 4.5% instead of 5.1%. Perhaps my good customer discount of -0.25% will grow to -0.85% next year? Or perhaps my bank simply made a mistake in their calculation.

No, no. Banks aren't stupid. The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARM can only reset by at most 2% after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

The other thing to note is that ARM loans generally have a maximum mortgage interest rate they can charge for the life of your loan. In my case, that maximum is 7.5%, but we're never going to get there in my opinion.

Unfortunately, after one full year at 4.5%, my bank can raise my ARM by another 2%, bringing my mortgage rate up to 6.5% for year seven.

However, I doubt rates will keep on surging higher as the global economy slows. Instead, by the time my ARM reset occurs again in 7/1/2020, we might very well be in a recession with one year LIBOR rates moving back down.

Paying Down Principal

In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.

They don't show them a 35-year historical chart of declining interest rates. By scaring their customers, they have a higher chance of locking them into 30-year fixed rate mortgages for fatter margins.

Don't be fooled.

Historical 30-year Mortgage Interest Rate Chart

You can see from the letter that despite my mortgage rate increasing from 2.5% to 4.5%, an 80% increase, my monthly payment is only expected to increase from $3,919.60 to $4,079.33, a mere 4% rise.

The reason for the slight increase in monthly mortgage payment is because we've paid down 32% of our loan in 4.5 years ($992,000 down to $734,000).

Paying down over $250,000 in our mortgage was partly due to normal monthly principal payments coupled with random extra principal pay downs. Although the 2.5% interest rate is low, paying down mortgage debt has always been part of my long term investment strategy.

Following my FS-DAIR strategy, I would regularly try and use 25% of my free cash flow to pay down debt and use the other 75% to invest. Again, I'm just taking action based on my own advice.

I kept on paying down principal randomly until the 10-year yield breached 2.5% in December 2017. Once the 10-year yield was higher than 2.5%, I stopped because I was now getting an interest-free mortgage since I could simply invest the amount of my mortgage in a 10-year bond yield to cover all my payments.

Living for free is one of the best things ever!

If I had taken out a 30-year fixed mortgage for 3.625%, I wouldn't have been able to experience interest-free living.

Your mileage will vary in terms of how much principal you actually paid down during the initial fixed rate period of your ARM. However, even if you didn't pay down any extra principal during a five year period, you will have still paid down ~10% of your principal balance, depending on your interest rate.

An Appreciation In Your Home's Value

Even if you've got to pay a higher mortgage rate when your ARM resets, you may be pleased to discover that your home has appreciated in value during the fixed rate period.

The San Francisco median home price increased from $1,100,000 in 2014 to ~$1,500,000 today, or a 37% increase.

A $420,000 principal increase more than makes up for a measly $159.63 monthly increase in mortgage payment, roughly half of which is going to pay down principal.

Again, your home's appreciation amount will vary. Unless you timed your home purchase completely wrong, such as buying in 4Q2017/1Q2018 or in 4Q2006 – 4Q2008, you'll likely come out OK.

Even if you did purchase at the most recent peak, normal downturns usually last no more than 3-5 years with 10% – 20% corrections.

Make A Mortgage Pay Down Plan

Given I have until 7/1/2019 before my mortgage rate jumps from 2.5% to 4.5%, I plan to keep paying my mortgage as usual and not pay anything extra to principal.

As soon as I exhaust all 60 months at 2.5%, I will pay down $50,000 in principal on month 61. After the initial $50,000 extra principal payment, I will keep paying down between $20,000 – $30,000 a month in extra principal until the mortgage is gone or until I find my Hawaiian dream home.

Based on my extra principal payments, the mortgage should be completely paid off by January 2022, or about 7.5 years after I first took out the loan.

Anything can happen between now and January 2022, which is why it's prudent to continue investing and paying down debt while having a good cash hoard.

Earning a 4.5% rate of return is excellent at this stage in the economic cycle, but so is having enough cash to find a gem of a property in Hawaii at a big discount. And boy, am I seeing discounts everywhere now!

The alternative solution to aggressively paying down principal is to simply refinance my mortgage when it's time to reset to another 5/1 ARM.

After checking online for the latest mortgage rates, I can get a 5/1 ARM jumbo for only 3.25%. This means that after 10 years, my blended interest rate is 2.875%. Not bad at all.

Article Summary

1) Match the duration of your mortgage's fixed duration with the estimated ownership duration or the length of time you estimate it will take to pay off the mortgage.

2) Paying for a 30-year fixed rate mortgage might provide you more peace of mind, but you're likely overpaying for that peace of mind.

3) Read the terms of your ARM loan carefully and figure out what is the maximum interest rate increase during the first reset and what is the lifetime interest rate cap.

4) Try to make extra payments during your ARM's fixed rate period to relieve potential interest rate pressure during the reset.

5) Don't borrow more than you can comfortably afford = no greater than a 80% loan-to-value ratio with a 10% cash buffer after a 20% downpayment. Being overly leveraged is what consistently destroys people's finances.

Readers, why do people take out overpriced 30-year fixed rate mortgages when the average homeownership duration is less than 9 years? Why pay a higher rate when interest rates have gone down for 30+ years in a row? If you have an ARM, how are you planning on paying it down?

The post The Anatomy Of An Adjustable Rate Mortgage Increase appeared first on Financial Samurai.

0 notes